LEADING AN INDUSTRY IT EXEMPLIFIES

TERRY ANDERSON OF ARC RESOURCES LTD. ON HIS COMPANY’S SUCCESS IN ALBERTA OIL AND GAS

OF ENERGY

VOL 5, ISSUE 2 | APRIL 2023

04

Kudos to Canada’s Municipalities for Encouraging Energy Fairness

By Cody Battershill06

“Just Transition” – Sustainable Jobs Cannot Be Disconnected From Fundamental Economics

By David Yager10 Cover: Leading an Industry it Exemplifies

By Melanie Darbyshire16 Empowering the Energy Evolution: Westgen’s Mission to Revolutionize Methane Emissions in the Oil and Gas Industry

PUBLISHERS

Pat Ottmann & Tim Ottmann

EDITOR

Melanie Darbyshire

COPY EDITOR

Nikki Mullett

ART DIRECTOR

Jessi Evetts jessi@businessincalgary.com

ADMINISTRATION/ACCOUNTING info@businessincalgary.com

THIS ISSUE’S CONTRIBUTORS

Melanie Darbyshire

David Yager

Cody Battershill

COVER PHOTO Riverwood Photography

ADVERTISING SALES CALGARY

Evelyn Dehner evelyn@businessincalgary.com

Melissa Mitchell melissa@businessincalgary.com

Courtney Lovgren courtney@businessincalgary.com

Brittany Fouquette brittany@businessincalgary.com

ADVERTISING SALES EDMONTON

Nikki Lacroix nikki@businessinedmonton.com

Mark McDonald mark@businessinedmonton.com

Brent Trimming brent@businessinedmonton.com

EDITORIAL, ADVERTISING & ADMINISTRATIVE OFFICES

1025, 101 6th Ave. SW Calgary, AB T2P 3P4

Tel: 403.264.3270 | Fax: 403.264.3276

Email: info@businessincalgary.com

The publisher does not assume any responsibility for the contents of any advertisement, and all representations of warranties made in such advertising are those of the advertiser and not of the publisher. No portion of this publication may be reproduced, in all or in part, without the written permission of the publisher. Canadian publications mail sales product agreement No. 41126516. COVER

KUDOS TO CANADA’S MUNICIPALITIES FOR ENCOURAGING ENERGY FAIRNESS

BY CODY BATTERSHILLNo matter how you slice it, suppliers that sell into a global energy market have earned the right to a fair shake and a level playing field.

For years, our organization has publicly encouraged Canadian policy makers at every level to consider taking a stand on Canada’s superb reputation as an oil and gas supplier.

We’ve suggested Canada deserves recognition for its strong commitment to environmental, social and governance standards that are as high as – or higher than – those of any of our competitors.

With our abundance of natural resources, our great wealth of technical knowledge, and our total commitment to environmental stewardship, safety and human rights, activists regularly block and oppose Canadian pipeline projects from reaching completion.

But those same activists turn a blind eye to less reputable regimes that supply Canada with energy products, all with apparent impunity.

LOCAL GOVERNMENTS SEE THE BIG PICTURE

I’ve made the argument before that this lack of fairness undermines our own energy security, threatens the resilience of Canadian workers, families and communities – both Indigenous and non-Indigenous – and only hurts the global climate.

So it’s the perfect time to update readers on a key initiative that’s been underway for years among our hard-working municipal government officials and their Canadian network, the Federation of Canadian Municipalities (FCM). Kudos to Whitecourt councillor Paul Chauvet and his colleagues for really championing this important initiative.

The good news is the initiative, a resolution that calls on the federal government to promote and encourage the consumption of Canadian oil and gas as Canada transitions to net zero emissions by 2050, has passed and is now official FCM policy. Earlier this year, the finalized policy was sent in a letter from FCM president and Vegreville councillor Taneen Rudyk to Federal Minister of Natural Resources Jonathan Wilkinson.

Most importantly, the policy also calls on the federal government to ensure that all oil and gas that’s imported and consumed in Canada meets the same stringent environmental, governance and social standards that Canadian oil and gas producers must adhere to.

FCM president Rudyk points out in the letter to the federal minister that her organization has consistently supported Canada’s net-zero emissions goal by 2050, and that it “continues to encourage the federal government to put local communities in oil and gas producing regions at the very heart of energy and climate policies.

“Local leaders see up close how broad national challenges like climate change and economic uncertainty play out in people’s daily lives, and we know what is needed to meet these challenges on the ground, where Canadians live, work and raise their families,” Rudyk’s letter adds.

ONE GOOD THING LEADS TO ANOTHER

It’s been gratifying to see this important resolution gain the backing of Alberta municipalities from Lloydminster, Wood Buffalo and Flagstaff County, to Drayton Valley and Whitecourt – not to mention communities in B.C., Saskatchewan and Ontario. With nearly 2,100 municipalities of all sizes

representing more than 92 per cent of Canadians, the FCM is perfectly positioned to build a bridge between the views of local political leaders and federal policymakers.

It may even be the case that the FCM is already influencing its senior-level counterparts on how they think about energy. Here’s how Deputy Prime Minister and Minister of Finance Chrystia Freeland described the Canadian energy sector in a CBC interview a few months ago:

“It’s a good opportunity for me to point out to people across the country…our entire economy is reliant on the energy sector. The energy sector is such a big part of our GDP, it is a huge part of our exports, and it is very, very important for our current account balance. So I really understand the importance of the energy sector.”

It’s a positive development that the new FCM policy places the foreign producer on the same footing as the Canadian one. At the end of the day, it seemed reasonable to FCM delegates

that, if Canadians are to be held to a higher standard, then there would have to be a level playing field for locally-produced natural resources to compete and to provide benefits to local families, communities, public programs and the planet.

Congratulations to the FCM for understanding that fair treatment of oil and gas in Canada means a competitive environment for Canadian product, and a better shake for the global environment, health, safety and human rights.

As long as the world is clamouring for oil and natural gas, then Canada, with its strong reputation for environmental, social and governance standards, has earned the right to full participation in meeting that demand. BOE

Cody Battershill is a Calgary realtor and founder / spokesperson for CanadaAction.ca, a volunteerinitiated group that supports Canadian natural resources sector and the environmental, social and economic benefits that come with it.

“JUST TRANSITION”SUSTAINABLE JOBS CANNOT BE DISCONNECTED FROM FUNDAMENTAL ECONOMICS

BY DAVID YAGER

BY DAVID YAGER

As politicians dominate the public narrative on jobs and job creation, this critical element of human existence is increasingly disconnected from economics.

Jobs require money. You can’t have the former without the latter.

The definition of a “job” is “a paid position of regular employment.”

“Paid” is a commercial buy/sell transaction.

Every time anyone is hired it is “job creation.” This is fundamental economics, not genius public policy.

There are two kinds of jobs.

One is the labour essential for private sector wealth creation like resource extraction, manufacturing, communications or transportation.

These jobs are “value added,” because what comes out is worth more than what goes in.

The other is hiring in the public sector, jobs funded by taxes or user fees levied on business and individuals.

Calculating the “value added” is more challenging. Governments can indeed change policies or be a catalyst to stimulate private sector investment and jobs.

But everything governments do that increases employment is done with somebody else’s money.

Cutting taxes is a proven job creator. Raising taxes does the opposite.

As a resource producing nation, many Canadian jobs are notoriously cyclical. Employment in oil and gas rises and falls with commodity prices.

However, when prices rise and industry goes back to work, the government of day it quick to take credit for “creating” the new jobs.

Thankfully, policies that intentionally cap or eliminate resource jobs are a new phenomenon. Otherwise Canada wouldn’t exist in its current form.

Statistics Canada data shows that the primary job creation success of governments has been increasing the size of the public service.

In 2015, there were 35.7 million Canadians. In January, StatsCan calculated 48.3 per cent of citizens were working in either the public sector, private sector or were self-employed. The split was 3.5 million public, private 11.6 million, and selfemployed 2.7 million.

In January of 2023 there were 39 million Canadians, an increase of 6.3 per cent. A total of 51.4 per cent were classified as employed in one of three categories. The split was 4.2 million public, 13.2 million private, and 2.7 million self-employed.

Over eight years public sector employment had increased by 21.6 per cent and the private sector only 13.3 per cent. Self-employed rose by only 0.5 per cent.

Asaresourceproducing nation,manyCanadian jobsarenotoriously cyclical.Employmentin oilandgasrisesandfalls withcommodityprices.

Public debt is at record levels. More job killing tax increases are inevitable.

Which brings us to the “Just Transition” employment program released by the federal government in February. It was renamed “Sustainable Jobs Plan” after numerous complaints.

But no job is truly sustainable. In business, jobs in companies without profits are always at risk.

Public sector jobs are sustainable only because governments retain the sovereign right to tax almost anything. When expenditures exceed revenue, governments then borrow against future taxes.

Anyone who thinks public sector jobs are sustainable as interest rates and debt rise – and corporate earnings and consumer taxable incomes decline – should think this through.

In the energy transition plan, Ottawa has a specific definition of sustainable. The program “… understands a ‘sustainable job’ to mean any job that is compatible with Canada’s path to a net-zero emissions and climate resilient future.”

Which means that other jobs in high carbon sectors are, by default, unsustainable. The correct

description should be job replacement. The term Just Transition is another feel good slogan to help those who force people to lose their jobs for the greater benefit mollify guilt.

Fundamental to Ottawa’s views on employment disruption is that a job is a job no matter who pays the salary, or if it creates wealth and corporate taxes.

But as noted above, private and public sector employment are different.

Whenever the job narrative is politicized and disconnected from economics, outcomes congruent with the stated intent or aspirations are unlikely.

The subtitle of Ottawa’s plan is “concrete federal actions to advance economic prosperity and sustainable jobs in every region of the country.”

Except this concrete is only aggregate and water. There’s no cement to bond them together.

A basic test for actual “economic prosperity and sustainable jobs” starts with scanning the document to review the language and words employed.

Export. Balance of payments. GDP. Extractive resources. Wealth creation. Disposal income. Taxes. Taxation. Deficit. Debt. Savings. Retirement.

Not one of them appear in the 32 pages. The document focuses on the federal climate plan, comforting words about the wonderful opportunities in changing jobs and careers, and how the government has your back.

A key assumption is that the so-called energy transition is real, and that the Liberal climate strategy will unfold as advertised.

But in this plan, oil and gas jobs are doomed. It’s just a matter of time.

It cites the International Energy Agency’s Net Zero by 2050 oil demand case. The NZE mission is determined by public policy. The unanswered question is how. Right now the primary means to emit less carbon is to radically reduce hydrocarbon consumption.

The document states, “With the right plans in place, the road to a 2050 net-zero emissions economy will secure and create good, well-paying jobs for Canadians in every part of the country… according to the International Energy Agency’s (IEA) net-zero emissions by 2050 scenario (NZE), could create almost 40 million new jobs in clean energy by 2030.”

It continues, “…in a 2050 net-zero world, according to the IEA’s NZE scenario, the world will still use about 25 million barrels of oil in 2050 – which is about a quarter of today’s consumption.”

However, OPEC has an entirely different view. OPEC countries sell oil to the 6.7 billion people who don’t live in the OECD countries that bankroll the IEA. They forecast oil demand in 2045 to be eight per cent higher than current levels based on world population and GDP growth.

The IEA scenario for Alberta is devastating. If the world is going out of the oil business, so is one of the world’s top producers – Canada.

But what is not referenced, or perhaps even understood, is that replacing oil and gas with electricity will result in the significant contraction of Alberta’s economy. The only reason 4.4 million people live in Alberta is because of massive oil and gas exports across North America.

Of the 3.7 million barrels per day (b/d) of oil produced in 2022, the Alberta Energy Regulator reports local consumption of refined products for transportation was only 113,000 b/d, or three per cent of total output.

Alberta refineries processed 515,000 b/d last year. What is not consumed locally is exported. The Trans Mountain pipeline carries refined gasoline and diesel fuel to the west coast.

The other 3.2 million b/d – 86 per cent – is shipped west, south and east for processing into a myriad of products. Alberta’s oil goes to the northwest U.S., east as far as Montreal, the U.S. Midwest, or the giant refining and export hubs of Gulf Coast of Mexico.

If world demand falls by 75 per cent, simple math indicates that 75 per cent Alberta’s oil jobs will disappear.

But they will not be replaced by clean energy jobs. They can’t. That’s because there is no export market for electricity on the scale of oil or natural gas. All the regions that buy our hydrocarbons exports already have electricity.

Exporting electricity is only possible with big hydro facilities like those in Quebec or B.C., or giant nuclear power plants. And that power must be delivered 24/7/365.

Nobody is going to install solar panels or wind turbines in Alberta to supply interruptible electricity to the U.S.

Then there’s the big taxes that hydrocarbon extraction generates. While it is fashionable to

Buttheywillnotbereplacedbycleanenergyjobs. Theycan’t.That’sbecausethereisnoexportmarket forelectricityonthescaleofoilornaturalgas.Allthe regionsthatbuyourhydrocarbonsexportsalready haveelectricity.

claim fossil fuels are subsidized – and fashionable for the economically delinquent to believe it – the taxes from oil and gas are huge.

Why? Because hydrocarbons are produced for a fraction of their market value. That’s the definition of value-added wealth creation.

Oil production is taxed immediately through royalties, then taxed again at the gas pump when it sold as gasoline or diesel fuel. Because production is profitable, producers pay corporate income taxes. Well paid workers pay big income taxes. The massive oil service and supply chain is profitable most years and is taxed at every level.

Producers pay property taxes and lease rentals for the land they use.

Low carbon energy sources cannot replace what hydrocarbon production pays in municipal, provincial, federal, corporate, income, and excise taxes, PST and GST, or dividends to shareholders.

Hydrocarbons are a cash generating machine

for the countries fortunate enough to own them. Exports of oil and gas are a source of wealth most nations in the world can only dream about.

Economics website https://www.ibisworld.com/ estimates that Canada’s top 10 exports in 2023 will generate $233.8 billion in revenue. Oil and gas extraction and petroleum refining alone (ranking 1st and 4th) will account for $124.8 billion, or 53 per cent.

This will contract or disappear by 2050 if the IEA predictions are correct. There is nothing in the low carbon energy portfolio to replace oil and gas in terms of GDP, taxes or employment.

All jobs are fundamentally economic. Sustainable jobs come from wealth creation and workable plans, not political aspirations.

Pay attention, Canada. BOE

David Yager is a Calgary oil service executive, energy policy analyst, writer and author of From Miracle to Menace – Alberta, A Carbon Story.

LEADING AN INDUSTRY IT EXEMPLIFIES

by Melanie DarbyshireIn Alberta’s energy industry, adaptability is key to business survival. Change – in commodity cycles, technological advancements, regulatory requirements, geopolitical realities – is inevitable, and those companies who transform along with that change are not only more likely to survive, they also often thrive. By turning apparent challenges into opportunities, they grow and evolve, not without struggle and setback, to become seasoned and stronger.

Just ask ARC Resources Ltd. president and CEO Terry Anderson. His company’s 26-year history spans a timeframe that saw every change imaginable, from major tax law changes that forced a transformation of the business structure (from trust to corporation), to revolutionary technological advancements (horizontal drilling and multi-stage frac), to commodity prices sliding and bottoming out (during the COVID-19 pandemic).

Through it all, a disciplined approach has underpinned ARC’s success. “When we talk about discipline, we mean making risk managed decisions all the time,” Anderson offers. “We have always focused on having a strong balance sheet and profitability. We never want to put the company in a position to be jeopardized when the downturn hits. It’s about managing risk to create value.”

Anderson, a petroleum engineer, started with ARC 23 years ago. At that time, the company’s production was around 20,000 BOE per day. Today, it’s 350,000 BOE per day. “Back then we had 50 employees,” he recalls. “Now we’re closer to 725 employees. The company has obviously changed considerably over that time.”

ARC was formed as an energy trust in 1996. When the federal government changed the tax rules, the company became an oil and gas exploration company. “That was a big switch for us at that time,” says Anderson. “It meant that if we wanted to survive and thrive, we needed to divest out of our old conventional assets and get into the new, big resource plays.”

And that is exactly what ARC did when, in 2005, it drilled the first horizontal well in the Montney. The team was led by Anderson. “That kicked off the whole Montney boom,” he recalls. “We acquired significant acreage in the Montney and continue to drill and explore there, while at the same time divesting out of our old conventional assets. We became experts in the Montney and that’s where we continue to focus the company and grow our production today.” Currently, ARC has assets in both northeast B.C. and Alberta.

ARC’s merger with Seven Generations Energy Ltd. (a Montney player as well) in 2021 means that today the combined company is the largest Montney producer, the largest condensate producer and the third largest natural gas producer in Canada. “The merger was the largest and most transformational deal in ARC’s history, doubling our production and

making us a larger, more efficient and profitable company,” Anderson notes.

Backed by this scale, strong ESG performance and a balanced production profile that includes 60 per cent natural gas, ARC is well positioned to be an LNG partner of choice. It currently has two natural gas supply deals (one on the U.S. Gulf Coast with Cheniere Energy, Inc. and one with an LNG Canada proponent).

“We believe in the energy diversification happening around the world,” Anderson offers. “It’s our role, as a Canadian energy producer, to play a part. With LNG, we’re actually helping to lower emissions globally. It’s the reliable, affordable and secure energy that the world is looking for. We believe that the LNG business is going to continue to grow significantly.”

He notes global LNG demand is expected to grow from the current 50 BCF per day to 100 BCF per day by 2040.

“Canada’s oil and gas industry is the most responsibly produced oil and gas in the world,” he continues. “We have strong regulations in place. We have been focused on emissions for decades already. We have an abundance of resource that the world is asking for.”

He notes countries like China, with the greatest emissions globally (largely due to burning coal), could really benefit from Canada’s LNG: “We’ve been trying to educate on this fact, and I think we’ll get there as a country, but it’s just taking longer with the federal government. Because although renewables are important, they cannot just replace oil and gas overnight.”

Over the last decade, he points out, there has been $3.8 trillion invested in renewables, yet oil and gas, as a proportion of the world’s energy consumption, has only moved from 82 to 81 per cent.

“Canada’soilandgas industryisthemost responsiblyproducedoil andgasintheworld.We havestrongregulations inplace.Wehavebeen focused on emissions fordecadesalready.We have an abundance of resource that the world is askingfor.”Responsible development is core to ARC’s culture. Recently, ARC achieved EO100™ Certification on 100 per cent of the Company’s production representing the largest production base certified under this standard in Canada.

Make this year your most successful year yet, by joining the premier club for Calgary Business.

• Young Professional Memberships and Social Memberships available

• New multi corporate, transferable memberships available

• 15 meeting & event spaces, for corporate and personal events

• Exclusive Member networking events

• Business Centre & Brew 319 workspaces to get you out of your home office

• Connected to the +15 keeping you warm through winter with easy access to the club

• Award-winning Executive Chef, Joanna Astudillo

• 70+ Affiliated clubs to access

You Belong Here

You Belong Here

I joined the club as an opportunity to access varied hosting venues for corporate events - a room for every occasion! It has not only served well in that capacity, but provides a business community which fosters genuine relationships built upon connections at the CPC. I love being able to meet for coffee at Brew 319 - avoiding lines and trying to find one another - and then join jump into to a business lunch all in one efficient venue. CPC is Calgary business, the place where deals are made, in a welcoming atmosphere, with progressive and responsive management. The club continues to evolve, remain relevant and cater to current needs, compete with the Calgary food scene, create a COVID friendly environment, provide an office aw and it is the place in Calgary to host that special connection.

- Carey Arnett, President, Arnett & Burgess Pipelines Business Centre and Brew 319 Work Bar Member & Guest Monthly MixersARC has been focused on environmental excellence for many years, in particular on keeping its own emissions low. “From 2016 to 2020 we grew our production by 26 per cent,” Anderson says, “and over that same time period, we reduced our greenhouse gas emissions by 27 per cent.”

While that might not seem logical at first blush, Anderson explains it’s due to the company’s dual focus on growing production and on electrifying its facilities (owned and operated by ARC) through BC Hydro to reduce emissions.

Electrification was possible because, in addition to holding over 1 million acres of contiguous land holdings, ARC also owns and operates a large network of infrastructure. “We’ve always talked about controlling our destiny,” Anderson explains. “That’s why we want to build and operate our own facilities, always with ESG in mind. We electrify

our facilities in BC in partnership with BC Hydro in order to have lower emissions.”

Today, 100 per cent of ARC’s producing assets are certified under the Equitable Origin’s EO100™ Standard for Responsible Energy Development, making it the largest certified production base in Canada.

“In addition to managing the emissions profile, owning and operating our own infrastructure gives us better operational control, higher reliability and contributes to our low cost structure,” Anderson adds. “This cost structure has also been supported by our relentless pursuit of efficiency across all aspects of our business which has been a true passion of mine.”

Another benefit to owning and operating its own infrastructure is flexibility. “If natural gas prices are weaker we can actually cool down our facilities

Transformation to the Largest Pure-Play Montney Producer

Large concentrated asset base drives efficiency

2014

2022

AVERAGE PRODUCTION: 350 Mboe/d Alsoimportantarethe communitiesinwhichARC operates.Sinceinception, thecompanyhasdonated approximately$40million tovariouscommunity needsandinitiatives.“It’s alwaysbeenpartofARC’s culture,”Andersonsays.

AVERAGE PRODUCTION: 110 Mboe/d

else matters,” Anderson says. “If we hurt somebody, it doesn’t matter how successful from an operational or financial perspective we are, it’s a failure on our part. We make sure all our staff are engaged in our safety programs and involved in continuous improvements. We are very proud of our strong safety culture and our historic performance of eight years without an employee lost-time incident.”

and extract more liquids,” he says, “and if prices are stronger, we can warm up the facilities and produce natural gas for more value. It’s all about control to maximize profitability.”

Notwithstanding its success in creating shareholder value, safety is the first priority at ARC. “Nothing

Also important are the communities in which ARC operates. Since inception, the company has donated approximately $40 million to various community needs and initiatives. “It’s always been part of ARC’s culture,” Anderson says. “We talk about our values of trust, integrity, respect and community, and our culture of caring. We’ve always been focused on being a responsible energy producer. Being responsible also means giving back to the community, whether that’s Calgary, Grande Prairie, Dawson Creek or out in our field operations. We want communities to thrive.”

Firmly in control of its own destiny, ARC epitomizes all that is great about Alberta’s oil and gas industry. It deserves all the recognition – and success – it can get. BOE

EMPOWERING THE ENERGY EVOLUTION:

WESTGEN’S MISSION TO REVOLUTIONIZE METHANE EMISSIONS IN THE OIL AND GAS INDUSTRY

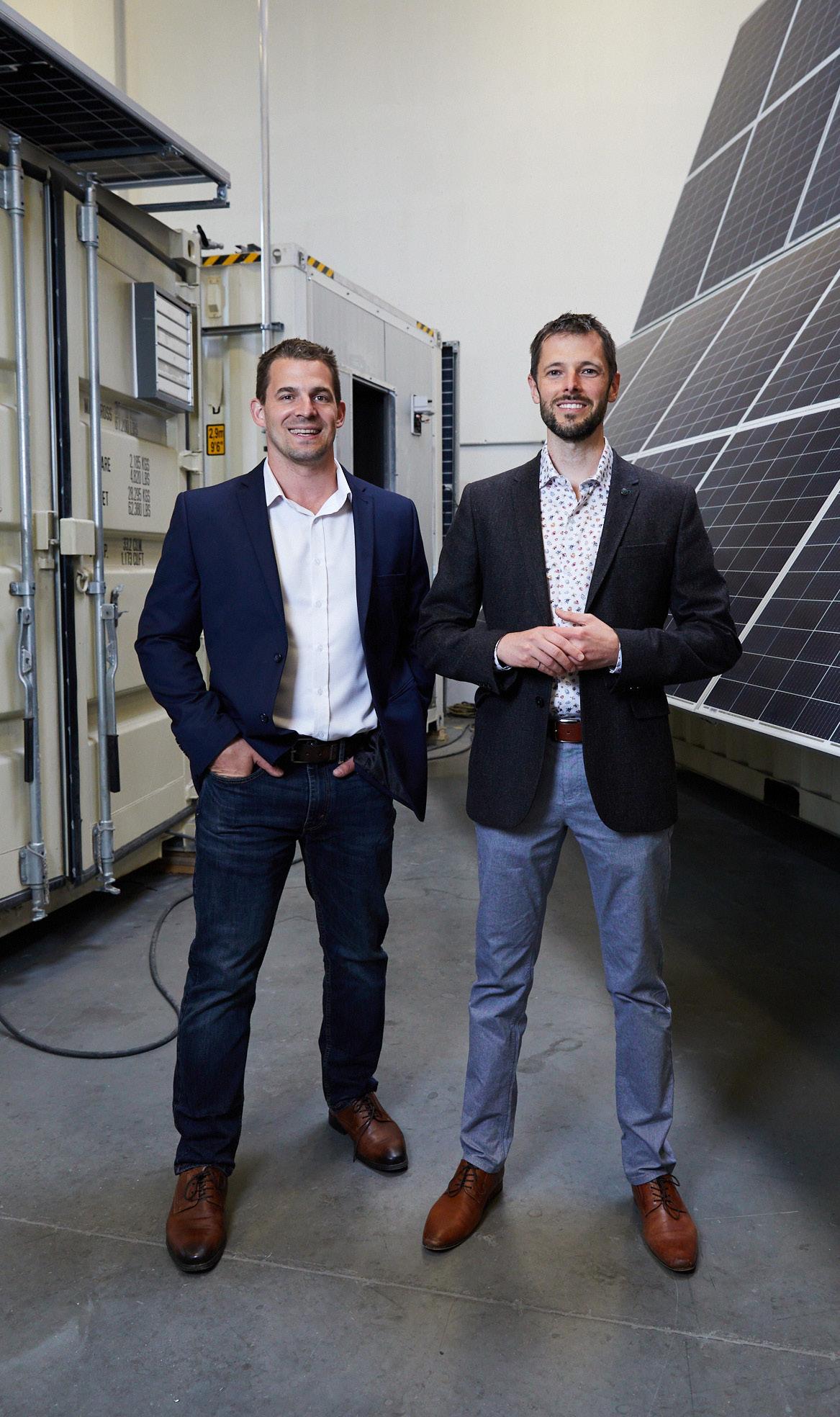

In the oil and gas industry, Westgen is bringing a breath of fresh air with their innovative approach to reducing methane emissions. Founded in 2019 by engineers Ben Klepacki and Connor O’Shea, Westgen’s mission is to empower the energy evolution by providing practical, scalable solutions that can be deployed on a wide scale to eliminate emissions today.

The Westgen story started with a serious accident on a wellsite. A field worker was injured when methane gas emissions vented from a pneumatic device caused a flash fire. There was no practical solution to eliminate these emissions at the time, but Ben and Connor felt that this was a problem worth solving. They pooled their savings, left their jobs and started Westgen.

In June of 2019, they built the prototype of the EPOD (Engineered Power on Demand), a solarhybrid power generation system designed to eliminate methane emissions from the energy industry. And in November of that same year, the first-ever EPOD was deployed to reduce emissions in northern British Columbia.

Since then, Westgen’s EPOD has gained rapid traction in the industry. The solar-hybrid power generation system provides an economic solution to eliminate methane emissions, reducing site emissions by up to 99.5 per cent. But beyond emissions reductions, the patented and awardwinning EPOD also reduces capital costs, improves reliability and generates carbon credits for oil and gas producers.

While there are less than 1,000 new wellsites developed in Canada each year, there are

hundreds of thousands of existing wellsites which emit methane gas to atmosphere through pneumatic devices. To address this problem, Westgen developed a new product called EPODMini, which launched commercially in February 2021 and quickly became the market-leading solution for pneumatics retrofits in Canada. To date, hundreds of EPODs and EPOD Minis have been sold to 50+ oil and gas producers across North America. Westgen’s innovative solutions have not gone unnoticed. The company has received numerous awards and recognition, including the Global Energy Award for Emerging Clean Technologies and the Calgary Chamber of Commerce Innovation Award.

But for Ben and Connor, the real reward is supporting the industry to reduce emissions intensity and to continue providing energy that the world needs. Each EPOD deployed reduces emissions from pneumatic devices by 99.5 per

cent, which in a typical application, is equivalent to reducing emissions from 250 cars to just one. The company’s big hairy audacious goal (BHAG) is to eliminate 50,000,000 tons of CO2e of emissions by 2030.

To achieve this goal, Westgen has continued to innovate and expand. They’ve signed agreements with two U.S.-based distributors and are poised to capture a significant percentage of the emerging retrofit market mandated by the U.S. Environmental Protection Agency. In the spring of 2022, the company raised $20 million in capital to scale faster and opened a 46,000 square-foot manufacturing facility in Balzac, Alberta.

In just four years, Westgen has established itself as a cleantech leader in North America, but they’re not stopping there. The world faces a great energy challenge, and Westgen is well-positioned to provide solutions the world needs. BOE