nue measures, the electronic trans fer levy (E-levy), downwards from 1.5percent to 1 percent, coupled with an increase in the Value Added Tax (VAT) from 12.5percent to 15percent rate.

This was disclosed by the Finance Minister, Ken Ofori-Atta, on Thurs day when he presented the 2023 budget to Parliament.

According to him, government has received several proposals for review of the Electronic Transfer Levy and is working closely with all stakeholders to evaluate the impact of the Levy in order to decide on the next line of action which will include revision of the various

the headline rate will be reduced to one percent (1%) of the transaction value alongside the removal of the daily threshold.

need to ramp-up the country’s domestic revenue mobilisation

agenda. “Last year, we started with the E-Levy which has not yielded the resources as expected.”

He said “The headline rate from 1.5% will be reduced to one percent (1%) of the transaction value as well as the removal of the daily thresh old,”

Among others, Mr. Ofori-Atta stated that the government intends to spend a total amount of GH¢205.4bn in 2023, including the clearance of its arrears.

revenue target of GH¢143. 9 billion –a situation which means govern ment will have to borrow GH¢ 61.9 billion from external sources to

“Total Revenue and Grants is projected at GH¢143,956 million (18.0% of GDP) and is underpinned by permanent revenue measures –largely Tax revenue measures –amounting to 1.35 percent of GDP as outlined in the revenue measures. Mr. Speaker, Total Expenditure (including clearance of Arrears) is projected at GH¢205,431 million (25.6% of GDP). This estimate shows a contraction of 0.3 percentage points of GDP in primary expenditures (commit ment basis) compared to the projected outturn in 2022 and a demonstration of Government’s resolve to consolidate its public

Further, on the increment in the VAT he explained that “unfortu nately, with the current economic

cated source of funding for road these demands. In that regard we are proposing the implementation of new revenue measures. The major one is an increase in the VAT rate by 2.5 percentage points.

The 2023 Budget, he announced will focus on government’s resolve to structurally transform the economy, as it plans to aggressively mobilise domestic revenue; boost local productive

vibrant value-added export sector; streamline expenditures; protect

and vulnerable; expand physical infrastructure; implement structural and public sector reforms.

Ofori-Atta indicated that the of the debt has been of exchange rate depre particularly on external as the crystallization of recent years.

current debt sustainability conducted reveals that now considered to be in

risk of debt distress, he noted.

rationalisation, government has the following directives

MDAs, MMDAs and SOEs are directed to reduce fuel alloca tions to Political Appointees and heads of MDAs, MMDAs and SOEs by 50%.

A ban on the use of V8s/V6s or its equivalent except for cross country travel. Limited budgetary allocation for the purchase of vehicles. Only

government including SOEs shall be shall be allowed for board members.

Accordingly, all government institu tions should submit a travel plan for the year 2023 by mid-December of all expect

Government sponsored external

dent, Ministries and SOEs must be year; Reduction of expenditure on appointments including salary freez es together with suspension of certain allowances like housing, utilities and clothing. A freeze on new tax waivers for foreign compa nies and review of tax exemptions for free zone, mining, oil and gas companies; A hiring freeze for civil and public servants, No new govern ment agencies shall be established in 2023; There shall be no hampers for 2022; There shall be no printing of diaries, notepads, calendars and other promotional merchandise by MDAs, MMDAs and SOEs for 2024; All non-critical project must be suspended for 2023 Financial year.

The current GDP of the country is expected to reach US$72 billion dollars by the end of 2022.

mission. The authors gave practical examples on how to what happens to us when we do not budget our expenses. A practical example is that of Samuel’s colleague who went to the market with a budget and make extra expenses that was not planned for and ended up with only transportation forgetting that trans portation these days can not be predicted.

and sharp deviation from the invest ment hullabaloo.

Money is little more than a tool that comes with a responsibility to use it wisely. The rich man is a fool who dies

Former Holder for the largest book signing and bestselling author of And Justice For All once said, “A Person

How true his statement is and even more now in these times. There is a need for everyone especially business owners to learn and know the basic rules of money. Even more important is the knowledge needed to make money work for you. In this masterpiece, the authors sort to educate owners of businesses and startups on explor ing clear road maps to navigate the market.

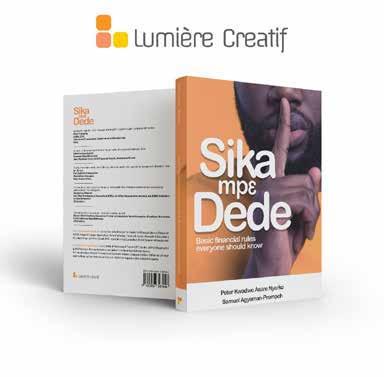

was the name. Sika mpe dede, a maxim the President used in his address to the nation which spread

book expands the many nuances of money which come to play in the life of the layman and the econo mist. In the quest to make the broad business subject easier to relate to and understand, the authors make use of everyday examples by making reference to the use of social media, and the stories of common brands such as the Mercedes Benz. Another striking feature of the

instead of

and topics. The book has seven rules (chapters) and each chapter elaborates on a basic rule of money.

Using the local nickname for side gig, the authors captured a relevant topic for discussion by a lot of people both in the corporate and informal sector. They drummed the need to have multi ple sources of income spiced with applicable ideas that people over look. They also touch on ways to balance the main hustle with the side hustle.

The authors display rich knowl edge on the happenings in the lives of consumers who are plagued daily with products they may not need. This rule focuses on frugal living as we spend and save money for unforeseen situations which we do not plan for. A case study is made of the COVID-19 and the Russia- Ukraine war.

This chapter admonishes us to give our money a mission because it has

Rule 4:

This rule might not be palatable to many considering the recent dips in investment. Yet, the authors prove a point and impress on the reader greatly. We all at a point try to live to the expectations of other people or spend beyond our budget when we go out with friends. We forget that the aftermath of the Joe Impre

Rule 5: Be Driven

“Be driven” a very simple but delicate phrase that guides our way in life. Have no plans for life and risk life changing opportunities. The authors ask pertinent questions that keep the reader on the edge of his seat. Though uncomfortable, this chapter puts a lot of things in perspective. I daresay this chapter adds a motivational touch to the book.

Rule 6: Plan for Financial Indepen dence & Retirement

This is a very sensitive subject many of us try to ignore in our youth but

Financial independence and retire ment (FIR), major expenditures, taxes, insurance, and estate and gift planning should all be included in our future. The authors break down the complex, confusing language of investments and guide the reader in choosing the investment plan that works for them. A refreshing read

that his wealth does well during his lifetime and after his passing. “A giving life is a great life. The act of giving is a great way to touch and impact thousands of people, millions of people, and even billions of people.” Peter Kwadwo Asare Nyarko.

This masterpiece Sika Mpe Dede speaks on the many silent topics regarding money and its usage in our society and the world at large. A great companion to the student confused about money to the trader who seeks to make the most of his money to the investor who is in a dilemma on what to do in these times.

The masterpiece is the work of anoth er addition to the knowledge econo

(CPT) by the International Association of People & Performance Develop ment (IAPPD-UK) Samuel

Financial Fitness Coach (FFC-USA); Peter Kwadwo Asare Nyarko. Samuel and Peter's ‘Sika Mpe Dede’ is

times.

Sika Mpe Dede is set to be launched on the 25Th of November at the Westlion Co, Accra opposite Wisconsin Univer sity at 1 pm.

The book launch is preceded by the Startup Dialogue with business experts, sharing important nuggets on hustle and investment.

The 97 paged book is published by Lumière Creatif a marketing commu nications company with bespoke publishing services.

Get a copy of this masterpiece to turn

unveiled the winners of their World Cup Promo “To Qatar, We Go Promo tion” in a brief but exciting ceremony

event was witnessed by customers, members of the media, management

FBNBank “To Qatar, We Go” Promotion was launched in August year by the Bank with the aim of garnering support for Ghana’s senior national team, Black Stars at this

year’s FIFA World Cup in Qatar. It was open to both FBNBank customers and prospects as well as members of the general public.

The ‘FBNBank To Qatar We Go’ promotion commenced on 1st August, 2022 and ended on the 31st October, 2022.

paid trip to Qatar which was won by Hakeem Abuba, Seidu Kwaku Tawiah and Cynthia Nyarkoah, all customers

of the Bank. Other prizes include 43-inch Smart TV sets plus GOtv decoders which were won by Emmanuel Ennin, Samuel Opoku Agyei, Benedicta Amissah, Janet Afrakomah, Edwin Nii Armah Ama Yeboah. In all, ten customers of the Bank received prizes at the event.

Speaking at the ceremony, Victor Yaw Asante, FBNBank’s Managing Director said, “at the end of last month, we gathered here to draw the curtain on our ‘To Qatar, We Go Promotion’ under the supervision of the National Lottery Authority. Out of the many customers who took part, ten lucky ones were drawn as winners. Our brand enjoins us to put our stakeholders have set out to do by supporting the Black Stars to prepare for the World Cup and to provide opportunities

for Ghanaians to be behind them.

The Bank has earlier on made a cash donation of Two Hundred Thousand Ghana Cedis (GH¢200,000) to the Black Stars during their preparations to the tournament. This was the Bank’s contribution of putting the team in great shape in order to increase their opportunities to put in an improved performance at the World Cup. On the back of that support, we rolled out the ‘To Qatar, We Go Promotion” for our customers. We wish all of you winners well as you journey to Qatar to support the national team. ble, I say thank you. Your passion for bringing to life what our brand stands for and making everyone appreciate what we mean by the ‘gold standard of value and excel lence’ is commendable.”

will travel to Qatar to take part in the sands of Ghanaians already in Doha who will be cheering on the Black Stars to win laurels for Ghana.

The winning customers were elated with the prizes they won and expressed gratitude to the Bank for the recognition and honour accord ed them. One of the winners, Seidu Kwaku Tawiah said, “FBNBank has really shown that they keep their word. Personally, I never dreamt that I will be a fan at a FIFA World Cup in my lifetime. However, FBNBank has made this possible. My

support that we can to our players and hopefully, great things will happen. We thank FBNBank. God

good services and products. The

good thing is that the other custom ers who will not be joining us in Qatar got TV and decoders so they can also enjoy the matches. FBNBank has truly made us proud.”

FBNBank has in its 26 years of oper ating in Ghana remained focused on putting its customers and communi

through the rich value and excel lence of what the Bank contributes to the relationship with its stakeholders as a whole, particularly the custom ers. FBNBank Ghana is a member of the First Bank of Nigeria Limited Group which is renowned for its great customer service and general stakeholder engagement garnered over its 127 years of operation.

FBNBank Ghana has 23 branches and three service points across the coun

individuals and businesses in Ghana.

The Hon. working Ghana iarization tour.

In Minister

the Bank. Hon. Cudjoe mentioned that, in March 2022, H. E. The Presi dent of the Republic charged him with oversight of the State Interest and Governance Authority (SIGA) cy of all entities that the Govern ment has interest in. This include CBG.

“My visit today is to familiarize myself with the activities of the

to provide simple, secure and to customers.

“We want customers' journey to be simple and secure because of our all we do.”

We have automated our loan origi nation which allows us to process and disburse loans in two days he said.

help build a sustainable culture

“Training is a key focus area in the Bank, of which an academy has been established to train and build the

In conclusion, the Minister commended the Management of CBG for a good work done. Hon. Cudjoe indicated his willingness to assist in achieving its vision whenev-

contribute a He Enter the

fore issues inherent in same for the attention of the President’s Cabinet and the Economic Management Team.

that the Ministry was developing a state ownership policy for the deployment of portfolio manage ment to ensure all state entities

team in increase their improved Cup. On rolled Promo wish all journey national Your what our every by the excel part in the in Doha Black

FBNBank has made this possible. My

support that we can to our players and hopefully, great things will happen. We thank FBNBank. God

good services and products. The good thing is that the other custom ers who will not be joining us in Qatar got TV and decoders so they can also enjoy the matches. FBNBank has truly made us proud.”

FBNBank has in its 26 years of oper ating in Ghana remained focused on putting its customers and communi

Yeboah. In all, ten customers of the Bank received prizes at the event.

Speaking at the ceremony, Victor Yaw Asante, FBNBank’s Managing Director said, “at the end of last month, we gathered here to draw the curtain on our ‘To Qatar, We Go Promotion’ under the supervision

have set out to do by supporting the Black Stars to prepare for the World Cup and to provide opportunities for Ghanaians to be behind them. The Bank has earlier on made a cash donation of Two Hundred Thousand Ghana Cedis (GH¢200,000) to the Black Stars during their preparations to the tournament. This was the Bank’s

The winning customers were elated with the prizes they won and expressed gratitude to the Bank for the recognition and honour accord ed them. One of the winners, Seidu Kwaku Tawiah said, “FBNBank has really shown that they keep their word. Personally, I never dreamt that I will be a fan at a FIFA World Cup in my lifetime. However,

through the rich value and excel lence of what the Bank contributes to the relationship with its stakeholders as a whole, particularly the custom ers. FBNBank Ghana is a member of the First Bank of Nigeria Limited Group which is renowned for its great customer service and general stakeholder engagement garnered over its 127 years of operation. FBNBank Ghana has 23 branches and three service points across the coun

individuals and businesses in Ghana.

my aggressively but sustainably. This push has seen the introduction of several initiatives such as the Digital Addressing System, a called Ghanacard which is being linked to all systems and services, Mobile Money interoperability, digital renewal of National Health Insurance, electronic pharmacy platform, and several others. The biggest institutional winners on the night were Volta River Authori ty (VRA), Anglogold Ashanti, Voda fone Ghana Foundation, MTN Ghana Foundation and Absa Bank

four and four honours respectively.

A call for public-private partner ship

of the National Development plan ning Commission of Ghana, who delivered a speech and received the honour on behalf of the Vice Presi dent, thanked the organizers for the special honour bestowed on the Vice President and charged business leaders to work closely with government and the public sector to stem the impact of climate change on the environment.

the public and private sectors cannot be overstated. There is a very tall list of instances and impact of partnerships but the most practi cal example of this is the joint response of both parties during the pandemic. It was a sharing of resources including time and strate gies which brought out the best in us at a time when humanity was most under attack. We can extend this partnership to the people whom we serve, either citizens or

customers to keep climate change in check,” he said.

Board Chair of the awarding committee, Dr. Diana Heymann Adu also urged organization to embed in their organizational struc ture sustainable activities that will help in enhancing the organisa tions.

Best Company in Charitable Giving, Fidelity Bank; Clean Water Provi sion Project, Vivo Energy; Climate Change Mitigation Projects, Volta River Authority; Economic Empow erment, MTN Ghana Foundation; Educational Sustainability Project, UBA Ghana; Employee Volunteer ing Initiatives, MTN Ghana Founda tion; Environmental Sustainability Project, Ecom Ghana; Financial Inclusion & Literacy Project, Access Bank Ghana; Girl Child Education & Empowerment Programme, Golden Star Wassa; and Good Governance & Transparency in Sustainability Reporting, Anglogold Ashanti. Project Promoting Arts & Culture, JRA Cosmetics; Promoting & Supporting Agriculture and Agribusiness, Advans Ghana Savings & Loans; Project Promoting Good Health & Wellness, Vodafone Ghana Foundation; Project Promot ing & Supporting STEM Education, Absa Bank Ghana; Project Promot ing Road Safety Education & Prac tices, Golden Star Wassa; Project Providing Educational Facilities, Golden Star Wassa; Project Supporting Educational Institu tions, Anglogold Ashanti; Educa tional Sponsorship Project, MTN Ghana Foundation; Supporting Local Content, B5 Plus Group; Promoting Gender Equality, Diver-

sity and Inclusion, Anglogold Ashan ti; and Promoting Voluntary Blood Donation, Lister Hospital & Fertility Centre.

Community Development & Infra structure Project, Vivo Energy Ghana; Livelihood Empowerment & Skills Development Project, Ecom Ghana; Stakeholder Engagement, Ghana Shippers Authority; Support ing Government Institutions, FBN Bank Ghana; Supporting Health Institutions, Vodafone Ghana Foun dation; Supporting SMEs & Start-ups, TotalEnergies Marketing Ghana; Supporting Sports Development, Interplast; Women Empowerment Project, Absa Bank Ghana; Youth Development & Empowerment Project, Fidelity Bank Ghana; Men torship Project, UBA Ghana; Health Awareness Education Programme, Anglogold Ashanti; Best WASH Initiative, Volta River Authority; and Disability Support & Employment Project, Opportunity International Savings & Loans.

SSI Innovative Project, Absa Bank Ghana (Absa Ready to Work Programme); SSI Project (Health), Access Bank Ghana (Fistula); SSI Project (Education); Karpowership Ghana; SSI Project (Environment), Volta River Authority (VRA Refor estation Pogramme); SSI Project (Socio-Economic), MTN Ghana Foundation; SSI Team of the Year, Vodafone Ghana Foundation; Com munity Support Project, Ghana National Gas; Best Partnership and Collaboration, Ecobank Ghana; SME of the Year (Small Business; Big Impact), Baraka Impact Ghana; Net Zero Carbon Strategy, Volta River Authority (CFMP); Sustainability & Operational Excellence Award, Total Energies Marketing Ghana; Product

Innovation Award, Bel-Aqua; SDG Pioneer of the Year, Volta River Authority; Providing Health Facili ties, Anglogold Ashanti; SSI Founda tion/Company of the Year, Vodafone Ghana Foundation.

Eco-Conscious Water Company, Bel-Aqua Mineral Water; Post-Disas ter Rehabilitation Support Programme, Ghana National Gas; Climate Change Leadership Award, Emmanuel Antwi-Darkwa, CEO of VRA; Women Empowerment Leader ship Award, Audrey Abakah, Head, SME Banking at Absa Bank; Female Personality of the Year, Ms Benonita Bismarck, CEO of Ghana Shippers Authority; SSI Disruptive Digital Pioneer Award, Alhaji Dr. Mahamu du Bawumia, Vice President, Repub lic of Ghana; and Social Impact Champion, Dr. Janet Amoanimaah Aggrey, CEO, Jaggreys Fertility Hospital.

CEO of the Year, Daniel Sackey, CEO of Ecobank Ghana; Stainability Professional, Emmanuel Baidoo, Senior Sustainability Manager, Anglogold Ashanti Ghana; Health Advocate, Dr. Edem K. Hiadzi, CEO, Lister Hospital and Fertility Centre; STEM Advocate, Naa Adei Dsane-Boateng, Executive Director, Youngstars Dev. Initiative Ghana; Disability Support Leadership Award, Kwame Owusu-Boateng, CEO, Opportunity Int. Savings and Loans; Humanitarian of the Year, Jane Reason Ahadzie, CEO, JRA Cosmetics; and SSI Exemplary Lead ership Award, Rev. Amaris Nana Adjei Perbi, Country Head, Vodafone Gh. Foundation & Sustainability.

Campina, Vivo Energy Ghana, Meridian Port Services (MPS), Price waterhouseCoopers (PwC) and Allianz.

The Orange Corners Ghana programme is a six-month accelera tion programme which includes access to working space at the Ghana Innovation Hub in Accra and its regional training centers in Ho, Kumasi, Takoradi and Tamale). The 2023 program is scheduled to start in January 2023 to June 2023 and will be in two phases.

and investment readiness with the aim to apply for a growth loan from the Orange Corners Innovation Fund (OCIF) managed by Fidelity Bank Ghana, of up to EUR50,000 at 5% interest with a 2-year tenor.

To be part, you should be a regis tered, youth led business, and the founder being between the ages of 18 35 years. The business must have been in operation and making sales for over a year and can produce

The Embassy of the Kingdom of the Netherlands has opened applica tions for the 2023 edition of its Acceleration Programme, Orange Corners. Ghanaians interested in being part of the programme have until 30th November 2022 to submit their application to be considered for the programme.

Orange Corners is an initiative of the Kingdom of the Netherlands executed by MDF West Africa at the Ghana Innovation Hub in Accra and its regional centers in Ho, Kumasi, Takoradi and Tamale in collabora tion with key private sector partners including Fidelity Bank, Emergent Payments, Friesland

online component, focused on the business model, where the teams will complete online e-learning mod ules, masterclasses, training work shops and peer-to-peer sessions.

The second phase is a Boot camp, also for a duration of three months where smaller group of companies workshops and individual coaching

ship and Human Resource strategies

year (2022). The applicant should be located in the region of application, Accra, Ho, Kumasi, Takoradi and Tamale and your business, products or service should have a clear innova tion and impact along your business value chain.

Apply before November 30th, 2022

form accessible at bit.ly/OR ANGECORNERSGH. Please reach out to accra@orangecorners.com or call 0556959376 in case of any questions.

gal and South Africa in alignment with this year’s selection criteria. Our team is eager to work closely

day in December.”

Here are details of the startups who have made it in the 2022 MEST Africa Challenge:

Sproutly Inc (Nigeria)

Building the tech infrastructure for investing in Africa.

Desert Green Africa Agri-Investments (South Africa)

Desert Green is an Agritech trans forming the Informal Agri-value chain in Africa by providing a more

from small scale farmers to informal traders.

They include Sproutly (Nigeria), Kweli (Senegal), Swoove (Ghana), Hisa (Kenya) and Desert Green Africa (South Africa)

The pan-African pitch competition opened applications in July this year for pre-seed and seed-stage technology startups in Ghana, Nige ria, Senegal, Kenya, and South Africa to bid for the ultimate prize of $50,000.

After going through the online application, regional pitches, and founder interview phases of the

Each startup will represent their

country at the Demo Day and Final Pitch Competition that will be held in Accra Ghana in December 2022.

Speaking on the selection of the top 5 startups, the Director of Portfolio at MEST Africa, Melissa Nsiah said:

“It hasn’t been an easy process. Mostly because, this year, we saw so many valid business models and met some incredible founders with huge visions that align very closely with ours.

able to zero in on the cream of the crop to select the top 5 companies from Ghana, Nigeria, Kenya, Sene-

Digital Banking, Tuition Financing for Teens & Students and Payments, Education Management and Credits for Schools. Kwely Inc (Senegal)

An innovative made-in-Africa B2B brand incubation and digital distri bution platform.

Swoove Inc (Ghana)

Swoove is a last mile delivery and ecommmerce infrastructure for SME's and commerce companies on the continent.

Hisa Inc (Kenya)

The failure of the cryptocurrency exchange FTX, the latest in a long shenanigans, was a doozy. “Never in my career have I seen such a complete failure of corporate controls and such a complete information as occurred here,” said the corporate restructuring special ist John Ray III, who is now oversee ing FTX’s bankruptcy.

The FTX collapse is only the latest in a sector that has been pummeled since April 2021, when the value of

just crypto. After markets sliced $89 tion, CEO Mark Zuckerberg announced he was shedding 13% of the company’s workforce (11,000 people). Then, within days of Elon Musk’s takeover of Twitter, which he purchased apparently on a lark for $44 billion, many began to fear for the platform’s future.

Idiosyncratic individuals wielding billions of dollars, intent on build ing corporate empires (including philanthropic ones), are far from unknown in the United States. Reading about Sam Bank man-Fried, FTX’s disgraced found-

er and former CEO, I recalled the “Erie Wars” of the late 1860s, when access to gargantuan amounts of capital and credit, sought to build tions: the transcontinental railroads. The railways got built, cial waste and corporate intrigue.

By Jonathan LevyMEST will provide the winning start up with investment capital to the amount of $50,000, coaching and access to a global network of resourc es and partners as they build and scale successful businesses that add value to African economies and liveli hoods.

All participating startups will have

host of exciting perks from MEST Africa and its strategic partners including global visibility, building their networks, professional coach ing, mentorship from experts, and the opportunity to join the global MEST community for lifetime bene

At the center of it all was Jay Gould,

history. In 1868, Gould, a young man recently arrived on Wall Street, took on the aging Commodore Cornelius Vanderbilt, who had made his fortune in steamboats. After the Civil War, Vanderbilt began to buy up shares of the New York Central Railroad, hoping to take control of it.

To conceal his intentions, Vanderbilt bought the stock by proxy. But Wall Street speculator Daniel Drew caught wind of it. Drew, a director of the competing Erie Railroad, loaned himself Erie stock, which he used as collateral to buy New York Central shares. Vanderbilt, angered that he now had to pay more to buy New York Central, cut a deal with Drew and worked in unison to bid up the

Drew, a former cattle-driver who fed salt to his herds so that they would drink more water and take on more weight, soon double-crossed Vanderbilt, joining with Gould and his partner, James Fisk, Jr. During the Erie Wars, Drew, Gould, and Fisk “watered”

cates in excess of the plausible value of the railroad’s existing assets. A New York judge in Vander bilt’s pocket ruled against them.

York with suitcases full of cash and Erie stock and bonds. I imagine the trio laughing and waving goodbye to Manhattan as they decamped to Jersey City, New Jersey much like Bankman-Fried and his coterie of chums, who became millionaires and billionaires while working beyond the reach of regulators from a Bahamas resort.

the Erie Wars than it does today. The US was struggling to return to the gold standard, and the Federal Reserve did not exist. Still, during these years, given the recent centralization of US capital markets in New York City during the Civil

with credit, which made possible the egregious manipulations and schemes of Gould, Drew, and their ilk.

tion, corporate access to easy credit fueled booming investment in the much of it was unproductive.

grabbed the cash, bought up land, and built railroads across Native Americans’ sovereign territories before competitors could arrive. When workers struck for higher wages and eight-hour days, they crushed them.

The specter of corporate monopoly loomed. But so did the menace of

hence money drained out of the age, there were two particularly 1893, followed by crippling economic depressions.

THE DIGITAL LAND GRAB

The parallels to today seem clear. Taking advantage of the low inter est rates of the 1990s and 2000s, and then the ultra-low rates that prevailed for more than a decade

crisis, Big Tech grabbed cheap money in order to gobble up rival companies, engineering talent, and

whenever possible. And now, with interest rates rising fast, there is less credit bidding up stocks and crypto currencies, and it turns out that for many companies that had been

to consumers at below cost may not be a viable long-term business strat egy.

Abundant credit, it seems, inevita bly taints animal spirits with greed, leading to excess and corporate malfeasance. It would be far better

and subject companies to the whip of scarce capital and market competition, right?

Not necessarily. What matters is not so much the sheer volume of credit as where it goes and what it funds relative to society’s preferences and needs. So long as legitimate prefer ences and needs exist, there is no such thing as overinvestment. There are only bad investments. Morally speaking, the right response is to recoil at reports of Bankman-Fried’s shenanigans,

throwing out “bad apples” before they spoil the entire barrel is not the central issue. The problem is not excess and greed, or even the

that something has gone awry at the nexus of political and economic power.

The Erie Wars are well known partly because they were the subject of the book Chapters of Erie (1871), co-au thored by Henry Adams and Charles Francis Adams, Jr., grandsons of US president John Quincy Adams. The Adams brothers, too, warned their readers not to focus on private greed but rather on politics. Reading their description of Vanderbilt, I cannot help but think of Musk ensconced at Twitter:

“[He] has combined the natural power of the individual with the factitious power of the corporation.

The famous “L’état, c’est moi” of Louis XIV represents Vanderbilt’s position in regards to his railroads. Unconsciously he has introduced Caesarism into corporate life…. Vanderbilt is but the precursor of a class of men who will wield within the state a power created by the State, but too great for its control.” Corporations – the Erie Railroad and Twitter, the New York Central

instance legal creatures of the state, and Vanderbilt was indeed a precur sor to the “class of men” who wield so much power today.

THE RETURN OF THE REPRESSED In a sense, FTX’s implosion is ironic, because Bankman-Fried’s mother, the Stanford Law professor and philosopher Barbara H. Fried, wrote

rate power: the public utility ideal. News reports have focused on a supposedly revealing essay by Fried in which she wrote that a desire to locate “personal blame” had “ruined criminal justice and economic policy.” But she was right. Followers of the FTX saga would do better by turning to her indispens-

able book The Progressive Assault on Laissez Faire: Robert Hale and the First Law and Economics Movement, published in 1998, when her son was six.

Hale, a Columbia law professor and economist, tirelessly argued that, because the railroads and corpora tions like electric utilities provide essential public services, they should earn a “fair” rate of return on invest ment, given their production costs, but nothing more and certainly not

credit-bloated capital markets. It is not clear that cryptocurrency

although I agree with the judgment of Bocconi University’s Massimo Amato and Luca Fantacci that, in challenging the current global mone tary system, crypto “poses the right question, but gives the wrong answer.” The public utility case is easier to make for social media companies.

Regulatory principles like “public utility” deserve rediscovery. Others do not. Among them, I would count

bureaucracy during much of the twentieth century, which sapped the dynamism of enterprise. The prob lem is that when dynamism came roaring back in the neoliberal 1990s, greater inequality amid newfound tech riches, as well as a lot of corpo rate fraud and malfeasance, came back with it.

Much of what Big Tech values is praiseworthy, from fun (a good thing) to wondrous creativity. But the meltdown of FTX, and the

have once again exposed the costs of blindly worshipping enterprise and

leave matters of vital public impor tance, including citizens’ savings and the principal means of public communication, to the whims of paper billionaires’ puerile fantasies.

On August 29, 1997, two gentlemen, Marc Randolph and Reed Hastings incorporated a company in the US state of Delaware. It was a US-based video business called Kibble, before the name was changed to NetFlix

It began DVD rentals by mail in April 1998, and introduced its subscription model the following started streaming videos and changed the way people watch

ing quickly, with about 120 employ ees and had been planning an IPO but was forced to put that plan on hold after the dot-com bubble burst and the September eleven attacks

third of its employees. But by early 2002 their DVD-by-mail subscription business was growing like crazy since DVD player became a special Christmas gift the previous year.

Suddenly they had far more work to do, with thirty percent fewer employees. One day Patty McCord,

being concerned went over to talk with one of their best engineers. This engineer had managed three but now he was a one-man depart ment working very long hours. So, Patty, in order to encourage this very engineer, told him not to

worry, "I hope to hire some help for you soon" she quickly said to him. Guess what his response was. This engineer who was doing the work of three persons coupled with his, rather than feel excited, surprising ly responsed, “There’s no rush I’m happier now.”

What? Why would he say such a thing happier doing the job of three engineers added to his? In the

ed HR, Patty McCord revealed that the three engineers that were laid

merely adequate. Their manager whom Patty was talking to at the time realized when they were gone that he’d spent too much time riding herd on them and

the two situations of working with those engineers and working alone he said, “I’ve learned that I’d rather work by myself than with subpar performers.”

Every role performed excellently, requires talent No matter the role small or big in any organization, there is a certain recurring pattern of thought, feeling or behavior that is required to perform that role excellentlythat's talent.

If, for example, you run a school there is a certain pattern of thinking that makes great teachers perform excellently.

So, if you want to increase produc tivity in your school and outperform

out this (you can get a good consul tant to help you do this) and ensure you bring on board teachers who think, feel and behave that way. Policing, investigative journalism will require talent like cynicism: healthy mistrust. The same with great nurses. I was at the hospital the other day and a friend of mine who had a loved one admitted in that hospital complained to me about the attitude of some nurses.

It was so bad that he wondered why such people have to be nurses at all. The problem is basically from the people that hire those nurses; they did not take time to consider the talent of the nurses they were recruiting.

So, they employed nurses that lacked empathy which is actually a talent of great nurses. It's been observed that when people of same level of experience and intelligence in a role are given same training and tools to work, those whose talents

selves and perform better. The key to excellent performance is matching talent with role Research conducted by McKinsey shows that, organizations that allocate right talents to right roles

zations tend to outperform competi tors 2-to-1." People add their most values when they play roles that match their talents. They may not necessarily lack the skill, knowledge and talent required to get work done but having them in the wrong role reduces their productivity.

It's an error to employ someone who doesn't have the talent you're look ing for hoping you will train them into performing the way you want. In reality you can teach your customer service employee what to say to your customers, how to greet them but you can't train them to care more for them. Care is something that happens naturally and unconscious ly it's a talent. Therefore, the right approach to fostering productivity and achieving optimal performance in any organization is to have a round peg on a round hole. And more importantly, this is one thing that when achieved can't be replicated by your competitors.

Godswill O. Erondu is the pioneer, Africa Workplace Leadership Summit. He is a leadership expert and works with organizationsprivate and public to transform their leadership and culture in order to achieve superior performance and

Labadi Beach Hotel, Accra on Satur day 12th November 2022 by Rotary International District 9102.

This maiden event, which had Ms Abena Amoah the newly appointed CEO of Ghana Stock Exchange as the Special Guest Speaker, was to celebrate Rotarians who have contributed to the good works of the Rotary Foundation and also encour age others to join the worthy cause.

facilitate long term capital and provide a platform for individuals and institutions to trade securities, the institution had celebrated some

markets to satisfy various sized companies or growing the equities market and have returned an aver

tors since 1990 with its process being automated since 2009. The Ghana Stock Exchange has won a number of awards over the years.

Her fascination with the content of her grandmother’s standing ward robe drove her into her career of investment banking and her curios ity grew each time she went through the stories of each item wealth creation and giving gener ously was instilled by “this remark able woman”, to quote Ms Abena

Amoah. This woman had single handedly looked after her children and a lot more others through her

aligned with Rotary’s motto, “Service Above Self”. This was a story that kept everyone in the room captivated and yearning to hear more at the Major Donor and Paul Harris Society ball held at the

Not new to Rotary, Ms Amoah certainly felt at home as she deliv ered the keynote address. She had many friends in the organization and had been a speaker at a number of Rotary clubs and interestingly, her father had worked at Texaco Ghana Ltd with Dan Michael Quist who introduced Rotary into Ghana in 1958.

In her address, Ms Amoah spoke about the thirty-two year old Ghana female Managing Director just like

With the task of getting more compa nies to list on the bourse and improve liquidity and returns for investors, Ms Amoah equated the Ghana Stock Exchange to the core principles of Rotary Integrity, Diversity, Service, Leadership, and Fellowship/Friendship. These ideals, in her opinion, foster sustainable wealth creation, a key requirement for the improvement of lives. The lives of the underprivileged especial ly that of children can be unbearable. The last twelve years have been an eye opener for her in this regard as she personally here travelled the

managing a rare condition for someone close to her and has increased her desire to work more on charity causes and sponsor

reason she supports many organi zations in various forms, using her network.

“We hold the solution to many of our social challenges,” she stated as she highlighted her drive and passion to enhance investment literacy, which is important to creating the wealth needed to assist our communities.

Concluding her address, she quoted, “Happiness is not about

what we posses but rather what we give. The gifts God has given us are not meant only to bring us satisfac tion but rather to be a blessing to others. When we share what God has given us and seek to bring Him

for our lives and this produces true happiness”, and urged everyone to grow in true happiness.

As the evening of celebration drew closer to an end, Sir Sam Jonah, the Guest of Honour spoke few words of encouragement to the cause and pledged his support to the Rotary Foundation.

The Rotary Foundation is the

national to achieve world under standing and peace through interna tional humanitarian, educational and cultural exchange programs. It is supported solely by voluntary contributions, which allow Rotari ans to become Major Donors and/or members of the Paul Harris Society. A Major Donor has cumulatively donated ten thousand dollars to the Rotary Foundation while a Paul Harris Society member donates one thousand dollars to the Rotary Foun dation annually.

tive and well-managed charitable organizations in the world, the Rotary Foundation helps Rotary

members to advance world under standing, goodwill, and peace by improving health, providing quality education, improving the environ ment, and alleviating poverty.

Rotary International is the world's about 1.4 million members in over 42,000 clubs worldwide. Rotary Club members are volunteers who work locally, regionally, and interna tionally to combat hunger, improve health and sanitation, provide education and job training, promote peace, pursue worthwhile social causes and are lead partners in such worldwide activities such as the Global Polio Eradication Initiative (GPEI).

COVID-19 has left a generation scarred in its wake. From the linger disruptions to supply chains across the world to the apprehension whenever an unmasked person sneezes, especially, in an enclosed space, the impact is undeniable. Ghana’s response to COVID-19 was heralded globally for being swift and comprehensive, and in many ways, it was. Restrictions on move ment in the earliest days, which were characterized by gross uncer tainty, the mandatory wearing of masks in public spaces and support for business were all enforced fairly well.

These measures, in part, kept the total number of positive cases to approximately 171,000 0.54 percent of the population, using the 2021 Housing and Population Census and a mortality rate of 0.85 percent (1,460). This compares favourably, for instance, with the 4.03 million cases record ed among South Africa’s 60 million, where, unfortunately, 102,000 persons died from the illness as of August 2022.

The most important component of undoubtedly the vaccines, which one study found that between December 2020, and December 2021, saved an additional 14.4 to 19.8 million deaths in 185 countries. Acutely aware that successful deployment could, among other things, improve the mental and emotional well-being of the citizen ry, decrease morbidity and mortali ty, and minimize disruptions to social and economic functions, managers of the pandemic response developed a National Deployment and Vaccination Plan (NDVP).

This was executed by applying the World Health Organization’s (WHO) Strategic Advisory Group of Experts on Immunization (SAGE’s) frame work for the allocation and prioriti-

zation of vaccination.

Under this framework, the govern ment had to ensure the provision of cold chain equipment (CCEs) across health centres in the country. In addition, vaccination safety proto cols, such as infection prevention and waste disposal were adhered to, even as vaccines were adminis tered in phases; targeting the most vulnerable and the most exposed.

On this front, Ghana was again at the fore of its peers, when in Febru ary 2021, it made history by becom

AstraZeneca/Oxford vaccines under the COVID-19 Vaccines Global Access (COVAX) facility.

The initiative bore fruit as the nation has recorded a modest vacci nation rate despite instances of hesitancy, mostly spurred by

indicates that some 14.9 million doses of the vaccines have been administered, meaning, 65 percent of eligible persons have had at least

one shot, with 27.6 percent, being fully vaccinated.

Considering the far-reaching impact of COVID-19, and how indispensable vaccines are to curbing its spread, there is a need for objective, data-driven monitoring and accountability to ensure satisfactory delivery. SEND Ghana has applied a social accountability framework to ensure this.

With funding support from the Partnership for Transparency Fund (PTF), SEND Ghana through a survey “monitored the compliance for Ghana’s NDVP and citizens' COVID-19 vaccination experience, with the view to promote equity, transparency and accountability of the COVID-19 NDVP and to inform future vaccination service delivery.”

The study surveyed more than 1,000 citizens, health workers and teach ers in 25 vaccination centres across

eight districts in urban and peri-ur ban areas equally chosen from Accra and Kumasi, which were character ized by high incidents of COVID-19. This was done to ascertain the level of uptake, thoughts and experiences around vaccination on the part of the target group and assess the distribu tion of cold chain equipment (CCEs) and vaccine logistics, among similar themes. An apparent theme of the exercise was the desire of the majori ty of respondents (52 percent) to get vaccinated with the goal of protect ing not only themselves but persons with whom they come on in regular, close contact.

Logistics are required for the successful implementation of any mass inoculation drive and the survey discovered that the distribu tion of CCEs was “somewhat fair.”

The available refrigerator models were considered “quite adequate” and their distribution across health centres in the districts “equitable.”

Gaps with other models, cold boxes

and vaccine carriers drew calls for “the Ministry of Health and the Ghana Health Service to adopt steps to increase the availability of vaccine logistics across districts within the country.” This comes to suggest that government needs to adopt necessary measures to ensure the supply of required capacity and the number of CCE and related accessories in districts with gaps.

The health facilities, it noted, observed strict adherence to safety and hygiene protocols, a phenome non largely attributed to the opera tors' deeper understanding of the risks, coupled with, in some the horrors of being infected. Most discrete waiting spaces for vaccine recipients to rest and be monitored

Hand hygiene amenities like alcohol-based sanitizers were also readily available.

Teachers and health professionals were given priority by the NDVP for the immunization exercise because of their susceptibility to contracting the virus. Despite this high vaccina tion rate, 1 in 10 medical profession als and 13.5 percent of teachers who

had not received the immuniza tions stated concerns about side

vaccines, and doubts about their

On account of the above, SEND recommended that the Ghana Health Service organize NDVP refresher training for its employees. Inasmuch as monitoring results indicate compliance was generally good, such a move would improve the NDVP guideline compliance rate. Health Directorates are encouraged to sustain the vaccine

contribute to the attainment of the country’s herd immunity target with an emphasis on assuaging

and safety, which featured promi nently.

Furthermore, building on the concern of respondents for the well-being of their close associates, it was recommended that the COVID-19 vaccination communica tion messages “should focus on the protection of family members and friends from the disease and possi ble deaths and less on mandates restricting access to services and employment reasons.” Ultimately, the GHS was urged to commend its

sionalism during the vaccination exercise.

Whilst it might seem that there is no imminent danger of a full-blown resurgence of the pandemic, there remains the possibility of mutation. Already, two subvariants of the omicron’s BA.5 strand BQ.1 and BQ.1.1 which emerged recently have both been described as “dan gerous” and “qualities or character istics that could evade some of the existing interventions,” according to

by its media.

Furthermore, the adoption of these recommendations would prove useful in the event of the outbreak of other illnesses. The threat of Ebola, Lassa fever, Marburg, and other severe respiratory diseases hangs over local healthcare systems almost in perpetuity. With the possible socioeconomic disruptions that a resurgence of COVID-19 or a similar pandemic would pose, the guidance provided in SEND GHANA and PTF’s survey must be implemented as a matter of urgency.

senior national team, the Black Stars, at the ongoing FIFA World Cup in Qatar, MTN wishes to commend the Black Stars once again for making it to the 2022 FIFA World Cup.

Ghana, Mr. Selorm Adadevoh said, “As the headline sponsor of the Black Stars, we are full of hope about the abilities of our gallant

men. We have no doubt that you taken all the necessary preparation. It’s time to put all that practice into action. We will remain your biggest fan every step of the way”.

“It’s your time, seize every moment and do what we know you to do best winning. Get out there and show them how it’s done! Go Ghana! Go Black Stars!’’ he added.

Mr. Adadevoh said, ‘’MTN Ghana wishes you the very best in this tournament. Indeed, the cheers are from all corners of the African conti nent. Having demonstrated our love and commitment to the game, MTN Ghana is proud to be associated with you as you take on the world to make us proud”.

MTN Ghana is the headline sponsor of the Black Stars. The company recently signed a sponsorship deal

to cover the Black Stars for the 2022 World Cup in Qatar and the next African Cup of Nations in 2024.

As part of activities to drive excite ment, MTN customers will receive regular updates from the camp of the Black Stars through its Ayoba Messaging app. As part of the compa ny’s special loyalty package, selected customers will also win tickets to attend some of the matches.

Chartered Institute of Bankers Ghana continues to support the banking industry’s sustainability through human capital develop ment. As part of delivering on its mandate to promote banking education and regulate the practice of banking in Ghana, the Institute has graduated 620 chartered bank ers in the last three years.

This was disclosed by the Chief Executive of the Institute, Robert Dzato, during the 13th induction and graduation ceremony held in Accra for the newly Chartered Bankers. These Chartered Bankers have completed the Institute’s requirements of examination and practical experience as well as orientation.

The 2022 ceremony was held under the theme ‘Future of Banking in Ghana: Ethics, Professionalism, and ESG Imperatives. In his keynote

Managing Director of GCB Bank, congratulated the Institute and its

He indicated that, to stay in the competition, the banking industry needs human capital in the areas of data analytics, AI, digital leader ship, customer centricity, ESG amongst others. Commenting on the theme, he said banks should adopt Environmental, Social, and Governance (ESG) policies and to have mechanisms in place to assess the impact on their businesses.

nance both within their organiza tions and with their customers, regulators and broader stakehold ers. How banks embed ESG concepts in their governance fabric and culture are things we should be thinking about.”

He also stated that the banking sector is facing a combination of disruptions and the necessity for banks to respond strategically.

leading the charge in deploying

able businesses that provide solutions based on customer

banks will have to reinvent the ecosystems, platforms and data assets that allow them to monetize data and pursue intelligent selling and cross-selling of products and services.

On his part, The President of the Chartered Institute of Bankers (CIB) Ghana, Benjamin Amenumey applauded the newly graduated students and inductees for their tenacity, diligence, and persever ance in getting this far. “I congratu late our inductees and graduands for this great achievement. I

Institute, facilitators, lecturers, examiners, our external teaching their contribution,” he said.

He urged the new inductees to keep learning with the

The Chief Executive of CIB Ghana, Robert Dzato, admonished the newly inducted Chartered Bankers to do more than just banking. He advised them to leverage their char tered banker status to take advan tage of the related banking services as stipulated in the Institute’s Act, 2016 (Act 991). To transform the perception of bankers, he advised the freshly graduated students and inductees to strive for and thrive on ethics and professionalism.

“You are graduating at a time when ethics is important. If you look at the Bank of Ghana report for 2021, GH¢61 million was lost due to fraud. Alarmingly, 53 per cent of the fraud

going out there as the voice of conscience and the voice of profes sionalism. We have a responsibility to re-professionalize banking,” he added.

He also indicated that the Institute is currently reviewing its syllabus to address skills gap and equip bankers with competencies in data and

digital and ESG; but ethics will remain fundamental to the CIB

Six (6) prizes were given out by the Institute to some inductees who demonstrated exceptional perfor mance by doing well in their respec tive courses. Kwabena Owusu Asante from GCB Bank won the

rate Governance of the Year Award; Christabel Naa Ayorkor Armah of Access Bank PLC won Risk Manage ment Award of the Year, and Michael Agbetepey of Agave Rural Bank PLC

Award of the Year.

Princess Jemimah Cato from the Bank of Ghana emerged as the valedictorian of the year winning the most promising inductee among her colleagues. Expressing her profound excitement, she reminisced about the long and often arduous journey which had brought them to their graduation day and on behalf of the graduation class thanked the admin

well as their families of the graduat ing class for their support. She further urged her colleagues to uphold the name of the institutes in high esteem by upholding the ethics, expertise, exposure and education.

“We must uphold our ethics, hones

ours so that they can't be minimized. And regarding education, I suggested that all bankers go through CIB Ghana to gain the professionalism required in the market. The world is

counsel banking management to do the same. Finally, they should know

she said.

Some key dignitaries who graced the occasion were the Immediate Past President of Ghana,