5 minute read

Economic Recovery is Swift

By Lynette Bertrand, Communications Manager, CACM

While it’s still a challenging time for the nation as a whole, the overall economy is seeing improvements, and the community management industry in particular is still a very healthy industry as far as job opportunity and security. As an essential industry, we have been able to buck the impact of the financial crisis, and that’s something to take refuge in as we look ahead at 2021.

Alexey Gutin, CEO of Web Scribble, provider of career center technology for hundreds of professionals and trade associations including CACM, recently provided a state of the job market webinar, showcasing statistics from some of the largest job boards including Indeed.

“Most associations’ career centers saw a modest decline in revenue compared to major job boards,” Gutin said. “The associations we work with are professional associations with highly skilled or unique labor that are hard to find on generalist job boards like Indeed. A lot of those people were lucky enough to still be within industries that are hiring and looking for talented people.”

CACM SEES GROWTH IN JOB POSTINGS

Taking a look at CACM’s own Career Center, new job activity on the job board slowed from March through May, but picked back up in June and has remained pretty active through November. Because community manager jobs are considered essential by the state of California, job losses were minimal if any. Most of the job loss happened at the industry partner level as some vendors saw business slow down due to restrictions and as some association boards limited their expenditures during the COVID crisis. In fact, through November 23, there were 53 paid job postings on CACM’s job board, the highest in recent years. There were 63 job openings across the state at the end of November on CACM’s Career Center.

NATIONWIDE JOBLESS NUMBERS IMPROVING

Nationwide, and looking across other industries, the story looks a bit different.

At the time of this writing, the unemployment rate nationwide was down to 6.9 percent, according to the Bureau of Labor Statistics. While still up compared to early this year before the pandemic, the recovery has been as rapid as the decline, according to Gutin.

“Up until February of this year, we had record low unemployment,” Gutin said. “There were more open jobs than unemployed people looking for work. That was a very good time for career centers and job boards because there was a war on talent. The majority of people were already employed. With the country shutting down and restrictions at the state and federal level around people going to work, that ratio spiked to us having five people unemployed for every single job open. People started filing for unemployment and companies stopped posting jobs.”

Unemployment shot up to 14.5 percent in April, the highest rate since the Great Depression, in two month’s time. By comparison, during the 2008 recession, unemployment peaked nearly two years after the start of the recession.

But while the quick rise in unemployment was surprising and alarming, Gutin added, the rate of recovery has also been fast, especially compared to other recessions in U.S. history.

“Prior recessions were much more gradual in growth of unemployment and also slower in full recovery,” he said. “This has been rapid in both directions.”

In terms of percent change in payroll, looking at the number of people who are currently employed, that percentage dropped a lot more rapidly than previous recessions, including 2008. This dropped to -14 percent and has since recovered to the high -7 percent range by September.

DATA SHOWS SOME INDUSTRIES RECOVER FASTER THAN OTHERS

Indeed is the largest job board in the U.S. and covers a wide spectrum of employers. The data they present is accurate and representative of what the country is seeing in economic growth and unemployment claims.

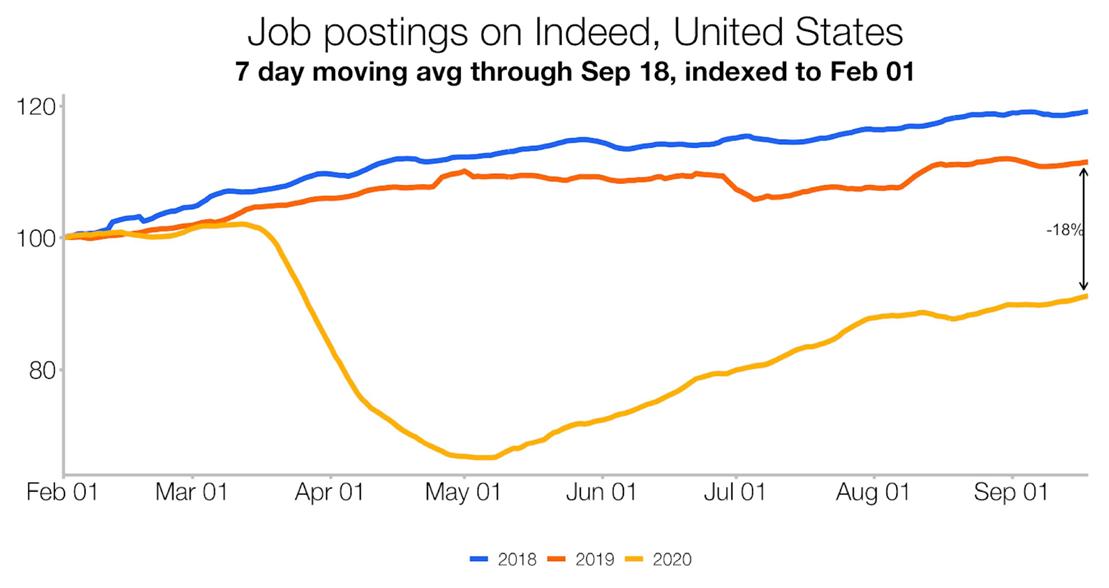

Through the first couple of months of the year, Indeed was trending the same as 2019 in terms of job posts. The decline in job postings started in mid-March with the bottom hitting in May with 40 percent drop in postings, according to data from Indeed. By September, that had improved to an 18 percent decline in job posts compared to 2019. But the recovery was also beginning to slow down with employers starting to hire less and being more cautious because some of the stimulus they were using was running out.

Gutin said Indeed has concerns about growth stalling and staying at -18 percent year over year.

Indeed’s data showed the industries that were particularly hard hit, which included retail, construction, banking and finance, hospitality and tourism. Retail has made a remarkable recovery in a short amount of time. Year over year they’re down 3 percent in job postings, and trending in the right direction.

Construction was up as well, after being down significantly from March through May. The hospitality industry is trending in the wrong direction, down almost 50 percent and trending down further. The sports industry hasn’t seen any recovery and banking and finance is seeing a flat/slow recovery.

QUICKLY IMPROVING INDUSTRIES

SLOWLY IMPROVING INDUSTRIES

HISTORIC ECONOMIC DOWNTURNS

MAJOR JOB BOARDS FEEL THE BRUNT

Major job boards laid off hundreds of employees as the recession hit in March (see sidebar), but some are starting to rehire. Web Scribble saw the same trends as these larger job boards, but recovery has been rapid, Gutin said.

Niche industries like the community management industry with highly skilled and essential workers are proving to be highly resistant to the financial turmoil and fallout from the pandemic this year.

TO WATCH THE JOB REPORTS WEBINAR IN ITS ENTIRETY, GO TO HTTPS://WWW.YOUTUBE.COM/ WATCH?V=W7UL3QIKFDE&FEATURE=YOUTU.BE NUMBER OF UNEMPLOYED PERSONS/JOB OPENING

NUMBER OF UNEMPLOYED PERSONS/JOB OPENING