The Marine Insurer

l Cargo fraud: Finding the solutions

l Sanctions: Are they working?

l Decarbonisation: New EU regulations looming

l Supply chain: Technology set to help

l Cyber wordings: Insurers need to mind the gaps

04 Crew claims

Why the maritime industry still faces significant challenges in ensuring the safety and protection of seafarers

08 Geopolitics and claims

Recent geopolitical unrest has had a major effect on marine claims and P&I Clubs will have to up their game

10 Marine war risk

Should the P&I market entertain the option of offering primary war risk cover?

12 To clause or not to clause

The simple but highly important question of whether sanctions are really necessary

16 Russian sanctions

The impact of sanctions against Russia on marine insurance companies’ compliance, and underwriting

18 An evolving landscape

Why insurers need to manage their risk carefully as the sanctions regime intensifies

20 Risk intelligence

How underwriters can leverage real time risk intelligence to drive value and minimise exposure

24 AI and ML

We look at how the insurance sector must use AI and ML to transform the business for the benefit of all

Why ship owners should take a close look at cyber wordings and exclusions in the

Unveiling some of the peculiarties of the Italian marine insurance claims system

Examining complex and increasingly significant static commodity claims

The challenges of hybrid knock-forknock clauses

Know your limits

Looking at

towards climate neutrality across the EU?

Geopolitics and the marine industry go hand in hand. Wherever trouble strikes, there are bound to be repercussions for the global supply chain – something maintained by the maritime sector.

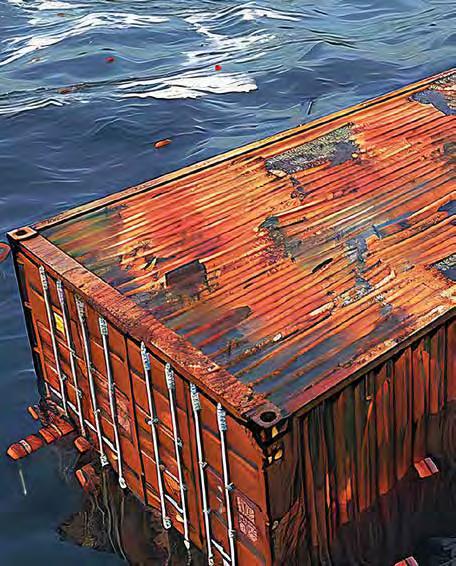

So, no surprise that the troubles in the Middle East have spilled over to impact the marine market. However, when the Houthis first started firing rockets at civilian vessels, there was a feeling that it would soon be brought under control. Sadly, that is not the case and with more than 100 vessels attacked and four seafarers losing their lives, the market is concerned that there is absolutely no sign of it abating.

The military attempts to stop the attacks have failed and the only glimmer of good news has been that the Sounion salvage was successfully, and most importantly safely, carried out with some brave salvors taking the risk accompanied by a military escort. However, overall the traffic through the Suez Canal is said to be at just 40% of its usual levels – something that will impact not just the Egyptian economy directly, but all of us indirectly as supply chains lengthen, containers are held up and cargos face new risks as shipping takes to the Cape route.

As always, one such issue is not the only challenge for the market. The marine insurance market continues to grapple with how and when to adopt artificial intelligence (AI) and machine learning. How do insurers embrace it within their own organisations and how do they view the risks as their insureds adopt the new technologies too.

Questions remain on cyber wordings. Are they fit for purpose, which clauses should insurers adopt, etc, etc? The tech experts would say that AI is an everyday part of life already and so is it a question of the insurance market simply playing catchup on existing risks?

Finally, we turn to crew claims. Seafarers are the life blood of the marine sector but it seems are often the last to be considered in the marine market chain. The latest figures from Gard make for sobering reading but perhaps will be a wake up call for all in the industry to pay more attention to the hard working people who make the industry tick.

Lots to mull over at the moment so I hope you enjoy the read!

Liz Booth, Editor, The Marine Insurer

Kunal Pathak , team leader, Gard AS and Lene-Camilla Nordlie , vice president, Gard AS review the P&I Club’s first analysis of crew claims. The conclusion is that the maritime industry still faces significant challenges in ensuring the safety and protection of seafarers from the operational hazards inherent in life at sea. Suicide cases remain worryingly high

The maritime industry is reliant on its people, be that seafarers, stevedores, surveyors or others working in our industry. When something goes wrong onboard a vessel, it can have serious consequences for that vessel’s crew.

As a marine insurer the safety of seafarers is a top priority. First and foremost, they are people. They are also the backbone of the maritime industry.

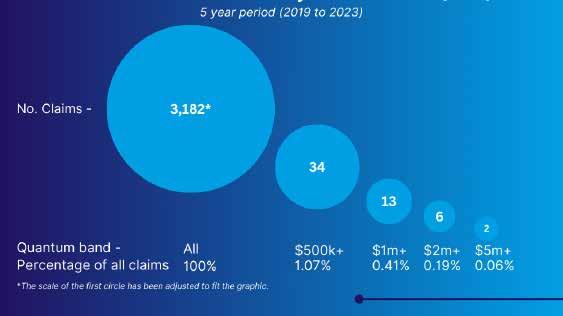

Regrettably, we deal with a lot of crew-related cases. Today, people claims form close to half of all our P&I claims (by number) and some 43% of the total claim amounts paid.

Gard recently published its first-ever Crew Claims Report, analysing five years’ worth of claims data covering the period 2019 to 2023. During these five years our claims teams dealt with more than 20,000 people-related claims cases.

As noted by Christen Guddal, chief claims officer at Gard in his introduction to the report: “The health and safety of

seafarers and their working environment will impact situational awareness and the decisions they make. This, in turn, has an impact on the risk and likelihood of maritime accidents.”

The report focuses on the top ten most frequent illnesses and injuries, and crew fatalities during this five-year period and highlights key trends. It highlights the importance of mental health, as well as on preventive measures that can be taken by shipowners, managers and by the seafarers themselves.

Injuries made up some 32% of all crew claims during the past five years, with the average claim amount for an injury usually being higher than for illness claims. This may be due to the urgency of the treatment required in connection with injuries, which could sometimes require significant diversion of the vessel or medical evacuation at sea.

We see a relatively high number of crush injuries, for example fingers getting trapped in hatch covers, burns, incidents related to heavy lifting and falling between levels or into cargo spaces.

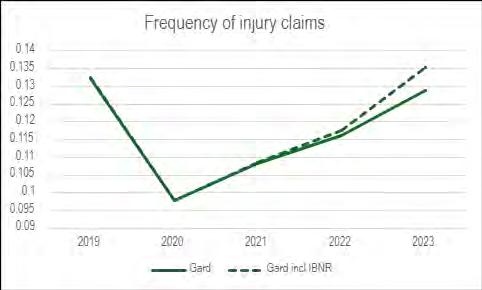

In 2023, we registered close to 1,000 injury claims, both crew and non-crew, and the frequency in 2023 increased by 44% compared to 2020. If we include the IBNR numbers, the

the frequency of injury claims, which is a matter of concern.

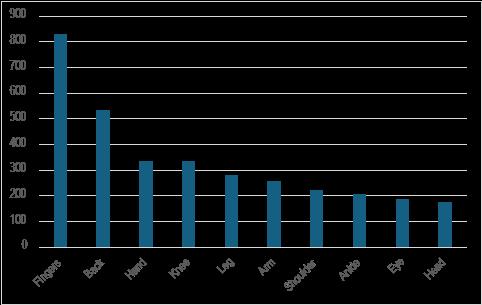

Figure 2 shows the top 10 body parts most frequently injured for all registered crew-related cases in the past five years. Finger injuries are the most common, often related to fingers being trapped in machinery.

Gard has published posters and alerts to help seafarers to prevent such injuries and it may be useful to revisit some of the recommendations. Among the recommendations made are:

>Selecting the appropriate glove for the job. The Code of Safe Working Practices has the following recommendations: >Leather gloves when handling objects which may be sharp or rough;

frequency increases further.

The increase in frequency of injury claims is a clear trend since 2020 and deserves the attention of both vessel operators and seafarers.

It is likely due to a combination of increased freight rates, which put pressure on operations and in turn lead to safety lapses, as well as the consequence of the period of reduced activity during Covid-19 during which time younger seafarers did not gain as much operational experience.

As we can see from figure 1, there has been an increase in

“Our claims data shows that the most frequently registered causes for injuries are slips, trips and falls, as we can see from figure 3. The second most common cause is being hit by an object or a line, mostly during mooring operations.”

>Heat resistant gloves when handling hot objects;

>Rubber, PVC or synthetic gloves when handling acids, oils, solvents or chemicals; and

>Insulated gloves when working on electrical equipment

>Use a cotton inner glove when wearing gloves for longer periods to prevent skin becoming hot and sweaty as well as to prevent skin problems.

Our claims data shows that the most frequently registered causes for injuries are slips, trips and falls, as we can see from figure 3. The second most common cause is being hit by an object or a line, mostly during mooring operations.

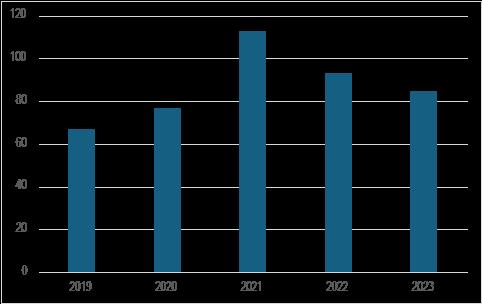

This category of claims should ideally be zero. However, as an industry we are unfortunately far from where we would like to be. In the past five years, Gard has recorded more than 400 crew fatalities. The frequency of death claims is fortunately low at 0.01 deaths per vessel year with the worst recorded year being 2021 in the last five years.

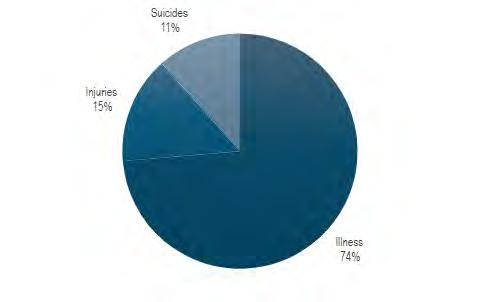

When it comes to the cause of death, 74% of the fatalities registered with Gard were due to illness. This correlates with other data sources, as according to the World Health Organisation (WHO), 74% of all deaths globally are due to non-communicable diseases.

The most common causes of death are cardiovascular disease, cancers, chronic respiratory disease and Type 2 Diabetes, according to WHO. Our registration of the increase in illnesses in the Gard fleet correlates with these statistics.

A concerning trend we can see from figure 5, is that some 11% of our registered crew fatalities are due to suicide. This is a worryingly high number and we believe that the actual number could in fact be much higher due to underreporting. We also believe that many cases of crew deaths are preventable.

The maritime industry still faces significant challenges in ensuring the safety and protection of seafarers from the operational hazards inherent in life at sea. There is still considerable work to be done to achieve the ideal state in which seafarers are safe and shielded from these risks.

Recent geopolitical unrest has had a significant effect on marine claims and P&I Clubs have had to up their game writes Andrew

Glynn-Williams VP, head of FDD Nordics and Eastern Europe business unit, Skuld

We live in increasingly uncertain and troubled times where there are areas of political instability and several conflicts taking place, the war in Ukraine and the Middle East being the obvious recent examples.

We have also seen shipping bearing the brunt of some of these conflicts, particularly in the Middle East, which has seen ships attacked frequently in the Red Sea and vessels “seized” in the region around the Straights of Hormuz.

While geopolitical events having a direct impact on shipping is nothing new, for example, during the Suez crisis, it’s our experience that the impact on insurers, particularly P&I clubs, is greater than ever.

The day to day running of P&I Clubs is affected in many ways. Our experience is that we see an impact on all lines of business, particularly P&I, hull and machinery (H&M) and freight, demurrage and defence (FDD).

What we also see is that while there is a direct financial impact due to claims brought following an incident, there is also a significant increase in the time and resources required to deal with the incident.

Furthermore, even routine procedures, such as paying a lawyer, can take significantly longer, especially where sanctions are involved.

At the time of writing, two ships have been sunk by Houthi rebels in the Red Sea since November 2023. In addition, two of the attacks have been fatal, and we must not forget that it is the ships’ crews who face the brunt of these attacks, sadly, sometimes with fatal consequences.

Other vessels have been hijacked in the region with crew still held hostage. P&I risks for these sorts of incidents might be injury, pollution and wreck removal, whereas H&M will be responsible for the damage to/loss of the vessel itself and any salvage, if possible. For the Red Sea losses, however, war risk insurers will likely be on the cover for the risk and therefore, there may be little or no additional financial exposure to an individual club or hull insurer for the sort of events that you see making headlines.

However, that does not mean a P&I club or H&M can sit back. For example, there might be claims handling agreements between the respective P&I or H&M and war risk underwriters.

We know from experience that assessing where the liability lies, sometimes with limited information, establishing lines of communication, agreeing on who is doing what etc can take a considerable number of hours and sometimes take weeks to sort out. If you throw a Russian nexus into the mix, for example, matters soon become resource intensive.

One of the most significant impacts that we see at the Club as a consequence of geopolitical events is sanctions and we see this right from before the inception of the risk to dealing with claims.

The landscape in this regard has changed significantly since around 2018 with the reinstatement of Iranian sanctions.

As with other clubs, we had Iranian members whose cover had to be terminated before the sanctions were reimposed. One of the biggest issues we saw during the wind-down period was the growing inability to make routine payments, where the banks were increasingly self-sanctioning, such that legitimate payments, such

“There can be no doubt that geopolitical events impact the day-to-day operations of a P&I club from both a financial and a time perspective. Dealing with sanctions issues is particularly time-consuming.”

In our experience, we see a lot of initial FDD enquiries whenever a new geo-political event occurs, recent examples being the invasion of Ukraine, the Israel and Palestine situation and most recently, the attacks by Houthi rebels in the Red Sea.

Typically, the sort of enquiry we get from our

owner members is: “Are we obliged to follow these orders / to go to a particular port, or can we refuse or deviate?”.

Whereas the opposite is often the case from the charterers side ie: “Can we insist owners follow our orders etc”.

as paying a correspondent, were stopped.

Where payments were allowed, several hoops had to be jumped through, all of which added significantly to the time taken to process something that ordinarily should have taken minutes.

We also had a small number of larger cases to carry over. To do this and continue working on such matters, special licences are required from the likes of OFAC, where the process of obtaining such licences is extremely time-consuming.

We saw a repeat of this when Russian sanctions were imposed and where any matter with the slightest Russian nexus requires much information to be provided to the banks before any payment can be processed.

Other requirements, such as dealing with “price cap” attestations, significantly increase a club’s administrative burden. Whilst we fully understand the reasons for this, it does not take away from the fact that relatively simple matters can become extremely time-consuming very quickly.

Closely linked to the impact of sanctions on claims is the impact on our “member assistance” cases; these are those more general enquiries which are not, in themselves, claims.

In particular, we see several enquiries related to members’ due diligence obligations in respect of calling at certain countries where sanctions operate, for example, in Libya or Myanmar.

While the Club cannot do the due diligence for a particular member, we can assist with certain of the necessary enquiries and do so frequently.

Through the years, we have seen several ‘similar’ type scenarios, and the key here is for the Club to keep a good precedent database so that claims handlers do not have to reinvent the wheel each time and which also avoids having to instruct external lawyers for each new enquiry. An example is the similarities in the legal issues faced by members following the invasion of Ukraine and the Red Sea situation. Cover questions also arise where there are deviations to the contractual voyage.

Inevitably, however, some cases are more complex than others, particularly where the member is in the middle of a chain of charters and the charter parties are not back-to-back or where we have to advise on bespoke or particularly not well-drafted clauses.

There is much to be said for using unamended standard forms to contract on. We also saw (and still do), particularly with the Red Sea situation, that because the risk situation was changing daily, the advice you gave one day may not be relevant the next.

There can be no doubt that geopolitical events impact the dayto-day operations of a P&I club from both a financial and a time perspective. Dealing with sanctions issues is particularly time-consuming.

However, Skuld had the foresight, quite early on, to see the direction of travel in this regard and has significantly increased its legal team to deal with sanctions-related queries that we in the claims team receive daily.

We also have suitable structures in place, including knowledge sharing. The reality is that a colleague in Singapore will be asked exactly the same question by a member as someone in Oslo.

Looking to the future, we do not see the present situation changing. But we know that we have the knowledge and resources to advise our members if they become caught up in a geopolitical situation.

Mark Cracknell, global head of P&I, Marsh, suggests that the P&I market should entertain the option of offering primary war risk cover as shipowners struggle to secure adequate solutions

Marine war risk exposure has intensified since the start of the Russia-Ukraine conflict in 2022 and has the potential to increase further, given current geopolitical conditions, including recent attacks on ships in the Red Sea.

As traditional war risk insurers tend to emphasise hull and machinery (H&M) coverage, now may be a good time to reconsider the role of protection and indemnity mutual clubs in managing P&I war risks.

As tensions in the Middle East have intensified, so has exposure to war risks in the region, including in the Red Sea, one of the world’s busiest shipping lanes, which was already of concern to underwriters.

Hostilities in the region have resulted in damage to several vessels, leading to at least two recent sinkings and the tragic deaths of up to four seafarers.

Shipping in the area had declined before the latest events and many ves-

sels now use alternate routes, which are generally safer, but take longer and add cost. Even as traffic has diminished, the underlying threat persists, as it does in the Black Sea and other bodies affected by the Russia-Ukraine war.

At the same time, war risks insurers have identified portions of west Africa and South America as high-risk areas (HRAs). Elsewhere, tensions in the Taiwan Strait and other parts of the South China Sea could pose additional potential threats to vessels and trade transiting these waters.

This begs the question: Should P&I clubs take on primary P&I war risk coverage?

Increased geopolitical friction has led shipowners to exercise caution and question how insurance may respond to liabilities they may incur from war risks.

Coverage for damage arising from incidents caused by war—including

“Hostilities in the Red Sea have resulted in damage to several vessels, leading to at least two recent sinkings and the tragic deaths of up to four seafarers.”

war, revolution, rebellion, insurrection, civil strife and weapons of war — are typically excluded from most P&I and H&M insurance policies. Shipowners therefore often purchase standalone coverage from war risks insurers.

Although traditional war risk insurers offer policies also including the P&I risk, they tend to focus more on H&M exposures. This raises the question as to why primary P&I war risks do not sit within the mutual P&I system.

Outside of HRAs, P&I war risks exposure is very limited. For HRAs, the clubs could take a mutual approach to assessing risk and allocating premium. This would likely result in some cost efficiencies, although they may not be significant.

More importantly, the mutual clubs have the resources and established global professional service networks to respond to a major P&I war event involving serious injuries, loss of life, pollution, or wreck removal.

Similar resources are not readily available for most war risk insurers, including various war risks mutuals that primarily focus on H&M exposure, which is generally their area of expertise.

Until the current surge in war risks activity, separating P&I and H&M war risks was challenging, in large part due to the traditional war insurers emphasizing the H&M risk.

However, as a result of the ongoing Russia-Ukraine conflict, war insurers, influenced by reinsurers, signaled that P&I exposure is of increasing concern by imposing a Russia-Ukraine-Belarus (RUB)

exclusion on the International Group (IG) excess of loss reinsurance program for the 2023 renewal.

The concern was amplified when insurers gave notice of cancellation for war risks cover in the Red Sea on non-pool club reinsurance in the lead-up to the 2024 P&I renewal.

If premiums for primary P&I war risks cover continue to rise, there may be advantages for turning to the mutual P&I system.

Premium paid to the mutuals would eliminate the need for a profit element and, as stated above, the mutuals may possess greater capabilities to handle P&I war risks claims.

As an added consideration, this approach would eliminate the requirement for P&I club members to insure their vessels for a specified value, in order not to fall short of the excess P&I war risks cover presently provided by the clubs.

The P&I clubs could simply offer a standard limit of “ground-up” P&I war cover — for example, to a limit of US$1bn — without reference to the H&M arrangements.

Finally, war insurers would no longer need to allocate capacity to the P&I risk, which could introduce more dynamism to the H&M war risks market.

Captain (Ret) Neil Watts , Culmen International LLC, asks the simple but highly important question of whether sanctions are really necessary

International sanctions regimes are constantly evolving, with new measures being added consistently and regularly, particularly with the latest sanctions against Russia over the conflict in Ukraine.

The global insurance industry had responded to the various forms of sanctions clauses by applying clauses to cargo, vessels and other insurance policies in the maritime sector since at least 2005 when sanctions against Iran were applied over its nuclear programme.

Typically, such sanctions clauses are exclusionary, meaning denying claims payments to sanctioned jurisdictions, designated companies, or individuals.

Notably, any activity in breach of sanctions will result in insurance coverage being withdrawn immediately and likely accompanied by the imposition of penalties.

Violating sanctions measures could result in relatively severe consequences for companies, from reputational damage to

fines – or even worse - being listed as sanctioned parties. Some jurisdictions, such as the EU, Japan, or the US, impose criminal liability for a breach of sanctions. The value of carefully crafted sanctions clauses in contracts can, therefore, not be underestimated.

Consequently, these clauses have become crucial for companies trading internationally for two reasons: to manage and mitigate sanctions risk and to remain compliant with the various sanctions regimes while continuing to do business in a highly competitive environment.

There are several best practices to use as a helpful frame of reference when developing appropriate clauses:

> Language matters. The LMA3100 clause (introduced in 2010) became widely used in the global insurance industry to prevent coverage under a policy that could expose an insurer to a breach of sanctions in the UK, US, or EU or those imposed by the UN. Following legal challenges, the title had to be changed from an “exclusion” clause to a “limitation” clause because it moved to suspend coverage rather than exclude it. LMA3200 was introduced to apply to non-English or US law jurisdictions and is used as a “condition” clause to meet the requirements for exclusion in other jurisdictions. Lloyd’s Market Association (LMA) provides guidance on sanctions clauses on its website at https://www.lmalloyds.com/LMA_Bulletins.

> A clause should define what is meant by sanctioned activity, the expectations of non-involvement in sanctioned activity or designation, what constitutes a breach of contract, and the consequences – such as termination or claim for damages. Charterers could require loaded cargo to be discharged at any port of their choice at the owners’ expense in case of a breach. It is incumbent on the charterers to ensure that any sub-charterers, shippers,

“Some jurisdictions, such as the EU, Japan, or the US, impose criminal liability for a breach of sanctions. The value of carefully crafted sanctions clauses in contracts can, therefore, not be underestimated.’’

Captain (Ret) Neil Watts, Culmen International LLC,

receivers and cargo interests are not sanctioned parties. Regarding supply chain compliance, the charterers must also ensure that the clause is incorporated into all sub-charters, bills of lading, waybills, or other documents for carriage relating to the contract. Lastly, precise language, terminology, and guidance on clauses concerning cargo/ freight are available on the BIMCO website at https://www. bimco.org/contracts-and-clauses.

> Manipulation of a vessel’s automatic identification system (AIS) is nearly always found in cases of sanctions evasion, particularly when deception is employed to hide a ship-to-ship transfer (of both petroleum products and dry goods), the port of origin or destination or provide a false identity.

The continuous operation of a ship’s AIS is mandatory under SOLAS. However, there are circumstances, such as transiting high-risk areas prone to privacy or Houthi attacks in the Red Sea, where switching it off may be necessary. A specific clause is therefore required to ensure that when it is switched off for legitimate reasons, the coverage will not be immediately terminated. This will help ensure a balance of the rights and responsibilities between owners and charterers to prevent AIS manipulation to circumvent sanctions. This clause should be part of a company’s sanctions compliance due diligence programme, spelling out the period (48 hours to 72 hours) for reporting why the AIS was off – called going “dark.” BIMCO also provides guidance on an AIS “switch off” clause for charter parties at https:// www.bimco.org/contracts-and-clauses/bimco-clauses/ current/ais_switch_off_clause_2021.

Several tools are available to detect a “dark” period, provided by specialised maritime databases on a subscription basis. Some databases also provide a virtual “geo-fencing” alert facility when vessels enter, or are about to enter, highrisk areas identified for sanctions evasion, such as those used for ship-to-ship transfers to evade North Korean or Russian sanctions or passing through waters under sanctions such as Syria and Iran.

Companies can, therefore, be alerted of vessel movements in relation to these areas and requirements of a clause could include providing more frequent positional updates, manual positional updates in the event of going dark, or the fitting of a long-range identification and tracking (LRIT) system required by some flag registries.

The LRIT frequency of position reporting can also be increased from the standard (every six hours minimum required by SOLAS) but at an additional cost. This aspect could be critical when carrying cargo to Japanese ports since Japan bans the entry of all vessels that have previously called at ports in North Korea.

It is important to note that sanction clauses are crucial to insurance policies but cannot offer complete protection

“The LMA3100 clause (introduced in 2010) became widely used in the global insurance industry to prevent coverage under a policy that could expose an insurer to a breach of sanctions in the UK, US, or EU or those imposed by the UN.”

against sanction violations in all circumstances. They do not provide indemnity for inadequate due diligence or compliance.

In addition, as insurance professionals, you must carefully assess whether a payment is permissible, despite a sanctions clause, due to sanctions or related AML restrictions. This assessment is critical before making a payment to a sanctioned company, individual, or bank.

Ultimately, using sanction clauses in insurance policies is a sound business practice, as they can help prevent sanctions violations or subsequent criminal liability falling on insurance companies and their employees.

29 January 2025

A brand new event for 2025, The Marine and Energy Insurtech Forum will take place in January bring together Heads of Digital Transformation, IT Directors, Chief Information Officers and technology providers to establish a forum for members of the market with a keen interest in digital transformation of marine and energy insurance technology.

Nelius Strydom, chief executive officer, Seamless.Insure, reviews the impact of sanctions against Russia on marine insurance companies’ compliance, governance, pricing and underwriting

At Seamless, we closely monitor the evolving nature of the marine insurance industry, with an eye on the Nordics, as we continuously enhance our technology platform to meet the sector’s changing needs. And those needs are definitely changing. The global maritime industry has faced significant challenges following the imposition of sanctions against Russia due to geopolitical tensions . The sanctions imposed against Russia have been comprehensive and multifaceted, targeting various sectors of the Russian economy in response to geopolitical tensions, particularly related to Russia’s actions in Ukraine and other international conflicts. Marine insurers, in particular, have been navigating a complex landscape of compliance, governance, pricing and underwriting.

Imposing sanctions against Russia has led to heightened compliance requirements for marine insurers worldwide. These insurers must ensure they are not inadvertently providing coverage to sanctioned entities or for activities that would violate these sanctions. This necessitates extensive due diligence and

compliance checks, which, when done manually, will be both time-consuming and costly.

Marine insurers must now employ rigorous screening processes to verify that clients and cargoes are not subject to sanctions. This includes cross-referencing databases of sanctioned entities, conducting thorough background checks and frequently updating compliance procedures to align with evolving regulations.

The increased administrative burden has compelled many insurers to invest heavily in compliance infrastructure, including specialised software and compliance teams dedicated to monitoring and managing these risks.

Many marine insurance companies report significant increases in their compliance efforts to address these new requirements. While exact budgets vary, it is clear that the financial impact of enhanced compliance measures is substantial across the sector.

Furthermore, insurers must stay abreast of international regulatory changes and ensure their operations comply with the legal frameworks of multiple jurisdictions.

Non-compliance can result in severe penalties, including substantial fines and reputational damage, which can further complicate the insurer’s operational landscape.

According to a 2024 report by the Centre for Research on Energy and Clean Air (CREA), UK insured tankers transported 33% of all Russian oil since the sanctions were implemented in 2022 until November 2023.

This amounts to approximately €46.4bn worth of Russian oil, highlighting the significant role UK insurers play in the global oil trade despite the sanctions, and the high stakes

Sanctions have also forced many marine insurers to limit or

completely withdraw coverage for Russian-owned vessels, cargo, or companies.

This includes hull and machinery insurance, protection and indemnity (P&I) insurance and cargo insurance. The withdrawal of coverage from these high-risk entities helps insurers mitigate potential legal and financial repercussions.

The restrictions on insurance coverage have had a cascading effect on the shipping industry. Russian vessels and cargoes now face difficulties in obtaining necessary insurance, leading to operational disruptions.

Lloyd’s of London reports substantial decreases in policies issued for Russian-related maritime activities since the sanctions were imposed and compliant insurers adopt a cautious approach, extending coverage only after ensuring that all parties involved are compliant with international sanctions.

This reduction in coverage options has not only affected Russian entities but also global trade routes.

Shipping companies that previously relied on Russian ports or transit routes have had to seek alternative pathways, often at increased costs.

A 2022 report by the United Nations Conference on Trade and Development (UNCTAD) highlighted that the RussiaUkraine conflict and related sanctions have led to longer shipping distances, higher fuel costs and increased transit times, all contributing to rising operational costs in the shipping industry. The resulting complexities have strained the relationships between insurers and their clients.

The sanctions have introduced significant volatility into the marine insurance market. The uncertainty and increased risks associated with Russian maritime activities have driven up premiums.

Insurers are pricing in the additional risk of further sanctions or legal challenges, which could further impact their own financial stability.

Increased premiums reflect the heightened risk environment. Marine insurers must account for the current and potential for further sanctions, the complexities of claims involving sanctioned entities and the overall instability in the geopolitical landscape.

Clients seeking coverage for operations involving Russia are now facing significantly higher costs, which impacts their operational budgets and strategic planning.

Moreover, the fluctuating premiums have affected the broader insurance market. Other regions and sectors are experiencing spillover effects, with insurers adopting a more cautious stance across the board.

The reallocation of underwriting capacity and resources to manage sanction-related risks has led to a tighter market, where obtaining comprehensive and affordable coverage has become increasingly challenging.

Leading global marine insurers have pulled back from underwriting Russian companies, including the oil shipping supply chain, as well as vessels due to the ongoing conflict in Ukraine and the impact of Western sanctions on Moscow, according to Thompson Reuters.

“As the geopolitical landscape continues to evolve, marine insurers must remain agile, adapting to new regulations and maintaining robust compliance frameworks to navigate these turbulent waters successfully.”

Sanctions against Russia have created substantial operational challenges for shipping companies and insurers alike.

One of the primary difficulties is navigating payments and other financial transactions involved in maritime insurance. Banking restrictions make it challenging to make payments to or receive payments from Russian entities, complicating claims handling and settlements.

These financial barriers necessitate alternative payment mechanisms and often lead to delays in processing claims. Insurers must establish clear protocols for managing claims involving sanctioned entities to ensure compliance while minimising disruption to their clients.

This involves close coordination with legal and financial advisors to navigate the complexities of sanctions law and international trade regulations.

Additionally, operational challenges extend to logistics. Insurers and their clients must ensure that any movement of goods or vessels adheres strictly to sanctions guidelines, requiring meticulous planning and execution.

Innovative operators can use technology that embeds intelligent cargo and ship data to cross-check information, helping to untangle the dynamic web of sanctions across the supply chain.

The sanctions against Russia have significantly impacted marine insurance companies, imposing increased compliance requirements, restricting insurance coverage, driving market volatility and creating operational challenges.

As the geopolitical landscape continues to evolve, marine insurers must remain agile, adapting to new regulations and maintaining robust compliance frameworks to navigate these turbulent waters successfully.

Through diligent compliance, strategic risk management, transparent communication and using technology, marine insurers can mitigate the challenges of sanctions and continue to provide essential coverage to the maritime industry. The ongoing challenges underscore the critical importance of the role technology can play in navigating geopolitical uncertainty.

David Savage , partner, and Bea Bray , associate, HFW, explain why it is more important than ever for insurers involved in covering trade with Russia to manage their risk as carefully as possible as the sanctions regime intensifies

Following Russia’s invasion of Ukraine in February 2022, sanctions have once again been put under the spotlight as the UK, European Union and US have all imposed rigorous and expansive restrictions, the nature and scope of which are constantly evolving. In the marine space, this is a difficult matrix to untangle.

This article will focus on some of the restrictions which have been imposed by the UK and the EU that apply to the insurance and reinsurance markets. It will also consider the steps re/insurers can take to ensure that they are not breaching these restrictions.

The UK and EU have imposed restrictions with the aim of encouraging Russia to cease actions which destabilise Ukraine, or undermine or threaten the territorial integrity, sovereignty or independence of Ukraine.

In both the UK and the EU, these restrictions apply to international trade, not only in relation to the underlying trades

themselves, but also to ancillary services such as finance and insurance which enable these trades to take place seamlessly.

The Russia (Sanctions) (EU Exit) Regulations 2019 (the UK Regulations) came into force on 31 December 2020 and have been regularly updated since the onset of the Russian war in Ukraine

The most recent update to the UK Regulations came into force on 31 July 2024 and amended Regulation 57F, a restriction which outlines the specification of ships which are subject to shipping sanctions as set out in Regulation 57A to 57E. Many provisions in the UK Regulations which apply to insurers apply to “financial services”. “Financial services” includes insurance, reinsurance and retrocession, as wll as insurance intermediation such as brokerage and agency as per Section 61(a) (iii)and (iv) of the Sanctions and Anti-Money Laundering Act 2018 (SAMLA).

The UK Regulations dictate that a person (whether natural or legal) must not directly or indirectly provide financial services in pursuance of or connection with an arrangement whose object of effect is inter alia:

(a)The import of iron and steel products;

(b)The import of oil and oil products;

(c)The import of coal and coal products; and

(d)The import of liquefied natural gas where those products originate from Russia or are consigned from Russia.

A person who directly or indirectly provides financial services (including the provision of insurance cover) in contravention of these restrictions might have committed an offence under the UK Regulations.

The UK Regulations apply within the UK and in relation to the conduct of all UK individuals wherever they are in the world. They also apply to UK companies incorporated or established in the UK and to branches of UK companies overseas.

As many insurance providers will have an EU nexus and will therefore be subject to both sets of restrictions, it is best practice to remain vigilant of EU as well as UK regulations.

The EU has also imposed various restrictions which impact the insurance market under Council Regulation (EU) No 833/2014 (the EU Regulation). The EU Regulation came into force on 31 July 2014 and, like the UK Regulations, is regularly updated.

Of particular relevance to marine insurers is Article 3s(f), which contains a prohibition on directly or indirectly providing insurance cover for a vessel listed in Annex XLII of the EU Regulations, which includes inter alia”vessels which are owned, chartered or operated by natural or legal persons entities or bodies listed in Annex I to Regulation (EU) No 269/2014, are otherwise used in the name of, on behalf of, in relation with or for the benefit of such persons”.

Article 3g(e) also mirrors Regulation 46H of the UK Regulations in that it prohibits the provision of insurance and reinsurance related to the provisions set out in Article 3g(a)-(d) covering the import and transport of iron and steel products from Russia.

Breach of UK Regulations relating to trade sanctions carries a maximum sentence on indictment of 10 years imprisonment and a fine, or both.

For the EU Regulations, penalties will depend on each member state. However, the new Directive (EU) 2024/1226 (the EU Directive) defines criminal offences and penalties for breaches of EU sanctions.

The EU Directive was published in the Official Journal of the European Union on 29 April 2024 and entered into force on 20 May 2024. Member states must transpose its provisions into national law by 20 May 2025.

As per Recital 10, EU restrictive measures include the prohibition of trading, importing, exporting, selling,

“It is prudent for insurers to ensure they are staying on the right side of the prohibitions, particularly since member states will soon be enforcing the EU Directive into national law.”

purchasing, transferring, transiting or transporting goods or services. The provision directly or indirectly, of insurance and any other service related to those goods or services, would also constitute a criminal offence.

Therefore, it is prudent for insurers to ensure they are staying on the right side of the prohibitions, particularly since member states will soon be enforcing the EU Directive into national law.

In circumstances under which an insurer believes it may have unintentionally breached the UK or EU Regulations there are some statutory defences available.

For example, if a person did not know and had no reasonable cause to suspect that the financial services were being provided in contravention of the UK Regulations or EU Regulations, they may have a defence under those regulations (see Section (3) of UK Regulations and Article 10 of the EU Regulation).

In the UK, insurers may also have a defence to payment under a policy by virtue of Section 44 SAMLA which provides a defence to civil liability where an act is carried out on the reasonable belief that it is in compliance with SAMLA.

It was confirmed in Celestial v Unicredit that Section 44 can be relied on where a party refuses to make payment under a policy on the belief that it will be acting in breach of sanctions, and this belief is objectively reasonable.

A party is not required to show how it came to the decision that it would be in breach of sanctions, but the belief should be assessed objectively, accounting for the novelty of the legislation and the time available in which to reach a view on the issue.

As the war in Ukraine looks increasingly likely to continue for some time, it is key that insurers continue to assess their risk in covering voyages and any activities with a Russian nexus. While the pace of change in the restrictions has momentarily slowed, regulatory expectations regarding risk management have never been higher.

Stefan Schrijnen , chief commercial officer, Insurwave, explains

how underwriters can leverage real time risk intelligence to drive value and minimise exposure to geopolitical risks

The fallout from geopolitical conflicts poses a constant threat to industries worldwide. From simmering regional tensions to the looming threat of cyberwarfare, insurers must navigate a complex web of geopolitical risks and respond swiftly to assess and address the impact of emerging events.

In such a volatile environment, the combination of realtime threat and risk intelligence and detailed historical data has grown in importance for underwriting teams.

The ability to anticipate and mitigate risk exposure can significantly enhance their decision-making and resilience.

Live threat intelligence plays a pivotal role in modern risk management strategies. It continuously monitors and analyses

real-time data to identify potential risks and threats.

This approach empowers organisations to proactively assess their risk landscape and promptly detect emerging vulnerabilities or malicious activities. By integrating live intelligence into risk management processes, organisations can swiftly prioritise and implement mitigation measures based on the most current threat insights.

This dynamic capability not only enhances situational awareness but also enables agile decision-making, ensuring that security resources are allocated effectively to mitigate the highest-priority risks in real time.

Consequently, organisations can strengthen their resilience against evolving threats and maintain a proactive stance to safeguard their assets and operations.

“This proactive approach minimises the likelihood of underestimating risks and ultimately helps maintain profitability. In the event of a claim, insurers can rely on timely and accurate information to assess its validity and manage payouts efficiently.”

Risk and threat intelligence provides insurers with real-time data on emerging risks and vulnerabilities that could affect policyholders.

By continuously monitoring threats such as cyberattacks, natural disasters, or geopolitical instability, insurers can better assess the likelihood and potential impact of these risks on insured assets and liabilities.

Similarly, accurate risk assessment leads to more precise underwriting decisions. Real-time intelligence enables insurers to adjust premiums based on current threat levels. It ensures that they adequately cover potential losses while remaining competitive in the market.

This proactive approach minimises the likelihood of underestimating risks and ultimately helps maintain profitability. In the event of a claim, insurers can rely on timely and accurate information to assess its validity and manage payouts efficiently.

Beyond insurance policies, insurers can offer risk mitigation services to policyholders based on live threat intelligence. This might include proactive measures such as security assessments, disaster preparedness training, or cybersecurity solutions.

By helping policyholders mitigate risks, insurers reduce the frequency and severity of claims, thereby improving overall risk management outcomes.

As the frequency of geopolitical events increases, so too does the regulatory pressure for insurers to demonstrate adequate due diligence in their underwriting and claims processes.

Service providers that can combine access to real-time threat alerts, enhanced security and risk data, and aggregation insights can help insurers with these compliance efforts by providing evidence of proactive risk assessment and mitigation strategies.

While applicable to many different areas of the insurance

market, the maritime industry is well-placed to benefit from this combination of threat intelligence and enhanced insurance systems and operations.

With shipping giants such as Maersk expecting Houthi disruption to last until the end of this year, live threat and risk intelligence plays a crucial role in ensuring the safety of vessels and mitigating potential risks associated with maritime operations.

In the instance of a Houthi attack, the value of combining live threat and risk intelligence with the insurance market and underwriters provides operators and insurers with an enhanced capability to be aware of incidents and reduce the severity of incidents when they happen through faster information exchange in anticipation of an event occurring.

It is also important to understand that geopolitical events do not occur in isolation, and to respond effectively in the short term and mitigate future threats, detailed historical data is also valuable.

Patterns of prior events, responses to them and the resulting impacts all have a bearing on present-day operations and business continuity.

For example, historical AIS (automatic identification system) data is a powerful tool that allows insurers to examine patterns and trends in vessel movements, identifying high-risk areas, times, and vessel types. This analysis can then help determine factors like what time of day would be best suited to traversing specific microzones.

Anticipating this trend, Insurwave partnered with Ambrey, a global leader in maritime security risk management, to deliver an integrated, comprehensive solution for marine insurance and risk management.

By combining Ambrey’s extensive experience in providing operational and digital maritime security services with Insurwave’s specialty insurance technology platform, risk managers, underwriters and exposure managers will have access to a comprehensive, global view of marine perils and risk.

“Getting relevant information to the people who need it as quickly as possible to save lives, time and money,” explained Joshua Hutchinson, managing director of intelligence and risk at Ambrey, in an interview with the publication Nautical Digital Online.

“Our vision is to provide the best commercially available real-time maritime domain awareness and intelligence globally. We can’t do this ourselves, so we believe in the power of partnerships. Working together across the industry ensures that any operation on our oceans is prepared and executed as securely and safely as possible,” added Hutchinson.

As part of the partnership, Insurwave’s dynamic risk zoning will use Ambrey’s dynamic elevated threat areas (DETAs), and sentinel alerts, which supply vessel-specific

“By continuously monitoring threats such as cyberattacks, natural disasters, or geopolitical instability, insurers can better assess the likelihood and potential impact of these risks on insured assets and liabilities.”

notifications triggered by users.

Leveraging both market-leading technologies and data-driven insights, the combined offering aims to further advance risk management and mitigation in the maritime and insurance industries.

For example, a newly built floating production storage and offloading (FPSO) vessel was due to move from Singapore to Israel via the Suez Canal, presenting a high-value target to opponents of Israel.

Using the combination of Ambrey’s threat intelligence, historical event data and live intelligence, the global maritime risk management firm was able to assess the vessel’s planned route and advise on an alternative one.

Ambrey Intelligence also provided advice to the vessel on when to move through critical areas at certain times of day and delivered an integrated asset tracking and monitoring service, ensuring the FPSO reached Israel securely without any incidents.

The convergence of live threat and risk intelligence with the insurance market holds the potential to transform the industry by enhancing risk assessment, improving claims management, enabling real-time incident response, and driving cost efficiencies.

By embracing these technologies, insurers and underwriters can better anticipate risks, reduce claim frequencies and severities, ultimately providing more value to their customers.

Andy Yeoman , co founder and CEO, Concirrus explains how the insurance sector must use AI and ML to transform the business for the benefit of all

Artificial intelligence (AI) and machine learning (ML) are reshaping the insurance industry, fundamentally altering how underwriting and claims processing are conducted.

These technologies bring unparalleled efficiency, accuracy and insight, promising a new era for insurers that adapt. The impacts are far-reaching, extending from routine tasks to complex risk assessments and from policy personalisation to fraud detection.

Yet, as these technologies revolutionise the industry, they also pose significant challenges, especially in terms of ethical considerations and regulatory compliance.

Underwriters have traditionally been the gatekeepers of the insurance industry, tasked with assessing risk and determining the terms and pricing of policies.

This role has historically been labour-intensive, relying heavily on historical data, actuarial tables and expert judgment. However, the introduction of AI and ML is shifting this dynamic, automating many routine tasks and allowing underwriters to focus on more strategic decision-making.

With AI and ML processing the data, underwriters now need to learn how to be data literate to understand the results. Data literacy enables underwriters to effectively

interpret, analyse and use data in their decision-making processes.

Here’s how underwriters can enhance their data literacy:

> Familiarity with diverse data sources: Underwriters need to understand the various types of data sources available, such as structured data from internal databases (eg historical claims data) and unstructured data from external sources (eg social media, news feeds, IoT devices). Recognising the relevance and reliability of these sources is crucial.

> Data types and formats: It is important for underwriters

“With AI and ML processing the data, underwriters now need to learn

how to be data literate in order to understand the results.

Data

literacy enables underwriters to effectively interpret, analyse and use data in their decision-making processes.”

to understand different data types (eg numerical, categorical, textual) and formats (eg CSV, JSON, XML) and how they can be used in risk assessments and pricing models.

> Statistical concepts: Underwriters should grasp fundamental statistical concepts such as mean, median, standard deviation, correlation and regression analysis. These concepts help in understanding data trends, variability, and relationships between variables.

> Data interpretation: Learning how to interpret data visualisations such as charts, graphs and dashboards is key. Underwriters should be able to extract meaningful insights from these visuals and apply them to risk assessments.

> Evidence-based analysis: Underwriters should shift from intuition-based to data-driven decision-making. This involves using data to support or challenge assumptions, justify pricing and identify potential risks that may not be immediately obvious.

> Predictive modeling: Understanding predictive models, such as those used in AI and ML, helps underwriters anticipate future risks and behaviours. While they don’t need to build models themselves, they should understand how these models are constructed, validated and applied.

> Analytical tools: Underwriters should become comfortable with data analytics tools such as Excel, SQL and more specialised insurance software. These tools are

essential for manipulating data, running analyses and generating reports.

> Visualisation tools: Tools such as Tableau, Power BI, or Google Data Studio allow underwriters to create and interpret data visualisations that make complex data sets more accessible and actionable.

> AI and ML Fundamentals: While underwriters don’t need to be data scientists, they should understand the basics of AI and ML, such as how these technologies process data, identify patterns and make predictions. Understanding these fundamentals enables them to better evaluate AI-generated insights and integrate them into their workflow.

> Model interpretation: It is crucial to understand the outputs of AI/ML models, including how to assess the accuracy, bias and reliability of these models. Underwriters should be able to question and validate the results provided by AI tools.

> Ethical data use: Underwriters need to be aware of the ethical considerations related to data use, including matters of privacy, bias and fairness. This involves understanding how data should be collected, stored, and used in a way that complies with legal standards and ethical guidelines.

> Data quality and integrity: Ensuring data quality is essential for reliable decision-making. Underwriters should learn how to assess data accuracy, completeness and timeliness.

AI and ML are enabling the development of highly personalised insurance products. By analysing individual risk profiles, insurers can offer customised policies that reflect the unique needs and circumstances of each customer. This level of personaliation not only improves customer satisfaction but also helps insurers manage risk more effectively.

One of the key advantages of AI and ML is the ability to learn and adapt through time. As more data becomes available, machine learning models continuously refine thus improving accuracy.

This continuous learning cycle ensures that underwriting and claims processes stay up-to-date with emerging risks and market trends, allowing insurers to remain competitive and responsive to change.

AI and ML are revolutionising the insurance industry, particularly in underwriting and claims processing, by bringing enhanced efficiency, accuracy and personalisation.

These technologies are shifting the role of underwriters from routine data processing to strategic decisionmaking, enabling them to focus on interpreting complex

“While underwriters don’t need to be data scientists, they should understand the basics of AI and ML, such as how these technologies process data, identify patterns and make predictions.’’

data insights, developing innovative products and optimising risk portfolios.

In the marine insurance sector, AI-driven solutions such as those offered by Concirrus are leading the transformation, providing insurers with the tools they need to navigate the complexities of the modern market.

However, as the industry embraces these advancements, it must also address the challenges of bias, transparency and regulatory compliance to ensure that the benefits of AI and ML are realised responsibly and equitably.

The future of insurance is undoubtedly digital and those who effectively integrate AI and ML into their operations will be well-positioned to lead the industry in the years to come. By partnering with companies such as Concirrus, insurers can stay ahead of market trends, improve operational efficiency and offer more personalised, data-driven products, ensuring they remain competitive and capable of meeting the evolving needs of their customers.

Vykundanathan, product manager at Noria AS, explains how investing in configurable software could be the answer to the insurance market’s legacy system problem and enable it to keep up with fast-evolving customers

Success in insurance is about adapting to change. New regulations, shifting customer demands, emerging market trends. Insurers have to be on their toes to stay competitive. The challenge is that many are stuck with decades-old, inflexible software systems.

Suppose you are an insurance provider intending to roll out a new product to cater to your customers’ changing needs, but your legacy software is so rigid and non-configurable that making even the smallest tweak becomes an ordeal.

The IT team becomes involved and dives into a tangled, spaghetti-like codebase. Six months later, you are still no closer to launching your new product.

Technical limitations are only the beginning. Non-configurable systems also make it a struggle to keep up with regulatory changes and industry trends.

People often wonder why the insurance sector appears to be evolving slower than parallel industries such as payments and banking. The answer lies in our legacy, non-configurable systems that simply cannot keep up.

By the time the IT team figures out how to make the necessary changes, the market has already moved on.

On the talent side of the equation, finding people who know how to work on legacy insurance systems will only become harder, like trying to find a mechanic who specialises in restoring vintage cars. The pool of qualified talent is dwindling and the costs just keep going up.

Perhaps the biggest challenge is around integration. We need to be able to seamlessly connect with all kinds of third-party services, from customer relationship management tools to data analytics platforms.

Non-configurable systems are holding insurers back from taking advantage of all the new insurtech solutions entering the market, expected to grow to $10.14bn by 2025.

The good news is that more companies are opting to purchase or implement configurable software as they seek enhanced flexibility, agility, cost efficiency, user empowerment and scalability without the cost of extensive redevelopment.

A report by Celent found that 72% of insurers have either implemented or are planning to implement configurable policy administration systems that allow for easy customisation and integration, streamlining policy creation, management and renewal processes.

The key benefit of configurable software is the ability to meet your clients’ demands for tailored software solutions. It allows businesses to customise features, workflows and interfaces without extensive coding, making it easier to adapt to changing requirements.

It empowers end-users and non-technical staff to make changes and tailored updates to the system without relying heavily on IT departments, leading to lower development costs, increased satisfaction and improved productivity.

Configurability is also about speed. It enables the rapid deployment

and modification of applications; a crucial capability in an environment where requirements can change quickly and businesses need to respond promptly to market demands.

This approach can also reduce development costs and time. Instead of building solutions from scratch, companies can configure existing platforms to meet their needs, resulting in significant cost savings.

Insurers are always looking for ways to differentiate themselves from competitors. Configurable software allows you to create unique, tailored solutions that provide a competitive edge in the market.

Configurable systems are better positioned to integrate with modern technologies and evolve through time, while new features and updates can be implemented faster through configuration rather than coding.

Additionally, cloud-based configurable software solutions provide accessibility, scalability and cost-effectiveness. The cloud allows businesses to leverage configurable software without needing extensive on-premises infrastructure.

Yes, implementing new, more configurable systems or making legacy systems configurable can be challenging and resource intensive. But, the costs are nowhere near as onerous as the ever-rising burden of maintaining legacy systems, especially when you factor in the opportunity costs.

A strategic approach involving thorough planning, modularisation and continuous improvement can help organisations successfully transform their business to meet modern demands.

At Noria, we recently took such an approach when onboarding a marine insurer to our cloud-based, highly configurable insurance platform, helping them migrate from their mainframe legacy system.

The entire onboarding process, from a signed contract to users starting to produce data on production, was completed in under five months; a real achievement in a sector where onboarding new insurers to a new system is a highly complex process.

This success was only possible because of the highly configurable nature of the Noria Insurance Platform, that allowed most business processes to be configured into the system with minimal or no coding involved. As a result, users can now perform their daily tasks more efficiently than before.

The journey towards adopting more configurable software solutions can seem daunting for insurers burdened by decades-old legacy systems. However, the process can be broken down into manageable steps to help ease the transition.

The first step is to carefully assess the current software ecosystem and identify the pain points that configurable solutions can address.

This may include challenges around product innovation, regulatory compliance, integration with third-party tools, or the ability to empower non-technical staff.

Understanding these pain points will help guide the selection of the right configurable platforms and implementation approach, or guide the decision to make legacy software configurable.

Next, research the configurable software options available in the market, evaluating their features, configurability, integration capabilities and total cost of ownership. Assess the vendor’s industry expertise, implementation track record and long-term product roadmap.

Pilot projects can then be undertaken to test the selected configurable solutions on a small scale, allowing your organisation to gain hands-on experience and validate the anticipated benefits before committing to a full-scale rollout. This iterative, agile approach helps minimise risk and ensure a smoother transition.

Throughout the process, it is crucial to secure buy-in from key stakeholders, including IT, business units, and executive leadership. Effective change management and training programmes will also be essential to empower employees to use the new configurable systems.

The rise in configurable software reflects a broader trend toward greater flexibility, efficiency and user empowerment in the digital world. This trend is likely to continue growing as technology evolves and businesses increasingly seek agile and adaptable solutions.

Configurable software is an adaptive technology that enables an adaptive workforce. With a highly flexible system that allows for rapid changes and control over business workflows, it helps employees become highly flexible and versatile, capable of quickly responding to changing conditions, technologies and business needs.

These legacy systems have been the backbone of the insurance industry for a long time. But the world has changed and insurers need to change with it.

They need to start investing in more configurable, adaptable software that can keep up with the pace of the industry. It is not going to be an easy transition, but the insurers that can stay nimble and responsive are the ones that will thrive as the landscape continues to transform.

Colin Lavelle and Reema Shour of Hill Dickinson LLP advise ship owners

and operators to take a close look at cyber wordings and exclusions in the maritime sector as

The global maritime industry continues to face an increasing risk of cyber-attacks that target both vessels, as well as ship owners and operators.

While the digitalisation of maritime operations has made them more efficient, it has also made them more vulnerable

The more that maritime and logistics businesses rely on interconnected systems and data exchange platforms to manage cargo movements, vessel operations and port logistics, the greater the risk of potential cyber threats, including supply chain disruptions, data breaches and ransomware attacks.

With the advent of autonomous ships and also the absence of onboard crew, the potential for one person onshore to be controlling hundreds of vessels with the help of artificial intelligence (AI) creates an even greater risk that hackers could steer an autonomous vessel off course, causing untold damage.

Some underwriters are already offering cyber insurance within their ‘all risks’ policies for autonomous vessels.

Ransomware activity is reported to have been the predominant source of cyber insurance claims generally in 2023 and that trend has shown no signs of abating in 2024.

In maritime, it has been estimated that about half of vessel operators have been exposed to some form of cyber-attack in the past three years, with most of the threats coming from Russia, China and North Korea. Some of these attacks have resulted in significant ransom payments.

As demonstrated by several much-publicised cyber-attacks on shipping companies in recent years, cyber incidents can be hugely expensive and can result in significant operational disruption and reputational damage.

Consequently, shipowners and operators must be proactive in addressing gaps in their cybersecurity – they cannot afford to make only minimal investments in cybersecurity or to have no (or inadequate) cyber insurance.

To this end, marine insurers have been extending the coverage they offer to include cyber risks. They are, in some cases, doing so by implementing clear and comprehensive cyber clauses into existing insurance policies to define the boundaries of coverage.

In recent times, concerted efforts in the marine insurance sector have resulted in a range of cyber provisions across different insurance classes, such as hull, cargo, specie and marine liability.

Reinsurers are also requiring cyber provisions in their reinsurance policies. In 2023, the Joint Excess Loss Committee of the Lloyd’s Market Association (LMA) produced a cyber clause designed specifically for the marine and upstream energy sectors.

The aim was to eliminate the need for separate underlying clauses and to address concerns around aggregation uncertainty, which gives rise to many reinsurance disputes.

However, while P&I cover usually has no express cyber exclusion and normal cover will respond to P&I liabilities arising out of a cyber-attack (as long as this does not come under the war risk exclusion), other more traditional marine insurance policies may exclude cyber cover.

Such an exclusion is often incorporated in the form of the Lloyd’s Market Association LMA5403 Marine |endorsement clause, which has effectively replaced the former CL380 Institute Cyber-attack exclusion clause since 2019.

Therefore, a standalone cyber policy is recommended. Many marine insurers are offering marine cyber insurance policies with specific coverage, risk management and cyber incident response service for the maritime sector, for example cyber hull insurance.

There are also cyber policies covering the specific cyber threats addressed by ports and terminals. Such policies are designed to address the fact that ship infrastructure and port activity are increasingly interconnected and reliant on operational technology, enhancing the risk of cyber-attack.

Specialised policies that cover a range of cyber threats, including data breaches and ransomware attacks provide a new revenue stream for insurers.

Furthermore, by working with cybersecurity experts to develop tailored risk assessment tools and mitigation strategies for their assured, insurers can help the assured to reduce their cyber exposure and prevent cyber-attacks before they occur.

“Insurers are looking to update their war exclusion for cyber coverage, specifically in relation to state-sponsored cyber-attacks.

The LMA has published various war, cyber war and cyber operation model exclusion clauses intended for standalone cyber policies.”

Among other things, insurers may use data analytics to better understand cyber security risks and vulnerabilities in the maritime and logistics industries and to make recommendations and give guidance to their assured on how to cyber-proof their businesses. These efforts and initiatives benefit both insurers and assureds by helping to reduce claims.

However, even standalone cyber policies may have exclusions. Insurers are looking to update their war exclusion for cyber coverage, specifically in relation to state-sponsored cyber-attacks. The LMA has published various war, cyber war and cyber operation model exclusion clauses intended for standalone cyber policies.

A cyber-attack in early 2024 on an Iranian vessel suspected of espionage activities in the Red Sea is just one example of the way in which cyber capabilities are being used to target shipping activity for political purposes.

Given the prevailing geopolitical landscape and ongoing global conflicts, the scope and effect of such exclusions is only likely to come to the fore in coming years.

Among other things, it may not be straightforward to determine whether an attack is state-sponsored or conducted by private criminal hackers. Nor may it be clear whether a

cyber-attack is an act of war.

The issue of attribution and questions of characterisation are likely to give rise to complex issues and, inevitably, disputes between insurer and assured.

The role of AI in cyber security should also not be underestimated. While AI systems in the maritime sector are as susceptible to cyber-attacks as those in any other industry and bring cyber challenges of their own, AI systems can also be used to improve cybersecurity, guard against threats, monitor crew behaviour and detect and block suspicious activities.

It has been estimated that global costs from cybercrime will exceed $10tn by 2025. Although shipping forms a small part of this amount, cyber-attacks in the maritime industry are becoming increasingly common and costly, both financially and reputationally.

Since 2022, the frequency of ransom payments in maritime has risen by 350%. Data in 2024 indicates that a cyber-attack in the shipping industry can cost the targeted organisation an average of $550,000 and shipping companies are paying an average of $3.2m in ransom.

The risk exposure for the targets and/or their insurers is considerable and it is in the best interests of marine underwriters and their assureds to work together to address the risks and minimise their exposure.

The inaugural Marine Insurance Nordics event was first held virtually in 2021 and was a resounding success. With a record number of attendees in 2023 , this event is specifically designed to bring together all the key players in the Nordic marine insurance market. The agenda it will feature a range of senior speakers discussing, debating and offering actionable insights into the issues affecting the region in 2024 and beyond.

08.55-09.00 Welcome Address: Grant Attwell, Managing Director, Cannon Events

09.00-09.20 Keynote Address: A Level Shipping Playing Field is a Serious A air Presenter: Christen Guddal, Chief Claims O cer, Gard

09.20-10.20 Panel Discussion: Seeing Red – New Risks in the Red Sea

With more than 90 attacks on shipping in the Red Sea, we examine the risks and the impact of the attacks on shipping patterns. We also consider the emerging risks for salvors attempting to operate in these waters and take a look at war clauses in the light of the new exposures.

10.20-11.20 Panel Discussion: The Unintended Consequences – Do Sanctions Really Work?

As neighbours to Russia, both the Nordics and also Turkey are impacted by the ongoing war between Russia and Ukraine. Two years on, new sanctions are being introduced to try to stem the tide of illegal ships transiting European waters. But, we ask in this session, will they work and what might the unintended consequences be? This session will include a look at the Andromeda Star case.

11.20-11.40 Presentation: The Investigation of Yacht and Superyacht Fires

The investigation of yacht and superyacht fires can be a complex process as they contain a large number of di erent systems and, dependent upon the construction of the superstructure, they are often significantly structurally a ected following a fire. This presentation will cover some of the main causes of fires on these vessels and the issues associated with modern water sports toys, which are often stored onboard yachts.

12.10-12.30 Panel Discussion: Energy – All Change Ahead?

Energy transition is particularly relevant to the Nordic market, where many projects are already underway. The marine insurance market is essential in enabling vessels to ply this new trade, so this discussion will centre on the new opportunities. It will include carbon capture, which could become a key market for the whole of the Nordics, but Norway in particular.

12.30-12.50 Presentation: AI in Practice

In this session, a technology expert talks with a customer about maximising the opportunities presented by new technology, the evolution of artificial intelligence in the marine insurance space and how that might impact on the underwriter of the future.

13.50-15.00Roundtable Sessions

15.00-15.20 Presentation: To be Compliant or Not to be? Sailing Close to the End of the First Calendar Year Under the EU ETS Regime

Since 1 January 2024, all cargo and passenger vessels calling an EU/EEA port for commercial purposes fall under the EU emission trading system (ETS). This session will address the challenges owners and charterers have shared with us when trying to navigate through the regulation and requirements to be compliant.

15.50-16.10 Case Study: The DALI Salvage

Examining the unique technical challenges posed and how the response is viewed through the OPA-90/ USCG Incident Command System.

16.10-16.30 Presentation: Dali – The Biggest Claim in Marine History?

The Dali incident in the Port of Baltimore shocked the world and could well result in the largest claim in marine history. Although the likely claims picture is only beginning to emerge, we look at the impact of the claim from the likely rises in rates at the upcoming renewals to the physical challenges posed by the incident.

16.30-17.00 Presentation: Resolving the Security and Collections Conundrum in Large Container Salvage and General Average Cases

In all large containership cases, the collection of security at the start is a crucial part of protecting the common interests in the maritime adventure. The industry needs to retain a global salvage industry. All of this underlines the importance of an e cient and e ective collections approach.

11.40-12.10, 15.20-15.50: Co ee break 12.50-13.50: Lunch 17.00: Close of conference