Ofori-Atta’s removal will restore hope – Parliament

You have our support for selecting Ghana as headquarters for India Africa Trade Council

ATM operation is brand awareness tool, says Felix Ugbebor

Central/West Africa - deputy minister declares

WEDNESDAY, OCTOBER 26, 2022

Story

on page 2 Story on page 3 Story on page 4

Limited

Ofori-Atta’s removal will restore hope – Parliament

By Eugene Davis

Both Majority and Minority Members in Parliament are calling for the removal of the Finance Minister, Ken OforiAtta and Dr.Charles Adu Boahen [Minister of State, Finance] over market turbulence and underperformance, reckons his sack will restore hope in the financial sector.

About 80 majority caucus in the country’s Parliament held a press conference in Accra yesterday, saying that they have had occasion to defend allegations of conflict of interest and lack of confidence against leadership of the Finance Ministry.

Ghana’s economic expansion has fallen short of a government forecast as soaring inflation, currency slide against the US dollar reduces private consumption and investment.

The IMF had projected a 3.6 percent growth rate this year and given signs of recovery towards the end of 2021 as the worst of the pandemic eased. But that recovery has been interrupted, leading to weakening cedi and businesses closing shops over hikes in taxes.

This among others have led to calls in some quarters for the resignation of the finance minister.

Addressing the press following the resumption of the 8th parliament of the second session of the third meeting from recess on Tuesday, the spokesperson for the caucus, Andy Kwame Appiah-

without any positive response.

We are by this medium communicating our strong desire that the president change the Minister of Finance and the Minister of State in the Finance Ministry without further delay in order to restore hope into the financial sector and reverse downward trend in the growth of the economy.

Mr. Appiah Kubi who is also the MP for Asante Akim North added that it is their hope “that the prayer will be carried to the presidency.

We want to serve notice that until such persons are made to resign or removed from office, we [MPs of the Majority caucus] herein parliament will not participate in any business of government by or for the president by any other minister.”

Ghana’s government is in the process of negotiating a support package with the International Monetary Fund, but some merchants say that help is not

seen in the last quarter of 2021 as the West African nation battled runaway inflation, a depreciating local currency and high public debt.

Minority endorses removal

The First Deputy Minority Chief Whip, Ibrahim Ahmed urged the majority to join forces with them to bring the matter up on the floor of parliament.

“We are not stopping with the motion for the impeachment of the finance minister and now that the indication is from our brothers [majority], they must support us to move the motion on the floor because if MPs don’t want Finance Minister, we cannot be blaming the president, we have the power to use 183MPs to impeach him. But if we don’t do this we reduce democracy to mere talk shop.”

According to Hon.Ahmed, the president is stalling on sacking the finance minister because the latter supported the ruling party during the election campaign.

The foundation of a great digital customer experience is humancentred design.

Today’s customers have changed to suit the times.

Customers are relying heavily on social media platforms, apps and websites to connect with brands and other customers. In comparison, not enough businesses have adjusted to suit their customers. To remain relevant, businesses must recognise which customer behaviours and patterns will endure in the long run, especially in the aftermath of the global COVID-19 outbreak.

Due to the growth of digital platforms, leading companies have created new digital experiences that have disrupted traditional in-store engagements. According to McKinsey, 80% of organisations believe they must digitalize their primary business

model in order to continue to be financially successful.

It’s no surprise that so many businesses rely on digital to stay afloat - it’s the only way to keep up with ever-changing customer needs. However, not all digital customer experiences are equal. Some are more effective and are more quickly accepted than others. Simply put, certain digital customer experiences are more human-centred.

Human-centred design refers to the process of developing goods and services with the user’s experience, including their physical and psychological requirements in mind. It essentially involves thoroughly researching your target market and how they will use your product or

By Angela Mensah-Poku

service before creating it.

At the height of the epidemic, when social distancing was an absolute necessity, Vodafone Ghana had to reconsider how we provided services to our clients to put their safety first. Our customer service has been significantly and positively affected by these choices. Today, several channels, including our chatbot TOBi, My Vodafone App and My Vodafone Web, allow our customers to access the services they need conveniently.

To create these platforms, we needed to learn more about our customers’ needs and preferences than ever before. Deep empathy for customers helped us discover insights, motivations and underlying continued on page 3

2 WEDNESDAY, OCTOBER 26, 2022| NEWS Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed. We value your support and loyalty. Contact: editor@business24.com.gh Newsroom: 030 296 5315 Advertising / Sales: +233 24 212 2742 Copyright @ 2019 Business24 Limited. All Rights Reserved.

needs that we were previously unaware of. In some instances, it even unveiled experiences that frustrated our customers that they were unable to express verbally.

It all starts with empathy. Organisations must find ways to walk the customer journey. At all stages in the development of products, new or existing, customer feedback must remain the single source of truth throughout the creative process. This is where research and analytics come into play to help create a genuinely memorable customer experience. Engaging customers in ideation and testing is not easy, but it is crucial because it ensures that their needs and opinions inform both original concepts and future improvements. There are many examples of well-intentioned features that never saw the light of day simply because they did not resonate with the customers. This co-creation approach has often led my team into pleasantly unexpected territories. In one instance, it led to a solution which dramatically benefits people living with hearing and communication difficulties. It eventually resulted in our SuperCare program, which is run across all our retail shops. Through the work that the team has done over the years, I have come to appreciate the

importance of delving deeper into our various customer groups to make our services more inclusive.

Feedback is key to remaining relevant in the ever-evolving world of customer experience. We are always listening and always improving the customer experience at Vodafone Ghana.

With so much emphasis on digital customer experience, businesses must be careful not to overlook conventional customer service touchpoints like call centres and retail stores as the human touch remains the most natural form of engagement. The goal is not to entirely shift to digital, but to find methods to provide a memorable positive experience across all customer touchpoints. Our strategic approach has been to harmonise our digital customer experience and conventional service outlets to guarantee that customers can enjoy the same support irrespective of their preferred platform.

To that end, we are continually updating our retail shops based on client input. For instance, our Accra Mall shop has been moved to a larger area inside the same site and remodelled to provide customers with a more modern, convenient experience.

The human-centred design process offers businesses a chance to win with customers

at the point of their need –whether digitally or otherwise. And the creative process should never come to a halt because its purpose is to continuously adjust

end, there emerges one universal truth – it’s all about the customer.

Putting your customers’ needs at the centre of your customer experience can only result in strong brand love and continual

ATM operation is brand awareness tool, says Felix Ugbebor

The Chief Operating Officer (COO) of UBA Ghana, Felix Ugbebor has stated that ATM operation forms a critical part of branding for any Bank.

The UBA COO was speaking at a conference where banking experts convened at the Movenpick Ambassador Hotel to participate in this year’s ATM Innovation Roadshow organized by INLAKS, an Information Technology Solutions provider.

Under the theme, “Self Service Innovation Summit: The changing landscape of ATMs and Mobile Technology.”

UBA Ghana’s Chief Operating Officer, Felix Ugbebor joined other banking industry leaders to speak at the roadshow.

Presenting on the topic “The Role of ATM Operations in Brand Transformation, Mr Ugbebor outlined three key points, saying “An ATM should be seen as a brand ambassador for financial institutions. Gone are the days where ATMs were simply seen as ‘cash-and-dash’ machines. These days they stand out, giving visibility to a bank’s brand even in

locations where the bank is not physically present.”

He added, “For financial institutions to remain competitive, it is essential to have an updated set of ATMs which are equipped with the latest technology and functionality.

At UBA, we recognize the importance of technology to enhance banking convenience and that’s why we have invested in our ATMs operations to meet industry standards and speak to our brand.”

Mr Ugbebor concluded, “Your ATM is your brand, offering more than advanced functionality and convenience to customers. ATM provides an array of services at the customer’s convenience, creating unique opportunities for brand visibility, customer loyalty and increased revenue.”

The other topics presented on the day included Next Generation and Global Trend, Digital Wave, addressing current industry challenges with cash management, which other banking experts led.

WEDNESDAY, OCTOBER 26, 2022 | NEWS 3

continued from page 2

You have our support for selecting Ghana as headquarters for India Africa Trade Council Central/West Africa - deputy minister declares

The Ga Mantse (King), Nii Tackie Teiko Tsuru II, and the Deputy Minister of Trade and Industry, Mr. Michael Okyere Baafi, have pledged the support of the Ga Traditional Council and the Government of Ghana for the India Africa Trade Council (IATC).

They expressed their profound gratitude to the IATC for selecting Ghana as its headquarters for the West and Central Africa region.

Speaking at the maiden IATC Trade submit held in Accra on October 18, 2022, the Ga Mantse said he was excited about Ghana hosting the West and Central Africa headquarters of the Council.

He therefore pledged his fullest support for the IATC.

Hon. Michael Okyere Baafi who doubles as a member of parliament for the people of Juaben South and Deputy Minister

for Trade, urged members of the IATC to embrace Ghana’s flagship industrialization programme, the One District One Factory (1D1F).

Hon. Baafi promised the doors of the Government of Ghana will always be open to investors, saying the Government will always support investors.

IATC delegation visits Ghana

The Global President of IATC, Dr. Asif Iqbal, was in Ghana to attend the summit and to also present to Dr. James Gnanaraj Rajamani, his letter of credence, confirming his appointment as the Chairman of IATC West and Central Africa.

Mr. Iqbal was accompanied to Ghana by his vice, Mr. Wali Kashvi and Trade Commissioner of Telanga state ,India Mr. Krishna Vamsi.

In his address at the summit, Dr. Iqbal admonished businessmen and women to take advantage of

international trade liberalization policies to ensure effective growth of the business communities.

On his part, Dr. James Rajamani assured his readiness to live up to his responsibilities in coordinating the activities of the Central and West Africa sub regions.

The submit attracted several key personalities from business industry, the diplomatic community, government,religious leaders, traditional authorities and the security agencies.

In attendance at the submit were: the Board Chairman of Tourism, Arts and Culture, Mr. Kwame Acheampong Boateng,Minister of Tourism and Cultural Affairs of Sierra Leone, Dr. Memunatu Pratt; the Chief of Staff of the Ghana Armed Forces, Major General Nicholas Andoh,the Ahafo Regional Minister, Hon. George Boakye;

Bono East Regional Minister, Hon. Akwasi Adu- Gyan; member of the Board of IATC and Chief Executive Officer of the EIB Network, Mr. Nat Adusei ( Borla Ray)as well as some selected Metropolitan, Municipal and District Chief Executives (MMDCEs).

About IATC

The idea is India Africa Trade Council came about in 2020 during the peak of the coronavirus pandemic.

IATC is a non-governmental organization established in consultation with the various heads of Trade bodies in Africa and the presidents/representatives and professionals of repute from the entire Indo-African region.

It was formed with a view to giving the business communities of both India and Africa a voice and a tool to foster development.

WEDNESDAY, OCTOBER 26, 20224 | NEWS

Ghana Exim Bank hosts Maltese High Commissioner

The Chief Executive Officer of the Ghana Export – Import Bank (GEXIM), Mr. Lawrence Agyinsam, on Thursday 20th October 2022 hosted the High Commissioner of the Republic of Malta to Ghana, His Excellency Jean Claude Galea Mallia at the Bank’s head office at the Africa Trade House, Ridge, in Accra.

Archer, received the Maltese High Commissioner.

The meeting afforded the Management of the Bank the opportunity to discuss areas of mutual interest for collaboration and building synergy with the High Commission of the Republic of Malta in Ghana, the first diplomatic

transformation of Ghana’s economy into an export one by supporting and developing trade between Ghana and other countries, overseas investments by Ghanaian Companies and elimination of critical market failures in the Ghanaian economy thereby making Ghana competitive in the global marketplace.

He further recommended a close working collaboration between the Bank and the High Commission of the Republic of Malta in Ghana for the benefit of Small and Medium Enterprises (SMEs) and other businesses in Ghana and Malta.

His Excellency Mallia on his part expressed his appreciation to the Chief Executive Officer and his team for the opportunity to discuss avenues of working together for the benefit of businesses and citizens of the two countries.

“Malta has made great strides over the years and I am confident there will be great things we can do together going forward in various sectors with expertise and technology from Malta as we try to assist the Government of Ghana in achieving its desire to move beyond aid”, he added.

High Commissioner Mallia also took the opportunity to tour the GEXIM Made-In-Ghana (MiG) Town located at the head office of the Bank. The GEXIM MiG Town is designed to be a one-stop shop for everything Made-In-Ghana at unbeatable prices and the highest quality.

GEXIM MiG Town is an outlet that stocks assorted, innovative and well packaged Made-In-Ghana products including food and ingredients, beverages, skin and beauty care products, textiles, apparel, garments, leather footwear and slippers and many others. It is open to the general public from Mondays to Fridays between the hours of 9:00am and 6:00pm.

Jonathan Christopher Koney, Assistant Manager, Corporate Affairs and International Cooperation of GEXIM, was present at the meeting.

FBNBank marks World Polio Day

FBNBank Ghana has joined the world to mark this year’s World Polio Day on Monday, 24 October 2022. This year’s celebration of World Polio Day was celebrated in Accra at the Airport View Hotel with the theme ‘A Healthier Future for Mothers and Children’.

FBNBank over the years has played an active role in advocating for an end to Polio with the support of the National Polio Plus Committee and Rotary in Ghana. In line with this, the Bank has supported the activities aimed at eradicating the disease. This year, FBNBank is supporting the national efforts with Twenty-five Thousand Ghana Cedis (GHS25,000) including a Fifteen Thousand Ghana Cedi (GHS15,000) donation to the National Polio Plus Committee, Five Thousand Ghana Cedis (GHS5,000) each to the Rotary Club of Ho and the Rotary Club of Hohoe.

Speaking on the Bank’s contribution to the campaign against Polio, Mr. Victor Yaw Asante Managing Director of FBNBank who doubles as the Governor of Rotary District 9102 which comprises Ghana, Niger, Benin and Togo said “Polio is an infectious disease, contracted by children which can lead to paralysis in the body. We are very optimistic that together with our partners we can go ahead and eradicate this canker that has been with us for decades. Eradication is possible through mass

immunization and vaccination. As a bank, we are committed to this fight because we have over the years remained focused in putting our stakeholders first which includes the entire Ghanaian populace.

Committee and the Rotary Clubs in Ghana. Working together, we will win.”

World Polio Day has been observed on the 24th day of October of every year since 1988 to raise awareness on polio and to

can draw inspiration from the WHO European Region which achieved a polio-free status 20 years ago to ramp up their efforts to achieve same for our country and the Africa Region. The unveiling of the “End Polio Now” flag, should serve as a reminder to strengthen the commitment to maintain equitable high immunization coverage, highquality surveillance to detect any presence of the virus and prepare to respond in the event of an outbreak and also use our sister agencies to continue the collaboration with all partners of the Global Polio Eradication Initiative in supporting the Government of Ghana to end Polio.”

the partners we have on our side. Rotary International is known worldwide for the efforts it has made in the fight against polio and the National Polio Plus Committee has been very instrumental in achieving the successes Ghana has made in the fight against Polio. On the FBNBank side, our commitment has been possible because of the passion of our people. We at FBNBank therefore believe that we can continue to make gain. We however believe we would achieve a greater impact if more corporate entities join the fight and support the activities of the National Polio

take measures towards eradicating this disease. The celebration also provides an opportunity to highlight global efforts toward a polio-free world and honor the tireless contributions of those on the frontlines in the fight to eradicate polio from every part of the world.

In a speech delivered on behalf of the World Health Organization Representative in Ghana, Dr. Francis Kasolo by Dr. Michael Rockson Adjei, Immunization Officer at the (WHO) said, “World Polio Day highlights the global efforts to end polio worldwide. As an organization, we

FBNBank has in its 26 years of operating in Ghana remained focused on putting its customers and communities first. This, it has sought to do through the rich value and excellence of what the Bank contributes to the relationship with its stakeholders as a whole, particularly the customers.

FBNBank Ghana is a member of the First Bank of Nigeria Limited Group which is renowned for its great customer service and general stakeholder engagement garnered over its 128 years of operation.

FBNBank Ghana has 25 branches and two agencies across the country with over 500 staff. FBNBank offers universal banking services to individuals and businesses in Ghana.

WEDNESDAY, OCTOBER 26, 2022 | NEWS 5

WEDNESDAY, OCTOBER 26, 2022| FEATURE6

A balanced view of customer experience has deepened customer satisfaction at Vodafone Ghana

Digital transformation is forcing many industries to evolve their business models to suit new market realities. The most fascinating thing is that customers are driving this change—not companies.

Today’s customers expect content that complements their lives anytime, anywhere.

For Angela Mensah-Poku, who is the Director of Digital Transformation and Commercial Operations at Vodafone Ghana, the only way businesses can keep up with this new breed of customers is by providing unmatched customer experiences both online and offline.

“Our strategy is to balance both our traditional and digital customer experiences. This viewpoint has inspired us to evolve our channels in deliberate ways. Customers must enjoy the same excellent experience no matter where they choose to interact with us,” she says.

To achieve that, Vodafone Ghana has been steadily upgrading the customer experience both online and at its retail shops. The most recent upgrade is the Accra Mall outlet, which has been moved to a much larger space in the banking area of the mall.

When it comes to digital, Vodafone Ghana’s channels simplify customer interactions online in flexible and convenient ways. MyVodafoneApp is a unique self-care mobile app that allows customers to buy voice and internet bundles, send money, top up their accounts, track transactions, raise concerns, and more. MyVodafoneApp centralises all customer interactions and inquiries. It is available for free in both the Google Play Store and the App Store.

The telecommunications company has also unveiled TOBi, a first-of-its-kind virtual assistant that performs customer care roles and offers customers advice on products, services, and enquiries around the clock. The machinelearning chatbot responds to simple questions via social media and MyVodafoneApp. TOBi continues to improve because it listens to and learns from customer feedback.

Over the years, Vodafone Ghana’s focus on digital transformation has helped it connect with customers and meet their expectations for a smooth experience, no matter what their limitations were.

“We strive to make our customer

experience more inclusive and convenient for customers with health conditions or impairments. It’s about creating experiences that bring our humanity and empathy to the forefront. That’s what allows us to produce innovations like SuperCare,” Angela explains.

In 2017, Vodafone Ghana started its groundbreaking SuperCare project to help people with speech and hearing problems by giving them specialised services and help. Customers with speech or hearing impairments can use the SuperCare customer support line. Trained specialists in customer service are always on hand to assist customers.

By dialling *494#, a hearingimpaired customer can request either a video or WhatsApp call, and get the help they need. The Vodafone SuperCare service is a first in Ghana.

Vodafone Ghana’s commitment to reshaping the customer experience extends to its mobile money platform as well. Today, payments for all Vodafone services are simple and free thanks to Vodafone Cash, Vodafone’s mobile money platform. Customers can also use the platform to purchase airtime and bundles and pay

for utilities. Vodafone has also waived charges on transfers to other mobile money users across platforms, which has brought great relief to customers.

Recently, Vodafone Cash added an overdraft feature that lets customers borrow money to complete certain transactions without getting turned down because they don’t have enough money in their accounts.

In an age where, more than ever before, the customer is king, Vodafone Ghana’s unique view of digital transformation has enriched its engagement with customers over the years. Looking forward to 2023 and beyond, Angela is excited and optimistic but acknowledges that there’s still a lot to be done. “We are empowering customers to access our products and services while enjoying convenience no matter where they interface with us. The next step involves a lot more listening to unearth insights about our customers’ changing needs. In the meantime, our customers can keep expecting more innovations wherever they interact with us. We remain committed to providing an unmatched customer experience for our customers.”

WEDNESDAY, OCTOBER 26, 2022 | FEATURE 7

Huawei opens application for Seeds for the Future 2022

Huawei Technologies Ghana has opened applications for its global flagship Corporate Social Responsibility Program “Seeds for the Future 2022”, set to commence from October 28, 2022 to November 9, 2022 in partnership with the Ministry of Communication and Digitalization, Ministry of Education, and the Huawei ICT Academy talent Partners.

The “Seed for the Future 2022 Program” seeks to promote the participation of more women and girls in ICT and empower them to take up careers in STEM (Science Technology Engineering and Mathematics). As a result, Huawei is offering 50 slots to outstanding female tertiary students who wish to take part in the program.

This year’s program which will

be held online for 8-days will focus on advanced courses like 5G, AI, Cloud Computing, Digital Power, Cybersecurity, Digital Trade and Smart City. The program will also introduce participants to leadership courses in the areas of Cross-Cultural Management, Strategic Management and Leadership Skills.

As part of the program, beneficiaries will embark on a ‘Tech4Good’ project, after being equipped with the necessary skills and knowledge in the study of new technologies to develop solutions for societal and environmental problems.

Beneficiaries will also get the opportunity to take part in an ICT mentorship session where female industry experts in the STEM field will be invited to share their

experiences with them.

After the program, awards will be given to the Best Tech4Good Project group, Top-10 excellent Students, Best Group members and outstanding students among others.

Participants will have the opportunity to take part in a series of virtual tech talks with professionals in the tech space and a virtual tour of the Huawei Head Quarters in China to learn more about latest technologies.

Some awards to be given to best participants of the 2022 Seeds for the Future Program include Huawei smarts tablets, Huawei mobile phones, Huawei smart watches, Cash prizes and some branded souvenirs among others.

To participate in this year’s program, interested persons

must: Be a University Student, 2nd Year (Level 200) upwards and must be offering STEM related courses, Provide their Resume/CV, A cover letter, Submit a motivation letter between 400-600 words that detailing why she want to participate in the program, relevant experience, interests, and expected contribution to the program.

Interested participants will send application materials to: SeedsGhana@Huawei.com . Deadline for submission of all applications and all required document is Friday, 26th October, 2022 05:00pm Ghana time (1500HRS GMT)

For more information visit: https://www.huawei.com/ minisite/seeds-for-the-future/ index.html.

WEDNESDAY, OCTOBER 26, 20228 | NEWS

Nerasol Ghana Honoured at GITTA 22

Nerasol Ghana and its Boss

Mr. Samuel Ofori-Gyampoh received recognition at the 12th Ghana Information Technology & Telecom Awards (GITTA) 2022 held at Mövenpick Ambassador Hotel in Accra Ghana.

It was under the theme; “Celebrating & Promoting Excellence In The Tech Industry”, and honoured several playersorganitions and individuals in the technology and telecom industry in Ghana and Nigeria.

Nerasol Ghana was awarded the Software Provider of the Year whiles Mr. Samuel OforiGyampoh the Chief Operating Officer (COO) of the ICT Group of the Jospong Group of Companies received an award for the IT Professional of the Year.

Addressing awardees and patrons of the event, Mr. Akin Naphtal-Founder/CEO of Instinct Wave, organizers of the awards stated that GITTA was created as a strategic platform to recognize, reward, and showcase the pioneering ICT initiatives

driving the private and public sectors with a vision of setting a benchmark to the sub-region’s wave of development in ICT.

GITTA will recognize organisations and individuals at the forefront of digitization with innovative products and services that keep the ICT sector exciting.

The prestigious annual ICT gala awards night has inspired and promoted further development, growth, and innovation of the country’s ICT industry as a regional leader.

Talking to the media, Mr. Samuel Ofori-Gyampoh, COO and Mr. Wisdom Elvis Ativoe, Managing Director of Nerasol Ghana expressed their appreciation to the hardworking staff whose

dedication and commitment has earned Nerasol Ghana this feat, adding “on behalf of the entire Nerasol Ghana Team, Mr. Gyampoh dedicated the awards to customers and potential customers of Nerasol Ghana and the ICT, whose patronage has

incorporated as a technology company under the ICT cluster of the Jospong Group of Companies, and specializes in tailor made Business Efficiency Software Solutions which help simplify work in a world of complex information by empowering organisations to- digitize and automate their business

Living the ESG principles in Ghana’s mining industry

The mining sector is increasingly exposed to Environment Social and Governance (ESG) risks, including concerns around emissions, water use, deforestation and community relations. At the same time, ESG reporting obligations, institutional and other investor interest in what resource companies such as mining are doing, are rapidly multiplying across the globe.

Alongside these developments, actual and perceived noncompliance with ESG regulations and best practices have engendered activist shareholder protests and class action litigation against parent companies of some global mining groups.

It is interesting to note that governments are more actively protecting local communities, environments, and heritage sites through legislation. Customers are voting with their wallets for suppliers and products that support ESG principles. And a new generation of labour is expressing a clear desire to work for companies that are responsive to ESG issues.

Galvanized by the same forces, the clean energy transition is now leading a resource transition and increasing demand for minerals that directly support electrification and the decarbonization of energy.

Opening a two-day seminar for Public Relations, Environment,

Mining Engineers, Sustainability and allied professionals within the mining industry, CEO of the Ghana Chamber of Mines, Mr. Sulemanu Koney espoused the issues around ESG principles and noted that the seminar was part of the Chamber’s initiatives to improve members’ ability to collaborate, foster goodwill, and forge stronger relationships with stakeholders.

Mr. Koney stated that, “ESG agendas are not the only forces dictating the industry’s future. New technologies are enabling the energy and mineral transition, and “future back” issues have more sway in growth ambitions. Both are working in concert with new and emerging sustainability expectations to open a once-ina-generation window to create distinctive value in responsible mining”.

He stressed the relevance of environmental protection and sustainability as they are of keen interest to the Chamber, hence the introduction of the Best Green Mine as well as the Most Innovative mining company categories in the prestigious Ghana Mining Industry Awards.

The CEO added that “it is our belief that as the industry expands, there is the need to adopt strategies and programmes that seek to protect and sustain our

environment while meeting the needs of our stakeholders”.

The two-day intensive training program, during which there were classroom sessions, had facilitators from both industry and academia taking sessions in PR, Sustainability and ESG issues, industry challenges, innovations and trends. Prof. Eric Kwame Addae led the discussion in the design and development of communication strategies and crisis management.

He is a well-seasoned lecturer with the Department of Journalism and Mass Communication at Drake University in the United States with vast experience in Ghana as a Communications professional. Mr. Eli Daniel-Wilson who is the Director of Sales and Strategy at Pulse Ghana led the session on digital innovations.

The conference attracted attendees from various mining companies, mine support service companies, and regulatory authorities in Ghana under the theme “leveraging Public Relations to Promote Environmental Sustainability.”

Setting the tone for the seminar, a Partner for Risk, Governance and Compliance at KPMG, Mr. Kwame Sarpong Barnieh explained why ESG was a critical factor in the mining industry.

Mr Barnieh noted that ESG was a part of all activities and as such organizations’ ESG strategies must be authentic, embedded in business strategies and owned by its Board of Directors. Additionally, ESG metrics of companies were used to compare different organizations by way of a rating and these metrics were closely scrutinized by shareholders to determine an organizations level of performance.

Dr. Eric Twum, in his conclusion, noted that organizations are expected to champion ESG principles as a way of demonstrating their commitments to ensuring sustainable development at all levels without compromising on the integrity of the environment.

Mining companies, especially, are being scrutinized regularly for environmental compliance, hence it is critical for them to live by the ESG principles and reshape the narrative regarding the negative impressions about mining companies.

The Ghana Chamber of Mines is at the forefront of the Responsible Mining Agenda and will encourage its members to be ESG compliant in order to obtain the necessary sociallicense from host communities and stakeholders.

Source: Ghana Chamber of Mines

WEDNESDAY, OCTOBER 26, 2022 | NEWS 9

Binance named The Most Innovative Blockchain Provider of the Year at the 2022 GITTA Awards

Innovation is at the heart of what crypto and blockchain stand for. The internet (Web2) revolutionised the transfer of information. Blockchain (Web3) is the technology that is revolutionising the transfer of value. To celebrate the innovative power of blockchain, Binance, the world’s largest cryptocurrency and blockchain infrastructure provider, received an award for “Most Innovative Blockchain Provider of the year” at the 2022 Ghana Information Technology and Telecom Awards (GITTA) which took place in October 21, 2022. This well-deserved award was presented to the blockchain giant for its unwavering commitment to providing its 120 million users access to financial freedom.

With a vision to increase freedom of money globally, the company has continued to expand its product line beyond the exchange by offering access to a vast array of financial tools and innovative job opportunities that blockchain provides. From Trust Wallet to CoinMarketCap, Binance NFT to Binance Earn, they cater to virtually any interest across the broad spectrum of what the technology has to offer. The past year has also seen the introduction of Auto-Invest, Binance Live, Learn and Earn, and a host of other services.

In 2018, Binance Labs - a chainagnostic incubator and the venture capital arm of Binance invested in and incubated over 200 projects worldwide. Just recently, Binance Labs closed a $500M investment fund to boost blockchain, Web3, and valuebuilding technologies. The fund would allow Binance Labs to continue its successful run and invest in more promising projects.

Most importantly, Binance has shown its commitment to empowering others. Binance’s focus on education and community has been instrumental in deepening cryptocurrency adoption

in Africa. In 2020, Binance rolled out the Binance Masterclass programmes across the continent to teach Africans the fundamentals of cryptocurrencies, how to identify scams and safeguard their crypto journey. Now, the company has provided free crypto education to over 600,000 Africans. This is even more important today, in a post-pandemic world that is plagued by economic downturn and rising inflation. As blockchain technology continues to revolutionise economies, Binance is ensuring its users have access to essential resources that will inevitably help them succeed.

In addition to the company’s product offerings, Binance has been vocal about the need for effective and appropriate regulation that boost mainstream adoption of digital assets. Over the past year, the company has engaged with governments and regulatory bodies across the globe in unprecedented levels in the industry. This happens against the backdrop of a shifting policy environment and marks a substantial step forward toward creating greater regulatory certainty for the industry. It also highlights a broader acceptance of the fact that cryptocurrencies are here to stay and that the industry is gaining steam toward mainstream adoption.

Commenting on this feat, Emmanuel Ebanehita, (Marketing Lead, Binance Africa) said: “As a company of the

future, Binance continues to evolve, build and find solutions in real time. This award is a testament of our unwavering mission to take financial inclusion for Africans to the next level and showcases our commitment to our users and the crypto community at large”

Now in its 12th year, the Ghana Information Technology & Telecom Awards (GITTA) has become the cornerstone that promotes and celebrates successful ICT innovations across various sectors and industries in Ghana. This year’s theme “Rewarding, and Promoting Excellence in Digital Innovations” reflects on and celebrates the progress of successful technological

as part of the Government’s vision for a more robust digital economy.

About Binance

About Binance is the world’s leading blockchain ecosystem and cryptocurrency infrastructure provider with a financial product suite that includes the largest digital asset exchange by volume. Trusted by millions worldwide, the Binance platform is dedicated to increasing the freedom of money for users and features an unmatched portfolio of crypto products and offerings, including: trading and finance, education, data and research, social good, investment and incubation, decentralisation and infrastructure solutions, and more. For more information,

WEDNESDAY, OCTOBER 26, 202210 | FEATURE

Ocean Network Express leadership tours MPS terminal 3

Members of the senior leadership team of Ocean Network Express paid a visit to Meridian Port Services Ltd (MPS Terminal 3).

The leadership were taken through a boardroom presentation & discussion and then proceeded to have a tour of the MPS Terminal 3 Facility.

During the Boardroom Presentation, the CEO of MPS Mr, Mohamed Samara impressed on the visitors the superior technology deployed in the Terminal and the successes chalked by MPS in promoting the Tema Port as a Trade Hub.

He intimated that there was a high trade potential in the African Sub Saharan Region and MPS was poised to facilitate the trade

for economic and social gains. He outlined the steady growth in transhipment volumes since MPS was named a transhipment hub by some shipping lines.

“MPS has been keen on cutting down avoidable costs for the shipping lines and consignees from the very beginning. With this we ensured costs like the congestion surcharges was removed and deployed a robust berthing window agreement that allows shipping lines the predictability, productivity, and reliability of being attended to when the vessels arrive. The added value at Terminal 3, MPS secured considerable transhipment volume form/to Nigeria, Ivory Coast and primarily the trade between South America

and the Far East”

The CEO of MPS added that although global trade may have taken a dip, it was expected that there will be a rise in the trade in the coming months.

The Chief Operations Officer, Mr. Curtiss Dakpogan mentioned to the audience that MPS thrives on guaranteeing the safety and security of cargo with the use of high-level technology that automatically identifies and tracks every container within the facility and was keen on building up its capacity.

“Our current yard capacity is hovering around 2million TEUS, in the future we are looking forward to about 3.3 million TEUS and so we are working on the yard space behind the 4th berth

to accommodate the new cranes that we have on order”

Mr. Michael Durant Cooper, the Managing Director of ONE Ghana who led the delegation to MPS revealed the motivation for the visit.

“The leadership of ONE is developing its strategic plan for the next few years and realising the key role of MPS Terminal 3 within then sub-region had to pay a visit to determine what business decisions could be made to benefit both parties and expand their network.”

Dwelling on different aspects of MPS operations and management culture, the leadership ofONE stated their positive imprints of the comprehensive and productive system run by MPS.

WEDNESDAY, OCTOBER 26, 2022 11| NEWS

Dr Ben Asante retained as president of Ghana Hockey Association

By popular acclamation, the members of the Ghana Hockey Association has accepted the continuity of the leadership of Dr Ben KD Asante for the next four years.

This was witnessed by the media at the Theodosia Okoh National Hockey pitch on Saturday. He went unopposed.

Dr. Ben Asante, who doubles as the Chairman of the Citizens International Hockey Club, urged members of the Association to rally behind hockey and strive to seek for sponsorship for the association.

Madam Elizabeth King, Vice President, also went unopposed.

“On behalf of the board, I want to thank you all for the support for the last four years. It’s been an exciting journey with ups and downs.

“Our commitment towards funding should be looked at. Our development agenda has remained the same but our funding has not reached the mark that can help us execute all

our plans,” he said.

“We still remain committed to develop our facilities and equipment, and also looking at our pillar number two, which is developing our personnel, not just the players, but rather the coaches and technical officials because we’re far behind.”

He reiterated that the Association’s commitment of funding has been a problem.

The main tool for purchase equipment, train coaches and enabling players to play at competitions has not been forthcoming, he noted.

The other members Mr. Kwame Owusu, Mr Albert Ofori, as honorary treasurer, while Mr. Frank Oti-Mensah and Grace Ankomah all went unopposed with two executive members of the association.

They were sworn in as the new executive members for a new four-year term.

The Association has successfully hosted two major international tournaments

being the African Cup of Club Champions (ACCC) and Africa Cup of Nations in November, 2021 and January 2022 respectively.

In the ACCC, two Women Clubs from Ghana, GRA Ladies won Gold and Prisons Ladies, Bronze.

None of the men’s team made it to the medal zone.

In the ACN, Ghana hosted 15 participating teams from South Africa, Zimbabwe, Egypt, Namibia, Kenya, Zambia, Nigeria, and Uganda.

Ghana’s female team sailed through to the finals but lost to South Africa, thereby winning silver.

The Black Stiks placed fifth in the men’s category.

Sequel to these tournaments and ranking, the men and women national teams qualified to the 2022 Birmingham Commonwealth Games in the United Kingdom, placing 10th in both men and women version.

On infrastructure, four new water-based artificial turfs have been installed, with the

support from the president of Ghana Hockey Association, Dr. Ben Asante. The association acquired turfs and its accessories to construct three new pitches at KNUST, UG and UCC and renovation of the national hockey stadium.

Human Resources after the first four years under the executives – Association has birthed a number of FIH officials and umpires who get appointments at international tournaments or represent Ghana.

The likes of Mr. Frank OtiMensah, Isaac Graham, Dr. Bayitse, Joyce Datsa, Aziz Adimah, Cynthia Clement, George Roland, Agatha Hagan, Kwabena Asante, Quagraine Kofi, Ebenezer Nortey, and many young people have had international appointments.

Coaches, trainers and officials, have all benefited under his leadership.

This achievements, wouldn’t have happened if not the intervention of the president Dr. Ben Asante.

WEDNESDAY, OCTOBER 26, 202212 | NEWS

WEDNESDAY, OCTOBER 26, 2022 13| EDUCATION

The Liz Truss tragedy

Liz Truss’s stint as British prime minister is over, but she was right that the United Kingdom needs growth. Her downfall is tragic, because growth is the only path out of the country’s economic dilemma.

The UK is surprisingly poor. Its GDP per capita is just $43,000, compared to $60,000 in the United States. The average British home is one-third the size of the average US home. Worse, the country’s economy is not growing. Its GDP per capita is lower than it was in 2007. Productivity – the underlying source of economic growth – has been flat for over a decade.

The UK desperately needs supplyside reforms. Surging inflation tells us that demand-side stimulus is a spent force.

If anything, Truss’s proposed reforms were too mild. A 40% top marginal income tax rate (down from 45%) would not make the UK a low-tax free-market Shangri-La, especially considering that it would also still have a 20% value-added tax (VAT), national insurance taxes, property taxes, corporate taxes, and more. Recall that US President Ronald Reagan and Speaker of the House Tip O’Neill (a Democrat) cut the top federal marginal rate from 70% to 28%.

Truss also proposed free-market “investment zones.” But if one accepts that pro-investment tax and planning conditions are good in blighted areas, why not the whole country?

The UK is at a post-Brexit crossroads. Will it become a freetrade, entrepreneurial, financial hub – a “Singapore on the Thames”? Or does Brexit mean protecting and subsidizing inefficient businesses and places even more than the

European Union allows?

Unfortunately, we now know the answer. Truss’s critics have no counterproposal that has any chance of reigniting growth. The stage is set for further hightax, high-subsidy, over-regulated decline.

As sound as Truss’s plans were in economic-policy terms, her government’s handling of the messaging and the politics was spectacularly inept. That is an important lesson for those of us who want to see more growthoriented policies in the US, Canada, and Europe.

One obvious mistake was Truss’s announcement of a £60 billion ($68 billion) blowout to hold down gas prices. That is not a good way to launch a pro-growth revolution.

She then moved on to “tax cuts,” predictably raising the ire of the high-tax intelligentsia. In announcing the policy, neither Truss nor her chancellor of the Exchequer, Kwasi Kwarteng, explained the point of lowering tax rates. For example, Kwarteng sold tax cuts as “putting money back into people’s pockets.” But such Keynesian stimulus is the last thing the country needs amid historic inflation. Kwarteng should have explained that lower tax rates improve the incentives to work, save, invest, start a business, or, in the case of corporate taxes, move a business to the UK or keep it there. (Ideally, one cuts tax rates but broadens the base, maintaining revenues until spending falls.)

If you can’t explain that clearly and consistently, you either don’t understand or believe your own message, or you think voters are too dumb to comprehend it.

Either way, your revolution will fail. In the face of predictable, implacable hostility from the entrenched left-wing media and economic commentariat, a freemarket revolution needs great communicators.

By starting with taxes and subsidies, Truss and Kwarteng guaranteed that nobody would pay attention to the most important parts of the plan: the essential pro-growth regulatory reforms that they had described in the 2012 book Britannia Unchained. Britain’s housing restrictions, as in the US, lead to absurdly high prices, which stymies many businesses and the workers they might hire. The situation is especially harmful to less-advantaged people who cannot afford to live near highproductivity jobs. Truss had also planned to bring back North Sea oil production and lift the UK’s ban on fracking. These are sensible responses to a global energy crisis.

The lesson is that growth-minded policymakers should start with microeconomic reforms. Everyone can see that over-regulation and restrictions on housing and energy production are hobbling supply. Even climate-change activists are noticing that it is too difficult to get permits for windmills and transmission lines. Everyone can see that schools are awful and getting worse. Workers as well as business owners and managers can see that labor regulations are straitjacketing their workplaces. People can see in everyday experience how social-program disincentives lead some people not to work at all.

Patiently explaining these problems to voters can also make for

good politics. We all long for simple mind-the-store competence in our governments. Fixing dysfunction is a visible achievement that works right away, with no short-run cost.

Truss’s handling of the politics was even worse than her marketing. Margaret Thatcher and Reagan faced the same withering scorn from the chattering classes, and they had to endure years of hardship before their reforms took root. But they held firm.

Truss’s critics seized on UK bondmarket hiccups, though these were tiny compared to those of the 1980s. They also were largely attributable to the Bank of England raising rates, and to a pension risk regulation fiasco. Nonetheless, Truss quickly gave in. By starting with an energy blowout to placate the left, she already encouraged her opponents to go in for the kill. When a shark is on your trail, you don’t offer it a foot and then assume that you’ll both get along. When an iron lady was needed, Truss proved to be made of straw.

The US, too, is a high-tax, overregulated, over-subsidized, highdebt, slow-growth economy. For us, too, supply-side reforms are the only way out. Yet many of our conservative voices now pander to voters by advocating biggovernment big-tax nationalism, protectionism, subsidies, and crony capitalism, albeit directed in different directions than the left.

For those of us who still understand that the only real solution lies in economic freedom and small, competent government, Truss’s downfall offers important lessons. We must heed them so that we don’t blow our chance if we get one.

WEDNESDAY, OCTOBER 26, 202214 | FEATURE

WEDNESDAY, OCTOBER 26, 2022 15| NEWS 35 Patrice Lumumba Street, Airport Residential Area (600 Meters from the National Service Secretariat) PMB CT 353, Cantonments, Accra Tel : 0501 601 810 Enjoy our exciting Motor & Home Insurance policies ALLIANZ GHANA www.allianz-gh.com

WEDNESDAY, OCTOBER 26, 202216 | NEWS

WEDNESDAY, OCTOBER 26, 2022 17| NEWS

WEEKLY MARKET REVIEW FOR WEEK ENDING - OCTOBER 21, 2022

MACROECONOMIC INDICATORS

Q3, 2021 GDP Growth 4.8%

Average GDP Growth for 2021 4.1%

2022 Projected GDP Growth 3.7%

BoG Policy Rate 24.50%

Weekly Interbank Interest Rate 24.96%

Inflation for February, 2022 37.20%

End Period Inflation Target – 2022 28.5%

Budget Deficit (% GDP) – Dec, 2021 6.4%

2022 Budget Deficit Target (%GDP) 6.6%

Public Debt (billion GH¢) – Dec, 2021 402.4%

Debt to GDP Ratio – Dec, 2021 68.0%

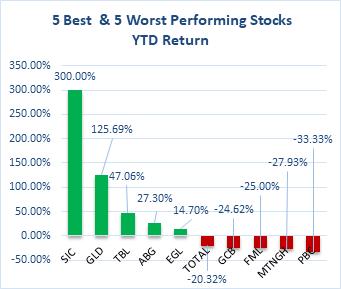

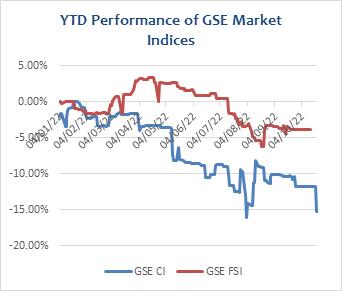

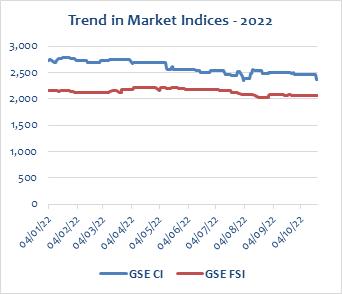

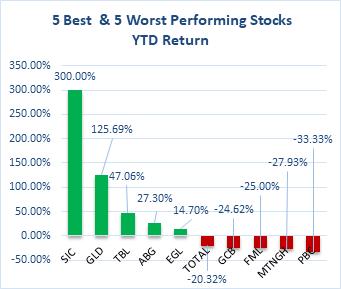

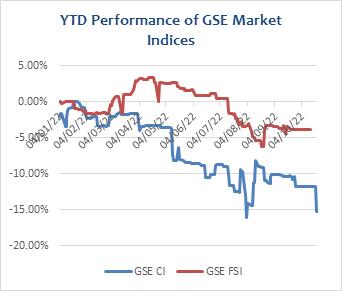

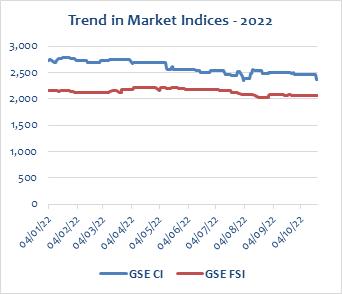

STOCK MARKET REVIEW

The Ghana Stock Exchange closed lower for the week on the back of price declines by 2 counters. The GSE Composite Index (GSE CI) lost 94.55 points (-3.84%) to close at 2,365.89 points, reflecting a year-to-date (YTD) loss of 15.18%. The GSE Financial Stocks Index (GSE FI) was flat for the week closing at 2,068.16 points (0.00%), reflecting YTD loss of 3.89%.

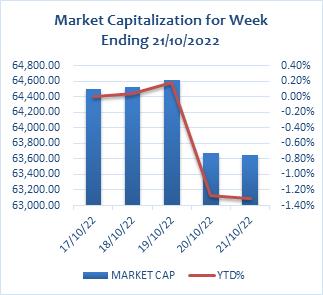

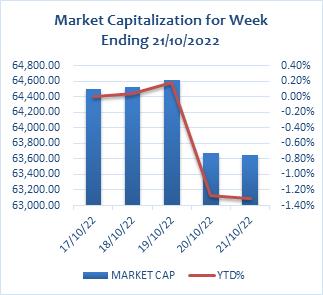

Market capitalization declined by 1.29% to close the week at GH¢63,646.60 million, from GH¢64,478.26 million at the close of the previous week. This reflects a YTD decrease of 1.32%.

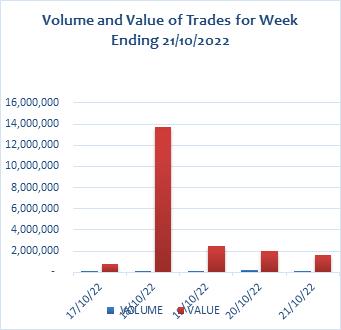

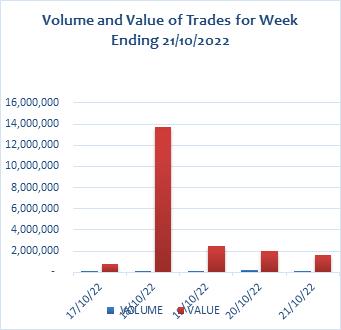

Trading activity recorded a total of 550,652 shares valued at GH¢20,555,072.32 changing hands, compared with 3,546,068 shares, valued at GH¢59,618,839.97 in the preceding week.

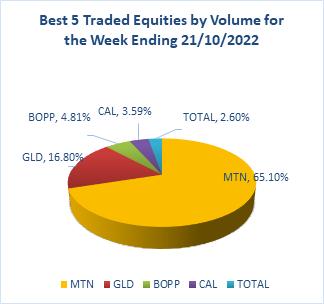

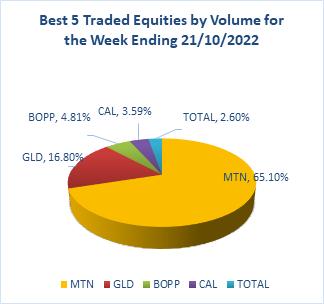

MTN dominated volume of trades whiles New Gold dominated value of trades for the week, accounting for 65.10% and 96.99% of shares traded respectively.

The market ended the week with 2 advancers and 2 decliners as indicated on the table below.

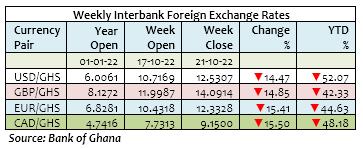

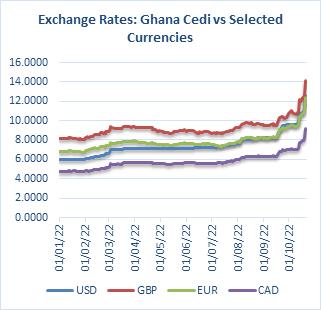

THE CURRENCY MARKET

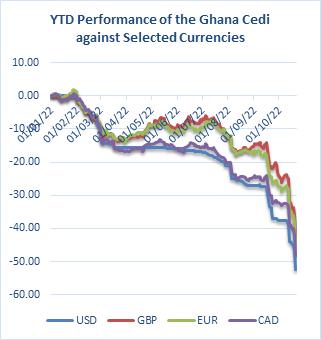

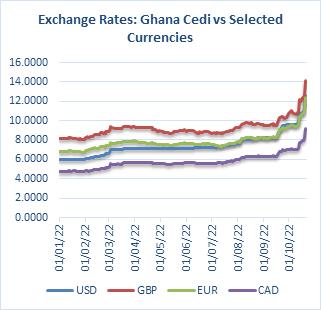

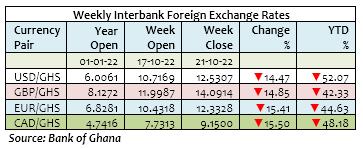

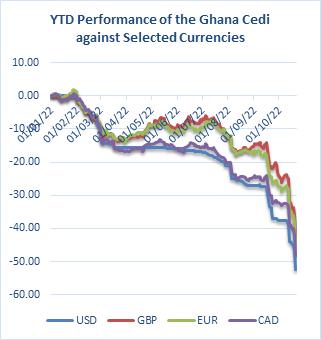

The Cedi lost more grounds against the USD for the week. It traded at GH¢12.5307/$, compared with GH¢10.7169/$ at week open, reflecting w/w and YTD depreciations of 14.47% and 52.07% respectively. This compares with YTD depreciation of 2.29% a year ago.

The Cedi again weakened against the GBP for the week. It traded at GH¢14.0914/£, compared with GH¢11.9987/£ at week open, reflecting w/w and YTD depreciations of 14.85% and 42.33% respectively. This compares with YTD depreciation of 3.05% a year ago.

The Cedi continued its downward trend against the Euro for the week. It traded at GH¢12.3328/€, compared with GH¢10.4318/€ at week open, reflecting w/w and YTD depreciations of 15.41% and 44.63% respectively. This compares with YTD appreciation of 2.84% a year ago.

The Cedi also weakened against the Canadian Dollar for the week. It opened at GH¢7.7313/C$ but closed at GH¢9.1500/C$, reflecting w/w and YTD depreciations of 15.50% and 48.18% respectively. This compares with YTD depreciation of 5.07% a year ago.

WEDNESDAY, OCTOBER 26, 202218 | MARKET REVIEW

GOVERNMENT SECURITIES MARKET

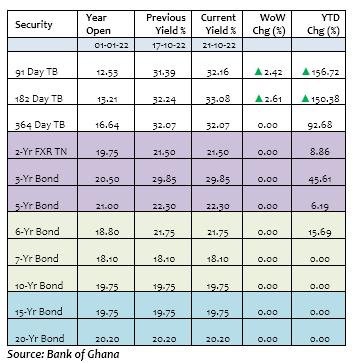

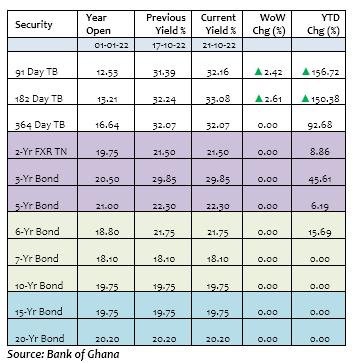

Government raised a sum of GH¢1,301.17 million for the week across the 91-Day and 182-Day Treasury Bills. This compared with GH¢974.51 million raised in the previous week.

The 91-Day Bill settled at 32.16% p.a from 31.39% p.a. last week whilst the 182-Day Bill settled at 33.08% p.a from 32.24% p.a. last week. The table and graph below highlight primary market yields at close of the week.

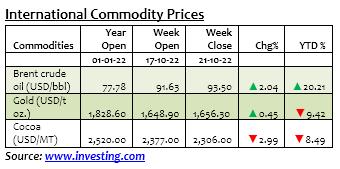

COMMODITY MARKET

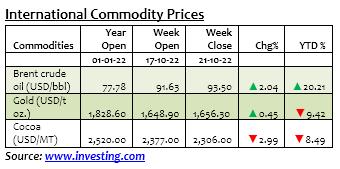

Oil prices settled up on Friday as hopes of stronger Chinese demand and a weakening U.S. dollar outweighed concern about a global economic downturn and the impact of interest rate rises on fuel use. Brent futures traded at US$93.50 a barrel on Friday, compared to US$91.63 at week open. This reflects w/w and YTD gains of 2.04% and 20.21% respectively.

Gold prices gained for the week as the dollar weakened amid reports of a potential debate amongst the U.S. Federal Reserve officials about the pace of rate hikes. Gold settled at US$1,656.30, from US$1,648.90 last week, reflecting w/w gain and YTD loss of 0.45% and 9.42% respectively.

The price of Cocoa saw a decline in growth for the week. The commodity traded at US$2,306.00 per tonne on Friday, from US$2,377.00 last week, reflecting w/w and YTD depreciations of 2.99% and 8.49% respectively.

INTERNTIONAL COMMODITIES PRICES

ABOUT CIDAN

CIDAN Investments Limited is an investment and fund management company licensed by the Securities & Exchange Commission (SEC) and the National Pensions Regulatory Authority (NPRA).

RESEARCH TEAM

Name: Ernest Tannor Email:etannor@cidaninvestments.com Tel:+233 (0) 20 881 8957

Name: Audrey Asiedua Wiafe Email:aaudrey@cidaninvestments.com Tel:+233 (0) 57 840 2700

Name: Moses Nana Osei-Yeboah

Email:moyeboah@cidaninvestments.com Tel:+233 (0) 24 499 0069

CORPORATE INFORMATION

CIDAN Investments Limited

CIDAN House Plot No. 169 Block 6 Haatso, North Legon – Accra Tel: +233 (0) 26171 7001/ 26 300 3917 Fax: +233 (0)30 254 4351 Email: info@cidaninvestmens.com Website: www.cidaninvestments.com

Disclaimer

The contents of this report have been prepared to provide you with general information only. Information provided on and available from this report does not constitute any investment recommendation. The information contained herein has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed.

Limited

Copyright @ 2019 Business24 Limited. All Rights Reserved.

Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed.

We value your support and loyalty.

Contact: editor@business24.com.gh Newsroom: 030 296 5315

Advertising / Sales: +233 24 212 2742

BUSINESS TERM OF THE WEEK

Unfunded Debt: This is a short term debt or financial obligation with up to one year maturity.

WEDNESDAY, OCTOBER 26, 2022 19| MARKET REVIEW

State how much forex has gone to commercial banks – Parl. Fin. Comm vice chair to BoG

By Eugene Davis

By Eugene Davis

The Vice Chairman of Parliament’s Finance Committee, Patrick Boamah has urged the central bank to reveal the amount it has given commercial banks with regard to foreign exchange.

According to Hon. Boamah, he also expects the Bank of Ghana to reconcile what importers have done with regard to certificates received, customs declaration forms and forex they have received from the banks.

“The Ministry of Finance has to find a way to stem the downward or depreciation of the cedi, we believe that there is some connection which is not helping the appreciation of the currency that the central bank is showing weak supervision over, I believe the central bank should be able to tell Ghanaians how much they have given to the commercial banks in terms of foreign exchange and how the commercial banks have been trading with those currency, we all know and it is a fact that most commercial banks have some dealings with black market operators and as bank of Ghana what have they been doing about it, we call on government to find immediate

solutions and to track every dollar that has been given to commercial banks and the rate at which they dealt with the open market and business men.

Secondly, a lot of importers are given licenses to import, we want the central bank as a matter of urgency to find a correlation or reconcile the import certificate, customs declaration forms and the amount as stated thereon as a means of finding out whether these importers truly use the foreign exchange that was given to them by the central bank and their respective commercial banks to import products.

Mr.Boamah also bemoaned the delay in the release of the Common Fund for the year, stressing that the assemblies are lamenting and eager for release for development.

“it cannot be that the Assemblies have not being paid their Common Fund for some time as a concern member of parliament, I have had discussions with my MCE, their IGF is bleeding and it cannot sustain the assemblies and they cannot undertake major projects that is dear to their hearts in their respective

districts, metropolitan and municipal assembly.

Ghana’s cedi slumped to become the world’s worst-performing currency this year as investors continued to squeeze foreign capital to the west African country before a deal with the International Monetary Fund.

The currency depreciated 9.5% last Thursday, the biggest decline in 22 years. That took losses in 2022 to

nearly 52%, the worst performance among 148 currencies according to Bloomberg.

A weakening cedi leaves Ghana exposed to higher food prices prompted by the war between Russia and Ukraine. The two countries account for about 30% of the world’s global wheat exports, and Ukraine for 15% of corn exports.

Ghana is negotiating a programme of up to $3 billion with the IMF.

ASA sponsors free health screening of 200 people at Sunyani-Penkwase

In line with its annual corporate social responsibility, ASA Savings and Loans has sponsored the health screening of about 200 residents of Penkwase, a suburb of Sunyani in the Bono Region.

Beneficiaries of the free health screening were mostly market women and micro business operators. They were screened for health conditions and diseases such as malaria, typhoid, blood sugar and blood pressure.

During the screening, all those who required medication were sorted out, while others who were in need of further medical attention were advised to do so. The women also received free treated insecticide nets.

The exercise took place at the Penkwase Business Centre under the umbrella of the Sunyani Area. Health professionals from the Rafchik Hospital at Abesim in the Sunyani municipality performed the screening.

The Sunyani Area Manager of ASA Savings and Loans, Isaac Agyapong, said the Penkwase screening was the third CSR activity implemented in 2022 within the Area’s jurisdiction, saying “we have organized similar activity at Berekum and DormaaAhenkro Business Centres. We will replicate the screening at Fiapre Business Centre and Sunyani main branch before the year ends.”

“These activities are in line with our corporate policy to among others organize free health screening for our cherished customers and community members every month. This is one way of giving back to society,” he added.

A beneficiary of the screening, Ayisah Abass, 42, in an interview commended the financial institution for expanding its priorities to incorporate the healthcare of customers.

“I have been selling groundnut

for

the

with

institutions, but the commitment of ASA to

is incomparable and worth emulating,” she said.

WWW.BUSINESS24.COM.GH | NO. B24/317 | NEWS FOR BUSINESS LEADERS WEDNESDAY, OCTOBER 26, 2022

almost 18 years and dealt

many financial

general wellbeing of women traders

PUBLISHED BY BUSINESS24 LTD. TEL: 030 296 5297, 030 296 5315. EDITOR: BENSON AFFUL editor@business24.com.gh | +233 545 516 133.

By Eugene Davis

By Eugene Davis