Mrs. Jemima Oware, the Registrar of Companies, has called on businesses to disclose their bene cial owners in line with the Companies Act, 2019 (Act 992) to promote transparency and provide a level playing eld for the business community in Ghana.

The bene cial owner is an individual (a natural person and not a company) who directly or indirectly, ultimately owns or exercises substantial control over a person, company or economic interest.

Speaking during the UKGCC’s Mandatory Regulatory Compliance for Businesses in Ghana webinar series on “The Mandate and Bene cial Ownership of the O ce of the Registrar of Companies (ORC), Mrs. Oware remarked that companies are required to provide information on bene cial owners during the incorporation of a business.

She added that during incorporation of businesses, companies have within 28 days to make amendments on their bene cial owners.

Companies may also provide information on bene cial owners when ling annual returns and as an update to the O ce of the Registrar. Furthermore, Companies Limited by Shares, Companies Limited by Guarantee, Unlimited Liability Companies, and External Companies are also mandated by the law to submit information of bene cial ownership to the Registrar.

During the webinar, the Registrar of Companies, whose o ce was created out of the Registrar General’s Department, observed that most companies fail to present the mandatory company and member registers when ling bene cial ownership documents. Others also state the O ce of the Registrar

as their bene cial owner.

She indicated that this was not the right practice. To rectify it, she remarked that “The o ce of the Registrar of Companies will compile registers online for businesses to purchase at a fee”. The O ce will also ensure that a company has a designated o cer (company secretary) who will ensure that their business is compliant.

Improved Corporate Governance and Professionalism

Mrs. Oware also discussed several other issues pertaining to her O ce and of crucial relevance to businesses. One of these was improved governance and professionalism.

According to her, the Company Act, 2019 states that Directors of companies are required to appoint duly quali ed professionals with some training in Company Law, Practice and Administration to e ectively perform the function of a Company Secretary.

Mrs. Oware advised businesses to appoint people from recognised professional bodies such as the Institute of Chartered Secretaries and Administrators, Institute of Chartered Accountants Ghana and a Barrister or Solicitor in the Republic. Promoting ease of doing business

Mrs. Oware revealed that her O ce is currently working on

migrating its digital platforms, to be ready by November this year, aimed at optimising processes in compliance with the Companies Act, (Act 992).

“If you go into the Companies Act, after it was passed in 2019, it said 5 years after that, we should go fully online and so we are pushing for that”.

The new platform will enhance ease of doing business, such as granting persons the opportunity to register their businesses from their phones.

The O ce is also working to establish a VVIP unit in service centres to reduce the turnaround time for document processing at a fee.

She also discussed other pertinent issues such as corporate insolvency and restructuring, the importance of keeping company registers, and reforms to company registrations.

She nally urged companies to either access essential government services themselves or engage the services of certi ed professionals to ensure that the government captures the right data to promote good governance.

The webinar was moderated by Theophilus Tawiah, Managing Partner at WTS Nobis elds and Lecturer at the University of Professional Studies.

Africa’s largest payment gateway, MFS Africa, has partnered with Western Union to enable individuals and businesses across the continent to receive money from over 200 countries and territories.

The partnership will enable funds to be sent from countries around the world to mobile wallets across Africa through the organization’s licensed payment rails. The service will rst launch in Madagascar, and eventually to other countries across the continent.

Kumar Shourav, Managing Director, MTO’s at MFS Africa noted that a partnership like this is unprecedented in the industry, with huge potential bene ts, value, and impact implications in the long run. “At MFS Africa, we have always believed in making payments as simple as possible. Payment infrastructures globally have traditionally remained fragmented and local in nature. Africa’s 54 countries are diverse not just in terms of population, development levels, growth rates, and stability but with payment infrastructure and regulations as well.

Africa's fast-growing populations and markets present important opportunities for businesses and individuals in an environment of slowing global growth. MFS Africa has more than a decade worth of experience in navigating the chal-

lenging Africa payments landscape. Its direct relationship with mobile wallet players, banks, cash pick up networks and regulators on the continent is unmatched in the industry.

Western Union is a global leader in cross-border, cross-currency money movement and payments. Through this partnership, both organisations will provide customers, businesses and Global Development Organisations across the world with access to convenient payout options in Africa. This will foster better integration between Africa and the rest of the world and will go a long way in supporting nancial inclusion across the continent. Therefore, this partnership made complete sense.”

Similarly, Western Union's ethos is based on empowering the aspiring populations of the world with accessible nancial tools to improve the lives of their loved ones and communities.

Hassan Chatila, Global Head of Account Payout Network, Western Union, says, “At Western Union, we aim to be the global leader in providing accessible nancial services to the world’s populations and, in turn, increase global nancial inclusion. Our e orts to drive global nancial inclusion means delivering on customer needs today and into the future. Through our partner-

ship with MFS Africa, we are excited to come together and deliver on our joint commitment to bring innovative solutions for customers as they support their families and accelerate their momentum up the economic ladder.”

Mohamed Touhami El Ouazzani, Regional Vice President of Africa, Western Union, "Innovation, commitment to customer focus and nancial inclusion are at the heart of everything we do at Western Union. We are deeply committed to the region and remain focused on advancing cross-border money movement solutions for the people in this region, their communities as well as the broader economy. Through our collaboration with MFS Africa, we look forward to achieving our common critical role in getting money to the places where and when it is most needed.” This collaboration to provide

access to transacting across borders will further cement MFS Africa as a preferred, better, and one-stop solution for payments into and within Africa. Whether you’re a young entrepreneur in the merchant marketplace, require access to collect loan repayments from customers or need to send bulk payments, MFS Africa strives to continuously connect senders, recipients, and service providers across the continent.

The organization’s full-service digital payments network connects over 400 million mobile money wallets, over 200 million bank accounts across Africa, and over 200,000 agents in Nigeria, to enable cross-platform and cross-border payments for remittance companies, mobile network operators, banks, non-bank nancial institutions and global merchants.

Stakeholders within the fruit and vegetables value chain from all over the world will converge at the Rimini Event Centre, Italy for this year’s edition of the Annual MacFrut Exhibition scheduled for May 3-5, 2023.

Macfrut is the international trade fair for the fruit and vegetable industry, a B2B event for sector professionals and opinion leaders from more than 90 countries. It is a benchmark event that brings together major industry players, innovations and market trends, o ering a unique business platform that allows participants

to expand their network of business contacts and enter new markets.

This year’s event will have over 1000 exhibitors, comprising 20% foreigners, these exhibitors will showcase goods and services from di erent sectors including: production and marketing of fruit and vegetable products, sorting and packaging machinery and technology, packaging materials, logistics and services, machinery and systems for fruit and vegetable growing, plant nurseries and seeds and biosolutions.

Participants and exhibitors will get to share and transfer knowledge, make business partners, and to buy or sell agricultural equipment whilst tapping Italy’s expertise as the world leader in agricultural production and the manufacturing.

Additionally, there will also be technical visits to company sites for a learning experience in terms of know-how and cutting-edge machinery and technology with extensive media awareness.

The Italian Trade Agency in Ghana in collaboration with the

Federation of Association of Ghanaian Exporters (FAGE), wishes to extend an invitation to government representatives and policy makers, and to agribusiness professionals within the fruits and vegetables value chain to join this event.

Ghanaian exporters within the fruit and vegetables ecosystem interested in participating can complete online forms via https://docs.google.com/forms/d/1wDEBnGNUjxbLQQ3MN8gW4KIjtlejTh-FoqUCUIx3Yo0/edit.

First National Bank has assumed a refreshed brand look that not only positions itself as more than a bank but also as a reliable partner o ering nancial solutions and services on enhanced platforms.

The bank’s refreshing iconic brand re ects its journey to becoming a more versatile banking and nancial services provider. The Chief Executive O cer of First National Bank Ghana, Warren Adams explains the brand’s evolution by pointing out that change is important to staying relevant to customers. “At the heart of our evolution is the appreciation of our responsibility to keep up with the step change in customers’ needs and the global transition to a platform era”, Mr. Adams says.

He a rmed that the bank intends

to stay deeply rooted in its brand heritage and brand promise of ‘How can we help you’. "The refreshed brand helps us to create a versatile brand look and feel that aligns with our transition to helping customers beyond banking into relevant personal and business solutions", he said.

Mr. Adams further added that First National Bank seeks to be a trusted partner helping customers, their families, and their businesses thrive and achieve their goals through positive changes in nancial behaviour. “We want to provide the right solutions for our customers’ needs and we want to help them through all of life’s stages for themselves, their families and their businesses”.

He emphasized the bank’s commitment to delivering safe and reliable banking services and

addressing issues of fraud holistically. “We recognize that fraud is a reality in our society, and we are continuously enhancing security measures to assist our digitally active customers in mitigating these risks”.

As a member of the FirstRand Group, which is the largest banking group in Africa by market capitalisation, First National Bank has been named the Strongest Banking Brand in the World in the Brand Finance Banking 500 2023 report.

On International Women's Day, 8th March 2023, the Ghana India Ko Annan Center of Excellence in ICT is set to host the Females in Tech (FEMITECH) Conference to bring together women in the tech industry and celebrate their achievements.

The FEMITECH conference is focused on female tech practitioners and aspiring females in Tech. The conference aims to inspire and empower women in this industry and create a supportive community to help them achieve their goals.

Speakers at the conference

include Fatoumata Doro- MD for Vilsco Ghana Group, Ing. Dr. Lucy Agyepong -Associate Dean of Engineering, Academic City University College, Suzanne Diop, Head Of Nestle Business Services For Sub Saharan Africa, and the Keynote address by the Honorable Minister of Communications and Digitalisation, Mrs. Ursula Owusu-Ekuful.

According to Kobi Hemaa Osisiadan-Bekoe, Director of Corporate A airs and Media Relations at the Ghana India Ko Annan ICT Center, women have been breaking barriers and pushing boundaries in tech for centuries, but yet

still, women are underrepresented in tech.

“At the Females in Tech Conference, we bring together women from across the tech industry to share their stories and experiences. We will discuss various topics, from leadership and career development to diversity and inclusion. There will also be networking opportunities, allowing women to connect and learn new skills." She added

The event, organised in partnership with the Ministry of Communications & Digitalisation and the National Information Technology

Agency (NITA), will be held at the Ko Annan ICT Centre auditorium opposite the Council of State Building near Parliament house will inspire a new generation of females in tech.

The Ghana-India Ko Annan Centre of Excellence in ICT (GI-KACE), is an agency under the Ministry of Communications and Digitalisation mandated to provide training, consultancy, research and development in ICT and electronic-related elds. For over two decades, the center has provided specialized training to various groups and helped organisations increase their performance and productivity.

Eco International, the Ghanaian partner of EcoFlow have introduced to the local market, the Eco ow portable power station, which is a newest innovation that is expected to revolutise the way people consume and use power stations.

The Eco ow is a portable power station – it o ers reliable, quiet, and clean power as an alternative to traditional, outdated sources. Since 2017, EcoFlow has provided portable power stations, home backup power, and eco-friendly o -grid solutions in over 100 markets including the US, Japan, China, Australia, and Europe to reinvent the way the world accesses energy.

“Complexities that come with installing solar motivated us to introduce EcoFlow”, Samuel Ayim Mawuli, Head of Business Development, Eco International told journalists at the EcoFlow launch at Megamax showroom in Accra on Thursday.

According to him, the device “is an integrated solution which is plug and play, very easy to use.

We also saw it as a very fantastic solution to introduce to our

clients simply because the issue with solar sometimes is that when the sun is really down you are unable to generate enough electricity and a lot of people have issues with acquiring a bigger battery bank so on the back of that we saw this as a great solution to be able to ll that gap.”

The company has set 20percent penetration target to ensure that EcoFlow becomes a household brand in the country, and have earmarked residential facilities, o ces, schools, hospitals, average Ghanaian because they reckon power is an indispensable part of people’s lives and is needed power to be able to thrive and be productive.

“Because of the startup cost, we have partnered some banks to be able to give our potential customers the ability to pay overtime -that is one innovative solution that we have introduced to help people acquire this technology.

For the rst year, we are looking at about 20percent because it is a new technology, we still educating people to really come to a full appreciation of what we have

brought to the market, subsequently we hope to have exponential growth to be able to reach our strategic goal”he added.

EcoFlow was founded with a mission to empower people and communities through portable, clean, reliable power for lasting impact and by dethroning the traditional gas generators through innovation.

Over the past few years, EcoFlow has taken a leading position in the European market, where consumers have shown exceptional enthusiasm towards eco-friendly energy products and renewable energy solutions. In 2022, the European market

became EcoFlow's second biggest market behind the USA. During Prime Day 2022, EcoFlow was the number one seller in Europe in the eco-friendly energy solution category.

Now, the company is excited to penetrate the African and Ghanaian market especially with high expectations for its newest product.

EcoFlow has combined cutting-edge research and development with extensive distribution and sales network to redene the battery industry with user-focused portable power stations.

The University of Ghana Business School (UGBS) has signed a Memorandum of Understanding (MoU) with Axis Pension Group to institute the Axis Pension Young Scholar Fellowship.

This remarkable partnership is aimed at supporting brilliant but needy students with an annual amount of Ghc 250, 000.

The signing took place on Friday, 24th February 2023, at the O ce of the Dean of the Business School during a meeting with a delegation from Axis Pension Group led by Mr. Afriyie Oware, Chief Executive O cer (CEO).

In a brief welcome address, the Dean of UGBS, Professor Justice N. Bawole shared his excitement for the partnership with a UGBS alumnus-led organisation. "As a school, one of the things we have been seeking to do is to expand our collaborations and networks, especially with companies led by our alumni.

The reason is that our alumni understand us better, and in the course of doing our work, these partnerships are things that we must hold dear because they are extremely important to our strategy," he added.

Giving a brief background to the partnership, Prof Bawole indicated that Axis Pension Group approached the school on its 10th Anniversary about the idea, how-

ever, the plan was delayed because of the turbulent times that the world encountered due to the COVID-19 pandemic and its associated challenges.

The Dean however expressed his optimism about things turning around for the better for the organisations. Emphasising on earlier assistance that the company has given the school, the Dean indicated that the Axis Pension team has already engaged UGSB sta and faculty in educative sessions on pension planning on two di erent occasions.

He further used the opportunity to thank them for providing nancial support for the UGBS faculty retreat.

Commenting about the AXIS Pension Young Scholar Fellowship Programme, the Dean mentioned that apart from the nancial support, the programme has an objective of creating a family bond between the bene ciary scholars and Axis Pension Group. He added that the young scholars will become an integral part of the company as ambassadors in educating their individual communities about pension planning.

In his speech Mr. Afriyie Oware, Chief Executive O cer of AXIS Pension Group indicated their company's belief in corporate organisations having responsibilities.

He enumerated the several corporate social responsibility activities that they have embarked on. Further emphasising on the institution of Axis Pension Young

Scholar Fellowship, Mr. Oware said his attention was drawn to the cause of helping needy students in September 2021 when a friend requested support for some university students. He mentioned his company's inability to assist because of policy issues hence his resolve to make amends "and so we are here as partners of the University to look at how we can contribute to better the lives of students. We believe that access to education should be available to all and that we should not deny any brilliant student access to education because they don't have the resources." He further pledged his company's support to the fellowship programmes and even extend it to other universities.

In a brief closing remark after the formal signing of the MoU, Prof Bawole reiterated the numerous challenges some students encounter in paying their fees. He mentioned the frequency of receiving letters from students pleading for time in paying their fees.

The Dean cited several instances when he had to solicit for support from his colleagues. Professor Bawole indicated that the support from AXIS Pension would provide some nancial certainty for such students. He added that many students have gone through such nancial di culties but are now in high positions creating value for the nation.

He used the opportunity to request for a sponsor to renovate

the unknown scholar edi ce at the Business school.

The Dean further explained that the unknow scholar edi ce represents many great people who have and will pass through the Business School without being noticed but are now creating value for society. These unknown scholars are the once Axis Pension Young Scholar Fellowship programme will give life to, Prof. Bawole noted.

. Professor Justice N. Bawole signed on behalf of the Business School, while Mr. Afriyie Oware signed on behalf of AXIS Pension Group.

The ceremony was witnessed by Heads of the Department of Finance, Dr. Emmanuel Sarpong-Kumankuma; Operations and Management Information Systems, Prof. Anthony A ul-Dadzie; Public Administration and Health Services Management Professor Albert Ahenkan, Professor Mohammed Amidu representing the Head of the Accounting Department. Also present were the Assistant Registrars of Academics, General Services, and Human Resources Ms. Celestina Majorie Quist, Ms. Saratu Salifu, Assistant RegistrarGeneral Saratu Salifu; Assistant Registrar - Human Resource Mr. Yeboah Yaw Tsen respectively. Also, present from AXIS Pension Group were Mr. Matthew Mani, Group Chief Finance O cer, and Mrs. Louisa Siaw, Chief Legal O cer.

The Global Chamber of Business Leaders (GCBL), the world's leading coalition of governmental leaders, CEOs and executives, has appointed some new delegates.

The new appointees are: Jakir Chowdhury who is serving as delegate for Bangladesh, Joanna James, the delegate for Australia, and Prof. Robinah K. Nanyunja, who has been appointed as delegate for Uganda.

All three appointees are to serve GCBL in their respective countries Prof. Nanyunja is the Founder and Chair of Pilot International, a social enterprise registered in Uganda with networks and partnerships promoting sustainable development in over 100 countries.

She holds various other positions such as First Vicr President of the African Greens Federation (AGF), the AGF Representative on the global committee organizing the Global Greens Congress expected to be held in Seoul, South Korea 2023.

Who Is Jakir Chowdhury? for a period of two years.

Who is Joanna James?A revolutionary di erence maker in the

design, construction and banking sectors, Madam James has been featured in several publications

Who is Prof. Robinah K. Nanyunja?Jakir Chowdhury is the Founder and Chief Executive O cer of JC & Hunter Capital.

He has expertise in nancial markets, business mergers and acqui-

including: Entrepreneur, Flaunt, The Advisor, MPA, Australia Broker, CIO and Insights Success.

She is a pioneering entrepreneur who led the International Ezy Group to become the industry powerhouse in the lending sector, currently managing over $4.5 billion of home loans.

sitions, asset management, consulting in aviation and sustainable entrepreneurship development in the United Kingdom and Globally.

Mr. Chowdhury joins GCBL with over 25 years of experience in commercial nance, including

equity release, regulated mortgages, commercial loans, real estate and protection and insurance.

The Global Chamber of Business Leaders is a coalition of governmental leaders, CEOs and executives, entrepreneurs, investors

and business and industry leaders who share a common vision: the sustainable well-being and growth of business in a disruptive and ever-evolving global economy.

Global Chamber of Business Leaders prioritizes activities that align with the UN-declared Decade of Action, promoting the impor-

tance of the inclusion of the Sustainable Development Goals in the business models of the future, allowing our partners, members, and participants to prepare their businesses to be vanguards of the future.

The GCBL fosters a vibrant and interconnected business community, encouraging resiliency,

growth and market expansion in a progressive business environment where collaboration spurs growth; education enhances the ability and promotes opportunity; and advocacy in uences authority.

The Majority in Parliament has justi ed the Electoral Commission’s decision to introduce a Constitutional Instrument which aims to promote the Continuous registration of voters and a proposal to adopt the Ghana Card as the sole source of identi cation for any person who wishes to register as a voter.

The Chairperson of the Electoral Commission (EC), Jean Mensa, on Tuesday told Parliament during a Committee of the Whole brie ng that the use of the Ghana Card as the sole identi cation document for continuous voters’ registration will guarantee the credibility and integrity of the country’s voter register and aid elections as a whole.

Addressing members of the Parliamentary Press Corps (PPC) on Thursday at parliament house in Accra, the Majority Leader, Osei Kyei-Mensah-Bonsu said the draft CI will not only ensure that the outstanding two million eligible voters who are yet to be registered are registered but will bring sanity and reform to the country’s electoral process.

He also debunk assertions from the minority that resorting to

only the Ghana card as proof of citizenship would curtail the right of citizens to vote “when the exercise of proof of citizenship to re-register begun, the EC allowed the use of birth certi cate, baptismal, driver’s license, passport, drivers license, National Health Insurance cards, now today one after, the Commission has peeled o some of these instruments of identi cation that is to establish one’s citizenship, so that exercise they have done in the past amounted to restraining Ghanaian citizenship or identity of Ghanaians to be registered.

According to the majority leader,the constitution in article 45 (A) mandates the EC to compile register of voters and revise it as may be determined by law, “the performance of the functions does not mean that you are eternally adding to, you substract from, sanitise it and the process of improving the establishment of your citizenship.”

Further, he added the majority will continue to engage the minority to reach a consensus on the CI which he reckons charts a new path as far as elections in the country are concerned.

The minority in spite of the EC’s

By Eugene Davispresentation to parliament remains unconvinced and have indicated that millions of eligible Ghanaian voters do not have the Ghana Card and therefore stand the risk of being completely disenfranchised, stressing that three groups comprising those who have registered for the Ghana Card but have not been issued with cards. The number of people in this category stands at a staggering 645,663.

According to the majority leader, the reason for the invitation of the three institutions to parliament “was to clear any lingering doubt about the impending continuous voter registration and the enabling constitutional instrument in which the electoral commission has indicated to

resort to the national identity cards (Ghana Card) as the only means to identify Ghanaian citizens for the registration of voters.”

The C.I. seeks to promote the continuous registration of voters and advocates an all-year round registration of eligible voters at the district o ces of the EC.

It is a clear departure from the previous system where voters’ registration was done for a limited period.

Under the limited voters’ registration exercise, the registration of new voters was only done for a limited period.

Audiomack has appointed Charlotte Bwana as the Vice President of Marketing and Brand Strategy for its African Operations, this promotion took e ect in February. In this new role, Charlotte will be responsible for leading operations in developing impactful brand strategies as well as securing promotional initiatives across Africa.

Charlotte’s leadership and promotional expertise has been instrumental in attracting and sustaining

a large and diverse customer base across Africa. She has over the years, secured major partnerships that have aided the company's expansion into the African continent as well as forge strong relationships with prominent entities, such as Afrochella, Y FM (South Africa & Ghana), Sportscene South Africa, Diageo Nigeria, MTN Nigeria amongst others.

Most recently, she led the team that negotiated another deal with

Paramount's MTV Base Africa through an editorial partnership that is aimed at integrating the curatorial voice and programming of MTV Base into the Audiomack platform throughout Africa. This deal further demonstrates her ability to strategically identify opportunities that will bene t Audiomack's growth. Commenting on the remarkable accomplishment, Jason Johnson, Senior Vice President of Marketing and Brand Strategy for

Audiomack, stated “I am very pleased to announce Charlotte as the new Vice President of Marketing and Brand Strategy for Audiomack in Africa. Over time, she has been pivotal in accomplishing numerous collaborations and achievements for the company, playing a fundamental role in the expansion of Audiomack’s music streaming services across Africa”.

“Her marketing expertise has been an essential factor in our

expansion and the e cient implementation of our business collaborations, resulting in remarkable growth for the company. Owing to this, we are delighted to advance her to this role, and I am eager to keep collaborating with her to accomplish our company’s objectives” he added.

Charlotte Bwana is a results-driven Media and Brand Strategy expert with over 9 years of impactful experience in the music industry. She is an astute relationship management strategist, with the ability to build trust through optimizing performance to achieve desired results. In 2021, Charlotte became a voting member of The Recording Academy (Grammys) and in 2022, she was listed as Billboard's International Power Player, an achievement that

further speaks to her in uence and impact within the industry.

Audiomack

Audiomack, which launched in 2012, currently reaches more than 20 million monthly users globally. The streaming and discovery service has played an integral role in breaking new acts, such as Roddy Ricch and Kaash Paige; served as a trusted partner to Eminem and Nicki Minaj, among other notable artists, to debut exclusive releases; and helped rising African stars, such as Omah Lay, reach an international audience.

Download the Audiomack app from the Google Play Store or the App Store.

After launching the TECH4ALL initiative at Mobile World Congress (MWC) Barcelona four years ago, Huawei and its partners shared the latest insights and practices on how technology is enabling digital inclusion and sustainability at a media roundtable on Day 1 of MWC Barcelona 2023. “All of our e orts with the TECH4ALL initiative wouldn’t have been possible without taking technology and partnerships as key enablers,” said Je rey Zhou, President of ICT Marketing for Huawei, in his opening speech. “Since the launch of TECH4ALL, more than 600 schools worldwide, over 220,000 K12 teachers and students in remote areas, unemployed youth, women, and the elderly, and 46 nature reserves have bene ted from the TECH4ALL program. Moving forward, we will keep innovating and using technology along with our global partners to build a more inclusive and sustainable digital world for all.”

At the end of his speech, Zhou o cially launched the TECH4ALL Digital Inclusion special publication, which shares the diverse visions, strategies, and best practices of global experts and partners in 15 stories set out in three sections: Insights, Technology in Focus, and Case Studies. The special publication is now ready to view and download on the Huawei TECH4ALL website.Also at the roundtable, representatives from UNESCO and the global NGO

Close the Gap explored how technology is helping to boost the digital transformation of education and improve digital skills, especially for underserved groups in remote and rural areas. These include providing connectivity, expanding digital literacy and skills, and supporting STEAM curriculum through projects such as Technology-enabled Open Schools for All, DigiSchool, and DigiTruck.

“Digital open schooling models are the manifestation of the digital transformation of school education. It’s an open approach to reinventing schooling systems to ensure school education, including knowledge learning, skills development, the fostering of values, and social caring, will be secured both under normal and emergency situations,” said Dr. Fengchun Miao, Chief of Unit for Technology and Arti cial Intelligence in Education for UNESCO. “The UNESCO-Huawei project Technology-enabled Open Schools for All is having a ground-breaking impact on the building and testing of digital open schools in African countries. The project directly covers more than 20,000 students and more than 1 million teachers in Ghana, Ethiopia, and Egypt.”

TECH4ALL partner Close the Gap described the value of the DigiTruck in providing free digital skills training for remote communities in Africa.

“We have partnered with

Huawei to develop and deploy DigiTrucks in Africa to rural and peri-urban communities specically targeted at preparing the young people in those communities for the digital jobs of the future,” said Ngosa Mupela, Business and Investment Manager for Close the Gap.

Under the TECH4ALL initiative, technology is also enabling sustainable management of natural resources and protecting biodiversity. Arno Cimadom from the National Park Neusiedler See-Seewinkel in Austria explored the pivotal role technology plays in wetland conservation, including protecting biodiversity and studying the e ects of climate change on ecosystems.

“Thanks to the new technology provided by Huawei and its partners, we are now for the rst time able to collect sound data 24/7, year-round, simultaneously from

more than 60 sites and analyze them via AI-models provided by Rainforest Connection. This makes research and management in di cult-to-access wetland areas more e cient and allows new investigations,” said Arno Cimadom, representing National Park Neusiedler See-Seewinkel.Alongside the media roundtable, the Huawei TECH4ALL booth at MWC Barcelona 2023 welcomes visitors to explore the latest progress in projects running under the initiative and learn about the crucial role that technology and partnerships can have in enabling inclusion and sustainability.

About Huawei TECH4ALL TECH4ALL is Huawei's long-term digital inclusion initiative and action plan. Enabled by innovative technologies and partnerships, TECH4ALL is designed to help promote inclusion and sustainability in the digital world.

Ghana Water Initiative (GWI), one of the initiatives under SafeWater, a strategic business unit within Grundfos, has announced the launch of SUREWATER mineral water. This is a new packaged water aimed at increasing water security by providing a ordable water to all and contributing to a more sustainable environment by reducing the use of sachet water in Ghana.

SUREWATER will provide access to clean water as a re ll service to 4,000 residents in Otoase, and 150,000 residents in Nsawam as well as citizens from other parts of Accra. This is part of the larger GWI project which aims to develop commercially viable solutions to provide water services to underserved communities in Ghana and reach one million people with drinking water by 2026.

SUREWATER is packaged in large

18.9 litre containers that are designed for multiple uses and can be re lled as needed. The use of dispenser bottled water can signi cantly reduce the amount of plastic waste generated from single-use plastic containers, helping to protect the environment and its ecosystems, while providing clean drinking water for communities previously without access. SUREWATER costs GHS60 for the rst-time purchase, to buy the bottle and the water, and GHS12 for subsequent re lls, paying for the water only.

The water is produced from a centralised, supervised facility in Otoase that can produce 400

bottles per day. This facility also provides clean water to the citizens of Otoase through smart water ATMs and home connections. The bottled water is sourced from the ground and goes through a robust treatment process that includes reverse osmosis to ensure that only the best quality water reaches the consumer.

Xorlali Yao-Kuma Kpodo, GWI’s Engagement Manager commented: "We are committed to improving people's quality of life through access to clean water, which we believe is a fundamental right. We are con dent that SUREWATER will make a positive di erence in Ghana, and we are eager to continue our e orts to create innovative solutions that tackle the world's water and climate challenges."

Grundfos established the GWI under the Grundfos SafeWater unit to design and test new approaches to water service delivery in rural communities in Ghana. As a true SDG-focused (UN Sustainable Development Goal) company focusing on both clean water and sanitation (SDG6) and taking action to combat climate change (SDG13), the GWI is invested in developing commercially viable solutions to provide water services to underserved communities. Since 2018, the GWI has established two pilot schemes. The rst, launched in partnership with the Community Water and Sanitation Agency (CWSA) at Abomosu in 2020, provides about 8,000 people with access to clean

and sustainable water through smart water ATMs and household connections. The second, launched in Otoase in 2022, includes a water bottling plant to provide SUREWATER mineral water, making clean drinking water a ordable and accessible both in Otoase and beyond.

Anise Sacranie, Grundfos Water Access Director: "This project is just one of Grundfos' many water initiatives in Africa. We recognise the pressing need for sustainable water solutions in Africa, and with the launch of SUREWATER we are aiming to make our water projects commercially viable, having a positive impact in the region both for the environment and by making clean drinking water more accessible."

Grundfos SafeWater: SafeWater is a strategic business unit in Grundfos (a global water technology company committed to pioneering solutions to the world's water and climate challenges and improving the quality of life for people). SafeWater creates lasting impact by transforming underserved communities through commercially viable

and sustainable smart water solutions.

SafeWater is working towards Grundfos' ambition of reaching 300 million people in 2030 with access to drinking water. It collaborates closely with some of the world's leading humanitarian and development aid organisations, and partners with local distributors, service partners, industries, energy service providers, private water service providers, banks and nancing institutions, investors and governments. SafeWater predominately operates in East and West Africa, Southeast Asia and the Middle East – and often in remote locations.

Grundfos

Grundfos pioneers solutions to the world's water and climate challenges and improves the quality of life for people. As a leading global pump and water solutions company, we promise to respect, protect and advance the ow of water by providing energy and water e cient solutions and systems for a wide range of applications for water utilities, industries and buildings. Find out more: grundfos.com

Ad Dynamo by Aleph has appointed Stephen A. Newton as its managing director for Africa. Newton will prioritise pan-African expansion and assisting Ad Dynamo by Aleph’s partners in overcoming the challenges of doing business across the continent.

Ad Dynamo by Aleph is Spotify, Twitter, Snap, and Yahoo’s exclusive media buying extension in Africa. As an enabler of digital advertising in emerging markets, the organisation is helping to break down barriers.

“As both a developing market and a continent with a rapidly growing population, Africa is poised to house not only a sizeable portion of the world's population but also

a sizeable portion of the world's eligible workforce,” says Newton. “I am excited to play a part in implementing Aleph’s goal of breaking barriers.”

“At Ad Dynamo by Aleph, we plan to continue to grow in anticipation of our partners’ needs and solidify our position as a preferred partner,” he adds. “We will build where they need us using tried and trusted methodologies, and we will continue to collaborate to create platforms that reduce the friction associated with doing business in these markets."

Newton, an entrepreneur at heart, has more than 25 years of experience leading EMEA busi-

nesses across the digital space. He is currently on a number of advisory boards for startups and mid-sized African companies that work in di erent parts of the online space. He is also the chairman and co-founder of The Illuminate Africa Group Ltd., a consulting rm that helps companies achieve their African expansion goals.

Newton has worked as managing director of Google South Africa, vice president and managing director of the Ad Exchange for Google-bought DoubleClick EMEA, managing director of Africa for PostivoBGH, chief executive o cer of Date.ce, and interim chief oper-

ating o cer of Universal Music Group Africa. About

Ad Dynamo by Aleph represents the leading digital media platforms in Sub-Saharan Africa and more than 115 markets through an extension of its global extension of subsidiaries. With a unique combination of access to the largest digital players, proprietary technology, local connections, and expert knowledge, Ad Dynamo by Aleph is able to support Aleph Group’s vision to equalise the digital ecosystem. Creating a world in which all advertisers have access to the vast opportunities of digital advertising.

Aleph is a leading global enabler of digital advertising, connecting thousands of advertisers in developing countries with the major digital platforms, in more than 115 countries through its global . As an extension of our partners, across new and existing geographies, we enable platforms including Twitter, Meta, Snapchat, TikTok and 35 others to expand into new markets, and empower advertisers to take full advantage of the platforms' advertising capabilities. Through these long-lasting partnerships, Aleph creates the opportunity for all people and businesses to advertise at a local and global level, without limits..

By Eugene Davis

By Eugene Davis

Parliament has approved the National Pensions Bill, 2021, which seeks to amend the National Pensions Act,2008 (Act 766) to exclude the security services from the pension uni cation process envisaged under section 213 of Act 766.

According to the report of the Committee on Employment, Social Welfare and State Enterprises on the National Pensions (Amendment)Bill,2021 the Ministry of Employment and Labour Relations established a Joint Technical Committee on the Uni cation of Pensions to develop the required technical instruments for uni cation.

As a result of the challenges associated with the uni cation process, it is necessary to amend Act 766.

The object of the bill is to exclude the Police Service, the Immigration Service, the Prisons Service, the Security and Intelligence Agencies and the Ghana National Fire Service from the uni cation of pensions.

Parliament’s Committee was informed that the subsection (2) of section 213 of Act 766 mandates the Board of the National Pensions Regulatory Authority to ensure uni cation of all pension schemes and the full operationalization of the Three-Tier pension scheme for all public sector workers, excluding the Ghana Armed Forces.

Further, an attempt at the uni cation of pensions during the payment of lump-sum bene ts to the rst batch of retirees from the security services under Tier 2 of the Three-Tier Pension Scheme in 2020 was fraught with massive employee data veri cation challenges, which stalled the entire uni cation process.

As a result of the challenges that emerged during the pension unication exercise and the unique nature of the security services in general, the Ministry recommended excluding the security agencies from the uni cation process to pave the way for establishing a separate regime to govern

pensions in the security and intelligence sector.

The amendment the report states would automatically reinstate the previous occupational pension schemes of the security services under CAP 30, which was the source of inequities in the delivery of pensions in Ghana.

The Bill seeks to reinstate the following enactments and schemes which ceased to be in force under the National Pension Act,2008 (Act 776) : Ghana Police Pensions Act,1985 (PNDCL 165), Immigration Service Pensions

Act,1986 (PNDCL 226),Prisons Service Pensions Act,1987 (PNDC 168),Section 34 of the Security and Intelligence agencies Act,1996 (Act 526) and Section 27 of the National Fire Service Act,2000 (Act 537).

The government was expected to institute measures to migrate bene ciaries of the associated public pension schemes onto the Three-Tier Pension Scheme by the expiration of the transitional period in 2014. However, by January 1,2015, the government had not put in place adequate measures for the uni cation of the public sector pensions.

At the 40th Chartered Accountants Professional Examinations, Mr. Richard Osafo Boadi an alumnus of the University of Ghana Business School (UGBS), was adjudged the Best Level Three candidate.

Mr. Boadi holds a Bachelor of Science (BSc) Degree in Business Administration from the University of Ghana and had his secondary school education at St. Peters Senior High School. The UGBS alumnus works as the Finance and Accounts Manager at Ferfed Business Consult Limited in Tema. His pro ciency in International Financial Reporting Standards, Computer Literacy and Tax Administration are considered impressive. In brief remarks, Mr. Boadi indicated his delight and how this has humbled him.

Zoomlion Ghana Limited has donated items including a cash donation to the family of the late Black Stars winger, Christian Atsu Twasam.

The donation was made by the Managing Director (MD) of Zoomlion, Mrs Gloria Opoku Anti, who led a delegation of senior managers of the company to commiserate with the bereaved family at their residence at Ashaley Botwe, on Friday, March 3, 2023.

The items, which included 25 cartons of bottled water and 2 branded waste bins all in in aid of the one-week observation of late Christian Atsu, which was slated for Saturday, March 4, 2023, at the Adrigarnor Astro Turf park.

According to Mrs Opoku Anti, management of the company had come to condole with the grieving family, expressing that “Ghana has lost a great footballer.”

While lamenting that Christian Atsu’s death was painful, the Zoomlion MD encouraged the family to take consolation in the fact that Christian Atsu was

resting in the bosom of the Lord.

In addition to the donation, Mrs Opoku Anti assured the family that her out t will take care of all sanitation matters before, during and after the one-week observation at the Adjirigarnor Astro Turf park.

She also used the occasion to sign

the book of condolence opened for the later Black Stars player.

Mrs Opoku Anti was accompanied by the Director of Finance and Group CFO of the E&S Group, Mrs Adokarley Okpoti-Paulo, Compliance Manager, Mr Prosper Ahey, Human Capital Manager, Mr Eric Osei Annor and Director of Monitoring and Service Quality, Mr

Other members of the delegation were Director of Communications and Corporate A airs, Mrs Emma Adwoa Appiaa Osei-Duah, Assistant Corporate A airs Manager, Mr Daniel Ohene Obeng and Mr Idris Adam, a Communications and Corporate A airs O cer.

Giving advice to his fellow mem-bers of the Institute of Chartered

Accountants Ghana, Mr. Boadi reminded them to always follow proper accounting procedures,

bearing in mind that a good name is better than money.

32%

Read

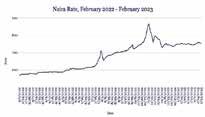

Forget Nigeria’s election: it’s the Naira shortage that markets are watching

As Nigerians prepare to go to the polls on Saturday to elect a new president, a cash shortage caused by a policy to exchange old Naira notes for newly designed bills continues to cripple the economy, creating a rift in the ruling All Progressives Congress (APC) party. The note swap plan championed by incumbent President Muhammadu Buhari has led to violent protests across the country and resulted in a temporary suspension of banking operations in some states. Several governors have petitioned the Supreme Court to overturn the policy, citing severe hardship faced by people and businesses dependent on cash for survival. Buhari’s apparent intention behind the policy is to curb vote buying by politicians, turning a deaf ear to APC governors who have made repeated calls to postpone the implementation of the policy. Amid fears of the current tensions spilling over to political violence, Buhari said he’s mobilising military and security agents to monitor polling stations for evidence of vote rigging. The severe cash shortage has held the currency steady in spite of the economic turmoil, with the Naira strengthening marginally against the dollar to 755 from 756 at last week’s close. In this context, resolving the cash shortage has become more significant for the Naira outlook than the election result—with the rate likely to hold around current levels until Naira supplies recover.

Alex Barmuta Forex Dealer, AZA Finance

Murega Mungai Trading Desk Manager, AZA Finance

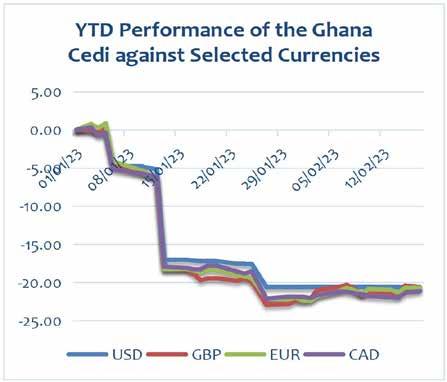

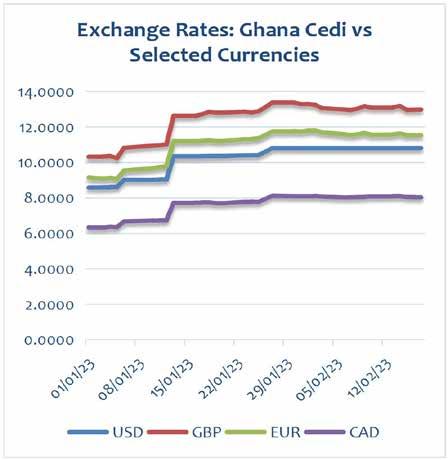

The Cedi weakened against the dollar, trading at 12.76 from 12.38 at last week’s close as Fitch Ratings cut Ghana’s foreign currency credit rating to ‘restricted default’ after the country missed a $40.6m coupon payment on one of its outstanding Eurobonds. The downgrade aligns with Fitch’s local currency rating, which was cut earlier this month. The foreign debt default was largely expected after Ghana said it would suspend payments on certain bonds as part of its restructuring plan to unlock $3bn in emergency funding from the IMF. The country faces pushback from bondholders over preferential treatment for bilateral lenders, who are being offered better terms in the debt restructuring. Against this backdrop—and with inflation remaining elevated despite a slight improvement in January—we expect the Cedi to depreciate further in the near term.

Mitch Diedrick

Foreign ExchangeDown Down 99%

Foreign Exchange Down

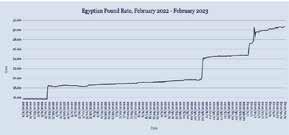

The Pound depreciated against the dollar, trading at 30.60 from 30.48 at last week’s close, amid broader risk-off sentiment and a stronger dollar. Egypt this week issued its debut Islamic finance bond, or sukuk, raising $1.5bn. The three-year deal priced to yield 11%, having attracted investor demand of more than $5bn. The deal provides some relief to Egypt’s finance ministry given the country’s need to boost FX inflows and repay existing debt. We expect the Pound depreciate further in the week ahead mainly due to dollar strength.

94%

Kenyan Shilling hits new low as FX reserves dwindle

11.7%

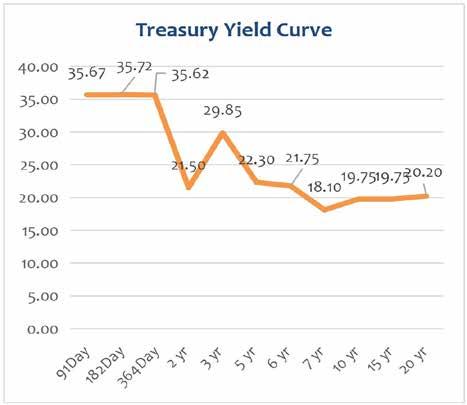

At the just ended Treasury Bill a uction , there was a 100% subscription rate across all tenors with government accepting total tendered bids to the tune of GH¢5.067 billion a cross the 91, 182 a nd 364- day bills, despite an a nnounc ed target of GH¢2.885 billion

The week-on-week yields witnessed a n overall drop of 12bps and 16bps across the 91 and 182-day bills respectively. Unlike the previous week, there was an auction for 364-day bill with a closing yield of 34.21%

n

elll l

tti i o o n n tto o M M a arrc c h h 2 2 0 0 2 2 3 3

G G o o v v e errn n me e n ntt a a n n n n o o un n c c e e s s s s e ettt tll e e m m en ntt o off D D D D E E P P p prro o g grra a m m m m e

G G h h an n a a’’s s llo o call d d eb btt s s c c o orr e rra aiis s ed d b b y y S S & & P P a a s s d d o o mes stti i c c d d e effa a u ullt t c c u urre e d d

J anua r y 20,202 3

February 17, 2023

J anua r y 20,202 3 February 17, 2023

One may either be a landlord or a tenant due to the necessity of housing as a basic need. It is not only the responsibility of the individual but the government has major part to play. Various governments have made several attempts to address Ghana housing need with the interventions of numerous national schemes to either make provision for housing or to make housing nancially accessible.

The rst president of Ghana, Dr. Kwame Nkrumah had several housing policies to make the lowand middle-income earners become homeowners. His interventions included the Roof Loans Scheme (RLS) to grant government workers soft loans to those building at their own pace, to roof their houses.

Also, Dr. Busia led government established Bank for Housing and Construction (BHC) to provide loans for housing construction. The BHC was to provide soft loans for people to access low interest loans for the construction of their houses.

Years on, upon the establishment of Tema Development Corporation (TDC), it was required of them to sell to their rst era tenants at an interest rate of 2% with 25 years repayment period. These home ownership policies including the a ordable housing scheme projects across the country. However, some have been questionable with a ordability and availability issues.

It is even alleged that most of these projects are made available to some top government o cials to buy for investment purposes.

In recent times, housing as a basic need has become a big challenge for most people to acquire espe-

cially in the major cities with high demand for housing. In addition, players in the rental space, most especially tenants are facing big challenges to a ord a decent accommodation in major cities.

To address the short to medium-term market challenges in rental failures where landlords demand years of rent advance payments, the government on 31st January 2023 launched the National Rental Assistance Scheme (NRAS) to provide rent loans to both formal and informal sector workers with veri able and regular income. The rst phase of the scheme is to be implemented with GH¢30 million.

This will provide eligible Ghanaians with a mechanism to pay low monthly rent, e ectively removing the need for rent advance payment within ve regions –Greater Accra, Ashanti, Western, Eastern, Bono East and Northern. This is swift process of providing such rent loan at 25% p.a. which is expected to completed within 5-10 days for its application.

The rent would then be paid directly by the Scheme Managers into the bank account of the landlady or landlord. This scheme is to support lower-income earning households and the youth to access the minimum standards of accommodation.

Today (2023), interest rate on mortgage ranges from 30-45% p.a. with maximum tenure of 20years. In the midst of high property prices as a result of high land values due to demand and high cost of nance and building materials.

In simple terms, loan for rentals (NRAS) is 25% whereas the loan on for purchasing (mortgage) 30-45%. Per United Nations standards, it is

By Ebenezer Oppong Aboagyeexpected that housing cost should not cover not more than 30% of the household income.

Another element of cost in housing has to do with agency fees. Recently, people do not have the luxury of time to go round searching for properties to rent or buy. It leaves them with no option than to fall on Agents to help them nd them their preferred properties to rent.

This helps them saves time and resources searching for oneself. Even in the sales market, it has become complex to a ord the necessity of a professional like agent and lawyers in the acquisition process. In my opinion, I see some positive consequence on the need of Agent.

Under the scheme, agents play their role by making suitable properties available for their client to present to the scheme manager for rent to be paid. Here, the only upfront payment the client may

end up paying possibly the contracted agent’s retainer fees and professional fees that comes in the form of commission.

It is emphatically stated that, the NRAS is not to abolish agency. Agency is not illegal; agency is backed by law. The Real Estate Agency Act, 2020 (ACT 1047) provides guidance for agency practices and conducts. The service of a real estate agent cannot be overemphasized. The responsibility lies on individuals to nd the right professional agent.

Associations like the Ghana Association of Real Estate Brokers (GAREB) has a search section to nd the right professional to assist you. (https://gareb.com.gh/search-member). Members have undergone professional trainings and have been cleared by Ghana police service to be people of no criminal record. Find a professional agent and stay safe in the industry as a consumer in the industry.