Gov’t, GUTA agree on concessions to re-open shops …as GRA VAT invigilation exercise suspended

By Eugene Davis

By Eugene Davis

empower farmers …as Trade Minister inaugurates GHS 6.7m maize company board

Prime Minister of Barbados calls for a new global financial paradigm that is fair to all

Newmont sees silver lining for Ahafo North project

FRIDAY, OCTOBER 21, 2022 NEWS FOR BUSINESS LEADERS

By Eugene Davis

By Eugene Davis

Story on page 2 Story on page 2 Story

on

page 3 Story on page 4

Gov’t, GUTA agree on concessions to re-open shops …as GRA VAT invigilation exercise suspended

By Eugene Davis

A Deputy Minister of Trade and Industry, Michael Okyere Baafi, has hinted that government has made some concessions with the Ghana Union and Traders Association (GUTA) in an effort to get businesses back on stream, chief among them is the suspension of the invigilation exercise being conducted by the Ghana Revenue Authority.

Members of the GUTA in Accra have closed down their shops in a nationwide protest over high taxes and difficulty in doing business. For them, their decision to halt commercial activities is based on the exorbitant tax rates and the continuous depreciation of the local currency against the US dollar.

This, the traders say, is adversely affecting their businesses and depleting their capital and profit margins.

However, speaking to journalists in an interview on the sidelines of GEA’s Covid-19 Response Grant Programme in Accra, he said

“Government has made a lot of concessions, at least one of

them being the suspension of the invigilation being conducted by the Ghana Revenue Authority, that is enormous -government was going to raise a lot of revenue from that exercise but GUTA says they don’t want it. We engage whiles we still do business, that is the way to go.

The way to go now is for these people to come together and set up businesses in Ghana to manufacture all those things that they import to Ghana, that will help the country to grow and overcome challenges we are going through now.”

He also revealed that the central bank and the finance ministry have agreed on a rate -which will be knocked down for the next three months, specifically for the traders in order for them to undertake their custom activities [payment of duties].

“These are some of the things we are doing and they are aware of it, so if government is making concessions, it is very good for GUTA and its allied bodies to also reciprocate in a good way, not

in the country, and the failure of government to address the growing economic decline.

The current economic decline is reflected in the depreciation of the Cedi as well as government’s fiscal deficits and the nation’s ballooning debt stock.

Newmont sees silver lining for Ahafo North project

By Eugene Davis

Newmont Ghana Gold Limited has given the clearest indication of developing its Ahafo North project in the coming months with the aim of reviving and shoring up its commercial production, Director of Communications and External Relations, David Ebo Johnson, has said.

According to him, the gold company faced some setbacks with regard to land acquisition but maintained that it had been resolved and the project is raring to get off the ground.

Speaking to Business24 in an interview on the sidelines of Ghana Club 100 awards held last Friday, where the company picked up two awards [named second best company out of 100 and ninth - Newmont Ghana Gold Limited and Newmont Golden Ridge Limited respectively], Mr. Johnson disclosed that “we are looking forward to bigger things as we progress on the Ahafo North project which is supposed to be coming on stream in the next year or so, we are looking

to the future with great prospect because of the Ahafo North project whiles we keep doing the great things, we are doing for Ahafo South as well as Akyem.

Ahafo North has had a few challenges with land acquisition and land take, but I think we have gotten to a point where a lot of these challenges have been resolved and it is our expectation that hopefully within the next few months or in the coming year, 2023 we should see a lot of work on the Ahafo North project to bring that asset into production, so it is an exciting time for us.”

On the awards, Mr Johnson stated “The efforts that we are putting in, employees, the support that we are getting from the communities is actually showing forth in the awards we have picked up, it is actually consistent with what we have been doing over the years.

If we look at the history of Ghana Club 100 both Akyem and Ahafo have been performing extremely well, placing in the

top five or top ten consistently over the years and I think that is testament to the value that we have been creating over the years, in the communities, for employees and government as well and for investors too.

We are quite excited that we are being recognized for the value that we are creating for communities and the economy as a whole.”

For Newmont, enabling sustainable development means conducting operations in a way that improves lives for current and future generations through its sustainability efforts, which include maintaining relationships with communities, serving as responsible stewards of the environment, and making a lasting contribution to local economic development.

He also indicated that they are looking forward to opportunities and more collaborations, and bigger things as they progress on the Ahafo North project which continued on page 3

2 FRIDAY, OCTOBER 21, 2022| NEWS Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed. We value your support and loyalty. Contact: editor@business24.com.gh Newsroom: 030 296 5315 Advertising / Sales: +233 24 212 2742 Copyright @ 2019 Business24 Limited. All Rights Reserved. Limited

1D1F Common User Facility expected to empower farmers …as Trade Minister inaugurates GHS 6.7m maize company board

By Eugene Davis

The Minister of Trade and Industry, Alan Kyerematen, has inaugurated a 10-member board to steer the affairs of a GH₵6.7m maize processing company at Nsuta Kwagyei in the Sekyere Central District of the Ashanti Region under the One District One Factory Common User Facility Initiative.

The 1D1F Common User Facility (CUF) is a farmer-owned agroindustrial processing facility established with seed funding from the Ministry of Trade and Industry (MOTI) under the Rural Enterprises Programme (REP).

According to the minister, the Model seeks to enhance the ability of farmers and other agricultural value chain actors, with little or no financial capacity to establish their own Common User processing facilities to process their farm products. In response to this constraint, MOTI sought funding from African Development Bank (AfDB) to introduce this new concept of establishing CUFs in five (5) Districts including the Sekyere Maize Processing facility.

These CUFs have been established in selected areas where farmers engaged in the same commodity value chains lack facilities to process the outputs from their farming operations.

Speaking to the press after the inauguration on Tuesday, he said “ they would supply raw materials or maize to their own processing plant, when they bring it , they would be paid just as they would if they were sending it to other processing plant, but the beauty of this is that because they own the processing plant, apart from they being paid for whatever they supply to the factory, they would also earn the dividends when the raw material is processed into higher value, so this is a breakthrough model for enhancing the profitability or value addition for farmers.”

continued from page 2

is supposed to be coming on stream in the next year.

“We have enjoyed considerable support from communities within our catchment areas and that is the kind of partnership we believe will help sustain our operations and going forward we continuously seek opportunities to strengthen those relationships with communities because when we grow, the communities grow, we have actually plucked the development of the communities into our own development, so the more we grow, the communities grow as well, and the community development models that we have developed have served us well over the years and we believe

their own processing plant, so we identified a number of these districts and we selected five of these based on the type of commodity where they have comparative advantage, so in this district , they have a comparative advantage in maize, what you see here is farmer owned company, owned by 600 farmers, with seed funding provided by government with the support of the African Development Bank, they are supporting the Rural Enterprises Enterprises programme which is run by the Ministry of Trade and Industry and we have used the funding to be able to establish this processing plant for farmers, but this is not a state enterprise but a farmer owned company and being able to empower farmers so that they can also participate in the 1D1F initiative.

We understand and appreciate that although we have supported the farmers to own such a facility they may not have the capacity to manage the plant on their own so again, government has facilitated the process of recruiting a management services company to provide

Further, he noted that with regard to its sustainability, “It is a proof of concept, so the farmers own the company and they have recruited a management services company,they would have their management services operational plan like any other company , the plan should determine the viability of this facility.

There is an oversight function provided by the board of directors which is chaired by the farmers and the majority of representation which is also the farmers, they will run it like any high profile,commercially viable entity.”

The Country Manager of African Development Bank, Eyerusalem Fasika stated that they were attracted to support the programme due to their engagement with the people of Ghana under the country strategy programming document which aligns their strategy with government strategy.

“When you look at this programme, it is very much in line with the government private sector development agenda,

maize Drying Plant and a Grit Milling Machine. It has a standby generator and a mechanized borehole to supply the factory with water. In addition, the factory has a Warehouse, fully furnished office accommodation for staff, a conference room, laboratory room and a canteen for the workers.

The total cost of the factory is about Ghs6.7m, including the cost of factory building, processing plant and machinery, offices, office equipment and a Pickup vehicle.

The CUF 1D1F is owned by a group of maize farmers and other stakeholders with the following shareholding structure: 70% by Sekyere Central Union of Maize Producers Associations (Mother Association of all Maize Farmer Based Organisations in the Sekyere Central District of Ashanti), 20% by Ministry of Trade and Industry and 10% by Traditional Council.

The Sekyere Central Union of Maize Producers Associations comprises of 18 individual FBOs. The total membership of the 18 individual FBOs is about 600 farmers.

that going forward we can only get better as we seek opportunities for more collaborations.”

Newmont’s presence in Ghana includes the Ahafo mine in the Ahafo region and the Akyem operation in the Eastern region near New Abirem.

Ahafo began commercial production in 2006 and operates both surface and underground mines.

Akyem began construction in 2011 and achieved commercial production on schedule and below budget in October 2013. The operation currently employs more than 1,900 direct employees and contractors.

FRIDAY, OCTOBER 21, 2022 | NEWS 3

Prime Minister of Barbados calls for a new global financial paradigm that is fair to all

The global financial architecture must be reconfigured completely to reflect the needs and participation of countries in the Global South, many of which were under the yoke of colonialism at the time the current order was fashioned, Her Excellency Prime Minister Mia Amor Mottley of Barbados has argued during the Sixth Annual Babacar Ndiaye Lecture, held on the sidelines of the World Bank-IMF Annual Meetings in Washington DC, USA.

The lecture, an initiative of the African Export-Import Bank (Afreximbank), was held on 14 October under the heading “The Developing World in a Turbulent Global Financial Architecture”. In his welcoming remarks, Professor Benedict Oramah, President and Chairman of the Board of Directors of Afreximbank, celebrated the enduring legacy and vision of Dr Ndiaye and called for “renewed efforts to reconnect Africa and the Caribbean through trade and investment in pursuit of the shared purpose of economic emancipation”.

President Oramah praised Prime Minister Mottley for her global leadership in the pursuit of fairness and equality. He referred to their shared belief that “African and Caribbean nations can turn the iniquities of history into platforms for economic prosperity today and in the future. Realizing that vision can only begin with the reconnection of the Caribbean people to their genealogical ties in Africa through trade and investment.”

The lecture was organized at a time of heightening geopolitical tensions, with the weaponization of the US dollar exacerbating the risks of global fragmentation. Simultaneously, the cycle of aggressive interest rate increases by systemically important central banks in response to surging inflation has aggravated macroeconomic management challenges, dramatically increasing debt-servicing costs and raising the specter of a debt crisis in the Global South.

Prime Minister Mottley said the current system operates to the disadvantage of Caribbean and African nations, whose unique circumstances are not accounted for in the decision-making of major financial institutions, but which are nevertheless affected drastically by those decisions. Recalling the genesis of the Bretton Woods institutions, she said they were designed at a time when “we were not seen, we were not heard, and we were not felt”. These structures must be reoriented as

a matter of fairness and to reflect the growing role that countries in the Global South play in the world economy.

She said global institutions must be reminded of their founding mandates and seek to fulfil their original purpose in a way that benefits all countries, but especially lower- and middleincome countries, which are currently facing severe challenges. Prime Minister Mottley outlined a set of recommendations for reforming the existing international financial system to better reflect the challenges of our time while concurrently creating the conditions for a process of globalization that serves us all. Among the various recommendations she articulated, the most pertinent include:

1. Reforming the United Nations Security Council, especially its panel of Permanent Members, which currently lacks representation for more than 1.5 billion people of African descent;

2. Democratizing the system of global governance, particularly the G7 and G20, by broadening representation to include the African Union as a full member;

3. Reallocating unused special drawing rights (SDRs) issued by the IMF to assuage liquidity constraints in the Global South;

4. Developing new facilities for food and agriculture, clean energy, and climate change adaptation in response to emerging global challenges;

5. Capping debt-service payments to a certain percentage of exports—for instance around 5% of total exports, as was done in Germany to help finance reconstruction following the second world war. As a percentage of exports, debtservice payments have risen to 24% and 20% in Africa and the Caribbean, respectively;

6. Reforming global credit rating agencies to correct their intrinsic biases, which over the years have led global investors to overprice risks in the Global South, with significant consequences for access to development finance, debt sustainability, and economic growth. To take but one example, Ghana’s Eurobond yield currently exceeds 25%, while Greece pays less than 2% for new issuances;

7. Suspending temporary

surcharges by the IMF, which further raise the debt burden at a time when rising interest rates are exacerbating the fiscal incidence of sovereign debt;

8. Taking advantage of the Review of Quotas by the IMF scheduled for 2023 to reform the Bretton Woods institutions and account for shifting economic weights. The Prime Minister deplored the fact that 27 low-income countries, with a population of 611 million, have fewer quotas combined than the United Kingdom, with a population of only 67 million, does alone;

9. Increasing long-term financing and longer maturity loans to support economic development and structural transformation in low-income countries. To underscore the benefits of long-term financing, the Prime Minister highlighted an example from Britain, where a bond issued in 1922 for reconstruction after the first world war was finally repaid in 2014, almost a century later.

10. Reforming the Bretton Woods institutions and holding them accountable to their mandate, specifically that of development and not just crisis management and structural adjustment. The Prime Minister reminded the audience that what we now call the World Bank Group began life simply enough as the International Bank for Reconstruction and Development. She stressed that its eponymous mandate, which was so effective during the reconstruction of Europe after the second world war, has been noticeably less pronounced in respect of promoting development in the Global South, where poverty is rampant and unemployment rates have been at Great Depressionlevels for decades.

Prime Minister Mottley emphasized the need to adopt a sense of urgency, arguing that the devastating effects of global warming, especially in countries on the frontline of the climate crisis, as well as ongoing energy and food crises demand bolder and swifter steps. “Urgent and ambitious action is necessary to save lives and l

She also tasked countries in Africa and the Caribbean to expand their own capacity through creative

linkages that will enable them to fund and execute projects. In that context, she praised Afreximbank for recently convening the inaugural AfriCaribbean Trade and Investment Forum, which she said provided an opportunity to build these bridges. “The presence of Caribbean banks in Africa and African banks in the Caribbean is one example of how economic bonds can be built and cemented,” she said. The Prime Minister also praised President Oramah for his Pan-African vision, which recognizes that global prosperity for Africans must include not only the continent of Africa but also its diaspora.

Furthermore, the Prime Minister highlighted the benefits associated with the emergence of digitalization and new technologies, especially in terms of economic development and shared prosperity between Africa and its diaspora. In that regard, she encouraged leaders in Africa and the Caribbean to prepare young Africans for rising development challenges by investing in artificial intelligence, information technology, cybersecurity, and digitalization. “We have to stop looking North, because we have the capacity,” she said.

“Technology has become the leading driver of growth and effective integration into the global economy. Investing in our youth is not only a path towards strengthening ownership of our development process, but also a way to reap the benefits of globalization,” Dr Hippolyte Fofack, Chief Economist of Afreximbank, said in his closing remarks. Dr Fofack thanked and praised the Prime Minister for her leadership on the subject of reforming the international financial system, which for too long has undermined the process of global income convergence and sustained the colonialist dichotomy of developed-developing countries by constraining access to capital in the Global South.

Dr Fofack also emphasized that the emergence of an improved international financial system, as articulated by the Prime Minister, must come as the result of collective effort, with success requiring support from all stakeholders. He invited world leaders—from the Global South and the North, as well as from the public and private sectors— to collaborate to implement the comprehensive recommendations outlined by Prime Minister Mottley to meet our shared challenges of the 21st century.

FRIDAY, OCTOBER 21, 20224 | NEWS

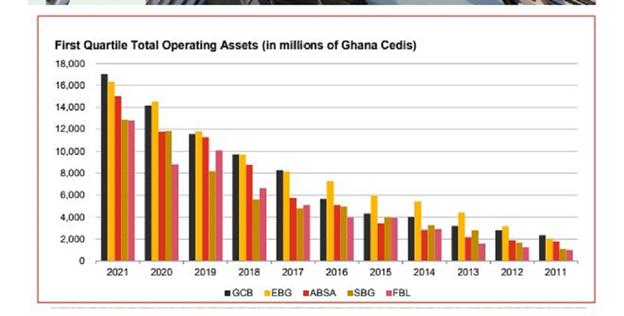

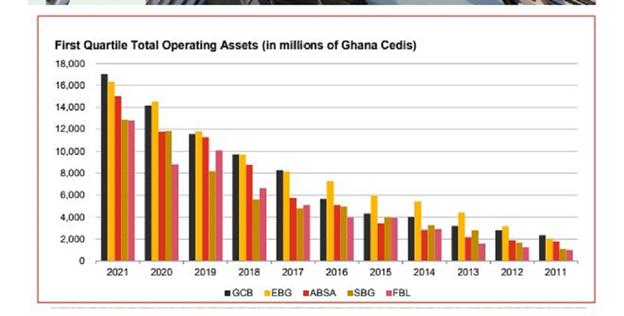

GCB Bank overtakes Ecobank as largest bank

GCB Bank Plc has overtaken Ecobank Ghana Limited (EBG) as the biggest bank by assets in an alternating battle for the top spot that has seen the two institutions occupy the prestigious position equally over the past six years.

GCB Bank’s assets strengthened to GH¢18.26 billion in 2021 to surpass those of Ecobank, which ended the year at GH¢17.93 billion.

The growth in the assets was driven by treasury (T) bills and bonds, and loans and advances, among other things.

A survey by accounting and auditing firm, PricewaterhouseCooper’s (PwC), showed that while GCB Bank’s assets accounted for 10.7 per cent of the banking sector’s total assets for 2021, Ecobank’s assets were equivalent to 10.2 per cent in the year under review.

Absa Bank Ghana Limited (ABSA), Stanbic Bank Ghana (SBG) and Fidelity Bank Limited (FBL) were the next largest banks by assets in that order, according to the 2021 PwC Banking Survey report Wednesday.

The PwC report said the growth in the assets of the top five banks was driven largely by investment in liquid assets such as the government treasury bills and bonds, and loans and advances and improvements in cash balances financed by growth in liabilities such as deposits and borrowings.

“The government securities increased by GH¢8.3 billion, loans and advances by GH¢2.7 billion and cash assets by GH¢1.8 billion representing a growth of 30 per cent per cent, 10 per cent and 10 per cent respectively,” the report said.

Banks’ assets largely comprise loans and advances, investments and cash and cash equivalents that the lenders directly deploy to generate interest income or related fee income.

To a large extent, the size of the assets determines the leverage that a bank has when it comes to generating income and maximising profit and efficiency.

GCB’s return to the top spot is the first since 2019 after it lost the

position to Ecobank in that year.

A largely indigenous bank, GCB Bank was the largest bank in the country for a long time until 2012 when Ecobank’s assets shot up tremendously after it successfully took over the now defunct The Trust Bank (TTB).

Since then, the two banks have been neck to neck for the top spot.

GCB Bank’s takeover of the good assets and liabilities of the defunct UT and Capital Banks, however, strengthened its asset base.

The PwC report said GCB, EBG, ABSA, SBG and FBL maintained their positions as first quartile banks with 46.5 per cent of the industry’s total operating assets.

“Their total operating assets grew by 21.2 per cent to GH¢74 billion compared to a 15.5 per cent growth in 2020.

“FBL and ABSA significantly contributed to the 2021 increase in total operating assets,” the report said.

It noted that Fidelity Bank recorded the highest growth of 45.5 per cent to replace Consolidated Bank Ghana Limited

(CBG) as the fifth bank in terms of operating assets.

It said ABSA, GCB, EBG and SBG also increased their operating assets by 27.6 per cent, 20.3 per cent, 12.2 per cent and 8.7 per cent respectively.

The report said the second quartile consisted of Standard Chartered Bank Ghana Limited (SCB), CAL Bank Limited, Zenith Bank Ghana Limited (ZBL), Access Bank Ghana (ABG) and CBG, which is the latest entrant.

It said the year-on- year growth in operating assets marginally declined from 20.9 per cent in 2020 to 20 per cent in 2021.

“All banks increased their operating assets in 2021, giving the quartile a total operating assets of GH¢44.4 billion.

“Although CBG held the largest operating assets in the group, it experienced the least growth during the year with 8.8 per cent. CAL and SCB led the growth by increasing their operating assets by GH¢2.2 billion (30.2 per cent) and GH¢2.1 billion (28.8 per cent) respectively,” the report said.

FRIDAY, OCTOBER 21, 2022 | NEWS 5

Purpose beyond poverty

By Prosper Andre Batinge

Ghana commenced its 2022 National Education Week celebration on Monday, October 10, 2022, with events centred around the theme of “Re-assessing Educational Policies for Effective Service Delivery and National Transformation.”

Major stakeholders in our education sector attended to find ways of making education more effective.

Salient in this year’s theme and prominent in our education discourse is the telos of educating a citizen: What does formal education seek to achieve both for the student and the nation?

Ghana’s Education Minister, Dr Yaw Osei Adutwum, touched on the purpose of education at the just ended 77th United Nations General Assembly (UNGA) when he spoke on the state of Ghana’s education.

He indicts Ghana’s educational system for being exam-focused with students eventually forgetting what they have studied.

Dr Adutwum also indicts Ghana’s educational system for taming students.

“I go to schools upon schools and I speak with the students and when I finish, I ask them … any questions for me? No hand goes up. A hand is yet to go up in all my counters in Ghanaian classrooms.”

The tamed Ghanaian student is too afraid to ask her education minister questions.

He further indicts Ghana’s education for producing uncritical thinkers. Because the Ghanaian student studies for exams, he only studies what the right answers to potential questions are and does very little, if at all, of critically engaging the material and internalising it.

Ghana’s education, Dr Adutwum told his New York audience, is not a game changer. “You can’t memorise your way out of poverty …” he asserts and invites African schools “to take a look at what [he] call[s] an assertive curriculum. A curriculum that empowers the African child to ask questions and challenge the status quo respectfully within the African cultural context” so that the continent “can critically think and innovate out of poverty.”

The minister’s view represents the dominant view in Africa, and probably in the world, of the purposes of Western formal education: a means out of poverty and a ticket towards material abundance.

Means out of poverty

Formal education is widely understood to be the means of producing agents of

developments. Our schools, colleges and universities are expected to arm students with the skills to advance agricultural, economic and infrastructural growth.

A successful curriculum, thus, churns out qualified engineers, farmers, economists, and any kind of skill profession relevant to national development. Where an educational system unsuccessfully turns out products who fail to proffer solutions to poverty and add to abundance, such an education is a failure.

Such an understanding of formal education makes sense for a poor continent: food, clean water, decent housing, basic medical needs are beyond the reach of the average person. The continent’s poverty is an indictment on its education.

It is this prevalent understanding of the telos of education that likely informed Dr Ahmed Jinapor Abdulai, the deputy director of the Ghana Tertiary Education Commission (GTEC), to remark recently that “institutions seeking reaccreditation of their programmes must demonstrate evidence of employment of graduates of such programmes informed by tracer studies before such programmes will be accredited.”

Ancient telos of education Western formal education has not always had wealth creation and material gains as its purpose. The ancient masters, starting from Socrates to Plato to Aristotle and reaching out to Thomas Aquinas and onwards perceived formal education as the cultivation of the cardinal virtues.

These cardinal virtues for Plato are justice, selfcontrol, courage, piety and wisdom.

The Hellenistic philosophers such as Plato had less confidence in

material wealth as a sufficient path to human well-being and human flourishing.

In fact, these thinkers doubted whether material things qua material things were necessary condition for human well-being and happiness.

As we understandably redirect our educational system to fit and create industries that would pick us out of poverty, we should do well to reconsider what the purposes of formal education were, of, which, Plato’s Republic stated: “Education is the craft concerned with doing this very thing, this turning around, and with how the soul can most easily and effectively be made to do it. It isn’t the craft of putting sight into the soul. Education takes for granted that sight is there but that it isn’t turned the right way or looking where it ought to look, and it tries to redirect it appropriately.”

[Republic at 518-d3-7].

Probably, when we also focus on these ancient virtues that education was expected to inculcate in students, we may find ourselves living in abundance and happiness as well.

And finally, one should agree with Dr. Adutwum that education should forge critical students “to ask questions and challenge the status quo respectfully within the African cultural context.”

But just as equally important, arguably more important, Ghanaian education should forge critical students to challenge the status quo respectfully outside our cultural context. The ancient Master of Education tried to get their students to think outside their cultures.

The writer is a lawyer/doctoral fellow at Fordham Law School, N.Y., USA. E-mail: pbatinge@ fordham.edu

FRIDAY, OCTOBER 21, 2022| FEATURE6

Republic Bank Ghana has introduced a new home ownership product to help reduce Ghana’s housing deficit.

Dubbed “Pensions Backed Mortgage”, it enables workers to acquire affordable homes through their Tier 3 pen sion contributions.

Speaking at the launch in Accra on October 7, the Head of Mortgage Banking at Republic Bank Ghana, Dan Adjetey Mohenu, said the product which offers applicants the opportunity to own a property at relatively low rates was available to workers who contribute to Tier 3 pension’s scheme for a minimum of two years.

“What we seek to do is to support customers to acquire homes leveraging on their tier three contributions, so we put a lien on your tier 3 then we advance 100 per cent mortgage financing to them so that you are able to acquire a home,” he said.

He described the mode of repayment as a flexible one adding that beneficiaries had 20 years of repayment period which could be paid weekly, monthly, quarterly.

“Our processes are seamless, straightforward, and flexible also

so we entreat all prospective homeowners to visit Republic Bank to understand what the product is about then you can make a choice as to which home you want to buy.

He urged Ghanaians to take advantage of the new product to become homeowners.

Target

The Managing Director of the bank, Benjamin Dzoboku, said “we have purposely made this wonderful product and we are targeting Ghanaian salary workers. You do not need any deposits and the rate is low. We believe this is the best product in the market.”

He described the bank as the premier home mortgage institution in the country with rich and diverse mortgage products and services such as the home purchase mortgage, home improvement mortgage, home completion mortgage, home equity, and pension backed

Turkish Commercial Counsellor pays courtesy call on Ghana Exim Bank

The Commercial Counsellor of the Turkish Embassy in Accra, Mr. Talha TOL, on Tuesday 4th October 2022, paid a courtesy call on the Executive Management of Ghana Exim Bank (GEXIM), at the Bank’s head office at the Africa Trade House, in Accra.

The Deputy Chief Executive Officer responsible for Banking, Ms. Rosemary Beryl Archer, received Mr. TOL.

The courtesy call was an opportunity for Mr. TOL, who started his duty tour in Ghana in September 2022, to acquaint himself with the operations of the Bank and explore areas of mutual interest between the Bank and the Turkish Embassy in Ghana for collaboration.

Ms. Archer highlighted potential projects in various sectors for possible collaboration with the Turkish mission in Ghana as well as ways of deepening the existing cordial relationship between Ghana Exim Bank and Türk Eximbank, in line with the Bank’s mandate in championing the repositioning of the Ghanaian economy into an export led-one.

the GEXIM Made-In-Ghana (MiG) Town located at the head office of the Bank. The GEXIM MiG Town is designed to be a one-stop shop for everything Made-In-Ghana at unbeatable prices and the highest quality. GEXIM MiG Town

care products, textiles, apparel, garments, leather footwear and slippers and many others. It is

open to the general public from Mondays to Fridays between the

FRIDAY, OCTOBER 21, 2022 | NEWS 7

Jonathan Christopher Koney, Assistant Manager of Corporate Affairs and International Cooperation of GEXIM, was present at the meeting.

FRIDAY, OCTOBER 21, 20228 | NEWS

FRIDAY, OCTOBER 21, 2022 | FEATURE 9

Sacred facts in power sector

By Rodney Nkrumah-Boateng

The national conversation in recent times has been around the galloping Ghana Cedi and the galamsey menace. The local currency’s performance is of particular concern because of its impact, not just on the economy in the larger sense, but also on citizens’ day-to-day life, as it directly docks unto the cost of goods and services.

Galamsey threatens our very survival and rightly deserves our utmost attention.

In recent times, literally on a daily basis, I receive a deluge of complaints and tales of frustration from many of my friends and acquaintances about how difficult life is getting by the day, and I am always urged to “tell the President to do something about the situation”.

While, of course, I am always flattered by the notion that I have the President of the republic on speed dial, the fact remains that he would not recognise me if he met me in the street, so I am totally impotent as far as their requests go.

But I understand the frustration, because I also experience the difficulties and pressures that the system has to offer at present.

Indeed, if there is one set of people whose shoes I do not want to wear at present, it is government or party communicators, who find themselves on media platforms every day, defending government’s corner.

Dumsor, ‘dirty’ word

Regardless of the situation, some positive news, when it occurs, remains just that, regardless of how much one would want to turn one’s nose up, shrug and mutter “so what?”.

It is quite understandable that when gloomy news is in the air, good news finds it difficult to permeate through the thick, dense fog of public perception.

But facts are facts and they are stubborn facts, particularly when they have to do with our daily grind and basic comforts.

One of the most defining features of the erstwhile Mahama administration was the horrendous power cuts christened ‘dumsor’.

Because ‘dumsor’ affected us all in a deeply personal and intrusive way by making our normal daily lives hell and also led to the collapse of many small businesses, it quickly became a Sword of Damocles over

the then government’s head and literally epitomised and aggravated public discontent over everything else to tipping point, contributing significantly to their loss of power in 2016.

Effectively, therefore, the word ‘dumsor’ became a politically dirty word that political leaders have learned to try hard to avoid because of its potency.

Of course, while stable power supply may not guarantee political power, an erratic power supply can definitely contribute to loss of political power.

But power issues go beyond a particular government’s political survival in office. In the 21st Century, any country that aspires to industrialise as part of her economic agenda and also assure its people of a decent quality of life must necessarily ensure that its citizens have access to stable, efficient, affordable power supply.

Electricity is no longer a luxury, but rather a basic necessity in this day and age and every government must commit itself to working hard to ensure that we achieve universal coverage in this country to spur economic growth.

A political party that fails to grasp this basic fact has no business being, or seeking to be, in government.

Commissioning

Over the weekend, the President commissioned the 330kV Kumasi-Bolgatanga Transmission Line Project at Anwomaso in the Ashanti Region as part of his regional tour currently under way.

The project sought to reinforce the Ghana Transmission System and ensure the export of at least 100 MW to Burkina and increase the reliability of the Ghana – Burkina Interconnection Project.

To achieve this objective, GRIDCo also constructed a 330 kV Transmission line from the Aboadze Power Generation enclave through Prestea to Kumasi.

According to the Ghana Grid Company Ltd (GRIDCo), which oversees the transmission aspect of the power chain, the 330 kV Kumasi-Bolgatanga Transmission Line Project consisted of the following key components:

• the construction of approximately 550km of 330kV Transmission Line from Kumasi to Bolgatanga;

• the construction of 330kV substations at Kumasi, Kintampo, Tamale and Bolgatanga, as well as expansions of the existing 161kV Substations at these locations

• the implementation of Environmental Mitigation Measures and a Resettlement Action Plan for the project.

• The Project was financed by the French Development Agency (AFD) at a total cost of USD 173.9 million.

• The first phase of the project, which involves the construction of 330/225kV Substation at Bolgatanga (Nayagnia) and the construction of the Bolgatanga – Ouagadougou Transmission Line was commissioned in June 2018 to supply a maximum of 100MW to Burkina.

• The various components of the Phase II of the project, which involves the construction of the 330kV transmission network in Ghana, were energised on the following dates:

• • Construction of the 330/161 kV Kintampo Substation and Extension of 161 kV Kumasi II (Anwomaso) Substation:

• The works under the contract was executed by Elecnor S.A. of Spain, and the works were completed and energised in September 2018.

• Construction of 330/161 kV Tamale II (Adubliyili) Substation and Extension of 161 kV Tamale I Substation:

• The works under the contract were executed by Eiffage Energies Transport and Distribution and ABB AG Joint Venture of France, and the works were completed and energised in September 2019.

• Construction of 330/161 kV Bolgatanga II (Nayagnia) Substation and Extension of 161 kV Bolgatanga I Substation:

• The works under the contract was executed by Sinohydro Corporation Limited of China, and the works have since been energised in September 2018.

• Construction of 551km 330 kV Kumasi - Bolgatanga

Transmission Line Project:

• The contract for the construction of 330kV Kumasi-Bolgatanga Transmission Line was awarded in three (3) Lots to KEC International of India as follows: Lot-1: 330kV Kumasi-Kintampo Transmission Line; lot-2: 330kV Kintampo-Tamale Transmission Line; and Lot-3: 330kV TamaleBolgatanga Transmission Line

All three Lots have been energised into commercial operation.

The projects have been successfully energised and are supplying about 150MW of power to Burkina. It has also increased transmission capacity to meet growing demand in Ashanti, northern Ghana and beyond.

The projects have also contributed to the reduction of transmission line overloads and associated high transmission losses and improved voltages particularly in Ashanti, Bono and Bono East regions.

The 330kV transmission lines have also helped to improve the quality and reliability of electricity supply in the country.

Facts are sacred

Already, the Kasoa and Pokuase Bulk Supply Points (BSPs) have been brought on stream to help stabilise power supply to their respective enclaves.

In addition to this is the Tema to Accra transmission line upgrade project to accommodate an increase from 161KV capacity to 330KV capacity.

In power generation, transmission and distribution, a great deal of work is ongoing to ensure a robust infrastructure fit for purpose, under the tenacious leadership of Energy Minister and Manhyia South MP, Dr Matthew Opoku Prempeh.

These hard, stubborn facts are significant and positive, and I believe the sector has a positive future.

In our current economic challenges, some may choose to dismiss them. That is fine. However, as they say, facts are sacred, but comments are free.

Rodney Nkrumah-Boateng, Head, Communications & Public Affairs Unit, Ministry of Energy, Accra. E-mail: rodboat@yahoo.com

FRIDAY, OCTOBER 21, 202210 | FEATURE

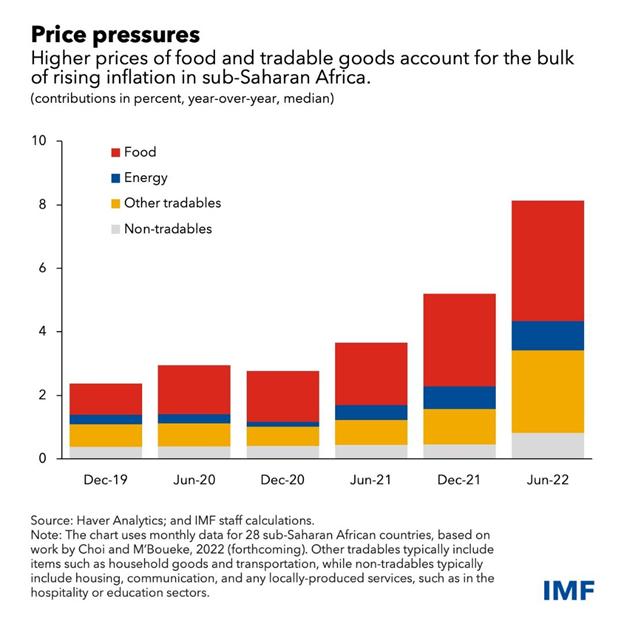

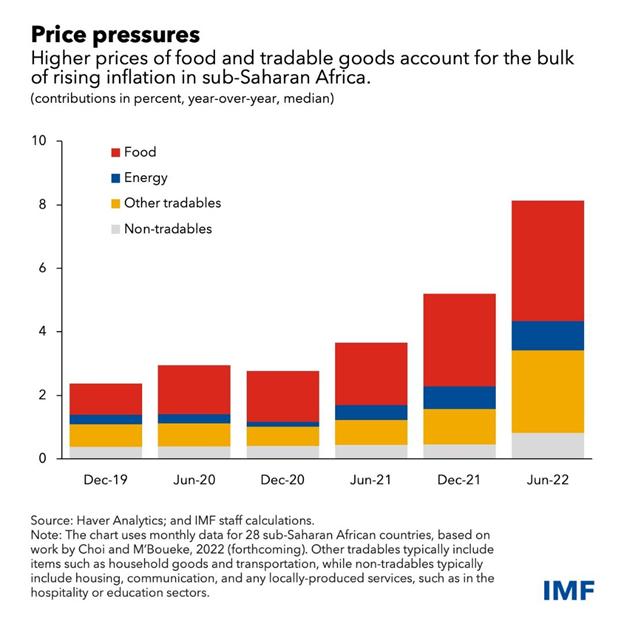

Africa’s inflation among region’s most urgent challenges

Sub-Saharan Africa faces one of the most challenging economic environments in years, marked by a slow recovery from the pandemic, rising food and energy prices, and high levels of public debt.

One of the most urgent issues confronting the region is the need to tackle decade-high levels of inflation—which are devastating incomes and food security—while also supporting growth.

While there are big differences between countries, the median of inflation rates in the region increased to almost 9 percent in August.

And even though the rise has been less dramatic than in other parts of the world, and the drivers are different, inflation is nearly double pre-pandemic levels, risking social and political instability and worsening food insecurity.

Rebound

Despite a rebound last year, the fallout from the pandemic has kept domestic economic activity in sub-Saharan Africa relatively

muted, and we expect growth in the region to slow this year.

Most countries in the region have lacked the resources to support and stimulate growth, in sharp contrast to richer countries elsewhere that could inject trillions of dollars into their economies.

In sub-Saharan Africa, inflation has been driven less by domestic activity than in advanced economies. Instead, external developments have shaped the path of inflation since the start of the pandemic.

They include the sharp spike in global commodity prices, swings in the exchange rate, global supply chain disruptions, and natural disasters.

In the case of food, the prices of key staples such as maize and wheat have increased since 2019, contributing two-thirds of overall inflation in fragile states and onehalf elsewhere in the region.

Higher global energy prices and the strong dollar have also fed through to inflation indirectly, via transportation and tradable

goods like household products.

By contrast, there have been only modest increases for the prices of goods and services that most reflect domestic demand pressures, so-called nontradables—which typically include any locally-produced services, such as in the hospitality, health, or education sectors.

With food and energy accounting for half of household consumption in sub-Saharan Africa, living costs across the region have spiraled. The IMF estimates that 12 percent of the region’s population will face acute food insecurity by the end of this year.

Turning to subsidies

Many countries have therefore turned to subsidies and tax cuts to alleviate the squeeze in household incomes. These measures should be temporary and as well targeted as possible to maximize their impact and minimize their costs on alreadystretched budgets.

Central banks across the region had already started raising

interest rates in response to rising inflation, capital outflows and currency depreciation resulting from monetary policy tightening in advanced economies.

Examples include Ghana, Malawi, Mozambique, Nigeria, Uganda and the economic and monetary unions for both Central and West Africa.

Monetary authorities also find themselves facing an increasingly delicate trade-off: raising rates to keep inflation in check will risk choking off credit for investment, depressing economic activity, and reducing incomes.

Meanwhile, fiscal consolidation and the global slowdown weigh on domestic economic activity.

That means central banks should proceed with caution and raise interest rates gradually so as not to jeopardize the recovery. But policymakers must also not be complacent: countries where domestic demand pressures are acute, or inflation is very high may need to tighten faster or more decisively.

The same applies to countries where monetary policy credibility is weak, the currency is depreciating rapidly, or foreign exchange reserves are shrinking.

While countries with exchange rates that are fixed or heavily managed have, so far, experienced lower inflation than those with more flexible regimes, their ability to control the pace of interest-rate increases is constrained by their currency arrangement.

There are some concerns that monetary policy could still be too accommodative, given that rate increases have not kept pace with inflation. Policy coordination can help.

Fiscal consolidation has a role to play in countries where policy is too loose, as can a combination of rate increases and currency depreciation .

Given sub-Saharan Africa’s fragile recovery, combined with the fact that domestic demand pressures have not so far been an important driver of inflation, policymakers must proceed with caution in coming months while closely monitoring inflation.

FRIDAY, OCTOBER 21, 2022 11| NEWS

GCB tops at Ghana Club100 Award

GCB Bank PLC at the weekend reestablished itself as Ghana’s number one financial institution when the bank was adjudged tops in the financial services in the Ghana Club 100 awards.

GCB Bank PLC was named the tenth best performing company/ bank at the 19TH Ghana Club 100 Awards ceremony in Accra on Friday. The event is organized by the Ghana Investment Promotion Centre (GIPC).

Although GCB placed 10th in the overall 100 best companies operating in Ghana it was the only bank and financial institution among the first 10 best companies in Ghana.

The Deputy Managing Director, Finance, GCB Bank PLC, Mr Socrates Afram, who received that award in an interview said the Bank is more flexible in granting credit to businesses during these turbulent times in order to support and sustain firms.

Interacting with the media after the Bank picked up the award, Mr. Afram said “the key for us is that in these difficult times, we can still see opportunities and businesses

we can pick and support.”

“I must say that generally this is not the time for any financial institution to be very aggressive and bullish on granting credit but in the midst of this challenge, there are still pockets of opportunities, it is up to us working with our customers to identify those opportunities and help so that we can all go through this seamlessly without disturbing the stability of the bank so that when things normalise we can come back and do greater things,” he said.

The GCB Bank PLC is poised to build a resilient bank and identify opportunities to support Ghanaians and businesses, Mr. Afram noted.

In apparent reference to the award and position, the Deputy MD said, “it is not so much about the position but about building a sustainable brand that can support Ghanaians, businesses and individuals to achieve their financial objectives.

“For us the recognition of the fact that we have shown profit, we have grown, we are committed to CSR, those are the things that

matter to us,” he emphasized.

In terms of operations, “I have said it about sustainability, we are going through turbulent times and as bank, our focus today is how do we build a resilient bank that will survive and go beyond these turbulent times so that we can continue to play our part as

the biggest financial institution in the country to support Ghanaians, businesses.”

Present with Mr Afram were the Chief Digital and Marketing Officer, Mr Eric Coffie, Legal Counsel, Ms Jessie Jacintho and Mr Kojo Kwarteng, Head of Corporate Affairs of GCB Bank.

Zoomlion announces $100,000 in support of sanitation in schools

Waste management company, Zoomlion Ghana Limited, a subsidiary of the Jospong Group of Companies (JGC) has announced a $100,000 package to support school children to learn more about sanitation and the need to protect the environment.

The Executive Chairman of the Jospong Group of Companies (JGC), Dr. Joseph Siaw Agyepong, who made the announcement, indicated that Zoomlion was also sensitising school children more through its Zoomkids.

“The whole idea of Zoomkids is to catch the kids young and educate them on good sanitation practices and hygiene,” he explained.

The Executive Chairman of JGC made the announcement at the launch of Waste Water Education organised by the Ministry of Sanitation and Water Resources (MSWR) in Accra on Thursday, October 20, 2022.

According to him, through Zoomkids, Zoomlion inculcates the culture of sanitation and

hygiene into children.

He said since its inception in 2008, Zoomlion Foundation can boast of about 526 Zoomkids in various schools in the country.

In 2016, he said, Zoomkids organised a quiz competition where a young girl emerged as the winner and was sponsored to Dubai to continue her education.

“The 2022 winner will be sent to Hungary for further studies,” he disclosed.

Dr. Siaw Agyepong gave a firm assurance that Zoomlion will also continue to sponsor schools that have Zoomkids with facilities that to aid them in learning as well.

The Minister of Sanitation and Water Resources, Mrs. Cecilia Abena Dapaah, cautioned farmers who farm on the banks of water bodies in the country to put an end to such practice.

She said stopping such a practice will contribute to polluting water bodies.

She reinforced that the fight against illegal mining (popularly known as galamsey) was a

collective commitment, hence urged Ghanaians to support President Nana Addo Dankwa Akufo-Addo on that front.

“We should all help fight against the few selfish people who want to destroy our water bodies and lands,” she charged.

The galamsey war, she asserted, cannot be won without the support of Ghanaians.

According to Mrs. Dapaah, President Akufo-Addo has shown massive commitment in tackling sanitation, stating that the evidence was obvious for all to see, especially as the country has been recording zero cases of cholera and other sickness relating to sanitation, for some time now.

Further, she maintained that her ministry was equally not relenting on its efforts to bring an end to irresponsible mining across the country.

She stressed that it was crucial that “we start inculcating good sanitation practices and protection of our water bodies and

environment into our children.”

This, she pointed out, will sink deep into the minds of children to consciously and always protect the environment.

For his part, the Chief Executive Officer of Pureco Group, Mr. Balint Horvath, stated that it was important for such programmes to be organised to protect Ghana’s environment.

He lamented the damage galamsey was causing to Ghana’s environment and water bodies.

Pureco Group seeks to let children know the importance of sanitation and hygiene through games,” he said.

“We want to bring a new way or alternative way of teaching in Ghanaian classrooms on sanitation and hygiene,” he further added.

Mr. Balint Horvath indicated that his outfit was in collaboration with Zoomlion to organise other projects aimed at helping the country to safeguard its environment.

FRIDAY, OCTOBER 21, 202212 | FEATURE

FRIDAY, OCTOBER 21, 2022 13| EDUCATION

Vodafone Foundation organises free ultrasound scan screening and e-learning for Okorase Community

The Vodafone Ghana Foundation has set up free ultrasound screenings for pregnant women and e-learning for students in Okorase in the Eastern Region.

The activities were part of efforts to commemorate Care Month, a period dedicated to customer service excellence and connecting with communities through impactful initiatives.

Speaking during the virtual learning exercise, the head of the Vodafone Foundation, Rev. Amaris Perbi, said, “This month of October is Care Month for Vodafone. In line with this, we make sure that we go into the various communities and show care across these communities. Again, it is World Teachers’ Month, so we did the STEM Teachers’ Award with the

Ghana Education Service and the Instant Schools roadshows where we are setting up STEM stations across the regions of Ghana. We started from the North where we went through communities like Dabokpa, and Sungtaba, among other communities”.

“Today, the team continues from the Southern belt, touching the Okorase community where we set up STEM Stations and engaged students through our Vodafone Instant Schools. In the Northern region, we were able to impact over 10,900 students and teachers. Here in Okorase, we are engaging over 3,500 students and we hope that by the end of the year, we will help more students,” he added.

The beneficiary schools included Okorase Methodist Primary and

Junior High School (JHS), Okorase Presbyterian Primary and JHS, and Old Asuoyaa Metropolitan Assembly (M/A) JHS. Eric Asomani Asante, STEM Teacher of the Year and Vodafone Instant Schools Platform’s ambassador, said the Vodafone Foundation Instant School Platform has exposed many pupils in rural communities to several activities which will help them in their academic work.

Rev. Perbi further explained that organising free ultrasound screenings in the community will help pregnant women who cannot afford the scan service.

“Apart from the virtual learning, we are having a free ultrasound screening for pregnant women in the CHPS compound in the Okorase area. The compound was

furnished a year ago by the staff of Vodafone Ghana to cater to the needs of pregnant women. They will also have a session with the midwife and health practitioners present.”

Ms. Lydia Agamah, the midwife in charge of the Okorase CHPS Compound, commended Vodafone Ghana Foundation for supporting about 100 pregnant women who could not afford the scan service.

She was grateful to Vodafone because the women in the community used to commute to Koforidua for ultrasound scans. She also stated that such exercises enable health practitioners to know the baby’s condition in the uterus so that they can take prompt action if something is wrong.

FRIDAY, OCTOBER 21, 202214 | NEWS

Adom City Estate organizes breast cancer awareness program and screening for female staff

By Daniel Kontie

By Daniel Kontie

“There can be life after breast cancer. The prerequisite is early detection” to wit there is hope for persons living with breast cancer, the most important is early detection.

This is a quote by an American Actress and actor Ann Jillian. Breast cancer has been a critical medical condition that stared humanity in the face for several decades particularly females. Even though there is no scientifically proven cure for cancer, the condition can be managed if detected early.

In this pursuit, a breast cancer survivor Betty Ford, initiated and hosted the first edition of breast Cancer Awareness campaign in the month of October 1985 in partnership with the American Cancer Society and the pharmaceutical division of Imperial Chemical Industries. The purpose of this initiative was to sensitize humanity on the causes, symptoms, treatment and preventive measures of the disease. Ever since, the month of October has been the month used to create awareness, educate and sensitize the whole world about breast cancer.

Taking this year’s breast cancer awareness month to another level, ADOM CITY ESTATE a real estate developer decided to champion this course for two reasons, first and foremost is the fact that the founder and CEO of the Adom Group of Companies, Dr. Bright Adom is a philanthropist who believes that the welfare of the human being is paramount and must be held in

supreme esteem above all other interest of mankind corporate or parochial, irrespective of race, class and ethnicity. This philosophy appears to be the essence of his whole being on earth as a person and no wonder this is evident in almost everything he does. A classic demonstration of this attribute of his found expression partly in the extremely reduced prices of our houses considering the quality and standards given in exchange.

His interest has always been “shelter over the heads of the human being” Second, is the fact that females constitute a greater percentage of our work force. The sales and marketing department for example is manned by 60% female and 40% male. Same is the case at the accounts department and the administration just to mention a few.

In this direction, the founder and Group CEO Dr. Bright Adom together with his management team decided to organize this program that came in two sessions: One, sensitizing the staff and also free breast cancer screening for all female staff of the group.

In her presentation, the health professional Madam Esther Adortey a midwife from the Adabraka Polyclinic enumerated the signs and

underarm that persists through your menstrual cycle, a change in the look or feel of your skin on your breast or nipple, redness of your skin on your breast or nipple, an area that’s distinctly different from any other area on either breast, a marble-like hardened area under your skin, a blood-stained or clear fluid discharge from your nipple et cetera. She also took time to educate the staff on conditions and other factors that predisposes women to breast cancer among which were: exposure to dangerous chemicals, excessive use of lifestyle body enhancing products, alcoholism et cetera. She also added that women at the age of 50 and above stand a higher risk of getting breast cancer. She ended her presentation by giving hope to all persons living with the condition that there are treatment options among which are surgery, chemotherapy, radiation therapy, immunotherapy and targeted drug therapy.

Adom City Estate is the leading real estate developer in Ghana for the past ten (10) years and still leading in the provision of affordable, mass and social housing. We are not only recognized as the leading developer by virtue of our works alone but a record-breaking capacity we are proud of. Since

chalked over the years among a few others are; Best Developer, Mass Social Housing at the enviable Africa Property Awards, the year 2021 – 2022, coupled with our most recent global award won this month of September 2022 as the Industry Leader in Affordable Housing in Ghana at the just ended Africa Real Estate Conference and Expo awards organized in partnership with the Ghana Real Estate Professionals Association (GREPA). Five (5) times consecutive winner, Ghana Property Awards as Best developer of the year – Mass Housing category between 2015 and 2019. Residential Developer of the year - Low Income Housing Category – Ghana Business Standards Awards 2021. Residential Developer of the year, Mass Housing Category – Ghana Business Standards Awards 2019. Real Estate Company of the year, CENBA AFRICA Business Excellence Awards, 2019. 1st Runner-up, Mass Social Housing - Africa Property Investment Summit and Awards, 2017. This is just to mention a few.

The visionaire, founder and CEO Dr. Bright Adom of the Adom Group of Companies, Adom City Estate is not only interested in providing shelter but also the health of everyone. This is because the most luxurious house is nothing to an unsound body soul and spirit. Long live all cancer survivors, long live all cancer patients and long live Dr. Bright Adom. Stay tuned for the commissioning of the Adom Medical Centre and other updates

FRIDAY, OCTOBER 21, 2022 15| FEATURE

FRIDAY, OCTOBER 21, 202216 | NEWS

FRIDAY, OCTOBER 21, 2022 17| NEWS

WEEKLY MARKET REVIEW FOR WEEK ENDING - OCTOBER 14, 2022

MACROECONOMIC INDICATORS

Q3, 2021 GDP Growth 4.8%

Average GDP Growth for 2021 4.1%

2022 Projected GDP Growth 3.7%

BoG Policy Rate 24.50%

Weekly Interbank Interest Rate 24.15%

Inflation for February, 2022 37.20%

End Period Inflation Target – 2022 28.5%

Budget Deficit (% GDP) – Dec, 2021 6.4%

2022 Budget Deficit Target (%GDP) 6.6%

Public Debt (billion GH¢) – Dec, 2021 402.4%

Debt to GDP Ratio – Dec, 2021 68.0%

STOCK MARKET REVIEW

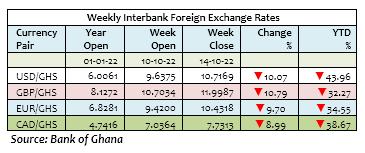

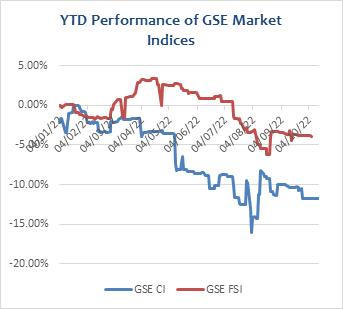

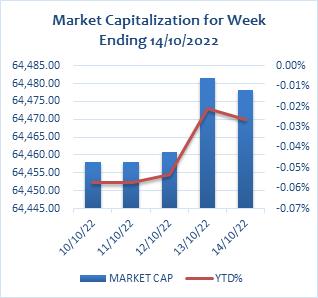

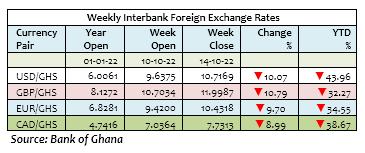

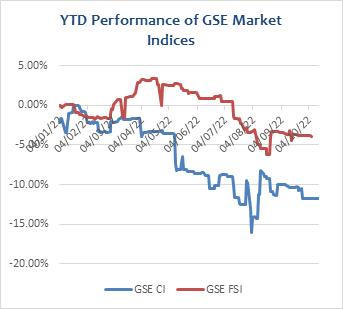

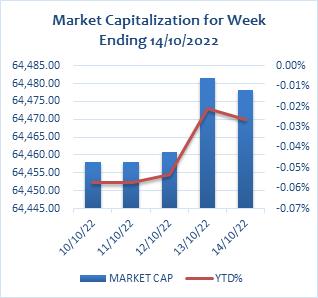

The Ghana Stock Exchange closed lower for the week on the back of price decline by 1 counter. The GSE Composite Index (GSE CI) lost 0.89 points (-0.04%) to close at 2,460.44 points, reflecting year-to-date (YTD) loss of 11.79%. The GSE Financial Stocks Index (GSE FI) also lost 1.60 points (-0.08%) to close at 2,068.16 points, reflecting YTD loss of 3.89%.

Market capitalization increased by 0.03% to close the week at GH¢64,478.26 million, from GH¢64,458.05 million at the close of the previous week. This reflects a YTD decrease of 0.03%.

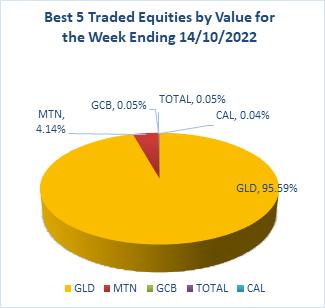

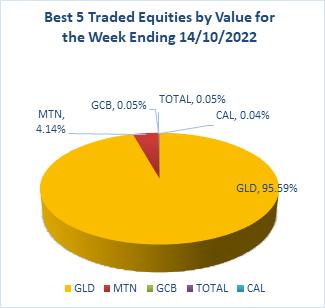

Trading activity recorded a total of 3,546,068 shares valued at GH¢59,618,839.97 changing hands, compared with 4,443,096 shares, valued at GH¢30,079,436.97 in the preceding week.

MTN dominated volume of trades whiles New Gold dominated value of trades for the week, accounting for 79.15% and 95.59% of shares traded respectively.

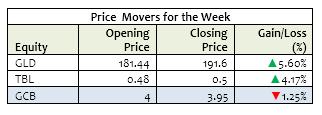

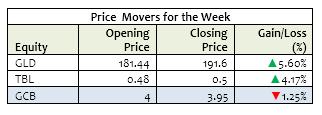

The market ended the week with 2 advancers and a decliner as indicated on the table below.

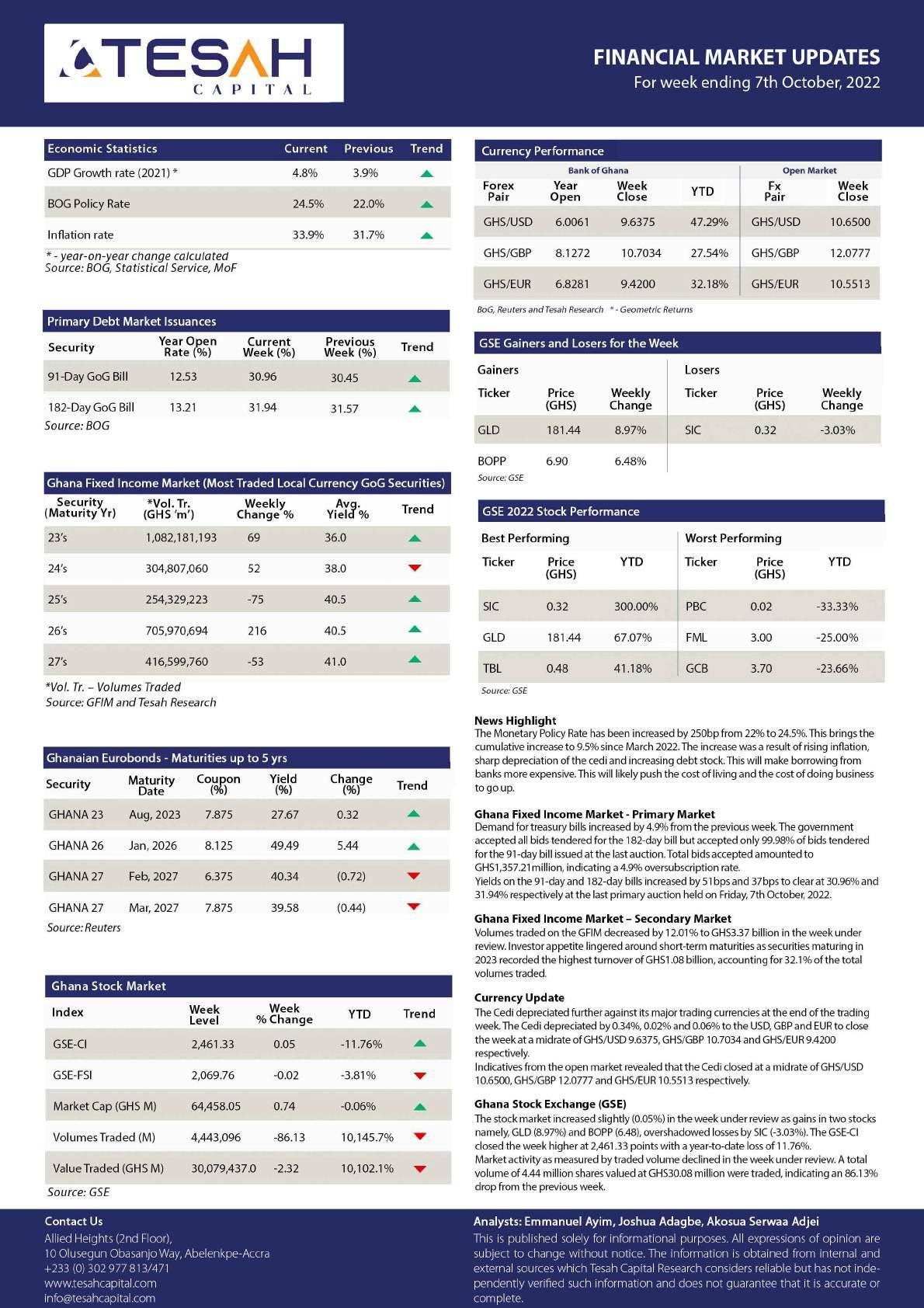

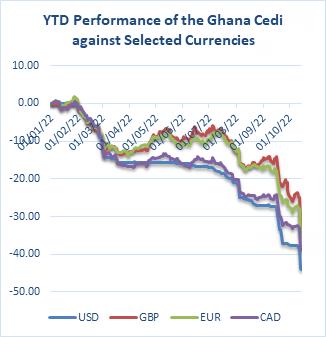

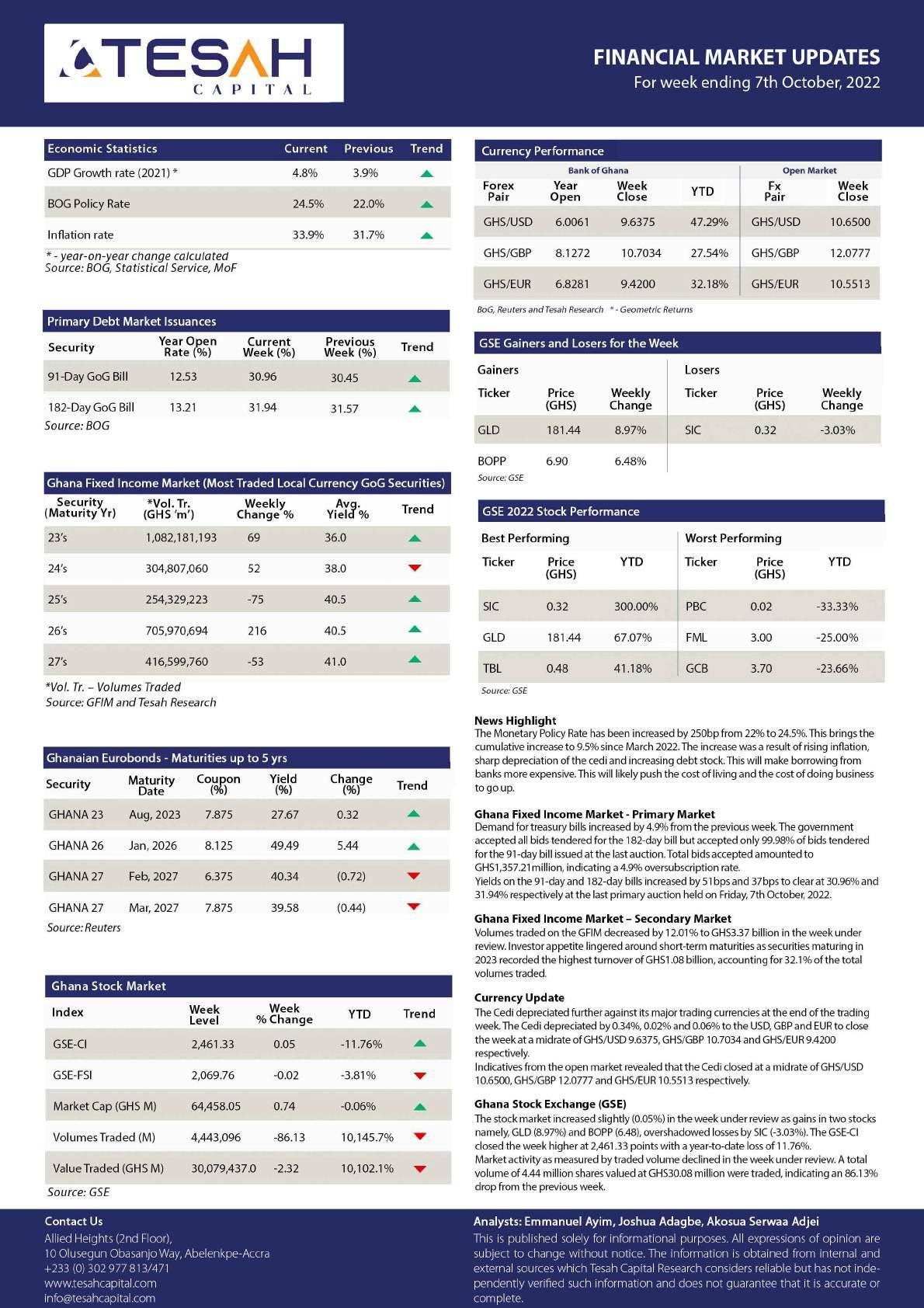

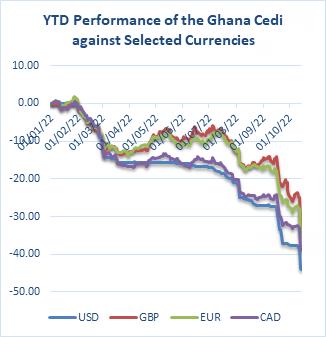

THE CURRENCY MARKET

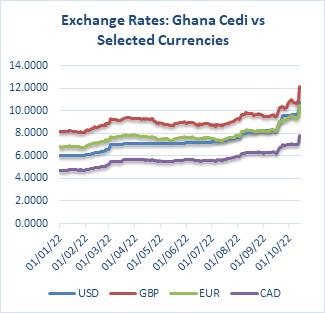

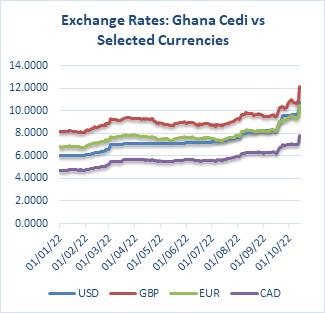

The Cedi weakened against the USD for the week. It traded at GH¢10.7169/$, compared with GH¢9.6375/$ at week open, reflecting w/w and YTD depreciations of 10.07% and 43.96% respectively. This compares with YTD depreciation of 2.07% a year ago.

The Cedi also weakened against the GBP for the week. It traded at GH¢11.9987/£, compared with GH¢10.7034/£ at week open, reflecting w/w and YTD depreciations of 10.79% and 32.27% respectively. This compares with YTD depreciation of 2.69% a year ago.

The Cedi continued its downward trend against the Euro for the week. It traded at GH¢10.4318/€, compared with GH¢9.4200/€ at week open, reflecting w/w and YTD depreciations of 9.70% and 34.55% respectively. This compares with YTD appreciation of 3.54% a year ago.

The Cedi again weakened against the Canadian Dollar for the week. It opened at GH¢7.0364/C$ but closed at GH¢7.7313/C$, reflecting w/w and YTD depreciations of 8.99% and 38.67% respectively. This compares with YTD depreciation of 4.78% a year ago.

FRIDAY, OCTOBER 21, 202218 | MARKET REVIEW

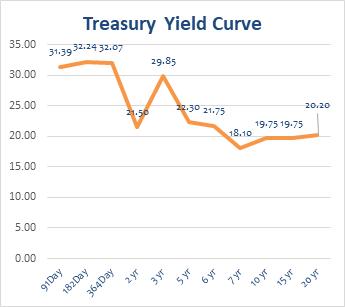

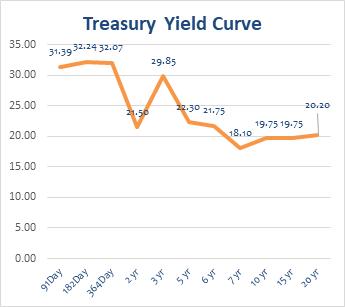

GOVERNMENT SECURITIES MARKET

Government raised a sum of GH¢974.51 million for the week across the 91-Day, 182-Day and 364-Day Treasury Bills. This compared with GH¢1,357.21 million raised in the previous week.

The 91-Day Bill settled at 31.39% p.a from 30.96% p.a. last week whilst the 182-Day Bill settled at 32.24% p.a from 31.94% p.a. last week. The 364-Day Bill settled at 32.07% p.a from 31.55% p.a last week. The table and graph below highlight primary market yields at close of the week.

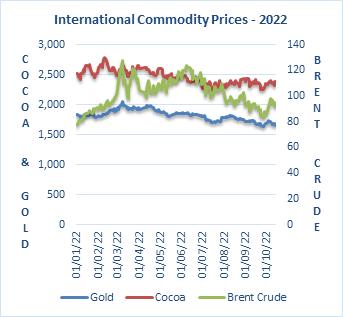

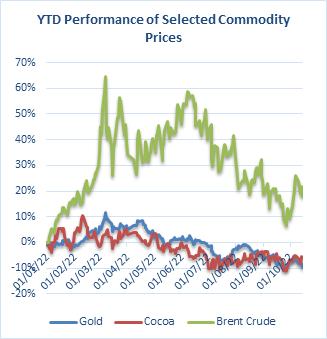

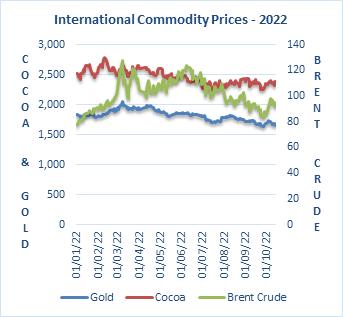

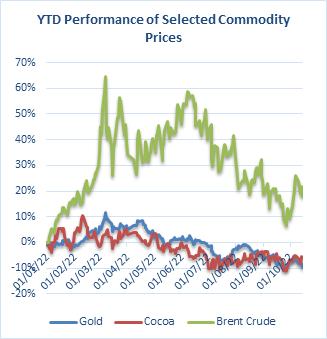

COMMODITY MARKET

Oil prices fell Friday, ending a difficult week on a negative note on fears a global economic slowdown and further Covid-19 restrictions in China will severely hit demand. Brent futures traded at US$91.63 a barrel on Friday, compared to US$97.92 at week open. This reflects w/w loss and YTD appreciation of 6.42% and 17.81% respectively.

Gold prices hovered above annual lows on Tuesday after tumbling sharply on hawkish signals from the Federal Reserve. Gold settled at US$1,648.90, from US$1,709.30 last week, reflecting w/w and YTD loss of 3.53% and 9.83% respectively.

Prices of Cocoa increased for the week. The commodity traded at US$2,377.00 per tonne on Friday, from US$2,396.00 last week, reflecting w/w and YTD depreciations of 0.79% and 5.67% respectively.

INTERNTIONAL COMMODITIES PRICES

ABOUT CIDAN

CIDAN Investments Limited is an investment and fund management company licensed by the Securities & Exchange Commission (SEC) and the National Pensions Regulatory Authority (NPRA).

RESEARCH TEAM

Name: Ernest Tannor Email:etannor@cidaninvestments.com Tel:+233 (0) 20 881 8957

Name: Audrey Asiedua Wiafe Email:aaudrey@cidaninvestments.com Tel:+233 (0) 57 840 2700

Name: Moses Nana Osei-Yeboah Email:moyeboah@cidaninvestments.com Tel:+233 (0) 24 499 0069

CORPORATE INFORMATION

CIDAN Investments Limited

CIDAN House Plot No. 169 Block 6 Haatso, North Legon – Accra Tel: +233 (0) 26171 7001/ 26 300 3917 Fax: +233 (0)30 254 4351 Email: info@cidaninvestmens.com Website: www.cidaninvestments.com

Disclaimer

The contents of this report have been prepared to provide you with general information only. Information provided on and available from this report does not constitute any investment recommendation. The information contained herein has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed.

Limited

Copyright @ 2019 Business24 Limited. All Rights Reserved.

Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed.

We value your support and loyalty.

Contact: editor@business24.com.gh Newsroom: 030 296 5315

Advertising / Sales: +233 24 212 2742

BUSINESS TERM OF THE WEEK

Funded Debt: Funded debt is a company’s debt that matures in more than one year or one business cycle. This type of debt is classified as such because it is funded by interest payments made by the borrowing firm over the term of the loan.

Funded debt is also called long-term debt since the term exceeds 12 months.

Source: https://www.investopedia.com/terms/f/fundeddebt. asp

FRIDAY, OCTOBER 21, 2022 19| MARKET REVIEW

GEA targets 68 SMEs in second phase of economic transformation project

By Eugene Davis

Sixty eighty (68) small medium enterprises are to benefit from a maximum of Ghs300,000 to a minimum of Ghs20,000 grant under the second phase of the World Bank Ghana Economic Transformation Project, the CEO of the Ghana Enterprises Agency (GEA), Kosi Yankey-Ayeh has announced.

The grant is to provide liquidity and support to enable SMEs to adjust and grow out of the Covid-19 crisis in selected sectors of the economy.

“For today, GHs8m has been done, in the past over Ghs30m was disbursed in the first phase, under the CAPBusiness Support over GHs500m has also been disbursed to support Ghanaian SMEs.

In this second phase we are going to give close to GHs40m and in the next phases, there are going to be about three different stages of it that would be more, then we roll out the other phases. Today 68 people would benefit, it is rolling application, so we will continuously do due diligence, it ongoing, so people should be patient with us, as we roll the process.

20,000 and a maximum of 300,000 for beneficiaries.”she

said.

The programme under the Ghana Economic Transformation Project will have a strong focus on Ghanaian export-oriented firms, female-owned enterprises, companies owned by persons with disability and youth enterprises.

Speaking at the Grant Agreement Signing and Orientation Ceremony in Accra on Thursday, she said “how best we can provide support to SMEs in Ghana on the umbrella of the Covid Response Grant under the Ghana Economic Transformation Project.

After the pandemic we still dealing with the ramifications, inflation, oil or gas prices going up and to be able to address and support our SMEs in Ghana, we have come up with a lot of initiatives, for us this is the second phase to provide funding of relief

able to utilize the funding.”

Further she disclosed that for this year, they are looking at other sectors including education, healthcare and tourism.

“ So in the past we didn’t have education, healthcare or tourism in the mix of sectors that we support, this time we have been able to add them, ,the reason being that we underestimated the impact on these sectors and so it important for us to continuously provide them with support and also looking at it, these are sectors a lot of entrepreneurs play a lot of role, considering that in the past we have been looking at having equity of both women and men in providing access to funding, so we will be paying close attention to all these parameters on what we would be providing them with.

So, this year, we are working on another one which is the High

interventions that government is leading.”

A Deputy Minister of Trade and Industry, Michael Okyere Baafi lauded the efforts from GEA to support businesses, stating that it was the way to go, he however bemoaned the current situation of the Ghana Union and Traders Association (GUTA) where most of its members have closed stops in protest of high taxes and doing business.

He disclosed that government has made some concessions with GUTA in a bid to salvage the situation.

“Government has made a lot of concessions, at least one of them being the suspension of the invigilation being conducted by the Ghana Revenue Authority, that is enormous -government was going to raise a lot of revenue from that exercise but GUTA says they don’t want it. We engage whiles we still do business, that is

The way to go now is for these people to come together and set up businesses in Ghana to manufacture all those things that they import to Ghana, that will help the country to grow and overcome challenges we are

WWW.BUSINESS24.COM.GH | NO. B24/317 | NEWS FOR BUSINESS LEADERS FRIDAY, OCTOBER 21, 2022

By Eugene Davis

By Eugene Davis

By Daniel Kontie

By Daniel Kontie