IN BANKING AND FINANCE MEET HAIPING FU AND THIS YEAR’S TENTH ANNUAL IMMIGRANT WOMEN OF INSPIRATION

CAST YOUR VOTE FOR 25 OF OUR NATION’S MOST INSPIRING IMMIGRANTS!

6

TAX TIPS FOR NEWCOMERS TO CANADA CRITICAL LIFE

LESSONS FAILURE CAN TEACH YOU

IN BANKING AND FINANCE MEET HAIPING FU AND THIS YEAR’S TENTH ANNUAL IMMIGRANT WOMEN OF INSPIRATION

CAST YOUR VOTE FOR 25 OF OUR NATION’S MOST INSPIRING IMMIGRANTS!

6

TAX TIPS FOR NEWCOMERS TO CANADA CRITICAL LIFE

LESSONS FAILURE CAN TEACH YOU

“My children really enjoy the city and want to live here forever. There is no hassle, no traffic, you can reach your destination within two minutes from wherever you are. This is a place to be. A place to live. An amazing, amazing amazing community.”

Felix Koros, April 2023, Canadian Immigrant Magazine

Volume 20 Issue 2, 2023

4 FUSION PROFILE: Raghuram Sitaram finds adaptability the key to success

NEWS: Cast your vote for the 2023 Top 25 Canadian Immigrant Awards, Complete an online survey on the future of Canadian immigration, Canada extends post-graduate work permits for international graduates

8 COVER STORY

Our tenth annual ‘Immigrant Women of Inspiration’ special shines on women who are contributing to strengthening the Canadian banking and financial sector.

15 CAREERS AND EDUCATION

CAREER COACH: You’ve landed your first job in Canada, what next?

Power up your career in 2023 HIGHER LEARNING: Make the most of your 20s

19 SETTLEMENT IMMIGRATION LAW: Study permit application refusal reasons and appeals

PARENTING: Funny or not funny?

25 MONEY AND BUSINESS

MANAGING YOUR FINANCES: Tax tips for newcomers to Canada

ENTREPRENEURSHIP: Balancing personal and business finances as an entrepreneur

30 BACKPAGE

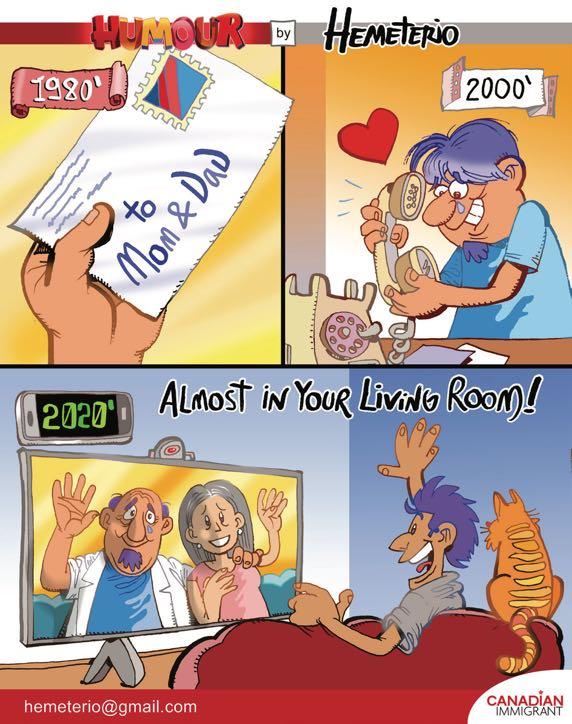

Humour by Hemeterio

Group Publisher Sanjay Agnihotri

Editor Ramya Ramanathan rramanathan@metroland.com

Editorial Design Safi Nomani

Sr. Ad Manager Ricky Bajaj rbajaj@metroland.com Tel: 416 856 6304

Assistant Manager Laura Jackman ljackman@metroland.com

General

info@canadianimmigrant.ca

Circulation/Distribution

ljackman@metroland.com

ISSN

Indian-born Raghuram Sitaram immigrated to Canada in 2015 with his family for better career opportunities. After working as a part-time digital marketing trainer in the initial years, he took on leadership roles at various digital marketing agencies. He currently leads operations, digital marketing competency development, and service delivery for TechWyse. Despite being a single parent, Sitaram also finds time to volunteer on the Board of Directors for an award-winning Canadian professional dance company, Sampradaya Dance Creations, and advises a non-profit, SAWITRI Theatre Group, on building their online presence.

Having worked in senior management roles in the India offices of leading American multinational companies, the logical next step from a career standpoint was to move to this side of the world. My wife was very supportive as she could further her career in Canada. We were just entering our 40s and it wasn’t an easy decision, as we were already well settled back in India. But we wanted to make sure our daughter would have the opportunity to grow up in a country where her career and life choices wouldn’t be limited in any way.

I assumed that my work experience with American companies would help me land decent job opportunities in Canada quickly. To my surprise, the lack of Canadian experience was a major hurdle. Going through the traditional route of applying for jobs did not yield great results. It was a chance meeting with a senior marketing professional at a conference that changed things very quickly. I helped with a small yet significant digital funding campaign which impressed her enough to recommend me to her professional connections, leading to my first proper career opportunity in 2016.

In my current role, I help with business strategy and manage service delivery for over 180 small and medium-sized North American businesses. I manage a Toronto-based team and also provide strategic leadership to a remote workforce of 100+ professionals in software development, program management and digital marketing.

On the personal front, I went through a divorce in 2017 and my ex-wife decided to move back to India.

Being a single parent to a seven-year-old daughter in a foreign country without any support had its fair share of challenges. I got home by 6 p.m. every evening. Travelling for work wasn’t an option as I did not want to interrupt my daughter’s school schedule, and there was no one I could depend on to take care of her if I were to be away. That heavily influenced my career choices, as well as many personal decisions. Now my daughter is 12, and things have become a lot easier.

During those initial years, I just put my head down and did the best I could as a parent and as a professional, taking one day at a time.

You were a famous child actor in India. Are you still acting today?

That was ages ago. But people still reach out to me asking if I was ‘Mani’ from ‘Swami and Friends’; one of the most popular seasons of the legendary Indian TV show Malgudi Days. This was back in the mid-’80s when there was just one national TV channel in India and the whole country watched the series on prime time. I am still passionate about acting and the performing arts. Last year, I played a small role in a Canada Arts Council-funded short film called There Are No Children Here which has been shown at six different film festivals so far, with the 2023 Mosaic International South Asian Film Festival (MISAFF) being the most recent.

What keeps you going when things are tough?

I firmly believe in Darwin’s philosophy that it isn’t the most intellectual or strongest species that survives, but the most adaptable to change. Immigrating to a foreign country with your family, with no connections and no job is hard enough. That, and being put into a single parenting situation suddenly, was a lot to handle all at once. Staying malleable, focusing on my priorities while still holding on to my core beliefs has seen me through some very interesting times.

Patience, focus and a can-do attitude is what it takes to really make it as an immigrant. On a practical level, communication and soft skills, and the ability to network could really set you up for that coveted career break. Once you have become a part of the economy, things will fall into place. As long as you have a strong ‘why’, you will have the drive to push through.

in this landmark year, it’s time to cast your vote for the Top 25 award winners, from among the shortlist of 75 finalists!

Canada and serve as role models for newcomers.

Did you know that the first and only national awards program celebrating immigrant success in Canada turns 15 this year? And,

The Top 25 Canadian Immigrant Awards is the leader in sharing inspiring stories of immigrants from coast to coast and recognizing the significant contributions they have made to their adopted country. Today, with rising immigration numbers, it’s as important as ever to combat negative stereotypes and spotlight how immigrants overcome systemic barriers to achieve personal success, give back to

Winners will join an inspiring group of past winners who are examples of true nation builders — from entrepreneurs and artists, to academics and community volunteers, to philanthropists and visionaries. Their motivations, circumstances and timing for coming to Canada have been as varied as their backgrounds. Nonetheless, they have all shared a common theme: rising above challenges in their immigration journeys to make Canada a better place for all.

This year’s Top 25 Awards are supported by our presenting sponsor Western Union, and our program sponsors Windmill Microlending and COSTI Immigrant Services. Returning in 2023 are special honours for a standout Youth and Entrepreneur, to be chosen from the Top 25 awardees.

The public can now vote for up to three favourite finalists online at canadianimmigrant.ca/top25 until June 9, 2023. The Top 25 winners will be announced in August 2023 in Canadian Immigrant Magazine and online at canadianimmigrant.ca.

In February 2023, Immigration, Refugees and Citizenship Canada (IRCC) announced the beginning of a continued, whole-of-society collaboration approach to capture a diversity of perspectives on immigration from a broad range of partners and stakeholders with its engagement initiative titled: An Immigration System for Canada’s Future.

Launched as a part of this initiative, an online survey invites input from individuals and

representatives of organizations to help shape a national vision for the future of Canada’s immigration system. This is especially important given the changing landscape in Canada — immigrants could soon represent 100 per cent of the growth of the country’s labour force.

The survey is anonymous, and participation is voluntary; it will not affect the immigration status or decisions on immigration applications.

The survey, which will take approximately 15 minutes to complete, is open from March 27 to April 27, 2023. Visit the IRCC website at canada.ca/en/services/immigration-citizenship. html for the survey.

In addition to the survey, the engagement initiative will include in-person dialogue sessions and thematic workshops towards informing Canada’s future immigration policies and programs.

Canada has announced the extension of post-graduation work permits for foreign graduates for up to 18 months, as a part of its efforts to retain high-skilled talent. This will allow international graduates with expired or expiring post-graduate work permits (PGWPs) to work in Canada longer.

Foreign nationals whose PGWP has already expired in 2023 and those who were eligible for the 2022 PGWP facilitative measure will also have the opportunity to apply for an additional 18-month work permit. Those with expired work permits will be able to restore their status, even if they are beyond the 90-day restoration period, and will receive an interim work authorization while awaiting processing of their new work permit application.

International graduates are an important source of future permanent residents for the country. A record number of 157,000 international graduates transitioned to permanent residence in 2021, and nearly 95,000 in 2022, the second-highest total ever.

Canadian credentials to enhance your international experience.

OsgoodePD offers the broadest range of programs available in Canada for internationally trained lawyers. Whether you are looking to specialize with a professional graduate degree or start the process of qualifying to practise common law in Canada, there’s a learning option to suit your needs.

Learn more at osgoodepd.ca/ITL

CENTERPOINT MALL

BRIDLEWOOD MALL

FAIRVIEW MALL SUITE 332

EAST YORK TOWN CENTRE

127 YONGE ST. @ ADELAIDE

4526 KINGSTON RD.

RICHMOND HILL

SHOPPERS WORLD BRAMPTON

SCARBOROUGH TOWN CENTRE

5447 YONGE ST. @ FINCH

MEADOWVALE TOWN CENTRE

253 QUEEN ST, BRAMPTON

2292 ISLINGTON, REXDALE

3161 HURONTARIO ST, MISSISSAUGA

BRAMALEA CITY CENTRE

475 PARLIAMENT @ CARLTON

SOUTH COMMON MALL

YORKDALE MALL

60 BRISTOL RD., MISSISSAUGA

GUELPH STONE RD.

MILTON MALL

3003 DANFORTH AVENUE

OTTAWA

NEWMARKET PLAZZA

YONGE EGLINTON CENTRE

YONGE SHEPPARD CENTRE

BURLINGTON MALL

Canadian Immigrant presents our tenth annual ‘Immigrant Women of Inspiration’ special – this year, the spotlight is on immigrant women who are contributing to strengthening the Canadian banking and financial sector.

Every spring, in recognition of International Women’s Day, March 8, Canadian Immigrant spotlights women of inspiration in different fields. This year, we feature women in finance and banking who have embraced their position of influence to make a positive impact on our economy. While these women come from diverse cultural backgrounds, and

even generations, they all have inspirational stories — and advice — about pursuing their passion and have committed to leading and inspiring others to do more!

Here are the journeys of Haiping Fu, Juliet ‘Kego Ume-Onyido, Souzan Esmaili, Ranjini Jha and Mehrsa Raeiszadeh.

By Rita Simonetta, Vivien Fellegi and Lisa Evansme,” says Fu. “He worked so hard to make a good living for his family.”

Haiping Fu’s successful career in the banking and finance sector began decades ago in China. The 41-yearold was born and raised on the island of Hainan, which was far removed from the hustle and bustle of neighbouring cities.

To provide a bright future for his five children, her father worked in business and trading, which involved extensive travel throughout China and time away from home.

“My father was always a big influence on

She was also inspired by her father’s affinity for new experiences.

“When he would return, I was always so excited to hear his stories, to meet his new friends and to receive the gifts and toys that were not available on the island where I grew up. So, in a way, my father planted the seed for my growth in the outside world.”

In time, Fu seized the opportunity to explore the outside world. Her cousin moved to Saint John to study at the University of New Brunswick. And once Fu graduated high school, she wanted to follow suit.

It was a big step, but her father was her most ardent supporter. “He said ‘go for it!’”

Those words have served as a guiding philosophy throughout her life. “I believe if I didn’t have this encouragement and support, I wouldn’t be who I am today.”

It’s also what convinced her to persevere as a new immigrant to Canada faced with the challenges of learning a new language and culture all while far from home and family.

At the University of New Brunswick, Fu earned her Bachelor of Business Administration. “I was always good at numbers,” she says, adding that her degree allowed her to combine her interest in math and business.

After graduation, Fu embarked on a journey of change and growth – she worked her way up the banking and finance sectors in Halifax, Calgary, and then in Saint John, New Brunswick, where she also completed her MBA.

“When I was presented with opportunities, I didn’t let them pass me by,” she recalls. “At the time, I had no idea where I would end up – many of us don’t, but I kept growing and preparing for ongoing learning.”

In January 2018, she joined RBC as an investment advisor, and she’s never looked back.

“It’s the best decision I have ever made. My team is now the biggest Chinese investment advisor group in the Atlantic Region. I am proud to be the only female Chinese-speaking investment advisor to serve my clients in Atlantic Canada.”

The mother of a young son, she finds time to volunteer at Imperial Theatre, a performing arts venue in Saint John. As a member of the Imperial Theatre Ambassador program, which is supported by RBC, Fu helps connect newcomers to the performing arts.

“The Ambassador Program is a wonderful way for me to share history and culture with new arrivals and to help other immigrants form meaningful relationships and feel that sense of belonging that I do.”

Providing a sense of belonging also extends to her role as an associate wealth and investment advisor with RBC. She says that throughout her career, she’s had the opportunity to meet many new immigrants

and realized that regardless of their level of wealth, most felt insecure about their financial health and their future. But she also knew she could make a positive difference.

“I learned how financial security and independence can have an amazing impact on people’s lives, especially women,” she says. “I developed a desire to help my clients financially achieve what is important to them in their life and to help them along the way when they are embracing their new life in Canada. And I always feel more accomplished in the process than anything else I do. Fortunately, by helping others to achieve their dreams, and as a woman, I have also reached my own financial independence.” – By Rita Simonetta.

Juliet ‘Kego Ume-Onyido has always been curious about the lives of the women around her. But, growing up in Nigeria, a country filled with women professionals and yet dogged by patriarchal norms, a lot of their stories were about entrapment.

‘Kego, fortunately, was born into a progressive family. Her father nurtured her potential, “He gave me wings to fly.” Both ‘Kego’s grandmothers opened their own businesses after they were widowed. Her paternal grandmother once slapped a customer who tried to squirm out of his debt. “This was a woman who stood up for her rights,” says ‘Kego. “[She] inspired me.” After high school, ‘Kego entered the maledominated field of electrical engineering.

But when ‘Kego was 28 years old. political instability swept through Nigeria, and she and her family decided to immigrate to Canada.

After arriving in Toronto, ‘Kego embarked on a Master of Engineering Program at the University of Toronto. But she couldn’t juggle the demands of the courses with the needs of her children, so she quit the program to work in the more flexible financial sector. But as ‘Kego shelved her dreams, she felt herself slowly slip away. By the time she hit her early 30s, she was just “going through the motions of life,” she says.

‘Kego turned to personal coaching to reclaim her identity. Her mentors encouraged her to use poetry as a tool, and,

as she began writing and performing her works, she found her way back to herself. Poetry distilled her essence, she says. “It allowed me to be me.”

Building a new community was also healing. After befriending another Nigerian woman, Diana Barikor, who felt similarly lost, the duo vowed to take charge of their lives. They began going on daily walks and were soon joined by other immigrant women. Together they shared advice about relationships, finances and healthy living.

As the women made strides in each of these areas, they decided to formalize this process of empowerment. ‘Kego and the others pooled their money in an indigenous financial model known as a Rotating Savings and Credit Association (ROSCA). In this system, the group collects a fixed amount of money each month, and each of the members receives the pot on a rotating basis. Whole Woman Network (WWN) was officially launched in 2010, and theatres, beauty salons and virtual platforms welcomed these speakers for workshops on topics ranging from fashion to personal transformation.

Soon, the WWN gained an international following, and women in trouble worldwide began reaching out for help. Most lacked the financial resources to leave situations of domestic violence. The WWN drew on their ROSCAs to loan them money or give them grants to start their own businesses and free them from psychological captivity.

As ‘Kego worked to liberate these women from their circumstances, she thought coaching could help them peel away the layers of societal expectations holding

them back. “Something had happened for them to believe they were not worthy,” says ‘Kego. The lack of financial agency also put them in harm’s way. Recognizing the influence of these factors, ‘Kego acquired multiple certifications in personal and leadership coaching, as well as in financial literacy. Today these courses are the mainstay of the WWN. ‘Kego puts her own spin on the programs, using poetry to help clients recover their voices, and enroll them in leadership classes where they learn to become their own guides.

Today, ‘Kego is thriving. She has completed an MBA from the Alliance Manchester Business School and is currently working full-time as a financial advisor for Sun Life Canada.

She also has a new, exciting venture she joined in 2021: the Banker Ladies. This is a Federation of women who run ROSCAs and are educating the government and financial institutions to create legal frameworks to make ROSCAs safe and effective to practice.

But ‘Kego’s biggest satisfaction is changing lives through the WWN, where she continues to volunteer. One recent coaching client, immigrant Bilkisu Umar, credits ‘Kego for helping her transform her love of cooking into a successful business, Elsutra Foods, whose products have landed on the shelves of over 30 stores across Canada. “I celebrate and appreciate (‘Kego),” says Umar in a testimonial.

This kind of happy ending fuels ‘Kego’s sense of optimism. “It reminds me why I do what I do,” she says. – By

Vivien Fellegi.For many women in business, it’s common to find a personal connection that has led them to their chosen field. For Souzan Esmaili, the motivation for pursuing a career in financial anti-crime came from an event that happened before she was even born.

Esmaili’s family were victims of an act of terrorism. During the Iranian Revolution, a 17-year-old armed with an assault rifle entered her aunt’s home during a family gathering and opened fire, instantly killing Esmaili’s grandfather, uncle and aunt. “It had a really traumatic effect on

my family,” she says.

While she didn’t initially seek out the field of anti-crime – Esmaili studied computer science and business – her work led her to discover its importance. Esmaili was working for an insurance broker right out of school. The company got fined and started a compliance division.

“When I started to educate myself around the topic, I got more and more understanding that it is important for every one of us to be able to identify and find out how we can stop terrorism and money laundering.” When she realized crimes like what had happened to her family were so deeply tied to finance and could be stopped before they happened, she decided this was what she was meant to do.

Financial crime was also intriguing to Esmaili due to the constant need for education. “It’s a field that you really need to be on top of. There are a lot of changes that happen very frequently and significantly.” On a daily basis, regulations change, or a new type of scam emerges.

“It’s constant and never-ending learning. To keep up with the bad guys you have to keep learning. They become very creative, and their creativity motivates us to try harder to stop them,” she says.

Esmaili never stopped learning. She earned an MBA from the American University of Sharjah, a Post Graduate Diploma in GTC from Manchester Business School, a Certificate in Anti Money Laundering, a FinTech Program Certificate from Oxford University and a Chainalysis Cryptocurrency Fundamentals Certification.

For 18 years, Esmaili worked for several firms in Dubai building their compliance framework, but when she immigrated to Canada in May 2019, she had a hard time finding a position. “They all told me that I was overqualified or that I don’t have Canadian experience,” she says. “It took me six months and 70 job applications to find my first job.”

During her exhausting job hunt, Esmaili took a break from sending out resumes and attended industry events, meeting others in the financial sector and continuing to learn. Esmaili summarized the events she attended and shared them on LinkedIn.

In October 2019, Esmaili decided to start TCAE (Toronto Compliance & AML Enterprise). It began as a hobby, with the goal of creating a community of professionals in the financial field and educating them on anti-crime and compliance.

Shortly after, in December of 2019, she started her first job in Canada at Wells Fargo, working on their anti-bribery and corruption program for Canada and Latin America.

When the pandemic hit in March 2020, Esmaili began organizing training sessions with TCAE on Saturdays, her day off, bringing in speakers from around the world. “On the first, call we had about 80 people. By the fourth call, we had over 200 people on the call who came from over 90 different countries,” she says.

After 13 months at Wells Fargo, Esmaili resigned to incorporate TCAE and decided to devote herself to the the company. TCAE has now held over 70 knowledge sessions and has a staff of over 20 volunteers from around the world. “So far we’ve educated more than 400 people in the financial community,” she says. TCAE has partnered with one of the biggest companies in the cryptocurrency space to educate on the risks of crypto and partnered with Seneca College to provide education on crypto compliance.

Esmaili is also passionate about speaking with newcomers to Canada. TCAE even has a newcomer program, a seven-week mentorship program to help newcomers in Canada in Regulatory Financial Crime and Crypto Compliance find their first job in Canada.

She tells other newcomers that the experience and knowledge they have in their home countries is not lost once they arrive in Canada. “It’s not that you had it in your home country, and you have to start from zero. It has a value.” – By

Lisa Evans.The College of Immigration and Citizenship Consultants licenses Regulated Canadian Immigration Consultants (RCICs) and Regulated International Student Immigration Advisors (RISIAs).

Regardless of your circumstances or the reason for your application to immigrate to Canada, use a licenced immigration consultant to protect your journey.

www.college-ic.ca

From becoming the first member of her family to graduate from university, Ranjini Jha now educates other students as a professor of finance at the University of Waterloo.

Jha grew up in Jamshedpur, India. Her father worked job at TELCO (now Tata Motors) and her family lived in a unique community called the TELCO Colony. “The company didn’t pay very high wages, but they had a lot of amenities for its employees,” she recalls. From low-cost housing to medical facilities and even school. Jha attended the Little Flowers School in the TELCO Colony, run by Jesuit and Catholic nuns. “I was in the first cohort that joined the school in grade 1 and completed my education there,” she says. Jha was always top of her class and was the first of her family to graduate from university, completing an undergraduate and a master’s degree in physics.

Jha saw a lot of potential for growth in the finance sector. She moved to Philadelphia and completed an MBA with a specialization in finance. Her journey to Canada happened when she decided to continue her studies by working toward a PhD. Academics, she felt, provided a good combination of research and teaching, two areas she felt passionate about.

In September 1993, Jha arrived in Alberta to pursue her studies. “I think with coming to Canada, I won the lottery. I got a great education and was mentored by outstanding faculty at the University of Alberta,” she says.

“I started my academic career at the University of Waterloo in 1998 where the work environment has been stimulating, exciting, and inclusive. I work with a terrific set of colleagues. Working with students has been rewarding. I met my partner here and made many friends. Finally, I live in a beautiful and vibrant city. I have enjoyed traveling across Canada from east to west.”

Jha was the Associate Director of Finance at the University of Waterloo from 2010 to 2017. Her primary task was to grow the school’s finance program. “We were primarily a school of accounting, and now we’re a school of accounting and finance.”

Jha and her colleagues introduced experiential initiatives to get students interested in finance. The Student Investment Fund was set up in 2012, providing students with hands-on experience in equity valuation and portfolio management of publicly traded stocks with guidance from industry experts and supervision by finance faculty. The funds are supported by a university donor but provide students with real world experience, with an access to investment funds.

As she gets ready to retire next year, Jha says she will continue to use her knowledge to give back to the community and is planning to be involved in the boards of not-for-profit organizations in the Waterloo region. It seems Jha will never stop learning. – By Lisa Evans.

“ I’ve always been a problem-solver and want to figure out a way to fix the problems that we have,” says Mehrsa Raeiszadeh, who has utilized that trait to find success. The 39-year-old is the cofounder (along with Mike Wood) and chief operating officer (COO) of Vancouverbased MintList, an online marketplace that enables consumers to buy, sell and trade their cars at the touch of their fingertips.

MintList was designed with a clear goal in mind: “I wanted to make an inclusive product that makes it fair and safe for female-identifying people, new immigrants and minorities struggling with language barriers to buy and sell cars,” Raeiszadeh says.

The entrepreneur has used her financial management skills to create a product that makes it possible for consumers to harness theirs.

“MintList changes the way cars are bought and sold by empowering people with data to make better decisions,” she says. “Cars are the second largest asset for most people and MintList helps them get the most money for their vehicles. The platform equips them with knowledge so they can navigate the cost of buying, the going prices in the market, and the best time to sell. With all this information they can save upwards of 1 to 2 per cent and that can translate to thousands of dollars.”

After graduation, Jha says she felt burned out and wanted to try something different. She got a job working at the State Bank of India. “I got promotions each time I was eligible and got exposure to retail banking, then small business and agricultural lending,” she says.

After 11 years in the banking sector, Jha decided to pursue a formal education in business and finance. “I saw firsthand how finance can help the economy and the community,” she says. “Finance can be a force for good for the community. The primary objective is to serve as an intermediary and keep the economy going.”

“Students don’t usually get this experience until after they graduate,” says Jha of the uniqueness of the program. She considers the program as one of her greatest professional accomplishments as an educator. “I’m very proud of having been involved in setting up these funds,” she says.

Jha is also a faculty mentor for Women in Finance, a student-run initiative that works to bridge the gender gap within the finance industry. “For the longest time, I was the only female faculty member,” says Jha, who is happy to see more women enter the field of finance.

Thanks to Raeiszadeh’s financial knowhow, her startup has partnered with Carfax and more than 200 car dealerships across B.C. and Alberta.

A year after MintList launched in 2020, it racked up more than $20 million in transactions and over $1 million subscription fees. The company began with a handful of dedicated staff members and has grown to a team of more than 20; 75 per cent is made up of women and visible minorities.

Raeiszadeh has also raised over $1 million in non-dilutives and $5 million in dilutives.

“You need to develop a strategy that includes knowing how to look for investors, what to look for in investors and how to channel funds to get the most impact,” she explains. “You need to be cautious with every dollar.”

She is also thankful for the government support her business has received and encourages newcomers to research government-related grants, subsidies and grants in order to take their company off the ground.

“As an immigrant, it’s fascinating to see the opportunities that exist for female entrepreneurs and I’m extremely grateful,” she says.

The startup was inspired by Raeiszadeh’s personal experience. Upon receiving her PhD in Process Engineering from Georgia Institute of Technology in Atlanta, Georgia, she decided to buy a car.

“It was going to be a celebratory gift,” she recalls.

But that initial excitement was tempered when she walked into a car dealership and told the dealer she was interested in buying a vehicle.

“He asked me where my dad was,” she remembers.

The seed was planted. “I grew up as a

fighter in Iran where you have to fight for your basic human rights and where women are told what to wear and how to act and who they can speak to. I don’t give up and that was shaped by growing up in an environment that can be very challenging for women.”

Raeiszadeh, who immigrated to Canada in 2016 and lives in Vancouver, B.C., says that although she’s encountered obstacles along the way, she’s remained determined and encourages others to continue on the path toward their goals.

“I started thinking about what makes me unique and what I’m really good at. That was my ‘aha’ moment. Think about what makes you unique and then put a laser focus on that.”

That unwavering vision has paid off. “Our first client was a 70-year-old grandmother who called me to tell me how proud she was that she was able to sell her car without having to ask anyone for help,” Raeiszadeh shares. “That moment was all worth it. When I see people using my product to solve a problem, it’s an amazing feeling.”

– By Rita Simonetta

– By Rita Simonetta

It’s great that you’ve gotten your first job in Canada! Congratulations! Now, let’s talk about what happens after your job offer.

As in many countries, jobs in Canada have a probationary work period. This is a discovery period and the deciding factor for your continued employment in this position. The most common probationary period is three months, unless the employer clearly states in their employment agreement that it is longer. Depending on the company and possibly the level of responsibility and/or difficulty of the position, the probationary period could be four months, six months or even a year.

Within this period, if you or your employer decide that it’s not a good fit, the employment arrangement can be ended without a mandatory notice period. What this means is that during this period, you can be asked to leave, or you can quit the job without having to work an additional two weeks which is the standard notice or transition period. The reasons could be anything from a lack of skills or expertise needed to do the job or how your personality fits in with the team.

Technically, a mismatch can be from both sides. If you find that the work environment is toxic or the employer is doing something unethical, you are probably better off looking for another job.

When it comes to the ‘fit’, employers tend to view it from two angles: hard skills, i.e., your technical skills and ability to do the job and soft skills, i.e., your ability to get along with the team. In Canada, often referred to as a very ‘polite’ country, positive workplace interaction and team dynamics tend to be especially important. There have been many situations where people have not passed probation

because of their ‘personality fit’ even though their technical skills and job abilities have been solid.

Here are three key areas to ensure a successful work probation period:

Analyze the job description and use it to identify your Key Performance Indicators (KPIs). KPIs establish the targets employees need to focus on; milestones to identify progress; and are also the process you use to make work decisions. Some employers will provide an actual list of KPIs along with the job description or mention it during the interview; so, take the time to review these requirements or to write them down. Armed with this knowledge, you will have a clear picture of the competencies and skills that you need to demonstrate in your work during the probationary period.

When you start in a new company, unless you already know someone there, you are technically starting with no credibility and zero relationships or friendships. You will have to work on

developing these from day one.

From a credibility standpoint, there are three factors that employers tend to look for: competence, character and caring. How does this translate into the workplace?

This means that you must show the people around you that you: a) know what you are doing on the job; b) have a strong character that demonstrates trustworthiness; and c) care about doing your best at work, which includes building relationships with your co-workers. While making friends can be natural and organic, you will have to put in the effort to establish relationships and socialize with your co-workers. If you can do this smoothly, you can gain credibility in the workplace almost immediately.

This point may seem like regular

common sense; however, I must make it clear how important this is for passing the probationary period. Often, the information you are given has been carefully selected to acquaint you with the level of difficulty, challenges that may come your way or the extra care needed to tackle the responsibilities.

While it is important to ask questions to ensure that you are equipping yourself to perform the role, make sure to take notes during conversations and the orientation process, and refer to these notes so as to avoid questions about something that was already explained. These behaviours will demonstrate that you are a quick learner and have the capacity to learn and develop new skills as required.

Hopefully, these tips will help with passing the probation period and continued success in the workplace.

Everyone fails in life, at some point or another. Did you know that failing to succeed could actually be beneficial for your personal and professional growth? Experiencing failure is difficult but is often a necessary part of developing your career and can help you motivate yourself and strengthen your resolve. View it as an opportunity to revise your approach and discover what strategies work best.

Here are reasons why failing can actually benefit your career.

Everything we experience in life teaches us something. Perhaps the greatest lesson with failure is helping you realize how strong you really are. In fact, failing at something can teach us valuable life lessons and build character better than succeeding ever could.

Your inner strength and resilience can help you recover quickly and effectively from setbacks. Learn to handle rejection and mistakes boldly and bounce back from setbacks.

Here is the famous quote from basketball legend Michael Jordan, “I’ve failed over and over and over again in my life and that is why I succeed.” While failure can be disappointing, it provides insights into strategies and practices that don’t work.

You may have failed many times in your life only to discover a better opportunity elsewhere. Maybe it was a job that didn’t suit you but led you to a better one. Or maybe a failed relationship eventually led to finding your perfect match? Regardless of the circumstances, the end result was often a sweet reward, wasn’t it?

A majority of people avoid taking risks simply because of the fear of failure. Most, if not all, prefer not to rock the boat and maintain the status quo. In short, failure requires courage. Whether the failure experienced was anticipated or not, it enables you to toughen up and be bold to try something new.

The courage to innovate and sharpen your problem-solving abilities is a great trait for innovators and leaders. So, don’t be surprised if your current team lead or future employers respect you for your failures.

Successful people are simply the ones who didn’t give up. Believing in yourself and finding the motivation to move forward

is of key importance. To quote Winston Churchill: “Success is your ability to go from failure to failure without losing your enthusiasm.”

Someone rightly remarked that if necessity is the mother of invention, failure is the father. Nothing brings out the best in you like failure. Not only can it reveal your strengths and weaknesses but it can also inspire you to fix your shortcomings. Be it life, work, play, academics, relationships or any area of life, the driving force behind every success is often failure.

Scientists, athletes, movie stars and creative people in every field know that if something doesn’t work out, they must try, try and

try again to find creative ways to succeed. If a traditional route doesn’t give you the desired outcome, you may need to embark on a new path.

Failure can be difficult to embrace and lead to a loss of confidence. However, the experience can help root you in humility and motivate you to try harder.

As stated earlier, everyone will face failure at some point in their life. Humility can help you handle difficult situations better and you can now also be an inspiration to others to keep trying and not give up. Being more relatable can help you grow your professional network and learn from new opportunities. So, go ahead, stay

rooted and never let anything especially the fear of failing, stop you.

Failure builds resilience. This is something required of everyone who wishes to succeed, and there is no better teacher than failure. The discomfort of a massive failure can motivate you to find the strength to take on any of life’s challenges.

Many times, taking risks can also offer unexpected rewards. For example, you can be more innovative in approaching hiring managers and stay determined to continue driving forward.

Did you know that J.K Rowling, author of the famous and successful Harry Potter series, failed over and over again? For over five years, she received nothing but “loads” of rejection letters from multiple publishers. Until Bloomsbury, a relatively unknown and young publishing company decided to publish the first Harry Potter book. And the rest, as they say, is history. Now that’s perseverance.

It’s important to learn from our mistakes and use them as stepping stones to success. Here are five tips to learn from failure.

Admit that you didn’t get the outcome you desired and that it is perfectly okay. By accepting responsibility, you could also inspire others to find ways to process and handle failure.

While it’s a good idea to take responsibility for failure, remember there could have been other factors that affected the outcome. Once you accept the reality, you can reasonably control the situation and prepare yourself to act intelligently in the future.

Being aware of your feelings can help you cope with the situation and enable you to manage your emotions. This way, you can address your emotions effectively to overcome failure or the fear of failure.

Looking at failure as a valuable lesson can inspire you to explore other options. When you fail you learn what works and what doesn’t, and can identify your own strengths and weaknesses. This can also help you develop other creative ways to success.

It can be helpful to study others, especially renowned people in your field, to glean useful information on handling failure. Remember that everyone fails at something at some point in their lives. You could discuss your situation with friends and colleagues and ask for advice.

In closing, find healthy ways of coping when you fail to succeed. Remember, there is more than one way to manage failure, and you can find the approach that works best for you.

You may also be able to effectively use positive affirmations about your intentions for success. This is a proven way to overcome the fear of failure and can help build confidence and resilience.

Murali Murthy is an acclaimed public speaker, life coach and best-selling author of The ACE Principle, The ACE Awakening, The ACE Abundance and You Are HIRED! He is also chairperson of CAMP Networking Canada. Learn how he can help unlock your magic at ACEWorldFoundation.com.

Your twenties, which often coincide with postsecondary studies, are loaded with opportunities. It can be an excellent time for finding yourself, building a social network, pursuing a career path, while developing personal, academic and intellectual interests. Try to make the most of these years because it is a good time for learning and making changes. In your twenties, you are typically healthy and not locked in by life’s circumstances, including children and mortgages. Therefore, this can be a time to invest in your future self. If you find you have made major mistakes in your choices, there is still time to recover.

Whether you are in a general program or have a prescribed course

load, there are many opportunities to broaden your learning. Schools, student clubs and the student associations often invite guests to give talks on various areas of expertise. You can participate in

enriching experiences otherwise hard to come by, such as joining school committees, sports, debates, charities, part-time work and more.

Your professors generally expect you to reach out and make use of their office hours to discuss your work for their class. If you have an interest in their area of expertise, they may also welcome a discussion with you including your plans to further intellectual and career pursuits.

Some students decide on a career path prior to their post-secondary studies, and others make a decision during these years. Schools offer services from interest testing to interview preparation. They are equipped to help students from finding part-time and summer employment to researching careers and companies. Using these services will make your career decisions and preparations easier.

Although students may plan for a particular career, they may find that they cannot or do not want to pursue their plan for a variety

of reasons. School is one place to work on alternative directions. You can change programs and talk to people who can help you with these decisions and transitions. It is much easier to change course when you are already in school than to do so later on.

For some students, postsecondary education coincides with developing independent living and studying skills. They may work on forming new habits that include a better management of time, money and the everyday tasks: shopping, cooking, laundry, cleaning, etc. It is a good time to develop healthy habits such as daily exercise, sufficient sleep, and good nutrition. Many students who were physically active in high school cut back because they are concerned about wasting time. Without this usual activity they find they don’t sleep as well, are sluggish and don’t think as clearly. Some exercise may be vital to your health and education.

Students also need to develop competencies in managing their social and emotional lives. Making friends and finding romantic partners are opportunities for personal growth and creating a supportive network and an interesting life. The challenges of life such as managing your own or a family member’s health challenges, unfulfilling romantic attachments, and learning from mistakes can build resilience in young adults.

The search for role models and mentors is part of building an identity that is in line with the person you are and the one you want to be. The twenties are a time for trying things out and making changing if needed. College and university settings can be a productive place for doing this.

Geneviève Beaupré and Susan Qadeer have extensive experience working in university and college settings, providing career, academic and personal counselling to international and immigrant students.

Now’s the time to build a foundation for future success!

The Government of Canada continues to try and meet our ambitious immigration quotas through new policies and pathways, including a recent announcement to extend Post Graduation Work Permits (PGWPs) for recent international graduates in Canada, in an effort to provide them with more time to transition to permanent residence status. However, these recent policy announcements do not affect foreign nationals outside of Canada who are applying for study permits to come to Canada for post-secondary studies. Applicants must still convince visa officers that they meet all requirements to be issued a study permit and continue to face application rejections if they fail.

Study permit applicants who receive refusal decisions from a visa officer often have no other recourse but to file an ‘Application for Leave and for Judicial Review at the Federal Court of Canada’. There are many different study permit refusal reasons, but often these reasons centre around concerns that the applicant will not leave Canada at the end of their studies due to various factors. During the process of appeal, the Federal Court judges whether the refusal reasons of the visa officer were reasonable. When assessing whether a certain refusal reason is reasonable or not, there is usually a long line of jurisprudence (sometimes conflicting, sometimes in agreement) that provides context and helps to inform. Here are some recent trends in jurisprudence:

Many recent decisions out of the Federal Court discuss whether the findings of a visa officer that an applicant is “single, mobile, not well established, and has no dependents” is a reasonable ground for refusal. These decisions add to a long line of established jurisprudence on this topic.

Recent Federal Court findings agree with past decisions and emphasize that an applicant’s lack of a dependent spouse or child should not be considered a negative factor without further analysis by the visa officer. In other words, a visa officer can consider an applicant’s marital status and lack of dependents only if their refusal reasons also contain an analysis as to why these factors would lead to an applicant overstaying in Canada. Study permit applicants are often young

adults who are applying to Canada for postsecondary studies. Most applicants are single, mobile, and without dependents, and therefore visa officers should not be able to refuse applicants based solely on these descriptors or it could lead to an unacceptable degree of arbitrary decision making. When analyzing an applicant’s familial ties to their home country, the visa officer should also consider the parents and/or siblings of an applicant rather than focusing on their lack of a spouse or children.

Visa officer refusal reasons that centre on purpose of study tend to focus on analyzing the applicant’s study plan, including their past education and employment experience, their choice of program of study, and whether their studies will benefit their future career pathway.

Federal Court jurisprudence on purpose of study tends to be fact-specific. Nevertheless, here are some broad concepts from recent decisions:

• It is unreasonable for visa officers to determine that an applicant already has “an acceptable combination of education, training and/or experience in their respective field” without addressing the applicant’s reasons for pursuing further studies.

• It can be unreasonable for visa officers to provide their own opinions on an applicant’s career choices, future intended career path, and educational background.

• Applicants have a duty to present their case with respect to how their proposed studies will benefit their future career path. Applicants should take care to provide specific reasons, and not general assertions, as to how their chosen program of study will benefit them.

Visa officer refusal reasons tend to be boilerplate, short, and minimal given the high volume of applications they deal with on a dayto-day basis. Nevertheless, their reasons must still be transparent, intelligible, and justified in order to be found reasonable. Certain grounds for refusal, such as finding that an applicant is single with no dependents or finding that an applicant’s purpose of study is not compelling, can be arbitrary and unreasonable if the visa officer does not take care to “connect the dots” and explain the reasoning process behind their decision making.

We received hundreds of nominations from truly inspiring newcomers coast to coast, all who have made a positive impact since their arrival in Canada. Now its your turn to help us chose this year ’s Top 25 Canadian Immigrant award winners!

Cast your vote for up to 3 finalists at: CanadianImmigrant.ca/top25

Presenting Sponsor: Program Partners: Media Sponsors:

Magazine

Sharing a laugh is a great stress reliever and a wonderful way to connect with others. But one thing to understand is that humour is culture and language specific. In a multicultural, multigenerational environment, jokes can be interpreted in specific ways due to differences in language, culture, generations and personality. Different cultures interpret specific types of humor differently

A joke might seem funny to you, but it can be offensive depending on how the recipient understands the joke. Moreover, some people might not share your sense of humour and be confused by the jokes, or even hurt by them.

Therefore, it is important to be mindful of how to use humour appropriately and teach your children to consider the following factors.

• Is it developmentally appropriate? Children often take things literally and might not understand when

people are joking. As a result, children’s feelings and self esteem can be hurt by some jokes.

• Are these jokes tasteless and offensive and/or prejudiced against certain vulnerable groups? It is best to avoid jokes targeting race, gender, age, disabilities and many more.

• What is the reason for using jokes? Humour can help diffuse tense situations during tough conversations.

• Are the jokes making fun of others’ misfortunes or mistakes? Instead of laughing at them, show kindness by offering a helping hand and kind words.

• Is anyone being hurt by the jokes or teasing? Some are fine with playful teasing, but meanspirited teasing can be hurtful and damaging.

• Is the context and timing of using humour appropriate? There are times when it is appropriate to joke around, and others when it is time to be serious.

• Are you reading the reactions of your audience, their body language and facial expressions? Awkward silences, uneasiness, tension and forced laughter might indicate that they might be offended by the jokes.

• How do you react when someone is hurt by the jokes you told? Dismissing someone with phrases such as “Just joking” or “Don’t be so sensitive” only worsens the situation. Instead, listening to those who are hurt by the joke and a sincere apology

could help remedy the situation.

• When you hear inappropriate jokes from others, do you stay silent or speak up? Sometimes the person telling the jokes might not be aware that the jokes was hurtful. Speak up if you witness or are victim of inappropriate joking and teasing.

Parents can set good examples by teaching children that while humour can beneficial, it can also be hurtful or cause embarrassment if used inappropriately. Teach children what is acceptable and unacceptable when joking with others. A good sense of humour, combined with quick wit, kindness and respect, can make the world a

Newcomers may find it a little daunting to file a tax return in Canada. The process can seem overwhelming, but it doesn’t have to be complicated since there are many available resources to help understand the fundamentals. However, it is important to file taxes on time to avoid penalties and to access refunds.

“Filing a tax return is as important as getting a health card,” says Indian-born Namrta Mohan, a Peel Region-based registered psychotherapist, who arrived in Canada in 2013 with her husband and a toddler. Mohan found filing their first tax

“She [the accountant] was very knowledgeable; she told us about first-time home buyer benefits, Trillium health benefits and, most importantly, about the recreational benefits that we claimed for my son,” she says. While Mohan found her accountant “quite randomly” by following a sign next to her bank, she suggests that some newcomers might find it beneficial to find an accountant in their community who speaks the same language to enable better communication.

Mohan also learned to save all the medical and grocery receipts for Goods and Services Tax/Harmonized Sales Tax (GST/HST) credits. “My accountant educated us, and we got better returns the next time.”

Canada’s tax system is progressive, which means the lower the income, the higher the benefits. The Canada Revenue Agency (CRA) creates tax brackets to determine the specific personal income tax rate depending on the range of income.

“You may not qualify for the benefits, or even if you qualify for them, you may not receive all of it simply because you haven’t filed a tax return,” says personal finance expert Enoch Omololu, founder and CEO of Savvy New Canadians, who stresses the importance of filing returns in the first fiscal year of landing.

Enoch Omololu came to Canada in 2011 to pursue his post-graduation at University of Manitoba, and filed his first return as a student.

“A newcomer who wants to get ahead of the curve would file taxes right away,” he says.

return challenging as she had to familiarize herself with a system different from her country of origin.

She still remembers working through the process and receiving her first refund. “Any amount was helpful in those days; it supported us in our settlement process.”

After the first couple of years, Mohan realized she had missed claiming a few benefits. Which was when she decided to seek the help of an accountant who introduced her to many family benefits that she could access and simplified the process for her.

Under Canada’s tax system, income tax obligations are based on residency status. Those with significant residential ties to Canada such as a home (whether owned or rented), a Canadian bank account or driver’s license, or living with a spouse or dependents are required to pay their taxes. To receive benefits and tax credits, residents have to file an income tax return on time, even if there is no income in the year. This also applies to a spouse or a common-law partner without any income.

Many new immigrants may not be aware of this and could delay filing their return. But tax experts explain that not filing on time is a big mistake, since this could come in the way of receiving benefits immigrants are entitled to such as the Canada child benefit, Climate Action Incentive payment, etc., in addition to benefits from certain provincial programs. Late filing also interrupts continuing benefits such as the caregiver benefit and GST/HST credit.

Omololu says that even a part-time job like “food delivery income is taxable,” and it’s important to declare this income. “And the reason for that is you don’t want to get audited because it’s a painful process.”

Newcomers should also note that delays in filing taxes can lead to a penalty, in addition to interest on the balance owed.

Most international students completing a degree in Canada on a study permit are considered residents for income tax purposes; however, taxes are based on an individual’s

specific circumstances. In addition to the other credits, international students are eligible for tuition carry-forward credits, and other provincial credits or tuition rebates.

Jeffrey Zhang, a district manager with H&R Block based in Victoria, B.C., emphasizes the importance of reporting foreign property/wealth that is over $100,000 worth in the second year of residency. Any income earned outside of Canada is non-taxable (depending on the treaty with the country) but should be declared.

“Not reporting foreign wealth is a big mistake that newcomers often make, and when they file it there’s a huge penalty as well as interest is levied,” he says.

Zhang advises newcomers to get organized by using file cabinets, folders, and tagging each envelope from the first day of their landing.

“Because they don’t know what is tax related or relevant. So, keep the documents organized throughout the year,” he says.

Zhang also strongly recommends consulting a professional accountant in the initial years, because otherwise he says “it’s a nightmare to fix.

Raising any red flags with CRA that may lead to a rabbit hole of audit process.”

Newcomers to Canada who are not familiar with the Canadian financial and taxation systems can often be targets for fraud. Scammers start to sprout as the tax season is in progress. They reach out with dire warnings and try to trick taxpayers to pay money they don’t owe. Often, it’s via threatening text messages, phone calls or emails.

Zhang says that the CRA never asks for e-transfers or payments via clicking links on emails.

“The general rule is if you have a doubt, do not answer the call. And if you’re not sure, call back! There are published numbers on the Canada Revenue Agency website,” he says.

Newcomers can find information on scam prevention on the CRA website to protect themselves from fraud.

Based on certain criteria, a simple tax return can be done with the help of a volunteer from the Community Volunteer Income Tax Program (CVITP), for free at any Canada Revenue Agency (CRA) tax preparation clinic, using the CRA webpage or the MyCRA mobile web app. Some educational institutions also offer on-campus works hops and filing support for international students.

The deadline to file a return is April 30. This year, since April 30 falls on a Sunday, returns will be considered filed on time if the CRA receives it, or it is postmarked, on or before May 1, 2023. Entrepreneurs have until June 15, 2023, to file their returns.

When you are employed, financial life seems so much easier. You know when you’re getting paid, and how much, and everything goes towards your personal expenses. But all this changes when you become an entrepreneur. You are now responsible for earning your income in a very different way. Not only do you need to find clients, provide a service, you actually need to collect payment. Plus, in addition to business expenses, you still have a personal life that requires money. Here are three tips to balancing your personal and business finances.

You’d be amazed how many people go into business without a plan on how to pay themselves. Or worse, they create an operating budget that does not even factor in paying themselves! Unless you have already had a side hustle and enough business to replace your day job, odds are you are going to enter the world of entrepreneurship and must make adjustments to your personal life for a while. You need to understand that you will not be bringing in the same amount of money as your 9 to 5 job right away so, you need to plan for how you are going to pay yourself in the interim. This is where a startup loan comes into play!

A lot of startups are afraid of taking on debt for their venture –what if it does not go well, how will you pay it back? A startup loan is important to help you until you have consistent income.

Not to mention, when you pay yourself from your business, your passion for being an entrepreneur increases! It gives you confidence and power versus working (for yourself) for free and adding to the personal financial burden in the interim.

2 Do not mix business and personal expenses

There are actually two reasons

you don’t want to mix business and personal expenses.

The first is from a bookkeeping perspective. Only your business expenses are eligible for write offs, and when you are mixing business and personal on the same credit card or from the same bank account, it can actually add unnecessary work in your bookkeeping process. Now your bookkeeper needs to question every single receipt as to whether it is business or personal. But if you just keep the business and personal separate, the bookkeeper is clear that the expenses are all business related and this can eliminate some of the questions and necessary follow up.

The second is from the perspective of knowing your numbers. When I do someone’s books and tell them they made a profit, I often hear, “Well, where is it?” Managing your cash flow is one of the most challenging aspects of being a small business, especially a new one. When you mix your business and personal finances you no longer understand whether your cash flow crunch is because of business deficiencies or personal overspending. A budget will help but keeping separate bank accounts and credit cards will really help you see the cash flow.

3 Don’t wing it, strategize it Accountants and lawyers seem to be two service providers people don’t want to invest in – until it’s too late. When you become an entrepreneur,

you have more options than an employed individual. Seeking guidance on how to best set yourself up for success can quite literally save you thousands of dollars. Choosing when to incorporate isn’t about a magic number; it’s a situational analysis that involves both legal

and tax advice. Sometimes we incorporate for legal reasons even if the tax reasons aren’t applicable because the set up makes sense and can save you hardship later (such as the separation of liabilities from personal assets, avoiding S85 rollovers). Sometimes we incorporate for tax reasons. A corporation by itself will not afford you tax savings, however, you need to strategize to use it properly.

While it may seem overwhelming to start a business, especially taking on the financial responsibilities that come with it, the key is having systems and processes that help make your life easier. Invest some time to ask questions to set yourself up for entrepreneurial success!

“Sault Ste. Marie is the best place you can ever live with your family. When we came with my family we got a very big reception from people we don’t even know.”

Felix Koros, April 2023, Canadian Immigrant Magazine

The city of Sault Ste. Marie, situated on the Canada-U.S. border (with a population of 75,000), is actively seeking to attract new residents and pulling out all the stops to support them with making the place home.

“When we came with my family, we got a very big reception from people we don’t even know,” says Felix Koros, who moved to the city from Kenya with his wife and five children in December 2022.

delay, partly due to the pandemic, Koros and his family were able to move in late 2022 through the recently launched Rural and Northern Immigration Pilot (RNIP). The city encourages local employers to use the program to fill local labour market needs. In 2022, Lackeisha Sogah, the city’s Labour Force Coordinator and point person for RNIP applications, oversaw 213 successful applications, bringing in new residents from within Canada and overseas.

Koros says that assistance he

helped the Koros family in their settlement process. On his first day in the city, Koros happened to meet Jane Omollo, the founding president of ACCANO (African Caribbean Canadian Association of Northern Ontario). Thirty minutes later, Omollo and her husband were driving Koros and his groceries back to his new home.

Interactions like this are not new to Omollo. “I like to connect, I like to reach out and if I am able to help in any

On his second day in the city, Lackeisha Sogah helped him pick up more winter essentials. And colleagues from JD Aero helped him learn to drive in Canada.

So, four months in, how are Koros and his family doing?

“[This summer] I plan to go fishing and visit all the parks here. We are also planning on going on the Agawa Tour train. My children said they really enjoy the city and want to live here forever. There is no hassle, no traffic, you can

3 9 25 100 Locations Entitites Languages

Women 60% Staff

5.95% Fixed-interest!

Until June 30, 2023

Now get greater peace of mind with a fixed-interest a ordable career loan.

As a skilled immigrant or refugee you can pay for accreditation and professional development to reach your career goals. No credit history required. Find out if you are eligible today: