‘’

Every time I hear what people are going through it just fires me up. A journalist once told me that I have ‘fire in my belly’. People need to hear what is going on ...

Read Ellen’s story on pages six and seven

Every time I hear what people are going through it just fires me up. A journalist once told me that I have ‘fire in my belly’. People need to hear what is going on ...

Read Ellen’s story on pages six and seven

VIEW MAGAZINE – A social affairs publication with in-depth reporting and analysis

VIEW guest editors Dr Ciara Fitzpatrick, Siobhán Harding and Andy McClenaghan argue that the crisis has compromised the future of our young people Pages four and five

Caroline Rice, from Lisnaskea, County Fermanagh, believes it’s vital to speak out against the shaming of people who are struggling Pages eight and nine

BBC Spotlight NI reporter Mandy McAuley writes about the scourge of paramilitary loan sharks who are preying on vulnerable communities Pages 12 and 13

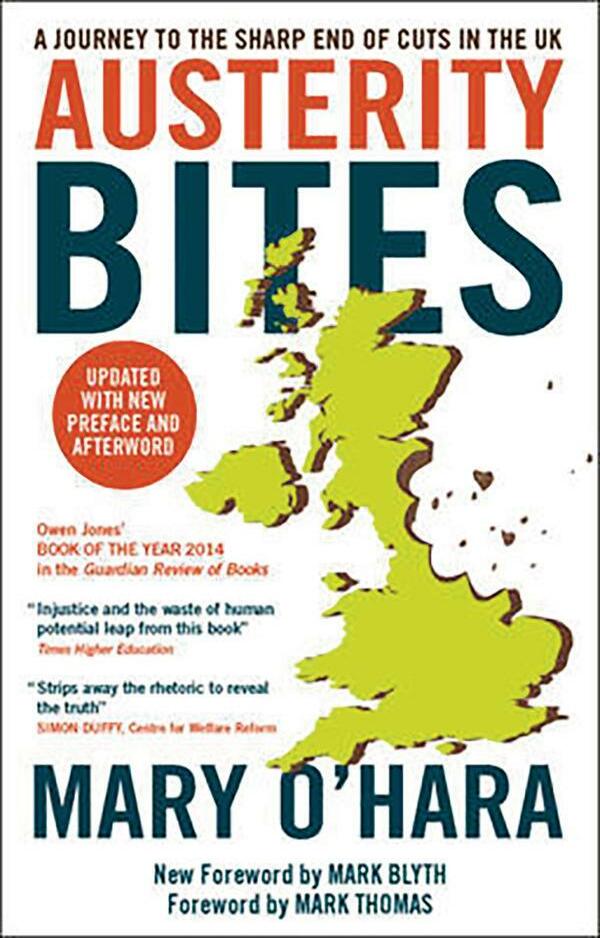

Award-winning journalist Mary O’Hara says she is hopeful that there are progressive and radical solutions to the Cost of Living crisis Pages 14 and 15

Professor John Barry, from Queen’s University, believes we should start describing the Cost of Living crisis in the UK as a Cost of Profiteering crisis Page 21

Trasa Canavan, from Barnardo’s, argues that an anti-poverty strategy is urgently needed in Northern Ireland Page 29

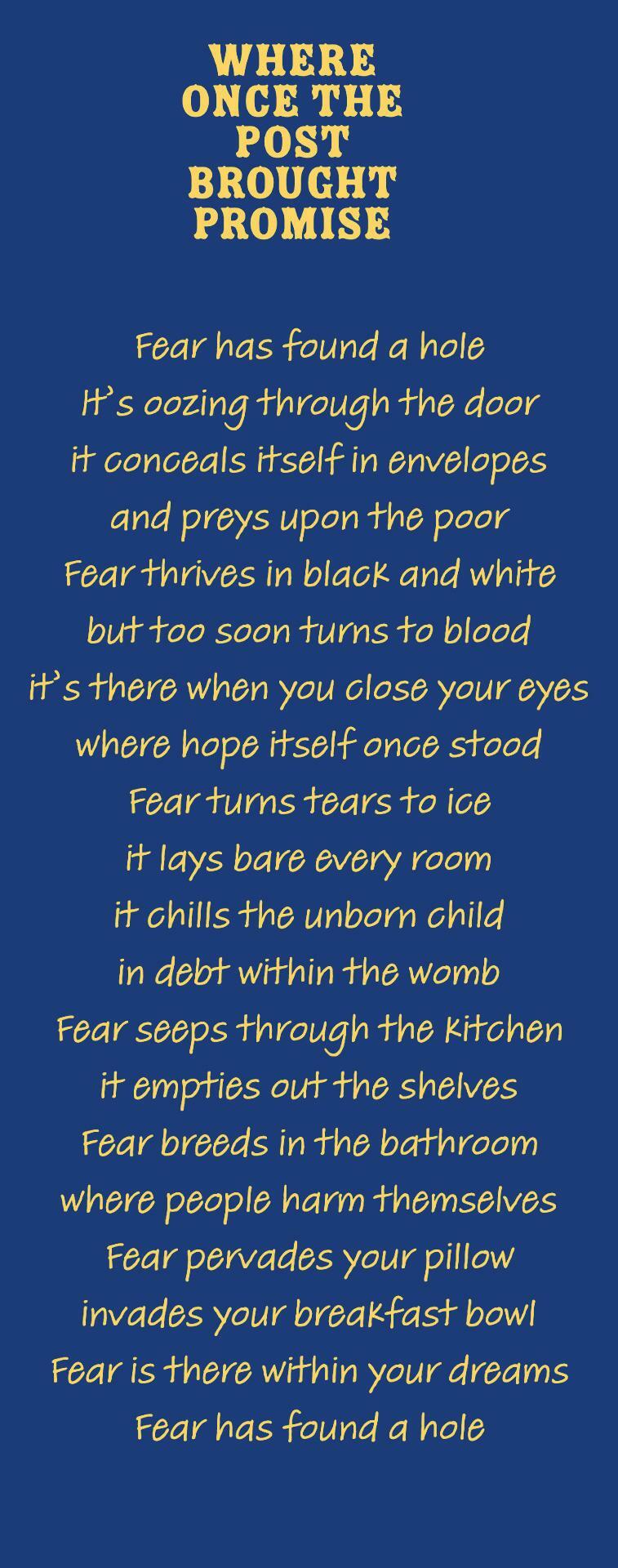

Poet Henry Normal shares his poem Where Once the Post Brought Promise with VIEW readers on Page 16

Editor Brian Pelan – brianpelan@viewdigital.org

Making a complaint to VIEWdigital –viewdigital.org/social-affairs-magazine-team/

Publisher Una Murphy – unamurphy@viewdigital.org

How bad will it be in 2023? I was challenged by a friend on what we’ll say that’s new about the Cost of Living crisis in this edition of VIEW magazine.

As a journalist who has concentrated on covering social issues for the past 10 years, it’s a question I pondered when writing this editorial.

We’ve seen the growth of food banks and the visibility of homelessness on our streets. Through our journalism at VIEWdigital we’ve tracked the age of austerity and its effect on communities.

We’ve seen how the growth of poverty has been reflected in police reports in the Republic of Ireland as an increase in thefts and burglaries due to the Cost of Living crisis.

We’ve seen how the state in Britain prepares to outlaw certain strike action by trade unions.

I’ve just finished reading Hilary Mantel’s novel on the French revolution A Place of Greater Safety. It struck me that the neo-liberal economic policies which have been pursued with the determination of

stormtroopers by those currently in power is now imploding.

People are afraid to go to the hospital due to a lack of beds, with patients being treated in public corridors. Nurses and hospital staff have had to go on strike to demand action, joining teachers, lecturers, postal, and transport workers on picket lines. The dogma of neo-liberalism has failed, and the next stage is to demand that changes will be made in society to reverse the inequalities inflicted on communities since the age of austerity began.

What I see that’s new in this edition of VIEW magazine on the Cost of Living crisis is the story of people showing defiance despite the struggle. Campaigners like our guest editors who have stood out in the cold, as well as in the corridors of power, to say end this hardship.

More and more people are courageously and determinately saying that the inequalities of this age of austerity must end. And in a representative democracy, we must question those who seek to lead us – irrespective of past loyalties to party or creed – on what action they will take. If we are not satisfied with their answers we must not give them our vote.

Now is the time to collaborate with those who seek to bring an end to this dreadful dogma which has led to record levels of child poverty, made older people afraid to turn on their heating and besmirched the democratic process by putting the needs to people in power and their powerful allies before the needs of citizens.

How bad will it be in 2023? Make this the year we get off our knees.

People in Northern Ireland are being crushed by the Cost of Living crisis without the benefit of any socioeconomic protection. We are victims of a country without a functioning Executive or Assembly, no caretaker ministers in post and no direct rule from Westminster, with a near-total breakdown in the governance of Northern Ireland.

The political abandonment of citizens, who are facing the severest financial crisis in decades, is a major dereliction of responsibility. The fallout is significant with many more people falling into the clutches of extreme poverty and unthinkable hardship. We should not tolerate this in the 21st century in one of the most prosperous economies in the world.

The lack of political stability in Northern Ireland over the last 10 years coupled with Westminster government-led austerity and cuts to public services means that the Cost of Living crisis with inflation surpassing 10 per cent has caused a bad situation to become completely catastrophic.

The National Health Service is on its knees with patients struggling to get a basic standard of care in primary care and social care settings. Waiting times are the worst in the UK. “Economic inactivity” (28.3 per cent) is higher here than in other UK regions (21.4 per cent average), while wages are lower, the cost of childcare is higher in NI and poor mental health is endemic, with poor infrastructure preventing people receiving the support they need – which some argue has led to increased drug-related deaths.

The female rate of economic inactivity (where women are more likely to rely on the social security system) has been consistently higher than the male rate. The proportion of women who are unable to work in the formal labour market due to them looking after their family is higher than the rest of the UK.

Women who are relying on social security are further likely to be impacted by punitive measures such as the two-child limit which limits the child element of Universal Credit (UC) and Child Tax Credit to the first two children born after April 2017. There are around 14,000

families in Northern Ireland currently impacted by this rule. The annual cut of around £3,000 per child fundamentally impacts a household’s ability to provide for the youngest members of society. It is most likely to be the mother who will go without food, heat and light in order to allow her children that dignity.

The review of welfare reform mitigations, which was published just before ministers left their posts,

importantly recognised the impact of welfare reform on women and the need to effectively target women through mitigations. The review put mitigation of the two-child limit at the heart of its recommendations. Due to the lack of a NI Executive and the “black hole” in Stormont’s finances, it is unclear as to when implementation of the important recommendations in this review will be possible. We are pleased that the Chair of the Review Panel is contributing to this issue.

The ability to work, especially for women, is exacerbated by the crisis in social care which has seen unpaid carers having to assume care responsibilities which should be provided by formal services. It is estimated that one in five adults here now has some form of unpaid caring role, with women making up close to two-thirds of the local carer population.

Department of Health data shows, that between October 2021 and August 2022 the number of people waiting for a home care package in Northern Ireland has risen by more than 60 per cent reflecting the urgent need for reform of the system and another crisis in the social care workforce.

As identified in the last issue of VIEW magazine, affordable housing is a perennial problem in Northern Ireland. The Joseph Rowntree Foundation (JRF) found that Northern Ireland has a greater proportion of homeowners in poverty than the rest of the UK and that twice as many of Northern Ireland’s mortgaged households were behind with their mortgage repayments (14 per cent) compared to the whole of the UK (seven per cent). Due to the colossal waiting lists for social housing (43,971), more and more people are turning to the private rental sector.

Problems exacerbated by poverty are placing intense pressure on a wide range of public services. We are pleased Professor Ray Jones, Chair of the Independent Review of Children’s Social Care Services, is also contributing to this edition of VIEW magazine. The once-in-a-generation review he is leading comes at a time when the number of children in the care of social services is the highest on record since the

VIEW guest editor team Dr Ciara Fitzpatrick, Siobhán Harding and Andy McClenaghan, argue that the current poverty purgatory has compromised the futures of thousands of our children and young people who are feeling the pain and the indignity delivered by lack of resources and disadvantage

‘’

introduction of the Children (Northern Ireland) Order 1995.

There is an established link between a family’s socio-economic circumstances and the chances that their children will experience neglect or abuse, with the likelihood and severity of neglect or abuse increasing as poverty worsens.

The perils of dealing with the symptoms of poverty and the Cost of Living crisis are clearly demonstrated through the latest food bank figures from the Trussell Trust which show that charitable food aid is increasing in NI. Midyear statistics reveal that the distribution of emergency food parcels went up 25 per cent compared to the same period (AprilSeptember) last year. The figures also revealed that 10,000 people have been forced to turn to a food bank in the Trussell Trust Network for the first time –which is a startling indication of what is to come. Food banks face breaking point as they struggle to meet the demand of those who can’t afford to put food on the table.

The risk of destitution is increasing across the UK. Destitution means that the member(s) of a household are unable to meet their most basic needs (heating, eating, keeping warm, turning on the lights and maintaining a basic level of hygiene). The National Institute of Economic and Social Research (NIESR) has used

economic modelling to estimate how inflation will impact on different parts of the UK. Northern Ireland is projected to have more than twice the average increase in destitution. The UK headline projection is 30 per cent because of the differential impact of inflation upon those in poverty –in Northern Ireland the figure is 67 per cent. This would bring the total number of destitute households to around 25,000.

The NI Consumer Council’s Expenditure Income Tracker underscores the point that destitution is a real risk for many households. In September 2022, when inflation reached 10.1 per cent, it found that NI’s “lowest earning households” (an average income of £12,200) have been left with only £29 per week after paying bills and costs, meaning that one unexpected bill could plummet individuals into destitution. The NI Consumer Council points to fuel, food, and transport as the financial pressure points.

Research by the NI Consumer Council published in October 2022 estimates that around 34 per cent of households (247,000) are currently in fuel poverty. This means that significant challenges remain, particularly for those who are most marginalised, such as those with disabilities. There was some relief when it was revealed that pensions and work-age benefits would rise with inflation,

but this will not happen until the new financial year. It is unclear how households who rely on the social security system will cope in the meantime.

The picture is incredibly bleak for many people, children and families in Northern Ireland. There is no light at the end of the tunnel for those who are crushed by the Cost of Living crisis. We can’t continue in this cycle of perpetual crisis, which is characterised by division and bitterness. The implications of the current poverty purgatory are the compromised futures of thousands of our children and young people who are feeling the pain and the indignity delivered by lack of resources and disadvantage. We need political leadership, and we need it now.

• Authors: Dr Ciara Fitzpatrick, Lecturer in Law at Ulster University; Siobhán Harding, Women’s Regional Consortium; and Andy McClenaghan, Public Affairs, Policy and Communications Lead at British Association of Social Workers Northern Ireland.

• Full version of this article can be read at https://bit.ly/3vI8fWB

Mother and grandmother Ellen Moore is a remarkable workingclass woman. Despite recovering from throat cancer and living with leukaemia, she has regularly added her voice to those protesting about the Cost of Living crisis.

I travelled to Derry to meet Ellen at her home on the Creggan estate. Her home was festooned with festive celebrations but the 62-year-old pensioner said her heart wasn’t really in it.

She knows all about trying to stretch out a meagre budget in order to try and survive the harsh economic climate.

“I will often sit in the dark rather than turn on the lights. Putting on the central heating is a no-no at the moment for a large part of my day,” said Ellen.

She has four sons and two grandsons. Her husband died a number of years ago.

“I was born and bred in Derry in Springtown Camp,” said Ellen.

Springtown Camp was a former US military camp near Derry, Northern Ireland, that housed up to 400 Catholic families in the 1940s to 1960s in substandard housing rented by the local authority. The outcry over the Unionistcontrolled city council’s failure to re-house the tenants in proper buildings gave rise to some of the first Northern Irish civil rights protests of the 1960s.

Ellen spent many years working in Bookworm in Bishop Street, Derry. The bookshop closed in 2014. Before working in the bookshop she had a number of cleaning jobs. She still enjoys reading, especially Ian Rankin’s crime novels. She moved into the Creggan estate in 1990.

She told me that she is currently receiving chemotherapy treatment for her leukaemia. “I am always cold due to having a blood cancer. I bruise very easily with the

least wee knock.”

I asked Ellen how does the current Cost of Living crisis compare to other tough economic times in her life?

“I thought it was tough when my boys were young but that was easy compared to now,” replied Ellen. “The price of heat and food seems to have doubled.

“I usually sit in my living room with a big blanket wrapped around me and a hot water bottle on my lap. I only put the heating on for a short while. I go to bed a lot earlier now because it’s warmer.

“I spoke to a young mother last week. She told me that when she goes to pick up her children from school, she will put a pile of hot water bottles on her bed. She brings her children in and puts them to bed. She then makes toasties for them. Whatever they don’t eat will be her main meal for the day. Her story broke my heart.”

Ellen got involved in a campaign earlier last year in Derry which is holding protests about the Cost of Living crisis. She said she was nervous at the start but is glad to speak out now. She has also been interviewed many times by the media.

“Every time I hear what people are

going through it just fires me up. A journalist once told me that I have ‘fire in my belly’. People need to hear what is going on,” she said.

“I'm doing something even though at times it feels like you are banging your head against a brick wall. I personally feel that the government in England and our politicians should hang their heads in shame for allowing this crisis to happen. When the war in Ukraine broke out the Government sent money, including tanks and aircraft, but they claim they have had no money for our health service.

“The NHS has been in decline for the last 20 years and yet they blame the nurses for going on strike. When I was growing up to be a nurse or a teacher, it was considered to be a good job. Now some of them are having to go to food banks. I know a nurse who actually gave up her job because of the poor wages. She is now stacking shelves in a supermarket.

“People are demoralised and worn out by the Cost of Living crisis. They just worry all the time about how they are going to heat their homes and put food on the table. I know of so many adults and children who are going without. My heart just breaks for them. Even food banks are having less and less donated to them.

“Nobody in this day and age should have to go to a food bank.

“I know there are going be so many old people who are going to die this winter because they don’t have the money for heat. They could be lying dead for a while before anybody notices.”

Ellen raised her fist for a photograph I took of her at the end of our interview. Despite her own health difficulties she really does have ‘fire in her belly’. It was an honour to meet her.

I spoke to a young mum last week. She told me that when she goes to pick up her kids from school, she will put a pile of hot water bottles on her own bed. She brings her children in and puts them in to bed. She then makes toasties for them. Whatever they don’t eat will be her main meal for the day. Her story broke my heart

One of the difficulties about producing an issue of VIEW which examines the Cost of Living crisis is getting people who have direct lived experience to share their story with a wider audience.

Single mother Caroline Rice who lives in Lisnaskea in County Fermanagh with her daughter is one of the exceptions. She believes it’s vital to speak out.

Given that austerity has been with us for a number of years I asked Caroline how she would describe the impact of the current Cost of Living crisis.

“It’s definitely got worse,” she replied. “I’ve noticed that my finances are getting tighter and tighter. I used to be able to save a number of years ago, but not now. There is no cushion any more.”

Caroline, who works as a classroom assistant, added: “My wages go out as quickly as they come in. Also, my pay is not stable as I don’t get paid when I’m not working. As classroom assistants, we are hired on 39-week contracts. Very few get offered a full 52-week contract. This means we don’t get paid for 13 weeks of the year. Nine weeks of this is over the summer holidays.

“So if you are married, you’re relying on your partner’s wages. If you are single, you are likely to have to sign on to universal credit (UC) or if you are already on it you learn to live with no income for at least six weeks.

“I get a basic UC of around £900 and

that includes my rent. I get a full wage in July from my June work, which means my UC award in August is very low and barely covers my rent, meaning I have no income in August to live on. When I go back to work in September, I get my UC of £900 but I am spending much of what should be spent on our household on getting myself to work daily.

“I receive a wage on July 15 and I don’t get another wage until October 15. Many classroom assistants find that they are not eligible for free school meals for their children because of the July wages.”

Caroline tells of her relief that she has a stove given the high cost for energy provision. “But the coal has gone from £8.50 a bag to £15 a bag,” she added.

She suffers from fibromyalgia – a condition which can leave her feeling exhausted. Caroline now struggles at times to carry out basic home improvements.

“What I really want is to do a day’s work and get properly paid for it,” she said. “My state benefits don’t make up for what I lose out on wages.”

Caroline said that because she is living in a rural area she would find it difficult to confide in other people living near her. “Most people here keep things to themselves. There is no real sharing of economic struggle.”

She doesn’t believe in keeping quiet though and has been a frequent contributor on news programmes.

“If we all kept quiet and said nothing,

then they'll just keep on doing it. They’ll keep squeezing you a bit more and more,” said Caroline.

“I go onto the radio to create a bit more awareness and to try and break the stigma and shaming of people. I’ve heard some people say that the bookies and the pubs will be full when the promised £600 energy aid is paid out. These people are automatically targeting low-paid workers.

“I believe that we should not attack those on lower wages.”

I asked Caroline did she have any views on the political response to what we’re going through such as those demanding that the Northern Ireland Executive is set up again to help combat the crisis.

“I believe that the political parties here have failed people for years and years. I believe that even if the Executive is set up again, it will fall again. It is just not stable.

“The reality is that people should not have to live like this. We’re constantly being pitted against each other by the rich and the politicians. We’re told that many children are not entitled to free school meals yet the politicians can get subsidised meals.”

One thing is certain, Caroline will definitely continue to call out injustice wherever she sees it. I left her standing at her front gate with a determined look on her face.

Imet staff members Joanne Leonard and Paul Breslin during a recent visit to a Simon Community-run hostel in Derry. Julie is the manager at the centre and Paul is a support worker.

Whilst the hostel provides a haven for those struggling with addiction and housing issues both workers admitted to also personally feeling the pressures of the Cost of Living crisis.

“Many people believe that the Cost of Living crisis just affects people who are not working and who may be living in homeless shelters,” said Joanne. “But in reality that is not true at all. I work full time and I would say that I get a good wage. But I still actually struggle with having to pay my

mortgage and my bills due to the rise in prices. I have gone from putting £20 to £30 a week for my gas to £100 now.”

Paul added: “I’ve had to take on a second job to try and cope. I am now working 40 hours a week and sometimes more than that.”

Joanne, who has two children, said she received little State help towards her childcare costs. “I couldn’t take on a second job even if I wanted to. Who would pay for the extra childcare costs?”

Paul admitted to his ongoing frustration about the current economic climate in Northern Ireland. “I’ve two older children and two stepkids. Everything needs to come down in price. They just can’t keep skyrocketing for ever.”

The toll inflicted by the relentless

economic pressures was summed up by Joanne. “The Cost of Living crisis incorporates so many things,” she said. There is low mood and a decline in your mental health. People are now saying ‘how much longer can I go on’.”

Paul added: “I find it hard to concentrate on anything but my family. I worry constantly about the money needed for heat, petrol and food.”

Joanne said: It's also a matter of pride. “A lot of people don't want to admit that they are struggling with their mortgage or rent arrears.”

Both Joanne and Paul said they were very supportive of workers’ battles to win pay increases. They enjoy the work they are doing at the hostel but are feeling the economic pain.

‘Mary’ is 24 years of age and is from Belfast. She lived at a Simon Communityrun family centre in west Belfast for six months before recently moving into a flat on her own. She has a young son who has additional needs. She said it was hard to find money to pay for activities to try and keep him occupied.

Mary, who has her own mental health issues, said that because of the Cost of Living pressures, she had no money to furnish her home. She managed to get a discretionary support grant to enable her

to get some furniture and kitchen items.

She said the cost of heating the house was unbelievable. “It used to be £10 would last a couple of days, but now the meter needs to be topped up every day.”

Mary said it was also very expensive to take her son on outings or treats. Recently she went to the Armagh Planetarium (organised via the Simon Community). She said she could not have personally afforded the transport and entrance fee herself. “It was a very emotional day for my son and me.”

Mary also referred to the high suicide rate among the homeless in Northern Ireland. “I can understand why the suicide rate is so high for homeless people. One minute you have a roof over your head and the next minute it is gone,” she said.

In terms of the present Cost of Living crisis, Mary feels it is just going to get worse. “I have constant anxiety when I think about it,” she said.

• ‘Mary’s’ real name has been changed to safeguard her identity.

‘The

As many mothers struggle with the Cost of Living crisis, a women’s centre in Craigavon, County Armagh, has responded by providing a range of vital services to try and help support them.

Amongst the resources provided by the Chrysalis Women’s Centre are new classes on basic mechanics, cooking on a budget, and a food bank. Director Ruth McKeever said: “We have had to think outside the box to see how we can support the community out there.”

The centre has also created a daily “warm well space” with free meals provided to the elderly and vulnerable. The centre has also produced winter packages, with support from local businesses, for distribution to those who come in.

“What came back to us was expensive things such as washing up powder, shower gel, and blankets. We put these items together after listening to the women who come here,” said Ruth.

She said the women who use the centre’s services just want to know how they are going to feed their families.

She added: “They are worried about Christmas, worried about their kids and

how they are going to provide for them. They are worried about the future.”

Amongst the top concerns for women were rising energy and utility costs. Mother-of-two Kat O'Reilly (30), said: “We just got our latest electricity bill, and even though we used less than the same period last year, it was 50 per cent more expensive.” She added: “When we moved into our house last year, our monthly payments to cover utilities and rates were just over £160 a month, and now it’s £375.”

Mother of three, Anna Clenaghan (45), said: “I put in £30 gas at the beginning of the week and it's already gone. Last night I had to keep the heating on longer because it was really cold.” She added: “£30 before would have lasted me at least a month.”

Dana Henry (52), who lives with four of her children, said: “I’m freezing all the time. There is always someone who is going to be sick because it’s so cold.” She added: “It’s terrible because I was always used to being warm in the winter.”

Rising costs and the resulting financial pressure means that women must make difficult decisions as they struggle to balance their family finances.

Anna said: “The shopping now doesn't go very far. I used to do a big shop and then the fridge and cupboards would be all full and the kids were used to that, but now I can’t be like that. Now it’s just essentials.” Kat added that her family had cut down on meat. “That cut our food bill by about £20 a week. I don’t buy any branded treats unless they are on discount. Something as simple as cereal is really expensive. I buy everything second-hand. I’ve even bought some of the kids’ presents on the online website Vinted.”

While the women are becoming accustomed to these tough choices, they also worry about the impact this has had on their children. Dana said: “The hardest bit has been saying no to kids and grandkids. It’s hard to make those decisions. When my son says other friends can get it and he asks why I can’t get it, it is hard. I hate saying no, but you have to.”

Ruth said the impact that this was having on children was “unacceptable”. She added that young children shouldn’t have to worry about these things.

She urged politicians “to get back to work” as she expects the situation to worsen.

Ruth McKeever, Director of the Chrysalis Women’s Centre in Craigavon

At this stage in my reporting career very little shocks me. However, there were moments during the making of the Loan sharks and Paramilitaries film with producer, Guy Grandjean, that my jaw dropped as we began to hear harrowing testimony from victims across Northern Ireland. All incredibly brave people who could not be identified on camera to protect the safety of both them and their families, but who wanted to tell their stories on the record in order to help others.

Over several months we slowly pieced together an evidence trail with input from single parents on benefits, people out of work through sickness, and low-paid families juggling two and three jobs. While loan sharks thrive in all impoverished areas, both loyalist and republican, senior community and security sources concur that paramilitary-linked money lending is most acute and widespread in loyalist urban areas. All of those featured on the programme live in loyalist communities across Northern Ireland.

They told us that, in some areas, entire streets and apartment blocks are now turning to money lenders – whether from paramilitaries or other criminal gangs – for instant cash as they struggle to cover basic bills and essentials. One man says he succumbed to loan sharks after he was forced to give up work due to illness and then his universal credit was cut.

“They’re waving the cash in front of your face. There are no complicated forms to fill in, and no credit history checks. I was desperate, and I thought this was a lifesaver. I can go and do a good shop, I can put electricity on, and I can finally relax,” he said.

One woman, a single parent, said she initially borrowed £50 for a bag of groceries and baby supplies. A month later her interest rate doubled, and then came the threats from the paramilitaries.

“And then they have you, you’re trapped. You and your family are trapped in this endless nightmare. For what? A bag of groceries,” she said.

Several women targeted told us they were initially approached by “a female friend” who knew they needed money, others said they believed they were singled out after they revealed on their neighbourhood WhatsApp and Facebook groups that they were struggling: “They used to target you at the shops and the post office. Now they do a lot of their business over social media where people are more likely to drop their guard.”

Paramilitary money lending is not new in Northern Ireland. During our investigation we heard that generations of the same families – grandparents, parents and adult children – have handed control of their finances, and benefit books, over to paramilitary-linked loan sharks. Several long-established charities and community groups told us the dependence on

paramilitary-linked money lenders appears to be most deeply rooted and ingrained in loyalist areas.

It’s viewed by some we spoke to as “a necessary evil, a service that your granny used”. However, many of those trying to help victims fear the deepening Cost of Living crisis, low wages, and a benefits system that, they say, needs completely overhauled, have created the perfect storm for extremely dangerous – and violent –loan sharks to flourish.

In Belfast, the Chair of the East Belfast Mission, Brian Anderson, told us that community intermediaries are now stepping in on behalf of terrified families who risk being criminalised by loyalist paramilitaries to repay small cash debts; “£50, £100, a couple of hundred pounds, the price of a second-hand fridge freezer,” he said. Asked what would happen if those intermediaries did not negotiate with paramilitaries, he is very clear about the potential short-term consequences for victims.

“It’s very easy to have your principles from a distance but this is real life and you can’t abandon someone who has a risk of a criminal record for only wanting a freezer in their home. We’re talking about the bare essentials of life. We have to step in.”

Between April and July this year over 10,000 people across NI sought help or were referred to the UK’s biggest food bank network, The Trussell Trust, which has 45 outlets here. The Trust’s NI lead, Jonny

In December last year BBC NI Spotlight broadcast an investigation which revealed that paramilitary-linked loan sharks had targeted food bank users and food parcel operations in some loyalist areas. As the Cost of Living crisis continues to deepen, reporter Mandy McAuley, left, writes about the growing sense of abandonment, desperation, and fear she encountered in some of Northern Ireland’s most impoverished communities

Currie, took part in the programme. He expressed concerns that food bank users are being preyed on by illegal money lenders. “Food banks and the network have reported back to us that folks that are referred to them have said they are part of that illegal system – illegal money lenders, criminal gangs, paramilitary organisations, whatever you want to call them, in those local communities, that are preying on those people who are in crisis.”

That concern is reinforced by the recent experience of Alan (not his real name). He said he was offered instant cash by two men who came to his home one evening after he had returned from his local food bank.

“I recognised one of them. He had been sitting in a car outside the food bank while we queued to go in.”

It’s clear from our sources that loyalist paramilitaries have especially tightened their grip on the most vulnerable households during the Covid lockdown. One woman who we interviewed anonymously told us some of her friends and neighbours are still struggling to repay small cash loans offered to them by paramilitaries at the height of Covid restrictions. They were targeted, she said, by community volunteers delivering food parcels to households who turned out to be loan sharks in disguise. They later returned to those households with offers of instant cash.

Her testimony is backed up by former Justice Minister, Naomi Long, who told us she was approached by churches and food

banks during lockdown with very serious concerns that some community food parcel operations had been infiltrated by loan sharks. She said she reported her concerns to the police but had been called a liar by some within the loyalist community. Almost two years on, fear is palpable in many of Northern Ireland’s most impoverished communities.

People struggling to make ends meet feel trapped and isolated and yet the vast majority of those we spoke to believe that asking the police for help would risk making their situation much worse. They fear serious reprisals for themselves and their families. “Nobody wants to be labelled a tout,” is a common refrain.

Detective Superintendent Emma Neill from the Organised Crime Branch acknowledges that illegal money lending is one of the most under-reported crimes but insists the police are being proactive. “We are trying to progress investigation,” she said. “We have four other prosecutions that have been reported to the PPS and in fact recently we’ve undertaken an operation in the mid and east Antrim area including Newtownabbey as well.”

Despite those operations there have been just two convictions for paramilitary money lending since 2016. Ms Neill said it was essential for the public to engage with the police.

“It is really important that the community engage with the police and help us identify those that are controlling, seeking to control and exploit members of their own community. We will take robust

action and we will investigate where there are allegations, threats, intimidation and violence.”

Last year the Stormont Executive launched a £200K public awareness campaign highlighting the impact of paramilitary moneylenders. The TV ad campaign was part of a long-term £73 million programme launched in 2016 to combat paramilitarism and associated criminality – a joint strategy with the police and HMRC.

As the former lead minister on the task force Naomi Long told us there had been some progress but acknowledged there was still a long way to go.

What’s clear from our investigation and from the volume of people who contacted us anonymously in the days after the broadcast with similar testimony is that there is much work to be done, both at an individual and community level. People want to talk about what’s going on in their communities. They want to break free from the coercive control. Time will tell if the Executive and the relevant agencies can come together to find a way of facilitating that conversation before it’s too late for victims.

• Spotlight: Loan Sharks and Paramilitaries is available to watch on BBC iPlayer –www.bbc.co.uk/iplayer/episode/ m001g75g/spotlight-loan-sharksand-paramilitaries

Ten years ago, when the then Conservative/Liberal Democrat coalition government decided to unleash a slew of ill-advised austerity measures in response to the global financial crisis, I travelled the country for 12 months to gauge the impact of the policies as they were rolled out.

A word that came up repeatedly wherever I went during those months of interviewing was ‘fear’. While talking with disability campaigners in Northern Ireland in early 2013 who were worried about the draconian changes to the benefits system, one person put it particularly bluntly: “I think you cannot underestimate the strength of the word ‘fear’. There’s a lot of fear.”

I had hoped – certainly after a decade during which the so-called ‘belt-tightening’ of austerity had unnecessarily pummelled the most vulnerable groups in society –that such stark assessments would no longer be part of the landscape. Yet, here we are in the midst of an extraordinary Cost of Living crisis that has thrust whole swathes of the population into deep financial difficulty, uncertainty – and fear.

Unparalleled hikes in energy bills along with sharp rises in inflation pushing food prices through the roof have knocked people for six. Food price inflation is running at its highest in a generation and in Northern Ireland has broken the 14 per cent mark. And this comes on top of the damage already inflicted by years of austerity, a punitive and ungenerous benefits system as well as unaffordable rents, stagnant wages and insecure employment for millions of people who are in work.

If the campaigning slogan, ‘heat or eat’ became familiar as austerity tightened its grip, we are now in the kind of uncharted territory where families are often not able to do either. Reports coming thick and fast of kids going hungry, turning up at school with nothing in their stomachs – even eating erasers or hiding in playgrounds from the shame of not being able to afford lunch – are a potent sign of just how bad things have gotten.

Sometimes it is downright disorienting

to look at the dizzying array of statistics that help build a picture of the dire economic situation. Following the Chancellor of the Exchequer, Jeremy Hunt’s Autumn Statement a ‘typical’ household can expect to see energy bill payments capped at £3,000 a year. That’s a whopping average of £250 a month for those ‘typical’ households.

Meanwhile, the Office for Budget Responsibility has forecast a seven per

cent fall in household incomes over the next two years – the largest fall in living standards since records began – along with an increase of more than 500,000 in unemployment. Many small businesses, which employ huge numbers of workers and rely on people spending money with them, are struggling to survive.

The Resolution Foundation has pointed out that average real household disposable incomes are forecast to fall by 7.1 per cent by the end of 2023 – that’s equivalent to £1,700 per household. This is after taking into account Hunt’s steps outlined in the Autumn Statement to counteract some of the worst fallout, such as uprating benefits in line with inflation (10.1 per cent) – albeit not until April.

The backdrop to all of this is an already threadbare social safety net shredded by austerity, and public services buckling under the pressure of cuts and underinvestment rendering them unable to provide the support people need. From jobs to healthcare, to transport to housing, the prospects are bleak.

It needs to be said that the situation the UK is in is not a ‘storm’ that is to be weathered. This metaphor, deployed by far too many in power, is a distraction. It suggests some natural force has hit, to which everyone is equally exposed. As with austerity, the pain is not equally shared.

Also as with austerity we’ve seen over the past year the re-emergence of the (economically illiterate) explanation that the country’s credit card is “maxed out” so there’s no choice but to fill that black hole in the public finances with cuts. The explanation was wrong then and it is wrong now. An economy is not the same as a household budget. There is no such thing as a national credit card.

Multiple crises have collided, some global such as Putin’s war in Ukraine, and some self-inflicted, such as Brexit. But, ultimately, how governments respond to turbulence is a choice. Responding to the global financial crisis with austerity in the UK was not inevitable – it was a political choice. Not staying in the Single Market was a choice. How the

government

I think you cannot underestimate the strength of the word ‘fear’

Award-winning journalist Mary O’Hara who travelled the length of the United Kingdom when writing her book, Austerity Bites, says she is hopeful that there are progressive, radical solutions to the Cost of Living crisis

‘’ Kids going hungry, turning up at school with nothing in their stomachs – even eating erasers or hiding in playgrounds from the shame of not being able to afford lunch – are a potent sign of just how bad things have gotten

addresses the present predicament going forward is also a political choice.

This current crisis, unlike the upheaval of the austerity years when those in society who most required support – the poorest and disabled people for example –were hit the hardest (and frequently labelled as skivers by the press and politicians) the pain is being felt across the population. (The exception are the very wealthy who have enough of a cushion to take a hit, including from the tweaks to tax thresholds announced by Hunt in November).

People with mortgages have seen repeated spikes in interest rates which, combined with inflation and other financial hits, constitute an enormous shock to the average household. Related to this, many renters face increases they can’t possibly afford as buy-to-let landlords move to offset rising mortgage costs.

However, as strange as this might sound given all of this, the sheer scale of the current catastrophe might usher in an opportunity to consider more radical, progressive solutions.

A clear-eyed assessment would suggest that a radical response is not going to be driven by the Official Opposition in Westminster. However, that doesn’t mean

Labour won’t be pushed by public opinion at some point. Labour has been riding high in the polls, mainly due to what the Tories

have and haven’t done rather than what Labour are proposing, but, coming out of the winter of 2022/23 with the public battered and exhausted from a ‘permacrisis’ of financial woes – might something shift? If elected come 2024, could Labour argue that taking more ambitious measures, for example to shore up public services and wages, are part of their mandate?

The optimist could look at the support for unions this past year as an example of shifting sands. If only we’d said ‘enough is enough’ when austerity was first rolled out 10 years ago the scale of today’s catastrophe would be less brutal and the mountain to climb out of it would be less steep.

One thing we know for sure is that sticking plaster politics won’t suffice. The Cost of Living crisis is unprecedented in modern times. There are choices to be made, and for everyone’s sake, they need to be the right ones. Fear is not an option.

• Mary O’Hara is the author of Austerity Bites: A journey to the sharp end of cuts in the UK and The Shame Game: Overturning the toxic poverty narrative.

Food banks, the rising cost of energy and the fear that invades people’s lives during a Cost of Living crisis were all touched upon during my conversation with the poet Henry Normal.

Henry (real name Peter James Carroll), who was born in 1956, is a writer, poet, TV and film producer. His CV includes the Mrs Merton Show, The Royle Family and Alan Partridge. He now spends most of his working time performing his poetry at a range of venues throughout the UK.

“The idea that we’re even discussing food banks in 2022 is crazy, he said. “We’re supposed to be on spaceships now wearing lycra. Every version of the future I’ve watched on TV never had food banks.”

Henry then read me aloud one of his poems, Where Once the Post Brought Promise, when I asked him about the effects of the economic hardship on working-class people. “I think this poem sums it up,” he said. “The idea once of receiving a phone call or getting something through the post always seemed like an exciting thing whereas now you don't want to receive a phone call on a landline, you don't want something to come through the door, because you know it’s a bill.”

Another poem by Henry, How to Make an Underclass, touches on the concept of the deliberate use of stigmatisation. “It was inspired by the Hillsborough football disaster in 1989 (97 fans were killed in the crush),” said Henry. “The prejudice that was shown towards Liverpool fans was such an injustice. We still see signs of that today towards working-class people and refugees.”

Henry, who will perform in Ireland later this year, ended by extolling the importance of public libraries as a haven for communities during these grim times. “Libraries are one of those public spaces where you can read a book or just talk to another human being. I think they are even more important now than when I was a kid.”

Fionnuala Walsh, current Chair of the Funders Forum for Northern Ireland (FFNI), outlines the work to date undertaken by the Forum in supporting communities through the Cost of Living crisis

The Funders Forum for Northern Ireland (FFNI) is made up of representatives of organisations who fund and allocate grants in Northern Ireland. We represent a mix of independent and semi-independent funders and the Forum provides us with a valued space for learning, networking, sharing information and collaboration.

We have been proud to work with the communities across Northern Ireland who stepped up to help people through the Covid pandemic. Those organisations and individuals within the NI Voluntary Community and Social Enterprise (VCSE) sector are once again rallying to support those communities most affected by the current Cost of Living crisis.

The VCSE sector also faces a number of challenges which need to be resolved to allow the sector’s vital work in communities across NI to continue.

There is an urgent need for flexible, multi-year core funding to provide breathing space for organisations to deliver their work. There is also an increasing need for infrastructure to sustain small grassroots organisations and space for sectoral leaders to plan for the future.

Last autumn, Forum members met to consider ways in which we could best support communities impacted by the

Cost of Living crisis. Through our conversations with the sector, we heard that many organisations were experiencing increased demand for services, challenges in recruitment and retention of staff while also having to deal with fast-rising, unsustainable core running costs.

These issues were perpetuated by the ongoing effects of the pandemic including relatively low-income generation via fundraising and donations and a critical loss of volunteers.

By way of a response, we identified a number of key actions within our own organisations and as a collective, including more flexible funding and uplifts to existing grantees. A more detailed outline of commitments can be found in our Cost of Living position statement on our website.

Our annual conference last November also gave us a chance to consider the impact of the shifting economic, political and cultural landscape in Northern Ireland. We recognised that the challenges arising through the current crisis are not short-term, but part of a longer-term period of austerity.

There was much discussion about the impact of widespread cuts to government and departmental budgets and the imminent ‘funding cliff edge’ arising due to the closure of the European Social Fund.

We also noted the looming mental health and debt crisis as a result of poverty and austerity and wider global issues such as the climate crisis, requiring both global and local solutions.

We identified a number of broader, longer-term recommendations. These include more strategic partnership working with each other and government departments; the importance of addressing the root causes of issues as well as the symptoms; a focus on supporting digital connectivity; an increased investment in research and advocacy; and clearer commitments to sustainability and climate action.

We have much work to progress as a Forum which will be informed by the conference findings and ongoing conversations with each other and the VCSE sector. We recognise that the sector is operating in a fast-changing and incredibly challenging environment; however we are committed to working together for greatest impact for the sector in Northern Ireland.

• More information on the Funders Forum, Cost-of-Living Position Statement and Conference Summary Report can be found here:

https://fundersforumni.org/

Vulnerable women are still at risk following the closure of the Regina Coeli hostel in west Belfast last year. Their situation has become even more precarious in the midst of a Cost of Living crisis and an increase in homelessness.

The hostel, which was run by a volunteer management committee with links to the Legion of Mary, cared for women from across Northern Ireland for decades.

The Department for Communities (DfC) and the Northern Ireland Housing Executive (NIHE) gave assurances that “expanded service for homeless women, including a women-only hostel in the city,” would be opened in May last year. The women are still waiting for this promise to be kept.

Actor and writer Louise Matthews, with the support of the Unite trade union and Kabosh Theatre Company, is now set to shine an artistic spotlight on the women with mental health and addiction issues living on the streets.

“This play will give a voice to the women who lived in Regina House,” said Louise. “It will show the struggle that they and those who worked there underwent to try and save the hostel.

“The play, which will be called Not On Our Watch, will be about women rising up on behalf of our women. It’s a call to activism, a call to say, ‘You are not alone’.

“When we unite together and stand together for a common cause then we can be successful. I know that each individual worker from Regina Coeli hostel felt isolated and frightened about losing their jobs.

“There will be three women in the play who will be performing a range of characters,” said Louise. “I feel so passionately about the fact that the only safety net that existed for these women and the whole of Northern Ireland is gone. Three women who stayed in the hostel have since died on the streets of Belfast.”

the women who fought back against closure of vital hostelRegina Coeli hostel in west Belfast Actor and writer Louise Matthews

‘’

The phrase ‘Cost of Living crisis’ has started to take on a strange sense of the mundane. I’d say some of us don’t even look up now when we hear it in conversation. More bad news to add to the other bad news.

According to the sight loss charity RNIB: “Even before prices began to rise, one in five blind and partially-sighted people said they had some, or great, difficulty in making ends meet. The Cost of Living crisis has made this situation worse.

People with sight loss are also more reliant on benefits than the general population as only one in four registered blind and partially-sighted people of working age are in employment.”

I want to try and refocus the Cost of Living conversation in terms of what I know. My lived experience as a blind dad, husband and consumer.

I’m blind. As blind as it gets. I can’t see a thing. I live in Belfast with my wife and kids. We both work and for that I’m grateful daily. Are we comfortable? Many would say we are, but I don’t feel that comfortable at the end of each month.

There’s no disputing that life costs more if you live with a disability.

I suppose where I’ve felt it the most is the endless shelling out on taxi fares. Some might say that taxis are a luxury and if you don’t like the prices then get out of the car. But that’s to totally dismiss those of us for whom taxis are essential transport. It’s easy to be blasé about taxis when you’ve got two cars parked in the driveway but for me, and many like me, jumping in a taxi two or three times a day to do the school runs, go to work, and everywhere else –those fares mount up.

Or maybe it’s the increasing costs of assistive technology which blind or

partially-sighted people need to live independently. Can we all now agree that decent, reliable internet connection isn’t a could have, it’s a must have? It’s essential to living independently when you’re blind.

Buying stuff online is sometimes the only way people with little or no eyesight can get hold of certain goods or services.

I’ve found that reductions or limited special offers are often presented in a way that most blind people completely miss.

This is either due to websites that are inaccessible or if you are in an actual shop, special offers are in small print, or in a separate area of the shop that I don’t know about because I can’t see it.

We live in a sighted world for sighted people. The Cost of Living crisis public conversation is dominated by those who shout the loudest but if I have to sit and listen to yet another debate featuring a group of vehicle owners collectively lamenting the soaring cost of fuel at the pumps, I’ll scream.

Our new addition to the family, little Eunan, was born in September last year so I’m really conscious of the amount of gas we’re burning for heating now. With a newborn in the house, sticking a jumper on and keeping the doors closed just won’t cut it. As both my wife and I are visually impaired, we often ask Oisin, our six-yearold, to read the display on our pre-paid gas meter. I like to think it helps with his reading too. Well, recently his reading has come on leaps and bounds due to the number of times we’re needing him to ‘go out and check the gas’.

In the face of this Cost of Living crisis, I’m not saying that blind people have it harder than everyone else or that blind people need more money than anyone else. What I am saying though is that once again, as with the Covid pandemic and many times before, when there’s a crisis that befalls us all, the voices and concerns of people with disabilities are scarcely heard within the mainstream media maelstrom.

We’re all affected by this financial plague right now, but it’s time society listened to our shouts as well.

Amid the Cost of Living hardship, Joe Kenny, who has been blind since the age of five, highlights the additional financial struggles faced by visually-impaired people in Northern Ireland ‘’

People with sight loss are also more reliant on benefits than the general population as only one in four registered blind and partially sighted people of working age are in employment

One remark stood out from my interview with Unite Regional Coordinating Officer Susan Fitzgerald at the trade union’s offices on the Antrim Road in Belfast.

“It’s more than a Cost of Living crisis, it’s a Cost of Surviving crisis for many of our members at the moment,” replied the north Dublin-born activist when I asked her about the effects of the steep rise in food and energy bills.

“In a survey carried out by Unite recently, one young trade union member, who has two children, said she hasn’t had heating in her house since the end of the pandemic in 2021. She has an oil tank but can’t afford to fill it. Other members are struggling to keep a roof over their heads.

“Even workers in decent, well-paid jobs, are finding it very difficult at the moment. One worker told us that he had broken up furniture in order to light a fire in his house.

“Last year alone Unite were involved in 450 disputes, many of those were in Northern Ireland. One thing that really shocked me was the word ‘destitution’ being mentioned again.

“We got sight of a report that came from the very senior levels of the Civil Service in Northern Ireland which forecasted that they were going to see a 67 per cent rise in destitution.”

A stark warning from the head of a leading charity last year also predicted that 76 per cent of households in Northern Ireland was expected to be in fuel poverty by the start of this year.

According to research by the University of York, the region hardest hit will be Northern Ireland with 76.3 per cent of families battling to make ends meet, followed by Scotland at 72.8 per cent, the West Midlands (70.9 per cent) and Yorkshire and the Humber (70.6 per cent).

Kevin Higgins, Advice NI Head of Policy, has warned that many families in Northern Ireland face “destitution” if solutions are not put in place to address the Cost of Living crisis.

“I just thought that was absolutely staggering,” said Susan. “It should ring every alarm bell. The word ‘destitution’ is like something from the end of the last century. You think of children in black and white photographs with no shoes on their feet. Are we expected to live with that? It’s just outrageous,” said Susan with anger rising in her voice.

I asked her what did she think was needed to effectively tackle the Cost of Living crisis?

“We need to take the supply of energy back into public control,” replied Susan. “It needs to be controlled for the public good and in a way that it doesn’t wreak havoc on the environment. You have to take profit out of the equation.

“The National Health Service is also at breaking point. We need investment in it if it is going to survive.

“I don't have any faith in the Labour Party under Sir Keir Starmer and I supported a lot of what Jeremy Corbyn stood for,” added Susan.

“What an indictment of capitalism, that the care of some of the most vulnerable people in our society is seen as a money-making opportunity.

“I think people are decent. I think people want a decent society. It just doesn't compute to me that we work and toil our whole life. And it’s getting harder and harder, and you’re doing it to make money for someone else. I just think that’s very wrong.”

We shook hands before Susan headed off to another meeting. Her passion and commitment in trying to improve workingclass people’s lives can’t be faulted.

“This grotesque greed is punishing the poorest and most vulnerable people while destroying our only common home. I urge all governments to tax these excessive profits and use the funds to support the most vulnerable people through these difficult times.”

Not the words of a left-wing politician or trade union leader, but those of UN General Secretary, António Guterres, calling out the obscene profits made by oil and gas corporations. Profits at the world’s largest fossil fuel companies have soared to nearly £150bn so far this year, and while some of the increase in price has to do with a decline in the supply of Russian oil and gas due to the war in Ukraine, this does not account for the increase in the price which has benefitted these corporations and caused misery for millions of people.

BP revealed its profits had nearly tripled in the past three months, surging to £7.1bn compared with £2.9bn a year earlier. In total, the world’s five biggest fossil fuel corporations saw their combined profits increase to £150bn last year. The figures come as the UK government said it is considering tax rises for millions of households and preparing the population for another period of austerity, with public-sector pay expected to be capped at just 2% while inflation is at 11 per cent, so effectively imposing a nine per cent pay cut on public sector workers such as nurses, care staff and firefighters.

And while a windfall tax has been imposed, this has been set at a low level and has a loophole that undermines the levy by enabling these companies to pay the bare minimum if they invest in more gas and oil projects. Yes, you read that correctly, in the context of the climate crisis, a crisis directly caused by the burning of coal, oil and gas, the UK government is effectively incentivising more investment in extracting fossil fuels. So the government’s response is

both worsening the climate crisis and failing to support people faced with higher fuel bills.

But it sadly gets worse, and the energy crisis has demonstrated the need to urgently transition beyond fossil fuels as quickly and equitably as possible. The reason for this is simple. Energy ‘hides in plain sight’ as the main input that enables and powers our economies, societies and ways of life to continue. To understand this, see if you can provide an answer to

the following question: can you name one thing in the room where you are reading this that has not been made, in whole or part, or transported there in whole or part, without the use of fossil fuels? Hard, isn’t it? The reality is that everything in our modern societies, from the electricity we use, the food we eat, how we heat our homes, how those homes are constructed, how to travel etc, is largely dependent on burning fossil fuels.

In other words, once the price of energy increases, almost everything else increases in price. This is what is driving inflation not wages as some in the rightwing media and right-wing politicians suggest. Wages are chasing prices not the other way around. And so in this way we can see that inflation, the increase in the cost of living, is caused by profiteering in the energy sector (and in other sectors such as food) with companies and governments justifying or explaining price increases by blaming it on ‘the war in Ukraine’.

And even if some of the inflation we are seeing is due to the supply chain shocks of that war, why is it the impact is borne by ordinary citizens having to pay more for essential goods and services, and not shareholders of fossil fuel corporations receiving lower dividends? It is often said that it is only when the tide goes out do you know who has been swimming naked. The cost of profiteering crisis has revealed how vulnerable so many of our citizens are.

The first job of government is to protect citizens, especially the most vulnerable. The UK and other governments in failing to do this not only indicate they would rather let ordinary people suffer than heavily tax or nationalise fossil fuel corporations, but also suggests that perhaps what we are witnessing and experiencing in this cost of profiteering crisis is not a crisis at all. Perhaps it is a robbery.

It’s

Professor John Barry from Queen’s University writes how the big energy firms have enjoyed bumper profits whilst hundreds of thousands of workers have struggled to pay their bills ‘’

Why is it the impact is borne by ordinary citizens having to pay more for essential goods and services, and not shareholders of fossil fuel corporations receiving lower dividends?

We are in danger of sleepwalking into a narrative which fails to recognise the structural problems underpinning poverty and income inequality. We are not in a ‘Cost of Living crisis’, instead, we face an ‘income crisis’. The people struggling financially before inflation and fuel costs rocketed will be the same individuals facing difficulties once these costs ease. What the increase in the cost of living has done is to cast the net wider leaving those in the bottom half of household income facing serious problems in making ends meet.

Over a decade ago, the mantra under George Osborne as Chancellor was that ‘we were all in it together’ when facing austerity. We were not. The Northern Ireland Human Rights Commission published its cumulative impact assessment of tax and social security reforms by household income and other factors in November 2019. The impact was that those in the bottom 20 and 30 per cent of household incomes had done worst losing around £900 a year. The bottom 10 per cent had lost slightly less due to the increase in take-up of Universal Credit. In contrast, those in the top 20 and 30 per cent of incomes had gained over the decade, and the top 10 per cent had made small losses, largely due to tax changes in occupational pensions.

The driver for the losses in income among poorer households was the greater reliance on social security benefits and tax credits which had been reduced in real terms as cuts were made to workingage benefits.

Bearing this in mind, the social security mitigations review panel set up by former Minister Deirdre Hargey at the Department for Communities (DfC) decided that any recommended additional mitigations focussed on working-age households on the lowest incomes. By doing this, the panel would substantially capture women, households with adults

and children with disabilities, carers, and other disadvantaged groups.

The centrepiece of our recommendations is the offsetting of the two-child limit in UC and Child Tax Credit and Housing Benefit only claims. Our analysis shows that this policy hits the poorest families in and out of work the hardest and if unchecked, would lead to further damaging rises in child poverty. The two-child limit leads to a loss of almost £60 a week per child, far outstripping any money coming from UK government-led support for energy and other costs.

The proposals also provide for a better start in life for children through lump sum payments at key child

development milestones, cover the recognition of the work of carers through a payment made twice a year alongside a young carer’s payment and an increase in the earnings allowed for Carer’s Allowance and support for people in work and on low pay acknowledging that NI remains behind the rest of the UK in levels of childcare support outside the social security system.

Further recommendations provide help with winter fuel bills in years to come for low-income households and those families with a disabled child at home, payments to encourage young people into work and to boost the work of independent advice agencies, particularly in rural areas.

The total cost of the package is £140 million in the next financial year rising to £150 million the year after. This must be considered alongside long overdue strategies planned by DfC to tackle poverty and inequality. The recommendations meet key goals in the NI Executive’s Programme for Government including giving children the best start in life, creating a caring society and supporting people to enjoy healthy lives.

Effective social security support can reduce poverty and spending elsewhere including on health. We should see the panel’s recommendations as a long-term investment so that people on low incomes are sustained once the current spotlight on the cost of living shifts to other issues.

• Les Allamby was the chair of the independent review panel on social security mitigations and is now the Discretionary Support Commissioner for Northern Ireland. The report is available on the DfC website at www.communitiesni.gov.uk/publications/welfare-mi tigations-review-independentadvisory-panel-report

A long-term investment is needed so that people on low incomes are sustained

Les Allamby, who led an expert panel which looked into welfare mitigations, argues that effective social security support can reduce levels of poverty in Northern Ireland ‘’

The people struggling financially before inflation and fuel costs rocketed will be the same individuals facing difficulties once these costs ease

Facebook pages detailing essential items. Huge wire metal baskets at the checkouts. Shelves of green plastic crates in the background of a TV interview with a tired and exasperated volunteer. It’s difficult to imagine a Northern Ireland where these images are not commonplace.

The first Trussell Trust food bank in Northern Ireland opened in 2011. Like many other communities responding to the impact of austerity, a church in Newtownards wanted to respond to people in crisis and joined the Trussell Trust network.

In 2022, there are 22 food banks in our network that also manage a further 23 food bank centres nearby. In addition to these, there are another estimated 20-25 independent food banks across Northern Ireland. A grassroots crisis support infrastructure has rapidly established itself – free from public funding, in response to government policy rather than supported by it.

Food bank use in Northern Ireland has risen much faster than any other part of the UK. In the first six months of this year, 10,000 people accessed a Trussell Trust food bank here for the first time. Earlier this year our food banks experienced their busiest ever August and September. Being forced to rely on emergency food is a deeply traumatic experience that is affecting more households than ever.

We know from speaking to people who are referred to food banks that the main reason they are forced to use our services is because of a lack of income.

Almost half of the people referred to a Trussell Trust food bank owe money to the Government. Emerging data also shows that one in five households referred to a food bank has someone at home who is working.

Ending the need for food banks is a priority for the Trussell Trust and must be a shared civic society goal. Policy solutions developed with people of lived experience are within reach but the political will is weak. Our food banks are only as effective as their referral partners, so strong referral pathways to well-funded local services can ensure that people receive the support they need earlier so they don’t have to be referred to a food bank.

Cash-first approaches put money into people’s pockets so they can afford the essentials themselves. There are already proposals on the table to improve existing schemes like the discretionary support fund and welfare mitigations. There is also evidence from the impact of the child payment scheme in Scotland and the recent cash-first pilot with Leeds City Council that food bank use can be reduced if people in financial crisis are supported with dignity, flexibility, choice, speed and convenience.

People working in food banks are tired, weary but most of all angry. As we navigate winter and an uncertain new year they are in a constant state of “brace” position for a time when they expect to be overwhelmed by demand. This is an exhausting place to be.

A photo opportunity with a smile and a pat on the back from a politician is cold comfort. Constituency offices are some of the biggest referrers to food banks. Food banks and other providers of crisis support are going beyond their own capacity to meet rising needs yet elected representatives are not fully utilising the powers at their disposal to prevent people from having to be referred in the first place.

As food banks are needed more than ever in this cost of living emergency, and the language of “warm banks” enters common parlance, now is the time for action – for a Northern Ireland where everyone can afford the essentials for themselves.

If not now, when?

Everyone living in Northern Ireland should be able to afford the essentials they need

Jonny Currie, Northern Ireland Network Lead at the Trussell Trust, says that being forced to rely on food banks is a traumatic experience that is affecting more households than ever ‘’

A photo opportunity with a smile and a pat on the back from a politician is cold comfort

In February last year the independent review of Northern Ireland’s Children’s Social Care Services, commissioned by Robin Swann who was then the Minister of Health, started. I am the independent reviewer and my report will be completed and published in June 2023.

And a sensible starting point for the review is to recognise that it has been a tough time for many children and families in Northern Ireland, and for those who seek to help them when lives get difficult.

There is still the continuing impact of the coronavirus pandemic which curtailed children’s schooling, hit the incomes of lots of households, escalated further pressures on and delays within health and other services, including children’s social care, and with families of, for example, disabled children left without respite care.

It may be timely to recall how until quite recently we were all encouraged to clap our thanks and bang our saucepans in recognition of nurses and other health and public and private sector key workers who were at significant personal risk while they sought to look after us and to keep essential services running.

They included teachers who were still in schools for the children of key workers who were at work, social workers who were visiting children and families when there were significant concerns, and foster carers and residential children’s homes workers caring for children and young people who could not stay within their families.

But memories seem to be remarkably short as these same workers are now seeing their real-term wages dramatically

reduced and are taking action as their income – which was never that high – and the services they provide for us all deteriorate amid the financial crisis across the UK which, at least in part, has been politically created. Clouds of dismay and anger are now shading out the rainbows which had been painted to thank NHS and other key workers.

So maybe as we pass a picket line it might be timely to honk the horn or give a clap to show that there is at least some memory of the commitment given by those who now see no alternative to being on strike and who are concerned about the cuts and deterioration in the services

they would want to provide – in hospitals, in schools, and across communities.

It is in this context that the review of children’s social care services is being undertaken and with the vacuum of no functioning political leadership in Northern Ireland, increasing poverty caused by the Cost of Living crisis, and public and community and voluntary services being cut.

And in addition to the UK-wide Cost of Living crisis and the absence of a political executive in Northern Ireland to mitigate the awful impact of increasingly pervasive and intense poverty, there is also for Northern Ireland the legacy of trauma from the Troubles, and in some communities and for some children and families today, the impact of current threat and fear which continues to generate trauma.

The review of children’s social care will be making recommendations to help tackle the problems and pressures within services for children and families and to assist the impressive dedicated and skilled workers I have been meeting who, whilst doing much exceptional work, are often hindered by too high workloads and not enough resources.

But recommendations will need to be converted into action if they are to have an impact. This will require an end to the current political impasse and a willingness to reverse the current direction of travel of more poverty, more children and families in difficulty, with less help being provided, and with those who seek to help given less recognition. Maybe it is time to bang those saucepans

again.

Perhaps it is time we started banging those saucepans

Professor Ray Jones, who is leading Northern Ireland’s independent review into children’s social care, says his recommendations will need to be converted into action if they are to have an impact on the lives of those who are struggling

‘’ Clouds of dismay and anger are now shading out the rainbows which had been painted to thank NHS and other key workers

Save the Children, and many other organisations, support the introduction of a Northern Ireland Child Payment because we know that it would dramatically improve children’s lives.

It’s not a complicated idea. It’s about getting cash into families’ pockets, targeting financial support to children most in need, to lift them out of poverty, and help families manage the cost of living when wages and other benefits are failing to keep pace with inflation.

It’s also not a new idea: in Scotland, the Scottish Child Payment is a centrepiece of the Scottish Government's commitment to lift children out of poverty, and the early evidence shows that it is helping families manage this Cost of Living crisis, and is helping lift children out of poverty. In Northern Ireland, it’s a key recommendation of the Anti-Poverty Strategy Advisory Group and of the Gender Equality Strategy Expert Panel.

But it’s an idea that would make a historic impact on children in Northern Ireland. A £20 weekly Child Payment would lift 27,000 children out of poverty and protect tens of thousands more children from being swept into poverty. Had it been in place now, as it is in Scotland, it would have dramatically reduced the impact of the Cost of Living crisis on children. But it’s not. Instead, children and their families are being left to fend for themselves during the worst Cost of Living crisis in decades,

having hardly recovered from a pandemic.

In our work, we see the impact that this is having on children. In the last several

months, with our partners, we have supported hundreds of children whose families have been plunged into emergency situations during this Cost of Living crisis. It’s not a choice between heating or eating for families we work with; they have no money for food or heating.