GEORGIA SPRING 2023 COMMUNITIES FIRST ADVOCACY HAPPENINGS | CONNECT CONVENTION PREVIEW | UPCOMING PROGRAMS SERVING THE COMMUNITY Moultrie Bank & Trust Celebrates First Year

About

Doroteya joined James Bates Brannan Groover LLP in 2011, after graduating from Mercer Law School. Prior to law school, Doroteya worked for Flagstar Bank in Atlanta. Doroteya resides in Smyrna, GA, with her husband Jason and their two boys. In her free time, you can find Doroteya cheering on her children at their youth sports games.

Special Areas of Expertise

• Regulatory compliance matters (BSA/GLBA/FDCPA)

• Cannabis banking implementation and compliance

• Review of vendor contracts

• Servicing actions (note amendments, collateral substitutions, and partial releases) for government-guaranteed (SBA/USDA) loans.

• All aspects of default work, such as foreclosure, forbearance agreements, workout agreements, and bankruptcy representation.

ATTORNEY legal news and updates for cba members OFFICES MACON + ATLANTA + ATHENS cbahotline @ jamesbatesllp.com “General Counsel Corner,” a recurring column featuring legal news and information of interest to CBA members, is brought to you by James Bates Brannan Groover LLP. Visit us at jamesbatesllp.com Have a topic you would like to see covered in “General Counsel Corner?” Email us at generalcounselcorner @ jamesbatesllp.com Spotlight

Contact Information dwozniak@jamesbatesllp.com or 404.997.6031

Doroteya N. Wozniak

John McNair President & CEO john@cbaofga.com

Lori Godfrey Executive Vice President and Chief of Staff, Government and Regulatory Relations lori@cbaofga.com

Kristi Greer Senior Vice President Professional Development kristi@cbaofga.com

Lindsay Greene Senior Vice President Member Services lindsay@cbaofga.com

Cassie Cornell Assistant Vice President Digital Strategy and Professional Development Marketing cassie@cbaofga.com

Becky Soto Assistant Vice President Professional Development and LEAD Board becky@cbaofga.com

Connie Shepard Assistant Vice President Professional Development and Member Engagement connie@cbaofga.com

Ellen Shea, CMP Director of Association Services ellen@cbaofga.com

Gwen Lanaghan Staff Accountant gwen@cbaofga.com

Winter 2023 | Georgia Communities First | 1 CONTENTS 29 Education Buzz 31 Retail Banking Leadership 33 Compliance Professionals Package 35 Popular Schools & Conferences 37 NEW! Intermediate & Advanced Compliance Courses 39 Wolrd-wide demand 40 Sponsorship & Advertising Opportunities 41 Student Loans 101 43 The Power of Tax Credits for Community Banks 44 Preferred Service Providers Community Bankers Association of Georgia 1640 Powers Ferry Road SE, Building 28, Suite 100, Marietta, GA 30067-1425 (770) 541-4490 or (800) 648-8215 • Fax (770) 541-4496 | www.cbaofga.com • cba@cbaofga.com FEATURES Spring 2023

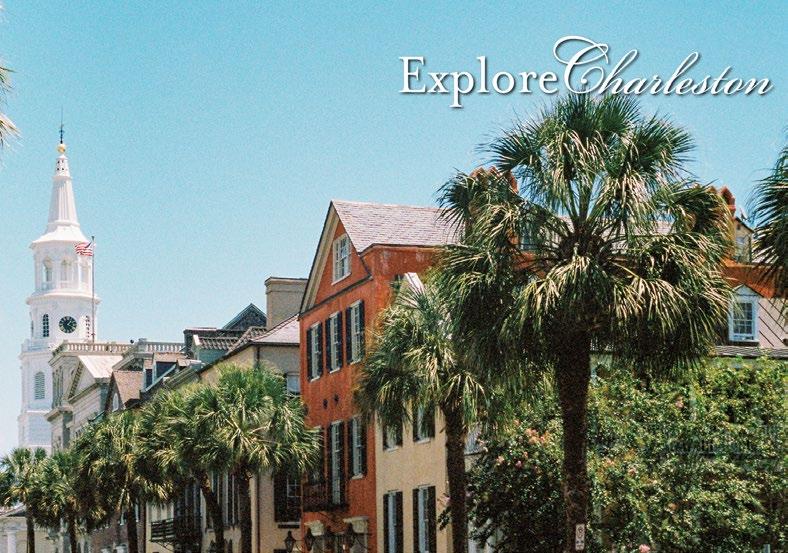

the latest 2 A Few Thoughts About Community Banking 3 Helping Small Businesses–What It Means to be a Community Bank 5 Topgolf Winners 9 Fall Clay Shoots/Town Hall Talks 11 Advocacy T-Shirts Highlights 13 CONNECT Agenda, Speakers Entertainment and more! 21 Georgia’s Newest Bank Celebrates One Year Anniversary. 26 CBA Launches New Website 27 Scholarship Winners stay connected @company/ cbaofgeorgia @CBAofGeorgia @CBAGeorgia professional development spotlights member services The place to be… CBA CONNECT, June 7-11, 2023, Charleston Place pg. 13

CBA STAFF

On the cover: Moultrie Bank & Trust management team: Chief Lending Officer John Peters, President & CEO Donna Lott, and Chief Financial Officer Collin Batchelor

John McNair President & CEO Community Bankers Association of Georgia

A Few Thoughts About Community Banking

As we enter 2023, the headwinds are many. Regarding SVB, we are all well aware of the reasons for the failure of Silicon Valley Bank (SVB) and Signature Bank. Regarding SVB, the key questions to be answered are who knew what and when and why nothing was done months ago. Hold onto your popcorn because this will be an interesting tale that will be told over time. Regarding Signature Bank, this is the irony of all ironies as the former Co-Author of the Wall Street Reform and Consumer Protection Act (A.K.A Dodd/Frank) Rep. Barney Frank is on the bank’s Board. Oh, what a tangled web we weave. Even though both institutions are nowhere near being considered a community bank, it has been the safety of the community banking industry that has been called into question by media and other “experts.” Really??

As we all know, community banks take in local deposits and make loans to local individuals and small businesses. While some are publicly traded, many are closely held/ family based banks that have been around century or more. They are well capitalized and have managed to

endure many financially turbulent times in the past due to exceptional balance sheet management. They are experts in the business of managing risk and are the epitome of “slow and steady wins the race.” In my view, it is high time for the experts and pundits to take some time and study the history of community banks and our overall system of banking and educate the public as opposed for looking for a controversial 30-second sound bite OR to secure social media “clicks.”

Finally, for legislators and federal regulators, I would like to remind all of the vital nature of the community banking industry with three letters- PPP. Without Georgia’s community banking industry working around the clock to effectively and efficiently distribute PPP funding, nearly 1 million Georgia’s would have lost their jobs. Let us all remember that small business drives the broader economy and community banks are the primary banking resource for small business.

2 | www.cbaofga.com | Winter 2023

VANTAGE POINT

Rebeca Romero Rainey President and CEO ICBA

Helping Small Businesses –What It Means to be a Community Bank

If there’s one universal truth about small businesses, it’s this: No two are the same. Whether it’s an agricultural entity, a business consultancy, a retail establishment or a host of other options, you’d be hard-pressed to find a replicated set of financial needs. Fortunately, community banks operate in the same fashion. Though you share common values in relationship-first banking, your models are based on the needs of the communities you support.

That’s what makes you so uniquely poised to serve small businesses: You are small businesses yourselves. Your ability to look at each organization independently allows you to underwrite not based on a one-sizefits-all approach, but on the individual needs of the business and the local community.

Yet the small business relationship extends beyond any transaction. Community bankers are there for their small business customers as lenders, financial advisors and overall business supporters. For instance, I recently visited my local dry cleaner, who always greets me by name, and he apologized that services had been delayed a week because his boiler went out and he had to close. Then, without knowing what I do for a living, he went on to tell me how thankful he was for his community bank, which was able to lend him the money he needed to

get back up and running. He shared that without this bank, he would have been out of operation.

This is but one example of the significant impact you have on the nation’s small businesses. Think about walking down Main Street of any community and how small businesses are the embodiment of that community. Whether the business is a large employer, the local gift shop or a hotel that’s growing, community bankers know the people and needs behind the business, and that personal connection creates a recipe for mutual success.

So, as you consider how to celebrate May’s Small Business Month, I invite you to take a look at the resources unveiled as part of our national campaign and those in the Tell Your Story toolkit. Both provide turnkey materials to help you share your stories and the work you do in supporting small businesses in your communities.

Telling this story matters, particularly as we continue to differentiate community banks from megabanks and credit unions. The impact you have on the small businesses you serve speaks volumes about where your priorities lie and what it means to be a community bank. And that’s a story worth shouting from the rooftops throughout Main Street America and beyond.

Winter 2023 | Georgia Communities First | 3

FROM THE TOP

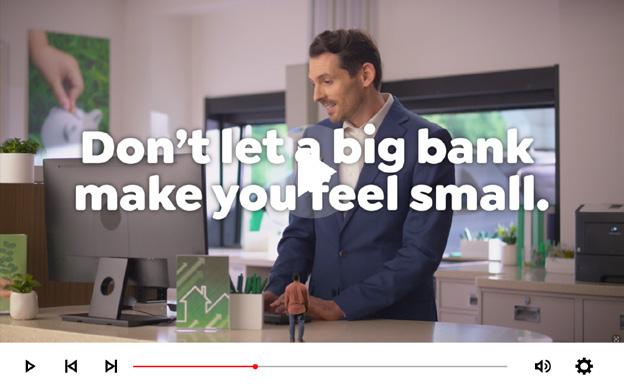

THE NATIONAL CAMPAIGN FOR COMMUNITY BANKS

ICBA launched a national campaign to raise consumer awareness of community banking. ICBA members can plug in and be part of the campaign at the local level by leveraging the free ICBA national campaign toolkit, which offers research insights and turnkey marketing assets.

4 | www.cbaofga.com | Winter 2023

Visit icba.org/campaign to access the campaign toolkit

TAKE PART IN

APRIL 27, 2022 | AUGUSTA

CBA Advocacy TopGolf Showdown

Lots of smiles and friendly competition at the 2023 CBA Topgolf Showdowns which raised funds for CBA’s Advocacy efforts. Bankers and partners enjoyed golf, food, refreshments, prizes and networking at three locations this year –Atlanta, Augusta and Chattanooga. Special thanks to our sponsors and to all who came out to support CBA.

PARTY OF FORE

Congratulations to the winners!

PAR PARTNERS

PLAYER OF THE YEAR

Winter 2023 | Georgia Communities First | 5 THE LATEST

I CHOOSE A PARTNER THAT PUTS MY SUCCESS FIRST. We’re the only nationwide independent, member-owned debit network, processor and core provider supporting community banks. As a leader in the industry, we have a simple mission: Strengthening financial institutions. 855-314-1212 / SHAZAM.NET /

THANKS TO OUR SPONSORS!

Party of Fore - Atlanta

James Bates Brannon Groover LLP

Par Partners - All Eclipse Brand Builders

ICBA

Point to Point Environmental

SHAZAM

Player of the Year - All First National Bankers Bank

BCC-USA

Par Partners - Atlanta

Abram Armored

BHG Financial

CalTech | Integris

Carr, Riggs & Ingram, LLC

DefenseStorm

Executive Insurance Agency

Fitech by Deluxe

Genesys Technology Group

ICBA

PRI - Profit Resources, Inc.

Quantalytix

STS Group Travelers

Vericast

Par Partners - Augusta

Abram Armored Executive Insurance Agency

Fiserv

James Bates Brannan Groover LLP

Par Partners - Chattanooga

Crescent Mortgage

DefenseStorm

Carr, Riggs & Ingram, LLC

Fiserv

Player of the Year - Atlanta

ACG

CRA Partners

Holtmeyer & Monson

Kasasa

PULSE, A Discover Company

ServisFirst Bank

Stokes, Carmichael & Ernst LLP

Player of the Year - Augusta

Crescent Mortgage

Kasasa

Player of the Year - Chattanooga

ACG

Bahr Consultants

BHG Financial

CRA Partners

Holtmeyer & Monson

Quantalytix

ServisFirst Bank

STS Group

Winter 2023 | Georgia Communities First | 7 THE LATEST

CBA Fall Clay Shoots – Right on Target

CBA’s fall clay shoots bring together bankers, associate member companies, and community banking friends to honor two legendary community bankers. Great locations, beautiful fall weather, lunch and friendly competition make the clay shoots a popular event.

Town Hall Talks are a multi-location Grassroots alternative to a Day at the Dome for you to meet your legislators in person. We are proud to be partnering with NFIB to host these “Town Hall” style events where attendees will have the opportunity to engage your legislators in a Q&A session and hear their perspectives on legislative issues that may impact community banks. Attendees will be presented with CBA & NFIB updates, programs, insights on the upcoming legislative session, and most importantly, meet & greet legislators. In addition, this will be a great opportunity to network with other CBA & NFIB members and affiliates. Bankers, we encourage you to invite any small business clients to join and attend these Town Halls with you.

Regional information, networking, refreshments, and legislative updates at six locations across the state:

• Cordele, May 24, 2023

• Greensboro, May 25, 2023

• Dalton, June 22, 2023

• Waycross, July 12, 2023

• Vidalia, July 13, 2023

• Bainbridge, July 20, 2023

THANKS TO OUR SPONSORS

Engage with legislators

Tell your bank’s story

Bring your small business customers

Winter 2023 | Georgia Communities First | 9 THE LATEST

Ready for a partnership that produces? Let’s get started.

The attrition you face from emerging fintechs is enormous. The desire to adopt a digital-first philosophy for your customers is essential. Overcoming the hurdles to remain competitive in an evolving market is a priority. Fitech by Deluxe can help.

Fitech knows that payment strategies are not one-size-fits-all. What works for a startup is different than a well-established business, and the needs of a mom-and-pop shop vary greatly from those of a retail chain. That’s why we provide flexible, customizable and meaningful services designed to help you strengthen your merchant portfolio across every type of business.

From electronic onboarding and real-time data to integrated tools and award-winning customer service, our tools remove the obstacles to make valuable engagement possible.

Sarah Humphrey Director of Sales shumphrey@fitech.com 903-241-0977 Tanner Rizenbergs Manager of Financial Institutions trizenbergs@fitech.com 817-575-7930

Winter 2023 | Georgia Communities First | 11 EXECUTIVE INSURANCE AGENCY, INC. Call Us for All Your Collateral Insurance Needs! • VSI • Flood • Creditor Placed • Collateral Protection • REO • GAP • Blanket • Tracking Services Mr. Ryan Sower • P.O. Box 480 • Stockbridge, GA 30281-0480 770-474-2355 • 800-772-1404 • www.executiveinsuranceagency.com Executive Insurance is a Preferred Service Provider of the CBA of Georgia, and has been working with community banks in Georgia since 1980. We are totally committed to the future of community banking and consequently are setting the standard in service, knowledge and innovation in this very important area. We encourage you to call on us for a comprehensive review of your specific needs. THE LATEST The ADVOCACY Limited Edition T-Shirt! Thank you to all of our ADVOCACY supporters. Don’t forget to share photos of your team in their limited edition shirts on social media. #CommuniTeeBanking #CBAofGA

12 | www.cbaofga.com | Winter 2023 TCM Bank, N.A. helps your community bank grow with a well-rounded selection of credit cards that come without the hassle of starting and managing a program yourself. We partner with over 750 community banks across the United States and meet the needs of more than 530,000 customers. Ask about TCM Bank’s Total Card Management® Program today. Compliance relief Improved market positioning Marketing support TCM takes on the risk and liability Speed-to-market technology NON-INTEREST REVENUE IS JUST THE TIP OF THE ICEBERG. www.tcmbank.com/program | tcmbank@tcmbank.com | (866) 861-7669 | We Bank on Diversity™ TCM Bank is a subsidiary of ICBA Bancard. Part of TCM’s revenue is dedicated to ICBA.

Winter 2023 | Georgia Communities First | 13 June 7 – 11, 2023 | The Charleston Place | Charleston, SC Why attend CBA’s Annual Convention, CONNECT? Stay up to date on the Current Topics, Trends, Resources! Three Days of Programming. Network, Learn & Gain Valuable Resources to Support Community Banking! Fun Activities while Supporting Advocacy Efforts CBA's 55th Annual Convention & Mini-Trade Show

Wednesday, June 7, 2023

1:00 - 3:00 AM

CONVENTION AGENDA

CBA Board Meeting

3:00 - 5:00 PM Convention Registration

3:00 - 5:00 PM

Exhibitor Set-Up

6:00 - 6:30 PM Board Reception*

6:30 - 7:30 PM Board Dinner*

*Events by invitation only.

12:00 - 12:35 PM Announcements & National Update. Derek Williams, ICBA Chairman

12:35 PM Afternoon and evening on your own

Saturday, June 10, 2023

7:30 - 8:00 AM Breakfast

8:00 - 8:15 AM Saturday Kick Off

Thursday, June 8, 2023

7:30 - 8:00 AM Breakfast

8:00 - 8:15 AM

Welcome & Opening Session

8:15 - 8:45 AM Community Banking TrendsLaws & Regulations, What are the happenings at our state Capital? Lori Godfrey, CBA

8:15 - 9:15 AM

Keynote: How Championship Leaders Lead With Passion, Purpose And Love For Their People. Aaron Davis

9:15 - 9:30 AM Stretch Break

9:30 - 10:15 AM Navigating the New Era of Banking. David Noël - EVP Support Services, Genesys

10:15 - 11:00 AM

Exhibit Break Time

8:45 - 9:45 AM Regulator Debrief/Recap and Legal Update with Q/A.

Moderators: Doroteya Wozniak & Mike White, JamesBates-Brannan-Groover, LLP & Lori Godrey, CBA

9:45 - 10:00 AM Stretch Break

11:10 - 11:55 AM

Current Credit Environment; Strategic Loan Review, Stress Testing, Credit Quality & Best Practices. David Ruffin, Qwickrate

12:00 - 12:30 PM

CBA Business Meeting & Announcements

10:00 - 10:45 AM Breakout Session A - The Plan for Succession & Success. Brian Rhonemus, Rhonemus Group

10:00 - 10:45 AM Breakout Session BImplementing an Effective Marketing Budget. Chris Bates, Agora Eversole

12:30 - 8:00 PM

Afternoon on your own 8:00 - 10:00 PM Night Event

(Advocacy Fundraiser)

10:45 - 11:15 AM Top to Bottom SolutionsUnconventional Ways to Grow Core Deposits

Neil Stanley, The CorePoint

Friday, June 9, 2023

7:30 - 8:00 AM Breakfast

8:00 - 8:15 AM

Friday Kick Off

11:15 AM - 12:15 PM Keynote Address: Heart of Leadership: Becoming a Leader Others Want to Follow Randy Gravitt, Integreat Leadership

8:15 - 9:15 AM

Creating a Winning Team - Learn from UGA Football Alumni & UGA FCA Chaplain Panel: Thomas Settles, Rennie Curran, Jeb Blazevich. Moderated by: Neil Stevens

9:15 - 9:30 AM

9:30 - 10:15 AM

10:15 - 11:00 AM

Stretch Break

Economic Outlook

Lindsey Piedgza, Ph.D., Stiffel

Exhibit Break Time

12:15 - 12:35 PM

Announcements

12:35 Afternoon on your own

6:30 - 7:15 PM

Chairman’s Reception

7:15 - 8:30 PM Chairman’s Dinner

8:30 - 10:30 PM Chairman’s Party. Join CBA as we present “Music City Nights” with a singer - songwriter evening featuring Makayla Lynn and Chuck Cannon

11:10 - 11:55 AM

General Session - Future of Banking Conversation with Andrew Couse, First Bank of Clewiston, FL & Pat Dix, Shazam

Sunday, June 11, 2023

8:30 AM Departures

14 | www.cbaofga.com | Winter 2023 SPOTLIGHT

Winter 2023 | Georgia Communities First | 15

Aaron Davis Attitude Expert Author-High Energy Thursday Keynote Speaker

Andrew Couse First Bank of Clewiston Executive Vice President Future of Banking Conversation

Brian Rhonemus Rhonemus Group The Plan for Succession & Success

Chris Bates CEO, AgoraEversole Balancing Your Marketing Budget

David Noël EVP Support Services Genesys Technology Group Navigating the New Era of Banking

David Ruffin Principal QwickRate Credit Quality

Derek Williams ICBA Chairman President & CEO Century Bank & Trust ICBA Update

Jeb Blazevich UGA Football Alumni, Employee Benefits Broker Connection: How to Build a Connected Team

Lindsey Piegza Ph.D., Stifel, Nicolaus & Company, Incorporated Managing Director, Chief Economist Economic Outlook

Neil Stanley CorePoint, Founder & CEO Winning the Battle for Deposits

Neil Stevens CEO Oconee State Bank How to Build a Connected Team - Moderator

Pat Dix Vice President of Strategic Alliances SHAZAM Future of Banking Conversation

Randy Gravitt Auther, Speaker, Podcaster, & Executive Coach Saturday Keynote Speaker

Rennie Curran UGA Football Alumni Keynote Speaker, Author, Leadership & Business Coach How to Build a Connected Team

Thomas Settles UGA FCA Chaplain How to Build a Connected Team

16 | www.cbaofga.com | Winter 2023 DIAMOND LEVEL GOLD LEVEL BRONZE LEVEL SILVER LEVEL PLATINUM LEVEL GENE S Y S TECHNOLOGY GROU P Thursday Cash Prize Thursday Promo Items Friday Breakfast Friday Cash Prize for Exhibits Bottled Water Board Meeting Refreshments & Gift GENE S Y S TECHNOLOGY GROU P 60-Second Commercial & Wifi Sponsor Convention Tote & Friday Cash Prize Friday Room Drop & Saturday Promo Items 60-Second Commercial Board Appreciation Reception & Dinner Co-Sponsor Chairman’s Reception & Dinner Co-Sponsor 60-Second Commercial & Thursday Casino Night Board Appreciation Reception & Dinner Co-Sponsor Thursday Coffee Station Saturday Breakfast Thursday Keynote Speaker Thursday Breakfast Saturday Cash Prize Friday Promo Items Name Badges 60-Second Commercial Board Appreciation Reception & Dinner Co-Sponsor Chairman’s Reception & Dinner Co-Sponsor Thursday Night Hosted Beer & Wine Co-Sponsors Friday Coffee Station Convention Swag Item Snack Bags Thursday Room Drop Saturday Coffee Station Thursday Desserts Co-Sponsor Thursday Night Desserts Co-Sponsor Friend of CBA Level Convention Signage Saturday Keynote Speaker General Sponsor JUNE 7 – 11, 2023 CHARLESTON PLACE CHARLESTON, SC

Thanks to our Exhibitors!

Abram Armored | ACG | Adlumin | Agora Eversole

BCC-USA | BHG Financial | College Ave Student Loans

CRA Partners Crescent Mortgage | DefenseStorm

DeNyse Companies | Eclipse Brand Bulders

Executive Insurance Agency | Federal Reserve Bank

Fitech by Deluxe | Genesys Technology Group

HC3Holtmeyer & Monson | ICBA | ICBA Securities

IntraFi Network | Kasasa | Newcleus Point to Point Environmental | QwickRate | SBA Works

SHAZAM | STS Group | Travelers | United Bankers’ Bank | Vericast | Warren Averett

HOTEL INFORMATION & RESERVATIONS: Click here for online reservations.

Winter 2023 | Georgia Communities First | 17

SPOTLIGHT

While safety is a top-of-mind, let your customers know that their large-dollar deposits can be eligible for FDIC protection with ICS®, or IntraFi Cash ServiceSM, and CDARS®. Solidify high-value relationships today by offering secure solutions that provide access to millions in FDIC insurance at participating network banks, working directly with just one bank—your bank.

Safety and convenience for your customers, plus increased cross-selling opportunities and franchise value for your bank. Talk to us today about ICS and CDARS.

Use of IntraFi’s deposit placement services is subject to the terms, conditions, and disclosures in the applicable program agreements, including the IntraFi Participating Institution Agreement. Limits apply and customer eligibility criteria may apply. A list identifying IntraFi network banks may be found at https://www.intrafi.com/network-banks. The depositor may exclude particular insured depository institutions from eligibility to receive the depositor’s funds.

18 | www.cbaofga.com |

Build loyal, less-rate-sensitive relationships now. Contact your Managing Director Danny Capitel at (866) 776-6426, x3476, or dcapitel@intrafi.com www.intrafi.com

Stop Deposit Runoff

HAVING FUN IS REQUIRED! FESTIVE ATTIRE IS OPTIONAL!

Join your fellow bankers at a swanky bootleg party to celebrate CBA’s advocacy efforts. The secret location will be revealed to the attendees during the convention. We will have continuous card play at our blackjack, poker, roulette, and craps tables not to mention CBA will also have the infamous silent auction that is sure to bring out a little bit of competitiveness amongst our attendees. Guys and Dames don your best 20’s glad rags for an opportunity to win some great prizes. (Dessert and Cash Bar)

Call for Silent Auction Items - Come Support the Voice of Community Banks in Georgia!

Don’t know what to donate? Take a look at some of these exciting ideas!

SATURDAY NIGHT ENTERTAINMENT

CHUCK CANNON

Chuck grew up in the South Carolina Low Country. He’s a Southern boy whose music echoes the R&B, Rock & Roll, Country and Gospel music he grew up on. Chuck’s songs have been recorded by an incredibly diverse array of recording artists from around the world and have logged over 25 million radio airplays.

MAKAYLA LYNN

Named by Rolling Stone Magazine as a new artist you need to know, Canadian born Makayla Lynn is a fresh face exploding into the Nashville scene. She has spent time at #1 on CMT’s 12 Pack Countdown and is a two-time East Coast Music Award winner in Canada.

Winter 2023 | Georgia Communities First | 19 SPOTLIGHT

20 | www.cbaofga.com | Winter 2023 Learn more or request a demo at Kasasa.com/loans. Consumers want a better loan. Make sure they get it from you. Get a 52% increase in total loan balances with a loan they actually love. All without changing your credit criteria or marketing. The Kasasa Loan® with Take-BacksTM gives borrowers more flexibility and control over their debt with the ability to pay ahead and take back the extra payments

if the unforeseen happens.

Georgia’s Newest Bank Celebrates One Year Anniversary

Get to know Donna Lott – President & CEO, Moultrie Bank & Trust

Moultrie Bank & Trust, Georgia’s newest bank, opened in May 2022 and what a year it has been for bank President & CEO Donna Lott and the team. CBA sat down with Donna to learn about the bank’s journey the first year and to learn about how the bank is serving their customers, shareholders and community.

According to Donna, the first year has been crazy busy but extremely rewarding. Along with Donna, the management team is led by Chief Lending Officer John Peters, Jr., and Chief Financial Officer Collin Batchelor. The bank currently has 13 employees with plans to continue to grow staff. “I have an incredibly dedicated and talented group of employees who embrace community banking all day, every day. They are career community bankers and would not have it any other way,” explained Donna.

“Realizing the importance of having a locally owned community bank, the founders and management team of Moultrie Bank and Trust set out to do what the “experts” thought was impossible: start a new community bank outside of a major metropolitan market. These savvy and civic minded individuals took on the challenge knowing that if they could establish a locally owned bank, the impact on their community would be substantial, stated John McNair, President & CEO of CBA.

Donna

President & CEO Moultrie Bank & Trust

“They are to be celebrated for making the personal and financial investment to make it happen. What makes this situation even more wonderful is how the entire community embraced the effort. Along with the founders, the bank has 486 total shareholders- the vast majority being small dollar investors,” continued Mr. McNair. “This is a wonderful American success story and proves that starting a new community bank outside a major metropolitan market CAN be done in a post Dodd/ Frank era. I hope this story will serve as motivation for other civic minded people across Georgia and the country to do similar. WELL DONE!”

Bank benefits:

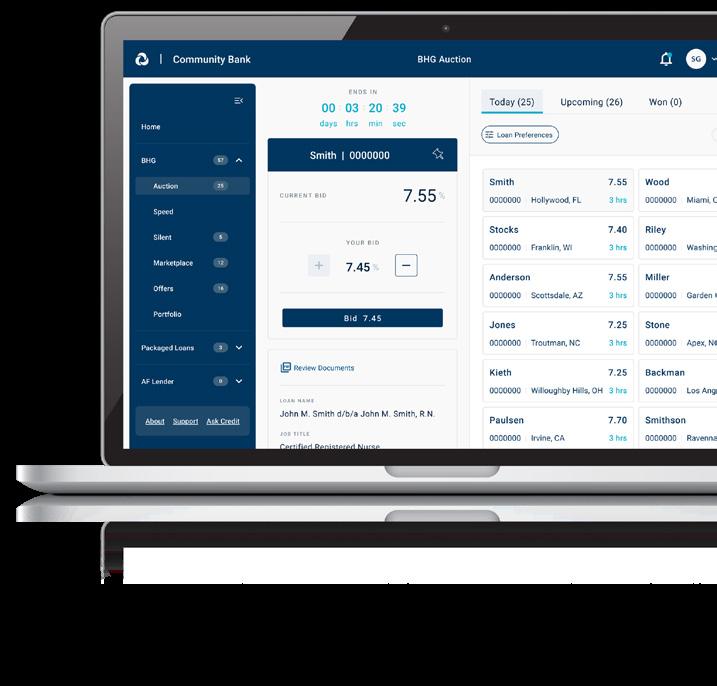

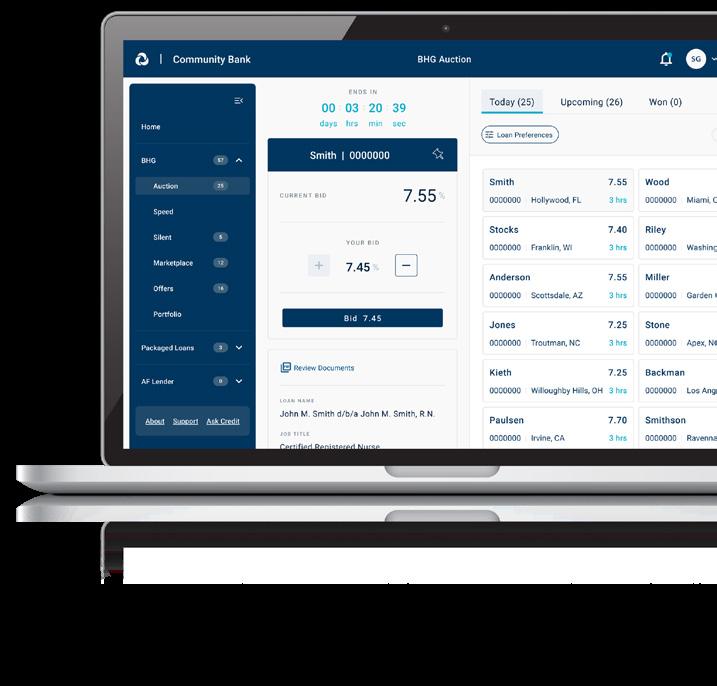

Our 1,525+ Bank Network members have earned more than $1B in combined interest income from exclusive access since 2001.

• Access top-tier assets

• Turn excess liquidity into revenue

• Receive direct ACH payments from borrowers

• Credit enhancements available

Become a member and see how easy it is to expand beyond your local borrower base.

The BHG Loan Hub is a secure, state-of-the-art platform that allows you to diversify your bank’s portfolio with top-performing loans.

Rachel Thornton AVP, Institutional Relationships 843.251.4223 rthornton@bhg-inc.com BHGLoanHub.com/GA

Rachel Thornton AVP, Institutional Relationships 843.251.4223 rthornton@bhg-inc.com BHGLoanHub.com/GA

Winter 2023 | Georgia Communities First | 21 SPOTLIGHT

Lott

LOAN HUB THE

BHG

Eclipse Brand Builders is an award-winning commercial design-build firm with unparalleled experience in the financial industry. We partner with financial institutions throughout the Southeast as a single source of responsibility for comprehensive consulting, design and construction services, which we provide with an unwavering commitment to honesty, integrity and helping our clients achieve long-term success.

22 | www.cbaofga.com | Winter 2023 FULL SERVICE DESIGN-BUILD ARCHITECTURE & ENGINEERING RETAIL & INTERIOR DESIGN & FURNISHINGS CONSTRUCTION MANAGEMENT SITE & MARKET ANALYSIS BRANDING & MARKETING NEW CONSTRUCTION RENOVATIONS & REMODELS www.eclipsebrandbuilders.com 678.894.4360

Tell us a little about you and your banking background. I started my banking career right out of college in 1998. I was given an opportunity to participate in the Management Trainee program at Southwest Georgia Bank in Moultrie and my banking career grew from there.

Is there a particular niche Moultrie Bank & Trust serves? Our niche is true community banking! Customers are choosing MB&T because we have local ownership with local management which has the autonomy to provide banking services that can be tailored to meet the needs of the communities we serve. Customers still value face-to-face, traditional banking services and MB&T has embraced that traditional model all while providing the latest in electronic banking services for consumers and businesses alike. One of the most repeated statements we heard early on in the formation process and still today is how individuals and businesses in our service area felt abandoned by the former community banks that were once headquartered in Moultrie, we knew we had to step up and put our local communities first and that’s exactly what we’re doing.

What prompted you to start a bank?

I received an unexpected yet interesting phone call from Byron Richardson, a bank consultant with Bank Resources, Inc. He gave me some insight into the organizing group he was working with and what they were trying to accomplish in terms of starting a truly locally owned and managed community bank in Moultrie-Colquitt County. At the time there was a significant disruption in the community banking landscape as there had been a number of corporate changes at other banks with branches located in MoultrieColquitt County and the surrounding service areas, so this opportunity could not have presented itself at a more opportune time.

I’m a career community banker by choice and was raised by a career community banker, so I have a deep appreciation for how a locally owned and managed bank impacts a community and I am proud I have earned the opportunity to lead and guide the efforts of Moultrie Bank & Trust.

How did the community support this new venture?

The community support has come from far and wide and has been tremendous! MB&T’s primary service area is Moultrie-Colquitt County, and our secondary service area consists of Brooks, Cook, Mitchell, Thomas, Tift, and Worth Counties and we were able to pull investors from all those areas and many more. We had a lot of interest from former residents of Moultrie-Colquitt County, many of whom still have family here. When we closed out our initial Stock Offering on April 27, 2022, we had 486 stockholders and raised a total of $21,571,970. The common statement from those that purchased stock was their desire to be a part of a bank that would invest in and support the local communities from a business as well as charitable perspective.

Share any challenges this first year, or before opening. Without a doubt the interest rate environment has presented a number of challenges for our Chief Financial Officer and Chief Lending Officer since opening in May 2022 but they’re making the best out of it. But by far our biggest

challenge this first year has been the construction of our permanent facility. I realize MB&T is not the only one feeling the pain of increased construction costs, labor shortages and supply delays but it has been a continuing point of frustration. Our executive management group and directors are determined to stick to our budget projections and business plan as we want to do right by our MB&T Shareholders.

What are you most proud of?

There are so many things to be proud of as we’ve been able to accomplish a lot in this past year, but I believe achieving our first month of profitability in January 2023 was HUGE! We’ve continued the trend with a profitable February and March, so it feels good to be ahead of our initial financial projections.

Winter 2023 | Georgia Communities First | 23 SPOTLIGHT

Q & A with Donna Lott cont.

Breaking ground on new building on Veterans Parkway in Moultrie.

(Above): It’s official! Ribbon cutting last spring at current Doc Darbyshire Road location. (Below): Management Team: CFO Collin Batchelor, Donna Lott and CLO John Peters, Jr.

Looking ahead – what’s next for Moultrie Bank & Trust?

I wish I had a crystal ball…. I feel we’ve got a great group of engaged board members along with a very talented group of employees who are working hard to make Moultrie Bank & Trust the go to for community banking in Moultrie-Colquitt County. We sincerely appreciate the shareholder and community support thus far and we look forward to being a responsive and supportive member of the community for many years to come.

What benefits of membership with CBA have you used during this process and how can CBA further assist you?

Our employees have been able to take advantage of numerous webinars as well as the Compliance Professionals Package.

Advocating for Community Banks is huge when it comes to public perception and the regulatory environment. I just thought the regulatory burden was huge when I worked for a $550 million dollar bank that was almost 100-years old and financially sound…. little did I know how things would feel in a $70 million-dollar denovo bank approaching its one-year anniversary.

MB&T supports the community in so many ways.

Winter 2023 | Georgia Communities First | 25 SPOTLIGHT

Q & A

with Donna Lott cont.

CBA Launches New Website & Member Portal

CBA is excited to announce the launch of our New Website and member portal, now called the Member Compass. With several new features, we’re sure you will love it as much as we do. Search for anything on our entire website from the upper right hand magnifying glass icon. Explore the new and improved Member Directory, now with an intuitive “search near address” map.

Finding professional development classes has never been easier with our searchable Event Calendar.

With your new login, you will be able to:

• Register for events

• Update your profile information

• Track event attendance

• View/Pay invoices

• .and more!

CBA has an answer for you on our FAQ’s & Help Guides page. With new help guides added frequently, and easy online contact form, you’ll be zooming around our website like a pro in no time!

CRA Investment and Lending Test Credit For Protecting Local Seniors

Our foundation partners with community banks on programs that promote safety in senior housing facilities. We support those that gave us so much with systems that prevent financial and physical abuse. Join the hundreds of banks that already participate. To get involved and earn CRA credit, please contact: info@shcpfoundation.org

26 | www.cbaofga.com | Winter 2023

SPOTLIGHT

Join our Peer Group to exchange ideas on current CRA topics thecracollaborative.com THE

Julian & Jan Hester

MEMORIAL SCHOLARSHIP

HesterScholarship

CBA is pleased to announce and congratulate the winners of the annual Julian & Jan Hester Memorial Scholarship. The 2022 scholarships were open to Georgia high school seniors who intend to enter a Georgia college, university or technical school in the fall semester of 2022. Applications were submitted to the association through CBA member community banks.

The scholarship is named for the late Jan Hester, daughter of Lalia and the late Julian Hester, long-time CEO of the CBA. The scholarship program began in 1991 and is based on academic merit, not financial need. In addition to supporting community banking, this scholarship fund is an opportunity to pass on the positive qualities both Julian and Jan Hester exemplified to further the development of tomorrow’s generations. Each winner received a $1,000 to the Georgia college, university or technical school of their choice.

CBA is appreciative of the participation from member banks from throughout the state. Special thanks to the panel of judges, which included Dr. Marguerite Brickman, University of Georgia, Athens; Katie Funderburke, Mauldin & Jenkins, Albany; Drew Kessler, Genesys Technology Group, Norcross; Kyle Ray, Builtwell Bank, Dalton; and Linda Smith, Embassy National Bank, Lawrenceville.

Robert Holt Awarded 2023 Annual J. Steven Walraven Memorial Scholarship Recipient

The Community Bankers Association of Georgia (CBA) is pleased to announce the winner of the 2023 J. Steven Walraven Memorial Scholarship. Congratulations to Robert Holt, Personal Banker at Oconee State Bank, Watkinsville. Robert attend University of North Georgia and was nominated by Neil Stevens, President & CEO, Oconee State Bank, Watkinsville.

This $500 scholarship is awarded to a Georgia community bank employee attending a college or university within the state of Georgia. The goal of the scholarship is to assist those employees interested in furthering their education to enhance their career in community banking. The scholarship is named for the late J. Steven Walraven, a former community bank president who dedicated much of his life to his community and community banking. His family developed the scholarship in his memory. Steve was a member of the Board of Directors of Community Bankers Association of Georgia and served as Treasurer.

Winter 2023 | Georgia Communities First | 27

Hayden Hulsey University of Georgia

Erin Meeks Mercer University

Will Miller University of Georgia

Sophia Sun Emory University

2023

SPOTLIGHT

Travelers and the ICBA celebrate 40 years of partnership and $75M+ of Policyholder Safety Group Dividends

28 | www.cbaofga.com | Winter 2023 Banking changes. Our commitment to you never does. Throughout our long history, we’ve stayed focused on keeping community banks on the cutting edge. We do this with industry-leading specialists, expertise and offerings – all backed with local banking knowledge. Learn more at travelers.com/business-insurance/financial-institutions 1964 Travelers becomes one of the first domestic markets to write Directors & Officers Liability insurance 1999

Identity Fraud Expense Reimbursement coverage to market 2011

CyberRisk coverage is

to the market 2023

Travelers brings its

Travelers

introduced

1890 Travelers begins to offer Financial Institutions coverage travelers.com Travelers Casualty and Surety Company of America and its property casualty affiliates. One Tower Square, Hartford, CT 06183 This material does not amend, or otherwise affect, the provisions or coverages of any insurance policy or bond issued by Travelers. It is not a representation that coverage does or does not exist for any particular claim or loss under any such policy or bond. Coverage depends on the facts and circumstances involved in the claim or loss, all applicable policy or bond provisions, and any applicable law. Availability of coverages referenced in this document may depend on underwriting qualifications and state regulations. © 2023 The Travelers Indemnity Company. All rights reserved. Travelers and the Travelers Umbrella logo are registered trademarks of The Travelers Indemnity Company in the U.S. and other countries. CP-9620 Rev. 4-23

Education Buzz:

Don’t Just Create a Door of Opportunity – Walk through it!

I had the honor to attend GMC’s (Georgia Military College) Vietnam Veterans 50th homecoming anniversary. I experienced a powerful keynote address from CAPT Charlie Plumb, USN (Ret). CAPT Plumb, a former fighter pilot, reminded us, “life is a choice” and you can “choose to be a victor or a victim” while sharing his Prisoner of

War experience from a 8 x 8 classroom (prison cell). What would you do in an 8 x 8 dark cell? CAPT Plumb walked his cell. He choose to make the situation an opportunity. Yes, it was challenging. Rather waste the time, use opportunities to learn, grow and prepare for the next thing. Value is measured when we are challenged, when we go through pain, when we choose to learn from our mistakes and authentically walk through the door. Expect and embrace challenges as opportunities for growth and development no matter what cell or door you face.

Kristi Greer Senior Vice President Director of Professional Development Community Bankers Association of Georgia

Dedicated to Community Banks. Driven to Provide Results.

With 25+ years of agency experience and endorsements from multiple state banking associations, AgoraEversole can take your marketing to the next level. Contact us to start our partnership today.

Winter 2023 | Georgia Communities First | 29

PROFESSIONAL

AgoraEversole.com | 601.366.7370 TRADITIONAL | WEB DESIGN | SEO | SOCIAL MEDIA | DIGITAL ADS

DEVELOPMENT

Capt. Charlie Plumb, USN (Ret), Former POW

Kristi Greer, CBA with Kate Pope, Director of Community Outreach & Business Development, Georgia Military College

EXPECT A NEW STANDARD OF SERVICE

Abram was founded with the speci c purpose of transforming the cash in transit industry, through the heart of a servant. Our vision is to positively transform lives in the communities we serve.

We invite you into our story and our vision, to partner with one another to make an impact.

Cash Vault

Cash Processing

First Line Maintance

Cash Vault

Cash Processing

First Line Maintance

twebb@abramarmored.com 770 | 855 | 2989 Abramarmored.com

Retail Cash Services

Small businesses count on your expertise. You can count on ours.

Your customers have never needed capital more than they do right now. Plus you need to offset narrowing margins by increasing noninterest fee income.

SBA/USDA lending is the perfect answer. And ICBA recommends just one provider to make the process hassle-free: Holtmeyer & Monson. Give customers exactly what they need, at no net cost to your bank.

Winter 2023 | Georgia Communities First | 31 PROFESSIONAL DEVELOPMENT

Closing SBA loans keeps doors open.

800.340.7304 to start www.holtandmon.com

Need a Career Path? This program is an excellent tool to cross-train and build the necessary skills for ongoing growth and development for both front-line and back-room retail focused roles in community banks. Register here.

Call

We are back in person! Gain insight straight for all our regulatory agencies as we work closely to provide hot topics, exam trends, and increased face time with your fellow bankers. Register today.

32 | www.cbaofga.com | Winter 2023 PROFESSIONAL DEVELOPMENT

Q2: Appraisal Regulations & Flood Insurance Compliance

Q3: Essential Lending Compliance

Q4: 3rd Party Risk Management & Environmental Social Governance (ESG)

We invite you to continue participating in CBA’s annual Compliance Program, the 2023 Compliance Professionals Package. CBA of GA continues to raise the bar on our program offerings to bring more benefits and value to our community bank compliance professionals. The Compliance Professionals Package will support your financial institutions strategies for managing an effective compliance program. As your professional development resource, we know you strive to continue growing your knowledge and skills as compliance professionals.

Your Compliance Professionals Package was built using our member’s ongoing feedback and survey results. Thank you for continuing to provide support and feedback so that we can offer the topics and ongoing resources you request.

CBA’s Compliance Professionals Package is intended to educate community bankers on updated compliance topics and regulatory issues that are useful and applicable to the ongoing bank strategy. These opportunities are designed for community bank professionals by providing annual education and techniques for monitoring and enforcing regulations which support the regulatory compliance success of community banks.

Why Join?

• Gain Continuing Professional Education Credits – CPEs.

• Receive Quarterly Professional Education Programs.

• Receive Special pricing to attend CBA compliance-related schools and seminars.

• Access to a Complimentary Legal Hotline.

• Access a complimentary toll-free compliance helpline. Within 90 days after a seminar/school led by a ProBank Austin speaker, attendees may call and discuss concerns with the speaker without charge.

• Collect Quarterly newsletters (InCompliance) that address current regulatory hot topics.

• Complimentary access to the CBA Compliance Officer online forums.

• Complimentary registration to attend Compliance R.A.P. sessions (including Banker Regulatory Forums)

*RAP = Roundtable Advice for Professional Development

Winter 2023 | Georgia Communities First | 33

PROFESSIONAL DEVELOPMENT

Our clients appreciate the “Real World Legal Solutions®” that we bring to the myriad legal matters facing banks today. We welcome the opportunity to put our experience to work for you. Please contact us to discuss how we can help you optimize recoveries for your bank.

34 | www.cbaofga.com | Winter 2023 Stokes Carmichael & Ernst LLP scelaw.com | mje@scelaw.com 404.352.1465 x441 At Stokes Carmichael & Ernst LLP, we have been bringing “The Power of Legal Knowledge®” to the challenges faced by the financial community in the areas of credit and collections, banking litigation, fraudulent conveyance litigation, bankruptcy representation, defense of lawsuits, and loan workouts since we opened in 1972.

THE POWER OF LEGAL KNOWLEDGE®

Popular Schools & Conferences

CONNECT – CBA’s Annual Convention

June 8-10 | Charleston, SC

Cyber Risk Summit

August 17–18 | Jekyll Island

Advanced BSA/AML Compliance School

August 21–25 | St. Simons

LEAD Retreat

September | TBD

Retail Lending School

October 2–5 | Macon

Advanced Compliance School

October 23-26 | Jekyll Island

Mortgage Lending School

November 14-16 | Perimeter

ICBA Community Bank Briefing: Overview of the New Small Business Lending Requirements under ECOA (1071)

On March 30, the CFPB published the final rule amending Regulation B to implement changes to ECOA made by section 1071 of the Dodd-Frank Act. These changes will require covered financial institutions to collect and report data on applications for small business credit. Click here to access the briefing held on April 14, 2023.

Upcoming 1071 Webinars

May 22 - Section 1071 Final Rule Highlights & Effective Dates

June 12 - Section 1071: Developing a Data Collection Process Under the Final Rules

Do you have an employee that wants to understand the full picture of the community banking industry? We want to support your bank’s talent development by offering this brand new class. Participants will establish a strong foundation of the banking industry and improve cross functional contributions for overall bank success. This program prepares bankers to participate in Barrett School of Banking. Register today.

Winter 2023 | Georgia Communities First | 35 PROFESSIONAL DEVELOPMENT

36 | www.cbaofga.com | Winter 2023 The Clock Is Ticking! Make CECL Compliance Simple, Practical and Affordable — with CECLSolver ™ • Data handling done for you – Let us aggregate the data and calculate your Weighted Average Remaining Maturity • Huge help for community banks – Produce a CECL analysis that is informed and defensible • No analysis paralysis – Replaces needlessly complex calculation methods and software services • Instant peer and historical data – Enhance your Q-factors with instant historical and customized peer data Get a Tour of CECLSolver. info@qwickrate.com 800.285.8626 qwickrate.com PROFESSIONAL DEVELOPMENT Need a Career Path? This program is an excellent tool to cross-train and build the necessary skills for ongoing growth and development for both front-line and back-room retail focused roles in community banks. Register today. Maximize the potential of your team members, retain talent, track performance, collaborate on employee strategies, and more. Your HR manger should join the league of community bank HR professionals. Register today.

Winter 2023 | Georgia Communities First | 37 PROFESSIONAL DEVELOPMENT NEW!! Intermediate and Advanced Compliance Courses NEW!! Intermediate Compliance: Essential Lending Compliance Coming Late September Don’t miss any of the community bank focused compliance education opportunities.

IS YOUR COMMUNITY BANK BOND PORTFOLIO PERFORMING?

Meet Jim.

Jim meets with community bankers across the U.S. to discuss ICBA Securities’ investment products, services, and education through our exclusively endorsed broker, Stifel. Investing through ICBA Securities is a direct investment back into the community banking industry.

When Jim is on the road, he always takes time to enjoy local restaurants and share on social media.

As an ICBA member, you’ve got Jim’s help investing.

Learn more at icba.org/securities

38 | www.cbaofga.com | Winter 2023

World-wide demand

Buyers

of U.S. debt come in many shapes and sizes.

I think we can all agree that there has been plenty to be concerned about in the last, say, five years. Some are environmental issues, some are social and, for community bankers, plenty are economic. What gets a lot of play in the business and even mainstream media is our growing national debt. There’s no doubt that the mountain of borrowings that keeps our federal government liquid and solvent is greater than ever before. It’s not surprising to me that there’s spirited debate about debt limits, or if Congress will ever in our lifetimes find a way to slow our dependence on deficit spending.

Related to this conversation is the concern that, to paraphrase Blanche DuBois, we have always depended on the kindness of strangers. It seems self-evident that foreign central banks have propped up our debt market for decades, buying dollar-denominated securities by the trillions, thereby keeping our borrowing costs manageable, and potentially even encouraging our bad behavior by going ever deeper in debt. But is any of this true?

Walked, then ran

First, let’s try to get our minds around the situation. The Federal government first borrowed money before there was a Federal government, when the Dutch and the French loaned money to the Continental Congress to help finance the Revolutionary War. Treasury borrowings, as we know them today, sort of date back to World War I, with the issuance of “Liberty Bonds,” which was just after the creation of the Federal Reserve Bank. As we have seen, the Treasury and the Fed have a long history of collaboration.

Even at the start of the 21st century, total Treasury debt was “only” $3 trillion, at a very manageable 30% of GDP. Just four years ago, our borrowings were about $17 trillion, at 77% of GDP. Today? We’re over $24 trillion, nearly 100% of GDP. While it would be tempting to blame a lot of the more recent growth on COVID and the fiscal response to that, the reality is each administration of the last quarter century has contributed to the current debt stockpile. And, now that rates are at a 15-year high, our interest payments alone are now over $900 billion per quarter. As Craig Dismuke, market strategist for Stifel, is fond of saying, “Interest is an expenditure that doesn’t create jobs.”

Bedrock option

Now, for some hopeful commentary. The owners of our Treasuries are a diverse lot, with diverse objectives. Investors include the savings bond/retail buyers, institutional money managers who run mutual funds, depositories, our central

Jim Reber President & CEO ICBA Securities

bank, and yes, other sovereign central banks. What’s interesting to note is that the percentage of our debt owned by China, Japan, Germany and the rest of the foreign investors has declined substantially in the last decade, from about 42% to less than 30%. The Federal Reserve, meanwhile, has picked up the pace, and has essentially absorbed the pro-rata share of the pie in the last decade. So it would be wrong to conclude we’re hostage to foreign governments’ largesse. Still, that leaves around half of our total debt in the hands of private investors.

Who are these people? Most are names you’ve heard of, and maybe even invested your personal or retirement moneys with. Large mutual fund families, state-sponsored retirement funds and life insurance companies are examples. In aggregate, they have owned nearly half of the total debt pie for most of this century, so their collective appetite for full faith and credit investments has mirrored Uncle Sam’s appetite for more borrowing. A lot of this can be attributed to the aging of the population, and the advent of “targeted date” funds.

Keeps the wheels turning

If you’re of a certain vintage, you may already be invested in these vehicles. Targeted date funds are built for individuals who have an eye on a retirement date, whether it’s five or fifteen years from now. Each fund will gradually reallocate its assets out of riskier sectors (e.g., equities) and into debt securities (including Treasuries) as the target date approaches. Collectively, retirement funds (and individuals acting on their own) that gradually, systematically, add more Treasuries to their portfolios may continue to keep up demand to absorb the ever-increasing supply.

So how does this rubber hit the road for Main Street? For starters, demand for U.S. debt helps keep a lid on our Federal deficit by subsidizing interest costs. It probably also keeps community banks’ net interest margins a bit lower than otherwise, even if most banks’ portfolios contain no Treasuries at all. Still, the global need for Treasury bills, notes and bonds may just possibly sync up with our growing deficit, and ultimately be supportive, long-term, of commerce as we know it. Unlike DuBois, the U.S. Treasury doesn’t depend on the kindness of strangers; rather, the global need for safe, liquid debt securities.

Winter 2023 | Georgia Communities First | 39 MEMBER SERVICES

40 | www.cbaofga.com | Winter 2023 MEMBER SERVICES SPONSORSHIP & ADVERTISING OPPORTUNITIES Ready to grow your brand recognition and drive sales? Upcoming Programs: • CBA Leadership Academy • Cyber Security Conference • Advanced BSA/AML School • HR/TD Rap Session • Advanced HMDA Let’s discuss your goals and design the best package for your needs. Contact Lindsay Greene. Schedule a demo with your Georgia Account Executive S T S i s t h e b r a n c h s e c u r i t y & t e c h n o l o g y e x p e r t s a n d t h e y h a v e e a r n e d o u r t r u s t . – R a f a e l R o d r i g u e z , V P / R i v e r B a n k & T r u s t ATM / ITM Fraud & Theft Protection Ryker Goodell ryker@stsgrp.com 470-514-0178 Safe Reinforcement Kits Swing Gates Natural Environment Video Analytics Anti-Skimmers Jackpotting Solution

Student Loans 101:

What Families Need to Know before Borrowing

While many families value higher education, figuring out how to cover those costs can feel overwhelming. And these parents aren’t alone. In fact, a recent College Ave Student Loans survey finds that 56% of parents were stressed about figuring out how to pay for college. At the same time, 71% of parents found the cost of college surprisingly high. For this reason, many families choose to explore a range of avenues for funding college. Understanding what options are available is the first step.

Once a family can establish the cost after any available scholarships and grants have been taken advantage of, it’s time to do the math. The next line of considerations will be personal contributions such as a 529 plan, savings, and household income. Any gap remaining in the total owed, will be the amount the family may consider borrowing in the form of a loan. If this is the case, here’s what to know:

First Things First

If the need to borrow does exist, federal student loans in the student’s name should be taken out first as those come with unique benefits and protections, not offered by private lenders. Families should fill out the Free Application for Federal Student Aid at FAFSA.gov to determine a child’s eligibility for certain scholarships, grants, work-study, and federal student loans and more. Families should also explore cost-saving housing options and ways to spend less on school supplies, such as buying used textbooks.

Shopping Around

If federal student loans don’t cover the remaining costs, families can shop around for a private student loan. Here are four factors families should consider when comparing loan options:

1. Competitive rates: Securing a lower interest rate can help a borrower land lower monthly payments and pay less interest over the life of the loan. To get a sense of the overall cost of the loan and monthly loan payment amount, use the College Ave student loan calculator.

2. Flexible loan terms: Find a student loan with a variety of repayment options. Some private student loan lenders, like College Ave, let the borrower choose how long they want to repay the loan. They also offer the option to start making

payments right away or defer until after graduation. Keep in mind that making any payments while in school can help lower the overall costs.

3. Fees: Private student loans don’t typically have an origination fee, but it is still a good idea to take the time to check. Families should also make sure the loans don’t have any prepayment penalties.

4. Cosigning a loan: Most undergraduate students don’t have enough credit history or income to qualify for a private student loan on their own. A parent will likely need to cosign the loan, meaning they equally share repayment responsibility, and the loan will be listed on both credit reports. That means good payment history will positively impact both the student and the cosigner’s credit score, and missed payments will have a negative effect on both.

Taking out a Loan

Wondering how much to borrow? A good rule of thumb is not to borrow more than the student’s expected first year’s salary.

Every family will follow their own path when it comes to how they pay for college and will likely need a variety of sources to help. Bottom line? Being a strategic borrower and finding a simple loan experience, like the one offered by College Ave, can help families get on with what matters most: preparing for a bright future.

Interested in applying for a loan? Visit: www.collegeave.com/cbaga

Brian Reed Head of Partnerships College Ave Student Loans

Brian Reed Head of Partnerships College Ave Student Loans

Winter 2023 | Georgia Communities First | 41 MEMBER SERVICES

42 | www.cbaofga.com | Winter 2023 Our Expertise: Preferred Service Provider of CBA 30+ years experience Specializing in financial institutions The GA Department of Banking recommends an outside review of fidelity coverage every 3 years. Hank@BahrConsultantsInc.com BahrConsultantsInc.com 1-888-272-7943 We analyze insurance risk for community banks on a fee-only basis. We put your interests first. Managing your bank’s risk requires a trustworthy insurance expert. Contact us today to get your risk managed

The Power of Tax Credits for Community Banks

As a community bank, you are essential in promoting economic development and driving social impact in your local community. The Community Reinvestment Act (CRA) requires banks to invest in their communities, particularly low-income areas, by providing access to credit and financial services. Meeting CRA goals can be challenging, especially for community banks with limited resources. Fortunately, tax credits provide a unique opportunity for community banks to invest in projects that benefit their communities while also generating a financial return. This article will explore how community banks can leverage tax credits to help achieve their CRA requirements and ESG goals.

Benefits of Low-Income Housing Tax Credits (LIHTC) for Community Banks

One of the most well-known tax credits available to community banking institutions is the low-income housing tax credit (LIHTC). The benefits of LIHTCs for community banks go beyond just tax savings. By investing in LIHTC projects, community banks can support affordable housing developments in their local communities, which can help improve their CRA score and meet their ESG goals. Affordable housing can attract new residents and businesses to the area, increasing economic activity and employment. In addition, investing in affordable housing can help improve local residents quality of life, which can positively impact the community.

Community Banking Benefits of Historic Tax Credits

Historic tax credits are another type of tax credit available to community banks. These credits are intended to incentivize the preservation of historic buildings and structures.

A community bank can invest in Historic Tax Credit funds, which provide equity to developers for the restoration of historic buildings that contribute to a historic district or individually listed on the national register. Renovations must meet certain State and Federal guidelines, such as preserving the historic character of the building and using materials that are consistent with the building’s original construction.

The benefits of the historical tax credit for community banks are very similar to LIHTC projects. Not only can the credit be used to offset the bank’s tax liability, but investing

in historic buildings can help preserve the character and identity of a community, promoting economic development within the community and increasing tourism.

Solar Investment Tax Credits

Solar investment tax credits (ITC) are a newer tax credit that can benefit community banks. These credits are designed to incentivize the installation of solar systems on commercial and residential properties.

The benefits of the solar tax credit for community banks are many. Investing in renewable energy projects, community banks can support the transition to clean energy, help combat climate change, align with ESG goals and potentially improve CRA scores.

Conclusion and Next Steps for Maximizing Tax Credits

By investing in LIHTC, HTC, and Solar projects, community banks can support affordable housing developments, historic preservation, and renewable energy. These investments can help community banks meet their ESG goals and potentially improve CRA scores by demonstrating their commitment to economic development, environmental sustainability, and community engagement.

Cabretta Capital is a specialty finance firm with expertise in structured tax credit equity, opportunity zone, and Real Estate Equity funds. Visit www.cabrettacapital.com for more information or contact Jesse Speltz at 770-545-2465.

Jesse Speltz Director of Tax Credit Investments Cabretta Capital

Jesse Speltz Director of Tax Credit Investments Cabretta Capital

Winter 2023 | Georgia Communities First | 43 MEMBER SERVICES

CBA’S 2023 PREFERRED SERVICE PROVIDERS

DIAMOND LEVEL

ICBA Securities

Jim Reber | jreber@icbasecurities.com | 901.762.5884

Independent Community Bankers of America

Scott Brown | scott.brown@icba.org | 334.328.5731

James Bates Brannan Groover LLP

Dan Brannan | dbrannan@jamesbatesllp.com | 404.997.6023

SHAZAM

Alex Jernigan | jjernig@Shazam.net | 229.220.0064

PLATINUM LEVEL

Genesys Technology Group, LLC

David Saylor | david@genesystg.com | 770.729.4139

GOLD LEVEL

BHG Financial

Rachel Thornton | rthornton@bhg-inc.com | 843.251.4223

Crescent Mortgage

Skip Willcox | swillcox@crescentmortgage.net | 478.357.4441

DefenseStorm

David Cross | David.Cross@defensestorm.com

Interested in becoming a Preferred Service Provider?

The Preferred Service Provider packages offers Associate Members the option of upgrading to package of your choice. A few benefits include early access to advertising, exhibiting and sponsorship opportunities, simplified budgeting and of course – increased exposure! All packages are reviewed by CBA’s Member Services Committee. To learn more, please contact Lindsay Greene at 770.541.0376.

44 | www.cbaofga.com | Winter 2023

| 716.244.1107 FITECH Sarah Humphrey | shumphrey@fitech.com | 817.698.2268 Holtmeyer & Monson Arne Monson | amonson@holtandmon.com | 800.340.7304 IntraFi Network Danny Capitel | dcapitel@promnetwork.com | 770.630.6796 Mauldin & Jenkins Ron Mitchell | rmitchell@mjcpa.com | 229.446.3600 Point to Point Environmental Mark Faas | mfaas@p2penvironmental.com | 678.565.4435 Ext 151 STS Group Adam Stephens | adams@stsgrp.com | 256.957.8018 Travelers Diana Baker | dcbaker@travelers.com | 678.317.7882 Wipfli Summer Gustin | summer.gustin@wipfli.com | 480.289.6052 SILVER LEVEL ACG Phil Winn | Phil.Winn@acgworld.com | 678.458.9899 BCC-USA John Gianacaci | JGianacaci@BCC-USA.com | 609.915.9168 College Ave Student Loans Lexy Spikes | lspikes@collegeave.com | 214.232.5272 CRA Partners David Lenoir | david.lenoir@shcpfoundation.org | 901.529.4786 Eclipse Brand Builders Joel Thompson | jthompson@eclipsebrandbuilders.com | 678.894.4360 Executive Insurance Agency, Inc. Ryan Sower | ryan@executiveinsuranceagency.com | 770.474.2355 Kasasa Ryan Busenitz | Ryan.Busenitz@kasasa.com | 678.595.0625 Newcleus Bank Advisors JR Llewellyn | jr.llewellyn@newcleus.com | 678.427.1015 QwickRate Melissa Wallace | melissa.wallace@qwickrate.com | 678.797.4062 Stokes Carmichael & Ernst LLP Michael Ernst | mje@scelaw.com | 404-603-3441 BRONZE LEVEL AgoraEversole Chis Bates | chris@agoraeversole.com | 601.366.7370 Bahr Consultants, Inc. Hank Bahr | hank@bahrconsultantsinc.com | 865.694.6098

Rachel Thornton AVP, Institutional Relationships 843.251.4223 rthornton@bhg-inc.com BHGLoanHub.com/GA

Rachel Thornton AVP, Institutional Relationships 843.251.4223 rthornton@bhg-inc.com BHGLoanHub.com/GA

Cash Vault

Cash Processing

First Line Maintance

Cash Vault

Cash Processing

First Line Maintance

Brian Reed Head of Partnerships College Ave Student Loans

Brian Reed Head of Partnerships College Ave Student Loans

Jesse Speltz Director of Tax Credit Investments Cabretta Capital

Jesse Speltz Director of Tax Credit Investments Cabretta Capital