Money Matter$

Consumers likely need no reminder that inflation has taken a notable toll on their finances in recent years. The cost of products and services has seemingly skyrocketed in recent years, leaving consumers with little recourse other than to scale back and find ways to save.

The online financial resource Investopedia notes that the inflation rate is the percentage change in the price of products and services from one year to the next. Data from the U.S. Bureau of Labor Statistics indicates the inflation rate reached 8 percent in 2022, or four times the 2 percent rate of inflation the Federal Reserve aims to maintain through its various monetary policies. Though the U.S. Inflation Calculator indicates the inflation rate cooled to 2.5 percent by the end of summer 2024, that may not comfort consumers who are still confronting high prices on various items, including housing.

Indeed, inflation continues to affect people from all walks of life. However, consumers can consider various strategies to save even when inflation is keeping costs up.

♦ Use rewards to your advantage. Consumers now have an array of ways to pay for products and services at their disposal. Conventional wisdom has long suggested credit cards should be used only in emergencies, but consumers who are confident they can pay off balances in full each month can consider using rewards-based credit cards to their advantage. Such

ceries and gas. Of course, this only benefits consumers if they pay off their balances in full each month. If not, the interest charges on credit cards will almost certainly exceed the 1 to 2 percent cash back consumers earn.

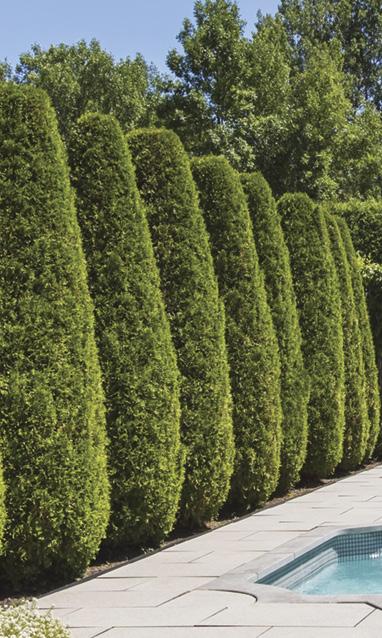

Statistics show that

inflation cooled considerably

in

2024. But the cost of many items remains high, forcing consumers to rely on various ways to save money.

♦ Open a high-yield savings account. The days of earning significant interest on savings accounts may seem like a distant memory, but high-yield savings accounts are still available at many financial institutions. Consumers intent on building their savings in the face of a higher cost of living can look into high-yield savings account options at their own bank or another financial institution. High-yield savings accounts typically mandate account holders maintain a minimum balance that is considerably higher than the minimum balances on accounts with lower interest rates, so this might not be an option for everyone. But consumers who have already squirreled away a significant sum in their savings accounts may be able to grow their money, and thus overcome inflation rates, by transferring the balance to a high-yield savings account.

cards return a certain percentage of each purchase (typically around 1 to 2 percent) to consumers, and they can be used to purchase everyday items like gro -

♦ Examine your spending. Perhaps the simplest way to save when inflation is high is to periodically assess your spending habits and make tweaks designed to save money. Such assessments can include everything from identifying ways to save at the grocery store to determining if entertainment subscriptions are worth the investment. Many consumers have lamented the high cost of groceries since 2022, and it’s possible a membership to a wholesale retailer like Costco can help reduce expenditures on various items, including paper products, that tend to be expensive at more traditional grocery stores.

The Brentwood Chamber of Commerce, in partnership with the city of Brentwood and the Small Business Development Center, has announced more dates for their business coaching program. The next sessions will be held on Feb. 12.

The program, launched in September of last year, has been a success, according to Karri Reiser, a past Chamber

president.

“Since it’s an appointment based program, I’m measuring success due to the fact that we’ve had appointments fully booked each month since it began,” she said.

Funded by the city of Brentwood and the Chamber, the coaching program provides no-cost, in-person advising sessions at the Chamber building at 35 Oak St. from noon to 4 p.m. every other Wednesday. Each session is 30 minutes.

According to Reiser, who invited the East Bay SBDC to

hold the sessions during her tenure as Chamber president, all Brentwood small businesses, as well as members of the Chamber of Commerce not located in the city, may schedule a session. Anyone who schedules a session is entered into the SBDC database and made eligible for the center’s other programs. She said that the advising program was inspired by her own experiences starting a business more than 10 years ago when she was unsure of

see Chamber page 6B

CA 94513 925-240-7257

Ahome is the most expensive purchase many people ever make. Buyers understand that certain costs come with home ownership. However, some of the costs associated with home ownership can catch even the most savvy savers off-guard. And in recent years, those extra costs have been surging.

The following are some of the unexpected expenses that come with living the homeowner dream.

Property taxes: Depending on where you live, property taxes can comprise a large portion of monthly expenses. Some people pay their property taxes separate from their mortgage payments. Others wrap the tax burden into their mortgage bill. Either way, Business Insider reports that New Jersey currently has the highest effective property tax rate in the United States, with a median Garden State property tax bill at $9,000 annually. The lowest property tax rate is found in Hawaii, and the average homeowner there pays only $2,000 in property taxes annually. Zoocasa reports that annual property taxes in Canada can cost anywhere from $2,500 to $10,000 depending on the province’s property tax rate and average cost of homes.

ownership can be costly. Buyers would be wise to familiarize themselves with some of the hidden costs of owning a home prior to purchasing one of their own.

ers to take out mortgage insurance, also called PMI, to offset their risk. Credit Karma says PMI depends on factors such as down payment and borrowers’ credit scores, but typically it’s around 0.2 to 2 percent of the loan amount per year. You can remove PMI from your monthly payment once you have 20 percent equity in your home.

Maintenance: Even a brand new home will require some measure of maintenance and routine upkeep. Bankrate indicates one of the biggest costs of owning a home is maintenance, coming in at roughly $3,018 a year and an additional $3,300 for improvements. Lawn care, home cleaning, pest prevention, replacing smoke alarms and batteries, roof repair, and clearing rain gutters are some of those costs.

Home insurance: CNN Business reports that home insurance premiums have surged in recent years, in large part due to extreme weather. In the U.S., insurance rates jumped 11.3 percent nationally last year, according to S&P Global. Severe storms, including hurricanes and wildfires, cost homeowners insurance agencies nearly $101.3 billion last year, and those losses have been passed on to policy holders through higher prices.

Mortgage insurance: Many people do not have the standard 20 percent down payment necessary to buy a home. To circumvent this, lenders will require borrow-

HOA and CDD fees: Some communities impose homeowners association fees on those who live within the neighborhood. Such fees cover items like maintenance in and around the community and snow removal. A Community Development District Fee is imposed by the developer of a neighborhood or subdivision to finance the cost of amenities in a neighborhood. Homeowners should be aware of these fees before buying in an HOA community. Apart from these expenses, annual utility payments can be quite expensive. Utilizing utility plans that offer a fixed cost per month can help homeowners budget for utility expenses more readily.

The recent wildfires in Los Angeles County and environs highlight the importance of protecting your assets, whether you own a home or rent an apartment. But how do you ensure you’re properly covered?

In risk management, you have two main options: self-insurance, where you retain the risk yourself, or transferring the risk to an insurance company through a policy.

Large corporations often selfinsure because they have the financial resources to manage and invest their own funds. For most individuals, transferring risk through insurance is the more practical option, especially when paying premiums is a more manageable solution.

You can work with insurance companies that have captive agents, who represent a specific company and

can guide you through coverage options, premiums, and payment plans.

Alternatively, you can use an independent agent, who works with multiple carriers and offers more choices. However, keep in mind that some insurers may not be as financially stable. Always choose a company with strong ratings from agencies like A.M. Best, Mood’s, or Standard & Poor’s.

When shopping for coverage, make sure you’re comparing ‘apples to apples.’

Many people focus on the lowest premiums, but it’s crucial to first determine the coverage limits you need.

Ensure that you’re fully protected for the risks you face. It’s a good idea to compare at least three quotes to find the best fit for your needs.

While shopping for insurance can feel overwhelming, with some research and careful comparison, it’s manageable — and essential. For a quote from an East County agent call Jayne Oertwig at 925-937-3520.

what to do before following her mother’s advice and going to the Antioch Chamber of Commerce.

“It just so happened that, on that day, there was a gentleman who was a volunteer at the office, who would do business coaching,” Reiser said. “I met with him and walked out of that meeting with a roadmap of what I needed to do to start a business. It was great!”

According to Reiser, the sessions are similar to a job interview. The adviser asks questions to ascertain the entrepreneur’s needs and those of their business, and then discusses what form of assistance would be best for them. Each advising day is overseen by one of four advisers who specialize in one field but can provide advice on numerous subjects, including finance, marketing, and business planning. If the in-person adviser cannot provide advice on a subject, they will notify East Bay SBDC, which will connect business owners with another adviser who can answer their questions.

When the project came together in September, Abraham Salinas said money for the project came from the Brentwood Economic Development Grant Program, which is funded by business permit fees. Salinas is the senior analyst at the

Brentwood Economic Development Division.

According to Nancy Mangold, executive director of the East Bay SDBC, the organization is part of the Northern California Network of the national board of Small Business Development Centers, is funded by the federal Small Business Administration, and serves Contra Costa and Alameda counties.

“We’ve had quite a bit of success,” she said. “In 2024 alone, we helped [East Bay] businesses raise $62 million in funding, helped 47 businesses start out, helped create almost 500 new jobs, and helped businesses increase sales by $18 million. In total, we’ve served about 1,400 small businesses this year.”

The other advice session dates for this year include:

Feb. 12, 26; March 12, 26; April 9, 23; May 14, 28; June 11, 25.

To get on a waitlist, email ebinfo@ eastbaysbdc.org with your preferred dates. If a cancellation occurs, the group will contact you.

Appointments can be made on the SBDC Northern California Network’s website at https://www.eastbaysbdc.org/ in-person-advising-brentwood/. There is a waiting list for new appointments.

For more information about the Brentwood Chamber of Commerce, visit https://www brentwoodchamber com/

Jennifer C Hamilton

Advisor

Financial security in retirement is a goal worth pursuing, but it’s one that a significant percentage of individuals feel is out of reach. According to a February 2024 report from the National Institute on Retirement Security, 55 percent of Americans are concerned they cannot achieve financial security in retirement.

Saving for retirement is an integral component of securing long-term financial security. There are many ways to save for retirement, and individual retirement accounts (IRAs) and employer-sponsored 401(k) plans are among the more popular ways investors build a nest egg for their golden years. IRAs and 401(k) plans differ in some notable ways, and recognition of what distinguishes these types of accounts can help people choose the right vehicle for them. Contribution limits can change from year to year, so individuals can expect to increase their contributions in future years if they hope to maximize the allowable amounts. The following breakdown, courtesy of US Bank®, notes some key differences

between a traditional IRA, a Roth IRA and a 401(k).

Traditional IRA

Eligibility: Anyone with earned income is eligible to open a traditional IRA.

Funding: A traditional IRA can be funded with after-tax dollars or as tax-deductible contributions.

Contribution limits: $7,000 annual limit in 2024, though individuals age 50 or older can contribute an additional $1,000 if they choose to do so.

Employer match: None.

Investment selection: Account holders can choose their own investments.

Anyone who aspires to create financial security in retirement should consider investing via a 401(k) or a traditional or Roth IRA.

Eligibility: Individuals aspiring to open a Roth IRA are urged to speak with a financial planner or accountant, as certain contribution criteria and tax filing requirements must be fulfilled.

Funding: A Roth IRA is funded with after-tax dollars.

Contribution limits: $7,000 annual limit in 2024, though individuals age 50 or older can contribute an additional $1,000 if they choose to do so.

Employer match: None.

Investment selection: Account holders can choose their own investments.

Eligibility: Individuals are urged to speak with human resources professionals at their place of employment, as US Banks notes most employers have certain qualifications their workers must meet in order for them to participate in these plans. Those qualifications can vary between firms.

Funding: A 401(k) is funded with pretax dollars deducted directly from participants’ paychecks.

Contribution limits: The annual limit for 2024 is $23,000, though participants age 50 and older can contribute an additional $7,500.

Employer match: Some employers match employee contributions up to a certain percentage. Investopedia notes the average match was 4.5 percent in 2023.

Investment selection: Various portfolios may be offered, but those available are generally chosen by employers.

For more details on these and more similar accounts, contact local advisors: –Tony Aguilar / Edward Jones Financial, at tony aguilar@edwardjones com or call 925-642-6038

–Jennifer C Hamilton / Edward Jones Financial, call 925-516-1821

–Jennifer Houts / Financial Services Professional, at jjhouts@ft.newyorklife.com

For second-generation framer Chris Ramos, it’s all in the family. CR Framing serves local artists and residents at wholesale prices, with excellent quality and quick turnaround. They offer an array of services, including custom framing, shipping, shrink wrapping, matting, and framing. The business is located at 700 Harvest Park Drive, Unit I, in Brentwood, and hours are 10 a.m. to 6 p.m., Monday through Friday, and 10 a.m. to 3 p.m. on Saturdays. For more information, call 925-634-7742 email crframing@aol.com or visit crframing.webs.com.