By Eugene Davis

By Eugene Davis

Government is expected to secure petroleum agreements with three International Oil Companies (IOCs) at the turn of the year, aimed at developing hydrocarbon and production to boost the country’s petroleum reserves, a parliamentary report has revealed.

According to the report of the Committee on Mines and Energy on the Annual Budget Estimates of the Ministry of Energy for the 2023 nancial year, o cials of the Ministry of Energy informed the committee that the Ghana Negotiation Team (GNT) continued negotia tions with three IOCs in 2022 towards potential petroleum agreements.

The percentage levels of completion of the petroleum agreements are China National O shore Oil Corporation (CNOOC) 95percent; ENI, 90percent and KOKA, 95percent.

This is aimed at enhancing hydrocarbon and production to increase the country’s petroleum reserves.

He, however, urged government “to pay attention to revamping the power sector and hydrocarbon.”

The report also disclosed that for next year, the ministry plans to produce oil, and export gas daily at an average of 31.1million barrels and 35.2 billion cubic feet of gas respectively from Greater

Partners to negotiate a post-foundation Gas Sale Agreement to govern gas o take by the state after 2022. Again, the partners have submitted a proposal for a combined Gas Sales Agreement for delivery of 200million standard cubic feet of gas from both Jubilee and TEN elds.

Trade and Industry Minister, Alan Kwadwo Kyeremanten, has urged for enhanced US investment in selected strategic sectors in Africa to help develop their economies.

Speaking at a roundtable between African Trade Ministers, U.S. members of Congress and Ambassador Katherine Tai, the US Trade Representative, on the sidelines of the U.S. - Africa Leaders’ Summit in Washington D.C,

Cont from page 2

USA, last week, Mr Kyremanten advocated, among others, for greater investment in agriculture and agribusiness as well as oil and gas sectors.

The roundtable was on the extension of the African Growth and Opportunity Act (AGOA) which is set to expire in September 2025.

He also called for more resources to be pumped into blue ocean economy, light manufacturing

industries, and support for the development of infrastructure including roads, rail, port infrastructure and renewable energy.

AGOA Preferential Trade Agreement is a unilateral agreement between the United States and sub-Sahara African countries which grants duty-free-quota-free access to the U.S. market for around 1,800 product lines in promoting economic development of these countries, he

added.

“It is also aimed at expediting integration of African economies into the world trading system while sharpening their productive capacities. Under AGOA, Ghana has exported garments and textile products, among others, to the US market.”

As part of activities during the conference, Mr Kyeremanten joined President Akufo-Addo to

attend a series of high-pro le meetings and events including, that with the Managing Director of International Monetary Fund (IMF) and the President of the World Bank Group.

He also represented the President at the National Black Chamber of Commerce Business Forum as well as the US Chamber of Commerce and the Corporate Council on Africa’s Presidential Dialogue all in Washington DC.

The suspension is to enable the government to restructure the external debts to make their servicing sustainable, while providing some leeway for government nances.

It is part of a raft of emergency measures to prevent a further deterioration in the economic, nancial and social situation in the country.

The government has suspended temporarily the payment of selected external debts to entities that have lent money to the country.

The category of debts includes dollar-denominated bonds

orderly and their servicing sustainable.

A statement issued by the Ministry of Finance yesterday said holders of the a ected debts would be engaged in due course in order to be presented with

sation for Economic Cooperation and Development (OECD) and the United Nations Development Programme (UNDP).

It would also not a ect all types of new debts contracted after yesterday or debts related to certain short-term trade facilities,

“We are also evaluating certain speci c debts related to projects with the highest socio-economic impact for Ghana which may have to be excluded.

“This suspension is an interim emergency measure, pending future agreements with all relevant creditors,” the statement

The statement added that the government was ready to engage in discussions with all its external creditors to make Ghana’s debt sustainable through a fair, transparent and comprehensive debt restructuring exercise, in line with international best practices.

“The Ministry of Finance will hold an investor presentation at a date to be announced at a later stage,” it said.

Receiving the buy-in of the country’s creditors is one of the cardinal conditions precedent to securing the approval of the management and the Executive Board of the IMF for Ghana’s extended credit facility programme with the fund.

The statement explained that the nancial resources of the country, including the Bank of Ghana’s international reserves, were limited and needed to be preserved at this critical juncture.

Barima Yaw Kodie Oppong, Manwerehene of Akyem Abuakwa Traditional Area, has been inducted as the new Director of Legal Education and also the Director of the Ghana School of Law.

The induction ceremony is the rst since the establishment of the Ghana School of Law in 1958.

The ceremony saw family, well-wishers and Justices of the Supreme Court, as well as students of the GSL in attendance.

Key among them were Justices Jones Victor Mawulorm Dotse, Paul Ba oe-Bonnie, Yonny Kulendi, all Justices of the Supreme Court, and the leadership of the Ghana Bar Association, led by its President, Yaw Acheampong Boafo; the Judicial Secretary, Justice Cynthia Pamela Addo; the Attorney-General and Minister of Justice, Godfred Yeboah Dame, among other

oath of o ce and oath of secrecy.

In his address, Barima Oppong said his focus as the new Director of Legal Education is to build a legal educational system that would mould students into lawyers with a sound legal foundation who would contribute positively to national development.

In pursuant of this vision, he said, he had already secured funding to build the capacity of workers and also motivate them.

Again, he said under his leadership, the GSL had reached an agreement with some universities in the United Kingdom (UK) to conduct remote and on-site lectures from UK-based Post Call Law Course students.

The new Director also revealed that he is working to revive a dormant law rm at the GSL to provide pro-bono service for the vulnerable and also o er practi-

and lecturer of the GSL, supported by two newly trained lawyers and further supplemented by 20 student volunteers.

When properly executed, the Pro Bono Unit of the GSL will gradually but steadily occupy a tiny but signi cant space in the noble eld of free legal represen

achieve two things. First, it will make reliable e orts to help the most underprivileged members of our community who are in dire need of legal representation but cannot a ord it.”

“Second, it will create a perfect platform for enabling, supporting and stimulating the development of our students’ legal skills and talents to serve their communities,” he said.

them, as well as their impact been felt, and adds that they have been very proud of their evaluation.

Speaking to journalists on the side of a Grant Contract Signing Ceremony of the Sectoral Expansion of the Covid-19 Response Grant Programme in Accra on Monday, she said ““Our advice to them is that, they need to utilize

nesses, but those who will misuse the funds and we try to stop, so we advise them; use it because this project does not end here, next year in the second week of January, we are going to roll out a major programme and that intervention will also expand and grow businesses and if we are going to do that and you have not utilized your funds properly, then you are not

these businesses and “we are very excited by what we have been able to achieve especially at a time when the whole world is going through certain challenges.”

“For this second phase, over 400 businesses have been impacted, we haven’t really started counting the jobs created because it is three months but if you look at

our last intervention, it is 373 businesses over 1500 jobs were created.”

The grant is being implemented under the World Bank funded Ghana Economic Transformation Project (GETP).

It is targeting small businesses with employees between six and 100 and those with annual turnover between GH¢180,000 and GH¢21.6 million.

To be able to access the fund, SMEs also need to have business operating certi cates and submit nancial statements or income statements between 2019 and 2021.

The fund must be used to purchase machinery and equipment, or technology, equipment installation and repair costs, working capital expenses including purchase of raw materials and marketing costs and payment of rent.

Holders of Ghana’s Eurobonds have formed a creditor committee after the Finance Ministry announced plans to suspend payments on its foreign debts. The Committee is representative of a diverse group of institutional investors including mutual funds, asset managers, insurance rms, hedge funds, and family o ces.

In a statement on Monday, the group announced that the steering members of the committee will include Abrdn, Amundi (UK) Limited, BlackRock, Greylock Capital Management and Ninety One

“The Committee is focused on the orderly and comprehensive resolution of Ghana’s debt challenges, recognizing that such resolution will require fair burden-sharing and collaboration among the Ghanaian authorities, private creditors (both domestic and international) and o cial sector creditors. The Committee welcomes the authorities’ ongoing engagement with the International Monetary Fund (the “IMF”) and

the recent announcement of the Sta Level Agreement.

The Committee notes that a process of good faith negotiation would avoid unilateral actions and would require, inter alia, the timely exchange of detailed economic and nancial information among the committee, the Ghanaian authorities and the IMF, and would need to be anchored in reasonably feasible economic adjustment by the Ghanaian authorities.

In this regard, the Committee endorses the Institute of International Finance’s Principles for Stable Capital Flows and Fair Debt Restructuring, which provide meaningful guidance for successful sovereign debt restructurings. The Committee stands ready for a swift engagement on that basis.

The Committee aims at securing an outcome that is both equitable to creditors and responsive to the economic and social challenges facing Ghana. A key factor in measuring the success of Ghana’s debt resolution would be the timely restoration

of international market access, which remains critical for Ghana to meet its development objectives.

The Committee has therefore appointed Orrick, Herrington & Sutcli e LLP as legal advisor and Rothschild & Co as nancial advisor.

This follows the announcement by the government on Monday that its has suspended payments on most of its external debts, e ectively defaulting as the country struggles to plug its cavernous balance of payments de cit.

The Finance Minister, Ken Ofori-Atta, said it will not service debts including its Eurobonds, commercial loans and most bilateral loans, calling the decision an “interim emergency measure”, while some bondholders criticised a lack of clarity in the decision.

The government “stands ready to engage in discussions with all of its external creditors to make Ghana’s debt sustainable”, the nance ministry said.

The suspension of debt

payments re ects the parlous state of the economy, which led the government last week to reach a $3-billion sta -level agreement with the International Monetary Fund (IMF).

Ghana had already announced a domestic debt exchange programme and said that an external restructuring was being negotiated with creditors. The IMF has said a comprehensive debt restructuring is a condition of its support.

The country has been struggling to re nance its debt since the start of the year after downgrades by multiple credit rating agencies on concerns it would not be able to issue new Eurobonds.

That has sent Ghana’s debt further into the distressed territory. Its public debt stood at 467.4 billion Ghanaian cedis ($55 billion as per Re nitiv Eikon data) in September, of which 42% was domestic.

It had a balance of payments de cit of more than $3.4 billion in September, down from a surplus of $1.6 billion at the same time last year.

In late November, the Intergovernmental Negotiating Committee on Plastic Pollution met for the rst time. The INC was established by the United Nations Environment Assembly with a well-de ned mission: to create the rst-ever legally binding global agreement on plastic pollution. The fact that delegates and observers nally met to have this discussion is welcome. But the meeting results are just the beginning of addressing the scale or scope of the problem.

Plastic pollution threatens people’s health and endangers the environment. And plastic causes harm throughout its entire lifecycle, beginning with resource extraction and continuing after disposal. But the problem is not just plastic itself. Plastic contains over 10,000 chemicals, more than a quarter of which are toxic to humans and wildlife. In the absence of a global requirement that companies make known exactly which chemicals are in which plastic materials and

goods, what we know about plastic in our lives is dictated by the whims of individual manufacturers and national legislatures. As a result, we are ignorant of the full extent of the problem. No one – from workers facing occupational hazards to parents trying to make healthy choices for their children – has all the information they could and should have.

Plastic does not a ect everyone equally. Vulnerable groups like low-income families, indigenous communities, and people of color are especially at risk. For example, the vulnerable and disadvantaged are more likely to live or work near petrochemical manufacturing facilities and re neries, exposing them to air, water, and soil pollution from the toxic chemicals used to manufacture plastic products. This inequality exists within and between countries. Plastic products are often made in developing countries, transported to developed countries, and then returned to developing countries as waste. It is not only the

last stage of plastics’ lifecycle that creates pollution and endangers communities. Plastic production itself is hazardous. Consider the textile sector, where workers create clothes from synthetic bers made of plastics. The workers are largely unaware of the toxicity of the chemicals they are using while they assemble skirts and shirts for people an ocean away. They do not have all the information they need to understand the risks they are facing from doing their jobs. There is an obvious gendered component to this, too, given that the textile sector in developing countries is dominated by women.

But while people are unfairly and unevenly a ected by plastic pollution, the reality is that no one is spared. Plastic pollution does not respect borders. Women everywhere use menstrual products containing plastics with chemicals that pose a direct risk to their health. Children all over the world, including in wealthy countries, play with cheap plastic toys containing unknown chemicals.

Given the high-stakes challenges facing the rst INC, it is disappointing that delegates did not even manage to adopt procedural rules. More substantive negotiations will be delayed until they do.

There were some small successes. The presence of observers permitted corridor conversations in which they could help delegates better understand the

link between plastic, chemicals, and health. This was re ected in some delegates’ statements, which highlighted the need for transparency on chemicals in plastics.

That is not nothing. But it is also not enough.

In May 2023, delegates will have another chance. Representatives of governments from around the world will convene in Paris for the INC’s second meeting. Their mission will once again be to work toward a legally binding agreement on plastic pollution.

Delegates cannot simply retread the same ground as in November. Delegates will need to demonstrate their governments’ commitment to reducing plastic production. Together, they will need to consider the entire plastic lifecycle and the dangers that it poses to communities, people, and the environment.

Perhaps most important, they will need to remember that the point of these meetings is to establish a global, legally binding instrument, not to shrug and sigh and let countries follow mere voluntary guidelines, e ectively allowing business as usual to continue.

In Paris next year, negotiations on plastic pollution need to be both more e cient and more ambitious. Delegates must act as though they are saving the world. If they get this right, they will be.

WE traditionally re ect during the end-of-year holidays on the consequences of our past behaviour, as well as contemplating the good to achieve in the twelve months ahead.

When we set resolutions, we are striving to determine how we can do better in our own lives.

Perhaps we could also take the occasion to consider how we might achieve such improvement on a larger scale.

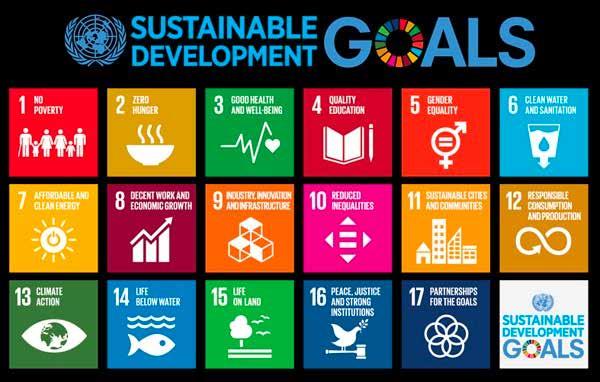

In 2015, the world’s leaders attempted to address the major problems facing mankind by establishing the Sustainable

Development Goals (SDGs) – a compilation of 169 targets to be hit by 2030. Every admirable pursuit imaginable made the list: eradicating poverty and disease, stopping war and climate change, protecting biodiversity and improving education.

In 2023, we’re at the halfway point, given the 2016-2030 time-horizon—but we will be far from halfway towards hitting our putative targets. Given current trends, we will achieve them half a century late. What is the primary cause of our failure? Our

inability to prioritise. There is little di erence between having 169 goals, and having none. We have placed core targets such as the eradication of infant mortality and the provision of basic education on the same footing as well-intentioned but peripheral targets such as boosting recycling and

promoting lifestyles in harmony with nature. Trying to do everything at once we risk doing very little at all, as we have for the last seven years.

It is, therefore, long past time to identify and prioritise our most crucial goals. The think tank Copenhagen Consensus, together with several Nobel

laureates and more than a hundred leading economists, has done exactly that, identifying where each dollar can do the most good.

We could, for example, truly hasten an end to hunger. Despite great progress over the past decades, more than 800 million people still go without enough food. Careful economic research helps identify ingenious and e ective solutions.

Hunger hits hardest in the rst thousand days of a child’s life, beginning with conception, and proceeding over the next two years. Children who face a shortage of essential nutrients and

vitamins grow more slowly, both physically and intellectually.

We can e ectively deliver essential nutrients to pregnant mothers. The provision of a daily multivitamin/mineral supplement costs a bit over $2 per pregnancy. This helps babies’ brains develop better, making them more productive and better paid in adult life. Each dollar spent would deliver an astounding $38 of social bene t. Why would we not rst take this path? Because in trying to please everyone, we spend a little on everything, essentially ignoring the most e ective solutions.

Consider, as well, what we could accomplish on the education front. The world has nally managed to get most children in school. Unfortunately, the schools are often of low quality, and more than half the children in poor countries cannot read and understand a simple text by the age of ten.

Typically, schools have all 12-year-olds in the same class, although they have very di erent levels of knowledge. No matter which level the teacher teaches at, many will be lost and others bored.

What would this cost? The shared tablet, charging costs and

extra teacher instruction cost about $26 per student, per year.

But tripling the rate of learning for just one year makes each student more productive in adulthood, enabling them to generate an additional $1,700 in today’s money.

There’s a resolution, both personal and social. That’s the pathway forward to a better future. Let’s resolve to walk down that road, as we consider the dawning of the new year.

The writers are President of the Copenhagen Consensus and Professor Emeritus at the University of Toronto, respectively.

We do not have the luxury of time at this crucial moment of the country’s nancial and economic history to look back and be asking how we got here or who caused it all, than to collaboratively and coordinately nd pragmatic solutions to the nation’s debt cataclysm.

De nitely, if the country is to be guided not to fall into this mess again, such poignant concerns cannot be shelved so they will be dealt with subsequently. This one seeks to address nagging questions of many; as to whether the unavoidable debt exchange programme is the best possible option to be addressing the crisis swamping the nation. Attempt is herein made to provide alternative mechanisms that are mostly considered in addressing such crunches.

National debt architecture Ghana’s estimated end of

year(2022), debt to Gross Domestic Product(GDP) of 105 per cent is certainly an economic, social, and political issue weighing heavily on the shoulders of every Ghanaian. The imminent crippling domestic social and economic sequences would be depriving individuals and families the most basic elements of living hence the need for urgent and drastic steps in averting situation that may prevent the state from participating e ectively in international activities such as trade. Without which there would be a further aggravation of su ering citizens. Ghana’s economic malaise has a domino knock-down e ect on individual investors, creditor nations and institutions hence, my subscription to the suggestion that we are all in this muddle together, needing concerted e orts to steer through the stormy

waters.

There are several categories of creditors, but what binds them is the impact of a debt crisis. Aside domestic creditors whom the state has spelt out mechanism to deal, are the multilateral agencies and bilateral lenders, providing di erent types of credit, either as aid in the form of a concession or on purely commercial terms. The debts of multi-lateral agencies, such as the International Monetary Fund(IMF) and its surrogates are, in case of default, renegotiated through the IMF, while that of bilateral and private commercial lenders are done through the Paris Club and London Club respectively. Investors funding brings its own particular and signi cant problems because they are amenable to swift capital ights, as the creditors could be geographically spread, and even anonymous in certain

instances. Indeed, recent developments where external entities 40 per cent ratio to the country’s debt has dwindled to a near single digit, points to the signicant problems of speed of light at which their securities can be withdrawn and its negative impact of weakening the local currency.

Di erent permutations could be involved in the new national debt architecture ,however, these articles seeks to focus on symbiotic win-win business-like solutions. The economic and social implications of appeals by the President on International stages and other various options will be discussed, along with sound principles upon which they are based.

Whenever credit is provided, a relationship between creditor and debtor is generated with the creditor earning the right to repayment or to enforce same, with a contrary obligation on the debtor to repay. Debt default could lend to operationalisation of contractual remedies made in a prior arrangement with the creditor to take possession of an item of value belonging to the debtor in exchange for the debt.

The second alternative includes court remedies such as levying execution or garnishee proceedings. If the debtor is simply unable to pay, the appropriate remedy is bankruptcy or insolvency proceedings. Another practical alternative is to renegotiate the loan with parties

agreeing on a new contractual framework for repayment. Readers would therefore appreciate the route Ghana is journeying in the circumstances. A temporary lack of liquidity or "cash- ow", rather than a pervasive shortage of working capital, could not be termed as insolvency. This draws a distinction between debtors who can a ord to pay their debts in a nick of time and those who require ample time to raise funds. If Ghana is to be declared bankrupt or insolvent, there couldn’t be any better arrangement than an orderly distribution of her assets by way of payment to creditors on a pari passu or pro-rata basis. Hence, the need for cool heads or cooperation for the state to keep head above the current stormy waters. It is very crucial we all put our shoulders to the wheel in rehabilitating the debtor. In the event of bankruptcy, it is not only the creditor who is protected. There are other objectives to protect the debtor, and the community as a whole, having regard to what the legal people term as extra-curial regimes; namely, deeds of assignment, composition scheme, and deeds of arrangement.

These developments propelled a design to balance the economic interests of both creditors and debtors by ensuring that the creditors ultimately get some sort of repayment, while the debtor obtains some concessions, (that is to say, more time within which to pay.) There are other options purposefully designed to clear the debts, urgently as possible.

loans were granted together with postponement of capital repayments and arrangements for longer maturities for existing commercial bank loans. This method appears to circumvent the real problem and provide only a temporary solution.

event.

Sika Mpε Dede, the maxim by the President has quickly metamorphosed into many things. From t-shirts to music and now, a book. The masterpiece authored by Certi ed Financial Fitness Coach; Peter Kwadwo Asare Nyarko & Certi ed Professional Trainer (CPT); Samuel Agyeman-Prempeh is an eye-opener on many salient money conversations. Launched at the WestLionCo premises on the 25th of November 2022, it was well attended by patrons who thronged the place. Preceding the book launch was the Start-up Dialogue which saw experts in their various elds such as Ethel Anne Komlaga of Enterprise Bureau, Peter Kwadwo Asare of Center for Financial Literacy Education (CFLE Africa), Paul Frimpong of WestLionCo and Samuel Agyeman-Prempeh of Role Model Africa headlining the

Debt reframing Solution, termed as "debt-framing" gives the debtor breathing space however, the debt itself largely remains, and may even grow bigger in some instances. They include debt restructuring;trading in debts in the secondary market;debt-for-equity swaps;securitisation of debt, (debt conversions);privatisation and debt forgiveness. (The president with cup in hand and perhaps a recant of his Ghana Beyond Aid mantra has been globetrotting either trumpeting or asking for what is generally termed as the Paris Club Conversion, restructuring of the global nancial architecture/resetting the global nancial system, swapping of debts for climate initiatives and slavery reparations).

In the 1970s, nations which couldn’t honour their debt obligations blatantly went unilateral in either declaring postponement (moratoria), rescheduling or simply refusing to pay. (You remember President Acheampong’s repudiation-with the unpopular phrase of we won’t pay!) Per the Brady Plan, commercial bank debt were exchanged for bonds and were more successful than the Baker Plan-which zeroed in on reducing sovereign debt.

Ethel Anne Komlaga who spoke on Entrepreneurship and Funding expounded the need for entrepreneurship in these uncertain economic crises. She explained the need for each entrepreneur to discover their makeup and use that to their advantage. She gave wonderful insights on how to position oneself for funding. In her words, “there is a lot of money for funding”. All one needs to do is to identify the many sources of funds available.

Debt restructuring, rescheduling Ordinarily, an orderly management of the debt should be bene cial to both sides in helping the debtor not to sink further the economic tumult.

Peter Kwadwo Asare Nyarko, Executive Director for the Center for Financial Literacy Education (CFLE Africa) and co-author of Sika Mpε Dede engaged participants with priceless nuggets on nancial planning. He broke down the complexities of money and the need for everyone to be nancially independent. He said, “everyone

Restructuring usually involves the consolidation of many debt contracts into just a few, with the accompanying standardisation of their clauses, and same, becoming debt of the central bank with the sovereign's guarantee. It is also common to nd restructuring accompanied by rescheduling, wherein new commercial bank loans and new IMF

Creditors to sovereign borrowers may not be interested in long-term relationships with debtor nation but insist on their contractual rights through court to frustrate the initiatives. Admittedly, there could be some legislative measures and some market practices such as the "collective action clauses" to discourage recalcitrant or dissenting creditors from doing it alone. Rescheduling remains, to a large extent a voluntary exercise, it does not guarantee a positive outcome either. How strong is Ghana’s secondary market?

would be traded. The sale-purchase transaction is usually at a heavily discounted price and this indeed is the main attraction for the purchaser of sovereign debt. The market ought to provide opportunities for commercial banks or other creditors to rid themselves of bad debt at some returns, however small. In the same vain, it should a ord speculators the opportunity to take chances on the repayment capabilities of the sovereign by whom the debts are owed.

must know the 5Ms of money. The Meaning of money, The Making of money, How to Manage it, How to Multiply and Move it”. He believes these pillars shape one’s nancial trajectory.

Paul Frimpong of WestLionCo spoke on investments. Explaining the intricate details of investments especially in these times, he gave a detailed breakdown of the everyday nancial jargons hurled at us by the experts. He explained that, “risk is closely tied to investment”. He asked all potential investors to read more before making any investment decisions.

Having been in existence for 32 years,the Ghana Stock Exchange (GSE) is of age not to be buoyant for an e cient secondary market activities. With restructuring, many debts with di erent characteristics were to be streamlined into fairly standardised nancial instruments capable of being widely traded. Rescheduling was necessary to facilitate trade in these "instruments," because it made them readily exchangeable as if they were commodities. It should be stated that rescheduling could only be considered as the mainstay of other propositions, rather than an answer to the debt problem in its own right. The secondary market is expected to be the market for the states' indebtedness, in which the debts of the country

There is inherent dangers with court actions by purchasers of sovereign debt in the secondary market though. A remarkable case, is often cited as the Dart case where, the Dart family bought Brazil’s debt at a huge discount of 60 per cent in 1993 and when Brazil requested to be allowed to convert one-third of its debt into bonds at much less than face value, the family refused and sued claiming accelerated repayment of both the principal and the interest but the court did not grant all their request.

The climax of the session enchanted participants with a delivery by co-author of the masterpiece, Samuel Agyeman-Prempeh sharing his perspective on the all-important subject of juggling between a day job and a side hustle. Broaching the topic which has become a favorite of many, both in the formal and informal sector, the IAPPD Certied Professional Trainer (CPT) engaged participants on the need for side hustles to become much more than something we do for survival. “We need to run our

Signi cantly, the secondary market has enormous advantage of providing liquidity for distressed loans. Lenders can commit to loans with the knowledge that the loans can be sold if it should become necessary. It is however pertinent to conclude on the emergence of vulture funds as running counter to the whole idea of market-based approach for debt crises’ resolution. (Vulture funds are investors that buy defaulted debt cheap and litigate against the issuer, demanding full payment thereby disrupting the whole restructuring process).

businesses so well that they function with e ective systems and process, he highlighted. Mr. Agyeman-Prempeh emphasized the need for entrepreneurs to disintegrate themselves understand all aspects of the business but very importantly trust and work with team mates and partners as that serves as a catalyst for the growth of the business. The event rounded up with the launch of what is potentially a bestseller ‘Sika Mpε Dede’. The book speaks on the many silent topics regarding money and its usage in our society and the world at large. A great companion to the student confused about money to the trader who seeks to make the most of his money to the investor who is in a dilemma on what to do in these times.

Peter Kwadwo Asare Nyarko and Samuel Agyeman-Prempeh’s ‘Sika Mpε Dede’ is a light for all in these challenging nancial times.

Published by Lumière Creatif, the book is available on Amazon, Sayda, Booknook and Selar.

Mozambique is ramping up e orts toward establishing a sustainable energy supply to drive its economy especially the industrialization programme. As it seeks reliable foreign partnerships, it has already shortlisted a few energy groups for the new US$4.5 billion Mphanda Nkuwa hydroelectric dam, on the Zambezi River, located in Tete province that is estimated to generate 2,070 megawatts for Mozambique. It will be 700 metres long and rise 86 metres above its foundations, with 13 oodgates.

The tender for the "Selection of the Strategic Partner or Investor for the Development of the Mphanda Nkuwa Hydroelectric Project" nally in December recieved the results of the market survey carried out in September involving the critical aspects of structuring the project, alignment with potential buyers and shareholder participation. The structure of the energy transmission line, the methodology for selecting the strategic partner, the implementation schedule, among other relevant issues related to the project transaction.

According to Malaysian newspaper The Star, the process of select-

ing the seven potential investors was made at the end of an investor conference held in Maputo. It further wrote that there were two individual companies and ve large consortiums that previously visited the site to understand the natural conditions of the area and assess the fundamental data to prepare proposals from a technical, economic and nancial point of view.

The newspaper estimated the infrastructure cost between US$4.5 and US$5 billion and have capacity to produce 1,500 megawatts, making Mphanda Nkuwa the second-largest hydroelectric dam in the country, after Cahora Bassa Hydroelectric (HCB), which generates 2,070 megawatts. With the two infrastructures in fully operational energy production, Mozambique hopes to achieve the goal of universal access to energy and respond to the growing energy de cit that plagues southern Africa.

General Director of the Mphanda Nkuwa development o ce, Carlos Yum, envisaged that

during the construction phase, more than 7,000 jobs will be created, and 50 percent of the energy generated will be exported, contributing to the country's economy and thus making a regional energy hub in Mozambique.

The Mphanda Nkuwa project will be a lower-cost power generation option which will position Mozambique as a regional energy hub, and contribute to universal access, industrialization, job creation and technical training while generating tax and concession fee revenue. The project is fundamental for the energy transition and decarbonization of the southern region of Africa.

Carlos Yum has laid out the status of the Mphanda Nkuwa hydroelectric dam construction project. According to Yun, the project is budgeted at around US$5 billion, and work will start in 2024, the year in which nancing is expected to be de nitively concluded.

The project will take a total of six to seven years to complete. Of the approximately US$5 billion

price tag, 60% is for the construction of the dam and 40% for the power transmission line. At this moment, the development o ce is preparing the launch of public tenders for the updating of the project's feasibility studies.

By December 2022, the o ce will launch a tender for the identi cation of the strategic investment partner, whose nancial closing a 2024 deadline has been set. In terms of shareholding, the Mphanda Nkuwa project will have the participation of the Mozambican state, through Electricidade de Moçambique (EDM) and Cahora Bassa Hydroelectric [(HCB), with between 30% and 35% of shares. The remaining 65% will be secured from private investors.

Carta de Moçambique also informed that there would be consultants involved – from Brazil, the United States, Sweden and South Africa – to assess possible problems associated with the project according to the best international practices, avoiding pitfalls that have marred previous projects imple-

mented in the province and in Mozambique generally.

It reported that experts and strategic investors, including the World Bank (WB) and the African Development Bank (ADB), have discussed some signi cant aspects concerning the implementation of the Mphanda Nkuwa hydroelectric project.

"Overall, we think this project is very important to the government's goal of universal access by 2030," said Zayra Romo, World Bank Mozambique Lead Energy Specialist and Infrastructure Practice Leader. As for the current stage of the project, which consists of the search for a strategic partner for the development of Mphanda Nkuwa, Romo said that the World Bank's support would consist of ensuring the greatest possible competitiveness for the project, with a view to selecting the best contractor or investors that have experience to e ectively manage Mphanda Nkuwa.

A press release from the Mphanda Nkuwa Implementation O ce said that these companies and consortia had replied to the

tender launched in December 2021, and delivered their pre-quali cation documents before the deadline, rst xed on 28 February but, at the request of several of the bidders, it was extended to 18 April. It is hoped that construction of the new dam (which has been on the drawing board for decades) will nally begin in 2024. Construction will last for at least seven years.

According to the media release by the Mphanda Nkuwa Hydroelectric Project Implementation O ce, the main objective is to ensure the coordination of actions for the implementation of the Mphanda Nkuwa project.

Location: The Mphanda Nkuwa Dam will be located in Tete Province, Centro region, on the Zambezi River, 61km downstream of the Cahora Bassa Hydroelectric Power Plant.

Project description: The Hydroelectric Power Plant will have a capacity of up to 1,500 Megawatts and an Electric Power Transmission Line from Tete to Maputo with 1,300 kilometres.

Budget: US$4.5 to US$5 billion, 60% for the construction of the dam and 40% for the power transmission line.

Strategic importance: The project will position Mozambique as an energy hub in southern Africa. It will provide lower cost energy in the country and region, contribute to universal access to energy in the country by 2030 and support rapid industrialization, with job creation, skills development and business opportunities (local content). Social and economic bene ts, in the form of royalties and income on concession fees for the Mozambican state.

Environmental approach: The project will be implemented in strict compliance with national standards and internationally accepted best practices for the development of projects of this nature, to mitigate negative impacts and maximize positive aspects. In this context, the Mphanda Nkuwa Hydroelectric Project Implementation O ce recently signed an agreement with the International Hydroelectricity Association for the assessment of the project's sustainabili-

ty, including training and capacity building.

Mozambique News Agency reported, citing government sources, that there were eight international consortiums interested to become strategic partners of Mozambique in building the Mphanda Nkuwa dam, with electricity production: ETC Holdings Mauritius, Longyuan Power Overseas Investment (Chinese), PowerChina Resources, WeBuild Group, Scatec (Norway), Sumitomo Corporation, EDF and Kansai Electric Power (Japan).

With an approximate population of 30 million, Mozambique is endowed with rich and extensive natural resources but remains one of the poorest and most underdeveloped countries in the world. It is one of the 16 countries, with a collective responsibility to promote socio-economic, political and security cooperation within the Southern African Development Community.

all startups are SMEs, but not all SMEs are startups.

These entrepreneurial endeavours are often founded by one to three entrepreneurs, who concentrate on creating a marketable product, service, or platform in response to a perceived market need.

prises are increasing, heralding the arrival of the Fourth Industrial Revolution in the nation (particularly since the onset of the COVID-19 pandemic).

As a result, the number of startups has dramatically increased.

developed entrepreneurial skills, and a robust corporate sector.

Ghana’s Startup Ecosystem at a glance.

Ghana is becoming one of the most vibrant and developing startup havens on the continent. The country is nally catching up fast with countries such as Egypt, Kenya, Nigeria, and South Africa as some of the continent’s giants when it comes to startups.

Startups are often seen as businesses that are just starting out and have the potential to expand quickly. Due to variations in setup and vision, we can say that

Gleaning from continent-wide prospects, Africa is going digital as a result of a decade of economic expansion, rapid urbanization, internet penetration, and the bankability of its population.

Technological innovation is advancing quickly. Ghana is no exception, as internet penetration has increased over the past ve years.

Ghana is leading the area in technical innovation, and the number and size of digital enter-

Given that the majority of Ghanaian businesses are informal SMEs that still don't use technology or digital solutions, the startup ecosystem's potential for innovation and growth in Ghana is still mostly untapped.

Talent is one of the key components of any start-up ecosystem, and Ghana is developing a sizable talent pool of future digital leaders.

Ghana's development is a result of a number of positive factors, including substantial consumer and business markets, highly

To succeed, most startups require the ideal combination of networks, nancial markets, rules, and culture. Over the past ten years, Ghana has created an environment with a lovely interplay of these elements.

The Ghana Government in recent years has launched various initiatives aimed at developing a robust entrepreneurial and startup ecosystem. For example, to tackle the Ghana government introduced the "National Entrepreneurship and Innovation Plan" (NEIP) in June 2017 as a $10 million program to address the funding gap and lower youth unemployment.

The government's main method for aiding start-ups and small businesses is now NEIP.

NEIP has given over 7000 entre-

preneurs across ten areas of the country specialized training in entrepreneurship and business development through tech hubs.

Again, it has provided 500 of those 7000 entrepreneurs with some initial money to support their most viable business concepts. Additionally, the government promises to give tax bene ts to NEIP participants based on how many workers they employ.

We are starting to witness momentum in the legislation space across Africa as more countries begin to nd the middle ground to launch Acts to regulate their startup ecosystem.

Startup Acts are extensive legislative and regulatory frameworks designed to promote entrepreneurship and make it possible for new businesses to develop with strong growth potential, typically by providing speci c incentives (tax, subsidies, procurement, etc.).

Tunisia, in 2018, paved the way as the rst country on the continent to pass the Startup Acts and this has been followed by Senegal in 2020. Other countries such as Rwanda, Mali, Nigeria, Ghana etc. have all activated conversation to be next in line.

Startups can function with the security provided by a de ned framework for expansion thanks to legislation. With the help of this legislative mechanism, innovative businesses with high growth potential are formed more quickly.

We cannot certainly talk about the startup ecosystem without touching base on the availability of strategic organizations such as entrepreneurship hubs, which have become the key and major driver of growth.

Startups and incubator hubs have become inevitable when it comes to startup ideation, execution, and growth.

Entrepreneurs and startups need a lot of capacity-building and support systems in order to succeed, and that is the critical role played by these entrepreneurship hubs, which are growing across various regions of the

country.

While most of these hubs are technologically driven, there are equally some of these hubs that are speci c to certain niches, such as women's entrepreneurship, students’ entrepreneurship, as well as covering multiple sectors to sector agnostic hubs.

Annan Capital Partners is currently building a pipeline of critical support systems through their venture building platforms, including crowdfunding setups.

to put in a lot of e ort.

The funding of your business is the next crucial component that needs to be taken into account. You must accurately pinpoint the resources from which you will be able to obtain nance for your company.

Additionally, it is preferable to have a plan in place in order to properly manage a company's budget.

nies).

This de nes how simple it will be for you to set up, but it also indicates how erce the competition will be. A low entry barrier industry is frequently overrun with shoddy start-ups. It can be quite challenging to distinguish out in a niche like this.

This will easily become known to you during the preparation of the business plan.

There are 1000 and 1 factors deemed critical to be considered before launching any business idea. These are mostly universally and globally acceptable factors and are not necessarily applicable to a single country.

It’s fair to say that in venturing into Ghana’s startup space, these would be some of the few key factors to be met.

It is obvious that no company can grow if it doesn't have a brilliant idea. The growth of your company will be solely dependent on a brilliant and workable idea.

Additionally, you need to have a distinctive idea that stands out in the market because there are many competing businesses.

It can come o as naive. But if you're going to focus on making your business idea a reality for the next 12 months, enthusiasm is extremely essential.

If your business venture aligns with your passion, you'll succeed as an entrepreneur. Even if you start anything, if you don't believe in it, you might not be able to stick with it over the long term, regardless of how successful it may be.

It is one of the most crucial things that will enable you to overcome all obstacles and challenges.

You will encounter many dangers and di culties during this process, and your optimistic outlook will be the only thing that will keep you alive. To build your own business, you will have

In our previous insights, we shared tips on Funding opportunities for startups in Ghana. That article will proof useful as well, as we will soon nd out that we cannot discuss the startup ecosystem without bridging the funding gap.

It’s important to develop strategies around the scalability of your idea and adequately defend it.

Scalability can be viewed as a company's capacity to expand when faced with a rise in demand for its goods or services and the ease with which its organizational structure and available resources can do so.

Scalability, then, is the ease with which your rm can grow without being restricted by your organizational structure.

The business plan Without a business strategy (plan), no company can grow to its full potential. You can get guidance and nd out if your idea is workable by creating a business plan. You will be able to determine every necessary next step with the aid of a company strategy.

For instance, a crucial component of creating a business plan that many entrepreneurs skip over is competitive study, allowing you to be on guard against new entrants and how to overcome such competitors e ectively.

The completion of legal paperwork is a crucial component that must be taken into account. The rst stage will be to register your business, and the documentation of this is referred to as business formation documents.

It’s a mandatory requirement to get your business registered in Ghana, (Registrar Generals’ Department/Registrar of Compa-

Opportunities for startup ideas in Ghana abound across all sectors. It’s almost certain that every sector of the Ghanaian economy has room for more business ideas and opportunities.

Technology is changing how entrepreneurs can create these opportunities in traditional and new sectors of the Ghanaian economy.

Annan Capital Partners is leading in building a venture support systems for Ghanaian startups, after initiating the yet to be launched Agoo Africa crowdfunding platform.

“Agoo Africa is a crowdfunding platform for African early-stage start-ups’ and small traditional businesses.”

“When launched, it will allow owners of such businesses to make their project and their pitch accessible to a large number of investors, from young non-professional business angels to established international funds.”

This

Annan Capital Partners (ACP) is a boutique investment advisory and business development agency o ering holistic wealth management and venture building services to a wide range of clients, from entrepreneurs to governments and from local SMEs to global corporations.

https://annancapitalpartners.com/ py.frimpong90@gmail.com

About Author Paul Frimpong, CGIA, ICCE Paul Frimpong is a development economist, top voice on Sino-Africa relations, and an award-winning entrepreneur. He’s currently the Global Head of Strategy & Membership at the Institute of Certi ed Chartered Economists (ICCE). article is originally curated for and published by: Annan Capital Partners.

written legal briefs on corporate and commercial law, taxation, corporate nance, corporate restructuring, mergers and acquisitions, etc. in Ghana for several multinational companies and international law rms.

member of the Ghana Bar Association.

The Board of Directors of the Ghana Center for Democratic Development (CDD-Ghana) has elected Mrs. Clara Kowlaga Beeri Kasser-Tee as the new Vice-Chair of the Board.

This took place at the Board’s 72nd meeting on December 14, 2022. Mrs. Kasser-Tee has been serving on the Board since January 2019.

CDD-Ghana has bene ted from the valuable insights acquired from her diverse experiences as a private legal practitioner, an academic, a consultant, an advocate, and a regular panelist on various national current a airs

programs on radio and television.

Since joining the Board, Mrs. Kasser-Tee has been an active member of the Board and Governance, Human Resource and Compensation sub-committee. Additionally, she has been involved in several of the Center’s programs and day-to-day public events as a resource person or moderator.

Mrs. Clara Beeri Kasser-Tee is the Founder and Head of Chambers of Kasser Law Firm, and a Lecturer at the University of Ghana Law School.

As a private legal practitioner, she has advised, researched, and

Mrs. Kasser-Tee has contributed immensely to legal education, and the development of public institutions through several engagements with the media and the Ghana Revenue Authority on relevant national issues. Among other things, she developed a concept to improve tax collection inGhana, using existing facilities such as the courts. This has been approved by the Ghana Judicial Service and the Ghana Revenue Authority. She has earned the respect and trust of the public including members of the judiciary, the Ghana Bar, and other public and private institutions.

She attended the Bolgatanga Girls Secondary School for her secondary education. She holds a BA (Philosophy and English), an LLB and LLM from the University of Ghana.

She also holds a BL from the Ghana School of Law, where she graduated top of her class, and was a recipient of the prestigious John Mensah Sarbah Prize given to the best overall (all round) graduating lawyer. She is a

Mrs. Kasser-Tee has published articles on oil and gas law, environmental law and regulation in Ghana, and taxation. She is currently an editor for the Legon Journal of International A airs and Diplomacy.

CDD-Ghana’s Governing Board is composed of Chairperson, Prof. Audrey Gadzekpo, an academic and media practitioner; Secretary Mr. James Sraha, a practising accountant and tax consultant; Prof. E.Gyimah-Boadi, Chairman of the Board of Afrobarometer Network, Co-founder and Former Executive Director of the Center; Dr. Ba our Agyeman-Duah, Co-Founder of the Center and currently Chief Executive O cer at the John A. Kufuor (JAK) Foundation; Mrs. Sadia Chinery-Hesse, an experienced lawyer and governance practitioner; Mr. Kweku A. Awotwi, an experienced international business executive; Mr. Felix Biga, Chief Operating O cer with the Afrobarometer Network; Prof. H. Kwasi Prempeh, Executive Director of the Center; Dr. Edem Selormey, Director of Research at the Center and Dr. Kojo P. Asante, Director of Advocacy and Policy Engagement at the Center.

In the face of Europe’s energy crisis, political and economic leaders in Italy, the European Union’s third-largest economy, are confronting two opposing forces. On one hand, there is fear of change, which leads policymakers to fall back on old solutions: drilling, new gas pipelines and gasi ers, and e orts to secure hydrocarbons in Africa and the Middle East. On the other hand, there is pressure for innovation from the electricity industry and all those sectors of society that see this crisis as a

By Eugene Davisclear signal that the fossil-fuel era is ending.

The con icting views of Italy’s political and economic estab lishment mirror the divisions within Italian society. A recent SWG survey shows that the debate about energy issues is rarely based on hard evidence, but rather on biases and perceptions that are related more to age than political a liation.

Italians over 55 seem to be stuck in the past: 33%, for example, believe that renewable energy has never exceeded 10% of

Italy’s total electricity production. Only 7.5% of this cohort came close to the real gure: today, Italy produces about 40% of its electricity from renewable sources. Young people under 24 are better informed: the share of those who correctly evaluate the contribution of renewables to electricity production is three times higher, at 22%.

Italians over 55 seem to have forgotten the country’s impres-

sive tradition of renewables. Few remember the avant-garde hydroelectric turbines that, since the beginning of the twentieth century, fed the electro-steel plants of Sesto San Giovanni with water owing from the Alps; or Larderello, the world’s rst geothermal power plant, in Tuscany. Similarly, few people seem to know that Italy is a world leader in solar power, or that the state-owned company

ENELGreen Power is one of the ve largest solar companies.

In 2014, Italy also brie y held the world record in solar-energy use,

most informed about renewables and the most enthusiastic supporters of the green-energy transition. But the over-55s far

Italy could become the new hub for trans-Mediterranean gas tra c, as Ukraine was for gas deliveries from Russia to Europe. Is that really what Italians want?

fers, was also highlighted as key to ensuring continuous supply of medicines in LMICs. Furthermore, the AtMI recognised AstraZeneca’s local capacity building initiatives and use of inclusive business models aimed at meeting the access needs of populations at the base of the income pyramid.

treatments.

-Top three pharmaceuticals include GSK, Johnson & Johnson and AstraZeneca

-The report shows that more pharmaceuticals are moving to address access to medicines The 2022 Access to Medicine Index has ranked the top 20 pharmaceutical companies globally. GSK, Johnson & Johnson and AstraZeneca took the top three positions in the list.

missed the targets. Despite these early successes, Italy has slipped to 12th place among EU countries in renewable-electricity production. In terms of e ciency, Italy still leads the continent’s large economies in terms of energy consumed per unit of GDP, but its competitive advantage is shrinking. In 1995, the Italian economy was 32% more e cient than the EU average; by 2019, this margin had dropped to 11%.

As the SWG survey shows, Italians under 35 are more aligned with the technological realities of the twenty- rst century. They are also the

AstraZeneca’s top three position in the 2022 Access to Medicine Index (AtMI) re ects the company’s leading work to strengthen global health systems, as well as increase equitable and a ordable patient access to life-changing

Pascal Soriot, Chief Executive O cer, AstraZeneca, said: "We believe it’s vital everyone has access to a ordable, sustainable, and innovative healthcare, particularly in low- and middle-income countries. This ranking re ects AstraZeneca’s strategic focus on improving access to medicines and to the crucial work with our partners to strengthen health system resilience.”

and the desire to slow down the energy transition seem to have prevailed. But Italy has an industrial-revival plan the likes of which it has not produced in decades. While the Marshall Plan, led by the United States, promoted hydrocarbons and the motorization of Baby Boomers in the 1950s, the new energy-transition plan to build e cient transport, housing, and production systems that are integrated with the biosphere and the atmosphere is ours – designed by us and for us. In terms of levelized cost of energy (LCE), renewables are the

AtMI is an independent ranking of 20 of the world’s largest pharmaceutical companies and evaluates their impact on improving access to medicine in low- and mid-

dle-income countries (LMICs). It focuses on three technical areas: Governance of Access; Research and Development (R&D); and Product Delivery. AstraZeneca moved up from 7th to 3rd position after performing well across all three technical areas.

AstraZeneca was recognised by AtMI as the industry leader in Product Delivery, noting its application of tailored access strategies for di erent countries re ecting their income classi cations across all product categories. The Company’s approach to patent transparency and sharing of intellectual property assets, using technology trans-

least expensive sources available. The greatest cost is the initial infrastructure investment, after which the source – water, sun, wind, or geothermal energy – is free. Of course, the transition also requires raw materials, reliable business partners to supply them, and industrial capacity to manufacture blades, panels, control units, and nets. But Italy has everything it needs to face this challenge. As the second-largest manufacturer in the EU, Italy does not lack production capacity. And dependence on metals and rare earths will be reduced with improved recycling technologies, a sector in which Italy is also at the forefront. The energy crisis has highlighted how energy systems based on fossil fuels create dependence on petrostates, which can then blackmail other countries by threatening to turn o the tap. Italy is currently attempting to replace Russian gas with supplies from unstable countries, many of them in the grip of violent con ict. By doing so,

Historically, Italy enthusiastically embraced energy innovation. In the late nineteenth and early twentieth centuries, it was among the leading countries in electri cation and among the rst to abandon petroleum derivatives in favor of cleaner and more e cient methane. Today’s Italians have an opportunity to revive this tradition and shift to the most advanced, e cient, and cheapest forms of energy currently available: renewable sources. To seize it, however, Italy’s young people will have to educate their parents.

AstraZeneca also performed well in the Governance of Access category re ecting robust compliance controls, and also in R&D for its access plans for projects in Phase 2 or 3 of clinical development. Ongoing company initiatives to support access to COVID-19 vaccines via manufacturing, procurement, and distribution agreements in the light of the pandemic were also recognised.

Read more about the delivery of AstraZeneca’s Access to healthcare commitments in the 2021 Sustainability Report and Sustainability Data Summary.

"#$%&'$&(&")$!)(*)$#+&%, "#$ #%## &'( &)*+,- ./01 234)564!&'(!&)*+,-!7*)!#%## ./81 #%## ()*94:,4;!&'( &)*+,- </=1 >*&!(*?@:A!B5,4! #=/%%1 C44D?A!EF,4)G5FD!EF,4)4H,!B5,4 #I/I#1 EF7?5,@*F!7*)!J*3$!#%## I%/<1 KF;!(4)@*;!EF7?5,@*F!L5)64,! #%## #0 I1 >N;64,!'47@:@,!O1!&'(P! Q4R$!#%## S .1 #%## >N;64,!'47@:@,!L5)64,!O1&'(P S S1 (NG?@:!'4G,!OG@??@*F!&TUP!! Q4R$!#%## .S=/. '4G,!,*!&'(!B5,@*! Q4R$!#%## =0/%1 ,+&$-!"#%-'+!%'.)'/

L-4!&-5F5!Q,*:D!KV:-5F64 :?*H4;! ?*+4) 7*)!,-4 +44D *F!,-4!G5:D!*7!R)@:4! ;4:?@F4H GA! . :*NF,4)H L-4 &QK!W*XR*H@,4!EF;4V!O&QK WEP ?*H, 88/8Y R*@F,H! O %/.I1P!,*!:?*H4!5, #$..Y/.< R*@F,H$ )47?4:,@F6 5! A45) ,* ;5,4!O[L'P!?*HH *7 8#/8Y1/!L-4 &QK!\@F5F:@5?! Q,*:DH!EF;4V!O&QK!\EP ?*H,!8./Y#!R*@F,H!O %/=#1P! :?*H@F6 ,-4!+44D!5, #$%S8/Y# R*@F,H$!)47?4:,@F6 [L'! ?*HH *7!./801

]5)D4,!:5R@,5?@^5,@*F ;4:)45H4; GA! %/<I1!,*!:?*H4! ,-4!+44D!5,! &TUS.$.8%/.8 X@??@*F$ 7)*X &TUS.$S<S/II X@??@*F!5,!,-4!:?*H4!*7!,-4!R)43@*NH! +44D/!L-@H!)47?4:,H!5![L'!?*HH *7!%/8<1/!

L)5;@F6!5:,@3@,A! )4:*);4; 5 ,*,5?!*7 88$.#8$8SI H-5)4H!35?N4;!5,!&TU#%$I0.$#I=/Y0 :-5F6@F6 -5F;H$ :*XR5)4;! +@,- .<#$<YS H-5)4H$ 35?N4; 5, &TUYY$IYI$8.I/#. @F ,-4!R)4:4;@F6!+44D/

]LJ ;*X@F5,4;! 3*?NX4 *7!,)5;4H!+-@?4H!J4+!

WEEKLY MARKET FOR WEEK ENDIN

DECEMBER 2 , 2022

DECEMBER 2, 2022 DECEMBER 9, 2022 DECEMBER 16 ,22

"#$$%&"'!()$*%+

L-4!W4;@ H,)4F6,-4F4;! 565@FH,!,-4!`Q' 7*)!,-4 +44D E,! ,)5;4;!5, &TU0/%%8#ab$!:*XR5)4;!+@,-! &TU8#/II0%ab!5,!+44D!*R4F$ )47?4:,@F6!+a+ 65@F! 5F;

L-4!W4;@ 565@F! H,)4F6,-4F4; 565@FH, ,-4!KN)* 7*)! ,-4!+44D/!E, ,)5;4;!5,!&TU0/.00=ad$!:*XR5)4;! +@,-!&TU8</##I0ad!5,!+44D!*R4F$!)47?4:,@F6!+a+ 65@F 5F;

50$6@A$!" 0+&*2$ 2*&*'$ 21&52$ "0&)% " 0')&)* 0)+$6@A$!" 02&+0$ 2(&*2$ 2(&%2$ "0&2( " 0'+&'* 2(1$6@A$!" 0(&(1$ 2(&05$ 2(&0%$ "%&+2 " 00(&5+ !"#$%&'(2+,.("3()*+,+ "-((-10+'!()$*%+

e@?!R)@:4H!)*H4!*F!)4F4+4;!-*R4!,-5,!W-@F5fH! 4:*F*X@:!)4*R4F@F6!+@??!?45;!,*!@F:)45H4;! ;4X5F;!F4V,!A45)$!5H!+4??!5H!,-4!F4+H!,-5,!,-4! >@;4F!5;X@F@H,)5,@*F!@H!H4,!,*!)47@??!@,H!H,)5,46@:! )4H4)34 >)4F,!7N,N)4H!,)5;4;!5, `Qb=Y/%. 5!G5))4?$! :*XR5)4;! ,*! `Qb=S/8% 5,!+44D!*R4F$! )47?4:,@F6 +a+ 5F;

H4,,?4; 5, <./Y<1!R/5!7)*X <I/I=1 R/5/! ?5H,!+44D!+-@?H, ,-4! 80# '5A! >@??! H4,,?4;!5, <S/%<1!R/5!7)*X <S/I<1 R/5/!?5H,!+44D/ L-4!<S. '5A! >@??!H4,,?4;!5,!<S/8%1!R/5!7)*X!<S/8Y1!R/5/!?5H,!+44D/

L-4! ,5G?4!5F;!6)5R-!G4?*+!-@6-?@6-,!R)@X5)A! X5)D4,!A@4?;H!5,!:?*H4!*7!,-4!+44D/

&*?;!R)@:4H!+4)4!XN,4; 7*)!,-4!+44D$ 57,4)! ?*66@F6!H-5)R!?*HH4H!@F!,-4!R)@*)!H4HH@*FH $ 5H! 6)*+@F6!745)H!*7!5!)4:4HH@*F!+4)4!:*XR*NF;4;! GA!H@6F5?H!7)*X!H434)5?!X59*)!:4F,)5?!G5FDH!,-5,! @F,4)4H,!)5,4H!+4)4!75)!7)*X!R45D@F6 &*?; H4,,?4;! 5, `Qb8$0%%/#%$ 7)*X `Qb8$08%/=% ?5H,!+44D$ )47?4:,@F6!+a+ 5F; [L' ?*HH4H *7 %/I01 5F;! 8/II1! )4HR4:,@34?A

L-4!R)@:4!*7!W*:*5! )4:*);4; 5F!@F:)45H4 7*) ,-4! +44D/ L-4!:*XX*;@,A ,)5;4; 5, `Qb#$I8=/%%! R4)! ,*FF4 *F!\)@;5A$ 7)*X!`Qb#$I%./%% ?5H,!+44D$

+8D7> 14E3g! L*V@:!;4G,!@H!NH4;!,*!;4H:)@G4!?*5FH! *)!*,-4)!,AR4H!*7!;4G,!,-5,!-534!5!?*+!:-5F:4!*7! G4@F6!)4R5@;!+@,-!@F,4)4H,/!L*V@:!;4G,!@H!h,*V@:f!,*! ,-4!R4)H*F!*)!@FH,@,N,@*F!,-5,! ?4F,!,-4!X*F4A!5F;! H-*N?;!G4!)4:4@3@F6!R5AX4F,H!+@,-!@F,4)4H,/!2FA! ;4G,!,-5,!;5X564H!,-4!7@F5F:@5?!R*H@,@*F!*7!,-4! ?4F;4)!:5F!G4!:*FH@;4)4;!,*V@:/

Q*N):4g! !""#$%&&'''()*+,-*$(./(01&!*2#-+3 5/0&60$-+*$$ 7*./8*75&9*6" 32/$$:75&

)@-#+!"01)&

WE'2J!EF34H,X4F,H i@X@,4;!@H!5F!@F34H,X4F,!5F;! 7NF;!X5F564X4F,!:*XR5FA!?@:4FH4;!GA!,-4! Q4:N)@,@4H!j!KV:-5F64!W*XX@HH@*F!OQKWP!5F;!,-4! J5,@*F5?!(4FH@*FH!B46N?5,*)A!2N,-*)@,A!OJ(B2P/

$%/%)$"B!+%)(! J5X4g!K)F4H,!L5FF*) KX5@?g4,5FF*)k:@;5F@F34H,X4F,H/:*X L4?gl#<<!O%P!#%!008!0YI= J5X4g!]*H4H!J5F5!eH4@ [4G*5KX5@?gX*A4G*5-k:@;5F@F34H,X4F,H/:*X L4?gl#<<!O%P!#.!.YY!%%SY

*,&7$)&3,%#)$(".($4#$0#6+#/#$(&$0#$,#6+.06#:$03($+()$ .%%3,.%2$.'1$%&7-6#(#'#))$.,#$'&($30:7:+"**9(

The Obuasi Municipal Health Director Madam Yaa Manu has commended the Fifty 50 Club for their continuous support towards quality healthcare delivery in Obuasi and neighboring districts. Interacting with the media at the sidelines following another donation event by the NGO, Yaa Manu said in an era where some health facilities especially within the rural communities have reported of lack of beds and other medical equipment, the Fifty 50 club has consistently come to the aid of health facilities with medical equipment and supplies.

Founded in July 2020, the Fifty 50 Club has made several donations over the past 2 years including contributing to the cost of heart surgeries for eight individuals (6 kids and two adults) with various heart/medical conditions, supporting community clinics with medical equipment and supplies, providing scholarships to brilliant but needy students, and setting up twenty-three people with trading businesses.

The Club on Saturday, 17th December, 2022 donated medical equipment and supplies totaling about GHS 34,500 to the Ntonsua CHPS Compound in the Obuasi Municipality and the Nsokote-Anomabo CHPS Compound in the Adansi Asokwa district.

The items included 4 Crank Beds with Drip Stands, 2 Nebulizing Machines, 2 Oxygen Cylinders with Trolleys and Flowmeters, 4 BP Apparatus, 2 Fetal Dopplers, 2

Medication Trolleys, among others. This came on the heels of a similar donation by the Club in August.

Two individuals (a stroke patient and another with intestinal disorder), were provided various nancial support totaling GHS 8,500 to undergo medical treatment at the same event.

The Health Director said the donations will go a long way to ease the stress and struggles of health workers in the bene ciary facilities and also promote the health of indigenes of the communities.

The Club also donated assorted food items worth about GHS 7,000 to Patmos Children’s Home in the Adansi Asokwa district.

Receiving the items on behalf of the Orphanage home, Cecilia Osei Wusu, a Caregiver lauded the Club for what she described as a timely intervention insisting that it will enable the children make merry during the Christmas season.

The total cost of the donations on the day amounted to GHS 50,000.

The President and Founder of the Club, Jacob Edmund-Acquah said the Club since its establishment has contributed in changing the lives of individuals and institutions with targeted donations.

He said feedback from the beneciaries over the years, lends credence to the impact the Club has made since it was formed in July 2020.

Whiles praising MTN Foundation for supporting the Club with GHS 20,000, he also appealed to other corporate bodies to consider making similar donations to support and promote the Club's activities.

The Obuasi Municipal Health Directorate however, presented a citation to the Fifty Club in recognition of their support to healthcare delivery in Obuasi and its surrounding communities within the Ashanti Region.

Sta from Stanbic Bank’s Commercial Banking, Accra North Suite, have begun the season of giving with a donation to the Airport Police Kindergarten and Primary C&D School at Airport, Accra.

The team donated items including books, mathematics sets and other stationery valued at GHC 9,500. The team also spent time with the students of the school and presented them with some food items.

The Head of Commercial Clients at Stanbic Bank, Alhassan Iddrisu Danaa, who presented the items on behalf of the bank said the donation was part of the bank’s overall goal to drive national growth.

He stated that, “As a bank, Stanbic is not only interested in making

pro t. We always say that Ghana is our home and we drive her growth. It will not be possible to drive the growth of the country without supporting education especially among young future leaders. By supporting their education, we believe that it gives them a better chance to grow up and become very productive members of the community”.

“We are grateful to the headmistress and the entire sta of this school for the warm reception that we received today. Raising and educating these children is a very important job and we are impressed by your dedication.

Apart from the stationery items we also have some drinks and biscuits to help the children enjoy the Christmas celebrations. These items are just the beginning and

we will de nitely return to do more”, he added.

The Headmistress of the school Madam Gloria Yeboah received the items on behalf of the school and thanked the bank for their generosity. She said, “If you look around, you can see that our school has a lot of challenges. We reached out to a lot of people for help but they rarely respond. We are very grateful to the Commercial Clients team of Stanbic Bank for taking time out of their regular schedules to join us here today. Inadequate stationery is one of the chal lenges we face as a school and it makes teaching and learning di cult. Because of the dona tion that you have made, more students will be able to take part in academic activities. We

are truly grateful and we pray your business continues to grow.”

Throughout the year, members of sta from various departments of Stanbic Bank Ghana have engaged in various employee community initiatives as part of the bank’s employees’ community engagement activities. In the