Textiles Tax stamp

By Eugene Davis

By Eugene Davis

By Edmond Kombat,

By Edmond Kombat,

Local manufacturers, retailers and importers of textile prints sold in the market are expected to have stamps affixed on them by November 1, 2022 when government rolls out the textile tax stamp policy, Minister of Trade and Industry, Alan Kyerematen has announced.

Speaking to the press after the launch of the textiles tax stamp policy in Accra on Wednesday, the minister said “On the 1st of November, textiles tax stamp policy would be rolled out, meaning that both for locally manufactured prints and imported textile print that are sold in the market they should have stamps affixed to them and we have explained the different colour schemes associated with both imported and locally manufactured fabrics.

Also, to reduce the burden of those engaged in retail trade, we have agreed that any existing stock, that any trader has in his or her stall or store would be ringfenced in terms of the applications of these policy measures, meaning that existing

be provided from any compliance requirement.”

The minister further explained that the move from government is not intended to introduce any tax measure nor is it intended to add to the prices or cost of the textile print in the market or create difficulties for those engaged in retail and wholesale trade, rather it will bring sanity in the retail trade in the textile print.

The move to push through this policy started with a stakeholder’s engagement from 2018 to ensure that there has been a wider consultation from parties involved, the minister added.

He adds “in terms of implementation we have given ourselves up to 1st of March 2023 for enforcement and compliance with the policy measures.”

The minister also indicated that it is in the interest of the government and Ghanaians in general, to see to the development and growth of domestic manufacturing in order to take full advantage of the AfCFTA which has a market size

manufacturers, retailers, and importers to prepare from November 1 to February, “to make sure that all the products going to the market are affixed with the stamp, the programme is essentially being rolled out by the Trade Ministry but GRA we have started the tax stamp and also leveraging on our law [Excise Duty Act and Tax Stamp Act] to introduce this policy and since we have the experience in this and we are ready to support in this regard.”

Faotumata Doro, MD Texstyles Ghana Ltd says her she was excited because “we have seen our businesses shrink over the years -we used to be over 15 textile industries contributing to more than 12percent of the country’s GDP, today we are left with four contributing to less than three percent, almost 2,500 employees instead of 25,000 employees that is a significant decrease, counterfeit today represent about 70percent on the market.

As long as there is a fair environment that makes sure that we are all abiding by the

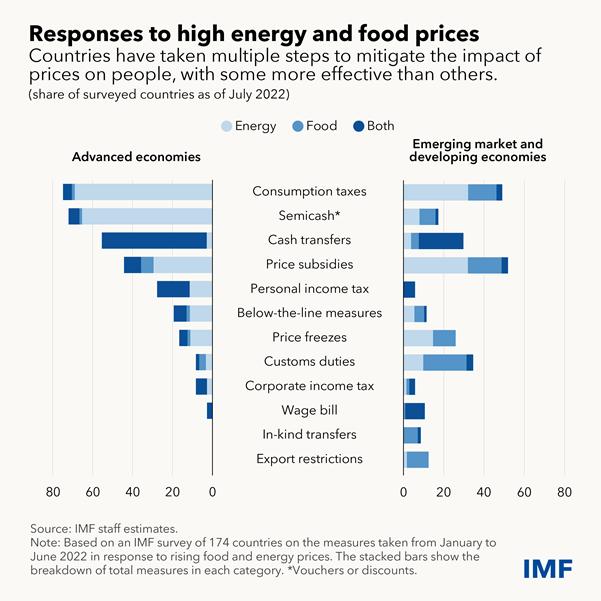

Governments confront difficult trade-offs amid sharp increases in food and energy prices. Policymakers must protect low-income families from large real income losses and ensure their access to food and energy. But they must also reduce vulnerabilities from large public debts and, in response to high inflation, maintain a tight fiscal stance so that fiscal policy does not work at cross-purposes with monetary policy.

Food prices have been up by half since 2019 and supply disruptions have persisted in both food and energy markets. Higher prices threaten people’s standard of living everywhere, prompting governments to introduce a variety of fiscal measures, including price subsidies, tax cuts, and cash transfers. We estimate the median fiscal cost of such measures at 0.6 percent of national gross domestic product, on top of pre-existing subsidies, among countries for which estimates were available.

Most governments face further pressure on public finances already strained by the pandemic. Rising inflation, weakening currencies, and climbing interest rates have led to surging credit spreads in many countries and higher interest expense going forward. Global public debt is projected to remain elevated at 91 percent of GDP in 2022—after receding from a historic high in 2020—and remains about 7.5 percentage points higher than prepandemic levels. Lowincome countries are particularly vulnerable: nearly 60 percent of the poorest economies are in debt distress or at high risk of it.

In our latest Fiscal Monitor, we discuss how policymakers can approach these trade-offs, helping people bounce back from the current crisis and better cope with future challenges.

Food and energy response

Facing high debt levels and rising borrowing costs, policymakers should prioritize targeted support through social

safety nets to the most vulnerable people. In some countries, this might entail providing discounts on utility bills (for basic usage) to vulnerable low- and middleincome families. Allowing energy prices to adjust is crucial to preserving broader incentives to curb energy use and increase supply. Faced with long-lasting supply shocks and broad-based inflation, governments should not attempt to limit price increases through price controls, subsidies, or tax cuts. Such a move would be costly to budgets and ultimately ineffective. With limited resources, many low-income countries will need greater global efforts in humanitarian assistance and emergency financing.

In a time of high inflation, policies to address high food and energy prices should not add to aggregate demand. Demand pressures force central banks to raise interest rates even higher, making it more expensive to service government debt. A tightening fiscal stance sends a

powerful signal that policymakers are aligned in their fight against inflation.

Fostering economic resilience

Our report highlights that governments need to build resilience over time to a range of adverse shocks. The pandemic and the global financial crisis, beyond country-specific natural disasters and other adverse events, have shown that governments must prepare for rainy days. Building fiscal buffers gradually would eventually allow policymakers to respond swiftly and flexibly to crises.

Several fiscal tools that have proved useful during the pandemic can be made part of a more permanent toolkit, depending on countries’ capacity and available fiscal space. Jobretention schemes, for example, proved effective during the pandemic by stabilizing more than 40 percent of individual income loss in the European Union. Exceptional financial support to companies can prevent widespread bankruptcies. But such support should be reserved for severe crises as it exposes governments to sizable fiscal risks.

More generally, social safety nets help people bounce back from unemployment, sickness, or poverty, making them more resilient to a broad set of challenges. Such systems can be made readily scalable and better targeted with the help of digital technology.

We have seen how major global crises during the past decadeand-a-half have led to innovative and forceful fiscal responses, against the backdrop of rising debt and constrained monetary policy. Countries should rethink the role of fiscal policy in a shockprone era—how it can better buffer against losses during crises and build resilience—and learn from experiences across the world.

IMF

German trade show specialists, agrofood & plastprintpack West Africa, will from November 29December 1, 2022, organise the 7th edition agrofood West Africa in Ghana.

The 2022 agrofood trade fair conference, the 7th edition of the fair, will come off at the Grand Arena of the Accra International Conference Centre (AICC).

It is expected to bring together exhibitors from thirteen (13) registered countries who will showcase their products at the fair.

The participating countries are Ghana, France, Germany, The Netherlands, Iran, Italy, Poland, Spain, Turkey, USA, South Africa, Egypt and Sri Lanka.

The agrofood & plastprintpack West Africa 2022 is a collaboration between fairtrade and the Ministry of Food and Agriculture (MoFA), Ghana National Chamber of Commerce and Industry (GNCCI), Ghana Enterprises Agency (GEA), and Ghana Investment Promotion Centre (GIPC).

The rest are the Association of Ghana Industries (AGI) and Food and Beverages Association of Ghana (FABAG).

Addressing a press conference in Accra Tuesday, October 11, 2022, in Accra, the Managing Director (MD) of fairtrade, organisers of the upcoming event, Paul Marz, announced that the trade fair will focus on agrofoods and plastic products, printing and packaging.

“From November 29 to December 1, 2022, at the Grand Arena of the Accra International Conference Centre, here in Accra, we are going to have exhibitors from 13 countries all over the world, displaying their latest technology, latest products from their respective countries in the entire food and agrofood value chain.

...From production processing to the final product on the table and everything you need,” he noted.

He added that the products that will be showcased will include food packaging and labelling, plastic printing and packaging materials.

He disclosed that the objective of the fair is to create trade partnerships and value between international and Ghanaian companies within the agrofood and plastic packaging industry.

“...and the second very important objective is to bring production to Ghana to enhance production in Ghana so Ghana becomes less dependent on food imports, and produce more in the country,” he further disclosed.

Elaborating on the plastics printing and packaging, Mr. Marz revealed that exhibitors in this space will display plastics raw materials, machinery for printing and labelling on plastic products.

“We will also have some of the exhibitors exhibit packaging machinery and products,” he

mentioned.

According to the MD of fairtrade, the international exhibition will be supplemented by a three-day programme that will be laden with presentations and conferences.

Mr. Marz used the opportunity to invite all professionals in the agrofood and plastics packaging sector to endeavour to participate in the event.

In a brief statement, the Director of Plant, Protection and Regulatory Services at the Ministry of Food and Agriculture, Eric Quaye, commended fairtrade for putting together the exhibition.

He stressed that such events were very crucial to the policies of the ministry, adding that there was the need to produce good quantities of foods that needed to be processed further.

He entreated Ghanaian businesses that will be participating in the event to take full advantage and shore up their businesses.

He pledged MoFA’s support to fairtrade to ensure that the event becomes successful.

The 6th agrofood West Africa held in 2019 featured 87 exhibitors from 17 countries.

The exhibition presented a platform for the exhibitors to offer solutions to hundreds of trade visitors and buyers from Ghana and neighbouring West African countries.

The exhibitors came from Belgium, China, France, Germany,

Ghana, India and Italy.

The rest were Jordan, Morocco, The Netherlands, Poland, Portugal, South Africa, Sri Lanka, Tunisia and Turkey.

About fairtrade

Founded in 1991, fairtrade has long been one of the leading organisers of professional international agrofood and plastprintpack trade fairs in Africa and the Middle East.

Over the decades, more than 36,000 exhibitors and 1.5 million trade visitors have expressed their confidence in fairtrade.

With its international trade shows, they employ innovative ways to connect emerging markets with solution providers from across the globe.

Facilitating valuable business contacts between their exhibitors and trade visitors -that is what fairtrade stands for.

fairtrade is managed by its founder, Martin Marz, and his son, Paul Marz, who joined the company in 2006 and builds on a highly motivated team of experienced and young professionals, many of them qualified in-house over three years in partnership with the German Cooperative State University to a Bachelor of Arts degree in Business Administration - Exhibition, Convention & Event Management or Media & Communication Management.

Of all of the optimistic futuristic dreams, a world of clean, renewable energy to combat climate change is perhaps the closest to realization, thanks to the growing acceptance of and demand for renewable energy (RE).

Not so long ago, the energy transition was an idealistic concept driven largely by researchers and environmentalists, with the most important drawback being the high cost associated with the deployment of clean energy technologies. But a decade-long cost reduction trends, spending, coupled with government policies has reinforced the broad consensus that renewables were vital for the global transition to a low or zero-carbon economy.

Following the signing of the Paris Agreement in 2015 clean energy investment grew by only 2 percent a year in the five years after the. But since 2020, the pace of growth has accelerated significantly to 12 percent. Spending on clean energy has been underpinned by fiscal support from governments and aided by the rise of sustainable finance, especially in advanced economies.

The drastically reduced price of PVs and wind turbines for instance, has ensured global attention for solar and wind energy. A similar situation is unfolding concerning emissionsfree hydrogen production, so called “Green” hydrogen. Already today and even more in the very near future, renewable energies will be the only reasonable and feasible power source for both industrialized and developing countries, by reason of rising concern over energy security, climate change, and affordability.

Over the past three years, renewable energy has recorded some interesting development within the broader energy system, with a promising uptick in growth, leading to a small reduction in global CO² production from the electricity sector overall, as noted by the International Renewable Energy Agency (IRENA). In International Energy Agency’s (IEA’s) report, “World Energy Investment” published in May 2020, is a description of a drastically changed energy markets in the wake of the coronavirus pandemic. Also, the IEA’s Global Energy Review 2020 report indicated that renewable energy has so far been the energy source most resilient to Covid-19

lockdown measures.

According to data released in April 2021 by the IRENA, the world added more than 260 gigawatts (GW) of renewable energy capacity in 2020 despite Covid-19 pandemic, exceeding expansion in 2019 by close to 50 percent. Renewable electricity capacity additions broke another record in 2021, despite the continuation of Covid-19 induced logistical challenges and increasing prices for new solar PV and wind installations. The world added a record 295 gigawatts of new renewable power capacity in 2021, overcoming supply chain challenges, construction delays and high raw material prices, according to the International Energy Agency’s (IEA’s) latest Renewable Energy Market Update.

As we know today, renewables were the only energy source that posted a growth in demand in the first quarter of the year 2022. The IEA forecast global capacity additions to rise this year to 320 gigawatts; equivalent to an amount that would come close to meeting the entire electricity demand of Germany or matching the European Union’s total electricity generation from natural gas. Solar PV is on course to account for 60 percent of global renewable power growth in 2022, followed by wind and hydropower. Going forward, the IRENA estimates that 90 percent of the world’s electricity can be produced from renewable energy sources by 2050.

The IEA projects that spending on renewables in 2022 will exceed the record US$440 billion invested in 2021. Global clean energy spending is expected to surge 12 percent in 2022, reaching US$1.4 trillion as the world pours money into renewables, electric vehicles and energy efficiency. The sustained progress in demand growth and spending is yet another proof of renewable energy’s resilience and acceptance.

BUT…. But while renewables continued to be deployed at a strong pace even during the Covid-19 crisis, there is looming market uncertainties increasing the challenge to grow clean renewable energy at the expected pace capable of meeting long-term climate and sustainability goals. The IEA noted in 2021 that the continuing decrease in cost trends alone will

not shelter renewables projects from a number of challenges. The pace of economic recovery, heightened pressure on public budgets and the financial health of the energy sector as a whole further exacerbate already existing policy uncertainties and financing challenges.

Now consider the following development around the world, and particularly within the broader energy sector:

First, the IEA may have suggested that global energy investment is set to increase by 8 percent in 2022 to reach US$2.4 trillion, with the anticipated rise coming mainly in clean energy, but that is less encouraging given that it also assert that the growth in investment is still far from enough to tackle the multiple dimensions of today’s energy crisis and pave the way towards a cleaner and more secure energy future. Again, the Paris based intergovernmental body finds that about half the increase in clean energy spending is due to rising prices— rather than investments in new clean energy capacity. It finds that those price increases have been driven in large part by bottled-up supply chains, which have been unable to keep up with surging demand for the critical minerals used in solar panels, wind turbines and electric vehicles. The IEA estimates that the share of cathode material costs in an electric vehicle (EV) battery, which include lithium, nickel and cobalt, has risen from 5 percent of a battery’s cost in the mid-2010s to 20 percent today. In the case of wind and solar, rising mineral costs threaten to reverse decades of falling costs.

Second, the IEA’s World Energy Investment 2022 report finds that the rise in clean energy spending is not evenly spread, with most of it taking place in advanced economies and China. Clean energy spending in emerging and developing economies (excluding China) remains stuck at 2015 levels, with no increase since the Paris Agreement was reached. This means that while the rich countries are pouring money into cleaner technologies, the energy transition largely bypasses less wealthy nations like Africa, a continent that is most vulnerable to climate change impacts under all climate scenarios above 1.5 degrees Celsius. Meanwhile, IEA’s Africa Energy Outlook 2022 report suggest that Russia’s invasion of Ukraine is increasing

the strains on African economies already hard hit by the Covid-19 pandemic. The overlapping crises according to the report are affecting many parts of Africa’s energy systems, including reversing positive trends in improving access to modern energy, and also deepening financial difficulties of utilities, increasing risks of blackouts and rationing. This is a massive setback for not only Africa, but the global system that seeks for clean renewables to combat climate change and energy security.

Third, the IEA’s World Energy Investment 2022 report noted that in some markets, energy security concerns and high prices induced by the war in Ukraine are prompting higher investment in fossil fuel supplies, most notably on coal. The crunch in fossil fuel markets has led to calls to increase spending on oil, gas and coal production. Already, 2022 has seen coal use rise due to the war and the subsequent energy crisis. Some European countries have also delayed coal phase-out plans, due to supply issues following the war, and emissions are likely to increase by 3 percent in the region as a result, according to the IEA. This is certainly a reversal of most of 2020’s decline caused by the Covid-19 pandemic.

Fourth, it must be noted that the pandemic and the Russia’s invasion of Ukraine has the potential to change the priority of government policies and budgets, developers’ investment decisions and the availability of financing in the coming years. Announcing its latest Renewable Energy Market Update earlier in the year, IEA said that although renewables are expanding faster than expected this year on policy support in China, the EU and Latin America, the outlook in the US is dimmed by uncertainty over new incentives for wind and solar and trade actions against solar imports. Certainly, the pandemic and the energy crisis casts a great deal of uncertainty on markets that had been expanding at a rapid pace in the previous five years. again, looking at projects pipeline through to 2025, some projects stands the risk of cancellation while some face the chance of further delays carrying over to 2023 and beyond on the back of government policies.

The US Ambassador to Ghana, Virginia E. Palmer, says efforts to improving the country’s macroeconomic conditions must show the market that reform is happening and concessional financing is imminent.

According to her, this is what the impending International Monetary Fund (IMF) program for the country would exactly offer, and therefore urged leadership to reach a robust and timely agreement with the IMF to get things back on track.

“Unpredictable interest rates and high inflation create uncertainty. The transfer from savers to investors breaks down. Additionally, high government borrowing can crowd out private lending. These macroconditions are tough right now in Ghana.

“It is a challenging time for farmers and the finance sector, in particular because of high inflation and depreciation of the cedi. Additionally, fertilizer prices have been high, reducing usage which could lead to smaller yields in the coming months. The cost of fertilizer has made access to credit even more crucial for agribusinesses and farmers, especially smallholder farmers,”

she said.

The US Ambassador made these remarks during the 2022 Agribusiness Investment Summit in Accra. The Summit was under the theme: “Strategic Partnerships for Sustainable Agriculture Financing.”

The Agribusiness Investment Summit was organized by the USAID-supported Feed the Future Ghana Mobilizing Finance in Agriculture (MFA) Activity. It brought together about over 400 stakeholders in the value chains of maize, soy, groundnut, cowpea, mango, cashew, shea, and other high-value exportable agro-commodities, focusing on how to build fruitful partnerships to expand lending to farmers and agribusinesses.

To help improve the agribusiness ecosystem in the country, Ambassador Palmer said the US Government is creating

“Despite the challenges, I know many of you have continued to keep the wheels of the economy rolling. In just the past two months, our programs facilitated $16 million in financing through 15 financial institutions. This financing in turn supported more than 7,500 agribusinesses, including 3,600 female-led enterprises. We know these agribusinesses by name, crop, and more. These are people, not just numbers,” she revealed.

Addressing the Summit, the Deputy Minister of Finance, Dr. John Ampontuah Kumah, affirmed government’s commitment to increasing agriculture financing with a clear determination to transforming agriculture for sustainable economic growth.

Buttressing his claims, the Deputy Minister said the government through the Ghana Incentive-based Risk Sharing for

at the forefront of agricultural financing, through the issuance of agricultural credit guarantee instruments, to improve credit to the agricultural and agribusiness sectors. In 2021, the value of agriculture loans for which credit Guarantee issued to financial institutions by GIRSAL was GH¢241.7 million,” Dr. Kumah said.

The Chief of Party, Feed the Future Ghana Mobilizing Finance in Agriculture (MFA) activity, Dr. Victor Antwi, said in approximately two years, the Activity has mobilized over $178.5 million (72.5% from commercial banks) for 18,636 farmers and agribusinesses (including 54% female-led agribusinesses) in Ghana.

“We achieved this through our network of transaction advisors and partner financial institutions who are supported with training, for-results incentives to facilitate and increase agriculture lending. The Activity is also implementing a $2.77 million COVID-19 Relief and Resilience Challenge Fund to benefit over 29,000 smallholder farmers, 66 percent of whom are

In 1897, the American newspaper magnate William Randolph Hearst sent illustrator Frederic Remington to cover the Cuban War of Independence. When Remington relayed that “there will be no war,” Hearst allegedly cabled back: “You furnish the pictures, and I’ll furnish the war.”

It’s an old story with a wellknown moral: Wealth confers power, and power begets a craving for more power. A familiar corollary follows: He who controls the means of mass communication controls how reality is constructed and conveyed.

The means of mass communication have changed since Hearst’s time, but the behavior of plutocrats has not. Having used Twitter quite effectively to promote his own businesses, Elon Musk recognizes that the platform commands significant influence in contemporary public life. While he has since tried to wriggle out of the deal that he signed to buy the platform, he may have no choice but to follow through. In any case, it is worth considering his stated reason for pursuing ownership of the company.

“Given that Twitter serves as the de facto public town square,” Musk tweeted on March 26, 2022, “failing to adhere to freespeech principles fundamentally

undermines democracy.” In deciding to buy the company, he explained a week or so later, “I don’t care about the economics at all … my strong, intuitive sense [is] that having a public platform that is maximally trusted and broadly inclusive is extremely important to the future of civilization.”

And so, as a self-described “freespeech absolutist,” Musk claims to be saving society’s public square by reversing Twitter’s policies to prohibit politicians like former US President Donald Trump and US Representative Marjorie Taylor Greene from using the platform to propagate demonstrable lies and disinformation in the name of free speech.

Musk’s call for “absolute freedom” of speech may sound simple enough in the abstract, but the implications are troubling. For example, Musk’s understanding of free speech would validate conspiracy theorist Alex Jones’s defense of his reckless and injurious lies, including his outrageous claim that the 2012 Newtown school massacre, in which a gunman murdered 26 people (20 of them six- and sevenyear-olds), was staged by “crisis actors.” A Connecticut court has just rejected that view, ordering Jones to pay nearly a billion dollars to the families of the Newtown victims.

The court is right. No freedom

– whether of speech or action – is absolute. On the contrary, meaningful freedom requires ground rules to limit abuses that would otherwise render it a dead letter. That is why we have laws against fraud in the marketplace of goods and services. Without such constraints, false and deceptive claims would proliferate, fomenting levels of mistrust that inevitably invite market failure.

The same goes for the marketplace of opinions and ideas. Freedom of speech is not a license deliberately or recklessly to issue statements that harm others or put their property rights at risk. That is why we have laws against defamation and the intentional infliction of emotional distress – as the Alex Jones case reflects. It is also why we have laws proscribing incitement to imminent violence, perjury, and lying to the authorities about criminal activity.

Some limits on speech have also been deemed essential to safeguard free and fair elections.

For example, there are laws in many states in the United States that proscribe deliberately spreading false information about polling locations, voting times, ballot authenticity, or voting instructions, nor can you make provably false claims about your status as an incumbent or about your campaign’s affiliations.

And as the criminal prosecution of participants in the violent mob that sought to block the peaceful transition of power at the US Capitol on January 6, 2021, makes plain, the freedom to hold unpopular political views does not confer a right to violent insurrection.

Even with current policies of content moderation, socialmedia platforms are awash in disinformation that is corroding public trust and undermining the essential function of free and informed political discourse. Such subversive tactics designed to crash the marketplace of opinions and ideas are, in fact, “anti-speech acts.” Their only purpose is to debase political discourse itself.

Musk has already offered a preview of the changes he might make at Twitter. What starts with reinstating Trump’s account, allowing him to disseminate more demonstrable lies about election fraud and his political opponents, may imply, more broadly, further evisceration of Twitter’s standards.

Musk’s claim that he will save society’s public square is fundamentally bogus. He will fuel its disintegration by permitting it to be overrun by toxic disinformation, including deep fakes, insipid propaganda, calls for violence, doxing, and other forms of illiberal antispeech acts.

TWO companies in the electronic (e) automobile business have combined forces to strengthen their operations and serve customers better.

MANA Mobility Ltd, a manufacturer of e-cars in Ghana, merged with Cargo Bikes Africa Ltd, an e-mobility start-up in the e-bikes, to create a new entity valued at $20 million.

The outcome of the merger, MANA Mobility, was unveiled in Accra by a German-Ghanaian enterprise focused at creating an ecosystem for e-mobility solutions in Africa. A press statement that announced the merger said Valerie Labi would be the Chief Executive Officer and Co-founder of the new entity.

Ms Labi is a former co-founder of Cargo Bikes Africa.

The statement said the new company would operate mainly from Ghana but provide services to other African countries.

It said the product portfolio would comprise an open e-mobility platform that connected drivers, passengers and goods in an easily accessible, inclusive, transparent, countrywide and multimodal manner.

It said MANA Mobility was a specialist in the development of electric vehicles, which were affordable, safe, reliable, functional, as well as Ghanaian-designed, engineered and manufactured.

It said Cargo Bikes Africa, on the other hand, was an e-mobility startup that was innovating mobility processes, boasting partnerships

with pan-African e-commerce platforms and supporting to make delivery services more sustainable through the design of local production and subscription of ebikes and e-trikes.

The statement said both entities were tackling major problems of the transport sector in African cities such as congestion, pollution and unemployment.

Following from the merger, the statement said the deal would combine Cargo Bikes Africa’s expertise in electric bike design, production and distribution models with MANA Mobility’s experience in manufacturing and

global supply chain management and application (App) development.

“The combined entity will be able to produce electric vehicles that meet the needs of African roads and customers,” it said.

The Chief Executive Officer of MANA Mobility Germany, Peter Schwarzenbauer, said his outfit was thrilled to be partnering Cargo Bikes Africa.

Mr Schwarzenbauer described the company as one that shared the vision of MANA Mobility in creating a world where everyone could access affordable and clean energy transportation

solutions that removed barriers to opportunity and enhanced mobility in emerging markets.

“This deal will enable us to make this vision a reality sooner than previously thought, the CEO, a former Board Member of BMW AG, said.

He expressed the hope that the CEO of MANA Mobility would lead to realise its vision of establishing local manufacturing operations for the local production of two, three and four-wheeler e-vehicles (eVs) as well as grow and develop an open-source technology platform that provides an ecosystem of EV services, and create a community of e-drivers and e-riders.

Absa Bank has engaged a total of 65 youth with financial, entrepreneurial and work skills as part of its ReadytoWork initiative. The programme seeks to equip the Ghanaian youth with the right resources to transit from learning to earning in the modern workplace.

The engagement took place in Accra in partnership with the Aequitas Foundation, which is currently organizing a 6-week internship programme for selected youth under a programme dubbed, “Aequitas Experience.”

A group of Absa employee volunteers, led by the bank’s Head of Citizenship, took the students through key skills in leadership, career strengths and people skills. The participants also had the opportunity to learn and develop robust workplace skills in their chosen fields of interest.

Head of Citizenship at Absa Bank, Priscilla Yeboah, said:

“We are in the business of creating and transforming the youth to fulfill their career and leadership aspirations as they transit from the school environment to the workplace.

The ReadytoWork initiative is a key part of the bank’s education and skills development pillar and has been impacting the lives of many youths in the past five years. It aligns with the bank’s overall CSR strategy of creating a valuable impact and pushing the frontiers of innovation and creativity.”

Speaking after the engagement, Executive Director of Aequitas Foundation, Rev. Ekua Ofori Boateng said:

“The unemployment rate among our youth remains high and this is largely due to the discrepancy between the kind of skills

sought by employers and what jobseekers bring to the market.

At Aequitas, we believe that with the proper training, coupled with a safe and enabling institutional environment, our youth would have a fair opportunity to be useful, relevant and adaptive in a dynamic job market.”

The ReadytoWork initiative utilizes knowledge and skills transfer through an online portal where the youth can sign on and track performance, through physical engagements, and virtual webinar sessions, in the execution of the programme.

At this point, the uncertainties are clearly before our eyes with the imbalances in the system capable of impeding efforts to reach the pace required to limit warming to 1.5 degree Celsius. Definitely, much more needs to be done, including by international development institutions, to boost these investment levels and bridge widening regional divergences in the pace of energy transition investment.

The lack of strong policies,

subsidies, incentives, and regulations that favour renewable energy technologies is what will hinder its wide growth in the years ahead. To attract investors and reduce the cost of renewables, the market needs clear policies and legal procedures, incentives and subsidies. While global cooperation and coordination is critical, domestic policy frameworks must urgently be reformed to streamline and fasttrack renewable energy projects and catalyze private sector

investments.

In the words of IEA Executive Director Fatih Birol: “Cutting red tape, accelerating permitting and providing the right incentives for faster deployment of renewables are some of the most important actions governments can take to address today’s energy security and market challenges, while keeping alive the possibility of reaching our international climate goals.”

Thanks to the strong policy support from China, the

European Union (EU) and Latin America, forecast additions for 2022 and 2023 have been revised upwards by 8 percent from end last year, as indicated by the IEA. The European Union has also shown the way by triggering an unprecedented policy momentum towards accelerating energy efficiency and renewables.

Written by Edmond Kombat, Director of Research & Finance, Institute for Energy Security (IES) ©2022. Email: edmond@iesgh.org

THE UN Secretary General, Antonio Guterres, has urged the comity of nations to raise their gender-equality ambitions to ensure that women everywhere have the same opportunity to seat at decision-making tables as men.

He said when women took up roles in public life, governments and legislatures, they were more responsive and accountable for all.

“I count on you to take action to better protect women in politics against the growing stress of violence” he stated.

In a recorded message to delegates attending the ongoing 145th Inter-Parliamentary Union (IPU) in Kigali, Rwanda, Mr Guterres said “We look to you to address gender inequality, including special temporary measures to help drive change and results as that is what our world needs,” he said.

The six-day event, which is

being held on the theme “Gender equality and gender-sensitive parliaments as drivers of change for a more resilient and peaceful world,” is being attended by over 1,200 delegates, including Speakers and deputy speakers of parliaments, representative of diplomatic corps and international observer bodies.

The meeting will facilitate the exchanges on good practices to make parliaments more gender-sensitive as well as encourage parliaments to pledge transformative action.

Rwanda commended

Mr Guterres said as a proud parliamentarian himself and a former member of the IPU, he knew the pivotal work the member countries of the union were playing in building stronger communities and a better world.

He said they were crucial bridge between the local and the global as they brought people’s concerns into international arena and translated international

agreements into national actions.

But to do so effectively, he stressed that Parliament needed to present the people they served.

The Secretary General commended the IPU’s focus on gender equality and gendersensitive Parliaments as drivers of change.

In line with that, he commended the host of the IPU’s assembly, Rwanda, for being the world’s first country with the female majority in Parliament.

He also emphasised the urgent need for parliaments to advance climate action at a scale that marched the scope of the challenge to defend human rights, the rule of law, mobilise resources to confront hunger crisis and escalating emerging humanitarian emergencies and to promote sustainable development and deliver the 2030 Agenda

“Together, let us go further and faster towards all the peace and equality opportunity for all,” he said.

We don’t condone military coups

The Secretary General of the Inter Parliamentary Union (IPU), Martin Chungong, expressed the union’s strong opposition to the emerging military takeovers on the African continent.

He said as a community of democrats, the union would not condone any assumption of power by military force.

In his view, the

African continent was regrettably experiencing the epidemic of instability and coups, citing the recent military takeover in Burkina Faso, which had suffered a second military coup in a year.

“Further afield, the Sahel region is facing threats to its peace and security, becoming a hotspot for terrorism, violent extremism and organized crime, alongside numerous other challenges.

“I am sure we will all be keen to lend our support to this endeavor, needless to say, the tensions and conflicts simmering on the continent are undermining democratic institutions,” he said.

He reminded the assembly that unstable and compromised democracies were holding back the socio-political and economic development of societies, saying that “A coup d’état is never the appropriate response to instability or terrorism”.

“The right of the people to freely express themselves through elections must be safeguarded above all else.

“We must put our best foot forward and strive to identify dynamic and innovative solutions to bring back lasting peace, discourage military responses to instability, and support sustainable development throughout Africa,” he said.

Give dialogue a chance

Reminding the assembly that the founding fathers of the African Union placed premium on dialogue to conflict resolutions, Mr said “we must give dialogue a chance for peace to prevail”.

“We must live up to AU’s founding fathers’ vision of deploying the full of parliaments and parliamentary democracy as our contribution to conflict resolution,” he added.

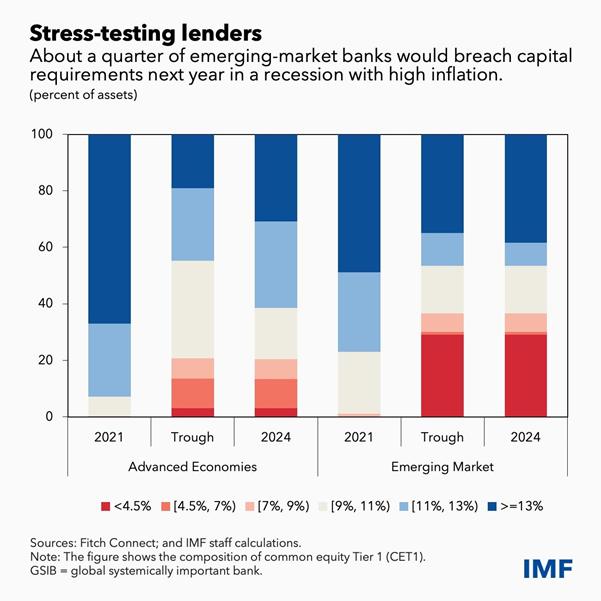

GLOBAL financial conditions have tightened as central banks accelerate monetary policy normalisation to keep rapid inflation from becoming entrenched.

Financial conditions have tightened as central banks continue to hike interest rates. Amid the highly uncertain global environment risks to financial stability have increased substantially.

Major issues facing financial systems include inflation at multi-decade highs, continuing deterioration of the economic outlooks in many regions, and persistent geopolitical risks, as we discuss in our latest Global Financial Stability Report.

To avoid inflationary pressures from becoming entrenched, central banks confronting stubbornly high inflation have had to accelerate monetary policy tightening. What’s more, those in advanced and emerging economies alike also face magnified risks and vulnerabilities across different sectors and regions.

Financial vulnerabilities are elevated for governments, many with mounting debt, as well as nonbank financial institutions such as insurers, pension funds, hedge funds and mutual funds. Rising rates have added to stresses for entities with stretched balance sheets.

At the same time, the ease and speed with which assets can be traded at a given price has deteriorated across some key asset classes due to volatile interest rates and asset prices. This poor market liquidity, together with pre-existing vulnerabilities, could amplify any rapid, disorderly repricing of risk, were it to occur in the coming months.

Global markets are showing strains as investors have recently become more risk-averse amid heightened economic and policy uncertainty. Financial asset prices have fallen as monetary policy has tightened, the economic outlook has deteriorated, recession fears have grown, borrowing in hard currency has become more expensive, and stress in some nonbank financial institutions has accelerated. Bond yields are rising broadly across credit ratings, with borrowing costs for many countries and companies already

rising to the highest levels in a decade or more.

The faltering property sector in many countries raises concerns about risks that could broaden and spill over into banks and the macroeconomy. Risks to housing markets are growing because of rising mortgage rates and tightening lending standards, with many more potential borrowers now being squeezed out of markets. Stretched housing valuations could adjust sharply in some market segments.

Emerging markets are confronting a multitude of risks, including high external borrowing costs, stubbornly high inflation and volatile commodity markets. They also face heightened uncertainty about the global economy, and policy tightening in advanced economies.

Strains are particularly severe in frontier markets —generally smaller developing economies— where challenges are driven by a combination of tightening financial conditions, deteriorating fundamentals, and high exposure to commodity price volatility.

Investors have so far continued to differentiate across emerging economies. While many frontier markets are at risk of sovereign default, many of the largest emerging markets are more resilient to external vulnerabilities to date. Having said that, after the stabilisation of outflows in the first half of the year, foreign investors are again pulling back.

Emerging and frontier market bond issuance in US dollars and other major currencies has slowed to the weakest pace since 2015. Without improved access to foreign funding, many frontier market issuers will have to seek alternative sources and/ or debt reprofiling and restructurings.

The global banking sector has been bolstered by high levels of capital and ample liquidity buffers. However, the IMF’s Global Bank Stress Test warns these buffers

may not be enough for some banks. In the event a sharp tightening of financial conditions causes a global recession next year amid high inflation, 29 percent of emerging-market banks (by assets) would breach capital requirements. Most banks in advanced economies would fare much better, the stress test indicates.

The challenging macroeconomic environment is also putting pressure on the global corporate sector. Credit spreads have widened substantially, and high costs are eroding corporate profits. For small firms, bankruptcies have already started to increase because of higher borrowing costs and diminished fiscal support.

Policy recommendations Central banks must act resolutely to bring inflation back to target and avoid a de-anchoring of inflation expectations, which would damage their credibility. Clear communication about policy decisions, commitment to price stability, and the need for further tightening will be crucial to preserve credibility and avoid market volatility.

Exchange rate flexibility helps countries adjust to the differential pace of monetary policy tightening across countries. In cases where

exchange rate movements impede the central bank’s monetary transmission mechanism and/ or generate broader financial stability risks, foreign exchange intervention can be deployed. Such interventions should be part of an integrated approach to addressing vulnerabilities as laid out in the IMF’s Integrated Policy Framework .

Emerging and frontier markets should reduce debt risk through early engagement with creditors, multilateral cooperation, and international support. For those in distress, bilateral and private sector creditors should coordinate on preemptive restructuring to avoid costly defaults and prolonged loss of market access. Where applicable, the Group of Twenty Common Framework should be used.

Policymakers face an unusually challenging financial stability environment. Though no globally systemic event has materialised so far, they should contain further buildup of vulnerabilities by adjusting selected macroprudential tools to tackle any pockets of risk. In this highly uncertain environment, striking a balance between containing these potential threats and avoiding a disorderly tightening of financial conditions will be critical.

Infrastructure expansion accelerates digital transformation and facilitates a connected African continent.

As the demand for cloud-based services grows across Africa due to the adoption of hybrid work, Microsoft has announced a partnership with Liquid Cloud through its Africa Transformation Office (ATO) to provide cloud services to businesses across the continent.

Liquid Cloud and the ATO will collaborate to deliver resilient cloud in Kenya, Ghana, Nigeria, Rwanda, Tanzania, Zambia, and Zimbabwe to meet regulatory

and data residency requirements, address low latency workloads, strengthen resilience, and enable business continuity.

“We witnessed an accelerated adoption of cloud technologies in Africa, and businesses are now reaping the benefits of their investment.

Our customers are increasingly moving to hybrid work culture, meaning the demand for cloudbased services will only grow. Our partnership will enable us to build comprehensive and edge-based cloud capabilities that meet customer regulatory requirements and ensure that they

deliver value to their customers,” said David Behr, CEO of Liquid Cloud and Cyber Security.

The hybrid cloud environment extends Azure capabilities enabling customers to create cloud-native applications faster with Azure platform and data services such as App Service, Functions, Logic Apps, Azure SQL Managed Instance, PostgreSQL database, and Azure machine learning.

As a result, customers will be able to innovate anywhere and use the Azure platform to bring new solutions to life that solves today’s challenges, while creating

the future.

On his part, Wael Elkabbany, General Manager Africa Regional Cluster, Microsoft said: “Critical infrastructure enablers are needed to provide access to the cloud to accelerate digital transformation and the adoption of digital technologies.

Working with Liquid Cloud, access to the local cloud will be available to more organizations and highly regulated industries across the continent. In addition, hybrid cloud provides in-country resources that address dataresidency, latency, and storage requirements.

The U.S. Government, through the U.S. Agency for International Development, and the Ghana Ministry of Food and Agriculture are working together to help more Ghanaian farmers access needed financing.

To this end, the two governments convened more than 400 stakeholders at the Ghana Agribusiness Investment Summit to discuss current challenges and support new financing partnerships.

Increased financing opportunities were discussed, including help for Ghanaian farmers to purchase new inputs and equipment to increase crop yields, improve food security, and stimulate economic growth.

“With better access to financing, Ghanaian farmers could be the breadbasket of West Africa,” said U.S. Ambassador Virginia Palmer at the event.

The Summit connects

agribusinesses in the maize, soy, groundnut, cowpea, mango, cashew, shea, and other highvalue export crop sectors with international and local investors, financial institutions, and transaction advisors. This will enable agribusinesses to purchase agricultural inputs and machinery to increase production and support broad-based economic growth.

U.S. Ambassador to Ghana, Virginia Palmer, and the representative of the Minister of Food and Agriculture, Forster Boateng the Deputy Chief Executive Officer, Tree Crops Development Authority (TCDA) opened the Summit, which is part of the USAID-supported Feed the Future Ghana Mobilizing Finance in Agriculture (MFA) Activity.

Deputy Minister of Finance, Dr. John Kumah also spoke at the event.

The U.S Government, USAID

and the Feed the Future Initiative are working to address credit constraints in Ghana’s agriculture sector using a value chain approach that leverages strategic partnerships.

This activity will unlock over a quarter of a billion dollars in financing for more than 81,000 enterprises in the maize, soy, groundnut, cowpea, mango, cashew, and shea value chains by 2024.

The U.S. Government has also released $2.77 million under the COVID-19 Relief and Resilience Challenge Fund to support farmers and agribusinesses to mitigate the negative impacts of the pandemic and become more resilient against possible future shocks.

Forster Boateng, in his keynote address noted, “It is crucial to transform and modernize Ghana’s agriculture sector and position the industry to better contribute to food security, economic growth

and the Ghana Beyond Aid strategy.

Achieving this requires strong partnerships with the private sector, and collaboration with the United States Government - a longtime development partner.”

Today’s event extends the United States’ short and longterm commitments to Ghana’s agricultural sector and small-scale farmers.

In September, the United States announced a$2.5 million initiative through the United States Agency for International Development (USAID) to ensure 100,000 smallholder farmers in Ghana receive affordable fertilizer for this planting season.

Since 2010, USAID’s Feed the Future program has provided more than $425 million to support Ghanaian farmers – especially in the north – to adopt new techniques, take advantage of new efficiencies, and access global markets.

Brand South Africa (Brand SA), the official marketing agency of South Africa with a mandate to build the country’s brand reputation, improve its competitiveness, and create employment through inclusive partnerships across the African Continent, has successfully hosted the 6th Annual Nation Brand Forum, with a clarion call to amplify the work of the African Continental Free Trade Area (AfCFTA).

Speaking at this year’s Annual Nation Brand Forum at the Sandton Convention Centre in Johannesburg, South Africa, the acting CEO Ms Sithembile Ntombela said “We must continue amplifying the work of the African Continental Free Trade Area (AfCFTA). There is an important role for everyone, especially the youth and women, to co-create and drive a mutually beneficial, integrated African magic.”

According to Ntombela, this also involves a focus on shaping the individual country’s reputation and competitiveness, because “if we show the world how competitive we are, we will be able to attract loyal investors and tourists”.

The AfCFTA aims to progressively eliminate intraAfrica trade barriers, develop

requires investments to reduce inefficiencies in the trade within the African continent.

The three-day event, which concluded on Thursday (6 October), comprised of a youth symposium, roundtable sideevents with various stakeholders including the media, and private sector open plenaries, focusing on key drivers of trade, investment, and sustainability.

On the first day, the key focus area was on engaging the youth to contribute towards tangible solutions for alleviating youth unemployment, further fuelling entrepreneurship. This culminated in plenaries with the private sector that focussed on the youth being key drivers of trade, investment, and sustainability.

The second day involved intense discussions about the value of building individual country brands on the continent in a way that promotes a united Africa proposition. This will encourage cohesiveness in the way Africa presents itself to the world and drive further investment amongst nations.

A demonstration of this was the support and attendance to the event by similar nation brand building organisations from Kenya, Botswana, and Namibia amongst others.

nation full of opportunities, through the lens of hope, despite all the challenges.

Ms Thembi Siweya, Deputy Minister in the Presidency, through a recorded video message, emphasised the progress being made on South Africa’s economic renewal and rebuilding.

“Strengthening our economy through engagements and dialogue such as the Nation Brand Forum, builds on the potential that already exists and reinforces public and private partnerships, which are key to overcoming our socio-economic challenges as a country,” she said.

African and international corporates Standard Bank, General Electric, Siemens, H&M, and Google stressed the advantages that South Africa has that should be leveraged for the Nation Brand.

These include South Africa’s good labour arbitrage, its youth’s entrepreneurial flair, as well as its diversities such as straddling two markets: the emerging and established ones, which make it a perfect breeding ground for training global corporate leaders.

Mr Jose Filipe Torres, CEO of the renowned Spanish international branding agency Bloom, affirmed Brand SA’s steadfast efforts and achievements in presenting South Africa to the world. “Keep up the good work and now move the brand a step further, by developing

one central positioning message for South Africa by using the country’s digital footprints to further excel the nation.”

Resolutely against the three days being yet another ‘talk shop’, the event lived up to its resolution of tabling and encouraging inclusive partnerships with the private sector to further grow the economy.

“Action is critical after meetings like these, which means there must be follow up to what we say. And one of the ways to do this is to continue to improve on our credibility as a country, because when Africa is organised, it’s easier to do business with from an international perspective,” said Nyimpini Mabunda, CEO of General Electric Southern Africa.

Other key take outs from the event were the critical role the SMME sector has to play in this economic, social, and environmental equation. Expanding on this is the importance of unlocking Environmental and Social Governance (ESG) opportunities for small businesses.

“In forging forward to grow our economy, doing so in a sustainable way that protects the environment is something we have to keep top of mind; this together with mindfully practicing inclusivity of all levels of our economy and not just the big corporates,” Ms Ntombela concluded.

Vodafone Ghana, in collaboration with the Ghana Education Service, has held the first Science, Technology, Engineering, and Mathematics (STEM) Teachers Awards to recognise exceptional STEM educators across Ghana’s sixteen regions.

The award ceremony was held over the weekend at the Academic City University College in Haatso, Accra, and brought together STEM education instructors, the STEM Education Unit of the Ghana Education Service, and other education sector stakeholders.

The teachers were given awards in categories like the Digital Choice Award, the Overall Best in JHS STEM education, the Overall Best in SHS STEM education, and the Dasebre Special Needs Awards.

Eric Asomani Asante, a science and ICT teacher at the Naylor SDA Basic School in Tema, Greater Accra, was named the Overall STEM Teacher of the Year. Mr. Asante was presented with a laptop, a certificate, a plaque, and a Vodafone

Ghana data subscription for one year. As the overall winner, he was also appointed the Vodafone Instant Schools Platform’s ambassador.

Solomon Nchor from the Obuasi Senior High School in Kumasi was named the category’s first runner-up, while Ditamina Gambil Emmanuel from the Kongo Junior High School in the Upper East region was named the category’s second runner-up.

The first runner-up received a certificate, a plaque, a tablet, and a modem with a free data subscription for six months, while the second runner-up received a certificate, a plaque, a tablet, and a modem with a free data subscription for three months.

Rev. Amaris Nana Adjei Perbi, the head of the Vodafone Ghana Foundation, told the media that the teachers were rewarded based on an inclusive and rigorous procedure that guaranteed no teacher in any of the regions was left out.

“Vodafone Ghana Foundation, with the support of the Ghana

Education Service, combed through all the 16 regions of Ghana to reach all teachers in STEM. It will interest you to know that the process was very exciting and rigorous. We went to every corner of the country and we made sure that, through our Instant Schools platform, we engaged with these teachers to ensure they were giving out the best to their students. And today, we climaxed everything with this awards event here at Academic City University College. This event was also to round up the celebration of World Teachers’ Day and World Teachers’ Week happening across the world.”

“Also, Vodafone Ghana Foundation is also joining Vodafone Ghana in the big picture of celebrating care month. This ties in with the theme of rewarding impactful service,” he explained.

On her part, Mrs. Olivia Serwaa Opare, who is the Director of Science Education at GES, said that Vodafone Ghana’s initiative is very commendable and has brought

attention to the great work that STEM teachers in Ghana undertake.

“I am excited and grateful to Vodafone Ghana for this initiative and for the vision that they have for the Ghana Education Service. Many thanks to Rev. Amaris, his team, and the board. I am also thankful to our own Director-General of the GES, Professor Kwasi Opoku Amankwah and the Deputy Director-General, Dr. Kwabena Bempah Tandoh, for openly accepting the vision that the Vodafone Ghana Foundation had.”

Eric Asomani, the overall winner of the awards, talked to the media about how happy he was to win and why he thought he deserved to win.

He said: “It is a challenge in Ghana for ICT teachers to teach certain internet-related topics because most of our schools do not have internet connectivity or computer labs. But I have been able to design a static website which enables me to teach all the internet-related topics, and I have shared it with thousands of teachers I have trained in scratch coding and HTML coding.”

The 19th edition of the esteemed Ghana Club 100 awards is set to take place on Friday, 14th of October, 2022, at the Kempinski Gold Coast Hotel in Accra.

Under the theme “Ghana’s Private Sector, a Catalyst for Post-Pandemic EconomicTransformation”, this year’s event will see outstanding Ghanaian companies ranked and honored, for standing the test of time, and making an impact in their respective industries.

Honors will be given to top 100 enterprises in strategic sectors such as; agriculture and agribusiness, financial services, ICT, infrastructure, petroleum, mining services, manufacturing, tourism, health and education.

The 18th edition of this event, which was held in 2019, saw telecommunication giant, MTN adjudged the best company in the country. This was followed by Kosmos Energy, GOIL, and Sunon Asogli Power Ltd, who were second, third and fourth respectively.

Coming back from the twoyear COVID-19 induced break, the 19th edition of the GC 100 awards promises to be exciting, as it will continually provide incentives for top performers across industries, and promote an open information culture within the Ghanaian corporate sector.

The companies to be celebrated on the night “were selected, after

being subjected to a rigorous screening exercise, and ranked based on their size, growth, profitability, and corporate social responsibility” the CEO of GIPC, Mr. Yofi Grant has noted. He added that, these firms, in spite of the global crises, have performed plausibly, and deserved recommendations.

This year’s GC 100 event will comprise three enthralling sessions. First is the Executive Networking Cocktail Session where the club members and other high-level business executives can network and deepen business relations. This will be followed by the Main event where businesses that have been ranked will receive

the prestigious honors.

Thereafter, the night will be capped off with postevent celebrations, which will be a semiformal session for participants to celebrate/party after a successful awards night.

To participate in the event; interested persons can purchase their tickets now at veetickets. com, or via the USSD short code; *365*2100#. Alternatively, one can Call 0244670301/0247600860 to RSVP.

All persons are encouraged to join, as Ghana’s business leaders are celebrated, for their immense contribution to the country’s growth.

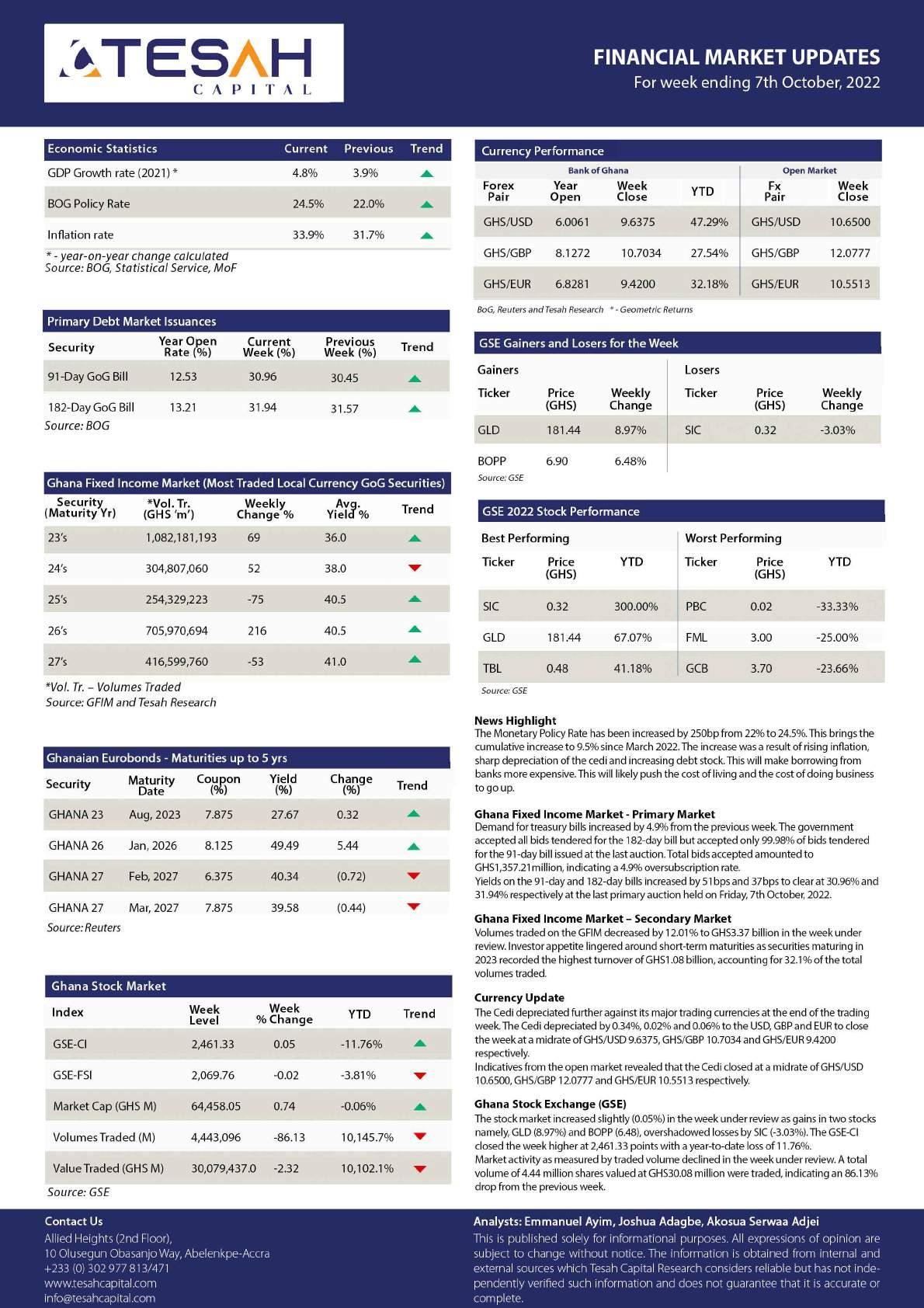

Q3, 2021 GDP Growth 4.8%

Average GDP Growth for 2021 4.1%

2022 Projected GDP Growth 3.7%

BoG Policy Rate 24.50%

Weekly Interbank Interest Rate 22.36%

Inflation for February, 2022 33.9%

End Period Inflation Target – 2022 28.5%

Budget Deficit (% GDP) – Dec, 2021 6.4%

2022 Budget Deficit Target (%GDP) 6.6%

Public Debt (billion GH¢) – Dec, 2021 402.4%

Debt to GDP Ratio – Dec, 2021 68.0%

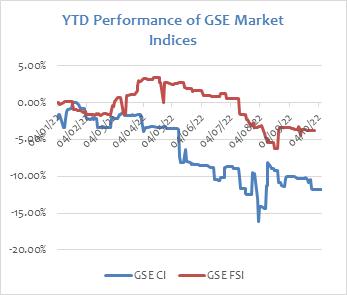

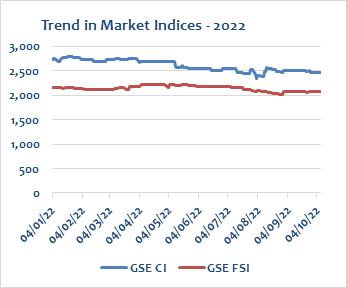

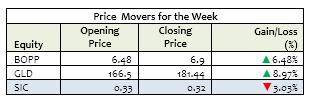

The Ghana Stock Exchange closed higher for the week following four consecutive weekly declines on the back of price increases by 2 counters. The GSE Composite Index (GSE CI) gained 1.21 points (0.05%) to close at 2,461.33 points, reflecting year-to-date (YTD) loss of 11.76%. The GSE Financial Stocks Index (GSE FI), on the other hand, lost 0.34 points (-0.02%) to close at 2,069.76 points, reflecting YTD loss of 3.81%.

Market capitalization increased by 0.74% to close the week at GH¢64,458.05 million, from GH¢63,985.81 million at the close of the previous week. This reflects a YTD decrease of 0.06%.

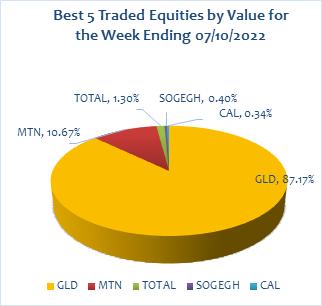

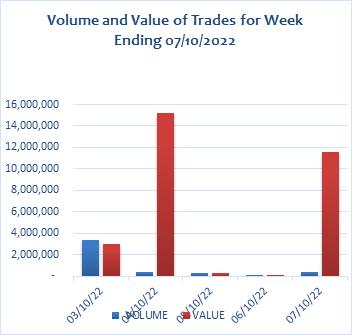

Trading activity recorded a total of 4,443,096 shares valued at GH¢30,079,436.97 changing hands, compared with 32,024,328 shares, valued at GH¢30,794,565.98 in the preceding week.

MTN dominated volume of trades whiles New Gold dominated value of trades for the week, accounting for 82.05% and 87.17% of shares traded respectively.

The market ended the week with 2 advancers and a decliner as indicated on the table below.

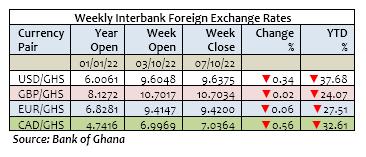

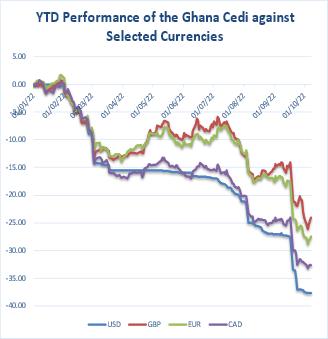

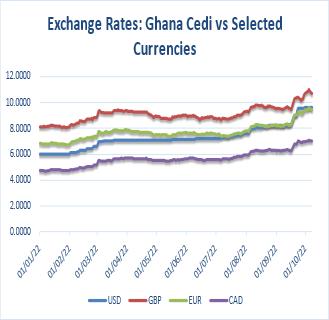

The Cedi weakened against the USD for the week. It traded at GH¢9.6375/$, compared with GH¢9.6048/$ at week open, reflecting w/w and YTD depreciations of 0.66% and 37.47% respectively. This compares with YTD depreciation of 1.85% a year ago.

The Cedi also weakened against the GBP for the week. It traded at GH¢10.7034/£, compared with GH¢10.7017/£ at week open, reflecting w/w and YTD depreciations of 0.02% and 24.07% respectively. This compares with YTD depreciation of 1.68% a year ago.

The Cedi continued its downward trend against the Euro for the week. It traded at GH¢9.4200/€, compared with GH¢9.4147/€ at week open, reflecting w/w and YTD depreciations of 0.06% and 27.51% respectively. This compares with YTD appreciation of 3.98% a year ago.

The Cedi again weakened against the Canadian Dollar for the week. It opened at GH¢6.9969/C$ but closed at GH¢7.0364/C$, reflecting w/w and YTD depreciations of 0.56% and 32.61% respectively. This compares with YTD depreciation of 3.83% a year ago.

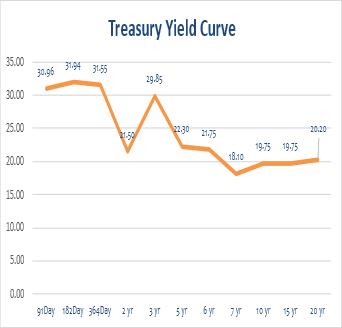

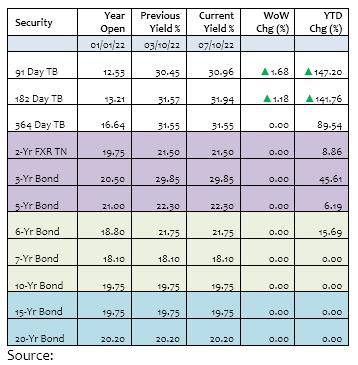

Government raised a sum of GH¢ 1,357.21 million for the week across the 91-Day and 182-Day Treasury Bills. This compared with GH¢ 999.86 million raised in the previous week.

The 91-Day Bill settled at 30.96% p.a from 30.45% p.a. last week whilst the 182-Day Bill settled at 31.94% p.a from 31.57% p.a. last week. The table and graph below highlight primary market yields at close of the week.

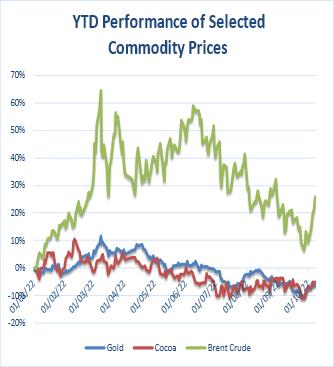

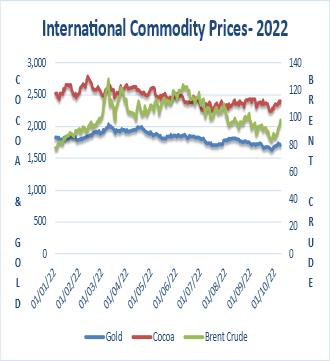

Oil futures rose to five-week highs for the week following an announcement by OPEC+ on Wednesday to cut output by 2 million barrels per day (bpd). Brent futures traded at US$97.92 a barrel on Friday, compared to US$85.14 at week open. This reflects w/w and YTD appreciations of 15.01% and 25.89% respectively.

Gold slid on Friday but still posted a second straight weekly gain as an upward run in the first two days of the week helped the long crowd in bullion weather a robust U.S. jobs report for September that strengthened the dollar. Gold settled at US$1,709.30, from US$1,684.90 last week, reflecting w/w gain and YTD loss of 1.45% and 6.52% respectively.

Prices of Cocoa increased for the week. The commodity traded at US$2,396.00 per tonne on Friday, from US$2,354.00 last week, reflecting w/w gain and YTD loss of 1.78% and 4.92% respectively.

CIDAN Investments Limited is an investment and fund management company licensed by the Securities & Exchange Commission (SEC) and the National Pensions Regulatory Authority (NPRA).

Name: Ernest Tannor

Email:etannor@cidaninvestments.com

Tel:+233 (0) 20 881 8957

Name: Audrey Asiedua Wiafe Email:aaudrey@cidaninvestments.com

Tel:+233 (0) 57 840 2700

Name: Moses Nana Osei-Yeboah Email:moyeboah@cidaninvestments.com

Tel:+233 (0) 24 499 0069

CIDAN Investments Limited CIDAN House

Plot No. 169 Block 6 Haatso, North Legon – Accra

Tel: +233 (0) 26171 7001/ 26 300 3917

Fax: +233 (0)30 254 4351 Email: info@cidaninvestmens.com Website: www.cidaninvestments.com

The contents of this report have been prepared to provide you with general information only. Information provided on and available from this report does not constitute any investment recommendation. The information contained herein has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed.

Copyright @ 2019 Business24 Limited. All Rights Reserved.

Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed. We value your support and loyalty.

Contact: editor@business24.com.gh Newsroom: 030 296 5315

Advertising / Sales: +233 24 212 2742

Deadweight Debt: A debt incurred, normally by a government rather than by an individual, as a result of borrowing, not secured by the purchase of an enduring asset, to meet current needs.

Source: https://finansleksikon.no/en/eng-finance/d/ deadweight-debt

Waste management giant, Zoomlion Ghana Limited, is donating handwashing items to schools.

The donation forms part of Zoomlion’s activities to commemorate Global Handwashing Day (GHD), which is celebrated annually on October 15th. The theme for GHD 2022 is “Unite for Universal Hand Hygiene.”

The Global Handwashing Day is an advocacy day dedicated to increasing awareness and understanding of the significance of handwashing with soap as an effective tool to prevent diseases and save lives.

The items included 150 Veronica buckets, 300 paper towels, 50 waste bins, 50 gallons of handwashing soap and 300 hand sanitizers.

The presentation was done by

the Director of Communications and Corporate Affairs of Zoomlion Ghana Limited, Ms. Adwoa Appiah Osei Duah, who was accompanied by the Coordinator of Zoomlion Foundation Thomas Narh Korley.

Speaking to the media on the sidelines of the ceremony, Ms. Appiah Osei Duah explained that Global Handwashing Day is relevant as handwashing among children formed the basis of hygiene, hence awareness must be increased, especially among children.

She said the items from Zoomlion were to aid in effective handwashing among school children, adding that the theme for the celebration was appropriate.

“The onset of Covid-19 taught us a lesson on handwashing; a practice that should be made

part of an individual’s life,” she advised.

She, therefore, encouraged Ghanaians to make handwashing a regular activity.

This year’s Global Handwashing Day will fall on Saturday, October 15, a reason Zoomlion chose to commemorate the Day with LaNkwantanang GES on Thursday, October 13, in order to meet and interact with the Zoomkids of Ayi Mensah Basic School in the La Nkwantanang Madina-Municipal Assembly (LaNMMA) in the Greater Accra Region.

The Municipal Director of Education, La Nkwantanang Madina-Municipal Assembly, Mr. Kean Adjei Appiah, who received the donations on behalf of Madina schools, thanked Zoomlion for the gesture, and assured that the items will serve their intended

purpose.

He indicated that handwashing has enormous health benefits, stating that the day was established by health authorities against the backdrop that diligent washing of hands with soap under running water has positive impact on lives.

According to him, diarrhoea has been reduced by 30%, acute respiratory infections by 20% and the transmission of outbreak-related pathogens such as cholera, Ebola, SARS and Covid-19 amongst others have largely been reduced, all because of handwashing during the Covid period.

He, therefore, implored parents to assist head teachers to instill hand washing discipline in children.