Annual Report 2022

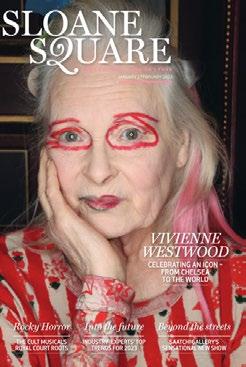

Cover image

The King’s Road Platinum Jubilee Street Party

Inside front cover Floral Queen’s Guard on Pavilion Road for Chelsea in Bloom 2022 ‘British Icons’

Cover image

The King’s Road Platinum Jubilee Street Party

Inside front cover Floral Queen’s Guard on Pavilion Road for Chelsea in Bloom 2022 ‘British Icons’

Cover image

The King’s Road Platinum Jubilee Street Party

Inside front cover Floral Queen’s Guard on Pavilion Road for Chelsea in Bloom 2022 ‘British Icons’

Cover image

The King’s Road Platinum Jubilee Street Party

Inside front cover Floral Queen’s Guard on Pavilion Road for Chelsea in Bloom 2022 ‘British Icons’

Cadogan is a family business which owns and manages an extraordinary property portfolio comprising mainly retail, residential and office assets in Chelsea and Knightsbridge. The business has a long heritage which provides a remarkable foundation upon which to base a contemporary, forward looking and dynamic business able to anticipate and respond swiftly to the changing needs of our customers and markets.

Cadogan’s long association with Chelsea began when Charles, Baron Cadogan, wed Elizabeth Sloane in 1717, some 300 years ago. Since that time, the family and place have grown together – today the Cadogan Estate is one of London’s most characterful and distinctive neighbourhoods.

Stewardship and community are central to our approach. Our long-term commitment comes with responsibility to ensure that we are making a positive contribution towards a sustainable environment, protecting the area’s unique heritage and supporting a thriving community.

• We aim to protect and enhance the Estate’s position as one of the world’s leading locations in which to live, work and visit.

• We have a proud heritage and aim always to safeguard our future and protect the portfolio as a long-term investment – creating and maintaining outstanding buildings and environment.

• As long-term stewards of Chelsea, we have a responsibility to make a positive contribution towards a sustainable environment and a thriving community.

• Our reputation is paramount. We always select the best external advisers and recruit the strongest internal team to deliver excellent customer service, be good neighbours and ensure that integrity is at the heart of all business decisions.

vibrant and compelling neighbourhood. In the spirit of a long-term, family business, our investment in Chelsea carried on throughout the pandemic despite the uncertainty we faced and the adverse impact on profits and property values at the time.

In 2022, total income increased to £186.5m (compared to £168.9m in 2021) exceeding the previous highest income recorded in 2019, which was £171.0m. The value of the property portfolio increased to £5.1 billion (2021: £4.8 billion), representing healthy growth even though this remains below the valuation in 2018 at £6.2 billion.

It gives me great pleasure to present a year in which Cadogan has performed so strongly. During 2022 total income has grown to the highest level in our history.

Looking back, I was delighted that my family’s business was able to significantly support our occupiers when they needed it most, together with charities serving the local community and the NHS, through the £20m Business Community Fund established at the very outset of the pandemic. This was coupled to extensive marketing activity to encourage footfall, supporting occupiers’ quick return to financial health. By the end of 2022, it was encouraging to learn that overall, our retail occupiers were reporting higher turnover and profitability than in 2019.

The ability of retailers to trade profitably has resulted in healthy demand for shops in Chelsea. This has been mirrored by a buoyant occupational market for office and leisure space together with a strong market for homes in Chelsea. The result has been good income growth and low vacancy levels across the portfolio.

Chelsea is a highly desirable place to live, work and visit. The success of Cadogan reflects this exceptional location in a residential area just outside the centre of London –one of the world’s truly international cities – together with our continuing investment in placemaking, the fabric of our buildings and careful curation to provide a

We made good progress during the year with our commitment to achieve Net Zero carbon emissions by 2030 and our other sustainability goals. The retrofit programme needed to ensure all our properties become compliant with Minimum Energy Efficiency Standards (“MEES”) is well underway.

Through a combination of my family’s charity, which is a shareholder of the business and chaired by my father, Earl Cadogan; the charitable donations made by the Cadogan business itself; and our "Chelsea 2030" strategy, Cadogan has continually supported and invested in charities, communities and a sustainable environment locally and far beyond. This approach is consistent with our values over a very long time and personally, I believe that it is vital in the twenty-first century that we are very clear on our broader purpose beyond the important job of delivering returns to our shareholders.

The placemaking investment of £46m into a transformation of Sloane Street’s public realm commenced during the year, in close partnership with the Royal Borough of Kensington and Chelsea.

One of our long-standing core objectives is to make a positive contribution towards a sustainable environment and thriving community

The project, which is a very good example of our long-term commitment to Chelsea, encompasses the entire length of Sloane Street from Knightsbridge in the north to Sloane Square in the south, and involves extensive greening including over 100 new trees, new high-quality paving and street furniture and widening of pavements to improve the pedestrian experience. The aim of this significant investment is to enhance Chelsea for residents and visitors alike and to cement Sloane Street’s reputation as one of the best luxury shopping destinations in the world.

Despite the poor macroeconomic environment, the continuing war in Ukraine, high inflation and interest rates and, more recently, several banking failures, I am confident that the investment we are making in the Estate will protect and enhance Chelsea for the long-term.

Our people are critical to our success, working in close partnership with our myriad of loyal suppliers and contractors, many of whom have worked with Cadogan for decades. Working physically together in Chelsea is a key factor in understanding the area, forging close relationships, creating a strong culture and encouraging

personal development. Since our team returned to the office virtually full time, I have seen strong evidence of the positive impact this has had on our performance.

I would like to thank all of our staff and external partners for their loyalty and efforts in helping to deliver an exceptionally strong performance in 2022. I was delighted to welcome Alison Nimmo to my board to provide further breadth to an impressive team. I would also like to personally thank all my fellow board members for their continued support, guidance and wise counsel.

4 May 2023

Above Summer in Sloane Square

An important contributor has been our unwavering focus on a long-term approach to managing and curating the Estate. Our concentrated, continuous property ownership of the area over very many years has allowed us to curate a mix of retail, restaurant, hospitality and cultural uses which contribute greatly to making the area a compelling place to visit. This includes the vital layering of uses over time that combine to create a place with which people develop an emotional connection, such as leisure uses in various forms ranging from a concert hall to a theatre and uses that matter to local residents such as medical facilities, eating and meeting places, schools, parks and beautiful open spaces. This approach applied consistently over a long period has supported a vibrant and thriving residential village in the heart of Central London that has a loyal residential population supplemented by local workers making it less reliant on tourists for footfall. This helps explain why our footfall figures have remained comparatively higher than other parts of central London.

This performance was driven by many factors. Amongst them was our commitment to continue investing throughout the various lockdowns. Our major development projects continued to operate safely, providing financial security for our loyal contractors and advisers as well as ensuring future income streams remained on target. Another factor was the carefully targeted support provided to our occupiers (as well as local charities supporting the community and the NHS) through targeted financial help from the £20m Business Community Fund, set up at the very start of the pandemic. Alongside this we delivered strong marketing support to encourage visitors to return when conditions made this possible, and the provision of over 900 alfresco seats and tables which provided a safe and attractive place to visit and meet family and friends as well as supporting local restaurants.

If 2021 was a year of recovery then 2022 was one where we finally emerged from the long shadow of the pandemic and benefitted from our carefully targeted support and investment to deliver an exceptional performance.

HUGH SEABORN CHIEF EXECUTIVE

Footfall is a good indicator of local economic activity. This started to recover following the end of the third national lockdown in April 2021, grew steadily through 2022 and consistently surpassed pre-pandemic footfall levels from April 2022 onwards. Compared to the UK as a whole and other prime central London areas, the footfall growth in Chelsea has been impressive. The high number of visitors was coupled with an increase in average spend per visitor, which led to the majority of our retail and food and drink occupiers seeing turnover and profitability return to or exceed numbers last seen in 2019.

We experienced increasingly buoyant retail leasing activity through 2022, resulting in competing interest for shops and restaurants towards the end of the year. The outcome has been that our vacancy levels remained low, averaging below 3.75% throughout the year and new retail lettings achieved an average rent of 25% above our valuers’ somewhat depressed December 2021 estimated rental values. In the second half of the year, coinciding with an

increase in international visitor numbers, there was a marked increase in activity for retail units on Sloane Street. This has been particularly from existing brands increasing the space they occupy, as well as international luxury brands seeking to open a first store in this location. Rents are typically being achieved at, or in excess of, pre-pandemic levels.

In terms of residential, there was strong demand in 2022 for short-let flats and houses coupled to a limited availability of quality units, which translated to healthy rental growth. We started 2021 with a higher level of residential short let vacant properties as a result of the large number of residents vacating during the pandemic and following lockdowns. We devoted significant resources to refreshing these properties so that by the beginning of 2022, vacancy levels had returned to the very low levels which are more typical. This allowed us to take advantage of the strong letting market and boosted rental growth to deliver our highest ever residential income.

“Pavilion Road off Sloane Square, created and managed by the Cadogan Estate, has become one of London’s most popular mews streets. With its collection of artisan food shops, cafes and restaurants that attract local residents and visitors alike, there’s always plenty going on, no matter the season.” – Vogue, July 2022

Our sustainability strategy, "Chelsea 2030", is an embodiment of our core objectives of creating and maintaining outstanding places and buildings while making a positive contribution towards a sustainable environment and a thriving community over the long term. Climate-related risks and opportunities are considered as part of our strategic approach and financial planning, through the lens of our long-term stewardship and commitment to the community.

In 2022 we focussed on our programme to de-carbonise the portfolio and made good progress, alongside extensive communication with our occupiers and suppliers to assist them with their sustainability objectives. In this report, we will share details of our performance to date against our Chelsea 2030 goals and the status of the various programmes comprising the strategy.

Underpinning our performance is a strong focus on customer service. We aim to:

• Create value through close, direct customer relationships.

• Deliver exemplary customer service to strengthen brand loyalty. We conduct regular surveys of our occupiers, including those that are departing, to understand and learn from their views and experience.

• Forge a strategic collaborative approach to promoting and developing our destinations to drive the success of commercial occupiers.

• Communicate regularly with our occupiers, including regular face-to-face briefings, to communicate our placemaking, development and marketing activities, allowing us to hear feedback and encourage networking.

• Collect trading data to advance our understanding of retail and hospitality performance and inform our estate management strategies.

We have continued to increase investment in destination marketing and local events to promote the area and encourage more people to visit more often and stay for longer. In support of this approach we have initiated and led the creation of two new Business Improvement Districts (BIDs) in the area (The King’s Road Partnership and The Knightsbridge Partnership) both launched after successful ballots, in late 2021. The two BIDs are already demonstrating their value through increased engagement with local property owners, occupiers and wider stakeholders including the local council and residents’ groups, to enhance the environment in their respective areas, increase visitor numbers and improve representation of their members.

We continue to invest heavily in the local area through development and refurbishment activity and through placemaking. The Duke of York Square, which is now well established and was thought to be the first public square created in London in over 100 years, was the result of our acquisition and sensitive redevelopment of the Duke of York’s Barracks. More recently, Pavilion Road was created after we consulted closely with residents about the types

of businesses they would like to see. As a result, it is occupied by a variety of artisanal shops able to provide the day-to-day needs of local residents and visitors. This includes a cheesemonger, fishmonger, wine shop, butcher, bakery, shoe repairer, dry cleaners, delicatessen and an eclectic range of restaurants and cafes. Since it has become established and pedestrianised by the local council, it has become a bustling environment in which to meet, be seen and people watch.

We are making an investment of £46m in Sloane Street in partnership with the Royal Borough of Kensington and Chelsea to comprehensively enhance the public realm. This includes replacing all the paving with the highest quality materials, installing carefully designed street lighting and furniture, widening pavements and introducing extensive planting and trees along the entire one kilometre length of the street. Our vision for the project is to reinforce the reputation of Sloane Street as one of the best luxury shopping boulevards in the world while providing beautiful public realm for local residents and all visitors to the area to enjoy.

“This Community Award is for a brand that has demonstrably supported its own people along all its value and supply chains as well as its local community and the community at large. The winning award goes to Cadogan for its outstanding contribution to making the Royal Borough a flourishing, sustainable community.”

– Caroline Rush, CEO British Fashion Council and Judge, Great British Brands Awards

The launch in 2021 of our sustainability strategy "Chelsea 2030", was accompanied by our Net Zero Pathway (which sets out how we intend to achieve the carbon target). The strategy was developed in collaboration with our local stakeholders and community, peer review and industry analysis. We engaged with a wide range of experts, local organisations and community members through a series of roundtables and a survey which gained over 2,000 responses from members of the local community. Our strategy spans all areas of our business including investments, development and operations.

Our approach is to seek to design, develop and manage buildings to enhance the health of the environment and improve the quality of life for our occupiers and local communities over the long term.

We have committed to designing and building net zero buildings. In every project we aim to reduce lifecycle emissions by prioritising material retention and reuse, adopting smart design, employing the latest construction methods and ensuring net zero is a target in every development from inception. Additionally, with long-term ownership and stewardship in mind, we design and build for resilience and adaptability in a changing climate and society.

To meet our net zero target and stay ahead of impending 2028 Minimum Energy Efficiency Standards (“MEES”) requirements of a minimum EPC rating of B for commercial buildings and minimum EPC rating of C for residential, we have developed a £90m decarbonisation programme which aims to improve the energy efficiency of our assets through insulation, airtightness and carbon reduction, efficient lighting and heating. Strong engagement with our occupiers will not only improve the energy efficiency of accommodation fitout but support behavioural measures to encourage a reduction in consumption within our spaces over time.

Net-zero carbon by 2030

10% carbon saving

Over 2,800 vulnerable people reached, across 39 grassroots organisations £90m decarbonisation programme launched

12.3% increase in Urban Greening Factor

£1.3m annual subsidy of keyworker and community housing, with rental freezes in 2022 to ease cost-of-living pressures

270 people supported with targeted skills development

60 community events

53% increase in operational waste recycled

Contributing towards a flourishing and sustainable local community has always been central to Cadogan’s approach to estate management. As a longterm family business, stewardship – the responsible management of resources for the benefit of current and future generations – has been at the heart of everything we do.CHELSEA 2030A SUSTAINABLE FUTURE CHELSEA 2030 Opposite Shopping, dining and summer events draw high footfall to Duke of York Square

88.9%

The business has performed strongly in 2022. Total income increased by 10.4% to £186.5m (from £168.9m in 2021), moving decisively ahead of the pre-pandemic high of £171.0m achieved in 2019. In 2022, there was no cost of rental support, rent free periods and write-offs of previously amortised lease incentives as a result of the pandemic (2021 – £3.1m).

Operating profit before capital items (an indicator of underlying operating performance as it excludes profit on the sale of investment properties and revaluation movements), reduced from £100.8m to £98.4m, down 2.4%. The decrease compared to the rise in total income was mainly due to an increase in property expenses as we increased investment in major projects such as the Sloane Street Public Realm.

The capital value of our property portfolio increased by 5.4%, adjusting for purchases, sales and capital expenditure, from £4.8 billion to £5.1 billion. This follows cumulative reductions in 2019 and 2020 before values stabilised in 2021. Values remain 17.2% lower than their 2018 peak of £6.2 billion (lower by 17.5% after adjusting for purchases, sales and capital expenditure).

In 2022, we invested £89.1m in purchases and development which will generate further rental income over time. This was substantially ahead of 2021 (£43.7m) and included three acquisitions of commercial properties with a total cost of £36.2m.

Rental collection has been impressive, returning to prepandemic levels and averaged 99% for commercial rents and 98.5% for residential rents during the year. Almost all the pandemic-related rent arrears have either been collected or disputes have been settled. The net figure for rents written off during the year was nil (2021: £0.6m).

In addition to the usual UK corporate taxes that apply to the group, the trusts that are the ultimate owners of the business are subject to a ten-yearly inheritance tax charge, based on the capital value of the assets and funded by the business. The latest charge was due and paid in 2022. Since 2013, over £200m of dividends paid by the business to its parent company have been used to fund the payment of this tax charge. We have a comprehensive strategy in place to ensure the substantial funding necessary to meet this tax charge is available and will continue to be so at ten-year intervals in future. Key financial highlights of 2022 are set out overleaf.

“...central London is all about location. But you have to ask why the location is desirable in the first place. It’s not because they are super-prime that they are being invested in and managed in this way; it’s because they are being invested in and managed in this way that they are super-prime.”

– FT Wealth magazine, Dec 2022

Total property portfolio value increase of 5.4% to £5.1bn

(equating to £262.5m increase after adjusting for purchases, sales and capital expenditure)

Commercial portfolio value higher by 5.2% to £3.6bn

Retail portfolio increased by 10.7% equating to £222.9m

Office portfolio lower by 4.2% equating to £31.2m

Leisure and other lower by 2.4% equating to £13.8m (after adjusting for purchases, sales and capital expenditure)

Residential portfolio value increase of 6% to £1.5bn (equating to £84.6m after adjusting for purchases, sales and capital expenditure)

While the portfolio grew in value overall, our principal sectors performed differently - which was also a theme over the pandemic – providing greater portfolio resilience, with retail and residential values growing while office and leisure values declined.

Retail was most affected before and during the pandemic by the acceleration of changes in consumer behaviour driving more retail transactions online and we have not been immune to these macro-forces. The speed of this change during the pandemic required retailers to rapidly rationalise their bricks and mortar presence, retaining stores in the best locations while closing down poor performers. Post-pandemic it has become clear that Chelsea has emerged well from these changes, as retailers have understood that they were able to trade profitably in this location. We have seen this evidenced by strong growth in demand and rents.

The Chelsea office market has proved to be resilient. Where space has become vacant, it has re-let quickly resulting in continuing low vacancy levels averaging less than 1%. Despite, or perhaps because of, continued higher levels of home-working, our experience has been that there is demand for well specified and located office space from small and medium sized businesses that place a high value on being located in an attractive ‘lifestyle’ environment. Office rents grew in 2022 but not sufficiently to offset an increase in valuation yields, resulting in a decrease in the value of the portfolio.

The residential short-term letting market in Chelsea proved very strong with high demand as people continued to return to London, coupled to limited supply. As a result, the short-let income has grown continuously since mid-2021 (when it stood at £30m) to nearly £34m at the start of 2022, ending the year at nearly £37m.

Retail, our largest sector at 45.3% of the portfolio, increased in value, up 10.7% to £2.3bn (after a cumulative like for like fall of 35% between 2018 and 2021). The result is that the retail element of the portfolio is £0.9bn (27.8%) below the 2018 value peak. Retail gross rental income increased by 7.1% to £86.3m per annum (47.7% of the total rent roll), remaining behind the 2019 high of £89.9m.

Offices, which represent 14.1% of the portfolio, decreased in value by 4.2% to £719.6m. The portfolio has remained virtually fully let through the pandemic and 2022. Office rental income increased by 16.0% to £39.1m per annum (21.6% of the total rent roll).

The Residential sector represents 29.5% of the portfolio by value. The headline valuation at £1.5bn was unchanged from the previous year but on a like-for-like basis after adjusting for purchases, sales and capital expenditure, the portfolio increased in value by 6.0%. This is the second annual increase following five years of declines which started in 2016. Gross rents for the market let portfolio increased by 8.7% to £36.7m from £33.8m, building on a 12.3% increase in the previous year. Adding ground rents from long leaseholds of £2.8m, residential comprised £39.5m or 21.9% of the gross total rent roll.

Post-pandemic it has become clear that Chelsea has emerged well…as retailers trade profitably in this location

Retail is our largest sector, accounting for 45.3% (up from 43.2% last year) by capital value and 47.7% (last year 48.8%) of income.

The growth in capital value was driven by an increase in rents achieved on new lettings in excess of our valuers' estimated rental values, offset by a modest widening of yields in some areas in response to rising interest rates and a worsening general economic outlook.

During the pandemic, retailers experienced an obvious acceleration in the underlying structural changes in consumer behaviour. Their response to the rapid move of sales online was to rationalise their store numbers, focusing physical presence in locations which traded well and most effectively supported their on-line businesses. Cadogan benefited from this, as retailers, when faced with such choices, generally opted to retain their Chelsea stores while closing others. Similarly, a number of strong retail brands chose Chelsea to open new stores because of the desirable demographic of the catchment and evidence from existing retailers of profitable trading. This has been supported by a positive outcome to the business rates revaluation for many of our retail occupiers, which will see their business rates bills reduce from 1 April 2023, easing the cost pressures arising from high inflation and energy prices.

2022 saw increasingly buoyant retail leasing activity and total retail rental gross income increasing by 7.1%

Based on sales data that we obtain from over 170 occupiers, it is evident that footfall and trading performance are closely correlated. As footfall rapidly returned to pre-pandemic levels on the Estate, driven in part by our curation of the area and marketing and placemaking strategies, we have seen a strong increase in demand for vacant retail and hospitality space and a consequent strengthening in lease terms and rents achieved. Despite the market adversity over the past few years, we have maintained our standard lease terms which support our holistic estate management strategy.

We have experienced healthy demand from new brands wishing to enter the area and existing retailers seeking expansion locally. The increasing retail lettings activity emerged in the second quarter of 2021 and continued through the course of 2022. The King’s Road and Duke of York Square were early benefactors of this interest which widened to Sloane Street by the second half of the year.

We have experienced healthy demand from new brands wishing to enter the area and existing retailers seeking expansion locally

We were thrilled to welcome many new and exciting brands during 2022. These included pre-loved luxury fashion from Lampoo, American women’s fashion label Anine Bing, sustainable women’s fashion brand Reformation, the great British success story of Rixo, women’s ready to wear brand Self Portrait, young UK independent fashion from Wyse, traditional French children’s fashion by Jacadi, eco-friendly footwear AllBirds and French beauty brand Oh My Cream; all on the King’s Road and Duke of York Square. On Sloane Street, we welcomed the family run luxury Italian menswear brand Kiton plus the fragrance and wellness maison Diptyque. In the meantime, both the multinational French luxury brand Christian Dior and the Florentine fashion house Ermanno Scervino, committed to substantial up-sizes. With the aim of further strengthening the food offer on Sloane Street we secured the restaurant group Aqua led by David Yeo, which will open a new concept in Autumn 2023.

The business continued its long track record of maintaining low vacancy levels, finishing the year with a retail vacancy rate of 2.0%, lower than the start of the year when it was 2.7%, including a reduced number of temporary retailers – pop-ups – which allow us to introduce new and emerging names and concepts as part of our wider curation of the mix, contributing to vibrancy and excitement for consumers.

The public realm project on Sloane Street commenced on-site during the year. When complete in 2024, Sloane Street will be transformed into a safer, greener and more beautiful one kilometre boulevard. This will include extensive greening including new street planting and over 100 new trees, carefully designed new lighting and street furniture and where appropriate, wider pavements. The result will be a hugely enhanced pedestrian experience with a neutral effect on vehicular traffic. Inevitably there will be some disruption during the period of the works affecting traffic using the road, local residents, businesses and occupiers. Cadogan are working in close consultation with the Royal Borough of Kensington and Chelsea, who are overseeing the project, to minimise disruption.

Offices account for 14.1% of the portfolio by capital value of £719.6m. By income, offices represent 21.6% of the total and gross rents increased by 16.0% over the year, primarily due to inflation-linked increases and a number of new lettings.

The office portfolio has continued to be virtually fully let through 2022, with a year end vacancy rate of 1.1%. Office occupiers on the Estate typically highly value the vibrant local environment and lifestyle. Our observation is that they also tend to favour physical collaboration and presence in the office and this contributes to our wider estate management by introducing an influx of workers to the area, stimulating physical and economic activity locally.

Activity across London has continued to increase through a combination of more workers returning to the office and a rise in tourists. London remains one of very few world capitals that offers a magnetic mix of access to talent, finance, culture and services which makes it a highly attractive location in which to live and to work.

Left Chelsea’s lifestyle appeals to many as a head office location

Opposite Louis Vuitton on Sloane Street, who have extended to offices above ground floor retail

Below 224-226 King’s Road development, including new office space

The office portfolio has continued to be virtually fully let through 2022

The gross value of our residential portfolio represents 29.5% (30.5% in 2021) of the total. Income from residential represents 21.9% (22.1% in 2021) of the total. Residential remains our second largest sector (after retail) and is important as it diversifies performance, drives our customer service understanding and reflects our strong stake in a thriving local community.

The high percentage change in value relative to the actual movement in gross value during the year is primarily due to a programme of planned disposals, representing £50.7m by book value.

The lower relative income yield produced by residential compared to commercial, reflects the combination of

reversionary long leases which produce little income (but provide a return when the long leaseholders choose to enfranchise) and the private rented sector portfolio which generates a rental yield that is lower than commercial property.

The proceeds from enfranchisement sales during 2022 were £34.5m compared to £26.3m in 2021, remaining significantly lower than the ten-year average prior to 2019 of £74m. These sales represent the disposal of interests in 48 units (2021 – 29 units). Proceeds from 16 further discretionary sales totalled £30.6m (2021 –£55.9m). These disposals generated an overall profit of £14.4m.

£1.3m

annual subsidy of keyworker and community housing, with rental freezes in 2022 to ease cost-of-living pressures

A review of residential leasehold reform legislation relating to long leasehold property was announced in 2021. The simplification of this arcane area of law is generally welcomed however, amongst the extensive proposals are two areas that we believe will have unintended adverse consequences and a direct impact upon the Cadogan business:

• An intention to “abolish” the marriage value element of compensation to freeholders. This would result in a completely inequitable one-off transfer of value (often a significant element) from freeholders to leaseholders. Prior to these proposals, leaseholders would have had no reasonable expectation of such a windfall. The impact for Cadogan would be to reduce future enfranchisement proceeds and inevitably reduce our ability to invest in the Chelsea estate over the long term. Although the financial impact over time will be substantial, this future potential revenue is largely discounted in our valuations as the timing is unknown and the proposed reforms have introduced greater uncertainty, and therefore only a small element is included within the balance sheet.

• The second element of concern is the proposal to lower the percentage of residential space required for collective enfranchisement claims (the compulsory purchase of a freehold) from 75% to 50%. Under this proposal more owners of commercial property assets will be bought out by the residential upper parts. The reduction in the ability to manage the properties will effectively deter investment in mixed use regeneration schemes which generate housing supply in city locations. It will also undermine high streets across the country by limiting the ability to effectively curate ground floor commercial uses and discourage long term investment.

There have been six housing ministers over the past 12 months - in this time these reforms have not progressed far. We are continuing to work with civil servants and the new housing minister to assist Government in understanding the potential impact of the proposals and our hope remains that these elements will be removed from the reforms.

Our private rented sector portfolio comprises nearly 700 houses and flats. A strong rental market led to properties letting as soon as they became available, often at higher rents. Our ability to take advantage of the very healthy market was strengthened by ensuring our short let residential homes are delivered to the specification and quality demanded by the market and supported by a very high level of customer service provided to our occupiers.

Residential is important as it diversifies performance, drives our customer service understanding and reflects our strong stake in a thriving local communityAll images and previous spread A beautifully refurbished period home on Sloane Street

This category comprises hotels, restaurants, pubs, our growing regional portfolio, and a variety of other properties such as schools, cultural and artistic venues, car parks and medical uses. Leisure and Other accounts for 11.2% of the value of the portfolio, up from 10.8% in 2021. Rental income increased by 10.4% (2021: 2.1%) due to growth in income of the regional portfolio and, to a lesser extent, new lettings on the Estate.

The main reason for the valuation decline on a like for like basis was a fall in the value of the regional portfolio of 14.8%, driven by a large widening of yields on industrial properties which comprise over half of the portfolio. The leisure component was subject to a like for like increase in value of 1.4%. The overall increase in gross value despite the like for like reduction, was due to acquisitions of £36.2m and development expenditure of £27.3m.

The gross value of the regional portfolio was £116.3m at the year end (£104.4m in 2021), the increase caused by the resumption of acquisitions totalling £26.3m following a long pause in investment as a result of firstly, political uncertainty in 2019, then the pandemic and finally the turmoil following the September 2022 mini-budget. Subsequently, as the property market has rapidly repriced, we have seen the market disruption caused by the increase in UK Gilt rates in the fourth quarter of 2022, as an opportunity to deploy investment capital at adjusted values providing stronger income for the future.

The number of food and drink offers on the Estate has more than doubled over the last five years

The sole strategic objective of the regional portfolio is to help finance the ten-yearly inheritance tax liability paid by the trust settlements that ultimately own Cadogan. Therefore, the aim is to secure commercial property investments that provide a secure level of income that is higher than the Chelsea estate. The resilience was evidenced during the pandemic when we experienced 100% rent collections and no tenant failures. Our intention is to grow this portfolio further over the coming years, subject to market conditions.

The leisure sector is vital to our strategic estate management approach as these uses contribute immensely to the identity of Chelsea and the connection which residents and visitors feel for the area. For example, we own eight pubs in Chelsea. We do so because we consider them to be an important use for a compelling locality and to support the community, as elsewhere in the area many pubs have been lost to residential conversion.

Our strategic aim is to increase the extent and breadth of food and drink outlets in the area. The number of food and drink offers on the Estate has more than doubled over the last five years to 39 businesses, with further opportunities planned. These businesses strengthen the holistic experience for visitors and residents and improve the attraction of Chelsea. In 2022 we converted two retail units to provide high quality space for restaurants on Sloane Street and Pavilion Road. The first of these units was let after strong competition for the space and will open later in 2023 as a 200-cover restaurant. The famous Tuscan restaurant Cantinetta Antinori on Harriet Street and Meat the Fish on Cadogan Gardens are both due to open in 2023.

We look forward with great anticipation to the launch of our latest hotel at 1 Sloane Gardens which will open in 2023 after an extensive re-development and fit-out. The intimate hotel (35 rooms) as well as a basement bar and top floor restaurant will be run by the celebrated Parisian hotelier and restaurateur Jean-Louis Costes. We expect this to transform the area around Sloane Square, complementing the existing restaurants such as Colbert and The Botanist.

Our strategic objective of raising investment in the hotel sector is aimed at increasing the diversification of our income coupled to the estate management advantages of enhancing local hotel provision. Since 2019 we have developed and opened two hotels, The Cadogan and Beaverbrook Townhouse and launched serviced apartments at 3 Sloane Gardens and 20 Cadogan Gardens. In December 2022 we acquired the Draycott Hotel on Cadogan Gardens – a well-established 35 room hotel - which is undergoing a rolling refurbishment while remaining operational. The hotel sector attracts visitors to Chelsea from abroad and from within the UK, who contribute to the local economy through their spend in local shops, restaurants and attractions.

We continually invest in maintenance, refurbishment and redevelopment across the Estate, to deliver consistently high quality outcomes for our customers, to respond to rapidly changing markets and to enhance the fabric of the Estate including environmental credentials and historical character. In 2022 our total expenditure on redevelopment and major refurbishments increased to £59.8m (£51.1m in 2021).

We maintained construction activities safely throughout the pandemic with the exception of small residential schemes which were typically in confined spaces where social distancing was challenging. This was considered important to maintain the momentum of our projects and financially support the wide eco-system of contractors and their sub-contractors and employees who we rely on to provide outstanding results.

The majority of construction expenditure in 2022 was in respect of two schemes.

1 SLOANE GARDENS , which is the restoration and conversion of an Edwardian apartment block into a boutique hotel and restaurant. This new hotel, opening in 2023, will be operated on our behalf by the celebrated Parisian hotelier and restaurateur Jean Louis Costes.

196/222 KING’S ROAD is a 100,000 sq ft redevelopment of a large site which will deliver flagship shops to the King’s Road, community retail on Chelsea Manor Street and affordable and market let residential apartments, a Curzon cinema, rooftop bar, public house and an enhanced Waitrose supermarket. We have managed this complex scheme carefully to enable the Waitrose supermarket to remain open despite surrounding construction, due to its importance locally. This development is due to reach practical completion of the shell construction later in 2023, followed by an 18 month fit-out programme for the offices and residential space.

Sloane Street Public Realm is a major scheme in partnership with the Royal Borough of Kensington and Chelsea, to transform Sloane Street into a compelling and elegant space for pedestrians, residents and visitors alike, and to reinforce the street’s position as one of the world’s finest luxury shopping boulevards. The bulk of the £46m

expenditure on the scheme will be reflected in our accounts during 2023 and 2024.

Our development pipeline at the end of 2022 comprised 81 projects of which 8 were under construction. The overall pipeline of expenditure was £554m (2021: £489m).

We are constantly aware that our construction activities can and do impact upon those around us. As well as ensuring we respond to our neighbours during construction and mitigate the disturbance where possible, we aim to be exemplary in the way in which we consult and engage locally when preparing a scheme, to understand local concerns and consider how we can respond to them. A programme of regular communication ensures that those people that are affected and/or interested, remain fully informed. Our aim is to be the most trusted local developer and therefore to be able to adapt and respond to changing needs to ensure the area remains relevant and desirable to present and future generations of residents and visitors.

Sloane Street’s transformation will reinforce its position as one of the world’s finest luxury shopping boulevardsBelow Seasonal planting scheme for Sloane Street by multiple Chelsea Flower Show award winner Andy Sturgeon Bottom Arts and Crafts inspired cast-iron lamppost detail, part of the Sloane Street transformation SPRING SUMMER AUTUMN WINTER

the pandemic behind and deliver an exceptional performance over the past year.

This perspective and agility has enabled us to carry on investing in the Estate throughout the uncertainty of the pandemic, provide crucial support to our occupiers and contractors, as well as assist charities serving the local community when it was needed most – looking beyond short term disruption to the future.

This consistent long-term approach, coupled with the unique features of Chelsea, our diversified but geographically concentrated portfolio and inflation protected income has enabled us to leave the effects of

Of course, the pandemic has been replaced by new and emerging uncertainties such as the Russian invasion of Ukraine which has led to increases in the cost of energy and food products, exacerbating a general inflationary environment caused by the sudden increase in world demand for commodities and raw materials and blockages in supply chains as life returned to normal. More recently there have been some high profile banking failures and concerns of contagion in the financial markets.

Central banks have acted to bring inflation under control by increasing the cost of borrowing. This contributed to fears of a recession in the UK, although more recent forecasts have been less negative and suggest that we will experience little or no growth in the UK. The long period of cheap and available money following the Global Financial Crisis has come to an end which brings challenges to real estate markets which rely on debt funding.

Our strength is our ability to consistently apply our strategic approach over the long-term, while being able to anticipate and respond swiftly to the changing needs of our customers and markets.

Inflation and supply chain pressures have particularly impacted construction costs which we have experienced in Chelsea. Although this is starting to settle, the cost increases continue to reduce returns on our development activities. It remains unclear whether rising mortgage costs will adversely impact consumer confidence and spending across the UK and therefore retailer prospects. Although Chelsea faces the same economic headwinds as the rest of the UK, the high quality characteristics of our portfolio, our occupiers and the consumer catchment, provide an element of protection, giving me confidence that we will deliver a positive performance in the year ahead as well as over the long term. This confidence is underpinned by the strong recovery of our retail, leisure and hotel occupiers, coupled to the index-linked characteristics of our income.

We are experiencing continued healthy demand for our residential, retail, office and leisure properties which is supported by limited supply in the market as vacancies remain negligible. The forecast continued gradual increase of international visitors to London, particularly the reopening of China’s borders to outbound travel, is expected to boost retail business in international centres including Sloane Street in particular.

Valuations for UK commercial property over the past year have been adversely impacted by the widening of yields driven mainly by expectations of higher long-term borrowing costs. The market appears to have adjusted swiftly and there are signs in many sectors that values are stabilising, which brings greater market stability and provides reasons for measured optimism for future capital value growth prospects.

We place great value on collaborative teamwork at Cadogan reflecting our agile, multi-disciplinary and highly experienced team. Our return to the office once restrictions were lifted last year, has been a decisive factor in our excellent performance as we have benefited from stronger collaboration, productivity and staff development which in turn has allowed us to respond to opportunities swiftly, navigate adversity nimbly and provide consistent, excellent customer service.

It has been a period of adjustment for everyone in the work environment. However, despite the additional challenges everyone has faced, I have never ceased to be impressed by the loyalty, determination, ‘make it happen’ ethos and dedication of our team and the extensive network of consultants and contractors on whom we depend. Therefore, it is entirely fitting to conclude by thanking my management team, all our staff as well as our external partners for their vital contribution to the delivery of an impressive set of results.

HUGH SEABORN CHIEF EXECUTIVE4 May 2023

We place great value on collaborative teamwork at Cadogan reflecting our agile, multi-disciplinary and highly experienced teamOpposite (L-R) Shoppping on Duke of York Square; a Corgi enjoys the King’s Road Platinum Jubilee party; Christmas on the King’s Road Left A giant floral Queen’s head on Sloane Square, for Chelsea in Bloom 2022 ‘British Icons’

booked as a cost in Cost of Sales. There was no impairment charge in the year (2021: £0.6m).

Rent collections returned to pre-pandemic levels in 2022, averaging 99% for commercial occupiers and 98.5% for residential tenancies.

Operating profit before capital items decreased by £2.4m to £98.4m. Had we restated the misstatement due to the rent smoothing adjustment above in 2021 we would be reporting a £7.8m (8.2%) increase in operating profit before capital items from £95.7m in 2021 to £103.5m in 2022. The improvement in turnover was mostly offset by a rise in property and administration expenses due to increased development and trading activity.

SANJAY PATEL FINANCE DIRECTOR

Turnover includes income from hotels and serviced apartments of £8.9m (2021: £3.1m), the increase driven by a strong recovery of the hospitality sector following the first year since the pandemic started when hotels were no longer faced with restrictions on opening or trading.

During the year an overstatement of 2021 gross rental income by £5.1m was identified relating to a rent smoothing adjustment. We have chosen not to restate the prior year revenue figure given the amount is immaterial. Had a restatement been made we would be reporting gross rental income growth of £16.5m (10.3%) between 2021 and 2022. The significant year on year increase reflects a year of strong growth in leasing activity accompanied by rents achieved on average in excess of ERV and the impact of inflation-linked rent increases across the commercial and residential sectors.

There were no additional rent concessions provided in the year recognised as a reduction to gross rental income (2021: £3.1m)

In relation to rent deferrals or rents outstanding, the rental income is recognised as normal with the deferred rent or rent receivable balance remaining in trade debtors until settled. Where there is a credit risk over recoverability of a balance that is contractually due, any impairment is

Property expenses increased mainly as a result of carrying out more refurbishments in the year and the commencement of the Sloane Street Public Realm project. Hotel and serviced apartments cost of sales reflected a full year of costs for the Beaverbrook Town House, which opened in August 2021.

Administration expenses increased mainly as a result of costs incurred for the arrangement of long-term private placement financing, increases in salary, marketing and overhead costs.

The profit from the sale of investment properties in 2022, which includes profits from leasehold enfranchisements, contributed £15.1m compared to £12.2m in 2021 despite lower net proceeds. There was a higher number of transactions completed at 64 compared to 49 in 2021.

The consolidated income statement reflects the movement on the annual revaluation of the investment property portfolio. All categories apart from office and the regional portfolio increased in value during the year resulting in a net revaluation gain of £262.5m (2021: £34.6m).

The charge for current taxation in the year was £13.3m, a decrease of £5.6m compared to 2021 and a larger decrease than the decrease in operating profit, mainly because of a larger gain chargeable to corporation tax in 2021 from the sale of investment properties.

Turnover increased by 10.4% to £186.5m

(2021 - £168.9m)

Gross rental income increased by 3.8% to £170.8m

(2021 - £164.5m)

Operating profit before capital items decreased by 2.4% to £98.4m

(2021 - £100.8m)

Gain on revaluation of investment properties £262.5m

(2021 – £34.6m)

Increase of 5.4% in capital values on a like for like basis

Residential property disposal and enfranchisement proceeds reduced by 20% to £65.8m

(2021 – £82.2m)

Profit on property disposals and enfranchisement sales increased by 23.8% to £15.1m

(2021 – £12.2m)

Profit on ordinary activities before taxation (including revaluation gains) of £340.2m

The overall figure for taxation in the income statement for 2022 was a charge of £79.0m (2021: charge of £228.7m). The reduction compared to 2021 is due mainly to a deferred tax charge in 2021 recognising an enacted future increase in the corporation tax rate from 19% to 25% in April 2023.

There were two dividends paid to shareholders in 2022, a first interim dividend of £49.6m in April and a second interim dividend of £26.9m in December. The first interim dividend was paid mainly to provide further funds to the major shareholder so it could meet an upcoming tenyearly inheritance tax charge which was due in 2022. A proportion of the second interim dividend and all normal dividends is set aside by the major shareholder to provide funds for future ten-yearly inheritance tax charges. A further portion of the dividend is paid to a charitable trust set up by the Cadogan family which requires the funds to make charitable donations.

Cadogan is mindful of its tax obligations and is liable for, and collects on behalf of HMRC, various taxes in its operations. The table below shows the tax paid by Cadogan and that collected and remitted to HMRC by Cadogan. As in previous years, the tax collected is significantly greater than the direct tax charge shown in our accounts, demonstrating our wider contribution to the UK economy.

income tax. Furthermore, a substantial proportion of the dividend is used to provide for the ten-yearly charge to inheritance tax in relation to certain of the trust assets. In the case of the principal trust, it paid the latest ten-yearly charge in 2022 and is now starting to put funds aside for the next ten-yearly charge, due in 2032. We calculate that total dividends required by the family trusts from Cadogan to pay the inheritance tax charge due in 2022 amounted to £205m.

The value of our properties at the end of 2022 was £5.10bn, an increase on the previous year’s figure of £4.80bn. On a like for like basis this reflected an increase in value of 5.4% compared to a small increase in 2021 of 0.7%. Consequently, Group shareholders’ funds increased from £3.26bn to £3.44bn. Net assets per share increased to £28.68 from £27.14, an increase of 5.7%.

Cash inflow from the Group’s operating activities rose to £126.5m, compared to an inflow of £44.0m in 2021. The cash flow in 2021 was lower mainly because of a £51m short-term loan advanced to the parent company Cadogan Settled Estates Holdings Limited to enable the latter to make a capital distribution to the trust settlements that own the Group to fund the 2022 inheritance tax liability. The loan was repaid in April 2022.

Year end borrowings, excluding cash of £62.0m (2021 –overdraft of £2.4m), increased during 2022 from £806.8m to £850.4m. In December we received £100m from a deferred drawdown of a private placement completed earlier in 2022. As a result of these proceeds, the revolving credit facility was not utilised at the year end, a decrease of £35m compared to 31 December 2021. There were loan repayments in the year totalling £19m, comprising a £4m capital repayment in March on a loan maturing in 2025 and £15m in December in respect of maturing loan notes from a 2012 private placement. There was a reduction of £2.4m in 2022 after translating our dollar denominated borrowings at the year end exchange rate and recognising the fair value of the related cross currency swaps. At 31 December 2022 the average maturity of our debt was 16.33 years (2021: 12.28 years) and the average effective rate of interest across all drawn loans reduced from 4.44% in 2021 to 4.19%. Apart from the revolving credit facilities, all our debt is at fixed rates.

There was a reduction in year end balance sheet gearing to 22.9% from 24.9%. Gearing as measured under our loan covenants, reduced by 1.6% to 18.9%, while interest cover decreased to 3.2 times from 3.4 times, comfortably in excess of our financial covenants. At the year end there were total undrawn facilities available to the Group of £300m under revolving credit facility arrangements.

In addition to the tax set out in the table, Cadogan Group’s dividends flow through to several family trusts and are (save in the case of a charitable trust) subject to

In February and March 2022, we arranged £300m of long-term funding from three private placement deferred loans, taking advantage of low interest rates in anticipation

of projected funding requirements over the next five years. £100m of this funding was drawn in December 2022, £50m is deferred to September 2024, £50m to March 2025, £50m to September 2025 and £50m to September 2026. The initial tranche of £100m matures in 2043 and the remaining tranches have maturities in 2060 and 2062.

On 15 March 2023 we refinanced our revolving credit facilities, increasing them by £50m to £350m in a new syndicated revolving credit facility for a term of 3½ years expiring on 15 September 2026, with two 1-year extension options exercisable from 1½ years and 2½ years of the start date.

We have undertaken a stress test with a severe but plausible downside scenario of an economic downturn beginning in the second half of 2023, to assess the potential impact on headroom for liquidity and loan covenant compliance, taking account of mitigations available. Details of the stress test are provided in the Going Concern section of the Directors’ Report on pages 94 to 95 and the conclusion is that, in the severe but plausible downside scenario modelled, we would have sufficient liquidity and satisfy all our loan covenants in 2023 and 2024.

Cadogan has a well-developed strategy and process for risk management. Overall responsibility for risk management lies with the Group board, which is responsible for determining the Group’s risk appetite and ensuring that the Group’s risk management system properly identifies, understands and manages all relevant risks.

The Group’s risk appetite and processes for managing risk are regularly reviewed by the board. The Finance Director, supported by the senior management team, is responsible for compiling the Risk Register which is updated on a regular basis. The Risk Register identifies the principal risks impacting on the business and the Group’s financial position. It provides an assessment of the likelihood of the identified risks materialising and includes an estimate of the potential impact of each area of risk on the business. The Register is formally reviewed by the board at least annually and this forms an important part of the overall risk management process. The Group also makes use of appropriate external specialists to advise on compliance with established policies and external regulations.

Cadogan is a long-term property investor with a clear focus on high quality property assets located in central London. Because of its private ownership and long-term outlook, the Group aims for, and is able to achieve, a high level of resilience in all areas of the business.

Cadogan assesses risk under three principal headings:

• Strategic risk

• Financial risk

• Operational risk

Our proactive support of occupiers during the pandemic, coupled with strong place making and curating of our portfolio has enabled the business to rebound swiftly during 2022 with high occupancy and demand for vacant space across all sectors driving robust rental growth. We have not yet seen a slackening in demand caused by the economic slowdown, benefiting from the high income demographic mix of the resident population in Chelsea and visitors to the area. Our occupiers, similarly, have experienced healthy increases in turnover as evidenced by the trading data we receive from a large proportion of our retail and hospitality occupiers.

With COVID-19 restrictions lifted and the success of the vaccination programme we view the pandemic as a receding threat but remain alert to the risk of more virulent variants emerging in future.

The recent stabilisation of the UK political environment is welcomed as it should reduce economic volatility notwithstanding the continuing risks posed by a high rate of inflation, forecast to reduce to low single digits by the end of 2023, consequential increases in the cost of borrowing and the ongoing war in Ukraine. Some of these factors could adversely impact rental income and UK property values.

Looking further forward, a change in government in 2024 could result in new policies, particularly on tax, the environment and property reform, which could impact our business.

Property market risks – the risks arising from property cycles and from shorter-term unexpected changes in the market for property investment, development and occupation. Retail has been subject to structural changes for many years, such as the ongoing shift to online transactions. These trends were accelerated by COVID-19, forcing the closure of many weak retail businesses, while others have successfully adapted their models to trade successfully in the new environment. Cadogan has been preparing for many years for the shift of retail sales to online by having a diversified asset portfolio, positioning its Estate towards luxury and distinctive retail propositions, increasing non-retail leisure and food and beverage options to increase attractiveness and increase dwell time in the area, and minimising vacant units with short-term lets to on-trend retail and hospitality occupiers. Cadogan led on the establishment of the first two Business Improvement Districts (BIDs) in 2021 in the Royal Borough of Kensington and Chelsea, on the King’s Road and Brompton Road. These are already helping to promote these areas, enhancing their vitality and attractiveness.

The move to more flexible working caused by COVID-19 has made the long-term demand for office space less certain, though Cadogan has not experienced a reduction in

demand to date with vacancy levels remaining low at around 1%. The migration out of London of residential short-let tenants caused by the pandemic has largely reversed since the second half of 2021 with residential demand and occupancy stronger than before the pandemic.

Most property markets are cyclical, and this is particularly true of central London. As a long-term investor the Group is less reliant than others on predicting property market cycles and aims to manage the impact of the property cycle and any other short-term fluctuations in values or activity levels by ensuring a relatively high proportion of committed long-term loan finance, planning for significant headroom against external financial covenants and high levels of available liquidity. These factors also assist the Group in managing cash flow and liquidity risks.

Geographic concentration – the Group accepts the risks inherent in the small geographic area in which the Group’s properties are concentrated. The Group’s properties are primarily located in Kensington and Chelsea which for many years has been an area renowned for long-term prosperity and economic resilience. The Group also seeks to balance this geographic concentration through a diversified portfolio of uses and through close attention to the balance between sectors. The largest individual property represents 5.1% of the total portfolio value and the highest individual rent 3.6% of total annual rental income.

Cadogan has carefully curated its Estate over many years to create a vibrant local neighbourhood where spending is dominated by its residents and less reliant on visitor footfall. This was evidenced by the comparatively smaller reduction in footfall during the pandemic than other central London areas.

The Group monitors and is actively involved in consultation with the Royal Borough of Kensington and Chelsea where it considers that it could be affected by changes or developments to local planning policies. The Group is committed to close liaison with stakeholders and the community to ensure that its strategy and developments are understood externally. In addition, there are statutory and regulatory risks which are closely monitored.

Development risks – Cadogan regularly undertakes substantial development projects, but carefully considers the timing to ensure that the Group’s exposure to development risk is controlled, both relative to the overall portfolio and to potentially competing schemes in the same area. Cadogan consults widely with diverse stakeholders on development schemes to ensure that schemes are designed to the highest quality and to assist in obtaining the most appropriate planning consent.

COVID-19 had a number of adverse effects on development activity. Some development projects were delayed to preserve financing headroom in the face of uncertainty as to the length and severity of the pandemic. Compliance with social distancing guidelines meant

fewer workers were allowed on some sites, affecting productivity. Materials shortages led to delays and increased inflation in input costs, which may lead to cost overruns on some projects. There is a need to incorporate additional flexibility in future development projects to allow a wider range of end uses following recent changes in planning use guidelines and changing market demand over time. Movement of international labour caused by travel restrictions impacted some projects relying on specialist skills from other countries. Most of these risks have abated during 2022, though high inflation continues to affect costs.

In 2022, we undertook a comprehensive review, resulting in changes to the way we procure major development projects (those costing more than £10m) and, for high value projects, we appointed new cost consultants and quantity surveying firms experienced in overseeing large, complex projects.

Risks associated with London's position as a global capital – London’s position as a global capital has been a significant factor in the overall prosperity of central London in recent years. There are risks to this position from several factors, most significantly from Brexit, from terrorism, from under-investment in infrastructure and from adverse changes to the tax regime, particularly affecting overseas investors. The Group cannot manage or control these risks but Cadogan takes an active role in lobbying through organisations such as BusinessLDN and the British Property Federation amongst others, to ensure that the long-term health of London is at the forefront of the minds of national and local government.

COVID-19 reduced the number of international visitors to the UK which adversely impacted retail on the Estate in the short-term. This has been exacerbated by the withdrawal of tax-free shopping by the Government, making the UK the only major European country that does not have a practical tax-free shopping scheme for overseas tourists. Inbound tourism has rebounded during 2022 but has still not returned to pre-pandemic numbers unlike some competing capital cities in Europe such as Paris, which is thought to be partially linked to the withdrawal of tax-free shopping. Cadogan is working closely with its retailers on enhanced marketing strategies for attracting more UK and international visitors to the area in 2023 and beyond.

Interest rate risk – The majority of long-term borrowings are at fixed rates of interest, achieved either by agreement with the lender, or through the interest rate derivatives market. The board requires at least 75% of long-term debt to be subject to fixed rates of interest. The Group does not undertake financial instrument transactions that are speculative or unrelated to trading activities. Board approval is required for the use of any new financial instrument. In December 2021 and January 2022, the Group took advantage of low prevailing interest rates to raise £300m of fixed-rate, long-term deferred borrowing

with maturity dates ranging from 2043 to 2062 which will be drawn in tranches in 2022, 2024, 2025 and 2026.

Inflation risk – The reopening of the world economy following the pandemic has led to widespread shortages of labour, raw materials and energy leading to higher inflation. This has been exacerbated by the war in Ukraine. The Office for Budgetary Responsibility forecasts that inflation will come down to target levels by the end of 2023, but the war in Ukraine and increasing demand from China as it emerges from its long period of isolation could mean that high inflation persists for longer and increases the risk of stagflation (low growth, high inflation). Interest rates have increased steeply to quell inflation, affecting our cost of debt and the economic outcome of investment decisions, impacting our investment strategy. Persistent inflation could also lead to increased operational costs. Rents on most of Cadogan’s commercial and residential leases are linked to RPI, mitigating against cost inflation.

Construction costs on development projects can be locked at the outset through fixed price contracts, but in a high inflation environment it could lead to higher construction costs for new projects and projects where the costs have not been fixed as contractors seek to mitigate their risk. High inflation can help retailer profitability where they are able to pass on costs through higher pricing, providing retail occupiers, particularly luxury retailers, with a hedge against higher rents.

Refinancing risk – The Group seeks to manage refinancing risk using a spread of loan maturities. In normal circumstances loan terms, other than bank loans, are for an initial period of ten years or more. The incidence of maturities is spread to ensure that major refinancing is spaced out over time. On 15 March 2023, the Group refinanced £300m of existing revolving credit facilities that were due to expire in April 2024, with a new £350m syndicated revolving credit facility having a 3½ year term expiring in September 2026 which has two 1-year extension options exercisable at any time 1½ years and 2½ years after the inception of the facility.

Foreign currencies – Some of the private placings of debt which the Group has undertaken have included a significant proportion of US dollar borrowings. All exposure to US dollars in relation to both interest and capital repayments has been swapped into sterling on the date on which the loans were committed, and as a result there is no residual foreign exchange risk exposure to the Group. Operationally the Group has no foreign currency exposure.

Compliance with financial covenants – The Group has provided financial covenants to its lenders to support its unsecured borrowings. The Group’s financial position is regularly monitored against the covenant requirements to ensure that the Group has significant financial headroom and is not at risk of breaching any of the covenants. Scenario planning is used to assess the sensitivity of potential changes to the principal financial measures which might impact the ability to meet covenant requirements.

Customer creditworthiness – COVID-19 resulted in a sharp fall in rent collection rates and an increase in defaults. Cadogan responded quickly through a number of initiatives. It identified a list of the smaller and most financially vulnerable businesses and offered various financial support packages including deferrals, waivers, turnover only rents and monthly in arrears payments, the purpose being to enable them to survive the crisis and remain operational afterwards. The frequency of credit control meetings was increased from 8 to 12 times a year, and additional staff were recruited to liaise with customers to help assess and deal with their requests. These actions resulted in minimising commercial vacancies and defaults and increased rent collection rates which have returned to pre-pandemic levels during 2022.

Property loss and damage – All the Group’s properties are insured against loss or damage on a full reinstatement basis, including three years’ loss of rental income. Cover includes terrorism risk which is provided by a major insurer and member of Pool Re. COVID-19 illustrated the limitations of insurance cover and highlights the importance of maintaining a strong financial position and liquidity headroom to enable the business to withstand uninsurable or unknown future events. In 2022 we started a project to digitise all our remaining paper property deeds and records to mitigate against the risk of loss due to fire or flooding.

Health and safety risks – The Group accords a high priority to health and safety. Health and safety issues are always discussed at the monthly Property Management Committee meeting of senior leadership and all incidents are reported and reviewed on a monthly basis. From time to time the Group undertakes external reviews and audits of its health and safety policies and procedures, the results of which have confirmed the quality and integrity of health and safety practices. An online health and safety system has been implemented since 2021 to enhance compliance monitoring.

Risk of energy shortages – The war in Ukraine highlighted the risk to the business and its occupiers of shortages in energy. We have back-up generators for our main site which can provide electricity for short periods of outage. Our teams are equipped to work from home for longer periods if necessary. We have collated a list of vulnerable residential tenants to ensure that vital support can be provided to them if there are prolonged power cuts, especially during cold weather.

COVID-19 resulted in employees working more flexibly. All staff are required to complete online assessments to ensure their equipment, furniture and home environment are suitable for working from home, in addition to workplace safety assessments. Mental health awareness training has been provided for staff as well as access to confidential helplines with trained professionals and there will be four mental health first aiders in place by the end of May 2023.

A similar emphasis is placed on health and safety on our construction sites, with our consultants monitoring contractors’ compliance with safety rules.

Climate change – Climate-related risks are considered to be principal risks and their management is integrated with the overall risk management strategy.

There are four climate specific risks identified which comprise both physical and transition risks and opportunities from climate change:

- Medium-term impact of climate change on our property and business, including the risk of damage caused by river or surface water flooding and the risk caused by rising temperatures and extreme weather events. The Group works closely with its principal insurer and external experts to support physical and transition climate risk assessments and strategies to implement mitigations.

- Short-term changes in environmental and climate regulation including increasing building energy efficiency and reporting requirements. Changes in legislation are monitored internally, by trade bodies of which Cadogan is a member, and our legal advisers, and suitable changes made where necessary.

- Medium-term, increasing energy and carbon pricing. Improved energy usage monitoring and management is intended to reduce consumption over time, alongside efficient equipment and renewable generation. Our energy prices were fixed under a three year contract which expires in October 2023. We will face potentially higher energy costs following that date if current high energy prices persist. Our carbon offset hedging strategy will explore the potential for pre-purchasing offsets to reduce exposure to extreme price increases in the latter half of this decade.

- Loss of social licence to operate if we are perceived not to be acting in the wider interests of the area and the country. We actively engage with the local council, the Royal Borough of Kensington and Chelsea and stakeholders in the community.

Cadogan publicly announced its new sustainability strategy, Chelsea 2030, in 2021 following its approval by the board in December 2020. Chelsea 2030 seeks to address and mitigate all the above risks.

In 2021 we conducted a climate risk review in line with the TCFD recommendations. The conclusions are summarised below, grouped under physical and transition risk.

- We worked with our insurers Zurich to understand the physical risks climate change poses to our Estate, taking a building-by-building approach to modelled global risks through qualitative and quantitative scenario analysis using climate data from Jupiter Intelligence’s Climate Score Global v2.3.

- We considered risk in the short term until 2030, and medium term up to 2050, with long term information to 2100 provided for context. Our analysis focused on two distinct climate scenarios (called “Shared Socio-economic Pathways” or “SSPs”) used by the Intergovernmental Panel on Climate Change (IPCC): a scenario where global average temperature increases by under 2 degrees by the end of the century (SSP 1-2.6), and a scenario where temperatures increase by over 4 degrees by 2100 (SSP 5-8.5). Following international pledges made at COP 26 in Glasgow, we look to be on track for a climate scenario between these two.

- The scenario analysis assessed the change over time of perils including fluvial flood, precipitation, wind, hail, thunderstorm, drought, heat and wildfire. These perils were considered in the context of building vulnerabilities, including building height, presence of basements, tenant type and building structure. Together, risk was quantified by impact on building value and rental income.

- An increase in precipitation severity of approximately 6% is modelled between the baseline period and 2020-2030, and a more marked increase of 11% - 14% is projected by 2050 for both scenarios. These extreme precipitation events would see more than an average historical month’s total rain falling in 24 hours, potentially resulting in surface flooding, due to the capacity of drainage systems being exceeded.

- A small differentiation between properties regarding river flooding is observed due to terrain effects, with two properties showing a significant increase in flood risk by end of century. Properties with basements are generally more vulnerable to river and precipitation flooding, and account for over 40% of the total building value and annual rent on the Estate.