5 minute read

Wind of change

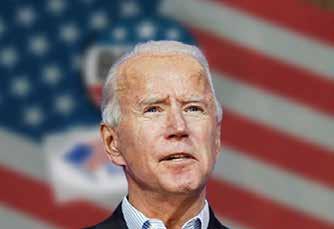

Stephen Barton, Chairman – Marine, Ed Broking, asks what the change of administration in the US means for the international shipping industry

Last year was one of unprecedented challenges in shipping as Covid-19 had a catastrophic impact in some sectors and a negative effect on all. So, does a change of administration in the US hold out any hope of better times ahead in shipping? Only time will tell but the initial signs might give cause for optimism, both domestically and internationally.

It would be wrong to imply that the outgoing President did nothing for shipping, particularly in port development grants and domestic ship-building. But the overwhelming impact on the industry was the ongoing trade dispute between the US and China. There are two sides to every story, but the Trump administration took centre stage.

Statistics show a very significant drop in volumes of goods exported from the US to China and this will have directly affected shipowners around the world, particularly in the shadow of the Covid-19 pandemic and a failure to compensate for its impact with increased volumes from other trading partners.

One of the Trump administration’s earliest acts was to pull out of the Trans-Pacific Partnership (TPP). This decision will be impossible to reverse because the TPP has now been overtaken by a new agreement – The Regional Comprehensive Economic Partnership. This, with China’s involvement, creates the largest trading bloc in the world. It does seem however that the Biden approach will be less protectionist and more focused on “free” trade. As we move towards a post-Covid-19 environment this must be seen as positive.

SHIPPING DIVIDEND

dividend arising from President Biden’s well-known credentials on environmental matters.

One of his first acts as President was to reverse his predecessor’s decision to leave the Paris Accord on Climate Change, which the US has now re-joined. President Biden has previously articulated the role shipping has to play in his decarbonisation plan during his election campaign.

Membership of the UN’s International Maritime Organisation (IMO) as a Category ‘A’ Council Member gives the US a leadership opportunity that it has not really been exercising with any real authority.

This is expected to change, particularly as the IMO moves towards its stated goal of reducing emissions by 50% by 2050, allied with President Biden’s stated interest in shipping becoming greener.

WHAT COULD THIS MEAN IN REALITY?

> Support for cleaner fuels such as Liquefied Natural Gas (LNG) and new methods of propulsion such as using fuel-cell technology to develop electrically powered ships (using hydrogen, ammonia for example); > Continued support for the development of the existing ports with a much greater emphasis on sustainability and accountability for measuring emissions; > Improving the immediate environment around ports; and, > Growing dependence on electrical power in all port activities.

The potentially big dividend for shipping, particularly but

One of the first acts of the Biden administration was to reverse the previous administration’s decision to leave the Paris Accord on Climate Change, which the US has now re-joined. President Biden has previously expressed the role shipping has to play in his decarbonisation plan during his election campaign.

NEW ENTRANTS

experience and the highly specialised vessels that will be required in some numbers to be able to realise the new President’s ambitions. The jack-up Wind Turbine Installation vessels that are essential to these projects are in limited supply and in great demand. South Korea for example has announced their commitment to constructing what will be the world’s largest offshore wind farm. Monaco headquartered and NYSE listed Scorpio Bulkers (now re-named ENETI) declared last August that it would quit the bulk carrier market, disposing of all its vessels to concentrate on the offshore wind market. ENETI is reportedly seeking to build four specialised installation vessels in South Korea. I mention this extraordinary move to illustrate the attraction of this sector and the interest of new entrants to the market. However, it should be noted that these will not strictly qualify as Jones Act ships. There is no doubt that the US has the capacity to mobilise its work force and economy to mobilise a ship construction programme and to deliver the tonnage that will be necessary. This will take time. For this reason, there may be a need for some pragmatism to access the right equipment and expertise in the initial phases of development. not exclusively domestically, is the development of Offshore Two Jones Act-compliant shipowners, Crowley and Wind Farms (OWF), an area where the US falls behind the EU. Great Lakes Dredge and Dock, have recently made

In another early policy announcement, the President announcements about their intentions to participate. launched his ‘Buy American’ initiative. This strengthens Crowley plans a logistical and project management existing legislation and creates new roles of responsibility joint venture with established onshore wind operator and transparency within the new administration. Watco. Great Lakes has ordered what will be the first US

The order very specifically highlights flag, Jones Act-compliant inclined fall pipe sub-sea rock the importance of Jones Act shipping, and installation vessel, a highly although not specifically included in the specialised key component for Presidential Order the development of “Membership of the IMO as a Category offshore wind construction offshore renewable energy has been projects. Great Lakes has also referenced in this context. ‘A’ Council Member gives the US a declared offshore wind to be a strategic growth area and has CLOSING LOOPHOLES leadership opportunity that it has not appointed a Head of Offshore Wind Promising to close existing loopholes, this to lead its programme. is what some commentators have described really been exercising with any real Offshore wind is a rapidly as an “unprecedented” level of support and growing sector and it is easy to endorsement of the maritime sector within authority. This is expected to change, envisage perhaps decades of growth the very early days of the new administra- as the demands for sustainable clean tion. This has been warmly welcomed by particularly as the IMO moves towards its energy seem likely to rise both the ship-owning and ship-building exponentially. As well as the concommunities in the US. stated goal of reducing emissions by 50%.” struction of new specialised units,

On the face of it this is all great news the demand could provide much for the domestic shipping community, and needed employment for the shipyards across the US. There is however a Stephen Barton, beleaguered OSV sector, as well as potential difficulty. Ed Broking dredging and other support

Currently the US does not have the functions.