supports students’ career and

empowerment

supports students’ career and

empowerment

We are committed to deepening collaborations with DBG to achieve its mandate—CBG MD

Gov’t commends Ethiopian Airlines for promoting interconnectivity…as it launches night flights from Addis to Accra

By Eugene Davis

By Eugene Davis

nationwide connectivity

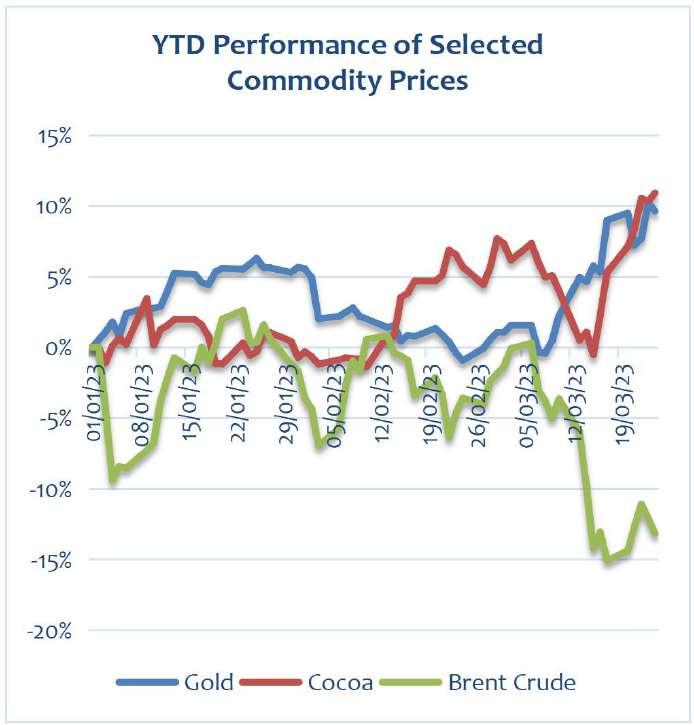

Gold announces C$27 million financing

African countries should promote the free movement of people across their borders to boost intra-African trade, says the Economic Commission for Africa (ECA), Director of Regional Integration and Trade Division, Stephen Karingi, calling for the speedy rati cation of the Protocol on free movement of people.

The African Union, recognizing the importance of human resource skills to the continent's development, adopted the Free Movement of Persons Protocol in 2018, which has been signed by 33 Member States. However, only four countries have ratied the Protocol to date.

"The state of rati cation is disheartening, to say the least, given that the Protocol is aimed at facilitating regional integration in general, and the implementation of the African Continental Free Trade Area (AfCFTA), in particular," Mr. Karingi said in Nairobi, Kenya during the Experts' Group Meeting to Review the Policy Report on the theme; "The Free Movement of Persons for Trade: Towards an Accelerated Rati cation of the AU Free Movement of Persons Protocol in Support of the implementation of the AfCFTA".

The two-day Experts' Group Meeting reviews the policy report, an outcome of a joint study by the African Union Commission (AUC) and ECA. The study showed the benets of the free movement of persons for the implementation of the AfCFTA and identi ed factors behind the slow rati cation of the Protocol.

The slow rati cation of the Protocol has been attributed to a lack of knowledge and appreciation of the bene ts of free movement of persons, lack of awareness of the Protocol, lack of political will, security and health concerns. Furthermore, the study recommended spirited advocacy and sensitization campaigns targeting member states and civil society to initiate domestic processes for ratifying the Protocol. Mr. Karingi noted that while some of the concerns around ratifying the Protocol were valid, policymakers and African citizens should be made aware of the support available to address some of the technical concerns raised.

The Free Movement of Persons Protocol is part of the treaty establishing the African Economic Community. It has been recognized as a tool to facilitate labour and skills mobility in accelerating trade in Africa.

Bemoaning that intra-African trade remained as low as 15 percent, Mr. Karingi said it was important that African governments embraced the free movement of persons as this would enable Africans to enjoy the full bene ts of the AfCFTA.

"Free movement of persons can be a catalyst for entrepreneurship and trade, providing employment opportunities and addressing poverty and inequality," said Mr. Karingi. The Policy Report provides evidence that countries scoring high on the Visa Openness Index have also made gains in trade, tourism, and employment. For example, the Seychelles recorded an annual

increase of 7 percent in international tourism between 2009 and 2014 as a result of its visa-free access to all Africans.

Mr. Oliver Konje, Director of International Trade, State Department of Trade and Enterprise of Kenya, said the free movement of persons has been shown to boost tourism and ease demographic pressure in sending countries while increasing cultural exchange at the sub-regional level.

Concurring, the Director of Trade in Services, Investment, Intellectual Property Rights and Digital Trade at the AfCFTA Secretariat, Emily Mburu-Ndoria, emphasized that the free movement of persons was a key vehicle in driving the successful implementation of the AfCFTA because business people can move across the continent, thereby boosting economic growth.

"Trade and mobility on the African continent are intertwined and the greater conditions for the mobility of workers have the potential to lower unemployment rates, promote integration and Pan-Africanism," said Ms. Mburu-Ndoria, in remarks made on her behalf by Desire Loumou, a senior trade expert at the AfCFTA Secretariat.

While the unrestricted movement of persons raised concerns about local workers and services providers in destination countries losing jobs, Ms. Mburu-Ndoria, said the gains and bene ts from the AfCFTA trade outweigh these worries. She recommended a balanced approach dealing with sensitivity of mobility relating to security, health, and the environment.

The Managing Director of Consolidated Bank Ghana Ltd. (CBG), Daniel Wilson Addo, has stated that his out t is committed to deepening collaborations with Development Bank Ghana (DBG) to facilitate and strengthen long-term credit ow to drive economic growth among Ghanaian businesses.

Commenting on the importance of the partnership, Mr. Addo said, "DBG has a big audacious goal to address very key challenges within the business community. We all know the importance of SME support to Ghana's economy, and CBG is

DBG-University of Ghana Business School (UGBS) Development Finance Series MoU Signing and Roundtable Meeting held at the University of Ghana, Mr. Addo also encouraged the Development Bank of Ghana (DBG) to stay focused as an enabler for businesses in Ghana and as a long-term capital provider in the market.

delighted to be associated with DBG because of our commitment to see SMEs thrive in Ghana."

"To add to our tall list of SME support activities, we partnered with DBG to train 160 SMEs on the Foundational Financial Literacy Course as part of an SME Financial Empowerment program. We at CBG look forward to deepening our relationship with DBG to on-lend to Ghanaian businesses in targeted industries such as agribusiness, manufacturing, ICT, and high-value services as the catalytic sectors of the economy identi ed by DBG", he noted.

In his keynote address at the

According to him, though, DBG is not required to maximise pro t, the institution must work to remain nancially sustainable with less reliance on capital injection from the government and ensure funds advanced to the Participating Financial Institutions are repaid when due in order to help DBG recycle capital.

“By the very nature of National Development Banks (NDBs), they are not required to be pro t maximisers. However, to e ectively discharge their mandates and limit the recourse to scarce public funds, they must be nancially sustainable. In a 2021 research report, Fitch estimated that one-third of 84 African NDBs posted losses in 2019 and the trend continues”.

“Whilst NDBs are not prof-

it-driven, consistently posting losses raises the need for continuous capital injection from a government that already has very little scal space to operate. This then opens the institution to government interference. To counteract this, DBG will have to manage its funding costs, operate at high levels of e ciency, and as much as possible employ funding structures that minimize credit losses”, he advised.

He added that it was also necessary for CBG to carefully identify the sectors where it could make the most impact and focus its lending and advocacy e orts appropriately.

Since CBG’s inception, the bank has granted over GHS 1.5 billion to the SME sector, provided an SME Center dedicated for advisory services, introduced a program dubbed the CBG Adesua Series, partnered with Ghana Enterprises Agency (GEA) to disburse concessionary loans totaling GHS 154 billion to 34,000 SMEs; German International Cooperation (GIZ) to train 500 artisans; and GIRSAL in supporting the agricultural sector.

FBNBank has given further meaning to its commitment to empowering the youth by collaborating with the University of Ghana Career & Counselling Centre to organise a career week for the students.

The week’s activities comprised an industry academia forum, a career fair, corporate icon contest, the decoded show, and the introduction of a uniquely student account, the XploreFirst Students’ Account.

The theme for this year’s University of Ghana Career Week is “Embracing Opportunities: Charting your Career Path” and it was held at the Cedi Conference Centre. The week-long programme started on Monday, 27 March 2023

and will end on Thursday 30 March 2023. The industry academic forum on the theme featured Dr. Bello Bitigu, Director of Sports at the University of Ghana, Joshua Ghanem, General Manager of ALX, Derrick Crentsil, Lead Consultant at La Lune Digital Limited and Kafui Dey, TV Host, Professional Master of Ceremonies and Public Speaking Coach.

Delivering the welcome address, Dr. Bridget Ben-Naimah, Director of the University of Ghana Career and Counselling Centre said, “the Career Week is meant to expose the participating students to opportunities within the

job market, training, and internships. Also, the students were to learn about the skills required for life after school and explore networking opportunities.”

As part of the activities of the Career Week and in line with FBNBank’s youth agenda, the Bank launched the XploreFirst Students’ Account which primarily empowers account holders for the future in addition to a variety of bene ts.

Introducing the XploreFirst Students’ Account, Head of Retail Banking at FBNBank, Allen Quaye said, “Our commitment

We are committed to deepening collaborations with DBG to achieve its mandate—CBG

Story continued from page 3 to the students’ cause and to a larger extent, the ght for youth empowerment has moved up to a new level with the introduction today of a unique student product which is designed to o er special bene ts to our younger brothers and sisters here and most importantly, o er them a good foundation for the future. Permit me to introduce the FBNBank XploreFirst Students Account, a savings account designed for students between the ages of 16 and 30 years. This account

allows the target group to save towards their future while providing them with the opportunity to access world-class nancial services in addition to some exciting bene ts including the possibility of internship at FBNBank, periodic invitations to events by the Bank and free shopping with their MasterCard for POS and online transactions. This product brings to life our brand promise to o er the Gold Standard of value and excellence to our customers and it is a testament of our commitment to continue to put the youth at the heart of

He went ahead to invite the students to join the FBNBank family by signing up for the FBNBank XploreFirst Students Account which will deliver great rewards for their future.

FBNBank has in its 26 years of operating in Ghana remained focused on putting its customers and communities rst. This, it has sought to do through the rich value and excellence of what the Bank contributes to the relation-

ship with its stakeholders as a whole, particularly the customers. FBNBank Ghana is a wholly owned subsidiary of First Bank of Nigeria Limited Group which is renowned for its great customer service and general stakeholder engagement garnered over its 129 years of operation. FBNBank Ghana has 23 branches, 3 agencies many agent banking partners across the country with over 500 sta . FBNBank o ers universal banking services to individuals and businesses in Ghana.

opian Airlines of its un inching support to promote interconnectivity of ight on the continent.

Speaking on behalf of the Minister of Transport, a Deputy Transport minister, Fredrick Obeng Adom stated that government is keen on supporting Ethiopian Airlines as well as providing the needed policy direction and the necessary support to promote the development and growth of airline operations and the aviation industry.

“I wish to congratulate Ethiopian airlines for the successful launch of its nights’ ights to Accra o ering the Ghanaian

connect more with the world through Ethiopian airlines.

It is not economically wise for a traveller to travel two continents just to connect to a neighbouring country via air travel. The story of air connectivity on the African continent must change and I am pleased to witness this signicant milestone of Ethiopian airlines.” he said at the launch of Ethiopian Airlines night ights to Accra”

He also disclosed that the government is in the process of decoupling the Air Navigational Services (ANS)from the Ghana Civil Aviation Authority (GCAA) to give indepen-

in accordance to ICAO regulation and the best practice in the aviation industry.

Ethiopian airlines is one of the pioneering airlines on the continent and boasts of being the airline with the largest eet and passenger numbers with over 120 destinations including 62 African connectivity.

The Managing Director at Ghana Airports Company Limited (GACL), Pamela Djamson-Tettey also lauded Ethiopian Airlines for the initiative, stressing that the new evening service will undoubtedly o er more connectivity options for travel-

and Asia.

She added that it was her hope that it will provide the needed competition and o er travellers a ordable fares.

“As Operators and Managers of Kotoka International Airport, Ghana Airports Company Limited is delighted and encouraged by this development.

GACL will continue to provide the needed facilities and services for a pleasant travel experience, in line with our mission of providing world-class facilities and

Story continues on page 5

Story continued from page 4

services for the bene t of our stakeholders.

We wish to assure Ethiopian Airlines, that we will provide them with the needed support for a smooth facilitation at Kotoka International Airport.”

The new night ights will complement Ethiopian Airlines’ regular midday ights making Ethiopian Airlines the largest operator by frequency (11 times per week) servicing Kotoka International Airport.

Mrs Aniley Eshetu, Area Manager of Ethiopian Airlines for Ghana, Sierra Leone, and Liberia, said the four additional night ights would further make Ghana the most connected country in the West Africa sub-region and boost trade and

tourism.

“Thickening our capacity in Ghana with additional frequency is also a continuation of the same commitment to better serve the Ghanaian travelling public.

Moreover, these new additions coupled with our daily morning ights will enable us to connect Accra eleven times a week to our expanding global network spreading across ve continents.” she said.

Currently, deploying 143 modern aircraft, Ethiopian Airlines serves 131 international passenger and cargo destinations, including 63 African cities with daily and multiple ights with a minimum layover in Addis.

sance of the development needs of Africa’s people,” said Punki Modise, Absa Group Chief Strategy and Sustainability O cer.

Absa Group, Africa’s largest funder of renewables, announced today its long-term ambition to reach Net Zero state by 2050 for scope 1, 2, and 3 emissions. Supporting a transition to a low carbon economy is underpinned by the Group’s aspirations to be an active force for good in everything we do, prioritising business activities that have the most positive environmental, social, and economic impact, while mitigating negative impacts.

“While we recognise Africa’s particular vulnerability to climate change, our approach to Net Zero also takes cogni-

“Our Net Zero declaration underpins our belief in and support for a Just Transition. The transition to a resilient and sustainable economy must be inclusive and equitable for communities, investors, and industries and leave no one behind. We are committed to mobilising the resources necessary for supporting our clients’ energy transition, thereby reducing their carbon emissions and, ultimately, those of the countries in which we operate”, she said. Our commitment to entrench environmental, social and governance (ESG) principles throughout our business underpins this support, as we believe that ESG is vital for delivering real long-term value and our purpose of empowering Africa’s tomorrow, together …one story at a time.

Operational Emissions: Absa Group recognises its contribution to a sustainable future and the extent to which its business needs to re ect that in the operating choices that it makes. As such, the Group

continues its journey towards a group-wide target to reduce operational emissions by 51.0% from 2018 levels by 2030. The Group is on track with this target and has achieved an overall reduction of 21.3% to date. The Group commits to setting near and long-term scope 1 and 2 targets and having these targets validated by the Science-based Targets initiative (SBTi).

Sectoral Targets on Financed Emissions: Coal: We support diversifying electricity and energy supply, and we strive for a balanced energy mix, supporting clients through the energy transition. Funding of the sector will be in line with the Group’s Coal Financing Standard, which provides a framework for addressing Absa Group’s sustainability risks and disclosures. Coal credit exposure as a percentage of the Group loans and advances to customers (including o -balance sheet items) was 0.04% in 2022. We expect to reduce the coal credit exposure limits from 0.20% in 2023 (2022: 0.20%) to 0.11% in 2030, with further reductions to 0.06% in 2040 and 0.03% in 2050.

Oil and Gas: Our credit expo-

sure limits to the oil sector are expected to peak at 1.41% of Group loans and advances to customers (including o -balance sheet items) in 2023 (2022: 1.03%). Thereafter, we target a signi cant reduction to 0.46% in 2030, 0.22% in 2040 and 0.04% in 2050. As we consider gas a transition fuel, the trajectory of our lending targets di ers from oil and coal. Our gas sector Group loans and advances to customers (including o -balance sheet items) are expected to exceed oil by 2027. We expect our total credit exposure limits to the gas sector to increase to 0.60% in 2023 (2022: 0.51%) and to peak at 0.83% in 2030. Thereafter, we target a material reduction to 0.52% in 2040 and 0.32% by 2050.

Wind and Solar Energy: Absa Group celebrates being the rst bank in South Africa to announce its plan to mobilise a cumulative R100 billion of sustainable nance by the end of 2025. Our Relationship Banking unit in South Africa aims to nance R2.5bn of embedded renewable power by 2025. The Group expects to grow its renewable energy lending at a compound

Story continued from page 5 annual growth rate of 26% by 2025, doubling the lending commitment over the period. In addition, the Group, through its Vehicle and Asset Finance division, commits to support the adoption of New Energy Vehicles (NEV), taking into account the charging and other infrastructure needs for both in-home and on-the-road usage.

Our Progress to date in Financing the Low-Carbon Energy Transition: Absa Group has made signi cant strides in delivering against its sustainability agenda and cemented its position as Africa’s leading bank in renewable energy nancing. The Group issued its rst green bond (Africa’s rst certi ed green loan), published its Sustainable Financing Issuance Framework, and closed a $400 million sustainability-linked term loan facility.

The Group invested in the African Rainbow Energy platform with an initial cash investment of R500 million and by transferring R5 billion of its existing renewable energy assets. This investment aligns with the Group's commitment to renewable energy and the green economy, and it brings expertise in renewable energy nancing, thus creating South Africa's largest, black-owned, renewable energy fund.

Additionally, the Group has delivered a landmark transaction with Harmony Gold Mining Company Limited which it believes will be a blueprint for other sustain-

able nance transactions over the course of 2023 and beyond. This R10.4bn transaction was the largest sustainability-linked transaction in the sector in 2022 and incentivised Harmony Gold Mining Company Limited to reduce its overall carbon footprint by setting targets for greenhouse gas emissions, renewable energy consumption, and water usage.

At the end of 2022, Absa Relationship Banking in South Africa had nanced over R1bn in SME embedded renewable power generation capacity. It also acted as sole sustainability coordinator in the rst sustainability-linked transaction in the paper and pulp industry for Sappi and enabled the evolution of Teraco's energy usage towards renewable sources by arranging a R1.5 billion green loan.

Absa Group endeavours to ensure that its nancing does not harm vulnerable communities and that they have access to a ordable renewable energy. Consequently, the Group applies enhanced due diligence when considering the environmental and social impacts of projects, ensuring that it adheres to best practices.

Reporting and Disclosures:

Absa Group aims to lead the nancial services sector in moving away from a reactive and compliance-based approach to sustainable nancing, reporting, and disclosures and instead consolidating a strategy-driven approach to unlocking the

social impact, climate resilience, and enterprise shared-value opportunities presented by our sustainability and Net Zero commitments. As a founding signatory to the UN Environment Programme Finance Initiative’s Principles for Responsible Banking (PRB), as well as a signatory to the UN Global Compact, Absa’s Net Zero strategy is aligned with the UN Sustainable Development Goals (SDGs) and the Paris Climate Agreement. The Group plans to maintain its sustainability reporting and disclosures in addition to the prescribed King IV Integrated Report, while ensuring that it incorporates the latest standards and best practices as the need for greater transparency grows. Currently, the following reports are provided:

1.Environmental Social and Governance

2.Task Force on Climate-Related Financial Disclosures

3.Principles for Responsible Banking

Absa Group Environmental, Social and Governance (ESG):

“In the past year, we’ve made signi cant progress in the area of sustainability, which is an integral part of our commitment to being an active force for good in everything we do. This commitment has also seen us accelerating the embedment of environment, social and governance across our business,” said Absa Group CEO Arrie Rautenbach.

Due to the severe load shedding situation in South Africa, our Group has taken the initiative to assist our clients during

this trying time. We are working closely with them to discover inventive approaches that can reduce energy usage, improve productivity, and support the reduction of greenhouse gas emission. Our objective is to aid our clients in reducing the impact of load shedding on their day-to-day activities and operations while simultaneously aiding the worldwide mission of mitigating climate change.

We are pleased with the latest tax incentives introduced by South African Minister of Finance Enoch Godongwana, which promote the adoption of renewable energy sources by both households and businesses. This has the potential to increase renewable energy production and alleviate the energy crisis. We support a Just Transition that addresses Africa’s energy poverty, and we have prioritised the promotion of sustainable and inclusive economic growth, employment, and decent work for all. Several of the countries in which we operate rely on oil and gas sectors for their socioeconomic development. Our objective, therefore, is to aid customers and communities in achieving sustainable and inclusive growth, and leaving no one behind, by providing services that facilitate the transition and adaptation process, promoting an ethical and inclusive supply chain, and ensuring that stakeholders have a say in our climate change decisions. Embarking on a journey to achieve a Net Zero state by 2050 is an important step towards supporting a Just Transition and a sustainable future.

Vodafone Ghana has announced an expansion of its national roaming service partnership with MTN, to improve connectivity for customers throughout the country. The initiative, which initially began with a pilot program last year, has been expanded to cover the entire nation.

The initiative is a result of an e ort by the government to facilitate universal access to telecommunications services and accelerate the country’s digital transformation. By

implementing a full national roaming regime among all operators, the government hopes to expand coverage and strengthen the telecommunications industry.

National roaming allows a subscriber’s SIM to connect automatically to an alternative telecom network when their primary network is non-existent or weak. The service not only extends the coverage of network operators’ retail voice and SMS services but also

Story continues on page 7

enables mobile users to continue using their phone numbers and data services within another jurisdiction.

Vodafone Ghana CEO Patricia Obo-Nai expressed enthusiasm for the initiative: “National roaming o ers customers a greater choice of network providers. In 2022,

we successfully collaborated with the government, the regulator, and MTN Ghana to pilot the national roaming service in the Volta Region,” she said. “We are excited that this partnership has extended to other regions.”

Patricia added that the initia-

tive would enable Vodafone Ghana customers to stay connected to its o erings no matter their location in Ghana.

“We o er a wide variety of products and services to consumers and businesses. With this initiative, we are glad that all communities in Ghana can

bene t from our o ers,” she said.

By fostering a more connected and digitally integrated nation, Vodafone Ghana is collaborating with the government to improve communication, access to information, and business opportunities for all Ghanaians.

manufacturing companies already siting production units outside Ghana to enjoy cheaper inputs.

that support businesses and help mitigate the negative impact of policy rate increase.

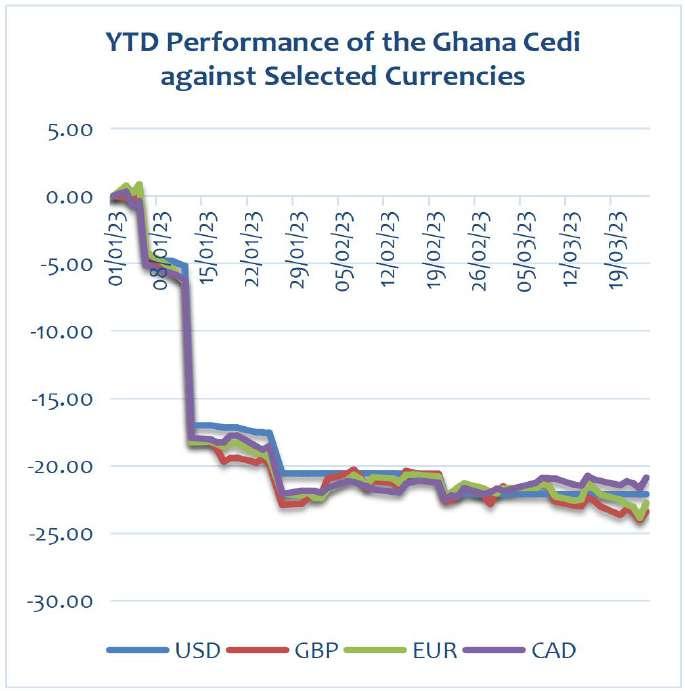

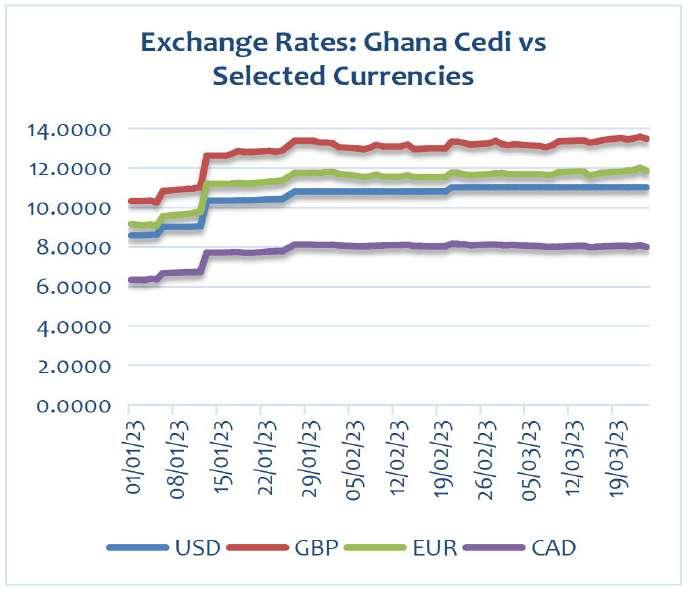

The Ghana National Chamber of Commerce and Industry (GNCCI) has said that the recent increase of the policy rate to a historical high of 29.5 per cent will worsen the plight of businesses in the country. The chamber expressed concern that the continuous increase of the policy rate from 14.5 per cent to the current level was alarming and would have detrimental impact on the business climate in Ghana.

A statement by the chamber stated that in the face of the

challenges business have encountered over the past few years, including supply chain disruptions, reduced demand, cash ow challenges, and the recent upward adjustment of utility tari s, the posture adopted by the Central Bank does not augur well in sustaining a conducive business environment.

“Majority of businesses including GNCCI members are struggling to break-even in their business operations which is critically undermining their competitiveness, with some

“The GNCCI holds the view that the recent hike in the monetary policy rate will exacerbate the challenges confronting businesses in Ghana, as it will result in higher borrowing costs and reduced investment, thereby hampering growth and employment prospects,” the release noted. The release also noted that the policy rate would also have adverse e ects on consumer spending, exchange rates, and in ation expectations, consequently dampening the business climate in Ghana. Furthermore, it said the proposed Excise Duty Bill and the Growth and Sustainability Levy Bill aimed at boosting government revenue would weigh heavily on businesses, posing signi cant obstacles to their performance, resilience, and sustainability.

In light of these concerns, the GNCCI advocates for policies

The Chamber’s proposals include providing targeted support for SMEs through nancial aid and access to credit, as well as implementing measures that promote economic growth, such as increasing investment in infrastructure and other sectors.

The release, which was signed by the President of the Chamber, Clement Osei-Amoako, said importantly, macroeconomic policies must aim at strengthening the micro economy and not weakening it Furthermore, the Chamber believes that Ghana’s economic management challenges were partially attributed to an overemphasis on macro prudential programmes, and instead, the way forward lied in prioritising microeconomic diligence by implementing competition laws, structures and path-walking, value addition, and export development,” it’s the release stated.

Asante Gold Corporation has entered into an agreement with a major institutional investor to sell 18,232,000 units of the company.

The deal which expected to be on a non-brokered private placement basis will go at a purchase price of C$1.50 per

unit and expected to raise C$27.34 million.

Proceeds from the o ering is expected to be used for exploration and development of the its mineral properties and for general corporate working capital purposes.

Closing of the o ering is

expected to occur on or about April 3, 2023, and is subject to a number of closing conditions including, but not limited to, the receipt of all necessary regulatory approvals, including the approval of the Canadian Securities Exchange.

The company also noted that the securities to be issued under the O ering would be subject to a four month plus one-day hold period from the date of issue in accordance with applicable securities laws. No commissions or nder’s

fees will be paid by the Company in connection with the O ering

The release further noted that the company was currently at an advanced stage of securing a senior debt facility to support capital investments and development of its assets.

The comapny also announced that Asante Gold had terminated the brokered private placement nancing previously announced on January 23, 2023, due to unfavorable market conditions.

exports, including grain, sh, sun ower and soybean oil, processed grain products and prepared meat products, among others.

Russian exports of agribusiness products to Côte d'Ivoire more than doubled to $41.6 million in 2021 from $18 million a year earlier, the report said. This included 96,100 tonnes of wheat worth $26.2 million, 12,900 tonnes of sh worth $8.7 million, 1,100 tonnes of sun ower oil worth $1.7 million and 400 tonnes of ice cream worth $0.5 million.

the reduction of purchases of cocoa beans and cocoa powder. At the same time, cocoa paste imports showed signi cant growth: 27% by volume and 37.2% by value,” the report said.

Around 7.5 million people made up the workforce. The workforce took a hit, especially in the private sector, with numerous economic crises since the 2000s. Decreasing job markets posed a huge issue as unemployment rates grew.

The Republic of Côte d'Ivoire has abandoned its import substitution policy and other economic measures, including the budgetary allocation for modernizing local agriculture and support for boosting domestic agricultural production. It, however, boasts around 64.8 per cent of arable and agricultural land, which largely remains uncultivated.

Arguably, Côte d'Ivoire, located on the Gulf of Guinea (Atlantic Ocean), could support its shing industry by spending adequate funds on

acquiring simple shing equipment for local people and even start its own large-scale sh ponds but instead plans to increase sh imports into the country.

It was gathered that the West African country might spend an estimated $100 million on exports of Russian food and agricultural products this second quarter of 2023.

The Russian Agriculture Ministry's Agroexport Center said it was ready to export such products to Côte d’Ivoire as its market is promising for

Statistics show that imports from the Côte d'Ivoire are far higher and grew to $237.5 million in 2021 from $223.7 million in 2020, although by the volume they dropped to 72,600 tonnes from 74,500 tonnes. These imports included 43,800 tonnes of cocoa beans worth $141.8 million, 18,100 tonnes of cocoa paste worth $69.3 million and 3,400 tonnes of cocoa powder worth $8.5 million.

“The decrease in Russian imports by volume was due to

With rising unemployment, especially among the youth, experts suggested the government engage in economic diversi cation, focus on support for improving local production. Therefore, preliminary solutions proposed to decrease unemployment included diversifying the economy and increasing nancial support in addressing domestic food security.

With an estimated population of 29 million, the economy of Côte d'Ivoire has grown faster than that of most other African countries since independence. One possible reason for this might be

Recent gures released by the Bank of Ghana indicate that Ghana’s public debt stock still remains constant at GH¢575.7 billion at the end of November 2022.

By this, Ghana’s total public debt stock increased from about GH¢467.4 billion in September 2022 to about GHC575.7 billion in November 2022.

According to the latest Bank of Ghana’s Summary of Macroeconomic and Financial Data for the period ending March 2023, the debt gure of about GH¢575 billion still puts Gha-

na’s debt to Gross Domestic Product (GDP) ratio at 93.5% as of November 2022.

Per the data, the country’s domestic debt, still stands at GH¢194.7 billion at the end of December 2022, representing 31.6% of GDP.

This is compared to GH¢195.7 billion recorded in September 2022, and ¢193.1 billion in November 2022.

Already, government has taken steps to restructure its domestic debt through the Domestic debt exchange program which closed on Friday

Story continues on page 9

MMTN moves to make Ghana ICT hub…announces construction of US$25m ICT project

Story continued from page 8

10th February 2023 with over 80% participation of eligible bonds.

The external component of Ghana’s total public debt is $29.2 billion (¢382.7 billion) in November 2022, equivalent to 62.1% of GDP.

This is an increase from $28.4 billion (¢271.7 billion) in September 2022, and $28.3 billion

in December 2021. The signicant increase in the cedi component of the external debt is attributed to a 37% depreciation of the cedi to the dollar in 2022.

This comes at a time when the government in December 2022 suspended payments on most of its external debt, defaulting, as the country continues to nd ways to rebal-

ance the economy.

The Finance Minister, Ken Ofori-Atta has also been engaging with external creditors to conclude external debt.

As part of this, Finance Minister, Ken Ofori-Atta travelled to China on March 23, 2023, to negotiate with China, which holds about $1.7 billion of Ghana’s debt.

He is however hopeful of a

successful meeting with the Chinese government.

The BoG data once again did not provide data for the nancial sector resolution debt and other liabilities such as the energy sector debt.

Meanwhile, the government’s scal de cit to GDP narrowed to 8.1% in December 2022, as against 9.8% in November 2022.

can remote workers, freelancers and digital professionals with frictionless, borderless payments, enabling global payment processing from over 130 countries.

The startup permits those on the continent and in the diaspora, to send and receive money in USD, GBP, Euros and 20 other currencies, allowing Africans to work remotely for international organisations, and be paid and withdraw money in the currency of their choice regardless of location.

Payday, the leading Pan-African neobank issuing global (USD, EUR & GBP) accounts to Africans, has announced a $3M seed round, led by Moniepoint Inc, with participation from HoaQ, DFS Lab’s Stellar Africa Fund, Ingressive Capital Fund II and angel investors - Dare Okoudjou Founder and CEO of MFS Africa & Tola Onayemi CEO of Norebase.

They join follow-on investors Techstars, Angels Touch, Ingressive Capital & Now Venture Partners. Along with existing investors Ethos VC, MAGIC Fund, Ventures Platform, Voltron Capital, and others.

This brings Payday’s total investment to date to $5.1m, following a $2m+ pre-seed round in 2021. In an over-

subscribed round, the new capital raised will be deployed to secure operational licensing in the United Kingdom and Canada, while building out operations in the United Kingdom, where the company has recently been incorporated.

Funding will also be used to boost talent acquisition as the startup’s team complement expands from 35 to 50 employees, as Payday looks to further fuel the future of work through borderless payment alternatives in major currencies.

The round also sees the expansion of the Co-Founding team with the addition of Elijah Kingson – Payday’s current CPO who previously led

product design for Premium and subscription products at British-Lithuanian neobank Revolut. Yvonne Obike, the company’s current COO, has also joined the Co-Founding team. Her work with Nigeria’s Bank of Industry saw her drive MSME growth, societal rehabilitation, economic recovery and development to local, national and international stakeholders.

The team has also brought on board former Goldman Sachs and Expedia Product Manager, Sean Udeke as Head of Products.

Launched in June 2021 by Favour Ori, Payday, the rst Rwandan company in history to join Techstars, was developed to support Afri-

Currently operational in Nigeria, Rwanda and the UK, Payday o ers its 330,000+ users virtual Visa and Mastercards, which can quickly be generated using the Payday App. Onboarding 100,000+ new users a month and processing an average of 40,000 transactions per day, Payday processes several millions in USD per day as a result of its increasing user base. In February 2023, Payday became a payment partner for Starlink, operated by SpaceX, which now enables Nigerian and Rwandan citizens to purchase Starlink routers seamlessly.

Commenting on the fundraise, Favour Ori CEO and Founder of Payday said, “We're thrilled that this round of funding will lay the foundation for the continued growth of our platform as we expand our services to a wider audience. This investment represents a signi cant milestone for our company and we are grateful for the trust and commitment shown by our investors both existing and new.

We’re amped to scale our platform and reach more Africans, not only on the continent, but around the world. Our passion for empowering individuals and businesses with convenient and Story continues on page 11

Story continued from page 9

secure payment solutions is tangible, and we believe that this funding will allow us to do so on an even greater scale”.

“Our goal remains the same: to make it easy and accessible for anyone to access their payments when on the continent, and with this new funding, we are one step closer to achieving that vision,” concluded Ori.

With the company increasing its user base by 100,000+ a month, the evolution of Payday and its services was inevitable with Payday 3.0 being launched in January of this year. Dedicated to building a super app that enhances and simpli es the UX for its customers, some of its new features include:

Global Accounts (USD, GBP, EUR, etc)

Virtual USD & NGN Cards

Currency Swaps

Payment Links

Local Bills Payment

Peer-to-Peer Transfers

The possibility to add user account information to platforms such as Deel to receive salaries in minutes rather than

Tosin Eniolorunda, CEO of Moniepoint Inc shared, “At Moniepoint, we’re excited about the unique things Favour and the team are doing with Payday. Personally, I connect deeply with his drive, technical depth, and desire to execute. The urge to encourage that re inspired us to want to be a part of this.

More important is the alignment in our goal to provide nancial happiness by addressing key payment pain points - Moniepoint with merchants and Payday with individuals. We see a potential to leverage their infrastructure to further deepen our suite of nancial services for merchants, and we’re looking forward to all that's to come”.

Temi Marcella Awogboro, General Partner at MAGIC Fund said, “We were early backers of Favour and the Payday team, supporting their audacious vision of enabling swift borderless online pay-

ments services for Africa. We are pleased with the positive signi cant milestones achieved on this journey and remain con dent in Favour and the teams’ ability to positively disrupt the sector and impact lives, connecting individuals and businesses with the vast opportunities around the world”.

Maya Horgan Famodou, Founder and MD at Ingressive Capital said, “Favour is one of the most savviest entrepreneurs I have met. He knows how to assess, execute, and pivot exactly when necessary. Hence why Payday has seen such explosive growth. This is certainly a gem in our portfolio. I’d bet on Favour and Payday again any day, both to realize the transformational value and also to make us proud with an exit the ecosystem will reference for years to come”.

Sunil Sharma, Managing Director at Techstars Toronto stated, “A word that best describes Favour Ori is relentless," says Sunil Sharma, Managing Director of Techstars

Toronto and one of the earliest investors in Payday. I was struck by his personal story which took him from Nigeria to the US for his computer science degree and some valuable early work experience, then to Rwanda to establish a team, then to the UK and back to the US in pursuit of growth. Favour is always in search of opportunity and nothing can get in his way”.

John Andreini, Founding Partner at Ethos VC said, “I had experience investing early on with Flutterwave and Chipper Cash and when I met Favour it became clear that he was the right person to lead the next generation of ntech companies in Africa”.

Currently, an estimated 80 million African citizens work remotely. Payday's global payment processing capabilities make it a valuable tool for the continent’s expanding digital nomad population looking to make and accept payments from around the world.

Emirates Airlines has been recognized as “Global Quality Airline Brand of The Year’’ and “Overall Best Quality Service Brand of The Year” at the 2023 Global Business Quality Awards, held on 24 March 2023, at the Labadi Beach Hotel.

The airline was awarded for its global standard of quality for decades and the most valuable airline brand in Ghana. This recognition is a demonstration of Emirates’ unwaver-

ing commitment to delivering the highest standard of service and quality to its customers in Ghana. The Global Business Quality Awards is an initiative of the Entrepreneurs Foundation of Ghana (EFG), to recognize esteemed global brands and quality leaders operating in Ghana. Currently in its seventh edition, the award program is considered a prestigious recognition for businesses, organizations, and personalities in Ghana.

here must always be remembered. It cannot be denied. It must be taught; history must be learned.”

By Philip GebuCape coast Castle has since becoming a tourist site attracted many tourists to Ghana and continues to be a feature of western leaders who visit Africa especially the western part. A visit to the Cape Coast Castle or the Elmina Castle will always be an emotional one. I watched a movie on the slave trade recently where Will Smith featured in and the story line was one depicting terror and pain and su ering. This followed events the slaves were subjected to upon arrival in the America. The followed rst, a long journey on foot from the Northern part of Ghana to the South where the castles where found. They again had to embark on another long journey in the most unbearable conditions across the Atlantic Ocean. The journey, from beginning to end is all about su ering.

The latest leader to add her voice to this sorrowful experience is United States Vice President Harris who toured the Cape Coast Castle on Wednesday. As reported by CNN, Vice President Kamala Harris emerged from the female slave dungeon at Cape Coast Castle visibly shaken. Inside the famous slave trading outpost’s dungeon, Harris set a bouquet of owers down and placed her hand on the centuries-old wall, connecting herself physically to the sorrow of the Africans it once imprisoned. After the tour she said, “Being here was immensely powerful. The crimes that were done here, the blood that was shed here, the horror of what happened

The Castle attracted President Obama in 2009 and after the visit, this is what he had to say. Michelle, the children, as well as other members of my family, just got an extraordinary tour of this castle. It is reminiscent of the trip I took to Buchenwald because it reminds us of the capacity of human beings to commit great evil. One of the most striking things that I heard was that right above the dungeons in which male captives were kept was a church, and that reminds us that sometimes we can tolerate and stand by great evil even as we think that we're doing good.

You know, I think it was particularly important for Malia and Sasha, who are growing up in such a blessed way, to be reminded that history can take very cruel turns, and hopefully one of the things that was imparted to them during this trip is their sense of obligation to ght oppression and cruelty wherever it appears, and that any group of people who are degrading another group of people have to be fought against with whatever tools we have available to us.

So obviously it's a moving experience, a moving moment. We want to thank those who arranged for the tour and the people of Ghana for preserving this history. As painful as it is, I think that it helps to teach all of us that we have to do what we can to ght against the kinds of evils that, sadly, still exist in our world, not just on this continent but in every corner of the globe. And I think, as Americans, and as African Americans, obviously there's a special sense that on the one hand this place was a place of profound sadness; on the other hand, it is here where the journey of much of the Afri-

can American experience began. And symbolically, to be able to come back with my family, with Michelle and our children, and see the portal through which the diaspora began, but also to be able to come back here in celebration with the people of Ghana of the extraordinary progress that we've made because of the courage of so many, black and white, to abolish slavery and ultimately win civil rights for all people, I think is a source of hope. It reminds us that as bad as history can be, it's also possible to overcome.

There are many international celebrities who have also visited the Cape Coast Castle and have provided very good reviews. The videos tourists share with their friends and family have all contributed to marketing the castle. According to researchers, out of the 66 forts and castles built along the coast of Africa, 43 were found in Ghana because of the rocky beaches. This explains the connection the country continues to enjoy with the diaspora. The future is Africa and we need to take advantage and position our tourism for the future. Many of this visits must be encouraged. For those who have not yet visited Cape Coast Castle it’s important to visit and learn about it. Cape Coast Castle, (Swedish: Carolusborg) is one of about forty "slave castles", or large commercial forts, built on the Gold Coast of West Africa (now Ghana) by European traders. It was originally a Portuguese "feitoria" or trading post, established in 1555, which they named Cabo Corso. In 1653, the Swedish Africa Company constructed a timber fort there. It originally was a centre for the trade in timber and gold. It was later used in the Atlantic slave trade. Other Ghanaian slave castles include Elmina Castle and Fort Christiansborg. They were used to hold enslaved

Africans before they were loaded onto ships and sold in the Americas, especially the Caribbean. This "gate of no return" was the last stop before crossing the Atlantic Ocean. Cape Coast Castle, along with other forts and castles in Ghana, are included on the UNESCO World Heritage List because of their testimony to the Atlantic gold and slave trades. The rst fort established on the present site of Cape Coast Castle was built by Hendrik Caerlo for the Swedish Africa Company. Caerlo was a former employee of the Dutch West India Company who had risen to the rank of scal before employing himself with the latter company established by Louis de Geer. As a former high-ranking o cer of the Dutch, Caerlo had the friendly relations with the local chiefs necessary to establish a trading post. In 1650, Caerlo succeeded in getting the permission of the king of Fetu to establish a fort at Cabo Corso (meaning "short cape" in Portuguese, later corrupted to English Cape Coast). The rst timber lodge was erected at the site in 1653 and named Carolusborg after King Charles X of Sweden.

Karlo returned to Europe in 1655, leaving Johann Philipp von Krusenstjerna in charge of Carolusborg. Louis de Geer had, however, died in the meantime, and Caerlo got himself involved in a serious dispute with his heirs. In Amsterdam, he convinced merchants to give a nancial injection to the Danish West India Company, for which he set sail to the Gold Coast in 1657, with the goal in mind to capture for Denmark the Swedish lodges and forts he had established himself. With the help of the Dutch, Caerlo succeeded in driving the Swedes out, leaving the

Story continues from page 13

It has become a feature of western leaders’ visits to West

Story continued from page 12

Gold Coast on the captured ship Stockholms Slott, and with Von Krusenstjerna on board as a prisoner.

Karlo had left Samuel Smit, also a former employee of the Dutch West India Company, in charge of Carolusborg. The Dutch were able to convince Smit in 1659 of the rumor that Denmark had been conquered by Sweden, upon which Smit rejoined the Dutch West India Company, handing over all Danish possessions to the Dutch. The King of Fetu was displeased with this, however, and prevented the Dutch from taking possession of the fort. A year later, the King decided to sell it to the Swedes. After the King died in 1663, the Dutch were nally able to occupy the fort.

The Danes had in the meantime established another fort, Fort Frederiksborg (1661), just a few hundred meters east from Carolusborg. Although situated perfectly to launch an attack on Carolusborg, the English capture of Carolusborg (1664) during the prelude to the Second Anglo-Dutch War, prevented the Danes from challenging them; the English had reinforced the fort, which they named Cape Coast Castle, to such an extent that even Dutch Admiral Michiel de Ruyter deemed it impossible

to conquer.[9] As the Dutch had captured the former English headquarters at Kormantin and had rebuilt it as Fort Amsterdam, Cape Coast became the new capital of the English possessions on the Gold Coast.[10]

In 1689, the pirate Duncan Mackintosh was hanged at the Castle with a few of his crew, though he would not be the last pirate hanged at the fort.[11] In 1722, the fort was the site where 54 men of the crew of the pirate Bartholomew Roberts were condemned to death, of whom 52 were hanged and two reprieved.

In 1762, an extensive spur ending in a tower was built on the western side and in 1773, a high building along the north curtain was erected, during which the last remnants of the 17th-century fort were demolished. Greenhill Point, a bastion to the east of the castle, was replaced by two new bastions, with a sea gate in the middle. To the south, two new bastions, named Grassle's Bastions, replaced an old round tower as the main defensive work. The tower, which now had no military use, was extended in the 1790s with two stories, now becoming the governors' apartments. The space

below Grassle's Bastions was used as the new slave dungeons (source) Wikipedia. Philip Gebu is a Tourism Lecturer. He is also the C.E.O of FoReal Destinations Ltd, a destinations management and marketing company based in Ghana and with partners in many other countries. Please contact Philip with your comments and suggestions. Write to forealdestinations@gmail.com / info@forealdestinations.com

Visit our website at www.forealdestinations.com or call or WhatsApp +233(0)244295901.Visist our social media sites Facebook, Twitter and Instagram: FoReal Destinations.Steve Harvey at Cape Coast Castle

Gillian White

The famous actress and wife of actor Jai White is another Hollywood celebrity who has shed tears at the Cape Coast castle. The actress together with his partner, Jai White and children visited Ghana in January 2019 to take part in the Year of Return program. As expected, Gillian and her family traveled to Cape Coast in the central region of Ghana to visit the castle. Gillian couldn’t hold back her tears as she toured the castle that was used to keep slaves captive before being shipped to

Europe.

Gillian White

Anthony Anderson

American sitcom king, Anthony Anderson, is all the time in his jovial mood and hardly would one see him with a grim face or even imagine it, but when the famous comedian visited the Cape Coast castle upon his arrival in Ghana, he lost his usual jovial and happy looking appearance. For once, Anthony Anderson looked emotional, sad and in utter shock as he was told the harrowing experience his forefathers were subjected to by their European slave masters. While he did well to hold his tears back, one could easily see the lively actor and comedian was emotional.

Other popular actors including Boris Kodjoe, Netherland international, Memphis Dapay and actor Jai White have all visited the castle in recent years but barely managed to hold back their tears. One thing is for sure, you cannot visit Cape Coast castle and not get emotional especially for blacks living in other parts of the world other than Africa.

tecost had males and females sharing the same ward.

This however caught the attention of the Tweapaease branch of the Church of Pentecost who decided to save the situation through the Obuasi area men's ministry.

The new men's ward which cost GH 166,531.00 consists of 10-bed main ward, 4-bed side ward and VIP ward.

of people.

He revealed that the Church saw it important to intervene to salvage the situation of men and women sharing the same ward, during routine evangelism by the District pastor Francis Wugban at the health facility.

The transformation agenda

In line with the vision of the Church of Pentecost to transform the lives of the people in their communities, the men's ministry (PEMEM) of the church in the Obuasi area has commissioned and handed over a 15-bed capacity male ward to the Tweapaease Health center.

The Tweapaease Health center which is the only health facility serving about ten (10) neighboring communities has not seen any major facelift since it was commissioned in 2015.

The facility until the intervention from the Church of Pen-

Speaking after the handing over ceremony the Obuasi area head of the church, Apostle William Boakye Agyarko underscored the importance of the project saying it is in sync with the teachings of the Holy Bible which enjoin Christians to do good to all manner

Apostle Boakye Agyarko reiterated the commitment of the church through their transformational agenda to change the lives of the people even as they admonish people to accept Christ and live a Christ-like life.

Observing a clean environment

The Obuasi area head talked

Story continued from page 13 about the essence of observing a clean environment as a means to prevent diseases.

" The Church of Pentecost true to its resolve to inculcate unto the people the need to observe a clean environment has set aside the 3rd month of the year (March) to clean the environment. He therefore admonish members to observe a clean and healthy environment".

The Amansie Central District Health Director Ampratwum Oppong Ahmed lauded the church for coming to the aid of

the health center. He described the facility as a welcoming relief saying the existence phenomenon of having men and women sharing a single ward became an albatross around the neck of personnel at the facility.

On challenges facing the Directorate in the district, Mr. Ampratwum cited the refusal of health personnel to accept postings to the district as a major threat to healthcare delivery in the district.

" The perception out there is that the district is a deprived one hence personnel who are

posted here refuse to come whiles those who accept postings nd it di cult to get accommodation due to the exorbitant rent charges", he said.

He however notes that, the Assembly is doing its best to add up to the existing health infrastructure but appealed to central government and other groups and institutions to also intervene.

Oheneba Kwadwo Ntoso III, Bekwai Dwonsuahene lauded the Church of Pentecost for their pioneering role in assisting in provision of social ame-

nities.

He added that the provision of male's ward for the Tweapaease Health center lends credence to the impact the church is making on the lives of the people in the country.

" The Church of Pentecost is noted for providing prison facilities, hospitals, schools, boreholes, Police stations among others. This is a feather in the cap of the Obuasi area and on behalf of the people of Tweapaease, I say congratulations to you for these major feet”.

A draft policy framework which is being fashioned out to develop the aluminium downstream sector is expected to bene t the Volta Aluminium Company Limited (VALCO), following plans to modernise and retro t the facility to smelt alumina produced in Ghana.

The downstream policy, according to the CEO of the Ghana Integrated Aluminium Development Corporation (GIADEC), Michael Ansah is hopeful it will pass to become a legal document sometime this year. Key partners such as VALCO, GBCL, Rocksure and MoTI have all had inputs in the maiden policy.

Valco is the second largest smelter in Sub-Saharan Africa and is a major producer of primary aluminium. Today, the company produces approximately 50,000 tonnes of aluminium per annum out of its installed capacity of 200,000 tonnes per annum.

Currently, the company is

100percent owned by GIADEC. As the only existing smelter in the country, Valco is integral to the development of the Integrated Aluminium Industry in Ghana. Under Project 4, GIADEC seeks to partner a strategic investor to upgrade the plant’s equipment and technology to improve e ciency and increase its capacity to 300,000 tonnes per annum.

The VALCO smelter is currently running on two out of its ve potlines and producing about 50,000 tonnes of primary aluminium per year, out of its installed capacity of 200,000 tonnes. The other 3 potlines have been shut down, and beyond repairs due to lack of maintenance and repairs over the years. VALCO has the capacity for direct employment of over 1,200 Ghanaians but currently employs 705 Ghanaians.

Bene ts

When all is said and done, and the VALCO retro t hits the ground running, approximate-

By Eugene Davisly 300,000 tonnes of aluminium will be available to the Integrated Aluminium Industry (IAI) annually. This is an increase from the 40,000 –50,000 tonnes produced presently.

The expected bene ts from the retro t following increased in aluminium production includes; it will encourage the consumption of aluminium locally, thereby replacing imports of aluminium products, new markets will be explored for aluminium export in Africa and beyond leveraging support of AfCFTA and other trade agreements.

Further, it will encourage the production and consumption in speci c sector -transport, construction, packing and electrical, as well as create a policy and incentive framework to attract both local and foreign investors into the downstream industry.

Valco started operations in 1967, with ownership then vested in Kaiser Aluminium and Chemical Corporation (Kaiser) and Reynolds Metals Corporation (Reynolds). Kaiser owned 90percent of the shareholdings and the remaining 10percent by Reynolds, but Reynolds sold its shares to Aluminium Company of America (Alcoa) before the company began operations in 1967.Following the establishment of GIADEC in 2018, and the consequent transfer of the Government of Ghana’s 100% holding to GIADEC, immediate steps were taken by GIADEC to

establish the VALCO Board. The Board was duly inaugurated in August 2020.

A collaboration between GIADEC and VALCO, as part of VALCO’s recovery plan, secured an approval from government for an injection of funds into the Company’s operations in 2021, leading to the maintenance and repairs of its two (2) and only operating potlines. This completed the stabilization phase of the Company.

GIADEC working closely with VALCO has recorded some modest gains over the period. VALCO for the rst time in twelve (12) years, recorded a positive Earnings Before Interest, Tax, Depreciation & Amortization (EBITDA) for the year 2021. The trend is expected to continue in 2022, and in the coming years, if the required investments are made.

The implementation of Project 4 - the modernisation and expansion of the VALCO smelter to improve e ciency and increase capacity, is to ensure that VALCO is positioned to sustainably grow and be pro table, and to contribute towards establishing and realising the linkages of the upstream and downstream components of the Masterplan for Ghana’s IAI. The mordenisation and retro tting of the VALCO smelter will result in a new installed capacity of

the Taiwan authorities, regardless of the rationale or pretext.

Noting China has lodged solemn representations to the U.S. side on this matter, Foreign Ministry spokesperson Mao Ning said at the regular press briefing that Tsai's reported trip is not so much a "transit," but an attempt to seek breakthroughs and propagate "Taiwan independence."

China is not overacting to the issue, Mao said, while pointing out that it is the U.S. that has been conniving and supporting "Taiwan independence" separatist forces, which is an act of egregious nature.

She added the issue is not provoked by the Chinese side, but by the U.S. side and the "Taiwan independence" separatist forces.

China rmly opposes Tsai Ing-wen's planned "transit" visit to the U.S. to meet U.S o cials and will take resolute countermeasures in such an event, Zhu Fenglian, a spokesperson for the Taiwan A airs O ce of the State Council, told a press conference on Wednesday.

The remarks came in response to reports that the Taiwan leader planned stopovers in the U.S. and is expected to meet U.S. House Speaker Kevin McCarthy in California at the end of her

Story continued from page 14

300,000 tonnes that will be a major boost to realisation of the plan.

A well-capitalized VALCO, operating with modern technology, will ensure that the plant is more e cient, more productive, competitive, and can ultimately drive the transformation of the downstream sector of the IAI in Ghana.

The execution of Project 4 alone, will require signicant investments in excess of USD 600 million. This will thus, require a strategic investor/partner with the nancial capacity and technical know-how, to partner GIADEC to expand, retro t and modernize the plant.

Ghana’s downstream sector remains underdeveloped using less than 7,000 tonnes of the about 50,000 tonnes

trip.

If Tsai contacts McCarthy, it will be another provocation that seriously violates the one-China principle and undermines China's sovereignty and territorial integrity as well as peace and stability across the Taiwan Straits, Zhu said.

The "transit" by the Taiwan leader is essentially a provocative act of "relying on the United States to seek independence," and the U.S. side is urged to strictly abide by the one-China principle and

of aluminium VALCO currently produces. With a forecast of about 300,000 metric tonnes of aluminium after VALCO has been retro tted, GIADEC is working to revive and expand the downstream sector to take advantage of the excess aluminium that would be produced. This will ensure that we maximize in-country value by producing nished aluminium products to substitute imports and grow domestic market share in the Automotive, Electrical, Construction and Packaging sectors.

A thriving Downstream Aluminium Industry will be a vibrant industrial powerhouse made up of manufacturing companies creating thousands of jobs, including high paying jobs for the teeming youth.

Project 4 - the modernization

the three China-U.S. joint communiques, and take concrete actions to ful ll the solemn commitment of not supporting "Taiwan independence," the spokesperson said.

The Chinese Foreign Ministry on Wednesday reiterated China's rm opposition against any form of o cial ties between the U.S. and Taiwan, stressing China strongly opposes any U.S. visit by the leader of

"We urge the U.S. to abide by the one-China principle and the three China-U.S. joint communiques, earnestly deliver on its leaders' commitment of not supporting 'Taiwan independence' or 'two Chinas' or 'one China, one Taiwan,'" said Mao.

She also urged the U.S.to stop all forms of o cial interaction with Taiwan, stop upgrading its substantive exchanges with the region, and stop obscuring and hollowing out the one-China principle. China will closely follow the developments of the matter and resolutely and forcefully defend national sovereignty and territorial integrity, Mao noted.

(Cover: The Taipei 101 skyscraper in Taipei City, southeast China's Taiwan. /Xinhua)

and expansion of VALCO is, therefore, key to achieving the vision for the downstream.

The Integrated Aluminium Industry is a ‘game changer’! It is at the heart of Ghana’s industrial transformation agenda. When fully implemented prioritized, it will lead to a transformation of Ghana’s economy, and massively turn-around the economic fortunes of Ghana. The IAI, alone, has the potential to create the hundreds of thousands of jobs across every level of the value chain and could be the panacea to Ghana’s unemployment woes, whilst improving Ghana’s GDP substantially.

The timing for developing Ghana’s IAI is right as the aluminium market, though volatile, is looking very favourable and is forecasted to even get better. There has been a rising demand in the use of alumini-

um signi cantly by about 54% in the last decade due to its lightweight, high strength, and recycling properties. This upward trend in production is likely to continue in the years to come along with the healthy pace of increase in the usage of aluminium. The development of the downstream will ensure we lock in value in Ghana while signi cantly boosting the economy.

The execution of all four (4) projects under the IAI masterplan are at various stages of implementation. The infrastructure underpinning the IAI i.e power, ports and harbour, railway and roads are equally being developed under the relevant agencies in tandem. This is a multi-year, multi-billion-dollar investment programme.

There are four projects in the

March 24,202 3

March 24,202 3

March 24,202 3

upstream part of Integrated Aluminium plan; rst one relates to the existing mine which is being expanded from 1.5m tonnes to about 5m tonnes production of bauxite per year [GIADEC, OPCl fully owned by Ghana], second one is expected to produce about 5m tonnes of bauxite at Nyinahin in a bid to develop a re nery solution which is at advanced stage with companies who can come in to produce alumina plants which will take stocks for these mines to re ne, the third project is a partnership which GIADEC is developing with a major European aluminium company which will lead to the development of a mine at Nyinahin-Mpasaaso area as well as a re nery [integrated project] which is before cabinet and the fourth project is the moderniza-

tion and retro tting of Valco.

The vision of developing an IAI in Ghana is now clearly de ned, and execution is on course. The integration of four (4) operating bauxite mines, two re neries, the VALCO smelter, and a vibrant downstream industry, accompanied by the supporting infrastructure i.e an expanded ports and harbour with increased capacity, railway and supporting network, and a low-cost and stable power supply, will be critical to success.

Since its establishment, GIADEC has been living up to its mandate of developing and promoting an Integrated Aluminium Industry, giving credence to President Akufo-Addo’s vision of a “Ghana Beyond Aid”

thing that we doing under the integrated aluminium plan, the downstream is actually the heart that will drive a lot of industrial transformation.

We are looking at a master plan that will lead to the modernization and retro tting of the Valco plant , once that is done we going to be producing in the region of about 300,000 tonnes of primary aluminium and we going to make sure that a lot of this is utilized in Ghana for the bene t of the country to grow the economy.”

The CEO of the Ghana Integrated Aluminium Development Corporation (GIADEC), Michael Ansah is betting on a draft policy framework which aims at developing the downstream aluminium industry, that is expected to attract companies to invest in the sector.

According to Mr.Ansah, GIADEC in partnership with stakeholders is seeking to prepare the policy environment, incentive framework that will support the downstream industry that will be set up.

Mr.Ansah disclosed that sometime this year the policy framework should be ready to become a legal document.

“so it’s a process, we have developed some initial studies which is what would be discussed, once we have formulated everything we will have a framework, we will work with Ministry of Trade,Finance, others to see when that can be turned into a legal document but that should be sooner, we looking this year to formulate that and drive that.”

Speaking to journalists at the opening of a two-day Downstream Aluminium Industry Workshop 2023 at Royal Senchi Hotel in Akosombo in the Eastern region he said “This workshop is about the development of the downstream aluminium industry and that’s important in every-

The potential of aluminium cannot be underestimated and GIADEC CEO believes the global economy is headed that way in terms of how the country utilizes aluminium in a big way and thinks that what is being doing to establish the integrated aluminium industry will propel Ghana to lead across Africa.

“We will build policies that will attract companies to come and establish here, we have done so successfully in the auto manufacturing part which is why we see these companies producing and I think we can repeat that success with getting a whole load of companies in the aluminium downstream sector.”

the policy will look at a raft of areas; what sort of policies does government put in place to make Ghana an attractive place for such companies who want to make these sorts of investments here…these are going to be multi-million dollar investments and as such with decisions like that , the policy backing is there, there is also the tax incentive framework -which is to ensure that we don’t give too many incentives to companies ..but is all around what we do that recognizes what industry needs and the important thing is that we are not coming here with pre-conceived ideas, we have done some work in terms of trying to de ne what would be attractive having engagement with industry.

several companies are represented here and we want to have a conversation that will lead to us listening to industry and we want to make sure that the ministry of trade who are also here, nance, agi so we got some building blocks for policy..

and we build the framework that industry is asking for and promote the indus-

try as a whole, so we hope to put this on the table of government to make sure that we can be prepared ahead of these industries coming to Ghana.

Embedded in the policy is power which is expected to support the production of primary aluminium -whether it can be green power which can help brand the aluminium produced in Ghana.

Also, the tax aspect as well as tari s, given that the country imports signi cant quantities of aluminium products into Ghana, the framework when

adopted and ready will check such imports and encourage the development of Ghanaian companies.

The Minister of Lands and Natural Resources, Mr. Samuel Abu Jinapor underscored the need to develop the aluminium downstream industry.

For him, the failure to do so over the years, has deprived the country signi cant revenue and employment opportunities for the youth.

He called for value addition to the aluminium produced in

Ghana, “ the real value of our mineral resources, lies I value addition. For example, while bauxite sells around Forty to Sixty US Dollars per metric tonne (USD 40 -60),re ned bauxite, alumina sells for over Four Hundred US Dollars (USD400) per metric tonne and primary aluminium produced from the alumina goes for USD2,000 per metric tonne.

Unfortunately, our failure, over the years to put in place a mechanism for developing this integrated industry has deprived us of the much-need-

ed revenue that will accrue from these resources.” he said.

The workshop seeks to obtain stakeholder input to develop a policy framework and implementation plan for an aluminium integrated industry for the country. It was under the auspices of GIADEC in partnership with the Strategic Anchor Industries Unit of the Ministry of Trade and Industry and the ODI (formerly Overseas Development Institute, with funding from the United Kingdom Government’s Foreign ,Commonwealth and Development O ce (FCDO).

Pan-African Savings and Loans, as part of its Corporate Social Responsibilities (CSR) engagements, recently donated a Water Tank and 6 Ceiling Fans to the Ashaiman No.1 Primary School.

The donation was received by Mrs. Bernice Kwamla, the Headmistress of the school. She expressed her profound gratitude to Pan-African Savings and Loans for the donation on behalf of the Ashaiman Municipal Directorate (G.E.S),

the entire sta , parents and students’ body.

Mrs. Linda Naykene, the Head of Corporate A airs for Pan-African Savings and Loans stated that “Pan-African’s CSR is focused on children and education and seeks to impact positively on the lives of students by supporting schools within its catchment area of operations”.

She further mentioned that “a

series of donations were earmarked for 2023”.

Pan-African made a second donation on 24th March, 2024 to the St. Louis Demonstration JHS in Ashtown, Mbrom in the Ashanti Region.

The school received a projector and 30 chairs for their Assembly Hall.

The students were elated as they sat on the chairs during

the donation ceremony.

Pan-African Savings and Loans Company Ltd is a member of the Ecobank group licensed by Bank of Ghana and has been operating in Ghana since 2008 as a registered Savings and Loans Company.

Its o erings include access to loans, various savings products, and provision of mobile money and remittance services as well as innovations that include digital nancial services.

Trillion US Dollars in revenue if fully integrated. Unfortunately, we have, over the years, failed to make the needed investment in this area.

He expressed Government’s optimism on the contribution of a fully-integrated aluminium industry to socio-economic development.

“It is for this reason that in 2018, the President of the Republic, H.E. Nana Addo Dankwa Akufo-Addo, took that bold decision to establish, by an Act of Parliament, the Ghana Integrated Aluminium Development Corporation (GIADEC), to promote and develop an integrated aluminium industry, here in our country,” the Minster said.

The Minister for Lands and Natural Resources, Samuel A. Jinapor, says government’s quest to build an integrated aluminium industry in the country is on course, and progressing steadily.

He said this is in line with the Ghana Integrated Aluminium Development Corporation Act, 2018 (Act 976), which establishes the Ghana Integrated Aluminium Development Corporation (GIADEC) to promote and develop an integrated aluminium industry in the country.

The Minister said this on Wednesday, when he opened a two-day Workshop on the downstream aluminium industry in Akosombo in the Eastern Region. The workshop, which was organised by

GIADEC, in partnership with the Strategic Anchor Industries Unit of the Ministry of Trade and Industry and the Overseas Development Institute (ODI), brought together stakeholders in the aluminium industry to deliberate on policy options and implementation plan for the downstream aluminium industry.

This follows an extensive research, data collection and technical analysis of best practices across the world carried out by GIADEC and ODI.

Delivering the keynote address at the workshop, Mr. Jinapor emphasised the need to add value to Ghana's mineral resources to ensure optimal bene t from these resources.

He said Government has since 2017 been pursuing this path for all our mineral resources including gold, bauxite, iron ore, lithium and other green minerals.

Speaking speci cally on bauxite, Mr. Jinapor said while the raw ore sells for around Sixty US Dollars (US$60.00) per metric tonne, primary aluminium, produced from bauxite, sells for over Two Thousand US Dollars (US$2,000.00) per metric tonne.

He said Ghana has an estimated bauxite resource base of over nine hundred million metric tonnes (900,000,000Mt), capable of creating some two million sustainable jobs, and generating over One

According to Mr. Jinapor, GIADEC has, since its establishment, developed a Masterplan for the upstream sector, and is implementing its Four Project Agenda, to expand the existing mine, build three additional mines, build re neries, and modernise the Volta Aluminium Company (VALCO), with all four projects at various stages of implementation. It is therefore necessary to prepare the downstream industry and make it ready to o -take products from the upstream industry. He urged participants at the workshop to bring their expertise to bear, and come out with policy options and plans that that will help build a robust, functioning and vibrant downstream aluminium industry that contributes, meaningfully, to our national economy.