Inside this issue: Meet Russia's repo (wo)men Then they came for the foreign retailers‌ Murky business in Moldova

February 2015 www.bne.eu

Turkey tightens screws on critics A tenuous grip on the tenge Special Report Capital Markets Survey 2014

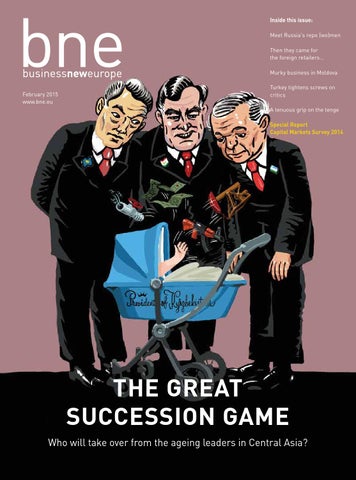

THE GREAT SUCCESSION GAME Who will take over from the ageing leaders in Central Asia?