Ghanaian lawmaker Samuel Okudzeto Ablakwa has asked government to annul the National Cathedral contract and dissolve the board of trustees amid economic crisis the country is facing.

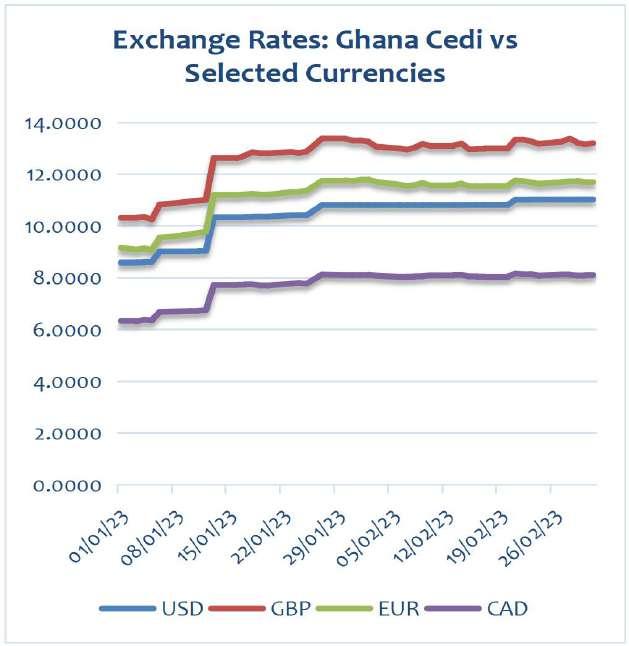

Mr. Okudzeto, who is the Member of Parliament for North Tongu, believes the government's priorities are misplaced, considering the country's current economic situation, including a depreciating currency, dwindling foreign reserves and strained public nances.

Speaking to journalists at parliament house in Accra yesterday, Mr.l Okudzeto Ablakwa, said the over US$1billion project would not materialise hence the need for the government to abrogate the project and dissolve the board of trustees.

“On the occasion of the rst anniversary, since the project was abandoned, we are saying that it is time for President Akufo-Addo and the Board of Trustees to cut their losses. They should abrogate this contract, close the shop and ask the contractors to go home, particularly at this time.

We cannot even meet obligations that we owe our creditors, we have defaulted on our loans, and we have been declared bankrupt. We have

been declared insolvent. For the rst time in our history, we cannot buy vaccines…this is where we are, our nances are in dire straits.

“The government itself admits and that is why it has made an embarrassing U-turn on the issue of road tolls. It is desperately looking for money and yet the government is refusing to abrogate this national cathedral project, which clearly has become a pipe dream, a project which clearly cannot materialize,” he said.

He also stated that the Ghanaian taxpayer could end up paying US$1billion for the construction of the edi ce that has already been embroiled in a lot of controversies and allegations of corruption.

Despite claims that the 5,000-seater cathedral project is a wasted priority, the government claim it will bring new

By Eugene Davis

By Eugene Davis

skills, technology and jobs to the country and act as a beacon to national, regional and international tourists. It has selected celebrated architect David Adjaye to design the building.

President Akufo-Addo rst revealed plans for the cathedral after he won the 2016 election and the architect was appointed two years later. But work on what the president has referred to as "his gratitude to God" only began in 2022, two years after his re-election.

Ghana is entering a belt-tightening phase after securing a preliminary agreement for a $3 billion bailout package from the International Monetary Fund.

The cathedral’s original price tag of $100 million has quadrupled amid an economic crisis that has seen the cedi currency plunge and in ation surge. The state has already spent more than $58 million on the project.

Newmont Africa has announced that its Ghana operations (Ahafo South and Akyem mines) paid a total of GHc 2.76 billion in taxes, royalties, levies, and carried interest to the Government of Ghana in 2022, through the Ghana Revenue Authority, Forestry Commission, and Ministry of Finance.

For the full year (2022), Newmont Africa paid GHc 1.53 billion as Corporate Income Tax, GHc 548.3 million as Miner-

al Royalties, GHc 261.3 million as Pay As You Earn, GHc 164.5 million as Withholding Tax, GHc 222.1 million as Carried Interest, and GHc 35.5 million as Forestry Levy.

In the last quarter of the year (September to December of 2022), Newmont Africa’s payment to government amounted to GHc 1.04 billion, across the two operations.

Breaking it down by operation, Newmont Africa’s Regional Chief

Financial O cer, Danquah AddoYobo, said, “the Ahafo operation contributed GHS 1.22 billion for the year while the Akyem operation contributed GHS 1.54 billion.”

“Over the years, Newmont Africa has been recognised as a compliant and signi cant tax payer in Ghana, and has been duly acknowledged as such by the Ministry of Finance and its revenue agency, the Ghana Revenue Authority.”

Beyond meeting its tax obligations to the government, Newmont Africa also supports the nation’s growth through employment opportunities, local supply chain development, and social investment, among others.

Newmont Africa played, and continues to play a major role in the government’s gold purchasing programme, designed to shore up the country’s gold reserves and help stabilize the national currency.

Emirates has boosted operations by 31% (total ASKMs) since the start of its nancial year and has further plans to increase seat capacity in its latest published northern summer schedule starting 26 March 2023. The airline has expanded its global network to include more destinations in Africa and other continents. This expansion will have a signi cant impact on connecting more African travellers and businesses to the rest of the world.

In the past months, the airline has planned and executed the rapid growth of its network operationsreintroducing services to 5 cities; launching ights to 1 new destination (Tel Aviv), adding 251 weekly ights onto existing routes, and continuing the roll-out of service enhancements in the air and on the ground.

Adnan Kazim, Emirates’ Chief Commercial O cer said: “Emirates continues to expand its global network and deploy its capacity to meet travel demand across the world. Our nancial year started relatively quietly as we held back our ramp up until the planned northern runway rehabilitation program at Dubai International airport was completed in June. From July 2022 onwards, it’s been non-stop expansion.”

He added: “Customer demand has been very strong, and our forward bookings are also robust. Emirates is working hard on several fronts - to bring back operating capacity as quickly as the ecosystem can manage, while also upgrading our eet and product to ensure our customers always enjoy the best possible Emirates experience. So far, 4 of our A380 aircraft have been completely refurbished with our new cabin interiors and Premium Economy seats, and more will enter service as our US$2 billion cabin and service enhancement program picks up pace.”

In the coming months, established routes to Europe, Australia and Africa will be served with more Emirates ights, while in East Asia, more cities are seeing route restarts.

Upcoming A380 deployments in Northern Summer 2023 season: Emirates continues to scale up its A380 operations with the reintroduction of the iconic double-decker across its network: Glasgow (from 26 March), Casablanca from (15 April), Beijing (from 01 May), Shanghai (from 04 June), Nice (from 1 June), Birmingham (from 1 July), Kuala Lumpur (from 01 August), and Taipei (from 01 August).

Upcoming route enhancements by region:

Europe

Brisbane.

Amsterdam: from 14 to 19 weekly ights starting 02 April.

Athens: Addition of a daily seasonal service to serve summer demand between 01 June to 30 September.

Bologna: from 5 ights a week to a daily service starting 01 May.

Budapest: from 5 ights a week to a daily service by 01 June.

London: start of 2nd daily service to London Stansted on 01 May. This will take Emirates’ London operations to 11 daily ights – including 6 times daily to London Heathrow and 3 times daily to Gatwick.

Venice: from 5 to 6 ights a week from 26 March, increasing to a daily service from 01 June.

Africa

Cairo: from 25 to 28 weekly ights by 29 October.

Dar es Salam: from 5 ights a week to daily ights starting 01 May.

Entebbe: from 6 ights a week to daily ights starting 01 July.

Australia and New Zealand Emirates’ non-stop Australia ights will return to pre-pandemic levels to Sydney from 01 May, Melbourne from 26 March, and Brisbane on 01 June.

Brisbane: An additional daily service starting 01 June will take Emirates to 14 ights per week to

Christchurch: restart of daily service from Dubai via Sydney from 26 March.

Melbourne: addition of 3rd daily service to Melbourne from 26 March via Singapore. This adds capacity to Melbourne and re-establishes connectivity between Singapore and Melbourne. The other 2 daily ights from Melbourne y non-stop to Dubai.

Sydney: addition of 3rd daily non-stop service from 01 May.

East Asia

Bangkok: Addition of 5th daily service from 01 August.

Beijing: To commence daily non-stop Boeing 777-300ER service from 15 March, upgrading to an A380 e ective 01 May. A second daily service will commence e ective 01 September with an A380.

Hong Kong: Addition of a daily non-stop ight from 29 March. This increases Emirates’ operations to 14 weekly ights including its existing daily Dubai-Bangkok-Hong Kong service.

Kuala Lumpur: Addition of a third daily service from 01 June.

Tokyo: Resumption of services to Tokyo Haneda with daily ights on 02 April. This takes Emirates’ Japan operations to 21 daily ights including a daily A380 service to Tokyo-Narita and a daily Boeing 777 service to Osaka.

FBNBank Ghana Limited, a subsidiary of First Bank of Nigeria Limited, has announced the appointment of Mr. Allen Quaye as the Bank’s Head of Retail Banking following approval from the regulator, Bank of Ghana.

Allen Quaye is an experienced marketing professional with about two and half decades working experience. His extensive experience covers roles at Unilever Ghana, Standard Chartered Bank, Fidelity Bank, Millicom Ghana Limited, Bank of Africa and GN Bank. Prior to assuming the role at GN Bank as the General Manager (GM), Marketing, Sales and Customer Service, Allen was the GM, Banking Operations of the same bank, a responsibility which covered all banking operations and branch network management aimed at driving business development.

In his new role at FBNBank, Allen

will be responsible for driving the Bank’s retail agenda and delivering its propositions to its key segments which include a strong focus on the youth. It also includes continuously driving the digital channels and agent banking aimed at o ering convenience, security and excellent service to the Bank’s customers and clients.

Commenting on Allen Quaye’s appointment, FBNBank’s Managing Director and Chief Executive O cer, Victor Yaw Asante said, “we are delighted to have Allen join our team at FBNBank Ghana. Allen has a wealth of experience in sales and retail banking and we believe strongly that he is a right- t for us. Our agenda is to continue to o er a retail banking proposition founded on our Gold Standard of Value and Excellence, which places the customer at the heart of whatever we do.

We have no doubt that Allen can build on the momentum we have generated and move on to deliver greater traction towards the attainment of our goals."

Speaking about his new role, Allen Quaye said, “I am excited at the challenge this role o ers and the opportunity to deliver on the Bank’s agenda for retail banking. FBNBank has a great team full of players who are very passionate about what they do and I am delighted to become a member of the team. As the Bank looks set to move on up after 26 years of operations in Ghana, I cannot nd a better time than now to be a part of this developing success story which will continue to touch many lives in Ghana.”

Allen Quaye graduated from the University of Ghana with a degree in Economics. He holds Post Graduate diploma in Busi-

ness Administration from Leicester University, and Marketing from CIMA Ghana and a Master’s degree in Marketing, from the University of Ghana Business School.

Ghana Link Network Services has begun its annual intensive refresher training programme on the Integrated Customs Management System (ICUMS) for various stakeholders across the country. The ICUMS platform has revolutionised customs processes in Ghana by integrating all stakeholders involved in the customs clearance process, from shippers, MDA’s (Ministries, Departments and Agencies) and freight forwarders to customs o cials and other regulatory bodies.

Raymond Amaglo, the Director of Operations for Ghana Link Network Services, told the media that, "The ICUMS is a game-changer in the way we do business at the ports. It has signi cantly reduced the time and cost of doing business while also ensuring the integrity and security of goods and our borders."

This year’s training also has covered the new additions to the ICUMS system on a range of topics, including the use of the ICUMS platform, customs procedures, and regulations, as well as best practices for customs clearance processes.

The training sessions which is still ongoing is being delivered by experienced trainers and industry experts from Ghana Link and

technical partners, who shared their knowledge and experience with the participants.

The rst phase of the refresher training programme, in collaboration with the Ghana Revenue Authority (GRA), started with various Ministries, Departments, and Agencies on ICUMS from the 23rd to the 31st of January 2023. It continued with training for the Trade Department of all Commercial Banks in Ghana on the 26th of January 2023.

The training continued in Tema with the Association of Customs House Agents, Ghana (ACHAG) on the 13th and 14th of February, followed by the Customs Brokers Association of Ghana (CUBAG) on the 15th and 16th of February, the Freight Forwarders Association of Ghana (FFAG) was done on the 17th of February, the Ghana Institute of Freight Forwarders (GIFF) from the 20th to the 22nd of February, the Importers & Exporters Association of Ghana (IEAG) also in Tema on the 24th of February, Self-Declarants in Accra on the 27th of February, Self-Declarants in Tema on the 28th of February, and Direct Applicants (Embassies & Foreign Missions) on the 2nd of March.

"We are committed to working with all stakeholders to ensure

the successful implementation of the ICUMS," Mr. Amaglo said and went on to state that Ghana Link the operators of the ICUMS believes the system will play a crucial role in improving the competitiveness of our ports and in boosting economic growth and development in Ghana. He further explained that the success of the ICUMS platform is closely tied to the level of knowledge and skills that stakeholders possess, which is why the company invested so much in organizing these training programmes to ensure that everyone involved in the customs clearance process is up to date with the latest trends and technologies.

"We are delighted with the positive feedback we have received from the stakeholders who attended these training programmes. It is clear that they have found the programmes to be very bene cial and have gained a lot of valuable insights into how to use the ICUMS system more e ectively," Mr. Amaglo said. The roll-out of these nationwide refresher training programmes is a testament to the commitment of Ghana Link Network Services and the Ghana Revenue Authority to ensure that the ICUMS platform continues to deliver value to stakeholders across the customs clearance process.

Saudi oil giant Aramco has announced a record pro t of $161.1bn (£134bn) for 2022, helped by soaring energy prices and bigger volumes.

It represents a 46.5% rise for the state-owned company, compared with last year.

It is the latest energy rm to report record pro ts, after energy prices spiked following Russia’s full-scale invasion of Ukraine in February 2022.

America’s ExxonMobil made $55.7bn, and Britain’s Shell reported $39.9bn.

Aramco also declared a dividend of $19.5 billion for the October to December quarter of 2022, to be paid in the rst quarter of this year.

Most of that dividend amount will go to the Saudi Arabian government, which owns nearly 95% of the shares in the company.

Brent crude oil, the benchmark oil price, now trades at around $82 a barrel – though prices exceeded $120 a barrel in March, after Russia’s invasion, and June.

“Aramco rode the wave of high energy prices in 2022,” said Robert Mogielnicki of the Arab Gulf States Institute in Washington. “It would have been di cult for Aramco not to perform strongly in 2022.”

In a statement on Sunday, Aramco said the company results were “underpinned by stronger crude oil prices, higher volumes sold and improved margins for re ned products”.

Aramco’s president and CEO Amin Nasser said: “Given that we anticipate oil and gas will remain essential for the foreseeable future, the risks of underinvestment in our industry are real –including contributing to higher

energy prices.”

To address those challenges, he said, the company would not only focus on expanding oil, gas and chemicals production – but would also invest in new lower-carbon technologies.

Aramco – the world’s second-most valuable company only behind America’s Apple – is a major emitter of greenhouse gas emissions that contribute to climate change.

Responding to Aramco’s announcement, Amnesty International’s Secretary General Agnès Callamard said: “It is shocking for a company to make a pro t of more than $161bn in a single year through the sale of fossil fuel – the single largest driver of the climate crisis”.

She added: “It is all the more shocking because this surplus was amassed during a global

cost-of-living crisis and aided by the increase in energy prices resulting from Russia’s war of aggression against Ukraine.”

Saudi Arabia is the largest producer in the oil cartel Opec (Organization of the Petroleum Exporting Countries).

But the Gulf kingdom has been condemned for a range of human rights abuses: its involvement in the con ict in neighbouring Yemen, the murder in 2018 of journalist Jamal Khashoggi, for jailing dissidents, and for widespread use of capital punishment.

BBC

The Global Chamber of Business Leaders (GCBL) has as part of e orts to open up the world to trade and economic partnerships, entered into a strategic cooperation agreement with one of the leading learning institutions in Vietnam, the Institute for Economic and Financial Studies (IEFS).

Both IEFS and the Global Chamber of Business Leaders have through their strategic partnership established the "CEO Club - GCBL".

Under the partnership, IEFS will serve as the representative unit of the Global Chamber of Business Leaders in Vietnam.

Also as part of its mandate under the cooperation, IEFS will run the GCBL CEO Club as the focal point to gather CEOs, Entrepreneurs of successful businesses and startups in Vietnam. IEFS will also work on encouraging business owners or

entrepreneurs in the Asian nation to join GCBL as members.

Bene ts of becoming a member of the CEO Club

Members of the CEO Club, will among other things, have access to GCBL's resource database to promote trade and investment opportunities between Vietnamese GCBL members and worldwide GCBL members.

Commenting on the partnership, Chairman of IEFS, Prof. Ho Quoc Nam, explained that enterprises that are members of GCBL Vietnam CEO Club could participate in summits and trade conferences to be organized by GCBL to connect GCBL members from di erent countries to their Vietnamese counterparts.

In addition to the numerous business opportunities, IEFS is expected to further cooperate with GCBL

to provide global GCBL members with short-term corporate training and coaching programs as well as Bachelor and Master and PhD programs to receive internationally-recognized French, UK and USA Degrees.

Such educational programs are to be conducted online through speci c learning software of Education Partners of IEFS or at training workshops to be organized by a liated universities of IEFS.

Additionally, IEFS is to build an online coaching and learning platform for global GCBL members.

On his part, the Chairman of GCBL, Dejan Stancer, said the cooperation between GCBL and IEFS was timely, saying such partnerships are needed to help promote global trade and link business owners from around the world to one another..

Malta Guinness, Ghana's leading non-alcoholic malt beverage brand, has rea rmed its commitment to creating a ‘World of Good’ through the launch of an initiative aimed at the celebration of the Ghana’s rich heritage manifested in its arts, food, culture, and tourism.

The campaign is dubbed ‘Cheers to Ghana’ campaign.

Marketing Manager for Malta Guinness, Dinah Adu-Asare notes, “we believe in creating a World of Good, and celebrating Ghana month is one of the ways we can achieve this. Malta Guinness is made by Ghanaians, for Ghanaians and in Ghana. The ‘Cheers to Ghana’ campaign is aimed at celebrating the farmers who have supported us and played a pivotal

role in bringing Malta Guinness to millions of Ghanaians by providing us with raw materials.

It is also to celebrate the many Ghanaians who have made us a part of their lives and celebrations for over 30 years. With this initiative, we have partnered several events to showcase the rich Ghanaian culture and connect more to our consumers and our roots as Ghanaians to promote Ghana to the world.”

In the spirit of promoting ‘Made in Ghana’ and celebrating Ghana Month, Malta Guinness has also launched Malta Guinness Cocoa which is a limited edition variant to bring more excitement to our celebrations in this season.

“As a product made in Ghana, from Ghanaian raw materials,

by Ghanaians for Ghanaians, Malta Guinness is also using the ‘Cheers to Ghana’ campaign to promote Made in Ghana, celebrate Ghanaian experiences and support local brands and businesses. This year, Malta Guinness kicked o the ‘Cheers to Ghana’ campaign with the Greenstreet Waakye Fiesta, Heritage Caravan, Gob3 Festival and Waakye Summit. Attendees participated in exciting activities including trivia on Ghana and Malta Guinness.” Other upcoming events include an International Women’s Day event highlighting the works and contributions of Ghanaian Women in Film and Production, Ghana Food Bazaar among others.

For the past 33 years, Malta Guin-

ness has provided millions of Ghanaians from all walks of life with refreshing goodness and vitality, creating memorable experiences and promoting Ghana’s rich, diverse culture. Anytime you pick a Malta Guinness can or bottle with the ‘Made in Ghana’ symbol, know that you are supporting the Ghanaian heritage and say ‘Cheers to Ghana’.

The Chairman of the Global Chamber of Business Leaders (GCBL), Dejan Stancer, has called for women around the world to be given top posts in multilateral institutions like the United Nations (UN), the International Atomic Energy Agency and the World Bank.

Mr. Stancer made the call in a speech during a virtual conference organized by the Global Chamber of Business Leaders on March 8, 2023, to celebrate the International Women's Day (IWD).

The 2023 edition of IWD was held under the global theme: 'DigitALL: Innovation and technology for gender equality' and was celebrated worldwide to help raise awareness about the need to create equal opportunities for both women and men in the digital or technological world. Speaking under the special theme for the virtual conference: "Unleashing The Power Of Innovation And Technology For Gender Equality," Mr. Stancer bemoaned that "women have held just 12 percent of the top posts in the 33 largest multilateral institutions since 1945, and more than a third of those bodies, including all four major development banks, have never been led by a woman."

He explained that since 1945, the 33 multilateral institutions have had 382 leaders, of whom only 47 were women, adding that "and

despite progress in recent years, only one third of institutions are currently headed by women."

According to him, ve of those bodies have only had one female president in their history, and that includes the current head of the World Trade Organization (WHO), Ngozi Okonjo Iweala.

Among the 13 institutions that have never had a woman at their head, Mr. Stancer mentioned, are the World Bank, the UN, the International Atomic Energy Agency (IAEA) and the Food and Agriculture Organization (FAO).

Giving reasons why women must be given opportunities to head multilateral institutions, Mr. Stancer made a demographic argument, saying "Women make up 50 percent of the world's population, so it's demographic justice to begin with.Women bring a combination of leadership, wisdom and empathy. Sometimes women have an even greater understanding of what's going on in the world, and about geopolitics."

Meanwhile, he said at the Global Chamber of Business Leaders, the situation is completely di erent, saying the share of women occupying leadership positions is almost 46%.

"In the working bodies of GCBL, as we call the committees, of which we have established six, the proportion of women is as much as 50%," he said.

According to him, "Appointments to the GCBL are never made on the basis of race, color, political or religious belief, and especially not on the basis of sex. At GCBL, we appoint exclusively on the basis of knowledge and experience. With us, everyone has the same opportunities, even to occupy the highest positions in the organization."

About GCBL

The Global Chamber of Business Leaders is a coalition of governmental leaders, CEOs and executives, entrepreneurs, investors and business and industry leaders who share a common vision: the sustainable well-being and

growth of business in a disruptive and ever-evolving global economy.

Global Chamber of Business Leaders prioritizes activities that align with the UN-declared Decade of Action, promoting the importance of the inclusion of the Sustainable Development Goals in the business models of the future, allowing our partners, members, and participants to prepare their businesses to be vanguards of the future.

The GCBL fosters a vibrant and interconnected business community, encouraging resiliency, growth and market expansion in a progressive business environment where collaboration spurs growth; education enhances the ability and promotes opportunity; and advocacy in uences authority.

Speaker of Parliament, Alban Sumana Kingsford Bagbin, has assured of Ghana’s commitment to collaborate with the Inter-Parliamentary Union (IPU) to ght intolerance and promote peaceful co-existence in societies. According to him, this is the only sure way for the world to know true peace and prosperity. In a speech at the 146th IPU Assembly in Manama, Bahrain, the Speaker touted the values of good democratic governance which the Ghanaian parliament is translating for the utmost bene t of its people.

Addressing participants at the conference, Speaker Bagbin said

this is evident in the large gender parity delegation the Ghanaian parliament sent to the conference to further the course of the theme and humanity as a whole. The Speaker also added charged legislators across the world to encourage tolerance and inclusive development through the laws they promulgate.

Some 2,700 delegates drawn from more than 179 countries across the globe have gathered in the Kingdom of Bahrain for the conference which is under the theme, “Promoting peaceful coexistence and inclusive societies: Fighting intolerance.”

the O shore Patrol Vessel ESPS

‘Audaz’ called at the port of Tema on March 6, where it carried out military activities with the Ghanaian Armed Forces for six days. In addition, the warship participated in the ‘Flintlock-23’ exercise, supporting a Force of Special Operations located in land. The main goals of the visit were to strengthen cooperation ties between Ghana and Spain and to promote maritime security in the Gulf of Guinea.

Taking advantage of these events, Lieutenant General Francisco Braco Carbó, Commander of the Operations Command, travelled to Ghana in order to oversee the military activities of the Spanish forces and to establish an agenda of high-level meetings.

Port visit in Tema

Audaz, constructed by Navantia, is one of the four OPVs (O shore Patrol Vessels) built for the Spanish Navy under the extension of “1st series navy ships”. It was delivered in July 2018, and it has its docking base in Cartagena, Spain. The current sta of ESPS. ‘Audaz’ is made up of 77 people, among them were an Operational Security Team of Marines and a reinforcement of soldiers and

seamen for speci c capacities. It is commanded by the Captain of Corvette Marcos de Sousa Fuchs.

After having covered more than 8.000 nautical miles since it left Spain last January, the ESPS ‘Audaz’ set course towards Tema (Ghana). Previously, it had participated in the ‘Obangame Express 23’ exercise and it had visited the ports of Lagos (Nigeria), Pointe Noire (Republic of the Congo) and Luanda (Angola). Audaz’s operations in Ghana fall within the scope of “Foco África 2023” and “Plan Africa”, two strategies of the Spanish Government, which consider Ghana a priority of Spain’s foreign policy.

The military cooperation activities carried out with the Ghanaian Armed Forces aimed at improving Ghana’s capacities in ghting terrorism, piracy and other maritime related crimes. The cutting edge equipment of the vessel, together with the high level skills of the Spanish soldiers, were shared with the Ghanaian authorities, who learned about the use of unmanned vehicles such as drones, medical services or

various defence mechanisms.

Exercise FLINTLOCK-23 and ESPS ‘AUDAZ’

Audaz also participated in the annual ‘FLINTLOCK’ exercise, organized and directed by the US Special Operations Command for Africa (SOCAFRICA). The exercise is designed to enhance the capabilities of Sahel countries to combat terrorist or extremist organizations, illicit tra cking and the ow of foreign ghters. It aims at increasing Border security, integrating the Air Forces of host nations in support of Special Operations, as well as adding

As part of activities to commemorate International Women’s Day, Stanbic Bank Ghana has organized a seminar for women dubbed, ‘The Feminine Code.’ The discussion was in line with this year’s theme for International Women’s Day, ‘DigitALL: Innovation and technology for gender equality’, and was led by female leaders from various tech-related departments in the bank who shared their experiences as women in technology and their journey so far.

The panelists included Estelle Asare, Head, Digital and Innovation, Marian Amartey, Head, Business Enablement, Jemilatu Abdulai, Head, Digital and E-commerce and Aya Ayettey, Head, Production Assurance and Customer Care, Tech and OPS.

Speaking on her experience as a

woman in STEM, Mrs. Marian Amartey shared that there needs to be a deliberate attempt and more focus on encouraging girls to take up STEM-related courses in school. She mentioned, “No matter what your area of interest is, problems are part of our daily lives. Even as women there are a lot of challenges that are speci c to our gender. One way or the other, be required to solve them at a point. STEM as a eld has what will suit you to achieve your purpose and beyond. Instead of relying on the other gender to solve our problems, we must encourage more young ladies to take up STEM-related courses. I believe that as women we are equally capable of excelling in the digital space. There are many opportunities for women in technology all they need is

the right training to succeed and do amazing things in this eld.” “It can really be intimidating as a woman entering a male-dominated eld. During my studies, I was one of the only girls in the class. Many times I was made fun of and asked why I was even there. But I knew what I was about so I remained focused and put in hard work and I excelled. I am very grateful to be working in a bank with men who are supportive of women and create a conducive environment for us to succeed.,” she added. Mrs Estelle Asare also encouraged women to take advantage of every opportunity that comes their way. She advised, ‘The future is exciting. Now careers in STEM are not as limited as it used to be and that has created more opportunities for women to play in the eld. As women, we cannot sit back and wait for things to

“Information Operations” into these scenarios. It is the rst time that a ship participates in this exercise.

Although special Operation Units from di erent countries participated in Flintlock, (1300 troops from 30 countries), the ship was the only vessel taking part in the exercise. Furthermore, Spain is participating in Flintlock with additional units from the three Armies and Civil Guard, all working under the leadership of the Commander of the Operations Command, Lieutenant General Francisco Braco (CMOPS).

happen. We need to take charge of our lives and go the extra mile to make things happen. Apply yourself to whatever you do and be hungry to learn more. I always encourage women to nd a mentor who can guide them and show them that indeed your dreams are valid and they are possible.”

Over the years Stanbic Bank has celebrated International Women’s Day by supporting young women across the country with access to and training in STEM. Last year the bank presented STEM books to female students of the Ogbojo Presbyterian Junior High School at Madina, Accra. The bank also organized a 5-day camp in partnership with WiSTEM Ghana to educate young girls from various secondary schools in Ghana. The camp provided young girls with adequate training and skills in various STEM-related areas.

The use of dry ice in cocktails has become increasingly popular in recent years, as it adds a unique and impressive visual e ect to many cocktails because of the dramatic "smoking" e ect it creates. However, it is important to educate the public on the proper handling and use of dry ice to prevent any potential safety hazards.

It is important to understand what dry ice is. Dry ice is the solid form of carbon dioxide (CO2), which is a colourless, odourless gas that is present in the air we breathe. Dry ice is extremely cold, with a temperature of around -78.5°C, which makes it a great option for chilling drinks quickly. While dry ice itself is not toxic, it can pose certain health risks if it is not handled properly.

The rst and most important aspect to consider is the risk of carbon dioxide exposure. When dry ice is added to drinks, it sublimates (i.e. moving directly from the solid state to the gaseous state), releasing carbon dioxide gas. This gas can displace oxygen in the air and create a hazardous environment, particularly in small

or enclosed spaces. To prevent this risk, it is important to use dry ice in a well-ventilated area and avoid using too much dry ice at once.

Additionally, bartenders must educate themselves and other sta on the proper handling of dry ice. This includes wearing gloves and using tongs or other appropriate tools to handle the dry ice, as it can cause frostbite or burns if it comes into contact with skin. Cocktail providers are also encouraged to always alert their sta and customers to avoid ingesting dry ices in their drinks which can cause serious injury to their mouths and stomach walls. Another important consideration is the proper storage and transportation of dry ice. It should be stored in a well-ventilated, cool, and dry area, and should not be sealed in airtight containers or rooms. It is also important to transport dry ice in insulated containers to prevent any potential safety hazards during transport.

Finally, it is important to properly label drinks that contain dry ice, to ensure that customers are

aware of the potential hazards and can handle the drinks safely. This can be done with a label or warning sign on the menu, or by informing customers directly when they order the drink.

The Food and Drugs Authority (FDA) will want consumers to be cautioned that Carbon dioxide exposure and the potential for frostbite and burns are the main risks associated with dry ice.

Use only small amounts of dry ice in cocktails as a little goes a long way when it comes to creating the "smoking" e ect. Using too much dry ice can be dangerous, as it can cause an excessive amount of carbon dioxide gas inhalation. Make sure that any room where dry ice is being used is well-ventilated and spacious to prevent the build-up of carbon dioxide gas.

By Chris KONEY

By Chris KONEY

Lieutenant General Francisco Braco Carbó (CMOPS), has visited Ghana to meet high-level authorities and to see rst-hand the activities carried by Spanish forces during the annual ‘FLINTLOCK’ exercise, organized and directed by the US Special Operations Command for Africa (SOCAFRICA).

To take advantage of the military activities and the strategic importance of Ghana to Spain, Vice Admiral Alfonso Delgado and Brigadier General Ángel Herrezuelo accompanied Lieutenant General Francisco Braco Carbó.

Lieutenant General Francisco Braco led the team to hold high-level meetings with local authorities and other key government o cials including the Minister of Defence, Hon. Dominic Nitiwul, Vice Admiral Seth Amoama, Chief of the Defence Sta , Rear Admiral Issah Yakubu, Chief of Naval Sta and General Francis Adu Amanfoh, Special Presidential Advisor for the Accra Initiative.

The delegation was accompanied by His Excellency Javier Gutiérrez, Ambassador of Spain in Ghana, who stated that “the visit of the Armada warship AUDAZ and of the Commander of the Operations Command of the Spanish Armed Forces are a testimony to the priority Spain attaches to Ghana and the security in the region”.l

The United Nations Industrial Development Organization (UNIDO) and the Ghana Enterprises Agency (GEA) today launched a call for applications for its program aimed at scaling up Ghana’s national initiatives on Micro, Small and Medium Enterprises (MSMEs) promotion.

The call for proposal under the joint implementation of UNIDO and the GEA is part of activities of its $3.9 Million project “Expanding the Kaizen Initiatives by Enhancing Sustainable Agri-Business”, funded by the government of Japan to sustainably and continually improve quality and productivity of businesses in Ghana.

Mr. Marin Mizuno, UNIDO Project Manager, noted acquiring proper enterprise performance management skills is crucial to the sustainability of MSMEs and enterprises' growth.

Mr. Mizuno said: “In this di cult time, the only control at our disposal is our own internal resources, which we can maximize to improve enterprise performance. And in this regard, I strongly believe that the Kaizen approach, which leverages the e ciency of internal resources, is the perfect tool for MSMEs to cope with the current di culties.”

He emphasised that UNIDO’s Smart and Sustainable Agri-busi-

ness, an innovative enterprise performance management tool which leverages digital solutions for productivity improvement will contribute to modernizing enterprise performance management in the MSMEs space.

Mr. Tetsuya Imaoka, Coordinator for Economic Cooperation of the Embassy of Japan in Ghana revealed the philosophy of Kaizen is to improve the enterprise performance by maximizing the e ciency with the available resources, rather than resorting to huge capital investment.

Mr. Imaoka a rmed: “I believe Japanese technology, experience and wisdom through a variety of methodologies and approaches is exactly what is needed in Ghana, especially for micro, small and medium enterprises as we go through a very di cult time.”

Hon. Samuel Abu Jinapor, Caretaker Minister for the Ministry of Trade and Industry and Substantive Minister for the Ministry of Lands and Natural Resources said data from the registrar General’s Department of Ghana indicates that about 90% of businesses registered in Ghana are MSMEs. He con rmed: “Micro, Small and Medium enterprises have been identi ed by Government as the means through which its Industrial Transformation Agenda and

other development goals of the country can be realised and we are grateful to Japan for this support.”

Mrs. Kosi Yankey-Ayeh, the Chief Executive O cer of GEA stated that the project is going to stimulate the National Expansion drive for MSMEs with an emphasis on production e ciency, food safety and compliance to make them more e cient and competitive.

Mrs. Yankey-Ayeh added: “We are committed, prepared and well-positioned to partner with UNIDO to ensure the smooth commencement and successful

implementation of the Project”.

MSMEs who meet the selection requirement would be selected for Kaizen and SSAB training. The selected MSMEs will also bene t from the capital investment component of the project. The Call for Proposals for this program will be open until the 30th of April for the enterprises to apply. The selection will be duly conducted for the nal nomination of the enterprises to be supported under the program.

An Assistant Commissioner in Charge of Value Added Tax (VAT) Administration with the Ghana Revenue Authority (GRA), Philip Acquah, has remarked that migration of businesses onto the Electronic Valued Added Tax (E-VAT) system is scheduled to end in December 2024.

The pilot phase, which started with 50 taxpayers across di erent sectors, was completed in October 2022.

The government has begun Phase One of the implementation process with 600 taxpayers in the same industries/sectors and is scheduled to end in June 2023. Phase two of the E-VAT implementation is projected to begin in December 2023.

Mr. Acquah disclosed this during a Quarterly Tax Dialogue Seminar Series on the implication of the E-VAT on businesses in Ghana, hosted by the UK- Ghana Cham-

ber of Commerce in partnership with PwC Ghana.

What is E-VAT?

According to Mr. Acquah, “E-VAT is just another term for the Electronic Invoicing system”. E-VAT transforms the manual invoice issuance process (paper-based) into an electronic format. It also allows for such invoices including debit and credit notes to be exchanged electronically.

“With E-Invoicing, GRA will authenticate and validate the invoices issued by taxpayers in real time”.

He further remarked that “we are not introducing any new law …[or] rate. All we’re doing is we’re connecting the Commissioner General’s invoicing system to taxpayers’ invoicing system such as that now the issuance of electronic invoices is made a default”.

Mr. Acquah noted that the manual

invoicing regimes was fraught with many challenges. These include issues of forgery, lack of data for e ective compliance, ‘carding’ of invoices, and signicant man hours on auditing among others.

He explained that the implementation of the electronic invoicing system will promote a fair and equitable VAT Regime, by eliminating bottlenecks militating against the current paper-based system.

Other bene ts to businesses include improved documentation and record keeping, streamlining VAT refund processing, and reducing the compliance burden, amongst others.

Issues with the Electronic Invoicing System

Mr. Acquah admitted that issues regarding the e ciency of the system were reported, such as system downtime and lack of

response.

While a pilot test of the system re ned its capabilities, the GRA is also providing technical remote assistance to address the taxpayers’ issues in real time.

Clarifying an erroneous notion that the Ministry of Finance had sought and gotten an amendment to the VAT ACT to disadvantage businesses, Daniel Nuer, the Head of Tax Policy at the Ministry of Finance said “the change was not to create a problem for everybody… the idea was to spread the onboarding of [businesses] onto the system over a year. But the law that was passed wasn’t that clear, so it was assumed that everybody had a year to transition.

“…And so, the one year was taken o is not because it was changed to make everybody a ‘tax criminal’, but then to allow the Com-

missioner General to continue his duties”.

He mentioned that the Ministry of Finance is currently working with the rst batch of businesses. After completion, another batch of businesses will be noti ed as to when their migration to the electronic system will begin.

Mr. Nuer added that the E-VAT system will improve revenue generation to reduce budget de cits and is leveraging technology to achieve this purpose. He believed that this system will make businesses e cient and compliant.

Tax Prosecution

Urging businesses to comply with the tax laws, Mr. Nuer reiterated that the non-payment of taxes is a criminal o ence, and that government is enforcing the law through criminal prosecutions because civil prosecutions have not yielded the desired results.

Speakers at the seminar, held on the premises of PwC Ghana, discussed other pertinent topics such as publicisation of the migration guidelines and 3rd Party invoicing.

The rst in the series of the Quarterly Tax Dialogues was moderated by Abeku Gyan-Quansah, a Tax Partner with PwC Ghana and UKGCC Executive Council Member.

The run on Silicon Valley Bank (SVB) – on which nearly half of all venture-backed tech start-ups in the United States depend – is in part a rerun of a familiar story, but it’s more than that. Once again, economic policy and nancial regulation has proven inadequate.

The news about the second-biggest bank failure in US history came just days after Federal Reserve Chair Jerome Powell assured Congress that the nancial condition of America’s banks was sound. But the timing should not be surprising. Given the large and rapid increases in interest rates Powell engineered – probably the most signi cant since former Fed Chair Paul Volcker’s interest-rate hikes of 40 years ago – it was predicted that dramatic movements in the prices of nancial assets would cause trauma somewhere in the nancial system.

But, again, Powell assured us not to worry – despite abundant historical experience indicating that we should be worried. Powell was part of former President Donald Trump’s regulatory team that worked to weaken the Dodd-Frank bank regulations enacted after the 2008 nancial meltdown, in order to free “smaller” banks from the standards applied to the largest, systemically important, banks. By the standards of Citibank, SVB is small. But it’s not small in the lives of the millions who depend on it. Powell said that there would be pain as the Fed relentlessly raised interest rates – not for him or many of his friends in private capital, who reportedly were planning to make a killing as they hoped to sweep in to buy uninsured deposits in SVB at 50-60 cents on the dollar, before the government made it clear that these depositors would be protected. The worst pain would be reserved for members of marginalized and vulnerable groups, like young nonwhite males. Their unemployment rate is typically four times the national average, so an increase from 3.6% to 5% translates into an increase from something like 15% to 20% for them. He blithely calls for such unemployment increases (falsely claiming that they are necessary to bring down the in ation rate) with nary an appeal for assistance, or even a mention of the

long-term costs.

Now, as a result of Powell’s callous – and totally unnecessary – advocacy of pain, we have a new set of victims, and America’s most dynamic sector and region will be put on hold. Silicon Valley’s start-up entrepreneurs, often young, thought the government was doing its job, so they focused on innovation, not on checking their bank’s balance sheet daily –which in any case they couldn’t have done. (Full disclosure: my daughter, the CEO of an education startup, is one of those dynamic entrepreneurs.)

While new technologies haven’t changed the fundamentals of banking, they have increased the risk of bank runs. It is much easier to withdraw funds than it once was, and social media turbocharges rumors that may spur a wave of simultaneous withdrawals (though SVB reportedly simply didn’t respond to orders to transfer money out, creating what may be a legal nightmare). Reportedly, SVB’s downfall wasn’t due to the kind of bad lending practices that led to the 2008 crisis and that represent a fundamental failure in banks performing their central role in credit allocation. Rather, it was more prosaic: all banks engage in “maturity transformation,” making short-term deposits available for long-term investment. SVB had bought long-term bonds, exposing the institution to risks when yield curves changed dramatically.

New technology also makes the old $250,000 limit on federal deposit insurance absurd: some rms engage in regulatory arbitrage by scattering funds over a large number of banks. It’s insane to reward them at the expense of those who trusted regulators to do their job. What does it say about a country when those who work hard and introduce new products that people want are brought down simply because the banking system fails them? A safe and sound banking system is a sine qua non of a modern economy, and yet America’s is not exactly inspiring con dence.

As Barry Ritholtz tweeted, “Just as there are no atheists in Fox Holes, there are also no Libertarians during a nancial crisis.” A host of crusaders against government rules and regulations suddenly became champions of a government bailout of SVB, just as the

nanciers and policymakers who engineered the massive deregulation that led to the 2008 crisis called for bailing out those who caused it. (Lawrence Summers, who led the nancial deregulation charge as US Treasury Secretary under President Bill Clinton, also called for a bailout of SVB – all the more remarkable after he took a strong stance against helping students with their debt burdens.) The answer now is the same as it was 15 years ago. The shareholders and bondholders, who beneted from the rm’s risky behavior, should bear the consequences. But SVB’s depositors – rms and households that trusted regulators to do their job, as they repeatedly reassured the public they were doing – should be made whole, whether above or below the $250,000 “insured” amount. To do otherwise would cause long-term damage to one of America’s most vibrant economic sectors; whatever one thinks of Big Tech, innovation must continue, including in areas such as green tech and education. More broadly, doing nothing would send a dangerous message to the public: The only way to be sure your money is protected is to put it in the systemically important “too big to fail” banks. This would result in even greater market concentration – and less innovation – in the US nancial system.

After an anguishing weekend for those potentially a ected throughout the country, the government nally did the right thing – it guaranteed that all depositors would be made whole, preventing a bank run that could have disrupted the economy. At the same time, the events made clear that something was wrong

with the system.

Some will say that bailing out SVB’s depositors will lead to “moral hazard.” That is nonsense. Banks’ bondholders and shareholders are still at risk if they don’t oversee managers properly. Ordinary depositors are not supposed to be managing bank risk; they should be able to rely on our regulatory system to ensure that if an institution calls itself a bank, it has the nancial wherewithal to pay back what is put into it.

SVB represents more than the failure of a single bank. It is emblematic of deep failures in the conduct of both regulatory and monetary policy. Like the 2008 crisis, it was predictable and predicted. Let’s hope that those who helped create this mess can play a constructive role in minimizing the damage, and that this time, all of us –bankers, investors, policymakers, and the public – will nally learn the right lessons. We need stricter regulation, to ensure that all banks are safe. All bank deposits should be insured. And the costs should be borne by those who bene t the most: wealthy individuals and corporations, and those who rely most on the banking system, based on deposits, transactions, and other relevant metrics. It has been more than 115 years since the panic of 1907, which led to the establishment of the Federal Reserve System. New technologies have made panics and bank runs easier. But the consequences can be even more severe. It’s time our framework of policymaking and regulation responds.

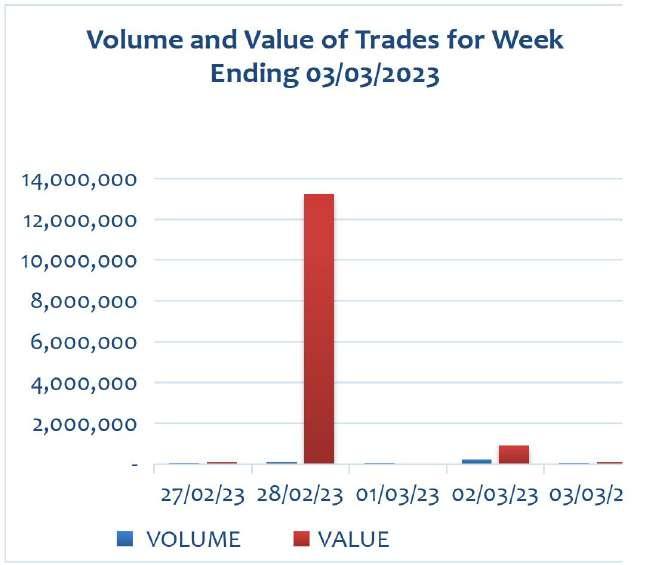

at the last treasury bill

�on held on March 3, 2023 rejected all submi�ed bid s on the grounds of high interest bid rates It in turn through the Bank of Ghana reopened the tender for auc�on and directed all investors to resubmit their bids at a reduced rate, preferably below 30% because it considered the c urrent bids at the 35% plus yields as expensive It was seeking to raise GH¢2.78 billion to refinance maturing

tt iin

rr e e s stt c c o o s stt ffo orr tth h e e lla a s stt tth hrre e e e m m o o n ntth h s s h hiit t ¢ ¢ 4 4 4 4 1 1 6 6 b b n n

B B o o n n d d m m a arrk k e ett d d e e c clli i n n e e s s b b y y a a b b o o u utt 5 5 2 5 5 0 0 % iin n m m a arrk k e ett ttu urrn n o o v v e err iin n tth h e e m m o o n ntth h o off F F e e b brr u u a arry y 2 2 0 0 2 2 3 3

T--b biil lll s s:: g g o o v v e errn n m m e e n ntt p p u u s s h h e e s s iin n v v e e s stto orrs s tto o b biid d b b e ello o w 3 3 0 0 % %

J anua r y 20,202 3 March 3, 2023

J anua r y 20,202 3 March 3, 2023

The African Development Bank, rated Aaa/AAA/AAA/AAA (Moody’s/S&P/Fitch/Japan Credit Rating, all stable), has issued a 1 billion Norwegian krone (NOK) 5-year Green Bond due March 2028.

The bond was issued on Thursday 2 March and marks the Bank’s rst green bond issuance in the Norwegian krone market. This follows successful green bond issuances in US dollars (USD), Swedish krona (SEK), Australian dollar (AUD), since the Bank established its Green Bond framework in 2013, and three NOK social bonds issued in 2019 and 2021.

The funds raised through this transaction will be used to nance eligible green projects in accordance with the African Development Bank’s Green Bond Program for the purpose of supporting African countries’ transition to green growth. The bond proceeds will contribute to building resilience against the negative impacts of climate change, achieving

sustainable infrastructure, developing ecosystems and promoting e cient and sustainable use of natural resources such as water, a sector particularly vulnerable to climate change across the continent.

This transaction emphasizes the Bank’s continued focus on delivering on its Ten-Year Strategy whose overarching objectives are inclusive growth and transition to green growth. It also illustrates the Bank’s consistent e ort to commit to its role as one of the main actors of climate nance in Africa, particularly in the Sustainable Water and Wastewater Management sector, which represents 28% of Bank’s green pipeline as of 31 December 2022. This is particularly relevant considering the forthcoming UN 2023 Water conference in New York(link is external), which aims to focus the world’s attention on the topic of water and the critical role it plays in delivering on the entire sustainable development agenda.

Commenting on the bond

issuance, Kristin Lien, Senior Portfolio Manager, Kommunalbanken, said: “Kommunalbanken is delighted to support African Development Bank’s rst Green Bond in the Norwegian market. It represents a great alignment of both our own and AfDB’s objective of mobilizing capital to nance the transition to a low-carbon, climate resilient future. We hope the success of this transaction will encourage other development nance institutions to raise more funding in the Norwegian Green Bond market in the future.”

Keith Werner, Division Manager, Capital Markets and Financial Operations, African Development Bank said: “As a pioneering participant in the ESG market, the African Development Bank is pleased to launch its inaugural Green Bond in the Norwegian market in collaboration with SEB in order to support the Bank’s commitment towards addressing the devastating e ects of climate change in Africa while extending its investor reach in the Nordic

market. This 15th Green Bond, issued under the Bank’s Green Bond framework, highlights the Bank’s consistent investments in sectors such as renewable energy, energy e ciency, clean transportation, biosphere conservation, but in particular, as we approach the UN’s Water Conference later this month, the increasingly important sector of sustainable water & wastewater management.”

“We are proud to assist AfDB’s continued expansion into new areas of the green nance market and support the delivery of their green growth strategy in Africa. Later this month at the UN Water conference in New York we will be reminded of how water plays such a critical role in delivering on the sustainable development agenda, so it’s a great opportunity to highlight AfDB’s nancing in this sector which represents close to a third of their green pipeline,” said Ben Powell, Head of Sustainable Debt Capital Markets, SEB.