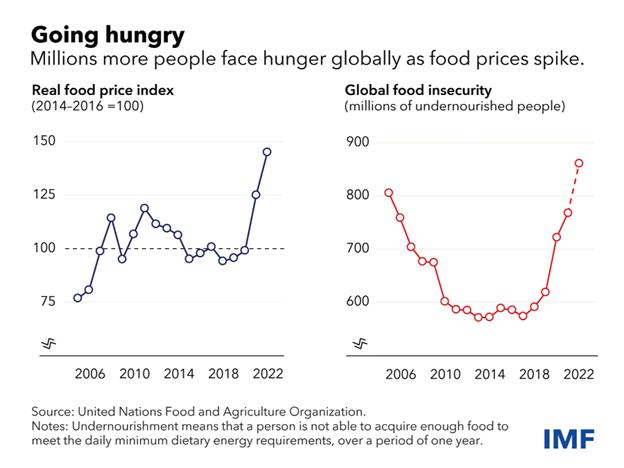

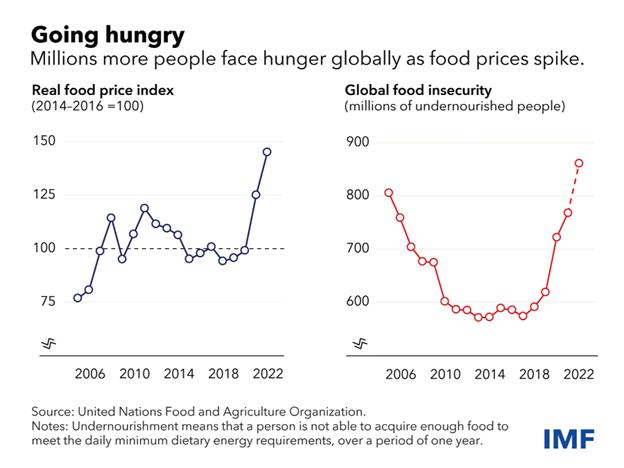

Food prices soaring amid high import reliance -IMF

Staple food prices in sub-Saharan Africa surged by an average 23.9 per cent in 202022—the most since the 2008 global financial crisis. This is commensurate to an 8.5 per cent rise in the cost of a typical food consumption basket (beyond generalised price increases).

In Ghana, prices for cassava escalated by 78 per cent in 2020-21, reflecting higher production costs and transport constraints, among other factors.

Global factors are partly to blame. Because the region imports most of its top staple foods— wheat, palm oil, and rice—the pass-through from global to local food prices is significant, nearly one-to-one in some countries.

Prices of locally sourced staples have also spiked in some countries on the back of

domestic supply disruptions, local currency depreciations, and higher fertiliser and input costs. In Nigeria for example, the prices of both cassava and maize more than doubled even though they’re mainly produced locally.

Using price data from 15 countries on the five most consumed staple foods in the region (cassava, maize, palm oil, rice, and wheat), we find that in addition to global food prices, net import dependence, the share of staples in food consumption, and real effective exchange rates drive changes in local staple food prices.

Of these, the consumption share of each staple has the largest price effect. This is due in part to income. Better-off households can afford a wider range of foods, but for the poor there are very few substitutes for staples, which make up nearly two-thirds of their daily diet.

Patricia Obo-Nai wins Best CEO of the Year at Africa

We estimate that a one per cent increase in the consumption share of a staple food raises the local price by an average 0.7 per cent; the effect is even bigger when a staple is mostly imported, raising the price by about 1.2 per cent. When a country’s net import dependence increases by one per cent, the local real cost of a highly imported staple is expected to increase by an additional 0.2 per cent.

The relative strength of a country’s currency is another driver as it affects the costs of imported food items. We find that a one per cent depreciation in real effective exchange rates increases the price of highly imported staples by an average 0.3 per cent.

More on page 2

Investment in treasury bills could still be a good idea

By Adigbli Ernest Kofi

By Adigbli Ernest Kofi

Connectivity is an entitlement: how can we make it everyone’s reality?

WEDNESDAY, OCTOBER 5, 2022 BUSINESS24.COM.GHNEWS FOR BUSINESS LEADERS

Story on page 3 Story on page 4

essential

keep

Horticulture fast becoming the new job-making machine

“When the last tree dies, the last man dies” they say and truly so because flora and fauna preserve the environment and hence human life, and at a time that economies are grossly feeling the harsh outcomes of climate change, the need to preserve our environment and green resources have become even more critical.

Aside the enviro-friendly outcomes, there is proven economic potential in the green economy, specifically the horticultural value chain.

Recent statistics put proportions of the youth (15 to 35) that are unemployed and seeking work at 34.2percent. Unemployment is therefore considered by many to be the most critical issue affecting the country.

It is trite to say that with the right national and individual orientation, policies, and drive, Ghana’s rich flora and fauna resources could provide millions of jobs to the country’s teeming youth.

Stratcomm Africa is leading the charge to green

page 1

business

Ghana for the varied purposes of beautification, wealth and job creation as well as a sustainable fight against climate change.

Now in is tenth year, the annual Garden and Flower Show challenges and motivates the youth and businesses in the sector to aspire to grow and reach their full potential, in order to improve their livelihoods and impact society.

This year’s theme “Growth Unleashed” preps the mind of young Ghanaians to burst forth and to grow beyond the norms to achieve a blooming environment.

The global horticulture market is estimated to be valued at USD 20.77 Billion as of 2021 and is projected to reach US$40.24bn by 2026 at a compound annual growth of 10.2percent whilst global flower and ornamental plants market was valued at US$475.6m in 2020 and is expected to reach US$725.4m by the end of 2027, growing annually at 6.3percent during 2021-2027.

Food prices soaring amid high import reliance -IMF

Staple food prices in the region are also impacted by natural disasters and wars, rising by an average four per cent in the wake of wars and 1.8 per cent after natural disasters, depending on the magnitude, frequency, duration and location of events.

We looked more closely at the variation in prices between countries and determined that those with stronger monetary policy frameworks were better at curbing direct and second-round

food price inflationary pressures, and in turn, controlling overall inflation. In contrast, food prices tend to be higher in countries with weaker fiscal management and elevated public debt.

These results suggest a mix of fiscal, monetary and structural reforms could help lower food inflation.

For example, improving public financial management could help free up resources for investment in well-targeted social assistance

programmes or in climateresilient infrastructure. This could help stabilise prices.

Policymakers could also help make agricultural inputs such as seeds and fertilisers cheaper by introducing structural and regulatory reforms that promote fair competition, as well as by streamlining trade procedures and better leveraging research and development to boost agricultural innovation.

2 | THEBUSINESS24ONLINE.COM News/Editorial Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is

to

the

community in Ghana wellinformed. We value your support and loyalty. Contact: editor@business24.com.gh Newsroom: 030 296 5315 Advertising / Sales: +233 24 212 2742 Copyright @ 2019 Business24 Limited. All Rights Reserved. Limited

continued from

Patricia Obo-Nai wins Best CEO of the Year at Africa Telecom Innovations and Excellence Awards

Patricia Obo-Nai, Chief Executive Officer (CEO) of Vodafone Ghana, has won the Best CEO of the Year at the prestigious Telecommunications Innovations and Excellence Awards, which is organised alongside the Africa Connected Summit, Africa’s leading telecom and digitalisation summit.

The multiple award-winning CEO was recognised for her exceptional leadership within the technology industry. In a short citation, the organisers extolled her for being an inspiration to millions of girls and women around the world, for being the voice for the unheard, and an inspiration for those who aspire to succeed in life.

The awards are organised by the International Centre for Strategic Alliance (ICSA) to celebrate technology and telecommunications innovations, growth, and leadership across the continent. A total of 21 coveted awards were given to various individuals and organisations for their outstanding contributions to the sector.

Commenting on the awards, Patricia said:

“I am really humbled by this recognition. I could not have

achieved this on my own. I have done this with my team who have been there for me and I dedicate this award to them. For me, driving purpose and leading from the heart have been core.

It is not just about how we make a profit but how we sustain the society in which we operate, and this has been the journey of Vodafone Ghana and what has translated into the results we are all seeing today. Thank you ICSA.

I am grateful. “

Organised under the theme ‘’Championing Connectivity in the Digital Era’’, this year’s edition featured tech and telecommunications experts, CEOs, CIOs, and CTOs from leading organisations across Africa who engaged in constructive dialogue with peers, shared insights, and presented on various topics.

These include Energising the Data Economy, Collaborating at the EDGE – Enhancing Data Throughput, Connectivity to the Metaverse and Beyond, The New Hubs of International Connectivity, Cyber Resilience, Transitioning from 4G to 5G –Enabling Digital Transformation, ICT Infrastructure and IoT Deployments.

Investment in treasury bills could still be a good idea

By Adigbli Ernest Kofi

In school, I remember learning about inflation tending to make lenders lose. The simple explanation is, when the lender (a surplus spending unit) gives out his/her money to a borrower (a deficit spending unit), the repayment amount will not be sufficient to pay for the quantity of goods or services the amount of money would have acquired before it was borrowed due to inflation. Lenders hence will naturally expect an interest on monies given out, interest rates above the inflation rate. Ghana currently has an inflation rate for August, 2022, is 31.7% which implies prices of goods and services worth GHC 1.00 in January, 2022 are now selling at GHC 1.32. This implies if someone had borrowed GHC 1.00 in January this year, to buy a commodity, the lender will not be able to afford that same commodity if the borrower returns the money today without interest. This has significant impact when figures are being quoted in thousands

and millions.

Recently, the government of Ghana decided to re- issue 2 years and 5 year bonds. The auction was expected to have been completed on 25th August of this year. At the eve of the completion date, the government rescinded on its decision. The government canceled the sale stating that investors were asking for higher interest rates on these debt instrument. Government Bonds and Treasury bills are documents of the government’s indebtedness to the bondholder, thus, whoever owns a bond or treasury bill is a lender to the government. These monies will be paid back with interest. Government bonds pay a fixed coupon amount semi-annually on the face value of the bond then the principal amount at maturity date. The treasury bills, on the other hand, is bought at a price lower than the face value- the difference is considered as the interest amount. The maturity term refers to how long to wait

till one receives his/her money plus interest. Treasury bills have shorter term maturity usually 91days, 182 days and 364 days whiles Bonds maturity term is 2 years and above.

In the investment world, lending to the government is a safer investment compared to lending to private corporations. Private corporations could declare themselves bankrupt and become relieved of all liabilities including debts owed on bonds issued. The government is seen as solvent since it can print money to settle its debts if they fall due. Due to this, lending to the government seems smart but not when one does not earn enough interest to cater for inflation increments. This is a possible reason an investor may want the government to grant higher coupon rates at 30% when the government was offering 21.5% and 20.75% on the 2 years and 5years bonds respectively. The government turned these counter offers down as a fiscal

measure to prevent spending huge sums of monies to pay for outstanding debts in the near future and theoretically, prevent circulating more than necessary monies in the economy which can further worsen inflation and create a demand-pull inflation.

I observed that contrary to my expectation, investors are patronizing government debt instruments at interest rates that are lower than inflation rate. A week before the government announced its decision to cancel the 2 years and 5 years bonds because of demand for a 30% coupon rate ,which is lower than current inflation rate of 31.7%. The governments treasury bills raised GHC 1.079 billion from the 91days and 182days bills. The bills were selling at 27.72% for the 91days bill and 29.29% for the 182days bill and these discount rates are also lower than 31.7%.

Considering this, government debt instruments

WEDNESDAY, OCTOBER 5, 2022 | NEWS 3

Continued on page 4

Connectivity is an entitlement: how can we make it everyone’s reality?

Connectivity is an essential ingredient to a healthy, safe and productive life. But there is a notable deficit across rural areas of the world that is blocking a large proportion of society from the benefits a connected life has to offer. In fact, there are 3.7 billion people globally currently living without an internet connection.

We know that demand for data outstrips supply, leaving many excluded. This is even more exaggerated in places such as subSaharan Africa where the population is growing 2.7% per year. With nearly 30% of Africa’s rural population still living without any mobile broadband coverage, ultra-rural expansion is desperately needed.

There is an appetite for change, yet deploying rural connectivity remains particularly challenging across rural Africa due to a lack of infrastructure and the extremely high costs associated. Mobile Network Operators and Tower Companies simply do not have the capacity to combat Africa’s coverage gap alone. Partnership is paramount. Africa’s coverage challenge calls for collective action

There is a basic economic challenge inhibiting the roll out of coverage in rural areas. Deploying infrastructure in remote areas can be twice as expensive, while revenue opportunities for MNOs and Tower Companies can be up to ten times lower. This combination of these financial barriers deeply impacts the business case for deploying infrastructure in rural areas.

Addressing this digital divide requires collective action and, as the number one high throughput satellite company in Africa, Avanti is working hard to identify sustainable and economically viable partnerships that will help to address some of the key barriers preventing access to connectivity across the continent.

Over the past year, Avanti has

launched several new partnerships to help Mobile Network Operators and other partners expand their networks and accelerate the rollout of low-cost connectivity solutions in some of the hardest-to-reach areas across sub-Saharan Africa. For example, we recently joined forces with the Smart Off-Grid company Clear Blue Technologies to forge a lifechanging partnership that is expected to deliver reliable cellular coverage to an extra 200 million people currently living in subSaharan Africa, within the next 3 to 5 years.

In May, we also announced a fiveyear partnership agreement with Free in Senegal. The partnership will extend the coverage of Avanti’s stateof-the-art HYLAS 4 Ka-band satellite to Senegal and the neighbouring West African countries of Guinea, Sierra Leone, Guinea Bissau, Gambia and Liberia, as well as completing Avanti’s coverage of Ivory Coast.

Through such partnerships, we have been able to harness satellite technology to create better access to education, medicine and help provide a safer environment for people to live and work. For example, this major milestone with Free in Senegal is set to significantly increase access to high-speed satellite internet for the countries’ schools, which will have a colossal impact on education by enabling e-learning services across the region.

Helping industry partners to accelerate progress

The success of such partnerships has resulted in Avanti launching its own service, Avanti EXTEND, a managed service for rural connectivity to support partners in their efforts to connect rural Africa. For the industry to remain on this upward trajectory, we must continue to seek out opportunities that address the barriers prohibiting MNOs and other partners from serving rural communities.

Avanti EXTEND provides highperformance and cost-effective 2G, 3G and 4G solutions to remote and hard-to-reach areas across subSaharan Africa. It enables MNOs and other partners to provide reliable cellular service to the 100 million people living in these challenging locations that would otherwise be impossible to reach using traditional terrestrial infrastructure.

Avanti EXTEND has a built-in and fully operational CAPEX solution that integrates seamlessly into MNOs terrestrial networks to reduce network complexity and increase efficiency. This offers the opportunity for partners to undertake large deployments quickly and effectively, and scale operations to support long-term rural expansion at no additional CAPEX. It removes the need for them to manage satellite configurations, hub infrastructure or terrestrial networks to deploy a

The industry has a key role to play in developing new technologies that will help to accelerate a faster, more reliable service, that will benefit millions of people – particularly if we are to keep up with the evolving digital landscape.

The future is now

In a post-pandemic world, where the reliance on connectivity is at the forefront, the unconnected are becoming even further removed from the modern digital world. We are incredibly proud of the part we have played in changing this reality, but we can’t stop here.

We must continue to work together, to leverage strategic partnerships and seek out opportunities that will enable all areas of society to benefit from a life that connectivity can offer. Connectivity is not a gift; it is a part of the human experience that everyone is entitled to – so let’s make that a global reality.

appears to be attractive to investors at interest rates from 27.72% to 30% for 91days to 2 years maturity terms. This means, people and private businesses consider lending their monies to the state at the aforementioned rates as a fair deal. This could be a motivation to lend monies to the government by acquiring treasury bills.

It is trite knowledge the convenience short term investments- treasury bills bring. One is able to retrieve his/her principal amounts quicker than bonds. This enables the person stay liquid to meet his/her transaction and precautionary needs. In times of rising prices, principal investment amounts deteriorate in purchasing power. The principal amount, when retrieved, is not

sufficient to purchase the quantity or quality of goods and services it would have afforded in times past. A 91days or 182 days treasury bill returns quickly the principal amount before inflation erodes its purchasing value completely by the year end.

Moreover, taking into account that bond investors wanted 30% coupon rate for bonds that would have matured in 2 and 5 years, it makes more sense for me to consider investing in the 91 days and 182 days treasury bill. The possibility of creating money to augment a principal amount and then recreate more from that combination sounds lucrative. All other things being equal, assuming the 91 days treasury bill rate of 27.72% remains constant for 2 years,

interest) is earned. Following the same principle for the next year generates an account balance of GHC 170.92. A government bond paying a coupon rate of 30% for 2 years generates a semi-annual coupon amount of GHC 15.00 on a hundred cedi investment. The coupon amount is fixed and paid regularly till maturity therefore a total of GHC 60.00 and GHC 100.00 is earned as interest amount and principal amount respectively for

the 2 years. Juxtaposing the final balance of GHC 160.00 to GHC 170.92 for the 91 days treasury bill, a better deal is earned on the short

Adigbli Ernest Kofi Accounting and Economics Graduate

of Ghana.

of Ghana.

WEDNESDAY, OCTOBER 5, 20224 | FEATURE

University

ernestkofi079@gmail.com / 0558275141

Continued from page 3

Johnnie Walker headlines 2022 EMY Awards

Ghana’s most iconic whisky brand, Johnnie Walker, sponsors the 2022 EMY Africa Awards held at the Grand Arena on October 1, 2022.

This year’s event, the seventh in the series of the prestigious awards ceremony, saw several distinguished men receive honours for their impactful

fields of endeavor. Some award winners were honoured with exclusive bottles of Johnnie Walker Blue Label whisky. The most coveted award of the night, Man of the Year, was presented by Board Chairman and Marketing Director of Guinness Ghana, Mr. Felix Addo and Estella Muzito. The winner was honoured with

Blue Label whisky.

Speaking at the star-studded event, Board Chairman of Guinness Ghana Breweries Limited, Felix E. Addo intimated that, “Johnnie Walker is a brand that believes in rewarding the efforts of people who strive to achieve great things. On a night dedicated to celebrating iconic men, what better way to celebrate than with our most iconic whisky, the Johnnie Walker Blue Label. This is one of our rarest products and we are glad to partner once again with the EMY awards to celebrate the rare efforts of our distinguished winners.”

“To all the men who won awards tonight, congratulations on your triumph.

I am confident that you will be encouraged to do even greater things and push the boundaries even higher. To the EMY awards team, continue in acknowledging the efforts of these great men and we are proud to partner with you. Keep doing great things and as we say at Johnnie Walker, Keep Walking”.

The 2022 EMY Africa Awards is the 7th edition of the event. It is second time Johnnie Walker will be the headline sponsor of the event. This year, Johnnie Walker headlined the event with one of their rarest whiskies, Johnnie Walker Blue Label.

Johnnie Walker is Ghana’s number one Whisky brand, and the most widely distributed brand of blended Scotch whisky in the world. It is perfect for moments of celebration and a luxurious gift for occasions big and small. Drink responsibly.

FBNBank staff support Rotary community projects

For the third year running, staff of FBNBank Ghana have displayed exemplary commitment to their communities by making a cash donation to the Rotary Club of Accra Ring Road Central in support of their child-focused projects. This was after the Club’s ”Walk for a Child” fund-raising walk on the University of Ghana campus.

The Club’s 2022 child-focused projects are the completion of the Berekuso community clinic at and the renovation of toilet facilities at the La Bawaleshie Presbyterian Primary School. For these two Rotary projects, the staff of the Bank made personal contributions totalling Fourteen Thousand Ghana Cedis (GH¢14,000) which was presented to the Club.

Acknowledging the contribution of the FBNBank staff, Kobla Nyaletey, President of Rotary Club of Accra Ring Road Central said, “service to our communities is core to what Rotary is about. Extending a helping hand to communities in need is a responsibility for all. We are very grateful for the support that our friends from FBNBank Ghana continue to lend to our efforts to positively impact lives. We remain eternally grateful and I believe the beneficiaries of our projects, like the people of Berekuso are also grateful.”

Since 2019, FBNBank Ghana staff have been supporting the activities of Rotary International’s clubs in Ghana aimed at delivering benefit to the communities. These include the renovation and construction of classrooms and library for the Golden Spring School in Tetegu and the purchase of essential equipment for the children’s cancer unit at the Korle Bu Teaching Hospital. This is apart from donations the Bank has also made over the years to support the work of Rotary especially in the area of polio eradication.

Commenting on the donation by FBNBank Ghana staff, Mr. Victor Yaw Asante, Managing Director and Chief Executive Officer who is also the District Governor of Rotary District 9102 said, “at FBNBank our people are expected to live our values of ‘entrepreneurial, professional, integrity and customer-centricity.’ We believe these values are the main drivers of the effort to continue to be of service to our communities. In seeking to achieve this we have joined forces with a worthy partner, Rotary International and through this partnership the personal commitments of

our staff find a useful platform to deliver exactly what we intend to achieve. The people of Berekuso and the students of the La Bawaleshie Presbyterian School, just like many other people in the numerous communities in Ghana need support particularly in the areas of education and health and we are willing to continue to support all efforts which seek to address these needs.”

The Berekuso Health Centre project is currently in Phase One of construction. The facility is being constructed on a parcel of land provided by the community. When completed it shall have amenities like an Out-patient department, a maternity ward, male, female and children’s wards, a laboratory, a psychiatric unit, injection and emergency room, an antenatal unit, a pharmacy, stores, washrooms, consulting rooms and a public

health section among others.

FBNBank Ghana has remained focused on putting its customers and communities first. This, it has sought to do through the rich value and excellence of what the Bank contributes to the relationship with its stakeholders as a whole, particularly the customers. FBNBank Ghana is a member of the First Bank of Nigeria Limited Group which is renowned for its great customer service and general stakeholder engagement garnered over its 128 years of operation. FBNBank Ghana has twenty-six (26) business locations; comprising 23 (twenty-three) branches, two (2) agencies and one (1) collection centre across the country with over 500 staff. FBNBank offers universal banking services to individuals and businesses in Ghana.

WEDNESDAY, OCTOBER 5, 2022 | NEWS 5

Victor Yaw Asante, second from left, Samini and some staff of FBNBank making the presentation to Roma Puni, Past President of Rotary Club of Accra Ring Road Central

WEDNESDAY, OCTOBER 5, 2022| NEWS6

Ghana retains seat on ITU Council

Ghana has been re-elected to the Council of the International Telecommunication Union (ITU) for the 2023 to 2026 term.

The elections for the Council membership were held yesterday at the ongoing ITU Plenipotentiary Conference 2022 in Bucharest, Romania.

The ITU Council acts as the union’s governing body in the interval between Plenipotentiary Conferences, held every four years.

Its role is to consider broad telecommunication policy issues to ensure that the union’s activities, policies and strategies fully respond to today’s dynamic, rapidly changing telecommunications environment.

The council is also responsible for ensuring the smooth day-

to-day running of the union, coordinating work programmes, approving budgets, controlling finances and expenditure.

A release issued in Accra by the National Communications Authority (NCA) said: “Ghana has been serving as a member of the Executive Council since 2002 and has also played various leadership roles in study groups as well as actively taking part in other ITU activities”.

According to the Minister for Communications and Digitalisation, Ursula OwusuEkuful, who led Ghana’s electoral campaign, “the Republic of Ghana will keep up with her sterling contribution to the ITU Council while ensuring that it carries its service to the telecommunication world in a resourceful, transparent and forward-looking manner.

“The government’s commitment to ensuring that its citizens across the country get connected is also on course.”

She explained in the release that the government had already done a lot through initiatives such as the innovative Rural Telephony project and Sectoral Computer Emergency Response Teams (CERTS) to secure the country’s cyber space among other things.

In a related development, Rev. Edmund Yirenkyi Fianko, the acting Director of Engineering at the NCA was elected to ITU’s Radio Regulations Board (RRB) for the 2023-2026 term.

Rev. Fianko is one of the three RRB members representing Africa on the 12-member board with the responsibility to approve the rules and procedure for the application of the Radio and

Regulations and to adjudicate on matters brought before the board.

Rev. Fianko is an electronic communications engineer with in-depth experience in radio frequency spectrum management, telecom and broadcasting regulation, as well as policy formulation at the national, regional and international levels.

Ghana secured 145 votes and ranked second among the 13 countries elected to the Council from Region D (Africa).

- This is the highest number of votes that Ghana has secured at an ITU Council election.

- Each of ITU’s five administrative regions is entitled to a specific number of Council seats.

- In total, forty-eight (48) ITU member states were elected to the Council.

ASA Savings & Loans supports 200 Bechem residents with free health screening

As part of its corporate social responsibility to give back to society, ASA Savings and Loans has organized a free health screening for residents of Bechem in the Tano South Municipality of Ahafo Region.

About 200 women-led micro business operators, who are clients of the financial institution benefited from the health screening. The medical examination covered conditions including malaria, typhoid,

hepatitis and blood sugar. It was administered by health professionals from Rafchik Hospital at Abesim near Sunyani.

The Bechem exercise was one of series of corporate social investment outreach activities

being implemented by ASA Saving Loans. Since the beginning of the year, the company has been rolling out activities including donations to the less-privileged in society, health screening and award of scholarships to needy school children.

In an interview, Emmanuel Asare Yeboah, Goaso Area Manager of ASA Savings and Loans who superintended the health screening said “As part of our yearly corporate social responsibility, we have organized this exercise at the Bechem Business Centre to assist out cherished clients. Apart from doing business to make profit, we also deem it fit to make the health status of our clients a priority.”

The beneficiaries of the health screening expressed their profound gratitude to ASA Savings and Loans for the kind gesture, indicating that it was heartwarming for a financial institution to think about the welfare of its clients beyond the business relationship.

Madam Georgina Twumasiwaa said, “I have worked with many financial institutions in the past but I can’t recollect any of them organizing free health screening or doing anything equivalent to what I’m seeing today. God Bless ASA for the love and care.”

WEDNESDAY, OCTOBER 5, 2022 | NEWS 7

Vodafone Ghana to reward customers in 2022 Care Month Celebration

Vodafone Ghana has announced activities to mark the 2022 edition of its Care Month initiative, scheduled from October 3rd to October 7th.

The telecommunications giant joins the world to celebrate International Customer Care Week, which is dedicated to celebrating customer service excellence, honouring employees who delight customers daily, and appreciating customers who support the growth of businesses.

Vodafone Ghana has also dubbed October ‘CARE Month’ and dedicated the period to celebrating its devoted clients at various touchpoints with Vodafone-branded mementoes, and free calls, as part of the celebration with the theme “Celebrate Service.”

Vodafone Ghana will also provide avenues for customers to engage in fun activities such as fastest fingers and captivating social media trivia to win several prizes, while also

rewarding its customer-facing staff.

Speaking ahead of the week-long celebration, the Director of Digital Transformation and Commercial Operations, Angela Mensah-Poku, said: “While we highlight our frontline workers and other employees for their excellent service to our customers, we also acknowledge the support and patronage of our customers that have significantly contributed to the progress of our business. Care Week also allows us to reaffirm our commitment to always give our customers value through excellent services and products.”

The telecommunications company is known for improving its products, services, and customer experiences with a focus on the demands of the client. Customers benefit from this and are better able to adapt to the rapidly changing digital world.

Vodafone Ghana will mark the 2022 Customer Service Week event across all its channels.

There will be no ban on cocoa from Ghana – EU Ambassador to Ghana

The European Union has dismissed reports that Ghana’s cocoa will be banned by members of the union.

Speaking on behalf at the EU Ambassador to Ghana, Irchad Razaarly, at the 2022 Orange Cocoa Day, a Director at the EU Office in Ghana, Celine Madsen Prud’homme, said the EU rather wants more of Ghana’s cocoa.

According to her, cocoa from Ghana and Côte d’Ivoire are amongst the best in the world as they meet requirements from the EU.

“As my ambassador said earlier, there will be no ban. All countries

EU market provided producers can demonstrate that products are legal and free from deforestation”.

“There is no ban on Ghana’s cocoa. On the contrary, we want more of Ghana’s cocoa, and we are in support of Ghana and Côte d’Ivoire amongst all of the producers who meet these requirements”, she added.

Information Minister, Kojo Oppong, had earlier hinted that Ghana’s Embassy in Belgium under the leadership of Ambassador Sena Boateng, has brought to the attention of the Government of Ghana that Europe via a new legislation could

international markets.

This is due to the destruction of cocoa lands by illegal mining activities, as there are fears that the activities of the illegal miners may poison some cocoa beans.

Meanwhile, the Ministry of Lands and Natural Resources is enforcing the Joint Framework for Action, signed in 2017 with 36 cocoa and chocolate producing companies, to halt deforestation and degradation of the forest in the cocoa value chain.

This is under the Cocoa and Forests Initiative to ensure cocoa lands are not taken over for illegal mining

Day, the Sector Minister, Samuel Abu Jinapor, said government is stepping up education and sensitisation, urging traditional and local authorities, farmers and members of the local community, to rally behind the government

“It is disheartening, that while we are taking all these measures, people are selling their cocoa farms to illegal miners without thinking about the long-term effect of their actions on the environment. This is a matter we must deal with, which we are fully committed to. But we need the cooperation of all”, he explained.

WEDNESDAY, OCTOBER 5, 20228 | NEWS

WEDNESDAY, OCTOBER 5, 2022 | FEATURE 9

A shocking ten days for the UK

By Mohamed A. El-Erian

The United Kingdom has had a sobering ten days, with its economy, financial system, and citizens’ well-being suddenly at risk. But with rapid and coordinated action, policymakers can still salvage the situation.

Last Friday, the ratings agency Standard & Poor’s placed the UK’s AA credit rating on “negative watch” – effectively threatening the country with a downgrade – over concerns that the new government’s proposed package of unfunded tax cuts (the “minibudget”) will increase the country’s debt burden. A downgrade would become more likely if “economic growth turns out weaker due to further deterioration of the economic environment or if the government’s borrowing costs increase more than expected, driven by market forces and monetary-policy tightening.”

While S&P’s rating action will not materially affect the UK’s access to credit, it represented yet another embarrassment – along with extraordinary borrowingcost volatility and a rebuke from the International Monetary Fund – for Prime Minister Liz Truss’s government. It further undermines three pillars of the UK’s well-being: policymaking credibility, economic performance, and financialmarket integrity.

S&P’s decision was far from the only consequence of Chancellor Kwasi Kwarteng’s announcement on September 23 of the mini-budget. The plan spooked financial markets and triggered a precipitous fall in the pound’s value, as it signaled that Kwarteng would be pressing hard

on the stimulus accelerator, even as the Bank of England taps on the brakes. In fact, just two days earlier, the BOE had decided to increase the policy interest rate from 1.75% to 2.25% – the highest level since the 2008 global financial crisis – and pointed to further hikes ahead.

Deepening the policy contradiction, the BOE’s chief economist warned a few days later that the government’s plan would demand a “significant monetary response.” But, the very next day, September 28, the BOE was forced to announce a two-week program to buy £65 billion ($73 billion) of long-dated bonds, in order to restore financial stability and avoid a pensions-sector meltdown.

The threat of a financialmarket accident thus significantly complicated the BOE’s alreadytricky task of striking the right balance between fighting inflation and minimizing the damage to economic activity. Financial stability was suddenly also in play. Undermining the UK’s policy credibility yet further, the government attempted to bypass the established institutional framework as it advanced its budget measures, including by failing to consult adequately with the Office of Budgetary Responsibility (OBR) and other agencies.

The adverse consequences for the economy immediately started playing out in the market for housing finance – an important sector not just economically, but socially and psychologically as well. A surge in the cost of mortgages accompanied a

disruption in their availability. Coming on top of the October 1 hikes in energy and gas prices, this is sure to further erode business and household confidence, despite measures to preclude additional energy price increases for some time.

The wild gyrations that seized UK financial markets for three days after the mini-budget announcement were unthinkable to many just a day earlier. Yet they pale in comparison to the BOE’s September 28 intervention.

Even in emergency mode, central banks prefer to wait for the weekend or, at a minimum, the end of the trading session, before making an abrupt policy move. This enables them to frame the policy decision and supply background information, thereby mitigating dramatic market overreactions.

This was apparently not possible for the BOE, which announced its bond-buying program at 11 a.m. on a Wednesday. The immediate dislocation in the pension sector, as well as fears of disruptive spillovers to other parts of the financial sector and the real economy, necessitated the BOE’s bold and historic move.

The bad news is obvious: the UK’s economic well-being and financial stability are in jeopardy. If policymakers continue down this road, the most vulnerable segments of the population –already bearing the brunt of a cost-of-living crisis, income insecurity, and higher borrowing costs – will suffer the most.

The good news is that the situation can be remedied. To this end, the government should

move up the release of the next OBR forecast (scheduled for November 23), taking this as an opportunity to postpone its unfunded tax cuts and provide more robust analytical content to its growth plan and gain stronger institutional support for it. The government should avoid spending cuts that would undermine the country’s growth potential and harm public services. For its part, the BOE’s Monetary Policy Committee should meet before the next scheduled date (November 3) and raise interest rates again.

These two steps must be accompanied by targeted measures to protect the most vulnerable segments of the population, as well as stronger prudential supervision of the non-bank sector and improved global policy coordination, which should be pursued in special partnership with the United States. In order to mitigate concerns about the political costs of significant adjustments to the mini-budget, this course correction can be presented as a response to external market instability, of which there is plenty, and evidence that the global economy is slowing faster than most expected.

After a difficult and shocking ten days, UK policymakers have an opportunity for a reset. Failure to seize it will exacerbate economic, policy, and financial imbalances today and necessitate a costlier and more complicated adjustment down the road.

WEDNESDAY, OCTOBER 5, 202210 | FEATURE

Demand excellent customer experience - it is your right!

“My whole holiday was destroyed!”, this was the summary she gave me on her holiday experience. What happened? I asked. Esi had been saving for years for a holiday on her 40th birthday, however, things didn’t go as expected. She was treated poorly during her check in formalities at the airport and was unduly delayed.

During the rush to the aircraft, she slipped on a wet surface and was badly hurt. On the flight, the special meal she requested for was not available because there was a ‘mixup’ and her meal had been given to another passenger. When she arrived at her destination, she was exhausted, hungry, and unhappy! She went on to narrate other service challenges experienced at the hotel and issues with her bank card when she tried to process payments with it. The frustrations behind the summary above, were unfortunately genuine.

Listening to her made me wonder whether her experience could have been better if she knew her basic rights as a customer. Very often, we talk about customer service from the organisation’s perspective, but rarely do we highlight the rights customers have and empower them to demand same.

To be treated like a king, you need to understand the kind of treatment a king deserves. Now let’s re-orientate ourselves on the rules of our kingship as customers.

As a customer, you have a right to

safety. When consuming a service, your safety within the premises where the service is offered is your right. Service providers need to take steps to ensure their customers are always kept safe within their premises. The accident Esi experienced could have been avoided if the service provider had taken steps to place a warning sign in the wet areas. Regular inspection of the environment, fixing of broken fixtures and placing of appropriate warning signs in areas where there are structural issues must be done. And for a customer, you have the right to speak up should you feel unsafe.

Service providers need to be prepared to give information; it is your right as a customer to demand information to aid in your decision-making process. Look out for information on the cost of the service - value additions if available - and any other information that you believe is important to you as a customer. Read the fine prints (which very few people do!) and go back for clarity if not sure. Information and education work very closely together. It is your right as a customer to be educated on the product or service you purchase. This can be done through various mediums, but it must be done, as this helps you to understand the service or product for you to maximize its full use and benefits.

When paying for goods or services - where there are multiple

options - as a customer, you have the right to choose. This right should only be exercised after you have gone through the available product information and are happy to proceed with one of the available options. Esi should have exercised her right as a customer because she made a choice after considering her options, however, her service provider failed to provide the correct meal during the flight.

What kept running through mind when Esi was giving me feedback on her trip was whether there were avenues available for where to safely seek redress. As a customer, it is your right to be heard, and this must be done through the proper channels made available for customer complaints. Exercising your right does not only ensure you get compensated, but it also helps the service provider to improve upon their services.

Esi had paid for and selected a special meal service, but the airline failed to deliver that service. She had a right to demand a correction of this. The service provider could have chosen other acceptable options to compensate Esi if they were unable to provide the service she paid for. The underlying information is that, as a customer you have a right to demand correction if the service or product falls short of the terms you signed up for.

Everyone deserves to be treated with respect and dignity. As a customer, you therefore have the

right to be respected and treated in a fair and courteous manner. Esi’s holiday issues started right from the check-in counter when she received that bad treatment from the front desk manager. What happened to Esi when she fell? Did she get any help? Did someone apologize to her? Did they hold the gate for her or offer to carry her bags? Or did they just point and laugh?

Had it been the latter, would Esi ever use that service provider or feel comfortable traveling through the same location again? As one who is paying for the service, do not compromise on being treated respectfully every time. Every customer engagement should be built on respect among all parties.

Perhaps Esi’s whole travel experience would have been much better if she had been aware of her rights and taken steps to enforce them. As consumers, it is in our interest to understand what our rights are and demand them from our service providers. In this customer service month, let’s not consume ignorantly, let’s arm ourselves with what we need to know to make informed decisions and even help improve service delivery from our providers.

Remember, it is your right to demand excellence!

Ama Amissah Wujangi Brand and Marketing Manager, Stanbic Bank

WEDNESDAY, OCTOBER 5, 2022 11| FEATURE

Greater Accra Regional Minister compels indiscipline property owners to abide by sanitation by-laws

The Greater Accra Regional Minister, Hon. Henry Quartey who is leading day two of a three-month Intensive “Operation Clean Your Frontage” exercise in the Greater Accra Region has compelled shop owners, Okada Boys, lorry park operatives, Landlords and other property owners to physically clean their frontages in accordance with the sanitation by-law that requires occupants of properties and spaces to ensure their frontages and surroundings are kept clean at all times.

He warned residents of Avenor and Kaneshie, Abufu when the joint team from the Regional Coordinating Council, Metropolitan and Municipal Assemblies (MMDAs), Zoomlion Ghana Limited, the Ghana Armed Forces and the Ghana Police Service throng there to enforce the law of environmental cleanliness.

He however warned the Operations Team that he has

not instructed anybody to seize properties of market women but to ensure that their frontages are clean.

the letter and spirit.

The exercise which started on Monday October 3, will end by the end of 2022 for the team to review

by the Executive Chairman of Zoomlion, Dr. Joseph Siaw Agyepong, military commanders and technical directors from the

WEDNESDAY, OCTOBER 5, 202212 | FEATURE

We need more resources to brighten the future of tourism in Ghana – GTA

The Chief Executive Officer, Ghana Tourism Authority, Mr Akwasi Agyeman, says more resources are needed to make the future of the tourism industry brighter.

He said, “the future of tourism in the country, we know looks bright, but we need more resources to be able to achieve that. The tourism landscape has opened, and we have a broadened mandate with other responsibilities, so one would expect that we get more resources, but it doesn’t come that way, so we struggle a bit.”

Mr Agyeman said as the main implementing Agency of the Tourism Ministry, the Authority wished to have branches in all regions and districts in line with the Tourism Act but lack of resources and pressure on government purse from other sectors was making the feat difficult.

He said, “this is one of our biggest challenges as an organization. GTA has done very well with a very young dynamic team. It has transitioned positively from tourism board to an Authority with a more broadened scope and mandate but with it has come a

few challenges.”

The GTA CEO was, however, said the one per cent tourism development levy had helped in terms of marketing and product development.

“We are hopeful, however, because we have a strong board and leadership and a dynamic and focused working team who understand and know what is required of them, and with the support from the fund for our operational activities, it will ease some of the pressures on us.”

On the impact of COVID-19 on the sector, he noted that the industry was one of the hardest hits by the pandemic, saying “the COVID-19 pandemic taught the industry a few things. At least nobody thought that for the first time we will have our airports shut down for six months, public gatherings will stop, hotels, schools and restaurants will be closed, but it happened, and we learnt a lot from it.”

Mr Agyemang said post COVID-19, the Authority had put in various interventions to help the sector to bounce back and build a very resilient industry.

He said one of the interventions

was product development to refocus attention on domestic tourism, and shift the focus a bit from international tourism, hence the inception of the “Experience Ghana: Share Ghana” as a campaign.”

“To do that we realized that it cannot be just marketing, but some product improvement and so we started some products upgrade, at some of the tourist sites across the country and so product improvement became imperative.”

The CEO said the Authority also concentrated on building resilience through partnerships, so working with other organisations and other event organizers like the GIPC, they launched the ‘Taste of Ghana’ and engaged with other groups in the diaspora to come back to Ghana to make sure that the partnership model would be solidified.

“We also looked at people

development where the sector skills needed to be improved.

Under the Ghana CARES Obatampa Project, tourism was chosen as one of the sectors and to date we have trained almost 3100 practitioners. Some in product development, customer service, digital marketing, and quality service assurance, among others.”

Mr Agyeman called on stakeholders to get on board so that together they would build a resilient industry and make tourism the number one contributor to Ghana’s GDP.

GNA

WEDNESDAY, OCTOBER 5, 2022 13| NEWS

Personal Loan Up to GHS400,000 in 2 days! TERMS AND CONDITIONS APPLY

Ghana-based Niche Cocoa locates first North American manufacturing facility in Franklin, Wisconsin

U.S. Under Secretary of Commerce for International Trade Marisa Lago joined Wisconsin Economic Development Corporation Secretary Missy Hughes and local officials today in welcoming Ghana-based Niche Cocoa to Wisconsin.

The company is choosing to build its first North American manufacturing facility in metro Milwaukee. The project will be the largest food and beverage investment by an Africa-based company in US history and the largest Ghana foreign direct investment ever in Wisconsin.

“Niche Cocoa’s historic investment in Wisconsin is an unmistakable signal to other companies across Africa and around the world — the United States is open for business,” said U.S. Under Secretary of Commerce for International Trade Marisa Lago.

“The Biden Administration is strengthening our relationships abroad to create jobs and prosperity at home. Niche’s investment here is more than just a new facility—it’s an investment in American workers and in the Franklin community. I applaud Edmund Poku and our Department of Commerce team — including SelectUSA — that helped to facilitate this investment. Niche Cocoa joins a broad and growing array of forward-looking businesses in expanding in the United States’ diverse, dynamic, and open economy — underscoring why we have remained the top destination for foreign direct investment for a decade running.”

“Niche Cocoa joins a growing list of international businesses that have chosen Wisconsin because of our highly educated workers, great transportation infrastructure, and central location,” Governor Tony Evers said. “I welcome their investment in our state and the diversity their business adds to our economy.”

Niche Cocoa Industry, Ltd., a privately held, global cocoa processing company

headquartered in Tema, Ghana, is establishing its first North American manufacturing facility in the Franklin Business Park in Franklin, Wisconsin.

Niche Cocoa is the largest cocoa processor in Ghana, the world’s second-largest cocoa producer after the Ivory Coast. The company’s North American expansion pioneers a change in the direction of African investment and showcases the rapid growth in African businesses, specifically in Ghana.

“Niche Cocoa Industries Limited (Niche) has established itself as a formidable business in Ghana and with some international customers mainly from extracting highquality semi-finished products from the cocoa bean,” said Niche founder Edmund Poku. “The value within the supply chain comes from adding more value upstream and given the market dynamics, most of those big markets are outside of the African continent. Niche is proud of not only the quality of the product it has delivered but also of the flavor and taste of the

human capital, and a businessfriendly environment, Wisconsin was a great choice. We know how to build factories so we could do that anywhere but the partnership between what we know how to do and what Wisconsin can offer Niche to succeed in our next chapter is what has brought us to the state,” Poku said.

The Wisconsin Economic Development Corporation (WEDC), the state’s lead economic development organization, assisted in the recruitment of Niche Cocoa and is pleased to welcome them into the state’s food and beverage manufacturing cluster.

“The food and beverage sector is one of our state’s economic drivers,” said WEDC Secretary and CEO Missy Hughes. “Niche Cocoa’s decision to locate here complements our existing businesses and opens new possibilities for collaboration in the supply chain.”

At its Franklin Business Park location, the company will lease over 44,000 square feet. In this facility, the company will

Park, joining several other well-known food processors/ manufacturers and equipment manufacturers,” said City of Franklin Mayor Steve Olson. “Niche Cocoa continues Franklin’s long history of welcoming international corporations to our fast-growing community. Niche recognizes our great location, highly skilled workforce and our great business climate and quality of life for their employees.”

Niche Cocoa is partnering with The Omanhene Cocoa Bean Company, a Milwaukeebased company that pioneered production of world-class, singleorigin, bean-to-bar chocolate manufactured in Ghana.

“Together, we’re creating cocoa products and compelling employment in both the US, and Ghana,” said Omahene’s founder, Steve Wallace. “We’re proving that a country’s competitive advantages, paired with strategic global partnerships, lead to winning outcomes in unexpected places. Together, Omanhene and Niche demonstrate the promise of a new globalism where international trade creates jobs and value instead of exploiting vulnerabilities.”

Milwaukee 7 (M7), southeastern Wisconsin’s regional economic development organization, assisted in the recruitment of Niche.

Ghanaian cocoa bean which is the world’s most premium bean. The US became a natural choice for expansion, given the market size and potential, to develop both semi-finished products and also selling more products up the value chain such as chocolates.

“Taking into account proximity to customers, logistics, high-quality

import cocoa cake, which will be pulverized to create cocoa powder for nationwide distribution as well as manufacture finished chocolate made with cocoa butter and cocoa liquor produced in Ghana. Niche will initially employ over two dozen workers at the new facility.

“We’re happy to welcome Niche Cocoa to the Franklin Business

“We’re thrilled that Niche has chosen to make its first North American investment in southeastern Wisconsin,” said Rebecca Gries, Vice President of Corporate Attraction & Expansion at M7. “Niche is precisely the type of company we want and can uniquely support in our region. The company adds to a strong cluster of global food and beverage manufacturers that call our region home, a reflection of our favorable business environment, strong manufacturing infrastructure and one of the nation’s highest concentrations of talented workers.”

WEDNESDAY, OCTOBER 5, 202214 | FEATURE

WEDNESDAY, OCTOBER 5, 2022 15| NEWS

WEDNESDAY, OCTOBER 5, 202216 | NEWS

WEDNESDAY, OCTOBER 5, 2022 17| FEATURE

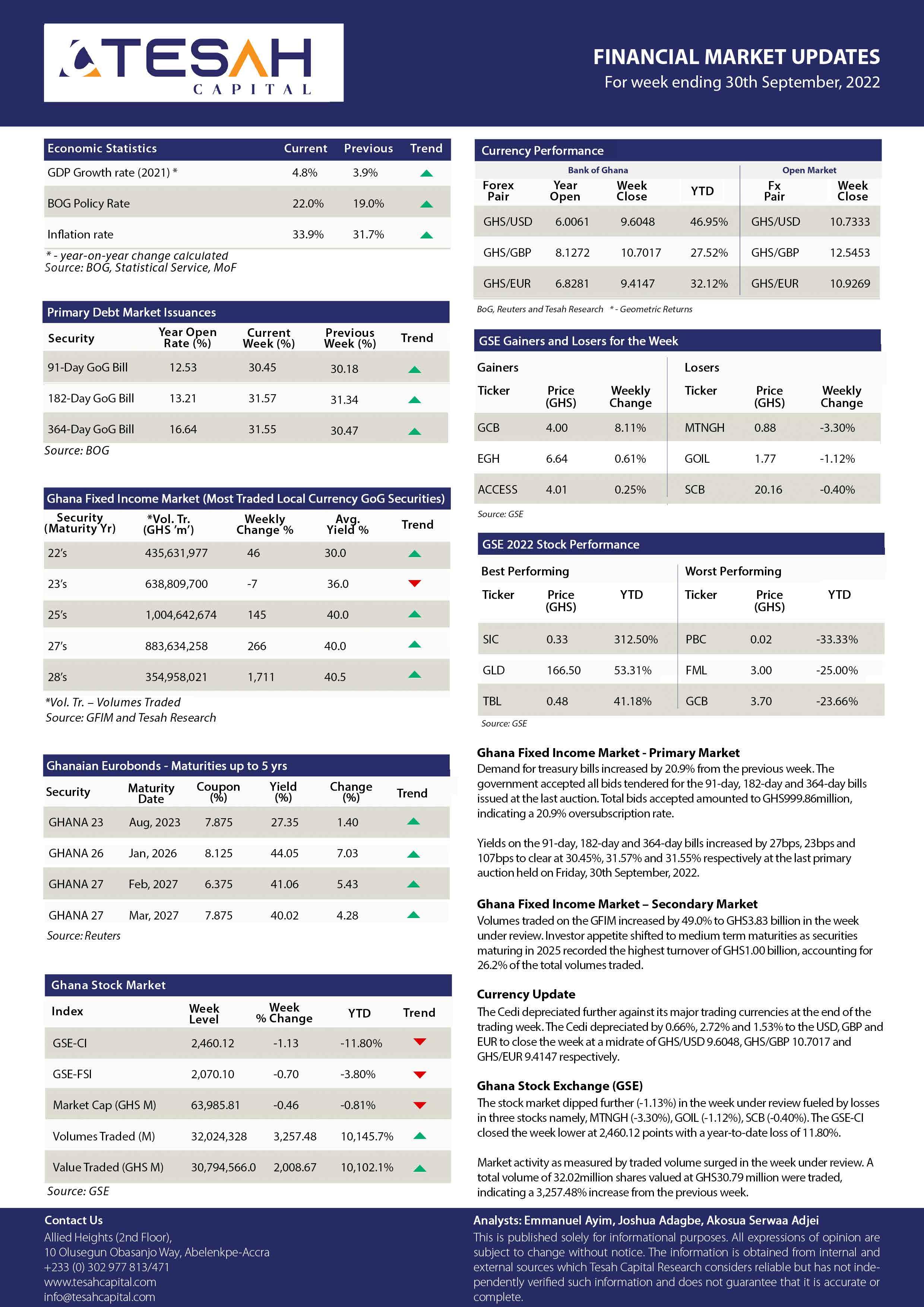

WEEKLY MARKET REVIEW FOR WEEK ENDING - SEPTEMBER 30, 2022

MACROECONOMIC INDICATORS

Q3, 2021 GDP Growth 3.3%

Average GDP Growth for 2021 3.3%

2022 Projected GDP Growth 3.7%

BoG Policy Rate 22.0%

Weekly Interbank Interest Rate 22.10%

Inflation for February, 2022 33.9%

End Period Inflation Target – 2022 28.5%

Budget Deficit (% GDP) – Dec, 2021 5.0%

2022 Budget Deficit Target (%GDP) 6.6%

Public Debt (billion GH¢) – Dec, 2021 393.4%

Debt to GDP Ratio – Dec, 2021 78.3%

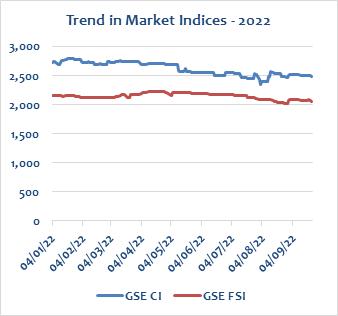

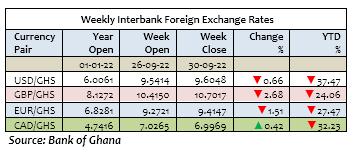

STOCK MARKET REVIEW

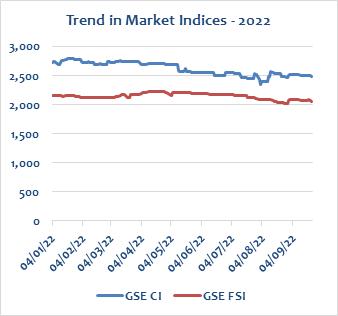

The Ghana Stock Exchange closed lower for the fourth consecutive week on the back of price declines by 4 counters. The GSE Composite Index (GSE CI) lost 28.09 points (-1.13%) to close at 2,460.12 points, reflecting year-to-date (YTD) loss of 11.80%. The GSE Financial Stocks Index (GSE FI), on the other hand, gained 14.46 points (+0.70%) to close at 2,070.10 points, reflecting YTD loss of 3.80%.

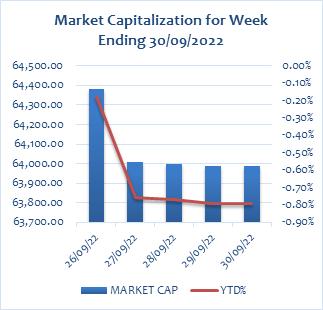

Market capitalization declined by 0.46% to close the week at GH¢63,985.81 million, from GH¢64,279.00 million at the close of the previous week. This reflects a YTD decrease of 0.79%.

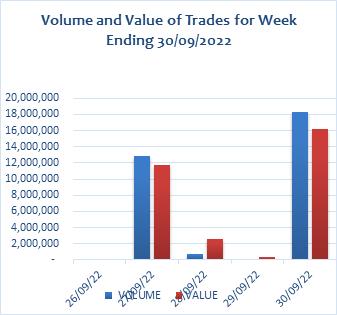

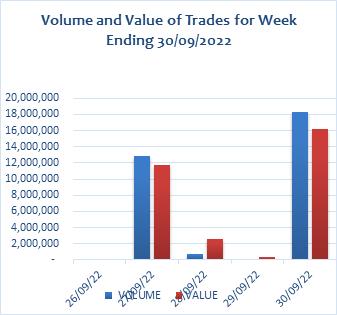

Trading activity recorded a total of 32,024,328 shares valued at GH¢30,794,565.98 changing hands, compared with 953,819 shares, valued at GH¢1,460,375.70 in the preceding week.

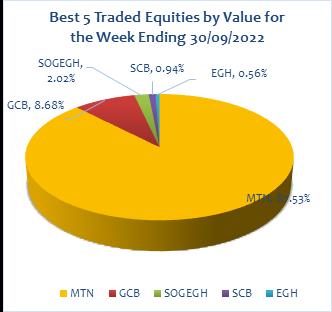

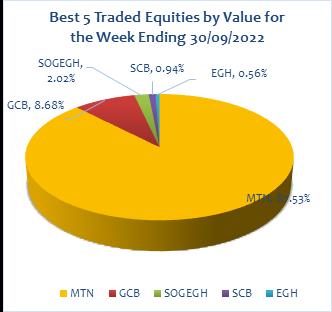

MTN dominated both volume and value of trades for the week, accounting for 95.63% and 87.53% of shares traded respectively.

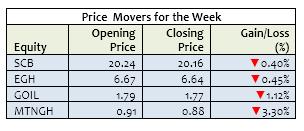

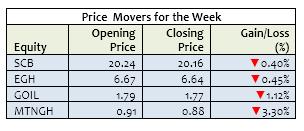

The market ended the week with 4 decliners as indicated on the table below.

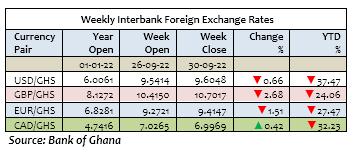

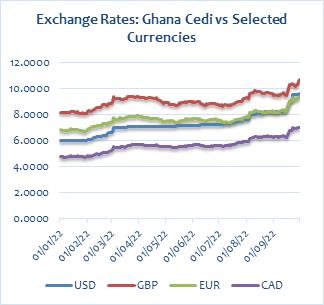

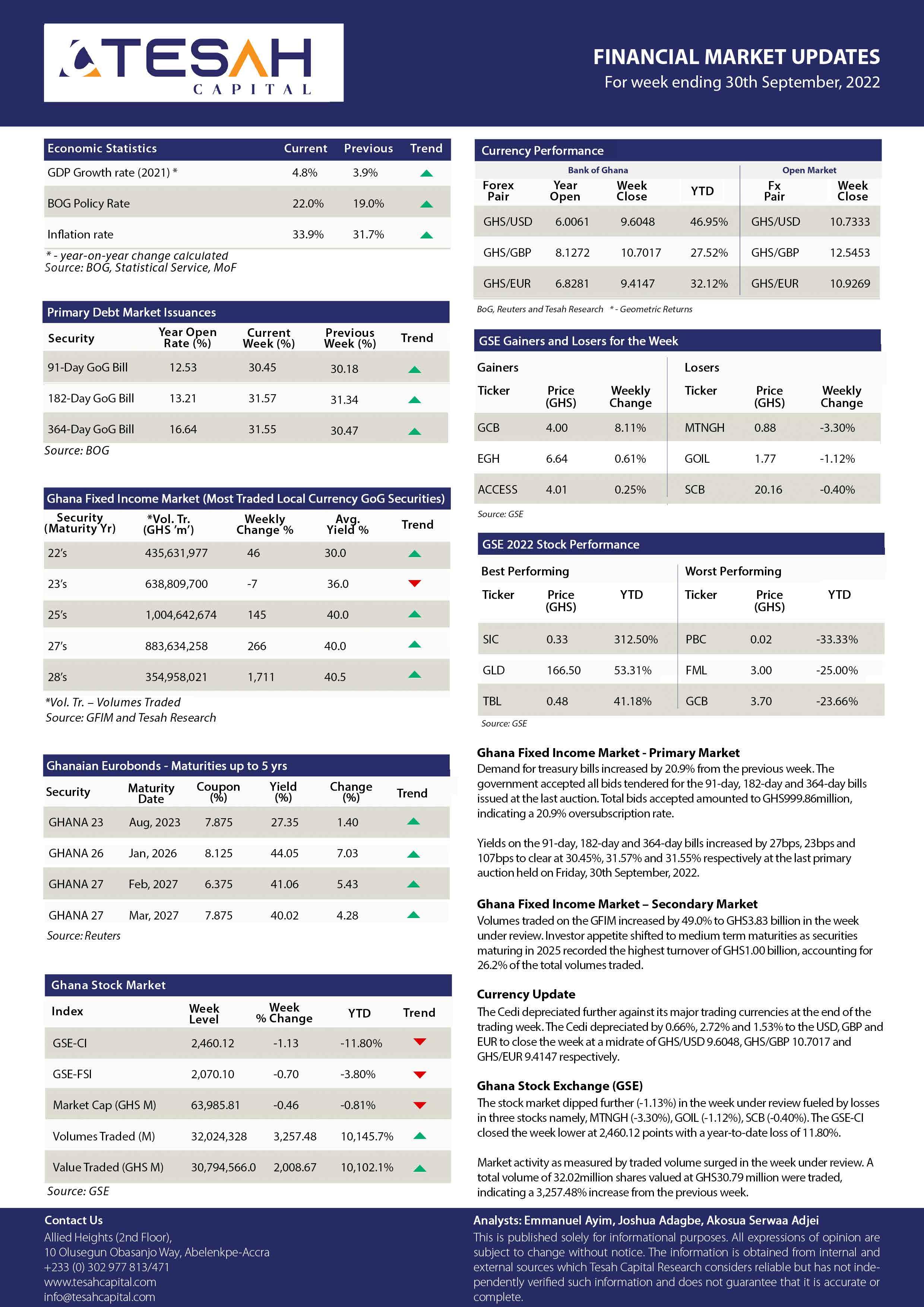

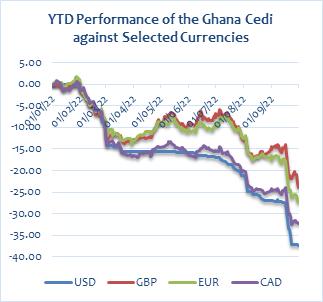

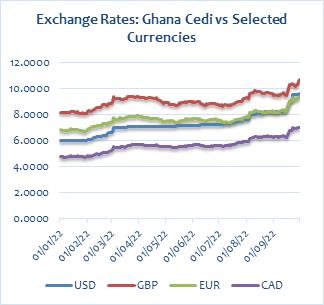

THE CURRENCY MARKET

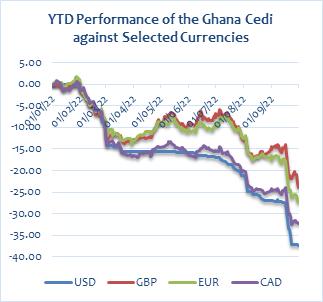

The Cedi depreciated against the USD for the week. It traded at GH¢9.6048/$, compared with GH¢9.5414/$ at week open, reflecting w/w and YTD depreciations of 0.66% and 37.47% respectively. This compares with YTD depreciation of 1.81% a year ago.

The Cedi also weakened against the GBP for the week. It traded at GH¢10.7017/£, compared with GH¢10.4150/£ at week open, reflecting w/w and YTD depreciations of 2.68% and 24.06% respectively. This compares with YTD depreciation of 0.91% a year ago.

The Cedi again weakened against the Euro for the week. It traded at GH¢9.4147/€, compared with GH¢9.2721/€ at week open, reflecting w/w and YTD depreciations of 1.51% and 27.47% respectively. This compares with YTD appreciation of 3.85% a year ago.

The Cedi meanwhile strengthened against the Canadian Dollar for the week. It opened at GH¢7.0265/ C$ but closed at GH¢6.9969/C$, reflecting w/w gain and YTD depreciation of 0.42% and 32.23% respectively. This compares with YTD depreciation of 2.16% a year ago.

WEDNESDAY, OCTOBER 5, 202218 | MARKET REVIEW

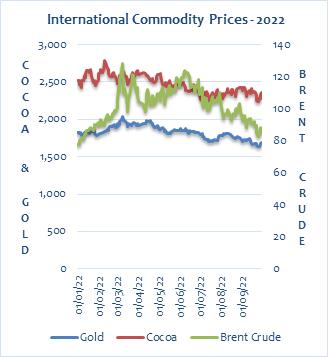

COMMODITY MARKET

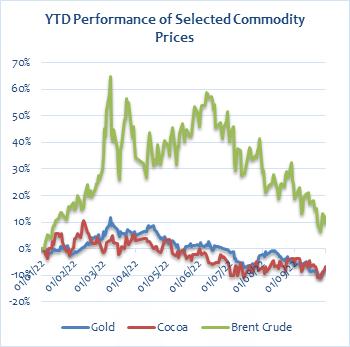

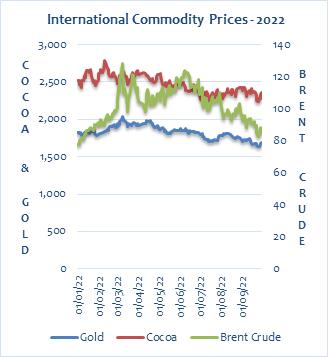

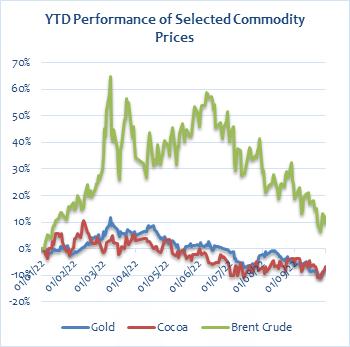

Oil prices closed marginally higher for the week as OPEC+ considers reducing output by more than 1 million barrels per day (bpd). Brent futures traded at US$85.14 a barrel on Friday, compared to US$85.03 at week open. This reflects w/w and YTD appreciations of 0.13% and 9.46% respectively.

Gold prices strengthened for the week as growing risks of an economic recession spurred some safe haven demand for the yellow metal. Gold settled at US$1,684.90, from US$1,655.60 last week, reflecting w/w gain and YTD loss of 1.77% and 7.86% respectively.

INTERNTIONAL COMMODITIES PRICES

ABOUT CIDAN

CIDAN Investments Limited is an investment and fund management company licensed by the Securities & Exchange Commission (SEC) and the National Pensions Regulatory Authority (NPRA).

RESEARCH TEAM

Name: Ernest Tannor

Email:etannor@cidaninvestments.com

Tel:+233 (0) 20 881 8957

Name: Audrey Asiedua Wiafe

Email:aaudrey@cidaninvestments.com

Tel:+233 (0) 57 840 2700

Name: Moses Nana Osei-Yeboah Email:moyeboah@cidaninvestments.com

Tel:+233 (0) 24 499 0069

CORPORATE INFORMATION

CIDAN Investments Limited CIDAN House

Plot No. 169 Block 6 Haatso, North Legon – Accra

Tel: +233 (0) 26171 7001/ 26 300 3917

Fax: +233 (0)30 254 4351

Email: info@cidaninvestmens.com Website: www.cidaninvestments.com

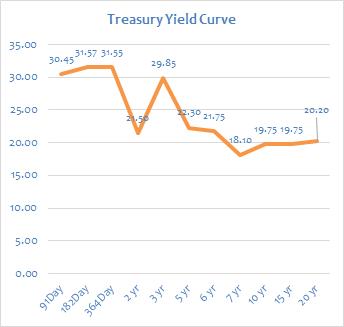

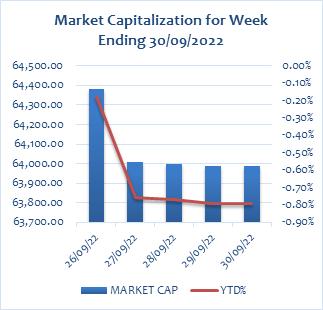

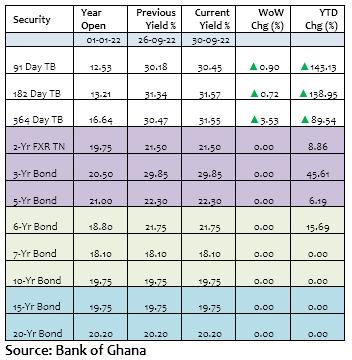

GOVERNMENT SECURITIES MARKET

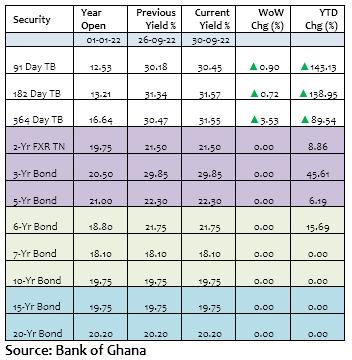

Government raised a sum of GH¢999.86 million for the week across the 91-Day ,182-Day and 364-Day Treasury Bills. This compared with GH¢1,192.42 million raised in the previous week.

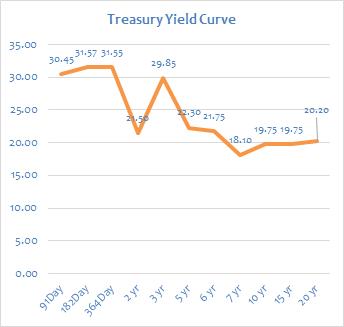

The 91-Day Bill settled at 30.45% p.a from 30.18% p.a. last week whilst the 182-Day Bill settled at 31.57% p.a from 31.34% p.a. last week. The 364-Day Bill settled at 31.55% p.a. from 30.47% previously. The table and graph below highlight primary market yields at close of the week.

BUSINESS TERM OF THE WEEK

Debt Reprofiling: It is a form of debt restructuring in which the time for repayment of the debt is extended while the interest rate and principal amount borrowed are not cut.

Disclaimer

The contents of this report have been prepared to provide you with general information only. Information provided on and available from this report does not constitute any investment recommendation. The information contained herein has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed.

Limited

Copyright @ 2019 Business24 Limited. All Rights Reserved.

Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed. We value your support and loyalty.

Contact: editor@business24.com.gh Newsroom: 030 296 5315

Advertising / Sales: +233 24 212 2742

WEDNESDAY, OCTOBER 5, 2022 19| MARKET REVIEW

Madina Sweeper Philomena Dzogbo receives distinguished award from GESA

A middle-aged lady, Madam Philomena Dzogbo has won the Most Distinguished Borla Woman of the Year 2022 Award.

She was presented a plaque and a luxurious plus hotel accommodation with meals all for free for a period of one month at the AH Hotel within East Legon.

Madam Dzogbo is a sweeper with Zoomlion and stationed under the capital of the La Nkwantanang Municipal Assembly Madina.

In an interview with Madam Dzogbo, she is inspired by the rewards by God than worldly possessions. “I look at how God made everything so beautifully and perfectly and that has inspired me to want to continue to dedicate my life for environmental cleanliness,” she said.“I work the whole day without complain making sure Madina is clean and hoping that God has seen my sacrifices without thinking about what salary or position I occupy” Madam Dzogbo intimated.

She said she will continue to work hard for a better Ghana and expressed great satisfaction about her award.She was thankful to the organizers of the awards and encourage her colleague sweepers to give the work all their best for their time will certainly come as she was not expectant of any recognition.

The Ghana Environmental and Sanitation Awards is organised for the first time by the founder and CEO, Nana Yaw Kwakye-Boadu.

Several people were recognised and awarded with plaques and citation including eight subsidiaries of the Jospong Group of Companies (JGC) namely, Zoomlion Ghana Limited, Sewerage Systems Ghana Limited, Metropolitan and Allied Waste Management Services and One Million Bin Project among others.

The Executive Chairman of the Jospong Group of Companies, Dr. Joseph Siaw Agyepong, Mr. Ernest Morgan Acquah, General Manager of Metropolitan and Allied Waste Management Services, Ms, Patricia Ofori Atta, Senior Communications Officer of Zoomlion and many others were awarded at the awards night at the AH Hotel in Accra.

WWW.BUSINESS24.COM.GH | NO. B24/317 | NEWS FOR BUSINESS LEADERS WEDNESDAY, OCTOBER 5, 2022

PUBLISHED BY BUSINESS24 LTD. TEL: 030 296 5297, 030 296 5315. EDITOR: BENSON AFFUL editor@business24.com.gh | +233 545 516 133.

By Adigbli Ernest Kofi

By Adigbli Ernest Kofi

of Ghana.

of Ghana.