Transit heads again ask state for funding help

RTA Board Chair Kirk Dillard, a former state senator, said in Tuesday’s hearing.

It was standing room only in a downtown Chicago committee hearing Tuesday as activists, transit experts and lobbyists hung on the words of the region’s transit agency chiefs.

Public transit has become an increasingly contentious issue in Chicagoland as the Regional Transportation Authority – the funding body which oversees Pace suburban bus routes, Metra regional rail lines and the Chicago Transit Authority – has reported a looming “fiscal cliff” in 2026.

While the agencies are currently buoyed by pandemic-era funding and temporary allowances in state law, the agencies will face a cumulative annual budget gap of $730 million in operating costs beginning in 2026, according to the Chicago Metropolitan Agency for Planning.

“The preliminary analysis from our consultant shows that the fiscal cliff scenario, without state funding assistance, could wipe out 30 to 40 percent of the service in northeastern Illinois,”

Under that worst-case projection, the fiscal cliff would cause a $2.4 billion drop in regional GDP in the first year and impact up to 25,000 jobs. But Dillard painted a much rosier picture if the state increases its annual support for the transit agencies: $2.5 billion annual growth in GDP and the addition of 27,000 new jobs.

“You’ve got a choice to make,” he told lawmakers Tuesday.

But some lawmakers in the General Assembly are unwilling to give carte blanche to the transit agencies, which have been criticized for service cuts, safety issues and poor workforce development since the early days of the pandemic.

Sen. Ram Villivalam, D-Chicago, the chair of the Senate Transportation Committee, called Tuesday’s hearing – the first in what will be a series meant to investigate possible improvements to public transit in Illinois. He said there will be “no votes

Gov. JB Pritzker is pictured in a file photo in his Illinois State Capitol office. The governor traveled to the During a Senate Transportation Committee hearing Tuesday, Regional Transportation Authority Board Chair Kirk Dillard looks at the heads of Chicagoland’s transit agencies: Metra CEO James Derwinski, Chicago Transit Authority President Dorval Carter and Pace Executive Director Melinda Metzger. (Capitol News Illinois photo by Andrew Adams)

Special exhibit at oswego’s Little White School Museum

Each Sunday within a few years of its inception in 1954, the Oswego Drag Raceway was drawing three times the village’s total population to the quarter-mile asphalt strip on the Wally Smith farm on U.S. Route 34 a mile and a half west of Oswego.

The Little White School Museum, 72 Polk Street (Polk at Jackson) in Oswego is bringing a bit of that exciting national and regional drag racing history back to life with a new, temporary exhibit, “SUNDAY! SUNDAY! SUNDAY!” available now through the end of August.

Admission to the special exhibit is free.

The title for the exhibit was inspired by commercials on popular “Top 40” AM radio stations including WLS, WJJD, and WCFL featuring announcer Jan Gabriel shouting “Sunday! Sunday! Sunday!” before reporting which famed drag racers and dragsters would appear during that weekend’s races. At a time when Oswego’s population was around 1,200 residents, the drag raceway regularly drew some 4,000 spectators each Sunday to see such well-known drag racers as Arnie “The Farmer” Beswick and Art Arfons and such famed dragsters as Arfons’ jetpowered “Green Monster,” not to men-

tion well-known local racers including Al Thompson from Aurora’s Al’s Speed Shop, and Oswego’s own Bob Mead.

The exhibit includes a variety of drag raceway memorabilia including trophies, drag racing magazines featuring the Oswego Drag Raceway, photos of dragsters and drag racers, and memorabilia from pit passes to tee shirts.

The exhibit was mounted by museum manager Anne Jordan with the help of museum assistant Emily Dutton.

“We’re always seeking more drag raceway memorabilia,” said museum director Roger Matile. “The drag raceway had a huge impact on the Oswegoland area for a quarter of a century, and we’re trying to keep a little of its history alive. We’re hoping visitors also take in the drag raceway exhibit in the museum gallery when they stop by as well.”

Museum admission is free. Regular hours are Thursdays and Fridays from 2 to 6:30 p.m.; Saturday and Sunday 9 a.m. to 2 p.m.; and Mondays, 4 to 9 p.m. The museum is closed to visitors on Tuesdays and Wednesdays.

Built in 1850 as a Methodist-Episcopal church, converted into a school in 1915, and fully restored largely by volunteers between 1977 and 2002, the

museum is a cooperative project of the non-profit Oswegoland Heritage Association and the Oswegoland Park

District.

For more information, call the museum at 630-554-2999, send an email

to info@littlewhiteschoolmuseum, or visit their website at www.littlewhiteschoolmuseum.org.

for funding” unless the general assembly and transit board first address service issues and governance reforms.

Earlier this year, Villivalam proposed legislation that would consolidate the four agencies into one organization.

This was in line with recommendations that the Chicago Metropolitan Agency for Planning, or CMAP, pitched to Villivalam and other lawmakers late last year. These recommendations were given further credence in April when the Civic Federation, an influential Chicago think tank, proposed similar reforms.

Both proposals provided options for either combining the four agencies or giving the RTA, or a new oversight agency, more authority to control regional transit policy.

But the heads of the

Chicagoland agencies balked at the idea of major reforms on Tuesday.

“We all want to do the best job we can,” Pace Executive Director Melinda Metzger told the committee. “I do not believe that combining us into one organization will make us better.”

Metzger said each agency has a board that includes local representation and that she believed “the needs of suburban areas will not be met as well as they’re met right now” if governed by a single agency.

CTA President Dorval Carter also defended the current system.

“The model that’s been set up for governance today didn’t come by by accident,” Carter said. “It was a really hardly negotiated compromise between the need for accountability and the need for local control.”

Metra CEO James Derwinski

also noted that many of the improvements that transit advocates seek are a funding issue, not an oversight one.

“If we adequately fund the system, the operators can do the right things,” he said.

Representatives of business groups spoke to lawmakers about transit’s economic impact, but they also mostly discussed the need for reform.

Jack Lavin, head of the Chicagoland Chamber of Commerce, echoed Villivalam’s call to improve service and governance before providing agencies with new revenues. He urged caution around potentially increasing taxes and called sales tax increases and congestion taxes “job and growth killers.”

Sen. Don DeWitte, R-St. Charles, the committee’s Republican spokesperson and former RTA board member, said he agreed with Lavin’s comments

around taxes.

“I think we need to be very careful about putting additional burdens on taxpayers or riders within the RTA system,” DeWitte said.

But DeWitte also noted he hopes to further explore the idea of increasing state or federal funding, noting that the state contributes 17 percent of RTA’s revenues, while other states contribute significantly more to large transit systems. Philadelphia’s transit system gets half of its funding from the state of Pennsylvania, according to a CMAP analysis cited by DeWitte during discussion.

“That’s an area that I think we are woefully shy on,” DeWitte said.

Transit advocates also spoke to the need for governance reform.

Micheál Podgers, a policy lead with the transit advocacy organization Better Streets Chicago,

said he wasn’t surprised by the agency heads’ lack of enthusiasm for reform.

“I will say, though, I was heartened to hear that, overall, it seems they’re in favor of increasing investment in transit, even though certainly some of the more conservative speakers and conservative members of the Senate were a little bit tentative on increasing taxes,” Podgers said.

Tuesday’s hearing will be followed up with five additional hearings around Chicagoland and in Springfield in the coming weeks. The hearings, according to Villivalam, will inform some kind of proposal by lawmakers’ spring session next year.

“We definitely need to take action, I think, at least 9 to 12 months before the fiscal cliff of early 2026,” he told Capitol News Illinois.

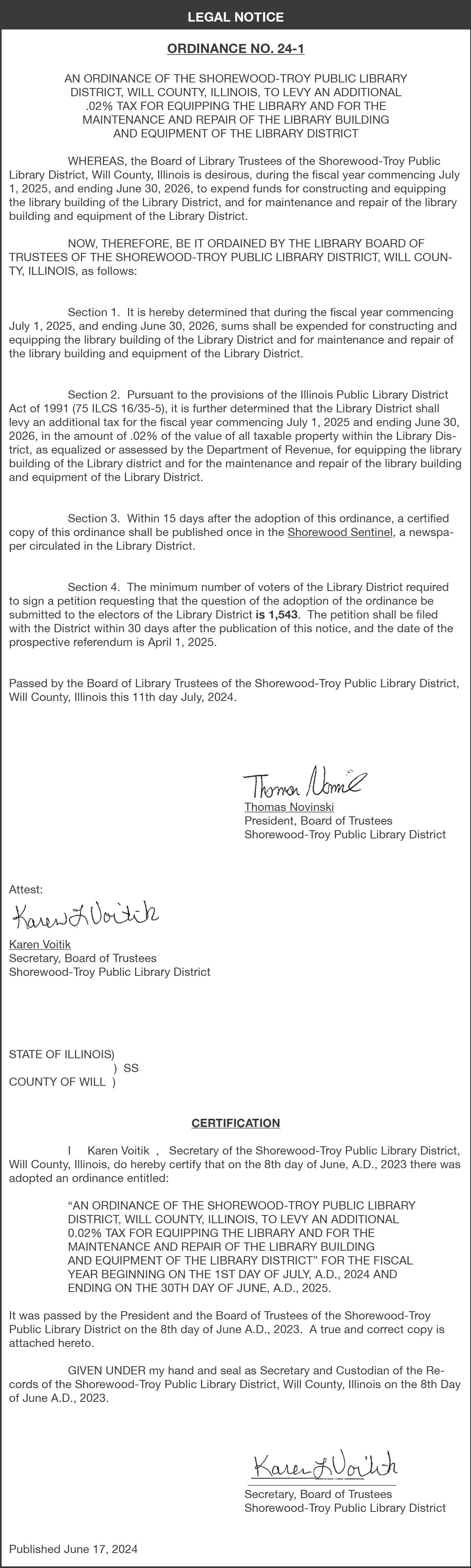

LEGAL NOTICE

TO: Charles D. Edwards, Charles F. Edwards, Charles Edwards, Unknown Heirs and Legatees of Charles D. Edwards, Unknown Heirs and Legatees of Sybil Edwards; Will County Clerk, Beaconridge Improvment Association RA: KarlaV. Rodas, Ian Edwards, David Edwards, Jacqueline Thorpe; Occupant, 461 Salem Square, Bolingbrook, IL; Parties in occupancy and possession; any unknown owners and occupants. TAX DEED NO. 2024TX000164. FILED: May 31, 2024. TAKE NOTICE. County of Will. Date Premises Sold 1/10/2022. Certificate No. 20-00924. Sold for General Taxes of (year) 2020. Sold for Special Assessment of (Municipality) and special assessment number N/A Warrant No. N/A Inst. No. N/A. THIS PROPERTY HAS BEEN SOLD FOR DELINQUENT TAXES. Property located at. 461 Salem Square, Bolingbrook, Illinois. Legal Description or Property Index No. 12-02-14-103-0430000. This notice is to advise you that the above property has been sold for delinquent taxes and that the period of redemption from the sale will expire on November 1, 2024. The amount to redeem is subject to increase at 6 month intervals from the date of sale and may be further increased if the purchaser at the tax sale or his or her assignee pays any subsequently accruing taxes or special assessments to redeem the property from subsequent forfeitures or tax sales. Check with the county clerk as to the exact amount you owe before redeeming. This notice is also to advise you that a petition has been filed for a tax deed which will transfer title and the right to possession of this property if redemption is not made on or before November 1, 2024. This matter is set for hearing in the Circuit Court of this county in the Will County Courthouse, 100 West Jefferson Street, Joliet, IL 60432, on 11/21/2024 at 9:00 AM in room 905. YOU ARE URGED TO REDEEM IMMEDIATELY TO PREVENT LOSS OF PROPERTY. Redemption can be made at any time on or before November 1, 2024 by applying to the County Clerk of Will County, Illinois at the Office of the County Clerk in Joliet, Illinois. For further information contact the County Clerk. ADDRESS: 302 N Chicago St, Joliet, IL 60432. TELEPHONE: (815) 740-4615. Scribe Funding LLC, Purchaser or Assignee. Dated: July 1, 2024.

Published July 4, 2024, July 11, 2024 & July 18, 2024

LEGAL NOTICE

TO: Mussarat Khokhar, Nasir Khokhar, Mussarat Khohar, Dawn Gallo; Will County Clerk, Mashal Alia Khokhar, Amber Khokhar, Shelby Smith, Derrick Smith, Amber Khokhar; Occupant, 533 Thomas Road, Bolingbrook, IL; Parties in occupancy and possession; any unknown owners and occupants. TAX DEED NO. 2024TX000160. FILED: May 31, 2024. TAKE NOTICE. County of Will. Date Premises Sold 1/10/2022. Certificate No. 20-00829. Sold for General Taxes of (year) 2020. Sold for Special Assessment of (Municipality) and special assessment number N/A Warrant No. N/A Inst. No. N/A. THIS PROPERTY HAS BEEN SOLD FOR DELINQUENT TAXES. Property located at. 533 Thomas Road, Bolingbrook, Illinois. Legal Description or Property Index No. 12-02-02-303-034-0000. This notice is to advise you that the above property has been sold for delinquent taxes and that the period of redemption from the sale will expire on 11/4/2024. The amount to redeem is subject to increase at 6 month intervals from the date of sale and may be further increased if the purchaser at the tax sale or his or her assignee pays any subsequently accruing taxes or special assessments to redeem the property from subsequent forfeitures or tax sales. Check with the county clerk as to the exact amount you owe before redeeming. This notice is also to advise you that a petition has been filed for a tax deed which will transfer title and the right to possession of this property if redemption is not made on or before 11/4/2024. This matter is set for hearing in the Circuit Court of this county in the Will County Courthouse, 100 West Jefferson Street, Joliet, IL 60432, on 11/21/2024 at 9:00 AM in room 905. YOU ARE URGED TO REDEEM IMMEDIATELY TO PREVENT LOSS OF PROPERTY. Redemption can be made at any time on or before 11/4/2024 by applying to the County Clerk of Will County, Illinois at the Office of the County Clerk in Joliet, Illinois. For further information contact the County Clerk. ADDRESS: 302 N Chicago St, Joliet, IL 60432. TELEPHONE: (815) 740-4615. Oakwood Real Estate LLC, Purchaser or Assignee. Dated: July 1, 2024.

Published July 4, 2024, July 11, 2024 & July 18, 2024

DEED NO. 2024TX000176

TAX

FILED June 21, 2024

TAKE NOTICE

TO: LAUREN STALEY FERRY, WILL COUNTY CLERK; CASIMIRO HERNANDEZ; CLASSIC INVESTMENTS, LLC; GABRIEL MARTINEZ; BEACONRIDGE IMPROVEMENT ASSOCIATION; OCCUPANT; MARTINA RIVERA; UNKNOWN OWNERS OR PARTIES INTERESTED; AND NONRECORD CLAIMANTS.

This is NOTICE of the filing of the Petition for Tax Deed on the following described property:

PARCEL 1:

LOT 2 AREA 2 UNIT 4 IN BEACONRIDGE SUBDIVISION UNIT NO. 2, BEING A SUBDIVISION OF PART OF THE NORTHWEST QUARTER OF THE NORTHWEST QUARTER OF SECTION 14, TOWNSHIP 37 NORTH, RANGE 10 EAST OF THE THIRD PRINCIPAL MERIDIAN, ACCORDING TO THE PLAT THEREOF RECORDED AS DOCUMENT NO. R67-5586 AS RESUBDIVIDED BY DOCUMENT NO. R67-10295 AND AS RESUBDIVIDED BY DOCUMENT NO. R684764.

PARCEL 2:

EASEMENT APPURTENANT TO THE ABOVE DESCRIBED REAL ESTATE AS DEFINED IN DECLARATION DATED AUGUST 24, 1967, AND RECORDED AUGUST 25, 1967 AS DOCUMENT NO. R67-12143 AND DECLARATION OF INCLUSION DATED NOVEMBER 24, 1967 AND RECORDED NOVEMBER 27, 1967 AS DOCUMENT NO. R67-18478, WILL COUNTY, ILLINOIS. Parcel Index Number 12-02-14-101-010-0000

On October 31, 2024 at 9:00 a.m., Courtroom 905 the Petitioner intends to make application for an order on the petition that a Tax Deed be issued. The real estate was sold on January 10, 2022 for general taxes of the year 2020. The period of redemption will expire October 25, 2024. Heather Ottenfeld, Attorney for Petitioner (847) 721-4996 Cert. # 20-00917 8147-944043

Published 7/4/2024 , 7/11/2024, 7/18/2024