Standard Bank enters its 17th decade as Africa’s largest financial services business

Clear existing obstacles for private sector to inject funds for clean energy transition

Georgetown University MBA students visit

WEDNESDAY, OCTOBER 19, 2022

SML Ghana…discusses how technology is helping plug revenue loopholes

Story

on page 2

Limited

Standard Bank enters its 17th decade as Africa’s largest financial services business

In October 1862 in the city of Port Elizabeth, South Africa, what was to become Africa’s largest financial services business was birthed.

Standard Bank, then known as The Standard Bank of British South Africa started doing business in a tent in Johannesburg, then known as Ferreira’s Camp, defying many odds in very challenging times.

From very humble beginnings, the bank has grown to span 20 African countries and 5 global financial centres. Very early in the life of the bank, it set out to build the leading African financial services organisation strategically positioned to drive growth on the continent. With a market capitalization of $15 billion, the bank currently employs approximately 50,000 people across all geographies with 1100 branches and over 6 500 ATMs on the African continent. This enables it to deliver a complete range of services across personal and business banking, corporate and investment banking and wealth management.

This year, the bank marks its 160th anniversary as Africa’s foremost financial services business. Sim Tshabalala, Group Chief Executive Officer and Executive Director of Standard

Bank dedicated the successes of the bank over the past 16 decades to clients of the bank across the world. He said “We enter our seventeenth decade with pride as Africa’s largest and most capable financial services business – and with enduring gratitude for our strong relationships with our clients.”

The Chief Executive of Standard Bank’s subsidiary in Ghana – Stanbic Bank, Kwamina Asomaning, reflected on the bank’s contribution to the country’s development over the two decades it has been operating in the country.

According to him, “Ghana epitomizes the can-do-spirit, and the ever-present relentlessness of Africa. We identify with many stories of the limitless resources and opportunities but are equally constrained by regular instances of missed opportunities and underutilized resources. That is a narrative the Standard Bank Group is reshaping, and to which we continue to contribute.”

He added that “Guided by these ideals, we take pride in our contributions to Ghana’s economic growth. Key investments in critical sectors such as agriculture, infrastructure, mining, and telecommunications have made a huge difference. For 23-plus

years we have advocated for sustainable prosperity while maintaining a robust risk framework. With our innovative and best-in-class products, we ensure that the right business is done the right way, for the right results.”

Kwamina Asomaning also thanked the thousands of employees who dedicated their time and skills to building the bank in Ghana. “We look back on our successes of the past two decades in Ghana with much appreciation of the thousands of employees who committed their time, skill and knowledge into building a pace setter brand. We acknowledge their dedication and, on this occasion, pay tribute to those here and beyond. We will look into the future with hope and optimism being confident that the future of humanity lies in this country and the continent”.

Standard Bank’s interventions on the African continent have been far-reaching. The bank’s CSI initiatives are aimed at achieving and sustaining positive social development of the communities across the continent. Through various community interventions, their effective community reinvestment reinforces their values as a bank dedicated to the growth of Africa.

2 WEDNESDAY, OCTOBER 19, 2022| NEWS Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed. We value your support and loyalty. Contact: editor@business24.com.gh Newsroom: 030 296 5315 Advertising / Sales: +233 24 212 2742 Copyright @ 2019 Business24 Limited. All Rights Reserved.

Ghana’s Ambassador-designate to Italy woos Italian businesses

Ghana’s AmbassadorDesignate to Italy, H.E. Merene Benyah, on 7th October, 2022 met with businesses in Palermo, Sicily, in an effort to attract trade and investment to Ghana.

During the visit to the southern Italian city as part of a consular outreach programme, H.E. Merene Benyah toured a packaging company, Salerno Packaging (SP). The ultra-modern packaging company provides metal packaging solutions for the fishing, agricultural as well as the cosmetics industries. Salerno Packaging was established in 1903. The Chairman of the group, Mr Antonino Salerno, led HE. Merene Benyah on a tour of the various stages of production.

He indicated that the factory had among others pioneered sustainable use of metal in an environmentally conscious manner and had also optimized the use of technology, such as Robots, to increase productivity.

During a meeting after the tour, HE. Merene Benyah, impressed on Mr. Salerno that as a result of several initiatives set in train by Government, Ghana was the new frontier for manufacturing and industrialization in the Region.

She encouraged the company to take advantage of Ghana’s conducive and enabling business environment to partner the vibrant private sector in establishing a similar production line in Ghana. This, the

Ambassador-designate indicated, would also open the door for the company to take advantage of the African Free Trade Zone to boost exports in the Region. Mr Salerno assured the Ambassadordesignate that he would send a delegation to Ghana soon to pursue the investment drive.

In a similar engagement, the Head of Mission met with Italian businessmen who are part of Palermo Mediterranea, an organisation that brings together entrepreneurs and businesses in Palermo. Members of the Group have expertise in various areas including infrastructural development, wine production, Real Estate, Engineering and Coffee.

The Ambassador-designate highlighted Ghana’s advantage as a peaceful haven with democratic credentials and a conducive and enabling environment for businesses. She assured of the Embassy’s availability to link the outfit with the appropriate entities in Ghana to enable them invest profitably in the country. She also spoke of the success that other Italian companies have had in Ghana over decades in the country. The president of the group, Marco Giammona, an Engineer, assured the Ambassador - designate of his group’s determination to engage with the private sector in Ghana for the mutual benefit of Ghana and Italy.

HE. Merene Benyah, as part of an outreach programme undertaken by the Embassy to provide consular services to the Ghanaian community in Palermo, also met with the executives of the Ghanaian Association of Palermo. Addressing the executives, the Head of Mission recalled the unfortunate demise of her predecessor, HE. Eudora Quartey Koranteng, almost a year ago and requested that a minute’s silence be respected in her honour.

The Head of Mission extended regards from the Government and people of Ghana to the community and thanked the executives for their togetherness and impressive organizational abilities.

The ambassador-designate entreated the community to continue respecting the laws of host authorities and endeavour to partner investors they encounter

communities. Present at the engagement was Ghana’s Honorary Consul in Palermo, Mr Francesco Campagna, the President of the Ghanaian Association, Mr Alexander Osei Menkah, as well as other members of the Embassy’s delegation; Minister for Consular Affairs, Mr Edward Cofie and Counsellor for Political and Economic, Mr Julius Goker.

Clear existing obstacles for private sector to inject funds for clean energy transition

By Edmond Kombat, IES

The shift from fossil fuels to clean renewable energy as the corner stone to the global energy transition has been at the tip of governments’ policy discussions across Africa and the world, with developed countries investing massively in renewable energy as part of efforts by their respective government’s energy security and climate action goals (ESI Africa, 2021).

Gielen D. and Boshell F. (2021), observe that while climate change mitigation remain a powerful driver behind the shift away from fossil fuel-based power generation, another factor influencing the shift is the fact that, renewable power has become the cheapest form of

electricity generation and the costs continue to fall thanks to improvements in technology and economies of scale. No wonder the International Energy Agency (IEA), found that the share of renewable energy sources (including hydropower) within the global electricity generation mix has jumped to 28 percent of the power mix in 2021, up from 27 percent in 2019.

Growth in renewables, according to the U.S. Bureau of Labor Statistics (BLS), presents many direct and indirect sustainable economic benefits (with less or no negative effects on the environment) through job creation, reduced energy cost, stable energy prices, energy

independence, and avoidance of climate impact et cetera. The International Renewable Energy Agency (IRENA) estimates the expected increase in human welfare from the deployment of renewables as close to 4 percent, far exceeding the 0.8 percent rate of improvement in gross domestic product (GDP). The agency suggest, savings from reduced health and environmental externalities, which are not fully reflected in conventional economic accounting systems, far offset the costs of the energy transition.

Africa missing in the Game

The World Economic Forum (WEF) estimates that by 2050, Africa will have roughly 2 billion

inhabitants, and two in five of the world’s children will be born on the continent.

However, the continent which is home to the world’s youngest population, is still energy poor.

According to data captured in the IEA Africa Energy Outlook 2022, some 600 million people in Sub-Saharan Africa still don’t have access to electricity, when in global terms only 768 million people lack access to electricity. Again, the data shows that today 970 million Africans lack access to clean cooking. Liquefied petroleum gas (LPG) remain the leading solution to urban population, but recent price spikes are making the commodity

WEDNESDAY, OCTOBER 19, 2022 | NEWS 3

Continued on page 4

unaffordable for 30 million people across the continent, forcing many to revert to traditional use of biomass. This makes the need for clean energy for both consumption and production more crucial; for purposes of socio-economic and human development.

The World Bank (2018), argue that lack of access to energy represents a fundamental barrier to progress, and has impacts on a wide range of development indicators, including health, education, food security, gender equality, livelihoods, and poverty reduction. Renewable energy has therefore been found to play a critical role in closing Africa’s energy gap, which remain a massive obstacle to advancing development continent-wide. IRENA’s paper “Scaling up Renewable Energy Deployment in Africa” shows that Africa has the potential to install 310 gigawatts (GW) of clean renewable power— or half the continent’s total electricity generation capacity, to meet nearly a quarter of its energy needs by 2030.

In another paper Renewable Energy Market Analysis: Africa and its Regions, IRENA and the AfDB (Africa Development Bank) estimate the continent’s solar PV technical potential at 7,900 GW, additional hydropower potential at 1,753 GW, and wind energy at 461 GW; suggesting that the continent possesses a respectable renewable energy potential.

Ironically, a recent paper titled The Renewable Energy Transition in Africa, jointly prepared by Germany’s KfW Development Bank, Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), and the International Renewable Energy Agency (IRENA), reports that most inhabitants of sub-Saharan Africa face severe energy poverty, with less than half of the population found to have access to electricity in 2018.

The paper found that in 2018, only 20 percent of the electricity generated in Africa came from renewable sources, a very low investment figure compared with the rest of the world. Further the paper notes that even though in 2019 two-thirds of all newly added energy capacity for supplying electricity worldwide was based on renewable sources, only a mere 2 percent of this new generating capacity was in Africa; confirming IRENA’s report that only 2 percent of global investments in renewable energy in the last two decades were made in Africa, with significant regional disparities.

This is a continent that has vast resource potential in wind, solar, hydro, and geothermal energy, with Central and Southern Africa holding abundant mineral

resources (IRENA 2022) essential to the production of electric batteries, wind turbines, and other low-carbon technologies. Furthermore, IEA (2022) finds that Africa is home to 60 percent of the best solar resources globally, yet only 1 percent of installed solar PV capacity. Also, the continent possesses vast resources of minerals that are critical for multiple clean energy technologies. The continent accounts for over 40 percent of global reserves of cobalt, manganese and platinum; and other key minerals such as lithium, graphite, and copper; critical for batteries and hydrogen technologies.

In spite of the immense benefits of renewable energy to the continent, coupled with the resource potential of the African continent, IRENA (2022) finds that the factors that would help accelerate green energy deployment in Africa have not yet been realized, because of exiting obstacles.

Africa’s Obstacles

In IRENA’s estimation, Africa will requires an annual investment of US$70 billion in renewable energy projects until 2030 to effectively transition from fossil fuels to clean energy. But it must not be lost on us that countries within the African continent are largely low-income economies whose capacities are not yet up to the task of funding this emerging form of energy in large-scale. Aside investment and policy related challenges, several economic, institutional, technical and socio-cultural barriers hinders countries from moving from the high to the low emission pathway (Seetharaman et al. 2019; Adeniran and Onyekwena 2020).

The African Development Bank Group asserts that the private sector is key to mobilizing green energy investment and sustainable development in Africa, and that climate change presents a US$3 trillion investment opportunity in Africa by 2030, of which 75 percent of the investment is expected to come from the private sector to complement public sector financing. However, there are few hurdles to surmount if the private sector would inject that level of funding expected of it.

The first hurdle, is the willingness of the private sector to maintain its commitments in accelerating climate related investments in particularly an emerging economy like Africa. Fruman (2016), argues that the willingness would require an enhancement of cooperation between governments and the private sector; to help build trust, close knowledge gaps, spur action, generate a sense of

combined ownership of agreedupon actions, and promote collaboration. Moreover, it is widely acknowledged that developing countries like Africa face obstacles from the policy and regulatory point. To make the Africa market accessible to the private sector investor, policy clarity, enhanced regulation, and a transparent implementation strategies that establishes Africa’s energy transition roadmap is indeed necessary. Additionally, IRENA (2022) finds that investors’ willingness to commit capital to the renewable energy sector is driven by the perceived risk/ return profile of investments, combined with risk mitigation— given that the sector face multiple barriers such as front-loaded cost structure of renewable energy projects, project proponents’ often limited knowledge and experience, and the lack of reliable investment data, particularly in developing countries.

Aside private sector investors’ willingness to inject capital in climate related technologies, it is well documented that the regional power pools across the African continent are faced with insufficient investment in infrastructure and network grids designed to accommodate conventional energy sources, resulting in high electricity losses and low supply quality, among other issues (Medillina et al. 2019).

Germany’s KfW Development Bank, GIZ & IRENA joint paper

The Renewable Energy Transition in Africa, found inadequate grid infrastructures as another barrier to introducing and up-scaling inexpensive variable renewable energy, such as solar and wind. Improving the planning, operation

report, needs to be combined with significant investments in the modernization and expansion of distribution and transmission infrastructure, as well as energy storage and other technology and market solutions that improve system flexibility, reduce greenhouse gas emissions, strengthen national and regional power systems, and reduce technical and commercial losses.

Additionally, there are some African governments and industry players’ unwillingness to change as quickly as required, or introduce incentives to support clean renewables, which often slow the progress we need to see in the energy space (Okafor J. 2020). This is so because the global effort to accelerate the clean energy transition risks dwindling export revenue for Africa’s oil and gas.

McKinsey’s 2022 analysis on ‘The future of African oil and gas: Positioning for energy transition’ found that most African countries are highly exposed to the global energy transition, as their economies depend on oil and gas exports for more than 50 percent of their total export revenues.

The resentment from industry players and government in emerging economies such as Africa is that abandoning their oil and gas resources for clean renewable energy would affect badly their macroeconomic and socio-economic progress. As such Africa wants that space to exploit their fossil resources, earn revenue from exports of same, and ultimately deploy the revenue into infrastructure and services that raise living standards today, while transitioning to renewables and a lower-carbon future.

and maintenance of electricity grids is of paramount importance for any form of energy transition and grid stabilization, the report noted. This according to the

WEDNESDAY, OCTOBER 19, 20224 | NEWS

Written by Edmond Kombat, Director of Research & Finance, Institute for Energy Security (IES) ©2022. Email: edmond@ iesgh.org

Continued from page 3

Georgetown University MBA students visit SML Ghana…discusses how technology is helping plug revenue loopholes

Strategic Mobilisation Limited (SML) Ghana, a revenue assurance and audit firm, has hosted MBA students from Georgetown University, McDonough School of Business, Washington D.C, USA, to seek practical exposure on how Ghanaian businesses are leveraging technology to impact lives and transform the economy.

The students, made up of different nationalities, are part of Georgetown’s Emerging Markets Network (EMN) – a student-led organization that promotes an understanding of emerging markets within the Georgetown community, facilitates a network of globally-minded individuals, and provides the community with resources to enable them to gain promising careers and opportunities in emerging markets.

The EMN organization facilitated the international trek experience to Ghana which has taken them to other companies in other sectors of the economy. Students’ backgrounds before business school were in management consulting, tech, real estate, finance, non-profit, and healthcare.

Addressing the students, Managing Director for SML Ghana, Christian Tetteh Sottie expressed his gratitude for the recognition of the company’s work across the world adding that the visit serves as a springboard to continue to offer the best services possible in order to advance the nation.

“The use of SML Ghana as a case study by these international students is highly welcomed,

and we appreciate it because what we are doing is valued both domestically and internationally. These students have traveled to visit us in order to learn about what we do and how it affects our economy, and this visit will only strengthen our resolve to keep doing what we are already doing whiles we look for additional ways to improve,” he said.

He said the organization’s next goal, is to provide such added value services across other economic sectors to aid in the country’s economic transformation. “We are in the downstream sector and in our next phase,we hope to be in the upstream sector where there is the drilling of hydrocarbons and the crude gas. Our aim is to also move into other sectors including the mining sector,” he said.

SML Ghana’s use of technology at more than 16 petroleum depots across the country has seen a significant rise in government revenues from the sector. Due to its end-to-end audit technology, revenue loopholes have been blocked and the direct impact has seen more than a billion cedis accrue to the government within 10 months of operation.

The President of Georgetown’s Emerging Markets Network (EMN) and an MBA student, Esther Adusei, explained that the goal of the trek to Ghana is for students to explore diverse business models and industries in Ghana and learn about how start-ups, established companies, and small and medium enterprises are adapting their business models to meet the needs of their customers,

impacting their communities.

“This year, EMN has picked Ghana as our first destination for what we plan to be an annual trek to the African continent. We will be visiting companies in Ghana in various industries to learn about how business is done in Africa. Our trek, in accordance with the goals of the McDonough School of Business, fosters a global learning experience through the understanding of the business landscape and the cultural experience of an emerging market like Ghana,” she explained.

Touching on the SML Ghana experience, she noted that SML Ghana was chosen as a case study due to the significant impact it has made in a short period of time.

“One of the things we wanted to do as a network was to bring emerging markets to the perspective of MBA students, because we believe it is the next frontier of opportunities and investments. We wanted to explore how businesses can be profitable and also impact communities and SML is really unique in that way because they have shown significant impact. So, while reviewing businesses making great impact in Ghana, SML came as one of such great companies to use as a case study to inspire the students,” she said.

She urged the government to increase economic transformation in the nation by examining more transparency in other sectors using the SML approach.

The President of the Student Government at Georgetown, Luke McGinty extended gratitude to

SML for the warm reception and exposure of the organization’s facilities to them. “I have had the good fortune to travel to Ghana and it is truly amazing to learn about the incredible advancements SML has achieved. One of the things that was most interesting is seeing how technology and business can intersect to make government more accountable, and to basically just create more resources for people to do,” he said.

The students also toured Ghana’s Investment Promotion Centre (GIPC) and other companies in the Financial Services and Energy sector which include Chipper Cash-fintech; Blackstar Groupfinancial services; Letshegomicrofinance; Cenpower-power utility; and Cybele Energy-Oil & Gas.

The full list of students include Esther Adusei; Nii Adamah Annan; Joao Felipe Gomes de Almeida; Chamme Moratwa; Jessica McLemore; Alexander Fine; Madison Moore; Laura Caicedo; Dazell Washington; Herrera Arturo; Seth Tanvi; Samad Reed; Caroline Fernandez; Andres Brillembourg; Luke McGinty; Tarun Thomas Philip; Samantha Poremba; Natalia Velasquez; Wucheng Wen; Genevieve Enowmbitang; Maesha Ulcena; Lauren Robinson; Wyesha Dillard; Andres Ramos; Renzo, Morales Miraval; Kofi Sakyi; Denise Morris; Kilandra Bass; Tereza Yerimyan; Sean Stanton; James Cogman; Erin Buthman; Shaurya Singh; and David Keptsi.

WEDNESDAY, OCTOBER 19, 2022 | NEWS 5

FBN Bank joins Ghana Club 100

FBNBank Ghana has officially joined the Ghana Club 100, the coveted league of Ghana’s top 100 companies for the first time. This year’s edition of the Ghana Club 100, which is in its 19th year, had FBNBank ranked 55th out of the top 100 companies in Ghana

Mr. Yoofi Grant, Chief Executive Officer of GIPC said “the companies celebrated this evening were selected after they had gone through a rigorous screening exercise and were ranked according to their performance.

I commend the Private sector for

governance among Ghanaian businesses, develop a transparent and fluid communication system in the Ghanaian corporate sector and spur positive economic entities.

economic development even as we are keen to build for the future by supporting the youth.”

Responsibility efforts. This year’s edition was organized under the theme, “Ghana’s Private Sector, a Catalyst for Post-Pandemic Economic Transformation” and was held at the Kempinski Hotel in Accra.

Speaking during the ceremony,

introduced by the Ghana Investment Promotion Centre (GIPC) in 1998 and it features an annual collection of 100 outstanding companies in the Ghanaian business landscape. The main objective of the Ghana Club 100 is to promote good corporate

According to Mr. Victor Yaw Asante, Managing Director and Chief Executive Officer of FBNBank, “We have over the years remained focused on putting our stakeholders first, and this includes our customers and the Ghanaian population generally. We have ensured that our agenda through all these remains aligned with the aspirations of Ghana. Our commitment has also been possible largely because of the passion of our people. The staff of the Bank have over the years contributed to our efforts in business and community related activities and I personally believe that this feat of being counted among Ghana’s top 100 companies would not have been possible without them. It is also an indication of how much progress our brand has made in the past 26 years we have been in the country. We are happy for the recognition and look forward to improving our contribution to Ghana’s socio-

Mr. Francis Nyamekye, Head of Compliance who received the award on behalf of the Bank said “the bank is delighted with the recognition from the GIPC and this award is dedicated to all staff of our bank for their hard work. I am very confident this award will spur us on to climb up the Ghana Club 100 league table. Our contributions in terms of the solutions we offer our customers and clients and the initiatives we support in the communities are a strong indication of how far we are prepared to go in order to contribute significantly to Ghana’s development. I can assure you that we remain primed for action.”

FBNBank has in its 26 years of operating in Ghana remained focused on putting its customers and communities first. This, it has sought to do through the rich value and excellence of what the Bank contributes to the relationship with its stakeholders as a whole, particularly the customers.

FBNBank Ghana is a member of the First Bank of Nigeria Limited Group which is renowned for its great customer service and general stakeholder engagement garnered over its 128 years of operation. FBNBank Ghana has 25 branches and two agencies across the country with over 500 staff. FBNBank offers universal banking services to individuals and businesses in Ghana.

Inflation in Ghana domestic driven – IMF

The International Monetary Fund (IMF) has attributed the high inflation in Ghana to largely domestic factors.

This dismisses the argument that inflation in the country is due to external factors such as the Russian/Ukraine crisis which has pushed prices of some foodstuffs, particularly wheat and cereals up At a press conference at the recent IMF/World Bank Spring Meetings, African Director at the Fund, Abebe Selassie, said its analysis show that inflation is driven more by domestic factors than exogenous factors

“On inflation, I mean, again, there are always trade-offs when you’re doing, policy calibration, and so in our regional economic outlook, we are very careful to flag that there are some countries where inflation has clearly been driven more by domestic factors than exogenous factors. I think

WEDNESDAY, OCTOBER 19, 2022| FEATURE6

From left to right: Mrs. Nora Bannerman, CEO, Sleek Garments & Export Co. Ltd. presenting FBNBank Ghana’s award to Francis Nyamekye, Head, Compliance.

Catholic Hospital Battor gets an oxygen generation system and other hospital equipment

By Baptista Gebu

Rotary club of Tema-Meridian in partnership with Rotary Club of Hannover-Ballhof, Germany have commissioned and handed over an oxygen generation system with other hospital equipment to the Catholic Hospital Battor, to facilitate oxygen supply and other hospital activities.

The Rotarian President for Rotary Club of Tema-Meridina Ethel Vandor-Odonkor, mentioned this project which cost close to 85000 USD and took about three years to complete was funded by the Rotary Foundation. She mentioned, apart from the Oxygen Generation System, a list of other hospital equipment were also delivered to the hospital from Germany. Madam Ethel Vandor-Odonkor speaking at the commissioning and handover of the project mentioned Covid – 19 pandemic was one of the major reasons for the delay of the project and acknowledge the supports gotten from past presidents of the club for the completion of the project.

“I want to thank the Rotary

Foundation, past presidents and members of the Rotary Club of Tema-Meridian and also our partners in Germany, the Rotary club of Hannover-Ballhof for partnering our club for smooth execution of this project. We believe our co-operation will be a long lasting one” she said. She further explained that the club was 21 years this year and since its inception has undertaking many projects across Ghana.

The Assistant Governor for Rotary district 9102, AG Mumuni Haruna who represented the District Governor said Rotary is a service and voluntary organization. It’s made up of different professionals who come together and help the community. Rotary is divided in zones and districts. Ghana is part of district 9102 which include Togo, Benin and Niger. Rotary has seven areas of focus and fighting of disease under which this project falls is one of them. He appealed to the hospital to take very good care of the Oxygen Generation System as well as the other equipment “ I

would like to appeal to all of you working at this hospital to take very good care of this equipment which should be transferred to the next generation. Sustainability is important and there could be breakdown so they must be well maintained for the next generation” he said.

Doctor Bernard Hayford Atuguba, the medical superintendent of Catholic Hospital Battor, mentioned the support of the Rotary Clubs came at the right time.

“The hospital has 76 cylinders and spend about Ghc 8000 to 10,000 weekly on refilling of our oxygen cylinders, this excludes maintenance and fuel. The stress and difficulties in pulling and swapping empty cylinder being an issue of the past should be much joy to our nurses”, He said.

Doctor Hayford Atuguba mentioned the facility is a 100 cubic meter oxygen generation system which has been designed to serve the entire hospital adding that “the hospital currently uses about 15 per cent of the oxygen

generated and the rest of the facilities would be connected soon.

He added that this will not only benefit people of the North Tongu District since the hospital has about 60 per cent of the of its users coming from Accra and 40 per cent from Volta Region and other districts including and countries like Togo.

The heads of the various units of the hospital applauded the gesture of the Rotary club of Tema-Meridian and Rotary Club of Hannover-Ballhof adding that “they have brought life to Battor since Oxygen is life”.

The Oxygen Generation System currently serves three wards which include emergency unit, recovery ward and the theatre.

Rotary International has been in service for more than 110 years and has more than 1.2 million members globally. It’s made up of neighbors, friends, leaders, and problem-solvers who see a world where people unite and take action to create lasting change across the globe.

WEDNESDAY, OCTOBER 19, 2022 | NEWS 7

Entravision partners Meta to expand Entravision 365 digital’s presence into West Africa

Entravision , a leading global advertising solutions, media and technology company, has announced that its Africa-based digital business unit, Entravision 365 Digital in Ghana, has become the authorized sales partner of Meta, the company that owns Facebook, Instagram and WhatsApp.

Entravision 365 Digital will provide support, training, lines of credit and local billing to advertisers in the Ghanaian market, thereby enabling them to meet their business objectives. “This partnership reinforces our commitment to advertisers to connect brands to consumers through local strategic support, creative expertise and relevant in-market training,” said Julian Jordaan, Chief Executive Officer of Entravision 365 Digital. “As we continue to expand our presence throughout the continent of Africa, we are thrilled to partner with Meta as their Authorized

Sales Partner in Ghana to equip and empower local businesses with our top-notch advertising expertise.”

Jordaan continued, “We are also pleased to welcome Stephen Sawyerr as Country Manager to spearhead our partnership with Meta in Ghana. With over 10 years of management, digital marketing and brand building expertise, Stephen is very well equipped to build a world-class team to support Entravision’s growth in West Africa.”

Entravision 365 Digital, as an Authorized Sales Partner, will deploy dedicated local expert teams in Ghana to provide businesses with each of the tools crucial to sales growth, while also assisting these same customers in deploying their advertising investments more efficiently across the Meta family of products.

“Ghana is an important country for Meta and it is a priority for

us to invest in the market and to be closer to the people and businesses here,” said Enitan Denloye, Regional Director for Africa at Meta. “As such, we are happy to bring in Entravision 365 Digital as Meta’s Authorized Sales

Partner in Ghana and believe that with their robust local market insights and expertise, we can provide better support for businesses and agencies locally, helping them unlock their potential growth.”

WEDNESDAY, OCTOBER 19, 20228 | NEWS

New report exposes the extent of IMF’s ‘pink washing’ and the devastating impact this is having on gender equality globally

ActionAid and Public Services International have published a new report exposing the devasting impact public sector cuts are having on women in low income countries, who face a triple threat of losing access to services, having fewer opportunities to access decent work and being forced to take on the rising burden of unpaid care work.

• Public sector cuts mean women are disproportionately shouldering the burden of unpaid care and domestic work, which will only get worse with the current cost of living crisis.

• ActionAid and Public Services International accuse the International Monetary Fund’s (IMF) of ‘pink washing’ with its new Gender Mainstreaming Strategy and says it fails to get to the heart of gender inequality.

• The report calls for a bigger vision of a feminist, just alternative to the cult of austerity and an agenda that builds economies and societies based on care.

The Care Contradiction: The IMF, Gender and Austerity highlights the ways in which the International Monetary Fund’s policy advice around austerity, and massive cuts to public spending, are exacerbating gender inequality. It also exposes the ways the IMF is failing to recognise and account for women’s disproportionate unpaid care and domestic work and commit to address how IMF policy advice increases this burden.

of the world’s population will be living in the grips of stringent austerity measures by next year.

Austerity measures include cutting or freezing the wages and numbers of teachers, health workers and other public sector workers.

The drive to cut public budgets and public sector wage bills has been going on for decades, but has no credible evidence base. It has blocked recruitment of nurses, care workers, doctors and teachers in many countries, even where there are desperate shortages, and it has blocked pay increases even where workers are on very low pay.

This has undermined health and education outcomes, especially in low and middle income countries. It is estimated that globally, there is a shortage of 5.9 million nurses.

In Ghana, ActionAid’s research found that on average there is one doctor to every 8,000 people. This is hugely impacting women, depriving them of health care and opportunities for decent work with data showing 90% of nurses globally are women and over 70% of healthcare staff are women.

In September 2022, the Government of Zambia was forced to agree a new loan deal with the IMF, and in just over three years the country is being pushed to move from a 6 per cent deficit to a 3.2 per cent surplus. Despite the aspirations of the Government to invest in education and health.

ActionAid Zambia’s Country Director, Nalucha Nganga Ziba said:

““Earlier this year the government

30,000 new teachers to address serious shortages. But with the squeeze now placed on public sector pay and school enrolments likely to rise dramatically at every level of education, class sizes will rise everywhere, and come 2025 the shortage of teachers will be more acute than ever.

“In summary, this IMF programme fails to pass the burden onto those who are most able to pay. It does not have an equity lens, least of all a gender equity lens.”

The report comes as the IMF and the World Bank meet in Washington DC, USA, for the 2022 Annual Meetings.

The report outlines the failings of the IMF’s Gender Mainstreaming Strategy which was launched in July 2022, and identifies the necessary steps needed to turn the tide for women everywhere. The report calls for the IMF to:

• Recognise the negative impact of public wage bill constraints and austerity more broadly on public services provision and women’s labour force participation.

• Commit to support countries to expand the percentage of GDP spent on wage bills wherever essential services are struggling through staff shortages.

• Assess critically the gendered and inequality impact of its austerity policies.

• Consult consistently with national and regional women’s

on Economic Justice and GenderResponsive Public Services and lead author of the report said: “The IMF’s Gender Mainstreaming Strategy is a perfect example of ‘pink washing’. The organisation is completely ignoring how its current policies are exacerbating gender inequality.

“Compensatory actions, like targeting social protection at some women after the damage is done by austerity policies, are not enough when the IMF has the power to prevent the harm being done in the first place.

Saalbrink added, “We need a bigger vision of a feminist, just alternative to the cult of austerity and an agenda that builds economies and societies based on care. This means moving beyond GDP growth to put human rights and care at the centre of economic objectives and indicators. We need a feminist approach to fiscal and tax justice and we need full recognition of the links between unpaid care work and the financing of public services. Fundamentally we need new international institutions that can shape and frame a fairer global economy.”

Rosa Pavanelli, General Secretary of Public Services International said: “To win gender justice, we have to reduce unpaid care work, revalue paid care work and end the privatisation of public services. The IMF must stop paying lip service to gender equality and instead make a move towards the rebuilding of the social organisation of care through reclaiming care as a public good

WEDNESDAY, OCTOBER 19, 2022 | FEATURE 9

I have had the best experience with Vodafone-lifelong customer

On a sunny Monday afternoon in October, Mr. Daniel Nii Ashong Morton, a retiree, admires his sleek new Samsung Galaxy S22 smartphone. It is one of the gifts Vodafone Ghana has given him to thank him for being a loyal customer.

A loyal Vodafone Ghana customer for the past 20 years, he vouched that the network is one of the best in Ghana.

“I have been on Vodafone for close to 20 years. In the second year after OneTouch was introduced, I bought my SIM. So, when Vodafone came, my SIM was moved to Vodafone, and since then I have been with Vodafone. I have had the best experience and I don’t want to move. So far, it’s been good,” he continued.

Another loyal customer, Mr. Ebenezer Ketsi, also commended Vodafone Ghana saying, “I’m very grateful for what Vodafone has done for me. Since I’ve been using Vodafone, I haven’t had any problems.”

The Vodafone Ghana Customer Experience team also visited

and rewarded other longterm customers including Madam Joyce Afua Haligah, a corporate professional, and Mr. William Antwi, an entrepreneur. They both expressed their appreciation to the Vodafone team.

In addition to brand-new smartphones, these Vodafone Ghana customers were also given Smart Rechargeable Beverage Mugs, power banks, and other Vodafone-branded products.

Since embarking on its Care Month campaign in October, Vodafone Ghana has awarded consumers at many touchpoints with Vodafone-branded souvenirs, free calls, and other gifts.

The Senior Management Team of Vodafone Ghana has also visited various Vodafone retail shops to meet with customers, offer them gifts, and thank them for choosing the network.

Angela Mensah-Poku, Director of Digital Transformation and Commercial Operations, commented on the Care Month initiative: “We are thrilled to devote an entire month to

thanking consumers for their loyalty to our brand. This is because our success story would be incomplete without our customers’ trust and support.”

She underlined the telco’s dedication to customers, stating, “Vodafone also wishes to restate its commitment to serving customers better and providing more innovative solutions that suit the needs of our customers.”

7,000 females benefit from Huawei, Rebecca Foundation digital technologies training

Huawei Technologies Ghana in partnership with the Rebecca Foundation and the Ghana Education Service (GES) has successfully engaged over 7,000 young girls and traders in its 2022 digital technologies training.

The initiative, which comes as part of Huawei’s Women in Tech program saw the training of 6,678 girls in Basic ICT skills, Coding, Data Transfer and Data Storage.

Over 500 traders across 3 regions (Ashanti, Eastern and Greater Accra) also benefitted from a Financial Technology (FinTech) training aimed at equipping them with the requisite digital tools to enable their businesses strive in a convenient and cost-effective manner.

Other areas of training for the traders include; Digital marketing, Cyber Security and Digital Payments.

Speaking on the essence of the training, Mr. Neil Owusu a representative from the Office of the First Lady, indicated the training is aimed at equipping more women and girls with advanced ICT skills to make them

competitive in the job market.

He further indicated that the training is also focused on empowering young girls with basic ICT skills whiles motivating them the take-up careers in STEM.

The Municipal Education Director for Tepa, Mrs. Grace Oppong Agyapong commended Huawei Ghana for the initiative and requested that the company should consider sustaining the initiative by training teachers in the communities.

The Public Relations Officer at Huawei Ghana, Mrs. Stephanie Horsu mentioned that the training falls in line with Huawei’s Women in Tech initiative aimed

at empowering more women and girls in ICTs.

The training she said, comes as part of Huawei’s effort to contribute its quota towards the achievement of the United Nations Sustainable Development (UN SDG) Goal 5, focused on achieving gender equality by empowering more women and girls.

As part of Huawei’s Tech4All initiative, the company also looks forward to ensuring that no one is left behind in the digital world by using technology, applications and skills to empower people and organizations everywhere.

Last year, Huawei in partnership with the Rebecca Foundation, the

Ministry of Communications and Digitalisation (MOCD) and the Ministry of Foreign Affairs and Regional Integration (MOFARI) trained 50,000 girls.

In a similar effort, Huawei, the Ministry of Communications and Digitalization and the Rebecca Foundation have trained over 22, 000 girls and women this year bringing the total number of beneficiaries to 72,000 in a space of two years.

Huawei Technologies Ghana, is committed to keeping the promise it made to the President of the Republic of Ghana, H.E. Nana Akuffo Addo to offer Information Communication Technology (ICT) training to 100,000 Ghanaians by 2024.

Some items donated during this year’s training in partnership with the Rebecca Foundation include Laptops, Huawei Tablets, Melcom Gift Vouchers, Diaries, School bags, Pens, Pencil Cases, and Shirts.

In total 43 schools, 10 districts and 3 regions benefitted from the training this year, in partnership with the Rebecca Foundation.

WEDNESDAY, OCTOBER 19, 202210 | NEWS

Ckrowd partners with Brown ROOF Studios on African myths animated series

Ckrowd, Africa’s leading, premium content streaming platform, has announced its partnership with Nigeria-based studio, Brown Roof Studios to create original content around African mythological heroes and heroines and develop franchise series and characters. This partnership with Brown Roof Studio will employ the usage of digital marketing tool and innovative tool, Ckrowd Advert to distribute comics and graphic novels based on African culture to readers worldwide.

Founded in 2020 by a number of young talented Ibadan-based comic book creators, Brown Roof Studio has developed a universe of characters based on Nigerian and West African myths to finally narrate the rich, diverse and varied African folk tales and

display the rich heritage of the Continent’s storytelling. Local cosmologies and mythologies, in particular across Africa, have been at times regarded as backward or even dubbed not relevant, which has led to a loss of cultural memory across different generations of Africans and individual of African descent.

However, with the inception of the Marvel Cinematic Universe global audiences have been entertained with stories based on Norse tradition and discovered tales that might have not been conversant with. Therefore, with African culture, music and entertainment now taking centre-stage, this partnership between these technological giants showcase that the time is

inspired by African historical culture and mythology.

The vast pantheon of Nigerian gods and goddess, from Sango, Ogun, Elegua, Elusu, Mami Wata, Oshun and Obatala to name a few, provide an extraordinarily diverse and varied set of tales with strong ethos and moral inspiration, which can teach and influence human life and different generations across the African continent and the Diaspora on important themes such as integrity, loyalty, love, friendship and family.

In the statement announcing the partnership, Crowd founder and CEO, Kayode Adebayo talked about the importance of bringing stories featuring characters from the vast African folklore to a wider audience and championing African storytelling and cultural

heritage through animation: “We are truly delighted at the prospect of exploring and building intellectual properties that will endure for a long time with Brown Roof Studios, especially concerning the celebration of African heritage and folklore. We are enthused to be using Ckrowd’s innovative technology tools, data and platform to distribute graphic and animation content to a wider audience across the world. Additionally, we also delighted to support emerging designer in exploring new ways of monetising these properties and products.”

Ckrowd’s collaboration with Brown Roof Studio will create and develop comic characters which will be co-owned by the two companies, and Ckrowd will won the highest equity as they are co-funding the project.

Brown Roof Studio CEO, Success Ikupolati, added, “One of our goals in Brown roof Studios is to tell real, rich, beautiful and authentic African stories to the world. This partnership between our studio and Ckrowd will help foster that goal by promoting the richness of African culture and mythology through the unlimited reach of technology. Moreover, this collaboration will bring together a host of amazing African and Diasporan talent, telling African stories and we are delighted to have Ckrowd’s support.”

Ckrowd will also support the studio with distribution, which has been one of the major value chain issues across the creative industry alongside conversations about monetisation and profit. Au contraire, on the basis of this announcement, industry professionals can attract glocal corporate partnerships, bolstering local brand recognition and ultimately increasing revenue generation. Additionally, Ckrowd will support Brown roof studio with one its greatest expertise, intellectual property protection, connecting creatives to the legal community to assist with intellectual property protection, which will allow them to maximise earnings on their creative works.

The goal of this new project is to tell unique African mythbased stories, support African and Diasporan creatives’ growth, economic development, and job creation.

WEDNESDAY, OCTOBER 19, 2022 11| NEWS

Global health from the ground up

By Paul Hudson

While the end of the COVID-19 pandemic may be “in sight,” as the World Health Organization recently declared, the world faces numerous emerging health risks. Some are exacerbated by climate change, others by travel, online misinformation, food scarcity, poverty, or wars. Fortunately, the pandemic has taught us valuable lessons for managing these risks – and for helping vulnerable developing economies better prepare for future health crises.

The WHO’s Access to COVID-19 Tools (ACT-A) Accelerator has been a massive global effort that facilitated testing, treatment, and vaccination worldwide. But it is clear that ACT-A failed to address the longstanding structural obstacles that impeded vaccination rollouts in low- and middle-income countries. Doing so requires a new framework that emphasizes local relationships with workers and entrepreneurs on the ground.

Developing countries have fewer health workers per capita than developed countries do. Africa, Southeast Asia, the eastern Mediterranean, and parts of Latin America face a shortfall of 5.9 million nurses and 18 million health-care workers by 2030. In 2019, 13.8 million infants worldwide did not benefit from routine immunization services, including 8.8 million from lowerincome countries. It is hardly surprising, then, that only 16% of people in low-income countries have received at least one COVID-19 vaccine dose as of May, even though global supply now far outstrips demand.

Pharmaceutical companies have a crucial role to play in overcoming the various obstacles to boosting vaccination rates in lower-income countries. And, as we seek to ensure access for a broader array of treatments, the challenges extend beyond vaccinations. Current efforts by several manufacturers, Sanofi among them, include providing a portfolio of essential medicines at cost. For example, Sanofi’s Global Health Unit distributes 30 essential drugs – including insulin and treatments for cardiovascular disease, tuberculosis, malaria, and cancer – to 40 developing countries.

But while reducing treatment costs is vitally important, the pandemic demonstrated the need for a more holistic approach

that views medicine, healthcare systems, and the global supply chain as interconnected challenges. As COVID-19 showed, assistance that does not empower local capabilities can do more harm than good, which is why companies must go beyond merely providing financial aid. To help improve access to health care in low- and middle-income countries, companies can tackle logistical and supply issues, use their data and analytics capabilities to assist frontline responders, and train local officials in innovative technologies.

Public-health experts around the world are increasingly focused on identifying and managing emerging diseases and hot spots and reshaping attitudes

data sets, computing power, and algorithms would allow publichealth officials to monitor disease spread, material shortages, logistical challenges, and drug reactions. Cloud technology facilitates data mining, information-sharing, and research and development, and enables us to identify disease outbreaks, new pathogens, and communities most in need of immediate help.

To this end, the global publichealth community should work together to enable innovation and cultivate entrepreneurial ecosystems by focusing on local startups. An Impact Fund to provide capital to local startups would need to be created, together with mechanisms for sharing skills and operational expertise. Sanofi

of rising costs, ongoing political conflicts, travel restrictions, and labor shortages. Sanofi, for example, is working together with Reach52, a tech platform from Singapore that offers rural districts health education, screening, and affordable medicines in one accessible subscription service. Reach52’s platform relies on an “offline-first” approach for lowconnectivity markets, enabling local aid workers to enroll residents in community-based screening sessions for diabetes and hypertension, conducted by nurses trained as “health coaches.”

Increasing access to health care in low-income countries in a meaningful way requires more than providing them with

and behaviors, while technology facilitates the data collection and information-sharing needed to improve outcomes. But gathering and assessing these data depends on collaboration with traditional and non-traditional partners. Such efforts must move rapidly, be driven by local communities’ priorities, and build on shared data derived from diagnostics, tracking, and modeling. During the pandemic, South Africa stood out for its prompt genomic sequencing, which involved cooperation among many actors and enabled the country to detect the Beta and Omicron variants early on.

Similarly, combining large

Global Health’s $25 million Impact Fund, launched in July, is already supporting local innovators that are able to deliver scalable solutions for sustainable health care in underserved regions.

Given lower-income countries’ need for more medical workers, fostering local expertise is crucial. In emerging markets, local medical professionals and supply-chain experts must train to become “expert generalists” who can address pressing publichealth concerns and reduce barriers to care.

Here, technology can provide an alternative to in-person training, which is becoming more challenging to manage as a result

low-cost medicines. We need a new framework of cooperation to address the myriad interconnected challenges we face as we adapt to new technologies and nurture local innovation.

As pharmaceutical companies, our job is to disrupt our own thinking and encourage on-theground innovators. This multipronged approach must center on a sustainable, locally-driven care model designed to reach vulnerable populations. As the Nobel laureate economist Angus Deaton wrote, aid that gives but does not strengthen is unhelpful –and can even hinder future gains.

WEDNESDAY, OCTOBER 19, 202212 | FEATURE

WEDNESDAY, OCTOBER 19, 2022 13| EDUCATION

Building bridges: Gender lens investing

By Paul Frimpong

By Paul Frimpong

achieved globally without broader consultation and deep conversation, birthing commitment from all stakeholders to take the necessary actions.

Between October 3 – 6, 2022, global leaders and influencers met in Geneva, Switzerland, for the annual Building Bridges Summit.

Building Bridges is an annual global event that gathers leaders in the finance industry, business, international organizations, governments, NGOs, academic institutions to create solutions that drive capital towards the Sustainable Development Gaols (SDGs).

The realization that “creating bridges” across the numerous players in the finance, government, real economy, and sustainable development communities is essential to the initiative’s success.

Annan Capital Partners (ACP), a Ghana-based boutique investment advisory and business development agency was a strategic partner to this year’s Building Bridges Summit in Geneva, focusing conversation on Gender Lens Investing and how to build gender equality in the financial services industry.

ACP is positioned to provide foreign companies with the requisite business and legal requirements, spearheading expansion projects for several multinational corporations and small-to medium-sized enterprises on the African continent and the establishment of foundations for several high-net-worth individuals.

Building Bridges is a powerful international movement of

and accelerating the shift to an economic system that is in line with the demands of a just and sustainable society (SDGs).

Gender, Equity & Financial Inclusion

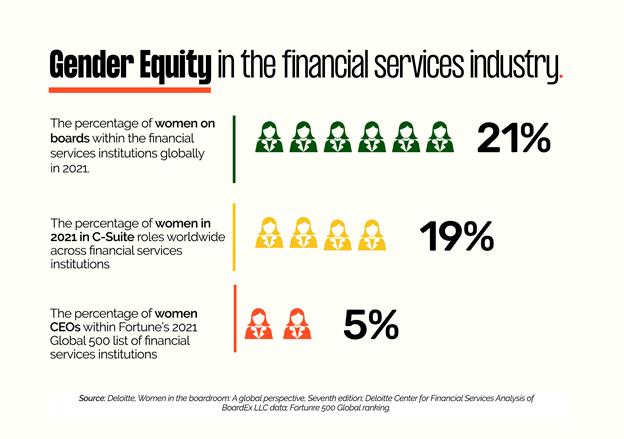

Known globally, there’s an underrepresentation of women across multiple sectors, and more so, in the financial services industry.

How has the representation of women in significant strategic roles changed over the last 20 years? Do

work, and how can we locate these areas?

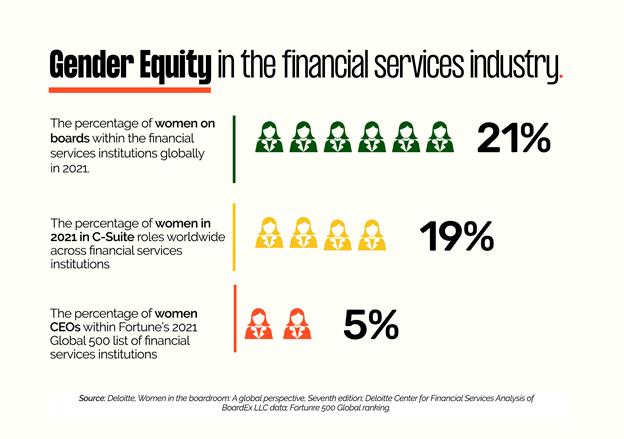

In the corporate world, women in executive roles make less than 20%. - Women occupy only 20% of executive committee roles - 22% of board positions - 9% of senior roles in venture capital - 6% of senior roles in private equity.

According to a Deloitte report (2021), women held 21% of board seats, 19% of C-suite positions, and 5% of CEO positions among the most

senior positions in financial services institutions (FSIs) worldwide in

With the use of such reports, data and analysis, we can acknowledge the progress that has been done and confirm the need for coordinated, geographically focused efforts to sustain growth in the next decades.

Women still do not fully participate in the global economy due to legal constraints, asset ownership limits, labor market restrictions, or access restrictions for education, health, and financial services.

And we simply cannot achieve

WEDNESDAY, OCTOBER 19, 202214 | FEATURE

long-term economic resilience without gender inclusive growth.

The OECD estimates that full gender parity in labor force participation would increase GDP by 12%. By 2030, the GDP would rise by 6% even if the difference were to be cut in half.

According to a recent study by the UNIDO, if women played an identical role to men in the labor force, as much as $28 trillion or 26% could be added to global annual GDP by 2025.

This is why conversation on bridging the gender gap is even more essential. Policymakers should prioritize ensuring gender balance as they attempt to manage the current economic difficulties. Of sure, it is a moral matter, but it is also critically important economically.

Women experience discrimination and are disproportionately susceptible in many societies. The most fundamental qualities of selfdetermination, dignity, and freedom are affected by unequal gender roles, which in turn affects financial inclusion.

Equity is a result of diversity, inclusion, and anti-oppression efforts; it occurs when all individuals have equitable access to opportunities, resources, and the capacity to prosper. Gender diversity must be examined and evaluated throughout an organization, industry, or territory before gender equity can be achieved.

Financial inclusion gives women the resources they need to build

up their assets, generate income, manage their financial risks, and participate fully in the economy, regardless of whether they work from home or outside the home or whether they are hired or selfemployed.

The financial services sector has the potential to both advance and measure gender equality. Financial inclusion by itself won’t lead to gender equality. However, women have the best opportunity of achieving social and economic empowerment when they have equitable access to the complete spectrum of needs-based financial services, including savings, credit, insurance, and payments, as well as the associated financial education.

Gender Lens Investing

Featuring strongly at the Building Bridges Summit this year is Gender Lens Investing (GLI).

The most recent research on GLI and its numerous advantages was presented in this session, along with methods asset owners and managers can use to incorporate it into their own corporate policies and throughout their portfolios.

What’s Gender Lens Investing?

Gender Lens Investing is simply a method or strategy for investing that, in order to achieve gender equality and better inform investment choices, considers gender-based considerations throughout the investment process.

GLI is purposefully incorporated into investment analysis and decision-making in the impact investment method of investing where investments are made in more women- owned or led

enterprises and/or investments are made in enterprises that promote gender equality at the workplace, as well as in products or services that substantially improve the lives of women and girls, building strong, resilient economies of the future.

Due to investors’ desire to give the nature of their investments additional dimensions, GLI has recently attracted more attention on a global scale.

Recent polls conducted by the Morgan Stanley Institute for Sustainable Investing reveal that 67% of global asset owners are interested in gender diversity for their investment portfolios.

GLI involves investing with the intent to address gender issues or promote gender equity, including by:

• Investing in women-owned or women-led enterprises

• Investing in enterprises that promote workplace equity (in staffing, management, boardroom representation, and along their supply chains); or

• Investing in enterprises that offer products or services that substantially improve the lives of women and girls

Why does GLI matter?

To serve women and girls in emerging markets and developing nations, GLI activities crosses international financial markets.

Gender Lens Investing is fundamentally an effort to close what is known as the “gender gap.”

As defined by the World Economic Forum, “the gender gap is the difference between women and men as reflected in social, political,

ABOUT THE AUTHOR

intellectual, cultural, or economic attainments or attitudes.”

The absence of gender equity has long been a pervasive problem in the business and investment world, but there is now mounting evidence that investing in gender equity will be good for society, industry, and the investment world.

Women’s purchasing power is increasing globally, and businesses and investors are seeing the chance to tap into this capital.

GLI offers the chance to unleash economic force and propel market development, attaining financial return and value creation while producing a verifiable impact for gender parity. It is not just about charitable giving or simple regulatory compliance.

It is a well-known fact that businesses with women in executive management consistently outperform those without women in high positions. The same applies to businesses with female board members.

Gender Lens Investing will likely continue to gather momentum and we will keep witnessing innovations within the gender impact investing space.

Government, business, nonprofit organizations, and the investing community will need to continue to form stronger alliances in order to work together to make a difference.

Acknowledgment that investing in women’s potential has disproportionately large social and economic benefits due to the knock-on effects on healthcare, education, and job creation.

Paul Frimpong, CGIA, ICCE Paul Frimpong is a development economist, top voice on Sino-Africa relations, and an award-winning entrepreneur.

He’s currently the Global Head of Strategy & Membership at the Institute of Certified Chartered Economists (ICCE).

This article is originally curated for and published by: Annan Capital Partners. Annan Capital Partners (ACP) is a boutique investment advisory and business development agency offering holistic wealth management and venture building services to a wide range of clients, from entrepreneurs to governments and from local SMEs to global corporations.

https://annancapitalpartners.com/ py.frimpong90@gmail.com

TOTAL Energies announces interim dividend for shareholders

Total Energies Marketing Ghana PLC has announced the payment of an Interim dividend of GH¢0.3546 for the financial year ended December 31, 2022.

All shareholders registered in the books of the company at the close of business on Friday,

December 02, 2022, will qualify for the final dividend.

A release issued by the Ghana Stock Exchange (GSE) said the register of shareholders would be closed from Monday, December 05, 2022, to Friday December 09, 2022.

“In view of the foregoing, the ex-dividend date has been set as Wednesday, November 30, 2022. Consequently, an investor purchasing TOTAL shares before this date will be entitled to the final dividend.

“However, an investor buying

TOTAL shares on or after Wednesday, November 30, 2022, will not be entitled to the final dividend,” the release noted.

The release further indicated that the final dividend would be paid from Thursday, December 15, 2022.

WEDNESDAY, OCTOBER 19, 2022 15| FEATURE

WEDNESDAY, OCTOBER 19, 202216 | NEWS

FeDems, Construction Ambassadors Ltd, others construct residential complex for appeal court judges

Fedems Limited, a Ghanaianowned engineering consultancy and construction company, in partnership with Construction Ambassadors Limited, Modern International Developers (MID) and Superior Royal, have completed the construction of an ultra-modern residential complex for Court of Appeal judges in Kumasi.

The project was executed within eighteen (18) months beginning 20th April, 2021.

The residential complex will serve as permanent residences for Court of Appeal judges based in Kumasi and who are mandated to handle cases in the northern part of the country. The project is a gated community of 20 units of four-bedroom town houses with boys’ quarters, a swimming pool, a guest house, a club house and a tennis court.

The complex also has another gated community of six units of three-bedroom houses with boys’ quarters, a parking lot for the directors and other supporting administrative staff members of the Judicial Service.

Other facilities incorporated in the complex are judges bungalows, apartments, guest house, club house with a road network and ancillary facilities.

It means that appeals from Upper West, Upper East, Savannah, North East, Northern, Bono, Bono East, Ahafo, Western North and Ashanti Regions will be conveniently heard within a much shorter period as judges will be permanently stationed in Kumasi.

Performing the commissioning ceremony on Monday, October 17, 2022 in Kumasi in the Ashanti Region, President Nana Addo Dankwa Akufo-Addo gave a firm assurance to do more for the

judiciary to advance the rule of law in the country.

“We will continue to implement policies that will advance the rule of law and, thereby, reinforce the confidence of the people in a country governed by the rule of law,” he underscored.

He commissioned the project in the presence of Asantehene, Otumfuo Osei Tutu II, and the Chief Justice, His Lordship Justice Anin Yeboah, and immediate past Chief Justice, Her Lordship Sophia Akuffo.

He was hopeful that the residential complex will motivate the judiciary to work even harder to promote justice and the rule of law in the country.

“Government, since the assumption of my office, has introduced a number of policy measures to help bridge the technology gap in the administration of justice.

...We launched the e-justice system, which is leveraging technology, in the delivery of justice,” he indicated.

According to the President, his government was also addressing the challenge posed by the inadequate number of courts in various parts of the country.

This, he said, the government was doing by constructing 120 courts and 150 bungalows for the judiciary across the country.

70 per cent of these ongoing projects, he stressed, were completed.

President Akufo-Addo, therefore, urged the Chief Justice, His Lordship Justice Anin Yeboah, to take over the Kumasi residential complex for Appeal Court judges and post officers to begin working

of the country are compelled to travel long distances to gain access to the courts.

This, he intimated, weakens the rule of law.

President Akufo-Addo expressed his government’s appreciation to the Asantehene, Otumfuo Osei Tutu II, for his immense support for the project including his “generous donation” of a 7-acre land for the project.

He also commended the Administrator of the District Assemblies Common Fund (DACF), Irene Naa Torshie Addo, the Chief Justice, the immediate past Chief Justice, Mrs. Sophia Akuffo, the Ministry of Local Government, Decntralisation and Rural Development (MLGDRD) and the contractors for their efforts in ensuring that the project was delivered on schedule.

The Chief Justice, His Lordship Justice Anin Yeboah, asserted that the newly completed residential complex for Court of Appeal justices in Kumasi marked an epoch in the history of the judiciary.

He admitted that the judiciary’s journey has not been smooth sailing, albeit they have worked to improve the legal and constitutional framework within which they operate.

“We have also had to deal with the lack and distressing poor physical infrastructure. The evidently deplorable state of most of our court structures and residences of justices in administering justice has been a major challenge,” he bemoaned.

To this end, the Chief Justice lauded the government, through the MLGDRD and the DACF for

He was also grateful to Otumfuo Osei Tutu II for making available land for the project, Members of Parliament (MPs), MLGDRD and the contractors for the expeditious execution of the project.

He disclosed that a land had been acquired in Adenta in Greater Accra for a similar facility to be constructed for the judiciary.

Justice Anin Yeboah charged the judiciary to build a system justice that will assure litigants.

Furthermore, he revealed that the Kumasi residential complex will require about 2,500 staff, and thus made a passionate appeal to the Ministry of Finance to grant financial clearance for the recruitment process to begin.

Earlier, in a welcome address, the Ashanti Regional Minster, Simon Osei Mensah, lapped praises on the Chief Justice for his active supervision of the project right from the sod-cutting ceremony by the President last year.

“I don’t see the project as residential facilities but as a community on its own,” he expressed.

He admonished the judiciary to properly maintain and put the facilities in the complex to good use to ensure a long life span.

For his part, the deputy Minister of MLGDRD, Mr. Collins Ntim, who represented his Minister, Mr. Daniel Kweku Botwe, noted that the residential complex will facilitate the adjudication of justice in the northern sector of the country.

Among the dignitaries who attended the event were judges, Members of Parliament, Ministers of State, metropolitan, municipal and district chief executives (MMDCEs), and members of the Judicial Council and Ghana Bar

WEDNESDAY, OCTOBER 19, 2022 17| NEWS

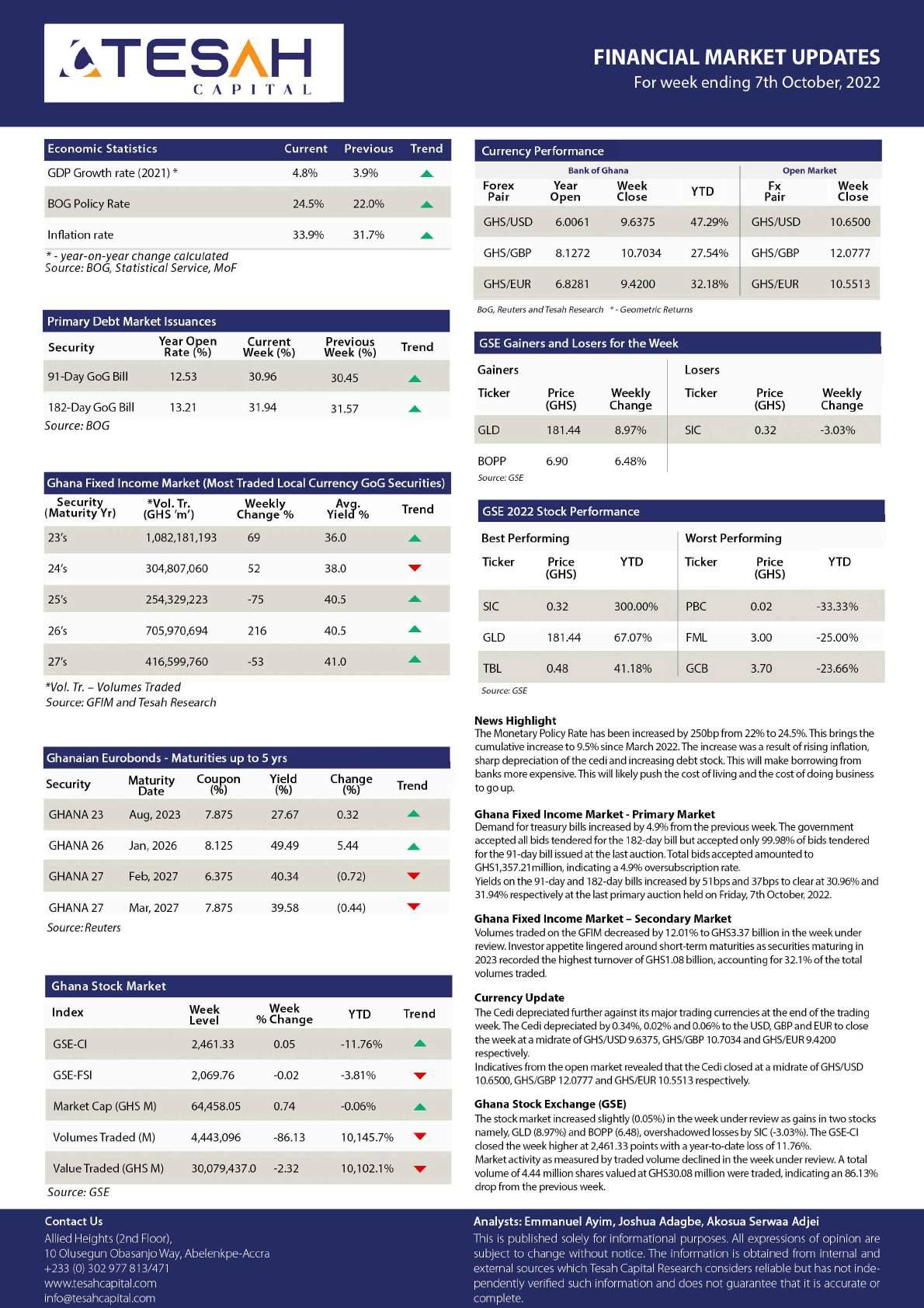

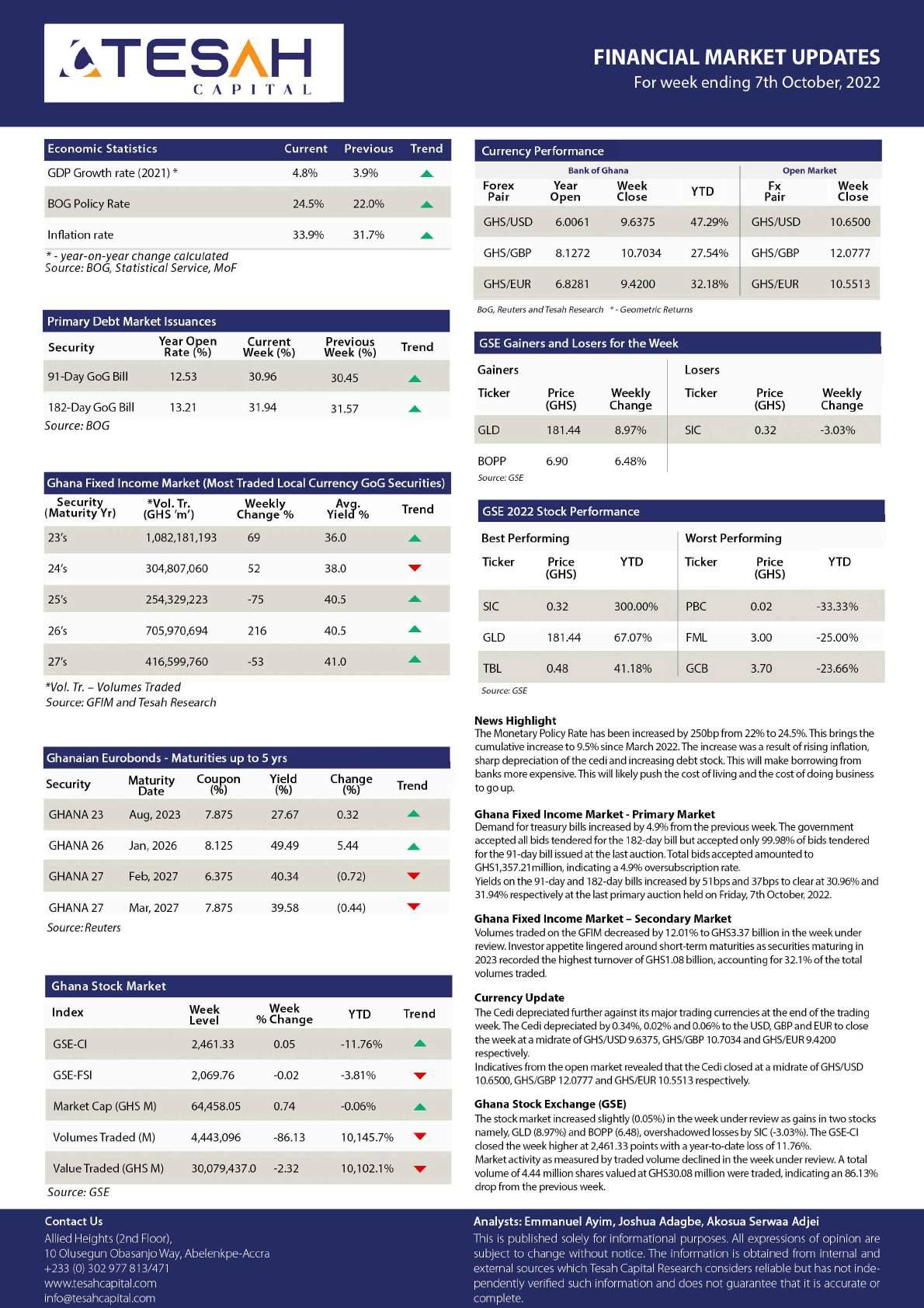

WEEKLY MARKET REVIEW FOR WEEK ENDING - OCTOBER 14, 2022

MACROECONOMIC INDICATORS

Q3, 2021 GDP Growth 4.8%

Average GDP Growth for 2021 4.1%

2022 Projected GDP Growth 3.7%

BoG Policy Rate 24.50%

Weekly Interbank Interest Rate 24.15%

Inflation for February, 2022 37.20%

End Period Inflation Target – 2022 28.5%

Budget Deficit (% GDP) – Dec, 2021 6.4%

2022 Budget Deficit Target (%GDP) 6.6%

Public Debt (billion GH¢) – Dec, 2021 402.4%

Debt to GDP Ratio – Dec, 2021 68.0%

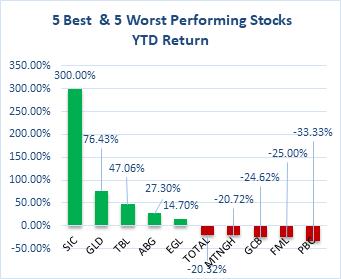

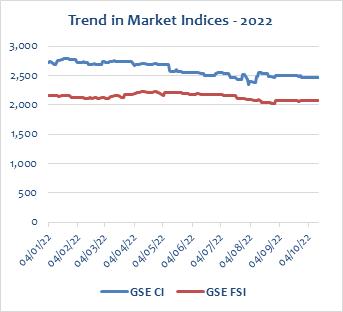

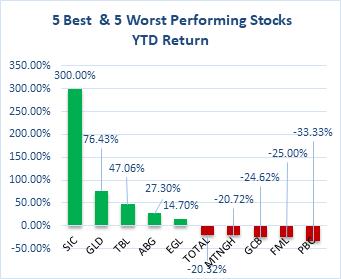

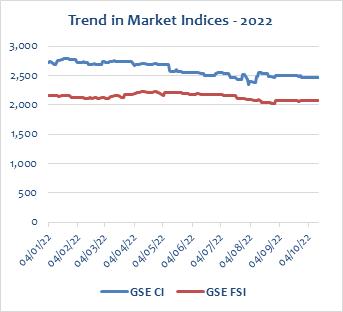

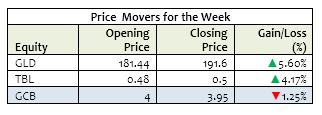

STOCK MARKET REVIEW

The Ghana Stock Exchange closed lower for the week on the back of price decline by 1 counter. The GSE Composite Index (GSE CI) lost 0.89 points (-0.04%) to close at 2,460.44 points, reflecting year-to-date (YTD) loss of 11.79%. The GSE Financial Stocks Index (GSE FI) also lost 1.60 points (-0.08%) to close at 2,068.16 points, reflecting YTD loss of 3.89%.

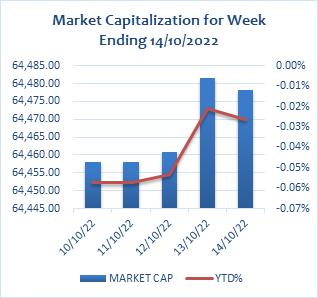

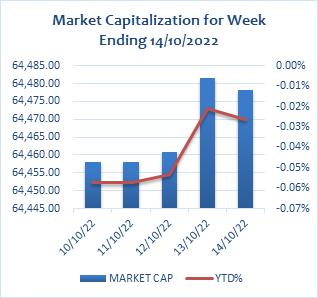

Market capitalization increased by 0.03% to close the week at GH¢64,478.26 million, from GH¢64,458.05 million at the close of the previous week. This reflects a YTD decrease of 0.03%.

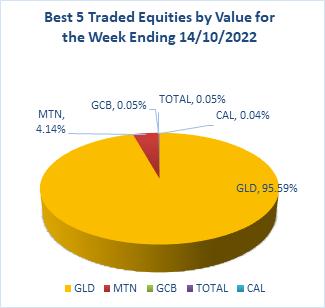

Trading activity recorded a total of 3,546,068 shares valued at GH¢59,618,839.97 changing hands, compared with 4,443,096 shares, valued at GH¢30,079,436.97 in the preceding week.

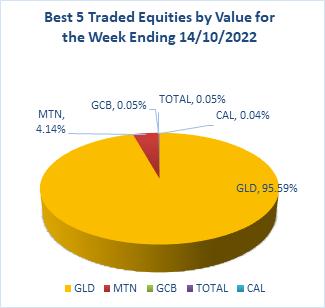

MTN dominated volume of trades whiles New Gold dominated value of trades for the week, accounting for 79.15% and 95.59% of shares traded respectively.

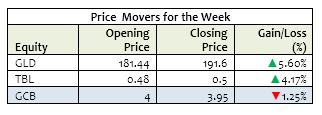

The market ended the week with 2 advancers and a decliner as indicated on the table below.

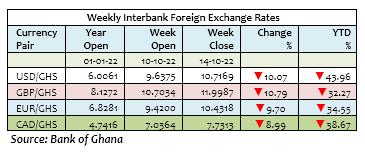

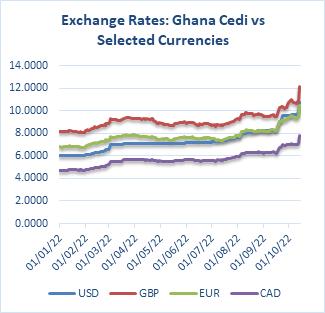

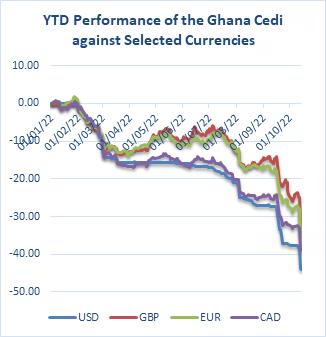

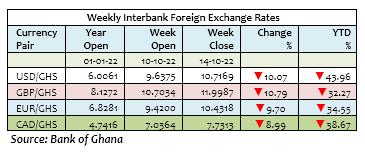

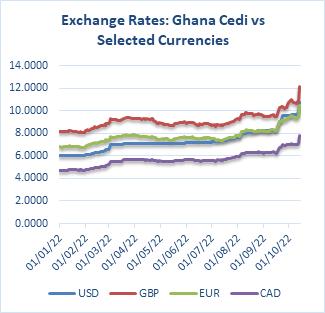

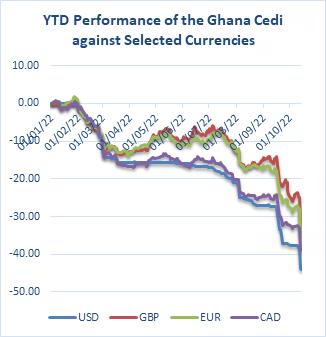

THE CURRENCY MARKET

The Cedi weakened against the USD for the week. It traded at GH¢10.7169/$, compared with GH¢9.6375/$ at week open, reflecting w/w and YTD depreciations of 10.07% and 43.96% respectively. This compares with YTD depreciation of 2.07% a year ago.

The Cedi also weakened against the GBP for the week. It traded at GH¢11.9987/£, compared with GH¢10.7034/£ at week open, reflecting w/w and YTD depreciations of 10.79% and 32.27% respectively. This compares with YTD depreciation of 2.69% a year ago.

The Cedi continued its downward trend against the Euro for the week. It traded at GH¢10.4318/€, compared with GH¢9.4200/€ at week open, reflecting w/w and YTD depreciations of 9.70% and 34.55% respectively. This compares with YTD appreciation of 3.54% a year ago.

The Cedi again weakened against the Canadian Dollar for the week. It opened at GH¢7.0364/C$ but closed at GH¢7.7313/C$, reflecting w/w and YTD depreciations of 8.99% and 38.67% respectively. This compares with YTD depreciation of 4.78% a year ago.

WEDNESDAY, OCTOBER 19, 202218 | MARKET REVIEW

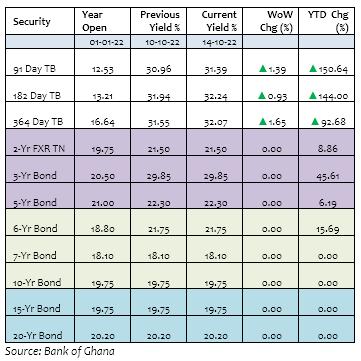

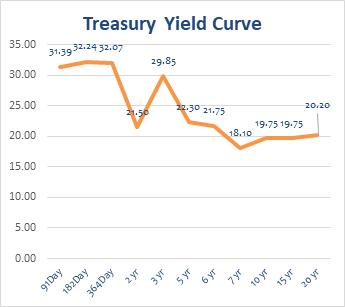

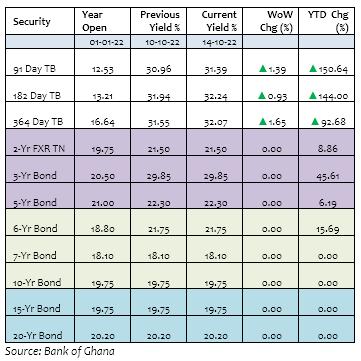

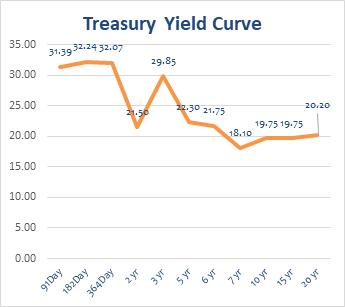

GOVERNMENT SECURITIES MARKET

Government raised a sum of GH¢974.51 million for the week across the 91-Day, 182-Day and 364-Day Treasury Bills. This compared with GH¢1,357.21 million raised in the previous week.

The 91-Day Bill settled at 31.39% p.a from 30.96% p.a. last week whilst the 182-Day Bill settled at 32.24% p.a from 31.94% p.a. last week. The 364-Day Bill settled at 32.07% p.a from 31.55% p.a last week. The table and graph below highlight primary market yields at close of the week.

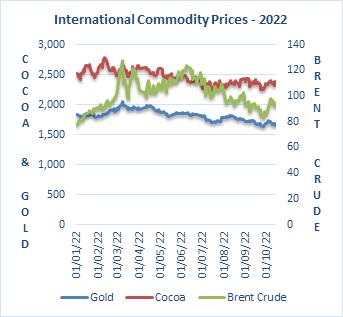

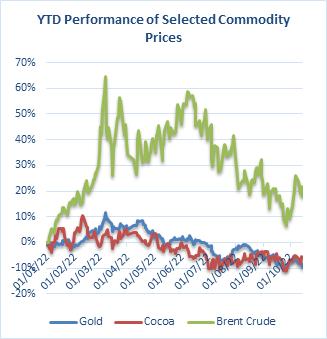

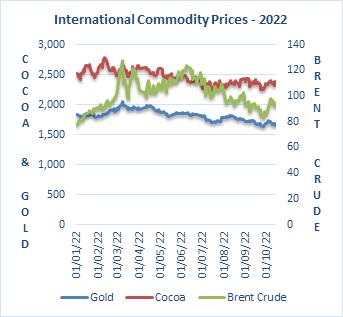

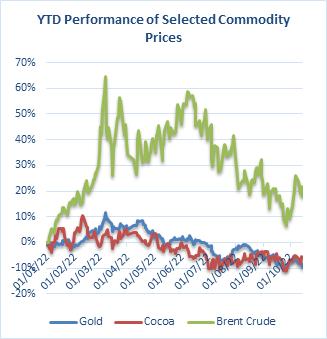

COMMODITY MARKET

Oil prices fell Friday, ending a difficult week on a negative note on fears a global economic slowdown and further Covid-19 restrictions in China will severely hit demand. Brent futures traded at US$91.63 a barrel on Friday, compared to US$97.92 at week open. This reflects w/w loss and YTD appreciation of 6.42% and 17.81% respectively.

Gold prices hovered above annual lows on Tuesday after tumbling sharply on hawkish signals from the Federal Reserve. Gold settled at US$1,648.90, from US$1,709.30 last week, reflecting w/w and YTD loss of 3.53% and 9.83% respectively.

Prices of Cocoa increased for the week. The commodity traded at US$2,377.00 per tonne on Friday, from US$2,396.00 last week, reflecting w/w and YTD depreciations of 0.79% and 5.67% respectively.

INTERNTIONAL COMMODITIES PRICES

ABOUT CIDAN

CIDAN Investments Limited is an investment and fund management company licensed by the Securities & Exchange Commission (SEC) and the National Pensions Regulatory Authority (NPRA).

RESEARCH TEAM

Name: Ernest Tannor Email:etannor@cidaninvestments.com Tel:+233 (0) 20 881 8957

Name: Audrey Asiedua Wiafe Email:aaudrey@cidaninvestments.com Tel:+233 (0) 57 840 2700

Name: Moses Nana Osei-Yeboah Email:moyeboah@cidaninvestments.com Tel:+233 (0) 24 499 0069

CORPORATE INFORMATION

CIDAN Investments Limited

CIDAN House Plot No. 169 Block 6 Haatso, North Legon – Accra Tel: +233 (0) 26171 7001/ 26 300 3917 Fax: +233 (0)30 254 4351 Email: info@cidaninvestmens.com Website: www.cidaninvestments.com

Disclaimer

The contents of this report have been prepared to provide you with general information only. Information provided on and available from this report does not constitute any investment recommendation. The information contained herein has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed.

Limited

Copyright @ 2019 Business24 Limited. All Rights Reserved.

Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed.

We value your support and loyalty.

Contact: editor@business24.com.gh Newsroom: 030 296 5315

Advertising / Sales: +233 24 212 2742

BUSINESS TERM OF THE WEEK