that road too.

that road too.

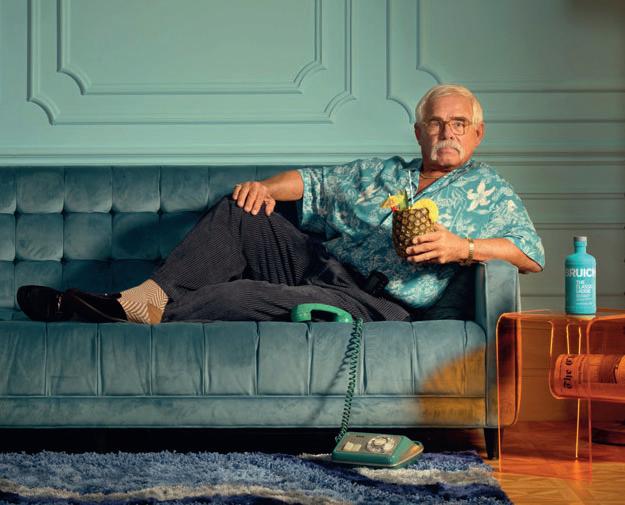

Brakes has launched a £1 million campaign to reward independent businesses over the Christmas period. Customers can receive up to £1,000 in cashback, and there are chances to win bonus cash prizes.

Paul Nieduszynski, Sysco GB CEO, said: “We believe that this is a real Christmas cracker of an offer.”

The initiative is part of the company’s mybrakes rewards programme, which was relaunched in 2023 to offer customers a more personalised rewards experience, offering cash rather than points.

More than 14,000 Brakes customers have signed up for the programme.

Brakes has also unveiled a second tranche of new products for Christmas, adding 30 to the 100 that had already been introduced.

In other news, Brakes has launched a range of almost 60 fresh beef products under its new Birchstead brand.

Sourced from British and Irish farms, the range features a variety of products, from steaks and joints to mince and burgers, along with a premium selection of dry-aged cuts. There are two tiers of products: Birchstead and Birchstead Reserve.

All partner farms supplying Birchstead beef are accredited by Bord Bia or Red Tractor.

JJ Foodservice is planning to open more branches in London.

Speaking at the wholesaler’s recent supplier conference, chief operating officer Kaan Hendekli said: “We’re committed to expanding our physical presence with new branches in London, presenting exciting growth opportunities for suppliers.

“We’ll also pursue targeted acquisitions in key sectors to enhance our capabilities and strengthen market influence.”

JJ is also set to expand its product range by 67%. It currently offers 3,000 lines and plans to increase this to 5,000. Some of the additions will cater to the Korean, Thai and Japanese food sectors,

‘We’re committed to expanding our presence with new branches.’

which are expected to grow over the next five years.

Hendekli said: “Our Advance Order marketplace will ensure nationwide availability of the expanded range, boosting both visibility and sales.”

The wholesaler reported 15% growth in its Advance Order marketplace and a 41% boost in JJ Home, which now features 900 lines.

JJ Foodservice is expecting the eating-out market to bounce back. Chief product officer Sezer Ozkul said: “With inflation easing, consumer confidence is beginning to return after two years of belt-tightening. The eating-out market is finally ready for a comeback.”

In other news, JJ Foodservice has launched a campaign to raise awareness of its MSC fish and seafood range and educate customers about the benefits of MSC-certified products.

JJ’s MSC range will be promoted on its website, app and social media.

SJB Foods has joined Fairway Foodservice.

Based in Sidmouth, SJB Foods supplies caterers throughout Devon and Somerset with a comprehensive range of ambient, chilled, non-food and frozen products. The company is led by father and son team, Stephen and James Berisford.

Fairway MD Coral Rose, said: “We are delighted to welcome SJB Foods to Fairway and look forward to working with Stephen and James Berisford. They operate a successful wholesale business, and deliver an excellent range combined with exceptional service levels to their broad customer

base. The buying, marketing and brand support that we will provide to the SJB Foods team will actively boost their ongoing success.”

Stephen Berisford added: “Joining Fairway Foodservice marks an exciting new chapter for SJB Foods. This partnership provides us with the opportunity to maintain our personal, community-focused approach, while also benefiting from Fairway’s vast industry experience, resources and buying power.”

He added: “As a family-led business, we take great pride in our strong local roots and our longstanding commitment to supporting independent caterers throughout Devon.

“It’s been especially rewarding to have my son, James, working alongside me for several years now.”

As Cash & Carry Management went to press, Bidfood warehouse workers were to be balloted on industrial action after pay negotiations broke down.

The Unite and GMB unions rejected the wholesaler’s £12.50 per hour pay offer and were preparing options for a jointly coordinated industrial action ballot.

GMB said that Bidfood “has decided to stop negotiating with the joint trade unions and has even gone so far as to rule out going into mediation at ACAS”.

Bidfood provides ‘food supply solutions’ for the Army, both domestically and abroad, and the unions wrote to Maria Eagle MP, one of the ministers covering the MoD, to highlight the issue.

The letter said: “Our members are the drivers and warehouse pickers that ensure this food gets to our

armed forces.

“GMB and Unite are currently in dispute with Bidfood over pay. Our members have jointly rejected a pay offer of a 50p per hour increase.

“Ten warehouses across the country would have a new rate of pay of £12:50 per hour. This is simply not enough to maintain a positive differential with the National Minimum Wage.

“Bidfood posted an operating profit of £57 million in 2023, they paid £18 million in dividends and reported strong revenue growth. They can afford to do better for the workers keeping our armed forces fed.”

Bidfood has not yet commented on the dispute.

United Wholesale Scotland has restructured its trading department and is putting renewed focus on its symbol operations Day-Today and USave.

The trading team, which is headed up by commercial director Anshu Chandra, has seen several promotions.

Chris Hewitt, formerly trading director – impulse, has been made senior trading director responsible for impulse, tobacco & vapes, chilled, fresh and frozen.

Normal Donaldson is trading director (licensed) while Bobby Gill is trading director (grocery). Anjum Mall is trading manager, and Naeem Khaliq is symbol group controller.

Three more members of staff at the Glasgow-based wholesaler have new job roles: Tanvir Moughal is supply chain & administrations manager, Adil Abbas is

trading & promotions manager, and Jordan Mclay is operations & finance analyst.

Chandra said: “The last five years were extraordinary for our business in terms of strong partnerships, opportunities and growth. Our next five-year plan is to accelerate the growth and the momentum. With the new structure in place, we are making sure that the team is fit for the future.”

Parfetts has awarded its employees a 12% profit share bonus. This follows an 8% increase in turnover to £696 million in the latest financial year.

The employee-owned wholesaler will share the bonus this month with all qualifying colleagues. The bonus comes in addition to the 4% sales growth bonus paid in July and a 10% company-wide pay rise awarded in April 2024.

Parfetts is growing rapidly with the launch of an eighth depot in Birmingham last year and over 1,300 retailers in its Go Local fascia.

Guy Swindell, joint managing director of Parfetts, said: “Our colleagues work

hard to ensure our retailers have the support they need to grow their businesses. Thanks to their efforts, we continue to go from strength to strength and deliver the service that attracts retailers from across the industry to partner with us.

“The trading environment is still challenging for retailers, and we are committed to

doing all we can to provide great value and industryleading service. We know that their success is our success. That’s why we continue investing in our people and service.”

Noel Robinson, joint managing director of Parfetts, added: “Many of our staff work with us for their entire careers, and our retailers benefit from this expertise across the business. It’s a can-do culture focused on delivering the best possible outcome for every customer.”

In other news, Parfetts has launched an exclusive Go Local cooking sauce range.

There are four variants –

Jalfrezi, Tikka Masala, Tomato & Basil, and Tomato & Chilli – all in 350g jars, price-marked at £1.49. Retailers can purchase the cooking sauces at £5.99 for a case of six, giving a 33% margin.

The Go Local range is expected to expand to more than 200 lines by the end of the year.

Country Range Group has welcomed its first foodservice wholesale member from mainland Europe.

Established in Spain in 1987, Europ Foods was set up by Johan van Barneveld and Robbert van Barneveld to supply the growing number of chefs, cooks and foodservice operators catering to the Mediterranean coastal tourist trade in the late ’80s and ’90s.

Today, the business has an annual turnover of £60 million, 200 team members including a multi-lingual salesforce, and a network of

One Stop, a subsidiary of Tesco, is phasing out its current own-label products and replacing them with Tesco’s core own-brand range across its portfolio of 1,000+ stores. Tesco’s core own-brand range will also be available on Deliveroo, Just Eat, Uber Eats and Snappy Shopper. This will open up access to customers further afield than the retailer’s immediate trading area.

In other news, 38 colleagues from One Stop took part in a charity challenge through the Yorkshire Three Peaks for BBC Children In Need, raising over £25,000.

offices, depots and partners supplying tourist destinations on the Spanish coast from Huelva to Barcelona, Portugal’s Algarve, the Balearics and the Canary Islands. The company’s head office is in Alicante.

Europ Foods specialises in offering a selection of British and Dutch food products and ingredients, alongside on-trend products from around the world.

The company also offers a wide selection of meats, cut to size by its team of professional butchers, and a pre-cooked convenience

meal range created by inhouse professional chefs.

Two other new members of CRG are family businesses Country Valley Foods, of Stockton-on-Tees, and First Choice Foodservice, of Burton upon Trent.

Country Valley Foods was established in 1971 as Teesside Frozen Foods to supply frozen foods to small local supermarket chains. The firm moved to Darlington in 1986 and rebranded as Country Valley Foods.

With strong growth, the business took on a second site in Stockton-on-Tees and in 2017 it became the company’s HQ.

Country Valley Foods now offers a range of fresh meat, dry goods, chilled, frozen and janitorial supplies to the hospitality, retail, education and healthcare sectors. It generated £29 million in turnover in 2023.

The subject of a management buyout in 2005, First Choice Foodservice serves thousands of customers in

the Midlands in the public and hospitality sectors, and is on track to achieve a turnover of £23.8 million in the current financial year.

Operating out of a 35,000 sq ft warehouse, the wholesaler has a portfolio of over 4,500 fresh, chilled, frozen, ambient and non-food lines.

In other news, CRG has recruited Tracey Redfearn as head of marketing (interim).

Redfearn (below) will work with the established marketing team to enhance their ongoing campaigns and drive innovative strategies.

Redfearn’s 34-year career has included over 23 years at Nisa-Today’s, plus stints at Nisa Retail and Unitas.

More than 700 meetings took place between Sugro’s members and suppliers at its recent networking event and business conference.

Held in Newcastle-underLyme, the two-day event commenced with a business conference that featured speeches from industry executives, as well as Sugro’s leadership team, who outlined the group’s key initiatives and accomplishments over the past year.

Yulia Petitt, head of commercial & marketing, said: “With the current year-todate growth of 12% year on

year, and with substantial multi-million turnover business done on the day of the networking event, I believe that the group is set for another successful year of growth.”

A highlight of the event

was the Sugro member anniversary awards, which went to: North West Wholesale (10th anniversary); C&S Distributions (20th anniversary); Becsco (25th anniversary); and Youings Wholesale (140th anniversary).

Sugro also recently announced that it has joined forces with one of its members, Rayburn Trading, to supply an extensive range of toiletries, household items, personal care essentials and medicated goods to other members of the buying group.

Kitwave Wholesale Group has acquired Creed Foodservice for an undisclosed sum.

The move will see Creed Foodservice take on the principal role within Kitwave’s Foodservice division, which includes the trading operations of David Miller Frozen Foods, Total Foodservice, MJ Baker Foodservice and Westcountry Food Holdings.

With Creed’s scale, Kitwave’s Foodservice division will see depot numbers increase to 10 (16 including the on-trade business). This will further establish the business as a national distributor with a total customer base of 10,700 across education, healthcare, leisure, hospitality, business and industry, and out-of-home sectors. Annual revenues are approaching £275 million.

There will be no changes to the Creed depot; operational, sales and head office

teams; management team; and board.

Chris Creed remains CEO of Creed Foodservice, with Philip de Ternant continuing as chairman, responsible for the integration into the Foodservice division.

Miles Roberts continues as MD. Philip Creed, the other family member involved in the business, will still support the company’s sustainability initiatives.

Chris Creed commented:

“We have been evaluating our plans to take our business to the next stage for some time now.

“Our objectives have always been to keep the Creed name, remain a member of the Country Range Group, secure the right investment, and strengthen our infrastructure and capacity to secure our long-term growth, and I’m pleased to say that all these goals have been achieved.”

Unitas Wholesale has appointed Nick Shaw as finance director. He replaces Richard Bone, who left Unitas in the summer to join Parfetts as commercial director.

Shaw joins Unitas from Glen Dimplex Consumer Appliances Europe where he was finance director for seven years. Before that, he held finance director positions at several businesses including Roberts Radio and Morphy Richards.

His appointment at Unitas completes the reconfigured executive team alongside retail director Victoria Lockie who joined the group last month, managing director John Kinney and trading director Cheryl Hope.

In his new role, Shaw will oversee key aspects of the Unitas ‘fitter, faster, fairer’ strategy. This includes the integration of a new finance portal and central invoicing

Bill Capper, former managing director of Capper & Co and a former chairman of the National Guild of SPAR, has died.

Based in Glamorgan, Capper & Co was established in 1901 as a grocery wholesaler and became the SPAR wholesaler for South Wales in 1959. Bill’s father, John, was one of the founding directors of SPAR in the UK.

Capper (pictured) began his career with SPAR in 1964, joining the family business after university. Four years later, at the age of 25, he took over as MD following the untimely death of his father.

Under his leadership, the company grew to service 500 SPAR stores, covering areas from South Wales to Gloucester, Oxfordshire, Sussex, Kent, and south of the River Thames.

Capper served two terms as chairman of the National Guild of SPAR, and in 2006, he became the executive chairman of Capper & Co.

system, which is designed to simplify the invoicing process for suppliers and improve the speed and accuracy of payments for members.

After the acquisition of Capper & Co by AF Blakemore & Son in 2011, he joined the AF Blakemore board of directors, retiring in 2016 after 51 years with SPAR.

In recognition of his contributions to business and the community in Wales, he was awarded a CBE in 2006.

The Scottish Wholesale Association (SWA) is partnering with Renault Trucks and contract hire firm Vertellus to offer members – both wholesalers and suppliers – the opportunity to rent a fully electric Renault E-Tech D 18tonne HGV for 12 months at the near equivalent cost of renting a diesel HGV.

As an added incentive, Vertellus is also supplying the required charger, but members can claim back £3,000.

Five vehicles (rigid, curtainsider or refrigerated) have been made available to the SWA, and interested members must have ordered their vehicle and take delivery by early December.

Ylva Haglund, the SWA’s head of sustainability, added:

“The offer is for a 12-month trial rental period, with a breakout period after three months, the hope of which is to build confidence within the wholesale channel and help transition members to net-zero fleets as part of their ongoing vehicle replacement strategy.”

In other news, Mark Murphy Dole has reduced its food waste by 33% after

Leicester-based Mason Food Service has joined Sterling Supergroup.

Mason Food Service has been serving caterers in Leicestershire since 1945. It started out as a small fresh fish and poultry business and developed its offering to include fresh bakery, ambient, chilled, frozen and cleaning products.

The business is now run by the grandson of the founder Reg Mason. George

Mason is said to have taken the company to the next level, including a rebrand in 2019.

Today, the company’s delivery service extends beyond Leicestershire, reaching Nottinghamshire, Derbyshire, Warwickshire, Northamptonshire, Rutland and the West Midlands. Its customer base includes restaurants, schools, nursing homes, child-care centres, airports and sporting ground/venues.

Last month, Sterling Supergroup announced that, following the departure of chief operating officer Paul Lee, the board had made two internal promotions: Daniel Larkin was appointed as chief commercial officer, and Jodie Garnham was promoted to head of finance & operations.

taking part in a project with the SWA and Zero Waste Scotland.

The Edinburgh-based wholesaler embarked on the six-month project in autumn 2023, focusing on four steps to tackle food waste: assessing its existing food waste data, measuring its food waste, analysing the findings, and developing a plan of action.

Despite making up only 0.2% of the total food passing through the depot, the amount of food waste within the business over one month measured 1.62 tonnes – the equivalent of 19.5 tonnes per year. The wholesaler identified savings of £11,877.

Meanwhile, an audit of the company’s bins revealed that food waste was routinely

discarded in general waste bins rather than dedicated food waste bins. It was estimated that food waste generated was therefore 10% higher than first thought.

As part of the project, Mark Murphy Dole introduced a ‘Green Champion’ programme. Following training and staff engagement, there was a 32% decline in contamination of the general waste stream compared to the previous year and the recycling rate also improved – by 5%.

Acting on recommendations from the audit, the firm focused on improving food waste measurement, introducing staff communication, training and engagement on the subject, and updating processes and procedures.

A total of 95 delegates attended Confex’s annual conference, where a mix of presentations and more than 300 one-to-one meetings focused on the themes of collaboration and business growth.

At the event, which was held over four days in Barcelona, Confex CEO Tom Gittins shared the group’s ambitious plans as well as its growth trajectory and six strategic pillars. He also reiterated how the group’s diverse membership represents more than 12% of the UK wholesale market, providing suppliers with an important route to market.

As a result of the conference, suppliers reported significant wins. For example, Nestlé Professional UK and Ireland secured more than £164,000 of orders, £24,000

of which was new business. It also gained 20 new listings and opened two new wholesale accounts, with more in the pipeline.

In other news, Confex has identified cyber security as one of its seven strategic pillars and has partnered with Cyber Tzar to offer support to its 241 members at ‘attractive market rates’.

The partnership is already under way, with Cyber Tzar scanning Confex systems, identifying vulnerabilities and working with the IT team at Confex to fix them.

SCAN TO DOWNLOAD THE REPORT

Glasgow-based wholesaler JW Filshill saw turnover increase to £215 million – up 6% – from £203 million in the year ending 31 January 2024.

Operating profit rose from £2.9 million to £4.2 million.

The fifth-generation business, which celebrates its 150th anniversary in 2025, recorded gross profit of £22.3 million, up from £19.4 million, while net assets increased to £21.6 million compared to £18.9 million the previous year.

The company supplies KeyStore stores and independent retailers across Scotland and the north of England, and national accounts including the Scottish Prison Service.

Keith Geddes, chief financial and operating officer, said improved growth and profitability was “particularly impressive” given that it relocated to its new site in

Renfrew during the period.

“The new facility is a major step forward in delivering our planned growth and business improvements, allowing us to push forward in achieving the ambitious targets we have set for ourselves over the short, medium, and long term,” he said.

“The investment in the new facility and other projects throughout the period has taken the level of investment in the future of the

business to £6.6 million over the last two years.”

He added: “Operational efficiency generated from the new distribution centre has created significant benefits in terms of operational process and improved safety, and has led to additional capacity being generated which has allowed us to seek out new opportunities with our suppliers and customers. Our product availability is industry leading as a result.”

Nisa has launched a beers, wines and spirits ‘Mega Deals’ campaign, designed to help Nisa retailers capitalise on the crucial festive trading period.

The campaign provides Nisa customers with new deals every week until the end of 2025 and includes discounts on top-selling beers, wines and spirits lines.

Ten products will be featured each week, and brands on offer will include Madri beer, Thatchers cider, Yellow Tail and Casillero Del Diablo wines, and spirits including Jack Daniels and Glen’s Vodka.

Nisa’s trading director Ayaz Alam commented: “We know how crucial the festive

trading period is for our customers and we’ve gone above and beyond to ensure they’re getting the most competitive prices on the market.”

In other news, Nisa has extended its partnership with convenience store chain TYS Retail for another five years, marking a decade of successful collaboration.

TYS Retail currently operates eight stores in the Peterborough area under the Nisa fascia.

Siva Thievanayagam, the owner of TYS Retail, said the

‘Bigger than ever’

SPAR’s national campaign, ‘Big Deals of Christmas’, is back and bigger than ever for 2024.

Launching in SPAR stores on 17 October in Scotland and from 31 October in England and Wales, this year’s campaign promises ‘unbeatable’ in-store deals plus recipe ideas, cocktail inspiration and festive tips to help make the holiday season extra special.

The Christmas campaign, which runs until 1 January, will be supported by a national media plan, including a £200,000 digital spend, in-store PoS displays, digital screen promotion, social media support, and TV advertising on STV in Scotland.

company was going to refurbish some of its stores and is also considering working with Nisa on a dual-branded store to put its own name above the door. “Nisa is supportive of this which is another reason why we want to work with them,” he said. a Nisa’s Making a Difference Locally charity is celebrating raising £18 million for small causes and community groups across the UK since its inception in 2008.

Nisa retailers and wholesale partners raise funds through the purchase of Coop own-brand products and then choose local beneficiaries. Additional money is raised via in-store collecting tins and clothing banks.

SPAR is also offering two tickets to the 2026 national SPAR conference in Abu Dhabi for the store with the best in-store display or customer engagement.

a With over 10,000 entries to its Community Cashback campaign this year, SPAR UK has awarded 54 charities and local causes across the UK grants of up to £10,000. In Northern Ireland, 20 local organisations were chosen to receive a grant.

Now running for three years, the campaign has seen SPAR give funding to a variety of charity organisations including those caring for people in their communities.

UP TO 1000* PUFFS PER POD. RECHARGEABLE. kit £5.99**

SOUR RAZZ

*P u ff count i s a max i mum est i mate o f 1 seco n d p u ff s p er p o d b a se s d on l ab a test i ng o f new l y manu f acture d pro d ucts. A ctua l num b er o f p u ff s

count is a maximum estimate of 1 second pu s per pod based on lab testing of newly manufactured products. Actual number of pu s may vary depending on individual usage and **Based on ITUK RRP as of July 2024. For the avoidance of doubt, retailers are free at all times to determine the selling price of their products.

r dependin g on individual usa g e and fl avour. **Based on ITUK RRP as of Jul y 2024. For the avoidance of doubt, retailers are f ree at a ll t i mes to d eterm i ne t h e se lli ng pr i ce o f t h e i r pro d ucts.

THIS PRODUCT CONTAINS NICOTINE. For existing adult smokers and vapers only. 18+ only. Not a smoking cessation product. © Fontem 2024

PRODUCT NICOTINE. For smokers cessation © Fontem

Recognition of the value of provenance has resulted in a shift in the way that large wholesalers like Bidfood are sourcing and presenting their local/regional offerings.

Wholesalers are increasingly focusing on providing their customers with a comprehensive local food and drink offering, in recognition that consumers are paying more attention to the provenance of products, whether in their neighbourhood store, a local café or a destination restaurant.

Of course, independent wholesalers have long made the most of offering a differentiated portfolio of local goods, but now Bidfood is going down that road too. It launched Bidfood Wales this year. Working closely with Welsh suppliers, it delivers products from its Chepstow depot to towns including Bangor, Wrexham, Cardiff, Newport, Shrewsbury and Oswestry, and it has just added 150 new products dedicated to Welsh provenance to its range.

The new ‘Wonderfully Welsh’ range boasts the best in local dairy, meat and poultry, store cupboard essentials and drinks, all of which have been produced or grown by SMEs across Wales.

To mark the launch of its regional offering, Bidfood Wales invited over 20 of those suppliers to Hensol Castle in Pontyclun to showcase the ‘very best in Welsh food and drink’ to existing Bidfood Wales customers.

Richard Dow, business unit director at Bidfood Wales, said: “This has been a much-anticipated launch for both the

According to research commissioned by the Welsh Government on the value of Welshness, nine out of 10 consumers think it’s important that a venue has a good range of dishes with Welsh ingredients.

business and our customers based in Wales, as we’re committed to highlighting the need to support local and regional businesses in the country. This new range will allow our customers to include products and ingredients with deep, strong Welsh roots on their menus, while also communicating the provenance stories behind them to consumers.

“It’s our mission at Bidfood Wales to deliver service excellence and be a positive force for change and I’m thrilled that we now have a ‘Wonderfully Welsh’ range that supports our customers and the small business owners in Wales passionate about showcasing what Wales has to offer.”

Lucy Quinnell, category development manager at Bidfood Wales, added: “Every single product within the new range has been tried and tested by our dedicated technical, sales and marketing teams who worked with local Welsh bodies such as Food & Drink Wales to ensure their authenticity.”

The launch of Bidfood Wales follows recent news that Bidfood Scotland, which was established in 2015, has increased sales of Scottish products by 28% following a successful year of collaboration with Scotland Food & Drink.

Over the past 12 months, 334 new customers have bought into Bidfood

“We know that there is a multi-billionpound opportunity for Scottish food and drink producers to grow within the UK and abroad. Scottish products enjoy a strong reputation.”

Scotland Food & Drink

Scotland’s Scottish range, and an additional 30,000 cases of Scottish products have made their way into kitchens across the UK.

This success is partly attributed to a strong focus on enhancing accessibility for Scottish suppliers, chefs, and caterers through the dedicated Scottish shop on the Bidfood Scotland Direct platform.

With the support of Scotland Food & Drink, the dedicated Scottish page has driven a 17% surge in online sales of Scottish products, now making up 56.4% of total sales. According to Bidfood, this increase underscores the power of increased digital visibility and local pride, with the results coinciding with the industry’s first-ever Scottish Food & Drink September campaign.

Scotland Food & Drink has delivered several impactful initiatives to promote the Bidfood Scotland collaboration, including supporting a digital campaign aimed at chefs.

A ‘Meet the Buyer’ event, held in November 2023, resulted in 39 new products securing a Scotland-wide listing on the Bidfood Scotland website.

“Since their launch in March 2024, these products have achieved 872% growth, reaching nearly 1,000 new customers. Even more impressive is that 79% of these sales have been driven by Bidfood Scotland Direct, marking a

“As consumers continue find provenance on menus appealing, many seem to be drawn to learn more about those cuisines that are on our doorstep, but which offer something different to the traditional English classic dishes that are familiar.

“Nearly half (43%) of consumers are interested in trying Scottish, Welsh and Irish cuisine, due to its traditional flavours, comforting nature and their desire to support British suppliers.”

CGA by NIQ, Bidfood 2025 Trends Survey; sample size 2000)

powerful shift in how we promote and present our local ranges to customers,” said Katie Sillars, head of commercial growth initiatives UK at Bidfood.

The Scottish Wholesale Association launched its Delivering Growth Through Wholesale (DGTW) local sourcing programme back in 2021 to educate and engage with producers on the opportunities provided by wholesale.

For the programme, the SWA has worked in partnership with SAOS (Scottish Agricultural Organisation Society) and Scotland Food & Drink, supported by the Scottish Government.

As part of the programme to identify local sourcing opportunities for wholesalers and help local producers to access new markets, the SWA launched its Wholesale Local Food Champion training programme. This encourages Scotland’s wholesalers to appoint an individual to take responsibility for shaping the local sourcing strategy within their business.

The fund represents the third phase of the DGTW programme and was set up to support wholesalers working closely with local Scottish producers, manufacturers, local authorities and other stakeholders to increase the volume, and customer base, of Scottish produce being sold through the wholesale channel.

Grant funding of up to £10,000 was available per wholesale applicant, and applicants had to commit to provide at least 50% of the total activity costs in match funding.

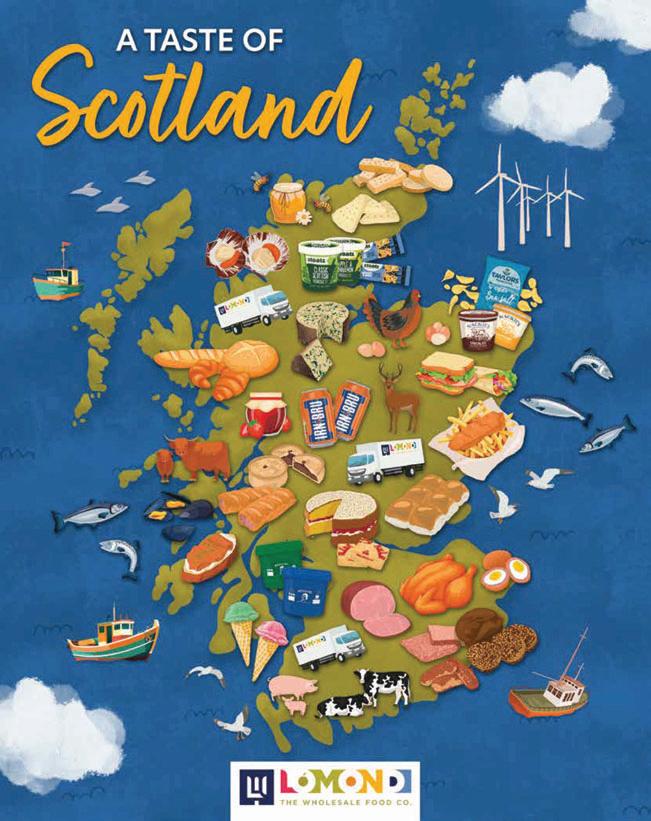

Many wholesalers in Scotland, including CJ Lang & Son and Lomond: The Wholesale Food Co, vigorously promote their support for local and regional producers.

According to the CJ Lang website, 50% of the products that it offers are Scottish sourced and it is “passionate about providing local products and supporting Scottish producers”.

Meanwhile, Lomond produces A Taste of Scotland food guide that features more than 80 Scottish producers. At the time of publication, Lomond was only 7.5% away from its target of 50% of products being from local suppliers.

Over in Wales, Harlech Foodservice recently secured two more major schools contracts worth over £2 million.

The wholesaler has a new £1.5 million deal to provide schools in Gwynedd with a range of products including Welsh beef. It has also landed a £700,000, 12-month agreement to supply schools and care homes in Rhondda Cynon Taf.

The third round of training these ‘Champions’ will take place on 30-31 October and is free to SWA members. The candidates will be given knowledge and insight into fostering a strong local food and drink supply chain.

What’s more, the SWA recently secured £195,000 from the Scottish Government to deliver a new Scottish Wholesale Local Food and Drink Growth Fund.

Menna Trenholme, head of procurement at Gwynedd Council, said: “It’s very important to us as a Council and to the parents to have a local firm supplying our schools with local produce wherever possible and it’s very important for the local economy as well.”

Harlech’s sales director Mark Lawton added: “We now have a real presence right across Wales and I know the Welsh public sector has a desire to using Welsh suppliers whenever commercially possible.”

Welsh wholesaler Castell Howell Foods also has strong ties with local authorities and the schools it supplies, and is a proud backer of Welsh products.

For example, it is involved with the

Lomond has a target of 50% of products being from local suppliers.

‘Welsh Veg in Schools’ project – its continuing work with Food Sense Wales and supply chain partners sees home grown veg by local growers on school menus across Wales.

The project builds on the commitment from the Welsh Government to ensure that every primary aged child in Wales is offered a free school meal and that the food used to produce that meal, where possible, comes from local suppliers.

Welsh Veg in Schools recognises that procuring Welsh, sustainable and resilient vegetables is more expensive than the frozen veg usually served (much of which is from Europe) and it covers the difference between that higher price and the usual price a local authority pays. CCM

* Based on NielsenIQ RMS data for the Nicotine Pouches category for the 18-month period ending 30/12/2023 for the UK total retail market (Copyright © 2023, NielsenIQ).

** This product is not risk-free and contains nicotine, an addictive substance. For adult nicotine consumers only.

Investment in the SPAR Scotland estate, coupled with a determination to combat market challenges, puts CJ Lang in a strong position to build on its success in the c-store sector.

Another annual increase in underlying profit has been reported by CJ Lang & Son –making this the seventh year in succession that SPAR Scotland’s wholesaler and retailer has achieved such growth. Pre-tax profits increased by 8% to £4 million in the year to 28 April 2024 while turnover was up by 14.2% to £253 million.

With its focus firmly on profitable growth, the long-established familyowned business last year acquired 12 new company stores – the Scotfresh group of nine convenience stores along with three of the former Eddy’s Food Station shops.

All three Eddy’s stores, and seven of the nine Scotfresh shops, have already been converted to SPAR Scotland, and the remaining two – at Cardonald and Denny – will be relaunched in the next few months.

The company has also completed major store refits at Kilwinning, Lawthorn and Erskine in the last 12 months. It has introduced the exclusive Barista Coffee offer, together with digital screens and electronic shelf-edge labels (all company-owned stores will have them by Christmas), to help modernise the customer shopping experience.

In addition, CJ Lang’s head office in Dundee has undergone a refit, producing a more modern, relaxed environment.

the company’s leadership team gave a progress report at the SPAR Scotland tradeshow and conference last month in Aviemore. This attracted almost 850 guests: store owners, managers and employees; colleagues from SPAR across the UK and internationally; and more than 200 suppliers.

McLean commented: “We have delivered robust growth over the last 12 months and achieved another year of strong sales and profits. However, this year the summer was against us.”

Despite a poor summer, CJ Lang has achieved 8% sales growth in the year to date, and its volume is up by around 3.5%. “We are significantly outperforming the total Scottish market in both sales and volume, and probably the

UK market too,” said McLean.

Nevertheless, rising operational costs, combined with changing consumer habits and supply chain unpredictability, are critical factors that will shape the year ahead.

“We are committed to working even harder to remain agile and proactive in addressing these issues,” he pledged.

Following its Scotfresh and Eddy’s store acquisitions, CJ Lang is focused on consolidation and improving existing sites, but it has not ruled out further acquisitions.

“With market pressures – legislation coming, the decline of cigarettes, etc – I think you will be seeing quite a few retailers run for the exit door over the coming weeks and months. That represents an opportunity for us, but it’s got to be the right stores,” said McLean. “It’s about quality over quantity, and trying to get that balance right.”

The company is about to embark on the second phase of its project to ‘take SPAR Scotland back to where it belongs’. There is still a target of hitting 30% as the overall retail margin – and SPAR Scotland is moving closer to this figure by enhancing the product mix in line with evolving shopper demands.

“The reality is that we have to be heading for 30% in order to sustain the cost pressures that have been with us, are still with us, and are still to come,” explained chairman Jim Hepburn.

Headed up by CEO Colin McLean, £253 million turnover – up 14.2% £4 million pre-tax profit – up 8% 7 years of growth in underlying profit 8% year-to-date sales growth

3.5% year-to-date volume growth

£30 million – investment in SPAR Scotland in the past five years

115 company-owned stores

210 independent stores

£2.99 breakfast deal of a Barista Bar coffee and a bacon roll

£1.99 lunchtime meal deal of a burger and a drink

The CJ’s food-to-go proposition, along with the introduction of a Barista Bar in place of Costa Coffee machines, is playing a key part in strengthening margins, as well as driving footfall back into stores in the face of declining sales of cigarettes, newspapers and magazines.

A total of 125 SPAR Scotland stores (100 company-owned and 25 independent) will have a Barista Bar by Christmas. In those stores that already have a Barista Bar, coffee volumes have gone up by about 25% versus Costa.

In addition, a £2.99 breakfast deal of a Barista coffee and a bacon roll is proving popular with consumers – and represents a saving of around 50p on the previous breakfast promotion. The company has also just launched a lunchtime meal deal, offering a burger and a drink for £1.99.

CJ Lang is using data, AI and best practice from SPAR International and SPAR UK stores to get a better understanding of the customer and therefore offer the right product mix. “We are also looking at how we tailor it sensibly,” said McLean. “While some retailers are talking internationally about tailoring the product mix to individual stores, that’s a big challenge. It’s the right journey, but it’s a big challenge.”

CJ Lang has invested £30 million in SPAR Scotland in the past five years, and that doesn’t include investment in pricing and promotions. Although McLean and Hepburn would not divulge their current budget, Hepburn did say that the company is “continuing to

invest probably twice as much as our nearest competitor in Scotland”.

McLean added: “As a genuinely Scottish family-owned business, we are well positioned to continue our journey to meet the needs of our customers with the best that SPAR Scotland can offer.”

He maintained that SPAR Scotland’s people give it a big advantage. “Our managers really have made a difference, and continue to do so. We’re not perfect but being 100% family owned we try to get the best of people feeling they’re part of the family and blend that with the best of corporate.

“As one of our managers said the other day, you’re a name, not a number. You are valued. We also have very visible management at all levels – for example, all the management team worked in stores over the summer and will do the same between now and Christmas.”

McLean himself also feels supported in his role. “I’ve got a good team. I’ve got great support from the main board, and I think that’s very important at a time when things are challenging.”

One of the challenges that CJ Lang continues to face is poor availability from some suppliers. “Given our sales growth, given our volume growth, we are urging suppliers to give us the stock because we can sell it. We’ll work with them, share our data, but we want the right products at the right time,” said McLean.

With inbound service levels at 94% (compared to 97.5% pre-pandemic), CJ Lang has had to increase its stockholding levels in order to protect its service to its own customers.

To improve availability, the business has also been investing in vehicles, equipment, and systems and processes. RELEX Solutions is delivering integrated store and distribution centre forecasting and replenishment as well as providing improved allocations, promotional estimating, order accuracy and forecast sharing.

Elsewhere within the business, SPAR Scotland continues to invest in a programme of marketing, advertising and digital campaigns. It has an ongoing partnership with the Scottish FA, and on 17 October it will launch the SPAR ‘Big Deals of Christmas’ campaign backed by advertising on STV.

Looking to next year, McLean said: “As we move into 2025, we do so with cautious optimism. SPAR has proven repeatedly that we can overcome challenges – through collaboration, innovation, and strategic planning – to ensure continued success and growth. We aim to reinforce that spirit and look forward to what the future holds.”

CCM

Danny Harding, head of route to market at Rémy Cointreau UK Distribution, highlights the exceptional quality of the company’s cognacs and explains why working collaboratively with wholesalers is so important.

What proportion of your business goes via the cash & carry/delivered wholesale sector?

Cash & carry/delivered wholesale

What are the key products in your portfolio?

We have three flagship cognacs:

VSOP is our classic offering and

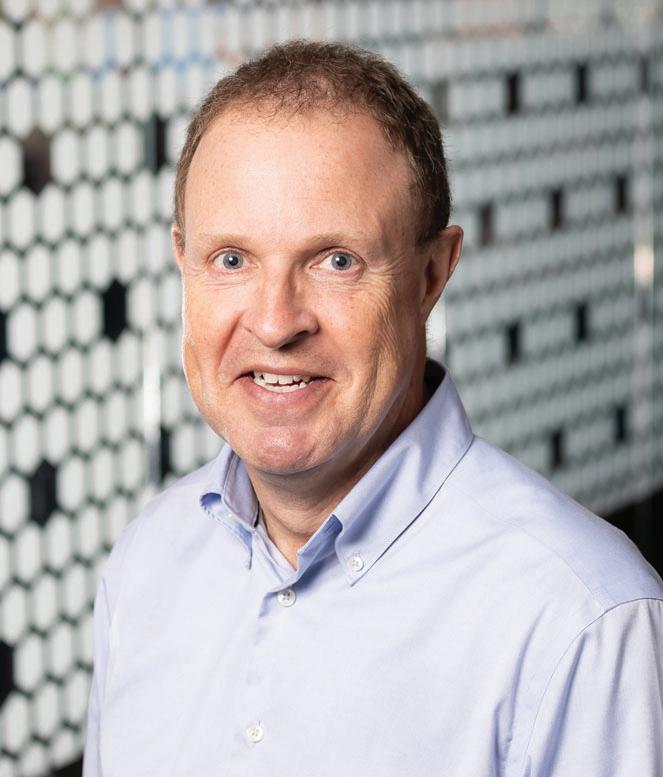

Danny Harding

Head of route to market at Rémy Cointreau UK Distribution

Why should cash & carries and delivered wholesalers store Rémy Martin cognacs over other brands?

XO is the signature of our Cellar Master allows royal approval and is a truly distinctive

crus of the Cognac region: Grande

The grapes growing on those crus are lees and long ageing then reveal the full

How does your company help wholesalers and retailers with advice on range, promotions and the cognac market in general?

to identify any further opportunities

How important to consumers is price and bottle size?

growth in fractional sales, particularly on

How important is the layout of the drinks

clear, and identify how we can help sell our products where

How can cash & carries/delivered wholesalers improve their sales of premium drinks in general

parties will also lead to good discussions around how

How are you looking to strengthen your partnerships

The wholesale channel is still relationship driven, which is one Connecting past, present and future with a year

With the countdown to Christmas on the way, it’s important that wholesalers are up to date with the supplier activity and current trends that enable their customers to make the most of the huge sales opportunities ahead in the confectionery category.

The confectionery category is a high-value segment for convenience retailers. With growth in both chocolate and candy sales, trend-driven innovation from manufacturers and multiple festive sales opportunities, it’s an area that wholesalers need to merchandise strategically.

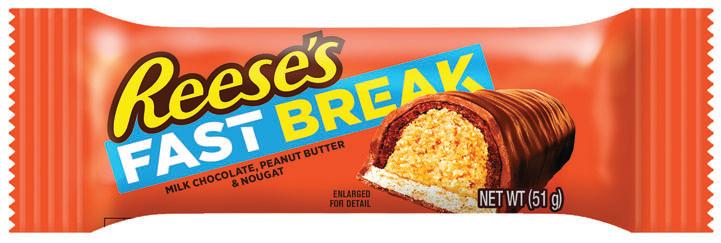

NPD that has recently hit the market includes Reese’s Fast Break bar, a combination of chewy nougat and peanut butter wrapped in a milk chocolate-flavour coating. The new 51g bar, available from The Hershey Company, has an rsp of £1.15.

The Reese’s brand is one of the fastest growing brands in the symbols & independents sector, with sales increasing by 25% in the last year (Circana). With Reese’s confectionery singles growing ahead of the category, the company recommends Reese’s Fast Break bar as a ‘must stock’ for retailers, to be merchandised alongside the brand’s other single bars.

Jackson Hitchon, general manager of Europe and world travel retail at The Hershey Company, comments: “We are excited to bring the Reese’s Fast Break bar to the UK, offering a new way to enjoy the beloved combination of peanut butter and chocolate flavours, now enhanced with soft nougat.

“At Hershey, we pride ourselves on delivering innovative, delicious products that meet evolving consumer tastes. Our Reese’s Fast Break bar is perfect for UK consumers seeking both indulgence and on-the-go convenience.”

Over at World of Sweets, the company has a new confectionery brand – Sweet Vibes. “We noticed there are gaps in the confectionery market for teenagers and young people,” says Chris Smith, partner brand manager.

“They often feel that the available products are either too childish or too mature for them. Sweet Vibes aims to fill this gap by offering a selection of treats that are fun, colourful, bold and trendy.”

The brand’s Freakshakes products are inspired by the dessert flavour trend and encompass the popular milkshake flavours of strawberry, banana and chocolate.

“There are limited products on the mainstream market that contain different components in one pack, which makes the Freakshakes range stand out,” Smith continues.

The new brand’s target shopping demographic is one that wholesalers and retailers need to consider in their range selection. “Data has revealed that 25% of total retail spend in the UK is from millennials and Gen Z, with most of this being discretionary. This highlights that younger generations are spending more, and spending on things that give them pleasure,” Smith explains.

‘Retro treats are trending. It’s crucial for brands to capitalise on this trend and enhance the taste experience through innovative and enticing flavour combinations’

Chris Smith, partner brand manager, World of Sweets

“Research has also revealed that retro treats are trending. It’s crucial for brands to capitalise on this trend and enhance the taste experience through innovative and enticing flavour combinations.”

There are also additions to the long-established Pez brand with partnerships with upcoming movies Lion King and Transformers One. The new dispensers are Mufasa, Pumbaa, Simba and Timon in the Lion King range and Bumblebee, Megatron and Optimus in the Transformers range.

The supplier has also added to the line-up from its Warheads American candy brand. The Warheads Super Sour Candy Floss Cup answers the trend for sour flavours and is competitively priced with an 80p rsp.

Mondelez International is currently running a ‘Win a Day to Remember’ promotion on its Cadbury Dairy Milk brand as part of its 200th birthday celebrations.

Running until November, the promotion offers more than 200,000 prizes in conjunction with partners like Odeon, Jet2holidays, F1 Arcade, Arsenal FC, Liverpool FC, Manchester United FC,

Sky, Goodwood, Merlin Entertainments, and Winter Wonderland. All entrants receive a £75 voucher from Jet2holidays.

“Chocolate is an incredibly buoyant category, with overall value growth of 9.2% and growing in independents and symbols,” says Susan Nash, trade communications manager.

“Standard chocolate is growing by 3% in the channel, with formats such as sharing bags and tablets growing by 6% and 12% respectively and together worth £295 million in independents and symbols (Nielsen).“

Candy confectionery is also in growth, representing 20% of the total confectionery market. “Format is key within candy, with bags making up over 60% (Nielsen), so offering both chocolate and candy bags is a must,” insists Nash.

The supplier recently launched a Strawberry flavour of Sour Patch Kids. The brand is performing strongly with growth of 51% year on year.

“Jelly-style sweets over-index with younger adult consumers; in fact, over three-quarters of shoppers in this demographic eat this type of sweet at least once a week (Mintel). However research also indicates that these shoppers are showing a clear interest in something new within sour sweets,” says Nash.

American candy producer Ferrara has partnered with biscuit producer FBC UK, which is now the sole importer of Nerds Candy in the UK&I. The partnership has brought NPD to the market in the form of Nerds Gummy Clusters.

The five-strong Nerds range features Fruits and Berries variants in 45g bags and 113g sharing bags, plus a Gummy Clusters Fruits Rope.

Ongoing brand investment includes outdoor and digital advertising, along with video on demand partnerships and targeted sampling.

The range not only offers something for the increasing number of consumers looking for interesting textures, it also taps into the growing ‘newstalgia’ trend – combining elements of the past with an updated twist.

Perfetti van Melle has launched its first Chupa Chups advent calendar. The brand has seen 8% year-on-year growth and is now worth £17.4 million (Circana). It also grew ahead of the sweets category last Christmas.

A further boost is expected from this NPD, which features a range of variants such as classic lollipops and jelly and bubble-gum treats.

“We’ve seen how our brand resonates with consumers, especially during the holiday season, and this advent calendar

is the perfect way to continue that momentum. With its broad appeal and unique mix of products, it’s set to be a hit with both existing fans and new customers alike,” says Kim McMahon, brand manager for Chupa Chups.

Two new releases hitting the shelves for this festive season come from Mars Wrigley.

In the self-eat category, which is up by 2% year on year (Nielsen), the supplier has unveiled the M&M’s Crispy Milk Chocolate Santa Treat. The new product is backed by above-the-line marketing on social media and out-of-home advertising from this month. PoS materials are also available.

RA Trading has partnered with Nestlé Turkey as the distributor for the supplier’s premium Damak confectionery brand.

“We were delighted when Nestle (Turkey), part of the world’s biggest food and drink company, shared our vision, and are honoured that they trust us to grow their premium brands through this long-term partnership,” says Niyazi Uludag, managing director.

The initial range features two formats: 60g square bars and 30g wafer singles. The wafers have a £1 PMP option, launched due to repeated retailer requests for a compelling value message at a fair margin.

The brand combines pistachios with dark, white and milk Nestlé chocolate variants, plus flavours such as baklava, caramel and Turkish delight.

“Pistachio, as well as other flavours such as authentic baklava, are currently under-served in the UK market. Damak squares also represent a great opportunity to unlock the affordable gifting shopper mission, again under-served at the moment. All this makes Damak a unique and timely incremental category opportunity which every retailer and wholesaler can enjoy,” says Uludag.

The brand is being supported by marketing and promotional activity.

For gifting and sharing, the Twix & Friends Medium Selection Box features an assortment of brands and formats to suit consumer demand, including a Twix Salted Caramel variant.

“Our new launches for Christmas 2024 tap into different shopper needs and will appeal to consumers looking to purchase their favourite brands and products with a seasonal twist,” says Laura O’Neill, Christmas & gifting senior brand manager.

“Chocolate plays an important role during many key seasonal rituals. Seasonal and gifting is worth £1.8 billion of total chocolate value sales (Nielsen).”

Artisanal confectionery manufacturer Stockley’s has launched a premium gifting offering with its Salted Caramel Malt Balls. These malt balls are covered in caramel flavour blonde chocolate with a lustred finish and packaged in a reusable champagne bottle.

A traditional gifting option tapping into the nostalgia trend is Stockley’s Sweet Shop Collection, featuring Cola Drops, Pear Drops, Lemon Sherbets, Chocolate Limes, Mint Humbugs, Chocolate Butter Fudge, Caramel Fudge and Berries & Cream.

The supplier has a longstanding reputation for quality handcrafted sweets, having previously been a supplier to confectionery brands. However, these seasonal products mark a move into the category under its own brand. “While we’re proud of our hard-earned reputation for sweets excellence, this autumn will see the arrival of some gifting and speciality offers where the Stockley’s name will sit loud, proud and centre,” says Andy Valentine, head of marketing.

Mondelez International also has some sharing and gifting NPD in its extensive Christmas line-up.

The Cadbury Buttons Selection Box now includes White Buttons in its treat bags selection, while the Cadbury Dairy Milk Creamy Advent Calendar features 24 Cadbury Dairy Milk chocolates with a soft creamy filling.

Peter Juty, Costcutter Culverstone

“Special seasonal packs always look impressive and are quite different, so the customers are always intrigued by them. We will ensure we have a huge range in store.

“At Christmas, we have every type of chocolate gifting boxes so we can offer our customers the full range, from budget-conscious chocolate boxed gifts to luxury highend chocolate boxed gifts, and everything in between. We don’t often have any left in stock [after Christmas] but if we do, we offer them at a discounted rate.

“In our store the seasonal products that sell best are Christmas gifting tins, such as Quality Street and Celebrations, and advent calendars. Christmas gifting tins sales are a huge opportunity for us as we open all over Christmas so we can offer that last-minute opportunity for customers to buy a Christmas gift or treat.

“Due to high demand of seasonal products, stock from wholesalers might run out way before the actual holiday. It would be helpful if extra stock was held by wholesalers so we can still purchase these lines up until the bank holidays if needed, as these seasonal lines tend to be popular with our customers.”

Other festive NPD consists of Cadbury Mini Puds, a bitesized bag format of the self-eat treat.

The supplier urges wholesalers to ensure they are following manufacturer guidelines when it comes to timings for festive ranges.

Retailers are already embracing the run-up to Christmas and should also be stocking for the increase of ‘big night in’ occasions as the nights draw in.

In October, consumers start to get into the festive spirit, so self-eat treats or low-value stocking fillers can appeal. November is the time for advent calendar purchases and holiday essentials, while December purchasing accounts for 50% of winter sales and is the perfect opportunity to drive sales through gifting and sharing formats, according to Mondelez.

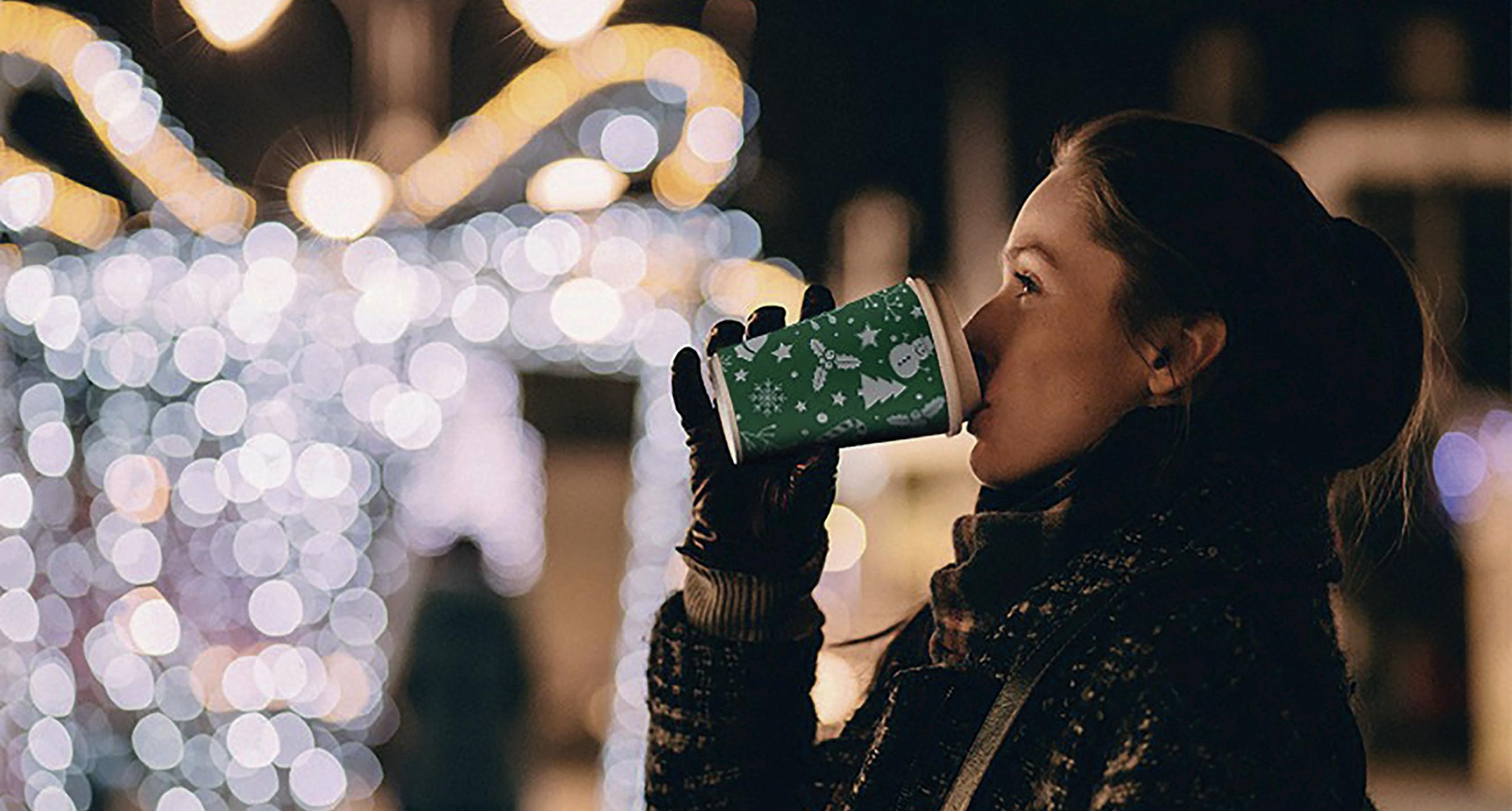

With shoppers looking for affordable indulgence both at home and while on the go, and café culture thriving in the colder months, it’s time for the hot beverages category to shine.

Hot beverages is a category with seasonal profit possibilities for food operators and convenience retailers. Out-of-home coffee drinking continues to be a popular choice for consumers, while inhome beverages are being upgraded with a selection of flavours, dairy alternatives and speciality roasts.

Despite the increasing year-round appeal of out-of-home hot beverages, winter continues to be the ideal time to increase sales with seasonal uplifts such as speciality flavours and festive packaging.

Celebration Packaging has launched a range of EnviroWare double-wall paper cups featuring festive green and red designs. The cups are available in 8oz and 12oz sizes, with optional CPLA and bagasse sipper domed lids. Environmental credentials include FSC certified paper and a PLA plant starch moisture barrier lining. They are commercially compostable and are certified recyclable in standard paper mills.

Research by coffee roaster Lincoln & York reveals that consumers aged 18-34 are now drinking more coffee than ever before and customising their orders. A survey of more than 1,000 consumers from 18-65+ was carried out, with the resulting report published to mark the company’s 30th anniversary.

Lincoln & York found that nearly 40% of those aged 18-34 are drinking more coffee out of home than in previous years, with 75% of consumers in the 18-34 group always or occasionally opting for a flavoured

syrup in their coffee. Though faced with an ever-growing selection of flavoured syrups, consumers are still choosing traditional sweet flavours – with caramel ranking as the top syrup choice, followed by vanilla and then hazelnut.

Whether through flavour preference or dietary requirements, 37% of those aged 18 to 34 now choose alternative milks such as oat, almond, soya or coconut in their coffee. This preference for alternative milks also extends to iced coffee options, with the younger age bracket twice as likely to choose alternative milk in their iced coffee than those aged 55+. The younger generation’s growing thirst for iced coffee options is also reflected in the company’s report.

Lincoln & York’s research also found a number of significant changes in coffee preferences over its 30 years in the industry. When the business first started roasting coffee, a dark roasted blend of Arabica and Robusta beans was the core offering. Today, changing consumer tastes mean it sees a much bigger demand for 100% Arabica blends and for medium-lighter roasts, which allow the individual flavours of the coffee to stand out.

Over the past decade specifically, Lincoln & York has also seen a major uptake in demand for speciality coffee. Almost half of those surveyed in the independent research said they would always or occasionally pay more to try a special blend or single origin coffee.

“During our 30 years in the industry, we’ve experienced the rise of UK coffee culture and have played a key role as

menus have evolved from white or black coffee to the ultra-customisable and even experimental coffee offerings we see today,” says Ian Bryson, managing director. “With younger consumers more likely to customise their drink or opt for speciality coffee, this trend is set to continue.

“To meet these evolving needs, operators need to embrace customisation and signpost the options they have for consumers to make their drink their own. Customisation also presents an opportunity for operators to demonstrate their expertise; for example by recommending a blend or roast profile to best suit a certain milk alternative.”

New to the UK market is coffee brand San Francisco Bay Coffees, which is being launched this month in three variants. These are Café Blend, a mix of African and Central American beans; Bay Bridge Blend, a mix of Central and South American beans; and Colombian Supremo, with notes of amaretto cherry, dark chocolate and sweet mandarin. These variants respond to the rising consumer desire for a high-quality, distinctive taste to elevate the coffee drinking experience.

The growing popularity of iced coffee is not confined to coffee shops and cafés; it’s also reflected in the on-the-go fixture in convenience.

From CCEP, the 100% HFSScompliant Costa range taps into the popularity of the instantly recognisable brand. Featuring Lattes, Flat Whites and Frappés, Costa’s range caters to a broad variety of different tastes and occasions, offering shoppers a choice of low, medium and high intensity caffeine options as well as different coffee flavours and levels of sweetness.

”The ready-to-drink (RTD) chilled coffee sector is becoming an increasingly popular choice with consumers, especially as an on-the-go breakfast option, with the segment worth more than £300 million and growing in value and volume in GB (Nielsen),” reports Amy Burgess, senior trade communications manager. “It is a highly incremental category, and at the end of 2023, more than a quarter of UK households were purchasing RTD coffee (Kantar).”

CCEP launched PMP versions of the Costa Coffee Latte and Caramel Latte RTD ranges earlier this year, offering a unique selling point exclusive to convenience retailers to help enhance their competitive edge in RTD chilled coffee.

It’s not just coffee and tea that are favourites all year round. The food beverage category has shown growth of 13.6% compared to the same period in summer last year

(Kantar), and Mars Chocolate Drinks and Treats’ sales have increased significantly at 62% on the same period in 2023.

A growing thirst for hot chocolate and iced chocolate has been reflected in the supplier’s investment and activity in its brands. “We believe that investing in various formats and packaging has broadened the range’s appeal, driving growth during the spring and summer months,” says Michelle Frost, general manager.

“The Galaxy brand contributes £23.1 million to the category, with our flagship product Galaxy Instant remaining a consumer favourite for 25 years. The taste of Galaxy continues to be a staple for loyal customers, while different formats like our Galaxy Sticks provide new shoppers with more choice.”

A trends report from Bidfood has identified hot chocolate as a product that should be embraced by foodservice operators and the on-the-go sector.

The wholesaler says that the ‘Chocolicious’ trend reflects the innovation that’s dominating the hot drinks (and dessert) category, with consumers looking for affordable luxuries when they eat out.

With over 80% of consumers seeing chocolate as an affordable treat and 38% of consumers considering hot chocolate as a low-cost way to boost their mood (Mintel), operators can respond by offering premium hot chocolates with innovative flavours and toppings that look the part.

Bidfood found that premium hot chocolate, white hot chocolate and flavoured hot chocolate, as well as mochas, are the hot drinks that consumers say they are most interested in trying in the next one to two years.

Examples of exciting options the wholesaler has seen on menus include black forest frozen hot chocolate, strawberry white frozen hot chocolate and crème brule inspired frappés. Some of the premium hot chocolates have loaded toppings including toasted marshmallows, chocolate flakes, sprinkles and whipped cream.

Bidfood also suggests that foodservice operators offer natural spices such as cinnamon, ginger, cardamom or chilli – whether in the drink or just sprinkled on top.

‘I’m pretty

What have been your biggest achievements in work and outside work?

I was the 1996 UK winner of the Keith Thurley Award (national recognition as part of the Institute for Supervision and Management programme). The ‘Range Management Blueprint’ project I presented went on to form the basis of a national SPAR UK initiative. Outside of work, I am fortunate to have travelled to many far-flung parts of the planet, and this year I cycled across frozen lakes and did dogsledding in the Arctic Circle.

Who has been the biggest inspiration to you?

I have had many incredible mentors over my working life, whose wisdom I still plagiarise today, but I am undoubtedly the product of my wonderful parents: a free-spirited mum and a selfless dad who have calmly supported every good (and bad) decision I’ve ever made! In 2003, when I ‘side-stepped’ into UK national accounts and international sales positions, I was let loose to develop new business in over 50 countries, and I met countless inspirational, courageous and entrepreneurial company owners who reinforced my belief that people make the difference to every business.

What were your ambitions when you were growing up?

I thought I had what it took to be a graphic designer or architect, but gave up on further education far too easily and found myself at the job centre looking for more interesting ways to pay for my teenage social life!

What are your interests outside work?

I combine a love of live music with a complete lack of inhibition – I have been lead vocalist for a number of bands over the last couple of decades, running open mic nights for local talent, with the Covid lockdown also encouraging me to write my own songs. I accidentally became the coach of my son’s football team when he was five, and learned then that if you want to spend quality time with your kids, you have to immerse yourself in their interests! Now he’s 19, I’m still doing the same thing, most recently adding golf to the long list of (usually) temporary past-times.

How would you describe your personality?

I’m pretty outgoing, and have a high threshold for personal embarrassment! I am comfortable to admit that others often know better, and I learn from them.

What is your favourite film and song/ piece of music?

Forrest Gump is a film that I could easily watch a hundred times. My musical tastes are wildly eclectic – everything from reggae to rock to rap. Just under 10,000 songs on my Spotify ‘liked’ list probably says it all!

If you won a holiday, where would you go and who would you take with you? It would have to be Australia – my youngest brother lives with his family just outside Sydney, and my nephew recently moved to Melbourne. I would take as many family members as possible, and relive Christmas surfing on the beach and New Year’s Eve fireworks over the Harbour Bridge!

What would people be surprised to know about you?

I have a crippling fear of heights which I’ve tried to fix at various times by skydiving, jungle canopy walks and abseiling – none of which have worked! CCM

After initially working as a mechanical engineer, Julian Smith found himself in the wholesale industry by accident. A Hertfordshire lad, at 18 he met a girl from Dundee on holiday and moved to Scotland, taking a job picking boxes in CJ Lang’s warehouse. He subsequently held various roles at CJ Lang (SPAR Scotland), before joining Nisa-Today’s where he was promoted to CBC trading controller. He then took on the post of senior trading manager at Wm Jackson. Making a conscious move into sales, he worked for manufacturers Unique Industries and RH Smith & Sons, latterly as head of international development. He returned to wholesale in 2015, working again at Nisa Retail before becoming senior trading controller at Unitas Wholesale. He was promoted to his current role of senior commercial controller in 2021.

Consumers continue to tuck into biscuits, and with Christmas coming, wholesalers and retailers can boost sales and profits with seasonal limited additions and assortments.

Last year, 98.2% of GB households purchased sweet biscuits, equating to £2.9 billion worth of retail sales (Kantar). What’s more, there was no dampening of demand through the cost-of-living crisis: the category was in volume growth from May 2023 through to February 2024 (NIQ).

Fox’s Burton’s Companies (FBC) has seen its branded sweet biscuit volume sales grow by 10.1% while the category as a whole grew by only 1.1% (NIQ and Kantar).

“The drivers of this success have included new products, but also above-the-line campaigns for Maryland Cookies and our recently relaunched Jammie Dodgers with a fruitier jam filling,” explains Colin Taylor, trade marketing director.

“A significant level of promotional support in partnership with customers has also helped our biscuits to stand out in store, while offering great value to shoppers.”

With the festive period approaching, FBC points out that it has held the No.1 position in the Christmas biscuits market for the past two years, with a 23.2% value share during the 2023 Christmas season (NIQ and Kantar).

Total seasonal sweet biscuits grew by 7% in the 16 weeks to 12 December 2023, taking total seasonal and assortment biscuits to £179 million.

FBC significantly outperformed during this time, with seasonal and assortments growing by 40% year on year, including its Fox’s Classic 550g Biscuit Selection, which maintained its position as the No.1 seasonal assortment.

Taylor says: “We recommend starting the season with a limited range of assortments, such as our popular Fox’s Classic 275g to generate early excitement. As December approaches, it’s important to shift focus to gifting packs.”

White chocolate is a popular flavour, growing by 111% year-on-year (NIQ),

and this Christmas FBC is tapping into this trend with the launch of Merryland White Chocolate Chip Mini Cookies. The product, which is available in a 150g sharing carton (rsp £1.75), tested well amongst consumers, with 91% purchase intent.

FBC is also capitalising on the popularity of spiced flavours during the seasonal period with its Fox’s Fabulous Winter Spiced Cookies (rsp £2.50). The milk chocolate chunk cookies are half enrobed in smooth milk chocolate with the addition of warming winter spiced flavours.

McVitie’s Gingerbread Flavour Milk Chocolate Digestives are back for Christmas this year with an ‘extra chocolatey recipe’ reports pladis.

The product is joined by festive designs for other McVitie’s favourites: Milk Chocolate Hobnobs and White Chocolate Digestives.

“Seasonal biscuits reached double-digit growth in 2023 as shoppers kept a careful eye on their spend and opted to enjoy quality time with loved ones in the comfort of their own home,” says James King, marketing director – McVitie’s. “As Brits continue to face price pressure across many expects of everyday life, we’re expecting a similar pattern in 2024.

“The stellar performance of seasonal biscuits is largely being driven by demand for assortments, particularly at the more premium end of the scale.”

As part of its 2024 Christmas range, Love Handmade Cakes has launched Decorated Gingerbread. Available in owl, snowman, Christmas tree and Santa variants, this selection of decorated individuallywrapped gingerbread comes in cases of 24.

The range is aimed at hospitality and foodservice outlets.

Consumers are increasingly keen to address sniffles at the first sign and there is a growing demand for medicated confectionery and remedies in the convenience channel.

It’s that time of year when wholesalers and convenience retailers should ensure that they have a comprehensive range of over-the-counter remedies for consumers to pick up.

Lanes Health has a strong presence in the category, representing brands such as Jakemans, Olbas Oil and Kalms. The supplier has expanded its portfolio with the acquisition of the distribution rights to the Go2 brand, a range of essential oil inhaler sticks. The four products initially available are the Energy Stick, Focus Stick, B.Calm Stick and Sleep Stick. Meanwhile, the Olbas Oil brand should benefit from increased awareness as a result of a targeted campaign promoting the importance of having a range of OTC remedies on hand for the increase in coughs and colds when children are back at school.

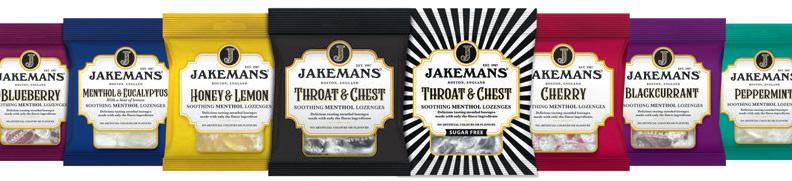

Also from Lanes Health, the Jakemans line-up has been extended for this cold and flu season with a limited-edition Blood Orange & Winter Spice cough/throat lozenge.

“The demand for OTC products remains high, with 93% of people purchasing these products within the past 12 months, and over a third (36%) of people buying OTC products several times a year (Statista),” says Elizabeth HughesGapper, senior brand manager for Jakemans.

“This demand can be attributed to the number of cold/flu/COVID symptoms that people are experiencing regularly, with 39% of the public suffering from these 2-3 times in the past year (Statista).”

The Jakemans brand contributes 24% of sales to the cough/throat lozenge category and has a heritage that has been building brand loyalty for more than 100 years. The range includes 73g bags in Throat & Chest, Honey & Lemon, Cherry, Peppermint, Menthol & Eucalyptus, Blackcurrant and Blueberry variants, with 160g bags and 41g stick packs available in Throat & Chest, Honey & Lemon and Cherry. In addition, Jakemans offers a sugar-free option for Throat & Chest in a 50g bag.

“Jakemans will be supported throughout the winter season with a strong TV, radio and PR campaign, ensuring the brand remains front of mind throughout autumn, winter and other key seasonal moments,” says Hughes-Gapper. “Given that 80% of

people have suffered from a cough and 72% from a sore throat in the past 12 months (Statista), stocking a variety of products, particularly throat lozenges, will be essential.”

Fisherman’s Friend also responds to the consumer desire for a trusted, recognisable brand for OTC remedies.

“Focusing on heritage brands that shoppers know and trust is important now more than ever – especially within categories such as winter remedies,” says Jon R White, regional business manager. “This is because we’re dealing with less disposable income than we’re used to, so many of us are thinking twice about what we’re spending our hard-earned cash on.

“In addition, shoppers tend to feel that little bit more vulnerable when sick, so they want to be 100% certain that the remedy products they’re investing in will deliver the relief they’re looking for.”

In total retail, the OTC remedy category is worth more than £79 million (Nielsen) and expected to increase this year. The Fisherman’s Friend brand, with its high menthol content and value price point (rsp 99p for a 25g pack), is currently worth £1.94 million and includes a sugar-free option in its nine-strong range.

”We are confident that the Fisherman’s Friend proposition and price point will continue to be right in the sweet spot of what many shoppers are looking for,” White continues.

“Our reputation for providing products containing high contents of menthol at a competitive price and in a convenient format has stood the test of time, and shoppers continue to trust us to deliver on this time and time again, increasingly drawn in by our wide range of different flavours and offerings. Despite this, a massive 55% of our sales still come from our Original Extra Strong product, showing this variant has most definitely stood the test of time.”

Matt Stanton, head of insight at DCS Group, which represents brands including Calpol, Lemsip and Sudafed, points out that, with many people still struggling to get a doctor’s appointment, shoppers will continue to resort to self-care for minor illnesses over the winter.

He adds: “Price continues to be a key driver in purchasing decisions. However, medicines shoppers who are ill and in distress are looking for a product they can trust to do the job. These shoppers trust brands as the experts.”

KP Snacks has announced a brand partnership for Butterkist with the Universal Pictures film, Wicked, which arrives in cinemas on 22 November.

The supplier has launched a limitededition 180g Sweet popcorn pack, Wicked designs on £1.25 PMPs, and an on-pack promotion.

Running until 31 December, the promotion offers consumers the chance to win a ‘Thrillifying adventure to London’.

KP Snacks is also supporting retailers with a prize draw, with 35 TV tech bundles to be won. Retailers will be automatically entered into the draw when they buy cases of all four £1.25 PMPs featuring the on-pack promotion.

SHS Drinks is supporting WKD with a £2 million nationwide poster campaign.

Advertising is running until the end of 2024. The 48-sheet and six-sheet posters will be complemented by 96sheet sites in high traffic areas.

The strategy behind the campaign is to reinforce consumer recognition of WKD as ‘the original and best’ RTD, with all executions focusing solely on the lead WKD Blue variant.

The posters are designed to talk to a key 18-21 demographic. The lead execution states ‘The CEO of Blueness’, referencing how young people use the term ‘CEO of’ to mean ‘what you’re known for’.

Kellanova has announced that Pringles is supporting men’s health charity Movember for a fifth consecutive year.

Following the success of last year’s ‘Scan My Mo to Help a Bro’ campaign, Mr P’s iconic moustache on tubes of Pringles has again been transformed into a QR code.

When scanned, the moustache will take people to Movember’s Conversations tool, where people can access resources and information to conduct meaningful discussions around mental health and wellbeing.

The Movember tube design can be found on Salt & Vinegar and Texas BBQ 185g flavours.

Burts is bringing back its Maple Pigs in Blankets potato chips for a limited period.

Last year’s overwhelming consumer demand of this flavour has paved the way for this year’s anticipated success, with sales projected to grow by 106% year on year for the 2024 festive season.

The product has an rsp of £1.25 per 40g bag. Offering a combination of smoky sausage and bacon flavours, balanced with the sweetness of a maple glaze, the crisps are handcooked in Devon.

As with all Burts products, the limited edition is gluten-free and contains no added MSG, artificial colours or flavours.

Mars Chocolate Drinks and Treats has introduced Milky Way milk drink in a 250ml can.

The move follows last year’s successful introduction of Mars and Galaxy milk drinks in cans and is part of the company’s ongoing commitment to more sustainable packaging solutions.