Independent think tank, Africa Center for Democracy and Socio-economic Development (CDS Africa) have asked banks to carefully balance the risks and rewards of their investment and lending strategies, considering the speci c economic and market conditions in which they operate.

According to a Senior Research and Policy Analyst at CDS Africa, Dr. Frank Bannor, while government securities may o er some degree of safety, it is important for banks to also consider that they may not be entirely insulated against risk as had been the case over the past years.

He also added that it is important for banks to have a diversi ed portfolio of assets and investments, rather than relying too heavily on any one type of investment. It is also important for regulators to ensure that banks are adequately capitalized and have e ective risk management practices in place to mitigate the risks associated with their investments.

Further, he stated that the Bank of Ghana must pursue a deliberate policy of encouraging banks to increase their lending to the private sector, particularly to SMEs. In doing so the Bank of Ghana will be supporting the growth and development of the private sector, which is essential for long-term economic growth and job creation.

CDS Africa, in a press statement also called on the Bank of Ghana to ensure a balanced approach that supports both

the growth of the private sector and the stability of the banking architecture. Such a measure is essential for sustainable economic development.

Background

The statement also revealed that banks facilitate the ow of funds throughout the economy. Through the issuance of loans and credit, banks can help businesses and individuals access the capital they need to invest in new projects, purchase goods and services, and grow their businesses.

Banks also act as intermediaries between savers and borrowers, allowing savers to earn interest on their deposits while providing borrowers with access to the funds they need. Banks also play a crucial role in providing nancial services to individuals and households.

Through checking and savings accounts, credit and debit cards, and other nancial products, banks provide individuals with a safe and convenient way to manage their money. This can help individuals save for the future, access credit when needed, and make purchases and transactions with ease, the statement noted.

Further, CDS Africa acknowledged that banks play a critical role in providing nancial services that support economic growth and development, including providing loans and credit facilities to individuals and businesses. However, they reckon, it also important for banks to operate in a safe and sound manner, subject to e ective regulatory oversight,

to ensure they do not take on excessive risks that could jeopardize their nancial stability and the wider economy.

“The situation in Ghana highlights some of the challenges that banks face in balancing their role as providers of credit with the need to manage risk e ectively. Many banks in Ghana have a signi cant portion of their investments in government securities and instruments, which may be seen as a relatively safe and stable investment compared to lending to private businesses. The government's debt restructuring exercise has highlighted the risks associated with such a strategy. If banks are too heavily exposed to government debt, they may be vulnerable to shocks or changes in government policy that could have a signi cant impact on their balance sheets. In the case of Ghana, the debt restructuring exercise may require banks to take haircuts, which could lead to losses and potentially impact their ability to lend to private businesses,” the statement captured.

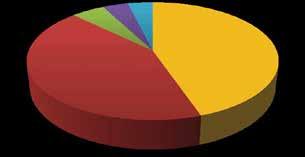

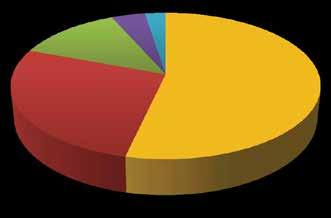

The statistics from the Bank of Ghana shows that the banking sector's holdings of government securities have increased signi cantly. In December 2019, the sum of the banks' bills and securities investments climbed by 27% to GH48.45 billion. Similarly, bank investments in government instruments increased by 33.6% in 2018.

Additionally, banks in Ghana held 30.6% of the total outstanding government bonds in 2020, compared to 17.2% in 2019. The data suggests that at the end of December 2019, commercial banks in Ghana had a largely skewed investment portfolio towards long-term debt instruments, with securities making up 68.2% of their investments.

This is an increase from 66.5% in December 2018. Conversely, the proportion of short-term bills in total investments declined from 32.4% in December 2018 to 30.9% in December 2019. The trend is more worrying when compared to 2016 and 2017 gures. In 2016, banks’ investment in securities was 19.1% with 79% investment in bills. By 2017, banks’ investment in securities had climbed to 41.2% with investment

in bills decreasing to 57.3%.

This shift towards long-term debt instruments is consistent with the trend of banks investing more heavily in government securities, as these tend to be longer-term instruments that provide a steady stream of income over time.

The increase in investment in government bonds by commercial banks, other things being equal, means a decline in lending to the private sector. This preference for investing in government bonds over lending to private businesses leaves much to worry about as a nation. It has the tendency of hindering the growth of the private sector and has a negative impact on economic growth and job creation, particularly in the small and medium sized enterprise (SME) sector.

This is because SMEs often have limited access to credit, and the reduction in lending by banks to the private sector may exacerbate this problem. Furthermore, the increased investment in government securities by banks may lead to a crowding-out e ect, where the government borrows more from the domestic market, reducing the availability of credit to the private sector. This could hinder private sector growth and job creation, which are essential for economic development.

It is also true that the Covid-19 pandemic has had a signi cant impact on the global economy, including in Ghana. The uncertainty and increased risk associated with default have made it more di cult for banks to make lending decisions.

As a result, some banks have turned to investing in Government of Ghana securities, which are relatively safe and o er high interest rates. However, this strategy carries its own risks. As mentioned, any restructuring of the government's debt through bond swaps or zero-coupon bonds could pose liquidity problems for banks that depended on coupon payments. Additionally, by investing heavily in government securities, banks may have missed out on lending opportunities to individuals and businesses, which could have generated higher returns but also carried lower default risk.

Budget Cash and Carry Ghana Limited, distributors of Blue Jeans Energy Drink, have added a brand-new product, ‘Blue Jeans Vodka Mix’, to provide its customers with a perfect taste, quality and sensational boost to complement nightlife and other events.

Speaking at the launch of the new

Vodka brand, the Chief Executive O cer (CEO) of Budget Cash and Carry Ghana Limited, Nana Egyir Aggrey said his out t has made a name for itself as the leading distributors of quality products such as the newly introduced ‘Blue Jeans Vodka Mix’.

“Budget Cash and Carry has been in

the Ghanaian market for the past 30 years and has made a name for itself as one of the leading distributors of energy drinks in Ghana. We started as a trading company selling biscuits and to ees. Currently, we have renowned products such as Blue Jeans Energy Drink, Dockers Energy Dink, and Halleluja Sparkling fruit juice. Our latest addition, Blue Jeans Vodka Mix promis-

es nothing but the best delight”.

“Over the years, we have also been supportive to the Government, Ministry of Tourism, Chiefs, and festivals in the country. We are grateful to customers and partners for their patronage and thank our distributors all over Ghana and the world; we appreciate all

their e orts to make us the number one quality-drink producer in Ghana. I am hopeful that the Ghanaian market will accept this new addition to the Blue Jeans family and drink responsibly as well”, he added.

Mr. John Yao Agbeko, the Chief Direc-

“On behalf of the Ministry of Tourism, Arts and Culture, we are very honored to be part of the outdooring of this product. This product is timely in this month and we expect that it will be the preferred beverage for most events”.

in Ghana. They have sponsored many festivals in Ghana and we hope they will continue with this new addition. The Blue Jeans family as well as other Budget Cash and Carry products are well known for their premium taste. This particular brand which is a perfect combination of unique avors with

and not recommended for pregnant women”, he concluded.

Budget Cash and Carry Ghana Limited, an energy beverage importer and distributor, believes that by successfully blending creativity and commitment, the company can deliver outstanding

tive Director responsible for Corporate and Investment Banking.

Sylvia’s appointment is aligned with the bank’s strategic intent of attracting quality talent in the nancial services industry, to deepen client access across its broad range of corporate and investment banking capabilities.

Prior to her appointment, Sylvia served as the deputy managing director at UBA Ghana. She is a highly motivated banking professional and a driven leader with a wealth of experience and expertise in national and international banking and nance.

With 18 years of experience in the Banking Sector (primarily in Corporate Banking, Relationship Management and Treasury). She has served in senior management roles overseeing negotiations, arrangement, and execution of several landmark transactions across various sectors.

She is a fellow of the Institute of Leader-

member of the Chartered Institute of Management Accountants (CIMA). She also has an executive certi cate in Corporate Finance from the London School of Economics and a certi cate in Strategic Client Management from the Graduate School of Business, University of Cape Town.

Sylvia attained a Bachelor of Science degree in Business Administration from the University of Ghana Business School, where she also received her MBA in Finance.

Sylvia expressed delight at her new appointment at First National Bank.

“I’m proud to be part of this strong brand which has just been named as the world’s strongest banking brand by Brand Finance 2022”, she said. “I have followed the bank’s approach of blending broad experience and specialist expertise in its operations and I am determined to contribute my best to unlock more value for our customers.”

Group Managing Director of Processing, Africa and Co-Head of Group Processing, at Network International Dr. Reda Helal, has said that the domestic payments and settlements sector is far from being over-saturated despite the rapid evolution and competition in the market.

Speaking in an interaction with the media, Dr. Helal stated that in many regions, including Ghana, there is still a signi cant opportunity for growth in terms of nancial inclusion, as many individuals and businesses remain unbanked or underbanked.

"In many regions, including Ghana, there is still signi cant room for growth in terms of nancial inclusion, as many individuals and businesses are still unbanked or underbanked. The growth of e-commerce and digital payments is driving the need for new and more secure payment systems, which provides ample room for new players in the market,” Dr. Helal explained.

Whilst Fintechs, particularly those in the payments space have historically attracted the most funding – US$1.8 billion across the continent in 2022 –he said the comparatively low levels of nancial inclusion leave room for competition-driven innovation.

Elaborating on this, Dr. Helal explained that healthy competition in the payments and settlements sector will drive innovation and lower costs, providing better services and increasing nancial inclusion. He encouraged new entrants to focus on identifying unmet needs and opportunities for innovation, rather than being discouraged by the level of competition in the market.

"While it is important to be aware of the level of competition in the payments and settlements market, this should not discourage new entrants. Instead, players in the sector should focus on identifying unmet needs and opportunities for innovation in order to di erentiate themselves and succeed in this dynamic and growing market,” he noted.

Dr. Helal also emphasized the importance of e ective payment systems in shaping a nancially inclusive society, saying that Network International is continuously working to adopt new technologies while ensuring that merchants' feedback is incorporated into their products.

"E ective payment systems play a crucial role in shaping a nancially inclusive society, as they enable individuals and businesses to partici-

pate in the formal nancial sector, regardless of their income level," Network International’s Group Managing Director of Processing said. "The payments sector has seen a considerable increase in the adoption of ever-changing technologies, and we are always working to adopt these new technologies while ensuring we incorporate merchants' feedback in our products to ensure the user interface and experience suit the merchants and their customers," he added. His comments come on the back of the launch of Network International’s o ce and data centre in the country at the end of 2022, which is expected to allow the leveraging of its expertise, resourc es, and relationships to support the growth of digital payments and nan cial services in Ghana and across the continent.

AfCFTA

With the African Continental Free Trade Area (AfCFTA) still in its nascent stage and requiring improved structures to realise its goal of raising income across the by 7 percent (US$450 billion), by 2035, Dr. Helal announced that his out t intends to assist the Central Bank with the Pan-African Payment and Settlement System (PAPSS).

"We are honoured to be recognized by the Central Bank of Ghana as a market leader in the card and mobile money space. We intend to assist the Central Bank with the PAPSS system for Africa, which is high on the agenda for the AfCFTA agreement," he said, even as the Bank of Ghana seeks to improve the cohesion between ntech companies and other stakeholders.

Member of Parliament for Wa Central, Dr Hassan Abdul-Rashid Pelpuo has been appointed the Climate Envoy for Africa by the Clover Climate Alliance.

Clover Climate Alliance is a social movement, a Citizens Assembly of 100 million Gen-Z and Millennials well-positioned to make a measurable di erence in climate and sustainability challenges.

Dr Abdul-Rashid who is also the Ranking Member on Parliament’s Lands and Forestry Committee of Parliament, by this appointment has thus become part of the core team of the Alliance in executing its mission of mobilization, incentivizing and empowering 100 million young people globally on

several climate oriented initiatives as the world prepares for the 28th Conference of Parties (COP 28) to be held in Dubai.

Speaking to journalists on his new appointment, Dr Pelpuo expressed readiness to mobilise and work with young people and other identi able groups including parliamentarians and governments across Africa to help minimise the negative impact of climate change on the continent by 2030.

Clover Climate Alliance at a press conference in COP27 held at Egypt in November 2022, announced the launch of the pilot of US$100 million Clover Climate Fund; a climate invest-

ment fund to be domiciled in the Abu Dhabi Global Markets (ADGM).

Dr Pelpuo explained that, the Clover Climate Alliance will work in partnership with the various African countries in synergy to achieve their climate policy objectives.

He identi ed sustainable agricultural practice as one potential focus to ensure the environment is protected against the devastating e ects of climate change.

The new Africa climate envoy said climate change is real and urged the public to accept the reality and help e orts to mininise the impact on

livelihoods.

The Wa Central representative was recently appointed President of the African Parliamentarians forum on Population and Development.

Hon Abdul-Rashid Pelpuo has been a lawmaker since 2005 and served as Minister for Youth and Sports, Deputy Majority Leader, member of the Pan African Parliament in South Africa, Minister of State responsible for Public Private Partnership and served as a Member of the Economic Management Team.

Societe Generale Ghana PLC has partnered with Optimetriks to hold a workshop on the new eld management application called ‘FieldPro’ for the bank’s customers.

The workshop demonstrated the app's bene ts and featured a practical demo by Optimetriks' Founder, Paul Langlois-Meurinne and Country Manager, Peter Worentetu .

The Deputy Managing Director of SG Ghana, François Pousse, highlighted the importance of digital solutions in streamlining business operations,

especially in di cult times.

SG Ghana's Head of Business Banking, Gabriel Siaw Owusu, expressed gratitude to attendees and emphasized that the bank will continue to provide platforms for businesses to learn about more innovative solutions in the future.

The event took place at the Innov8 Hub, a space designed for creativity and technological innovation, and George Adjebeng, Head of the SG Innov8 Hub, thanked attendees for their support.

FBNBank Ghana is showering gratitude on its customers by giving them a special treat as part of the National Chocolate Day celebrations which falls on 14 February 2023.

In a statement released by the Bank, it stated that “FBNBank is renewing its commitment to its customers and assuring them of a great year. We rst of all like to show our appreciation for the wonderful relationship throughout 2022. You have been very loyal and supportive as we walk together towards our joint objectives.”

As part of the Bank’s plans, all customers who visit the branches would receive a very Ghanaian welcome and also be o ered made-in-Ghana chocolate.

It is expected that the Bank will engage its customers and clients across all its 23 branches and three agencies in Ghana. Customers should expect some exciting activities within the Bank’s branches according to the Bank’s statement.

Speaking about the Chocolate Day activity, Agatha Nketsia, Head, Enterprise Process Improvement (EPI) of FBNBank stated that, “over the years, FBNBank has developed a very strong relationship with its customers. We have gotten to know them better, understanding their evolving needs and challenges as we walk together. By so doing we have also been able to design products and services for them in order to address these needs. In all these we cannot help to point out how grateful we are in how supportive the customers have been and how very passionate our sta have also been in their delivery of services and products. As a Bank, FBNBank has stayed true to our promise of putting our customers rst and at the heart of whatever we do. At every given opportunity, therefore, we show our appreciation to them and commit to strengthening our resolve to meet their needs in a timely fashion. This is what we mean when we say we deliver the gold standard of value and excellence. This is what FBNBank believes its customers deserve.”

Aside increasing its branch network in a

bid to deepen interaction between the Bank and its relationship with customers, the Bank has also strengthened its digital o ering with the capacity to deliver products and services on a foundation of security and convenience following ISO and PCI DSS certi cations. With all these, in addition to the establishment of the Bank’s Contact Centre to tackle customer enquiries, FBNBank has developed stronger bonds with its customers necessitating the e ort on the part of the Bank to deepen the relationship further on the occasion of Chocolate Day.

FBNBank has in its 26 years of operating in Ghana remained focused on putting its customers and communities rst.

FBNBank Ghana is a member of the First Bank of Nigeria Limited Group which is renowned for its great customer service and general stakeholder engagement garnered over its 128 years of operation.

FBNBank Ghana has 23 branches and 3 agencies across the country with over 500 sta . FBNBank o ers universal banking services to individuals and businesses in Ghana.

We must face, and act upon, an inconvenient truth. The impact of human activities on Earth’s geology and ecosystems is threatening the foundations of life on our planet and decades of progress in human development.

We are acting counter to the goals of the United Nations 2030 Agenda for Sustainable Development – a future that guarantees a decent life for all. Our survival and continued prosperity demand structural change and immediate action.

Scientists warn that breaching planetary boundaries will trigger tipping points, leading to irreversible damage and a catastrophic decline of natural systems. Collapsing sh stocks, melting perma-

frost, rising antimicrobial resistance, and the loss of tropical rainforests are just a few examples of trends that are undermining the foundation of development. While large-scale, acute disasters tend to attract the most attention, the ongoing depletion of valuable natural assets (including aquifers, air, and soil) does not generate headlines but has become a chronic burden for the world’s poorest communities.

These global challenges are also deepening economic inequality between and within countries and exacerbating social exclusion. This not only de es the Sustainable Development Agenda’s principle of leaving no one behind; it also impedes the poverty reduction that

comes from inclusive economic growth, undermines the social contract in rich and poor countries alike, and threatens global security. No country alone can tackle these transboundary problems. Moreover, they are increasingly correlated with other risks, such as massive supply-chain disruptions. All these issues are born of an economic system that has turned out to be more fragile than many thought. Whereas properly functioning systems are able to manage and absorb risks, our current system is doing the opposite. The world needs a global system that engenders security, promotes sustainability, and absorbs shocks. To achieve it, the international community could

begin by making a handful of practical changes this year, starting at the Spring Meetings of the International Monetary Fund and the World Bank.

First, as part of the World Bank’s “evolution” (which shareholders called for in October 2022), we need to modernize its mission by elevating sustainability and resilience as core institutional goals, and by strengthening its analyses and operations to address new transboundary challenges.

We know that for every $1 invested in sustainability and resilience today, there are $4-7 in savings down the line. But to usher in a new paradigm of resilience and sustainability, we must incorporate these principles into operational,

lending, and debt-sustainability models with appropriate incentives and accounting standards. Many reforms and investments can have positive cross-border spillovers. But we will need new and stronger incentives – both analytical and nancial – to promote national investment in global public goods, and to support countries with their conservation e orts.

We also need to explore all our options for boosting multilateral development banks’ nancing capacity. The key, here, is to leverage existing capital while preserving these institutions’ AAA ratings and countercyclical lending capacity. As the G20 Capital Adequacy Review showed, MDBs can increase their risk appetite and boost nancing volumes by lowering their minimum equity ratios. Similarly, we welcome proposals calling for an issuance of non-voting hybrid capital to boost lending at still-lower concessional rates – to be provided either by a shareholder “coalition of the willing” or through sales to private investors.2

We also need to explore our options for re-channeling special drawing rights (SDRs, the IMF’s reserve asset) to boost the capital stock of international nancial institutions.

The IMF’s new Resilience and Sustainability Trust is based on this premise and represents a promising rst step toward

maximizing the e ectiveness of SDR allocations. But, given the challenges, the size of the trust is currently too small. We also call on MDBs and development nance institutions to propose addition al options – as the African and Inter-American Development Banks have already begun to do. Either way, MDBs must do far more to leverage their balance sheets.

Separately, MDBs must also use their balance sheets to catalyze private investment in the transition to low-car bon energy, transportation, and agricul ture throughout the developing world. Without e orts to lower the cost of capital of these investments at su cient scale, global warming will hurtle past 1.5° Celsius, triggering cascading e ects. Finally, we urge all lenders and borrow ers – including the development banks and private-sector creditors – to include or accept natural-disaster and pandemic clauses in nancing instruments. These provisions are present-value neutral, on net, and they o er valuable support to countries by allowing them to ensure su cient liquidity when they need it most.

The scienti c consensus about climate change and biodiversity loss is overwhelming. But we urgently need to translate this understanding into a new economic paradigm at the international nancial institutions.

nize that the provision of global public goods is essential to the ght against forward is through sustainability and resilience. We must modernize our institutions accordingly.

Ghana’s plans to transform its health sector through new partnerships, pioneering technology, infrastructural developments and policies aimed at extending the reach of services into rural areas will be mapped out in a forthcoming report by the global research and advisory company Oxford Business Group (OBG).

The Report: Ghana 2023 will shine a spotlight on the country’s rapidly changing health ecosystem, charting the facilities and services that are being rolled out by both the public and private sectors.

The key role that the latest technological developments are set to play in ushering in a new era of healthcare in Ghana will be a focal point.

Updates will also be given on the National Health Insurance Scheme. Other topical issues set for analysis include Ghana’s plans to expand the country’s pharmaceutical industry by increasing manufacturing production.

OBG has signed a rst-time memorandum of understanding (MoU) with the Africa Medical Information Centre (AMIC) as it begins work on The Report: Ghana 2023. Under the agreement, AMIC will team up with OBG to produce the Health Chapter of the report and

other content for the Group’s suite of research tools.

The MoU was signed by Ramona Tarta, OBG’s Country Director for Ghana, and Dr Akshay Rath, Medical Director, AMIC, and former UN physician.

Commenting after the signing, Dr Rath described OBG as an ideal partner for AMIC, given its reputation as a go-to source of accurate, reliable business intelligence for investors seeking untapped opportunities in emerging markets like Ghana and the wider region.

“Oxford Business Group will be highlighting the potential in Ghana’s health sector, while also identifying uncharted areas for medical research and making medical data and information accessible to end-users,” he said. “It is our hope at AMIC that the report will help attract the investments that are needed, especially in the manufacturing of medical supplies and vaccines in Ghana, the sub-region and Africa as a whole.”

Tarta said AMIC’s decision to choose Ghana for its head o ce as part of broader plans to modernise healthcare delivery across the region aligned well with the national overhaul gaining pace of medical facilities and services.

“Ghana is set to bene t from a range of new services and facilities making use of cutting-edge technology, through a wealth of public-private partnerships that include screening initiatives, surgeries and second opinions for diagnoses,” she said. “As part of its preparations to spearhead healthcare improvements across the continent, the Africa Medical Information Centre has established extensive resources, including in-depth, credible industry data that will undoubtedly enhance our research. I’m delighted that our on-the-ground representatives and, ultimately, investors eyeing Ghana’s potential, will bene t from this fruitful partnership.”

Also present at the signing, Dr Nitish Shetty, CEO of Aster Hospitals, Bangalore, one of AMIC’s partners, highlighted the pivotal role that AMIC was set to play in addressing gaps and challenges in Ghana’s healthcare system and others regionally.

“The African Medical Information Centre will be supported by all 30 of our hospitals in seven countries. Our 1500 doctors are leaders in their specialised elds and are keen to help with capacity-building locally, arranging training programmes and exchange programmes,” he said. “Our aim is that over time, together with our stakehold-

ers in Ghana and across the wider region, we can address the challenges they face in the medical eld, while paving the way for this centre to become Africa’s medical tourism hub.”

The Report: Ghana 2023 will be produced with AMIC, the Association of Ghana Industries, PwC Ghana and other partners. It will contain contributions from leading personalities in the public and private sectors, including: Kwaku Agyaman-Manu, Minister of Health; Yo Grant, CEO, Ghana Investment Promotion Centre; Ken Ofori-Atta, Minister for Finance; Joseph Boahen Aidoo, CEO, Ghana Cocoa Board; and Ernest Addison, Governor of the Bank of Ghana.

The Report: Ghana 2023 will mark the culmination of months of research by a team of analysts from Oxford Business Group. It will be a vital guide to the many facets of the country, including its macroeconomics, infrastructure, banking and other sectoral developments. The Report: Ghana 2023 will be available online and in print. It will form part of a series of tailored studies that OBG is currently producing with its partners, alongside other highly relevant, go-to research tools, including ESG and Future Readiness reports, country-speci c Growth and Recovery Outlook articles and interviews.

Russian President Vladimir Putin has not met any of the strategic objectives that he alluded to when he launched his full-scale invasion of Ukraine one year ago. In fact, no reasonable person can deny that the war has been a complete debacle for Russia.

Still, it is worth considering the counterfactual. What if Russian forces had not bungled the invasion? Where would we be now if the Ukrainian resistance had collapsed, or if the West had responded not with unity but with confusion and disarray?

Through quick, decisive action by special forces – and perhaps with the help of collaborators on the ground –Russia would have gained control of Kyiv within a day or two, proceeded to install a puppet government, and held victory parades. In this scenario, Ukraine’s duly elected president, Volodymyr Zelensky, most likely would have been murdered by Russian special forces or incarcerated after a swift trial. At best, he would be leading a government in exile from Warsaw or somewhere else.

Meanwhile, the ow of refugees eeing the country would have been an order of magnitude larger than it was. There would now be perhaps 20 million Ukrainians scattered across Europe and the West, dwar ng all other recent global refugee crises combined.

Aside from a handful of rogue countries, no one would have recognized the puppet authorities in Kyiv. In due time, they would probably simply disappear as Ukraine was incorporated into Russia as a collection of new federal districts. Ukraine as a political entity

would have ceased to exist, returning to the status that it held under the Russian imperialism of the nineteenth century – which seems to be Putin’s model. Still, most of the rest of the world would have continued to recognize a Ukrainian government in exile, and many would be prepared to lend it support for more or less open military operations against the Russian occupiers.

The Russian e ort to control Ukraine would have been exceedingly brutal. Judging by what happened in Bucha, Irpin, and many other Russian-occupied towns, there would have been summary executions of many thousands – perhaps even tens of thousands – of Ukrainian politicians, journalists, local o cials, and others.

This is not merely hypothetical: Russia already had long lists of Ukrainian o cials drawn up before it launched the invasion.

Tens – or hundreds – of thousands of other Ukrainians would have been sent to so-called ltration camps, where they would have been subject to interrogations, torture, and brutal treatment by Russian security forces. In many cases, children would be separated from their parents and sent to Russia to have their Ukrainian heritage expunged through re-education. Again, we know this because it is precisely what has happened in the few territories that Russia currently occupies.

In this situation, the sanctions against Russia would probably be even more extensive than they already are, because it would have been much more di cult for countries like India or

South Africa to justify their continued trade with the aggressor. Moreover, the direct costs associated with occupying Ukraine would have been enormous.

Last September, Putin ordered a massive mobilization of Russian conscripts following the failure of the initial invasion – and evidently is mobilizing many more for a possible spring o ensive. But this would have been necessary even in the event of a successful operation, just to hold the country. With Ukrainians continuing to wage an insurgency, maintaining the Russian army’s morale would have grown only more di cult with time.

For the rest of Europe – especially those countries nearer to Ukraine – a successful Russian invasion would have introduced the imminent threat of further aggression against Moldova, Poland, or the Baltic states. All these countries would be on full wartime footing, and a

substantial number of US and other European forces would be permanently deployed to bolster their defenses. The remaining Ukrainian forces would have retreated across the borders with Poland and other neighboring countries, where they would remain fully determined to continue the ght. Europe today would be on the verge of a much, much larger war.

Putin’s decision to invade was truly insane. His war of aggression has been a massive strategic failure, and it is bound to get even worse for him. But this is no time for complacency or self-congratulation. Had Russia succeeded, it would have been an unmitigated disaster from every conceivable point of view. Continued support for Ukraine’s defense of its freedom is essential to European security and to the preservation for all people of the bedrock principle of international law – the prohibition of aggressive war.

Newmont Golden Ridge Ltd (Akyem Mine) has presented a cheque for GH¢184.6 million to the Government of Ghana, as dividend for the year 2022.

The amount represents the government’s carried interest in the operations of the Akyem mine.

The cheque presentation was made by executives of Newmont Africa, led by the Regional Senior Vice-PresidentAfrica Operations, David Thornton. Mr Thornton thanked the government for its continuous support to Newmont Africa’s Ahafo and Akyem mines and reiterated the company’s commitment to responsible mining operations, while looking to expand Newmont Africa’s footprint in the country with the Ahafo North project.

“Our Ahafo North project remains a

key strategic growth prospect for Newmont Africa, and its successful construction and subsequent operation will have immense bene ts to our host communities, the local economy, as well as the broader economy of Ghana, in terms of employment creation, local supply chain opportunities, as well as taxes, royalties, and dividend payments to government,”

Mr Thornton said.

On Newmont Africa’s direct support to the Ghanaian economy in the past year, beyond statutory payments, Mr Thornton mentioned the company’s support for the government’s gold buying programme that was meant to shore up the country’s gold reserves and help stabilise the economy.

In spite of global economic challenges that had negatively impacted

businesses globally, Newmont Africa was the rst mining company to support the government’s gold buying programme by selling 3,500 ounces of gold to the government, through the Bank of Ghana (BoG) in May 2022.”

“An additional 22,500 ounces of gold was sold to BoG in October and November 2022, making a total of 26,000 ounces of gold sold to government in 2022,” he added.

Newmont commended

Receiving the cheque, the Minister of Finance, Ken Ofori-Atta, commended Newmont Africa for its compliance to tax and other nancial payments to the government of Ghana.

The minister also lauded Newmont Africa for its prompt payment of taxes and acknowledged the potential bene-

ts of the Ahafo North project.

He said, “We welcome payments such as these, especially during these challenging times, and we wish to commend you for being prompt with your payments, be they taxes, royalties, or dividends.”

“We are aware that the Ghana Revenue Authority has recognised you, on several occasions, for your tax compliance. We look forward to the resumption of your Ahafo North project this year, which will bring in even more revenue to the state.”

Through a combination of tax payments in United States dollars, as well as making forex available to the BoG, Newmont Africa has supported and impacted forex availability to the government of Ghana.

The AfricaGoGreen Fund (AGGF) has made headlines today with the announcement of its successful second fundraising close, securing $47 million in combined investments from top nancial organizations, including the International Finance Corporation (IFC), the African Development Bank (AfDB), the Nordic Development Fund (NDF), and the Sustainable Energy Fund for Africa (SEFA).

The funding will allow AGGF to broaden its nancing for climate-friendly

projects in Africa, including purchasing high-e ciency appliances and industrial equipment, retro tting existing buildings and new green buildings, and installing rooftop solar and battery storage for residential, commercial, and industrial consumers.

IFC provided $17 million in equity, which includes nancing from the IDA20 Private Sector Window Blended Finance Facility. In addition to equity,

IFC committed $30 million in debt to the fund, providing AGGF with

long-term capital to complete the second close fundraise.

The African Development Bank, the Nordic Development Fund(link is external), and the Sustainable Energy Fund for Africa each invested $10 million in equity. An additional $10 million in debt from Calvert Impact Capital was closed in December 2022.

Launched by KfW on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ) in early 2021 and managed by LHGP Asset

Management, AGGF is the rst structured debt fund in Africa focused on energy e ciency solutions. The fund targets reaching between $230 million and $250 million at nal close. With the current fundraising round, total funding stands at $138 million, demonstrating that the fund is getting traction to reach its full scale.

AGGF is accompanied by a technical assistance facility of $3.3 million from KFW on behalf of BMZ, which supports project development and market

studies, and provides transaction advisory and capacity building to stakeholders. Fully operational since 2021, AGGF has provided nancing to AktivCo(link is external), a telecom energy services company, to develop clean energy solutions for powering telecommunication towers in Burkina Faso, Cameroon, Chad, Côte d'Ivoire and Niger, and to BBOXX(link is external), a pay-as-you-go solar-powered solutions provider, to accelerate access to clean cooking solutions for millions of Africans.

AGGF has also more recently closed the Solarise transaction investing in energy-e cient appliances in Kenya, South Africa and Mauritius, and upsized both the AktivCo and BBOXX transactions.

“KfW is glad to welcome the new inves-

was initiated with seed capital from the German Government. We hope that more like-minded investors will follow. This successful second fundraising demonstrates that the fund is on track to play a crucial part in the just energy transition in Africa,” said Johannes Scholl, Head of Division at KfW.

“IFC is partnering with AfricaGoGreen because its innovative energy e ciency focus is making critical capital available to businesses that are supporting the region’s energy transformation while also expanding access to electricity, green building, and e-mobility solutions,” said Henrik Elschner Pedersen, IFC Regional Industry Director in Africa for Manufacturing, Agribusiness, and Services.

"With great pride, the African Develop-

Fund for Africa united other investors with the same ambition to build a more climate-resilient Africa and support the decarbonization of African countries. We look forward to seeing other like-minded development institutions and commercial investors join us in ghting the detrimental impacts of climate change on the continent,” said Dr. Daniel Schroth, Director of the Renewable Energy And Energy E ciency Department.

Henrik Franklin, Director for Portfolio Origination and Management, Nordic Development Fund, said: “Increasing access to clean and a ordable energy in Africa is key for achieving the SDGs and enhancing climate resilience. AGGF is a trailblazing initiative to promote energy e ciency, not only through nancing, but also by

ment through capacity-building and developing regulations.

NDF is a proud early-stage and catalytic investor in AGGF and looks forward to joining forces with AfDB, KfW, IFC, SEFA, Lion’s Head and other partners to deliver climate action,” Franklin said.

“With AGGF, we are breaking new ground in supporting the African climate transition. The urgency of combatting global warming forces all of us to leave no stone unturned to reduce C02 emissions. This is precisely what AGGF has been set up to do. Having such a strong group of investors shows broad alignment on the objectives of AGGF. We are proud to be given the opportunity to meet the tasks and challenges ahead of us,” said Clemens Calice, CEO of LHGP

LA delegation from the Africa Export and Import Bank (AfriExim Bank) has paid a curtesy call on a Deputy Minister for Finance, John Kumah.

They used the occasion to o cially inform the Ministry of the Bank's decision to have Ghana host its 30th Annual General Meeting (AGM) in Accra from 19th to 25th June 2023. The Bank was established in Abuja, Nigeria in October, 1993 by African Governments, African private and institutional investors as well as non-African nancial institutions and private investors for the purpose of nancing, promoting and expanding intra-African and extra-African trade.

Mr. Tito Alai, Director for Communication and Events of the Bank and leader of the delegation noted that like Ghana, the Bank has been promoting integration of African economies for the total liberation of Africa, adding that they could not have chosen a better place than Accra where the liberation story for Sub-Saharan Africa begun.

He noted further that, deliberations on the upcoming Annual General Meet-

ings would continue earnestly in the coming months and commended the local team for taking them on a tour of the hosting facilities and expressed their joy at the facilities.

Hon. John Kumah in welcoming the delegation on behalf of the Minister, commended the Bank's commitment to African values and Pan-Africanism adding that these values were ingrained in the Ghanaian.

The Deputy Minister added that, the time was ripe for Africa to harness their collective resources for the growth and prosperity of its citizens and so it was highly commendable for the Bank to represent what the continent stood for.

He said Ghana’s desire has always been for Africa to have a common front on economic and political issues to give Africa a solid bargaining power adding, “we can do better when we harness our collective e orts in all elds”.

He indicated Government's prepared ness to host the event that was expect ed to bring over 3000 participants into

the country.

He assured them that the Ministry will accord them all the needed assistance and that the Minister was particularly enthused about their overall commitment to African growth.

“We are not just hosting the event, we

are happy to be part of the success story of the Bank” Mr. Kumah added. Present at the meeting were o cials of the Ministry and other team members of the Bank.

The Nana Amoasi VII Foundation chose the past weekend Saturday 11th February 2023 to throw another round of party for kids in the Ekum Abor community and its catchment, in the Central Region.

This gesture has become an annual new year a air since Nana Amoasi VII was installed as the chief of Ekum Abor, and the Ankobeahen of Ekum Traditional Area in February 2020.

The object of these annual events is to put smiles on the faces of the little ones, make them feel special, honour their achievements, and to celebrate the birth of Christ.

In spite of the economic challenges the country is facing presently, this year's

event could not have been overlooked by the Nana Amoasi VII Foundation because kids are always expectant of their parents, guardians and leaders.

I look back on my childhood and recall few magical memories from children's party. As the ruler of the town and the father of these little ones, it is just as exciting to throw parties for the kids at every opportune time to give them tonnes of memories to look back on.

The interaction that these children experience with other kids of similar age during such events is vital for their early development. Their interaction and social skills are developed through the fun and constant interaction with their peers. Additionally, it is a medium to build their con dence, particularly

for those children that tend to be quite shy.

At this year's event, children numbering 700 plus as usual had a lot of music to dance to and have fun. Food, biscuits, to ees and drinks were o ered to each child in attendance.

Dancing competitions, Choreography, and games like "Musical Chairs" and "Pick & Act" were organised by the MC Fii Michael (a Senior Journalist with Coastal FM in Mankessim) for the kids during the occasion. There were volunteers led by Nana Tekyi Enua the Gysehemaa of Abor, to assist with the organisation of the entire programme.

The occasion was chaired by Mr. Samuel Oliver Nana Sackey, a retired United

Nation sta , and a senior citizen of Ekum Abor.

Special guests of honour for the occasion was Nana Kwasi Nyame the Adontenhen of Ekum Ebuakwa, and the Managing Partner of Kays EasyHomes; a realty, management and investment rm.

In attendance to support the Foundation, Nana Amoasi VII and Nana Arhinfua III (Queenmother of Abor) were Nananom of Ekum , Honourable Abeiku Crentsil Member of Parliament for Ekum , representatives of the District Chief Executive (DCE) of Ekum Honourable Ebenezer Monney, and senior members of the Abor Community including Opayin Amoasi Andoh and Regent Nana Adumadzi.

AIDEC Consultancies International Ltd (AIDEC Digital) has opened its ultra-modern Arti cial Intelligence (AI) Centre of Excellence at AIDEC Plaza, East Legon, Accra with co-location at Academic City University College, Accra, Ghana.

The two AI centers of excellence is a result of a Consortium Partnership between them, the Institute of ICT Professionals (IIPGH), Ghana, and their International Partners, 7W Arti cial Intelligence company Ltd of Slovenia. The Centre will provide both in-person and virtual training, educational programmes and consulting services to organizations, and institutions in the private, public, and third sectors, giving practical knowledge in areas of AI and its application for agriculture, health, education, ntech, mechanical engineering etc.

The press statement by the Consortium Partners was signed by Ambrose Yennah, Executive Chairman of AIDEC Digital; Professor Fred McBagonluri, President, and Provost of Academic City University College; David Gowu, Executive Director of the Institute of ICT Professionals, Ghana; and Katja Gersak, CEO of 7W Arti cial Intelligence Company Ltd of Slovenia. Executive Chairman for AIDEC Digital, Ambrose Yennah, said: “the agreement seeks to provide value creation services and equip students with

practical hands-on-training in Design thinking, Data Analytics, Machine Learning, Deep learning, and other advanced technological training in Arti cial Intelligence (AI) to e ciently work in the job market.

The Consortium Partners will provide top notch business, educational and technology solutions and services including Massive Open Online Courses (MOOC) platform (Africoursity.org) as a virtual and open educational resource facility as well as a Schools Management System (SMS), (Aidecia.com) to our target customers in the public, private and third sectors.”

The Consortium Partnership is a private sector initiative between the four Organizations/ Institutions to compliment government’s digitalization agenda and that of the African Union (AU) and its agenda for digital transformation under the 4th Industrial revolution.

The CEO of 7W Arti cial Intelligence Company Ltd, Katja Gersak said: “the agreement will include but not limited to the study and application of Digital Twin, State Leadership Arti cial Intelligence Managerial Tool (SLAIMT), Articial Intelligence (AI), Cyber Security, Robotics, Data Analytics, Machine Learning, Deep learning, with speci c focus on the health and educational sectors including Executive Training in Ghana and scaling up to the continent

of Africa in the near-term.”

The President and Provost of Academic City University College, Professor Fred McBagonluri, said: “the Consortium will help in developing ready job skills by providing access to AI programs in areas of Science, Technology, Engineering, Arts and Mathematics (STEAM) to help student use advanced engineering and technology to pursue research initiatives that is focused on solving complex problems for industry and society in general.

The Consortium Partners will establish, implement, and create opportunity for students to engage in consulting assignments in collaboration with industry and academic institutions for practical, hands-on training, research, and eldwork for their mutual good.”

The Executive Director of the Institute of ICT Professionals, Ghana, David Gowu, on his part said: “The Consortium will work with Global Networks and Partners to help develop the ICT ecosystem for Students, ICT Professionals and Entrepreneurs through the operation of Business Process Outsourcing (BPO) services and identify other projects ideas that will create jobs in IT/Digital Solutions and Services.

The Consortium will help to advance IT policy formulation and advocacy and provide an avenue for upgrading the skills and competencies of ICT Profes-

sionals and students with creative and innovative ideas as part of their continuing professional development in preparing them for the job market.”

The Consortium Partners will continue to identify and establish a Network of Professionals in Ghana, Africa and the Diaspora and work to improve and expand their Institutional capacities in Digital skills education in Arti cial Intelligence, Robotics, Data Analytics, Machine learning, Deep learning.

This will also include online learning platforms (Africoursity.org) and other programs to whip up the interest of students enrolling for higher education for STEAM, SparX learning Xperience and other competency-based professional training programs for an all-inclusive digital transformation for Ghana and Africa as a foundation for the establishment of the Africa UNESCO Centre for Arti cial Intelligence.

About AIDEC Consultancies International (AIDEC Digital)

AIDEC Consultancies Agency is a general management consulting rm within a multi-sectorial group in leadership skills, entrepreneurship, and business development. AIDEC is an innovation-driven company and is investing in digital infrastructure for skills development, jobs, and value

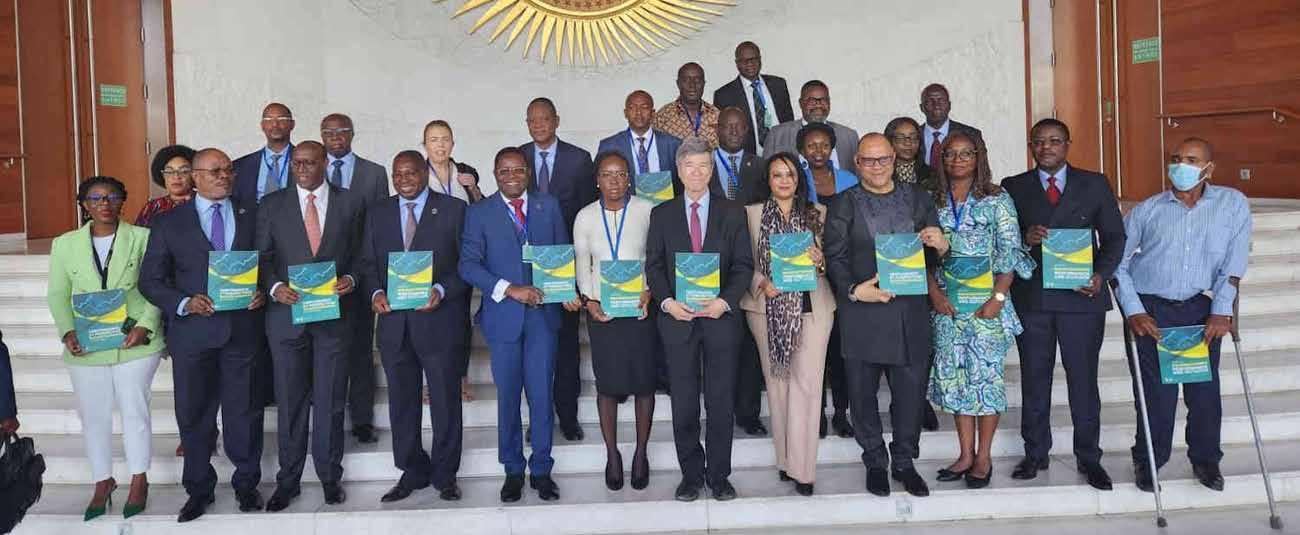

African leaders have pledged to take immediate action to integrate the recommendations from the newly released Africa’s Macro-Economic Performance and Outlook report into their national development plans.

Zambian President Hakainde Hichilema said the study, conducted by the African Development Bank Group, provided an impetus for the continent’s leaders to forge ahead with needed reforms. His remarks were read on his behalf by Zambia’s Minister of Finance and National Planning, Dr. Situmbeko Musokotwane, during an event to present the report at the 36th African Union Summit in Addis Ababa.

The Zambian president described the report as a signi cant milestone in the quest for evidence-based knowledge to inform policymaking for a more prosperous and sustainable future for Africa.

“The ndings of this important report, therefore, provide us with a set of concrete policies that we must urgently implement to sustain the recovery and build resilience in Zambia, and on the continent more generally,” President Hichilema stressed. He observed that although Zambia was not spared from global shocks, the country’s economy has shown resilience.

He also acknowledged the impact of Zambia’s heavy debt burden on the country’s scal stability and said his administration had launched reforms that would spur economic growth to 4.0 percent in 2023 and 4.3 percent in 2024.

The African Development Bank Group released the inaugural Africa's Macroeconomic Performance and Outlook report on January 19. It has since attracted signi cant interest among decision-makers in Africa and globally.

The biannual report o ers policymakers, global investors, researchers, and other development partners, up-to-date, evidence-based assessments of the continent’s recent macroeconomic

performance. It also provides a short-to-medium-term outlook.

In his opening remarks, African Union Commission Chairperson Moussa Faki Mahamat told participants that the report would be presented to heads of state at the African Union Summit to help steer national planning.

“Knowledge is power. The report, to be published twice a year, is a wealth of knowledge - with deep insight into what is going on in Africa in the macroeconomic sphere. It identi es challenges and opportunities for the good of our continent,” he said. “If governments, the private sector, and other stakeholders adopt the report, they will be better placed to make informed decisions.”

The report calls for timely structural reforms to enhance government-enabled private-sector industrialization in key areas.

Nigeria's Minister of Finance, Budget, and National Planning Zainab Ahmed said:

“All the issues raised in the report a ect our country as well. We have steered the country towards pre Covid-19 era, but we still face some challenges.”

Ahmed said: “We have been asking for a liquidity facility as part of the SDRs (Special Drawing Rights) to act as a cushion for us. We have also asked multilateral development banks to give us longer-term nancing. Nigeria has shown a lot of resilience. We just need that support to enable us to take the full potential.”

African Development Bank President Akinwumi Adesina observed that although African economies have shown impressive resilience, global support is needed to help the continent navigate nancial burdens and its security challenges.

“Despite the slowdown occasioned by multiple shocks, Africa demonstrated continued resilience in all but one country and maintained a positive growth

rate in 2022 with stable outlook in 2023 and 2024. African economies are indeed resilient,” Adesina said. He called for strong and collective support to Africa to help the continent navigate the challenges it faces, especially debt burden and debt vulnerabilities. The bank president explained further: “Africa cannot run up the steep hill carrying a bag of debt on its back. The channeling of the additional $100 billion of Special Drawing Rights will make a huge di erence. We must join hands to harness the enormous opportunities in Africa. There is no doubt that we will make good progress. However, we must work fast, be inclusive, and be competitive.”

Also speaking, Assistant Minister of Finance for Policies and Economic A airs of Egypt, Dr. Mohammed Ibrahim, said the report is helpful for African policymakers and researchers as a timely databank of sound and evidence-based projects for development and planning.

In a presentation, the Director of the Center for Sustainable Development, Columbia University, Prof. Je rey Sachs, said that Africa had the capacity to achieve 7- 10 % yearly growth.

He observed that Africa could take advantage of its population to grow a robust single market, citing examples like China and India.

"Building a single market will enable Africa to position itself among the three largest global marketplaces. The continent has the greatest growth potential,” he said, challenging African leaders to build vital regional infrastructure and close the infrastructure gaps over the following decades.”

He urged governments to lead a revolution to bring about a ordable access to health care and education. Sachs called for greater nancing for the continent to place it on sustainable growth, observing that the African Development Bank is

critical to meeting the continent’s nancial needs.

“The African Union needs to become a permanent member of the G-21,” he added.

Acting Chief Economist and Vice President of the African Development Bank, Prof Kevin Urama, highlighted the importance of Africa’s Macroeconomic Performance and Outlook 2023.

He said: “As we gather here today, global macroeconomic conditions have become increasingly uncertain due to multiple overlapping shocks that make policymaking and investment decisions very challenging. Countries need regular diagnostics and focused policy actions to address these recurring and overlapping shocks.”

Professor Urama a rmed that Africa remains the place to invest despite su ering global shocks.

What the 2023 Africa’s Macro-Economic Performance and Outlook report says Following two years of global shocks, the report notes that African economies are set to overcome various domestic and global shocks and return to a path of economic recovery, stability, and growth.

The lingering e ects of the Covid-19 pandemic, the ravages of accelerating climate change, and the impact of rising geopolitical con icts and tension slowed Africa’s growth to an average of 3.8% in 2022.

To sustain growth, Africa’s economies will require comprehensive information and insights to navigate a labyrinth of intertwined global risks, the report stated.

The bank will release the report in the rst and third quarters of each year to complement its agship Annual African Economic Outlook. The African Development Bank is the rst institution to release a macroeconomic outlook for Africa for 2023.

Minister for Finance, Ken Ofori-Atta has met with his German counterpart, Christian Lindner to discuss broad areas of partnership in Accra.

The bilateral meeting which was to further enhance Germany-Ghana relations discussed among other things, the scaling up initiatives that build resilience and promote sustainable inclusive growth and, safeguarding both climate/environment and internal security.

Other topics included strengthening the capacity and governance of public sector institutions, strengthening Ghana’s anti-money laundering regime, digitalization and exploring avenues to address scal imbalances and debt vulnerabilities.

In his address to the media after the bilateral discussions, Hon. Ofori-Atta disclosed that, Ghana’s long-standing

EDITOR: BENSONrelationship with the Federal Republic of Germany has bene tted the country in several areas of the economy.

“Our partnership with Germany has already led to signi cant advancements across Ghana’s energy, nancial and governance sectors. And crucially, both myself and Christian look forward to maintaining this forward momentum” he noted.

The Government of Ghana, he stated, would continue to “rely on Germany and other key development partners as we embark on a journey to fundamentally reposition our economy and shape our collective progress”.

The German Finance Minister, Christian Lindner also in his address to the media noted the e ect of the Global pandemic and the impact of the Russian war in Ukraine on Ghana’s economy and said that “this is why

Germany supports your e orts, Germany, is the second largest bilateral creditor of Ghana, so, we have a responsibility”.

According to Mr. Lindner, the role of the private sector banks was critical in ensuring the economy bounced to the path of growth and that it was essential for Government to consider possible ways to restructure the country’s sovereign debt which was held by bilateral creditors.

“We cannot only focus on debt restructuring without fostering the policy reforms you have already introduced so you have to apply scal measures in your budget, macro-economic recovery, and debt operations. Only the three of these together will bring Ghana back to sustainable economic development over the next years,” German’s Finance Minister emphasized.

PUBLISHED BY BUSINESS24 LTD

He went on to speak about Germany’s interest in Ghana’s development, politics and stability indicating that they were engaged in Ghana, through the KfW Development Bank which was nancing a number of projects in both public and private sector.

“We have a vital interest in the success of Ghanaian politics. We want to see West Africa as a whole stay stable. We are interested in the economic well-being, progress of Ghana. We know that there are opportunities across this country it has dynamism, and we really appreciate the e orts the government has made over the last year; extending human capital, and focusing on improving social mobility in society” he said.

The Minister later called on bilateral creditors such as China to as swiftly as possible join the International Creditors Committee under the common framework for