5 minute read

CHED-13 TAPS HEIS, PARTNERS FOR TYPHOON RESPONSE

The Commission on Higher Education (CHED)-Caraga is gearing towards a needs-based, demanddriven approach to assist typhoon-affected constituents in the higher education sector in the region.

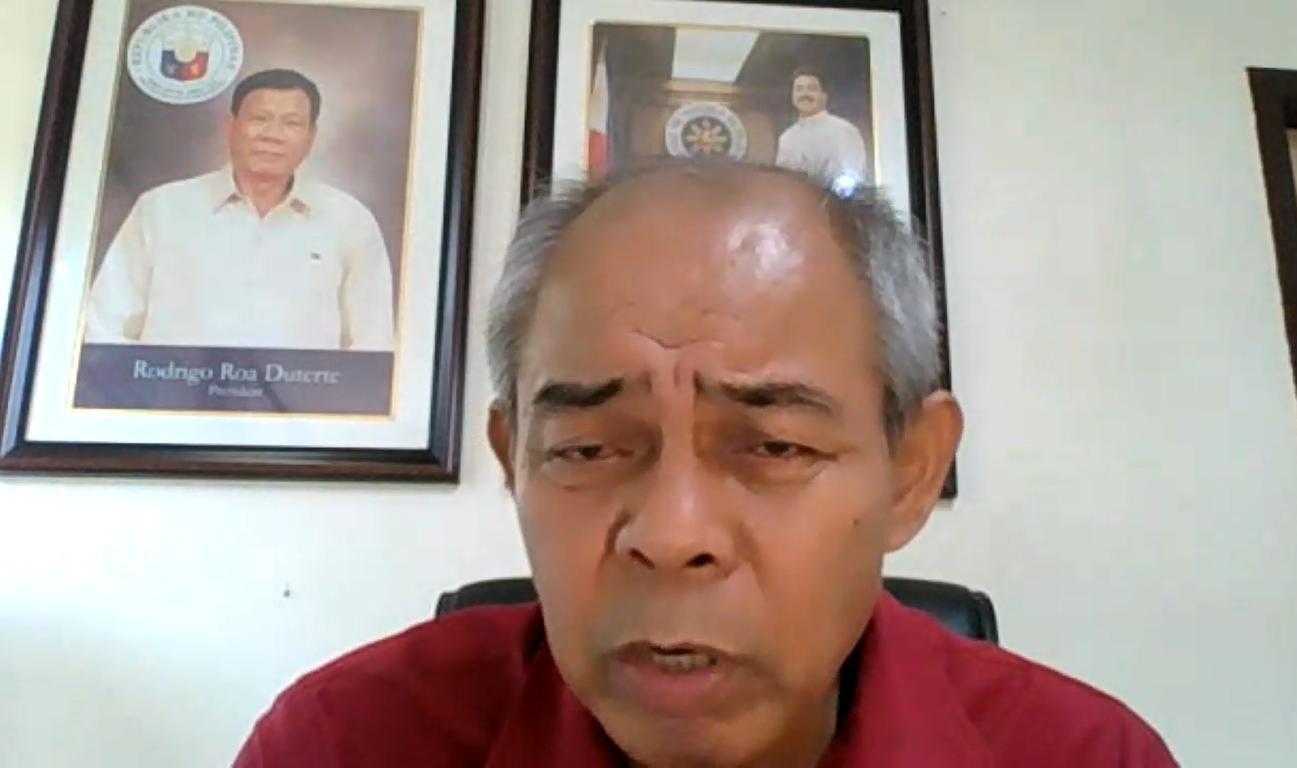

CHED-Caraga regional director Dr. George Colorado on Monday, February 14, in an interview with PIACaraga, said that they will be working closely with higher education institutes (HEIs) and CHED scholars in the region to solicit their inputs and come up with a comprehensive strategy to address the specific needs of typhoon-battered schools and students, especially those in the provinces of Surigao del Norte and Dinagat Islands.

Advertisement

“I think that it would be better that [solutions]

Colorado

would come from them because it will strengthen their determination to implement them later on,” said Colorado.

After the onslaught of the typhoon, Director Colorado and his personnel immediately visited affected areas, particularly in Siargao Islands and the Bucas Grande Islands in Surigao del Norte, to assess the schools.

As of press time, CHED-Caraga has estimated a total of PhP344,555,704.07 in damages sustained by HEIs across the region and PhP91,288,000 in the municipality of Socorro and the rest of Siargao Islands, and recorded an estimate of PhP383,274,063.03 in rehabilitation needs.

As part of their initial interventions, scholars and grantees continue to receive funds from their respective programs to help support their needs during the disaster. The regional director has instructed HEIs to utilize the funds downloaded to them for mobilizing

faculty members to personally reach out to their students and personally assess their situation.

As for learning continuity, submission of school requirements has relaxed in all affected HEIs.

“Our response to this is the same as when we experienced the first wave of the COVID-19 pandemic. We relaxed on the requirements, allowing the students to tackle the courses beyond the term, if necessary,” said Colorado.

“They may not be able to submit their requirements within the semester, it’s alright to extend the semester. They can still enroll in their subjects and continue submitting the requirements for the previous semester,” he added.

Schools have also initiated their own interventions for both their students and faculties. Universities and colleges that offer social work/health programs rendered psychosocial support for their students. Others offered their facilities to help faculties in need of temporary shelter.

CHED-Caraga convened those involved in the higher education sector to map out its interventions for schools affected by the disaster in a press conference on Friday, February 18. They are yet to make a statement on this.

Colorado said they will look into their linkages and networks to expand their response and ensure that help will be given to all those affected in the sector, and expressed that they are open to collaborating with former scholars who wish to extend help.

“The network is there, our government system is existing, our connections abroad, our alumni students looking after their schools, they will respond,” said the CHED-Caraga chief. They are also eyeing approaches “outside the box’’ and will look into areas where they may conduct advanced research to tackle various issues.

As for students and their parents, Colorado commended the resilience they have shown despite their situation. While solutions are still in the works, he appealed for their patience.

“This is not a onetime approach to the problem. We will take the root of the problem. We have realized that one big shot help is not sufficient for these students to graduate,” he said.

“It is going to be a long battle. They need themselves to sacrifice and be patient, and prepare themselves for a long haul,” he added.

“We are assuring them that we will do what we can.” (DMNR/PIACaraga)

SEC approves Bank of Commerce IPO, SMC bond offering

The Securities and Exchange Commission (SEC) has considered favorably the initial public offering (IPO) by Bank of Commerce and fixed-rate bond offering by San Miguel Corporation (SMC).

In its February 15 meeting, the Commission En Banc resolved to render effective the registration statements of Bank of Commerce and SMC covering 1,403,013,920 common shares and up to P60 billion in fixed-rate bonds under shelf registration, respectively, subject to their compliance with certain remaining requirements.

Bank of Commerce will offer to the public up to 280,602,800 common shares priced at up to P12.50 per share. The shares will be listed on the Main Board of the Philippine Stock Exchange (PSE).

The bank expects to net about P3.34 billion from the offer. Proceeds will be used to fund the bank’s lending activities and finance capital expenditure requirements, in connection with upgrading its automated teller machine (ATM) fleet and core banking system. Any remaining proceeds will be used for the acquisition of investment securities to meet regulatory liquidity requirements.

A subsidiary of SMC, Bank of Commerce provides banking products and services in deposit, commercial loans, credit card services, consumer banking, corporate banking, treasury, asset management, transaction banking, and trusts and investments. It has a network of 140 branches and 257 ATMs, as of September 30, 2021.

The IPO will run from March 7 to 15, with listing on the PSE scheduled for March 23, according to the latest timetable submitted by the bank to the SEC.

Bank of Commerce engaged BDO Capital & Investment Corporation, China Bank Capital Corporation, Philippine Commercial Capital, Inc. (PCCI), and PNB Capital Investment Corporation as the joint issue managers, joint lead underwriters, and joint bookrunners for the transaction.

SMC may issue the P60billion fixed-rate bonds in one or more tranches within three years.

For the first tranche, the listed conglomerate will offer to the public up to P25 billion of five-year Series J bonds due 2027, with an overallotment option of up to P5 billion of seven-year Series K bonds due 2029.

Assuming the overallotment option is fully exercised, SMC could net up to P29,632,386,875 from the offer. Proceeds will be used for the refinancing of shortterm loan facilities of the company and for other general corporate purposes.

The bonds comprising the first tranche will be offered at face value and will be listed on the Philippine Dealing and Exchange Corp. on March 1, based on the latest timetable sent to the SEC.

SMC tapped BDO Capital and China Bank Capital as joint issue managers for the offering. They will work alongside BPI Capital Corporation, PCCI, PNB Capital, RCBC Capital Corporation, and SB Capital Investment Corporation as joint lead underwriters and bookrunners. (SEC/PIACaraga)