Electricity in Canada: Always On

PREPARED BY PREPARED FOR

Forward and Acknowledgments

CONTEXT FOR STUDY

An important evolution in the provision and consumption of electricity services is underway, driven by a pressing need to address climate change. Canadian utilities are at the forefront of the transition, and our collective success in achieving net zero and a clean energy economy will, in large part, hinge on the success of Canadian utilities in navigating unprecedented change while maintaining reliability. Canadian homes and businesses, as well as those looking to invest in our nation, expect nothing less than to access the electricity they need at the flick of a switch; in short, reliability is Always On. This report aims to highlight the utility’s perspective on what is needed to ensure reliability and affordability during a period of structural transition.

Electricity Canada is the national voice for sustainable electricity for its members and the customers they serve as the country works towards a net zero by 2050. Electricity Canada currently represents 42 members and 87 corporate partners, a group that includes integrated electric utilities, independent power producers, transmission and distribution companies, power marketers, system operators, technology vendors, and service providers.

This paper reflects the perspectives and opinions of the authors and does not necessarily reflect those of The Brattle Group. However, we are grateful for the valuable contributions of many Electricity Canada members and industry experts who provided valuable insights that enabled us to author this report.

2

ABOUT BRATTLE

The Brattle Group answers complex economic, finance, and regulatory questions for corporations, law firms, and governments around the world. We are distinguished by the clarity of our insights and the credibility of our experts, which include leading international academics and industry specialists. Brattle has 500 talented professionals across North America, Europe, and Asia-Pacific. For more information, please visit brattle.com.

Tom Chapman PRINCIPAL

Tom Chapman PRINCIPAL

Toronto, Ontario

Mr. Tom Chapman is an experienced energy economist with expertise in wholesale energy markets and energy policy design across North America and Europe. He has worked with utilities, electricity system operators, and all levels of government – as well as regulatory and industry stakeholders – on policy and strategy initiatives related to the design and evolution of the energy sector.

Mr. Chapman has experience working on a diverse range of projects, from community solar projects and electricity and gas price forecasting to market demand studies and intertie assessments. He has lectured on electricity markets at Toronto Metropolitan University and serves on the university’s Centre for Urban Energy advisory board. Prior to joining Brattle, Mr. Chapman was responsible for the wholesale electricity market at Ontario’s Independent Electricity System Operator, and he also worked at the Ontario Ministry of Energy as Director, Transmission and Distribution Policy Branch.

Kathleen Spees PRINCIPAL

Kathleen Spees PRINCIPAL

Washington, DC

Dr. Kathleen Spees has worked in more than a dozen international jurisdictions supporting the design and enhancement of environmental policies and wholesale power markets. Her clients include electricity system operators in PJM, Midcontinent ISO, New England, Ontario, New York, Alberta, Texas, Italy, Singapore, and Australia.

For system operators and regulators, Dr. Spees provides expert support through stakeholder forums, independent public reports, and testimony in regulatory proceedings. For utilities and market participants, her assignments support business strategy, investment decisions, asset transactions, contract negotiation, regulatory proceedings, and litigation. Dr. Spees has developed and applied a wide range of analytical and modeling tools to inform these policy, market design, and business decisions.

3

4 TABLE OF CONTENTS Executive Summary.................................................................................................5 Key Findings ............................................................................................................................. 6 Recommendations................................................................................................................. 11 Background and Methodology........................................................................12 Reliability During the Clean Energy Transition ................................................14 A. A Structural Shift is Underway ....................................................................................... 15 B. Grid Impacts and Reliability Needs ................................................................................ 17 C. Grid Modernization 26 D. Grid Hardening ............................................................................................................... 29 Implementing Net Zero...................................................................................32 A. The Utility Business Model ............................................................................................. 32 B. Gaps in the Current Framework..................................................................................... 33 C. Cost and Affordability 48 Conclusion ......................................................................................................54 Recommendations..........................................................................................56

Executive Summary

In recent years, Canada has made great strides towards sustainability in the country’s electricity systems, with ambitious net zero policies establishing the common goal. Actions have focused on replacing fossil-fired generation at the wholesale level and providing greater clean energy choices for consumers, such as microgeneration and electric vehicles.

However, the reliability impacts on delivery infrastructure, such as transmission and distribution networks, are not keeping pace with the rapidly evolving landscape. If left unchecked, these misalignments will slow the pace of change and, in more extreme conditions, lead to severe reliability events, the risk of which is already exacerbated by climactic threats. Compared to international competitors, Canada is falling behind in developing coordinated implementation plans that prioritize reliability.

To address these concerns, Electricity Canada – the national voice of the Canadian electricity sector – retained The Brattle Group (Brattle) to develop an understanding of how the energy transition is impacting reliability.

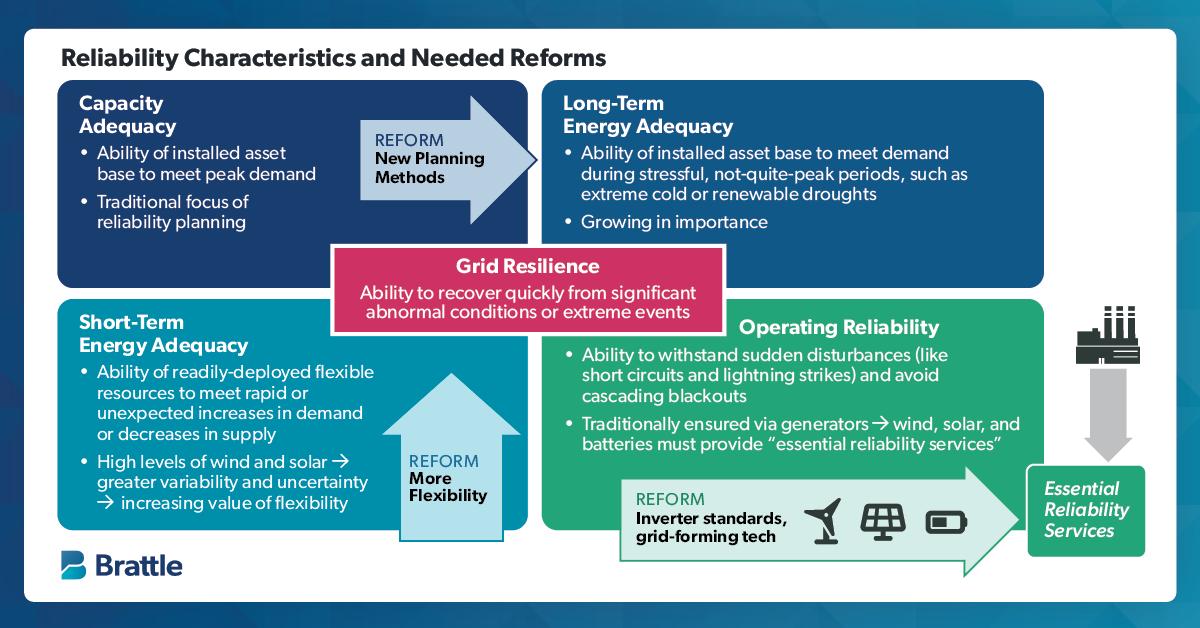

Through our discussions with Canadian utilities and industry professionals, the message was clear: the definition of reliability is expanding. In addition to meeting peak needs, reliability requires investments in resilience to mitigate extreme weather events, additional flexible resources to manage increased supply and demand uncertainty, and grid modernization to enable distributed resources and electrification. In addition, reliability investments, sustainability objectives, and affordability policies must be closely orchestrated to deliver structural change that is necessary to achieve ambitious policy goals. The alignment of these core values will determine the pace and extent of change.

In this report, Brattle shares key findings based on these discussions and, in turn, develops recommendations on how to best address reliability concerns as the nation’s electricity system supports the transition to a clean energy economy.

5

Key Findings

The Canadian electricity grid is undergoing profound changes that will accelerate in the coming years to meet federal and provincial policy goals and shifting consumer preferences. At the wholesale grid level, the introduction of intermittent renewable generation, integration of new technologies such as energy storage, and the proliferation of demand-side resources are changing how electricity is generated and delivered to consumers. Managing more frequent and extreme weather events and replacing aging infrastructure is occurring at the same time as rapid grid expansion, putting pressure on utilities to meet multiple concurrent priorities.

Canadians are also using electricity in new ways, including through the adoption of electric vehicles (EVs), the use of heat pumps in homes, server farm-based cloud computing, industrial processes, and electronic chips embedded in appliances and devices. At the same time, utilities must also increasingly manage the two-way flow of power produced by a range of distributionconnected energy resources. In all facets of daily life, there is increasing electrification.

Through our discussions with Electricity Canada members and industry professionals from across the globe, we can report the following key findings that highlight the increasing challenge of ensuring reliability is Always On.

Prioritizing reliability is essential to achieving an orderly transition to a clean energy economy.

Reliability is central to achieving sustainability. Without reliable electricity supply, customers will not accept the pace of change, and businesses will not invest. Likewise, reliability and affordability go together, as electricity is integral to homes and businesses, and the loss of power has significant economic consequences. It is in everyone’s interest – customers, utilities, regulators, and policymakers – to ensure reliability investments are prioritized. Always On isn’t just about keeping the lights on and the EV charged, but it is also applicable to utilities, regulators, and policymakers who must remain vigilant, proactive, and aligned regarding the key role reliability will play in transitioning to net zero.

6

Investments in clean energy are only half the story: reliability requires enabling investments in network infrastructure, grid modernization, and grid hardening.

Grid reliability needs are changing in response to significant supply and demand side uncertainty as well as the impacts of more frequent, intense extreme weather events. Increasingly, system operators must plan to ensure there is sufficient energy for all time periods rather than just summer or winter peaking needs. In addition, a greater reliance on variable generation can result in large, unexpected intra-day swings in demand and supply that need to be incorporated into reliability planning tools.

As customers add new technologies to their homes and businesses and new resources are connected to the distribution grid, reliability assessments will need to be broader in scope than have traditionally been the case. The challenge is compounded by changing weather patterns and the frequency and intensity of events, which are difficult to predict and not well captured by deterministic planning models. Canadian utilities are actively updating planning assumptions, tools, and processes to ensure these risks are accurately reflected in reliability assessments and incorporated into their utility business plans.

A long-term goal of net zero requires a long-term vision from utility regulators that explicitly includes electrification and decarbonization.

We found that the pace of change is heavily influenced by the degree of alignment between net zero policies, regulatory mandates, and the utility business model. In some regions of Canada, there is close alignment between these three pillars, but in other regions, significant misalignments persist. Regulators who do not have a mandate to include long-term investments associated with net zero and climate adaptation are not able to readily approve utilities’ plans that do include these types of investments.

Furthermore, grid modernization requires investments in technologies that are quite different from traditional poles and wires, and many utilities will need to develop greater capability to manage distributed assets on their network. Many of these technologies are evolving, and new business and operating models carry greater risk and uncertainty than in the past. More flexibility from regulators is needed to manage

7

these risks and support a revenue model that facilitates urgently needed, long-term reliability investments.

The utility business model is central to achieving a successful energy transition, but many risks to future reliability lie outside the direct control of utilities.

Traditionally, resource adequacy assessments have focused on capacity adequacy to meet peak needs, but the evolving resource mix places heightened importance on long-term energy adequacy. Despite best efforts to account for long-term adequacy, executing large-scale projects entails a new level of risk management. In some instances, provincial and federal governments are better placed to manage these risks since they have access to the infrastructure, resources, and networks that utilities do not. For example, there is a pressing need for federal and provincial policymakers to develop strategies to address supply chain constraints and develop workforce capacity building. Without additional support, important projects may face delays and cost pressures that will further increase costs for consumers.

For some utilities, large capital investments over a short timeframe have the potential to result in unsustainable financial pressures over the long term. In addition, access to capital for smaller and municipally owned utilities is becoming a constraint on their ability to fund investments that facilitate electrification and grid expansion. Targeted support to manage these risks will be important to sustain a viable utility business model and ensure a reliable transition.

Effective policies to address affordability and local economy impacts are required.

New infrastructure is costly compared to legacy equipment, and energy inflation is increasing consumer prices. Higher-emitting regions that must decarbonize and expand the grid to meet net zero goals are faced with the highest cost burden. Without additional support and effective policies, these costs have the potential to adversely impact the competitiveness of the local economy, especially in smaller provinces and territories.

While there are limited opportunities to influence input costs, policies that incentivize energy efficiency and conservation can be very effective in reducing electricity bills for consumers. Regulators can help by encouraging long-term utility investment plans that

8

lead to steady, predictable, and manageable rate increases. However, in those provinces where structural change is required, greater use of targeted public funding should be expected to ensure a fair and equitable clean energy transition

First Nation, Indigenous, and utility partnerships are an emerging success story, but additional partnerships are at risk if utility reliability concerns are not addressed.

Partnerships with First Nations and Indigenous communities have become an important feature of the Canadian electricity landscape. Utilities and First Nations have successfully partnered on clean energy and transmission projects that have led to mutually beneficial outcomes. Although there is not a one-size-fits-all approach to partnership opportunities, there are common themes that lead to fair and equitable outcomes. Joint decision-making has emerged as a central tenet.

Likewise, enabling equity investment is important – not just from a business perspective but as a demonstration of reconciliation. Access to federal and provincial funding to support investment opportunities has proven very important to write down the investment risk of projects. Finally, partnership opportunities go well beyond the provision of new infrastructure. Partnerships provide local employment benefits and ongoing revenues to support local economies and disadvantaged communities. Future benefits are at risk if reliability concerns slow down the pace of change, resulting in fewer partnership opportunities

Enhanced engagement is required to strengthen relationships among utilities stakeholders, policymakers, and regulators to ensure reliability concerns are addressed early in the policy development process.

Misalignments between federal policy goals and utility business needs, particularly on issues of reliability, affordability, and long-term investments, will slow the pace of change. In the European Union, United Kingdom, Australia, and other jurisdictions, ongoing stakeholder forums facilitated by government agencies have been established to allow utilities, industry groups, consumers, and other interested stakeholders to participate in the development of policies. By proactively identifying reliability issues ahead of time, electricity consumers benefit from more informed decision-making, and the likelihood of costly unintended consequences is reduced.

9

A

cohesive, integrated planning strategy is required to facilitate strategic investments in enabling infrastructure.

The net zero challenge requires holistic regional planning facilitated through interregional cooperation and interconnectedness. Effective, coordinated regional planning is needed more than ever before to maximize the economic potential of assets and deliver reliable outcomes. Large-scale on and offshore wind and nuclear projects, coal and natural gas retirements, and other large-generation developments can have broad regional impacts that extend well beyond provincial borders.

In the US and Europe, federal governments have recognized the need for holistic planning and identified transmission expansion as a strategic investment that requires additional funding to get projects built. In Canada, federal and provincial funding has been successful in supporting new projects, but to facilitate the next phase of the transition, a more comprehensive, integrated vision is required to develop mutually beneficial enabling transmission and distribution infrastructure.

10

Recommendations

Our recommendations are focused on addressing the emerging gaps in the current electricity framework and aim to ensure reliability concerns are proactively addressed as Canada’s electricity system facilitates a transition to a clean energy economy.

• Greater effort is required to strengthen relationships between the utilities responsible for reliability, the policymakers who set strategic direction, and the regulators who oversee the utility business model.

Focus on Reliability

• Enhanced industry engagement in strategic planning and policy implementation is urgently required, and opportunities to engage in greater regional planning should be pursued.

• A key short-term priority is to ensure provincial regulators are enabled with a broader mandate that aligns with decarbonization and electrification policy objectives to ensure resource adequacy goals are met.

Regulatory Reform

• Provide utilities with greater flexibility to manage increased risks by developing mechanisms that enable utilities to seek approval of and recover prudently incurred net zero transition costs.

• Provide clear regulatory guidance for those utilities seeking to invest in grid modernization and develop distributed system operator capability.

• Proactively mitigate extreme weather risk by facilitating grid hardening investment based on long-term future projections rather than historical events.

Fairness & Affordability

• Governments at all levels should establish Indigenous loan guarantees to facilitate partnership opportunities.

• National policies are needed to address critical supply chain and workforce risks.

• Targeted public funding is needed to address utility capital constraints, facilitate investments in enabling infrastructure, and support the most impacted provincial economies.

11

Background and Methodology

Members of Electricity Canada, and the Canadian electricity sector as a whole, recognize the challenges set out by the Clean Electricity Standard and broader emissions goals: to achieve a net zero grid by 2035 and a net zero clean energy economy by 2050. For the Canadian economy to become net zero by 2050, electricity companies will need to at least double the amount of generation – and likely a commensurate amount of distribution and transmission capacity –while ensuring that electricity continues to be affordable and reliable for Canadians now and into the future.

To understand the scale of the challenge and how reliability could be impacted and maintained during the transition, Brattle interviewed ten Electricity Canada members from across the country. This information was supplemented with additional interviews from subject matter experts in Australia, Europe, and North America to ensure we captured the broader perspective and key developments underway elsewhere.

The interviews were structured around four themes:

1. Energy Transition Challenges: We explored key challenges and risks impacting utilities resulting from the ongoing energy transition.

2. Emerging Reliability Needs: We discussed the operational risks that are resulting from implementing policy commitments, managing extreme weather events, and how structural changes in the supply mix and demand-side developments are impacting reliability.

3. Business Impacts: We reviewed how significant new capital and operational investments are impacting the utility business model and explored how heightened risk is managed in a more uncertain business and operational environment.

4. Opportunities to Support Change: We discussed how utilities are facilitating economic greening by working with the broader stakeholder community, including partnerships with First Nations and local communities.

In addition to interviews, Brattle reviewed developments in other relevant jurisdictions, including the US, Australia, Great Britain, and the European Union. The purpose of the review was to understand how these markets were addressing the reliability challenge and what, if any, lessons could be applicable to Canada.

12

The information gathered through the interviews and jurisdictional research was used to identify gaps in how net zero is being implemented today. Our recommendations are focused on addressing these gaps to support Electricity Canada members, regulators, and policymakers in their pursuit of a more reliable, sustainable, and affordable Canadian electricity grid

13

Reliability During the Clean Energy Transition

The Canadian electricity sector has a proud history of rising to the challenge to meet the electricity needs of Canadians. Since the Adams 37MW Niagara Power Station No. 1 became the world’s first large-scale alternating current (AC) generating station in 1895, Electricity Canada members have been at the forefront of the industry and created a grid that is 84% emissions-free, ensuring Canadian goods and services are made with some of the world’s cleanest power.1

Whether generating and transmitting electricity using the latest – and often homegrown –technologies or connecting a growing population while supporting the economy, the Canadian electricity industry has demonstrated its capability to manage change while maintaining reliability. Today, the utility sector is already working hard to support net zero policy goals. By engaging with local communities and partnering with First Nations and Indigenous communities, Canadian utilities are committed to creating a prosperous future for generations to come.

Canadian utilities are not unfamiliar with structural change. Across the country, utilities have managed periods of rapid population growth, the increase in electricity demand that came with the introduction of air conditioning, and the integration of new technologies such as nuclear, renewables, and demand-side resources. During previous periods of transition, the goal remained focused on reliability at the lowest cost.

The current challenge of net zero layers on additional obstacles. The foremost of these is the need to dramatically expand the grid to electrify parts of the economy that previously relied on fossil fuels and, in the process, develop only clean sources of power, which are often less reliable and less flexible than traditional sources of generation. In addition, many utilities will need to retire large amounts of existing fossil-fired generation and manage the cost, workforce, and local economic impacts of doing so. The costs of transitioning off fossil fuels and significant grid expansion are, understandably, a concern for utilities, regulators, and ratepayers.2 Taken

1 Source: Canada’s 2022 National Inventory Report (2022 NIR)

2 Major cost drivers include the cost to replace aging infrastructure; the significant investments required in new sources of non-emitting supply; additional investments to firm up intermittent renewable generation; increased capital expenditure in electricity networks; rising capital costs as a result of higher interest rates; and wage and operating cost inflation

14

together, the pursuit of net zero to meet federal and provincial policy goals and changing consumer preferences will result in profound changes that will accelerate in the coming years.

Through the course of our research, we aimed to identify how the Canadian utility industry was positioned to meet the challenge of net zero and whether there were any gaps that needed to be addressed to implement an orderly and reliable energy transition. The remainder of this section focuses on:

a. Understanding the scale of the challenge

b. How reliability needs are evolving at the wholesale level

c. Importance of grid modernization and grid hardening

d. Affordability impacts

A. A Structural Shift is Underway

It is widely recognized that climate change is one of the greatest threats to humanity and must be addressed urgently. The Paris Agreement was adopted by 196 parties at the UN Climate Change Conference (COP21) in Paris, France, on December 12, 2015. The agreement is a legally binding international treaty on climate change and came into effect on November 4, 2016, with a stated goal to pursue efforts “to limit the temperature increase to 1.5°C above pre-industrial levels.”3 In response, governments around the world, including Canada, have made clear and ambitious commitments to significantly reduce greenhouse gas (GHG) emissions and decarbonize the economy.

Since 2016, the Government of Canada has implemented policy measures to support its national and international targets, including the introduction of an economy-wide carbon pricing scheme in 2019. In addition to carbon pricing, the federal government has passed various acts to phase out unabated coal use by 2030, facilitate nuclear plant extensions, reduce upstream methane emissions, impose stringent vehicle emissions standards, and encourage new energy efficiency measures. Federal policy commitments rely heavily on the cooperation and support of individual provinces and territories since electricity policy and regulation are predominantly a local jurisdiction in Canada.

As a result of these policy commitments and actions, the Canadian Energy Regulator has projected that electricity demand will double from current levels, reaching 1.2 terawatt hours

3 The UN’s Intergovernmental Panel on Climate Change indicates that crossing the 1.5°C threshold risks unleashing far more severe climate change impacts, including more frequent and severe droughts, heatwaves, and rainfall.

15

(TWh) by 2050. Traditional sources of demand from homes and businesses are expected to increase modestly due to conservation and energy efficiency measures. More significant increases in industrial demand are expected, as well as new demand from the electrification of transportation and from the support of the production of hydrogen as an alternative fuel. The increase in demand is unlikely to be evenly distributed. Urban and industrial zones will see a much larger increase than rural and remote locations, and regions that are currently summer peaking may become winter peaking due to the electrification of heating and transportation.

The Canadian Energy Regulator’s latest forecast of Canadian electricity demand resulting from net zero policy commitments is shown in Figure 1.

“It’s tough to make predictions, especially about the future.”

–Often attributed to Yogi Berra,

baseball catcher

Long-term energy forecasts are notoriously difficult to get right and carry a large margin of error. Many variables, such as how consumers will respond to prices and adopt new technologies and products, mean that change is rarely linear. The challenge with the energy transition is that the degree of uncertainty is higher than ever before; the actual rise in electricity demand will depend on the rate of electrification and innovation within the incumbent industry, but also the development of whole new industries such as the hydrogen economy.

4 Source: Brattle calculations using Canada Energy Regulator datasets which can be found here: https://www.cer-rec.gc.ca/en/data-analysis/canada-energy-future/2023/access-and-explore-energy-futuredata.html

16

FIGURE 1: NET ZERO EMISSIONS POLICIES ARE PROJECTED TO DOUBLE CURRENT ELECTRICITY DEMAND4

Utilities manage this uncertainty by pursuing “least regrets” planning solutions that aim to manage risk and minimize costs to consumers. As we explore later in this report, opportunities to de-risk the transition will ensure that utilities’ least-regrets plans can be more ambitious and speed up the pace of change. Conversely, if these risks are ignored, utilities’ plans will, by necessity, be more cautious. Understandably, Canadian utilities are concerned that while the trajectory of demand growth is clear, the range of future demand is highly uncertain, introducing significant risk into their planning processes.

B. Grid Impacts and Reliability Needs

To meet the projected load growth, significant sources of new non-emitting supply will be required. Growth in wind and solar deployment is expected across Canada based on current utility and system operator long-term resource adequacy plans.5 New or additional nuclear power is also expected to play a significant role in some provinces. Full-scale Canada deuterium uranium (CANDU) reactors have proven to be a reliable provider of baseload energy since the technology was first introduced in the 1960s, and recent developments in small modular reactors (SMRs) have the potential to complement the existing fleet.

Reliability

is Being Directly Impacted by the Energy Transition

Recent reliability events in western Canada are a look into the future for all Canadian utilities managing increased renewable generation and electrification. The lessons are clear: policy and reliability must be aligned or there are undesirable consequences. At the same time, greater public funding is required to support enabling infrastructure to enable the grid to transition to net zero safely and reliably.

The Government of Canada has provided some guidance on how the most impacted provinces might meet the policy goals but has not yet committed to providing large-scale public funding or regulatory support to implement these projects.6 For example, they anticipate investments

5 For example: Quebec’s Action Plan 2035 projects over 10 gigawatt (GW) of new wind; Ontario recently announced a series of competitive procurements to target 3–5 GW of new non-emitting resources including wind; New Brunswick and Saskatchewan have committed to developing 1,400 MW of new wind in the province; Nova Scotia announced plans to 1,100 MW of renewable energy; BC Hydro is targeting 3 GWh of additional clean energy supply.

6 Proposed Clean Electricity Regulations, Regulatory Impact Analysis: https://www.gazette.gc.ca/rppr/p1/2023/2023-08-19/html/reg1-eng.html

17

in biomass in Nova Scotia, nuclear in New Brunswick, hydroelectric facilities in Ontario, nuclear in Saskatchewan, and natural gas with carbon capture and storage in Alberta. In all cases, these options are typically less flexible and more expensive than conventional sources of power, such as natural gas and coal-fired generation In some cases, technologies are still being developed, such as SMRs, battery storage, and carbon capture and storage. The common theme is that all of the proposed solutions introduce significant risks and uncertainty that will need to be managed to reliably operate the grid at expected standards.

In addition, there are times when large-scale deployment of renewable resources can overwhelm a local grid, resulting in the need to curtail output from these resources or other existing baseload resources on the grid, such as hydroelectricity or nuclear.

Case Study: Policy Leading to Heightened Reliability Risks

The Yukon is an example that illustrates the reliability risks of incentivizing a greater penetration of solar generation than the grid can cost-effectively handle. In the Yukon, solar generation has been incented by attractive governmentfunded microgeneration programs. Unfortunately, despite best intentions, the success of this program is leading to operational challenges for the grid operator and increased reliability risk for consumers.

The Yukon is an isolated grid, which means it cannot rely on interconnections with neighboring grids to import power when needed or export excess when there is greater generation than required to meet domestic demand. In the summer months, demand is low and hydroelectric generation is plentiful, often more than enough to meet demand. However, solar generation is at its greatest in the summer months, resulting in difficult decisions for the territory. Yukon Energy must balance supply and demand at all times. During these conditions, clean hydroelectric generation must be curtailed or de-rated to provide generation reserves in case solar output suddenly drops due to cloud cover or storms.

The Yukon government has also implemented programs to incent the electrification of home heating. This is driving up demand during the winter months, but solar generation is at its lowest during these times, and batteries are not yet proven at grid scale or under extreme weather conditions. As a result, Yukon Energy must rely on backup generation, such as diesel generators,

18

to ensure reliability. The misalignment between policy and grid needs is undermining efforts to decarbonize the grid and resulting in higher costs for Yukon customers. Greater interconnections would help with the operational challenges, but the distances are very high, and the development costs are too high for Yukoners to bear on their own.

On August 10, 2023, the Government of Canada released the draft Clean Electricity Regulations (CERs)7 for public comment. The final CERs are anticipated to be registered under the Canadian Environmental Protection Act, 1999 (CEPA) in 2024 and come into force on January 1, 2025. The CERs are proposed as part of a suite of new federal measures to achieve net zero targets on GHG emissions by 2050 and regulate emissions of carbon dioxide (CO2) from electricity generating units that meet the following criteria: combust any amount of fossil fuel for the purpose of generating electricity; have a capacity above a 25 MW; and offer electricity for sale into a regulated electricity system. In response to the proposed regulations, Electricity Canada noted:8

“Electricity Canada and member companies across Canada are deeply concerned that the proposed Clean Electricity Regulations will have significant impacts on the reliability and affordability of electricity in Canada.”

The reliability concerns expressed by Electricity Canada members echo those expressed by the North American Electric Reliability Corporation (NERC),9 a nonprofit regulatory organization responsible for establishing reliability standards across North America. NERC’s most recent Long-Term Reliability Assessment10 underscored the threat that generation retirements –including those using fossil-fired generation – pose to long-term reliability. The report noted that the resource mix is expected to continue to transition to a greater reliance on wind, solar

7 Details on the CER can be found here: https://www.gazette.gc.ca/rp-pr/p1/2023/2023-08-19/html/reg1eng.html.

8 Source: https://www.electricity.ca/files/reports/Final-Electricity-Canada-CER-Response.pdf

9 The North American Electric Reliability Corporation (NERC) is a not-for-profit international regulatory authority whose mission is to assure the effective and efficient reduction of risks to the reliability and security of the grid. NERC’s area of responsibility spans the continental United States, Canada, and the northern portion of Baja California, Mexico. NERC is the Electric Reliability Organization (ERO) for North America, subject to oversight by the Federal Energy Regulatory Commission (FERC) and governmental authorities in Canada.

10 NERC Long-Term Reliability Assessment 2023: https://www.nerc.com/pa/RAPA/ra/Reliability%20Assessments%20DL/NERC_LTRA_2023.pdf

19

photovoltaic (solar PV), and battery resources. NERC has highlighted that the vast majority of new wind and solar PV resources use inverters to convert their output power onto the grid.

Challenges with Inverter-Based Resources (IBRs)

Generators have long played an important role in stabilizing the grid so that it can sustain sudden disturbances (such as lightning strikes or short circuits). However, high penetrations of renewable generation can lead to grid reliability issues since these resources typically lack the capability to ride-through even a minor system disturbance. Instead, as a result of dynamic system conditions and local disturbances, these resources can trip, leading to a sudden loss of generation. With increasing amounts of IBRs on the grid, these unexcepted events have the potential to become a major disturbance, leading to wide-spread outages. Sudden changes in generation can also lead to the overloading of transmission equipment, which can cause wildfires, as occurred in the 2016 Blue Cut Fire in California and similar events in 2023.

According to NERC, IBRs (which include most solar and wind generation as well as new battery energy storage systems or hybrid configurations) account for over 70% of the new generation in development. The industry has recognized the reliability threat posed by the performance deficiencies of existing IBRs and is working on technological solutions to enable greater ride-through capability but, in the near term, proven solutions at grid scale are not available. Instead, grids that are reliant on conventional generation must continue to rely on natural gas-fired generation to ensure reliability. NERC has issued recommended practices in their reliability guidelines and emphasized that policymakers and regulators should ensure utilities have sufficient flexibility in their implementation plans to ensure that the pace of change mirrors the availability of replacement resources with the capability to maintain grid inertia and ensure reliability.

Wind and solar bring challenges with regard to normal weather pattern variability, as output can change dramatically and unexpectedly as clouds move in or the wind stops blowing. Renewable generators are also typically inverter-based resources (IBRs) that are susceptible to tripping or power disruption during normal grid fault conditions, making the grid less reliable. Inverters with “grid-forming” capabilities, or GFM, are needed to support the growing penetration of inverter-based resources. Without GFM, system operators can reliably integrate 30% to 75% of IBRs by keeping synchronous generation (coal, gas, hydroelectric) online, and a

20

far smaller percentage in the absence of conventional generation sources. Most GFM solutions are based on reprogramming inverters with new software based on established standards.

The following provides a brief summary of recent developments from Great Britain, Australia, and the European Union to develop GFM capability:

• Great Britain: The National Grid Electricity System Operator (NGESO) has conducted a number of studies and undertaken a series of pilots to assess the issues of IBRs systems. In one such study, IBRs were retrofitted with GFM controls and operated for six weeks to demonstrate the ability of a wind-based GFM IBR to operate in an islanded condition and provide system restoration and black-start services. This initiative led to the Great Britain Stability Pathfinder Program (NGESO, 2019–2022) to procure new technologies to provide stability services to meet identified system needs.

• Australia: Given the proliferation of solar generation in the Australian market, there is an urgent need to address the IBR issue. At times, renewables can provide 80% of the grid’s energy needs, with system lows occurring during the middle of the day when solar output is at its greatest. As with the Yukon, this has created significant operational challenges. The various entities responsible for planning and developing the Australian grid have worked together to understand the potential of GFM inverters to address many of the challenges facing the future power system. As a result of these efforts, several GFM battery energy storage systems are being installed or proposed for connection in various parts of the Australian National Electricity Market (NEM). These range from 30 MW to between 500 and 600 MW.

• Europe: Efforts to develop GFM have been led and coordinated by ENTSO-E, the organization representing transmission system operators. A 2021 report11 outlined the progress that has been made in defining GFM standards and applications. ENTSO-E and ACER (Agency for Cooperation of Energy Regulators) are working to recommend GFM capabilities that can be included in European connection network codes to harmonize the requirements throughout the European Union.

North America has not yet established a uniform standard for GFM, and until it does, the performance issues of IBRs will be a reliability constraint on the rollout of renewables. In a future with no conventional generators online, IBRs (including batteries) will need to be programmed to replace this inertial response with similar functionality to immediately increase output following the loss of a generator and thereby stabilize frequency. Canadian grid

11 Source: Grid-Forming Capabilities: Towards System Level Integration (entsoe.eu)

21

operators will increasingly need to define and procure this service. To address these issues, utilities that are currently reliant on fossil-fired generation will need to:12

1. Add new resources with needed reliability attributes, including flexibility;

2. Make existing resources more dependable and protected against extreme weather; and

3. Continue to rely on natural gas-fired generators until sufficiently proven alternatives are available.

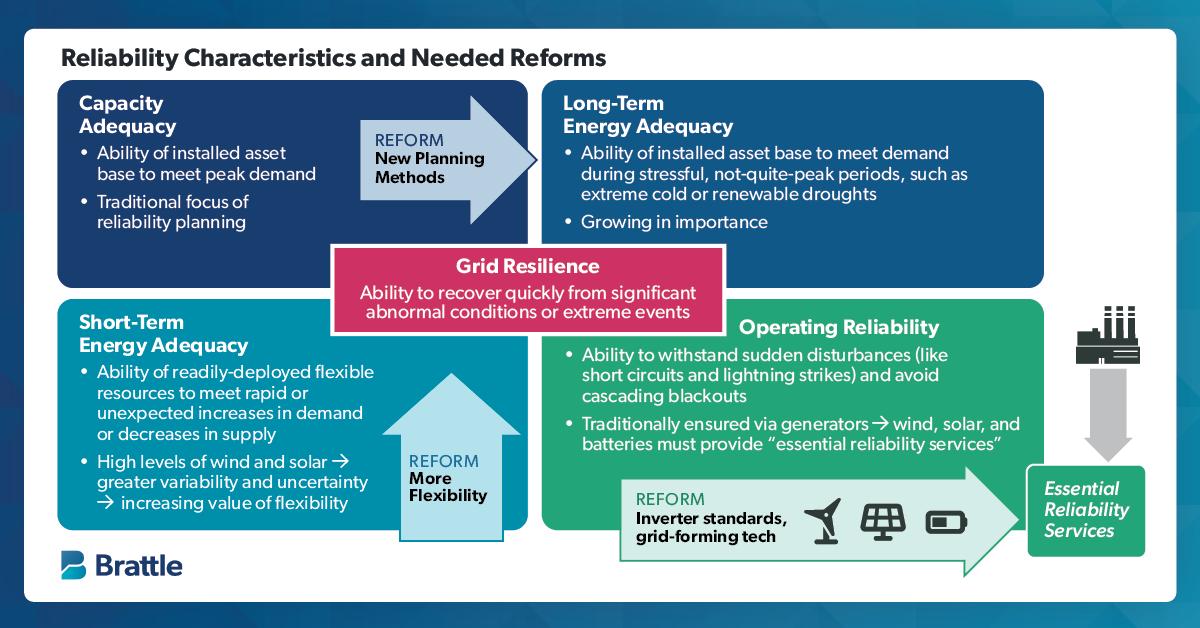

Reliably integrating wind and solar PV or IBRs onto the grid is paramount, and evidence indicates that the risk of grid vulnerabilities from interconnection practices and IBR performance issues is growing. However, it is not the only issue facing grid operators Traditional reliability criteria and metrics are in focus as a result of the structural changes underway. The Brattle Group has studied how reliability needs must adapt to changing grid conditions across all operational timeframes, from long-term resource adequacy to real-time operational needs.13 These requirements are summarized in Table 1.

12 Those systems that have a high proportion of hydroelectric generation are better placed to manage loss of inertia in the short term. However, as penetration of renewables increases, even these jurisdictions will need to ensure they have sufficient flexible generation on the system to maintain reliability as a result of sudden changes in generation due to tripping or other grid disturbances.

13 Source: Brattle report, Brattle Electricity Experts Examine System Reliability for Tomorrow’s Electric Grid in New Report Brattle

22

TABLE 1: EMERGING RELIABILITY CRITERIA AS A RESULT OF THE ENERGY TRANSITION

Aspect of Reliability

Capacity Adequacy

Objective

Ensure sufficient power capacity of the installed fleet of resources to meet peak demand

Long-Term Energy

Adequacy

Operational Energy

Adequacy

Ensure sufficient attributes of the installed fleet to meet system needs at all times.

Schedule sufficient flexibility, sustained output capability, and other attributes to instantaneously match supply to demand, given variability, uncertainty, and transmission constraints

Operating Reliability

Avoid rapid cascading failures that lead to uncontrolled and widespread blackouts

Typical Solutions

• Utility-integrated resource planning

• Capacity markets or capacity adequacy requirements

• Evaluation and accreditation of capacity adequacy value of resources by evaluating availability during peak period

• Many parts of the analysis utilize year-round modeling (e.g., effective load-carrying capability for calculating adequacy value, hourly analysis for identifying the resource requirement, and overall adequacy metrics)

• Similar solutions to capacity adequacy, but with enhanced modeling (e.g., production cost modeling)

• Ancillary services such as regulation, load-following reserves, and new ramp reserves (together with corresponding NERC standards)

• Optimized daily schedules of generators, storage resources, and other resource types

• Grid codes specifying dynamic response of inverter-based generator controllers (e.g., Institute of Electrical and Electronics Engineers (IEEE) 2800)

• N-1 operations

• Essential reliability services such as inertial response, frequency response, and voltage regulation, as well as ancillary services such as contingency reserves

LONG-TERM ENERGY ADEQUACY

Traditionally, resource adequacy assessments have focused on capacity adequacy to meet peak needs. However, the evolving resource mix places heightened importance on long-term energy adequacy to meet energy needs across all hours and not just peak times. Long-term energy adequacy is a broader definition of adequacy and is required to enable investments in a resource fleet and transmission network that can meet demand under all kinds of conditions 14 Ibid., p. 25

23

14

To determine full resource adequacy needs, new assessments will be required to ensure all potential grid disturbances (which are more widespread and potentially more intense) are captured. These assessments would include evaluations of generator failures, sustained periods of low wind and solar availability, and unexpected changes in the capability and availability of flexible sources of supply such as batteries and hydropower generators.

Many North American ISO/RTOs and utilities have or are in the process of developing a method called Effective Load Carrying Capability (ELCC). ELCC is a method to calculate the long-term adequacy value of a resource given patterns in its output relative to patterns in adequacy risk in all hours of the year. ELCC is itself a well-established method, though it has not been widely deployed until recent years as interest has grown in tools for long-term energy adequacy. Many ELCC analyses account for weather dependency of renewables and thermal resources as well as energy storage limitations of batteries and hydro, with detailed accounting for emergency procedures including demand response and other flexible demand.

California is a good example of where the industry is heading, given its ambitious decarbonization goals and high deployment of wind and solar resources. California’s wellknown “duck curve” provides an example of how large volumes of renewable output are leading to increased needs for flexible resources. When solar output drops off as the sun sets, the reduction in output must be backfilled using flexible resources with the ability to increase output. Since 2011, the California Public Utilities Commission (CPUC) has been required by law to assess future adequacy across all hours of the year using an effective load-carrying capability model that simulates the time-varying capabilities of wind and solar. The result is fed into the

Reliability Standards Are Changing

NERC underscores the importance of this change: In their 2023 ERO Reliability Risk Priorities Report (August 17, 2023), they state, “It is now insufficient to assume that the system is adequately planned by comparing the peak load hours with the generation capacity. Assessments must look at the magnitude, duration, and impact of resource adequacy across all hours and many years while considering that future events may be outside of historical patterns.”

24

Utilities Need to Plan for Reliability in All Hours, Not Just Peak Times

resource investment mechanism so that both capacity adequacy and some features of longterm energy adequacy are addressed in the installed resource mix.

REAL-TIME ENERGY ADEQUACY

In the real-time operational timeframe, grid operators will need to manage a far more diverse set of resources (and market participants if the grid is managed through a wholesale market) to ensure there is sufficient energy available to meet demand. NERC has proposed to distinguish operational energy adequacy, which covers shorter timeframes (including both shorter-term operations planning and real-time operations), from long-term energy adequacy, which covers a timeframe of one or more years. Operational energy adequacy will require greater orchestration, planning, and execution of day-to-day operations to balance supply and demand.

All System Operators Are Experiencing a Growing Need for Additional Reserves and Flexible Sources of Supply

As more renewables have been integrated into the grid, grid operators have found that they need to increase quantities of existing operating reserves secured (e.g., nonspinning reserve in ERCOT and Ontario) or developed new types of reserves such as ramp products in CAISO (a proposed energy imbalance reserve), SPP, and MISO. ISO New England has introduced day-ahead ancillary services initiative enhancements. The common theme is that more resources, and in particular flexible resources, are needed to manage the greater supply and demand uncertainty.

Grid disturbances have always been a feature of electrical grids. However, with the proliferation of renewable generation and IBRs, together with distribution-connected resources and uncertain demand, grid planners should anticipate that the frequency and intensity of grid disturbances will increase. Operating reliability is the ability of the grid to recover from sudden disturbances and reflects the physics of AC electric power systems. Grid operators manage the risk of grid disturbances by ensuring there is sufficient redundancy to ensure reliable grid operations. Typically, the grid is planned to meet “N-1,” or security-constrained operations, to ensure transmission lines are not overloaded and to avoid cascading failures that lead to widescale, costly outages.

25

ESSENTIAL RELIABILITY SERVICES

In addition to increased investment in resource adequacy, Canadian utilities will need to plan for additional services, referred to by NERC as “essential reliability services,” or “ancillary services ” Under NERC requirements, all grid operators support operating reliability using “contingency reserves,” which are resources that are capable of rapidly increasing supply (or decreasing demand) to maintain operating reliability following the sudden loss of a large generator. With a greater share of more unpredictable supply and demand as a result of the changing grid, the addition of new ancillary services to support operating reliability will be required. In addition to contingency reserves, all grid operators will need to increase investment in flexible generation to meet ramping needs. Dispatchable ramping capability over a minutes-to-hours timeframe is used to match large and sustained swings in demand and available supply. Ramp capability is currently secured using coal, natural gas, and hydroelectric generation. Wind and solar can be very flexible in their downward ramp capability but cannot be relied upon for upward ramp unless they are under curtailed conditions and can be brought back to full output. Looking ahead, with the retirement of coal and natural gas plants, there are limited options to provide on-demand and sustained upward ramps. Long-duration energy storage is a potential option, but it remains in development and is not proven at grid scale aside from pumped hydroelectric storage applications.

Regulators in Canada should anticipate that utilities will bring forward reliability plans that include expanded definitions of reliability in the short and long term.

C. Grid Modernization

In addition to developments at the wholesale level, management of the distribution network is changing. The utility of the future, and in some cases of today, will need to manage a perfect storm of operational and environmental challenges that go far beyond today’s grid. As shown in Figure 1, customer demand for electricity is going to increase dramatically over the coming decades, driven by economy-wide electrification. As electric vehicles (EVs) and heat pumps become commonplace and distributed energy resources (DERs) are connected to the distribution grid, new investments will be needed. Utilities are going to require far greater visibility of the assets connected to the distribution grid and operational tools and mechanisms will be needed to control them.

Consumers are increasingly adopting new technologies such as rooftop solar, home battery storage, and purchasing EVs. These developments mean consumers are generating and using

26

electricity in ways for which the distribution grid was not designed. Figure 2 shows how a typical household’s consumption could change with the addition of a cold weather heat pump. Not only will demand for electricity increase, but the heat pump will change when electricity is being consumed, and potentially result in a very large winter demand for electricity when output from renewable generation is at its lowest and most uncertain.

Utilities require visibility on the deployment of these assets to ensure critical infrastructure, such as transformers, are protected. Federal and provincial policies that incent large-scale adoption of these new applications need to be accompanied by parallel investments in network infrastructure to ensure the grid is not overwhelmed by the surge in demand during the winter months. The traditional grid, characterized by a one-way flow of power from generators to consumers, is rapidly evolving into a multi-directional, decentralized network of connected assets. Increasingly, utilities need proactive support from regulators and policymakers to

15

Source: Brattle calculations using end use load profiles for Michigan, which can be found here: https://www.nrel.gov/buildings/end-use-load-profiles.html

27

FIGURE 2: IMPACT OF A HEAT PUMP ON A TYPICAL HOUSEHOLD ELECTRICITY CONSUMPTION IN A COLD WEATHER CLIMATE15

recognize the dramatic impacts these changes will have on local networks so that utilities can invest in network upgrades to ensure reliability.

MANAGING DISTRIBUTED ENERGY RESOURCES

Traditional approaches have presumed minimal consumer responsiveness, no access to realtime building controls, and one-way power delivery; future retail structures will presume the opposite. As an example, consider the opportunities offered by an aggregated fleet of buildings, each with a different mix of DER assets, including distributed solar, controllable heating/cooling systems, distributed storage, and electric vehicles. If a substantial share of these resources were enabled and actively controlled at precise levels of consumption, they could collectively deliver to the distribution grid a large proportion of the system flexibility and reliability services needed to manage the transition to a clean grid.

Traditional distribution and wholesale operational structures cannot capture the full value of advanced control technology. Modified tools and processes will be required to enable DER aggregators to optimize their consumption/production patterns to provide value to the grid in response to wholesale market energy prices. Accurate price formation and new grid service definitions could enable powerful incentives for demand to respond in real-time current system conditions.

Time-of-use rates have been shown to help incentivize shifting net consumption to times of day that tend to be more favorable to the grid. In the future, however, more dynamic price signals on a more granular level would enable consumers and distribution-connected resources to respond more efficiently.

In response to these challenges and the need for two-way power and communication flow, new system operator models are emerging, and, at a minimum, we expect the distribution company to invest in tools, processes, and expertise to manage assets connected to the distribution grid. There are several distribution system operator (DSO) models being contemplated, including:

1. Total DSO. In the total DSO model, the DSO operates a new distribution system services market at the distribution-transmission interface in ISO markets and coordinates distributed energy resource dispatch. The total DSO model is currently hypothetical and has not yet been implemented.

2. DSO as a DER aggregator. In the DER aggregator model, a local distribution company would operate as a DER aggregator does today and sell its DER portfolio to the utility or

28

bulk system operator for a range of bulk system products and services. The DSO aggregates demand bids and supply offers from DER aggregators and its own portfolios within its local distribution areas. It then submits an aggregated net demand bid curve and ancillary service offers to the utility or bulk system operator, which schedules and dispatches the portfolio rather than as individual resources. The DER aggregator model has been used by demand-response providers in Ontario for more than a decade.

3. DSO as a fully integrated enhanced LDC (ELDC) model. In the ELDC model, the ELDC interacts with the utility or bulk system operator but is also a buyer in whole markets. In the future, the ELDC would aggregate loads and DER resources, and submit net demand bid curves into the wholesale market.

In addition to these three models, there are variants or hybrids that could be contemplated. For example, the DSO could coordinate and dispatch aggregators on its network, and in the total DSO model, both the utility and DSO could potentially dispatch resources on the distribution grid. As the degree of interaction increases, the need for visibility, control, and coordination also increases, together with computational requirements that likely exceed current capability.

D. Grid Hardening

MANAGING EXTREME WEATHER EVENTS

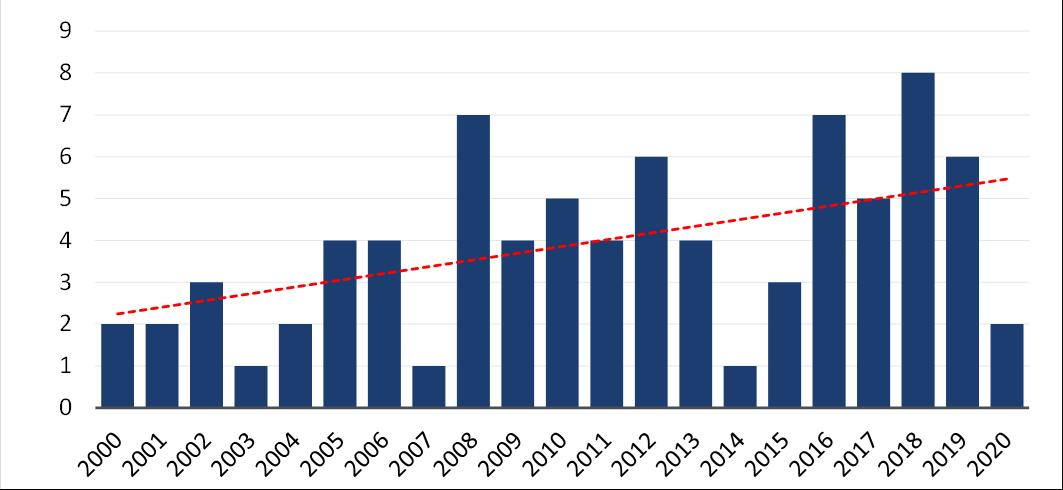

At the same time, as new technologies are integrated and changing patterns of electricity demand are managed, utilities must manage increased extreme weather events. According to the United Nations, extreme weather events globally have increased 83% between 2000 and 2020. Canada is no exception; since 2000, extreme events have been on an upward trend across the country, both in terms of frequency and severity.16

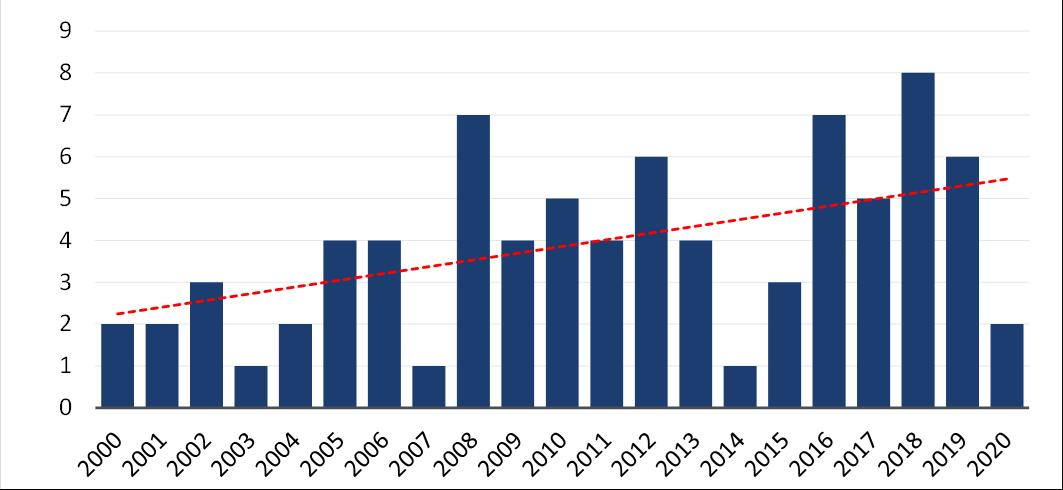

Wildfires, hurricanes, heatwaves, and winter storms have all impacted Canadians in recent years, leading to widespread impacts on electrical grids. In the most extreme conditions, these events can threaten lives and livelihoods. Figure 3 shows how the increase in extreme weather events is currently trending at about 4.5% annually, although there is considerable year-overyear variation.

16 Source: United Nations Office for Disaster Risk Reduction Report 2020, http://www.undrr.org/publication/undrr-annual-report-2020

29

2023 was a record-breaking year for wildfires in Canada, and the consensus is to expect more of the same in future years. Indeed, the Alberta government declared an early start to the 2024 wildfire season. The season traditionally has run from March 1 to October 31, but with such an unseasonably mild winter and low overall precipitation, the start date was moved up ten days earlier than usual to February 20, 2024.18 The challenge with wildfires is that they come without warning, and while vegetation management is key to reducing fire risk to power systems, there are technologies increasingly available that can help prevent grid-initiated fires from starting –for example, specially designed fuses can prevent the escape of sparks that could ignite nearby brush.19 Products and systems that provide remote protection and control capabilities allow utilities to act quickly, for example, to de-energize equipment when threatened with a wildfire. The best defense against wildfires and other weather-related events is undergrounding transmission and distribution lines.

Whether undergrounding or deploying new technologies, Canadian utilities will need to invest a greater share of capital expenditure in preventive measures to ensure reliable grid operations impacted by severe weather events. While these investments require additional capital expense, they avoid larger economic impacts resulting from power outages It is more economical to proactively make investments to avoid costly outages than to wait for these

17 Source: Brattle calculations using data from Public Service Canada: Canada Disaster Database

18 Source: https://globalnews.ca/news/10330545/alberta-wildfire-2024budget/#:~:text=The%20Alberta%20government%20declared%20an,20.

19 Source: https://new.abb.com/news/detail/87307/abb-helps-utilities-protect-against-wildfires-with-new-hitech-valiant-fire-mitigation-fuse

30

EXTREME WEATHER EVENTS IN CANADA 2000–202017

FIGURE 3:

events to occur. Regulators should account for future trends and place a reduced reliance on historical events when reviewing and approving utility grid hardening plans.

Extreme Weather Events Are Increasing in Frequency and Cost

In 2022, Hurricane Fiona knocked out power to more than 500,000 customers in the Maritimes and caused $660 million in insured damage, according to an estimate by Catastrophe Indices and Quantification Inc. According to the Insurance Bureau of Canada (IBC), the storm was the costliest extreme weather event ever recorded in Atlantic Canada in terms of insured damages. IBC has also noted that insurance claims from severe weather events have more than quadrupled across Canada since 2008, with the “new normal” for insured catastrophic damages in Canada at $2 billion a year, compared to an annual average of $632 million between 2001 and 2010.

31

Implementing Net Zero

A.

The Utility Business Model

The success of a clean energy transition will hinge on the ability of Canadian utilities to execute implementation plans that will fundamentally change how electricity is generated, delivered, and consumed by Canadians. The stakes are high since Canadian consumers and businesses will be more reliant on electricity than ever before. At the same time, Canadian utilities are equally reliant on a business model where the majority of future investment is determined by regulators and influenced by policymakers. The schematic in Figure 4 illustrates how the utility business model is the sum of multiple components that comprise a broader ecosystem.

The effectiveness of implementing structural change is closely tied to how each of the four components – partnerships, regulatory framework, implementation policies, and reliability –support the underlying utility business model. Utilities are well placed to identify future reliability investments since they have the technical expertise and experience to determine what is needed and how it should be deployed. Regulators approve or deny utility applications according to established regulatory criteria. Policymakers at all levels of government may impact the utility business model by influencing public investments.

32

FIGURE 4: UTILITY BUSINESS MODEL IS PART OF AN INTRICATE ECOSYSTEM

In addition to regulatory and policy support, in recent years, partnerships have emerged as a key component of the utility business model to ensure a just and inclusive transition. Across Canada, many utilities have worked hard to develop partnership models that benefit all parties and deliver results that go beyond the provision of electricity.

This arrangement has worked well to facilitate incremental investments in existing infrastructure to ensure reliability. However, the introduction of economy-wide net zero policies represents a structural shift, not incremental change, with far-reaching implications for all aspects of the electricity value chain. Under these conditions, if there are gaps or deficiencies in any of the supporting components, then the utility will be constrained in its ability to achieve its objectives.

In the coming decades, the utility business model will be the vehicle that drives change. Therefore, it is imperative that every effort is made to ensure that it is closely aligned and strongly supported by regulators and policymakers. However, at the present time, we have observed misalignments between utility reliability needs, available regulatory tools, mandates, and broader policy support, including access to sufficient public funding. These gaps leave many Canadian utilities in a difficult position – they have developed effective implementation plans to meet the needs of their customers and policy goals but may not have the resources (human and financial) to support all necessary investments. Instead, many Canadian utilities must increasingly prioritize resources at the expense of one or more of their three core objectives: reliability, affordability, and sustainability.

We should note that the degree of misalignment varies considerably across Canada. In those provinces with a single, provincially owned integrated utility that operates a non-emitting fleet, there is typically greater alignment compared to deregulated markets, or those that have a greater reliance on fossil-fired generation. Even so, all Canadian utilities will face a common challenge to expand the existing grid and integrate new technologies and customers while managing policy and regulatory misalignments

B. Gaps in the Current Framework

Through discussions with Canadian utilities and reviewing policy and regulatory best practices from several comparable jurisdictions, we have identified the following gaps that increasingly impact the ability of utilities to execute all of their objectives:

• Grid reliability impacts: These are not fully appreciated during the policy development process;

33

• Limited regional planning: Significant integrated power system planning takes place at the provincial level, but there are few opportunities to engage in regular, inter-provincial strategic planning;

• Enabling investments in interregional transmission: Compared to the other jurisdictions we surveyed, Canada exhibits a limited focus on interregional enabling investments such as transmission expansion;

• Regulatory mandates are too narrow: Mandates are often misaligned with electrification and decarbonization policies;

• Regulatory toolset needs reform: The existing toolset would benefit from additional mechanisms to facilitate grid expansion, modernization, and hardening;

• Lack of clear regulatory guidance: Additional clarity is needed to support investment in the efficient operation of distribution networks where there is a high penetration of DERs and “distribution system operator” models;

• Partnerships: First Nation, Indigenous, and utility partnerships are working well in some regions but not in all provinces; and

• Risk mitigation: Policy support is needed to manage risks that are not controlled by utilities, such as supply chain and workforce challenges

Each of these is explored in more detail in the remainder of this section.

GRID RELIABILITY IMPACTS

The success of an ambitious policy goal requires a cohesive and coordinated implementation plan that empowers utilities to implement change. Developing such a plan is a challenge in the Canadian electricity sector, where the federal government can enact policies that directly impact Canadian utilities, but provinces have constitutional jurisdiction over electricity and other natural resources. Despite this challenge, the issue cannot be ignored. Utilities require provincial and federal support to implement national policies, and where there is misalignment, there is both a policy and reliability risk.

“Canada needs a Canadian electricity strategy to coordinate funding and building infrastructure projects across Canada and to work with the electricity sector to implement the planning and building process.”

–Francis Bradley, CEO, Electricity Canada

34

To address this gap, there is a need to strengthen relationships among reliability stakeholders, policymakers, and regulators to ensure decision-makers have a full understanding of the potential grid impacts Making informed policies and decisions in matters that have the potential to affect electric grid reliability requires a high level of awareness as future electricity resource reserves shrink in the face of demand growth and the interconnected nature of the electric and natural gas systems are more pronounced.

There is a need for dialogue among a broad group of electricity stakeholders when policies and regulations have the potential to affect future electricity supplies, demand, and the development of electricity and natural gas resources and infrastructure. Regulations that have the potential to impact utility operations must have sufficient flexibility and provisions to support grid reliability. Meanwhile, grid expansion will bring new challenges and interdependencies requiring close coordination with other critical infrastructure sectors.

To address these issues, enhanced engagement is required through established and enduring forums. Great Britain, Australia, and the European Union have well-designed processes to enable stakeholders and policymakers to engage in informed dialogue to develop implementation policies, ones grounded in the practical realities of the electrical grid. We found far greater working groups with representation from industry, regulators, and policymakers that help inform and guide policy development at the federal level. This institutional infrastructure is largely lacking in Canada, although it can be found in varying degrees in the provinces that have greater experience in managing change in the electricity sector. As Ontario and Alberta have experienced, managing structural change in their wholesale markets requires a new level of stakeholder engagement to deliver efficient outcomes that reflect the practical needs of market participants.20

20 A good example of enhanced engagement would be the IESO’s Market Renewal Program, which was initiated in 2016 and is currently in the implementation phase. At each stage of the project lifecycle, working groups with impacted stakeholders have informed aspects of market design and implementation based on agreed upon Principles. These principles – which include efficiency, competition, implementability, certainty, and transparency – provide a shared vision for the sector on where the program is heading and how it will get there. Backstopping the principles is a commitment to respecting reliability and policy as two fundamental pillars.

35

DEVELOPMENTS IN AUSTRALIA

Australia is a good example where the federal government has established enhanced engagement to implement economy-wide reforms and facilitate investment in enabling infrastructure and partnerships.

The National Energy Transformation Partnership is a framework for Commonwealth, state, and territory governments to transform Australia’s energy system to achieve net zero by 2050. The partnership reports to the Energy and Climate Change Ministerial Council (ECMC), the decisionmaking body for energy, climate change, and adaptation reforms. Priority work agreed under the partnership is underway, including:

• Establishing a new capacity investment scheme (CIS) to accelerate the deployment of firmed renewable power

• The Australian government will negotiate new bilateral Renewable Energy Transformation Agreements (RETAs) with state and territory governments

• “Rewiring the Nation” program21 to modernize the electricity grid, with agreements made with the state and local governments of Victoria, Tasmania, New South Wales, and Western Australia to provide concessional finance and facilitate the timely delivery of major transmission projects, offshore wind projects, and renewable energy zones

• Developing a First Nations Clean Energy Strategy in partnership with First Nations communities and organizations to help ensure First Nations people have a say in the energy policies and programs in the transition to net zero

• Progressing a National Energy Workforce Strategy to help forecast the workforce capabilities and needs to deliver the energy transformation

• Incorporating an emissions reduction objective into the national energy objectives to give Australia’s energy market bodies the capacity to consider emissions reduction in their work

• Collaborating on energy security management, including cyber security and fuel availability

In addition to the partnership, Australia has fostered many working groups and community energy groups in Australia that demonstrate a strong culture of collaboration between federal market bodies and local communities. For example, The Distributed Energy Integration Program (DEIP) is led by the Australian Renewable Energy Agency and represents utilities, market authorities, industry associations, and consumer associations to maximize the value of customers’ distributed resources for all energy users.

21 For additional information, please see: Rewiring the Nation - DCCEEW

36

LIMITED REGIONAL PLANNING

Interregional cooperation and interconnectedness will be key to managing future demand and supply uncertainty by leveraging a larger footprint to manage these risks In many cases, developing greater interregional connectedness would provide benefits across provinces and territories.

In Atlantic Canada, there are significant opportunities to develop clean energy with favorable wind regimes that will help transition local grids off fossil fuels. Investing in transmission infrastructure to connect these locations to major load centers in Canada and the US will enable this power to be exported when it is not needed locally, maximizing the economic potential of all assets and reducing costs to consumers. Meanwhile, in Western Canada, greater interconnectedness between British Columbia, Alberta, Saskatchewan, and the Yukon would provide similar environmental, economic, and reliability benefits.

In the past, transmission projects connecting clean energy supply in the north with US markets in the south have been the most economical. That dynamic is changing, with expected load growth in Canada opening opportunities to flow power between provinces and the potential for pan-province macro grids. To understand the potential opportunities and grid impacts, greater regional planning would be beneficial and consistent with developments elsewhere. As noted previously, in the US, regional planning has received an enhanced focus in recent years, as facilitating new transmission investment is seen to manage the reliability risks associated with large volumes of renewable generation and reduce costs by making sure assets are being fully utilized. While Canadian utilities are in regular contact with their counterparts, and Electricity Canada ably coordinates dialogue between its members, the addition of dedicated regional planning working groups would help identify and facilitate beneficial strategic projects to create greater regional interconnectedness as well as standards development for new technologies.

These forums could leverage existing networks such as the Canada Electricity Advisory Council, Intergovernmental Councils, and other federal forums to establish an ongoing energy transition forum to implement and steer change. Ideally, these working groups would have representation from utility experts, regulators, and policymakers. Some jurisdictions may wish to explore whether the introduction of independent, not-for-profit entities with a broader scope (electricity, natural gas, hydrogen, other fuels) to undertake long-term integrated planning would be beneficial.

We note that the Government of Canada proposed to create a Pan-Canadian Grid Council in partnership with provinces, territories, Indigenous peoples, the private sector, labor, and civil

37

society. The purpose of the council would be to “establish national standards, best practices, and incentives to promote infrastructure investments, smart grids, grid integration, and electricity sector innovation, with the goal of making Canada the most reliable, cost-effective, and carbon-free electricity producer in the world ” Such a development is consistent with developments elsewhere; we would, however, emphasize that utilities and reliability be central to the formation of such an organization.

ENABLING INVESTMENTS IN INTERREGIONAL TRANSMISSION

There is a growing realization that the next phase of the energy transition will require significant investment in transmission infrastructure, in part to address highly congested generator interconnection queues but also to create greater regional interconnectedness and, ultimately, an integrated national grid.

“The current power grid took 150 years to build. Now, to get to net zero emissions by 2050, we have to build that amount of transmission again in the next 15 years and then build that much more again in the 15 years after that. It’s a huge amount of change.”

–

Princeton study coauthor Jesse Jenkins