By Eugene Davis

MON DAY , MA RC H 2 0 , 2023 BU S I NE S S24 C O M G H N E W S F O R B U S I NE S S L E A D E R S ReZultz Advertising sponsors free health screening for kanda residents Stor y on page 3 Sto r y on page 4 Gold Fields, AngloGold to create Africa’s largest gold mine Majority Leader wants parliament to check fiscal discipline amid rising debt Stor y on page 5 Stor y on page 3 Page 9 Stor y on page 2

CalBank, AMPATH donate to Cape Coast Teaching & Takoradi Hospitals

By Eugene Davis

IMF bailout may happ en in in June, Ato Forson predic ts Africa needs to deeopen its regional integration to see economic benefits,ECA report

Minority Leader Dr. Ato Forson has encouraged the President to be more innovative and not rely much on the International Monetary Fund (IMF) to turn around the ailing economy as a deal with the fund may not happen at the end of the month.

According to him, the President should have known that the March deadline for an IMF bailout has been missed.

The Minority Leader made this known during a debate on the State of the Nation Address on Friday.

“This address was made on the 9th March 2022 and we have just about 15 working days to end the month and little to nothing has been done to obtain the needed nancial assurances. I can bet that the best time we will get the IMF board approval may be June 2023 or even September 2023.

I will like to entreat the President to get more innovative and stop putting all our hopes on the IMF bailout.”

The minority MPs explained that the government has not been able to satisfy the nancing assurances regard-

By Eugene Davis

IMF bailout may happen in June, Ato Forson predicts

Ghanaians to this President have gone into consumption expenditure, remarking that no wonder the country has seen a very sluggish economic growth.

Further, he revealed that the NPP government have borrowed GH 455.7billion (US$68.42billion) from all sources and channeled it into unproductive wasteful spending.

ing the bailout which includes the board documents.

President Nana Addo Dankwa Akufo-Addo recently expressed optimism that the government is systematically ful lling the terms of the sta -level agreement reached with the IMF and is con dent that it will secure a deal by the end of March.

Dr. Forson stated that the Akufo-Addo government over the past six years have used the unprecedented level of resources which have been made available to them on consumption.

“Once again, the President said in his statement that his government have spent most of the resources which they have received on roads. Mr. Speaker, this could not be any further away from the truth. it can be seen that overall only 1.3% of all the resources received by the government have been allocated to the road sector.

As a whole, from [table 6] only 6.5% of the resources received by the President from 2017 to 2022 have gone into capital expenditure,” he added.

He disclosed that a whopping 93.5% of all the resource envelope which have given by

Currently, the minority says the country’s debt stock stands at GH 575.5billion as at November 2022 which is about 103% of our GDP. This amount excludes the Sinohydro Debt, ESLA Bonds, Cocoa Bills and many more.

“There has been a tacit policy of one problem, one bond by the nance minister.

While we are su ering collectively as a result of this government’s reckless borrowing, the Finance Minister has personally bene ted from our misery by way of transaction fees on our bond issuance his company earns.”

Ghana is now working to restructure about $30 billion of public debt, which reached an estimated 105% of gross domestic product in 2022, according to the IMF.

The country is on track to present its request for the $3 billion loan program to the IMF’s executive board by the end of March, said President Akufo-Addo. Ghana, which secured an IMF sta -level agreement in December, is also putting in place scal adjustments and structural reforms.

2 MONDAY, MARCH 20, 2023 | NEWS Your subscription along with the suppor t of businesses that adver tise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed. We value your suppor t and loyalty Contact : editor@business24 com gh Newsroom: 030 296 5315 Adver tising / S ales: +233 24 212 2742 Copyright @ 2019 Business24 Limited All Rights Reser ved L imi t e d

Africa needs to deepen its regional integration to see economic benefits, ECA report

particular on those that are net energy importers. Africa’s energy demand is mainly driven by Nigeria, South Africa and North African countries.

African countries have made commendable progress in implementing the regional integration agenda and promoting intra-regional trade, but more work is needed to accelerate the African Continental Free Trade Agreement (AfCFTA) and the rati cation of the Protocol on the Free Movement of Persons, Right of Residence and Right of Establishment.

This was said by Stephen Karingi, the Director, Regional Integration and Trade Division, in his presentation on the Assessment of progress on regional integration in Africa.

The report, which is based on monitoring frameworks and tools, including the indicators developed by the ECA, the African Union Commission and the African Development Bank was presented to experts meeting ahead of the 20-21 March ministerial segment of the Conference of African Ministers of Finance, Planning and Economic Development taking place in Addis Ababa, Ethiopia.

Member states will need to address integration challenges,

which include inadequate nancial resources; poor infrastructure networks; increasing violence, terrorism and political instability.

Furthermore, the integration agenda is experiencing slow implementation of policies and agreements.

For instance, the Protocol on the Free Movement of Persons, Right of Residence and Right of Establishment, needs rati cation because, “It is the bedrock of deepening integration as it interacts with the ability to move goods and services and help to optimise the AfCFTA,” stressed Karingi.

“Collective e orts are required from all member States, regional economic communities, key partners and stakeholders to realize the economic bene ts of integration and the African Continental Free Trade Area,” he said.

Macroeconomic integration

According to Karingi, to support member States in their formulation and implementation of economic policy and enhance macroeconomic integration, ECA has developed a prototype macroeconomic model

and provided support and training in 15 countries. On the scal side, ECA supported taxation policy reform and revenue collection in Ethiopia, Kenya, Tanzania and Zambia.

Infrastructure and energy sectors

Africa remains constrained by huge infrastructure gaps, with an estimated annual nancing need of between $130 billion and $170 billion, and an annual nancing gap of between $68 billion and $108 billion.

But improvements were reported in access to information and communications technology constituting an important driver of the African infrastructure development index. Digitalization in Africa was further accelerated by the pandemic, creating greater potential for trade and business growth.

“The COVID-19 pandemic and the war in the Ukraine have however, worsened public de cits and the debt burden, which have reduced infrastructural investment in Africa,” said Karingi. Energy price increases, exacerbated by the war in Ukraine, has put a strain on African countries, in

Participants from Burkina Faso, Chad, Tanzania, Cote d’Ivoire, Tanzania, raised concerns about the worsening insecurity, poor infrastructure, high cost of communication across the borders that are hindering the integration process.

Antonio Pedro, ECA Acting Executive Secretary said collaborative e orts, including the United Nations, the African Union, and regional economic communities, have continued to be deployed to respond to threats to peace and security, to participate in the management and resolution of con ict, and to stem the tide of terrorism and coups on the continent, albeit with mixed results.

In West Africa and the broader Sahel area, he said ECA through its West African o ce in partnership with the African Union, ECOWAS and other key players continue to ght the spread of violence, terrorism and drug tra cking while showcasing the opportunities available in the region.

“To foster regional integration on the continent, ECA will continue to prioritize the support that it provides to member States, regional economic communities, the African Union Commission and the secretariat of the African Continental Free Trade Area towards the implementation of the free trade area,” said Pedro.

ReZultz Advertising sponsors free health screening for kanda residents

On 16th March 2023, Decathlon Ghana, Kawukudi was abuzz with excitement as the community of Kanda came out in large numbers for the 'Love Brewed in Kanda' health screening initiative. The event was organized by ReZultz Advertising, an award-winning strategic and creative marketing communications agency, that is situated in Kanda for the past 11 years. The goal of the initiative was to

encourage preventative healthcare among the residents of Kanda and Emmanuel Eye Clinic partnered with ReZultz Advertising to make this event a success. Love Brewed in Kanda o ered the residents of Kanda an opportunity to get their health checked by medical professionals.

The screening covered a range of medical tests, including blood Story continues on page 4

MONDAY, MARCH 20, 2023 | NEWS 3

Story continued from page 3

pressure, blood sugar, eye, and hepatitis B tests among others.

Additionally, medical professionals from Emmanuel Eye Medical Centre were available to o er health education and advice to the community members.In an interview with the media, Justin Antwi-Darkwah, the Chief Operating O cer of ReZultz Advertising, emphasized the importance of giving back to the community that has supported the business for the past 11 years.

"We recognize the need to show support to the community that has shown us love all these years.

"As a responsible corporate entity, we have a duty to contribute positively to the welfare of the people we serve," said Mr. Antwi-Darkwah.The event was a massive success, and it would not have been possible without the support of the Kanda community.

Love Brewed in Kanda was the company's way of ful lling its corporate social responsibility. The event was graced by the representative of the assembly man, Mr. Adamu Abdul, who commended ReZultz Advertis-

ing for the initiative.

He urged other businesses to follow in the footsteps of ReZultz Advertising and give back to the community that supports them.Love Brewed in Kanda was not only about health screening. The event was also a platform for community members to interact with one another and have fun. There were several activities that community members could participate in, including games, music, and dancing.The Love Brewed in Kanda initiative was particularly important because preventative healthcare is often neglected in many communities, especially those that lack access to quality healthcare services. Overall, the Love Brewed in Kanda event served as an excellent example of how corporate social responsibility can positively impact a community.

By providing access to preventative healthcare and education. ReZultz advertising and Emmanuel Eye Clinic demonstrated their commitment to the health and well-being of the Kanda community.

Gold Fields, AngloGold to create Africa’s largest gold mine

The Parties have agreed in principle on the key terms of the Proposed Joint Venture.

Gold Fields, AngloGold to create Africa’s largest gold mine

Gold Fields and AngloGold Ashanti (“The Parties”) have agreed the key terms of a proposed joint venture in Ghana between Gold Fields’ Tarkwa and AngloGold Ashanti’s neighbouring Iduapriem mines (the “Proposed Joint Venture”).

The Tarkwa Mine is held by Gold Fields Ghana, in which Gold Fields currently owns a 90% share and the Government of Ghana (GoG) holds 10%. The Iduapriem Mine is currently 100% owned by AngloGold Ashanti. Both mines are located near the town of Tarkwa in the country’s Western Region.

The Parties have commenced with preliminary, high-level and constructive engagements with senior government o cials in Ghana and will continue engaging with the GoG, relevant regulators and other key stakeholders, with a view to implementing the Proposed Joint Venture as soon as practically possible. The Parties have agreed to mutual exclusivity during this engagement.

It is intended that the Proposed Joint Venture will be an incorporated joint venture,

constituted within Gold Fields Ghana and operated by Gold Fields. AngloGold Ashanti will contribute its 100% interest in Iduapriem to Gold Fields Ghana in return for a shareholding in that company.

The Parties do not anticipate that any material, additional capital injection will be required by either company to establish the Proposed Joint Venture and is expected to materially improve its capital intensity once operational.

Excluding the interest to be held by the GoG, Gold Fields will have an interest of 66.7%, or two-thirds, and AngloGold

Story continues on page 5

MONDAY, MARCH 20, 2023 4 | NEWS 4 | NEWS

Story continued from page 4

Ashanti will have an interest of 33.3%, or one-third, in the Proposed Joint Venture.

The Proposed Joint Venture would create the largest gold mine in Africa and one of the largest in the world. It will be a high-quality operation, supported by a substantial mineral endowment and an initial life spanning almost two decades.

Operational synergies will be achieved by optimising mining of the combined ore bodies and consolidating the infrastructure of the immediately adjacent mines for the long-term bene t of all shareholders and stakeholders.

Martin Preece, Interim CEO Gold Fields:

“The Proposed Joint Venture is an exciting opportunity to combine mining operations that are essentially part of the same mineral deposit and is something that Gold Fields and AngloGold Ashanti have discussed many times before over the years. The ability to optimise mining and the use of shared infrastructure across the combined operation will result in signi cant exibility in mine planning, materially

enhancing the economics of the mine and ensuring quality and scale of operation that will be world class. That unlocked value will underpin the Proposed Joint Venture’s continued contribution to our host communities and Ghana for decades to come. For Gold Fields, it will also signi cantly enhance the overall quality of our portfolio.”

Alberto Calderon, CEO AngloGold Ashanti:

“This combination puts together two parts of the same world-class ore body, allowing us to share skills and infrastructure to signi cantly enhance every aspect of this mining operation, from exploration and planning, to mining and processing. By creating one of the world’s largest open-pit gold operations, in a pre-eminent mining jurisdiction, we will create longer-term value not only for AngloGold Ashanti and Gold Fields, but for the combined stakeholders in our local host communities and for all of Ghana.”

Bene ts of the Proposed Joint Venture include:

• Estimated life of at least 18 years, which could increase through an extension and opti-

misation plan, which will be considered under the Proposed Joint Venture over the next three years, and which could also enhance envisaged production and cost parameters.

• Estimated average annual production (100% basis) of almost 900koz over the rst ve years and average annual production in excess of 600koz over the estimated life of operation.

• Estimated all in sustaining cost (in 2023 terms) of less than US$1,000/oz over the rst ve years and less than US$1,200/oz over the estimated life of operation.

• It is expected that the Ore Reserves for the Proposed Joint Venture will exceed the sum of the Ore Reserves for the stand-alone operations due to the anticipated operational synergies, and the declaration of additional Mineral Resources and Ore Reserves as a result.

Key principles of the Proposed Joint Venture:

• Gold Fields and AngloGold Ashanti have collaborated across a broad and comprehensive range of work streams

to formulate the indicative base case for the combination, which underpins the estimates above. Additional, detailed work will now be undertaken to develop the optimised initial operating plan which will apply from commencement of the Proposed Joint Venture.

• Gold Fields and AngloGold Ashanti have agreed the governance principles of the Proposed Joint Venture, including their respective representation in management committees for the Proposed Joint Venture and the board of Gold Fields Ghana. As operator of Gold Fields Ghana, Gold Fields will receive a management and technical fee determined on an arms-length basis.

• Implementation is subject to reaching agreement with the GoG regarding the Proposed Joint Venture, conclusion of con rmatory due diligence and de nitive transaction agreements, and securing all requisite regulatory approvals. Subject to satisfaction of these conditions, the Parties intend to implement the Proposed Joint Venture as soon as practically possible.

Majority Leader wants parliament to check fiscal discipline amid rising debt

By Eugene Davis

mark as far as development is concerned, because, that is what the electorate shall remember the government for.

However, he added that the country should be equally concerned about the means to that end, stressing that every government has been borrowing to add to the stock of debt.

ment plan is not properly situated. Until we put the proper mechanism in place, what is happening today may repeat itself.

We need scal discipline. The otherwise central role of NDPC which remains unful lled is one of the reasons why many are calling for a holistic review of the Constitution,” he added.

Majority Leader, Osei Kyei-Mensah-Bonsu, has asked the legislature to step up its oversight role to ensure scal discipline is followed by central government in a bid to curb over-borrowing.

According to him, all stakeholders including parliament have been negligent in its oversight responsibilities, explaining every government will strive to leave an indelible

Mr. Kyei-Mensah-Bonsu during the nal debate on the State-of-the-Nation Address on Friday, said “Parliament should be the body to ensure that we spend within our means. Parliament does no have a Committee on the economy to do this analysis.”

“The NDPC which exists to create a long-term develop-

He also justi ed the government’s decision to seek a US$3bn funding from IMF, contending that “No country engages the IMF if the country is not a icted by economic challenges.

MONDAY, MARCH 20, 2023 | FEATURE 5

Story continues on page 6

Story continued from page 5 Have we been reckless in borrowing and expenditure? The records do not lead to that conclusion. Could we have done better? Upon hindsight it may appear we over exaggerated our strength in a few areas. Notwithstanding, there is empirical evidence to show that this government has not underperformed. In sharp contrast with its immediate predecessor administration the government has done enormously well, notwithstanding the current hiccups.”

Drawing sectorial comparisons, he indicated that in the area of agriculture, for the last 3 years of the NDC regime agriculture growth averaged 2.0 whereas for NPP’s tenure over the past 3 years the average, if we include the provisional gure for 2022 of 4.9%, takes it to an average growth of 6.7%, that is more than 200% better.

Under President Mahama, industry grew at 1.1% in 2014; 1.2% in 2015; 4.3% in 2016. The average rate of growth for industry in the last 3 years of President Mahama was 2.2%. Under Akufo Addo in 2017, industry grew at 15.6%; in 2018 it grew at 10.5%. In 2019 it grew at 6.4%. The average industrial growth for the rst 3 years under Akufo Addo was 10.8%.

This compares to the 2.2% under John Dramani Mahama.

Further, he disclosed that the rate of economic growth has more than doubled from the average2.8% growth that President Mahama bequeathed to his success or administration.

He also stated that in spite of the COVID-19 and Russian-Ukrainian con ict, the country remains self-su cient in the staples of cassava, plantain. “We no longer import them from Cote d’lvoire. We have not imported maize for human consumption over the past 3 years. Rather, neighbouring countries have been buying these, especially maize, yam and rice from Ghana.

We cleaned up the banking sector and saved depositors from the mismanagement of some deposit-taking houses which really should not have been given licences to operate as banks.”

The debt stock of the NDC calculated year-on-year in dollar terms, he said was about $47 billion. Year-on-year what the NPP has added is in the regionof $32billion.”In Cedi terms the debt stock appears insurmountable but we must workour way out, together. And that is why we have had to

go back to the IMF.”

Parliament is required to partner government to hasten the negotiations with the IMF after achieving the Sta Level Agreements in December 2022, by passing the remaining nancial bills of the Income Tax (Amendment) Bill, Excise Duty (Amendment) Bill, Excise Stamp (Amendment) Bill and the Growthand Sustainability Levy Bill. The passage of these Bills would sanctify the country before the IMF Board and at the same time rev up our domesticrevenue mobilisation e orts, the Majority Leader noted.

Economy stabilised

For the majority leader, the President at the very outset admitted that any honest assessment of our country’s situation would necessarily involve the “gravity of theeconomic situation of our country, and how we can quickly stabilise the economy, and work our way back to the period of rapid economic growth”.

Continuing, the President did not mince words, when he stated: “our currencyhas been bu eted, our in ation rate has been very high and, for the rst time in our lives, debt exchanges have become the

language of everyday conversation”.

“That is brutal frankness. A lot of critics have jumped onto the bandwagon to blame the current administration for where we are today and it is the reason why the President stated, Mr. Speaker, when we make an assessment of what the Stateof theNation is, it would necessarily have to include what state it was inyesterday, the State it is in today, and what state it would be in tomorrow, basedonreasonable grounds of expectations”

The economy, it goes without saying that next elections would not only be fought on th estateof the economy today, no thanks to the rampaging e ect of the Corona-Virusand the Russian-Ukrainian imbroglio, but also on the management of theeconomy. In this, the track record of the two parties is crystal clear to all who have eyes to see and ears to hear, except persons whose stock-in-trade is propaganda.”he added.

President Akufo-Addo listed agriculture, health, education, roads, tourism, and digitization initiatives as areas that bene tted from funds borrowed under his administration.

Standard Bank to re-capitalise Stanbic Bank

“It may become necessary for us to inject capital in that business and we will, at the appropriate time,” Chief Executive

O cer, Sim Tshabalala, said in an interview with Bloomberg.

Banks in Ghana are staring at

losses after the government restructured GH¢83 billion ($6.8 billion) of local debt as part of a move to nalise a $3 billion bailout from the International Monetary Fund. Standard Bank on Thursday joined FirstRand Ltd in accounting for the impairment. Ghana has an estimated GH¢576 billion of public debt according to the report. Standard Bank said it had set aside 1.5 billion rand ($81 million) to cover potential losses arising from the West African nation’s loan-restruc-

turing programme. The bank said its total holdings of both domestic and onshore dollar-denominated bonds was about 2.6 billion rand.

“We believe that the pain that we have taken in Ghana is exquisite,” Mr Tshabalala told Bloomberg.

He added that: “The numbers are very large, but we have a portfolio, and the portfolio is calculated to do that. Notwithstanding the impact of Ghana, our Africa region’s business

Story continues on page 7

MONDAY, MARCH 20, 2023 | NEWS 6

Standard Bank Group Ltd, Africa’s biggest lender by assets, is ready to re-capitalise its Ghana business, Stanbic Bank, after making provisions to cover more than half of its holdings in the nation’s debt.

Story continued from page 6

performed very well.”

According to Mr Tshabalala, the government of Ghana has been “textbook” in their approach to the restructuring, extracting the appropriate bargain from all stakeholders. “They’ve been very tough in the negotiation process, as you can expect, because they have

a public policy role to play,” the CEO said. The government has “extracted what they consider to be the appropriate bargain, which while appropriate from a policymaker and a government point of view, it’s been painful for holders of that debt.”What others did

FirstRand said last week it impaired 496 million rand to cover potential losses. Nedbank Group Ltd., which has an indirect exposure to Ghana through its 20 per cent holding in Ecobank Transnational Inc., estimated its exposure to the country’s sovereign debt at 175

million rand. Despite the challenges, Standard Bank said it remained committed to Ghana. It plans to leverage its “fortress balance-sheet” to drive market share and capitalise on growth opportunities when they arise, it said.

AngloGold announces 257.60 South African cents per share to shareholders

AngloGold Ashanti (AGA) has announced the payment a dividend of 257.60 South African cents for the nancial year ended December 31, 2022.

The dividend, according to the company, will be converted on Tuesday, March 14, 2023. The nal dividend is however expected to be paid on Friday March 31, 2023.

To this end, all shareholders registered in the books of AGA at the close of business on Friday, March 17, 2023, will qualify for the nal dividend. In view of the foregoing, the mining giant stated in a circular that the ex-dividend date has been set as Wednesday, March 15, 2023.

Consequently, an investor purchasing AGA shares before the date will be entitled to the

nal dividend.

However, an investor buying AGA shares on or after Wednesday, March 15, 2023 will not be entitled to the nal dividend.

AngloGold recorded gold production of 2.742 million ounces in the year through December 31, 2022. This was an 11% improvement versus gold production of 2.472 million ounces in 2021. The operational result was underpinned by solid performances across most of the portfolio, with the Obuasi gold mine in Ghana meeting targeted production of 250,000 ounces as it continues on the ramp-up path to its full production run-rate in excess of 400,000o ounces, which is expected by the end of 2024.

Africa must lead the charge on tackling poverty

taken South Asia with 37.6 percent, while the COVID-19 outbreak had pushed 62 million people into poverty in just one year, with an additional 18 million estimated to have joined their ranks by the end of 2022.

Africa must lead the charge in mobilizing domestic resources to recover from multiple economic and social crises which have deepened poverty and widened inequality on the continent, Acting Executive Secretary of the Economic Commission for Africa, Antonio Pedro, has urged, warning

that Africa risks missing the Sustainable Development Goals.

“Africa currently leads in global poverty,” Mr. Pedro told participants at the 41st meeting of the Committee of Experts that kicked o today, ahead of next week’s Conference of African Ministers of

Finance, Planning and Economic Development Addis Ababa, Ethiopia.

Mr. Pedro cautioned that without bold nancial and climate action, Africa will be locked into a poverty trap. With more than half of the world’s poor –54.8 per cent in 2022 being in Africa, the continent had over-

As many as 149 million non-poor remain at high risk of falling into poverty, Mr. Pedro said, further elaborating that 695 million people in Africa were either poor or face the risk of falling into poverty.

“Women and girls remain particularly vulnerable, and we are facing a potential

Story continues on page 8

MONDAY, MARCH 20, 2023 | NEWS 7

Story continued from page 7 reversal of the hard-won gains made on gender equity,” said Mr. Perdo, adding that, “Africa cannot just stay the course and hope that it gets better. It must lead the charge.”

The challenges are not insurmountable if Africa can implement systemic change and build resilient and sustainable systems, shifting away from a primary focus on e ciency that has dominated past decades.

Mr. Pedro said investments in sustainable building up capital in critical assets – including human, infrastructure, and natural resources - were needed to provide an environment that can facilitate achieving the ambitions of the 2030 Agenda and Agenda 2063. Therefore, governments must design strategies that simultaneously integrate economic, social and environmental objectives, he noted.

“First, we need to nance our development, " Mr. Perdo urged, emphasizing that

getting the macroeconomic fundamentals right can unlock the potential of home-grown solutions. Nonetheless, he said, Africa still needs a fairer and more just global nancial architecture that responds to its needs, bemoaning that many countries currently cannot access international nancial markets because of rising interest rates and unworkable existing debt relief mechanisms.

He noted that Africa must aggressively pursue sustainable industrialization and economic diversi cation to transform its natural resources into tangible bene ts for its people. The battery and electric value chain development was a case in point.

“Put simply, our wealth in natural resources must work for the majority, not the few. To get to this point, we must be intentional in our approach, said Mr. Pedro, citing that the African Continental Free Trade Area (AfCFTA) can increase intra-Africa trade.

“We must take center stage on climate action. While we cannot overlook the fact that we are disproportionately su ering on impact and nancing alike, we have signi cant opportunities to rebalance the scales on climate nance,” he said.

Africa rainforests and the development of its carbon markets, for instance, could unleash an estimated $82 billion a year in value at $120 per ton of CO2 sequestered and create 167 million additional jobs.

In opening remarks at the conference, Nemera Gebeyehu Mamo, State Minister for Planning and Development of the Government of the Federal Democratic Republic of Ethiopia, emphasized that Africa must accelerate changes needed for its economic recovery.

“Poverty is Africa’s most pressing challenge,” Mr. Mamo told participants, remarking that Africa should advocate for nancial changes to aid recov-

ery.

“Climate action is impossible without nance,” stressed Mr. Mamo, noting that leveraging climate change nancing can help tackle poverty in Africa. Africa’s growing poverty is linked to the worsening economic and nancial conditions it has experienced, Mahamodou Bamba Diop, Director General of Planning and Economic Policies of the Republic of Senegal and Outgoing Chair of the Bureau of the Committee of Experts, said in an overview of the situation in Africa.

Mr. Diop noted that Africa’s economic growth had slowed over the past year due to the combined e ects of COVID pandemic, the Ukraine war, global economic slowdown and climate change.

“We need to build a resilient Africa,” Mr. Diop urged, highlighting the need to reform the current nancial architecture, develop e ective data and statistical systems and tackle the impact of climate change.

Tullow holds workshop on Crane & Forklift Services for over 85 participants

Tullow Ghana held the rst in a series of webinar workshops for 2023 on Crane & Forklift Services and Well Drilling Tools on 14 March 2023, in collaboration with the Petroleum Commission (PC) under the Tullow Ghana / PC Business Academy Partnership.

Director for Local Content at the PC, Mr. Kweku Boateng, commended Tullow Ghana for its support and urged the over 85 participants to take advantage of the session to understand all requirements needed for participation in the bidding for Crane, Forklift and Well Drilling service bids.

Tullow Oil's Head of Supply

Chain, Atul Sahay, emphasised that the development of local capacity remains an important component of Tullow's strategy and has been an instructive means for Tullow to consistently increase and sustain local participation in all of its operations.

He deemed the workshop exceptional due to its cross-functional approach and wished the participants and presenters a good discussion. Participants' feedback indicated that expectations for upcoming tenders were e ectively outlined, understood, and appreciated.

MONDAY, MARCH 20, 2023 8 | NEWS

CalBank, AMPATH donate to Cape Coast Teaching & Takoradi Hospitals

CalBank PLC together with AMPATH donates to the Cape Coast Teaching & Takoradi (European) Hospitals. The Bank’s donations come as a much-needed relief to the hospitals in the two regions. Speaking on the occasion, the Marketing Head of CalBank, Mr. Ko Siabi remarked that, CalBank is committed to making a positive impact on the communities it serves and is proud to support these two important hospitals in their e orts to provide exceptional medical care.

“We are honored to support the sel ess medical professionals who are on the frontlines of providing quality healthcare to patients in the regions. Our contribution of medical supplies is a small gesture of our gratitude for their tireless e orts,” he said.

MONDAY, MARCH 20, 2023 | NEWS 9

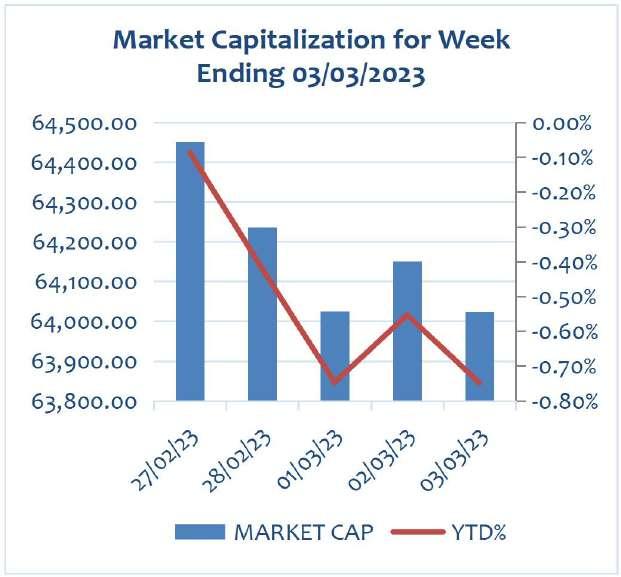

NTHC WEEKLY MARKET SUMMARY

11/23

At the just ended Treasury Bill auc�on, the Government accepted a total bid of GH¢3.32 billion across the 91, 182 and 364-day bills in the f ace of a total tender of bids, amoun�ng to GH¢4.20 billion

The week-on-week yields witnessed an overall approximated drop of 4.16bps, 3.71bps and 0.72bps across the 91, 182 and 364-da y bills respec�vely.

MONDAY, MARCH 20, 2023 10 | NEWS Subsidiaries

EDITION:

E E S S T T . 1 1 9 9 7 7 6 6 NTHC Securi�es NTHC Trustees NTHC Registrars NTHC Commodi�es NTHC Proper�es NTHC Asset Management T T R R E E A A S S U U R R Y Y B BIIL L L L M M A A R R K K E E T T A A C C T TIIV VIIT T Y Y A A U U C C T TIIO O N N RES S U U L L T T S S | | TEN N D D E E R R 1 1 8 8 4 4 1 1 | | 1 1 3 3 TH--1 1 7 7 T T H H M M A A RC C H H,, 2 2 0 0 2 2 3 3

Securi�es Bid Tendered GH¢ (M) Bid Accepted GH¢ (M) Weighted Average (%) 91 Day Bill 1,991 19 1,434 52 19.9998 182 Day Bill 1,161 83 924.23 22.8483 364 Day Bill 1,056.17 959.57 26.8239

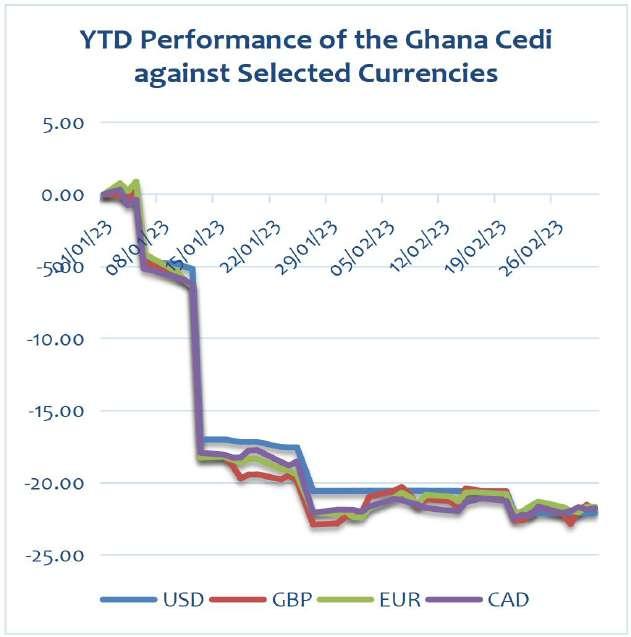

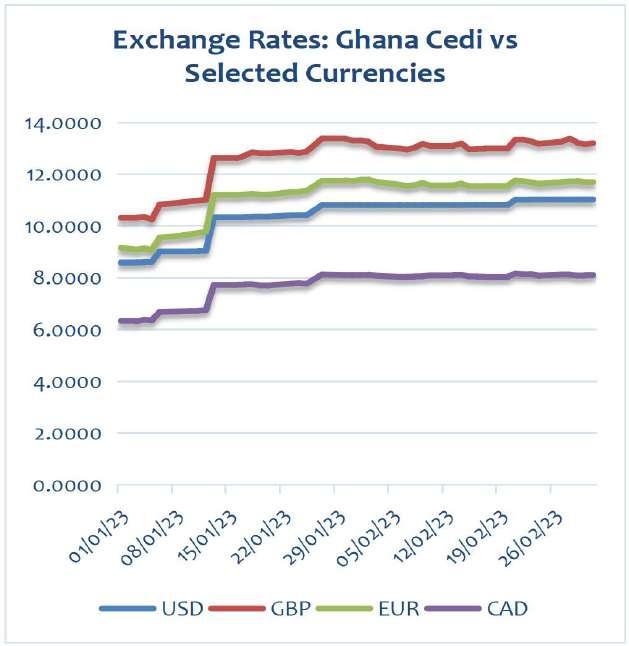

Securi�es Current Yield (%) Previous Yield (%) Change (bps) 91 Day Bill 19.9998 24.1610 -4.1612 182 Day Bill 22.8483 26.5564 -3.7081 364 Day Bill 26.8239 27.5442 -0.7203 E E Q Q U UIIT T Y Y M M A A R R K K E E T T A A C C T TIIV VIIT T Y Y | | 0 0 6 6 T T H H M M A A R R -- 1 1 0 0 T T H M M A A R R,, 2 2 0 0 2 2 3 3 Days Date Volume Value GH¢ GSE Composite Index (GSE-CI) Monday 06/03/23 - -Tuesday 07/03/23 32,982 43,787.94 2,392 18 Wednesday 08/03/23 71,450 110,211.37 2,391 80 Thursday 09/03/23 37,915 56,742.51 2,420 65 Friday 10/03/23 3,234,930 3,276,899.59 2,479 53 TO O P P T T E E N N T T R R A A D D E E D D EQU UIIT TIIE E S S | | 0 0 6T T H H M M A A R –– 10 0 T T H M M A A R R ,, 20 0 2 2 3500.00 1,000.00 1,500.00 2,000.00 2,500.00 3,000.00 3,500.00 M TN C A L G G BL TOT… BOPP G O IL S IC G C B PBC CPC s 0 0 0 ' n I BO O ND D M M ARKET A A C C T TIIV V IIT T Y Y | 0 0 6 6 T T H H M M AR R -- 10 0 T T H H M M A A R R ,, 2 2 02 2 3 35 00 1 0 00 1 5 00 2 0 00 2 5 00 4 Y r 4 . 5 Y r 5 Y r 5 5 Y r 6 Y r 7 Y r 8 Y r 9 Y r 1 0 Y r 1 1 Y r 1 2 Y r 1 3 Y r 1 4 Y r 1 5 Y r Bond Coupon Rat e Cur ve20 00 40 00 60 00 80 00 100.00 120.00 4 Y r 4. 5 Y r 5 Y r 5. 5 Y r 6 Y r 7 Y r 8 Y r 9 Y r 10 Y r 11 Y r 12 Y r 13 Y r 14 Y r 15 Y r s 0 0 0 , 0 0 0 ' n I Bond Value Traded D D O O MEST TIIC C M M A A RKET A A C C TIIV VIIT T Y Y | 1 1 3 3 T T H H M M A A RC C H,, 2 2 0 0 2 2 3 3 Domes�c Indicators Current (%) Previous (%) Change (bps) Interbank Rate 25.87 25.87 0.00 Infla�on 53.60 54.10 50.00 Monetary Policy Rate 28.00 27.00 100.00 C C U U R R R R EN N CY Y M M AR KET A A C C TIIV VIIT T Y Y | 1 1 0 0 T T H H M M A A RC C H,, 20 0 2 2 3 Currency Currency Pair Buying Selling US Dollar USD-GHS 11.0086 11.0196 Pound Sterling GBP-GHS 13.3292 13.3447 Euro EUR-GHS 11.7645 11.7751 Japanese Yen JPY-GHS 0.0819 0.0820 O O U U R R S S O O U U R R C C E E S S:: G G S S E E / / G G F FIIM M / / B O O G G /C C S S D D N N E E W W S S H HIIG G H H L LIIG G HTS T T--b biil lll s s a a u u c ctti i o o n n:: IIn ntte erre e s stt rra atte e s s ffo orr tth hiis s w w e e e e k k ffa alll l tto o 1 1 9 9 % %,, g g o o v v e errn n m m e e n ntt g g e ett s s G G H H ¢ ¢ 4 4. 2 2 0 0 b b n n. Go o v v e errn n m m e e n ntt tto o s s e ett T--b biil lll rra atte e s s att llo o w wlly y 1 1 5 5 % % iin n c c o o s stt-c c u uttt tiin n g g m m o o v v e e

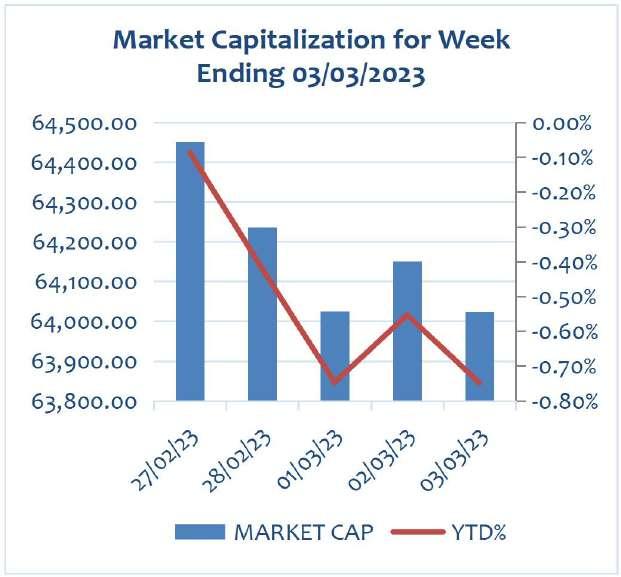

MONDAY, MARCH 20, 2023 16 | NEWS Thursday 26 January 2023 – In v estment T im e s 9 J anua r y 20,202 3 March 3, 2023

J anua r y 20,202 3 March 3, 2023

MONDAY, MARCH 20, 2023 17 | NEWS WEDNESDAY, NOVEMBER 16, 2022 17 | NEWS Thursday 26 January 2023 – In v estment T im e s 10

J anua r y 20,202 3 March 3, 2023

MONDAY, MARCH 20, 2023 18 | NEWS Thursday 26 January 2023 – In v est m ent T im e s 11

MONDAY, MARCH 20, 2023 19 | NEWS 12 J anua r y 20,202 3 March 3, 2023

Rotary Club of Accra-West congratulates Dr. Leticia Adelaide Appiah

Chair of the Host Organizing Committee for the forthcoming Rotary International District (RID) 9102 Training Assembly and Conference which will come o in mid-April and which will host Rotarians from Ghana, Togo, Benin, Niger (which form RID 9102) as well Rotarians from other Districts across the globe.

President Nana Addo Dankwa

Akufo-Addo presided over the 2023 National Honours and Awards Ceremony which came o on Tuesday March 14, 2023, at the Accra International Conference Center (AICC). The National Awards are presented to persons who have made immense and recognized contributions to key sectors such as civil service, military, education, public health, agriculture, commerce and industry, the judiciary, scienti c and other research, sports, culture & arts and the nancial sector. Dr. Leticia Adelaide Appiah,

Executive Director of the National Population Council who is also a member of the Rotary Club of Accra-West, was awarded “ORDER OF THE VOLTA (COMPANION)” in recognition of her sel essness, hard work and outstanding contributions as a member of the National Covid-19 Task Force. She is a Medical Doctor and a Public Health Specialist with over 25 years of experience.

The Board and members of Rotary Club of Accra-West extend a hearty congratulation to their fellow Rotarian, Dr.

Leticia, following this conferment of a state honour by His Excellency Nana Addo Dankwa Akufo-Addo at this year’s National Honours and Awards Ceremony. She was inducted into the Rotary Club of Accra-West in 2019 and was loaned the classication Public Health. She has diligently served the Club as Assistant Treasurer in the 2019/20 Rotary year and currently serves as the Club’s Honorary Secretary. Beyond the club she serves as the Medical Sub Committee

Rotary International is a humanitarian organization where neighbors, friends, and problem-solvers share ideas, join leaders, and take action to create lasting change. The Rotary club of Accra West was chartered on February 5, 1969, with 22 charter members. Fifty-four years on, and now with a membership of 52. The Club has produced several distinguished Rotary leaders and executed several service projects across the length and breadth of the country. Some recently completed projects of the club include the provision of 8 mechanized borewells and a 16-seater toilet facility to communities in the Akwapem North, Kpone Katamanso and Kwabibirem Districts, carried out with the support of the Rotary Foundation and the Rotary Club of Dallas, USA.

WWW.BUSINESS24 COM GH | NO B24/317 | NEWS FOR BUSINESS LEADERS MONDAY, 20 MARCH, 2023

PUBLISHED BY BUSINESS24 LTD. EDITOR: BENSON AFFUL editor@business24 com gh | +233 5 45 516 133