Copyright @ 2019 Business24

Limited All Rights Reser ved

Your subscription along with the suppor t of businesses that adver tise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed.

We value your suppor t and loyalty

Contact : editor@business24 com gh

Newsroom: 030 296 5315

Adver tising / S ales: +233 24 212 2742

Vice President Dr. Mahamudu

Bawumia has outlined an ambitious 17-point plan aimed at revitalising Ghana’s private sector and fostering a business-friendly economy.

Speaking at a CEO dinner gathering top business leaders and private sector stakeholders, the NPP agbearer rea rmed his commitment to creating an economic environment that supports businesses, stating that a thriving private sector is essential for sustainable national growth.

“When businesses do well, the economy does well,” Dr. Bawumia told the audience.

“Show me a buoyant national economy in any part of the world, and I’ll show you strong and resilient businesses behind it.” Emphasising the need for “bold, innovative solutions,” he described his plan to tackle the pressing challenges of high taxes and regulatory ine ciencies faced by Ghanaian businesses.

Tax Reforms and Business-Friendly Policies

Among his proposed measures, Dr. Bawumia promised a tax amnesty to give businesses and individuals with prior tax issues a fresh start, aiming to encourage compliance and boost investments. He also committed to introducing a at tax rate for individuals and businesses, designed to simplify Ghana’s complex tax system and reduce the time businesses spend on tax administration.

“A simple, at tax rate will ease the burden on taxpayers and eliminate the need for constant back-and-forth with tax o cials,” he said. Electronic

ling and faceless tax assessments are also part of his reforms, which he argued would improve transparency and reduce corruption.

Dr. Bawumia also pledged to empower the private sector to participate in public infrastructure projects. This includes nancing, building, and leasing infrastructure like schools, roads, and healthcare facilities to the government, which he believes will stimulate job creation and cut down on waste and corruption in government spending.

“We will leverage government purchasing power to boost local businesses,” he stated, outlining plans to reduce government expenditure by 3 percent of GDP and redirect those funds to private sector-led infrastructure projects. His administration, he said, would focus on Public-Private Partnerships (PPPs) as a primary model to bridge Ghana’s infrastructure gap.

Supporting SMEs and Women-Owned Businesses

Recognising the vital role of small and medium enterprises (SMEs), Dr. Bawumia announced plans to establish an SME Bank dedicated to providing nancing to small and medium-sized enterprises, which employ over 80% of Ghanaians. Additionally, a Women’s Trade Empowerment Fund would support female entrepreneurs with expansion and working capital.

He assured the CEOs that the proposed initiatives would support Ghana’s industrial

growth and create a conducive environment for local businesses to thrive. “A Bawumia Presidency will be for business. All I ask is for business to be with me,” he declared.

Highlighting the need to adapt to digital trends, Dr. Bawumia proposed creating a Fintech Fund with an initial capital of $100 million to support Ghanaian start-ups focused on payment and nancial services innovations. A Venture Fund would also be established to provide funding for high-tech projects led by Ghanaian entrepreneurs, driving tech entrepreneurship and innovation.

He mentioned the recent launch of Ghana’s rst credit scoring system, myCreditScore, which he believes will increase access to credit for Ghanaians, boost domestic demand, and create more jobs. “With this system, Ghanaians can buy on credit – ‘buy now, pay small, small,’” he said, explaining that it would support local businesses by increasing consumer purchasing power.

Dr. Bawumia also pledged to make electricity more a ordable for industries by aligning commercial tari s with residential rates. Additionally, he promised a streamlined port charge structure to make Ghanaian ports competitive with those in the region, aiming to attract more trade and reduce logistical costs for local businesses.

By Xatse Derick Emmanuel

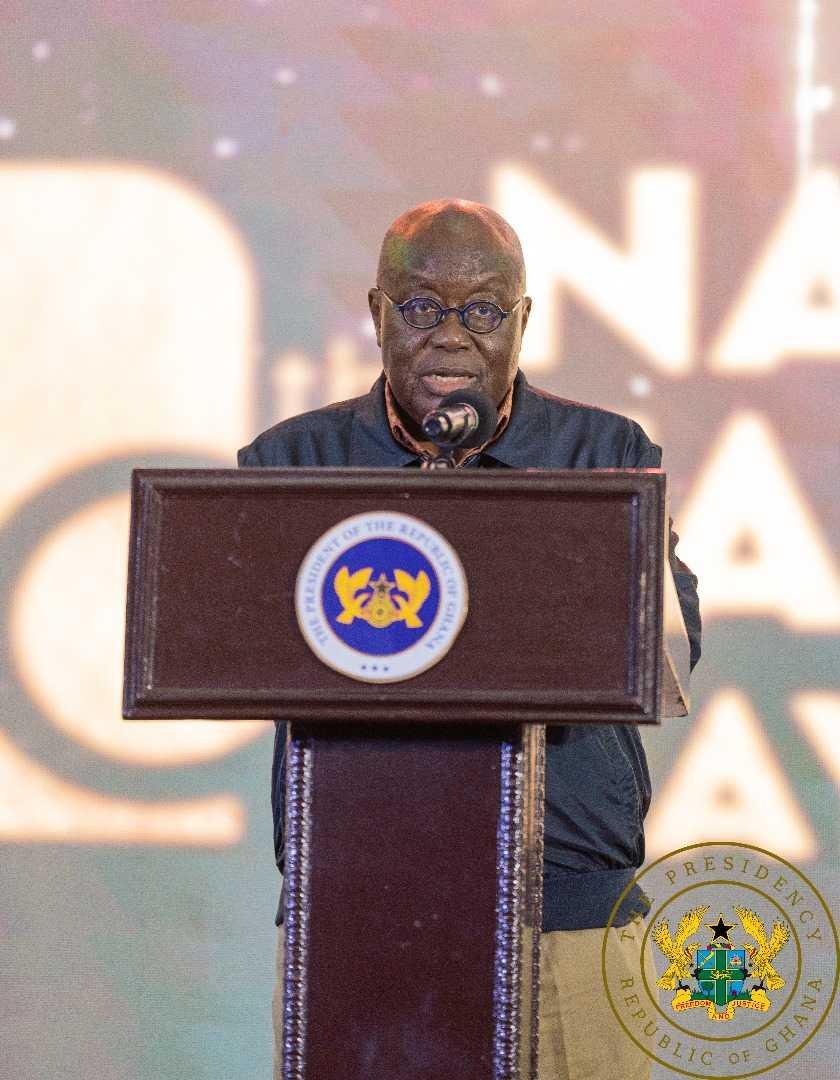

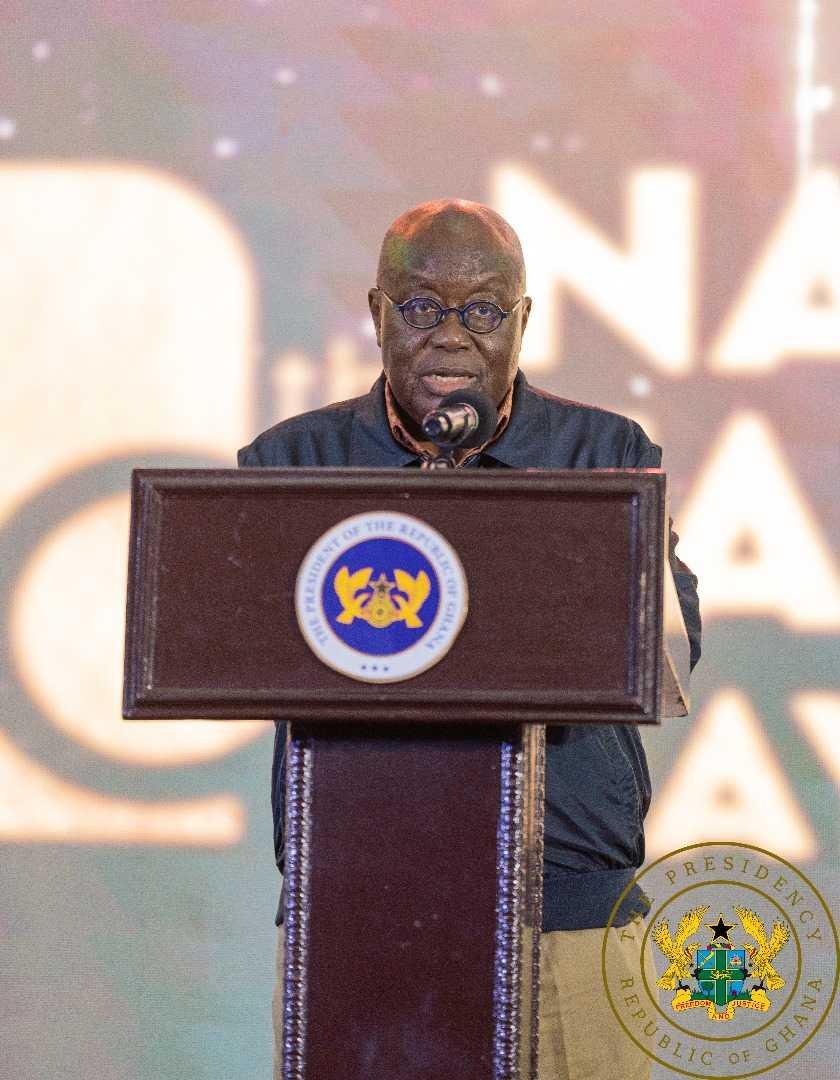

President Nana Addo Dankwa Akufo-Addo has announced an increase in the producer price of cocoa from GH 3,000 to GH 3,100 per 64kg bag, a 0.03% rise from the rate set in September for the 2024/2025 crop season.

The president explained that the increase is intended to align cocoa prices with current market conditions.

Speaking at the National Farmers’ Day awards in Accra on Friday, November 8, President Akufo-Addo stated, “On the advice of the producer price review committee, I am pleased to announce an increase in the producer price of cocoa from GH 48,000 to GH 49,600 per tonne, raising the price from GH 3,000 to GH 3,100 per bag.”

He noted that the adjustment follows his directive to the Minister to ensure periodic reviews to support farmers’ incomes amid challenging conditions.

Meanwhile, Nana Owusu Achiaw Brempong, a 70-year-old from the Sekyere Central district of the Ashanti Region has been adjudged the National best farmer.

Nana Owusu, whose farming journey began 50 years ago, owns North American farms with 168 workers cultivating diverse crops, including cocoa and cashew.

He received one million Ghana cedis as part of his reward.

In his acceptance speech during the Farmers Day celebration on November 8, the National Best Farmer called for increased e orts to ensure food security.

The Farmers Day Celebration took place concurrently across the country, recognizing farmers for their dedication and contribution to the economy.

President Nana Addo Dankwa Akufo-Addo and other dignitaries were present at the event.

Nana Owusu Achiaw Brempong, a 70-year-old from the Sekyere Central district of the Ashanti Region, has been adjudged the National best farmer.

Nana Owusu, whose farming journey began 50 years ago, owns the

North American farms with 168 workers cultivating diverse crops, including cocoa and cashew.

He received one million Ghana cedis as part of his reward.

In his acceptance speech, during the Farmers Day celebration on

November 8, the National Best Farmer called for increased e orts towards food security.

The Farmers Day Celebration took place concurrently across

the country, recognizing farmers for their dedication and contribution to the economy.

President Nana Addo Dankwa Akufo-Addo and other dignitaries were present at the event.

Telecommunications giant MTN Ghana, as part of its commitment to climate change and sustainability, has held a panel discussion in Accra to drive forward conversations on sustainable practices in the corporate sector.

The panel discussion, part of MTN Ghana’s sustainability week, centered on the theme “Sustainability: Our Collective Responsibility” and highlighted the roles that businesses, communities, and individuals play in promoting sustainable development in Ghana.

Dr. Felix Addo Yobo, Deputy Director of the Sustainable Development Goals (SDGs) Advisory Unit at the O ce of the President, emphasized the shift toward sustainable solutions for addressing environmental issues.

“If you don’t embrace sustainability, you risk being left behind. Businesses across industries are embracing it, and for good reason—it’s more than just good PR. It gives you a competitive advantage, increases customer loyalty, and even opens new avenues for pro t,” he said.

Dr. Addo-Yobo stressed the importance of avoiding "greenwashing"—making false or exaggerated claims about environmental e orts—to maintain sustainable business practices.

“To avoid this, businesses need to go beyond compliance and make sustainability part of their core operations, as a passion and vision. When it becomes part of the company’s DNA, greenwashing isn’t a concern because sustainability goals are integrated into their mission and values,” he explained.

He also highlighted that sustainable practices enhance a company’s ability to attract funding. “Many investors now demand companies demonstrate a commitment to ESG. When businesses can show this, it gives them an advantage, not just in reputation but in actual nancing,” he noted.

He explained that the impact of ESG (Environmental, Social, and Governance) practices goes beyond external gains, whilst adding that “Companies should also consider their internal practices. Fair pay, exible working arrangements, and non-discriminatory policies all contribute to a positive workplace that boosts

productivity. Employees are happier, which bene ts the business long-term.”

Bernard Owusu-Ansah, a Manager with KPMG Ghana’s Governance, Risk, and Compliance Services (GRCS) unit, also spoke on the importance of sustainability for businesses and its societal impact.

He noted that companies can achieve sustainability by integrating strong leadership and setting clear goals within their strategic plans.

“No business thrives without the right strategy and leadership commitment. For MTN, sustainability might seem remote, but the emissions from data centers, for instance, show that even telecom companies have roles to play in climate impact,” he said.

Mr. Owusu-Ansah urged businesses to evaluate their impact, saying, “It’s vital for companies to assess their resource e ciency and stewardship to ensure that future generations will have access to these resources.”

He warned against greenwashing, emphasizing that it could harm a company's reputation if it misrepresented its sustainability e orts.

“Greenwashing can be a major setback, whether deliberate or accidental. Companies need to maintain data integrity and be transparent about what they are truly achieving,” he advised, recommending a structured reporting framework to help businesses avoid overstating their achievements and ensure that sustainability goals align with

actual practices.

By Jessel Lartey Therson-Cofie

Mr Owusu-Ansah also pointed out that the Environmental Protection Agency (EPA) had signed a critical agreement to regulate environmental practices across industries.

“This agreement is crucial for future projects, as businesses will need to meet speci c thresholds and undergo regular assessments. It’s part of our national e orts towards sustainable development,” he explained.

The Participant Engagement and Outreach Manager at the United Nations Global Compact, Mina Pokuaa Agyemang, described how ESG principles o er businesses a structured framework to measure their contributions to a sustainable global economy.

“The whole conversation around sustainability started at the United Nations, and ESG is a way for companies to assess how they’re impacting society. It’s not just about pro t but about evaluating their contributions to humanity and the environment,” she stated.

Miss Agyemang noted that Ghana’s banking sector is particularly strong in its commitment to ESG, with nancial institutions beginning to ask crucial questions before extending credit.

“Now, banks in our network ask not only about pro tability but also about the impact of the loans they give. They want to know, ‘What will you use the money for, and will it be sustainable?’” she said.

The UN Global Compact, she explained, provides resources like the SDG (Sustainable Development Goals) Manager Tool, which helps small and medium-sized enterprises (SMEs) align their operations with speci c sustainability goals.

“Any company—big or small—can use these tools. Just enter your industry details, and you’ll get suggestions on which SDGs to focus on and speci c ways to integrate sustainable practices. Resources are available to those who are open-minded about embracing these principles,” Agyemang said.

The Chief Corporate Services and Sustainability O cer at MTN Ghana, Mrs Adwoa Afriyie Wiafe, emphasized MTN’s dedication to embedding sustainable practices across its operations.

“When it comes to our buildings, we have built in energy e ciencies. Through our MTN Foundation, we contribute signi cantly in areas of health, education, and economic empowerment. For example, yesterday we provided nancial support to SMEs, including youth- and women-owned businesses and those operated by individuals with disabilities,” Wiafe said.

Mrs Wiafe also outlined MTN’s dedication to digital inclusion, particularly in equipping young people with digital skills to prepare them for future jobs saying that “We believe everyone deserves the bene ts of a modern connected life, and we are working to ensure connectivity and expand our network,” she added.

Japan Motors Trading has proudly celebrated a historic milestone with the o cial launch of three Geely vehicle models in Ghana.

The grand unveiling event marked a signi cant expansion of Japan Motors’ automotive portfolio, bringing the innovative Geely brand to Ghanaian consumers.

The newly launched Geely lineup includes three dynamic models:

The Coolray: A high-performance SUV designed with global modular architecture (BMA) and featuring Geely’s next-generation 1.5TD NordThor powertrain. With advanced engineering, the Coolray promises a powerful and smooth driving experience for modern drivers.

The Starray: An ultra-modern SUV inspired by Geely’s visionary “Vision Starburst” concept model. The Starray’s bold, futuristic design and advanced features set it apart as a standout choice in the SUV category.

The GX3 Pro: A stylish and cost-e ective city SUV, o ering

practicality and economy without compromising on quality. Ideal for urban commutes, the GX3 Pro makes the dream of a ordable, e cient mobility a reality.

In an exciting development, Japan Motors also announced that the Coolray SUV will be assembled locally at its state-of-the-art Japan Motors Vehicle Assembly Plant in Tema.

This local production further underscores JMTC’s dedication to advancing Ghana’s automotive industry. Alongside its assembly of other brands like Nissan, Peugeot, and Foton, Japan Motors has produced over 1,000 vehicles with a record of zero defects, contributing to job creation and skill development in Ghana.

Speaking at the event, Mr. Amine Kabbara, General Manager of Sales and Marketing at JMTC, highlighted the importance of this milestone. “The launch of

We are excited to o er Ghanaian drivers an unmatched driving experience de ned by innovation and advanced technology,” he said.

Mr. Nouhad Kalmoni, Executive Director of JMTC, expressed enthusiasm for the three new models, saying, “Geely’s diverse product lineup o ers something for everyone, whether it’s a compact car for city commuting, a versatile SUV for family adventures, or reliable options for company eets.

“The locally assembled Coolray symbolizes our commitment to local manufacturing and the future potential of Ghana’s automobile industry. The Coolray stands as a symbol of what Ghana’s automobile industry can achieve and a potential for growth and innovation in the years to come”.

Mr. Kalmoni also assured customers of comprehensive after-sales support, with an

er comes rst) for Geely vehicles, setting a new standard for customer service in Ghana.

Geely’s General Manager for West Africa, Mr. Sco eld Wu, added, “Geely has a strong global presence in over 70 countries, and we are excited to introduce our exceptional products to the Ghanaian market.”

“Japan motors is one of the biggest auto groups in Ghana with a long history and good reputation, as such Geely will work together with the company to focus on users, continuously improve product and service capabilities, and we believe this will bring a more excellent car experience to every consumer in Ghana.

With this successful launch, Japan Motors and Geely are poised to become key players in Ghana’s automotive sector, meeting the growing demand for quality, technology, and a ordable mobility solutions.

Dignitaries unveiling the new

By Allen OLAYIWOLA

Every business faces tough decisions about where to invest spare cash, and it’s tempting to cut corners when it comes to technology. After all, keeping old systems running might seem like an easy way to save money. But in reality, outdated technology can drain resources, frustrate sta , and put your entire business at risk. For Ghanaian businesses looking to remain competitive, the true cost of clinging to old tech is far greater than the price of upgrading. Here’s why modernizing your technology is not just an option—it’s a necessity.

1. The hidden costs of outdated technology

Old technology may seem like it’s still working ne on the surface, but behind the scenes, it’s costing your business in more ways than one. From frequent breakdowns to the high cost of maintenance, using outdated systems can consume up to 75percent of your IT budget just to keep things running. Here’s a look at how old tech silently eats into your pro ts:

• Data loss and downtime: Outdated systems are prone to crashes, failures, and data loss. The older they get, the more frequent these problems become, leading to expensive downtime and potential data loss. For businesses in Ghana, where every hour of downtime translates into lost revenue, this can be a crippling blow. Recovering lost data is not just costly; it’s time-consuming and often incomplete, leading to further disruptions in business operations.

• Data theft and cybersecurity risks: Running old systems without regular updates is like leaving the door open to cybercriminals. In today’s increasingly hostile cyber environment, outdated technology is a prime target for hackers. Data breaches can result in hefty nancial penalties, loss of customer trust, and reputational damage that could take years to repair. With Ghana’s growing focus on data protection, businesses must stay vigilant or risk severe regulatory consequences.

• Operational ine ciencies: Old technology often relies on manual processes that slow down operations and waste valuable employee time. Repetitive tasks like manual data entry can be automated with modern solutions, cutting costs by up to 75percent. Modern business process designs can further reduce costs by 20percent and free up sta to focus on higher-value tasks that drive growth. For businesses

looking to stay agile and competitive, these e ciency gains are essential.

2. Frustrated sta and disappointed customers

Outdated technology doesn’t just impact your bottom line; it a ects the people who use it. Employees who constantly battle slow, clunky systems are less productive and more likely to feel frustrated. This dissatisfaction can quickly spill over to your customers, who expect fast, seamless service. In a highly competitive market, slow service can send customers straight to your rivals.

• Impact on sta morale: Ghanaian businesses rely on motivated employees to provide excellent service, but outdated tech can make their jobs harder than they need to be. Instead of focusing on meaningful work, sta are bogged down by ine cient systems and manual tasks. This not only leads to burnout but also increases the likelihood of mistakes, further damaging the quality of service delivered.

• Losing your competitive edge: Customers today have high expectations, and they won’t hesitate to take their business elsewhere if your systems aren’t up to scratch. A survey by Microsoft found that over 90percent of consumers would consider switching to a competitor rather than deal with outdated technology. For Ghanaian businesses, this is a wake-up call: investing in modern tech isn’t just about improving e ciency; it’s about staying relevant in a fast-paced market.

3. Investing in technology: a strategic decision While upgrading technology requires upfront investment, the bene ts far outweigh the costs. Modern systems not only reduce maintenance expenses but also unlock new opportunities for growth and innovation. Here are some key areas where investing in technology can deliver signi cant returns:

• Enhanced data security: Investing in modern cybersecurity solutions can protect your business from data breaches and other cyber threats. Advanced security tools come with regular updates and proactive threat detection, giving you peace of mind that your data is secure. In Ghana’s evolving digital landscape, staying ahead of cyber threats is crucial for maintaining customer trust and meeting regulatory requirements.

• Improved customer expe-

rience: Upgraded technology means faster, more reliable service for your customers. Integrated systems allow sta to access information quickly, resolve issues promptly, and provide a better overall experience. For businesses competing on customer service, this can be a key di erentiator that sets you apart from competitors.

• Increased productivity and cost savings: Automation tools can streamline work ows, reduce errors, and cut down on manual tasks, leading to higher productivity across your organization. By freeing up your sta to focus on more strategic work, you not only save money but also boost morale and job satisfaction. This positive work environment can, in turn, enhance your company’s reputation as a great place to work, helping you attract and retain top talent.

4. Making the case for technology investment in Ghana Ghanaian businesses have a unique opportunity to leverage technology to drive growth and resilience. By making smart investments in IT infrastructure, companies can future-proof their operations, improve customer satisfaction, and stay competitive in a rapidly changing market. Here are some steps to consider when planning your tech investments:

• Conduct a technology audit: Start by assessing your current technology stack. Identify outdated systems that are prone to failure, require high maintenance, or hinder productivity. This audit will help you prioritize which areas need immediate attention and guide your investment decisions.

• Focus on high-impact upgrades: Not all tech upgrades are created equal. Focus on high-impact areas that directly in uence your business outcomes, such as customer-facing systems, cybersecurity, and automation tools. By aligning your tech investments with your strategic goals, you can maximize your return on investment.

• Train your teams: Investing in technology also means investing in your people. Provide ongoing training to ensure that your sta can make the most of new tools and systems. This not only enhances their skills but also ensures that your business gets the full bene t of its tech investments.

Conclusion: Don’t let outdated technology hold your business

back

For Ghanaian businesses, the decision to invest in technology is not just about keeping up with the latest trends; it’s about protecting your business, enhancing your operations, and staying competitive in a fast-paced market. While it might be tempting to hold onto outdated systems to save money, the hidden costs of doing so are far greater. From data loss and security breaches to frustrated sta and lost customers, the risks of old tech are simply too high. By prioritizing technology investment, you can turn these challenges into opportunities, driving growth, e ciency, and success for your business. Don’t let outdated technology be a nancial drain—invest in the future of your business today.

>>>the writer is a seasoned cloud architect and systems administrator with expertise in leading technical teams to create innovative platforms. As CTO of eSolutions Consulting, he has spearheaded major projects like the O ce 365 rollout for Ghana’s government and infrastructure deployment for the Ghana Revenue Authority. Recognized for his strategic use of emerging technologies, Allen has led his team to multiple Microsoft Partner of the Year awards, solidifying his role as a key leader in tech-driven business transformation.

If you'd like to explore how these strategies can help your organization thrive, reach out to discuss tailored solutions for your business growth journey. He can be reached via allen@esolutionsghana.com and or 0540123034

In a celebration marking 15 years of impact and innovation, MTN Ghana honoured top-performing partners, agents, and merchants who have been instrumental in the growth of its mobile money service, MTN Momo.

The MTN MoMo @15 National Stakeholder Dinner and Awards night held on Friday, November 8, 2024, at the Mövenpick Ambassador Hotel highlighted its commitment to nancial inclusion and recognized key contributors to MoMo’s success story in Ghana.

Since its inception in 2009, MTN MoMo has transformed the nancial services landscape in Ghana, providing millions with access to convenient, secure, and a ordable mobile money services. The platform has millions of users and continues to be an essential tool for nancial transactions.

In his speech, the Chief Executive O cer of MobileMoney Limited, Shaibu Haruna, expressed gratitude to all stakeholders such as bank and non-bank partners, merchants and agents for their various plays in ensuring that MTN MoMo grew in leaps and bounds.

He highlighted that after 15 years, MTN MoMo has surmounted challenges especially encountered in it early stage of introduction and has contributed signicantly to Ghana’s economy, stressing that it will continue to do so into the future.

Shaibu Haruna indicated future strategies for MTN MoMo, focusing on leveraging emerging technologies to enhance service o erings which will meet the evolving needs of Ghana’s nancial landscape, rea rming its dedication to expanding MoMo’s reach by unlocking new nancial opportunities.

“The Ghanaian Fintech industry is on the verge of explosive growth and I hope you believe in that. Given the robust infrastructure and policy framework that are in place, we believe we are on the verge of an even stronger evolution of the industry.

It is a fact that despite all the great strides we have achieved, the level of service penetration which is critical in the nancial ecosystem is still very low. We continue to see signi cant opportunities [and some will call it gaps] in the area of digital payments, cross-border payments, insurance, investment and e-commerce. These are opportunities that we can co-create and develop in the future. The key to unlocking this piece is around how we collaborate focus and scale. Our ambition for the next decade is to provide nancial freedom for every Ghanaian by

empowering them to be able to do every service,” he said.

The MTN MoMo @ 15 National Stakeholder Dinner and Awards night saw distinguished agents, merchants, and partners recognized for showing exceptional service and dedication. Winners were recognized not only for their transaction volumes but also for their role in fostering a customer-centric approach, ensuring nancial inclusivity, and promoting the use of MoMo for various daily transactions.

Special recognition was given to Madam Rita Mensah for starring in MTN Ghana’s ‘Mensa Aka’ advert. She received a cash prize of GH 30,000.

Chief Executive O cer of Ghana Interbank Payment and Settlement Systems (GhIPSS), Archie Hesse, was also recognized as the Fintech Champion Of The Decade.

W

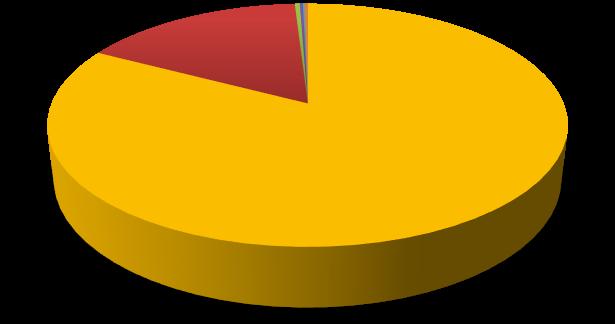

The Ghana Stock Exchange closed higher this week on the back of price increases by 7 counters. The GSE Composite Index (GSE-CI) grew by 160 27 points (+3.67%) for the week to close at 4,529 30 points, reflecting a year-to-date (YTD) gain of 39.58%. The GSE Financial Index (GSE -FI) also gained 24.68 points (+1.11%) for the week to close at 2,239.89 points, reflecting a year-to-date (YTD) gain of 17 79%

Market capitalization edged higher by 2 46% to close the week at GH¢101,938 10 million, from GH¢99,493.22 million at the close of the previous week. This reflects a YTD gain of 37 95%

The week recorded a total of 5,920,591 shares valued at GH¢73,473,078.87, compared with 801,810 shares, valued at GH¢12,890,891.38 traded in the preceding week.

MTNGH dominated the volume of trades while New Gold Exchange Traded Fund dominated the value of trades for the week accounting for 91.28% and 82 70% of the volume and value of shares traded respectively

The market ended the week with 7 advancers, as indicated in the table below.

GSE CI GSE FSI5,000,000 10,000,000 15,000,000 20,000,000 25,000,000 30,000,000 35,000,000 40,000,000 45,000,000 50,000,000

Volume and Value of Trades for Week Ending 01/11/2024

The Cedi furthered its depreciation run for the third straight week. It traded at GH¢16.3001/$, compared with GH¢16.1500/$ at week open, reflecting w/w and YTD depreciations of 0.92% and 27.12% respectively. This compares with a loss of 25.44% a year ago.

The Cedi also depreciated against the GBP for the week. It traded at GH¢21.1126/£, compared with GH¢20.9579/£ at week open, reflecting w/ w and YTD losses of 0 73% and 28 32 % respectively This compares with a depreciation of 27 57% a year ago

The Cedi slipped against the Euro for the week It traded at GH¢17 6852/€, compared with GH¢17.4605/€ at week open, reflecting w/ w and YTD depreciations of 1.27% and 25.78% respectively. This compares with a depreciation of 25.95% a year ago.

The Cedi lost grounds against the Canadian Dollar for the week. It opened at GH¢11.6352/C$ but closed at GH¢11.6916/C$, reflecting w/w and YTD losses of 0.48% and 22.93% respectively. This compares with a depreciation of 24.86% a year ago

Source: Bank of Ghana

Source: Bank of Ghana

Source: Bank of Ghana

The government raised a sum of GH¢4,078.20 million for the week across the 91 -Day, 182-Day and 364-Day Treasury Bills. This compared with GH¢4,421.54 million raised in the previous week.

The 91-Day Bill settled at 26.56% p.a. from 26.19% p.a. last week whilst the 182 -Day Bill settled at 27.58% p.a. from 27.29% p.a. last week. The 364Day Bill settled at 29.04% p.a. from 28.97% p.a. last week.

The tables below highlight primary market activity at the close of the week.

Oil prices closed slightly lower , on a report that Israeli Prime Minister Benjamin Netanyahu will hold a meeting for a diplomatic solution to the war in Lebanon Brent futures traded at US$73 10 a barrel, compared to US$75 63 at week open, reflecting w/w and YTD depreciations of 3.35% and 5.11% respectively.

Gold prices edged higher , trading close to record highs as the run-up to the 2024 presidential election and uncertainty before upcoming data prints kept safe-haven demand in play . Gold settled at US$2,749.20, from US$2,742.20 last week, reflecting w/ w and YTD gains of 0.26 and 32.70% respectively.

The price of Cocoa increased for the week. Cocoa traded at US$7,321.50 per tonne on Friday, from US$6,789.50 last week, reflecting w/w and YTD appreciations of 7.84% and 74.49% respectively.

YTD Performance of Selected Commodity Prices

CIDAN Investments Limited is an investment and fund management company licensed by the Securities & Exchange Commission (SEC) and the National Pensions Regulatory Authority (NPRA).

Name: Ernest Tannor

Email: etannor@cidaninvestments.com

Tel: +233 (0) 20 881 8957

Name: Moses Nana Osei-Yeboah

Email: moyeboah@cidaninvestments.com

Tel: +233 (0) 24 499 0069

Name: Julian Sapara-Grant

Email: jsgrant@cidaninvestments com

Tel: +233 (0) 20 821 2079

CIDAN Investments Limited

CIDAN House

House No. 261

Haatso, North Legon – Accra

Tel: +233 (0) 27 690 0011/ 55 989 9935

Fax: +233 (0)30 254 4351

Email: info@cidaninvestments com Website: www.cidaninvestments com

INVESTMENT TERM OF THE WEEK

Moving average convergence / divergence (MACD): It is a technical indicator to help investors identify price trends, measure trend momentum, and identify entry points for buying or selling

Source:

h�ps://www.investopedia.com/terms/m/macd.as p

Disclaimer : The contents o f this report have been prepared to provide yo u with general info rmation o nly Information provided in a nd available from this report does not constitut e a ny inv estment recomm endation.

The info rmation contai ned herei n has b een obtained from sources that we beli eve to be reliable, but its accuracy a nd complet eness ar e not guaranteed.

Bernard Owusu-Ansah, a Manager with KPMG Ghana’s Governance, Risk and Compliance Services (GRCS) unit, has urged Ghanaian businesses to rst align their organisational vision with their strategy to e ectively mitigate Environment, Social, Governance (ESG) risks in their businesses.

Mr. Owusu-Ansah made this call while speaking during a UK-Ghana Chamber of Commerce (UKGCC) webinar with KPMG Ghana on "Mitigating and Managing ESG Risks: Building Resilience for a Sustainable Future”.

According to Mr. Owusu-Ansah, recent studies indicate that over 70% of companies globally are now exposed to moderate to high ESG risks. This exposure makes businesses more vulnerable to ESG-related impacts that may weaken their ability to withstand and adapt to operational and nancial shocks.

Environmental risks involve potential adverse impacts from the natural environment, such as extreme weather conditions, pollutions and emissions and resource scarcity. These risks can a ect a business’s reputation, nancial performance, and long-term sustainability. Social risks, on the other hand, are challenges related to a business’s impact on its workforce and communities. These include non-compliance with labour standards, inadequate compensation, or insu cient health protection for employees. Governance risks refer to issues around governance structures, ethical practices, and overall corporate conduct.

To e ectively manage these risks and strengthen business resilience, Mr. Owusu-Ansah remarked that, “It all starts with your strategy.

“Everything starts with strategy, and cascading your vision and ambition through the organisation, because if you are implementing a corporate strategy that runs parallel to your risk approach, you’re

EDITOR: BENSON AFFUL

going to have a lot of issues”.

He advised that businesses rst establish a vision which that incorporates ESG principles, then consider available opportunities in the strategy.

Following this, business leaders must de ne the ESG ownership from the board level. Here, Mr. Owusu-Ansah cautioned that whoever is appointed to own ESG in the business must be able to quantify how the business is bene ting from the ESG strategies that have been implemented to counter a potential perception that the business is ‘wasting money’.

He stressed, however, that “Risks are not always counter-productive to the business; they can also create opportunities.

“You can thrive by using risk as a competitive advantage or by developing new products that exploit these risks”, he explained.

To align your business’s vision with its strategy, Mr. Owusu-Ansah suggested that companies may assess their risk landscape and identify who matters to their objectives (i.e. key stakeholders) such as investors, regulators, community members, employees, customer and the supply chain.

“It is important to consider the community in which you operate because it is not only about the nancial impact on your business. For instance, there are powerful people, leaders and social in uencers in communities who can change public opinion about your business. It is essential to understand and consider what matters to these people”.

He further advised businesses to focus on material issues that matter

to their business, clarifying what they seek to achieve with ESG as a function, i.e. if they want to be simply compliant with regulations, strategic, or transformative with their entire operating model; and consider both the local and international regulatory landscape.

“There are a lot of issues. You cannot tackle everything simultaneously, but prioritising those most material to your business, and leads to what your ambition is”, he said.

ESG: Opportunities and Challenges

ESG also presents opportunities such as enabling businesses to grow and innovate with new products and services, making it attractive to businesses leaders.

However, challenges such as integrating ESG with corporate strategy, a complex regulatory environment, and di culty in de ning what is sustainable, in addition to

responsibility for reporting and measurement amongst others, can make its adoption arduous to several companies.

Despite these challenges, Mr. Owusu-Ansah emphasised that adopting ESG principles and managing its related risks is worthwhile.

“ESG is ultimately about doing the right thing. If you set out to do the right thing in every aspect of your business, you will realise that you are complying with most of the regulations, regardless of where your business extends to”.

The webinar, moderated by Emma A. Opoku-Pare, an Assistant Manager with KPMG Ghana’s Financial Risk Management Unit, also covered topics such as ESG risk drivers, Enterprise Risk Management Frameworks, creating value from ESG, risk identi cation and materiality assessment, and prioritisation and mitigation strategies, among others.