GCB DMD calls for flexible loans for

By Eugene Davis

By Eugene Davis

By Eugene

By Eugene Davis

By Eugene Davis

By Eugene

By Eugene Davis

By Eugene Davis

By Eugene

By Eugene Davis

By Eugene Davis

By Eugene

The Deputy Managing Director, Finance of GCB Bank PLC, Socrates Afram has called for more flexible terms in granting credit to businesses by financial institutions during these turbulent times in order to support and sustain these firms.

GCB Bank PLC was named the tenth best performing company/ bank at the 19TH Ghana Club 100 Awards ceremony in Accra on Friday.

Speaking with the press after the bank picked up the awards, Mr.Afram said “ The key for us is that in these difficult times, can we still see opportunities, are there businesses we can pick and support.

I must say that generally this is not the time for any financial institutions to be very aggressive and bullish on granting credit but in the midst of this

challenge, there are still pockets of opportunities, it is up to us working with our customers to identify those opportunities and help so that we can all go through this seamlessly without disturbing the stability of the bank so that when things normalise we can come back and do greater things.”

The GCB Bank PLC is poised to build a resilient bank and

identify opportunities to support Ghanaians and businesses, Mr. Afram noted.

“It is not so much about the position but about building a sustainable brand that can support Ghanaians, businesses and individuals to achieve their financial objectives.

For us the recognition of the fact that we have shown profit, we have grown, we are committed to CSR, those are the things that matter to us.

In terms of operations, I have said it about sustainability, we are going through turbulent times and as bank, our focus today is how do we build a resilient bank that will survive and go beyond these turbulent times so that we can continue to play our part as the biggest financial institution in the country so support Ghanaians, businesses.”

The Country Director of Google South Africa, Dr. Alistair Mokoena, says the company’s US$1bn investment over the next five years on the African continent is a testament that multinationals have confidence in Africa’s growth.

The tech company has already announced a $1 bn in Africa over the next five years to ensure access to fast and cheaper internet and will back startups to support the continent’s digital transformation.

The company would be targeting among others, startups focusing on fintech, e-commerce and local language content.

Speaking to Business24 on the sidelines of this year’s Annual Nation Brand Forum at the Sandton Convention Centre in Johannesburg, South Africa, Dr. Mokoena said “what we have done through our announcement of a billion dollars across Africa over the next five years is that we have given the nod to Africa’s business opportunity to Africa’s viability as an investment

opportunity that sends signals that big multinationals have confidence in Africa’s growth.”

Africa has 1.2billion inhabitants and only just over 300million are on the internet, Dr.Mokoena revealed, “so there is still a long way to go in terms of ensuring there is inclusive growth, broad access to the internet by every African.

So, what we will do with this investment is that we will bring faster, cheaper, reliable internet access to the continent.”

According to him, the initiative from Brand South Africa with a mandate of nation branding, driving investment into the country and boosting tourism all aligns with Google’s plans to foster partnerships and collaborations on the continent.

He disclosed that the company has constructed a subsea cable that has landed in Togo,Nigeria,Namibia and recently in Cape Town aimed at connecting the continent.

The company has also announced the establishment

of Google Cloud region bringing cloud services closer to the continent, which would be connected by four interconnect sites in Lagos, Niarobi,Cape Town and Johannesburg, giving the continent full scale cloud capability.

Further, Dr.Mokoena explained that user experience on the internet is determined by internet access, speed, bandwidth, capacity and cloud is a big storage enabler.

“With e-commerce, fintech growing on the continent.

All these developers on the continent trying to create jobs rely on this infrastructure spend and also, we know that Africa’s economy is driven by entrepreneurs and small businesses that is why we have launched the Africa Investment Fund [US$50m] to power small businesses across the continent.”

The Commercial Manager of Zeepay Limited, Dede Afriyie Quarshie, has underpinned the company’s success at this year’s Ghana Club 100 Awards to the ingenuity of the Chief Executive Officer, Andrew Takyi-Appiah, adding that the company has set sights on taking over the fintech and mobile money space beyond Ghana.

Zeepay Ghana Limited was adjudged the number one company in Ghana, at the 19TH Club 100 Awards at the plush Kempinski Gold Coast Hotels in Accra.

Zeepay Ghana, a financial technology (FinTech) company came tops as the outstanding company in the country after it beat ninety-nine (99) companies enlisted in the 19th edition of the Ghana Club 100 awards scheme.

Speaking to the media after the event, Mr. Quarshie stated that “ Post covid and onset of the Ukraine/Russian war, we have stood tall, it is a proud moment

for us.

It is the fortitude of the people of the company, thank you to the people of the company for their hardwork, today this is the reward, it is really down to the staff and the ingenuity of our CEO especially.

I think we are taking over the fintech industry, mobile money space, I think not just in Ghana but across the continent as well.”

Zeepay is the fastest growing fintech focusing on digital rails to connect digital assets such as mobile money Wallets, Cards, ATMs, Bank Account and Digital Tokens to International Money Transfer Operators, Payments, Subscriptions, International

Airtime and Refugee payments.

The company last month announced that it has raised $10 million.

The medium-term debt raise, which forms part of its A.5 series, comes to support Zeepay in a bid to augment its fast growing remittance to wallet business. The raise was led by Symbiotics BV with USD 9 million and

supported by a Mauritius-based fund with USD 1M totalling USD 10 Million.

According to management the raise was necessary and comes at the time when Zeepay is planning to increase our annual turnover from USD 1.5 billion circa 2021 to USD 200 billion over the next 5 years.

The Senior Advisor to the President, Yaw Osafo-Maafo, has disclosed that government is not oblivious of the current economic challenges and is working tirelessly to turn the corner.

Speaking on behalf of the president [Nana Akufo-Addo] at this year’s Ghana Club 100 Awards ceremony in Accra on Friday, he said “We will continue to do everything in our power to ensure that the private sector flourishes. Government is aware of the issues besetting the private sector and is working assiduously to change the tides of this economic downturn.”

He also indicated that government believes in the private sector in helping to transform the economy post pandemic and the effects of the Russian -Ukraine war.

According to him, a number of options are being considered including the current negotiation with the IMF to ameliorate the suffering of businesses and the Ghanaian in general.

“We believe in developing the economy based on the shoulders

of the private sector, we believe in the economy that is led by the private sector, growth must be led by the private sector.

Although it is our responsible to facilitate and maintain an environment that is condusive to conducting businesses with ease, government is not reneging on that, hence the roll out of Ghana Covid-19 Alleviation and Revitalisation and Enterprises Support, Ghana Cares Obaatanpa programme has the ambition of raising about 70percent of the targeted 100m from the private sector to mitigate the impact of covid-19 pandemic and return the country to a sustained path of robust growth.”

He acknowledged that the country is at a crossroad and the world economy has been badly affected by the Russian-Ukraine war, with the two unrelated episodes having affected the fortunes of the entire world adversely.

“it is important to recognize

interest rate and increasing utility tariffs are taking a toll on businesses in this country. Government is not oblivious of your challenges and is working hard to stem the tide of this adverse macroeconomic difficulty.”

He added that the revitalization and transformation phase from 2021 to 2023 aims at embracing the productive sectors of the economy via competitive import substitution and economic diversification.

The CEO of Ghana Investment Promotion Centre (GIPC), Yofi Grant, in his remarks at the event stated that the country is spearheading Africa’s economic and political emancipation, with

government poised to provide the private sector the necessary support to” growth from strength to strength.”

He also added that the private sector, the most important contributor to GDP and employment in the Ghanaian economy has been resilient and is the engine of the country’s post pandemic recovery.

“It behooves on us all, herein gathered, to accelerate that recovery with innovations and the interventions that have been implemented thus far.

Occasions like this one (GC 100),whiles setting a high standard for corporate excellence, have an added importance of creating the right avenue for us to encourage the private sector and to redouble efforts in building a more resilient economy.”

Trade Minister, Alan Kwadwo Kyeremanten, visited the Sentuo Oil Refinery Limited located in the Tema Heavy Industrial Area to ascertain the status of work in the development of a 5 million tons/year refining project to better meet the needs of the local market.

The project falls part of the ministry’s industrial

transformation agenda in developing new strategic anchor industries aimed at diversifying the Ghanaian economy beyond cocoa and gold.

The operationalization of this and many such companies are part of efforts by the government to dampen the demand for foreign exchange for imports and grow our gross domestic product.

The three-day football scouting tournament organised by Africa 1 Media and sponsored by FBNBank has successfully ended with coaches and scouts discovering exciting football talents across age categories U-15 and U-17 at the Ajax Park on the University of Ghana campus in Accra.

The Football scouting tournament, which was aimed at unearthing football talents brought together youth and development football scouts and agents from Europe including representatives from Arsenal F.C. and West Ham F.C. Some former Black Stars players like Tony Baffoe, Samuel Osei-Kuffuor and Yussif Chibsah were also Patrons of the tournament with FIFA High Performance Specialist, AbdulFaisal Chibsah providing the technical support.

The tournament featured a player education panel discussion on topics like the importance of education in sports, sports nutrition, how to train effectively as a player after games, how to manage your earnings as a player, the footballer and the law and what

it takes to become a professional.

F.C. Raisa won the under-17 tournament and Sondisco F.C. won the under-15 tournament. An under 19 exhibition match between F.C. Raisa and Taking Over F.C. was won by F.C. Raisa.

At the end of the tournament, about 12 talents were selected from different clubs who will go on to be nurtured and coached to achieve greater heights in their football profession.

In a statement released by Africa 1 Sport after the tournament, the organisers said “this initiative sought to unearth football talents and to equip them with the requisite skills and knowledge in order to make them competitive on the world stage. Ghana abounds in football talent which, if harnessed properly, will offer yet another channel for our youth to get onto a more secure path for their future. We at Africa1 believe that we are on the right track to offer a great opportunity for our youth and are grateful that our partners including FBNBank also believe in what we are doing to the point where they have shown

equal commitment. This maiden event has been very successful and we are encouraged that it can get better. We look forward to an even greater support in the years ahead particularly because we aim to give each region in Ghana an opportunity to host a tournament and for the youth there to have an equal chance of being scouted.”

For FBNBank the tournament was an opportunity to deliver on the Bank’s commitment to support the youth of Ghana to secure a better future. This is in line with FBNBank’s declaration last January that “2022 is the Year of the Youth.”

According to FBNBank Managing Director and Chief Executive Officer, Mr. Victor Yaw Asante, “FBNBank is keen to see a focused and well-prepared youth take on what the future holds for them. We are therefore very committed to contributing to make that expectation possible as it bodes well for the country’s development. Our partnership with the Football Scouting Tournament is one of the ways

FBNBank is supporting the youth in their preparation for the future and this gives credence to our commitment. FBNBank is convinced that the youth of Ghana have the capabilities to compete with their peers across the globe and it must be a national imperative for all to make this possible. Growing up we knew of talents such as Abedi ‘Pele’ Ayew, Tony Yeboah and recently, Michael Essien and Asamoah Gyan who rose from the age categories. We are not seeing much now but we believe it is necessary that we see more of such players coming out of Ghana onto the world stage. We hope to work closely with Africa 1 Media to ensure that talents are nurtured and given an enabling environment to thrive. As a bank that operates in a country so passionate about the game, we want to ensure that our partnership will be the right ingredient to maintain and perhaps grow the love Ghanaians, our stakeholder, have for football.”

FBNBank has in its 26 years of operating in Ghana remained focused on putting its customers and communities first. This, it has sought to do through the rich value and excellence of what the Bank contributes to the relationship with its stakeholders as a whole, particularly the customers. FBNBank Ghana is a member of the First Bank of Nigeria Limited Group which is renowned for its great customer service and general stakeholder engagement garnered over its 128 years of operation. FBNBank Ghana has 25 branches and two agencies across the country with over 500 staff. FBNBank offers universal banking services to individuals and businesses in

Hon. Kwaku Ofori Asiamah, has urged the International Maritime Organization (IMO) to provide full support to the players in the maritime industry to achieve a safer, more secure and greener industry.

According to him, of utmost importance to the shipping industry are more innovative measures designed by the IMO to ensure that global standards are implemented uniformly considering the fact that member states are at varying stages of socioeconomic development and are tackling varying developmental issues and priorities at varying times.

He argued that the implementation of the IMO technical cooperation activities, including the Integrated Technical Cooperation Programme (ITCP), designed to assist developing countries to improve their technical expertise in accordance with IMO’s global mandate to promote safe, secure, environmentally sound, efficient and sustainable shipping, is a very

would bring the member states to speed in reaching the global level that all are craving for.

“It is imperative that the IMO achieves harmonization by implementing global standards uniformly across the different jurisdictions. The shipping industry is dynamic, and the growing demand for measures towards ensuring a safer, more secure and greener industry is justified in every sense. No member should be left behind as that would not aid in achieving the global mandate of promoting safe, secure and greener shipping. It is essential that we all move along”, he noted.

Hon. Asiamah made this observation on Wednesday, October 12, 2022, when he was contributing to a panel discussion on the occasion of the International Maritime Organization World Maritime Day Parallel Event held at Durban ICC in Ethekwini, South Africa.

His comment was in reaction to what the IMO could do more to promote its Integrated Technical

(ITCP), enhance its financial sustainability and also increase the representation of African countries.

The theme for this year’s World Maritime Day Parallel Event is “New Technologies for greener shipping” which calls for the global family of nations to take action on decarbonization of shipping and ports through the use of zero or low carbon technologies, fuels and infrastructure.

Speaking on the financial sustainability of the IMO, Hon. Asiamah urged the IMO to ensure the continued financial viability of the ITCP through core funding via the Technical Cooperation (TC) Fund and access to external and in-kind support.

He encouraged member states to honour their financial commitments to the Technical Cooperation Fund, and also provide financial and in-kind support to the ITCP through bilateral arrangements.

Further to that, he urged member states to co-operate with the IMO in the development

and execution of resource mobilization campaigns.

The South Africa Minister of Transport, Fikile Mbalula, in his keynote address urged players in the maritime business to be proactive in coming up with mitigation measures in dealing with greenhouse gas emissions from ships which is projected to increase from the current 3% to 250% by 2050 because future demand of cargo would be carried by international ships.

He told the gathering that South Africa has expressed commitments in various multilateral platforms of its intent to decarbonize its economic sectors that are currently reliant on fossil fuel for energy.

“This is on the basis that there is a just transition which considers the socio-economic factors of the country and her people. We believe that the abundance of renewable energy potential can accelerate the development of greener technologies and alternative fuels in order to meet the demand of supplying bunker to ships at our ports,” he noted.

Britain’s finance minister Kwasi Kwarteng has been sacked after less than six weeks in the job, the BBC reported on Friday, as the government’s massive tax cuts sparked financial market turmoil.

Kwarteng is no longer chancellor of the exchequer, the BBC said. The Times newspaper reported earlier that Kwarteng was expected to be sacked.

His sacking makes Kwarteng Britain’s shortest serving chancellor since 1970, and his successor would be the UK’s fourth finance minister in as many months as the nation grapples with a cost-of-living crisis.

The United Kingdom’s new prime minister, Liz Truss, is turning the page on selfdestructive populism. Meanwhile, the United States continues to wallow in it. If she can navigate her premiership through its current choppy waters and into calmer seas, she might end up providing a model that American conservatives could follow.

The story begins with the 2008 global financial crisis, which created so much slack in US labor markets that inflation-adjusted wages fell for the bottom half of workers for several years running. Not until 2015 did real median wages recover to their 2007 level, and not until 2016 did real wages for the bottom 20th percentile recover.

As typically happens, these economic ramifications from the crisis led to a surge in populism in the US. On the left, democratic socialists like Senator Bernie Sanders of Vermont took out pitchforks for the rich, declaring that “there should be no billionaires.” And on the right, Donald Trump ran for the presidency as a nationalist populist and won, defeating a candidate who was closely associated with “the establishment.”

The UK also had a populist episode during this period. A chief motivation for Brexit – the decision to leave the European Union following an in-or-out referendum in June 2016 – was to protect the typical British household from the purported ill effects of globalization and immigration.

Though Truss enthusiastically campaigned against Brexit in 2016, she supported the referendum’s

outcome, quickly accepting the electorate’s decision. But despite Truss’s pro-Brexit stance, she is moving British politics beyond populism in several important respects, providing a model that US politicians – particularly those on the right – should follow.

As the prime minister told the Conservative Party conference in early October, “I have three priorities for our economy: growth, growth, and growth.”

This stands in stark contrast to Republican Senator Josh Hawley of Missouri, who offers a populist lament aimed at the working class. Sure, “growth is important,” Hawley allows. But in the US “we don’t make things here anymore – at least, not the kinds of things a normal person without a fancy degree can build with his hands.”

According to Hawley, “above all we must get good work for the American people.”

The problem, of course, is that slow growth breeds the kind of distributional conflicts on which populism thrives. It is no surprise that American populists, who exploit such conflicts, tend to prioritize cultural goals and identity politics over growth.

One of populism’s most corrosive features is that it treats people as helpless victims. In accepting the Republican Party’s nomination for president in 2016, Trump declared that he entered politics “so that the powerful can no longer beat up on people who cannot defend themselves.” And in the same speech, he indulged authoritarianism: “I alone can fix it.” Similarly, on the political left, Democratic Senator Elizabeth Warren of Massachusetts has long argued that “the game is rigged” against typical Americans.1

If you feel that you lack agency and are the victim of a rigged system, you will conclude that you aren’t responsible for your economic circumstances. You may seek recourse through grievance.

In her Tory conference speech, Truss sent a very different message, telling Britons that if they take responsibility and aspire, they can better their economic circumstances. She identified as “heroes” those who “take responsibility and aspire to a better life for themselves and their family,” and she declared herself to be “pro-aspiration and pro-enterprise.”

One of the ugliest aspects of right-wing populism has been its tendency to demonize immigrants. In launching his 2016 campaign, Trump famously claimed that Mexican immigrants are “bringing drugs, they’re bringing crime, they’re rapists.” In contrast, Truss’s first cabinet fight was over her plan to liberalize immigration, which faces resistance from pro-Brexit ministers. She wants to allow more agriculture workers and engineers into the UK, and she is considering an easing of Englishlanguage requirements for foreign workers.1

In the US, populism has led the political right to turn its back not just on immigration but also on trade. Before becoming prime minister, Truss came to prominence as the UK’s trade secretary, when she tried hard to forge a post-Brexit trade agreement with the US. But with Trump in the White House, she ran into a brick wall.

US political leaders should take a page from the prime minister’s

book. The economics of grievance – “grievance-onomics” – is a demonstrable failure. Trump’s trade war reduced manufacturing employment – the opposite of its intended effect. Policies to limit immigration are making it more difficult to ease US labor shortages and boost longterm productivity. The economy isn’t “rigged” against ordinary workers: the link between pay and productivity is strong. People do have agency, and they should have strong aspirations because America is not a class-based society without upward mobility. The American Dream is not dead.1

Of course, it’s premature to declare Truss’s premiership a success. She has been in office for only six weeks, and her economic agenda has gotten off to a rocky start. She has now sacked her chancellor of the exchequer, Kwasi Kwarteng, in an effort restore the confidence of financial markets. She is preparing to revise much of her economic agenda. And she has a lot of work to do to convince Parliament and the British people that her government’s approach to economic policy is sound, both empirically and morally. To succeed, she must get the policies right and implement them competently.

But messages matter, and, looking through the turmoil, Truss is saying the right things. Britons do not need more culture wars; they need growth, dynamism, opportunity, openness, confidence, and a renewed sense of agency and personal responsibility. So do Americans. Conservatives should take note.

StarLife Assurance, a leading life insurance company in Ghana, has presented a cheque of GHC10,000 to a member of the Old Toms (St. Aquinas SHS) 1997 Year Group as first claim payment to its newly introduced ‘My Clique’ life insurance policy.

The StarLife ‘My Clique’ Plan which was launched 3 months ago is a group welfare insurance policy designed for old students’ associations or alumni groups to provide financial compensation to members and their loved ones when unexpected life events occur.

Mr. Emmanuel Glenn Addotey, the beneficiary of the GHC10,000, lost his dad 3 months after the 1997 alumni of St. Aquinas SHS sign-up on the ‘My Clique’ policy when it was launched.

Presenting the cheque to Mr. Glenn Addotey, Mr. Alexander Twumasi, Head of Commercial Business of StarLife Assurance, said:

“My Clique Plan is a novelty in the industry, especially for all alumni groups. We introduced this unique product to minimize the many unscheduled contributions

made by members of old students’ associations when the unexpected such as, total disability, critical illness and the death of member, spouse or parent occur. The good thing about this policy is that the sum assured paid is far bigger as compared to contributions usually made by alumni members”

At StarLife, we will continue to innovate to provide our clients with unique financial security solutions. We urge all alumni groups across the country to get on board the ‘My Clique’ policy to help reduce the financial burden

on members, he added.

Expressing his appreciation to StarLife Assurance for the payment of his claims, Mr. Glenn Addotey, stated that, “when my group signed up for this policy few months ago, I didn’t expect that I would be the first beneficiary. This amount has never been paid before in our group and it has really helped me with expenses of my dad’s funeral. I want to urge all old students’ associations to join this policy without hesitation. I also thank StarLife for being prompt with the payment.”

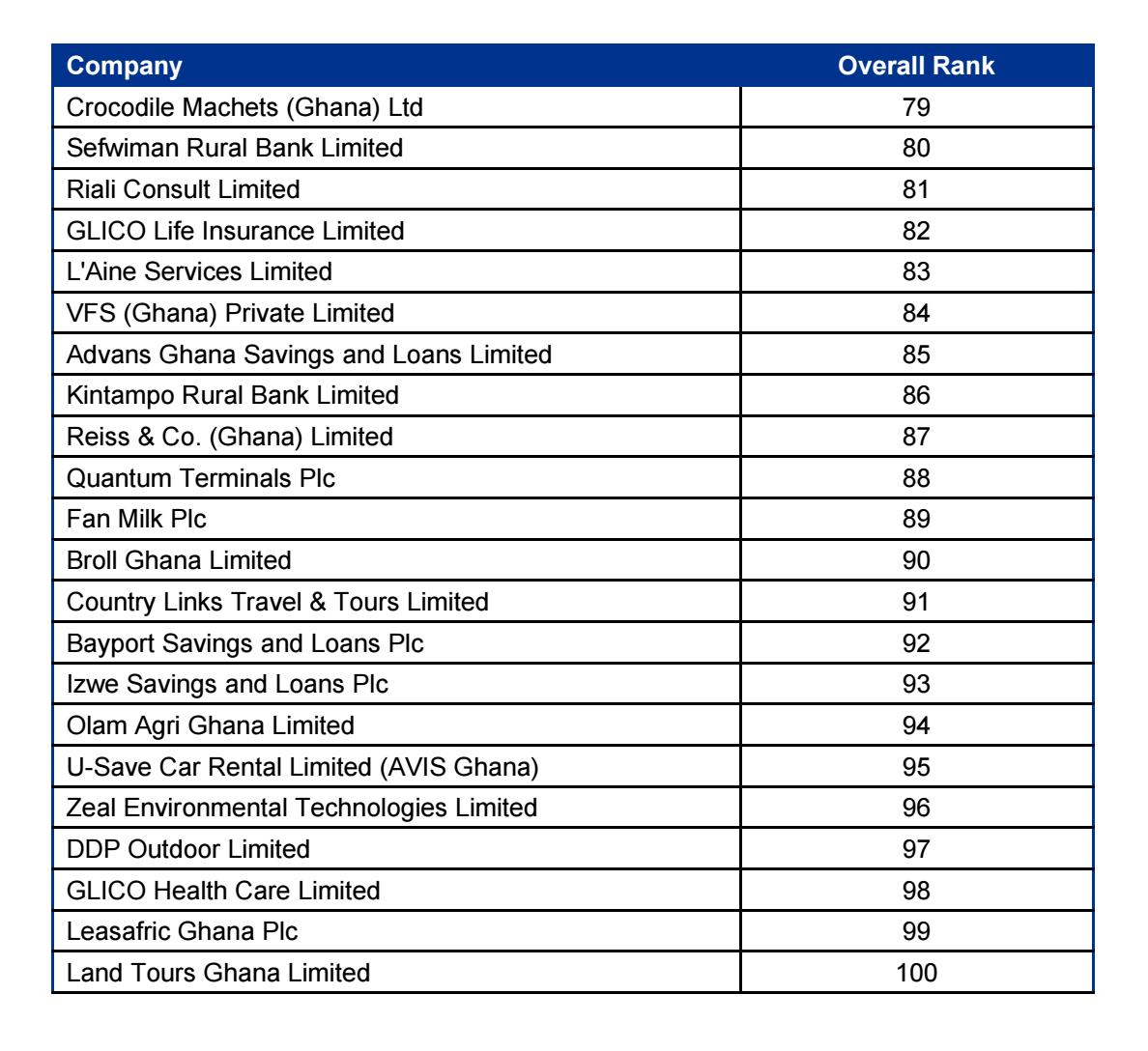

The table

Company

Zeepay Ghana Limited

Newmont Ghana Gold Limited

Multipro Private Ltd

Gold Fields Ghana Limited

Scancom Plc

Maphlix Trust Ghana Limited

Amanex Co.Ltd

IDS Consult Consult Agency Limited

Newmont Golden Ridge Limited

GCB Bank PLc

Savings and Loans Ltd.

EcoBank Ghana Plc

Nestle Ghana Limited

IT Consortium Limited

Polytank (Ghana) Limited

Distribution Limited

Amenfiman Rural Bank Limited

Absa Bank

Abosso Goldfields Limited

Benso Oil Palm Plantation Plc

AngloGold Ashanti Iduapriem Mine

Access Bank (Bank) Plc

Cable and Conductor Limited

Forever Living Product (Ghana) Limited

Wilmar Africa Limited

Delta Paper Mill Company Limited

Trustees Limited

Standard Chartered Bank Ghana Plc

Federated Commodities Limited

Guaranty Trust Bank (Ghana) Limited

Letshego Ghana Savings and Loans Plc

Fidelity Bank Ghana Limited

Zenith Bank (Ghana) Limited

Crop Doctor Ghana Limited

Bank

First Atlantic Bank Limited

Rank

India, like China, takes enormous pride in its civilization’s scale and antiquity – and rightly so. But such pride can also lead to a complacent and sometimes dangerous insularity. Since gaining independence from the British Empire 75 years ago, India has mostly looked inward, focusing on improving the welfare of its population by building a strong democracy and a healthy economy.

China has also focused on domestic reform over the past four decades. But, having transformed its economy, it is now flexing its newly developed muscles throughout the IndoPacific region. Given China’s geopolitical ambitions, India must now look outward and take a leading role in securing regional stability, particularly among its increasingly unstable immediate neighbors.

To the west, Pakistan remains India’s most vexing concern, owing to its nuclear arsenal, unstable governance, and affiliation with terrorist networks that have fueled instability in Afghanistan, as well as Jammu and Kashmir in India. To India’s south, Sri Lanka, its economy in tatters, is once again mired in political chaos (albeit nothing like the bloody civil war that erupted in the 1980s and dragged on until the late 2000s).

To India’s north, an increasingly assertive China has repeatedly – and violently – encroached on Indian territory in the Himalayas,

including Arunachal Pradesh and Ladakh, and along India’s borders with Bhutan and Sikkim. China’s “string of pearls” – a chain of naval bases and commercial projects extending from the Indian Ocean to the Horn of Africa – threatens to give China control of sea lanes crucial to India’s survival.

With its newest “pearl,” the naval base in Pakistan’s Gwadar port, China is now Pakistan’s de facto protector. India’s challenges are compounded by the United States’ risky, if not reckless, attempt to keep the Pakistanis from fully siding with the Chinese by supplying Pakistan with hightech weaponry, such as upgraded F-16 fighter jets.

And then there are the problems to India’s east. Until relatively recently, India’s relations with its eastern neighbors seemed to be headed toward closer security partnerships and deeper economic ties. But Myanmar has since returned to military rule. With deposed leader Aung San Suu Kyi imprisoned and a fledgling resistance movement emerging across the country, Myanmar seems to be on the verge of civil war. Meanwhile, neighboring Laos is in dire financial straits and deeply in debt to China – mostly from building infrastructure projects that benefit the Chinese military far more its own people.

In Malaysia, endemic corruption has hollowed out democratic institutions to such an extent that the conviction and imprisonment of former

prime minister Najib Razak and his wife for looting the country’s treasury look increasingly like a diversionary tactic meant to allow corruption to continue unabated. And Thailand – destabilized by a seemingly unbridgeable political divide – is once again teetering on the edge of a political abyss as it prepares for a contentious election under a new and unpopular constitution next year.

The growing instability within ASEAN countries is a boon for China, allowing the Chinese to increase their influence by manipulating rival factions. For India, however, the region’s political decay poses an everescalating national-security threat. Hundreds of thousands of Rohingya Muslims, for example, fled genocide in Myanmar to neighboring Bangladesh as well as to India itself, leading to heightened social tensions along India’s borders.

India can no longer afford to ignore the growing instability across Southeast Asia and the broader Indo-Pacific. Its vast size is no longer enough to shield it from the gathering storm. While undoubtedly filled with talented people, its foreign service may be large enough for a mid-sized ASEAN country or a minor EU member, not a superpower with a population of 1.4 billion. Given its mounting foreign-policy challenges, India needs experienced and visionary diplomats who can protect its interests and pursue peace and

stability in the Indo-Pacific.

Fortunately, India could soon be closer to achieving this goal. The main opposition party, the Indian National Congress, which has governed India for much of its modern history, is now in the midst of a leadership election. And one of the leading candidates has the skills to address the country’s pressing domestic problems and the stature required to lead India on the global stage.

For decades, Congress has been the fiefdom of the NehruGandhi dynasty. But following two successive general-election defeats, party leader Rahul Gandhi stepped down and left the party’s delegates to choose between two finalists: Mallikarjun Kharge, an 80-year-old former opposition parliamentary leader, and Shashi Tharoor, an acclaimed novelist and historian who has served as under-secretarygeneral of the United Nations and as India’s minister of state for external affairs and human resource development minister.

The result of this leadership contest could have implications for India and for its unstable neighborhood. Congress can either choose continuity and risk losing more elections or vote for Tharoor, the candidate with a vision for restoring India’s economic vitality and the vast diplomatic experience required to meet its domestic, regional, and global challenges. The choice, for Congress and India, is clear.

Chief Executive of Stanbic Bank, Kwamina Asomaning, joined customers of the bank at the Makola Market in Accra as part of activities to commemorate customer service week.

Mr. Asomaning, accompanied by a team from the Tudu branch of the bank, spent time with the traders and store owners to thank them for their loyalty to the bank and discussed ways of improving the two-way relationship.

Speaking during the interaction, Kwamina Asomaning said, “As we celebrate customer service week it is important for us to appreciate our clients who have stuck with us through thick and thin. You are a very important part of what we do at Stanbic Bank, and I am here with my team to personally say a big thank you to our loyal

customers here at the market.”

“We are grateful for partnering with us and trusting that we would grow your money. Today we are not here to sell any product to you. Rather, we are here to thank you for your commitment. If there is any way we can help you grow your business, we are here to listen and lend a helping hand. Thank you for allowing us to help make your dreams possible,” he added.

Kwamina Asomaning added that, “We are in difficult financial times but you our customers have been very patient with us and supported us even as we work with you through this time. We are truly grateful and pledge to continue working hard to put

Mr. Kweku Amoah, CEO of KanKanduro Enterprise thanked Stanbic bank for their customer service and helping his business grow. He said, “I joined Stanbic bank last two years and it is through their support that my business has grown. I was with a different bank before Stanbic but they were not of much help but when I joined Stanbic my business is doing much better. I always recommend them to my colleagues because I know they can help them to. When you go to some places the people talk to you anyhow but at Stanbic they check up on us regularly and they always ready to help us out when we need it. I am happy that their boss has come here today and I

Kwamina Asomaning and the team rewarded the customers for their loyalty with exciting gifts including souvenirs from the bank. The team also took a tour of the Stanbic Tudu branch building. Mr. Asomaning congratulated the staff of the bank for their excellent customer service and encouraged them to continue their hard work and continue to push the brand promise of making dreams possible.

This year, Stanbic Bank celebrates customer service week under the theme “Service the Stanbic Way”. The bank has outlined a number of activities for the entire month of October, targeted at celebrating their loyal customers for their support and also members of staff for their

By Diane Coyle

By Diane Coyle

What is the government’s proper role in an advanced market economy? That is the fundamental question at the heart of the economic debacle in the United Kingdom. So far, the focus has been on Prime Minister Liz Truss’s disastrous macroeconomic judgment and the (entirely understandable) reaction of financial markets to her fiscal plan. But Truss and her Chancellor of the Exchequer, Kwasi Kwarteng, got one thing right: the UK’s core problem is that long-term growth has ground to a halt.

Few would disagree with Truss and Kwarteng’s diagnosis of the UK’s economic challenges. The current confluence of global crises has exposed the country’s chronically low growth rate and flat-lining productivity. But their proposed remedy – cutting taxes for the rich and undoing economic regulations, thereby unleashing innovation and investment – turned out to be a harder sell. Even financial-market traders (hardly statist left-wingers) do not believe in Truss’s vision of a twenty-first-century Hayekian utopia.

When courting rank-and-file Conservative Party members in the contest to replace Boris Johnson, Truss presented herself as Margaret Thatcher redux, copying not only the Iron Lady’s radical right-wing policies but many of her outfits and photo ops. But unlike Thatcher, who

was elected in 1979 with a popular mandate and ample political capital, Truss became prime minister by winning over 81,326 Conservative Party members – just 21,000 votes more than her rival, Rishi Sunak. The wider British public remained on the sidelines.

Thatcher also commanded a vastly different economy than the one Truss was handed. Unlike the highly inefficient and relatively high-tax economy that Thatcher inherited, today’s UK economy is already relatively lightly taxed and regulated, limiting policymakers’ scope to cut taxes or deregulate. Moreover, there is no clear correlation across countries between the government’s share in the economy and GDP growth. Considering that the UK economy is still less productive than its peers after decades of tax cuts and deregulation, the idea that lowering tax for the wealthy would act as a supply-side stimulus struck most people as wishful thinking at best.

To reinvigorate the UK economy, Truss and her government must look to the future instead of mining the past. The character of advanced economies has changed significantly since the Thatcher era, following a steady worldwide shift toward services and knowledge work, the emergence of sophisticated supply chains that enable greater connectivity within

and among economies, and the growing importance of intangible assets. Today’s weightless, globalized, high-skill economy requires a different kind of supplyside strategy, whereby governments would have to play a different role.

Some of the classic elements of the “minimal state” are essential to this transition, including the rule of law, contract enforcement, basic infrastructure, and, of course, education. Other widely accepted government functions, like publicly funded basic research and tax support for corporate research and development, are similarly crucial.

But the transition toward digital and green technologies requires governments to take a more active role in shaping markets. Digital markets, for example, must be competitive to encourage new entrants. Several reports in the UK, the European Union, and the United States have outlined steps regulators and competition authorities could take to make today’s winner-take-all markets more contestable.

Likewise, the use of data plays an important role in companies’ success. Research shows that data-equipped companies are more productive and profitable than other companies in their sectors and pay higher wages on average. This makes national data strategies – defining what should be open, setting the terms on which

competitors should be able to access certain data, and establishing adequate safeguards and control for consumers – vitally important.

Lastly, governments today have a critical role to play in setting technical and regulatory standards for emerging technologies. And they must do so in a timely fashion to ensure that markets grow big enough to attract investors. Public procurement and advancepurchase commitments can be powerful tools to incentivize innovation and investment. This was the case with the development and production of COVID-19 vaccines, and it may be the case with clean-energy technologies or biomedical discoveries.

In short, an economy undergoing major structural shifts requires a forward-looking economic strategy.

Just as the 1960s-era approach of subsidizing selected “winners” survived well past its expiration date, so has the tax-cutting and deregulatory approach of the past 40 years.

Today’s knowledge economy requires an innovative state to provide a long-term framework for investment and set the rules of the game. Unless Truss and Kwarteng stop living in the past, the prospects for the UK economy on their watch look bleak.

Project syndicate

In line with Access Bank Ghana’s goal of bringing banking services closer to customers, the bank held a two-day market storm activation of one of its products, AccessClosa, at the Kejetia and Bantama markets in Kumasi in the Ashanti regional capital.

AccessClosa is Access Bank’s agency banking which seeks to bring banking services closer to the doorsteps of the unbanked and underbanked population, by employing the services of persons in local neighbourhoods to serve as agents in offering banking services.

The widely patronised events dubbed ‘MO NK3KN P33” which means closer to you, attracted hundreds of businessmen and

women in the brisk markets to the Access Bank activation stands to gain an understanding of AccessClosa.

Speaking in an interview, Executive Director of Retail and Digital Banking at Access Bank Ghana, Pearl Nkrumah, explained that about 57 per cent of the Ghanaian population is either unbanked or underbanked and Access Bank has seized the opportunity to bring banking services closer to its cherished customers.

“As part of our bank’s strategy to make banking accessible to every Ghanaian, we officially launched AccessClosa in July this year to enable customers enjoy the

convenience of banking right in their neighbourhoods.

We are also offering an exciting opportunity for all eligible interested persons to earn an income of up to GH¢10,000 monthly through AccessClosa,” she said.

She explained that AccessClosa is a function of commercial banks that allows banks to contract third party retail entities as agents and added that agents are stationed in retail outlets such as pharmacies, barbering shops, mobile money kiosks and supermarket among other locations in their vicinities.

Touching on eligibility criteria for one to be an AccessClosa Agent, Head of Agency Banking at

Access Bank, Hetty Mercer, said “the person must be an Access Bank customer with a registered business; must have a business account and open an additional account called an AccessClosa account; must be profiled; trained and branded as an AccessClosa Agent to render services.

She further explained the mandate of agents sayin: “AccessClosa agents can facilitate customers’ accounts opening, cash withdrawal and deposits, card requests, funds transfer, balance enquiry, bill payment services, mobile money services, remittance and insurance payment among others.”

Q3, 2021 GDP Growth 4.8%

Average GDP Growth for 2021 4.1%

2022 Projected GDP Growth 3.7%

BoG Policy Rate 24.50%

Weekly Interbank Interest Rate 22.36%

Inflation for February, 2022 33.9%

End Period Inflation Target – 2022 28.5%

Budget Deficit (% GDP) – Dec, 2021 6.4%

2022 Budget Deficit Target (%GDP) 6.6%

Public Debt (billion GH¢) – Dec, 2021 402.4%

Debt to GDP Ratio – Dec, 2021 68.0%

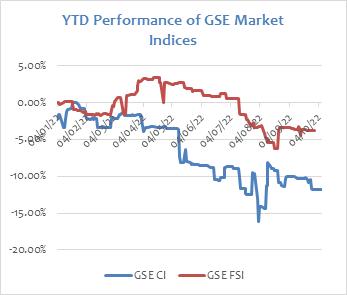

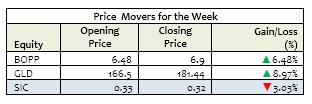

The Ghana Stock Exchange closed higher for the week following four consecutive weekly declines on the back of price increases by 2 counters. The GSE Composite Index (GSE CI) gained 1.21 points (0.05%) to close at 2,461.33 points, reflecting year-to-date (YTD) loss of 11.76%. The GSE Financial Stocks Index (GSE FI), on the other hand, lost 0.34 points (-0.02%) to close at 2,069.76 points, reflecting YTD loss of 3.81%.

Market capitalization increased by 0.74% to close the week at GH¢64,458.05 million, from GH¢63,985.81 million at the close of the previous week. This reflects a YTD decrease of 0.06%.

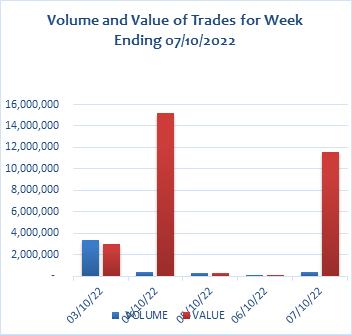

Trading activity recorded a total of 4,443,096 shares valued at GH¢30,079,436.97 changing hands, compared with 32,024,328 shares, valued at GH¢30,794,565.98 in the preceding week.

MTN dominated volume of trades whiles New Gold dominated value of trades for the week, accounting for 82.05% and 87.17% of shares traded respectively.

The market ended the week with 2 advancers and a decliner as indicated on the table below.

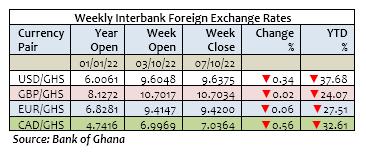

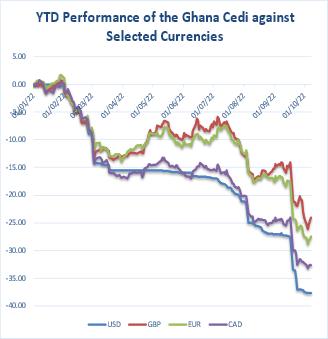

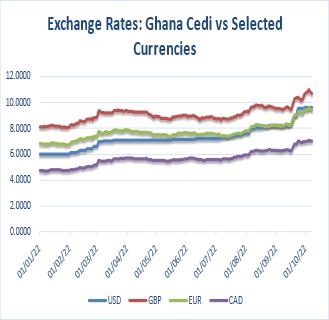

The Cedi weakened against the USD for the week. It traded at GH¢9.6375/$, compared with GH¢9.6048/$ at week open, reflecting w/w and YTD depreciations of 0.66% and 37.47% respectively. This compares with YTD depreciation of 1.85% a year ago.

The Cedi also weakened against the GBP for the week. It traded at GH¢10.7034/£, compared with GH¢10.7017/£ at week open, reflecting w/w and YTD depreciations of 0.02% and 24.07% respectively. This compares with YTD depreciation of 1.68% a year ago.

The Cedi continued its downward trend against the Euro for the week. It traded at GH¢9.4200/€, compared with GH¢9.4147/€ at week open, reflecting w/w and YTD depreciations of 0.06% and 27.51% respectively. This compares with YTD appreciation of 3.98% a year ago.

The Cedi again weakened against the Canadian Dollar for the week. It opened at GH¢6.9969/C$ but closed at GH¢7.0364/C$, reflecting w/w and YTD depreciations of 0.56% and 32.61% respectively. This compares with YTD depreciation of 3.83% a year ago.

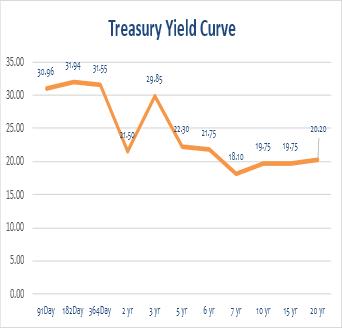

Government raised a sum of GH¢ 1,357.21 million for the week across the 91-Day and 182-Day Treasury Bills. This compared with GH¢ 999.86 million raised in the previous week.

The 91-Day Bill settled at 30.96% p.a from 30.45% p.a. last week whilst the 182-Day Bill settled at 31.94% p.a from 31.57% p.a. last week. The table and graph below highlight primary market yields at close of the week.

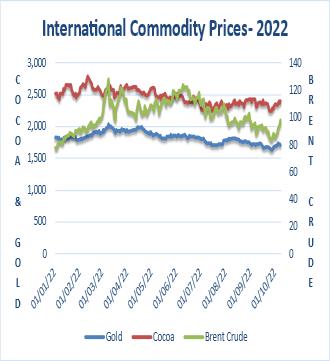

Oil futures rose to five-week highs for the week following an announcement by OPEC+ on Wednesday to cut output by 2 million barrels per day (bpd). Brent futures traded at US$97.92 a barrel on Friday, compared to US$85.14 at week open. This reflects w/w and YTD appreciations of 15.01% and 25.89% respectively.

Gold slid on Friday but still posted a second straight weekly gain as an upward run in the first two days of the week helped the long crowd in bullion weather a robust U.S. jobs report for September that strengthened the dollar. Gold settled at US$1,709.30, from US$1,684.90 last week, reflecting w/w gain and YTD loss of 1.45% and 6.52% respectively.

Prices of Cocoa increased for the week. The commodity traded at US$2,396.00 per tonne on Friday, from US$2,354.00 last week, reflecting w/w gain and YTD loss of 1.78% and 4.92% respectively.

CIDAN Investments Limited is an investment and fund management company licensed by the Securities & Exchange Commission (SEC) and the National Pensions Regulatory Authority (NPRA).

Name: Ernest Tannor

Email:etannor@cidaninvestments.com

Tel:+233 (0) 20 881 8957

Name: Audrey Asiedua Wiafe Email:aaudrey@cidaninvestments.com

Tel:+233 (0) 57 840 2700

Name: Moses Nana Osei-Yeboah Email:moyeboah@cidaninvestments.com

Tel:+233 (0) 24 499 0069

CIDAN Investments Limited CIDAN House

Plot No. 169 Block 6 Haatso, North Legon – Accra

Tel: +233 (0) 26171 7001/ 26 300 3917

Fax: +233 (0)30 254 4351 Email: info@cidaninvestmens.com Website: www.cidaninvestments.com

The contents of this report have been prepared to provide you with general information only. Information provided on and available from this report does not constitute any investment recommendation. The information contained herein has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed.

Copyright @ 2019 Business24 Limited. All Rights Reserved.

Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed. We value your support and loyalty.

Contact: editor@business24.com.gh Newsroom: 030 296 5315

Advertising / Sales: +233 24 212 2742

Deadweight Debt: A debt incurred, normally by a government rather than by an individual, as a result of borrowing, not secured by the purchase of an enduring asset, to meet current needs.

Source: https://finansleksikon.no/en/eng-finance/d/ deadweight-debt

Deputy Governor of the Bank of Ghana (BoG), has called on Rural and Community Banks (RCBs) to leverage growing digital technology to maintain relevance within the financial services sector.

She said commercial banks were riding on digital technology and the government’s digitisation drive to increase appeal among rural and local communities.

The Deputy Governor, who was addressing the 21st Annual CEOs Conference of the ARB Apex Bank in Ho on Friday, said the reach and acceptance of digital technology should encourage the RCB sector to re-strategise.

“Digital technology is redefining the financial landscape. Commercial banks now can reach communities costeffectively using technology.

“That divide between what belongs to the RCB sector and the commercial banks are gone. There is no boundary in the financial market, and it’s a wakeup call for the RCB sector,” she stated.

Mrs Awadzi said customers would be forced to rethink the use of rural banks as commercial banks continued to break ground in a space that was considered exclusively for RCBs.

She said RCBs must consider digital technology an “enormous growth area,” and leverage their strengths in penetrating local communities, in seeking to revise strategies to add value to the products and services to suit customers.

“Repositioning RCBs means it’s essential to take stock of the strengths and weaknesses of the industry. Customers are driving innovation. They are asking for ways of banking that are more suitable and deliverable to their taste.

Any financial institution that has not adopted digital transformation technology is clearly behind the curve. RCBs should endear to reorganize their business modalities to remain relevant,” the Deputy Governor added.

She said the Government and its stakeholders recognised the place of RCBs within the nation’s financial security structure, and that the Ministry of Finance and the BoG would continue to support the sector to grow along the digital transformation path.

Mrs Awadzi said the Government and the World Bank would work together to strengthen the Apex Bank to scale up and revive RCBs and help enhance technology exposure for

the sector.

She urged the management of the sector to “keep in mind the compliments and the risks,” and said with “strong governance, and strong risk management systems,” the risks should be mitigated.

Mrs Awadzi said RCBs would have to augment their capital base to be able to implement the appropriate systems and strategies.

She noted that several RCBs were yet to implement the BOGs 2018 cyber security strategy and that CEOs must ensure their institutions took the line.

She further said the BoG’s sustainable banking principles launched in 2019 should be embraced by RCBs, which are expected to use their lending power to promote clean and more environmentally sustainable ways of doing business.

The three-day conference was on the theme: “Positioning Rural Banking at the Center of Financial Services Delivery in Ghana- the Role of Stakeholders”, and brought together top management of the Apex Bank, the Bank of Ghana and other related financial institutions.

Alex Kwasi Awuah, Managing Director of the ARB Apex Bank, said the rural financing gap,

which formed the rationale behind the establishment of the rural banking system in Ghana by the BoG, had not been addressed 50 years on.

He said it was because the sector had not embraced the tools available.

“Digitisation and growth in financial technology solutions would help fully embrace the digital revolution by delivering the right products and services to bridge this yawning gap in the rural and community banking sub-sector,” Mr Awuah said.

The Managing Director said the ARB remained confident that with its agency and digital banking systems, the sector’s needs would be met.

He said CEOs remained the guarantors of the successes of the banks and should focus on saving banks from deterioration.

He called to price products and services to help draw customers closer and to tighten controls to prevent fraudulent practices that had been rampant in the sector.

Dr Toni Aubynn, Board Chairman of the Apex Bank, challenged RCBs to “use turbulent times to seek innovative thoughts and skills to bear in withstanding global whirlwinds and be able to emerge stronger.”

Source: GNA

The membership of the Public Interest and Accountability Committee (PIAC), the statutory body with oversight responsibility for the management and use of the country’s petroleum revenues, has been reconstituted following the expiration of the tenure of some Members.

Nana Yaa Ansua, the Paramount Queen Mother of the Drobo Traditional Area, has replaced Hajia Dr Kansawurche Azara Bukari as the representative of the Queen Mothers Association of Ghana, while Ms Freda Stephanie Frimpong has replaced Mrs Mary Karimu, who represented the Trades Union Congress (TUC) on PIAC. Emerita Professor Elizabeth Ardayfio-Schandorf has been reappointed by the Ghana Academy of Arts and Sciences

These members have since been sworn into office by the Chairman of the Committee, Professor Kwame Adom-Frimpong, upon the authorization of the Minister for Finance for a 2-year term, in accordance with the Petroleum Revenue Management Act, 2011 (Act 815).

In a meeting held on Thursday 6th October, 2022, the reconstituted Committee elected Professor Kwame AdomFrimpong, representative of the Institute of Chartered Accounts, Ghana, (ICAG) and Mr. Nasir Alfa Mohammed, representative of the Ghana Bar Association as Chairman and Vice Chairman respectively for a one-year term after the expiration of their tenure in September.

Accepting his re-election, Prof. Adom-Frimpong expressed gratitude to the Committee for the confidence reposed in him, and pledged his commitment

to the service of PIAC and the citizenry. Prof. Adom-Frimpong is currently the Managing Director of Mainstream Reinsurance Company.