2022 CO-CHAIRS

39th International Conference on the

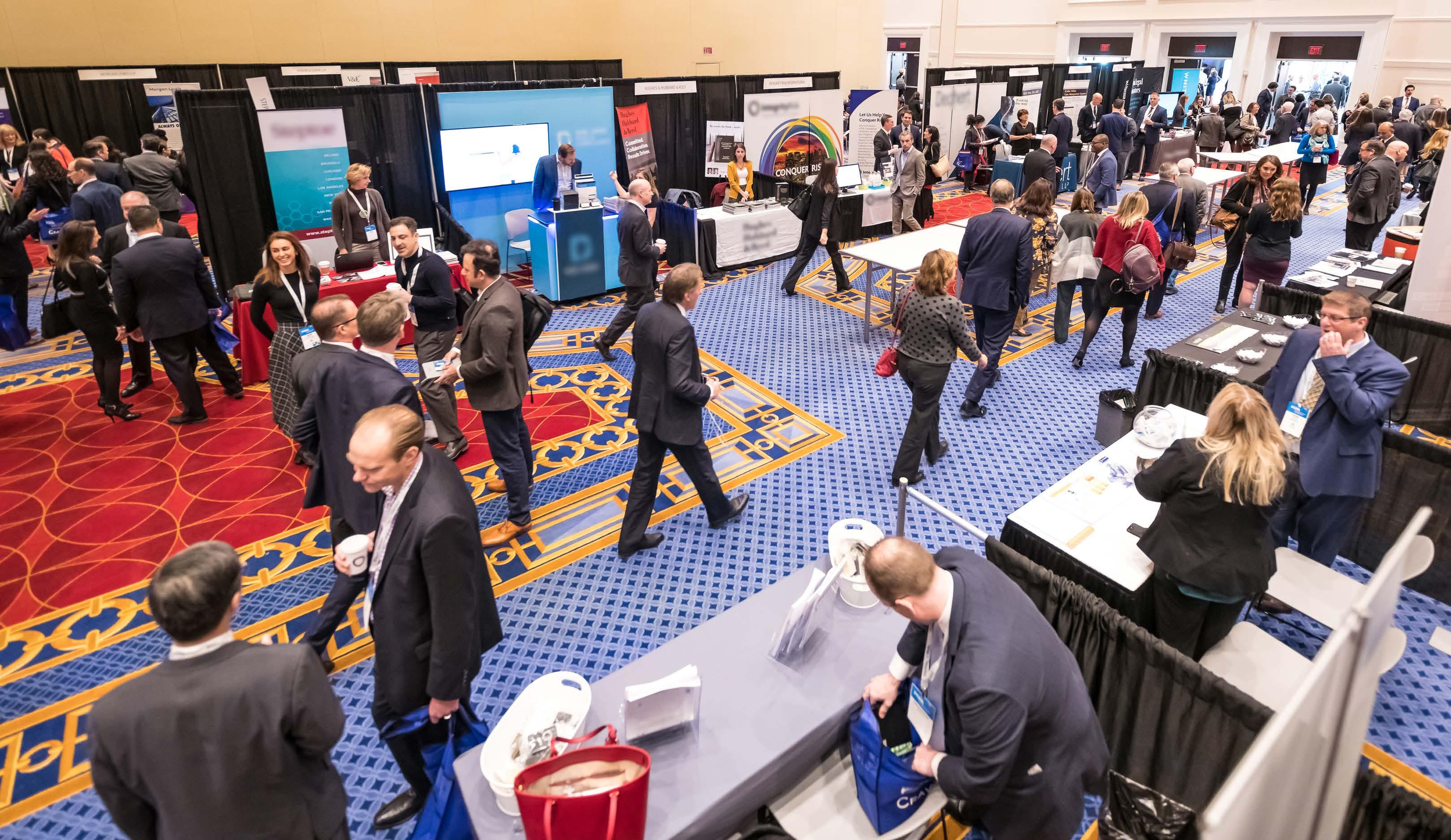

You get to hear from Government Officials on their latest thinking and what they are focusing on, and you get to hear from the best experts in the world on what are some cutting edge practices.

Excellent opportunity to discuss regulatory updates and exchange experiences with outstanding professionals.

The greatest benefit of attending the ACI conference is getting together with your peers, as well as prosecutors and regulators in an open forum. It’s a really great way to spur innovation.

Tuesday, November 29, 2022

PRE-CONFERENCE WORKSHOPS* (In-Person Only)

Workshop A | 9:30 am–1:00 pm

FCPA Boot Camp

Workshop B | 2:00 pm–5:30 pm

Third Party & Supply Chain Due Diligence, Monitoring and Risk Management

Tuesday, November 29, 2022*

8:30 am–5:30 pm

Wednesday, November 30, 2022

MAIN CONFERENCE DAY ONE

7:30 Registration & Breakfast 8:30 Opening Remarks from the Co-Chairs

FCPA YEAR IN REVIEW 8:45

PART I: DOJ Year in Review 9:15

PART II: SEC Year in Review

9:45 FCPA and National Security Series

MAIN CONFERENCE DAY TWO

7:30 Breakfast

8:30 Opening Remarks from the Co-Chairs

8:35 Special Interview

9:15

Compliance Under Pressure

10:30 Networking Break

Special Industry Groups (SIGs) Technology & Telecommunications Special Industry Groups (SIGs) Oil & Gas / Energy

PART I: Sanctions as the New FCPA: The Increasing Overlap of Anti-Corruption and Economic Sanctions

10:45 Networking Break

ACI’s 3rd Practical Guide to

12:00 pm–5:30 pm

Pre-Conference Registration 5:30 pm–6:30 pm

Networking Cocktail Reception

Practical Guide to FCPA Data Analytics *Pre-event workshops and FCPA Data Analytics are not included in Main Conference Price. *Some sessions may not be included in the livestream version of the conference. Please refer to agenda for details.

Special Industry Groups (SIGs) Defense & Aerospace International Risk & Compliance Exchanges Andean Region 11:15 Special Interview 11:45

The New Realities of Corporate and Individual Liability Risks: Defense Counsel Perspectives on the DOJ’s Enforcement Posture and the Path Ahead

12:45 Networking Luncheon 12:45 Women in FCPA Luncheon (by invitation only) 2:00 Special Interview 2:40 BREAKOUT SESSIONS A

TRACK 1: Interactive Benchmarking: Pressurized Compliance TRACK 2: Internal Investigations and Crisis Management

TRACK 3: International Think Tank Series: Spotlight on Brazil 3:35 Networking Break

Special Industry Groups (SIGs) Life Sciences International Risk & Compliance Exchange Africa 4:05 BREAKOUT SESSIONS B

TRACK 1: The Intended (and Unintended) Consequences of Compliance Program Certification

TRACK 2: Revisiting Your Self-Disclosure Calculus

TRACK 3: Creating a Best-in-Class ESG Compliance Program

5:05 BREAKOUT SESSIONS C

TRACK 1: Corporate Culture in Uncertain Times

TRACK 2: The Big Return of Monitorships

TRACK 3: Easing the Newest Concerns of the Board

6:00 Welcome Back Networking Cocktail Reception

11:00 BREAKOUT SESSIONS D

TRACK 1: The Latest Successes in Managing Ephemeral Communications

TRACK 2: The SEC’s Enforcement of the FCPA’s Internal Controls Provision

TRACK 3: International Think Tank Series: Spotlight on China

12:00 Networking Luncheon

12:00

Global Anti-Corruption Advisory Board Meeting (by invitation only)

1:15 FCPA and National Security Series

PART II: Task Force KleptoCapture

2:15 General Counsel Exchange

3:00 Networking Break

International Risk & Compliance Exchange Southeast Asia International Risk & Compliance Exchange Mexico

3:30

Life Before, During and After an FCPA Settlement 4:15

Closing Town Hall with the DOJ, SEC and FBI

5:00 Conference Concludes

2022 has seen the enforcement agencies put more resources behind the evaluation of corporate compliance programs, and that trend is expected to continue into 2023. Join us as we convene to discuss key DOJ, SEC, compliance and certification updates, and hear first-hand insights from U.S. and UK enforcement decision-makers, in-house industry executives and outside counsel involved in some of the most significant cases to date.

Daniel Kahn Partner

Davis, Polk & Wardwell LLP (Former Deputy Assistant Attorney General of the Criminal Division, U.S. Department of Justice)

Una Dean Vice President, Assistant General Counsel, Head of Global Investigations IBM

Justin Siegel Vice President, Global Head of Conduct and Integrity Goldman Sachs

The highly anticipated kickoff to the flagship event — “Year in Review” — will be enhanced this year to include the FCPA Unit Chiefs, Deputy and Assistant Chiefs from the DOJ and SEC, as they provide key updates and field audience questions on the most pressing enforcement issues.

Don't miss government, in-house and defense counsel perspectives on the future of the compliance function, individual liability concerns, and compliance program certification.

You will not want to miss out on highly interactive sessions that will provide important updates and best practices for ensuring that compliance initiatives are aligned with evolving DOJ national security priorities and geopolitical realities.

Meet up during the breaks to ask questions and gain important takeaways for managing the "on the ground" risks in high risk markets. Space will be limited toward ensuring a smaller-group interaction.

As in past years, the closing session of the event will include the acclaimed “Government Town Hall.” It will again comprise of open Q&A with senior officials from the DOJ, SEC, FBI, and the U.S. Department of the Treasury.

Back by popular demand, connect in smaller-group settings with peers from your industry. This is a great opportunity to expand your network with like-minded professionals; and share best practices that are specific to your industry and realities of your business.

General Counsel from leading organizations will offer their perspectives on some of the biggest issues to address in 2023. Gain first-hand insight into strategies to ensure that legal department activities are aligned with the strategic goals of the business — while striving to maintain an effective compliance program.

New to the program this year, don't miss out on these new must-attend sessions addressing the most pressing, high stakes issues at the forefront. With so much at stake, this is truly the year to ensure that you are fully up-to-speed on compliance program readiness, liability risks and much more!

Caret-right

Sanctions As the New FCPA: The Increasing Overlap of Anti-Corruption and Economic Sanctions and the Anticipated Impact on Compliance Strategy

Caret-right

Compliance Under Pressure: The High Stakes, Evolving Compliance Role, and the Future of Individual Accountability, Global Program Expectations and Certification

Caret-right The New Realities of Corporate and Individual Liability Risks: Defense Counsel Perspectives on the DOJ’s Enforcement Posture and the Path Ahead

Caret-right

Task Force KleptoCapture: Enforcing the Sanctions, Export Restrictions and Economic Countermeasures Levied Against Russian Officials and Oligarchs

With a user-friendly digital polling system, participants will respond to panel questions confidentially. An effective way to compare your compliance and investigations practices to your peers across the globe.

The 2022 program includes more opportunities to connect in a smaller-group setting to discuss country, region and industry-specific challenges. Another fantastic way to build your network and compare notes!

Connect with the community during longer breaks that are designed for you to interact with some of the most well-known anti-corruption practitioners from across the globe and expand your network.

An enhanced opportunity to ask questions to enforcement authorities; and to hear directly from key agencies about trends and priorities for the year ahead.

Glenn Leon

Chief, Fraud Section

U.S. Department of Justice

David Last Chief, FCPA Unit, Fraud Section, Criminal Division U.S. Department of Justice

Lisa Osofsky

Director

Serious Fraud Office (UK)

Charles Cain

Chief, FCPA Unit, Division of Enforcement U.S. Securities and Exchange Commission

Lorinda Laryea

Acting Co-Principal Deputy Chief, Fraud Section

U.S. Department of Justice

Daniel Kahn Partner

Davis, Polk & Wardwell LLP

(Former Deputy Assistant Attorney General of the Criminal Division, U.S. Department of Justice)

Andrew Gentin

Assistant Chief, Fraud Section, Criminal Division

U.S. Department of Justice

Lisa Miller

Deputy Assistant Attorney General, Fraud and Appellate Sections, Criminal Division

U.S. Department of Justice

Acting Principal Deputy Assistant Attorney General, Criminal Division U.S. Department of Justice

Matt Galvin Counsel, Compliance & Data Analytics U.S. Department of Justice

Assistant Chief, FCPA Unit, Fraud Section, Criminal Division U.S. Department of Justice

Andrew Adams

Director, Task Force KleptoCapture U.S. Department of Justice

Matthew Axelrod

David Fuhr

Assistant Chief, FCPA Unit, Fraud Section, Criminal Division U.S. Department of Justice

Lauren Kootman

Assistant Chief, Fraud Section, Criminal Division

U.S. Department of Justice

Assistant Secretary for Export Enforcement U.S. Department of Commerce

Tracy Price Deputy Chief, FCPA Unit

U.S. Securities and Exchange Commission

Robert Dodge

Assistant Director, FCPA Unit

U.S. Securities and Exchange Commission

Amie Stemen

Supervisory Special Agent Federal Bureau of Investigation

Una Dean

VP, Assistant General Counsel, Head of Global Investigations IBM

Vice President, Global Head of Conduct and Integrity

Goldman Sachs

Donald Anderson

Chief Commercial Officer

TDI Greg Andres Partner

Davis Polk & Wardwell LLP

Kathryn Atkinson

Member, Firm Chair

Miller & Chevalier Chartered

Carlos Ayres Partner

Maeda, Ayres e Sarubbi Advogados (Brazil)

Debevoise & Plimpton LLP

Eric Bruce US Head of Disputes, Litigation and Arbitration, and Global Investigations

Freshfields Bruckhaus Deringer LLP

Cohen

Sidley Austin LLP

Andrew Coles Partner

Resolution Economics LLC

John D. Buretta Partner

Cravath, Swaine & Moore LLP

Shana Cappell

Senior Director, Chief Anticorruption/ Investigations Counsel PepsiCo, Inc.

Benton Curtis Partner

McDermott Will & Emery

Salvador Dahan

Executive Director, Chief Governance & Compliance Officer Petróleo Brasileiro S.A. (Petrobras)

Matteson Ellis Member

Miller & Chevalier Chartered Steven E. Fagell Partner

Covington & Burling LLP

Ibie Falcusan

Assistant General Counsel, Head of Global Trade and Ethics Compliance Weatherford International

Harris Fischman Partner

Paul, Weiss, Rifkind, Wharton & Garrison LLP

Nick Barnaby

Deputy General Counsel and Assistant Corporate Secretary General Dynamics Corporation

Marilyn Batonga Partner

Baker McKenzie

Vanessa Salinas Beckstrom

Investigations & Forensics Partner PwC

Iris Bennett Partner

Steptoe & Johnson LLP

Christopher Cestaro Partner

Wilmer Cutler Pickering Hale and Dorr LLP

Hui Chen Senior Adviser, R&G Insights Lab Ropes & Gray LLP

Marie Dalton

Director, Strategic Response Coinbase Stephanie Davis Chief Ethics & Compliance Officer

Volkswagen Group of America

Katherine Choo

Vice President and Chief Counsel, Global Investigations General Electric Company

Doug Cohan

Deputy Compliance Officer, Senior Assistant General Counsel Hess Corporation

William (Widge) Devaney Partner

Baker McKenzie Edward (Ted) B. Diskant Partner

McDermott Will & Emery

Andrew J. Dunbar

Chief Compliance Officer, SVP Herbalife Nutrition

Daisuke Fukamizu Partner

Nagashima Ohno & Tsunematsu (Japan)

James Gargas Partner

PwC

Kevin Gingras

Vice President and Associate General Counsel – Litigation & Compliance Lockheed Martin

Daniel Grooms Partner

Cooley LLP

Steven G. Gyeszly

Chief Compliance Counsel

Marathon Oil Company

Erin Brown Jones

Partner

Latham & Watkins LLP

Lynn Haaland

Chief Compliance and Ethics Officer, Chief Privacy Officer Zoom Video Communications

Stacey J. Hanna General Counsel, E&C Lonza

Brooke Horiuchi

Senior Corporate Counsel, Global Compliance Program Northrop Grumman Corporation

Robert A. Johnston Partner

Lowenstein Sandler LLP

David Kass Chief Compliance Officer

Verizon

Dr. Donatus Kaufmann

Strategic Executive GRC Advisor Kaufmann & Company (Germany)

Channing Landreth

Associate Vice President, Managing Counsel LabCorp

Candy Lawson SVP, Chief Compliance Officer and Senior Deputy General Counsel

Comcast Tara Lee Partner White & Case LLP

Andrew Levine Partner

Debevoise & Plimpton LLP

Mark Mendelsohn Partner

Paul, Weiss, Rifkind, Wharton & Garrison LLP

Rita D. Mitchell Partner

Willkie Farr & Gallagher LLP (UK)

Sandra Moser Partner

Morgan, Lewis & Bockius LLP

Anne Murray Partner

Orrick Herrington & Sutcliffe LLP

Helen Hwang Partner

Covington & Burling LLP

Marianne Ibrahim

Chief Compliance Officer

ChampionX

Nkechi Iheme

Global Anti-Bribery Lead and Senior Counsel

Google Billy Jacobson

Partner

Allen & Overy LLP

Beth Jones

Senior Managing Director, Risk and Investigations FTI Consulting

David N. Kelley Partner

Dechert LLP Michael Koenig Global Chief Ethics & Compliance Officer JBS

James M. Koukios Partner

Morrison & Foerster LLP

Darryl Lew Partner White & Case LLP

Rachel Maiman Partner

Lowenstein Sandler LLP

Salim Saud Neto Partner Saud Advogados

Michael Ortwein

Assistant General Counsel & Chief Compliance Officer General Motors

Valerie Lam

Anti-Corruption Compliance Counsel and Risk & Compliance Programs Lead

Dell Technologies

Corinne A. Lammers

Partner Paul Hastings, LLP

Jennifer Mattis Director and Lead Counsel, Global Ethics & Compliance, Anti-Corruption Policy and Analysis

Raytheon Missiles & Defense

Zane David Memeger Partner

Morgan, Lewis & Bockius LLP

Eoin O’Shea Partner

CMS Legal LLP

Kimberly A. Parker Partner

Wilmer Cutler Pickering Hale and Dorr LLP

Mona Patel Partner

Covington & Burling LLP

Laura Perkins Partner

Hughes Hubbard Reed LLP

James Prince

Vice President – Legal Sustainability Baker Hughes

Claire Rajan Partner Allen & Overy LLP

Frederick Ratliff

Managing Counsel, Anti-Corruption Shell

Christine E. Savage Partner

King & Spalding LLP

Cheryl J. Scarboro Partner

Simpson Thacher & Bartlett LLP

William D. Semins Partner

K&L Gates LLP

Ruti Smithline Partner

Morrison & Foerster LLP

Patrick F. Stokes Partner

Gibson, Dunn & Crutcher LLP

Shannon Stokes Assistant General Counsel Legal & Compliance World Fuel Services

Karyl Van Tassel Senior Managing Director J.S. Held, LLC

Steven A. Tyrrell Partner

Weil, Gotshal & Manges LLP

Sarah Walters Partner

McDermott Will & Emery Ashley Watson General Counsel, Medical Devices Johnson & Johnson

James G. Tillen Member Miller & Chevalier Chartered

Ryan Rohlfsen Partner

Ropes & Gray LLP

Justin Ross

Staff Vice President, Chief Compliance Officer FedEx Corporation

Claudius Sokenu

Chief Administrative Officer, General Counsel, and Corporate Secretary UUnisys

Daniel L. Stein Partner

Weil, Gotshal & Manges LLP

David C. Rybicki Partner

K&L Gates LLP

Martin J. Weinstein Partner

Willkie Farr & Gallagher LLP

Viktoriya Torchinsky-Field Vice President, Legal Avantor

Tim Treanor Partner

Sidley Austin LLP

Albert Stieglitz, Jr. Partner

Alston & Bird LLP

Ephraim (Fry) Wernick Partner

Vinson & Elkins LLP

Pei Li Wong Partner BDO USA, LLP

Leo Tsao Partner

Paul Hastings LLP

Jeremy Zucker Partner Dechert LLP

Clock 9:30 am–1:00 pm

Expert faculty members will take a deep dive into the nuts and bolts of FCPA compliance toward laying the groundwork for the rest of the conference. Participants will benefit from a solid foundation, smaller-group learning, enhanced Q & A and helpful reference materials for their daily work after the event.

Topics will include:

• Who is covered by the FCPA

» Foreign Private Issuers (FPI) — who qualifies?

» Foreign subsidiaries, joint venture partners?

» What is the extraterritorial reach of the FCPA?

» What are the implications for employees, executives and board members?

• Key enforcement agencies, their roles and jurisdictions

• A close look at new, heightened risks affecting organizations and their employees:

» Criminal liability

» Civil liability

» Regulatory actions and shareholder suits

» Reputational damage

» Whistleblower complaints

» Debarment

• What it means to “pay, offer or promise to pay, or authorize the payment of anything of value to a foreign official in order to influence any act or decision of the official in order to obtain or retain business”

• Who is a “foreign official” under the FCPA and how to deal with employees of stateowned enterprises

• What does “anything of value” mean?

» Gifts and entertainment

» Travel

» Charitable and political contributions

• What are the exceptions under the FCPA?

• Facilitating payments: limits on “grease”

» Reasonable and bona fide expenditures

» Third party due diligence and monitoring requirements

» Distributors and sub-distributors

» Agents

» Consultants

» Joint venture partners

» Customs agents and brokers

• Books and records requirements: What it means to maintain records that “accurately and fairly” reflect transactions

Clock 2:00 pm–5:30 pm

In-Person Only

Partner Latham & Watkins LLP

Valerie Lam Anti-Corruption Compliance Counsel and Risk & Compliance Programs Lead Dell Technologies

At this practical, industry-driven working group, expert speakers will discuss how companies are using a tiered due diligence approach based on the appropriate risk level and type of third party in question. The session will discuss how to re-evaluate your risk ranking approach and manage the costs of a robust program.

With evolving risk factors and compliance obligations, don’t miss this worthwhile opportunity to upgrade your best practices. Discover how your approach to managing high stakes risks compares to your peers, and benefit from important takeaways for your work. Ample time will be left for Q & A, so please bring your questions!

We will discuss:

• How far you need to go in vetting 1st, 2nd, 3rd, 4th and lower third parties

• How to incorporate effective front-end vetting and screening protocols based on the type of relationship and interests represented by the third party

• Developing a model that stratifies your risk based on third parties — and how to Perform due diligence accordingly

• What you need in a questionnaire for third parties

• Addressing resistance to follow-up questions after an initial questionnaire

• Impact of GDPR on third party due diligence

• How much due diligence is enough: How to know if your approach is truly “risk-based”

• Unique challenges associated with critical types of third parties for your global business

• When and how much due diligence to perform for an ongoing, existing third-party relationship

• Understanding the local business environment, customs and practices

• What to do with information uncovered during the vetting process: How to evaluate red flags

• Making the decision regarding which parties to use/not use: “On the Ground” obstacles to monitoring third party conduct

• Special considerations for exercising audit rights

• When and how much to train third parties

Tuesday, November 29, 2022

Compliance programs must be customized to the challenges facing each company; and be comprehensive enough to deal with all of the risks the company has identified. An effective risk assessment is crucial, and should begin with a detailed picture of the compliance landscape your company operates in.

Since your compliance efforts should be aimed squarely at the risks that are most critical to your business, it is important to identify all of the variables that represent the threats and dangers.

In this session we will examine best practices for identifying the threats and developing your risk profile, such as:

• Developing an understanding of the current state of affairs; finding out what risks already exist; and documenting the key company processes, systems, and transactions that need to be monitored for risk

• Ensuring a full understanding of your business operations when conducting a risk assessment

• Mapping out the potential risk contact points that exist throughout your company

• Assessing the current controls in place to prevent, detect, and correct violations

• Determining and prioritizing the compliance enhancement measures you undertake

• Updating your risk assessment periodically

After mapping your risk profile, the next step is to ensure that you are acquiring internal and external data from reliable sources. During this session our speakers will review real-world examples of data output reports; discuss how to assess the data; and, determine if the program is capturing the right data.

• Defining high-value data and progressively accessing it—to avoid accessing everything all at once

• Collecting data across multiple different systems and assessing what data is important; what data is being captured; and what data is not being captured accurately

• Identifying data sources and deciding how to aggregate the data to ensure good input and output

• Evaluating the internal and third-party data analytics tools that are available, and deciding which data feeds your organization can leverage

• Cleaning the Data by utilizing a continuous feedback loop to eliminate false positives

An effective data governance program is comprised of many moving parts, as critical data can be coming in from a variety of sources, documents, systems, and technologies that are needed to run operations. In addition, it is crucial to evaluate existing and available resources—budget, personnel and technology—to navigate and prioritize areas of higher risk.

Join us in this session as we review key considerations when developing an effective data governance program, such as:

• Do compliance and control personnel have the appropriate experience and qualifications for their roles and responsibilities?

• Has there been sufficient staffing for compliance personnel to effectively audit, document, analyze, and act on the results of the compliance effort?

• Determining what to do when payments and expenditures are above aggregate risk score thresholds:

» Define what constitutes a red flag

» Understand the details of the activity—and analyze whether approvals, third parties, amounts, and circumstances align with existing policies and procedures

» Track and document each follow-up activity

» Assess remediation and consider whether follow-up risk assessments, communication and/or discipline is necessary

• Using data feeds for continuous risk re-assessments and monitoring program upgrades

• Providing training and ongoing support to ensure that employees and third parties can analyze incoming data to determine if it is consistent and trustworthy

• Steps to take when data reveals employees and third parties are not following critical policies:

» Understanding whether any controls failed

» Determining if the employee received the appropriate compliance training—and if the compliance expectations were extended to third parties

» Performing the appropriate investigative steps and addressing remediation

» Deciding if additional predictive and detective measures should be implemented

A data-driven compliance program requires having the monitoring tools that are necessary to retrieve data from multiple systems, databases, and different parts of the business automatically; both domestically and internationally. This often leads to the necessity of having the IT department build such a program in-house; and having data scientists analyze all of the data for risk identity and assessment.

However, many successful compliance analytics and transaction monitoring initiatives can be utilized with applications that do not require the construction of a costly and complicated on-premise infrastructure. The advantages of utilizing such applications from a compliance standpoint, is they put more control in the hands of the compliance team instead of IT—which may not prioritize the transactions in the same way.

Key Takeaways for this session:

• Determining the next steps for the compliance team when addressing payments and transactions that are above aggregate risk score thresholds

• Ensuring the data feeds and monitoring tools are coming in and working in real time – and developing processes for determining what warrants internal investigations and further action

• Which transactions to monitor and how to monitor them:

» Gifts

» Donations

» Effective feedback through communications and HR teams

• Identifying the solutions and applications that are needed to risk-rank transactions and geographic regions; to readily identify areas that require enhanced due diligence and potential internal investigations

• Equipping the compliance team with data and “actionable insights” early in the transaction lifecycle, so they are able to make betterinformed decisions

Using Data Analytics to Measure the Effectiveness of Your Compliance Program: Concrete Examples of Using Metrics and KPIs to Evaluate Risk Detection and Compliance

Recent DOJ guidance stresses to companies the importance of leveraging data analytics and other objective evidence to demonstrate a compliance program is working effectively. As such, metrics-driven solutions are needed to align compliance accountability; and embed a proactive compliance function on the first line of defense.

By utilizing compliance metrics to identify corruption risks early, companies are in a better position to reduce risks and understand whether the correct controls are in place.

Key Takeaways:

• The importance of tracking the numbers at regular intervals, and keeping records over an extended time period; in order to have a firm grasp on trends, and the ability to compare where you are now versus where you started

• Determining which compliance metrics to measure, and comparing them to industry standards and benchmarks for improved predictability

• Assembling qualitative data-gathering tools—such as surveys and questionnaires—to encourage adaptability and accountability

• Concrete examples of metrics used for assessing and analyzing risk

This session will walk you through a practical case study that defines how to get started and refine your blueprint for effective data-driven compliance and monitoring.

Topics will include:

• The goals for those compliance analytics efforts

• Detailed walk-throughs of those compliance analytics efforts

• Approaches to building such programs (e.g., internal, external or hybrid) and the resources needed

• Identifying the data needed, the process for acquiring the data and overcoming challenges around data availability and quality

• Connecting monitoring programs with existing or new pre-approval systems

AI and ML technology can improve the efficiency of compliance operations and reduce costs in today's data-driven compliance environment, by autonomously categorizing compliance-related activities and alerting them to important updates, events and activities.

In this session we will discuss the advantages and best practices for leveraging AI and ML in your compliance program:

• Conducting periodic reviews of your risk assessment program, based on continuous access to operational data and information over time and across functions

• Leveraging Machine Learning by learning from past data and past transactions, and by reviewing false positives

• What can be gleaned from anomaly detection

• Feeding back learnings from algorithms and human learning that allow you to leverage AI and ML toward making them more predictive

• Managing risk around your third-party organization over the “lifespan” of the relationship

• Identifying emerging risk factors before they become a broader compliance concern—and assessing whether or not a review or an internal investigation is needed

Daniel Kahn Partner

Davis Polk & Wardwell LLP (Former Deputy Assistant Attorney General of the Criminal Division, U.S. Department of Justice)

In-Person and Livestream

David Last Chief, FCPA Unit, Fraud Section, Criminal Division U.S. Department of Justice

In-Person and Livestream

PART II: SEC Year in Review

Una Dean VP, Assistant General Counsel, Head of Global Investigations IBM

Justin Siegel Vice President, Global Head of Conduct and Integrity Goldman Sachs

David Fuhr

Assistant Chief, FCPA Unit, Fraud Section, Criminal Division U.S. Department of Justice

Tracy Price Deputy Chief, FCPA Unit U.S. Securities and Exchange Commission

MODERATOR: Patrick F. Stokes Partner Gibson, Dunn & Crutcher LLP

Last year, the Biden Administration announced that fighting corruption was a core U.S. national security interest and announced its intent to fight illicit finance. In addition, as a result of Russia’s invasion of Ukraine earlier this year, the United States began to issue increasingly punishing economic sanctions and export controls, and Biden administration officials have begun publicly signaling their intention to aggressively enforce them.

The overlap of sanctions and FCPA was confirmed earlier this year when Deputy Attorney General Lisa Monaco emphasized the importance of sanctions and export controls as a DOJ priority, explaining that “one way to think about this is as sanctions being the new FCPA”. As such, legal and compliance professionals should heed this comparison and take steps to leverage internal resources to strengthen compliance across the board.

In this session, our panelists will explore the interplay and overlap of anti-corruption, national security and economic sanctions. Topics of discussion will include:

• How increased sanctions enforcement will impact FCPA enforcement

• The growing overlap between corporate crime and national security, including: the use of money laundering to evade sanctions; terrorist group financing; and cybercrime

• The proposal that will improve the United States’ ability to work with international partners to recover assets linked to foreign corruption

• Increasing collaboration across various enforcement authorities who investigate and prosecute such crimes and the impact on the enforcement landscape

Matthew Axelrod Assistant Secretary for Export Enforcement

U.S. Department of Commerce

Kara Brockmeyer Partner Debevoise & Plimpton LLP

Daniel L. Stein Partner Weil, Gotshal & Manges LLP

Mark F. Mendelsohn Partner

Paul, Weiss, Rifkind, Wharton & Garrison LLP

Christine E. Savage Partner King & Spalding LLP

10:45

In-Person Only

Participants from your industry will convene separately for smaller-group networking and compliance benchmarking. Expand your network, make new industry contacts, and exchange best practices for managing heightened risks affecting your business.

Brooke Horiuchi

Senior Corporate Counsel, Global Compliance Program Northrop Grumman Corporation

Jennifer Mattis

Director and Lead Counsel, Global Ethics & Compliance, Anti-Corruption Policy and Analysis Raytheon Missiles & Defense

Microphone-alt

Glenn Leon

Chief, Fraud Section

U.S. Department of Justice

In-Person Only

Join this highly anticipated, smaller-group meet-up to compare notes on the realities of FCPA and anti-corruption compliance in the Andean Region. A great way to expand your brain trust and connect further with the community!

MODERATOR: Martin J. Weinstein Partner

Willkie Farr & Gallagher LLP

Almost two full years into the Biden Administration is a great time to assess whether the Administration and DOJ are making good on their pledge to “surge resources” in order to combat corporate crime. The assurances made by the DOJ suggest that they will be routing resources back to investigating financial crimes — and also signal that would-be corporate defendants should expect a renewed wave of inquiries.

In this session, leading defense counsel will highlight the new realities and some of the areas that the DOJ “surge in resources” will be allocated, such as:

• The creation of an FBI squad dedicated to the DOJ’s Criminal Division, Fraud Section, and the anticipated impact on investigations

• The nuances of the DOJ's corporate enforcement policy, and individual liability risks

• DOJ's expectations for implementing data analytics-and the impact on compliance program evaluations

• Increased enforcement of sanctions and export controls through the continued use of new tools and innovations

• How the enforcement of cryptocurrency crime will affect FCPA, AML and fraud enforcement

• Stringent enforcement of NPA, DPA, and plea agreement violations, and warning that violations of such agreements may engender more painful results than originally posed by the underlying charges

Eric Bruce

US Head of Disputes, Litigation and Arbitration, and Global Investigations

Freshfields Bruckhaus Deringer LLP

Laura Perkins Partner Hughes Hubbard Reed LLP

David N. Kelley Partner

Dechert LLP

Ryan Rohlfsen Partner

Ropes & Gray LLP

Steven E. Fagell Partner Covington & Burling LLP

Data Analytics

U.S. Department of Justice

Ibie

FalcusanAssistant General Counsel, Head of Global Trade and Ethics Compliance Weatherford International

Karyl Van Tassel Senior Managing Director J.S. Held, LLC Mona Patel Partner Covington & Burling LLP

Kevin Gingras Vice President and Associate General Counsel

Kevin Gingras Vice President and Associate General Counsel

– Litigation & Compliance

Lockheed Martin Vanessa Salinas Beckstrom Investigations & Forensics Partner

PwC Eoin O’Shea Partner

Today’s compliance function is called upon to address compliance weak spots and mitigate heightened risk factors. In addition, the DOJ’s FCPA Unit will continue to evaluate corporate compliance programs to ensure that companies are designing and implementing effective compliance systems and controls, creating a culture of compliance, and promoting ethical values.

Implementing compliance programs that are well designed and effectively work in practice is challenging, so it is critical to closely monitor your program and build strong controls to detect and prevent misconduct.

Be sure to join this interactive panel as we discuss some of the most vexing challenges confronting the compliance community, and review what the DOJ is looking for, such as:

• Examining the company’s process for assessing risk and building a program that is tailored to then match those resources to the specific risk profile

• Reviewing the qualifications and expertise of your compliance personnel and other gatekeeper roles

• Continuously testing the effectiveness of your compliance program to show that it is: improving, adapting, and updating the program to ensure that its sustainable and adapting to changing risks

• How to truly know if your program is working—and when to sound the alarm

Participants from your industry will convene separately for smallergroup networking and compliance benchmarking. Expand your network, make new industry contacts, and exchange best practices for managing heightened risks affecting your business.

Miller & Chevalier Chartered

MODERATOR: Edward B. Diskant Partner

McDermott Will & Emery

Assistant Chief, FCPA Unit, Fraud Section

U.S. Department of Justice

Salvador Dahan

Executive Director, Chief Governance & Compliance Officer

Petróleo Brasileiro S.A. (Petrobras)

Salim Saud Neto Partner Saud Advogados Carlos Ayres Partner Maeda, Ayres e Sarubbi Advogados Ratliff Managing Counsel, Anti-Corruption ShellCMS Legal LLP

With clear signs that anti-corruption enforcement remains a top DOJ priority, now more than ever companies are focused not simply on prevention and detection but preparedness for the possibility of defending against enforcement activity.

Starting from the first signs of a compliance issue to successful resolution, our panel will discuss best practices for managing internal investigations, reputational risk and more.

• Reviewing the impact of recent DOJ enforcement actions and settlements

• Pitfalls to avoid when assessing confidentiality and privilege

• Best practices for investigations involving former employees

• Creating standards, manuals, policies, operating procedures for the team

• Budget: How much you need to spend and mitigating the risk of spiraling costs

• When to involve outside counsel

• When and when not to investigate new or peripheral red flags

• When to stop: How to know when to conclude the investigation

The increased focus on Brazil illustrated the DOJ’s continuing commitment to combatting corruption there and in the international marketplace. In addition, the extent of coordination between U.S. and Brazilian enforcement agencies is quite challenging.

In this session our regional panel of experts will discuss:

• How critical it is to voluntarily and timely disclose bad conduct

• Implementing, testing and maintaining an enhanced compliance program

• The continuing risk facing companies that operate in Brazil

• Legislation vs. enforcement in Brazil: dissecting the roles and responsibilities of Brazilian agencies at the federal, state and municipal levels

• The two critical areas of Leniency Agreements and key considerations for each area: compliance program assessment and continuous cooperation after signing the agreement

• Modifications to the Administrative Improbity Law, and the uncertainties brought about by non-prosecution agreements and reductions in enforcement levels

McDermott Will & Emery

Viktoriya Torchinsky-Field Vice President, Legal AvantorJoin this highly anticipated, smaller-group meet-up to compare notes on the realities of FCPA and anti-corruption compliance in Africa. A great way to expand your brain trust and connect further with the community!

Morgan, Lewis & Bockius LLP

Brian E. Kowalski Partner

Latham & Watkins LLP

Beth Jones Senior Managing Director, Risk and Investigations FTI Consulting

Beth Jones Senior Managing Director, Risk and Investigations FTI Consulting

Kimberly A. Parker Partner

Wilmer Cutler Pickering

Hale and Dorr LLP

MODERATOR: Rita D. Mitchell Partner

Willkie Farr & Gallagher LLP (UK)

Devaney Partner Baker McKenzie Michael Ortwein Assistant General Counsel & Chief Compliance Officer General Motors

Devaney Partner Baker McKenzie Michael Ortwein Assistant General Counsel & Chief Compliance Officer General Motors

Candy

Lawson SVP, Chief Compliance Officer and Senior Deputy General Counsel Comcast

Ruti Smithline Partner Morrison & Foerster Daniel Kahn Partner Davis Polk & Wardwell LLP (Former Deputy Assistant Attorney General of the Criminal Division, U.S. Department of Justice)

As the DOJ indicated it would earlier in the year, they have officially mandated — as part of resolving a corporate enforcement action — that a Chief Compliance Officer and CEO must certify under penalty of perjury and pursuant to a robust obstruction statute, that their organization’s compliance program is reasonably designed to prevent future violations.

With this expansion of the enforcement process, the C-suite and upper management must now expect these certifications in future resolutions with the DOJ in plea agreements or pre-trial diversion agreements.

Join us in this session as we discuss what it now takes for your program to be “reasonably designed”, such as:

• Your commitment to compliance that highlights the policies, procedures and systems needed for proper oversight

• The extent of due diligence required to ensure that compliance programs are “reasonably designed”

• Conducting periodic risk-based reviews

• Training and guidance initiatives

• Internal reporting and investigation capabilities

• Enforcement and discipline processes — including for third-party relationships

• Assurances in place for seamless and compliant mergers and acquisitions

• Steps in place for effective monitoring, testing and remediation

• Accurately identifying your organization’s risk profile to ensure that your program is well-designed; adequately resourced; and empowered to function effectively

• What may trigger a DOJ finding that a certified program is not "reasonably designed" — and the consequences

James G. Tillen Member

Miller & Chevalier Chartered

The DOJ does provide specific benefits to companies that self-disclose in the context of FCPA violations. However, when companies are evaluating whether to self-report violations of the FCPA, it is important to carefully consider a myriad of factors.

The risk calculus is complicated and fact-intensive. During this session, leading outside counsel will discuss key factors to incorporate into your analysis and decision-making:

• Initial considerations regarding the benefits and risks of self-disclosure

• Whether the company is a recidivist

• The practical impact of U.S. disclosure on foreign corruption investigations — will this expose your organization to foreign prosecution?

• The likelihood of similar, but undiscovered, misconduct in other locations or countries in which the company operates

• Assessing the possibility of full cooperation with the DOJ, including the production of documents and witnesses, both within the United States and overseas

• Possible exposure to parallel investigation by other U.S. and international authorities, and civil litigation

• The company’s compliance program and internal controls and their willingness to enhance that program

• The dynamics of whether self-disclosure will be considered “voluntary”

• Getting the sequencing and the substance right:

» Identifying in which order to disclose, how much to say, and to whom

William D. Semins PartnerK&L Gates LLP Iris Bennett Partner Steptoe & Johnson LLP

An increase in investor and shareholder focus on ESG has further emphasized the link between a robust anti-corruption program and a company’s ESG program.

Recent and expected shifts in the regulatory reporting landscape pushed ESG to the forefront along with anti-corruption. In this session we will review best practices for successfully bringing ESG into the broader due diligence and compliance process, and walk you through the steps needed to implement and sustain a successful ESG program.

• How to define ESG — along with the corresponding strategy, lessons learned, priorities and resources that are needed

• Operationalizing ESG and identifying the key data, metrics and risk factors to prioritize in your program

• Identifying potential human rights risks associated with business operations, including how to effectively conduct human rights impact assessments

• Implementing a technology solution that enables your organization to have a cohesive workflow that can capture and assess anti-corruption and ESG risks

• Assessing self-reported information provided by third parties, and supporting it with independent checks to better understand and verify your ESG footprint and approach

• Finding the right setup for merging ESG and compliance teams, based on: the factors driving your ESG interest; the specific risk profile and tolerance of your organization; and, the types and locations of the work your company does

Volkswagen Group of America

David Kass

Chief Compliance Officer Verizon

Claire Rajan Partner

Allen & Overy LLP

Hui Chen Senior Adviser, R&G Insights Lab Ropes & Gray LLP

Marilyn Batonga Partner

Baker & McKenzie LLP

With an intensifying enforcement landscape and newfound compliance pressures, there has never been a more crucial time to foster and strengthen an ethical corporate culture.

In this session we will review how to foster and sustain a “see something, say something” culture to ensure that employee concerns and complaints of potential ethical lapses are appropriately handled; by:

• Ensuring the commitment and accountability of senior management, the C-suite and the Board

• Training and educating team members to spot and mitigate compliance risks

• Influencing the behavior of the workforce to develop a strong and ethical culture of compliance through hypotheticals and other alternative methods of training

• Encouraging a view beyond “the law” and considering what it truly means to be ethical

Acting Deputy Chief, Fraud Section, Criminal Division

U.S. Department of Justice

Tim Treanor Partner

Sidley Austin LLP

Most compliance professionals anticipate that the DOJ’s new policies relating to corporate criminal enforcement will result in greater scrutiny of compliance programs and the imposition of more monitorships.

The recent policy shift is likely indicative of what is to come, as the DOJ seeks to ensure that companies have strong compliance programs in place. In this session we will discuss key components and challenges for a monitorship’s successes and missteps, such as:

• Conditions, process, criteria and selection of monitors

• Steps companies under investigation should take to avoid a monitor

• Best practices for managing an independent compliance monitorship

General Counsel, E&C

Lonza

Chief Compliance and Ethics Officer, Chief Privacy Officer Zoom Video Communications

John D. Buretta Partner

John D. Buretta Partner

Cravath, Swaine & Moore LLP

Dr. Donatus Kaufmann Strategic Executive GRC Advisor

Dr. Donatus Kaufmann Strategic Executive GRC Advisor

Kaufmann & Company (Germany)

Jeremy Zucker Partner Dechert LLP

With the evolving DOJ enforcement posture, program certification and heightened liability risks, what should the Board consider moving forward? Be sure to join us in the interactive session as our group will look to provide answers to some of the most pertinent questions related to the new requirements and corporate governance challenges, such as:

• The impact of the CCO Certification Requirement on Board priorities and concerns

• New types of questions being asked by the Board — and how to best address them

• Evolving liability risks for the Board and Board members — and perspectives on how to mitigate them

• Winning the Board over: Securing buy-in for key initiatives and resources amid competing priorities

Davis Polk & Wardwell LLP (Former Deputy Assistant Attorney General of the Criminal Division, U.S. Department of Justice)

The Administration and enforcement agencies are putting more resources behind the evaluation of corporate compliance programs than ever before. In addition, when the agencies are considering how to resolve a case with a company, they are increasingly asking for interviews with compliance personnel and data on the effectiveness of a compliance program; they are not just looking at whether a company has a strong program on paper.

The enforcement agencies want to see that the compliance personnel are qualified, trusted by the company, and committed to the goals of the compliance program. Join us in this session as we delve into:

• Perspectives on the changing expectations for the compliance function

• Re-assessing individual liability risks for C-Level and other executives

• The benefits of investing in a meaningful and effective compliance program to limit recidivism

• Satisfying obligations to report on the status of the compliance program

• Monitoring and auditing compliance program components, as well as reporting on current or anticipated enhancements

• Scope of individual prosecutor discretion to decide, or will there be leadership team directives on when to apply certification requirements?

• Possibility of “penalty of perjury” clause that would subject CEOs and CCOs to personal liability if DOJ disagrees with their conclusion that the program is “reasonably designed"

• Strengthening detection and prevention of violations of law and company policy

• Verifying that compliance officers have adequate access to — and engagement with — business functions, management, and the board of directors

• Continuously testing the effectiveness of your compliance program and that it is functioning effectively

Kootman Assistant Chief, Fraud Section, Criminal Division U.S. Department of Justice

Kootman Assistant Chief, Fraud Section, Criminal Division U.S. Department of Justice

Participants from your industry will convene separately for smallergroup networking and compliance benchmarking. Expand your network, make new industry contacts, and exchange best practices for managing heightened risks affecting your business.

Participants from your industry will convene separately for smallergroup networking and compliance benchmarking. Expand your network, make new industry contacts, and exchange best practices for managing heightened risks affecting your business.

Una Dean VP, Assistant General Counsel, Head of Global Investigations IBM Justin Ross Staff Vice President, Chief Compliance Officer FedEx Corporation

Harris Fischman Partner

Paul Weiss Rifkind Wharton & Garrison LLP

Daniel Grooms Partner Cooley LLP

Andrew Levine Partner Debevoise & Plimpton LLP

From a compliance point of view, ephemeral communication apps and messaging are a serious risk dilemma. Uncertainty exists among companies on whether to prohibit the usage of these apps, or to implement a risk-based approach.

The DOJ has refined its position on the Enforcement Policy, and allows companies to use applications that support ephemeral messaging. However, companies are bound to implement the necessary guidelines. Join us in this session as our experts discuss the DOJ stance, and how it impacts investigations and compliance.

Topics for discussion include:

• Utilizing archiving tools that allow the organization to capture and retain content

• The new expectations for retaining business records and correspondence

• Best practices for ensuring that there is a specific business justification for the use of ephemeral messaging

• Adopting written policies governing the use, maintenance, and retention related to ephemeral messaging that specifically address litigation and regulatory responsibilities

• Providing regular, documented training about the appropriate use of ephemeral messaging

• Imposing appropriate and recorded discipline for instances in which employee misconduct occurs in violation of company policies

Cheryl J. Scarboro Partner Simpson Thacher & Bartlett LLP

Cheryl J. Scarboro Partner Simpson Thacher & Bartlett LLP

A company’s responsibility for its internal controls extends to its overall compliance program. As such, it is critical for a company trying to avoid internal accounting controls violations to focus on preventing corrupt payments of any kind, even if those payments would not strictly violate the FCPA provisions.

In this session, our experts will discuss how industry can strengthen controls with examples of what is adequate — and also review where organizations have gone wrong.

Topics for discussion include:

• The latest “no bribery” cases enforcing the internal controls provisions against issuers

• Confirming that employees in finance and accounting functions — and in higher-risk roles, appreciate their obligations help the company to manage risk

• Correcting inaccurate books and records and confirming that they have a well-documented account of how they addressed any control deficiencies

• Best practices for advising the organization on internal controls; including through legal, compliance and financial perspectives

• Identifying common examples of inadequate internal controls and related program deficiencies to avoid

• Achieving cross-department collaboration to assist in identifying systematic patterns of bribery and lapses in controls

With the interplay of geopolitical tension, an ongoing trade war, national security and anti-corruption risks; doing business in China poses unprecedented risk factors. In addition, there are contrasting enforcement risks for local vs. multinational companies.

Multinationals are re-assessing their risk in China amid proposed data security protection laws; the Anti-Foreign sanctions law; China/U.S. policy updates; and recent enforcement actions in the region.

Be sure to join us in this session as our experts take a look at the new landscape of compliance and enforcement risks — and the interplay of geopolitics and other high stakes issues. Topics to be discussed include:

• How companies and financial institutions are evolving their programs in response to geopolitical tensions with China

• Revisiting interactions with local government officials and local agencies

• Contrasting enforcement risks for local and multinational companies

• How the key local agencies communicate with companies, and approach regulatory approvals and investigations

• The end of DOJ’s China Initiative, and how walking back the initiative will affect China-related FCPA enforcement

• How to support your business development and marketing in the wake of China’s Anti-Unfair Competition Law

Mitigating new compliance risks posed by China’s new social credit system How China’s data governance regulation has impacted anti-bribery compliance strategies

On March 2nd, the DOJ announced the creation of the interagency Task Force KleptoCapture (the “Task Force”) to enforce the sanctions, export restrictions, and economic countermeasures against Russian officials and oligarchs in response to the conflict in Ukraine. The formation of the Task Force follows an increased awareness of the destabilizing threat of kleptocracies to national security, as outlined in a June 2021 White House National Security Memorandum that established the fight against corruption as a core national security policy.

The Task Force works cooperatively with the transatlantic task force that President Biden, leaders of the European Commission, France, Germany, Italy, the United Kingdom, and Canada announced in February. Where violators cannot be detained, assets will be seized and forfeited; and information will be shared with foreign partners to further assist with the identification and recovery of assets abroad. In this session, our panel of exports will discuss the resources and tools that the Task Force is leveraging for enforcement, such as:

• Access to advanced investigative tools:

» Data analytics

» Cryptocurrency tracing

» Foreign intelligence sources

» Information from financial regulators and private sectors partners

• How the Task Force interacts with other DOJ Departments and other enforcement agencies

• Coordination with the recently established National Cryptocurrency Enforcement Team

• Enhanced subpoena authority under the recently enacted AntiMoney Laundering Act of 2020

Our panel of General Counsel from leading organizations will offer their perspectives on strategic "big picture" issues to address in 2023, including:

• How General Counsel are evaluating and prioritizing risks for 2023

• How to align legal department activities with the strategic goals of the business — while striving to maintain an effective compliance program

• Determining the messaging that is needed to convey the necessity and value of the corporate compliance program

• Implementing cost-containment strategies that won’t diminish the compliance program

• Perspectives on the scope of legal exposure amid DOJ's enforcement posture

• The outlook of General Counsel for compliance, enforcement, and the budget increases that will likely be needed to remain compliant

Andrew Adams

Director, Task Force KleptoCapture

U.S. Department of Justice

Leo Tsao Partner

Paul Hastings LLP

David C. Rybicki Partner K&L Gates LLP

Ashley Watson

General Counsel, Medical Devices Johnson & Johnson

Sandra Moser Partner

Morgan, Lewis & Bockius LLP

Chief Administrative Officer, General Counsel, and Corporate Secretary Unisys

Nick Barnaby Deputy General Counsel and Assistant Corporate Secretary General Dynamics Corporation

In-Person Only

Join this highly anticipated, smaller-group meet-up to compare notes on the realities of FCPA and anti-corruption compliance in Mexico. A great way to expand your brain trust and connect further with the community!

Mexico

Networking Break with: 3:30 Life Before, During and After an FCPA Settlement

Michael Koenig

Global Chief Ethics & Compliance Officer JBS

Join this highly anticipated, smaller-group meet-up to compare notes on the realities of FCPA and anti-corruption compliance in Southeast Asia. A great way to expand your brain trust and connect further with the community!

Be sure to join us for this session as our panelists share first-hand accounts of the challenges and successful strategies that were implemented before, during and after enforcement actions — and lesser-known, "on the ground" takeaways for confronting worst case scenarios.

Andrew J. Dunbar

Chief Compliance Officer, SVP Herbalife Nutrition

Stephen Cohen Partner

Sidley Austin LLP

James M. Koukios Partner

Morrison & Foerster LLP

Sarah Walters Partner McDermott Will & Emery

In-Person and Livestream 5:00 Conference Concludes

In-Person and Livestream

4:15 Closing Town Hall with the DOJ, SEC and FBI

Participants will gain further insights on cross-agency coordination and compliance investigations.

Engage with the panelists through an extended opportunity for open Q&A with key enforcement officials — or feel free to submit your questions anonymously to: Townhall@AmericanConference.com

Lorinda Laryea

Acting Co-Principal Deputy Chief, Fraud Section

U.S. Department of Justice

Charles Cain Chief, FCPA Unit U.S. Securities and Exchange Commission

Amie Stemen Supervisory Special Agent Federal Bureau of Investigation

Greg Andres Partner

Davis Polk & Wardwell LLP

With conferences in the United States, Europe, Asia Pacific, and Latin America, the C5 Group of Companies: American Conference Institute, The Canadian Institute, and C5 Group, provides a diverse portfolio of conferences, events and roundtables devoted to providing business intelligence to senior decision makers responding to challenges around the world.

Don’t miss the opportunity to maximize participation or showcase your organization’s services and talent. For more information please contact us at: SponsorInfo@AmericanConference.com

We offer a comprehensive range of anti-corruption and FCPA-related capabilities and experience, including representations of companies and financial institutions, their boards, management and individual executives. Our experience runs the gamut from the defense of government investigations to internal investigations to all aspects of compliance work. Our criminal defense expertise across the globe is particularly suited to this moment with U.S. authorities routinely working with their overseas counterparts.

Allen & Overy’s global reach is both geographic and cultural, operating in over 30 countries. This includes expertise in local anti-corruption laws, data privacy laws, and investigative rules and procedures. The result is an integrated team that can efficiently gather facts and analyze potential corruption issues globally, and then credibly present that analysis to regulators in the U.S. and around the world.

WilmerHale represents companies and individuals in DOJ, SEC, UK Serious Fraud Office, and Chinese Administration for Industry and Commerce investigations; performs internal investigations on the ground in Asia, Africa, the Middle East, Europe, Latin America and elsewhere; conducts risk assessments and benchmarking; advises on strategic transactions; develops and enhances compliance programs; and drafts and conducts anti-corruption training. Clients benefit from the advice of more than 60 experienced anti-corruption lawyers with extensive knowledge in all aspects of the field. Our team, which has been practicing in this area since active enforcement of the FCPA began, has advised on more FCPA public settlements since late 2008 than any other law firm. For each of the past seven years, Global Investigations Review has placed WilmerHale among the top five firms in its annual list of the world’s 30 leaders for investigations. www.wilmerhale.com/en/solutions/foreign-corrupt-practices-act-and-anti-corruption

Baker McKenzie has one of the world's top Foreign Corrupt Practices Act teams. Across our US offices, our group consists of seasoned investigators and white collar defense attorneys, several former federal prosecutors and SEC enforcement lawyers with more than 140 years of collective DOJ experience. We are best known for conducting multi-layered, multi-jurisdictional investigations and defending clients in cross-border enforcement actions, as well as providing risk management advice in a variety of practice areas -- anti-bribery and corruption, trade compliance, sanctions and boycotts, customs, cybersecurity, data privacy, AML and financial regulatory, health and safety, tax and supply chain.

Lowenstein Sandler is a national law firm with over 350 lawyers working from five offices in New York, Palo Alto, New Jersey, Utah, and Washington, D.C. We represent clients in virtually every sector of the global economy, with particular strength in the areas of technology, life sciences, and investment funds.

We have built a reputation for pursuing every matter with creativity and passion. Our industry knowledge, entrepreneurial drive, and proven commitment to our communities deliver a different and better law firm experience to our clients. We focus on building long-standing relationships and anticipating our clients’ needs, rather than responding to them. Working side-by-side with our clients, we serve not only as lawyers, but as trusted advisors.

We approach each case, each client, and each other with integrity and respect, and our awardwinning pro-bono work enables us to connect individuals and communities with unimaginable success.

We see our colleagues as family and commit to the personal development, support, and mentorship of all those under our roof. We work tirelessly to create a fully inclusive environment in which differing views and perspectives are welcomed and honored.

Morgan Lewis routinely represents clients who conduct business internationally and face increased challenges addressing anticorruption and other international regulatory risk. Our FCPA/Anticorruption team is made up of a dynamic team of lawyers, including a former chief of the US DOJ Criminal Division Fraud Section, a former US Attorney, more than a dozen former Assistant US Attorneys, and more than 25 SEC alums, including two former SEC regional directors, along with numerous additional federal and state prosecutors and leaders from other government agencies. Our international presence and substantial experience allows us to respond effectively and quickly to FCPA-related issues anywhere they arise. We assist clients with every aspect of FCPA/UK Bribery Act internal investigations, counseling, and response, including a review of international business activities, analysis of local laws, and FCPA/UK Bribery Act risk assessments. For more information click here or visit www.morganlewis.com

Willkie’s Compliance, Investigations & Enforcement practice represents companies, financial institutions, boards and individuals on sensitive, highstakes matters in the United States, United Kingdom and around the world. With leading practitioners on both sides of the Atlantic, many of whom have prior government experience, we have handled the most complex cross-border cases of almost any firm resulting in significant wins for our clients.

Our work is recognized by The Lawyer, Chambers USA, Chambers UK, and by GIR, which named Willkie the “Most Impressive Investigations Practice of the Year” and honored the firm for its role in the “Most Important Case of the Year” in 2020.

Thought leaders and innovators, Willkie partners have published a newly updated landmark FCPA treatise, The Foreign Corrupt Practices Act: Compliance, Investigations and Enforcement. The Willkie Compliance Concourse App has become a must-have resource for compliance professionals with over 200,000 users and includes a popular compliance-focused podcast.

Davis Polk has one of the world’s premier Foreign Corrupt Practices Act practices. We offer a unique platform that combines our experience and reputation in anti-corruption investigations and reviews with an integrated team to support clients around the globe. Our lawyers have been involved in some of the largest and most complex anti-corruption investigations in history, and many have substantial government experience in anti-corruption matters, including as leaders of the global FCPA programs at the DOJ and SEC. Clients turn to us for advice on all facets of FCPA compliance, acquisition due diligence, internal investigations, and defense against governmental enforcement. www.davispolk.com

Dechert is a leading global law firm with 22 offices around the world. We advise on matters and transactions of the greatest complexity, bringing energy, creativity and efficient management of legal issues to deliver commercial and practical advice for clients. For further information, click here

Miller & Chevalier is a recognized leader in anti-corruption investigations, counseling, and compliance. Consistently ranked as a top FCPA firm by Chambers Global, Chambers USA, and Chambers Latin America, which note our "strong team with talent across the board," we are "frequently called upon to handle high-stakes global investigations” and for our “[s]uperb compliance offering with extensive experience in everything from transactional due diligence to major corporate monitorships.” For over 40 years, we have partnered with our clients to help them successfully protect against and mitigate significant FCPA and corruption-related legal, commercial, and reputational risks.

K&L Gates has one of the largest, most comprehensive, and most geographically diverse investigations, enforcement, and white-collar practices of any law firm. Whether a matter involves the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), the Department of Justice (DOJ), the Federal Trade Commission, Financial Services Authority (FSA), BaFin, the Securities and Futures Commission of Hong Kong, state Attorney Generals, or another law enforcement agency, our lawyers located across Asia, Australia, Europe, and the United States have substantial experience in addressing matters early and proactively. Our team includes two former United States Attorneys, former DOJ prosecutors, former SEC staff, former state securities regulators, and staff lawyers from FINRA, the Commodity Futures Trading Commission, and numerous other law enforcement agencies.

Learn more at https://www.klgates.com/Government-Enforcement-Practices

MoFo’s FCPA + Global Anti-Corruption practice is led by two former managers of DOJ’s FCPA Unit: the Deputy Chief who supervised all DOJ FCPA investigations and resolutions in the U.S. and served as a principal author of A Resource Guide to the U.S. Foreign Corrupt Practices Act; and the former Assistant Chief who successfully tried two landmark FCPA-related cases and was later promoted to Senior Deputy Chief. We routinely develop and test compliance programs, mitigate risk in business partner relationships, perform transactional due diligence, undertake risk assessments, conduct internal investigations, and defend against enforcement actions in the U.S. and abroad.

Our team advises clients on all aspects of anti-corruption law — designing and improving compliance programs, conducting due diligence on M&A targets and intermediaries, leading internal investigations and negotiating with government enforcement authorities, handling post-resolution compliance responsibilities, and navigating the civil litigation that often accompanies anti-corruption investigations. We offer our clients a deep bench of seasoned professionals, including senior defense lawyers as well as former enforcement attorneys from both the DOJ and SEC. We remain the go-to firm for the largest and most complex global FCPA and anti-corruption investigations and have negotiated the joint-most FCPA settlements since 2008, and have led more FCPA monitorships than any other firm since 2004.

Our record of success has garnered numerous accolades for our practice: Paul Hastings is ranked Band 1 for Nationwide FCPA according to Chambers, and Law360 named Paul Hastings “White Collar Practice Group of the Year 2022.”

To learn more, visit https://www.paulhastings.com/

Weil’s White Collar Defense, Regulatory and Investigations Practice is regarded as a leader in FCPA and other anti-bribery and corruption (AB&C) investigations and compliance counseling. We offer clients deep experience in the most complex AB&C matters in both private practice and government service, global coverage, and excellent working relationships with AB&C regulatory agencies, which have helped us secure five declinations from the DOJ over the past six years on behalf of companies we represent. Our practice features a former Chief of the Fraud Section of the DOJ, as well as a former Chief of the Criminal Division in the U.S. Attorney’s Office for the Southern District of New York, and both a former Chief and Deputy Chief of the Business and Securities Fraud Section in the U.S. Attorney’s Office for the Eastern District of New York. Drawing on these and other members of our team in the U.S., Europe, and Asia, we provide counsel on sensitive investigations and related litigation, compliance program development, and transactional due diligence. https://www.weil.com/

As a truly global law firm, White & Case is uniquely positioned to help clients facing legal and regulatory challenges worldwide. Our cross-border experience and diverse team of local, US and English-qualified lawyers consistently deliver results for our clients. In both established and emerging markets, our lawyers are integral, long-standing members of the community, giving our clients insights into the local business environment alongside our experience in multiple jurisdictions.

Diligent is the leading provider of modern governance solutions. Our holistic view of governance, risk and compliance (GRC) enables transparency and connectivity across an organization — sparking the insights that the most influential organizations need to make better decisions and drive change. From secure collaboration, compliance and ESG solutions to our industry-leading insights and governance network, we are changing how work gets done at the board and executive levels.

Freshfields is a distinguished global investigations firm and offers deep familiarity with US enforcement agencies. Our anti-bribery and corruption practice works efficiently with team members around the world and understands the global regulatory arena, and regularly represent clients before the DOJ and SEC in government investigations conducted under the FCPA, alongside understanding the interplay with foreign regulators. We work as one firm with our colleagues around the world to investigate, address and advise on risks to our clients’ businesses.

Ever-changing market dynamics, technologies, regulations and unplanned events can obscure the path forward. Through an investigative mindset, intelligence and data analytics, we help our clients build resilient strategies and protect what matters most: reputation and value.

Our Investigations & Forensics specialists who understand the threats and vulnerabilities that exist across industries and territories bring extensive regulatory experience that can help you get the facts fast.

We work with you to institute an FCPA compliance strategy that employs a balanced approach with both proactive measures and defensive tactics, helping you prepare, respond and emerge stronger. To learn more, please visit www.pwc.com/us/forensics

We counsel clients on a range of issues with multi-jurisdictional connections, from bribery and money laundering to fraud, sanctions and securities violations. We work with some of the world's most respected and well-established financial institutions and other businesses, as well as startup visionaries, governments and state-owned entities. We help our clients adopt sound policies and practices, ensure compliance, and protect their competitive advantage.

FTI Consulting is an independent global business advisory firm dedicated to helping organizations manage change, mitigate risk and resolve disputes: financial, legal, operational, political & regulatory, reputational and transactional. FTI Consulting professionals, located in all major business centers throughout the world, work closely with clients to anticipate, illuminate and overcome complex business challenges and opportunities.

Ranked among the “Top Ten Law Firms in the World for Investigations” in the 2022 edition of Global Investigations Review’s GIR 100, Sidley’s FCPA lawyers assist businesses around the globe to navigate the challenges of managing their international operations compliant with U.S. anti-corruption law. In a climate of intensified regulatory scrutiny, Sidley’s Global Enforcement and Compliance team, consisting of former senior DOJ and SEC officials, is well-positioned to handle the most complicated FCPA and other international anticorruption matters involving the DOJ and the SEC.

Our lawyers are highly experienced and well-versed in the issues and processes companies and individuals can face in what are often multi-year, multi-agency matters of enterprise-wide significance. With high level DOJ alumni including a Deputy Attorney General, former U.S. Attorneys, over a dozen former Assistant U.S. Attorneys, 19 SEC alumni, including former Associate and Assistant Directors of the SEC’s Division of Enforcement, as well as a former Associate White House Counsel, and many Chambers-ranked lawyers, our team is well-qualified to assist companies in addressing FCPA and related challenges. We conduct internal investigations, create and implement compliance programs, perform compliance risk assessments, and conduct due diligence on potential merger and acquisition targets, joint venture partners, and high-risk third parties. We also counsel clients on compliance issues that arise from international licensing, and sales and marketing, and we have experience working with government officials and authorities around the world.

The BDO Forensics team provides clients with the knowledge, experience, technology and insights to navigate challenges and crises arising from disputes, regulatory compliance, fraud and corruption. With scale and speed, we leverage our global capabilities, innovative technology and deep functional and industry experience to help our clients simplify complex matters working with management to remain focused on operations and strategy.

BCG is a global consulting firm that partners with leaders to tackle their most important challenges and capture their greatest opportunities. Our success depends on a spirit of deep collaboration and global community of diverse individuals. Dr. Donatus Kaufmann/Managing Partner Kaufmann & Company Rechtsanwaltsgesellschaft mbH (former Executive Board Member ThyssenKrupp AG) combines strategic management consultancy with legal, ethics and compliance advice. He also acts as monitor with long standing collaborative experience with tier-one strategic consultancies.

CMS is a Future Facing firm. With 78 offices in more than 40 countries and 5,000+ lawyers worldwide, we combine deep local market understanding with a global overview, giving us the ability not only to see what’s coming, but to shape it. In a world of ever-accelerating change where technology is increasingly important in the deployment of global strategies, our clear, business-focused advice helps clients of every size to face the future with confidence.

Clients partner with Cooley on transformative deals, complex IP and regulatory matters, and high-stakes litigation, where innovation meets the law. Cooley has 1,500 lawyers across 18 offices in the United States, Asia and Europe, and a total workforce of 3,300.