climate shocks threatening to reverse two decades of development progress in Africa, experts have called for urgent concessionary nancing to help the continent build resilience and boost economic growth.

A mix of shocks including food and fuel impact of the Russia-Ukraine war, climate change impacts, con ict, and tighter global nancial conditions have increased Africa's development nancing gap and debt vulnerability, experts concurred during a one-day virtual workshop on Catalysing Access to the IMF Resilience and Sustainability Trust (RST), organized by AfriCatalyst and the Economic Commission for Africa (ECA).

ECA Director, Macroeconomics and Governance Division, Adam Elhiraika said that in the past six decades, every global recession has led to a rise in global government debt and that many African countries had increased their public debt. A bulk of the public debt was incurred between 2020 and 2021 when countries sought to combat the impacts of the Covid-19 pandemic.

As a result, many countries were struggling with high debt and in servicing it which was impeding poverty reduction and hindering their recovery from shocks.

“Despite national and international e orts, an increasing number of countries on

struggle with substantial debt burdens and servicing their debt, with some already in debt distress or at high risk of debt distress,” Mr. Elhiraika said, emphasizing that this was impeding resilience-building to future shocks, which is key for sustainable development.

In a bid to help developing and lower middle-income countries build resilience to external shocks and achieve sustainable growth, the International Monetary Fund (IMF) established the Resilience and Sustainability Trust (RST). Under the RST, is the Resilience and Sustainability Facility (RSF), an innovative nancing instrument to help countries address long-term structural challenges, including climate change adaptation and mitigation and pandemics.

AfriCatalyst, an-Africa based global development advisory rm, has developed a practical guide to inform policymakers and domestic stakeholders about the RSF’s key features, eligibility criteria, and objectives.

The guide also explores how the IMF assistance under the RST could support the design and implementation of national macroeconomic policies to integrate climate and pandemic risks as well as the cost of adaptation into their macro- scal frameworks.

AfriCatalyst Founder and CEO, Daouda Sembene, said the RST had potential bene t

for African countries, reeling under high indebtedness. With the support of the Bill & Melinda Gates Foundation, AfriCatalyst was bolstering evidence generation and technical advisory support for African policymakers to promote access of Sub-Saharan African countries to IMF nancing under the RST.

Mr. Sembene noted there was high demand for climate nancing, but available resources were limited. The IMF was currently seeking $40 billion for the RST but had only e ectively raised $26 billion.

“African countries need additional resources,” Mr. Sembene said, remarking that the cumulated climate nance of 52 African countries under the Nationally Determined Contributions was estimated at $2.3 trillion.

Ms. Fenohasina Rakotondrazaka Maret, Senior Advisor, AfriCatalyst, said access to this nancing will be granted based on the nations' reform strength and debt sustainability. The concessional loans have a 20-year maturity and a ten-and-a-half-year grace period. Borrowers will pay an interest rate that is a modest margin over the three-month SDR rate, with the poorest countries getting the most favourable nancing terms.

Rwanda is currently the only African country with an RSF-supported programme approved by the IMF. Rwanda received US$ 319 million to be

Story continues on page 3

Story continued from page 2

used for climate change programming.

Senior Adviser Ali Mansoor, a former IMF Assistant Director and Mission Chief noted that Rwanda has embedded climate issues into national strategies for transformation. During COP27, Rwanda launched its “Ireme Invest” program, to

provide funding for green projects for small and medium enterprises.

Mansoor said Rwanda will use the RSF to catalyze further nancing and organize better planning within their budget process for risks related to climate change and accredited its Ministry of Environment under the Green Climate Fund and the Adaptation Fund.

ed.”

Vodafone Ghana has been working closely with law enforcement agencies to tackle the problem of cable theft and mitigate its impact on the company’s services and customers.

The arrest and conviction of William Ntow are signi cant steps forward in addressing the issue and deterring potential criminals.

The Odumase-Krobo Circuit Court convicted a man, William Ntow, to a 7-year prison sentence today after he was found guilty of stealing Vodafone telecommunication cables in the area.

The Akosombo District Police arrested Ntow near Sakora Park, a suburb of the town, after Vodafone Ghana lodged a complaint regarding frequent cable cuts, which had been causing disruptions to the company’s services for the past few weeks.

O cers arrested Ntow with a 200-pair size cable measur-

ing 1,400 meters and valued at GH 552,500.00.

The conviction comes as a relief to Vodafone Ghana, which had been grappling with the ongoing issue of cable theft and its impact on services. John Animah, Corporate Security Manager at Vodafone Ghana, spoke about the arrest and subsequent conviction, stating, “We are grateful to the Akosombo District Police for their swift action in apprehending the suspect. Cable theft has been a persistent issue for our company, and this arrest sends a strong message to would-be thieves that such criminal activities will not be tolerat-

Preba Greenstreet, Legal and External A airs Director at Vodafone Ghana, also commented on the case.

“The conviction of William Ntow serves as a warning to others who may consider engaging in cable theft. It’s important to understand that this isn’t a victimless crime. It disrupts vital communication services and a ects businesses and individuals alike. We will continue to collaborate with law enforcement and other relevant stakeholders to combat this problem and protect our infrastructure.”

The cable theft issue has far-reaching consequences,

a ecting not only Vodafone Ghana but also its customers and the larger community. Service disruptions caused by cable theft can cause signicant nancial losses for businesses and create inconveniences for individuals who rely on stable telecommunications services for work, education, and daily life. As Vodafone Ghana continues to invest in and expand its infrastructure across the country, ensuring the security and integrity of its networks is a top priority.

The company has implemented various measures, including enhanced surveillance and security systems, to protect its assets and ensure reliable services for its customers. This recent conviction highlights the need for continued vigilance and cooperation among all stakeholders to protect critical infrastructure and ensure a stable, secure, and connected future for all Ghanaians.

The Attorney-General and Minister for Justice, Godfred Dame, has disclosed that three persons are facing prosecution for their complicity in the collapse of fund management companies.

Appearing before parliament on Tuesday to answer questions on the steps his ministry has taken to prosecute the directors and managers of the collapsed fund management

companies that committed various nancial crimes, he said that the A-G’s o ce has completed the prosecution of one of the four banking cases.

The cases involving the collapsed fund management companies are categorized into two. Banking Cases

“I report that the O ce of

Story continued from page 3 the Attorney-General has completed the prosecution of one of the four banking cases that were put before the High Court, Accra. The remaining three are still ongoing and progressing steadily. Details of the cases are below: The Republic v William Ato Essien and Others (Capital bank case): The accused persons were charged before the High Court with the o ences of stealing and money laundering.

The third accused person was acquitted at the close of the prosecution’s case. At the end of the trial, the rst accused person applied under section 35 of the Courts Act, 1993 (Act 459) for a plea of guilty to be entered for him.

In accordance with relevant provisions under section 35 of Act 459, the court accepted a plea agreement between the rst accused person and the prosecution. The rst accused

was sentenced to refund GH¢90 million in three instalments together with other disabilities placed on him by the Banks and Specialised Deposit Act, 2016 (Act 930) and other provisions of Ghana law. The second accused person was acquitted and discharged. Judgment was delivered on 13thDecember 2023.”

Further, he explained that; The Republic v Dr Kwabena Du uor and 8 Others (Unibank case): The accused persons have been charged before the High Court with the o ences of dishonestly receiving, falsi cation of accounts, money laundering, fraudulent breach of trust, contravention of the Bank of Ghana Act and wilfully causing nancial loss to the state. The trial is ongoing, with counsel for the sixth accused currently cross-examining a prosecution witness.

The Republic v Johnson Pandit Asiama and 5 Others (UT case): The accused persons have been charged before the High Court with the o ences of deceit of a public o cer, fabrication of evidence, money laundering, fraudulent breach of trust and wilfully causing nancial loss to the state.Third prosecution is being cross-examined by counsel for third accused. 4.The Republic v Michael Nyinaku (Beige case): The accused person has recently been charged before the High Court with the o ence of stealing, fraudulent breach of trust and money laundering. The rst prosecution witness is being cross-examined by counsel for the accused person.

Micro nance and Savings and Loans Companies: On 31st May 2019, the Bank of Ghana revoked the licenses of 347 insolvent micro nance and

savings and loans companies. The Economic and Organized Crime O ce (EOCO) investigated some of these companies and submitted dockets on 13 of them to the O ce of the Attorney-General for study and advice. On receipt, the O ce requested further investigations to be conducted.The Prosecutions Division is working closely with EOCO and Pricewaterhouse Coopers (PwC), the Receiver for all 13 companies. to get the dockets readied for prosecution.

Additionally, the Attorney-General announced that his o ce is in the nal stages of preparing charges to be led in court. The O ce intends to le charges in respect of 6 of the institutions before the end of this legal year, [i.e. before July, and the remaining 7 at the commencement of the next legal year, in October.]

assist the Ministry of Finance to develop and execute medium-to-long-term reforms needed to improve debt sustainability and support a competitive, dynamic government debt market.

The project, according to the USA will complement and build on the Government of Ghana’s debt restructuring e orts.

The United States government has promised to intervene on Ghana’s behalf with the Paris Club as the country seeks debt forgiveness as part of the International Monetary Fund’s balance of payment support.

The US Vice President, Kamala Harris, announced this at a joint Press Conference with President Akufo-Addo.

According to Mrs Harris, the US will help Ghana with all the

support it needs to ensure that it scales through its current economic crisis.

“We welcome Ghana’s commitment to reform its economy for sustainable and inclusive growth. We support Ghana’s engagement with the IMF, and we will continue to push all bilateral creditors to provide meaningful debt reduction for countries that need it.

“It is critical to do so to build long-term economic growth and prosperity and to increase US investments. Our partnership is already strong, and I believe that today we have strengthened it.”

The US has also announced that its Department of Treasury’s O ce of Technical Assistance (OTA) will deploy a full-time resident advisor to

This project is part of OTA’s ongoing engagement to strengthen public nancial management and nancial sector oversight across sub-Saharan Africa.

Ghana, which is struggling with its worst economic crisis in a generation, secured a sta -level agreement with the International Monetary Fund (IMF) in December for a $3 billion loan, though asking lenders to provide nancing assurances is a condition for the IMF’s board to sign o the programme.

e orts to ensure that the university returns to full and normal operations post the Covid pandemic.

She also commended management for innovative e orts to resource the university and also to ensure best management practices including being the rst university in Ghana to institute a gender policy statement.

A leading Ghanaian banker, Nana Dwemoh Benneh, the Chief Executive O cer of the Universal Merchant Bank (UMB), has urged graduates of the University of Ghana to take advantage of the bene ts of digital tools to establish themselves as entrepreneurs.

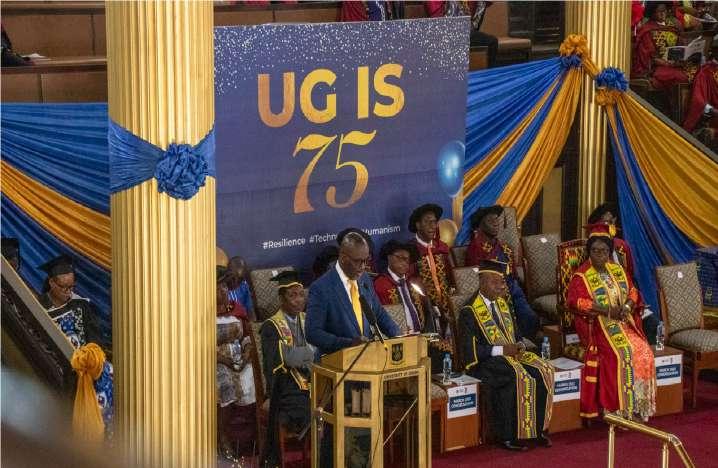

Nana Dwemoh Benneh made these comments at the 75th congregation ceremony of the College of Education where he was the guest speaker. The ceremony saw the graduation of 11,711 students drawn from the constituent schools of the college namely School of Continuing and Distance Education, School of Information and Communication Studies and the School of Education and Leadership.

The Provost of the College of Education Prof. Samuel Nii Ardey Codjoe in his opening remarks noted that the graduating class had students from over 50 other countries amongst the cohort, once more cementing the University

of Ghana’s place as the premiere University in Ghana.

In her remarks read for her by the Pro Vice–Chancellor Prof. Felix A. Asante, the Vice –Chancellor of the University noted some key successes chalked by the University for the year under review. Key highlights here included the Vice–Chancellor’s Student Digitization Initiative to allow for synchronous and asynchronous virtual learning.

She also noted that the University of Ghana had taken pride of place in Ghana as the top ranked school in the Webometrics/ Alper Doger school rankings.

In her speech prior to conrming the conferment of degrees on the presented candidates, the chancellor of the University Mrs. Mary Chinery–Hesse, represented by Ms. Doris Kisiwa Ansah and Mrs. Yvette Adounvo Atekpe, members of the University Council congratulated management for continuing

Nana Dwemoh Benneh, the CEO of the Universal Merchant Bank in his speech reiterated his pride in being an alumnus of the University, graduating some 23 years ago. He painted a vivid picture of a contrast between the world he graduated into and the world of today.

He noted that the key di erentiator was how much digital tools had transformed the world, especially the world of work.

He noted for instance that unlike in 1996, his year of graduation, new music albums could top the chart without a CD or a cassette being pro-

duced. He used this example to establish the point that the world we nd ourselves in the age of the digital entrepreneur and admonished graduating students to follow the examples of other successful entrepreneurs in and out of Ghana and seek to establish their own enterprises. “Opportunities exist for the diligent who apply themselves to exploiting the digital world and creating di erent kinds of work relevant to the emerging society.”

The College of Education is made up of the following schools: School of Information and Communication Studies, School of Education and Leadership and the School of Continuing and Distance Education and is one of the colleges of the University of Ghana. The university of Ghana was founded in 1948 as a university college of the Gold Coast. This year’s congregation marks the 75th congregation of the university.

One of the most important protections and control against fraud is the addition of safekeeping from the investment portfolio. If necessary, investment policies should include a section regarding safekeeping and custody that de nes how the holding institution should have its securities held by an independent third party for safekeeping to minimize the risk of a fraudu-

lent transaction.

Ko Pianim, Head of Global Markets at First National Bank explains custody as when an investor—whether a retail investor, an employee pension fund, a mutual fund, or any other kind of institutional investor invests in a nancial asset such as an equity or debt security, and needs someone to hold

Story continues from page

Story continued from page 5

and safe-keep the asset on its behalf. ‘This is where a custodian comes in to receive any dividends or interest payments made by the company that issued the security; alert the investor of any votes or other actions the investor needs to take with respect to the security (such as responding to an o er by the issuer to exchange the security for another security)”, Ko says.

Custodians provide all of these custody services to investors by contracting with the investor either directly or with an agent of the investor, such as an investment manager. In short, a custodian provides custody and related services to investors—broadly characterized as

the safekeeping and servicing of an investor’s assets. They play a critical role in helping investors to build and maintain wealth. “Usually, if the investor wishes to sell the security or purchase another security, the custodian processes the transaction on the investor’s behalf”, a rmed Ko .

Although custodians may have separate commercial or consumer lending relationships with certain custody clients, such lending relationships do not generally extend to the nancing of clients’ custodied investment positions through loans or long-dated credit facilities. “Generally, the only lending custodians engage in

as principal as part of their custody services business involves the provision of short-term credit (generally intraday or overnight) to facilitate e cient settlement across di erent payment and settlement systems and time zones, cover overdrafts, facilitate client redemptions, enable the payment of management fees and other expenses, and allow their clients to manage liquidity” Ko suggested. On whether the custodian faces credit, market, liquidity, and operational risk, Ko emphasized that the nature of risk with custody and related activities in which custodians engage are presented often di erently in scale from those

presented by other banking activities. “At First National Bank, we have world-class and robust systems/platforms in place to provide quality services to our clients. These include our fast trade settlement, secure cash interface, and easy-to-use self-service platform for clients to instruct electronically, which feeds into our processing system”. First National Bank also o ers Global Custody o ering e cient market information gathering.

“We leverage our expertise for custody and clearing solutions across our proprietary network to help grow our client business and investment through e cient market access” he ended.

points to 29.5%”, he said. He said the recent Domestic Debt Exchange Programme (DDEP) has impacted negatively on banks, hence the need for the Central Bank to make necessary adjustments to its regulatory requirements to support the banks.

“Whiles the domestic economy still faces relatively tight global nancing conditions and heightened uncertainty about the global economic outlook, the e ects of these could be ampli ed inherent vulnerabilities including structural and excess liquidity following the DDEP and the widening negative outlook gap”.

“The domestic debt exchange, new revenue measures, and structural scal reforms will provide signicant reduction of debt service and help create scal space”.

Dr. Addison added that the scal outlook is contingent on nancing of the budget and will require the conclusion of the domestic debt exchange programme as well as securing the requisite nancing assurances from bilateral donors.

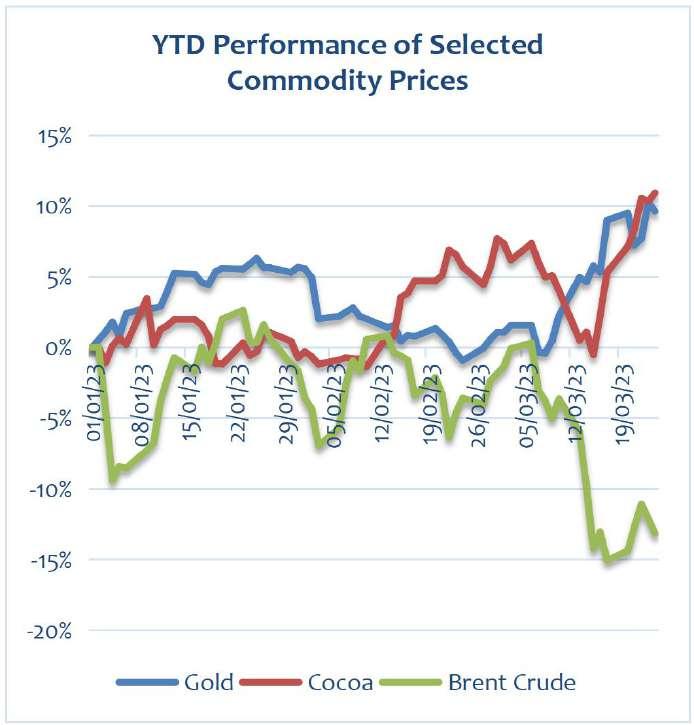

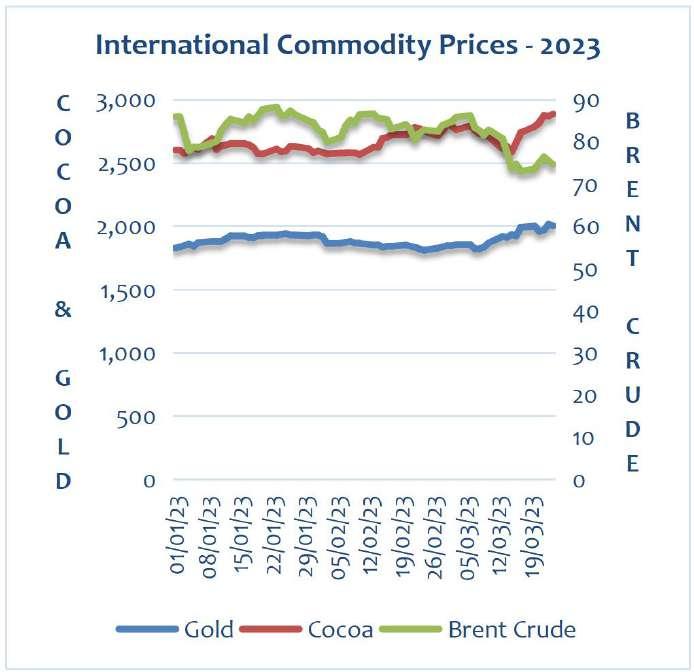

The Bank of Ghana has increased its policy rate by 150 basis points to 29.5% to help check the high in ation and any downside risks to the economy.

This means the cost of credit will continue to remain high, a ecting household spending and private sector growth. Average lending rates shot up marginally to 36.64% in February 2023, from 35.58% recorded in December 2022. This is equivalent to 3.02% interest rate on loans per month.

Announcing the development few minutes ago, Governor of the Bank of Ghana, Dr. Ernest Addison, said the ease in price

pressures abroad will likely impact positively on Ghana’s domestic in ation pro le going forward.

“Headline in ation has declined marginally for two consecutive months, but continues to remain relatively high compared to the medium-term target of 8±2%. To place the economy rmly on the path of stability and reinforce the pace of disin ation, it is important that the monetary policy stance be tuned further to re[1]anchor in ation expectations towards the medium-term target. Given these considerations, the MPC decided to increase the Monetary Policy Rate by 150 basis

He, however, said the banks remain strong, sound and stable based on its recent stress test.

He added that the Monetary Policy Committee of the Bank of Ghana will continue to monitor developments within the banking industry to reduce the downside risks to the economy.

He explained that on scal policy, the Committee noted that the budget statement for 2023 has set scal policy on a consolidation path which is consistent with key elements agreed with the IMF at the Sta Level in December 2022.

“Indications are that these discussions are proceeding well. Based on the above, it is imperative that Parliament prioritizes the passage of the revenue bills currently before it. Under the Sta Level Agreement with the IMF, the Bank of Ghana and the Ministry of Finance have nalised a Memorandum of Understanding on zero nancing to the budget, which will be signed shortly”, he said.

He added that the passage of the relevant revenue bills by Parliament will conclude the required prior actions to advance Ghana’s programme to the IMF Executive Board. This, he said will be critical in resetting the economy on the path of recovery, including putting it rmly on a disin ation path and sustained growth.

To support mature and growing green and sustainable entrepreneurs who have innovative products and services that do not harm the environment or makes use of waste materials in the Ashanti and Western Regions, SNV Netherlands Development Organisation has been rolling out a 6-month business support and training programme called, GrEEn Acceleration Programme in partnership with Innohub, a business accelerator and advisory hub in Ghana.

The GrEEn Acceleration Programme forms part of the 4-year Boosting Green Employment and Enterprise Opportunities in Ghana (GrEEn) Project which is being implemented by SNV Ghana with funding from the European Union Emergency Trust Fund (EUTF) for Africa and the Embassy of the Kingdom

of the Netherlands in Ghana.

On Friday, 24 March 2023, eleven (11) green businesses from cohort 3 and cohort 4 of the GrEEn Acceleration Programme graduated after receiving training on securing national and diaspora investments, meeting environmental and social safeguards requirements, good manufacturing practices and eco-friendly packaging, and many other support services.

Overall, a total of 12 green entrepreneurs representing the 11 greenbusinesses graduated and include: Amdiya Abdul Lati of Eco-Me Africa,Hanna Boakye-Asiamah of Baanuena Farms, Georgina Filson of Ginal Foods Processing, Hospitality & Entrepreneurial Development Training Centre, Michael Acquah of Supreme Pod Industry Limited and Nana Yaa Manu Adjei of Waterforce Ventures

from the cohort 3 batch.

Under Cohort 4: Elizabeth Bayo of Nasag-Lach Company Limited, Louisa Agartha Manu of LOMEL Foods and Catering Services Limited, Mavis Prah of Yebitom, Rita Aku-Shika Diabah of Yesli Ice, as well as Rashida Moro and Zachariah Abubakar, co-founders of Mushfam Enterprise.

Out of the 11 entrepreneurs who graduated from the GrEEn Acceleration Programme, 6 of them have been awarded grants totalling three hundred and ninety-seven, thousand, thirty cedis (GHS 397,030) from the European Union and SNV under the GrEEn Innovation Challenge in 2021 and 2022 as well as the GrEEn Business Plan Competition in 2021 and 2022 to scale up their businesses and create jobs for youth job seekers in

the Ashanti and Western Regions. A total of 20 businesses have received training under the GrEEn Acceleration Programme.

As part of the graduation ceremony, entrepreneurs from the 11 businesses pitched their products and services with Rita Aku-Shika Diabah of Yesli Ice emerging as overall winner and receiving GHS 10,000 from Innohub and Wangara Capital to purchase equipment to scale up production of her natural beverages.

Aside the GrEEn Acceleration Programme that targets matured businesses in the Ashanti and Western Regions, SNV is also rolling out the GrEEn Incubation Programme in partnership with business hubs in these two regions which targets small businesses and start-ups.

Kasapreko Company Limited and its Group Chairman, Dr. Kwabena Adjei, have been honoured by President Nana Addo Dankwa Akufo-Addo at the 2023 National Honours and Awards ceremony in

Accra, Ghana, for their roles in the ght against the COVID-19 pandemic.

The company – one of the largest indigenous beverage producers – was recognised for its contribution to changing its

production line to manufacture hand sanitisers to aid in the ght against the global virus.

The Group Chairman was honoured for his role in helping establish the COVID-19 Private

Sector Fund. The fund built the Ghana Infectious Disease Centre (GIDC), a 100-bed capacity facility, to improve the medical diagnostic and research capacity of Ghana

with regard to infectious diseases. The hospital was built in a record time of 100 days since the country has no such facility and there was a need to control the infection rate of COVID-19.

Richard Adjei, Managing Director for Kasapreko, who received the honours on behalf of the company and the Group Chairman, expressed gratitude to the President for the recognition, saying that the company responded quickly to the country's urgent need by stepping in as a local producer of sanitisers.

He further stated that the company converted some of its production facilities to produce hand sanitisers at an a ordable rate or more or less break even to ensure that people get sanitisers at a cheaper cost and also make them more available across the nation to help prevent the Covid-19 virus.

“Kasapreko on our part as one of the biggest importers of alcohol and with alcohol being 99 percent of sanitiser production saw the need and decided to convert some of our lands to produce sanitisers at an a ordable rate or more or less break even to make sure that people get sanitisers at and also make it more available across the nation in order to help prevent the COVID-19 virus,” Kasapreko’s Director said.

The gesture by Kasapreko

helped make hand sanitisers readily available and cheaper to meet the demand for the product in the country, curbing the spread of the virus.

Kasapreko’s Managing Director added that the company donated GH¢2 million in cash, as well as other items to communities and other institutions, including Korle-Bu Hospital, Ridge Hospital, the Prisons Service, Ministries, Schools, and the community where they operate.

Kasapreko’s e orts, coupled with other protocols and measures instituted by the government and other stakeholders, greatly assisted in containing the coronavirus and earned Ghana commendations from the international community. The president’s recognition adds to a long list of awards Kasapreko has received, particularly, in the last decade, including consistent appearances on the coveted Ghana Club 100 list.

“Again, I must say we are truly honoured by Mr. President’s gesture. We are also very humbled by the impact we were able to make during such a di cult time. We recognize that this recognition comes with great responsibility, and we are committed to using our company's resources and expertise to continue playing an active role in the development of our nation.,” the Managing Director added.

Recent gures released by the Bank of Ghana indicate that Ghana’s public debt stock still remains constant at GH¢575.7 billion at the end of November 2022.

By this, Ghana’s total public debt stock increased from about GH¢467.4 billion in September 2022 to about GHC575.7 billion in November 2022.

According to the latest Bank of Ghana’s Summary of Macroeconomic and Financial Data for the period ending March 2023, the debt gure of about GH¢575 billion still puts Ghana’s debt to Gross Domestic Product (GDP) ratio at 93.5% as of November 2022.

Per the data, the country’s

domestic debt, still stands at GH¢194.7 billion at the end of December 2022, representing 31.6% of GDP.

This is compared to GH¢195.7 billion recorded in September 2022, and ¢193.1 billion in November 2022.

Already, government has taken steps to restructure its domestic debt through the Domestic debt exchange program which closed on Friday 10th February 2023 with over 80% participation of eligible bonds.

The external component of Ghana’s total public debt is $29.2 billion (¢382.7 billion) in November 2022, equivalent to 62.1% of GDP.

Story continues on page 9

Story continued from page 8

This is an increase from $28.4 billion (¢271.7 billion) in September 2022, and $28.3 billion in December 2021. The signicant increase in the cedi component of the external debt is attributed to a 37% depreciation of the cedi to the dollar in 2022.

This comes at a time when the government in December

2022 suspended payments on most of its external debt, defaulting, as the country continues to nd ways to rebalance the economy.

The Finance Minister, Ken Ofori-Atta has also been engaging with external creditors to conclude external debt.

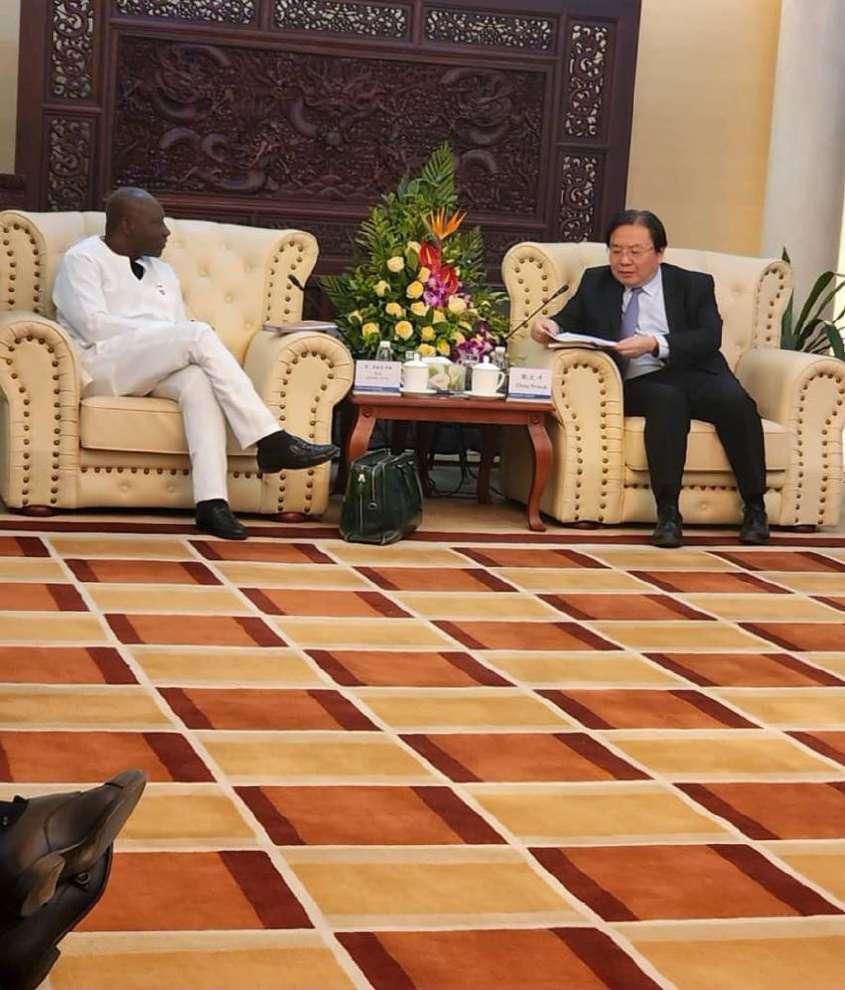

As part of this, Finance Minister, Ken Ofori-Atta travelled to China on March 23, 2023, to negotiate with China, which holds about $1.7 billion of Ghana’s debt.

He is however hopeful of a successful meeting with the Chinese government.

The BoG data once again did

not provide data for the nancial sector resolution debt and other liabilities such as the energy sector debt.

Meanwhile, the government’s scal de cit to GDP narrowed to 8.1% in December 2022, as against 9.8% in November 2022.

force with high levels of pro ciency and professionalism.

Orsam is currently made up of a 90% Ghanaian workforce, with over one million man-hours completed successfully without a single safety incident, making it a success story of true local capacity development. To date, the yard has successfully fabricated, integrated, and completed manifolds, pile tops, water injection structures and other critical subsea infrastructure for installation in the Jubilee South-East eld.

Skandi Africa is one of the world’s largest subsea installations vessels and is operated by Technip FMC. It is one of their newest subsea installation vessels, tted with state-of-the-art technology and capacity to conduct complex subsea pipe-laying activities. The pipe-laying system is about 70 meters high o the deck of the vessel and weighs about 2,000 tonnes.

Members of the Tullow Ghana (TGL) leadership team, led by Managing Director Wissam Al-Monthiry, have undertaken a day-long working tour of the Orsam Fabrication Yard and subsea installation vessel Skandi Africa, in Takoradi.

The visit provided an opportunity for TGL leaders to inspect complex subsea infrastructure currently under fabrication, as well as ongoing preparations for installation by Skandi Africa.

These installations form part of execution works for the Jubilee South-East (JSE) eld development project, and the visit preceded commencement of installation activities.

In its full year results issued on 8th March, 2023, Tullow expressed its con dence to

deliver further pro table growth with the execution of the JSE project, which is on track for the second half of 2023.

The expectation is that this added infrastructure will bring undeveloped reserves online and increase the Jubilee elds’ gross production to more than 100,000 barrels of oil per day (100 kbopd) before the end of the year.

Commenting on the visit, Wissam Al-Monthiry, said the visit to both sites was not only invigorating, but insightful as well. He said, “Seeing rst-hand all the work that has gone into the preparations for the JSE expansion project is a reminder to all of us of the local capacity that has been developed over the years. The project will increase output in the Jubilee eld, providing value not only for Tullow, but for Ghana and all stakeholders.”

He acknowledged that the complexity, magnitude and scale of the operations at the Orsam Fabrication Yard in Ghana are a testament to Tullow’s commitment to the development of local capacity to manage complex engineering.

Since its establishment in November 2021, the Orsam Fabrication Yard has undertaken several work scopes, training, and development initiatives to equip the work-

challenge in online businesses and online marketplaces in Ghana. Consumers are advised to exercise caution when shopping online, to research sellers and products thoroughly, and to use secure payment methods such as mobile money or credit cards.

E-commerce has emerged as a signi cant driver of economic growth in Ghana. With the growing use of the internet and mobile technology, e-commerce has transformed the way business is conducted, allowing consumers to buy and sell goods and services online from anywhere in the world. Online marketplaces such as Jumia, Tonaton, and Jiji have become popular among consumers, providing easy access to a range of products and services.

However, the growth of e-commerce in Ghana also presents new challenges, including the risk of fraud and scams. In this blog post, we will explore the growth of e-commerce in Ghana, the impact of online marketplaces on the economy and consumer behavior, the legal frameworks safeguarding the e-commerce space, and the challenges and opportunities faced by e-commerce businesses.

E-commerce in Ghana has witnessed tremendous growth in recent years, with the number of online shoppers increasing year-on-year.

According to a 2020 report by the Ghana Statistical Service, e-commerce accounted for 3.1% of total retail sales in the country, and this gure is expected to grow in the coming years.

According to a report by Statista, the e-commerce market in Ghana was valued at US$300 million in 2020 and is expected to grow at a compound annual growth rate of 21.6% between 2021 and 2025[ https://www.statista.com/topics/10270/e-commerce-in-ghana/#topicOverview].

The growth of e-commerce has had a signi cant impact on the economy of Ghana. Firstly, online marketplaces have created jobs for young people in the country, as e-commerce businesses require a signi cant workforce to operate. Additionally, e-commerce has facilitated the growth of small and medium-sized enterprises (SMEs) in Ghana, as businesses can leverage the online platform to reach a wider audience, expand their customer base, and increase revenue.

The rise of online marketplaces has also had a signi cant impact on consumer behavior in Ghana. Firstly, e-commerce has made it easier for consumers to access products and services from di erent parts of the country and the world. Secondly, it has facilitated the growth of the cashless economy, with more consumers opting for digital payments. Finally, e-commerce has created a more competitive

market, with businesses striving to o er better prices and quality to attract customers.

Faced by e-commerce Businesses in Ghana

Like in any other country, online businesses and online marketplaces in Ghana are also vulnerable to scams and fraud. While e-commerce has many advantages, it also presents new opportunities for fraudsters and scammers to exploit unsuspecting consumers.

One of the most common types of fraud in online marketplaces in Ghana is "fake product" scams, where sellers list products for sale that are counterfeit or do not t the description made to the consumer. Another common type of fraud is "advance fee" scams, where fraudsters request payment upfront for goods or services that they never deliver.

To mitigate these risks, online marketplaces in Ghana have put in place measures such as seller veri cation, buyer protection policies, and dispute resolution mechanisms. For example, Jumia Ghana o ers a "Jumia Guarantee" program, which provides buyers with a refund or replacement if they receive counterfeit or faulty products. Tonaton also has a "Buyer Protection" policy that allows buyers to request a refund or return for products that are not as described.

Fraud and scams remain a

Despite these challenges, e-commerce o ers signi cant opportunities for businesses in Ghana, particularly those that can adapt to the unique needs and preferences of Ghanaian consumers. By leveraging the advantages of online marketplaces and addressing the challenges facing the industry, e-commerce businesses in Ghana can help drive economic growth and development in the country.

In Ghana, the Electronic Transactions Act, 2008 (Act 772) is the primary law that regulates e-commerce activities, including online marketplaces. The Act provides for the legal recognition of electronic transactions and electronic signatures and sets out the legal framework for electronic commerce in Ghana.

In addition, the Sale of Goods Act, 1963 (Act 137) is relevant to e-commerce in Ghana as it governs the sale of goods between parties in commercial transactions. The Act applies to contracts for the sale of goods. It sets out the rights and obligations of the seller and the buyer, including the transfer of ownership and risk, delivery of goods, warranties, and conditions, and the remedies available for breach of contract.

Moreover, the Data Protection Act, 2012 (Act 843) is also applicable to online marketplaces and e-commerce businesses in Ghana. The Act regulates the collection, use, disclosure, and protection of personal data in Ghana and seeks to ensure that data subjects have control over Story continues on page 12

Story continued from page 11

their personal information.

Online marketplaces and e-commerce businesses in Ghana are also subject to general laws that regulate businesses, such as the Companies Act of Ghana, the Value Added Tax Act, the Electronic Transfer Levy (Amendment) Act, 2022 (Act 1089), and the Income Tax Act, The Ghana Revenue Authority requires businesses to register and pay taxes.

Overall, while there are laws that regulate online marketplaces and e-commerce businesses in Ghana, the regulation of the sector is still evolving, and there are ongoing discussions on the need for more comprehensive laws to address emerging challenges and protect consumers in the digital economy.

Conclusion To sum up, the rise of e-commerce in Ghana has revolution-

ized the way commerce is conducted, providing a plethora of choices and convenience to consumers. The increasing popularity of online marketplaces has played a vital role in expanding the reach of businesses and improving consumer experiences. However, the exponential growth of e-commerce in Ghana has also created new risks, such as online fraud and scams. To maintain consumer trust and promote fair competition in the sector,

e-commerce businesses, and online marketplaces must take measures to safeguard their customers. Furthermore, the government must continue to enact and enforce laws that provide consumer protection and a level playing eld for businesses. Despite these challenges, the growing e-commerce industry in Ghana o ers tremendous opportunities for businesses and entrepreneurs to contribute to the country's economic growth.

they do, but I beg to di er. We must be the change we want to see in our country and each one of us must assume the leadership we seek because if we don’t, success and sustainable development will remain just out of our reach.

needed new solutions, brave ideas and out-of-the-box thinking.

As we have gathered here today under the theme ‘Supporting the foundation that shapes future generations’ I need not remind you that our great school has shaped our fathers before us and will do same for our aspiring young ones seated amidst us today.

It is a tremendous honour to stand before you all today, at this yearly gathering that has come to mean so much to me. My time at St Augustine’s is one I remember with warmth and pride, and coming back here reminds me of why this place looms so large in my mind, as I look out at my fellow alumni in this audience, distinguished men and women who have brought pride and honour to this institution.

On my desk I keep a few mementos, personal items that inspire me in my work. Among photos of my family and artifacts from my father there is a St Augustine’s plaque, in pride of place, as a reminder of where I hail from and what proud legacy I have to live up to.

As happy an occasion this is, we come together at a di cult time in our nation’s history. We are in the midst of an economic crisis, social unrest and a fundamental lack of faith in the future from the very generation we depend on to build it.

It may seem like an odd time to speak about success, but I rmly believe it is not just the right but a crucial time to do so.

It is often said that our leaders must serve as example for our behaviour, that nothing can truly change until

Ghana has long su ered with revenue mobilization, despite its abundance of God’s bounty, and though e orts have been made on both political sides, we’ve found ourselves repeatedly seeking relief for the same problems. Our nation needs a new deal, a new path forward, and as an entrepreneur in learning I rmly believe that the path to prosperity is spelled entrepreneurship, as it is what has shaped our world and continues to do so.

Entrepreneurship is something we often pay lip service to, claiming to want our youth to engage in, but we don’t necessarily realize its value until disaster hits. The pandemic not only showed us the true importance of national ingenuity and self reliance but it also democratized the use of technology for the very basic things of life, such as bill payments, food delivery and online education. Suddenly, there was no time for long-winded committee meetings and political debate – we

Fellow apsunians, it is high time for us to invest in shaping these young minds that are on the cusp of adulthood. We need to embrace design thinking in our knowledge dispensing protocols, we need to encourage opinion thinking and individualism, we desperately need to develop tomorrows Zeepay's, Glico, Vanguard, Star Assurance and the many local companies that employ young people and contribute to GDP.

Such change requires commitment from all sides, be they political, civil society or the general public, all bonding together to provide the youth of today with the tools to become the leaders of tomorrow. There are many things that need to go into that toolbox - from startup hubs to mentorship programs, tax incentives for aspiring businesses and easy and safe access to necessary government services – but I would like us today to focus on the less obvious necessities.

I stand before you all today as the founder and CEO of ZeePay, but I didn’t just nd

Story continues from page 13

Story continued from page 12 myself in that position. My road to success was paved with trial-and-error, disappointment and downright failure, and that is the story of any entrepreneur worth his or her salt.

Fostering a nation of entrepreneurs does not merely require us to build the aforementioned infrastructure to enable nancial growth but it also requires us to change the way we measure success in ourselves and how we model it to others.

In this country, we put a high value on social validation, which is a fancy way of saying that we like to show o . The cars, the clothes, the parties, the lifestyle, it is all broadcast throughout our communities and the message is that the destination – not the journeyis what matters and that things equal accomplishment. That kind of societal culture is poison to the entrepreneurial mind, as it tells him or her that it I better to have US$500 today than US$5000 tomorrow and

that success is immediate and lavish, which I can tell you from personal experience is simply not true. Success grows, it doesn’t explode, it is birthed through pain and patience, as anything else which is truly worthwhile.

So how do we change the mindset of our youth, and thereby the fate of our nation? We do so by not just telling our success stories, but also actively sharing the tales of our failures, to normalize the journey of growth and encourage young entrepreneurs to stick it out, to keep going, to try and fail so they may learn and succeed.

My fellow students, I used to sell pineapple juice out of a cart on the street. It was my rst business venture and I spent all my waking hours in the sun and dust, many days living o nothing but my own merchandise. I started a diaper business that went bust, a local fabric line that didn’t take o , I fell down and got up again and again until I found my footing. I’m not

successful now despite these experiences, I am successful now because of these experiences, and the stories of the journey is just as important for the future graduates of this room to hear as the stories of my destination.

As I look across this room today, I see many successful men and women, fellow alumni who have distinguished careers and ourishing businesses. I will ask of you today to join me in mentorship of those around us who are just starting out, those still roaming these halls and mapping their futures between classes. I ask of you, my peers, to tell them about your journey, about the non starters, the bumps in the road and the failures on the way to success. Let us teach the younger generation what success really is, how it is achieved and the role of perseverance in greatness. By mentoring our young the right way we will build this country, right our wrongs and instill a Ghanaian dream in our young that is no longer to leave this country but to lead this

In that vein of responsibility, Ilishment of an innovationtribution of GH¢1million to an endowment fund purposely targeted at innovation as part of curricula to develop the beautiful minds that will shape tomorrow. Along with that commitment also comes a promise of an open door to any of you who seek council ship, a humble o er to pay forward the lessons I I thank you all for the sincere honor bestowed upon me today, and I extend a special thank you lations for your tenacity and drive to make this day a success, you are a credit to our great alma mater. Let’s all continue to enjoy this weekend and to take the precious opportunities given here to learn from and with each other. Until we meet again -

China’s Finance Minister, Liu Kun, says his country has con dence in the management of the Ghanaian economy, and that his country would help Ghana seek debt servicing relief.

At a meeting in Beijing with Ghana’s Finance Minister, Ken Ofori-Atta, last week, Mr. Kun said the Chinese authorities “have con dence in Ghana’s economic management and its long-term economic viability.”

Mr. Kun said he wanted to ensure that Ghana’s external debt treatment request was considered expeditiously and was thus accompanied to the meeting with Mr. Ofori-Atta by a high-level delegation including Mr. Wu Fuli, Chairman of China Exim-Bank.

Minister Kun said “we know that these are short-term challenges which we as responsible creditors, remain committed to resolving”.

“The long-standing and prosperous relationship between Ghana and China imposes on us a responsibility to help,” the Chinese Finance Minister added.

He said that just like other African countries, Ghana was facing economic di culties from a once-in-a-lifetime pandemic, geopolitical tensions and interest rates hike in advanced countries with a spillover e ect on developing countries.

This week, all eyes are on Ghana’s parliament which will consider three key revenue measures whose approval is expected to rake in ¢4.4 billion in domestic revenues. It is one of the major actions on the part of Ghana, critical to trigger IMF Executive Story continues

Story continued from page 13

Board approval of a $3 billion dollar facility for the country to ease its current economic di culties.

The Chinese o cials have expressed commitment to help Ghana resolve the current short-term liquidity challenges and continue to support Ghana’s medium and long-term development aspirations.

They said China believed in promoting debt sustainability and sustainable development and would advocate for more concessional and grant funding for Ghana, especially at this time.

“Ghana needs more concessional and grant fund from creditors,” said Mr. Zhang Wencai, Vice President of China Exim bank, adding that “the Multilateral Banks should therefore do more for Ghana.”

Mr. Ofori-Atta congratulated Liu Kun on his reappointment as Minister for Finance following the recently-ended National People’s Congress and thanked the Chinese authorities for participating in the G20 Creditor Committee meeting on Tuesday March 21, 2023.

He indicated that this was a sign of China’s show of leadership in the global nancial ecosystem, and an a rmation of their support for Ghana.

Other Chinese o cials who met Mr. Ofori-Atta were Deng Li, Vice Minister of Foreign A airs; Li Fei, Vice Minister of Commerce; Wang Weidong of the China Development Bank (CDB), Yang Haitao, General Manager of the International Commercial Bank of China (ICBC), and Luo Zhaohui, Chairman of the China International Development Cooperation Agency (CIDCA).

together, they can strengthen their position in the region and foster a more secure environment.

The UAE government should revise its legal and regulatory framework to create a more conducive environment for Israeli-UAE investments. This includes easing restrictions on Israeli companies, simplifying visa processes, and ensuring the protection of intellectual property rights. A transparent and predictable legal system will encourage more Israeli companies to invest in the UAE with local businesses' cooperation

encouraging collaboration between Israeli and Emirati startups through joint incubator and accelerator programs. This will enable startups from both countries to access resources, mentorship, and funding opportunities, fostering innovation and creating new business opportunities.

Author: Samuel Shay is an International Business Expert and Chairman of leading Israeli tech rm, Gulf Technologies Systems

As my activities in the Gulf region increase, the need for future cooperation between Israel and the United Arab Emirates, (UAE) emphasizes the importance of policy changes, required from the UAE government regarding local investment, to develop new industries and projects in partnership with the Israeli private sector.

My analysis underscores the signi cance of a strengthened bilateral relationship, and potential economic and technological bene ts, and provides recommendations to further enhance cooperation between the two countries.

The normalization of diplomatic relations between Israel and the UAE under the Abraham Accords in 2020 has opened up a range of opportunities for cooperation in various elds, including technology, security, agriculture, healthcare, and education. I try to analyze the requirements for future cooperation and the policy changes the UAE government needs to

facilitate local investment and encourage collaboration with the Israeli private sector.

A strong partnership between Israel and the UAE can unlock signi cant economic potential for both countries. The UAE can bene t from Israel's expertise in agriculture, cybersecurity, and water management, while Israel can access the UAE's vast nancial resources and investment opportunities. This collaboration can lead to increased trade, job creation, and overall economic growth.

Israel is renowned for its innovative technology ecosystem, often referred to as the "Start-Up Nation." Through collaboration with the UAE, Israeli companies can gain access to new markets, while UAE-based businesses can leverage Israeli technological advancements to improve their operations and services.

Enhanced cooperation between Israel and the UAE can contribute to regional stability and security. Both countries share common strategic interests in countering threats posed by extremist groups and ensuring stability in the Middle East. By working

To attract Israeli investors, the UAE government should o er nancial incentives and support, such as tax breaks, grants, favorable loan terms, and join investment programs. These incentives can reduce the barriers to entry for Israeli companies and encourage investment in new industries and projects.

The UAE government should actively facilitate networking and matchmaking opportunities between UAE and Israeli businesses. This can be achieved through organizing joint trade shows, conferences, and business forums, as well as promoting the exchange of business delegations.

promoting joint research and development initiatives between UAE and Israeli institutions, focusing on sectors such as renewable energy, articial intelligence, and biotechnology. This will enhance knowledge transfer and facilitate the development of new technologies and innovations.

prioritize investment in high-tech industries such as renewable energy, cybersecurity, arti cial intelligence, and biotechnology. These industries have signi cant growth potential and can lead to the creation of high-value-added jobs.

establishing special economic zones (SEZs) specically designed for Israeli companies with high technological pro les. These SEZs can o er a range of incentives, such as tax breaks, simpli ed regulations, and streamlined licensing procedures, making it easier for Israeli businesses to establish a presence in the UAE. Both countries should prioritize investing in human capital development through joint educational and training programs. This can include exchange programs, joint research initiatives, and professional training courses, enabling the workforce to acquire the necessary skills to succeed in emerging industries. promoting public-private partnerships (PPPs) to facilitate investment in large-scale infrastructure and development projects. By leveraging the resources and expertise of both the public and private sectors, the UAE can ensure the successful implementation of new projects while reducing the nancial burden on the government.

The normalization of relations between Israel and the United Arab Emirates presents a unique opportunity for both countries to deepen their economic ties and bene t from each other's strengths.

To fully harness the potential of this partnership, the

Story continues on back page

March 24,202 3

March 24,202 3

March 24,202 3

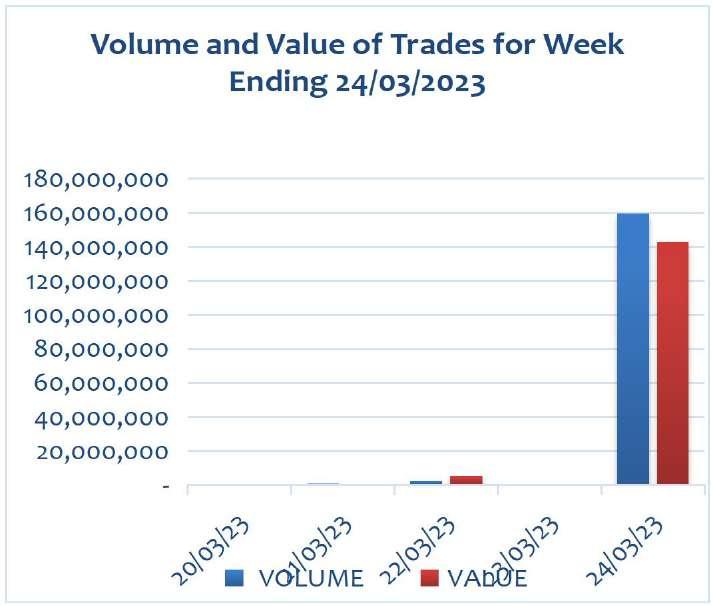

Government had earlier anno unced a set target o f GH¢2 775 at the treasury auc tio n but a t the end, tot al bids amounting to GH¢3.895 billion was tendere d , of whic h Go vernment acc epted 99 41 % amount ing to GH¢3 .872 billion

The week-on- week yields witne s sed an o verall appro ximated d ro p of 1.47b ps and 1 58bps across the 91 and 182- day bills respectively

At the j ust ended Treasury Bi ll auc�on, the Government accepted a total bid of GH¢3.32 billion across the 91, 182 and 364-day bills in the f ace of a total tender of bids, amoun�ng to GH¢4.20 billion

The week-on-week yields witnessed an overall approximated drop of 4.16bps, 3.71bps and 0.72bps across the 91, 182 and 364-da y bills respec�vely.

Story continued from page 15

UAE government must implement policy changes that encourage local investment in new industries and projects, in collaboration with the Israeli private sector. This will not only lead to economic growth and job creation but also contribute to regional stability and security in the long term.

By focusing on high-tech industries, strengthening the startup ecosystem, establishing special economic zones, investing in human capital, and encouraging public-private partnerships, both countries can create a robust framework for cooperation and ensure a prosperous future for their citizens.

As part of the future development between the two countries, I think that there is a high potential for economic joint development in third parties countries.

The New Frontier:

Israeli-UAE Cooperation in Developing Strategic Technological Projects in Africa, South America, and Asia Israel and the UAE, both recognized as global leaders in innovation and technology, possess a wealth of knowledge, expertise, and resources that can signicantly bene t developing regions such as Africa, South America, and Asia. By collaborating on strategic technological projects, Israel and the UAE can contribute to economic growth, job creation, and sustainable development in these regions.

Developing regions often face challenges in infrastructure development and connectivity. Israeli-UAE cooperation can lead to the deployment of advanced

technologies to enhance transportation systems, develop smart cities, and improve internet connectivity in rural areas. By investing in infrastructure projects, Israel and the UAE can help bridge the digital divide and promote economic growth in these regions.

Agriculture and Food Security

Agriculture is a critical sector for many developing countries, and Israeli-UAE collaboration can revolutionize agricultural practices through the implementation of advanced agri-tech solutions, including precision agriculture, irrigation systems, and biotechnology. By sharing their expertise in water management and desert agriculture, Israel and the UAE can contribute to food security and climate change resilience in Africa, South America, and Asia.

Both Israel and the UAE have made signi cant strides in renewable energy development. Joint projects in renewable energy can help developing regions access clean, a ordable, and sustainable energy sources, mitigating the impact of climate change and fostering green growth. This includes solar power, wind energy, and innovative energy storage solutions, which can reduce the dependence on fossil fuels and help achieve the United Nations Sustainable Development Goals.

Israeli-UAE cooperation in healthcare can contribute to improved medical infrastructure and access to advanced treatments in developing

regions. By collaborating on the development of telemedicine platforms, mobile health clinics, and innovative medical technologies, Israel and the UAE can enhance the quality of healthcare services and contribute to the overall well-being of local populations.

The potential bene ts of Israeli-UAE cooperation in developing strategic technology projects are vast. Engaging in trilateral cooperation with countries in Africa, South America, Asia, Israel, and the UAE can create synergies and build strong partnerships that transcend regional boundaries.

Trilateral cooperation can foster goodwill and strengthen diplomatic relations between Israel, the UAE, and countries in developing regions. By working together to address common challenges, the countries can build mutual trust and create a foundation for future diplomatic initiatives.

Through trilateral cooperation, the countries involved can share knowledge and expertise to address global challenges. This collaboration can lead to joint research initiatives, technology transfer, and capacity-building programs, ultimately contributing to sustainable development.

By partnering with countries in

Africa, South America, and Asia, Israel, and the UAE can contribute to regional stability and security. This includes combating terrorism, piracy, and human tra cking, as well as addressing issues related to migration and refugees.

Israeli-UAE cooperation in developing strategic technology projects across Africa, South America, and Asia has the potential to transform these regions, contributing to economic growth, sustainable development, and enhanced quality of life. By engaging in trilateral cooperation, Israel and the UAE can strengthen diplomatic ties, share knowledge and expertise, and enhance regional stability and security. This collaboration can create a new frontier for innovation and progress, forging strong partnerships that transcend regional boundaries and foster global prosperity.

As the world becomes increasingly interconnected, countries need to work together to address shared challenges and build a better future for all. The Israeli-UAE partnership serves as a powerful example of how two countries, once adversaries, can come together to create positive change on a global scale. By extending this cooperation to developing regions in Africa, South America, and Asia, Israel, and the UAE have the opportunity to make a lasting impact and contribute to a more sustainable, secure, and prosperous world.