Ghana’s oil production outlook hangs in a the balance, says Fitch Solutions

Qatar Airways, Airbus reach amicable settlement inlegal dispute

Strong passenger demand continues in June

Qatar Airways, Airbus reach amicable settlement inlegal dispute

Strong passenger demand continues in June

Fitch Solutions expect Ghana’s total liquids production to see moderate growth in the near term, with crude, NGL and other liquids production increasing from 142,440 barrels per day (b/d) in 2022 to 145,390b/d in 2024 following recent investments in the Jubilee and TEN elds by Tullow Oil.

While these investments would prevent signi cant short-term declines, the key upside to Ghana’s long-term oil production outlook is the 110,000b/d Pecan Field development, the future of which is currently in limbo following a dispute over the involvement of Russia-based Lukoil.

Provided that the controversy surrounding Lukoil’s participation is resolved and a nal investment decision is achieved by the end of 2024, we expect Ghana’s oil production to grow to nearly 200,000b/d by 2029.

These investments consist of a multi-year drilling campaign at the Jubilee and Tweneboa-Enyenra-Ntomme (TEN) elds, which currently account for approximately 80 per cent of Ghana’s upstream output.

In 2022, Tullow’s investments included four new wells (three water injectors and one producer). In 2023, Tullow plans on introducing six wells, which will come online by the third quarter.

These investments will enable Ghana’s oil industry to reverse natural declines and moderately boost short-term production with production at the Jubilee eld expected to exceed 100,000b/d in 2024.

To maintain this level of output, a total of 49 production and injection wells are planned to be introduced to the elds by 2030. As of February 2023, Tullow plans to invest approximately USD300mn in Ghana to support these projects.

Jubilee Field boost to prevent declines in 2023

Further progress on the Final Investment Decision (FID) in the Pecan development is essential for Ghana to return to pre-pandemic levels of oil production (which averaged 197,000 b/d in 2019).

The Pecan eld, which is part of the Deepwater Tano Cape Three Points licence block, has an kestimated reserve of 334mn boe. It is operated by Aker Energy, who maintains a 50

per cent stake while the other partners include Russia-based Lukoil (38 per cent), Ghana National Petroleum Corporation (GNPC) (10 per cent), and Fueltrade (two per cent).

The development of the eld has faced a variety of headwinds over recent years such as concerns over the capital cost of the project and the size of GNPC’s stake.

However, the key barrier since February 2022 has been the participation of Lukoil. Due to the Russian invasion of Ukraine, Aker Energy has been hesitant to put forward its updated Plan for Development to the Ghanaian government and commit to FID whilst Lukoil is involved in the project as the risk of sanctions levied on Russian oil and gas companies could limit Aker’s ability to work with Lukoil and interfere with operations at the eld. According to media reports, Aker CEO Øyvind Eriksen noted that development plans would not be passed to Ghanaian authorities until Lukoil’s participation was resolved.

To overcome this hurdle, Aker has recommended that Lukoil divest their share. As of February 2023, the latest update on the dispute indicates that Aker is continuing a dialogue with Lukoil and the Ghanaian authorities to come to a solution and has not put the project itself on hold, instead just delaying their development plans.

Provided that the controversy surrounding Lukoil’s participation is resolved and FID is achieved by the end of 2024, we expect Ghana’s oil production to grow to nearly

200,000b/d by 2029.

Given the willingness of the Ghanaian government to support the project, potential for breakthroughs and compromise in the negotiations between the partners, and the higher oil price environment, we believe that FID is still possible despite the dispute, but is not likely to be reached until 2024 at the earliest.

In terms of sanctions, as of February 2023, Lukoil is subject to US energy sector sanctions under Executive Order 13662, which prohibits investment in upstream projects abroad where Russian-based oil and gas companies have participating interests of over 33 per cent.

Aker seeks to comply with all international sanctions. Despite Lukoil’s 38 per cent stake, the restrictions levied on Lukoil would not apply to the Pecan eld development as the project was initiated before January 29, 2018. Given this exemption, it is still possible that the project can proceed with Lukoil still participating, though we acknowledge signi cant downside risks from the historic record of delays. We forecast that it will take 35 months from FID for the rst oil at the eld, meaning that if FID is reached in 2024, production will begin in 2027 at the earliest. With this in mind, we forecast that Ghana’s oil production will grow to a peak of 198,190 b/d by 2029, before declining by an average of three per cent a year until 2032 due to the lack of other projects in the pipeline.

Global business leader and technology professional Lucy Quist is next to speak on LEADTIONARY Series, a leadership conversation platform, hosted by Bishop Gideon Titi-Ofei that engages in uential leaders to share the inspirational stories behind their rise to leadership and global in uence.

The 2014 CIMG Marketing Woman of the Year will rede ne leadership tomorrow on the virtual leadership conversation platform, which will be live on Facebook at www.facebook.com/bishopgideontitiofei.

The event, which is expected to feature about 50 in uential global leaders in a year-long webinar series, will witness the former Chief Executive O cer of Airtel Ghana shares her views on leadership.

Lucy Quist is currently the Managing Director at Morgan Stanley, serving as the Global Head of Firm Resilience.

She is the author of the book, ‘The Bold New Normal’. She is a thought leader and the rst Ghanaian woman to head a multinational telecommunications company as the former CEO of Airtel Ghana.

She is a co-founder of the Executive Women Network and also served as the Vice President of FIFA's normalisation committee in Ghana.

She is a member of the boards of INSEAD, Mercy Ships and Margins ID Group. She also serves on the advisory board of Yemaachi Biotech.

Lucy is a chartered electrical and electronic engineer with a rst-class honours degree from the University of East London. She is a member of the Institute of Engineering and Technology (UK) and holds an MBA from INSEAD in France.

Speaking in an interview, Bishop Gideon Titi-Ofei, who is the host and the Presid-

ing Bishop of the Pleasant Place Church, said LEADTIONARY aims to create a world of inspirational leadership ideas that grow leaders.

He said LEADTIONARY uses inspirational approach to leadership growth and development instead of the traditional informational approach used by many organizations and academic institutions. “The latter teaches the principles of leadership whiles the former talks to/about personalities behind the principles.

In the inspirational approach, leadership practitioners share their experiences and ideas intended to inspire a generation of leaders who can lead change, drive innovation, and solve complex problems,” he added.

Bishop Titi-Ofei noted that every recognized leader is a proven problem solver, saying “problem solving is what

According to a release by Qatar Airways, a repair project was now underway and both parties look forward to getting these aircraft safely back in the air.

The details of the settlement, the release said, were con dential and the parties would now proceed to discontinue their legal claims. Meanwhile, the release noted that the settlement agreement was not an admission of liability for either party. “This agreement will enable Qatar Airways and Airbus to move forward and work together as partners,” the release said.

In a related development, Qatar Airways has re-opened its luxurious Premium Lounge at Paris-Charles de Gaulle Airport (CDG), complementing the airline’s triple daily ights, available for premium passengers and

eligible one-world alliance partners. The Premium Lounge features all of the facilities and qualities of the airline’s premium product, including both The Brasserie and The Global Deli, prayer rooms, business centre, shower facilities, Wi-Fi and zoned seating for more than 200 guests. Far-reaching views of Paris and the Ei el Tower contribute to a warm and relaxing atmosphere.

Commenting on the airline’s latest Premium Lounge re-opening, Qatar Airways Group Chief Executive, Akbar Al Baker, stated: “This milestone illustrates our focus on continuous product enhancements. The re-opening of the Qatar Airways Premium Lounge at Paris-Charles de Gaulle Airport marks our fth global lounge within our growing network. This further demonstrates our commitment to provide unparalleled services to our

customers, especially in France.”

At more than 1,000 square metres, the Qatar Airways Premium Lounge at Paris-Charles de Gaulle o ers Qatar Airways First and Business Class passengers a sophisticated, modern and spacious environment in which to relax and commence their ve-star journey experience.

Catering to exceptional premium culinary standards, the lounge is equipped with a full kitchen for freshly-prepared à la carte orders, in addition to an existing bu et spread, o ering an international menu from across the globe.

Qatar Airways Paris Premium Lounge launched its operations in 2017 to serve the growing capacity of passengers travelling with the airline from Charles de Gaulle Airport.

Presently, Qatar Airways operates 18 weekly ights to Paris, o ering passen-

gers with the ultimate connectivity to Skytrax’s World’s Best Airport, Hamad International Airport.

A multiple award-winning airline, Qatar Airways, was recently announced as the ‘Airline of the Year’ at the 2022 World Airline Awards, which is managed by the international air transport rating organisation, Skytrax.

The airline continues to be synonymous with excellence having won the main prize for an unprecedented seventh time (2011, 2012, 2015, 2017, 2019, 2021 and 2022), while also being named ‘World’s Best Business Class’, ‘World’s Best Business Class Lounge Dining’ and ‘Best Airline in the Middle East’.

Qatar Airways currently ies to more than 150 destinations worldwide, connecting through its Doha hub, Hamad International Airport, currently named the ‘Best Airport in the World” by Skytrax World Airport Awards 2022.

Qatar Airways and Airbus have reached an amicable and mutually agreeable settlement in relation to their legal dispute over A350 surface degradation and the grounding of A350 aircraft.

per cent of preCovid-19 levels, the International Air Transport Association (IATA) has announced.

It said the development was driven by strong passenger demand despite the challenging times for the aviation industry.

The IATA, therefore, called for exibility to ensure that the increasing passenger demand can be met during a time of great disruption at airports worldwide, which are su ering from sta shortages.

Data released by the IATA last week showed total tra c in June was up 76.2 per cent compared to June 2021, driven by the ongoing strong recovery in international tra c.

Domestic tra c for June 2022 was up 5.2 per cent compared to the same

month a year ago.

The IATA attributed the positive trend to improvements in most markets combined with fewer Covid-related restrictions in the Chinese domestic market.

In total, domestic tra c in June was at 81.4 per cent of June 2019 levels.

International tra c, meanwhile, increased by 229.5 per cent over June 2021 again due to fewer travel restrictions in most parts of the Asia-Paci c region. June 2022 international tra c reached 65.0 per cent of June 2019 levels.

In Europe, June tra c increased by 234.4 per cent compared to the same month in 2021. Capacity rose by 134.5

per cent and load factor by 25.8 percentage points to 86.3 per cent.

International tra c within Europe is now above pre-pandemic levels in seasonally adjusted terms, the IATA said.

The Director General of IATA, Willie Walsh, said demand for air travel remained strong.

He said after two years of lockdowns and border restrictions, people were taking advantage of the freedom to travel wherever they could.

He said airlines and their passengers at some hub airports were being confronted with a number of issues.

“Flexibility is still essential in support of a successful recovery. By capping

passenger numbers, airports are preventing airlines from bene ting from the strong demand,” he said.

A glance at other markets: Middle Eastern airline tra c rose by 246.5 per cent in June over June 2021 and capacity by 102.4 per cent.

North American carriers marked a 168.9 per cent increase in tra c and capacity rose by 95.0 per cent.

June tra c for Latin American airlines rose by 136.6 per cent and capacity by 107.4 per cent.

China’s domestic tra c fell by 45.0 per cent year-on-year in June while Japan’s was up by 146.4 per cent.

The IATA represents some 290 airlines that comprise 83 per cent of global air tra c.

Monday 30 January 2023 –&

TFounder and Chief Executive O cer (CEO) of AZA Finance, Elizabeth Rossiello, has said that the gradual move to web-based payment solutions, from telco-operated platforms, will lead to enhanced e ciency, lowered cost and greater adoption of digital nancial solutions on the continent.

Since its introduction in Africa almost 20 years ago, mobile money has evolved to become one of the preferred payment options, resulting in the continent accounting for 70 percent of the US$1 trillion in mobile money processed across the globe in 2021, as the value of Africa’s mobile money transactions soared by 39 percent year-on-year, from US$495 billion in 2020 to US$701.4 billion the following year.

But Mrs. Rossiello believes that in spite of the strides made by mobile money, the emergence of web-based solutions will drive competition as surmounting geographical barriers become easier and the customer would be the better for it.

“Moving away from solutions o ered primarily by telcos to web-based o erings takes it global which makes it more competitive and better for the user,” she said in an interaction with the B&FT during a recent working visit to the country.

She added that building on Ghana’s recent markedly improved nancial inclusion performance, which rose to 68 percent in 2021 from 58 percent in 2017, as measured by the 2021 Global Findex, would require signi cant investment to

make the internet more accessible across the country.

Noting that access to web-based FinTech solutions remains concentrated in urban and peri-urban centres, she said it highlights room for growth in the adoption of such services. “The internet penetration rate is still relatively low, so it o ers much room for growth as we do not have a lot of internet access in the rural areas so they cannot access these web-based products, so for now, we see a heavy concentration on USSD products and similar telco-based solutions but that will change as internet access improves,” she stated.

According to analyses by the intelligence arm of the GSM Association and digital technology consultancy, Kepios, the

internet penetration rate in the country stood at 53 percent at the beginning of the year, from a total of 44.9 million cellular mobile connections. The rate places Ghana at number 12 on the continent.

Also in the country’s favour is the comparatively low internet usage cost, as captured in the 2022 Worldwide Mobile Pricing report, which surveyed 233 countries and territories and shows that ve of the 10 most expensive countries (US$10 or more for 1 gigabyte) to buy mobile data in the world are in sub-Saharan Africa, with the same amount of data selling at US$0.61, on average, in Ghana.

Parliament has approved and passed the National Vaccine Institute Bill, 2022 to strengthen production of vaccines in Ghana.

The bill is to establish a National Vaccine Institute to coordinate and supervise the research, development and manufacture of vaccines and sera in the country.

The lack of a sustainable supply of vaccines to address the ght against diseases in the country has informed the need to establish a National Vaccine Institute.

Ghana established the Expanded Programme on Immunisation (EPI) in 1978. Since then, the programme has received substantial nancial and technical assistance from Gavi, the vaccine alliance.

Currently, Gavi supports over 89 per cent of the cost of vaccines and vaccine delivery within the country. However, Ghana has attained lower middle-income country status and must transition from Gavi support by the year 2027.

Consequently, Ghana needs to be self-reliant, especially with regard to the domestic development and manufacture of vaccines and sera.

memorandum

A memorandum accompanying the bill explained that the novel Coronavirus disease (COVID-19) pandemic had ravaged global health systems and economies.

Since recording its rst two cases in March 2020, Ghana had not been spared the negative impact of COVID-19 on public health and socio-economic lives, it said.

“The emergence of new variants of COVID-19 has also put the country in a state of uncertainty.

“Although the world now has COVID-19 vaccines to help ght the pandemic, there has been inadequate deployment in Africa due to limited manufacture capacity and global supply chain challenges,” it stated.

The memorandum noted that vaccine nationalism also remained a challenge to achieving satisfactory immunity for adequate protection for the targeted

population.

By Eugene DavisAs of September 14, 2021, it said Ghana had fully vaccinated only 5.1 one per cent of the population, a far cry from the national target of 66 per cent of Ghanaians needed to achieve herd immunity.

Additionally, it said domestic vaccine development and manufacture was needed to aid in the ght against communicable diseases such as malaria, cholera, HIV/AIDS and tuberculosis, which continued to be a burden on the country.

The memorandum pointed out that the government of Ghana’s policy direction of “Ghana Beyond Aid” also highlighted the need to chart the route towards self-reliance in order to boost economic development.

In view of the above, it said the President set up a Presidential Committee on Vaccine Development and Manufacturing to bring to life the vision of domestic vaccine manufacture.

The committee, it added, held extensive

engagements with stakeholders relevant to the development and manufacture of vaccines in Ghana and undertook an assessment of the country’s capacity for vaccine development and manufacture.

“The committee recommended the establishment of a National Vaccine Institute to coordinate the manufacture and development of vaccines and sera in the country,” it said.

The memorandum added that President Nana Addo Dankwa Akufo-Addo, during his 26th update on July 25, 2021, on measures taken by the government on the COVID-19 situation in the country, announced that a National Vaccine Institute would be established with a seed fund of $25 million per the recommendation of the Presidential Committee on Vaccine Development and Manufacturing.

“The National Vaccine Institute is thus expected to operationalise the government’s vision of securing much needed vaccines through domestic vaccine development and manufacturing in the short, medium- and long-term phases,” the memorandum said.

host the "Invest in African Energy Recep tion" at Frankfurter Botschaft on February 23, primarily aims at showcasing investment opportunities across Africa's burgeoning energy sector as the next signi cant phase on the organization's European investment tour. The Invest in African Energy gathering at Frankfurter Botschaft is organized by the South African based African Energy Chamber (AEC).

Following successful Invest in African Energy Receptions held in London last year and Oslo in January 2023, in partnership with global energy market research rm, Rystad Energy, and leading pan-African nancial services provider, the African Export-Import Bank , the AEC's German leg of the Invest in African Energy European Roadshow aims to maximize energy investment partnerships between Africa and Europe’s largest economy.

Featuring German, European and global investors, private and public sector institutions, African energy policymakers and companies as well as stakeholders across both the German and African energy value chains, the Invest in African Energy Frankfurt event will highlight energy investment, economic growth, energy resilience and environmental sustainability prospects for both Germany and Africa on the back of improved energy development, exploitation and trade ties.

It will also address the energy infrastructure development and energy monetization initiatives in partnership with global players, foreign investors and governments. As Africa's biggest gathering for energy ministers, energy policymakers, companies and investors – it will, therefore, be crucial for shaping discussions to nd pragmatic approach around the key role the continent's massive yet largely unexplored hydrocarbon resources play in driving making energy poverty history while triggering newfound socioeconomic growth.

"The Chamber is honored to expand its Invest in African Energy European Road-

holders. German companies have the technology and expertise which Africa needs to maximize its global energy leadership role and we hope platforms such as the Invest in African Energy will foster a new era of improved cooperation between the country and the African continent ahead of the 2023 edition of African Energy Week this October, where more industry changing deals will be signed and partnerships formed," said NJ Ayuk, the Executive Chairman of the AEC.

According to several reports, European countries are seriously looking for more reliable energy suppliers. With Germany optimizing the diversi cation of its energy supply away from Russia due to the Russian-Ukraine war that began February 24, Africa appears to represent a perfect partner to drive the energy market stability.

While the demand for gas via lique ed natural gas continues to increase and take on a sizable share of the global energy mix, Africa is expanding its share of global gas supply.

With Africa requiring up to $1.7 trillion in the upstream gas sector to increase its gas production as the continent’s role in shaping global energy security intensies through 2050, Germany has a key role to play in helping the continent maximize and monetize resources. African countries such as Senegal, Mauritania, Algeria, Tunisia, Mozambique, Republic of Congo, Namibia and Angola are well positioned to supply Germany, and the Invest in African Energy Frankfurt event represents an ideal platform for Germany to enhance energy ties with Africa and secure its energy future.

"Hydrogen projects have been on the platform of all Germany Africa energy investments. Natural gas has seen new interest from Germany. Germany's launch of two LNG import facilities within 12 months highlights the country’s commitment to securing its energy supply via gas and LNG. Africa is well positioned to be the country's number

one supplier and the Invest in African

industry.

NJ Ayuk observes that Africa has already made an indelible mark in the oil and gas industry. Africans must therefore become more accountable, and plan better in the energy sectors. Some potential external investors, such as Russia, have for many decades shown interest in this sector but have not delivered promptly on their promises and signed agreements.

energy investments in Africa to accelerate the continent's build-up of infrastructure across the entire green hydrogen value chain. This will in turn provide a win-win situation for both Germany and Africa as both parties seek energy market stability, economic expansion, environmental sustainability and GDP growth.

With over 600 million people across the African continent lacking access to reliable electricity and 900 million to clean cooking solutions, the continent's estimated 125.3 billion barrels of crude oil, 620 trillion cubic feet of gas and untapped renewables potential present a huge opportunity to alleviate energy poverty. In this scenario, Germany represents an ideal partner for the continent as it moves to maximize energy investments and make energy poverty history by 2030.

By exploring the bene ts and challenges associated with these exploration campaigns, investors play unique role in sustainable development as Africa has roughly 40 billion undeveloped barrels of oil and gas reserves in the energy industry. According to the World Bank, Russia also holds the world's largest natural gas reserves, the second largest coal reserves, and the eighth largest oil reserves. With the Russia-Ukraine crisis and Russia the leading energy supplier redirecting its search markets in Asian region, it has brought good opportunities for new partners for Africa.

Over the past years after Soviet collapse, Russia has expressed heightened interest in exploring and producing oil and gas in Africa. Emboldened African leaders and industry executives have accepted proposals, signed several agreements with Russian companies, but little have been achieved in the sector. With the rapidly changing geopolitical conditions and economic fragmentation fraught with competition and rivalry, African leaders have to understand that Russia might not heavily invest in the oil and gas sector, not even in the needed infrastructure in this

Some experts believe that Europe can look to Africa as preferred energy supplier. Africa is ready to welcome investors currently pulling out of Russia if they can genuinely invest in developing oil and gas infrastructure which Africa seriously lacks in this industry. For Africa at this point in time, that's a real opportunity and understandably Russia aspires to be the leading supplier on the global market and therefore seeks to marginalize potential producers such as Africa. In practical terms, it is very cautious making nancial commitments in Africa.

"The demand for oil and gas from Africa is on the rise, especially as we expect domestic usage to rise signi cantly, driven by growing population and corresponding economic activity. It is therefore key for countries across the continent to leverage existing oil and gas infrastructure to fast-track the development of assets that would otherwise have been stranded," said Verner Ayukegba, Senior Vice President of the African Energy Chamber. "We are delighted to continue working with interested investors and researchers to bring forward vital data that allows decision makers to drive investments in Africa's energy sector, that ultimately will lead to ending energy poverty in Africa by 2030."

According to Ayukegba, the African Energy Chamber continues to investigate how the accelerated investment and development of Africa’s infrastructure landscape will be key for ensuring oil and gas discoveries translate into long-term developments. Currently, there exists an infrastructure gap across the continent, a gap which signi cantly impacts exploration initiatives, bringing newfound challenges to project take-o and completion. Therefore, during the panel, speakers will explore this gap while making a strong case for alternative, expert-backed solutions.

If Africa is to make energy history in Africa by 2030, the continent needs to maximize utilizing all available resources. As such, African countries with energy resources have the potential to change the continent's energy landscape, especially at this time of unprecedented global changes and large-scale developments set to establish a multipolar system. In spite of these, Africa needs to boost its energy security and work consistently towards energy self-su ciency within the framework of the Sustainable Development Goals (SDGs) and within the African Union Agenda 2063

The videos circulating on social media, about leading businesswomen, paying glowing tributes to Absa bank for its support and in uence in their enterprises, tell it all.

When a bank is relentless about its business purpose and determines to pursue it, no matter the odds; the results are priceless.

It has been three years since Absa Bank, o cially established its presence in Ghana. In that time, the bank has been a beacon of hope for Small Scale Enterprises (SMEs) and a trailblazer in its innovative approach to banking.

When the bank transitioned from the century-old Barclays heritage into Absa in 2020, it was with a mission to empower the nation's small businesses - the lifeblood of the economy. And it has been steadfast in its dedication,

aspirations of many small business owners. This is not just a matter of economic pragmatism; it is a moral imperative.

Take for example, Francesca Sroda, a small business owner who deals in stationery items. It had always been her dream to expand her business but never had the means to go the extra mile. Absa Bank came to her rescue, providing her with the necessary funding and nancial advice to take her business to new heights. Today, Francesca’s business is thriving, and she employs over 20 people in her sphere of in uence.

However, Absa Bank's impact in Ghana is not limited to its commitment to small scale businesses alone. The bank has also been a game-changer in the

online, make transactions using mobile banking and digital wallets, and access nancial services with ease. These digital solutions, like the ATM QR code, Absa mobile app and contactless cards, sparkle like diamonds in a sea of outdated banking practices. This is not just a matter of convenience; it is a matter of responsibility.

The bank's leadership is also committed to the principles of environmental, social, and governance (ESG) principles. The bank's operations have a positive impact on the country and its people, not just for the environment and the communities in which it operates but for the bank itself as well. This is not just a matter of expedience; it is a matter of integrity.

Moreover, Absa Bank is a leading

Ghana's workforce. This is not just a matter of fairness; it is a matter of destiny.

As we look to the future, it is clear that Absa Bank will continue to play a vital role in Ghana's nancial landscape. The bank's commitment to small scale businesses, its innovative approach to digital banking, and its adherence to ESG principles make it a valuable and respected member of the country's nancial community. But more than that, its actions demonstrate a commitment to the moral and practical responsibilities of a society. This is what makes Absa Bank truly stand out, and it is what will ensure its continued success in Ghana and beyond.

In this context, it is important to remember that a bank is not just an institution, it's a re ection of the values and aspirations of the society it serves. And Absa

Ghana’s plans to transform its health sector through new partnerships, pioneering technology, infrastructural developments and policies aimed at extending the reach of services into rural areas will be mapped out in a forthcoming report by the global research and advisory company Oxford Business Group (OBG).

The Report: Ghana 2023 will shine a spotlight on the country’s rapidly changing health ecosystem, charting the facilities and services that are being rolled out by both the public and private sectors.

The key role that the latest technological developments are set to play in ushering in a new era of healthcare in Ghana will be a focal point.

Updates will also be given on the National Health Insurance Scheme. Other topical issues set for analysis include Ghana’s plans to expand the country’s pharmaceutical industry by increasing manufacturing production.

OBG has signed a rst-time memorandum of understanding (MoU) with the Africa Medical Information Centre (AMIC) as it begins work on The Report: Ghana 2023. Under the agreement, AMIC will team up with OBG to produce the Health Chapter of the report and other content for the Group’s suite of research tools.

The MoU was signed by Ramona Tarta, OBG’s Country Director for Ghana, and Dr Akshay Rath, Medical Director, AMIC, and former UN physician.

Commenting after the signing, Dr Rath described OBG as an ideal partner for AMIC, given its reputation as a go-to source of accurate, reliable business intelligence for investors seeking untapped opportunities in emerging markets like Ghana and the wider region.

“Oxford Business Group will be highlighting the potential in Ghana’s health sector, while also identifying uncharted areas for medical research and making medical data and information accessible to end-users,” he said. “It is our hope at AMIC that the report will help attract the investments that are needed, especially in the manufacturing of medical supplies and vaccines in Ghana, the sub-region and Africa as a whole.”

Tarta said AMIC’s decision to choose Ghana for its head o ce as part of broader plans to modernise healthcare delivery across the region aligned well with the national overhaul gaining pace of medical facilities and services.

“Ghana is set to bene t from a range of new services and facilities making use of cutting-edge technology, through a wealth of public-private partnerships that include screening initiatives, surgeries and second opinions for diagnoses,” she said. “As part of its preparations to spearhead healthcare improvements across the continent, the Africa Medical Information Centre has established extensive resources, including in-depth, credible industry data that will undoubtedly enhance our research. I’m delighted that our on-the-ground representatives and,

potential, will bene t from this fruitful partnership.”

Also present at the signing, Dr Nitish Shetty, CEO of Aster Hospitals, Bangalore, one of AMIC’s partners, highlighted the pivotal role that AMIC was set to play in addressing gaps and challenges in Ghana’s healthcare system and others regionally.

“The African Medical Information Centre will be supported by all 30 of our hospitals in seven countries. Our 1500 doctors are leaders in their specialised elds and are keen to help with capacity-building locally, arranging training programmes and exchange programmes,” he said. “Our aim is that over time, together with our stakeholders in Ghana and across the wider region, we can address the challenges they face in the medical eld, while paving the way for this centre to become Africa’s medical tourism hub.”

The Report: Ghana 2023 will be

produced with AMIC, the Association of Ghana Industries, PwC Ghana and other partners. It will contain contributions from leading personalities in the public and private sectors, including: Kwaku Agyaman-Manu, Minister of Health; Yo Grant, CEO, Ghana Investment Promotion Centre; Ken Ofori-Atta, Minister for Finance; Joseph Boahen Aidoo, CEO, Ghana Cocoa Board; and Ernest Addison, Governor of the Bank of Ghana.

The Report: Ghana 2023 will mark the culmination of months of research by a team of analysts from Oxford Business Group. It will be a vital guide to the many facets of the country, including its macroeconomics, infrastructure, banking and other sectoral developments. The Report: Ghana 2023 will be available online and in print. It will form part of a series of tailored studies that OBG is currently producing with its partners, alongside other highly relevant, go-to research tools, including ESG and Future Readiness reports, country-speci c Growth and Recovery Outlook articles and interviews.

Gulf Technologies Systems (GTS) has recently signed several memorandums of understanding (MOU) with key entities in African countries including Ivory Coast, Mali, Burkina Faso, Togo, Democratic Republic of the Congo (DRC), Central Africa, Guinea Conakry, and Uganda.

These MOUs are aimed at promoting economic growth and development in these countries by establishing new projects in key sectors such as agriculture, agro-industry, energy, water, education, and light industry.

The cooperation between GTS and the community leaders in these countries is crucial for the success of these projects.

With the support of the United Nations Federations (UNF) in Africa, GTS and the local communities will work together to create a solid foundation for the imple-

mentation of these projects, with the goal of improving the quality of life for residents and promoting sustainable economic growth.

Agriculture and agro-industry play a critical role in the economies of many African countries, and the development of these sectors is expected to create jobs, increase food production and food security, and provide a source of income for local communities. Similarly, the development of energy and water projects will provide much-needed infrastructure and services to these communities, improving the quality of life for residents and attracting investment from other sectors.

Education and light industry are also critical components of economic growth and development, providing the knowl-

edge and skills needed to drive innovation and progress. These projects will not only bene t the local communities but will also contribute to the global e orts to mitigate the e ects of climate change and promote sustainable development.

The partnership between GTS and the local communities is critical for building trust and promoting sustainable development. This collaboration will provide the foundation for the successful implementation of these projects and ensure that the bene ts are shared by everyone. With the full cooperation of the UN Federations in Africa, GTS and the local communities will work together to create a brighter future for the people of these countries.

In conclusion, the signing of these MOUs

by Gulf Technologies Systems is a signicant step forward in promoting economic growth and development in Africa. By working together with local communities and with the support of the Union Nations Federations in Africa, GTS is helping to build a stronger, more productive and sustainable future for the people of these countries. This cooperation is vital for the development of a strong economy and a productive community, and will pave the way for a more prosperous and equitable future for all.

The Chief Enabling O cer of Korba, a wholly-Ghanaian-owned multichannel and interoperable digital payments platform, Nelson Da Seglah, has been adjudged the Fintech Personality of the Year (male category) at the Ghana Fintech Awards 2022.

At the same event Korba was also named as the co-recipient of the “Leading Fintech Solutions of the Year” award for 2022.

The event, jointly organised by Ghana Fintech and Payments Association and Arkel Consult and Management Services, recognises the role of industry players in driving last mile solutions, promoting Ghana’s competitive advantage in the FinTech space, and working towards building a resilient and inclusive nancial system for economic

growth.

Speaking after the ceremony, Nelson Korshi Da Seglah praised the hard work of his team at Korba and promised to deliver more.

“I am honoured to be the recipient of this year’s prestigious award which recognises players in the Ghanaian ntech space for their contribution to nancial inclusion and the socio-economic development of the country.”

This award speaks to the energy and commitment that everyone at Korba brings to the table every day. It is through their hard work and determination to push the boundaries that continue to make Korba an industry leader in end-to-end digital payments.”

He said the awards would push team Korba to do more, to deliver truly revolu-

tionary innovations to improve business performance and enable its customers to make payments, transfer funds and remit without boundaries.

Nelson Da Seglah’s Korba is an Enabler which leverages Financial Technology to deliver nancial products and services to the last mile customer.

The platform currently hosts 5000+ active agents; and over 300,000 registered customers. Transactions on Korba are delivered through multiple channels, including Mobile Apps, USSD, WhatsApp and social media for Self Service as well as Assisted Service via Korba’s network of agents across the country.

The Fintech provides easy access to its services without any complications; enabling its’ clients to make payments

via a unique USSD Short Code. Licensed by the Bank of Ghana as an Enhanced Payment Services Provider (EPSP), Korba has integrated with all banks (including rural banks), all mobile network operators and Insurance Companies in Ghana to provide a one-stop-shop for digital payments, collections and management, as it aggregates various products and utility service providers onto one platform. The platform o ers customers the convenience of completing nancial transactions (purchases, settlements, bill payment, premiums payments, contributions and dues) without having to visit the premises of the service providers thus saving them time and making their lives simple.

A recent survey has shown that having an active interest in cryptocurrency could be the new language of love.

This Valentine’s Day, Binance, the world’s leading blockchain ecosystem and cryptocurrency infrastructure provider, takes a look at crypto’s role in romance thanks to a global survey of 2,600 people. The results prove that crypto could in fact make a di erence to your dating potential.

According to the survey:

An active interest in crypto can be a signi cant plus in a romantic relationship: 83% of participants said that liking crypto was an attractive feature in a relationship.

Interest in Web3 can be a way to get noticed, as the survey found that almost 70% said they would be more

someone if they found out they were interested in crypto.

Having enthusiasm for crypto also shows an openness to innovation and technological advancement. Almost 60% said that they nd people interested in crypto appealing because they are tech-savvy.

Nearly 38% of those surveyed said their partner was just as passionate about crypto as they were, while 27% credited themselves for introducing their partner to the world of Web3 and its underlying technology.

A staggering 83% of respondents said they would prefer to receive a crypto gift card rather than owers or chocolate for Valentine’s Day. The survey ndings are compelling and show that having an interest in

crypto could be the key to a romantic relationship with like-minded enthusiasts this Valentine’s Day. As digital assets continue to rise in popularity, online resources make it easy to jump into the world of crypto and Web3. Binance Academy o ers many online courses and other free learning resources to either begin or grow your crypto knowledge.

About the survey

The survey was conducted from February 6th to 9th, 2023 on the Binance Survey platform, and was open to both Binance users and non-users. 2,600 adults interested in crypto, ranging from 18 to 46 years old, participated in this global survey.

About Binance

Binance is the world’s leading blockchain ecosystem and cryptocurrency infrastructure provider with a nancial product suite that includes the largest digital asset exchange by volume. Trusted by millions worldwide, the Binance platform is dedicated to increasing the freedom of money for users, and features an unmatched portfolio of crypto products and o erings, including trading and nance, education, data and research, social good, investment and incubation, decentralization and infrastructure solutions, and more. The results of this survey are based on the responses of a limited sample of individuals and are not representative of the views of Binanc

Read

Naira note chaos in election run-up

Two weeks before Nigeria’s election, a scarcity of cash and fuel is stoking chaos in the country. After clashes at empty ATMs and accusations of banks hoarding new Naira bills, the Supreme Court on Wednesday suspended the central bank’s second deadline to end the use of old bank notes. Meanwhile, Africa’s biggest oil exporting nation continues to struggle with severe petrol shortages, with retailers unwilling accept old Naira notes and to sell at o cial subsidized rates. Amidst concern that cash and fuel shortages will prevent the mobilisation and payment of o cials by the Electoral Commission of Nigeria, its Chairman Mahmood Yakubu said on Wednesday that polling will go ahead as scheduled on Feb. 25 and that the Commission is working with the national oil company and the central bank to assure supplies.

Turnout to the polling stations could prove the deciding factor, with a Stears poll this week putting Labour’s Peter Obi as favourite in the event of high voter turnout and the ruling APC’s Bola Tinubu given a low turnout. For the currency markets, the lack of physical cash has held the Naira stable against the dollar this week, trading at 747 from 748 at last week’s close. We expect renewed Naira weakness once the new notes are fully circulating and business returns to normal.

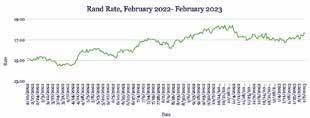

Rand hits three-month low as PMI signals contraction

The Rand slumped to its lowest level since November, trading at 17.82 from 17.48 at last week’s close as energy shortages hamper economic activity. S&P Global’s South Africa Purchasing Managers’ Index fell to 48.7 in January from 50.2 in December, signalling a contraction in activity. The country’s capital expenditure also fell by more than a third last year as the government scaled back spending on infrastructure projects. The economy continues to be crippled by ongoing rolling power blackouts, with food insecurity and unemployment rising. We expect the Rand to continue its current downward trajectory in the short term as investors seek better alternatives.

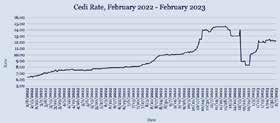

Cedi climbs as Ghana sweetens debt restructuring o er

The Cedi appreciated against the dollar, trading at 12.05 from 12.25 at last week’s close as FX demand eased. The Bank of Ghana sold only $9.2m of dollars in the spot market last week, compared to $40m at the previous Jan. 30 sale. Ghana is sweetening its debt swap o er to encourage participation of local pension funds, which would under the latest plan receive their full interest payments but over a longer time horizon. Other bondholders will receive lower interest payments as part of the debt swap. Ghana is also expected to convert around GHS40bn of loans it owes to the central bank into bonds as part of the broader restructuring plan to unlock a $3bn IMF bailout. As the country continues to advance with its restructuring e orts, we expect the Cedi to appreciate in the near term.

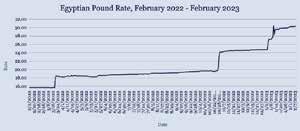

Egypt Pound nears record low after Moody’s cut

Mitch Diedrick

resists rate rise

The Shilling strengthened against the dollar, trading at 3674 from 3684 at last week’s close. Uganda’s central bank kept its benchmark interest rate on hold at 10% for a second consecutive monetary policy meeting. The bank last raised by 100 basis points in October, with rates ending the year 350 basis points higher than they were at the start of 2022. Policymakers said the decision to hold rates was aimed at containing domestic demand pressure and supporting economic recovery. The bank said it expects in ation to slow to its 5% target by the end of the year despite in ation edging up to 10.4% last month. In the near term, we expect the Shilling to weaken amid continued food and energy price in ation. 4%

31% 10%

The Pound weakened against the dollar, trading at 30.43 from 30.28 at last week’s close, continuing its slide towards its record low 30.50 hit in early January. Moody’s Investors Service cut Egypt’s credit rating one notch to B3, six levels below investment grade, citing reduced ability to deal with external macroeconomic shocks while the economy undergoes a structural adjustment towards private sector and export-led growth. Companies face deteriorating conditions as output prices rise at their fastest pace in six years and purchase cost-in ation is the highest in more than four years. We expect the Pound to continue depreciating until structural reforms start to take e ect.

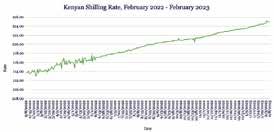

Kenya Shilling at new low while de cit narrows

The Shilling slipped to a fresh low against the dollar, trading at 124.92 from 124.62 at last week’s close amid sustained pressure from importers to meet their obligations and broader dollar strengthening. Shortages of foreign currency in Kenya have continued to weigh on business growth in the country. Despite such strains, the current account de cit was lower than forecast last year, coming in at 4.9% of GDP compared to 5.4% in 2021 on the back of increased exports and diaspora remittances towards the end of the year. The central bank had expected the de cit to hit 5.6% in 2022. With dollar demand continuing to outweigh supply, we expect the Shilling to remain under pressure in the coming days.

Talent might be universal, but opportunity is not. Throughout my life, I have met numerous schoolchildren and university students who were enjoying their studies, acquiring knowledge and skills, making lifelong friends, and working toward their future before a dramatic, life-changing event took it all away. Suddenly, they were in danger and forced to ee their homes. Their talent remained undiminished, along with their enthusiasm and desire, but the opportunity disappeared – sometimes for good. In addition to jeopardizing young people’s physical and mental well-being, forced displacement has a devastating e ect on their education, imperiling their future health, employment prospects, and incomes. If every adult in the world completed primary and secondary education, according to UNESCO, the global poverty rate would be more than halved. A World Bank study found that each additional school year can increase a girl’s future earning power by 12%. Moreover, adults with a college education and above have been shown to live healthier and longer lives, marry later, and be less likely to experience early pregnancy.

But there’s more. Beyond creating opportunities for career advancement, education can provide a safe environment, particularly for displaced children. For young people uprooted from their homes, playgrounds, sports teams, and friend groups, school o ers a protected space, a measure of stabil-

ity and normality, and the chance to form new connections, enabling children and adolescents to explore and investigate while giving them the tools to thrive in the adult world.

Given the bene ts that education can bring, it is unacceptable that nearly half the world’s school-age refugee children are currently not in school.

According to the UN Refugee Agency (UNHCR), which I lead, refugee children’s gross enrollment rate at the primary level stood at 68% during the 2021-22 school year, compared to roughly 100% enrollment for their non-refugee peers. At the secondary level, the gross enrollment rate for refugees was signi cantly lower, at 37%, which was below the average for non-refugees in every region.

Encouragingly, refugee enrollment at the tertiary level has increased from 1% to 6% over the past few years, re ecting the UNHCR’s e orts to increase young refugees’ enrollment in higher education by 2030. But there is still much work to be done. Of the 26.7 million refugees currently under the UNHCR’s mandate, three-quarters live in low- and middle-income countries, and more than 20% reside in the world’s least-developed countries. While many refugee-hosting countries have enacted inclusive refugee policies, they lack the resources, such as extra teachers and facilities, to provide quality education. And even when resources are available, many refugee

EDITOR: BENSON AFFUL editor@business24 com gh | +233 5 45 516 133

families – like all economically vulnerable people – must weigh the cost of books, transport, and fees against other necessities like health care and electricity.

Investing in education means investing in development, human rights, and peace, particularly when it comes to refugees who could rebuild their countries of origin when they are able to return. But to ensure that they are educated by quali ed teachers and have access to up-to-date learning materials, young refugees must be integrated into their host countries’ education systems.

Accomplishing this would require a massive collective e ort, which is why the international community must support host countries, many of which have relaxed immigration controls to allow for the integration of refugees. In January 2021, a joint UNHCR-World Bank report estimated the annual cost of educating all refugee students in low-, lower-middle, and upper-middle-income host countries, from the rst grade to the last year of high school, at $4.9 billion. But this was well before Russia’s invasion of Ukraine displaced millions more pupils.

This gure may seem intimidating to many. But it is a fraction of the average annual education expenditures in refugee-hosting countries and minuscule compared to high-income countries’ education spending. Moreover, when weighed against education’s positive impact on employment and skills, health outcomes, poverty allevia-

PUBLISHED BY BUSINESS24 LTDtion, and economic inclusiveness – not to mention intellectual ful llment and human dignity – $4.9 billion per year is an extremely modest outlay. Moreover, spending wisely can yield outsize returns. The World Bank study also showed that by focusing on lowand lower-middle-income countries, which account for just 20% of global education expenditures, we could ensure that nearly half of all school-age refugees complete their education.

At the UNHCR’s rst Global Refugee Forum in 2019, hundreds of companies, foundations, universities, and philanthropists committed to provide support for refugee education, from funding to policy and advocacy work. The second forum, which will be held in Geneva in December, o ers an opportunity to scale up these commitments. Several countries, including Norway, Sweden, and Denmark, have already introduced or pledged to adopt more inclusive policies. But to capitalize on these measures and develop the necessary infrastructure, more investment is needed.

Providing all children in crisis with the educational opportunities they deserve is among the de ning challenges of our time. Ensuring that children eeing from con ict can still learn will contribute to a more peaceful, resilient world and help close the yawning gap between talent and opportunity. The cost of failure could be immense, but success would pay dividends for many years to come.