Despite the seemingly ever present snow and chilly temperatures, Spring really is just around the corner In preparation for the sweet sign of greenery on healthy trees, Camrose County Ag Services is offering a free information workshop on the basics of pruning, how to plant, tree care, tree maintenance, and pests and diseases, for all County ratepayers The session will take place at Camrose County Council Chambers on March 29 from 5:30 until 8:30 p m , with special guest, tree expert Toso Bozic

The paper

farm families and rural

of east central

8 PAGES | MARCH 7, 2023

created EXCLUSIVELY for

residents

Alberta

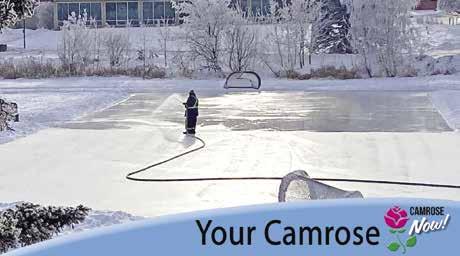

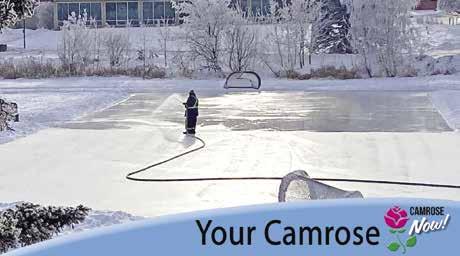

Photo by Lori Larsen

Trees It's all about the Inside... A variety of merchandise, services, events and more! Win a colour photo of your farm! See page 8 News Features Pest control stops pesticide use on fields 2 BRCF grants funds for Killam Ag Society 4 Lifestock numbers down in rural Alberta 7

Camrose County Agriculture Services assistant manager Corey Stuber demonstrates the use of longhandled loppers for trimming harder to reach branches.

Wise year to build

Pest control stops pesticide use on fields

By Murray Green

By Murray Green

The Pest Management Regulatory Agency (PMRA) recently changed approved uses for lambda-cyhalothrin, an effective pesticide that many farmers rely on to control grasshoppers and flea beetles.

The Pest Management Regulatory Agency is the Canadian government agency responsible for the regulation of pest control products in Canada under the federal authority of the Pest Control Products Act and Regulations. The agency is a branch that reports to Parliament through Health Canada.

Among other changes, the pesticide can no longer be used for any crop that may end up as livestock feed. As a result, its manufacturers have pulled their products from Western Canada.

Due to a continued drought in some parts of Alberta and Saskatchewan, grasshoppers are again likely to be a concern in the 2023 growing season and the PMRA’s decision leaves farmers with one less tool to address potentially destructive pests.

It could also mean the inability for canola producers to sell their products as livestock feed, which could impact availability for cattle and lamb producers. There are also possible total food production impacts in a time of worldwide food insecurity.

“At a time when our farmers are finally finding their footing after a rough couple of years, this decision could set many of them back. I urge the federal ministers and the PMRA to reconsider their decision and make it easier, not harder, for Alberta’s farmers to

feed people in Canada and across the world,” said Nate Horner, Alberta Minister of Agriculture and Irrigation.

“Without access to effective insecticides, Saskatchewan producers are at risk of being placed at a competitive disadvantage and will be facing significant losses. Saskatchewan supports industry’s calls for an extension to the lambda-cyhalothrin reevaluation decision to alleviate pressure on producers and help ensure a stable supply of feed for livestock,” added David Marit, Saskatchewan Minister of Agriculture.

“With extreme flea beetle pressure, hot spots for grasshoppers and cutworms across the Prairies and forecasted outbreaks, the lambda-cyhalothrin decision could severely impact our yields, our livelihoods, feedstocks and food prices. Lambda-cyhalothrin has a significant market share, and it will strain farmers to source alternative products. The PMRA needs to base its decisions on sound science and be aligned with our largest trading partner,” said Roger Chevraux, chair Alberta Canola.

In 2019, the United States’ Environmental Protection Agency removed restrictions on lambda-cyhalothrin’s use. The PMRA made the opposite decision, which has led to confusion about what will be done about livestock feed coming from Alberta’s largest trading partner.

Horner and Marit have written to the ministers of Health Canada and Agriculture and Agri-Food Canada, outlining producers’ concerns and urging them to encourage the PMRA to reconsider its decision.

through Friday, 8 a.m. to 5 p.m.

Phone 780-672-3142 Fax 780-672-2518

News email: news@camrosebooster.com

Display Ads email: ads@camrosebooster.com

Classified Ads email: ads@camrosebooster.com Website: camrosebooster.com

4925-48 Street, Camrose, AB T4V 1L7

The

The COUNTRY BOOSTER, March 7, 2023 – Page 2 Devan Herder Phone 780.672.8818 Fax 780.672.1002 6809-48 Avenue, Camrose Gar th Brett

Our team can help you with a basic building package or a turn-key structure, and can even set you up with dependable quali ed trades, if that’s your preference.

Let ’s get star ted on your plan. Then you will be ready to begin construction early this spring . is published for Controlled Distribution By CAMROSE BOOSTER LTD. Blain Fowler Publisher Circulation 11,639 copies Providing coverage to the communities of Camrose (RRs and Boxes only), Ohaton, Edberg, Meeting Creek, Donalda, Bawlf, Kelsey, Rosalind, Daysland, Heisler, Strome, Forestburg, Galahad, Castor (farms), Killam, Sedgewick, Lougheed, Coronation/Brownfield, Alliance, Hardisty Amisk, Hughenden, Czar, Metiskow, Cadogan, Provost (farms), Armena, Hay Lakes, New Sarepta, Round Hill, Kingman, Tofield, Ryley, Holden, Bruce, Viking, Kinsella, Irma, Wainwright (farms and lock boxes), New Norway Ferintosh, Bashaw Bittern Lake, Gwynne, Stettler (farms). Hours: Monday

This is a

most

most

advertising medium in the Camrose area. The entire contents of

THE

BOOSTER are protected by copyright and any unauthorized reproduction of it, in whole or in part, without consent in writing, is expressly prohibited.

effective,

economical

THE CAMROSE BOOSTER and

COUNTRY

CRUSH SEMIFINALS Murray Green, Camrose Booster RJ Reed of the Camrose Crush, team formerly Daysland North Stars, fights for the loose puck with the Red Deer Rustlers goalie. The Rustlers were up 3-2 in games in the best of seven series.

Agriterra Equipment is one of North America’s largest AGCO agricultural equipment dealers with 12 locations. We provide our customers with new and used equipment, complimented with product support through our parts and ser vice departments. Our brands include Massey Ferguson, Fendt, Rogator, Cub Cadet and more.

Now hiring…

PARTS TECHNICIAN (Journeyman or Apprentice)

We are looking for someone who:

• consistently demonstrates exceptional customer ser vice

• sells and orders parts for customers, including pricing, locating and receiving parts

• has excellent communication skills and is highly organized

• is eager to take direction, learn and become a key member of our parts team

• excels at analyzing and interpreting information

• reads and interprets parts diagnostics and diagrams

• uses computerized inventor y system and parts libraries

• merchandises parts department sales area

We will give preference to individuals with:

• previous product and industr y knowledge and experience

• excellent customer ser vice and leadership skills

• valid driver’s license

• Agco and Bourgault product experience

We would like to offer you:

• an exemplar y health and dental benefits package

• a matching RRSP plan

• a competitive wage

• tenure bonus

We would to thank all applicants in advance; however, only those selected to be inter viewed will be contacted.

Please forward resumés to:

Blaine Heck at bheck@agriterraeq.com 4716-38 Street, Camrose | Phone 780-672-2452

CHEQUES!

Reduce salt in your diet

By Murray Green

Think about taking care of your heart. Reducing salt in your diet is one way to improve your heart health. Eating too much salt (sodium) may cause high blood pressure. If you lower your blood pressure, you may lower your risk of heart attack,

heart failure and stroke, according to Alberta Health Services.

The top sources of sodium in our diets include ready-made bread, crackers and muffins, as well as takeout pizza and lasagna, and processed meats such as deli meat and sausages. Cheese,

soups and condiments such as soy sauce and ketchup are also very high in salt.

If you reduce the amount of processed, fast food, take-out food and restaurant meals you eat, you may reduce the sodium in your diet.

Another way to lower sodium is to prepare food

at home. When cooking at home, you can use little or no salt. Try flavouring your food with garlic, onions, herbs, spices, lemon juice and vinegar instead of salt. For more information on this topic, search heart health at ahs.ca/nutritionhandouts

The COUNTRY BOOSTER, March 7, 2023 – Page 3 SAVE up to $200 per tire on select Goodyear Optitrac, AgraEdge, and radial rear tires SAVE up to $100 per tire on select bias rear tires SAVE up to $50 per tire on select flotation tires (excluding LSW tires) SAVE $20 per tire on select bias and radial implement tires Instant Rebate offers valid on selected tires between February 20 and May 31, 2023 at participating Fountain Tire locations. Per tire discount applicable on our Every Day Pricing (EDP). Not or payment on account; cannot be combined with any other offer Inventory may vary by location. All applicable taxes (i.e. GST, PST, HST and tire taxes) are extra. See in-store or fountaintire.com for details. ®™ Trademarks of AM Royalties Limited Partnership used under license by LoyaltyOne, Co. and Goodyear Canada Inc. Fountain Tire is licensed by AMVIC in Alberta. Fountain Tire is licensed by AMVIC in Alberta. GOODYEAR/TITAN BRANDED FARM TIRES: SAVE $200 per tire on select Alliance Agriflex, Agristar II, and radial rear tires SAVE up to $150 per tire on select flotation tires SAVE up to $50 per tire on select bias rear tires SAVE up to $20 per tire on select radial implement tires SAVE $10 per tire on select bias implement tires ALLIANCE BRANDED FARM TIRES: The more you buy, the more you save. From February 20th to May 31st, 2023, SAVE UP TO AN ADDITIONAL $50 per tire when you buy 2 qualifying tires together and SAVE UP TO AN ADDITIONAL $100 per tire when you buy 4 qualifying tires together. See in-store for complete details. CAMROSE LOCATION: East End 4720-36 Street Phone 780-672-5545 Request an appointment online at fountaintire.com

the Servicing Dealer Difference 4716-38 Street, Camrose

Phone 780-672-3142 4925-48 St ., Camrose All security features, unique background pattern to head off reproduction, copying and cut-and-paste operations. 80 cheques $38.60 160 cheques $52.00 320 cheques $95.50 Duplicate Personal Cheques Handy duplicates for easy record keeping. 80 duplicate cheques $45.80 160 duplicate cheques $61.50 320 duplicate cheques $112.00 it ft i All Small Business Cheques 7.5” x 3.25” plus stub, black ink , white paper numbered 250 cheques $105.00 500 cheques $130.00 1000 cheques $180.00 Duplicate Business Cheques also available.

for your

Pay up to 50% LES S OUR PRICES BE AT THE BANKS! Our cheques are bank-qualit y with bank secure features.

Experiencing

• Phone 780-672-2452

Stop overpaying

UNRESERVED ONLINE AUCTION

Fa rm Truck Inspections

Camrose County Enforcement will be conducting a FR EE Fa rm

Truck

Safety Inspection

for Camrose County resident s on Ma rch 29 and March 30 , 2023 for farm registered vehicles

4500 kg s an d over GV W.

Inspections will be conduc ted by appointment only at the Wild Rose Co-op Cardlock located at 3611-47 Avenue , sout h of th e east en d Foun ta in Ti re

For furt her details or to make an appointment, please call Susan with Protecti ve Serv ices at 78 0.672.4449 or email

skelndor fer@ county.c am rose.ab.ca

– Enter a draw for a door prize! –

DIRECTIONS: From Three Hills, go 20 miles South on HWY 21, then 1

MOWER & YARD TRACTOR

PTO, 36” tracks, PS trans w/ LH shuttle, Luxury cab w/ leather, Pro 600 w/ auto steer, high capacity pump, oil level site glasses, 5 hyd plus return, diff locks

• 1999 John Deere 7410 MFWD w/ JD 740 ldr, 8’bucket & grapple, 9328 hrs, 16 spd trans w/ reverser

WHEEL LOADER / DOZER / EXCAVATOR

•2011 Caterpillar 928 HZ wheel loader, only 709 hrs, C6-6 eng, 9’/3.4 yd bucket, front aux hydraulics, joystick, Good-Year 20.5-25 tires, PIN CAT0928HCCXK01271

• 2007 Caterpillar D6R Series III XW Dozer, 2430 hrs, C-9 eng, 13’ 6-way blade, 28” tracks, 3 tooth ripper (5 total), SN HDC00228

• 2005 Caterpillar 315C L Excavator, 4070 hrs, Cat 3046 eng, 36” tooth bucket w/ hyd thumb, 27-1/2” tracks, aux hydraulics on stick, SN CAT0315CCCJC02298

GRAVEL TRUCK & PUP

•1992 Peterbilt 379 gravel truck w/ 15’ Midland XL1000 box, Detroit Series 60, 15 spd, 1,284,680 km, air ride

• 2004 Midland XL2100 TA 14’ gravel pup, flip over tarp

SCRAPER / VERTICAL TILL / DISCS

• Leon 1350 A-Series hyd scraper, very ltd use, 13.38 cu yd heaped capacity

•37’ Horsch Joker RT-370 vertical disc

• (2) 35’ Ezee-On 6650 TA disc, notched fronts

MOWER & FUEL TANKS

• 15’Woods BW180 Series 2 Batwing Mower

• (2) Westeel 1000 gal Fuel – Vault dbl wall fuel tanks on skid, 30 GPM pump & meter, retractable hose

• Westeel 1000 gal sgl wall fuel tank, Fill-Rite 15 GPM 12V pump

•John Deere Z997P diesel zero-turn commercial lawn mower, 7 Iron Pro 60” deck, 136 hrs

•John Deere X729 MFWD yard tractor w/ JD 60” HD sweeper & 54” mower, 273 hrs

TRAILERS

•2015 Wells Cargo 14’ TA enclosed trailer, rear ramp door

•2010 Aluma 2 place snowmobile trailer

•2012 11’ Aluma utility trailer

SNOWMOBILE & QUADS

•2011 Polaris RMK 600 snowmobile, only 20.4 mi, reverse, elec start, 155” track

•2007 Can-Am Outlander 800XT HO EFI quad, 4x4, 847 k m / 60 hrs

•2009 Can-Am Outlander 500XT EFI quad, 4x4, 805 k m / 48 hrs

•2 Can-Am DS 250 2WD quads, 2008 & 2009

•2006 Yamaha Raptor 50 2WD quad

SKID STEER ATTACHMENTS

•2016 Bobcat LT 313 trencher

•7’ Edge VR84P vibrating pad foot roller

•7’ Edge angle broom w/ hyd angle

•6’ Edge snow blower

•Postmaster hyd post pounder w/ post grabber, hyd tilt, Model 8287

BRCF grants funds for Killam Agriculture Society

Submitted

The Battle River Community Foundation awarded a $4,000 grant to the Killam District Agriculture Society.

The grant is from the Lindseth Family Fund and the Gordon Enghoj Fund, both established as Field of Interest Funds benefitting Killam and area.

The grant was awarded to assist with spectator netting at the Killam Memorial Arena to protect spectators from pucks coming from the ice surface.

The Battle River Community Foundation exists to support organizations in East Central Alberta, which benefit the local com-

munities and have a positive impact on the future. Grants from the Battle River Community Foundation are primarily made possible through the generosity of individual donors and organizations that have created endowment funds. The principal of these endowment funds are kept intact and the income is made available annually to support local projects and organizations.

Since it was founded in 1995, the Battle River Community Foundation has granted over $8,679,700 to support charitable activities in the Battle River Region.

The COUNTRY BOOSTER, March 7, 2023 – Page 4

Submitted Battle River Community Foundation Secretary, Sharleen Chevreaux presents the cheque to Charlene Sutter representing the Killam District Agricultural Society.

BIDDING OPENS MARCH 28 AND CLOSES APRIL 4 FOR

PREMIERAUCTIONS.CA STAFFED AUCTION PREVIEW: APRIL 2 & 3 , 2023 10AM-5PM OR BY APPOINTMENT Equipment Info. and Viewing Appointments: Fredie Froese 587.377.2118 • Gary Torhjelm 403.820.3134 TRACTORS • 2008 Case IH 535 Quadtrac, 2567 hrs,

MORE INFO. AND TO BID, PLEASE VISIT

mile West on TWP RD 28-4 (North side).

Changes to tax return season

By Murray Green

The tax season is here, and these are the biggest changes you should factor into your return this year.

Repaying COVID-19 benefits. If you received COVID-19 benefits from the CRA in 2022, such as the Canada Recovery Benefit (CRB), Canada Sickness Recovery Benefit (CSRB) or Canada Recovery Caregiving Benefit (CRCB) you will receive a T4A slip with the relevant information you need for your tax return.

If you received the CRB and your net income after certain adjustments is more than $38,000, then you may have to repay all or part of the benefits you received in 2022.

If you have repaid all or parts of COVID-19 benefits in 2022, you can choose which year to claim the tax deduction. You can either claim the deduction in the year you received the benefit, or the year you repaid it.

Plus, any one-time provincial payments to help you through COVID-19 will not be taxable, and you don’t need to report them as income on your 2022 tax return.

You can claim up to $500 for work-from-home expenses. Making a return from last year, you can once again claim the workfrom-home tax credit. If you’ve been keeping track of your expenses, you can go ahead and claim your calculated total. Otherwise, you can use the flat rate method of

$2 for each day worked from home during the pandemic.

The Basic Personal Amount (BPA) has been increased. As part of their policy to continue increasing it over time until it reaches $15,000 in 2023, the government increased the Basic Personal Amount for the 2022 tax year to $14,398. This means that every Canadian will get a slight boost to their return this year, and it’s likely you can expect another increase next year as well.

Tax brackets have shifted to account for inflation. The government has adjusted tax brackets for 2022 to maintain buying power for Canadians as prices of goods continue to slowly increase.

The new federal tax brackets for 2022 are as follows: up to $50,197 of income (15 per cent); more than $50,197 to $100,392 (20.5 per cent); more than $100,392 to $155,625 (26 per cent); more than $155,625 to $221,708 (29 per cent) and $221,708.01 and higher (33 per cent).

The adjustment upwards means that Canadians on the edge of a tax bracket might find themselves shifted into a lower bracket this year and pay less taxes because of it.

The TFSA limit has been increased. The contribution limit has increased to $6,500 for the year. This means that if you’ve had an account since 2009, were 18 years of age and have been a resident of Canada throughout

that period, the cumulative total you can have in your TFSA is now $81,500.

New OAS limit amounts. The OAS is designed to provide retirees with a source of income to support their retirement. However, if your income is over certain limit amounts, you might find your OAS amount reduced, and even canceled entirely. For the 2022 tax year, if your taxable income was over $81,761, you would need to repay some of your OAS. Similarly, if your taxable income was over $134,626, you would not have received any OAS payments. Thanks to the CRA’s new Affordability Plan, seniors aged 75 and over received an automatic 10 per cent increase of their Old Age Security pension, as of July 2022.

Canada Pension Plan maximum contributions have been increased by 2.7 per cent, the maximum pensionable earnings are $64,900, with a basic exemption of $3,500 for 2022. For CPP, the employee and employer maximum contribution is $3,039.30.

Note that any self-employed individuals must account for both the employer and the employee sides of the contribution. For 2022, their maximum contribution amount for the CPP is $6,078.60 and for the QPP it is $6,999.60.

RRSP dollar limit is increased to $29,210. Remember that your RRSP contribution limit is capped at 18 per cent of your earned in-

come in the previous year. This means the dollar limit is the maximum amount you can contribute regardless of your income.

Changes to tax credits you need to know. Some credits have been added, changed, reinstated, or expanded for the 2022 tax year.

Some of the federal changes to tax credits are the Air Quality Improvement Tax Credit: Eligible businesses including sole proprietorships, can claim 25 per cent of their qualifying ventilation upgrades to a maximum of $10,000, creating a $2,500 tax credit.

Automobile Income Tax Deduction Limits: The changes include an Increase in Capital Cost Allowance (CCA) ceiling limits for zero emission and passenger vehicles, deductible monthly leasing costs also increased by $100, and the per kilometer rate paid by employers to employees who use their personal vehicle for work has increased by two cents per km from last year.

Home Accessibility Tax Credit (HATC): If you’re 65 or older, are eligible for the disability tax credit, and have remodelled your home for safer access, you can claim up to $20,000 of your related HATC expenses.

Labour Mobility Deduction (LMD): This new deduction allows tradespeople, apprentices and employees working in construction to claim meals and lodging expenses paid to earn income at a temporary work location.

The COUNTRY BOOSTER, March 7, 2023 – Page 5

23031dg2

SE E WH AT’S HAPPE NING

in your favourite communit y. New information ever y day.

Alberta bucks the trend in live lamb prices

By Murray Green Alberta lamb, sheep market looks good in this province.

By Murray Green Alberta lamb, sheep market looks good in this province.

“Provincial live lamb prices as reported by Statistics Canada show an annual decrease in 2022 compared to 2021 for all provinces except Alberta,” reported Ann Boyda, provincial livestock market analyst with the Alberta government.

“Alberta average live weight price was reported at $242.44 per hundred weight for 2022, up 4.7 per cent from 2021. Ontario has normally been the benchmark market for western pricing. Quebec reported an average live lamb price of $286.98 per hundredweight, down seven per cent from 2021,” she added.

Information reports that auction market price volatility increased in 2021 and 2022. In 2021, aver-

age weekly price for heavy weight lambs peaked in January at $396.50 per hundred weight, but declined to a low of $182.50

per hundred weight during the first week of October.

In 2022, average weekly price for heavy lamb rose to $316.50 per hun-

dred weight the first week of May, but plummeted to a low of $134 per hundredweight in mid-August.

Light weight lamb prices

experienced even more dramatic swings in 2022.

Boyda points out provincial slaughter has followed a seasonal trend in 2022, but adds the total slaughter volume of 22,980 head was eight per cent lower than 2021, nearly 23 per cent lower than 2020 and almost 11 per cent lower than the five-year average.

“Alberta has maintained a relatively stable market in light of the recent sale of an Alberta lamb processing plant and Iron Springs feedlot to Préval Ag,” said Boyda. “The Quebec-based company is recognized as a leader in the agri-food industry (veal, beef, lamb, field crops, horticulture and grain processing). With Préval Ag’s strong foothold in the international market, the future for the Alberta lamb sector looks brighter.”

The COUNTRY BOOSTER, March 7, 2023 – Page 6

Follow the app daily to

Murray Green, Camrose Booster

The Alberta sheep and lamb producers have been doing better than some parts of the country. Market prices have been staying firm over the last few years.

Livestock numbers down this year in rural Alberta

By Murray Green

By Murray Green

Last year a decrease in heifer retention, auction volume and imports were experienced compared to 2021, but there was an increase in beef output.

“Alberta beef producers retained fewer breeding heifers for replacement in 2022, suggesting expansion is not in the immediate future,” said Ann Boyda, livestock economist with the Alberta government.

“The Canfax Cattle on Feed reports show a 9.4 per cent increase in heifer placement in feedlots in 2022 compared to 2021. Heifer placements were higher in the first half of 2022 and declined by three per cent in the second half. The rate of heifer to steer placement increased to 37.5 per cent in 2022 as compared to 33.1 per cent in 2021. Steer placement declined by 10.2 per cent in 2022 as compared to 2021.”

Alberta auction feeder steer and heifer volume for 2022 was 638,769 head, down nine per cent from 2021 and down 26.1 per cent from the five-year average. The first three weeks of 2023 report volumes down 13.4 per cent over the same period last year.

According to the Canadian Beef Grading Agency, slaughter volume for 2022 in federally regulated plants was 2,641,249 head in Western Canada, comparable to 2021 levels (down 0.04 per cent). The 2022 slaughter level is 8.5 per cent higher than the five-year average (2017 to 2021).

Heifer slaughter volume in 2022 rose by 6.9 per cent over 2021 and nearly 15 per cent over the five-year average, whereas steer slaughter volume dropped by 5.8 per cent when compared to 2021. Cow slaughter also increased in 2022 by 4.8 per cent over 2021, however this level was comparable to the five-year average (up 0.9 per cent).

Agriculture Canada estimates beef output in Western Canada for 2022 at 1,028,580 tonnes, up from 2021. The strong performance stems from good packer margins and strong beef demand.

Livestock Identification Services reports

485,544 cattle leaving Alberta in 2022. The majority, 328,911 head, were destined to the United States, 294,078 head of which went direct to slaughter. Slaughter cattle sales to the U.S. were up by 21.2 per cent over 2021 levels.

“With one month left for recorded data, 2022 will fall short of the volume in 2021,” pointed out Boyda. “Agri-Food Trade On-Line database indicates that live cattle imports were highest in 2021 at over 234,919 head (excluding purebred cattle), 61.7 per cent greater than the five-year average of 145,294 head.”

Total cattle imports to Alberta reached 1,240,768 head in 2021. Preliminary estimates for 2022 suggest that total cattle imports will be down from 2021 by as much as eight per cent. Alberta’s feedlot capacity draws feeder steers and heifers from Saskatchewan.

“Last year started with a backlog on cattle stemming from the heights of COVID. The industry is still feeling its repercussions. January and February are typically seasonally lower demand for beef and most signs point to a smaller calf crop in 2023,” concluded Boyda.

Our farm equipment lines of credit ective ways to make re ef ficient and less

Remember… t is your profit. years, our members ha ve bated 25% for ever y dollar of loan interest, and an additional er y dollar in interest

We see banking differently

The COUNTRY BOOSTER, March 7, 2023 – Page 7

We understand the challenges and recognize the opportunities for our ag producers.

Lori Larsen, Camrose Booster

The number of livestock, mostly heifers, kept over the winter months is slightly down compared to the last few years. A shortage of feed or low beef prices factor into the decision of how many animals are kept over winter.

The farm appearing in this photograph is located in the Camrose trading area. If you recognize it as yours, come to the Camrose Booster, 4925-48 Street, Camrose. You will be presented with a free 8” x 10” colour enlargement of the photo.

• The Mystery Far m winners for February 21 is Bart Sand of Edberg.

• This week’s prize must be claimed by March 14, 2023.

BRCF grants Killam Health Care

Submitted

The Battle River Community Foundation awarded a $5,000 grant to the Killam and District Health Care Foundation.

The grant is from income earned in the Lorne Lemay Memorial Fund, established as a Field of Interest Fund supporting assisted living or palliative care facilities in the Battle River region; the Stan and Sharleen Chevraux Fund, established to support health and education in the Killam area and the Foundation’s Community Funds which are named Endowed Funds that permit the Foundation Board to select grant recipients from applications received annually.

The grant was awarded to assist with the cost of a large wall mural in the continuing care unit depicting a farm scene, an image familiar to the fifty residents who once lived in the rural community or surrounding areas. The mural will provide an attractive, soothing, and maintenance free addition to the Campus of Care.

The Battle River Community Foundation exists to support organizations in East Central Alberta, which benefit the local communities and have a positive impact on the future.

HEALTH

Submitted

Grants from the Battle River Community Foundation are primarily made possible through the generosity of individual donors and organizations that have created endowment funds. The principal of these endowment funds are kept intact and the income is made available annually to support local projects and organizations.

Since it was founded in 1995, the Battle River Community Foundation has granted over $8,679,700 to support charitable activities in the Battle River Region.

The COUNTRY BOOSTER, March 7, 2023 – Page 8 INSURANCE Camrose Insurance Financial Solutions Ltd. MICHAEL KELEMEN 5704-48 Avenue, Camrose 780-672-9251

780-672-2273

F

ou could win a photograph of your farm! THIS WEEK’S MYSTERY FARM IS SPONSORED BY:

this is your f arm,

DIRECTORY

If

BUILDING MATERIALS Hauser Home Hardware Building Centre 6809-49 Avenue, Camrose Phone 780-672-8818 5000-51 Ave., Camrose 780-672-8759 Toll Free 1-877-672-8759 “We Sell for Less Than Big City Stores” When purchasing appliances at our store, you will receive a 2nd year warranty absolutely FREE! *See store for details OFFER ENDS MARCH 29, 2023 Dependability lasts, Deals won’t Buy any 2 qualifying kitchen appliances SAVE $200 Buy any 3+ qualifying kitchen appliances SAVE $300 Dependable Savings Event on qualifying Maytag® Major Kitchen Appliances CENTRAL AGENCIES INC. 4870-51 Street, Camrose Phone 780-672-4491 Edm. Direct 780-429-0909 The value of your home t ypically increases over the years. Make sure your coverage doesn’t lag behind the current value of your home and contents. Don’t let your policy la g

CARE

Battle River Community Foundation secretary Sharleen Chevraux, left, presented a cheque to Killam and District Health Care Foundation chair, Sharon Moser, with Killam Health Care Centre Resident Care manager, Cheryl King.

By Murray Green

By Murray Green

By Murray Green Alberta lamb, sheep market looks good in this province.

By Murray Green Alberta lamb, sheep market looks good in this province.