minister

The Project Owner of poultry processing company Buntaa Farms, Kwame Gyan, believes the needed liquidity support of close to US$8m could boost growth and enable them meet demand locally and globally in the agro processing sector.

According to Mr. Gyan, an urgent funding is needed to complete and commission the project.

Speaking to the press after leading the Trade and Industry Minister, Alan Kyerematen, to inspect the facility at Kwabeng in Atiwa West District of the Eastern Region on Saturday, Mr. Gyan said “So far what we have done here is coming from our own private resources, we have applied to the Ghana Exim Bank to support us, they have come here to review the situation on the ground and we are waiting for them to come and say something positive to us.

We are looking at about US$8m, we have not looked at other financing options because of the interest rate. We have put in a lot of money and what we have put in is more than what we are asking Exim Bank to give us.”

Already, the management of the company has revealed that a term loan of GHs4.95m to finance capital expenditure, namely electrical cables from Tropical Cables and Conductors Limited (Ghana), partial funding for a feed mill from Buschhoff GMBH (Germany), Water pumps from Grundfos Limited (Germany), as well as a working capital loan

of GHs79.7m with a moratorium period of 18months to provide adequate cover for the first twelve (12) months of operations.

In spite of the call for financial support, Mr.Gyan indicated that the company benefited from a waiver of duty by registering under One District One Factory(1D1F) on all the equipment, stressing that they only paid for the handling charges, and if not for the exemptions on duties, their budget would have been crippled.

Also, the company will be exempted from income tax for the next five years when they start yielding income.

On the plans for the company, he stated “our plan is that once this facility is completed egg import [we have first class European technology so you would not have a reason to have any issues with the quality of the eggs that would be produced here and when we get to the broiler side,

our plan is to produce at the start; 4.2 million broilers a year and upgrade to 8.4 million in about three years.

The national import is about 30million birds a year, so if we can do 8.4million in the next three years, it means we have almost done one-third of the import. It will make a serious impact on the economy. We would try to reduce the foreign exchange component of our operations to make our prices competitive.”

Buntaa Farms is a Ghanaianowned company located at Kwabeng in Atiwa West District of the Eastern Region and seeks to undertake business in the areas of farming, sale of agricultural equipment, agro processing, export of agro products and poultry farming.

The company was registered in 2019 and accepted under Government’s flagship industrialization programme, One District One Factory in May 2021. Buntaa Farms has adopted an advanced technological infrastructure positioning itself to be a disruptive poultry farm business, issuing better feed, lighting, and temperature regulation systems to reimaging poultry in Ghana.

The project comprises of a layer component and a broiler, which are being delivered in three phases.

The Minister of Finance, Ken OforiAtta has urged Ghanaians not to panic or put further pressure on the cedi, as the cedi continued its rapid slide against the US dollar in October.

Thursday’s depreciation (as much as 9.5 per cent against the US dollar), the biggest in 22 years took losses chalked by the Ghana cedi to nearly 52% this year, the worst performance among 148 currencies tracked by Bloomberg.

According to the Minister of Finance, Ken Ofori-Atta, it was quite perplexing to see the level of the cedi’s depreciation. He said the depreciation of the cedi in October may have been occasioned by a rush for dollars for the import of Christmas goods.

Mr Ofori-Atta was hopeful that the slide would be halted when the government reaches an agreement with the International Monetary Fund (IMF) for economic support this

year.

“...It’s quite perplexing to see where it’s going, of course, typically in October, people are importing for Christmas and maybe there’s a rush for that (the dollar) but my expectation is that once we also conclude with the Fund (IMF), that will lead to the fund’s disbursement early next year to do that,” Mr OforiAtta said in an interview with Asaase Radio.

“The support we are getting from countries like Germany and France, we are confident that we will get the resources needed, so we really would want people to know not to panic or be rushing in order to put pressure on the currency, I think it’s unnecessary and we are in good shape”.

Ghana is hoping to receive as much as $3 billion under an IMF extended credit facility program to bolster its

France would provide the country with the funds needed to halt the slide of the cedi.

The Minister of Water and Energy for the Federal Republic of Ethiopia, Dr. Ing. Habtamu Itefa, has commended Jospong Group of Companies (JGC) for their impressive work towards the environment in Ghana.

He, therefore, gave a firm assurance to recommend the JGC to his government on his return home, so that Ethiopia can equally benefited from the better environment that Ghana is enjoying.

“I am impressed with what I have seen, especially the compost plant. It is very wonderful,” he satisfactorily expressed.

He disclosed that most African countries are facing the challenge of finding sites for disposing of refuse generated, but said he was optimistic that a similar plant like the Accra Compost and Recycling Plant (ACARP) would be extended to other African countries, particularly Ethiopia.

He asserted that JGC has been a very exceptional group as far as waste management was concerned.

The Ethiopia Water and Energy minister made the commendation when he led a team of participants who attended the All Systems Go Africa 2022 Symposium in Ghana,

Accra on Friday, October 21, 2022.

The Executive Secretary for Environmental Service Providers Association (ESPA), Madam Ama A. Ofori Antwi, said the international conference was attended by key stakeholders in the water, sanitation and hygiene (WASH) sector from all over the world.

She pointed out that as private sector operator in Ghana, they took the opportunity of the All Systems Go Africa Symposium to exhibit their products in Ghana.

The private sector, she said, as a stakeholder in the environment sector, plays a key role as far as systems were concerned, adding that

the sector had taken the lead in the

“The private sector has especially taken the lead to implement the necessary infrastructure on the system that would be needed to ensure that the SDG Goal 6 is achieved,” she said.

Madam Ofori Antwi reiterated that the private sector was playing a key role in the sanitation space of Ghana, and thus called on the government to continue supporting players in the WASH space.

The Chief Corporate Communications Officer of JGC, Madam Sophia Kudjordji, explained that her group was at the “All Systems Go Africa Symposium” to represent the private sector on their role play

in the WASH sector.

According to her, participants at the symposium were amazed at the level of investment made in the country by JGC in the area of waste treatment plants to support government of Ghana’s agenda of a sustainable clean nation.

She added that the participants’ visit to the ACARP was to give them an insight into the practical work of the private sector in Ghana.

She however, condemned the destruction caused to the country’s water bodies through illegal mining, stressing that people have to learn how to do the right thing by putting human beings above everything else.

All Systems Go Africa is a bilingual event dedicated to strengthening water, sanitation, and hygiene systems.

This year’s All Systems Go Africa Symposium was hosted by the Government of Ghana, IRC and UNICEF from 19th to 21st October. It brought together policy makers, academia, development partners, service authorities, providers, among others, to explore and act on opportunities to build effectiveness and resilience into water, sanitation, and hygiene service delivery in Africa.

The ECOWAS Bank for Investment and Development (EBID) has signed an agreement to extend a loan facility of 60 million dollars to the Ghana Grid Company Limited (GRIDCo).

A statement issued by the Bank, copied to the Ghana News Agency said the signing ceremony took place in Lome, Togo, its head office.

Dr George Agyekum Donkor, the President and Chairman of the Board of Directors, EBID, signed on behalf of the bank, while Mr Ebenezer Kofi Essienyi, the Chief Executive Officer of GRIDco, signed for the Company.

The facility is to finance the installation and upgrading of transmission lines in Ghana.

Dr Donkor said as ECOWAS Member States worked towards post COVID-19 economic recovery, it was necessary to expand regional electricity connectivity to accommodate growth.

Therefore electricity infrastructure expansion in the sub-region is a key sector that must be given the necessary attention.

The Bank’s total commitment to Ghana stood at 250 million dollars as of October 12, 2022, he said.

He reiterated the Bank’s commitment to continuously finance infrastructure projects across all sectors of the economies of ECOWAS Member States to accelerate recovery

and development of the Sub-region.

The project is in line with the Bank’s strategic objectives and aligned perfectly with Ghana’s Agenda for Jobs II.

Mr Kabral Blay-Amihere, the Chairman of the Board of Directors, GRIDco, said projects to be

undertaken with EBID’s facility were part of a broader plan to upgrade infrastructure for improved efficiency and increase power transmission within Ghana and other West African countries such as Togo, Benin, Burkina Faso, Mali and the Ivory Coast.

While appreciating the confidence reposed in GRIDCo by EBID, he noted that the completion of the project would lead to reduction in technical losses to enhance businesses and livelihoods in Ghana and the ECOWAS sub region.

Mr Blay-Amihere commended the President of EBID and his team for their dedication and professionalism that saw the expeditious completion of the credit process and the consummation of the transaction.

Present at the ceremony were Mr Kofi Demetia, Ghana’s Ambassador to Togo, Mr Philip Owiredu, the Managing Director of Calbank PLC., and executives from C-Nergy Ghana.

EBID is a leading regional investment and development bank, owned by the 15 ECOWAS Member

These are Ghana, Benin, Burkina Faso, Cape Verde, the Ivory Coast, The Gambia, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone, and Togo.

Based in Lomé, Togo, it is committed to financing developmental projects and programmes covering diverse initiatives from infrastructure and basic amenities, rural development and environment, industry, and social services sectors, through its private and public sector windows.

To climax its year-long 15thanniversary celebration, Fidelity Bank Ghana has launched ‘Orange Impact’, a social impact project in education which seeks to support 15 marginalised schools across the country with a suite of customized resource and facility upgrades.

The initiative was officially launched at a ceremony held on the premises of one of the beneficiary schools, the Duose D/A Primary school, Duose, in the Upper West Region.

In a speech to a gathering of pupils, teachers, inhabitants of the Duose community and other dignitaries during the launch, the Deputy Managing Director, Operations and Support Functions of Fidelity Bank, Mr. Atta Yeboah Gyan, stated: “Right from day one, Ghanaians have accepted and co-owned the vision of Fidelity Bank and supported us. From our customers to our partners, shareholders and our regulator, Ghanaians have

pushed the Fidelity Bank agenda and made our meteoric rise in the Banking industry possible. We therefore decided that the best way to celebrate this milestone is by saying ‘Thank you’ to Ghanaians for the relentless support that has brought Fidelity Bank thus far.”

He further stated, “We acknowledge that the most effective tool for empowering our youth, harnessing their limitless talent, and securing a bright future for this country, lay in providing quality educational opportunities for majority of our youth by levelling the educational playing field as much as possible across the country. Therefore, in commemoration of our 15th anniversary, I am glad to officially set the ball rolling on our ‘thank you’ initiative aptly dubbed Orange Impact,” he added.

The Orange Impact Initiative is funded by Fidelity Bank as an entity as well as donations from staff of the Bank. The initiative will

ensure that beneficiary schools receive support in various forms such as construction of classroom blocks, refurbishment works and provision of teaching and learning materials, depending on the peculiar need of each school.

On his part, the Duose Naa, Naa Bawa Seidu, expressed his profound gratitude to Fidelity Bank for selecting a school in his town as the flagship beneficiary of the Orange Impact project. He stated that the leaders and people of Duose were overjoyed at the impending project which would see the Duose D/A Primary School receive a comprehensive facelift, transforming its current facility into an ultra-modern 6-unit classroom block.

“I am surprised and overjoyed that Duose, a deprived community has been chosen for this project by Fidelity Bank. In fact, this gesture has made me rather emotional. We are grateful to Fidelity Bank and God almighty for what is about to happen, and I

believe I speak not only for myself but for the people of Duose, when I say that I cannot wait for this building to be put up”, he said.

The Wa West District Chief Executive, Hon. Vida Dioretey and the Wa West Director of the Ghana Education Service, Mr. Amatus D. Tug-uu who were all present to grace the occasion, commended Fidelity Bank Ghana for its contribution to education and human resource development. They assured the bank of their full support for the project and urged other corporate organisations to take a cue from Fidelity Bank.

With the launch of the initiative, similar projects are also being rolled out in 14 other beneficiary schools located in various regions across the country. Each Branch and Business Office of the Bank has been assigned a supervisory role over a specific school, while staff of the Bank have been enjoined to play a direct role in seeing each project through to completion.

The Sea Chief of Buchanan, Grand Bassa County of Liberia, Wesseh Doko, has called on artisanal fishers in Ghana to consider paying license fees to support the government’s fisheries management efforts.

This, according to him, will push the government to reduce the number of trawlers in Ghanaian waters.

“I am jealous that artisanal fishers in Ghana get all this support from the government even though they do not pay taxes.”

Mr Wesseh Doko made this call during a 10-day study tour by artisanal fisher associations in Liberia to Ghana to learn from members of the Ghana National Canoe Fishermen Council (GNCFC) on how they have been collaborating with the government of Ghana over the last four decades to manage the country’s fishery resources. The Liberia team made up of members from the Liberian Artisanal Fishers Association (LAFA), the Collaborative Management Association (CMA) and the National Fisheries and Aquaculture Authority (NaFAA).

The study tour forms part of the four-year Communities for Fisheries

Environmental Justice Foundation, EJF, in Liberia, with funding from the European Union. The project seeks to reduce illegal fishing and improve the sustainability of fisheries by expanding and strengthening community co-management associations, creating effective capacity for community monitoring and reporting of illegal fishing.

According to the Sea Chief of Buchanan, the government of Ghana’s inability to generate income from local fishers may be the reason for the proliferation of trawlers in Ghanaian waters. Ghana currently has over 75

licensed trawlers, whereas Liberia, which has a longer coastline, has less than ten licensed trawlers.

Mr Doko said fishers in Liberia pay taxes to the government based on the size of their vessels. He said annually, canoes that use paddle pay 50 dollars, while canoes with a maximum of 15 horsepower pay 250 dollars and canoes with 16 to 40 horsepower pay 450 dollars.

For his part, the acting President of the Ghana National Canoe Fishermen Council, GNCFC, Nana Jojo Solomon, emphasised the need for regional collaboration in fighting all forms of illegal, unreported and

unregulated (IUU) fishing practices. He, therefore, encouraged artisanal fishers in Liberia to work closely with the government to ensure that the country’s fisheries are managed sustainably. Nana Solomon added that the fisheries sector plays a vital role in the development of every coastal nation and its economy.

The acting President of GNCFC said Ghana’s fisheries have been declining in the last decades affecting the livelihoods and incomes of artisanal fishers. He admonished artisanal or local fishers in Liberia to avoid all forms of illegal fishing to safeguard their livelihoods and provide a future for generations after them.

During the study tour, the fishers were exposed to mechanisms being employed by GNCFC to efficiently collaborate with the government to manage the sector. The team toured the four coastal regions of Ghana, Volta, Greater Accra, Central and Western, and interacted with fishermen, fish processors, clam processors, traditional authorities, leadership of the GNCFC, FCWC, CEWEFIA, and staff of the Fisheries Commission.

The Minister for Communications and Digitalisation (MoCD), Ursula Owusu-Ekuful has been adjudged the Digital Leader of the Year for the second consecutive time at the 12th Ghana Information Technology and Telecom Awards (GITTA) held on October 21, 2022, at the Movenpick Hotel in Accra.

The award was in recognition of her efforts in championing Ghana’s digital transformation agenda for national development.

The GITTA awards also celebrated other changemakers and those providing digital leadership in the Information and Communication Technology (ICT) industry with the aim of spurring business and enabling corporate leaders to innovate and provide better and more efficient services and products.

The Deputy Minister for MoCD, Ms Ama Pomaa-Boateng (MP), who received the award on behalf of the sector minister, commended the organizers, INSTINCT WAVE, for a laudable and inspiring event to encourage individuals and institutions to continue to work hard for a resilient digital economy.

She said the GITTA event was one of the most celebrated ICT awards in recent times and might be referred to as the Oscars of the ICT and Telecom industry.

Ms Pomaa-Boateng said innovation remains the hallmark of entrepreneurship which provides huge opportunities for job creation

and economic growth to build a robust digital economy.

She added that having a digitally literate workforce was necessary to enhance the widespread adoption and use of digital products and services by all Ghanaians irrespective of geographical location and economic status.

According to the Deputy Minister, it was against this background that governments across the world continue to adopt digital technologies to fast-track their development, provide better and more efficient services, while better responding to the needs of the people.

She said the MoCD remained committed to the President’s digitalization agenda and would continue to work around the clock to transform Ghana’s economy.

To achieve this, she mentioned that the Ministry has implemented several initiatives including the annual Girlsin-ICT programme that provides a platform for Ghanaian girls in High Schools to acquire digital skills and stir up interest in them to pursue ICT courses at higher educational levels.

“Over 9,000 girls have been trained so far since the inception of the initiative in 2012 in Ghana. We also have the cyber security version of the Girls in ICT which focuses on the Senior High Schools and has so far trained over 50,000 young women across the country”, she stated.

She indicated that, in order to equip the youth with digital skills to manage

the labour market’s expectations of growing the digital economy, the Ministry facilitates ICT knowledge and skills acquisition by individuals and institutions.

She revealed that the MoCD has established a mini tech hub, called the Ghana Digital Centres Limited (GDCL) to harness the digital potential of Ghana by driving Digital innovation and entrepreneurship to create digital and ancillary jobs for the youth through the hosting of tech firms and digital start-ups.

She noted that the centre which commenced operations in 2017, has incubated 200 digital start-ups over the period, adding, that with funding from the World Bank, the Ministry set up an Innovation Centre at the GDCL made up of an Innovation Hub (iHub) and a mobile Applications Lab (mLab).

The CEO of Instinct wave, Mr Akin Naphtal in a welcome address indicated that the GITTA awards is aimed at promoting and celebrating

governments, institutions, digital operators, and infrastructure providers among others to share the progress of their successful innovations aimed at further enhancing the Ghanaian community as part of Government’s vision of building a robust digital economy.

“GITTA was created as a strategic platform to recognize, reward and showcase the pioneering ICT initiatives driving the Ghanaian private and public sectors with a vision of setting a benchmark to the sub-regions wave of development in ICT”, he said.

According to him, GITTA will recognize organizations and individuals at the forefront of digitization with innovative products and services that keep ICT sector exciting.

“The prestigious annual ICT gala awards night has inspired and promoted further development, growth, and innovation of the country’s ICT industry as a regional leader”, he said.

More critical than ever, consumers have become particular and discerning about brands. Consumers make purchasing decisions with brands that they feel are dedicated to giving back, particularly with causes they also believe in and support.

We can all attest that we live in an age where customers and consumers have infinite options. It is easy to switch brands based on price and availability.

In this sense, there is an increase in traditional loyalty programs such as loyalty points, discounts, and rewards to woo customers. But today’s consumer has so many choices of where to shop. How times have changed. Organizations now realize that being a good corporate citizen can prove enormously beneficial all rounds.

Now let’s delve into Corporate Social Responsibility (CSR) and Corporate Social Investment (CSI) phenomenon that has shaped the mutually beneficial relationship between organisations and the society in which they operate. Previously, the terms CSI and CSR were used interchangeably, but have now been defined separately. According to CSI Solutions, CSR refers to an organisation’s total responsibility towards the business environment in which it operates. CSR describes the broader solution to triple-bottomline matters of the 3Ps – profit, people and planet while CSI is one of the sub-components of CSR and aims to uplift communities in such a way that the quality of life is generally improved and safeguarded.

CSR runs both broader and deeper and gets beyond the corporation’s spend to the true spirit of the initiative. This is where a business refuses to use suppliers that take advantage of child labour. It could mean the company obtains its raw materials from sustainable sources and ensures that its sources are environmentally friendly. This then fulfils the company’s compliance to both CSR and sustainability requirements.

Besides being a Public Relations exercise, or a way to become media friendly, CSI fulfils a company’s obligations to be compliant to legislature and for some, they expect a return the investments they make into CSR. But Corporate Social Responsibility is a display of a company’s values.

Nevertheless, all firms engaging in CSR are pledging to conduct

their business in ways that protect the interests of current and future generations.

Fundamental to most CSR models for organisations are economic, legal, and ethical responsibilities. Consumers belief that firms have a moral obligation to behave in certain ways.

This might include a focus on issues like employee rights, health and safety in the workplace, product quality and safety, charitable work, education activities and environmental conservation.

companies are becoming more aware of their environment including recycling, use of organic products, contributions to local charities and support for community projects.

I have had the opportunity to be part of executing CSR projects for some leading Ghanian companies.

For instance, United Bank for Africa (Ghana) Ltd contributes a part of its annual profits to education through their National Essay Competition where three top winners are given a grant of US$ 5,000, US$3,000, and

Optimizing the impact of CSR on customer loyalty should therefore be high on the agenda of companies. A focus on sustainable development offers a route towards achieving this objective.

Companies can create positive perceptions in consumer minds using Public Relations and publicity to promote itself as socially responsible. Another area could be the use of digital media and influencer marketing to further project the great work done by companies in the area of CSR.

of CSR often prove a worthwhile initiative for the company. Research shows that CSR can be more effective than advertising when it comes to attracting interest from consumers. Of even greater worth is its potential to enhance customer loyalty. This effect emerges as a result of “generalized reciprocity” whereby customers reward an organization for the indirect benefits provided to them when its CSR activities positively impact on their society.

Now few people will doubt the importance of customer loyalty to business organizations due to the addition to the bottom line. Loyal customers boost a firm financially through their willingness to spend more per transaction; make frequent purchases and provide positive word-of-mouth (WOM) recommendations and referrals to significant others.

It is widely acknowledged that loyalty becomes most powerful when it is comprised of both behavioural and attitudinal components. The blend of repeat purchase behaviour and emotional attachment to the company and its brands helps generate loyalty that is robust and enduring.

Recently, many Ghanaian

the company also donates over 2,000 pieces of African Literature books to some Senior High Schools to boost reading culture. The total CSR budget which was under my control for the year was in the region of USD100,000.00.

Guinness Ghana sources about 61% of local raw materials i.e., maize, sorghum and cassava used to produce its premium beverages, from 30,000 farmers in 11 of the 16 regions in Ghana.

Three years ago, I was part of a team who launched and executed activities for the 25th anniversary celebration of Gold Fields Ghana Ltd. As part of the anniversary celebrations, the mining company commissioned a 33km reconstructed road worth US$15million from Tarkwa to Damang their host communities.

Other companies such as Voltic, Verna and Awake are also pushing environmental and health related CSR activities which is commendable. Research indicates that the impact of CSR on customer loyalty can be direct or indirect in nature. A range of different intermediaries have been identified including customer satisfaction, consumer identification with the firm, trust, and brand image.

To many consumers like myself, experiential and emotional benefits play a significant role in solidifying our loyalty. That’s where things like social causes and the charitable organizations that your brand supports enter the loyalty equation.

Your loyalty programme needs to be unique for your customers. Highlighting charitable causes is a great way to engage new members. These emotional moments go a long way toward delivering higher levels of brand loyalty.

Loyalty is developed over time and through a series of moments such as emotional connections a brand makes with its customers.

What charitable causes could your brand stand behind that would be supported by your customers?

Customers who feel an emotional connection with a brand will recommend it more than those who don’t feel the same emotional connection.

This kind of business-customer relationship can’t only be achieved through generic advertising and discount sales. It’s achieved through offering a unique customer experience and humanising your brand through CSR initiatives.

Experts will gather from 24 to 28 October 2022 in Addis Ababa, Ethiopia, for the Experts Group Meeting of the 6th Ministerial Conference on Civil Registration and Vital Statistics (CoM6) organized by the Economic Commission for Africa (ECA).

The meeting will review progress in developing civil registration and vital statistics (CRVS) systems over the last ten years, including taking note of new developments since the previous Ministerial Conference and the fastapproaching deadline of the 2030

agenda.

The meeting will also share innovative practices and strategies for developing CRVS systems and; provide policy directives on priority measures for accelerated improvement of CRVS systems which will constitute the new regional CRVS strategy and plan.

Oliver Chinganya, Director of the African Centre for Statistics at the ECA, explains the importance of this meeting in “identifying priority strategic actions that will accelerate the progress of civil registration and vital statistics

systems in Africa over the next eight years. Ensuring considerable progress in achieving 100% and 80% registration of births and deaths respectively as set by agenda by 2030.”

Africa needs to build its statistical capacity to produce accurate, high quality and timely data to inform policies that will support the full implementation of the sustainable development goals and the continent’s Agenda 2063.

Timely, accurate, high-quality data and statistics to inform policy remains a significant challenge

across Africa.

The Expert Group Meeting will bring together country experts drawn from Ministries responsible for Civil Registration, Ministries of Health, National Statistical Offices, National Identity Management offices, Young African Statisticians, and development partners for technical deliberations aligned to the theme and the statutory issues of the meeting.

Several side events and exhibitions will be held on the margins of the meeting.

Amid the political turmoil of outgoing British Prime Minister Liz Truss’s shortlived government, the Bank of England has found itself in the fiscal-financial crossfire. Whatever government comes next, it is vital that the BOE learns the right lessons.

On September 23, Truss’s government announced a large, unfunded fiscal-stimulus package that undermined the BOE’s price-stability mandate and caused governmentdebt and foreign-exchange markets to malfunction. To prevent systemically important markets from seizing up, the BOE postponed its planned offloading of government bonds (gilts) and instead purchased more. But these unsterilized (monetized) asset purchases amount to an expansionary monetary policy, which will further frustrate the BOE’s efforts to bring down inflation – unless and until the purchases are reversed.

Unfortunately for the BOE, it had no choice. Financial stability is a precondition for sustainable price stability, so it is a central bank’s overriding concern. When the circumstances demand it, central banks must act as lenders of last resort (LOLR) to preserve or restore funding liquidity for systemically important counterparties. They also must serve as market makers of last resort (MMLR) or buyers of last resort (BOLR) to maintain or restore market liquidity in systemically important financial markets.

The BOE got its latest interventions partly right, but it also made mistakes. When market participants in the UK – notably liability-driven

investment (LDI) funds –panicked, the BOE intervened, on September 28, with a powerful statement about its willingness and ability to act. Purchases would be carried out “on whatever scale is necessary” to restore orderly markets. Moreover, the Treasury would fully – and quite properly –indemnify the operation for any losses incurred.

But the BOE undermined this show of force by putting a time limit on its emergency intervention. It stated that the planned sales from its Asset Purchase Facility would be delayed from October 3 to October 31, and that it would purchase up to £5 billion ($5.4 billion, as of September 28) of gilts per day for 13 days. These dates were offered not as mere estimates but as a firm interval.

On October 10, the BOE reported that it had bought only around £5 billion of gilts in total over the course of eight daily auctions. It was a demonstration of credibility at work. If market participants believe that the MMLR is willing and able to intervene “on whatever scale is necessary” to restore order, the actual intervention required may be small. In the case of the European Central Bank’s Outright Monetary Transactions (launched in 2012), no actual purchases were needed to restore market functioning.

With £60 billion of unused capacity in its emergency facility, the BOE then announced that it would increase the maximum size of the remaining five auctions to £10 billion each. It also added index-linked gilts to the program and initiated a temporary LOLR facility, the Temporary Expanded Collateral Repo Facility, to extend further

assistance to stressed LDI funds; it eased collateral requirements for its regular Indexed LongTerm Repo operations; and it made additional liquidity available through a new, permanent Short-Term Repo facility, launched the week of October 3.

All this made sense. But the BOE’s continued insistence that its emergency gilt-purchase program would end on October 14 was unhelpful, because it contradicted the assertion that it would carry out purchases on whatever scale it deemed necessary. Moreover, that date was never credible. If bondholders were to start dumping gilts again on October 15 or any later date, the BOE would be right back to acting as a BOLR.

It is unclear whether the BOE’s emergency gilt purchases were on penalty terms, which are necessary to minimize excessive risk-taking by market participants who know that the central bank will intervene should fire sales or other dysfunctional behavior threaten market functioning. Penalty terms that apply when markets are disorderly are an important complement to well-designed regulations constraining excessive risk-taking when markets are orderly. But it can be difficult for a central bank to determine a purchase price that is both materially more attractive to would-be sellers than the disorderly market price as well as less attractive than the (unobservable) orderly market price.

A separate but important issue is that the BOE’s Monetary Policy Committee played no meaningful role in creating and implementing the emergency

program. That is surprising, considering that the new gilt purchases will complicate and delay the process of bringing inflation back down to the target rate. According to a statement by the BOE’s Deputy Governor for Financial Stability, Jon Cunliffe, the MPC was merely “informed of the issues in the gilt market and briefed in advance of the operation, including its financial-stability rationale and the temporary and targeted nature of the purchases.”

By emphasizing the temporary and targeted nature of the purchases, Cunliffe seemed to be suggesting that they do not constitute monetary policy operations. But, in that case, was the specific emergency program – both the unsterilized asset purchases and the postponement of the asset sales – formally recommended by the Financial Policy Committee, whose mandate is financial stability? Cunliffe’s statement is ambiguous on this question: “The FPC was engaged ahead of [the program’s] launch, recognizing the risks to UK financial stability from dysfunction in the gilt market. The FPC recommended that the Bank take action, and welcomed the Bank’s plans for temporary and targeted purchases in the gilt market on financial stability grounds at an urgent pace.”

Given that these emergency operations have both financialstability objectives and monetary-policy implications, they ought to have been properly approved by all the designated decision-making bodies – the FPC and the MPC. If that was not the case, the program’s legitimacy may be significantly undermined.

The Economic Commission for Africa (ECA) will host the Eighth meeting of the Regional Committee for Africa of the United Nations Global Geospatial Information Management (UN-GGIM: Africa) in Ethiopia from 24-28 October to discuss opportunities and look at issues related to geospatial information policy at the national and regional levels that require a decision, resolution or recommendation to be issued by Member States, ECA or partners and other stakeholders.

UN-GGIM: Africa was established to coordinate African geospatial development and to contribute to the wider global initiative. UN-GGIM: Africa plays a leading role in making joint decisions and setting directions on the use of geospatial information within national, regional and global policy frameworks.

It also works with Governments to improve policy, institutional arrangements, and legal frameworks, addressing global issues, contributing to the collective knowledge as a community with shared interests and concerns.

As one of its major activities, UN-GGIM: Africa conducts annual meetings across the continent. With the support of local and international organizations, UNGGIM: Africa has organized until now seven of such meetings in Tunis (Tunisia) in 2014, Nairobi

(Kenya) in 2015, Abidjan (Cote D’Ivoire) in 2016, Addis Ababa (Ethiopia) in 2017 and in 2018, Kigali (Rwanda) in 2019; Virtual meeting in 2020; and Abidjan (Côte D’Ivoire) in 2021. Each of these meetings is attended by delegates from African countries, as well as observers from international organizations, academia, regional organizations and networks, and the private sector.

The meetings look at policies, measures and steps African countries could take to ensure a successful implementation of the UN-GGIM initiative in the region as well as reviewing the UN-GGIM: Africa’s governance structure and modus operandi; the terms of reference of the Executive Working Groups, the African Action Plan on Geospatial Information for Sustainable Development in Africa (GI4SD), among others.

The Eighth meeting scheduled to be held at the United Nations Conference Centre, in Addis Ababa will bring together from national officials in mapping, cartography, surveying, statistics; high-level experts selected from academia, research institutions, government, and the private sector; representatives from sub-regional and regional organizations.

The meeting will be co-located with the Statistical Commission for Africa (StatCom-Africa)

Conference to maintain and strengthen the synergy between geospatial and statistical communities in all domains of applicability.

The meeting will help member States to consolidate existing consensus on the Regional Committee and to review its structure, functions and operations in Africa while defining its funding mechanisms. The meeting will review the progress made on the recommendations and actions of past meetings of the Regional Committee.

It will also provide opportunity for participants to share knowledge and best practices related to the development of geospatial information in Africa, increasing their awareness of the benefits of utilizing geospatial information for sustainable development, as well as promote networking among institutions and practitioners in geospatial information and generate synergy at the national level to facilitate its management.

Emphasis will be given to experiences sharing and identification of ground-level geospatial infrastructures that will be required for the post-COVID-19 recovery at the national level.

Participants will also take time to exchange views on means and measures for modernizing national mapping agencies and their workflows in response to the current trends of geospatial

technology, so that they remain relevant in providing authoritative facts and evidence for use in policymaking. Equally, they will review a comprehensive programme ECA is putting forward to streamline innovative geospatial activities in Africa that will provide ideas, insights and strategic pathways for the intelligent and integrated management of fit-for-purpose development information and services.

It is expected that the outcomes of the meeting will help to consolidate the consensus and drive the political will to leverage geospatial information technology to support the African development agenda and address emerging global challenges.

ECA notes that strategic guidance that has emerged from the United Nations Global Geospatial Information Management has been essential in ensuring that the Regional Committee continues to play a leading role in determining the way forward in the use of geospatial information in national and regional policy frameworks.

With ECA support, the Regional Committee has also made a substantive effort to provide a forum for African nations representatives to meet and to discuss and collaborate on important issues relating to integrated geospatial information management in Africa.

When Deng Xiaoping came to power in 1978, following the death of Mao Zedong, he outlined a new national strategy that emphasized gradualism, ideological flexibility, and discretion. Deng summarized his doctrine with the dictum: “Hide your strength and bide your time.” In the decades that followed, this approach underpinned China’s transformation into an economic powerhouse, with Deng’s successors focusing on growth and maintained a low international profile. But it is clear that a low-profile foreign policy is not part of Chinese President Xi Jinping’s plan to deliver “the great rejuvenation of the Chinese nation.”

Xi’s confirmation as China’s first three-term president, which will almost certainly happen during the Communist Party’s 20th National Congress this week, comes at a delicate moment.

According to Oxford Economics, China’s annual GDP growth will average 4.5% over the next decade, before slowing to about 3% between 2030 and 2040. Over the past 50 years, China’s economy has grown at an average annual rate of nearly 10%. But its economic boom could soon become a thing of the past.

Against this backdrop, the United States’ annual GDP growth rate could soon overtake China’s for the first time since 1976, the year Mao died. In fact, the two economies are now growing at roughly the same pace: the World

Bank has recently revised down its forecast for China’s economic growth this year to 2.8%, compared to an expected rate of 2.5% in the US.

In recent decades, much Western policy toward China has rightly focused on the need to integrate it into the international community so that its rapid economic rise would be peaceful. In the coming decades, the international community will have to prepare for a scenario in which China’s economy does not achieve more than moderate, or even low, growth.

Moreover, China’s spectacular economic growth has generated rapidly widening social inequalities, which could compromise its social cohesion in the future. It is unclear how Xi’s “common prosperity” campaign will affect economic growth. But whether Xi can achieve his stated goal of narrowing the wealth gap without damaging the economy is an open question.

China’s centrality to the global economy means that its policy decisions have far-reaching implications. Shanghai’s port, the world’s largest, was operating at lower capacity for months, owing to Xi’s zero-COVID policy. While repeated lockdowns have caused the Shanghai province’s GDP to contract by 13.7% year on year, they have also severely disrupted global supply chains and caused inflation to surge worldwide.

Since he came into power in

2012, Xi has repeatedly signaled his ambition to increase China’s influence on the international stage. The recent Shanghai Cooperation Organization Summit in Samarkand, Uzbekistan, where Russian President Vladimir Putin was forced to acknowledge China’s “questions and concerns” about the war in Ukraine, was a case in point.

Xi has been clear about his desire to reshape the international order to accommodate Chinese interests. The existing globalgovernance architecture, after all, was established after World War II by Western leaders who founded institutions like the World Bank and the International Monetary Fund, and established the dollar as the world’s dominant reserve currency.

As former Australian Prime Minister Kevin Rudd argues in his recent book The Avoidable War, China wants to play a leading role in shaping the global norms that will define the international order in the coming century. Although it remains to be seen how China intends to rewrite these norms, it is unlikely that the international liberal order that was built after WWII will remain fully intact.

While Xi is guaranteed a third five-year term, recent developments suggest that he could stay in office indefinitely. Last year, a CPC resolution elevated the Chinese leader to the status of Mao and Deng, thus

clearing the way for him to remain in power long after 2028.

Xi’s sense of his historic mission as China’s leader could prove to be catastrophic. “Resolving the Taiwan question” is central to what Xi views as his legacy, and he has repeatedly signaled his intentions to reclaim the island. But while Xi’s recent foreign-policy assertiveness has stoked fears that China will invade, American and Chinese leaders must keep communication channels open to avoid escalation.

US-China relations will define the twenty-first century, so forging a path to peaceful coexistence is crucial. This will depend not only on Xi’s geopolitical ambitions but also on America’s political future. Next month’s midterm elections will be a major test for the health of US democracy. But they could also have a significant impact on the future of Sino-American relations.

US-Chinese economic decoupling would be catastrophic for both countries and must be avoided. Improving global governance requires that the world’s two major powers be economically and politically healthy. But, more than that, tackling global problems like climate change would be impossible without cooperation. If we are to build a new international order suited for the challenges of the twenty-first century, sanity must prevail.

The quality of petroleum products sold by oil marketing companies in Ghana has improved significantly, with the level of adulteration reducing from 35 percent in 2012 to 1.59 percent in 2022.

The National Petroleum Authority (NPA), regulator of the petroleum downstream industry who revealed this recently said, the authority is committed to ensuring that users of petroleum products get value for money.

Speaking to the media in Ho, the Volta Regional Capital, Saeed Kutia, the Head of Quality Assurance at NPA explained that the feat had been reached due to several stringent measures instituted to that effect.

These include the revision of operating procedures in the importation, exportation, and production of fuels by Petroleum Service Providers (PSPs).

The introduction of Petroleum Product Marking Scheme (PPMS) and Bulk Road Vehicle (BRV) tracking system.

The Authority has also deployed a standby intelligence and security team that responds swiftly to consumer complaints of fuel adulteration and other dodgy conducts of service providers.

These and several others have ensured that products scarcely adulterated and meet the required specification along the supply chain.

It is therefore not surprising that even when the contaminated fuel reduced to 2.5 percent in August 2021, the Authority was able to record a further reduction to 1.59 percent a year later (2022).

Mr. Kutia noted that fuel contamination could be reduced further with the help of the public.

He, therefore, encouraged petroleum consumers to report

Oil Marketing Companies/ fuel stations (OMCs) that sell adulterated and substandard petroleum products promptly; preferably within 48 hours for swift action against culprits.

Reports can be made to the regulator in any of their regional offices nationwide or through phone calls (0545006111/0545006112/toll free on 080012300) or via their website – www.npa.gov.gh.

On the issue of unstable fuel prices, Abass Ibrahim Tasunti, Head of Economic Regulation at NPA said the Authority does not regulate the prices of petroleum products in the country.

Petroleum Products pricing in Ghana are done using two pricing windows in a month; between 1st and 15th and between 16th and end of the month.

He explained that the current situation is due to global factors such as geopolitics, wars, natural disasters and political unrest. These he said have led to volatility in prices in every window since factors affect global market prices and the Ghana Cedi/Dollar exchange rate.

Mr. Tasunti expatiated that although the NPA does not regulate fuel prices, it ensures that Bulk Distribution Companies (BDCs) and OMCs set prices based on the prescribed petroleum pricing formula and also determines the price benchmarks BDCs must use in setting the ex-refinery price of each petroleum product.

In summary, the NPA as a regulator ensures that consumers and suppliers get value for money by adhering to the approved quality and pricing formula for petroleum products in the country.

President Nana Addo Dankwa Akufo-Addo, on Saturday (October 22, 2022) commissioned Specialty Beers Ghana (SBL) Limited, an enterprise operating under Government’s One-District-OneFactory initiative.

Located in Kwasi Tenten, in Nsawam Adoagyiri Municipality of the Eastern Region, Specialty Beers was established on a five-acre land to manufacture speciality “ale or top-fermented” beers for the Ghanaian market.

The company was registered in Ghana in 2012, but became active in 2020 and applied in January 2021 to take advantage of the One District One Factory (1D1F) Programme being implemented by the Ministry of Trade and Industry.

Construction of the factory started in May 2021 and the first brew test run was completed in April 2022. SBL is a medium size craft

brewery with an annual production capacity of 10,000 hectolitres.

As part of SBL vision to reduce dependency on the importation of raw materials, the company has already invested in the development of a number of beer recipes using mainly adjuncts (such as maize and broken rice) partly replacing malted barley which cannot be sourced in Ghana.

A number of local suppliers of these cereals, including Avnash Limited and Hila Farms, Limited have been engaged as anchor suppliers of basic raw materials.

The brewery will be the first to introduce the top fermentation brewing process in Ghana. This high-end brewing technology allows the usage of over 70% unhusked grains during the mashing process while ensuring the absolute clarity of the beer without stripping any flavour or aroma due

to the centrifuge filtration system.

The company has introduced four brands into the market, namely Farmhouse Ale (5% abv), Hibiscus IPA (6% abv), Ginger Triple (7% abv), and Cocoa Stout (8% abv).

The entire production process of the facility is environmentally friendly and utilises only recyclable materials (no plastics). In addition, the company uses cleaning chemicals that allow the wastewater (by-product) to be used as fertiliser and potassium acetate.

Currently, the company has engaged 20 permanent staff who are involved in the pre-factory launch activities in specific areas of factory operations. It is expected that once the company starts full operation, over 60 additional staff would be directly engaged whiles about 1500 indirect employment

opportunities will be generated.

The second phase of the project is intended to develop exports to the wider ECOWAS region, the rest of Africa and possibly the European market via specialized international distributors. For this reason, Specialty Beers Ghana Limited has already acquired ECOWAS Trade Liberalisation Scheme Certification (ETLS) certification.

The One-District-One-Factory initiative has seen the ongoing construction of two hundred and ninety-six (296) factories across the country, of which one hundred and twenty-five (125) have been completed.

In the Eastern Region alone, there are seventeen (17) completed 1D1F enterprises, with sixteen (16) more under construction and four (4) in the pipeline.

President Nana Addo Dankwa Akufo-Addo, has backed the OneDistrict, One-Factory initiative, under the broader industrialisation agenda of government, as a basis for developing a home-grown infrastructure that is capable of withstanding the uncertainties of exogenous shocks to the Ghanaian economy.

In this regard, the President pointed out that the Eastern Region, alone, has seen seventeen (17) completed 1D1F enterprises, with another sixteen (16) at various stages of completion and soon to be commissioned, as well as another four (4) at the project conception stage.

The performance and success of the completed 1D1F projects across the country, with regards to minimizing unemployment and shoring local production, has thus far, been a clear indication of President Akufo-Addo’s long held belief that Ghana’s path towards self-reliance is largely premised on the country’s determination to

industrialise.

According to the President who is began a three-day tour of the Eastern Region on Friday, “the whole purpose of the policy means having factories and enterprises here in Ghana, which will substitute the ones that are coming from abroad. That is the whole purpose of the policy. Instead of importing XYZ, you’re going to have them made here.”

He added that, “when we said we wanted to implement 1D1F and certain strategic industrial policies, we were told it couldn’t be done, but today everyone is talking about how important it is for the Ghanaian economy to lessen its dependence on foreign goods and foreign services.”

“Now people are beginning to understand that indeed we had the foresight, we knew exactly what we needed to do to bring substantial progress, real progress not intermittent progress, but substantial progress which is going to be strong and resilient. That is

what I’ve noticed is ongoing,” he added.

President Akufo-Addo indicated further that, “by the time we are through, then the commitment of a 1D1F would have been established. And we can only strengthen the industrial development of the country, which is very important to note that foreign import dependence will not inure to our growth. We have the panacea, the solution, and Government is working to towards it.

President Akufo-Addo’s 1D1F initiative is meant to change the nature of Ghana’s economy from one which is dependent on import and export of raw material to one which is focused on manufacturing, value addition and export of processed goods from raw materials that are largely found in the districts across the country.

Thus far, the One-District-OneFactory initiative, which has seen the ongoing construction of two hundred and ninety-six (296) factories across the country, of

which one hundred and twentyfive (125) have been completed, is part of the foundation on which the Akufo-Addo Government is we are building a comprehensive industrialization programme, inspired by the development of strategic anchor industries, such as the emerging automotive industry and the co-ordinated exploitation for the entire domestic value addition of our bauxite and iron ore resources.

“I am hopeful that, by the end of my term, the full complement of two hundred and ninety-six (296) factories will be in operation to help provide quality domestic alternatives to the consumption needs of Ghanaians, and reduce substantially our dependence on imports. We do not only account for the youth as labour in the 1D1F programme, but also as managers and owners. Indeed, fifty-eight (58) of these factories are wholly owned by young people who have received direct government support”, he added.

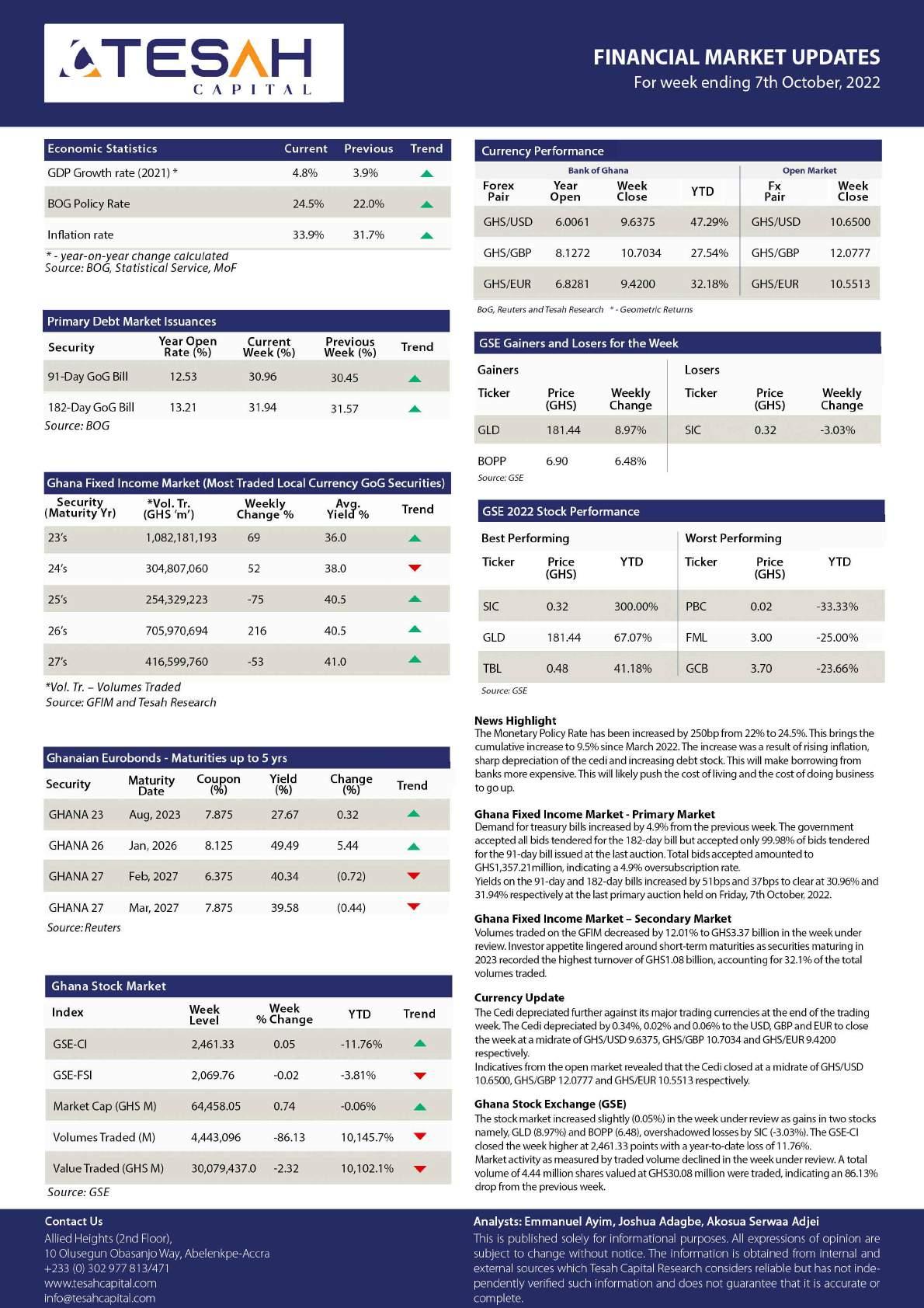

Q3, 2021 GDP Growth 4.8%

Average GDP Growth for 2021 4.1%

2022 Projected GDP Growth 3.7%

BoG Policy Rate 24.50%

Weekly Interbank Interest Rate 24.15%

Inflation for February, 2022 37.20%

End Period Inflation Target – 2022 28.5%

Budget Deficit (% GDP) – Dec, 2021 6.4%

2022 Budget Deficit Target (%GDP) 6.6%

Public Debt (billion GH¢) – Dec, 2021 402.4%

Debt to GDP Ratio – Dec, 2021 68.0%

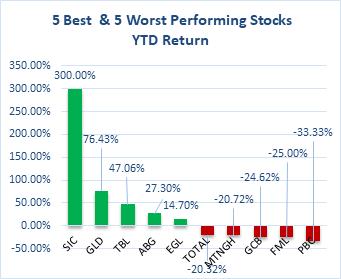

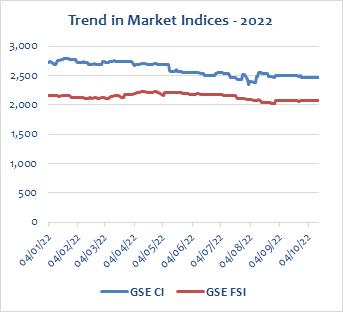

The Ghana Stock Exchange closed lower for the week on the back of price decline by 1 counter. The GSE Composite Index (GSE CI) lost 0.89 points (-0.04%) to close at 2,460.44 points, reflecting year-to-date (YTD) loss of 11.79%. The GSE Financial Stocks Index (GSE FI) also lost 1.60 points (-0.08%) to close at 2,068.16 points, reflecting YTD loss of 3.89%.

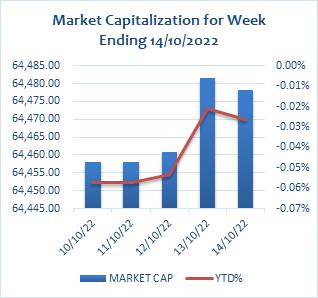

Market capitalization increased by 0.03% to close the week at GH¢64,478.26 million, from GH¢64,458.05 million at the close of the previous week. This reflects a YTD decrease of 0.03%.

Trading activity recorded a total of 3,546,068 shares valued at GH¢59,618,839.97 changing hands, compared with 4,443,096 shares, valued at GH¢30,079,436.97 in the preceding week.

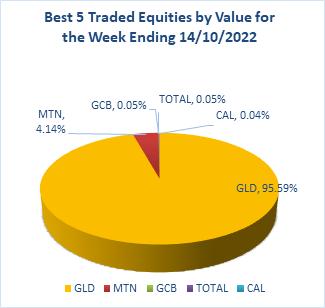

MTN dominated volume of trades whiles New Gold dominated value of trades for the week, accounting for 79.15% and 95.59% of shares traded respectively.

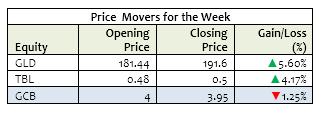

The market ended the week with 2 advancers and a decliner as indicated on the table below.

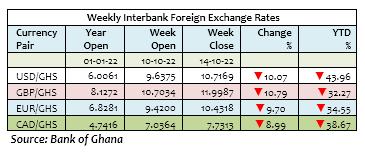

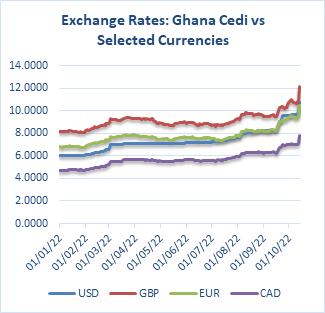

The Cedi weakened against the USD for the week. It traded at GH¢10.7169/$, compared with GH¢9.6375/$ at week open, reflecting w/w and YTD depreciations of 10.07% and 43.96% respectively. This compares with YTD depreciation of 2.07% a year ago.

The Cedi also weakened against the GBP for the week. It traded at GH¢11.9987/£, compared with GH¢10.7034/£ at week open, reflecting w/w and YTD depreciations of 10.79% and 32.27% respectively. This compares with YTD depreciation of 2.69% a year ago.

The Cedi continued its downward trend against the Euro for the week. It traded at GH¢10.4318/€, compared with GH¢9.4200/€ at week open, reflecting w/w and YTD depreciations of 9.70% and 34.55% respectively. This compares with YTD appreciation of 3.54% a year ago.

The Cedi again weakened against the Canadian Dollar for the week. It opened at GH¢7.0364/C$ but closed at GH¢7.7313/C$, reflecting w/w and YTD depreciations of 8.99% and 38.67% respectively. This compares with YTD depreciation of 4.78% a year ago.

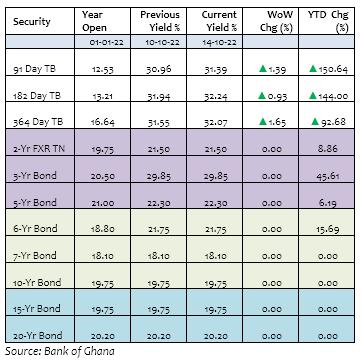

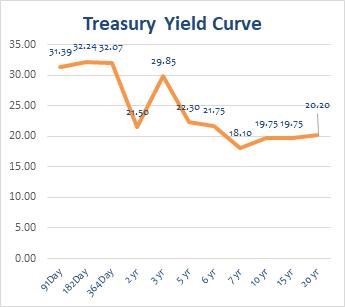

Government raised a sum of GH¢974.51 million for the week across the 91-Day, 182-Day and 364-Day Treasury Bills. This compared with GH¢1,357.21 million raised in the previous week.

The 91-Day Bill settled at 31.39% p.a from 30.96% p.a. last week whilst the 182-Day Bill settled at 32.24% p.a from 31.94% p.a. last week. The 364-Day Bill settled at 32.07% p.a from 31.55% p.a last week. The table and graph below highlight primary market yields at close of the week.

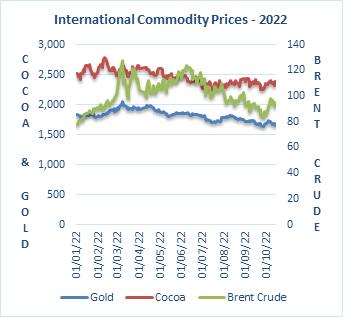

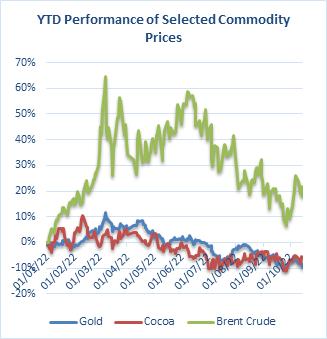

Oil prices fell Friday, ending a difficult week on a negative note on fears a global economic slowdown and further Covid-19 restrictions in China will severely hit demand. Brent futures traded at US$91.63 a barrel on Friday, compared to US$97.92 at week open. This reflects w/w loss and YTD appreciation of 6.42% and 17.81% respectively.

Gold prices hovered above annual lows on Tuesday after tumbling sharply on hawkish signals from the Federal Reserve. Gold settled at US$1,648.90, from US$1,709.30 last week, reflecting w/w and YTD loss of 3.53% and 9.83% respectively.

Prices of Cocoa increased for the week. The commodity traded at US$2,377.00 per tonne on Friday, from US$2,396.00 last week, reflecting w/w and YTD depreciations of 0.79% and 5.67% respectively.

CIDAN Investments Limited is an investment and fund management company licensed by the Securities & Exchange Commission (SEC) and the National Pensions Regulatory Authority (NPRA).

Name: Ernest Tannor Email:etannor@cidaninvestments.com Tel:+233 (0) 20 881 8957

Name: Audrey Asiedua Wiafe Email:aaudrey@cidaninvestments.com Tel:+233 (0) 57 840 2700

Name: Moses Nana Osei-Yeboah Email:moyeboah@cidaninvestments.com Tel:+233 (0) 24 499 0069

CIDAN Investments Limited

CIDAN House Plot No. 169 Block 6 Haatso, North Legon – Accra Tel: +233 (0) 26171 7001/ 26 300 3917 Fax: +233 (0)30 254 4351 Email: info@cidaninvestmens.com Website: www.cidaninvestments.com

The contents of this report have been prepared to provide you with general information only. Information provided on and available from this report does not constitute any investment recommendation. The information contained herein has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed.

Copyright @ 2019 Business24 Limited. All Rights Reserved.

Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed.

We value your support and loyalty.

Contact: editor@business24.com.gh Newsroom: 030 296 5315

Advertising / Sales: +233 24 212 2742

Funded Debt: Funded debt is a company’s debt that matures in more than one year or one business cycle. This type of debt is classified as such because it is funded by interest payments made by the borrowing firm over the term of the loan.

Funded debt is also called long-term debt since the term exceeds 12 months.

Source: https://www.investopedia.com/terms/f/fundeddebt. asp

The Minister of Trade and Industry, Alan Kyerematen, has assured poultry company, Buntaa Farms, of government’s support in ensuring it goes into processing in other to become competitive and one of the “signature” companies in the country.

Buntaa Farms Limited is an ultra-modern chicken production, processing and marketing complex, comprising of a layer component and a broiler component, which are being delivered in three phases.

Phase one comprises a layer component with the capacity of 232,000 layers planned. Phase two comprises two pullet houses and five-layer houses, also with a capacity of 58,000 per bird house, whiles Phase three is a broiler production component with an estimated capacity of one million birds plus a slaughtering house with adequate refrigeration facilities.

Addressing journalists after touring the facility, Mr. Kyerematen said “Government is determined as a matter of policy to enhance local capacity for the production of chicken and other poultry products because we believe that it will create significant opportunities for job creation particularly once you have investors like [Mr.Gyan] who put in their resources into building this particular anchor facility, then it

allows other smaller producers to feed into this particular anchor facility.

I have no doubt in my mind that since this is consistent with government’s policy to support local poultry production, that this should become one of the signature companies for us in this country and once this phase is completed, we will support the company to go into processing and that becomes the final stage of the value chain.”

Buntaa Farms is a Ghanaian-owned company located at Kwabeng in Atiwa West District of the Eastern Region and seeks to undertake business in the areas of farming, sale of agricultural equipment, agro processing, export of agro products and poultry farming.

The company was registered in 2019 and accepted under Government’s flagship industrialization programme,

infrastructure positioning itself to be a disruptive poultry farm business, issuing better feed, lighting, and temperature regulation systems to reimaging poultry in Ghana.

At full operations, Buntaa Farms would be well positioned to significantly contribute to the reduction of the import bill on frozen poultry products into the country while creating massive sustainable jobs to the youth.

In another development, the minister had earlier toured Specialty Beers Ghana (SBL) Limited, a foreign-owned company located in Kwasi Tenten in Nsawam Adoagyiri Municipality of the Eastern Region on a five-acre land to manufacture specialty ‘ale or top fermented’ beers for the Ghanaian market.

The Minister after inspecting the

the beauty of this investment is that it is using 70percent local raw material -broken rice and maize grains and other ingredients. So, it speaks very much to the concept of 1D1F, it is located in a rural economy, it is creating jobs.

The Managing Director of Speciality Beer, Kristof Henot says the company wants to differentiate itself from the established brewery companies, and adds that their vision is to bring new flavours into the market and create a niche market.

The second phase of the project is intended to develop exports to the wider ECOWAS region, rest of Africa and possibly the European market via specialized international distributors. For this reason, Specialty Beers Ghana Limited has already acquired ECOWAS Trade Liberalisation Scheme (ETLS) certification. The company would also take advantage of AfCFTA to secure market access opportunities in Africa once it is able to meet the Rules of Origin requirement under the Agreement.

facility told the press that “We are very pleased that we have this investment undertaking under the 1D1F initiative,

Specialty Beers Ghana Limited has so far invested €4M (Euros) for the acquisition of land, construction of factory building and installation of equipment and other logistics.

The Head of Community of Wanis International Foods, Mr. Paul Harrison, has paid a visit to the Deputy Chief Executive Officer of Ghana Exim Bank (GEXIM), Ms. Rosemary Beryl Archer, at the Bank’s head office at the Africa Trade House, in Accra.

Accompanying Mr. Harrison was Mr. Dennis Tawiah, the Chief Executive Officer of Akwaaba UK, London-based organizers of the world-famous Ghana Party in the Park event in London.

The visit builds on a successful exploratory meeting between the Deputy CEO of the Bank and Management of Wanis International Foods in London on Tuesday 19th July 2022, in which participants took a closer look at the operations of Wanis International Foods; key players in

the export of Ghanaian produced food products.

Wanis International Foods has an unrivaled range of over ten thousand (10,000) world food products from over nine hundred (900) brands, serving a network of several thousand-food businesses including independent retailers, caterers, restaurants, online sellers, supermarkets, and wholesalers.

The visit was an opportunity for Ms. Beryl Archer to acquaint Mr. Harrison and Mr. Tawiah with the operations of the Bank, exploring areas of mutual interest, including creating international market access for MadeIn-Ghana products.

After the meeting, Mr. Harrison and Mr. Tawiah took the opportunity to

tour the GEXIM Made-In-Ghana (MiG) Town located at the head office of the Bank: a one-stop shop for Made-InGhana products including food, skin, and beauty care products, footwear

and more. It is open to the general public from Mondays to Fridays between the hours of 9:00am and 6:00pm.