Newmont Ahafo North project stimulates local

By Edward Adjei Frimpong

By Edward Adjei Frimpong

By Eugene

By Eugene

By Edward Adjei Frimpong

By Edward Adjei Frimpong

By Eugene

By Eugene

In the same way that mining supports the way we live, it also cushions economic growth and development.

Mining of precious metals like gold has been a major contributor to socioeconomic development in many African economies.

Mining contributes to foreign exchange earnings, government revenues, employment and gross domestic product (GDP). Ghana is no exception to economies that have and continue to enjoy the socioeconomic impact of that particular extractive sector.

Gold mining in Ghana has been practiced for over a century and involves multinational companies, small scale mining firms, and illegal miners also known as ‘glassier’.

One of the leading multinational mining companies in the industry is Newmont Ghana, a subsidiary of Newmont Corporation, the world’s leading gold mining business.

In 2002, Newmont acquired its first concession through Normandy Mining Limited. Currently, the company operates two mines in the country-Ahafo South and Akyem in the Ahafo and Eastern Regions respectively.

Since it started operations in 2006, Newmont’s Ahafo South mine has been very impactful across the spectrum of socioeconomic development. The impact of the mine spreads across the local environment (host communities) and the country at large.

For instance, in 2021, Newmont made a total tax payment of GH¢1.869 billion to the state of which Ahafo South contributed GH¢777 million. As the end of June 2022, Newmont Ghana had made a total payment of GH¢1.2 billion to the government of Ghana. It covered corporate tax, mineral royalty, PAYE tax, carried interest, withholding tax and forestry levy.

Besides, the corporate social responsibility arm of the company, Newmont Ahafo Development Foundation (NADeF) has also been a major driver of sustainable development across the Ahafo mine area.

The foundation, among others, had released about $34.1 million for different projects. In all, 127 infrastructural projects were completed and handed over for use as at the end of 2021.

Other good things about mining include the technological and productivity gains that help not only the mining industry, but other sectors.

In this case, one of the biggest and most positive impact of mining creation of jobs, and community funding that mining companies make to local towns and regions.

Newmont’s operational areas [Ahafo and Akyem] are epitome of the description, where locals strive for opportunities – and mining can provide that. As at the second quarter of 2022, the total number Ghanaian Newmont workers at the Ahafo South and North mine was 1,311 of which 565 were locals while 746 were drawn from other parts of the country.

On the other hand, subcontractors of Newmont had 3,989 employees; 1,803 of them were beneficiaries from host communities and 2,186 were recruited outside the boundaries of the mine.

The success of the Ahafo South mine coupled with the vision to expand operations have set a good foundation for the development of Ahafo North project at the Tano North area in the Ahafo Region.

Newmont Africa’s Ahafo mining lease hosts two key deposits which is the Ahafo South mine with the Ahafo North Project in the Tano North Municipality.

The Ahafo North project is located about 50 kilometers north of the existing south mine. Facts gathered indicate that the project is 3.35 million ounces of reserves and it has a projected lifespan of 13 years.

It is expected to generate about 1,800 jobs during the construction phase and 550 direct jobs during operations.

Just like many other businesses, construction firms (big and small in the Ahafo North enclave are lacing their boots to explore opportunities that will be created by the pending mining project. The companies are working around the clock to acquire all the needed expertise, equipment and certifications to tap into gold mine.

Movelta Construction Limited is a Yamfo-based supply and construction firm which was incorporated in 2013. The General Manager of the company, Eliot Adjei Acheampong, in an interview said: “We are bracing ourselves to maximize the opportunities that Newmont Ahafo North project will generate.

I’m aware of the massive construction opportunities including the resettlement development. This will open the floodgates to employ more during

such developments. I’ll appeal to Newmont to help develop the capacities of local construction firms so that we’ll meet their requirements to secure contracts within their space.”

Sources within Newmont revealed that the company in partnership with international and local companies has started a training programme for construction workers. The target is the locals in the five host communities where selected candidates will be trained and equipped with employable skills such as welding, scaffolding, masonry, and carpentry among others.

Development of small-scale enterprises

Many residents have high hopes that the project will stimulate the local economy for exponential growth and development and therefore prudent for them join the business fraternity. Many are now venturing into different entrepreneurship activities, ranging from micro, small and medium-scaled enterprises. The people have started profiling potential profitable businesses to determine exactly what type of business is the best choice to invest in. On the other hand, existing businesses are also working around the clock to sharpen their skills and expand operations in order to tap into the anticipated economic development in that part of the Ahafo Region.

It is not out of place that Newmont in partnership with the German Development Cooperation (GIZ), has initiated a women economic resiliency programme (WERP) for the host communities. The US$420,000 initiative seeks to promote the growth and development of women-based dressmaking enterprises through technical and business management trainings. The programme with a well-equipped training centre at Susuanso is expected to create about 300 direct jobs every year for women and young dressmakers in the host communities.

Commenting on the Ahafo North Project, the Chief of Terchire, Nana Okoh Agyemang II, said: “it is an undeniable fact that mine cannot employ everybody and therefore the youth must not fold their arms in anticipation of manna falling from heaven once the mine starts operation; even if you are fortunate to be employed by Newmont, it will not guarantee

that you will be rich overnight.

“The youth in the communities must be measured in their expectations with regards to securing life-changing jobs. It is important for the youth, especially those without educational qualifications and employable skills to endeavour to add value to themselves by learning technical and vocational skills. This will position them to be relevant in the expected transformation of the local economic environment. Nananom will also continue to negotiate with Newmont to ensure that the locals are not given raw deals in terms of recruitment, and procurements to boost the local economy.”

On her part, Nana Yeboah Pene, Managing Director of Ememess Co. Ltd., a cleaning services firm implored Newmont to help create the enabling environment for local businesses to transform.

“As the project inches closer to become operational, many people are going to lose the source of livelihood, particularly farmers and therefore, Newmont must prioritise alternative livelihood programmes to absorb those casualties.

Existing and potential small local businesses must also be supported to grow and develop so as to create more employment opportunities. For instance, my company has 18 workers; we are

working assiduously to become the preferred choice to secure more contracts in the coming years. This will definitely create more job opportunities.”

On the backdrop of the Ahafo North project coming on stream, one other economic area that has great potential for growth and development is agribusiness. Traditionally, Ahafo North is largely an agrarian area. Hectares of farmlands will be consumed by the mine, and obviously, the production of food will reduce as against anticipated increase in demand for food due the influx and demographical changes. This makes agribusiness a viable sector for investors. Developments along the agricultural value chain including supply of inputs,

agro products will be critical to meet the needs of the population. If the opportunity is well utilized, agribusiness will surely become one of the main generators of employment and income.

To this end, an agribusinessbased NGO at Adrobaa christened ‘Focus’ has stepped up its activities. The organization, established six (6) years ago is into mechanized production of organic vegetables including cabbage, cucumber, carrots and lettuce. Currently, the NGO has engaged about twenty (20) youth working on its farm.

Mr. Roger Joseph Adusei-Antwi is the Chief Executive Officer (CEO) of Focus. “In anticipation of expansion of the local economy, management of the organization has resolved to equally expand

acquired vast arable land for commercial production of exotic vegetables. We’ll employ more hands along the value chain. Focus aims to become the leading vegetable producer and supplier in the Ahafo Region and beyond.”

The benefits of mining to the host communities can be more sustainable and impactful, if the proportionate share of royalties, taxes and other charges borne by mining companies are returned to the local people for judicious use in the form of investment into schools, hospitals, infrastructure and alternative livelihood activities. With the Ahafo North project in sight, it is therefore incumbent on all stakeholders to help make the mine a blessing to the enclave and the country as a

Vodafone Ghana, in partnership with the Ghana Chamber of Telecommunications, has educated Ghanaians about Mobile Money security and how to avoid being defrauded.

Representatives from Vodafone Ghana, other telcos, and the Telecoms Chamber engaged market men and women, drivers, passengers, and residents on how to protect themselves from mobile money scammers at the Tema Community 1 Main Station.

The Vodafone team also took advantage of the occasion to highlight Vodafone Cash’s unparalleled benefits for individuals and businesses, including the zero-fee for money transfers and the newly-introduced Vodafone Cash Overdraft, which allows customers to borrow money to complete specific transactions without experiencing a decline because of insufficient funds.

Samuel Gyimah, the Executive

Head of Sales for Accra East at Vodafone Ghana, said about the activities held during the market storm that it was great to see Vodafone Ghana making a difference in the community.

“Vodafone Ghana has successfully positioned itself as an innovative digital leader in the telecommunications industry. Our digital impact on society will, however, fall short if we do not educate people on the need for cybersecurity even as they benefit from our digital products and services. Therefore, we embarked on this initiative to educate people on mobile money fraud and how to avoid it,” he said.

He added that the engagement also provided an opportunity to highlight Vodafone Ghana’s enhanced financial products and services, namely Vodafone Cash and Vodafone Cash Overdraft, which continually improve financial inclusion. “I am very

confident that the education, products, and services from Vodafone Ghana will ensure that we go further together in the digital world,” he said.

The Chief Executive Officer of the Ghana Chamber of Telecommunications, Dr Kenneth Ashigbey, revealed that the exercise was part of activities to mark the Chamber’s 10th anniversary.

He explained that the best way to show their appreciation for customers’ support was to return to the communities and make an impact.

“The Ghana Chamber of Communications is celebrating its 10th anniversary. We marked that in November 2021, so we are still celebrating an annual 10th anniversary. We believe we need to come back to the subscribers

and customers of our members to bring the service close to them, interact with them, educate them, and create awareness. We also brought some regulators, such as the Radiation Protection Institute, to demystify some challenges people have with masts and more. This activity also allows the community to get answers to their questions, register their SIM cards, and interact with the brands they subscribe to.”

The market storm also served as a medium for the Vodafone team to highlight the telco’s commitment to the SIM registration process, educate the crowd on its importance, and conduct SIM re-registrations.

The forward-thinking, proactive posture and actions of the primary financial sector regulator – the Bank of Ghana (BoG) – guarantees the nation will be at the forefront of the fourth industrial and digital financial revolutions on the continent, Chief Executive Officer (CEO) of AZA Finance, Elizabeth Rossiello, has suggested.

Over the course of the last two decades, the regulator has fostered an enabling regulatory environment with the introduction of tools such as the Ghana Interbank Settlement (GIS) system, Ghana Interbank Payment and Settlement Systems Limited (GhIPSS), Payment

Systems and Services Act in 2019, the establishment of a dedicated FinTech and Innovation Office the year after, as well as the introduction of a regulatory sandbox.

These, in addition to the relative ease of doing business, clarity of the regulatory regime, in addition to the rapidly-expanding pool of local talent, she argues, will ensure the country attracts critical investment and serve as a blueprint for its peers.

“In all my recent interactions, I have had to mention how great it is to see how active the regulator is. Here in Ghana, we are seeing licenses being processed in a reasonable time without

sacrificing due diligence,” she said at the conclusion of a recent working visit to the country.

She added that inasmuch as some FinTechs are apprehensive over interactions with regulators, the future of digital finance demands regulated entities; ones that adhere to standard AntiMoney Laundering/Combating the Financing of Terrorism (AML/ CFT), and Know-Your-Customer (KYC) protocols.

“Although some FinTechs struggle with the concept and application of regulation in some way, I believe it is the path forward because, without regulatory oversight, many institutions would not want to

work with you. As innovative as we come, we need to have that to offer a standard of certainty and security,” she added.

Mrs. Rossiello – who co-chairs the World Economic Forum’s Council on Blockchain and sits on the Global Advisory Board of the Centre for the Fourth Industrial Revolution – agrees with other international bodies such as the International Finance Corporation (IFC) that, with adequate funding, the local talent compete with their peers from other regions.

“One of the most exciting things for me is the abundance of local tech talent and I believe if the digital drive is sustained and there is adequate investment in developing this talent, it would be tremendous.”

The IFC estimated that between 2020 and 2030, Ghana could have business-to-business and business-to-government opportunities that reach about 18 million people who require digital skills with revenue potential in excess of US$4 billion.

Offering thoughts on the growing partnership between banks and FinTechs, the AZA Finance CEO said she expects continued collaborations which would lead to more efficient and streamlined offerings. “I foresee a streamlining of banking operations, with banks getting smaller headcount wise, and banks will, perhaps, focus more on corporate lending whilst the FinTechs participate more in consumer offerings.”

The cost of loans in Ghana is set to increase again for the average borrower, following an upward review of the rate at which banks can borrow money from the central bank, otherwise referred to as the policy rate.

The central bank has announced a hike in the policy rate by 250 basis points to 24.5%, from 22% in August, the highest increment since 2017.

This will further worsen the high cost of living in the country.

The move, according to the central bank, is to curb the rising

inflation of nearly 40%.

Inflation in the country is likely to go up significantly in the coming months following recent adjustments in utility tariffs and local currency depreciation.

Multiple credit rating agencies have downgraded the economy to junk status, meaning the country is no longer credit-worthy.

Ghana is currently negotiating a $3bn (£2.7bn) IMF bailout programme to run for a period of three years.

Source: BBC

A Deputy Minister of Transport, Hassan Tampuli, has backed the request of Ghana Airport Company’s (GACL) to have their user fees and services reviewed upwards to enable them undertake proper maintenance service in the new airports that are springing up across the country.

The government of Ghana is committed to improve the aviation sector to ensure the country become an aviation hub, however one of the critical agencies responsible for planning, developing, managing and maintaining all airports and aerodromes in Ghana -GACL is pushing for a review of its Airport Passenger Service Charge (APSC) in order to properly maintain and manage effectively the new airports being developed in some of the regions.

Speaking to the press on the sidelines of a day’s visit to the Kumasi and Tamale airports by the leadership and members of the Select Committee of Parliament’s Roads and Transport, and officials of GACL, led by the sector minister, Hassan Tampuli, he said “now revenue from APSC for Accra is also a subject of a loan

facility so payment more or less go to amortise those loans, so we need excess funds to be able to maintain these facilities. So, we need a sustained revenue stream, even itemize in the budget that this is the purpose it is going to be used for.

For us at the ministry we are excited that leadership and members of the parliamentary select committee on roads and transport appreciate the fact that the 5Ghana cedis that we have in the price buildup of domestic air travel is woefully inadequate, so we appreciate the fact that they recognise it needs to be reviewed, so they have asked that we come with a justification paper for us to be able to go through the numbers and see whether there is a justification, maybe whatever figures that we put across maybe inadequate as far as they are concerned, they may be give us more than we requested for, seeing what we have here, it tells us that there is a bright future as far as our aviation industry is concerned.”

Mr. Tampuli also explained that “We have not moved into these facilities yet, in order not to get

to a point where it will be difficult to maintain the facility, we need to be proactive and get revenue stream put in the price build up way before the opening of these airports.

“We need to be ahead of the curve and get a stable revenue stream and I believe when parliament resumes from recess, these are matters that would be considered in the next meeting”.

The chairman of Parliament’s Road and Transport committee, Kennedy Osei Nyarko has urged the ministry and officials of GACL to submit the law mandating them to review the user fees and charges to the committee.

He expressed concerned about the paltry amount GACL charges for domestic passengers “now they use to charge 5ghc for all our domestic airports, [Ho,Wa, Tamale] every passenger passing through domestic airport.

All international passengers are charged 200 dollars at Terminal 3, and that is the money they are using to support the domestic airports, how can you have a domestic facility, the person is not

I have instructed them to bring back the law so we will be

able to amend it, they should not be charging less than 50ghc to maintain this airport. But we want them to run the numbers with us and justify it.

I can assure you that if we don’t look for revenue stream to maintain it, in less than a year, all these beautiful edifices would go down the drain.”he said.

The Managing Director of GACL,Pamela Djamson Tettey indicated that they are resolved to push through with the APSC and they would work closely with the sector minister to ensure that they meet up with parliament when they resume to attain the objective.

Ranking member of the Parliament’s Select Committee, Kwame Governs Agbodza advised the GACL to be more innovative to raise funds to sustain the domestic airports without recourse to government.

Both Kumasi and Tamale airports are nearing completion and is expected to be fully handed over sometime next year, according to management of GACL.

Finance Minister, Ken OforiAtta, has expressed satisfaction with progress made so far with regards to negotiation with the International Monetary Fund for an economic programme.

According to him, the government is committed to working tirelessly to create a stable and resilient macroeconomic environment, ensure debt sustainability and maintain social cohesion.

This is coming after the IMF Mission Team led by Stéphane Roudet completed its work in assessing the state of the Ghanaian economy.

“This has been a very productive mission and I thank the IMF Team and all stakeholders for their commitment over what has been a marathon fortnight. The Government of Ghana is deeply encouraged by the progress made so far.”

“We look forward to continuing our engagement and remain committed to working tirelessly to create a stable and resilient macroeconomic environment,

ensure debt sustainability and maintain social cohesion. Ghana is at a pivotal moment in its history and we are grateful for the IMF’s support, and indeed the support of all Ghanaians, as we work together to bolster Ghana’s build back effort”, he stressed.

He further said the government of Ghana remains steadfast in its resolve to fast-track negotiations with the IMF, towards achieving a historic agreement that will help strengthen post-Covid economic growth.

IMF reaffirm commitment to

The IMF Team reaffirmed its commitment to support Ghana in these challenging times, consistent with the Fund’s policies.

This was the statement made by the Mission Team to Ghana that concluded its discussions with the Ghanaian authorities and other stakeholders on an economic programme for the country.

The team said it had constructive discussions on policies aimed at restoring macroeconomic stability and laying the foundation for stronger and more inclusive

growth.

Key areas of focus included ensuring public finance sustainability, while protecting the vulnerable, bolstering the credibility of monetary and exchange rate policies to reduce inflation and rebuild external buffers, preserving financial sector stability, and steps to encourage private investment and growth.

“We had constructive discussions on policies aimed at restoring macroeconomic stability and laying the foundation for stronger and more inclusive growth. Key areas of focus included ensuring public finance sustainability while protecting the vulnerable, bolstering the credibility of monetary and exchange rate policies to reduce inflation and rebuild external buffers, preserving financial sector stability, and steps to encourage private investment and growth, including by improving governance, transparency, and public sector efficiency”.

After two years of virtual Lectures, the African ExportImport Bank (Afreximbank) will hold its annual Babacar Ndiaye Lecture on 14 October 2022 in Washington, DC, USA. This year’s event will be held under the theme “Africa and the Developing World in a Turbulent Global Financial Architecture”.

Speaking during a press briefing this past Friday, 7 October 2022, and leading the coordination of the 2022 edition Babacar Ndiaye Lecture, Dr Hippolyte Fofack, Chief Economist and Director of Research at Afreximbank, elaborated on the importance of this year’s theme, “Africa total external debt is less than $800 billion. That makes it about a third of Italy’s debt. Yet we talk more about Africa’s debt than Italy(...) Compared to France and America, the African sovereign debt spread is prohibitively high.”

This year’s keynote lecturer is Prime Minister of Barbados, HE Mia Amor Mottley, QC. “She is really a fantastic and amazing speaker. She also happens to be one of the rare politicians who understands the arcane language of finance fairly well.” Speaking on why he believes that Prime Minister Mottley is the right

person to articulate and elaborate on the theme of the Lecture, Dr Fofack recalled to his meeting with the Prime Minister on the sidelines of the UN General Assembly, “One important point she made was that you have a country like England. It took them maybe 100 years to pay in the debt that they incur during the last war, yet, many developing countries in the Caribbean Africa are actually more subject to short term, short term loan than longer maturity.” The government of Barbados recently released what they called the “Bridgetown Initiative”. We expect Prime Minister Motley to elaborate on this programme so that we have concrete policy actions come out of the IMF/ World Bank meetings.

Held annually on the sidelines

of the World Bank meetings, the Babacar Ndiaye Lectures serves as a nexus for Afreximbank shareholders, partners, and professionals, along with existing and potential clients spanning all industries. The event also welcomes senior government officials and central bankers, leaders and representatives of international organisations and DFIs, researchers and members of the academic community, as well as the continent’s diplomatic corps and Chambers of Commerce.

Speaking on the importance of the upcoming lecture Dr Fofack said, “it’s very important to stress that what we are going to be doing next week, is not just a technical academic exercise, it’s also a policy exercise, which is likely to have tremendous consequences on the life of Africans and others around the world.”

Angela Mensah-Poku, the Director of Digital Transformation and Commercial Operations at Vodafone Ghana, has said that the human touch is the most important part of the customer experience.

Even though digitization has made client interactions faster and more efficient, she believes that quality and targeted human interactions will always win out. Speaking at the 2022 edition of the CXP Conference held at the Labadi Beach Hotel, she stated: “As much as I love technology, the human side of customer experience will never go away. The thing we have to remember is that we have different people who make up our customers. It is never one size fits all. “

Angela Mensah-Poku said that for customers to experience great service, they should be able to choose whether they want to use a digital channel or talk to a person.

Speaking about how Vodafone Ghana promotes inclusiveness in customer experience, she explained that while data shows 80 percent of people who call their customer service use smartphones, Vodafone Ghana never forces these customers to use digital channels in

their interactions with the organisation’s customer service.

Any choice to modify customer service at Vodafone Ghana, she claims, is based on consumer input. She also said that her team at Vodafone Ghana is always looking for feedback to improve and make sure customers have a smooth experience.

The Director went on to say that providing a good customer experience is a journey that always humbles its practitioners. According to her, an organisation may believe it is implementing all of the necessary services to improve customer service, but only real-time feedback from consumers may expose or provide insights into what truly satisfies customers.

Angela used the event to remind everyone that Vodafone is committed to coming up with new ways to improve the customer experience journey, meet customers’ expectations, and give customers a better overall experience.

Vodafone Ghana has designated October as the month to commemorate its Care Month initiatives. The event is a way to appreciate both employees who consistently make customers happy and customers who help the business grow.

In line with its annual corporate social responsibility, ASA Savings and Loans has organised a free health screening at Nkoranza in the Bono East Region, benefiting over 150 people.

The exercise which took place at the Nkoranza Business Centre of the financial institution covered screening for diseases and conditions including malaria, blood pressure, blood sugar, typhoid, and hepatitis.

The beneficiaries of the screening were mostly micro and small business operators (women) in the Nkoranza enclave. The health screening was conducted with the support of personnel

from Rafchik Hospital at Abesim near Sunyani.

Speaking in an interview, Seth Morgan Arhin, Techiman Area Manager of ASA Savings and Loans who supervised the exercise said, “The purpose of this

free health screening programme is to ensure a healthy lifestyle to promote growth and the wellbeing of our customers and the community as well.

We noticed that most of the people are always busy with their business activities and they hardly get time to go for medical checkup.”

He noted that the company will initiate more CSR activities such as donations to orphanage homes, and award of scholarships

to brilliant but needy school children, adding that “ASA savings and Loans will always continue to fulfil its corporate social responsibilities and support the community at all times This is not the first as we have been doing it over the past years. We feel proud to take such initiatives and we will continue to support the community as they can always count on us.”

The women beneficiaries expressed profound gratitude for the kind gesture of ASA Savings and Loans, indicating that it was rare for a financial institution to prioritise the health needs of its customers.

Vodafone Business has climaxed this year’s SME Month event with an exciting session on Twitter Spaces for over 2000 entrepreneurs.

The digital event, which was moderated by Deloris Frimpong Manso, also known as Delay, introduced entrepreneurs to effective ways of leading and managing teams. Some wellknown businesses that took part in the programme were Pistis, an indigenous fashion house; Caveman watches; Doughman Foods; and Nyonyo Essentials.

Every year in September, Vodafone Business’ SME Month initiatives reward and recognise SMEs for their contributions to the nation. The theme for this year was “Further Together, Accelerating SME Businesses.”

During September, Vodafone Business gave small and medium-

sized enterprises (SMEs) free websites, business registration, digital advertising, store rebranding, and training on a variety of topics related to SMEs.

One such training, a legal training session for 50 SMEs in collaboration with SESI Legal, provided attendees with the legal knowledge they needed to do business successfully in Ghana.

Mrs Rosa Kudoadzi, the Managing Partner of SESI LEGAL, stated that “Laws and regulations govern every business in Ghana.

We are confident that the key outcomes we shared on statutory obligations and regulatory approvals, negotiation and enforcement of contracts, and succession planning will guide businesses to be legally compliant and plan for their future growth”.

She advised all businesses to seek legal counsel in order to

understand and comply with all applicable laws and regulations.

In addition to these activities, Vodafone Business implemented a brand-building training in collaboration with resource people from Meta, formerly Facebook. Vodafone Ghana’s Senior Management Team also reaffirmed Vodafone’s commitment to SMEs during customer visits.

Many longstanding Vodafone Business customers thanked the brand for its stellar services. “We are satisfied with the delivery of the 20Mbps dedicated internet service. We have had no downtime since the service was deployed,” said Folajimi Shopeju, the Finance Director of FrieslandCampina West Africa.

The Director of Vodafone Business, Tawa Bolarin, stressing on Vodafone’s commitment and

focus to SMEs, explained that SMEs are the engine of growth for most economies, including Ghana. “Vodafone Business is strategically positioned to be the propeller for the growth of SMEs. Our purpose as an organisation is to connect people and businesses for a better future. Therefore, we will continue to empower businesses with innovative solutions to grow,” she explained.

Vodafone Business, the enterprise arm of Vodafone Ghana, helps organisations succeed in a digital world with innovative products such as Your Business Online (YBOL) and Vodafone Cash for Business. For more information about Vodafone Business products and services, customers can send an email to vodafonebusiness. gh@vodafone.com or call 0302334040.

The strategic partnership between the United States and India is pivotal to maintaining the balance of power in the vast Indo-Pacific region and counterbalancing China’s hegemonic ambitions. The US is India’s second-largest trading partner, and deepening the ties between the two countries is one of the rare bipartisan foreign policies that exists in Washington today.

The upcoming October 18-31 joint military exercise known as Yudh Abhyas (War Practice), in a high-altitude area less than 100 kilometers (62 miles) from India’s border with China, highlights the partnership’s growing strategic importance. India holds more annual military exercises with the US than any other country, as the two powers seek to improve their forces’ interoperability. As Admiral Michael M. Gilday, the US Navy’s Chief of Naval Operations, put it recently, India is a “crucial partner” in countering China’s rise.

But President Joe Biden’s decision to withdraw US forces from Afghanistan and effectively surrender the country to a Pakistan-reared terrorist militia, in addition to tensions related to Russia’s invasion of Ukraine, have strained the relationship between

purchase discounted oil from Russia, rebuffing the Biden administration’s offer to replace Russian oil with US supplies. Instead, India has increased its imports of Russian crude.

At the heart of India’s decision is fear of losing out to China. Since 2019, the US has used the sanctions on Iran’s oil exports to deprive India of cheaper Iranian oil, thereby turning it into the largest market for US energy exporters. The main beneficiary of the sanctions is China, which has increased its purchases of Iranian oil at a discount and developed a security partnership with the Islamic Republic without facing US reprisal.

While the US has already surpassed Russia as India’s largest weapons supplier, the American defense sector views the war in Ukraine as a “great opportunity” for arms sales to India to “surge.”

Moreover, US Defense Secretary Lloyd Austin has urged Indian officials to avoid buying Russian equipment and purchase USmade weapons from now on.

Yet Biden’s overriding focus on punishing Russia could exacerbate India’s security challenges, especially if the international efforts to pressure Russian President Vladimir Putin inadvertently empower an

increase in land-based imports, which, unlike sea-borne deliveries, cannot be blockaded if Chinese President Xi Jinping decides to invade Taiwan.

Meanwhile, America’s recent $450 million deal to modernize Pakistan’s F-16 fleet – unveiled days after the US helped the country stave off an imminent debt default through an International Monetary Fund bailout – has evoked bitter memories of the US arming Pakistan against India and supporting the initial development of the Pakistani nuclear-weapons program during the Cold War.

The Biden administration’s disingenuous claim that upgrading Pakistan’s US-supplied F-16 fleet would advance counterterrorism has prompted a sharp response from India. During a recent visit to Washington, Indian Foreign Minister Subrahmanyam Jaishankar publicly condemned the deal, saying that the American explanation “is not fooling anyone”: Pakistan would undoubtedly deploy the upgraded fighter jets against India.

Against this backdrop, some observers have revived the old theory that US-India ties fare better under Republican administrations. Bilateral relations thrived during President

shift, Trump ended the 45-year US policy of aiding China’s rise. He also cut off security aid to Pakistan for not severing its ties with terrorist groups.

Biden, on the other hand, has resumed America’s coddling of Pakistan, made outreach to Beijing a high priority, and said nothing about China’s encroachments on Indian territory in the Himalayas. But by locking horns with China in a 30-month military standoff, India has openly challenged Chinese power in a way no other world power has done in this century.

Nothing better illustrates Biden’s neglect of the relationship with India than the fact that, since he took office, there has been no US ambassador in New Delhi. Meanwhile, the US ambassador to Pakistan, Donald Blome, caused an uproar during a visit to the Pakistani-held part of Kashmir, which he called by its Pakistani name – “Azad [Liberated] Jammu and Kashmir” – instead of “Pakistan-administered Kashmir,” as the United Nations calls it.

Moreover, the Biden administration has been trying to leverage human-rights issues against India. In April, US Secretary of State Antony Blinken alleged a “rise in humanrights abuses” in the country, prompting Jaishankar to counter that India is similarly concerned about the state of human rights in the US. Likewise, prominent members of the US Democratic Party can barely conceal their hostility to Indian Prime Minister Narendra Modi and his brand of Hindu nationalism.

the world’s most powerful and most populous democracies.

Like many other countries, including US allies such as Israel and Turkey, India has taken a neutral stance on the war in Ukraine. Much to the chagrin of the US and Europe, the country has continued to

expansionist China. The US-led sanctions and Europe’s shift away from Russian energy effectively put Russia – the world’s most resource-rich country – in the pocket of the resource-hungry Chinese. Its alliance with Russia has allowed China to build an energy safety net through an

Donald Trump’s administration, which relied heavily on India in developing its Indo-Pacific strategy. Trump instituted new US policies on China and Pakistan, whose increasingly close partnership has raised the prospect of India fighting a two-front war. In a major policy

Given that the US and India are both bitterly polarized democracies, officials should avoid statements that could inflame domestic tensions. If the US wishes to shift strategic focus to the Indo-Pacific, it must improve relations with its most important strategic ally in Asia. To that end, Biden must not squander the historic opportunity to forge a “soft” alliance with India. If the US is to prevail in its escalating rivalry with China and Russia and avoid strategic overreach, it needs India more than ever. But without mutual respect, the bilateral partnership is doomed.

Some fear that this year’s United Nations Climate Change Conference – to be held here on November 6-18 –will be an unintended casualty of the geopolitical tensions and economic challenges the world is facing.

I believe the opposite: COP27 represents a unique and timely opportunity for the world to come together, recognize our common interests, and restore multilateral cooperation.

The human cost of climate change is making headlines almost daily. Global warming is no longer a distant or theoretical threat, but an immediate material one – a phenomenon that affects each of us, our families, and our neighbors. No society has been left unscathed by more frequent and intense droughts, wildfires, storms, and floods. Millions of people are already battling for survival.

And that is with temperatures having risen by just 1.1° Celsius, relative to pre-industrial levels. As the Intergovernmental Panel on Climate Change has made clear, every additional tenth of a degree makes matters worse.

Yet the changes needed to avert catastrophe are not being made, at least not fast enough, and the developing world is increasingly frustrated with rich countries’ refusal to pay their fair share for a crisis for which they bear overwhelming responsibility.

But there is reason for hope. In my discussions with delegations around the world, I see their determination to make COP27 a success. Already, societies are starting to act. Climate adaptation and new forms of collaboration are gaining traction, and investment in climate tech is booming. This includes new carbonremoval technologies, electric transport solutions, and renewable energies. As a result, clean-energy

prices continue to fall: almost twothirds of renewable power added in G20 countries in 2021 cost less than the cheapest coal-fired options. My country, Egypt, is on track to produce 42% of its energy from renewable resources by 2035.

At the same time, civil society is devising mechanisms for holding companies and governments to account, guarding against greenwashing, and ensuring a just transition. There is a new focus on restoring nature.

More ambition, scale, and speed are needed, and the rules remain unclear or contested. But a process is underway, and there is no going back. Even in countries that might seem to be wavering in their commitments – say, by investing in fossil-fuel infrastructure – officials insist that stopgap measures necessitated by immediate challenges should not be mistaken for long-term strategies. No one doubts the greener road ahead.

The question for those of us who will participate in COP27 is straightforward: How can we seize the opportunity the conference offers to create a sense of common endeavor, prevent backsliding, and inspire an approach based on science, trust, justice, and equity?

At its heart, climate action is a bargain. Developing countries have agreed in good faith to help tackle a crisis they did not cause, on the understanding that support – particularly financial support –would be provided to complement their own efforts, which are often limited due to their scarce resources and competing development needs. Developed countries must uphold their end of that bargain, by supporting both mitigation and adaptation, thus fulfilling their envisaged responsibilities in the Paris agreement.

On the mitigation front, we must move from rhetoric to action in cutting our greenhousegas emissions and removing carbon from our atmosphere. All countries must embrace more ambitious Nationally Determined Contributions, and then translate those pledges into programs. We must act now to ensure appropriate resources are available to developing countries to unlock their potential.

At the same time, we must craft a transformative adaptation agenda, so that communities – especially in climate-vulnerable regions – can protect themselves from the effects that are already unavoidable. The bill for this agenda must be divided fairly.

To date, a disproportionate share of climate finance has been directed toward mitigation, leaving developing countries largely to fend for themselves in financing adaptation investment. But even the finance provided for mitigation is far from sufficient and has not been delivered with the appropriate instruments.

In 2009, developed countries pledged to provide $100 billion annually for climate action in the developing world by 2020. This is only a small portion of the more than $5.8 trillion that is needed (up until 2030), according to the UN Framework Convention on Climate Change’s Standing Committee on Finance. And yet this amount has not been delivered. We need an increase in the scale of finance pledges – especially for adaptation –at COP27, compared to those made at COP26 in Glasgow.

Developed countries must also honor the pledge they made last year to double adaptation finance by 2025, and they should provide the assurances needed for the Green Climate Fund’s new replenishment.

And the time has come to address the loss and damage suffered by countries that did not cause the climate crisis. This remains contentious, but I believe that we can approach it constructively, guided by the priorities of developing countries, for the benefit of all.

A just transition must account for the needs of various regions. For example, African countries are committed in principle to adopting renewable energy and refraining from exploiting their fossil-fuel resources. But 600 million people in Africa – 43% of the continent’s population – currently lack electricity, and around 900 million don’t have access to clean cooking fuels. The climate-action bargain demands that this be addressed, and the continent’s broader development needs be met, in sustainable ways.

All of these imperatives must be pursued together, with a carefully designed package of actions, rather than through piecemeal measures. They are the pillars of a just transition. If one is missing, the entire edifice collapses.

Ahead of the 2015 COP in Paris, few believed that an agreement would be reached. Yet delegates from all over the world came together, and through skill and perseverance, reached a groundbreaking deal. In 2022, we face even higher hurdles, so we must work even harder to clear them. If we do, we will usher in a new age of clean energy, innovation exchange, food and water security, and greater climate justice.

As daunting as this challenge is, we have no choice but to confront it. We must negotiate with one another, because there can be no negotiating with the climate.

The Board of Mzansi National Philharmonic Orchestra (Mzansi NPO), has appointed an Artistic Planning Committee, formed with the purpose of engaging with and advising the Orchestra on a number of matters, including the following:

• the allocation of the artistic budget of the Orchestra, in particular, the funding to regional and youth orchestras;

• the provision of high-level input into the planning processes of the Orchestra;

• advising on the selection criteria for musicians who play for Mzansi NPO;

• advising on the selection of cadets and fellows and other Mzansi NPO artistic related matters.

Justice Leona Theron, Chairperson, Mzansi NPO said: “The future of orchestral music in South Africa looks bright. I’m delighted that artists and arts managers of such high calibre have agreed to assist Mzansi NPO in a crucial area of our work which relates to the artistic programming, planning and the distribution of

funding to regional and youth orchestras and other entities.”

The Artistic Planning Committee comprises of distinguished artists and arts managers, including Nina Schuman, Samson Diamond and Karéndra Devroop. Schuman holds a piano professorship at the University of Stellenbosch, passing on her artistic knowledge and producing students of the highest caliber.

In addition, her services to the South African musical community include co-founding an independent record label, Two Pianists Records, and the founding of the renowned Stellenbosch International Chamber Music Festival in 2004, which has quickly become the best-known chamber music festival on the African continent. Two Pianists Records assumed the role of Yamaha International Artists in 2014.

Diamond is the leader of the award-winning Odeion String Quartet since 2013, resident at the University of the Free State. He is a lecturer at the Odeion School of Music and concertmaster of the Free State Symphony Orchestra

(FSSO).

Diamond has enjoyed an association with the London based, Chineke! Orchestra since its inception in 2015. Chineke! is Europe’s first black and ethnic minority orchestra, and Diamond has had the honour of performing as their concertmaster for various international tours.

On his part, Devroop is the Director of the University of South Africa’s Music Foundation. He is also South Africa’s leading saxophonist, having performed with most of South Africa’s top jazz and classical talent, and collaborated with an impressive list of artists from all over the world.

He has several live and studio recordings to his credit. In addition to his small ensemble and big band work, he has performed as soloist with the Lamont Symphony (Colorado), Johannesburg Philharmonic Orchestra, Cape Town Philharmonic Orchestra, Sanremo Symphony Orchestra, Johannesburg Festival Orchestra, Ochestra del Teatro Traetta and

Unisa Symphony Orchestra.

Devroop said: “I’m honoured to serve on the Mzansi NPO Artistic Planning Committee as I believe the Orchestra will continuously assist and add value to the benefit of the entire orchestral industry in South Africa. I’m also glad to be working so closely with Mr. Bongani Tembe on this committee as I have immense respect for the massive contribution he has made to music and the arts in South Africa over many decades.”

Launched in July, Mzansi NPO’s role is to identify, develop and nurture young and talented South African orchestral musicians and to help outline a career path for them in order to transform the orchestral industry, and create innovative community engagement events and programmes aimed at connecting classical music to a broader audience.

An important objective of the orchestra is to use music and concerts to bring together South Africans of all races and ages with the aim of promoting nation building.

In line with Access Bank Ghana’s goal of bringing banking services closer to customers, the bank held a two-day market storm activation of one of its products, AccessClosa, at the Kejetia and Bantama markets in Kumasi in the Ashanti regional capital.

AccessClosa is Access Bank’s agency banking which seeks to bring banking services closer to the doorsteps of the unbanked and underbanked population, by employing the services of persons in local neighbourhoods to serve as agents in offering banking services.

The widely patronised events dubbed ‘MO NK3KN P33” which means closer to you, attracted hundreds of businessmen and women in the brisk markets to the Access Bank activation stands to gain an understanding of AccessClosa.

Speaking in an interview, Executive Director of Retail and Digital Banking at Access Bank Ghana, Pearl Nkrumah, explained that about 57 per cent of the Ghanaian population is either unbanked or underbanked and Access Bank has seized the opportunity to bring banking services closer to its cherished customers.

“As part of our bank’s strategy to make banking accessible to every Ghanaian, we officially launched AccessClosa in July this

year to enable customers enjoy the

Q3, 2021 GDP Growth 4.8%

Average GDP Growth for 2021 4.1%

2022 Projected GDP Growth 3.7%

BoG Policy Rate 24.50%

Weekly Interbank Interest Rate 22.36%

Inflation for February, 2022 33.9%

End Period Inflation Target – 2022 28.5%

Budget Deficit (% GDP) – Dec, 2021 6.4%

2022 Budget Deficit Target (%GDP) 6.6%

Public Debt (billion GH¢) – Dec, 2021 402.4%

Debt to GDP Ratio – Dec, 2021 68.0%

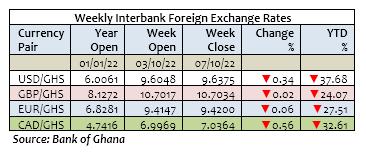

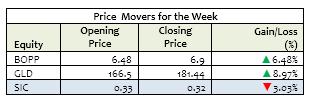

The Ghana Stock Exchange closed higher for the week following four consecutive weekly declines on the back of price increases by 2 counters. The GSE Composite Index (GSE CI) gained 1.21 points (0.05%) to close at 2,461.33 points, reflecting year-to-date (YTD) loss of 11.76%. The GSE Financial Stocks Index (GSE FI), on the other hand, lost 0.34 points (-0.02%) to close at 2,069.76 points, reflecting YTD loss of 3.81%.

Market capitalization increased by 0.74% to close the week at GH¢64,458.05 million, from GH¢63,985.81 million at the close of the previous week. This reflects a YTD decrease of 0.06%.

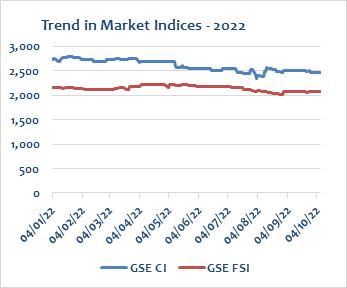

Trading activity recorded a total of 4,443,096 shares valued at GH¢30,079,436.97 changing hands, compared with 32,024,328 shares, valued at GH¢30,794,565.98 in the preceding week.

MTN dominated volume of trades whiles New Gold dominated value of trades for the week, accounting for 82.05% and 87.17% of shares traded respectively.

The market ended the week with 2 advancers and a decliner as indicated on the table below.

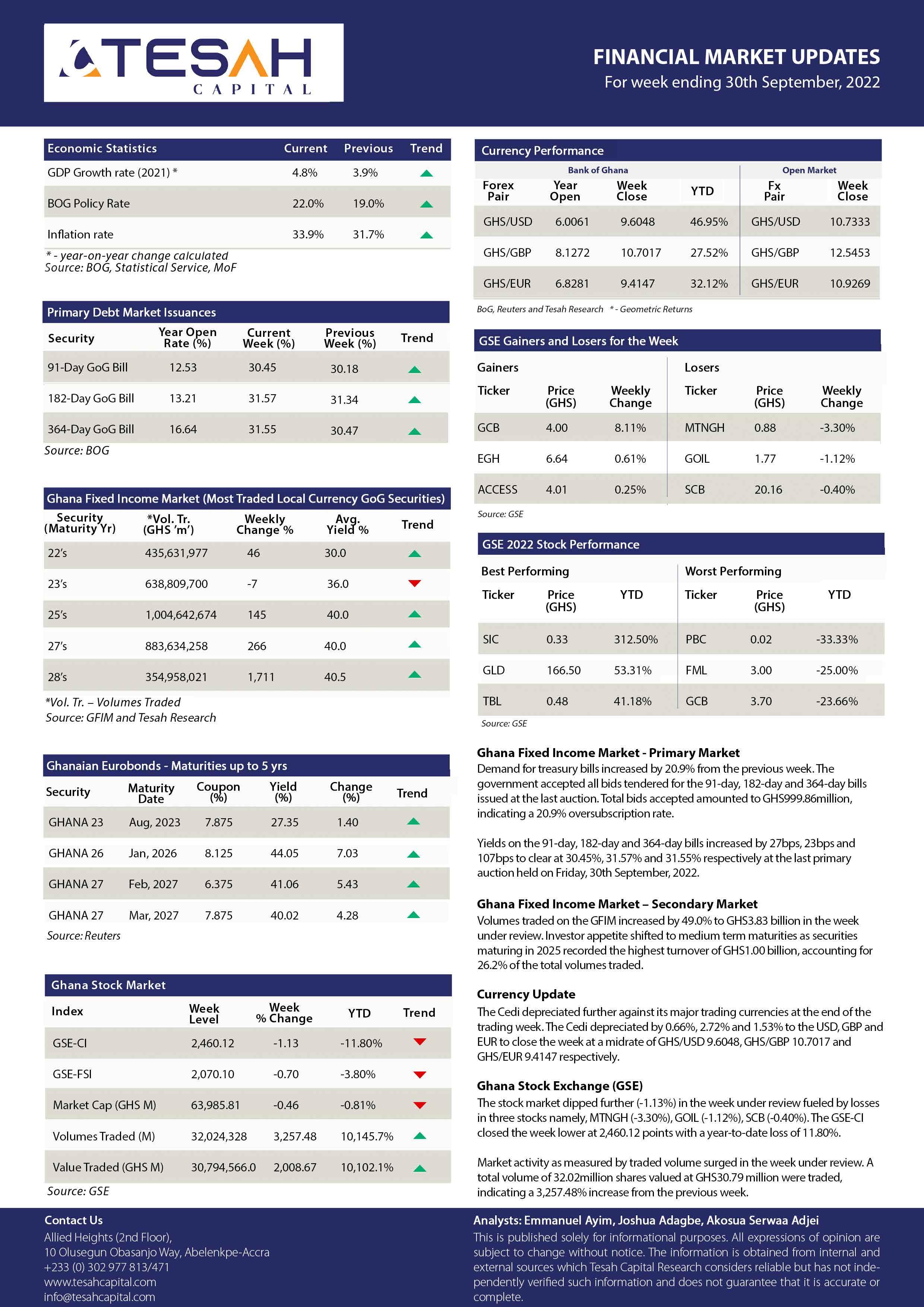

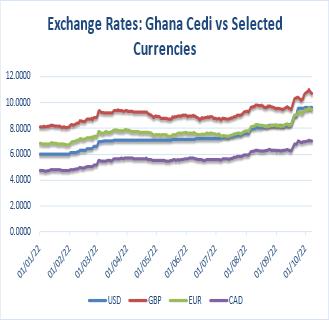

The Cedi weakened against the USD for the week. It traded at GH¢9.6375/$, compared with GH¢9.6048/$ at week open, reflecting w/w and YTD depreciations of 0.66% and 37.47% respectively. This compares with YTD depreciation of 1.85% a year ago.

The Cedi also weakened against the GBP for the week. It traded at GH¢10.7034/£, compared with GH¢10.7017/£ at week open, reflecting w/w and YTD depreciations of 0.02% and 24.07% respectively. This compares with YTD depreciation of 1.68% a year ago.

The Cedi continued its downward trend against the Euro for the week. It traded at GH¢9.4200/€, compared with GH¢9.4147/€ at week open, reflecting w/w and YTD depreciations of 0.06% and 27.51% respectively. This compares with YTD appreciation of 3.98% a year ago.

The Cedi again weakened against the Canadian Dollar for the week. It opened at GH¢6.9969/C$ but closed at GH¢7.0364/C$, reflecting w/w and YTD depreciations of 0.56% and 32.61% respectively. This compares with YTD depreciation of 3.83% a year ago.

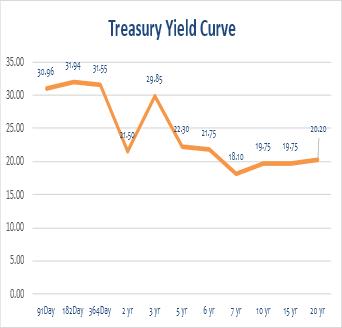

Government raised a sum of GH¢ 1,357.21 million for the week across the 91-Day and 182-Day Treasury Bills. This compared with GH¢ 999.86 million raised in the previous week.

The 91-Day Bill settled at 30.96% p.a from 30.45% p.a. last week whilst the 182-Day Bill settled at 31.94% p.a from 31.57% p.a. last week. The table and graph below highlight primary market yields at close of the week.

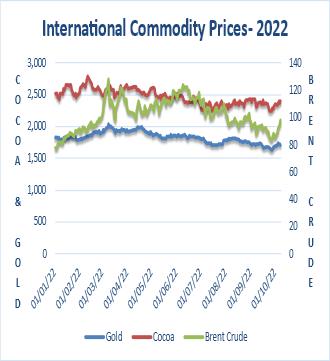

Oil futures rose to five-week highs for the week following an announcement by OPEC+ on Wednesday to cut output by 2 million barrels per day (bpd). Brent futures traded at US$97.92 a barrel on Friday, compared to US$85.14 at week open. This reflects w/w and YTD appreciations of 15.01% and 25.89% respectively.

Gold slid on Friday but still posted a second straight weekly gain as an upward run in the first two days of the week helped the long crowd in bullion weather a robust U.S. jobs report for September that strengthened the dollar. Gold settled at US$1,709.30, from US$1,684.90 last week, reflecting w/w gain and YTD loss of 1.45% and 6.52% respectively.

Prices of Cocoa increased for the week. The commodity traded at US$2,396.00 per tonne on Friday, from US$2,354.00 last week, reflecting w/w gain and YTD loss of 1.78% and 4.92% respectively.

CIDAN Investments Limited is an investment and fund management company licensed by the Securities & Exchange Commission (SEC) and the National Pensions Regulatory Authority (NPRA).

Name: Ernest Tannor

Email:etannor@cidaninvestments.com

Tel:+233 (0) 20 881 8957

Name: Audrey Asiedua Wiafe Email:aaudrey@cidaninvestments.com

Tel:+233 (0) 57 840 2700

Name: Moses Nana Osei-Yeboah Email:moyeboah@cidaninvestments.com

Tel:+233 (0) 24 499 0069

CIDAN Investments Limited CIDAN House

Plot No. 169 Block 6 Haatso, North Legon – Accra

Tel: +233 (0) 26171 7001/ 26 300 3917

Fax: +233 (0)30 254 4351 Email: info@cidaninvestmens.com Website: www.cidaninvestments.com

The contents of this report have been prepared to provide you with general information only. Information provided on and available from this report does not constitute any investment recommendation. The information contained herein has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed.

Copyright @ 2019 Business24 Limited. All Rights Reserved.

Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed. We value your support and loyalty.

Contact: editor@business24.com.gh Newsroom: 030 296 5315

Advertising / Sales: +233 24 212 2742

Deadweight Debt: A debt incurred, normally by a government rather than by an individual, as a result of borrowing, not secured by the purchase of an enduring asset, to meet current needs.

Source: https://finansleksikon.no/en/eng-finance/d/ deadweight-debt

German trade show specialists, agrofood & plastprintpack West Africa, will from November 29December 1, 2022, organise the 7th edition agrofood West Africa in Ghana.

The 2022 agrofood trade fair conference, the 7th edition of the fair, will come off at the Grand Arena of the Accra International Conference Centre (AICC).

It is expected to bring together exhibitors from thirteen (13) registered countries who will showcase their products at the fair.

The participating countries are Ghana, France, Germany, The Netherlands, Iran, Italy, Poland, Spain, Turkey, USA, South Africa, Egypt and Sri Lanka.

The agrofood & plastprintpack West Africa 2022 is a collaboration between fairtrade and the Ministry of Food and Agriculture (MoFA), Ghana National Chamber of Commerce and Industry (GNCCI), Ghana Enterprises Agency (GEA), and Ghana Investment Promotion Centre (GIPC).

The rest are the Association of Ghana Industries (AGI) and Food and Beverages Association of Ghana (FABAG).

Addressing a press conference in Accra Tuesday, October 11, 2022, in Accra, the Managing Director (MD) of fairtrade, organisers of the upcoming event, Paul Marz, announced that the trade fair will focus on agrofoods and plastic products, printing and

packaging.

“From November 29 to December 1, 2022, at the Grand Arena of the Accra International Conference Centre, here in Accra, we are going to have exhibitors from 13 countries all over the world, displaying their latest technology, latest products from their respective countries in the entire food and agrofood value chain.

...From production processing to the final product on the table and everything you need,” he noted.

He added that the products that will be showcased will include food packaging and labelling, plastic printing and packaging materials.

He disclosed that the objective of the fair is to create trade partnerships and value between international and Ghanaian companies within the agrofood and plastic packaging industry.

“...and the second very important objective is to bring production to Ghana to enhance production in Ghana so Ghana becomes less dependent on food imports, and produce more in the country,” he further disclosed.

Elaborating on the plastics printing and packaging, Mr. Marz revealed that exhibitors in this space will display plastics raw materials, machinery for printing and labelling on plastic products.

“We will also have some of the exhibitors exhibit packaging machinery and products,” he

mentioned.

According to the MD of fairtrade, the international exhibition will be supplemented by a three-day programme that will be laden with presentations and conferences.

Mr. Marz used the opportunity to invite all professionals in the agrofood and plastics packaging sector to endeavour to participate in the event.

In a brief statement, the Director of Plant, Protection and Regulatory Services at the Ministry of Food and Agriculture, Eric Quaye, commended fairtrade for putting together the exhibition.

He stressed that such events were very crucial to the policies of the ministry, adding that there was the need to produce good quantities of foods that needed to be processed further.

He entreated Ghanaian businesses that will be participating in the event to take full advantage and shore up their businesses.

He pledged MoFA’s support to fairtrade to ensure that the event becomes successful.

The 6th agrofood West Africa held in 2019 featured 87 exhibitors from 17 countries.

The exhibition presented a platform for the exhibitors to offer solutions to hundreds of trade visitors and buyers from Ghana and neighbouring West African countries.

The exhibitors came from Belgium,

China, France, Germany, Ghana, India and Italy.

The rest were Jordan, Morocco, The Netherlands, Poland, Portugal, South Africa, Sri Lanka, Tunisia and Turkey.

About fairtrade

Founded in 1991, fairtrade has long been one of the leading organisers of professional international agrofood and plastprintpack trade fairs in Africa and the Middle East.

Over the decades, more than 36,000 exhibitors and 1.5 million trade visitors have expressed their confidence in fairtrade.

With its international trade shows, they employ innovative ways to connect emerging markets with solution providers from across the globe.

Facilitating valuable business contacts between their exhibitors and trade visitors -that is what fairtrade stands for.

fairtrade is managed by its founder, Martin Marz, and his son, Paul Marz, who joined the company in 2006 and builds on a highly motivated team of experienced and young professionals, many of them qualified in-house over three years in partnership with the German Cooperative State University to a Bachelor of Arts degree in Business Administration - Exhibition, Convention & Event Management or Media & Communication Management.

The membership of the Public Interest and Accountability Committee (PIAC), the statutory body with oversight responsibility for the management and use of the country’s petroleum revenues, has been reconstituted following the expiration of the tenure of some Members.

Nana Yaa Ansua, the Paramount Queen Mother of the Drobo Traditional Area, has replaced Hajia Dr Kansawurche Azara Bukari as the representative of the Queen Mothers Association of Ghana, while Ms Freda Stephanie Frimpong has replaced Mrs Mary Karimu, who represented the Trades Union Congress (TUC) on PIAC. Emerita Professor Elizabeth Ardayfio-Schandorf has been reappointed by the Ghana Academy of Arts and Sciences (GAAS).

These members have since been

sworn into office by the Chairman of the Committee, Professor Kwame Adom-Frimpong, upon

the authorization of the Minister for Finance for a 2-year term, in accordance with the Petroleum

Revenue Management Act, 2011 (Act 815).

In a meeting held on Thursday 6th October, 2022, the reconstituted Committee elected Professor Kwame Adom-Frimpong, representative of the Institute of Chartered Accounts, Ghana, (ICAG) and Mr. Nasir Alfa Mohammed, representative of the Ghana Bar Association as Chairman and Vice Chairman respectively for a one-year term after the expiration of their tenure in September.

Accepting his re-election, Prof. Adom-Frimpong expressed gratitude to the Committee for the confidence reposed in him, and pledged his commitment to the service of PIAC and the citizenry. Prof. AdomFrimpong is currently the Managing Director of Mainstream Reinsurance Company.