Banks must commit more resources to climate action, says Alhassan Andani

Funding opportunities for SMEs in Ghana

of businesses has been identified as a top bottleneck for businesses of all sizes, irrespective of location, region, and or industry.

This is supported by centuries of surveys conducted to ascertain the challenges that businesses face.

All businesses, regardless of size, require cash to cover ongoing operating expenses, build infrastructure, and for marketing, R&D, and client acquisition, among other things. The reasons for capital injections vary, yet the bottom line is that, at a point in every business, funding is a key element.

While businesses of all sizes require funding, the sources and opportunities for such funding differ. Large businesses frequently have a wide range of financial support alternatives available to them.

But for small and medium-sized businesses (SMEs), obtaining conventional funding can be extremely difficult and even fatal.

The focus of this article is to build a pipeline of funding opportunities that SMEs could explore to meet their short-, medium-, and long-term funding needs.

Fortunately, Annan Capital Partners has been at the forefront of supporting multiple SMEs

in Ghana and across the African sub-region to access funding for their businesses.

What’s an SME?

It is widely acknowledged that an SME is different from companies that are primarily used by their owners as vehicles for selfemployment.

A business is considered a small- to mid-size organization (SME) if its revenues, assets, or workforce are below a specific threshold.

Unfortunately, there isn’t a universally accepted definition of a SME. Each nation is free to choose its own definition and may also opt to impose particular restrictions on particular businesses. The standards for classifying a SME differ between nations and occasionally between industries.

Small and medium-sized businesses (SMEs), which make up a significant portion of firms in Africa, are the backbone of the global economy.

SMEs are thought to account for 90% of the private sector in the developing world and for 80% of jobs on the continent of Africa, making them a significant force behind economic progress.

Abor and Quartey (2010) claim that the SME sector makes up the majority of firms in Ghana,

By Eugene Davis

Ghana to open tourism and

in New

next

WEDNESDAY, SEPTEMBER 28, 2022 BUSINESS24.COM.GHNEWS FOR BUSINESS LEADERS CBG commissions ultra-modern SME center at Kokomlemle …relocates Trade Fair branch to Ultimate Height Building-La

cultural hub

York

year

Story on page 2 More on page 3 Story on page 4 Story on page 4

Your subscription along with the support of businesses that advertise in Business24 -- makes an investment in journalism that is essential to keep the business community in Ghana wellinformed.

We value your support and loyalty.

Contact: editor@business24.com.gh

Advertising

Horticulture fast becoming the new job-making machine

“When the last tree dies, the last man dies” they say and truly so because flora and fauna preserve the environment and hence human life, and at a time that economies are grossly feeling the harsh outcomes of climate change, the need to preserve our environment and green resources have become even more critical.

Aside the enviro-friendly outcomes, there is proven economic potential in the green economy, specifically the horticultural value chain.

Recent statistics put proportions of the youth (15 to 35) that are unemployed and seeking work at 34.2percent. Unemployment is therefore considered by many to be the most critical issue affecting the country.

It is trite to say that with the right national and individual orientation, policies, and drive, Ghana’s rich flora and fauna resources could provide millions of jobs to the country’s teeming youth.

Stratcomm Africa is leading the charge to green

Ghana for the varied purposes of beautification, wealth and job creation as well as a sustainable fight against climate change.

Now in is tenth year, the annual Garden and Flower Show challenges and motivates the youth and businesses in the sector to aspire to grow and reach their full potential, in order to improve their livelihoods and impact society.

This year’s theme “Growth Unleashed” preps the mind of young Ghanaians to burst forth and to grow beyond the norms to achieve a blooming environment.

The global horticulture market is estimated to be valued at USD 20.77 Billion as of 2021 and is projected to reach US$40.24bn by 2026 at a compound annual growth of 10.2percent whilst global flower and ornamental plants market was valued at US$475.6m in 2020 and is expected to reach US$725.4m by the end of 2027, growing annually at 6.3percent during 2021-2027.

Banks must commit more resources to climate action, says Alhassan Andani

By Eugene Davis

Former Chief Executive Officer of Stanbic Bank Ghana, Alhassan Andani, has called for the introduction of a standard system that measures banks or financial institutions’ collective compliance with climate action goals.

“We need to have a standard that measures not just compliance with financial numbers but financial institutions. We must have a standard that measures the collective compliance with this climate action goals, as we individually finance firms to achieve this. We should have a broad view which is being monitored either by a regulator or some kind of industry agency so that we can get the impact of what we doing at the firm level, “he said this virtually at the 2022 Accra SDG Investment Fair.

According to him, approaching it on individual firm basis will not be useful, arguing that “how will banks or finance houses have a portfolio review that says that for all of us involved in the extractive industry, for instance gold, this is our position on what we should see happening to every industry or firm within that sector. If we looking to energy generation, this is our global position otherwise it comes to the micro level analysis of a credit officer and an amount is given.”

Mr. Andani also urged banks and financial institutions to pool resources as recommended under the SDG Delivery Fund to make it more impactful investment whether in quality water, air and river beds.

Government has already

approved the Nationally Determined Contributions (NDCs), which has some 47 adaptation and mitigation measures on climate change and embodies efforts by countries to reduce national emissions and adapt to the impacts of climate change.

Already, Ghana is facing the impact of climate change and requires between US $9.3bn and US $15.5 billion of investment to implement climate interventions from 2020 to 2030 to build resilience for the protection of vulnerable communities and ecosystems.

The two-day virtual fair aimed at increasing investments in green enterprise development as a sustainable pathway to climate resilient growth in Ghana.

The event saw high panel discussions on sustainable financing to promote green enterprise development, as well as the transition to a low carbon economy by exploring the opportunities in green jobs investment.

Dubbed the “Accra SDGs Investment Fair 2022,” the event also discussed the opportunities for investors and project developers at local level implementation of the Sustainable Development Goals (SDGs).

The event held under the theme, “Investments in Green Enterprise Development: The Sustainable Pathway to Climate Resilient Growth” was also used to launch the 2021 SDGs Budget Report.

2 | THEBUSINESS24ONLINE.COM News/Editorial

Newsroom: 030 296 5315

/ Sales: +233 24 212 2742 Copyright @ 2019 Business24 Limited. All Rights Reserved. Limited

Funding opportunities for SMEs in Ghana

from page 1

accounting for over 92% of all businesses.

In addition, it was predicted that in 2018, SMEs contributed an estimated 70% of Ghana’s Gross Domestic Product (GDP), or around 90% of all enterprises that were in operation. Close to 85% of jobs in Ghana are reportedly provided by this industry.

It is impossible to overstate the importance of SMEs to the stability of any economy, especially, that of Ghana and the rest of Africa.

Numerous studies about the primary forward-thinking function that SMEs play in every economy have been conducted in both developed and developing nations.

For these enterprises to grow, create more jobs, and generate economic growth, they need access to funding opportunities.

Funding gateways for SMEs

The owners of SMEs frequently gripe that a lack of funding prevents them from expanding and fully using lucrative investment prospects.

The “funding or financing gap” refers to this difference between the financing options available to small and medium-sized businesses and the financing they could effectively employ.

There are quite a lot of potential funding sources for SMEs. However, a lot of them have real-world issues that can make them less beneficial.

The ideal scenario, according to many SMEs, is to never need to raise money; instead, the business would support its own initial start and expand going forward at the rate at which it makes money.

Many SME CEOs who don’t want to answer to outside investors find this strategy to their liking. And the successful consequence is typically a stable business with little growth.

Let’s begin by exploring some of the funding gateways available to SMEs as they set out to fund their businesses.

Owner, Family & Friends

This is always the first attempt and source of funding for SMEs. Even before receiving external funding, you are typically asked how much of your own resources you initially invested in the business.

Due to the fact that these individuals’ (family and friends’) motivations for investing may not be solely financial, they may be ready to accept a lower return than many other investors, making this a potentially excellent source of funding.

The main drawback is that, for the majority, the ability to raise money from friends and family and on our own is relatively constrained.

Bootstrapping

Bootstrapping is the practice of launching a business using only one’s own finances, together with money borrowed or invested from family or friends and revenue from the first few sales.

Self-funded firms do not rely on conventional financing techniques like bank loans, investor money, or crowdfunding. Instead, as the name implies, business owners must “pull

themselves up by their bootstraps” by starting with their own money.

Bootstrapping is the best place to start for new businesses, especially if market validation of their goods or services has not yet been completed.

The benefit of this approach is that the SME owner retains total control. Since it shows the owners’ faith in and dedication to the company, it might also be used to persuade investors to join.

Angel Funding

Angel investors are people or organizations who make investments in start-ups or earlystage businesses in exchange for an equity ownership interest.

However, securing an angel investor is only half the battle. Once you’ve connected, you’ll need to sell your business to investors.

One drawback is that these people are uncommon and frequently very picky about what they are willing to invest in.

Once a business angel expresses interest, they can be of considerable assistance to the SME because they frequently possess excellent commercial judgment and are likely to be connected to a wealth of resources.

Angel investors may be relatives or family members, but they are mostly outsiders eager to support start-up businesses with creative ideas.

Some of the angel investor networks in Ghana/Africa includes the following:

• African Business Angels Network

• Accra Angels Network

• Ghana Angels Investor Network Venture Capital (VC)

Most people undoubtedly picture VC when they think of early-stage financing. Some investors will put money into a new business, while others may wait until it has been operating and proving itself.

A venture capitalist firm is very often a subsidiary of a company that has significant cash holdings that they need to invest in. The venture capital subsidiary is a high-risk, potentially high-return component of their investment portfolio.

These companies invest quite a significant amount of capital into a SME and have already performed market research and generated initial sales.

In return, they receive stock in the business, which entitles them to a seat on the board and a voice in its operations. The injected capital may occasionally be set up as a convertible debt.

A presentation to a venture capitalist must demonstrate how they would be able to “exit,” or release their value, after a number of years, as these investors rarely wish to remain invested for the long term.

This is frequently accomplished by either selling the business to a larger firm engaged in the same industry or expanding it to the point where a stock market listing is feasible.

An SME needs a business idea that could generate the high returns a venture investor is looking for in

order to get venture capital funding.

Invoice Factoring / Discounting

Invoice factoring is a type of accounts receivable finance that is also known as “factoring” or “debt factoring”. Invoice factoring enables businesses to sell outstanding invoices (accounts receivable) to a third-party commercial finance company (a factor).

These sources of finance effectively let a company raise finance against the security of their outstanding receivables.

This funding is only temporary and frequently costs more than an overdraft. One advantage of these sources of funding, though, is that when a SME expands, their existing receivables will expand as well, increasing the amount they can borrow from their suppliers or through invoice discounting.

Therefore, factoring and/or invoice discounting are two of the extremely limited number of financial sources that expand on their own in tandem with the expansion of the business.

Loans & Bank Finance

Here, a business borrows money from an individual, a microfinance organization, or a bank that must be repaid with interest after a certain amount of time.

When a loan can be secured against significant assets like land and buildings, banks may be ready to offer some type of overdraft as well as long-term loans.

Accessing loans can be challenging, particularly when collateral is needed. But thanks to technology, it’s now simpler to get unsecured loans through mobilebased services.

Crowdfunding

Crowdfunding is a method of obtaining outside money from a big audience as opposed to a limited number of specialized investors (such as banks, business angels, or venture capitalists), where each person contributes a small portion of the desired funding.

The contributions are then given a reward by the company, which may take the form of gifts, special offers, or even stock.

When it comes to crowdfunding, individuals provide the funds that the business requires. Crowdfunding typically occurs through specialized networks, particularly the internet, with the business owner outlining the activities and goals of the company, sometimes in the form of a business plan, and asking for funds under a set of rules and regulations.

With regard to traditional types of financing, this constitutes the main novelty of crowdfunding because it allows business owners to access big audiences’ savings without the need for a middleman like a bank.

Agoo Africa Crowdfunding

Coming highly recommended as an efficient crowdfunding platform for small businesses and start-ups in Africa is the yet to be launched Agoo Africa by Annan Capital Partners.

“Agoo Africa is a crowdfunding platform for African early-stage start-ups’ and small traditional

businesses.”

“When launched, it will allow owners of such businesses to make their project and their pitch accessible to a large number of investors, from young nonprofessional business angels to established international funds.”

“On the other hand, any investor can now have access to a curated database of small Ghanaian companies from various sectors and invest in them seamlessly via our platform.”

Another distinguishing feature of Agoo Africa is that, unlike most of the existing equity crowdfunding/ crowdinvesting platforms, Agoo doesn’t require your startup to be incorporated in Delaware. On the contrary, it’s the first such platform which clearly encourages fundraising for companies registered in Africa.

When to Raise Finance

When you’re not in need of funding is the best moment to begin looking. On-boarding new investors requires time, especially if they are corporate investors like venture capitalists (VC) and or even angel investors.

Utilize every opportunity you get to inform potential investors about your company, your vision, and what makes it special. This will ensure that they have heard of you and, ideally, are familiar with your narrative when you approach them later to discuss a fundraising effort.

Annan Capital Partners, bringing on board decades of experience in connecting multiple SMEs across the African region to funding opportunities, will be an ideal partner in your quest to fund your SME.

Paul Frimpong, CGIA, ICCE

Paul Frimpong is a development economist, top voice on Sino-Africa relations, and an award-winning entrepreneur.

He’s currently the Global Head of Strategy & Membership at the Institute of Certified Chartered Economists (ICCE).

This article is originally curated for and published by: Annan Capital Partners.

Annan Capital Partners (ACP) is a boutique investment advisory and business development agency offering holistic wealth management and venture building services to a wide range of clients, from entrepreneurs to governments and from local SMEs to global corporations.

https://annancapitalpartners.com/ py.frimpong90@gmail.com

About Author

WEDNESDAY, SEPTEMBER 28, 2022 | NEWS 3

continued

CBG commissions ultra-modern SME center at Kokomlemle…relocates Trade Fair branch to Ultimate Height Building-La

Consolidated Bank Ghana (CBG) has commissioned its ultra-modern SME Centre at Kokomlemle to cater for the needs of SME Clients.

Commending the Bank, the Deputy Minister of Finance incharge of Wealth Creation, Dr. John Ampontuah Kumah, praised the Bank for its unflinching support to the SME Sector.

According to the Deputy Minister, who is also a Member of Parliament for Ejisu in the Ashanti region, SMEs account for an overwhelming proportion of employment creation in Ghana. In supporting them CBG aligns with the Government’s agenda for SME growth and development.

The Deputy Minister also commended the Bank for partnering with the Ghana Employment Agency in rolling out the YouStart programme thus positioning the Bank as the SME Bank of Choice in Ghana.

Speaking at the event, the Managing Director of CBG, Mr. Daniel Addo said the Centre provides SMEs with a one-stop shop for capacity building and financial support.

According to him, SMEs are the backbone of the Ghanaian economy, contributing about 75% of GDP and constituting almost 85% of businesses in Ghana. He said, at the SME Centre, experts will provide advisory services to the SMEs.

The Managing Director announced that Euromoney’s recent ranking of CBG as 2022 Market Leaders in SME is a strong complement to what the Bank has done over the last 4years, granting over 1.5billion to the sector. He also

• Partnering with German International Cooperation (GIZ) to train 500 Artisans by December 2022.

• Partnering GIRSAL in supporting the Agric Sector

The Guest Speaker at the event,

of our MSMEs largely depends on the financial support that is needed to be injected into viable and high-growth firms as well as start-ups. I wish to congratulate CBG for its profound support for the promotion of MSMEs in the country”.

The Deputy Minister further indicated that on an ongoing basis she would personally visit the Centre to see how Entrepreneurs are faring.

Earlier in the day, CBG also commissioned its plush Trade Fair Branch located on the Giffard Road. The Branch re-emphasizes the Bank’s commitment to superior customer experience and convenience. The Managing Director, Mr. Daniel Addo indicated that the Bank is embarking on a bank-wide standardization exercise to project the branches by making them more customer friendly.

touched on the number of activities to boost the sector. This includes:

• Introduction of a programme dubbed CBG Adesua Series. This programme engages and educate entrepreneurs.

• Partnering with Ghana Enterprises Agency (GEA) to disburse concessionary loans totaling GHS154billion to 34,000 SMEs

Nana Ama Dokua AsiamahAdjei, Deputy Minister of Trade and Industry in charge of MSME commended lauded CBG for the initiative.

“I am particularly excited about the Bank’s focus on prioritizing support towards Micro, Small, and Medium Enterprises (MSMEs) promotion for national development because the growth

Present at both events were, the Deputy Managing Director, Corporate Resources, Madam Nana Ama Poku, Director, Retail and Business Banking Mr. Emmanuel Nikoi, Director, Global Markets Mr. John Zigah, Director, Operations Mr. Samuel Barketey, Director, Information Technology Mr. George Mensah, General Managers and Heads of Departments of CBG and some Customers of the Bank.

Ghana to open tourism and cultural hub in New York next year

Dr. Ibrahim Mohammed Awal, Minister of Tourism, Arts and Culture for Ghana, has announced the official opening of a tourism and cultural hub in New York to serve the North American Market and help promote tourism to Ghana.

He made the announcement at the Destination Ghana Networking event that was held in New York City.

The event, a collaboration of the Ministry of Tourism, Arts, and Culture, the Ghana Tourism Authority and the Ghana Investment Promotion Centre brought together business leaders and leaders of the African diaspora community to network and learn more about the opportunities for tourism, business and investment in Ghana. The event also served as an opportunity to engage with the community and learn more about what their needs were when travelling to Ghana.

“The U.S. is very important to Ghana in areas of culture and tourism,” Hon. Awal said. The United States accounts for the largest

number of tourists that visit Ghana annually, making them a significant place of marketing to Ghana. “We’re going to open a Cultural and Tourism office in New York next year to serve as the tool and vehicle to drive culture and tourism between the U.S. and Ghana. By March next year it will happen and I can assure you that it will help facilitate all the issues of our tourism and culture.”

Members of the Ghanaian delegation included, Akwasi Agyeman, CEO of Ghana Tourism Authority, Yofi Grant, CEO, Ghana Investment Promotion Centre, Ekow Sampson, Deputy CEO, Ghana Tourism Authority, Annabelle McKenzie, Director, Beyond the Return Secretariat.

The event was graced by Rocky Dawuni, Grammy-nominated artist, Barkue Tubman, Chief of Staff of Essence Communications, Jerry Adinkra, Cultural and Tourism Ambassador and members of the Ghanaian and historical diaspora community. The event was well

attended and also featured cultural performances.

“We are building a Ghana brand that will be a hub for tourism and culture in West Africa.

We need your support to builld that Ghana brand and drive a lot of tourists from New York to Ghana every year,” Hon Awal said. The Consul General of the Ghana Mission in New York, Ambassador Atta Boafo assured the gathering that the processes of obtaining visas would be simplified and also addressed that Ghanaians abroad could use both their Ghana passport and U.S. passport when travelling to and from Ghana with ease.

Akwasi Agyeman, CEO of the Ghana Tourism Authority highlighted the activities lined up for December in Ghana this year which includes Afrochella, Taste of Ghana, AfroNation, Little Havanna, Detty Rave amongst others and invited the African Diaspora to be part of it.

The minister also assured everyone that important tourist

sites are undergoing renovations and will be modernized to create a better travel experience. Earlier this year the Kwame Nkrumah Memorial Park and Museum were closed for renovations. Hon. Awal said it will reopen next year. “We will have a fully furnished and modernized Kwame Nkrumah Memorial Park by March of next year, ‘’ he said. “The museum is being expanded and refurbished.”

The minister’s announcement was part of the Destination Ghana Networking event in New York. The Destination Ghana campaign was launched earlier this year in London, U.K. to promote Ghana as a tourism destination worldwide. Hinged on the fact that Ghana is at the centre of the world, the campaign builds off the strength of Ghana’s Year of Return campaign which encouraged the diaspora to come to Ghana and helped boost international arrivals to over 1.1 million in 2019.

WEDNESDAY, SEPTEMBER 28, 20224 | NEWS

stability

Governor of the Bank of Ghana (BoG) Dr Ernest Addison says the bank will not relent in its efforts to tame inflation and attain price stability despite global and local pressures.

In a speech read on his behalf at the 39th Annual General Meeting (AGM) of Ghana Association of Banks by the Head of Banking Supervision at the central bank, Osei Gyasi, the Governor said although inflation remains significantly above the medium target band, the bank was committed to the tight monetary policy stance to achieve price stability.

Dr Addison said the banking sector had been resilient but warned that recent developments in the macroeconomy pose some upside risks to the wider financial sector and urged the banks to employ strong risk management systems to ensure the stability of the banking industry.

“Currently, the banking sector continues to exhibit strong performance despite challenges in the macroeconomic environment. The sector remains healthy with some improvement in assets.

However, the recent developments in the micro economy may put some outside risk to the sector in the outlook, hence banks must deploy a strong risk management system to ensure stability,” he said.

On her part, Mrs Mansa Nettey, President of GAB, said while the government was taking the necessary actions to achieve debt sustainability, it should not be done at the expense of gains in the sector.

“Government must ensure that this is not done at the cost of financial sector stability, inadvertently undoing so much of what has been achieved in strengthening the banking sector,

as a sound and stable economy needs an equally sound and stable banking system, one that can support the country’s longterm goals.”

Mrs Nettey said further stated that while the industry recognises drastic measures need to be taken by the central bank in effectively combatting inflation, banks must be encouraged with regulatory incentives to soften the impact.

“We recognise that the Bank of Ghana had to front-load the tightening; however, they must be provided with regulatory incentives to help them navigate the current economic challenges and continue to support the economy,” she said.

With the expectation of a tough business environment in the near term, she said it is important that banks review existing operations and investment strategies to ensure sustainable performance as they remain risk-aware and

undertake effective credit management processes.

Speaking in an interview with Journalists, the Chief Executive of the Ghana Association of Banks, John Awuah, said the industry was adopting strategies to deal with digital-related fraud.

He said the banks were working to find solutions by arresting and prosecuting such offences as well as retooling to be able to detect and avoid some of these activities.

Meanwhile, the Association has launched the second edition of its magazine known as the Banker’s Voice.

The magazine, with support from the Auditing and Accounting Firm, KPMG, as the knowledge partner, analyses the prospects of the industry and some signals that may keep the financial sector going.

GNA

WEDNESDAY, SEPTEMBER 28, 2022 | AFRICAN BUSINESS 5

BoG will not relent in efforts to tame inflation, achieve price

Tel: +233 (0)302 21 6000 www cbg com gh cbgbankltd CBG Controller Loan • Eric Oppong-Johnson - 0596912267 • Samuel Asewe - 0556493505 • Get up to GH¢250,000 • Tenor - 72 Months • Fix rate throughout the loan tenor • No penalty for early pay off • Buy off other loans FEATURES • Mandate Pin • Competitive interest rate • Mandate Number • Settlement quotation (applicable to pay off) REQUIREMENTS (CONTROLLER)

ASA Savings & Loans organizes free health screening at Dormaa

ASA Savings and Loans Limited has extended its benevolence to the people of Dormaa-Ahenkro in the Bono Region where it organized free health screening for the residents.

About 200 people made up of customers and non-customers of the financial institution benefited from the free medical screening. The beneficiaries were mostly women who operate micro businesses in the community and its environs.

The screening covered diseases such as malaria, blood sugar, typhoid, diabetes and blood pressure. The exercise was administered by personnel from the Berekum Health Centre at Berekum in the Bono Region.

The Dormaa-Ahankro exercise formed part of the broader corporate social investment activities undertaken by ASA Savings and Loans across its operational area the country.

The Sunyani Area Manager of ASA Savings and Loans, Isaac Agyapong said the company among others was committed to ensuring that its customers and the community as whole enjoy

quality healthcare to promote healthy working population.

He said, “the company has made part of its operational objective yearly to organize free medical screening programme in addition to several other corporate social responsibility activities for members and non-members in the Dormaa Municipality. As a Company, in our yearly plans or budget we actually donate

hospital, schools and others.”

He expressed appreciation for the people’s participation and enthusiasm in the corporate social activities of the company, especially with the health screening, indicating that the gesture would urge the company to initiate more of such activities.

The beneficiaries were grateful to ASA Savings and Loans for its kindness in addition to the

offering the business community, particularly women-led micro enterprises.

In an interview, a 42-year-old, Lydia Tamea, who sells ladies’ clothing thanked the company for the health screening saying, “thanked to today’s screening, I have learnt more about how to stay healthy and stronger to avoid contracting lifestyle diseases.”

WEDNESDAY, SEPTEMBER 28, 2022| NEWS6

In search of a development plan for Asia

Can a region as complex and fast-changing as Asia devise and implement a comprehensive development plan? The Jakartabased Economic Research Institute for ASEAN and East Asia, which just released its third “Comprehensive Asia Development Plan” (CADP), thinks so.

The report deserves serious consideration. Drawing on the research and insights of experts from the ASEAN Secretariat and institutes from 16 countries, including Australia, New Zealand, and East Asian countries, it maps out how Asia could deepen regional economic integration, narrow development gaps, and advance sustainable development.

CADP 3.0 represents a major step forward from its predecessors. CADP 1.0, published in 2010, focused largely on transport infrastructure, from roads to airports. CADP 2.0, released in 2015, recognized that true connectivity – essential to regional integration – also depended on information and communications technology. CADP 3.0 takes this further, examining the role of digitization in supporting integration, innovation, inclusiveness, and sustainability.

This sequence mirrors the “three unbundlings” the economist Richard Baldwin has described, each of which defines a phase of globalization. The first – the separation of production and consumption – occurred when advances in transportation drastically lowered the costs of

moving goods. The second – the separation of various parts of the production process – arose when information and communications technologies reduced the costs of moving ideas, enabling coordination across any distance.

The third unbundling is the separation of service delivery and use. From teleconferencing to telerobotics, technologies increasingly enable people to provide services without having to travel. This means that service workers in developing countries can increasingly do knowledge work for advanced-country customers, but at a much lower cost. As Baldwin points out, wage rates in the services sector represent the “greatest remaining global arbitrage opportunities.” At the same time, professionals in advanced economies can also provide services to developingcountry clients at high rates.

CADP 3.0 seeks to seize the opportunities the third unbundling creates. It urges East and Southeast Asian countries to invest in artificial intelligence and industrial robots, expand 5G broadband networks, and build on the Regional Comprehensive Economic Partnership to improve data standards and digital rules. Ultimately, East and Southeast Asia would create a digital single market, underpinned by shared data infrastructure and common rules and standards.

It is difficult to argue with the logic behind this vision. But in a region as diverse as Asia, translating it into reality would be difficult, to say the least, especially

at a time of deepening ideological and geopolitical fault lines. The main barrier to success is neither technological nor financial. Instead, it is the implementation capacity – or lack thereof – of local, national, and international institutions.

CADP 3.0 is a broad strategy to advance simultaneously a large number of complex and interconnected goals in areas ranging from rural poverty and population aging to water safety to pollution. The level of onthe-ground coordination this demands may well be beyond the capabilities of most developingcountry bureaucracies, not least because of their siloed structures.

Multilateral development banks and aid agencies, for their part, are well equipped to handle largescale projects and programs. But they have considerable operational weaknesses when it comes to managing large numbers of projects involving diverse micro, small, and medium-size enterprises.

No matter how elegant and compelling a top-down development plan for Asia might be, it is unlikely to be implemented. Instead, we must embrace a bottom-up approach.

Digital technologies should play a central role in such an approach, for example, by providing the data and processing power (through AI) to deliver bottom-up feedback and facilitate coordination. And connectivity hubs – from regional financial centers like Singapore and Hong Kong to new technology platforms – can

improve the allocation of funding and knowhow. Direct engagement and consensus-building will be essential to avoid collectiveaction traps.

Narratives are vital here. Topdown plans often lack the appeal to emotion and sentiment that is needed to change human behavior. But bottom-up efforts reflect people’s ideas and aspirations. This supports the creation of narratives capable of inspiring and empowering social movements and triggering a huge number of small changes, thereby creating systemic change.

The relatively slow pace of ASEAN integration is probably frustrating to those who believe that a clear plan is the key to progress. But integration can never be a neat and efficient process in a region comprising highly diverse countries at vastly different stages of development.

Actors need time to learn how to work with one another, build local and regional consensus, and develop the necessary design, implementation, and oversight capabilities.

Development is a complex adaptive process, and we are living in a time of profound geopolitical, technological, and environmental change. As attractive as topdown plans like the CADP 3.0 might be, they cannot deliver what Asian integration requires: bottom-up institutions that advance compelling narratives and can respond nimbly to new information and imperatives.

Project Syndicate

WEDNESDAY, SEPTEMBER 28, 2022 | FEATURE 7

Ghana re-affirms position to leave no one digitally behind

The Minister for Communications and Digitalisation, Ursula OwusuEkuful, has reaffirmed Ghana’s commitment to leaving no one digitally behind.

This she said can be achieved by collectively focusing attention within the next eight years on the attainment of the ICT-enabled sustainable development goals and targets by 2030.

According to her, the government of Ghana, under the leadership of President Nana Addo Dankwa Akufo-Addo, CoChair of the Group of Eminent Advocates for the United Nations’ SDGs, was committed to the global strategy of working together to improve lives everywhere through technology deployment.

“This is even more critical as the devastating impact of the COVID-19 pandemic on economies of all nations, makes it imperative for our governments to accelerate digital transformation as the key for our economic recovery,” she noted.

The Minister was speaking at a Round Table meeting today at the Ministerial Roundtable Sessions on the topic: “Building a Better Digital Future For All” at the Palace of Parliament, Human Right Hall in Bucharest, Romania.

The meeting forms part of preparations ahead of

International Telecommunication Union (ITU) Plenipotentiary Conference, 2022, and it’s scheduled for 26th September to 14th October 2022.

The Minister said Ghana has started the preparation to facilitate the expansion of digital infrastructure aimed at opening up broadband access to accelerate the provision of meaningful content and smart services that would benefit all citizens in the country.

“The bridging of the digital divide is a major concern of Government, and we continue to create digital opportunities for the marginalised, the elderly, and people in rural, remote, and underserved areas under our

Universal Telecommunications/ ICT Fund Management,” Mrs Owusu-Ekuful said.

She, therefore, stated that government was also implementing strategic policies that would ensure inclusiveness of inculcating basic digital literacy in the educational curricula and also putting up communitybased digital laboratories while being mindful that digital skills development was the cornerstone of digital transformation.

Touching on gender technological gap, she indicated that, Ghana had prioritised digital gender equality and that women and girls were encouraged and empowered to pursue Science, Technology, Engineering, and

Mathematics (STEM) disciplines.

“We are committed to a crosssectoral approach to development and enhanced collaboration with the private sector to aid rapid digital transformation. The Government of Ghana continues to work towards the creation of a fair regulatory environment and stability through the development of new spectrum farming policies to encourage the private sector to roll out new generation infrastructure and provide affordable and meaningful connectivity,” Mrs. Owusu-Ekuful said.

She emphasised the need to build confidence, trust, and security in cyberspace so as to promote a safe digital /ICT ecosystem.

“It was important to work with the guidelines provided by the ITU and other global cooperation networks, and also work with other neighbours to build a regional cyberspace that would be resilient to attacks,” she added.

She noted that “Ghana is committed to the global growth strategy that we have given ourselves under the guidance of the ITU to ensure that all nations pursue a path of digital transformation that will enhance meaningful universal connectivity and access”.

the National Theatre on October 1 & 2

All roads lead to the National Theatre in Accra this weekend when Imagebureau in partnership with April Communications Limited presents the world’s bestwritten comedy, “Run For Your Wife”.

The hilarious play will be staged on Saturday October 1st October

and Sunday 2nd October 2022 at 4pm and 8pm each day. The much-anticipated play according to the organisers will be the beststaged play ever to be witnessed in Ghana.

The cast includes some of the finest talents in the business, including George Quaye playing

the role of Adjei Sowah, Naa Ashorkor as Mrs Mary Sowah and first wife of Mr Adjei Sowah, Sitsofe Tsikor plays Naa Shome Sowah and Adjei’s second wife.

Others are Fiifi Coleman, Roland Adom, Francis Osei Bonsu, Andrew Adote Tandoh and introducing for the first time in a stage play, respected Public Relations personality and Media Person, Arnold Asamoah Baidoo.

The play is produced by Imagebureau in partnership with April Communications Limited and the National Theatre is part of the 2022 Theatre week celebrations. “Run for Your Wife” is an adaptation of a 1983 comedy by British playwright, Ray Cooney.

“Run for Your Wife” chronicles the life of Adjei Sowah, an Accrabased taxi driver with a very tricky secret. He is married to

two women that live five minutes apart, yet do not know about each other’s existence.

This he achieved by maintaining a rather tight schedule and a clever lifestyle. All is well until an accident interrupts his busy schedule, inviting the police and media – two organizations that do not understand privacy as far as he is concerned. How smart can an ordinary taxi driver be to prevent matters from getting out of hand when the two wives find out about each other?

Tickets are currently selling for GHC 100 only at JoyFM, Tema Community 11 Shell, Koala, Frankies, XMen, Baatsonaa Total, Nallem Stores, Ahoom Store and Bloom Supermart. Also visit www.imagebureaugh.com or dial *365*2020#. #LaughterRunsWild!

WEDNESDAY, SEPTEMBER 28, 20228 | NEWS

“Run for Your Wife” at

WEDNESDAY, SEPTEMBER 28, 2022 | FEATURE 9

University of Oxford, Ghana Gold Expo to hold CSR workshop

Oxford University’s African Studies Centre will collaborate with the Ghana Gold Expo Foundation to organise a strategic mining workshop on corporate social responsibility (CSR) and community engagement impact in the country.

The workshop slated for the Western Regional capital, Takoradi, forms part of the centre’s focus on the CSR and community engagement in the country’s mining industry.

The December 6 and 7, 2022 event will focus on CSR in the Mining Sector, Investment Agreements between the government and the mining companies, and the use of royalty funds, encompassing the themes of stakeholder engagement, human rights, reporting and impact assessment.

The Director of the African Studies Centre, Professor Miles Larmer, in a release issued by the two entities, explained that the vision for the workshop, which had been jointly developed with Ghana Gold Expo and key stakeholders, was to bring together international and national leaders in the mining sector – governmental and mine

company representatives – with non-governmental organisations, local community leaders, and academics.

“In Ghana, the corporate social responsibility impact assessment by major mining companies has key policies that ensure the fulfilment and pledges by mining companies in areas including: Education, Governance, Health, Infrastructure Development (Roads, Housing, Lighting) Conservation and Sanitation, Capacity Building & Women’s Empowerment, Agriculture,” the release quoted him as saying.

The Executive Director of Ghana Gold Expo Foundation, Dr Steven Blessing Ackah, indicated that the workshop would assess the extent to which current CSR programmes and mechanisms were meeting the promise of the policies.

He said the cooperation with the University of Oxford was crucial and had come at the right time when mining activities had become the bedrock of the Ghanaian society, a requisite for the country’s development.

It was also the need to have the national framework on CSR impact

and reporting in host communities, Dr Ackah stated.

The Western regional Minister, Kwabena Okyere Darko-Mensah, noted that the workshop would involve the Ministry of Finance, Ministry of Lands and Natural Resources, The Ghana Chamber of Mines, Minerals Development Fund, Minerals Income Investment Fund, Minerals Commission, Small Scale Miners Association, Gold Fields Ghana Limited, Adamus Resource Limited and Northern Ashanti Mining, Newmont Ghana Limited, among others.

WEDNESDAY, SEPTEMBER 28, 202210 | NEWS

Green jobs hold the key to poverty eradication in Africa

By Janet Southern McCormick | Senior Programme Manager, Afri-Plastics Challenge, Carl Acolatse, Nelplast Eco Ghana Limited

By Janet Southern McCormick | Senior Programme Manager, Afri-Plastics Challenge, Carl Acolatse, Nelplast Eco Ghana Limited

It is a moment of reflection as the world marks the International Day for the Eradication of Poverty. The occasion provides an opportunity to acknowledge the effort and struggle of people living in poverty and a chance for them to make their concerns heard. Through resolution 47/196, adopted on 22 December 1992, the UN General Assembly (UNGA) declared 17 October as the International Day for the Eradication of Poverty, and invited all Member States to devote the Day to presenting and promoting, as appropriate in the national context, concrete activities with regard to the eradication of poverty and destitution. This year’s event will be held under the theme: DIGNITY FOR ALL IN PRACTICE: The commitments we make together for social justice, peace, and the planet.

Africa continues to bear the brunt of poverty. According to Statista, in 2022, the extreme poverty rate in Africa stood at around 50 percent among the rural population, compared to 10 percent in urban areas. Together with poverty, malnutrition is also widespread in Africa. Limited access to food leads to low health conditions, increasing the poverty risk.

In 2022, around 12 percent of the world population lived in extreme poverty, with the poverty threshold at 1.90 U.S. dollars a day, living in Nigeria. Moreover, the Democratic Republic of the Congo accounted for around 10 percent of the global population in extreme poverty. Other African nations with a large poor population were Tanzania, Madagascar, and Mozambique.

With specific reference to Ghana, Statista reports that in 2022, over 3.4 million people in Ghana lived in extreme poverty, the majority in rural areas. The count of people living on less than 1.90 U.S. dollars a

day in rural regions reached around 3.1 million, while 265,000 extremely poor people were located in urban areas. Overall, within the period examined, the poverty incidence remained above three million in rural communities and between 250 thousand and 400 thousand in urban areas.

Covid-19 worsens poverty situation

But even as we celebrate the International Day for Poverty Eradication, it is not lost on the international community that the COVID-19 pandemic has exacerbated the poverty situation. According to the World Bank, the COVID-19 pandemic is likely to have pushed between an additional 143 and 163 million people into poverty in 2021. The number of people living under the international poverty lines for lower and upper middleincome countries is projected to have increased in the poverty rate of 2.3 percentage points. Almost half of the projected new poor will be in South Asia, and more than a third in Sub-Saharan Africa.

As we embark on the post-COVID recovery and getting back on track with the Sustainable Development Goals, many are talking of “building back better,” but the message is clear from the people living in extreme poverty that they do not want a return to the past nor to “build back” to what it was before. They do not want a return to the endemic structural disadvantages and inequalities. Instead, people living in poverty propose to build forward.

Building forward means transforming our relationship with nature, dismantling structures of discrimination that disadvantage people in poverty and building on the moral and legal framework of human rights that places human

dignity at the heart of policy and action. Building forward means not only that no one is left behind, but that people living in poverty are actively encouraged and supported to be in the front, engaging in informed and meaningful participation in decision-making processes that directly affect their lives. In building forward, we need to let ourselves be enriched by the wealth of wisdom, energy and resourcefulness that people living in poverty can contribute to our communities, our societies and ultimately to our planet.

Eradicating poverty through green jobs

It is with this in mind that Nelplast Eco Ghana Limited is bringing about change in environmental conservation through plastic waste collection, recycling, and ecofriendly building and construction materials. Nelplast Eco Ghana Ltd is an environmental and social impact company that recycles all types of waste plastics through a polymer-sand extrusion process, into waterproof, heat resistant, and durable, reusable eco bricks for various domestic and large scale construction works. As finalists of Strand 1 of the Afri-Plastics Challenge themed Accelerating Growth, they are receiving capacity building support to help in implementing their scaling plans, alongside a grant of £100,000.

Based in Katamanso, Ashaiman in the Greater Accra Region of Ghana, the company has created employment opportunities and is a testament that green jobs can help in poverty eradication. According to a joint report by ILO and UNEP, a greener economy can make a major contribution to poverty reduction and social inclusion. In view of the global climate emergency, the green economy appears to be

the best alternative to the current dominant economic model and is indispensable to achieving sustainable development, especially in developing economies such as Ghana.

Given the importance of green jobs, governments should invest in a green future by offering incentives for investment in programmes geared at creating a large number of green jobs. Above all, investments in both public and private sectors will provide the mechanism for the reconfiguration of businesses, infrastructure and institutions, and for the adoption of sustainable consumption and production processes.

Such reconfiguration will lead to a higher share of green sectors in the economy, more green and decent jobs, reduced energy and material intensities in production processes, less waste and pollution, and significantly reduced greenhousegas emissions.

Governments should also implement policies that promote economic opportunities for the poor and expand social protection. There is a need to stimulate economic growth to increase incomes and expand employment opportunities for the poor, undertaking economic and institutional reforms to enhance efficiency and improve the utilization of resources; prioritizing basic needs of the poor in national development policies.

As the world marks the 30th anniversary of the International Day for the Eradication of Poverty, we are all duty bound to honour the millions of people suffering from poverty and their daily courage and recognize the essential global solidarity and shared responsibility we hold to eradicate poverty and combat all forms of discrimination.

WEDNESDAY, SEPTEMBER 28, 2022 11| NEWS

Nespresso premiers new boutique concept in Accra at Marina Mall

Nespresso, the worldwide pioneer in premium portioned coffee, will officially launch an innovative new boutique concept in Ghana this week at the Marina Mall, Airport City, Accra.

The new Nespresso retail environment surrounds guests in an immersive coffee experience allowing for deeper learning and coffee exploration. Throughout the boutique, visitors will experience elements that reflect Nespresso’s deep commitment to sustainability and adherence to a circular economy, one that is restorative by nature and works to minimise waste through careful design.

“The new Nespresso boutique concept centers around five key principles: a simplified and holistic customer journey through carefully sequenced areas, a celebration of coffee moments with bespoke coffee rituals, new architectural codes for a warm and cozy yet premium atmosphere, a sustainability statement to nourish the Nespresso ambition to become the highest quality and the most sustainable coffee brand in the world. By combining all of these elements, the retail experience becomes fully immersive with consumers all over the world able to discover the

Nespresso coffee world in a new enhanced way,” explained Racha Chamseddin, Nespresso MEA Business Development Manager. Nespresso announced in September of 2020, they will become carbon neutral by the end of 2022. This will be possible thanks to a certified protocol which measures carbon footprint reduction for each new boutique opening. The new concept demonstrates this commitment with elements such as table-tops made from used coffee grounds from the Nespresso factory in Switzerland, wood that has been 100% sourced from reforestation programs, technological systems to reduce energy and water

consumption and a recycling collection point.

The new boutiques are a true celebration of coffee and its origins and guests can discover tributes to this throughout the space. Everything from the muted color palette of rich coffee browns and crema inspired golds to the floor tiles and lamps that echo those used on the coffee farms have been carefully designed to link to coffee.

The contemporary and luminous space, invites guests to explore new experiences in coffee tasting rituals which include a sensorial welcome upon entering the boutique with Coffee Specialists introducing guests to

the vast range of coffees to provide a hands-on experience with the coffee grounds inside a capsule, discovering the aromas and then finishing with a tasting.

“We are excited to introduce the Nespresso boutique concept as a first in Ghana to our club members and coffee enthusiasts in the country. The environment will also provide an opportunity to transform our team into highly empowered brand ambassadors,” added Sabine Nakouzi, Managing Director, Marina Distribution.

A private reception to celebrate the opening of the Nespresso boutique opening will be held at Marina Mall, Airport City, Accra.

MTN Business campaign shows how it gets #businessdonebetter

them do the things that make an impact and support their growth, helping them get it done better.”

MTN Business provides the tools to shift small, medium and large enterprises and multinational corporations and those in the public sector to being modern, connected and digital. These include Mobile as well as Fixed and ICT converged services i.e. managed network services; cloud services; unified communications; security solutions; and Internet of Things (IoT).

Mr Selorm Adadevoh said MTN Business also had a key role to play in realising the MTN Group’s Ambition 2025: Leading digital solutions for Africa’s progress: “Building the largest and most valuable platforms is one of Ambition 2025’s four strategic priorities. Enterprise Services is one of MTN’s five platform businesses and operates under the ‘MTN Business’ brand.”

African enterprises have a valuable role to play in addressing the continent’s most pressing challenges by providing muchneeded jobs, products and services. World Bank data shows that SMEs contribute up to 60% of all employment and as much as 40% of the GDP in emerging economies. This makes them the cornerstone of most economies in Africa.

to businesses in their digital evolution and ultimately achieve #BusinessDoneBetter across the continent.

“We understand that growing a business is hard. Business leaders are juggling many priorities and often cannot attend to them all,” said MTN Ghana, Chief Enterprise Business Officer, Mr Samuel Addo. “MTN Business’s role is to assist

Mr. Samuel Addo, Chief Enterprise Business Officer, said the plan was for MTN Business to become the empowering, leading ICT expert providing value to enterprise clients. Among our customer base, we already have more than Three thousand (3,000) enterprises who are instrumental in contributing to Ghana’s economic growth.

Ambition 2025 targets MTN Group enterprise revenue of more than R30 billion by 2025. This compares to R16.6 billion in 2021. In the first six months of 2022, enterprise revenue accelerated, increasing by 26.8%* in constant currency terms to R9.9 billion. This was driven largely by MTN Business growth in South Africa, Nigeria, Ghana and Côte d’Ivoire. Ghana’s Enterprise growth was 44.9% for H1 2022 and a revenue of R331m.

“We want to be the business enabler of choice in Ghana, meeting the communication and ICT demands of business clients throughout the country,” said Mr Samuel Addo, Chief Enterprise Business officer. “With a customercentric approach to providing cutting-edge services, we are doing this by leveraging our brand and advanced network as well our strong customer base of top companies across sub-Saharan Africa.”

WEDNESDAY, SEPTEMBER 28, 202212 | NEWS

WEDNESDAY, SEPTEMBER 28, 2022 13| NEWS

First Atlantic Bank brightenslives across Ghana

First Atlantic Bank is entrenching its role as one of the leading banks in Ghana’s competitive banking industry with carefully curated initiatives aimed at adding value to society as well as to itself.

As a celebrated bank by way of industry awards and a strong financial performance, it has embarked on these initiatives to positively impact the communities in which it operates for over 25 years.

Just recently, in line with the bank’s Corporate Social Responsibility (CSR) ethos of supporting the education and health of women and children, it has handed over classroom blocks to the Abua D/A Primary School in the Pru West District of Bono East Region.

That singular gesture is enough to improve teaching and learning in the farming community, as pupils used to run home anytime it was threatened by rain.

The project which is fully funded by the First Atlantic Bank included the renovation of an existing sixunit classroom block, washrooms, and the provision of furniture for that block and built another sixunit classroom block including an ICT and staff common room to address the infrastructure needs of the over 500 pupils in the school.

Addressing the teachers and pupils of the school after handing over these classroom blocks and other facilities to the school, the

Board Chairman of First Atlantic Bank Mr Amarquaye Amar reiterated the bank’s primary objective which is to help the Pru West District of the Bono East Region to create more conducive teaching and learning environment for education at the primary school level”.

“First Atlantic Bank is proud to have been able to put in place a key building block towards accomplishment of this objectivethe renovation, modernization, and Expansion of facilities at the Abua D/A Primary School”, he added.

BoG commended the bank’s efforts

In a speak read for the Governor of Bank of Ghana (BoG), Dr Ernest Addison by Nurudeen Yussif Musah, the Bono Regional Deputy Manager of BoG, said “I highly commend the joint effort and commitment of the community leadership together with the staunch support of First Atlantic Bank towards improving the lives of the youth, through the provision of good infrastructure and facilities in the Abua Community”.

Dr Addison further congratulated the management of First Atlantic Bank, staff of Abua D/A Primary School and the community whose spirit of cooperation has contributed towards the project for the benefit of the children.

Nana Kwadwo Nyarko III, the President of Prang Traditional

of the occasion in his remarks applauded the efforts of First Atlantic Bank for such a wonderful gift to the Abua community.

He further called on the bank and its allies to shift attention to Pru West to support their developmental agenda of the district.

The District Director of Education, Evans Kofi Mati expressed his profound gratitude to First Atlantic Bank and its leadership for the wonderful edifice and advised the teaching body of the Abua D/A Primary School to ensure they keep them in good shape.

The Abua D/A Primary School project is the fourth major CSR project coming after the Atlantic Lounge, a modern and comfortable waiting area for family and friends of patients on admission at the Korle-Bu Teaching Hospital in Accra in 2021.

Ghana’s First Lady Mrs. Rebecca Akufo-Addo who commissioned the state-of-the-art facility christened‘The Atlantic Lounge’ provides sitting space for 150 people and has restrooms and a place for banking services.

Visitors to the premier hospital have attested that the Atlantic Lounge has been beneficial to them and their sick relatives and friends on admission.

No discrimination

The bank does not discriminate in the provision of health and education support which is

development of the country.

In this regard, the bank built and handed over a fully furnished classroom unit to the School for the Blind and Deaf in Cape Coast in the Central regional capital in 2019.

Unlike other financial institutions whose CSR projects are only concentrated in the southern parts of the country, First Atlantic Bank’s CSR projects are evenly distributed across the country.

For instance, the bank handed over a fully equipped Mother and Baby Care Unit to the people of Talensi in the Upper East Region in 2018 to provide access to better health care to enhance the general wellbeing of women and children in the community.

What does the bank stand for?

Indeed, the First Atlantic Bank which is a full-scale commercial bank with over 25 years’ experience in the country originally founded as a merchant bank.

It became a universal bank in 2011 with an expanded product portfolio. The bank has won several awards recognizing its excelling leadership in customer care, trade finance and corporate banking.

The First Atlantic Bank, which has 35 conveniently located branches and over 40 ATMs dotted across the country, offers excellent and distinctive service in retail, corporate and institutional banking as well as private banking and electronic banking.

WEDNESDAY, SEPTEMBER 28, 202214 | NEWS

Core dangers for the Fed and China

By Stephen S. Roach

It is tempting to give America’s Federal Reserve great credit for its recent about-face in tackling inflation. It is equally tempting to give Chinese President Xi Jinping great credit for his stewardship of a rising and strong China. But neither deserves it – and for a similar reason.

That is certainly true of today’s Fed. Yes, the US central bank has now hiked the federal funds rate (FFR) by 75 basis points three times in a row – the sharpest increase in the benchmark policy rate over a four-month period since early 1982. Predictably, many politicians and pundits are howling in protest, warning of the risks of overkill. I disagree. It was past time for the Fed to start digging itself out of the deepest hole it has ever been in.

My emphasis is on the word “start.” The nominal FFR, now effectively at 3.1%, remains five percentage points below the three-month average of the headline CPI inflation rate of 8%. Notwithstanding the Fed’s newfound determination to arrest a serious outbreak of inflation, it is all but impossible to accomplish that objective with a sharply negative real FFR of around -5%.

Fed Chair Jerome Powell has now conceded that a restrictive monetary policy will be needed to tame inflation. Let’s decode what that means. Based on the headline CPI, the neutral policy rate – basically an average of the real FFR from 1960 to 2021 – is +1.1%. Restrictive, by definition, must be a number greater than neutrality; for

the sake of argument, call it a 2% real FFR. With the real FFR at -5%, the Fed is not even close to being neutral, let alone restrictive.

This is where the debate gets tricky: Powell asserted during his September 21 press conference, that Fed policy is now in the lower end of the restrictive zone. He framed that judgment through the lens of underlying inflation measured by the so-called “core personal consumption deflator,” which excludes food and energy. Annual core inflation on this basis was running at 4.6% through July.

This is a disappointing observation for two reasons: The nominal FFR is still well below Powell’s favorite inflation metric, and, more seriously, the Fed’s fixation on core inflation is dangerous. That latter point was true in the early 1970s, when I was part of the Fed’s staff that created the core, and it is also true today.

The very premise of the core is to dismiss major price shocks as transitory, just as Powell initially did. I am still haunted by the “original sin” of my first boss, Fed Chair Arthur Burns, who ignored one transitory shock after another some fifty years ago until it was far too late. The painful lesson: A Fed that lives by the core can die by the core.

For China, the “core” is less about inflation and more about the personal dimension of leadership. Xi Jinping, China’s self-anointed “core leader,” is at the crux of an extraordinary regression in Chinese governance. Unlike the “reform and

opening-up” policies that began under Deng Xiaoping over four decades ago, the heavy hand of the Xi-centric Communist Party is now everywhere. That is especially the case with the regulatory assault on internet-platform companies – long the leading edge of China’s dynamic private sector – as well as in the new push toward income and wealth redistribution under the guise of Xi’s “Common Prosperity” campaign.

I stand by my initial assessment of the combined impact of these developments: the emergence of an “animal spirits deficit” that could inhibit Chinese entrepreneurial activity, new startups, indigenous innovation, and productivity. With an aging China now hitting the demographic wall sooner than most observers, including me, had feared, the lack of a productivity offset is all the more disturbing in constraining the economy’s growth potential. The same can be said for China’s untapped consumers. The animal spirits deficit can only reinforce their concerns about an uncertain future, perpetuating the fear-driven precautionary saving that has long inhibited Chinese consumption.

The Fed’s fixation on core inflation and the overreach of China’s core leader have one important feature in common: susceptibility to major policy blunders. To the extent that monetary policymakers continue to be misled by an inflation problem that proves to be more intractable than a focus on core inflation suggests, they and the financial

markets are underestimating the ultimate monetary tightening that will be required to return inflation to a 2% target.

I suspect that the nominal FFR may well have to rise into the 5-6% zone to accomplish that task, implying that the Fed may be only about halfway into its inflationcontrol campaign. That spells recession in the United States in 2023, which comes on top of the downturn already evident in Europe. China, currently in the midst of an unusually sharp slowdown, is unlikely to be an oasis of growth. A global recession next year is all but inevitable.

To the extent that China’s core leader is blinded by a fixation on ideology and control and unprepared for the harsh economic climate that lies ahead, his troubles may be only just beginning. That is an ironic prospect only a few weeks ahead of the 20th Party Congress, which is widely expected to bestow on Xi an unprecedented third fiveyear term as China’s leader.

Just as a fixation on core inflation can mislead central banks, the power of a core leader is a recipe for misdirected and ultimately unsustainable policies. The very notion of a core lends a false sense of precision to solutions of complex and tough problems. That is true of both inflation targeting and national governance. The core fixation is just as dangerous for America as it is for China – to say nothing of the shared vulnerability that is driving a worrisome and growing conflict between them.

WEDNESDAY, SEPTEMBER 28, 2022 15| FEATURE

Will Ghana attract two million tourists by 2024?

The President of the republic of Ghana Nana Addo Dankwa AkufoAddo has officially opened the National Museum Gallery which was closed for refurbishment in 2015. Prior to its closure, a Business &Financial Times reportage informed us all that both local and foreign tourists were shunning museums in the country due to their poor state and inadequate artefacts – with one Ghanaian visitor to the National Museum calling it a “national disgrace” “The national museum is a disgrace to the nation for such an educational edifice to be neglected. Many of the things in there are so primitive and only highlight certain cultures, and that does not speak well of us’. Fortunately, government decided to refurbish the museum and it is back to its best. The facility, located on the premises of the Ghana Museums and Monuments Board in Adabraka, Accra, had not seen any major refurbishment since it was first opened in 1957 in commemoration of Ghana’s Independence Day. Some additions have been made to the already existing things to see. Let’s all take for hours off and visit the National Museum. That will also be our little way of supporting domestic tourism.

During the launch, The President challenged the Ministry of Tourism and Creative Arts and it implementing agencies to work towards achieving 2 million international arrivals by 2024, with expected revenue of $4 billion by the year 2024. This is indeed a daunting task put upon the ministry. Less than two years to work towards doubling the numbers we enjoyed prior to COVID-19 pandemic. No matter how ambitious this target may be, I’m somehow skeptical this target may be achieved. Below are some of the possible reasons.

1. We have been affected by COVID-19 pandemic since 2019 and a rebound is just on the horizon. Tourism expects predicted that the rebound may not really take place until the middle of 2023. The COVID-19 pandemic reduced international travel by 80 % according to figures provided by UNWTO. A vaccine has been put in place and tourists are gradually gaining confidence and many nations have come to accept the fact that we may have to live with COVID-19. Many international tourists may still not perceive Africa and Ghana as the safest place to visit yet and may prefer taking tours closer to them despite a vaccine being in place. A reasonable alternative is intra-Africa tourism which is still not very successful on the

continent and there are many reasons. One which comes to mind immediately is the fact that there is still a large part of the population struggling to make ends meet and are unable to earn a discretionary income. Tourism is perceived as an expensive activity on the continent and that may deterred many Africans. Africa’s working class do not also enjoy paid up holidays entitlements as part of their working conditions.

2. With international growing economic hardship and the increases in fuel prices globally, I cannot foresee a drastic increase in the number of arrivals in Ghana. According to statistics from UNWTO, Africa enjoyed 5% of all international arrivals and on the African continent, some of the top receiving countries include South Africa, Kenya, Morocco, and Egypt. Ghana needs to compete with these top preferred destinations which will become difficult even more difficult. The WTTC’s latest annual research shows that Following a loss of almost

slow the rebound could be.

3. According to the UNWTO report, the number one reasons for travel and tours to Africa are for wildlife, followed by culture and Heritage. When it comes to wildlife, Ghana is at a disadvantage compared with other competing countries on the continent and that becomes a challenge. Culture and heritage is the preferred advantage for Ghana yet the greatest success was during the year of return and the best we could achieve was a little over 1 million. With many tourist having lost their jobs and incomes having been affected especially in North African which is the number one generating country according to data from WTTC, It will becomes difficult increasing the numbers to 2million unless something unexpected happens.

4. Many countries who have developed their tourism and succeeded have depended on domestic spending. A WTTC report further revealed that, domestic tourism continues to represent about 73% of the

are still not easily accessible due to the nature of the poor roads and to achieve our target a facelift of roads leading to all major attractions will need to be considered.

6. One reason why Europe enjoys more than 50% of all international arrivals is due to the well-developed transportation system. This makes traveling easy and affordable. Tour Operators are thus able to package very affordable tours. On the contrary, connecting flights on the African continent is very cumbersome and expensive. Until this challenge is resolved, a large number of African and international tourists will be dissuaded.

7. The top tourism generating countries to Ghana per the latest report from WTTC indicate as follows;

• United States 32%

• Nigeria 18% 3.

• United Kingdom 13%

• Côte d’Ivoire 9%

• Germany 7% We therefore have two from West Africa, two from Europe and The USA. The US market is dominated

by US$1 trillion (+21.7% rise) in 2021.

• In 2019, the Travel & Tourism sector contributed 10.3% to global GDP; a share which decreased to 5.3% in 2020 due to ongoing restrictions to mobility. 2021 saw the share increasing to 6.1%.

• In 2020, 62 million jobs were lost, representing a drop of 18.6%, leaving just 271 million employed across the sector globally, compared to 333 million in 2019. 18.2 million Jobs were recovered in 2021, representing an increase of 6.7% year-on-year.

• Following a decrease of 47.4% in 2020, domestic visitor spending increased by 31.4% in 2021.

• Following a decrease of 69.7% in 2020, international visitor spending rose by 3.8% in 2021. The above data shows how

between countries, domestic contributions to Travel & Tourism reached 94% in Brazil and 87% in India, Germany, China and Argentina; with China accounting for 62% of global absolute growth in domestic spending over the past ten years. This growth has enabled China to climb from fourth position in 2008 to the top spot, overtaking the USA to become the largest domestic travel market in the world. Unfortunately for Ghana domestic spending is still not encouraging. Local tourists hardly make use of paid up accommodation especially on travels for funerals.

5. Government intend refurbishing a number of tourist site which is a good initiative, however the success of any destination is dependent on the 3As i.e. attractions, amnesties, and accessibility. Many attractions

by the diaspora who visit mostly for heritage tourism. We need to ensure that we grow the Nigeria and Cote d’ivoire market if we are to increase our arrivals. These are our neighbors and we must take advantage and also tap into the East African and Southern African Markets.

Philip Gebu is a Tourism Lecturer. He is the C.E.O of FoReal Destinations Ltd, a Tourism Destinations Management and Marketing Company based in Ghana and with partners in many other countries. Please contact Philip with your comments and suggestions. Write to forealdestinations@gmail. com / info@forealdestinations. com. Visit our website at www.forealdestinations. com or call or WhatsApp +233(0)244295901/0264295901.

Visist our social media sites

Facebook, Twitter and Instagram: FoReal Destinations

WEDNESDAY, SEPTEMBER 28, 202216 | NEWS

WEDNESDAY, SEPTEMBER 28, 2022 17| FEATURE

WEEKLY MARKET REVIEW FOR WEEK ENDING - SEPTEMBER 23, 2022

MACROECONOMIC INDICATORS

Q3, 2021 GDP Growth 3.3%

Average GDP Growth for 2021 3.3%

2022 Projected GDP Growth 3.7%

BoG Policy Rate 22.0%

Weekly Interbank Interest Rate 22.10%

Inflation for February, 2022 33.9%

End Period Inflation Target – 2022 28.5%

Budget Deficit (% GDP) – Dec, 2021 5.0%

2022 Budget Deficit Target (%GDP) 6.6%

Public Debt (billion GH¢) – Dec, 2021 393.4%

Debt to GDP Ratio – Dec, 2021 78.3%

STOCK MARKET REVIEW

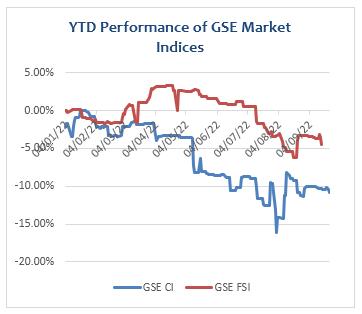

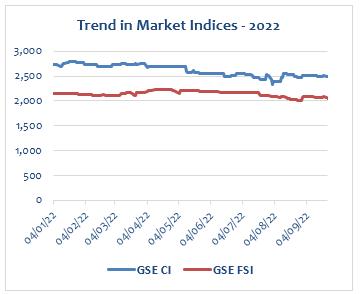

The Ghana Stock Exchange closed lower for the third consecutive week on the back of price declines by 4 counters. The GSE Composite Index (GSE CI) lost 11.69 points (-0.47%) to close at 2,488.21 points, reflecting year-to-date (YTD) loss of 10.80%. The GSE Financial Stocks Index (GSE FI) also lost 17.69 points (-0.85%) to close at 2,055.64 points, reflecting YTD loss of 4.47%.

Market capitalization declined by 0.19% to close the week at GH¢64,279.00 million, from GH¢64,401.07 million at the close of the previous week. This reflects YTD decrease of 0.34%.

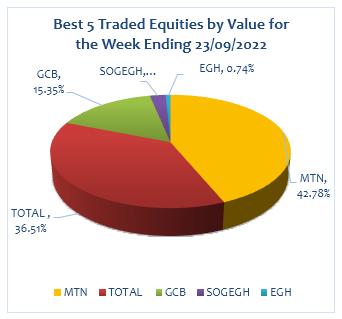

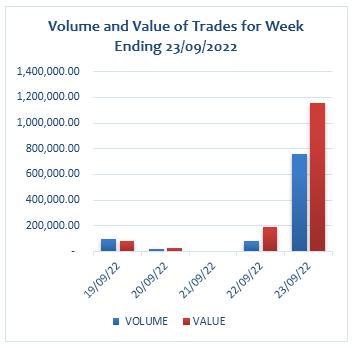

Trading activity recorded a total of 953,819 shares valued at GH¢1,460,375.70 changing hands, compared with 11,666,517 shares, valued at GH¢12,084,263.04 in the preceding week.

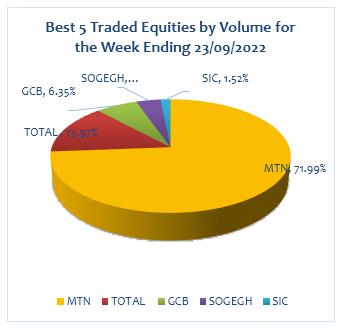

MTN dominated both volume and value of trades for the week, accounting for 71.99% and 42.78% of shares traded respectively.

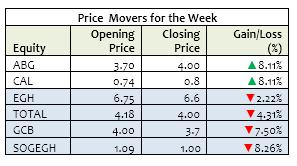

The market ended the week with no advancer and decliner as indicated on the table below.

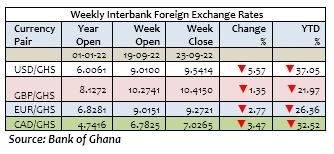

THE CURRENCY MARKET

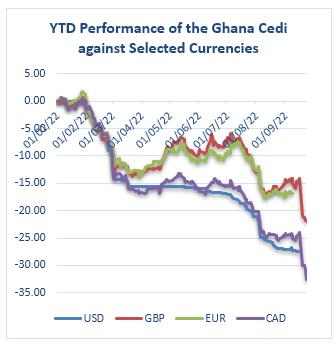

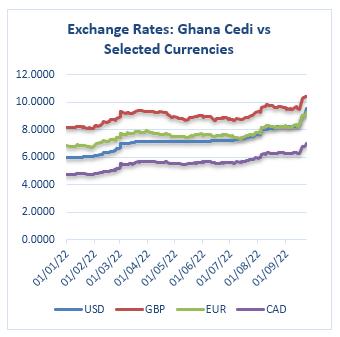

The Cedi weakened against the USD for the week. It traded at GH¢9.5414/$, compared with GH¢9.0100/$ at week open, reflecting w/w and YTD depreciations of 5.57% and 37.05% respectively. This compares with YTD depreciation of 1.78% a year ago.

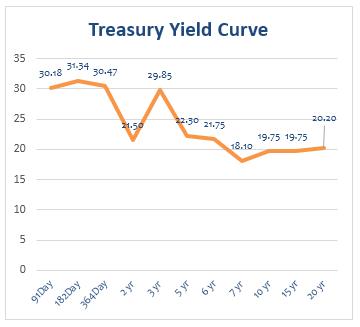

The Cedi also weakened against the GBP for the week. It traded at GH¢10.4150/£, compared with GH¢10.2741/£ at week open, reflecting w/w and YTD depreciations of 1.35% and 21.97% respectively. This compares with YTD depreciation of 1.77% a year ago.