Let me use this opportunity to say that the project is not limited to the Accra -Tema stretch of the motorway, is just a project name and it goes out to Tetteh Quarshie, Apenkwa bridge and ends at the Neoplan tra c light and is a major work.

He said the motorway itself between Accra and Tema is going to have as many as four interchanges at various sections and some of the lanes will go up to 10 and 5 on the other side, stressing that it will lead to the remodelling of the Tetteh Quarshie to deal with the current tra c situation being experienced at the Accra Mall area.

In addition, he said there would be another interchange at the Fiesta Royale tra c to deal with the tra c situation there and the Apenkwa bridge is also going to be remodeled under the same programme, so it is a major thing.”

The highway was opened to tra c in November 1965 to link the harbour city of Tema to Accra.

The Tema Motorway is a 19.5-kilometre highway that links Tema to Accra—capital of Ghana. It is the only motorway in Ghana and was built in the 60's but has outlived its design, with potholes developing on it.

He made this known as a response to a question from Ko Adams, MP for Buem, enquired from him when the Tema Motorway will be reconstructed during a public hearing of the Public Accounts Commit-

there are plans to reconstruct the entire motorway and as much as government plans to reconstruct that road, there are few challenges and I believe that very soon we shall go over those challenges and start work,” the minister said.

He added “but I would not mention any speci c date on it but we have gone very far and it may not be long that work on the motorway would start. It comes under the project name of Reconstruction of the Motorway.

It was built under the administration of Kwame Nkrumah, the rst president of Ghana. Its construction was fashioned after the Autobahn in Germany and was purposed to be the rst in motorway systems that would link major towns and cities in Ghana. In August, 2009, rehabilitation work began on the road and was to cost 500,000 cedis. Part of the motorway was to be reconstructed using epoxy cement. The rehabilitation work took eight weeks and involved the removal and replacement of the concrete slabs which had developed potholes and the repair of the asphalt surface on shoulders of the road.

The Director General of the State Interest and Governance Authority (SIGA), Amb. Edward Boateng, has stated that his out t would not hesitate to hold back budget of State-Owned Enterprises (SOEs) and Speci ed Entities if they fail to live up to expecta-

tion.

SIGA in November last year commenced the 2023 Performance Contract Processes with Specied Entities (SES). The processes, which included the Performance Contract Pre-Negotiation Meetings, the Performance Con-

tract Negotiations as well as the Performance Contract Signing Events, were geared towards ensuring that SEs operated e ciently and pro tably this year.

The exercise was in pursuant to the SIGA Act 2019 (Act 990), Section 4 (b), which ensured adherence to the terms and conditions of the annual performance contracts signed by SIGA with State-Owned Enterprises (SOEs) and other Speci ed Entities.

In an engagement with news editors on Thursday at the SIGA o ce in Accra, Mr. Boateng said “We are going to recommend to the Minister of Finance to hold their budget for 2023.

He added that in July last year, they published the names of all the entities that did not meet the deadline and submission of management accounts, saying these are actions that has never been taken before and stressed that they intend to continue with the name and shame, if entities fail to perform to task.

“As long as we push these things forward, people will begin to act responsibly.”

The Public Financial Management Regulations 2019 (L.I. 2378) mandated SIGA to sign Performance Compact with Speci ed Entities and submit as part of Speci ed Entities nancial plans for approval.

It said in addition to setting of performance targets and Key

Performance Indicators (KPIs) for 2023, the performance of Specied Entities in the current scal year would be reviewed to ensure accountability and measurement of the attainment of set goals.

The maiden SIGA Editors’ Forum which was themed “Understanding the Role of SIGA”, is an initiative intended to strengthen the existing relationship between the Authority and the media and provide the public with accurate information by way of data, facts, statistics and new developments.

Mr. Boateng lauded the role of the media in nation-building and stressed their importance as key stakeholders in disseminating information and educating the public on activities of Speci ed Entities.

He said SIGA was established to oversee government interests in the Speci ed Entities to ensure they operate pro tably and e ciently.

“We are therefore poised to make a change to support President Nana Addo Dankwa Akufo-Addo’s vision for Speci ed entities to contribute 30% to Ghana’s GDP. In light of this, our stakeholders and Ghanaians must be informed of the numerous programmes and initiatives that our Speci ed Entities are implementing to help the country's socioeconomic development.

As a result, we will need your understanding and support to communicate our progress, chal-

lenges, and success stories to the public," he added.

Africa should invest in infrastructure resilient to climate change, which has pushed countries to spend almost 5 percent of their GDP in adapting to its impacts, said Antonio Pedro, Acting Executive Secretary of the Economic Commission for Africa (ECA), on the margins of COP27.

The continent already has an infrastructure nancing gap of more than $100 billion per year, according to the African Development Bank.

There is a case for Africa to ramp up investment in developing infrastructure that is vital to improving the standards of living for the African citizens as well as for the continent’s global competitiveness.

The Executive Secretary noted that the Africa Climate Resilient Investment Facility (AFRI-RES) was a boost to climate proo ng infrastructure in Africa.

“There is an urgent need to close Africa’s infrastructure de cit at scale and at speed if the continent is to meet its development objectives - as stipulated in various national development plans, the UN 2030 Agenda for Sustainable Development, and Agenda 2063,” said Mr. Pedro.

The Executive Secretary noted that closing the infrastructure development gap means investing up to US$170 billion per year in sectors such as energy, transport, water, sanitation, urban, and ecosystems.

These sectors are sensitive to the adverse impacts of climate change, including more frequent and intense oods, droughts, and heatwaves.

“Against a background of increasing climate change impacts that are already costing Africa on average 5% of GDP per year, it is important to boost the condence that the infrastructure investments will deliver services and return on investments in both today and tomorrow’s

climate,” the Executive Secretary noted.

A 2015 landmark study on Enhancing the Climate Resilience of Africa’s Infrastructure (ECRAI) by the World Bank and the ECA has shown that some river basins – such as the Orange River Basin and Congo River Basin - could become wetter under certain scenarios of global emissions pathways.

In addition, some river basins such as the Zambezi River Basin could become drier and lose up to 60% of hydropower production potential with resulting huge increases in energy costs.

Mr. Pedro stated that in 2016 the Kariba dam on the Zambeziwhich supplies most of the electricity consumed in Zimbabwe and Zambia - almost shut down as the volume of water in the reservoir dropped to about 12% of capacity because of the unusual El Nino and La Nina events of 2015/2016 attributable to climate change.

The ndings of the report led to the establishment of the Africa Climate Resilient Investment Facility – AFRI-RES – supported by the Nordic Development Fund. The AFRI-RES facility supports countries, regional entities such as river basin commissions, and projects developers with the capacity and tools to integrate climate resilience in investments in key sectors.

AFRI-RES is a joint initiative of the ECA, the African Union Commission, and the African Development Bank. During its rst phase, the ECA and the AUC have led the component of training and advocacy and also the development of a climate knowledge and information portal.

“Africa can take advantage as a late comer in infrastructure development to make sure that it builds quality climate resilient infrastructure,” said Mr. Pedro, highlighting that the capacity and tools provided by AFRI-RES are critical inputs in the development agenda for Africa.

The Food and Drugs Authority (FDA) has echoed its commitment to safeguard public health and safety in this new year.

In a press statement copied to Business24, and signed by its CEO, Delese A. A. Darko, the authority reminded manufacturers, importers and other stakeholders in the food value chain to

uphold the standards and strive to register their products.

The statement captured “To this end, the Authority hereby reminds manufacturers, importers, exporters and the public that it is an o ence under the Public Health Act, 2012, Act 851, to manufacture, prepare, import, export, distribute, sell,

supply or exhibit for sale any of FDA’s regulated products namely-food, drugs, cosmetics, medical devices and household chemicals which have not been duly registered with the Authority.

Media houses as well as social media in uencers and celebrities who endorse products are to note that it is an o ence under Section 100 of Act 851 to advertise any food as a preventive or cure for a disease, disorder, or an abnormal physical state.”

Furthermore, drug advertisements for the treatment, prevention or cure of diseases listed in the Fifth Schedule of Act 851 such as sexually transmitted diseases, cancer, hypertension, sexual impotence etc are prohibited under law, the statement noted.

Media presenters are to note that Live Presenter Mentions intended to advertise or promote any FDA regulated products are not allowed.

It is also to be noted that all approved advertisements are valid for one year and must be renewed thereafter.

Pursuant to Section 129 of Act 851, persons who contravene the above provisions are liable to “a summary conviction and/or a ne of not less than 7500 penalty units and not more than fteen thousand penalty units or to a term of imprisonment of not less than fteen years and not more than twenty- ve years or both".

The Authority encourages the public to continue to take advantage of the Progressive Licensing Scheme to expand the scope and reach locally manufactured products. We also urge the public to return any unused and expired medicines to designated pharmacies as partmof the Take Back Unwanted Medicines project aimed at protecting public health and safety.

By Alice Senam Nimoh – Appea

Commission marks a great milestone in the relationship between Ghana and Malta and provides an opportunity to strengthen the bilateral relations between the two countries and the continent at large.

Mallia and his team for a remarkable job in strengthening Ghana –Malta relations.

It was a colourful ceremony when the High Commission of Malta in Ghana, located at North Ridge in Accra, was o cially inaugurated on Tuesday, 17th January 2023, with the Minister for Foreign and European A airs and Trade of Malta, Hon. Ian Borg, as the Guest of Honour.

Several dignitaries including the Deputy Minister for Foreign A airs of Ghana, Mr. Kwaku Ampratwum-Sarpong, Deputy Minister for Trade and Industry responsible for International Trade, Mr Herbert Krappa and

Kyerematen attended the event.

Also in attendance were members of the Diplomatic Corps, Heads of Government Agencies and Departments, Ghanaian Industry Captains, Ghanaian and Maltese Business Owners and Entrepreneurs as well as other distinguished personalities and members of the media.

Speaking at the commissioning event, Hon. Borg indicated that the establishment of the High

”Being the rst Maltese High Commission in Sub Saharan Africa, this is another important link in the implementation of our country’s policy strategy towards the African continent with the aim of continuing to see more collaboration on the continent. This goes hand-in-hand with our foreign policy strategy for Africa for 2020-2025”, he added.

On his part, the Deputy Minister for Foreign A airs of Ghana, Mr. Kwaku Ampratwum-Sarpong, stated that it was an honour for Ghana, for the Republic of Malta, which forms part of the European Union to decide to open its rst diplomatic mission in Africa in Ghana. He further commended the Maltese High Commissioner to Ghana, H.E Jean Claude Galea

The commissioning of the High Commission followed the successful organization of the third Malta-Ghana Business Forum also held on Tuesday 17th January 2023 at the Movenpick Ambassador Hotel in Accra with over twenty- ve Maltese companies from various sectors represented.

The High Commission of Malta in Accra is committed to promoting friendly exchanges and pragmatic cooperation between the people of Malta and the people of Ghana and intensifying relations with Ghana as a priority for the Maltese government’s broader strategy in West Africa and beyond.

Diplomatic relations between Malta and Ghana date back to 1974. Since then, relations our-

have come this far without the support of our agent partners and for that we are grateful,” he added., The Head of Agency Banking at Fidelity Bank, Dr. David Okyere, also indicated that the introduction of the Yenko Dubai promo has positively impacted the performance of Fidelity Bank’s Agents.

“The performance of our Agents in the last few months has been highly impressive. In fact, there was over 100% achievement for most of the Key Performance Indicators (KPI) set for the campaign. This shows how committed our Agents have been to our agenda of nancial inclusion.”

Fidelity Bank has rewarded the winners of its maiden Agents promotion campaign dubbed yenkodubai.

The Yenko Dubai promo, which formed part of activities to mark our 15th-anniversary celebrations, sought to reward eight (8) of our most outstanding Agents and Agent Network Sta with the ultimate prize of an all-expenses paid vacation to Dubai. This is in recognition of the pivotal role Fidelity Agents have played in expanding our reach and driving our inclusive banking agenda.

At the end of the promotion in

December 2022, the agents of S-Duah Enterprise, (Kumasi), Ko ay Mobile Money Ventures (Berekum), Frimaud Ventures (Accra Central), Quickeagle Services (Kasoa), Brilin Top Enterprise (Nkawkaw), Mupaason Enterprise (Tarkwa), Majesty Authentic (Kasoa), and Frimpee A1 Enterprise (Sunyani) were rewarded with the ultimate prize after emerging as the 8 overall best performing agents. Additionally, ten (10) other deserving Agents were also rewarded with a lunch date with our executives, while six (6) Agents were rewarded with a weekend staycation at

the Maaha Beach resort in the Western region. Thirty other Agents who performed commendably were also rewarded with brand-new mobile phones during the promo.

Commenting on the promo, our Director of Channels and Sales, Mr. Godfred Attafuah, expressed his gratitude to all Fidelity Bank Agents who responded to the call and played various roles to make the Yenko Dubai promo a success.

“We, at Fidelity Bank are proud to maintain our position as a leader in the Agency Banking space. We acknowledge that we could not

Dr. Okyere thanked the various stakeholders who contributed to the success of the campaign. He also urged the Agents to look out for other exciting campaigns in the near future, especially as we are slated to celebrate ten (10) years of providing Agency Banking services in Ghana in 2023.

Fidelity Agency Banking was introduced as an alternative distribution channel after we became the rst bank to receive approval from the Bank of Ghana to operate the Agency Banking model in Ghana in 2013. Today, we have over 5000 Agents across all the regions of Ghana and maintain the distinction of being the market leader in Agency Banking.

Lorem ipsum dolor sit amet,government announced last year its controversial policy --domestic debt exchange--that seeks to restore debt and nancial sustainability.

According to the SEC, Zenith Bank is no longer required to carry out trustee functions for the securities sector.

Zenith Bank Ghana Limited. is no longer mandated to carry out any Trustee activities within the securities industry,” it added.

rates to help restore macroeconomic stability.

The Securities and Exchange Commission (SEC) has announced Zenith Bank’s decision to voluntarily leave the capital markets.

The bank becomes the rst to leave the stock market after

“Zenith Bank Ghana Limited, a licenced trustee that engaged in trustee services in the securities industry and capital market, has voluntarily requested to suspend operations,” the Securities and Exchange Commission (SEC) announced in a statement.

“The SEC has, after a thorough assessment of the circumstances, approved the voluntary cessation of business of Zenith Bank Ghana Limited as a licensed Trustee.

SEC continued, “all investors, market operators, and the general and investing public are hereby assured that the SEC is committed to ensuring rigorous enforcement of all the rules for operators in the capital market in order to promote the growth and development of an e cient, fair and transparent securities market in which investors and the integrity of the market are protected.”

Ghana, which is going through its worst economic crisis in a generation, in December last year launched a plan to exchange its local bonds for new ones with fresh maturity dates and coupon

But some groups representing the nancial institutions that hold Ghana's debt have raised concerns that the restructuring as presented by the nance ministry would not work.

Parliament’s Ranking on Finance, Dr. Ato Forson has disclosed that about ve banks are likely to go bust following government’s impending domestic debt exchange programme (DDE) if the latter fails to engage further.

Speaking to journalists during a minority press conference on DDE on Monday at parliament house, he cautioned government to engage extensively or things could get to its head.

will operate a total of 28 weekly passenger ights to China when the services are fully restored.

The Chief Executive O cer (CEO) of Ethiopian Group, Mes n Tasew, said: “We are glad that we are ramping up the frequencies of our ights to Chinese cities; thanks to the easing of ight restrictions by the Government of China.

“China is one of the largest markets for Ethiopian Airlines outside Africa, and the increase in ight frequencies will help revive the trade, investment, cultural and bilateral cooperation between Africa and China in the post-Covid era.

airline in Africa, has announced that the frequency of its ights to Chinese cities will increase as of February 6, this year.

It is an indication of a return to the pre-COVID-19 levels following the lifting of restrictions by

From February 6, 2023, Ethiopi an Airlines will operate daily ights to Guangzhou while increasing its weekly ights to Beijing and Shanghai to four each and maintaining the thrice weekly operation to Chengdu.

The

tion relative to the rate recorded in November 2022 (78.1 per cent).

In a statement, the Ghana Statis tical

said

Likewise, from March 1, 2023, the ights will surge back to the pre-COVID-19 levels, with daily ights to Beijing and Shanghai, as well as ten and four weekly ights to Guangzhou and Chengdu respectively.

Accordingly, Ethiopian Airlines

“Thanks to our large network across Africa, the increase in the number of ights to Chinese cities will bring Africa and China closer. We are keen to further expand our service to China going forward.”

In addition to its passenger ights to Guangzhou, Shanghai, Beijing and Chengdu, Ethiopian Airlines is also operating freighter ights to Guangzhou, Shanghai, Zhengzhou, Changsha and Wuhan.

in December 2022.

Mining and quarrying at 73.4 per cent, manufacturing 64.2 per cent, transport, and storage; 63.6 per cent recorded rates above the national average, while information and communication activity recorded the lowest rate of 2.7 per cent in December 2022.

When President Joe Biden took o ce in 2021, his rst message to the rest of the world was: “America is back.” Having assumed his third term as general secretary of the Communist Party of China (CPC) in October, President Xi Jinping appears to be issuing a similar proclamation.

Over the past two months, China’s leadership has announced or signaled a series of major policy reversals, abruptly ending nearly three years of severe zero-COVID restrictions, easing the crackdown on tech companies and the real-estate sector, rea rming its commitment to economic growth, and extending an olive branch to the United States at the G20. With the world’s second-largest economy apparently re-opening its doors for business, investors are reacting with enthusiasm. But, while China’s pro-business reset certainly bodes well for international trade and global peace and stability, putting the Chinese economy on the right track will require more than just a reversal of recent policies. What is really needed is bringing pragmatism and honest feedback back into the political system. As I showed in my book How China Escaped the Poverty Trap, these attributes de ned China’s famously adaptive governance during the Deng Xiaoping era.

There is a common misperception that the “China model” means top-down control by a strong, authoritarian government, anked by muscular state enterprises. In fact, 30 years of poverty and su ering under Mao Zedong proved that the combination of top-down planning, state ownership, and political repression was a recipe for failure. That is why Deng quietly introduced a hybrid

system that I call “directed improvisation.” The CPC remained rmly in power, but the central government delegated authority to numerous local authorities across China, and, at the same time, liberated private entrepreneurs from state controls. Playing the part of a director rather than a dictator, the government in Beijing de ned national goals and established appropriate incentives and rules, while lower-level authorities and private-sector players improvised local solutions to local problems.

In practice, a wide variety of local “China models” emerged, delivering transformative innovations from the bottom up, often in ways that surprised central authorities. The rise of the digital economy is one example.

Since ideas must come before action, Deng made sure that he rst changed the CPC’s own mindset and norms. In his historic December 1978 speech launching China’s era of “reform and opening up,” he made “emancipating the mind” a top priority for the party. Under Mao, people dared not speak the truth, for fear of severe punishment, creating a chilling political climate that gave rise to disastrous policies like the Great Leap Forward. But under Deng, the new imperative was to “seek truth from facts.” Policies should be chosen because they improved people’s welfare, not because they were politically correct.

Deng’s hybrid system – top-down direction combined with bottom-up autonomy – has been overlooked both by Western China hawks and by Xi’s own leadership. When Xi came to power, he favored a di erent story about China’s success, cele-

brating the “institutional advantage” that a top-down command system supposedly has over Western democratic capitalism. To be sure, a top-down approach yielded impressive results during the initial COVID-19 outbreak. Through mass testing, strict containment, and other measures that could be maintained only under a strong, authoritarian government, China achieved near-zero infections and deaths from 2020 through 2022. Xi embraced zero-COVID as one of his signature achievements, declaring as recently as the October National Congress that China would stick to the policy “without wavering.”

But then events took a rapid, unexpected turn. Exasperated with endless lockdowns, Chinese citizens from various walks of life poured into the streets in protest, forcing Xi to change his position. But the sudden reversal of the zero-COVID policy has led to a massive surge of cases and hospitalizations with which China will continue to struggle for some time.

Xi and his team are eager to put the pandemic behind them and restore business con dence. Relaxing economic regulations and ending pandemic controls have indeed buoyed capital markets. Moreover, after COVID-19 infections peak, domestic consumption is likely to come back with a vengeance ( ight bookings already jumped several-fold immediately after quarantine requirements for travelers were lifted), and manufacturing and logistics will return to normal. The central government has also pledged additional infrastructure spending to boost growth.

But for the new economic terrain to bear fruit over the longer term, Xi needs to reopen the political system’s feedback channels. That means setting a personal example and making clear to party-state o cials that he genuinely wants them to report the realities on the ground. That will not happen if, in practice, truth-tellers are silenced and propagandists are

The government also needs to give civil society and the media more space. It is short-sighted and ultimately self-defeating to think that quashing free speech will strengthen the CPC’s hold on power. Without a regularized system of policy feedback, governance su ers, leading to the kinds of mass protests that exploded in November and eroding the CPC’s performance-based legitimacy. Yet another problem with Xi’s top-down approach is that it will leave investors wondering when China might pivot again. Over the past decade, Xi has repeatedly proclaimed a devotion to various “reforms,” only to do the opposite. Empowering o cials with track records of pragmatism and candor would go a long way toward reassuring markets. Changing the political system’s criteria for recruitment and promotion would speak louder than mere slogans.

Finally, China’s leadership should recognize that the overarching goal of tackling the country’s “Gilded Age” problems, such as curbing speculative investment in real estate and protecting the rights of delivery workers in e-commerce, was not wrong. Previous policies back red because they were implemented arbitrarily, leaving businesses nervous that the party could change them at any time. Xi and his circle must practice transparency and consultation in their policymaking, rather than simply abandoning the pursuit of inclusive development.

China accumulated ample experience in adaptive governance between the late 1970s and the early 2010s. But by the time Xi came to power in 2012, Deng’s economic model had reached its limits and had begun to produce unsustainable levels of corruption, inequality, debt risks, and environmental pollution. Still, the solution can never be a return to Maoism. Rather

FBNBank ended 2022 on a high note with special festive activities, receipt of awards and brand sponsored events serving as the main highlights which lled their customers, clients and other stakeholders subsequently with much expectation and hope as they entered the new year, 2023.

For FBNBank, the month of December in particular was packed with exciting activities which was kicked-o by a Festival of Nine Lessons and Carols hosted by employees of the Bank, sponsorship of Pellafest, an Acapella festival and the hugely patronized “Samini Experience Festival II” which featured the Bank’s Product Ambassador and the visit to the Royal Seed Orphanage at Papaase. In the midst of the activities the Bank also received awards for its Commercial Banking and Small and Medium Enterprises Banking e orts. All together, these activities created a great feel for the FBNBank brand giving its variety of stakeholders a true sense of being placed at the heart of the Bank’s e orts.

The Festival of Nine Lessons and Carols, featured performances by employees including Frank Akuamoah, Anointed Virtue Music, Linda Goraseh and the very exciting Sta Choir, Angelic Voices of FBNBank, who gave excellent

renditions of popular Christmas and Gospel songs. There was also Dulcet, a choral group that rendered melodious music and got the employees cheering. The Exhortation, which was delivered by the Head, Commercial Banking, William Amon Neequaye called on “FBNBank’s employees and Ghanaians as a whole not to lose sight of the lessons that Christmas taught. It wass a time to renew our commitment to serve our customers and clients in humility. It was a time to recharge our energies in order to be able to deliver on expectation in the new year.”

The Pellafest Christian Music Festival was organised by United Praise in partnership with FBNBank and it lived up to its billing. This purely praise, worship, prayer and thanksgiving event was in its fourth year and it attracted a slew of patrons to the National Theatre in Accra including the Bank’s customers, clients and employees who used the opportunity to renew their faith and hope in Jesus Christ. The theme for the 2022 event was “The Coming King.”

The Bank’s Product Ambassador, Samini, once again established his credentials as a force-to-be-reckoned-with on the music scene with the second Samini Experience Concert

which left patrons and all present asking for more. With a repertoire which appeals to both the younger and older generations, Samini thrilled the audience and set the tone for greater expectations for the 2023 edition.

The Bank, in December, also received two awards. The “Best Commercial Banking Brand” and “Best SME Banking Brand” at the 2022 Global Brand Awards Ceremony held at Dubai Palm Jumeirah-Waldorf. This was in addition to other achievements by FBNBank earlier in 2022. These include “Best Bank for SMEs” at the Connected Banking Summit West Africa Innovation & Excellence Awards, “Corporate Social Responsibility (CSR) Excellence Award” at the Health Environmental Safety and Security (HESS) award and the Bank’s induction into the Ghana Club 100.

The crescendo for FBNBank in the activity packed December 2022, was a visit to the Royal Seed Home at Papaase on the Kasoa-Bawjiase Road in the Central Region. Cash and food items worth thousands of Ghana cedis were presented to the children of the Royal Seed Home as part of employees’ end-of-year activities. The Home has a total population of 150 children between the ages of 6 months and 19 years. Sta

and Management of FBNBank extended this special goodwill as their contribution to support the Home during the festive season. Presenting the items, Grace Isaac-Aryee, Treasurer at FBNBank and leader of the delegation said “in a season like Christmas, we need to share goodwill and bring hope and joy to those who may not have the means to get what some people may take for granted. As driven by the Bank’s brand, we have put you rst at this time and have come to spend time with you today. We have also come with our token of goodwill and friendship.”

FBNBank has in its 26 years of operating in Ghana remained focused on putting its customers and communities rst. This, it has sought to do through the rich value and excellence of what the Bank contributes to the relationship with its stakeholders as a whole, particularly the customers. FBNBank Ghana is a subsidiary of First Bank of Nigeria Limited, which is renowned for its great customer service and general stakeholder engagement garnered over its 128 years of operation. FBNBank Ghana has 23 branches and three service points plus a network of agents across the country with over 500 sta . FBNBank o ers universal banking services to individuals and businesses in Ghana.

The Ghana Stock Exchange (GSE) has extended the dates for the ling of unaudited nancial statements for two listed companies. They are Guinness Ghana Breweries PLC and Fan Milk PLC. A press release issued in Accra today (January 18, 2023) by the GSE said Guinness Ghana Brewer-

ies PLC has February 14, 2023 to le while Fan Milk PLC has up to February 15, to do same.

It said the two companies have been granted extension for the submission of their Unaudited Financial Statements for the period ending December 31, 2022.

The Member of Parliament for Yendi on the ticket of the New Patriotic Party, Farouk Mahama, has urged the youth of the country to strive hard to achieve their set goals.

He urged the youth not to be discouraged by the temporary setback of the economy. He assured that government would do everything possible to overcome them/current challenges.

He also asked them to take advantage of the numerous skills and employment programs the government is enrolling in the course of the year to build themselves.

Hon Farouk who also serves on Food, Agriculture and Cocoa A airs and Gender and Children Committees in Parliament, was very con dent that the youth of the country would be given the necessary support to achieve their objectives.

He stated that as pillars of the state, they would not be left out in the socioeconomic development of the country.

Hon Farouk, who is the board chairman of the Ghana Integrat ed Iron and Steel Development Corporation assured that the Corporation would work very hard to prosecute its vision for the betterment of the economy.

He expressed his gratitude to Allah and all persons, individu als, and organizations who are helping him in his Parliamentary and other governmental duties.

Some youth in the constituency commended him for the numer ous projects, programs, and opportunities he has created and continued to create for them.

They assured the Hon MP that they would be agents of peace and development wherever they would nd themselves.

The Member of Parliament for Yendi on the ticket of the New Patriotic Party, Farouk Mahama, has urged the youth of the country to strive hard to achieve their set goals.

He urged the youth not to be discouraged by the temporary setback of the economy. He assured that government would

do everything possible to overcome them/current challenges.

He also asked them to take advantage of the numerous skills and employment programs the government is enrolling in the course of the year to build themselves.

Hon Farouk who also serves on Food, Agriculture and Cocoa A airs and Gender and Children Committees in Parliament, was very con dent that the youth of the country would be given the necessary support to achieve their objectives.

He stated that as pillars of the state, they would not be left out in the socioeconomic development of the country.

Hon Farouk, who is the board

chairman of the Ghana Integrated Iron and Steel Development Corporation assured that the Corporation would work very hard to prosecute its vision for the betterment of the economy.

He expressed his gratitude to Allah and all persons, individuals, and organizations who are helping him in his Parliamentary and other governmental duties.

Some youth in the constituency commended him for the numerous projects, programs, and opportunities he has created and continued to create for them.

They assured the Hon MP that they would be agents of peace and development wherever they would nd themselves.

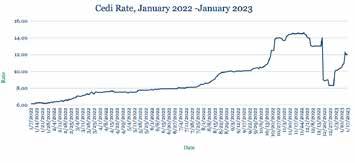

The Institute for Energy Security(IES) has received news of tari review by the Public Utility Regulatory Authority (PURC). The review captured in the PURC statement released on 16th January, has stated the e ects of the Cedi depreciation, In ation rates, Generation mix and the Weighted Average Cost of Gas (WACoG) as the factor which informed the end-user tari increment by 29.96% for electricity for all consumer groups. The IES is concerned in particular about the assumption used in

establishing the new electricity tari s beginning February 1st 2023. On the four key variables, the IES believe the rates for Cedi/Dollar exchange rate and in ation rates re ects market conditions.

The IES however considers the assumption used by the PURC on the electricity generation mix of 26.11% hydro-thermal and 73.89% thermal as baseless. That assumption amounts to given priority to thermal power generation over hydro, given that water elevations for Bui and Ako-

sombo generating stations (GS) have improved, and capable of producing close to 38% of power in 2023, in IES' estimation.

Data from Akosombo and Bui indicate elevations at the beginning of 2023 compared to previous years are in a better position to produce more electricity than the thermals. Bui's water elevation is expected to help produce more megawatts to meet increasing electricity demand at particularly peak hours, and extended mega Vars to support voltage on the grid and help reduce trans-

mission losses, if dispatched conservatively throughout the year.

The Institute agrees with the expectation that bulk of the capacity generation for 2023 would come from thermal sources if natural gas supply is sustained, and planned plant maintenance schedules is strictly adhered to. However, with improved water-head levels, hydropower generation is estimated to produce close to 38% of 2023 capacity, should

hydro-electric have dispatch priority over thermal in the generation mix.

With a year-start Akosombo water level elevation of 83.10 metres (272.66 feet), it is estimated that total energy production from Akosombo GS could fall between 7,500 and 8,000 gigawatt hours (GWh) for 2023, with the Kpong GS producing roughly 990 GWh of electric energy over the period.

Also, Bui GS’ year-start elevation of 178.99 metres above sea level (masl) is enough to possibly produce an estimated 1,056 GWh of electricity in 2023.

Although the IES has anticipated that the average electricity end-user tari (GH /kWh) covering residential, non-residential and special load tari electricity consumers would see an increase within the year, the expected increase in tari was anticipated to be marginal should more of hydro-electric power be produce from the generation mix.

IES therefore calls on the PURC to reconsider the energy mix assumption used in the tari adjustment (to re ect improved water-head levels) as that has an

impact on the Weighted Average Cost of Gas, which has been reviewed to $6.0952/MMBtu from $5.9060MMBtu. This, the IES believe will bring down the 29.96% tari increase for all electricity consumer groups, thus introducing some relief to the already burdened citizens, in the face of the current economic crisis.

Should the PURC decide to maintain the 26.11% hydro-thermal and 73.89% thermal electricity generation mix for 2023 as the basis for the high tari increment, that position would amount to promoting ine ciency and deliberately burdening the Ghanaian with high electricity cost.

A Deputy Minister of Finance, Abena Osei-Asare, has urged insurance companies to adopt business models that embrace technology for service delivery. She said technology was adding value to insurance business, adding that digital platforms would make the process of doing insurance faster and much less cumbersome.

Mrs Osei-Asare made the call at the inauguration of a new head o ce building for Activa Interna-

tional Insurance Company (Ghana Ltd) in Accra.

Known as the Activa Square, the building — which is the rst phase of a three-phase complex — consists of a basement for parking, a ground oor and three other oors including the rooftop level for entertainment.

Mrs Osei-Asare entreated insurance companies to join forces to intensify public awareness campaigns on the importance of insurance.

The deputy minister, who was the guest of honour for the occasion, further urged the companies to partner the regulator, the National Insurance Commission, to ensure standardisation across the sector.

She commended Activa International Insurance Company for the project.

Mrs Osei-Asare said it was important for insurance companies to have complementary hardware and software to e ectively address concerns of the public.

Such software, she said, must be anchored on people, partnership and technology which must ensure e ective communication during sales and claims payment

time, and also promote professionalism in handling clients.

The Chairman of Activa Insurance Group, Richard Lowe, expressed appreciation to the company’s clients, saying without them the company would be non-existent.

The Managing Director of Activa Insurance Ghana, Benjamin Yamoah, said the new head o ce signi ed the fruit of Activa’s hard work over the past 13 years that it had operated in the country.

He said work on the building started in September 2020, and though its progress was heavily impacted by the COVID-19 pandemic, the building was handed over to Activa in July 2022.

Mr Yamoah expressed gratitude to the contractor, Key Contracting Company Ltd; the consultant, DC&M; the Project Manager, as well as the local building committee for the work done.

Also present was the Minister of Trade and Industry, Alan Kyerematen; the Head of Finance of the National Insurance Commission, Dr Mahama Wayo, and the President of the Ghana Insurers Association, Seth Aklasi.

After three long years, the pandemic shows no signs of slowing down. Unfortunately, public resistance and fatigue toward COVID-19 interventions and restrictions are at an all-time high. Even China, which was once considered a leader in virus control, has rapidly dispensed with most mitigation strategies. COVID-19 still poses a clear and present danger. Research shows that two or more COVID-19 re-infections doubles the risk for death, blood clots, and lung damage, among other negative

By William A. Haseltinehealth outcomes. The risk of cardiovascular events has been found to increase by 4.5% up to 12 months after infection, regardless of age, race, sex, obesity, smoking, or other factors. Moreover, the latest waves of infection are being fueled by new variants that evade immunity from both vaccination and previous infections.

The good news is that we still have powerful prevention tools at our disposal. In fact, there is one widely underused strategy that doesn’t require behavioral

change or restrictions, that can be used just about anywhere, and that would also help protect us against other airborne viruses, such as RSV and in uenza. It requires investing much more in basic measures such as ventilation, air ltration, and ultraviolet germicidal light, and accelerating the exploration of newer discoveries, such as the potential use of aerosol acidity levels to inactivate certain airborne viruses. Vaccines are highly e ective in reducing the risk of death and serious illness, but they are

generally not as e ective in preventing transmission. Mask-wearing has become so highly politicized and stigmatized in many Western countries that even some health-care workers are neglecting to wear them. Yet aerosols carrying viruses can linger for hours in the air after they have been exhaled, making it di cult to judge what counts as a high-risk situation. Given all these factors, the best way to reduce the risk of transmission is to decrease the concentration of

airborne viruses that are available to be inhaled in the rst place. We need to challenge the prevailing attitude that treats the spread of airborne pathogens in indoor spaces as an inevitable part of daily life. Unlike our ancestors, we spend almost 90% of our time indoors. For decades, governments around the world have invested heavily in food safety, sanitation, and clean drinking water – all in the name of protecting public health. In developed countries, food and waterborne disease have largely been eliminated through a combination of research, legislation, the development of authoritative public-health agencies, and infrastructure funding. Why shouldn’t we give the same priority to achieving clean, pathogen-free air in public and private spaces?

Taking the ght to pathogens before they can infect us will require a multi-pronged strategy. Professional engineering bodies need to develop comprehensive ventilation standards, and new measures will be needed to ensure that these standards are met. That means establishing regulatory bodies to oversee monitoring and enforcement, not just for new construction but also in the retro tting of existing buildings. To that end, governments should help to provide specialized training for building operators and owners. The goal for all buildings should be to recirculate the air supply of occupied spaces at a rate of at least six air changes per hour.

This may sound like an enormous task. But improvements can be rolled out gradually, and strategically, across di erent sectors. The immediate priority is to ensure pathogen-free air in hospitals and health-care settings, to protect vulnerable patients, and in airplanes, to stop the rapid spread of new variants around the world.

After that, our focus should shift to public transportation, including trains and buses, and then to o ces, schools, and daycare facilities. In addition to preventing viral transmission, better-ventilated areas have been shown to improve children’s cognitive performance and reduce

illness-related absenteeism. Finally, we should address ventilation in individual homes and residential buildings.

Critics of such proposals will cite the up-front cost as a barrier. Yet even an average u season is known to cost the United States $11.2 billion, owing to the resulting absenteeism and reductions in productivity. According to an August 2022 Brookings Institution report, long COVID may be “keeping as many as four million people out of work” in the US, at an annual cost of $170-230 billion per year in lost wages.

Having a workforce that is repeatedly getting sick means that we are accepting continued disruptions across all industries. But this is unsustainable. Parents are already exhausted and overwhelmed by the “tripledemic” (in uenza, RSV, and COVID-19) that has been tearing through schools and daycares.

Beyond the direct nancial costs, the trauma and turmoil in icted by the pandemic make it clear that investing in pathogen-free indoor air is not only the most economically sound option but also the most ethical one. Like other e ective investments in public health, this one would soon pay for itself.

The escalating Sino-American rivalry and the broader concerns about China’s economy have caused Western rms to reevaluate their operations there – and rightly so. Given the uncertainty surrounding President Xi Jinping’s economic policies and geopolitical intentions, it may be time for investors and corporate leaders to consider scaling back their exposure to Chinese assets and markets.

The events of the past year, particularly Xi’s dogged refusal to ease his strict zero-COVID policy and his con rmation as China’s rst three-term president, have spooked global investors. Likewise, Xi’s “common prosperity” agenda, which aims to redistribute wealth from the wealthy to the poor and rein in the country’s new business elite, has been viewed as anti-business and damaging to economic activity.

As part of his common prosperity campaign, Xi pledged that the authorities would “reasonably regulate excessively high incomes and encourage high-income people and enterprises to return more to society.” With this kind of rhetoric, it is no wonder that China’s stock market dropped roughly 20% last year. China’s policies have also led to vast capital out ows and an accelerated sell-o of Chinese stocks. According to the Institute of International Finance, investors withdrew $7.6 billion from Chinese equities last month, along with $1.2 billion from the bond market.

Of course, investors’ reactions to economic trends and political developments depend on their portfolios, diversi cation needs, risk appetites, and investment horizons. But prudent investors and business leaders will use this opportunity to assess their portfolios’ risks and consider what to do about their China positions. Clearly, the widening gulf between the United States and China and the broader shift toward deglobalization will upend how multinational companies run their business. Speci cally, companies must rethink how they obtain nancing, hire across borders, and allocate capital. They should also consider centralizing procurement and building resilient supply chains. What paths could investors reassessing their China exposure take? One option is to divest from all of their Chinese assets, reducing their exposure to zero. But reducing exposure to China is likely to be a protracted process, whether it involves shrinking a portfolio of publicly-traded Chinese stocks or unwinding a private equity investment. Repositioning will also likely be complicated, as sellers must nd buyers in an already-challenged valuation market.

Moreover, investors looking to unwind their Chinese holdings must consider the e ects on their taxes, intellectual-property rights, and transfer pricing, as well as many other stranded costs. And corporate investors who have long been bullish on China would need to come to terms with the possibility that they might not have any exposure to China’s economy when growth begins to pick up.

Alternatively, investors could accept their sunk costs, write down the value of their investments, and still retain some exposure to China. In essence, this would mean acknowledging that previous investments cannot be recovered while holding o on

making new ones.

In the context of an equity portfolio, a sunk-cost approach would result in recorded mark-to-market losses, leaving investors with the option of retaining their positions in the event of a market rebound. Similarly, a corporation that owns a factory in China may write down its asset value. But instead of shutting it down and writing it o entirely, it could run it as a going concern without expanding output or making new capital commitments, thereby maintaining a foothold in China when the economy nally recovers.

Another option is to double down. Investors could not only hold on to their current China exposure, but also take advantage of low valuations and market weakness to enlarge their Chinese footprint. But even in this scenario, global investors would be wise to recalibrate their investment strategies by adding a local partner to minimize the risk of expropriation.

Companies that decide to stay and increase their presence in China, however, could be forced to operate as ring-fenced businesses. This would likely complicate nancial reporting and increase their regulatory burdens, particularly in the face of rising trade protectionism and regional balkanization.

Ultimately, however, investors and corporations committed to investing in China must be innovative in how they do business in – and with – China. They would need to reevaluate the governance and board-oversight structures of new local entities that may trade only on Chinese stock markets. They would also have to rely on unconventional metrics, since traditional measures such as macro statistics, P/E multiples, internal rate of return, Sharpe ratios, and volatility measures similar to the VIX are less reliable in such a fast-moving geopolitical, economic, and nancial environment.

Whatever choice they make, Western investors in China face a completely di erent economic terrain than the one in which they operated for more than a decade. This shift re ects domestic political developments such as Xi’s iron grip on power. But it also attests to a new geopolitical order in which China and the US compete for economic, technological, and military superiority. In a rapidly deglobalizing world, investors must consider their next moves carefully.

In the seventh episode of the Vodafone Healthline Spin-O edition, the team went to Dawhenya to check on Ewurabena, a seven-year-old girl who had surgery three years ago with help from Vodafone because she had been having trouble eating since she was born.

Ewurabena, who was born with a throat blockage, was unable to eat or drink through her mouth and had to be fed through a tube implanted in her stomach.

Her mother, Jennifer Hagan,

described to the team how she would not have been able to a ord the surgery for many years. She said that, despite challenges two months after Ewurabena's operation, she is now doing well, eating and drinking through her mouth, and living normally.

"Vodafone Healthline is for everyone," Ewurabena's mother said, thanking the team and telling anyone who needed help to contact the team.

During the episode, Drs Kweku-

ma Yalley and Aba Folson, together with host Frema Asiedu, examined the idea that massaging a baby's head with hot water will give it a better shape.

Both doctors agreed that the practice does not change the baby's head shape. Dr Yalley emphasized how sensitive a baby's head is and credited heredity for determining its shape.

He dispelled the misconception by clarifying that, while warm water is pleasant and calming, it does not a ect the form of a baby's skull. He expressed concern that hot water could cause burns.

In the seventh episode, the panel also talked about how insulin resistance, irregular periods, and other things can make women more likely to have polycystic ovary syndrome.

Dr Padi Aryetey, an obstetrician and gynaecologist, highlighted several frequent symptoms of the polycystic ovarian syndrome.

According to him, the symptoms include irregular menstruation, chin hair, and other hormonal issues.

However, he asserted that insulin resistance was the primary cause, explaining that high insulin levels cause the ovary to produce more male hormones, which in turn causes the polycystic ovarian syndrome.

Dr Aryetey talked about treatments for the syndrome and suggested ways to treat it with medicine.

Through the Vodafone Healthline show, Vodafone has provided free medical education and interventions to the public. The show keeps giving useful information through interesting content on social media and some other media outlets.

The Vodafone Healthline Spin-O edition airs on UTV on Mondays from 9:30 p.m. to 10:00 p.m. and on DGN on Tuesdays from 6:00 p.m. to 6:30 p.m.

Co-principal investigator for CREATE and consultant family physician at Korlebu Teaching Hospital, Dr. Roberta Lamptey has advised Ghanaians to pay attention to non-infectious diseases as they are becoming more common in Africa.

Speaking at the CREATE Ghana meeting held at Accra City Hotel where CREATE collaborators, the ministry of health, representatives from hospitals and various health related elds met to deliberate on integrated care for people living with multiple long-term conditions, she said that the most common non-infectious diseases are cardiometabolic diseases.

“In Africa, when asked to mention fatal diseases, names such as Ebola and Covid quickly comes up. Across media platforms, there are always precautionary messages on these. This is because African healthcare systems were developed to focus on infectious diseases; and in

Ghana, it is no di erent. While this may not be bad, it however means that African healthcare is better set up to cope with infec tious diseases than non-infec tious diseases. But lately non-in fectious diseases are becoming more common in Africa; with the most common being cardiometa bolic diseases. These include heart disease, diabetes, obesity and high blood pressure”.

“According to World Health Organization (W.H.O), 1.5 million deaths are directly attributed to diabetes, each year while about 17.9 million deaths each year are caused by cardiovascular diseases (CVDs), making it the leading cause of death globally. And at its current rising rate, it may not be too farfetched to say that every home in Ghana has 1 or more persons with any or more of the above-mentioned conditions.

Increasingly, people below 40years have to learn how to live with multiple chronic long-term conditions such as strokes, obesi-

“To change the trends

with multiple long-term chronic conditions”.

“Recruitment of patients living with chronic long term cardiac diseases and data collection processes for a feasibility trial to test a self-management education model, developed by the CREATE Collaborators is planned for this quarter after the necessary ethical approvals have been obtained. This may ultimately strengthen Ghana’s health system in providing integrated care for chronic conditions”, she concluded.

CREATE is funded by the National Institute for Health and Care (NIHR, UK).

Every home in Ghana has one or more persons with cardiometabolic disease - Dr. Roberta Lamptey

The Executive Chairman of the Jospong Group of Companies (JGC) has attributed the success story of his group to God.

According to Dr. Joseph Siaw Agyepong, God has been his guide and pillar throughout the JGC's journey so far.

The JGC, he contended, is founded on the principles of God and people, stressing that the group's "primary goal is to improve the lives of people."

Dr. Siaw Agyepong was speaking at the opening of the 2023 Jospong Leadership Conference (JLC) on Wednesday, January 18, 2023, at the Pentecost Convention Centre (PCC) at Gomoa Fetteh in the Central Region.

The ve-day conference, which is being participated by over 1,000 directors, managers, senior o cers among other sta members of JGC, is on the theme: People, Process & Performance --The Pathway to Success in a Turbulent Market."

This year's conference marks the 10th anniversary of the JLC series.

Dr. Siaw Agyepong indicated that throughout his business life, he has consistently seen that the God factor triumphs over all challenges adding "I am always grateful to

God."

"When I face any challenges, I go down on my knees with my wife and pray and God has been so good to us. We feel so blessed by God Almighty," he gratefully expressed.

The mission of the JGC, he said, is to be the leading environmental sanitation management company in Africa, with its vision aimed at "improving the lives of people and their environment."

In this regard, he encouraged his sta members to be prayerful in all endeavours, and to work hard to improve the lot of people.

Recounting how far the JLC has come since its inception in 2013, tthe Executive Chairman of JGC said the leadership conference started as retreats.

"It is amazing how time ies. Ten years ago, speci cally in 2013, we started this journey in the form of retreats at the Presbyterian Women’s Centre, Abokobi, Accra. The rst retreat was held in January with the theme: “Seeking God’s guidance on the perfect will of God”, and the second in July under the theme; “Let’s Build Together.”

...The objective was to discuss

our plans and activities for the year. It was attended by many employees and stakeholders from all over the country. And the keynote speaker was the then Managing Director for Stanbic Bank, Chief Alhassan Andani," he recalled.

The outcome of the retreats, Dr. Siaw Agyepong noted, led to the creation of the Group O ce and many other remarkable achievements.

"The 2013 January and July retreats thus became a de ning moment for the Group," he stressed.

He thus seized the opportunity to commend, especially President Nana Addo Dankwa Akufo-Addo, for his leadership guidance and support for his group.

He was equally full of praise for the Minister of Sanitation and Water Resources, Mrs. Cecilia Abena Dapaah, and others within his group's operational activities, and all the sta members of JGC for their hard work and sacri ces.

"We have come this far because of the critical role played by every sta of JGC," he asserted.

The Guest Speaker, Reverend Sam Adeyemi, a Nigerian clergy and motivational speaker, in a presentation christened: "Celebrating the Champions in People", said transformational leaders empower employees with praise and appreciation.

He said there was nothing like a "perfect employee" in this world, insisting that leaders must rather leverage on the skills and talents of people.

"Leadership is not about titles and egos but one that must make champions in the people," he said

According to the man of God, a leader must help people to overcome fear, low-self esteem, complacency, self-doubt, bad attitude and procrastination.

"When you are a leader avoid speaking negative things about your people," he advised.

guarantors -where applicants are required to present guarantees from the banks to safeguard government’s investment in bene ciaries.

Government over the years has been sponsoring public sector workers to pursue higher education abroad with various sums of money. Most of these bene ciaries at the end of their service fail or never return to the country where their services are needed, and additionally default in the repayment of the investment made in them.

Health and their various agencies appeared before the Committee to respond to a number of infractions cited in the Report of the Auditor-General on the Public Accounts of Ghana, Ministries, Departments and Other Agencies (MDAs) for the year ended 31st December, 2020.

According to the report of the Auditor-General the former workers of Korle-bu Teaching Hospital have failed to honour their bonds or refund an amount to the tune of Gh 98,546.00 which was spent on their studies abroad.

the guarantor system used to support

workers to pursue higher education.

According to him, it is time for government to insist for bank

Mr. Klutse Avedzi made this known on Wednesday at PAC sitting when the Ministry of

Speaking with journalists after the PAC on the matter, he said “We think that the best way to do that

!"#$%&'()*+,")-'.#'$( /0/1

+%,,%-!./01!./!2032.)-.4).%!54*%-62!7),,!4-8!/-!'914:) !$2'%#$()324$2,'$()-'.2,)52662.)7289.%)"2$),:#$):;)32.28'6<)='>79')'.&)3:#,") ?;$94'),"9%)@22A<)@9,")":B2%)"98"):.),"2)4:.,9.2.,):;)'&&9.8)%#7%,'.42),:)C$2%9&2.,) -:2)D9&2.E%)4:>>2.,%)6'%,)>:.,"),"',),"2)F3)9%)G'66)9.):.)?;$94'E%);#,#$2HI)52662.) ;:66:@%)J"9.2%2)K:$298.)L9.9%,2$)M9.)N'.8O%),:#$),"9%)>:.,"),'A9.8)9.)P,"9:B9'<) N'7:.<)?.8:6'<)D2.9.)'.&)P8(B,H)J"9.' ?;$94')796',2$'6),$'&2)',)R/ST7.);:$)/0/*)9%) ;:#$),9>2%)"98"2$),"'.)F3 ?;$94'),$'&2H)J"9.2%2);:$298.)&9$24,)9.U2%,>2.,)9.)?;$94') $:%2),:)RT17.)9.)/0/0H)V#$9.8)"9%)U9%9,<)M9.);'42&)4$9,949%>);:$):B'W#2),2$>%)'.&) :.2$:#%)4:66',2$'6)&2>'.&%):.)J"9.2%2)6:'.%<)2XB:%9.8)4:#.,$92%),:)B:,2.,9'6)Y&27,) ,$'B%HO)M9.)4:#.,2$2&),"',)J"9.2%2)>:.2()"'%)"26B2&)9>B$:U2),"2)69U2%):; ?;$94'.) B2:B62)'.&)4'662&);:$)9.,2$.',9:.'6)4::B2$',9:.)$',"2$),"'.)4:>B2,9,9:.H)52662.)9%) 2XB24,2&),:)&9%4#%%)9.;$'%,$#4,#$2)9.U2%,>2.,<)&27,<)'.&)2.2$8()'.&);::&) %24#$9,(< 2XB'.&9.8):. D9&2.O%)B62&82):;)>:$2),"'.)R*S)79669:.)9.),$'&2)'.&) 9.U2%,>2.,)&2'6%<)'.&)"9%)B$:B:%'6),:)9.46#&2),"2)?;$94'.)F.9:.)9.),"2)N/0)8$:#B):;) >'Z:$)24:.:>92%H)D9&2.)9%)%4"2>&),:),$'U26),:)?;$94')6',2$),"9%)(2'$<)'6:.8)@9,") [942)C$2%9&2.,)\'>'6')]'$$9%H)!"2)U9%9,%)4:#6&)>'$A)/0/1)'%),"2)(2'$)F3) 2.8'82>2.,)9.)?;$94')>:U2%)72(:.&)'%%9%,'.42),:)')>:$2)2W#'6)B'$,.2$%"9B);:$) ,$'&2)'.&)9.U2%,>2.,H

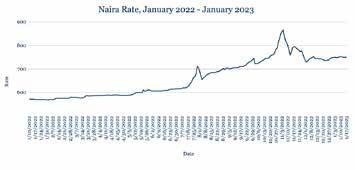

;.)34,42%*!<)41)!.1%-*4-=!,/>%1!)(%)*!/9!%,%:.4/!"2)^'9$')"26&)$26',9U26()%,'762)'8'9.%,),"2)&:66'$<),$'&9.8)',)_S*);$:>)_T+)',)6'%,) @22AO%)46:%2H)^982$9')$28'9.2&)9,%)B:%9,9:.)'%)?;$94'O%),:B):96)B$:*$)';,2$)B#>B9.8) Z#%,):U2$)*H/)>9669:.)7'$$26%)B2$)&'()9.)V242>72$H)!"2)9.4$2'%2)9.)B$:,9:.);:66:@%) 2;;:$,%)7()^982$9'),:)722;)#B)%24#$9,()%#$U2966'.42);:$)9,%):96)9.;$'%,$#4,#$2),:)$2*) ,"2;,H)K:66:@9.8),"2)9.,$:,9:.):;).2@)^'9$').:,2%)6'%,)(2'$<),"2)U:6#>2):;)4#$$2.4() 9.)49$4#6',9:.);266),:)^N^1H*`,$)9.)^:U2>72$);$:>)^N^1H/+,$)9.)a4,:72$H)!"',)9%) 69>9,9.8),"2)'>:#.,):;)4'%")'U'96'762);:$)B:,2.,9'6)U:,2)7#(9.8)'%)K27$#'$(O%) B$2%9&2.,9'6)2624,9:.)'BB$:'4"2%H)?%)&2>'.&)4:.,9.#2%),:)7#96&)8:9.8)9.,:),"2)(2'$<) @2)2XB24,);#$,"2$)7#,)8$'&#'6)&2B$249',9:.):;),"2).'9$'H

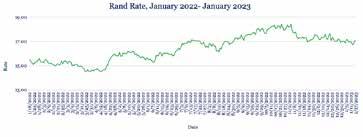

?()-)62!=/,*!9/1!/4,!(%,@2!2.%)*A!B%*4 !"2)J2&9)"'6,2&)9,%)$242.,)%"'$B)%69&2)'8'9.%,),"2)&:66'$<),$'&9.8)',)*/H0*);$:>)*/H/b) ',)6'%,)@22AO%)46:%2) %,966)%98.9;94'.,6()@2'A2$),"'.)9,%)(2'$ 2.&)62U26):;)bH1S) ;:66:@9.8)N"'.'O%)&27,)&2;'#6,)9.)V242>72$H)!"2)8:U2$.>2.,)9%)":B9.8)9,%)7'$,2$) ,$'&2):;)8:6&);:$):96)@966)2'%2)Kd)&2>'.&)7()'66:@9.8)N"'.'),:)#%2)8:6&),:)7#():96) B$:,%)9.%,2'&):;)9,%)&:66'$)$2%2$U2%<)@"94")9.),#$.)%":#6&)%#BB:$,),"2)J2&9):U2$),"2) >2&9#>),2$>H)!"2)J2&9)$2>'9.%)#.&2$)%#%,'9.2&)B$2%%#$2)89U2.);698",);$:>)N"'.'O%) 7:.&)>'$A2,)'%),"2)4:#.,$()%22A%),:)$2%,$#4,#$2)9,%)&27,)'%)B'$,):;)'.)eLK) 2>2$82.4()6:'.)B$:8$'>>2H C-%1=A!:14242!@4,%2!@1%2201%!/-!D)-* !"2)f'.&)@2'A2.2&)'8'9.%,),"2)&:66'$<),$'&9.8)',)*_H**);$:>)*`Hb*)',)6'%,)@22AO%) 46:%2)'%)3:#,")?;$94'O%)2.2$8()4$9%9%)&22B2.%H)C$2%9&2.,)J($96)f'>'B":%')4'.42662&) ')%4"2>&),$9B),:),"2)g:$6&)P4:.:>94)K:$#>)9.)V'U:%)'%)$:669.8)76'4A:#,%)@:$%2.) '.&)%,',2)#,969,()4:>B'.()P%A:> $2%B:.%9762);:$)+0i):;)3:#,")?;$94'O%)B:@2$ %,$#8862%),:);9.&)')%:6#,9:.H)!"2)8:U2$.>2.,),"9%)@22A)%'9&)9, 9%)B6'..9.8)').2@)6'@) ,:)'44262$',2),"2)&2U26:B>2.,):;)B$9U',2)B:@2$)B6'.,%),:)9.4$2'%2)82.2$',9.8) 4'B'49,(H)!"2)4:#.,$()"'%)%#;;2$2&)76'4A:#,%)2U2$()&'(),"9%)(2'$)';,2$)')$24:$&)/0S) &'(%):;)6:'&)%"2&&9.8)9.)/0//H)3:#,")?;$94'.%)"'U2)722.)@9,":#,)B:@2$);:$)#B),:)*/) ":#$%)')&'():U2$),"2)B'%,)@22A)'%)P%A:>)%4$'>762%),:)%'U2),"2)4:#.,$(O%)2624,$949,() 8$9&);$:>)4:66'B%2H)?8'9.%,),"9%)7'4A&$:B<)@2)2XB24,),"2)f'.&),:)4:.,9.#2) @2'A2.9.8):U2$),"2).2'$),2$>H

E%F),0%*!C=A@.!G/0-*!94-*2!HI!,%F%,!=1/0-*!)J4*!"#!4-9,/>2 !"2)C:#.&)@2'A2.2&)'8'9.%,),"2)&:66'$<),$'&9.8)',)/+H`+);$:>)/bHS`)',)6'%,)@22AO%) 46:%2) ,":#8"),"2)4#$$2.4()"'%)%":@.)%98.%):;)%,'7969%9.8)',),"2)4#$$2.,)62U26<)@"94") 9%)'7:U2),"2)$24:$&)6:@):;)1*HT0H)P8(B,O%)42.,$'6)7'.A)%'9&),"',)'66:@9.8),"2)C:#.&) ,:);6:',)>:$2);$226()4:>79.2&)@9,")9,%)6',2%,)&2U'6#',9:.)"'%)%#BB:$,2&)8$2',2$)Kd) 9.;6:@%<)@"94")"'U2),:,'662&)>:$2),"'.)R+/S>)%9.42)6'%,)@22AH)V'96()Kd),$'&9.8) '4,9U9,()"'%)%#$82&),:)>:$2),"'.)/0),9>2%),"2)&'96()'U2$'82)%22.)9.)$242.,)@22A%H) K9,4")f',9.8%)%'9&)P8(B,9'.)7'.A%O)4'B9,'6)$',9:%)4'.)@9,"%,'.&);#$,"2$)&2B$249',9:.):;) ,"2)C:#.&<)@9,")B$9U',2)%24,:$)7'.A%)72,,2$)B:%9,9:.2&),"'.),"29$)%,',2 :@.2&) 4:#.,2$B'$,%)),:),"29$)8$2',2$)4'B9,'6)82.2$',9.8)4'B'7969,92%H)e.),"2)'7%2.42):;) ;#$,"2$)>'4$:)%":4A%<)@2)2XB24,),"2 C:#.&),:)4:.,9.#2),$'&9.8)'$:#.&),"2)10)62U26)9.) ,"2)%":$,),2$>H

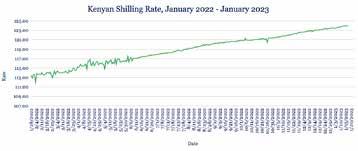

K%-A)-2!(/)1*!*/,,)12!)2!;(4,,4-=!(4.2!-%>!,/> !"2)3"9669.8)"9,)');$2%")$24:$&)6:@)'8'9.%,),"2)&:66'$<)%69&9.8),:)*/TH00j*/TH/0);$:>) */1H_Sj*/1H+S)',)6'%,)@22AO%)46:%2H)!"2)@2'A2.9.8),$2.&<)@"94")9%)>'A9.8)\2.('O%) 2X,2$.'6)&27,)B'(>2.,%)>:$2)2XB2.%9U2<)4:.,9.#2%)'>9&)$9%9.8)9>B:$,)4:%,%H)g2'6,"() \2.('.%)"'U2)722.)7#(9.8)&:66'$%)'%)')"2&82)'8'9.%,),"2)&2B$249',9.8)3"9669.8)'.&) '$2).:@)%9,,9.8):.)')$24:$&)\P3+//7. @:$,"<)B#,,9.8);#$,"2$)B$2%%#$2):.),"2)6:4'6) 4#$$2.4(H)!"2)4:#.,$(O%)Kd)$2%2$U2%)$2>'9.)'&2W#',2)', R_HT7.<)2.:#8");:$)TH*S) >:.,"%):;)9>B:$,)4:U2$H)g2)2XB24,),"2)3"9669.8),:)4:.,9.#2)&2B$249',9.8)'%)$9%9.8) 9.;6',9:.)B#%"2%)#B),"2)4:%,):;)69U9.8)9.)')4:#.,$(),"',)9%)&2B2.&2.,):.)9>B:$,%<) 9.46#&9.8);#26<)>'4"9.2$(<)>2&949.2<);::&)'.&)46:,"9.8H

L/>%1!./0142J!@1/2@%:.2!>%4=(!/-!M=)-*)-!;(4,,4-= !"2)3"9669.8)@2'A2.2&)>'$89.'66()'8'9.%,),"2)&:66'$<),$'&9.8)',)1`_0);$:>)1``/)',) 6'%,)@22AO%)46:%2H)!"2)eLK),"9%)@22A)%'9&)9,%)2X24#,9U2)7:'$&)"'%)'BB$:U2&),"2) $262'%2):;)'7:#,)R/T0>)9.);#.&9.8);:$)F8'.&')'%)B'$,):;)9,%)1` >:.,")2X,2.&2&) 4$2&9,);'4969,(),"',)"'%)722.)9.)B6'42)%9.42)-#.2)/0/*H)!"2)4:#.,$(O%);9.'.42)>9.9%,$() 9%)B$:Z24,9.8)8$:@,"):;)`i)9.),"2)/0/1j/T);9.'.49'6)(2'$<)%#BB:$,2&)7()9.4$2'%2&):96) %24,:$)'4,9U9,(<)$289:.'6),$'&2)8$:@,")'.&)')$27:#.&)9.)'8$94#6,#$'6):#,B#,H)!"2) 8:U2$.>2.,)%'9&)9,)2XB24,%),:)7:$$:@)'$:#.&)R/H`7.);:$),"2)4:>9.8);9%4'6)(2'$H) F8'.&')4'.42662&)')R/H17.)$'96@'()B$:Z24,)@9,")')J"9.2%2)4:.,$'4,:$)';,2$);'969.8),:) ',,$'4,)J"9.2%2);#.&9.8H)e,)9%).:@)%22A9.8)9.U2%,>2.,);$:>)!#$A2();:$),"2)B$:Z24,<) D6::>72$8)$2B:$,2&H)g2)2XB24,),"2)3"9669.8),:)&2B$249',2):U2$),"2)6:.8),2$>)';,2$) ,"2)8:U2$.>2.,)%6'%"2&),"2)4:#.,$(O%),:#$9%>)7#&82,<)B:,2.,9'66()$21.8),"2) '>:#.,):;)Kd)4:>9.8)9.,:),"2)4:#.,$(H

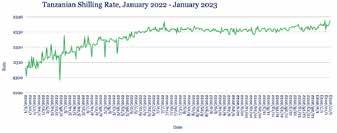

N)-O)-4)-!;(4,,4-=!>%)&%-2!./!-%)1!9/01 A%)1!*/,,)1!,/> !"2)3"9669.8)%69BB2&),:)9,%)@2'A2%,)62U26)'8'9.%,),"2)&:66'$)9.)'6>:%,);:#$)(2'$%<) ,$'&9.8)',)/11b);$:>)/11`)',)6'%,)@22AO%)46:%2H)g"962),"2)&2469.2)9%)>'$89.'6<),"2) 4#$$2.4()9%)%,'$,9.8),:);:$>)')%698",)@2'A2.9.8),$2.&)'8'9.%,),"2)8$22.7'4AH) !'.k'.9'O%)42.,$'6)7'.A)%:6&):;;)'),:,'6):;)R*/T>);$:>)9,%)Kd)$2%2$U2%)&#$9.8),"2);9$%,) "'6;):;),"2);9.'.49'6)(2'$)9.)')79&),:)4#%"9:.),"2)24:.:>()'8'9.%,)9.;6',9:.)'.&):,"2$) 4:%,%)$26',2&),:)8::&%)9>B:$,%H)e.),:,'6<)Kd)$2%2$U2%)"'&);'662.),:)RTHS7.)9.) ^:U2>72$)4:>B'$2&),:)R`H`7.)')(2'$)2'$692$H)f2%2$U2%)@2$2)%#BB:$,2&)7()!'.k'.9') 9.4$2'%9.8)4:'6)2XB:$,%),:)'6>:%,)R*T/>);$:>)R*1>):U2$),"2)%'>2)B2$9:&)'%)P#$:B2) %:#8",)'6,2$.',9U2)2.2$8()%:#$42%)'>9&)f#%%9'O%)@'$)9.)FA$'9.2H)g"962),"',)7::%,)9%) 69A26(),:)72)%":$, 69U2&<),"2)4:#.,$()9%)%22A9.8),:)',,$'4,);#$,"2$)9.U2%,>2.,)'.&),$'&2) @9,"),"2)P#$:B2'.)F.9:.)9.),"2)(2'$)'"2'&H)g9,"),"',)9.)>9.&<)@2)2XB24,),"2)3"9669.8) ,:)@9,"%,'.&)'.()%98.9;94'.,)6:%%2%)'8'9.%,),"2)&:66'$)9.),"2).2'$),2$>H

January 13, 2023

82,200 in just six months. Over $2.2 million in BUSD was donated during 2022 with projects spanning France, Senegal, Nigeria, Australia, Germany, Cyprus, Ukraine, South Africa, and Brazil, o ering students the opportunity to study Web3-related courses free of charge.

So far our donations have funded 259,180 hours of training and education in the classroom, in boot camps, and in community workshops. In total Binance Charity will be o ering 67,155 scholarship places but many of these are yet to even open to applications.

Binance Charity is partnering with Binance Academy and several top academic and vocational institutions to deliver these projects including the University of Western Australia, the University of Nicosia, Frankfurt School of Finance & Management - Blockchain Center, Simplon, Utiva and

unprecedented, showing the keen appetite of so many people to learn about blockchain, De-Fi, NFTs, coding, and much more. And, we’re seeing interest from a diverse range of people, including a great ratio of women, which is something I feel particularly passionate about. With so many more education initiatives and amazing pipeline partners, we’ve never been more excited to build a more inclusive Web3 world,” Said Helen Hai, Head of Binance Charity.

IT Generation kick-started the global Binance Charity Scholar Program in June, an initiative designed to help Eastern Ukrainians, who have lost their jobs due to the war, to re-train and re-enter the job market in Western Ukraine, in partnership with the Ministry of Digital Transformation.

Other projects include vocational training for 10,000 people,

Blockchain, Germany. In France, we’ve partnered with Simplon to enable 10,000 people from disadvantaged communities in Francewhere unemployment is rapidly rising - to learn, study and enter the growing Blockchain industry. “What we saw was interesting–I knew a little bit about the world of cryptocurrency before, but this time I got to learn about blockchain technology. It was clear– I had no idea you could do so much with it. I can’t wait to learn more,” comments Terry Genly, student Simplon.

In Brazil and South Africa, we’re working with Women in Tech to provide vocational training for 2,800 women in rural communities, creating future entrepreneurs and job creation. And, UTIVA in Nigeria educates 50,000 young people in Blockchain/Web3 and provides scholarships for 1,000 Africans in a 1-year intensive skill training program, supporting

blockchain application, coding, cryptocurrency, decentralization, NFT, Metaverse, Fan token, and Trading. This is just the beginning of Binance Charity’s education initiative, more projects are set to be announced early this year.

Binance Charity is a non-pro t organization dedicated to unlocking Web3 as a powerful tool for social change. Its mission is to enable Web3 as a driver of social transformation by making its education and research accessible to all and advancing global solutions for local humanitarian impact. Binance Charity uses its 100% transparent donation platform to build a future where technology is used as a force for good. To date, Binance Charity has supported over 2 million end bene ciaries through various projects. For more information, visit https://www.binance.charity/.

so that people can continue to bene t is to ensure that before you bene t from this facility, provide a bank guarantee -you go to your bankers, tell them that government is sponsoring me for this course and I want a guarantee to prove to government that I am coming back, you are my banker and my salary comes here all the time, the bank will have to do studies to ensure that de nitely you will come back and if you don’t come back the bank must have a way of ensuring that the money is retrieved from you, so that government will easily fall on these banks if the people fail to return.”

He added that, it remains the way forward if the status quo is to be changed, to ensure that government does not continue to lose money.

Members of the Committee asked questions relating to the queries cited in the Auditor-General’s Report and o cials from the Ministry of Health and agencies including NTC-Pantang, Ghana Institute of Clinical Genetics, Nurses Training College Damongo among others.

When the Minister of Health, Hon. Kweku Agyeman Manu, Director General of the Ghana

Health Service, Dr. Patrick Kuma-Aboagye, Chief Director and Senior O cers of the Health Service appeared before the Committee, the Chairman ordered for the arrest of two guarantors of two former sta of Korle-bu Teaching Hospital for failing to ful l bonds after being sponsored to pursue their higher education.

The Chairman of the Public Accounts Committee (PAC), James Klutse Avedzi, has asked government to review the guarantor system used to support workers to pursue higher education.

According to him, it is time for government to insist for bank guarantors -where applicants are required to present guarantees from the banks to safeguard government’s investment in bene ciaries.

Government over the years has been sponsoring public sector workers to pursue higher education abroad with various sums of money. Most of these bene ciaries at the end of their service fail or never return to the country where their services are needed, and additionally default in the repayment of the investment made in them.

Mr. Klutse Avedzi made this known on Wednesday at PAC sitting when the Ministry of Health and their various agencies appeared before the Committee to respond to a number of infractions cited in the Report of the Auditor-General on the Public Accounts of Ghana, Ministries, Departments and Other Agencies (MDAs) for the year ended 31st December, 2020.

According to the report of the Auditor-General the former workers of Korle-bu Teaching Hospital have failed to honour their bonds or refund an amount to the tune of Gh 98,546.00 which was spent on their studies abroad.

Speaking with journalists after the PAC on the matter, he said “We think that the best way to do that so that people can continue to bene t is to ensure that before you bene t from this facility, provide a bank guarantee -you go to your bankers, tell them that government is sponsoring me for this course and I want a guarantee to prove to government that I am coming back, you are my banker and my salary comes here all the time, the bank will have to do studies to ensure that de nitely you will come back and if you don’t come back the bank must

have a way of ensuring that the money is retrieved from you, so that government will easily fall on these banks if the people fail to return.”

He added that, it remains the way forward if the status quo is to be changed, to ensure that government does not continue to lose money.

Members of the Committee asked questions relating to the queries cited in the Auditor-General’s Report and o cials from the Ministry of Health and agencies including NTC-Pantang, Ghana Institute of Clinical Genetics, Nurses Training College Damongo among others.

When the Minister of Health, Hon. Kweku Agyeman Manu, Director General of the Ghana Health Service, Dr. Patrick Kuma-Aboagye, Chief Director and Senior O cers of the Health Service appeared before the Committee, the Chairman ordered for the arrest of two guarantors of two former sta of Korle-bu Teaching Hospital for failing to ful l bonds after being sponsored to pursue their higher education.

A new directive by the Bank of Ghana (BoG) has introduced new mobile money transaction and wallet limits. Customers with Daily Transaction Limits of GHC 1,000, GHC 5,000, and GHC 10,000 have had their limits increased to GHC 2,000, GHC 10,000, and GHC 15,000, respectively. Additionally, account balance limits of GHC 2,000, GHC 15,000, and GHC 30,000 have been increased to GHC 3,000, GHC 30,000, and GHC 50,000, respectively.

"With these improved transaction limits, our customers will be able to transfer much more money without incurring extra charges and also keep more money in their digital wallets securely," noted David Umoh, the Director of the Central Business Unit at Vodafone Ghana. He encouraged users with dormant or inactive accounts to reactivate their accounts to take advantage of the new wallet limits.

To help lighten the nancial burden on its customers brought on by the COVID-19 pandemic, Vodafone waived all charges on any Vodafone Cash transfers in

July 2020. The telco has continued to waive all transfer fees to any network till date, even after the implementation of Ghana's electronic transfer levy.

Mr. Umoh further explained that a key feature that sets Vodafone Cash apart from other mobile money wallets is its commitment to customer safety. In recent times, Vodafone has improved its safety features by including a simple self-reversal process for customers who accidentally send money to the wrong wallet. "With this feature, customers can easily and quickly undo a transaction without having to call customer service," David added.