Q2 2023 Market Report

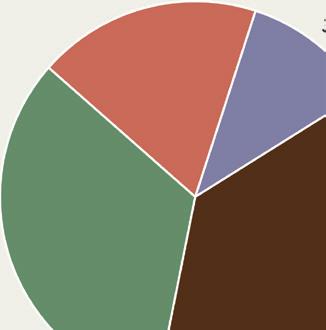

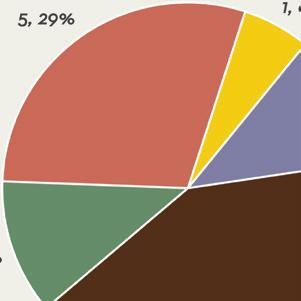

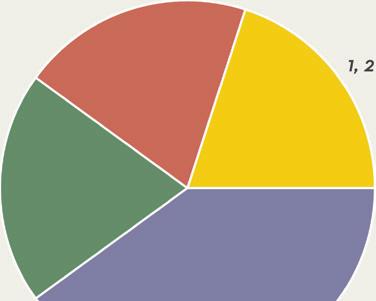

Carmel-by-the-Sea & Carmel Point ■ Greater Carmel ■ Carmel Valley

■ Pebble Beach ■ Carmel Highlands Big Sur & South Coast

Carmel-by-the-Sea & Carmel Point ■ Greater Carmel ■ Carmel Valley

■ Pebble Beach ■ Carmel Highlands Big Sur & South Coast

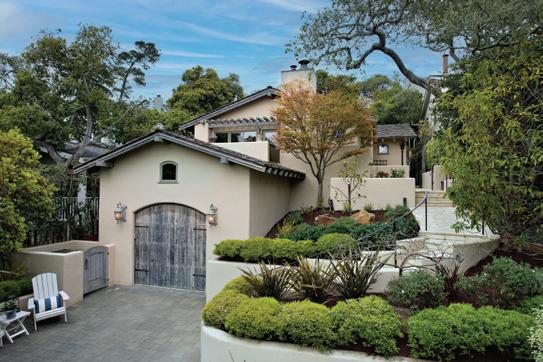

03 Carmel-by-the-Sea & Carmel Point

07 Carmel Valley

09 Pebble Beach

11 Carmel Highlands, Big Sur & South Coast

03 Carmel-by-the-Sea & Carmel Point

07 Carmel Valley

09 Pebble Beach

11 Carmel Highlands, Big Sur & South Coast

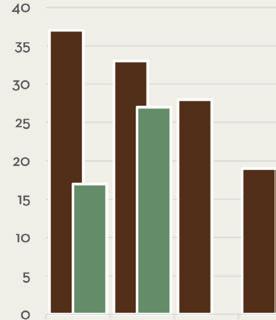

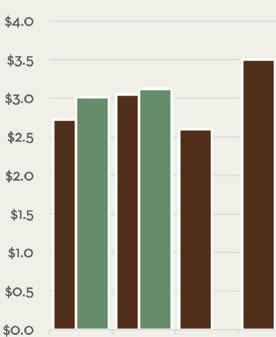

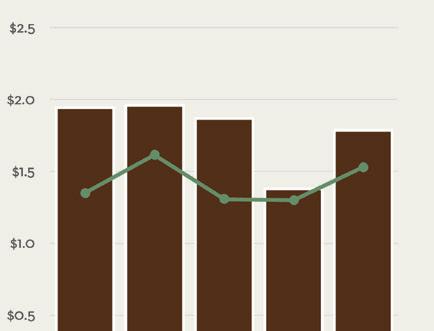

e Monterey Peninsula experienced a strong rebound in the second quarter of 2023 a er almost nine months of slow activity. Beginning in Q4 of last year, transaction and dollar volumes in most markets across the Peninsula were down over 50% year over year. However, in this second quarter of 2023 we saw the amount of sales increase by 25.7% and the total sales volume was up 29.3% in comparison to the rst quarter of this year. While volume levels are still down year over year, we are beginning to experience a much healthier market. is market is beginning to perform like it did in 2019 prior to the Covid initiated spikes. e fear over the banking crisis and other macro-economic concerns appears to be tapering. e impact our market experienced from months of heavy rain and inclement weather is behind us and the demand for living on the Monterey Peninsula remains high.

As you might expect the gradual rebound from a slow market varies by area. is quarter, Carmel-by-the-Sea experienced an increase of 58% in units sold and 71% in total dollar volume over the last quarter. Carmel-by-the-Sea is now only down 15% year over year in total dollar volume, while the greater Carmel area is down 72% and Paci c Grove is down 26% year over year. Pebble Beach also remains down 35% year over year, however, our company alone has experienced a meaningful improvement in homes going into escrow in June and we expect a much healthier Q3.

We expect the momentum to continue through summer and hopefully into next year. Many of the conditions are in line for a healthy market, however, inventory is still down 50% from pre-Covid periods. While this negatively impacts the number of transactions it is good for retaining home values. In our key markets we only experienced high single digit decreases in home values in the last year, and that is a er those same markets experienced 30-40% increased between 2020-2022.

e current market conditions are improving but remain very dynamic. It is essential to have a strong command for exactly what is happening in each market and price point. Our inhouse analytics team tracks dozens of variables in real time and reviews them regularly with our team of professional agents. ere has never been a more important time to ensure you are being represented by the very best. We hope you will reach out to our team with real estate activity you, your friends or family may be considering.

e following report breaks out the seven markets we track with additional performance detail. We hope you will nd this report informative.

Usanditia ne endem. Es ellictor sitat andendam et quae omnimendamus il ium sapieni mustenis rerat pera et utes corerem nimus et, testrum faccusandus.

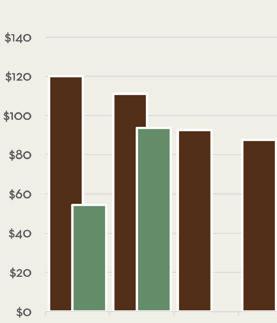

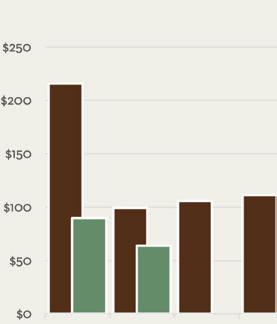

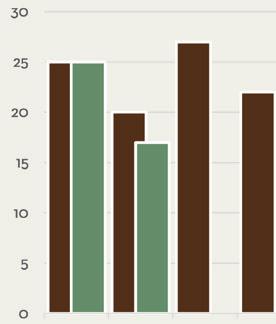

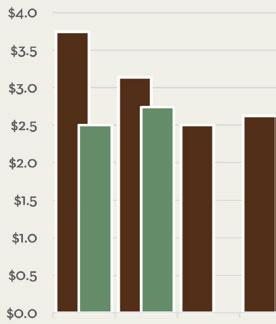

Carmel-by-the-Sea rebounded in Q2 a er an extremely slow rst quarter of the year. e total number of sales crept back to 27, up from 17 and 19 in the two previous quarters, but still well below the typical average in the mid-30s to low 40s. Average sale price was strong in Q2 2023 at $3.47M. is marks the second highest out of the last six quarters. Five sales over $5M was back to the typical level of high-end sales a er we saw just one such sale in Q1 2023.

Tate nonsequi doloris sus natem debis mos earcipsapid quia volum que si acestem unt quos volor mo ma veliquam harum re ne laut accus alic tentis eos a simpos apiet eum fuga. Ut quiae simincit aut omniantiis dem rerehenem ipit quat il ipsum re ni optatur, con necabore magnatur, niae. Omnim debit et occum quidel ius ma diorepeliat vendio enest, con core voloratiam qui o ciis dolupiet lignate nisquas quam, corendae magniet o cimos mi, que occat minus, ommo cone omnitem volorest eictian destem. At o cie nditiore quassita idelit quiam, cuptatati dolorestio volorrovide sitiur as as expeles ratiasperis eaquo

Average Selling Price

$3,468,153

8.1% 3.1% versus Q1 2023 versus Q2 2022

Days on Market

37 23.3% 362.5% versus Q1 2023 versus Q2 2022

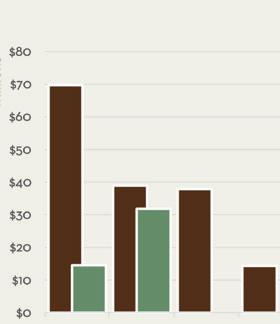

Sales Volume

$93,640,131

71.7% 15.7% versus Q1 2023 versus Q2 2022

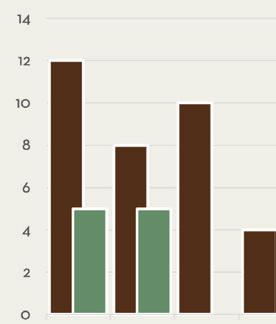

Units Sold

27

58.8% 18.2% versus Q1 2023 versus Q2 2022

Did You Know?

Carmel-by-the-Sea’s one-square mile village is as unique in charm as it is in fun facts. No high heels law, no street addresses, Clint Eastwood was once mayor, and Doris Day helped make Carmel dog heaven on Earth.

e areas outside of Carmel-by-the-Sea & Carmel Point

e greater Carmel area experienced yet another tough quarter, tallying just 13 sales. is marks four consecutive quarters below typical sales levels. Eleven of the 13 sales fell in the $1M-2M range with just one sale above $3M for the quarter. With $44.4M in total sales volume thus far in 2023, the greater Carmel area is on track for its lowest level in this category since 2012.

Average Selling Price

$1,692,258

9.4% 44.3% versus Q1 2023 versus Q2 2022

Days on Market

31 42.6% 24% versus Q1 2023 versus Q2 2022

Sales Volume

$21,999,355

1.8% 72.1% versus Q1 2023 versus Q2 2022

Units Sold

13 8.3% 50% versus Q1 2023 versus Q2 2022

Did You Know?

Point Lobos State Reserve near Carmel hosts a geologic wonder: rocks of four “ages” can be found there, including the unusual Carmel formation dating back to the Paleocene age (over 60 million years old).

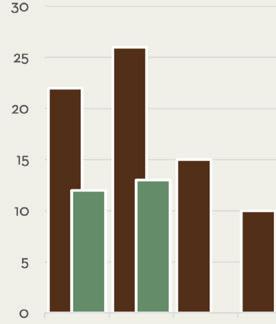

Including e Santa Lucia Preserve

A er six months of slow sales, Q2 bounced back to healthy levels in Carmel Valley. Fi y-three total sales mark the most since Q2 of 2022, up from 39 and 34 in the two previous quarters. While average sale price ($1.785M for the quarter) was down 8.2% year over year, it was up 29.6% from Q1 2023. A er zero home sales over $3M in Q1, we saw 10 such sales in Q2, showing high priced buyers are coming back to the area. Carmel Realty Company had a hand in four of the top seven sales in the area for the quarter, two of which were double ended.

Average Selling Price

$1,785,639 29.6% 8.2% versus Q1 2023 versus Q2 2022

Days on Market

49

7.5% 63.3% versus Q1 2023 versus Q2 2022

Sales Volume

$94,638,850

76.1% 21.5% versus Q1 2023 versus Q2 2022

Units Sold

53 35.9% 14.5% versus Q1 2023 versus Q2 2022

Did You Know?

Monterey County is the largest grower of Chardonnay in the United States and the largest grower of Pinot Noir in California. Monterey County has 349 vineyards, 82 bonded wineries and 65 tasting rooms.

High-priced sales remained hard to come by in Pebble Beach during Q2 2023. Just one sale over $10M occurred in Q2, closing on the last day of the quarter, with Carmel Realty Company representing both seller and buyer. Just 17 sales and $63.8M in total sales volume closed in the quarter, each result being the lowest in the area over the last three years. irty homes remain on the market heading into Q3, the most over the last nine months. is includes 15 homes over $5M, four of which are over $10M. ere are a few healthy sales currently in escrow and expected to close in Q3, indicating a much stronger quarter ahead in Pebble Beach.

Average Selling Price

$3,751,294

4.4% 24.3% versus Q1 2023 versus Q2 2022

Days on Market

48

41.2% 17.1% versus Q1 2023 versus Q2 2022

Sales Volume

$63,772,000

29% 35.7% versus Q1 2023 versus Q2 2022

Units Sold

17 32% 15% versus Q1 2023 versus Q2 2022

Did You Know?

e Lone Cypress tree, located on 17-Mile Drive in Pebble Beach, is a scenic landmark for the Peninsula and is nearly 300 years old. Monterey Cypress trees are a species native only to this region and can live up to 4,000 years.

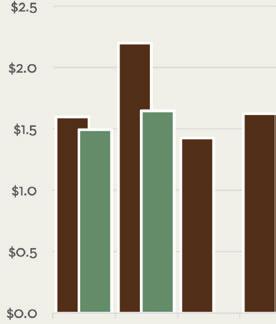

Five closed sales during Q2 matched the previous quarter and was down from eight in Q2 2022. $24.5M of the $31.9M in total sales volume for the quarter came from a single sale in Big Sur. With the remaining four sales making up just $7.4M, the median sale price dropped to $1.55M for the quarter. Eleven of the 15 active listings on the market are above $3M in list price.

Average Selling Price

$6,380,000

118.5% 30.9% versus Q1 2023 versus Q2 2022

Days on Market

78

27.1% 8.2% versus Q1 2023 versus Q2 2022

Sales Volume

$31,900,000

118.5%

18.2% versus Q1 2023 versus Q2 2022

Units Sold

5 no change 37.5% versus Q1 2023 versus Q2 2022

Did You Know?

e Bixby Bridge in Big Sur was built by prisoners eager to earn “good time” o their prison sentences. It is one of the world’s highest single-span bridges at 714 feet long by 260 feet high.

Carmel Realty Company was founded in 1913, predating the incorporation of the City of Carmel. For four generations since then, e Mitchell Family has been a leader in the Real Estate market in Carmel and Pebble Beach. When the Mitchell Family sold their billion-dollar real estate company, e Mitchell Group, to Sotheby’s International Realty in August 2005, Dan and Shelly Mitchell Lynch purchased Carmel Realty Company in order to continue its century of quality and rich tradition as local, luxury real estate experts. e goal was to remain local business owners and to maintain the family’s impeccable position in the local real estate market. Carmel Realty Company is the oldest real estate company in Carmel with a rich history and heritage of being family-owned and a reputation for integrity, longevity and excellence. Our longevity is no accident. It is an incredible brand and brand name. Carmel Realty Company has been in business since 1913, and we operate upon the principles of integrity, work ethic, teamwork, collaboration, communication and customer service. We are very excited and proud of the company, the vision and our team of professionals who have been hand-picked, proven and benchmarked as the best in the business.

As the market leading luxury brokerage, for over 100 years we have consistently delivered outstanding quality and service to our clients. Our handpicked team of agents share our commitment to quality, integrity, and the community. Unmatched experience, local knowledge, and collaboration has allowed our team to achieve the highest average agent production in the market year a er year.