7 minute read

The Case for a New Retirement Planning Model: The Missing 4th Phase

By Jon Thomas

Last year I left a role and career in the financial services industry as a financial & insurance wholesaler and joined Amada Senior Care, a senior care agency dedicated to helping seniors age in place at home and find the financial resources to do so. I had come to recognize in my time engaging in the retirement planning conversation, that as retirees aged into the stage of life where they began to need some assistance and support, their best-laid ‘retirement plan’ was inadequate. They had planned, often with the guidance of their financial advisor or planner, for a specific amount of retirement income that was now woefully insufficient with the additional cost of health care, caregiving support services or the transition to a senior community. I met the Amada team at a conference and learned what they, ‘a senior care company’, were doing to help seniors uncover financial resources to fill this income gap. It was one of those ‘aha’ moments for me that led me to this question – does retirement end?

I’m sure you are perceptively saying to yourself now –‘well no, obviously retirement doesn’t end’. Unless of course your thought was, ‘Yes it ends…ahem…when you reach eternal retirement… Haha. That aside, most Americans work through their career years and have a corresponding financial plan that involves saving & investing with the goal of generating enough income to retire well and not have another financial care in the world, right? That is until they age to the point that they need significantly more income to address the costs of their aging. If their goal is to stay home, and they need caregiving support to do so, they could need anywhere from an additional $5K - $15K of additional income monthly. In some cities, a couple could need an additional $30K a month to stay home and receive caregiving support around the clock. Genworth’s annual cost of care study now estimates the median cost of home care in CA at nearly $7K monthly and just over $13K for a private room in a nursing home.

This reality is often an unwelcome surprise to retirees who don’t realize or understand the substantial expense of aging & care options and don’t have a plan to deal with it head on. This then begs the question –if retirement doesn’t end, why aren’t financial professionals addressing ALL of retirement in their clients’ retirement plans?

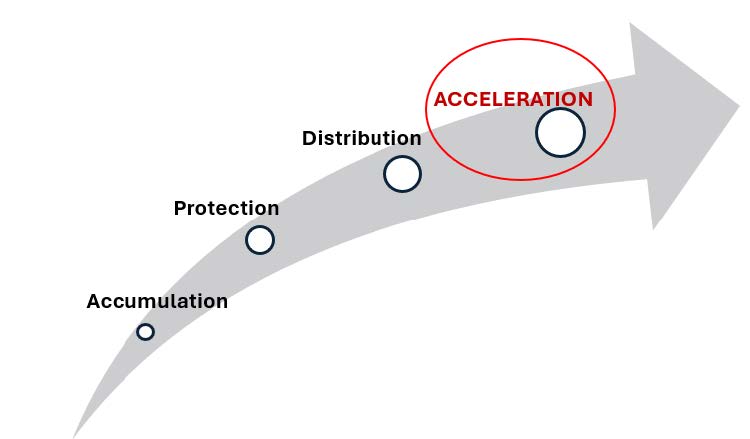

When I have a chance to consult with financial advisors or Medicare planners, I’ve been advancing the idea to use more than a 3-phase model for retirement or wealth planning. This model of Accumulation, Protection & Distribution leads to a retirement income plan that may not account for these increased aging costs. I’ll posit my proposed revision here:

The addition of an Acceleration phase accounts for the reality that the end of the aging continuum often requires an acceleration of assets to provide additional income. This acceleration can be a larger distribution of assets, retirement funds, annuity income or even the acceleration of insurance products.

One of the challenges with planning for this acceleration phase is that unlike retirement expenses which are often fixed, senior care expenses are variable depending on health changes and the degree of care that’s necessary. We cannot know with certainty whether our client will age gracefully, only needing a few thousand a month in income for help around the house and personal care services, or if they will need substantial care for an Alzheimer’s or Dementia condition. This uncertainty is one of the reasons that I’m a big advocate of LTC insurance. It can create a substantial pool of benefits to cover some or all LTC expenses with the benefit of 1:4 or even 1:6 leverage on an investment. This can be a sort of forced savings for this Acceleration phase of retirement. . Additionally, for clients with life insurance, living benefit or death benefit acceleration riders are a great planning tool for this phase. This allocated resource can protect other assets, investments and keep legacy or inheritance plans in place.

You may now be thinking that this topic is worth some additional exploration, and you might even be open to implementing aging costs into your retirement income modeling. Your reservation is that you don’t have the expertise. Since retirement planning does not include standard aging costs it can be hard to broach this topic without a resource to partner with you in this journey.

This disconnect is why Amada Senior Care has begun partnering with financial professionals across the county and why I encourage you to build partnerships with senior care experts & advocates in your community. Not only can we serve as an aging resource to your clients, but we can also provide you with a real time picture of what the average aging or care story is in your community and what those costs really look like to aid in your client retirement planning. There are key benefits for your practice in this sort of partnership as well. A few reasons I would take this into consideration:

1. Mitigating Financial Risk:

Long-term care expenses can quickly deplete savings and investment portfolios, leading to a drastic reduction in a client’s standard of living. A strategic partnership with your client’s care planning team or agency can allow you to work together to fund care expenses in the most advantageous manner for your client’s portfolio.

2. Reputation and Competitive Advantage:

As the market evolves, financial advisors who broaden their service offerings to include long-term care planning will differentiate themselves from competitors. Clients are increasingly looking for comprehensive services – an advisor with meaningful senior advisor partnerships can bridge that gap for their clients. It’s astounding how many folks not only don’t have a financial plan for aging, but don’t have a Will in place or a POA, advanced directives or legacy plan. They end up vulnerable and their families scrambling when they inevitably have a health issue or care need.

3. Generational Retention:

Planning for long-term care expenses also significantly impacts generational retention. Family dynamics often shape financial decisions, and by proactively involving clients in long-term care discussions, advisors can also engage the next generation. When clients feel secure in their long-term care strategies, they are more likely to involve their children or heirs, fostering a family-oriented approach to wealth management. This multi-generational advisory relationship ensures that clients’ heirs understand their parents’ financial plans, which can lead to a seamless transfer of wealth and continuity in client relationships.

Some estimate that 90% of heirs change advisors promptly upon receiving their inheritance. At Amada, we strategically invite our client’s advisors into a care & financial planning meeting with our clients’ kids or family members, to ensure that connection to the next generation is established.

For an additional resource and more reasons to consider this type of partnership, check out – Amada & Advisor partnership guide

It seems to make great sense that our two industries should seek to partner together. I think of it as a relay race and your client successfully entering retirement. They worked hard, saved & invested. You’ve helped them navigate up to retirement, including Medicare and in many cases financial planning. When it comes time to consider medical and residential care needs, make sure you have subject matter experts to collaborate with to help your clients and their loved ones understand their options and connect them with resources.

Jon Thomas, ChFC, CLTC, Director of National & Strategic Accounts

Jon joined Amada Senior Care in 2023 after spending the last 15+ years working as a financial & insurance professional with companies - Nationwide Insurance and most recently Securian Financial, dedicated to helping grow market awareness of the importance of long-term care (LTC) planning. Jon has firsthand experience caring for aging loved ones and is passionate about the dignity and freedom quality LTC solutions can provide.

949-994-9690