BUILDING ON THE PAST

LOOKING TO THE FUTURE

GEORGIA SUMMER 2023 COMMUNITIES

CONNECT HIGHLIGHTS | SOLUTIONS ISSUE | MEET CBA BOARD

FIRST

John McNair President & CEO john@cbaofga.com

Lori Godfrey Executive Vice President and Chief of Staff, Government and Regulatory Relations lori@cbaofga.com

Kristi Greer Senior Vice President Professional Development kristi@cbaofga.com

Lindsay Greene Senior Vice President Member Services lindsay@cbaofga.com

Cassie Cornell Assistant Vice President Digital Strategy and Professional Development Marketing cassie@cbaofga.com

Becky Soto Assistant Vice President Professional Development and LEAD Board becky@cbaofga.com

Connie Shepard Assistant Vice President Professional Development and Member Engagement connie@cbaofga.com

Ellen Shea, CMP Director of Association Services ellen@cbaofga.com

Gwen Lanaghan Staff Accountant gwen@cbaofga.com

Summer 2023 | Georgia Communities First | 1 CONTENTS 26 Education Buzz 27 Enhance Your Cyber Security Posture 28 We Are Back in Person with the Regulators 29 1071 Resources/Popular Schools & Conferences 30 Community Bank Focused Compliance Education 33 ICBA Affiliate Education Program 34 Value Added – High Baseline Yields Accompany Surprisingly Wide Spreads 36 7 Ways Open Banking Can Benefit Your Financial Institution 39 Small Business Administration – Making Strides to Encourage Small Business 40 Looking For Solutions? Look To CBA First! 42 Preferred Service Providers Community Bankers Association of Georgia 1640 Powers Ferry Road SE, Building 28, Suite 100, Marietta, GA 30067-1425 (770) 541-4490 or (800) 648-8215 • Fax (770) 541-4496 | www.cbaofga.com • cba@cbaofga.com FEATURES SUMMER

ADVOCACY 2 Commitment to Execute on Vision 3 L.E.A.D. 5 Town Hall Talks 7 A Night to Remember/ICBA Capital Summit 9 CBA Fall Clay Shoots/ CBA Takes You Out to the Ballgame 11 $25 to Win $2,500 12 Connections, Culture, & Community 14 Get to Know 2023-2024 CBA Chairman Neil Stevens 15 Welcome 2023-2024 CBA Board 17 Jessica Hudson Named CBA LEAD Board Chair 18 Building on the Past Looking to the Future 100+ Year Old Banks st AY CO nne C te D @company/ cbaofgeorgia @CBAofGeorgia @CBAGeorgia pr O fessi O n A l D e V el O pment sp O tlights member ser V i C es Connections, Culture, & Community

Advocacy

2023 CBA STAFF

pg.12.

Speakeasy Style pg.7.

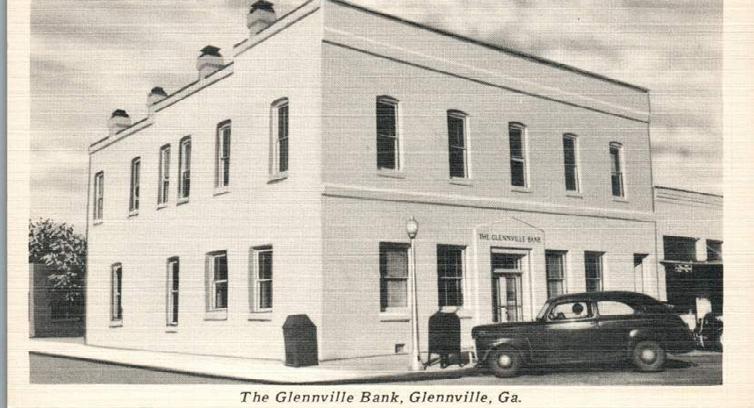

On the cover: Celebrating a rich history – just a few of the 40+ community banks in Georgia who have been in business over 100 years.

John McNair President & CEO Community Bankers Association of Georgia

Commitment to Execute on Vision

Around this time five years ago I met with CBA leadership bankers to discuss my candidacy for the President/ CEO job opening. During the many individual and group conversations, it became apparent that the leadership bankers had a vision for what they wanted CBA to become. It was clear to me that there were several core tenets, they were:

-Remaining independent: CBA was started 55 years ago to serve as the exclusive voice for Georgia’s community banking industry. Maintaining CBA’s independence was as important to them as it was for those bankers that started the association.

-Advocacy: Expanding CBA’s advocacy presence both in-state and with our federal legislators was extremely important. With Dodd/Frank in the not-too-distant past, CBA’s leadership bankers recognized the need for CBA to carry the community bank message directly to our legislators.

-Education: As the primary source of community bank education in Georgia, increasing the focus on up to date and forward-thinking curriculum was also a major item. Additionally, making CBA education programs more accessible was a top priority.

Knowing that that leadership had a vision for what they wanted CBA to become, the key question was whether there was a commitment to execute. As I sit here five years later, I can answer clearly that CBA’s leadership bankers were EXTREMELY committed. At every turn, CBA leadership bankers and our partner firms dedicated their time, talents, and financial support to transform the association into the organization they wanted. Their contributions often go unnoticed, which is why I wanted to take this opportunity to say THANK YOU and express my sincere gratitude for their collective commitment to execute on the vision.

Moving forward, CBA’s leadership continues to evaluate and evolve its collective vision for the association. A formal strategic planning process is currently underway and will result in the setting the vision and direction for the next several years. Once again, a commitment to execute will be required by all and I have every confidence that that will occur. We have an amazing group of leadership bankers that serve on our Board, LEAD Board, and committees. Their collective commitment is inspiring and motivating for all associated with CBA and especially for all of us that proudly serve as CBA staff. Stay tuned in and engaged as I believe the future is bright and ours to determine.

2 | www.cbaofga.com | Summer 2023

VANTAGE POINT

L.E.A.D.

It is a pleasure to serve as the 2023/2024 CBA Chairman. In my opening speech at our Connect Convention this past June at The Charleston Place, I outlined Four Focus Items for the coming year. These four items spell the acronym L.E.A.D.

L-Love Our Members E-Equip Our Members A-Affirm Our Members D-Develop Our Members

In the next four issues of Georgia’s Communities First, I will briefly unpack one of these focus items.

In this issue, let’s begin with what it means to “Love Our Members.” In his well-known letter to the church in Corinth, Greece, the Apostle Paul probably said it best of all. We’ve probably all heard parts of the famous thirteenth chapter at a wedding or two over the years, where he writes, “Love is patient, love is kind,” and so on. But the first part of that portion of his discussion on love is what we need to never forget. He explains that no matter how eloquent, or discerning, or generous, or faithful, or hardworking we are, if our heart and actions are void of love, they mean nothing.

Steven Furtick said it this way, “Love is not words, it’s actions, and love isn’t feelings, it’s a decision.”

I am far from perfect and constantly fail at showing genuine, authentic love to others. But, I am committed to improving. As the CBA Chairman, what are some ways I can demonstrate love to our members? Here are three:

1. By Recognizing Our Members.

We want to recognize our community banks in formal and informal ways. But, most importantly, we want to do it in a way that embraces the contributions of everyone, not just the contributions that are tied to formal metrics. Such contributors include those in your banks who get to work well before an important meeting to make sure the conference

Neil Stevens President & CEO Oconee State Bank, Watkinsville 2023-2024 CBA Chairman

room is in perfect order. The clerical level employee, who is active in local charity work, giving freely of his or her time and energy to help the disadvantaged. Or the single mom who lost her husband two years ago in a tragic accident, but continues to perform her daily duties flawlessly with energy and grace. Over the next year, I will commit to recognizing our members in unique ways that makes an impact on the life of every employee in your banks.

2. By Being a Friend to Our Members.

Being a “friend” in the sense I am speaking of is not necessarily spending time together away from the workplace. At its core, it is showing that we care about our members individually, and value them, according to who they are, not what position they hold. As we move through the year, I want to get to know our members better in order to become a friend who loves through caring.

A number of years ago, I was given an extensive personality assessment. My number one area of improvement was TO LISTEN BETTER! When I mentioned this to my wife, Tricia, she said, “You didn’t need an assessment to tell you that. You simply needed to ask me.” By nature, I am not a good listener. But over the next year, it is my desire to listen intently to our members. What are your greatest desires, needs, struggles, etc. that the CBA can help you with? By listening better, I hope to help the CBA serve your bank in remarkable ways.

I am excited about the coming year. I am committed to demonstrating love to you (our members) by recognizing you, being your friend, and listening to you with intentionality.

I appreciate the opportunity to serve as your Chairman.

Sincerely,

Summer 2023 | Georgia Communities First | 3

3. By Intentional Listening.

FROM THE TOP

CBA Advocacy Town Hall Talks

Held in Cordele, Dalton, and Eatonton, this year’s Town Hall Talks showcased CBA’s grassroots advocacy efforts. Led by CBA Chief of Staff and EVP of Gov and Reg Relations, Lori Godfrey, CBA is leading the charge in getting our message out in all parts of Georgia. Special thanks to Hunter Loggins and National Federation of Independent Business (NFIB) for participating and making these events available for their small business members as well.

Summer 2023 | Georgia Communities First | 5 ADVOCACY

Keep your eyes peeled, more dates to be announced soon!

FDIC REPRESENTMENT CLARIFICATION

By: Doroteya N. Wozniak

On June 16, 2023, the Federal Deposit Insurance Corporation (“FDIC”) issued an updated guidance (FIL32-2023) revising its prior Supervisory Guidance on Multiple Re-Presentment NSF Fees (FIL-40-2022) to provide certain clarifications on its supervisory approach for corrective action. The key take away is that FDIC will consider the likelihood of substantial consumer harm in deciding whether to request a lookback review.

Under the previous guidance, institutions that had issues accessing accurate ACH data were considered as having made full corrective action if the institutions self-corrected this issue and provided restitution to harmed customers for transactions occurring two (2) years prior to the date of FIL-40-2022. Under the revised guidance, FDIC notes that it has observed extensive challenges in identifying representment items, and, as a result, FDIC does not intend to request a lookback review unless there is a likelihood of substantial consumer harm.

For any financial institutions that have self-identified and fully corrected prior to their consumer compliance exam, FDIC will generally not cite UDAAP violations. FDIC also retained its prior stance that if examiners identify violations of law due to re-presentment NSF fee practices that have not been self-identified and fully corrected prior to a consumer compliance examination, FDIC will evaluate appropriate supervisory or enforcement actions, including civil money penalties and restitution, where appropriate.

If you have any quesitons please contact Doroteya Wozniak at (404) 997 6031 or dwozniak@jamesbatesllp.com.

Corner GENERAL COUNSEL Summer 2023

legal news and

for

PRESENTED BY GEORGIA’S LAW FIRM:

updates

cba members

OFFICES MACON + ATLANTA + ATHENS

“General Counsel Corner,” a recurring column featuring legal news and information of interest to CBA members, is brought to you by James-Bates-Brannan-Groover-LLP. Visit us at jamesbatesllp.com

cbahotline @ jamesbatesllp.com

Have a topic you would like to see covered in “General Counsel Corner?” Email us at generalcounselcorner @ jamesbatesllp.com

A Night to Remember: Supporting Advocacy Efforts Speakeasy Style!

Casino tables, 1920’s attire, cork pull, and silent auction made for a fun night at CBA’s Speakeasy event supporting community bank advocacy efforts. Held at the The Riviera, a revitalized art deco theater, convention attendees enjoyed desserts, beverages, music and competition at the blackjack, poker, roulette, and craps tables. Guests enjoyed the popular Cork Pull for a chance at bottles of wine or bourbon. The Silent Auction featured a variety of cool items including sporting events, jewelry, electronics, and much more. Thanks to everyone who dressed in theme, donated to the auction, and supported these important fundraising efforts.

Georgia

Community Banks Well Represented at 2023 ICBA Capital Summit

“The CBA delegation had a great visit to Washington DC as part of the annual ICBA Capital Summit. The resounding message from the Georgia Congressional delegation was that the community banking industry is different from other financial services providers and clearly should not have to pay for the failures of a few large, regional banks. This recognition was shared on a bi-partisan basis as was the support for a deposit insurance carve out of the special assessment,” said John McNair, President & CEO of Community Bankers Association of Georgia. “As single constituent advocates, CBA and ICBA will continue to exclusively champion the community bank message both in Atlanta and in Washington, DC.”

Along with McNair, bankers making the trip to DC included: George Andrews, Unity National Bank; Scott Curry, First State Bank of Randolph County; Frank Griffin, Flint Community Bank; Stephen Lewis, First National Bank of Coffee County; Ron Quinn, Peach State Bank & Trust; Bran Thompson, South Georgia Bank, and Derek Williams, Century Bank & Trust. Special thanks to Capital Summit sponsors for their support and participation: ICBA Securities, IntraFi, James Bates Brannan Groover LLP, and Newcleus. Thanks also to FHLB Atlanta for their hospitality in DC.

Summer 2023 | Georgia Communities First | 7 ADVOCACY

2023

I CHOOSE A PARTNER THAT PUTS MY SUCCESS FIRST. We’re the only nationwide independent, member-owned debit network, processor and core provider supporting community banks. As a leader in the industry, we have a simple mission: Strengthening financial institutions. 855-314-1212 / SHAZAM.NET /

CBA Fall Clay Shoots – Right on Target

CBA’s fall clay shoots bring together bankers, associate member companies, and community banking friends to honor two legendary community bankers. Great locations, beautiful fall weather, lunch and friendly competition make the clay shoots a popular event.

ATL vs PIT, Sept 9th - CBA of Georgia

CBA takes you out to the ballgame. Root, root, root for the CBA Team!

Our CBA members, families, and friends have a great opportunity to come together for a night of networking and cheering on our favorite Atlanta Braves. Help us start an annual event with CBA supporting one of our favorite local teams

“BATTER UP!” - The Game

The Braves play the Pittsburgh Pirates on Saturday, September 9th and we hope that you will join us for a memorable event. The game starts at 7:20 pm at Truist Park in Atlanta.

Banker’s MVP Tailgate

(Exclusively for bankers, their families, and tailgate sponsors) Those attending can join their fellow CBA members and their families for some networking and tailgating at the Galleria 500 Land located near the 400 and 600 buildings on Cobb Galleria Parkway. We will have family games, food trucks and more. After the tailgating, we will all walk together to the stadium.

Show Your CBA Pride

We encourage our members to show their CBA pride and wearing their 2023 Advocacy shirt. If you don’t have an advocacy shirt, we encourage you to wear the Association colors of navy blue and green!

Tickets

Tickets are $43 a ticket with a portion of the proceeds from ticket sales going directly to the CBA Advocacy Fund. Everyone will purchase their tickets directly with the Braves.

Summer 2023 | Georgia Communities First | 9 ADVOCACY

10 | www.cbaofga.com | Summer 2023 Call 800.340.7304 to start www.holtandmon.com Small businesses count on your expertise. You can count on ours. Your customers have never needed capital more than they do right now. Plus you need to offset narrowing margins by increasing noninterest fee income. SBA/USDA lending is the perfect answer. And ICBA recommends just one provider to make the process hassle-free: Holtmeyer & Monson. Give customers exactly what they need, at no net cost to your bank. Closing SBA loans keeps doors open.

$25 to Win $2,500

Grass Roots Advocacy - Join us in Raising Awareness and Funding for Advocacy Efforts.

We are selling raffle tickets at $25 towards a chance to win $2500. Ask a co-worker or friend to go in with you and increase your chances to win. Monies raised are used to support the hard work your association is doing to support the community banking industry by lobbying and educating legislators with information that will help make decisions for the best of our community banking stakeholders. Last day to purchase tickets is September 28th!

Drawing to be held September 29, 2023 at the LEAD Retreat. *You do not have to be present to WIN!

| Georgia Communities First | 11 ADVOCACY

June 7 – 11, 2023 | The Charleston Place | Charleston, SC

CBA's 55th Annual Convention & Mini-Trade Show

Connections, Culture, & Community

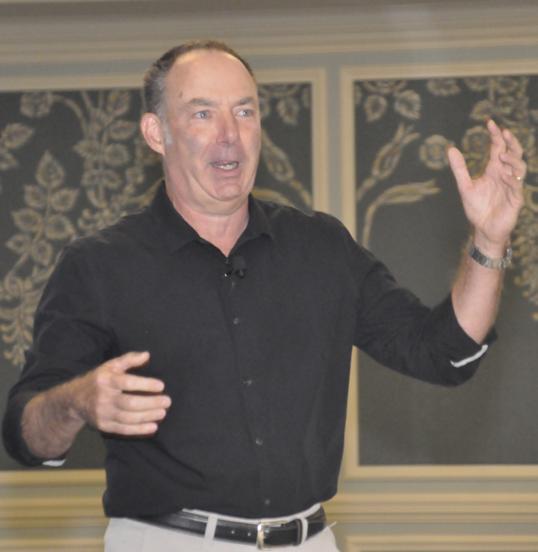

What an incredible time for everyone who attended CBA’s 55th Annual Convention CONNECT! Bankers and partner firms left energized and inspired, armed with new information to help their bank continue to thrive.

Special thanks to CBA’s Convention Committee for their guidance over the last year to plan a meeting with the perfect balance of education and networking time. Held at beautiful Charleston Place, events ranged from the 1920’s casino night advocacy event to the Chairman’s Banquet and singer-songwriter entertainment.

The convention kicked off with high energy motivational speaker Aaron Davis, who presented on the attitude of a champion. Topics covered at the convention included current credit environment, the future of banking, economic outlook, the new era of banking, an update on community banking at the national level, interest rate environment, deposits, succession planning, marketing budgets, community banking laws and regulations, regulatory panel and a panel on connectedness and creating a winning team from UGA football alumni and UGA FCA chaplain.

12 | www.cbaofga.com | Summer 2023

SPOTLIGHT

Special Thanks to Connect

Sponsors and Exhibitors:

CBA’s 2023 convention, CONNECT, would not be possible without the support of our valued sponsors and exhibitors. Thank you for your continued support!

Exhibitors:

ACG

Abram Armored

Adlumin

Agora Eversole

BCC-USA

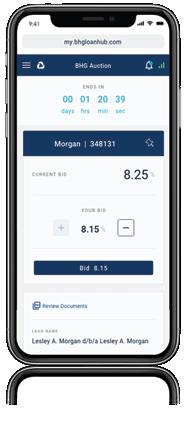

BHG Financial College Ave Student Loans

CRA Partners

Crescent Mortgage

DefenseStorm

DeNyse Companies

Exlipse Brand Builders

Executive Insurance Agency

Federal Reserve Bank

Fitech by Deluxe Genesys Technology Group

HC3

Holtmeyer & Monson

ICBA

ICBA Securities

IntraFi Network

Kasasa

Newcleus

Point to Point Environmental

QwickRate

SBA Works

SHAZAM

STS Group Travelers

United Bankers’ Bank

Vericast

Warren Averett

Summer 2023 | Georgia Communities First | 13

YOU TO OUR PREFERRED SERVICE PROVIDERS DIAMOND LEVEL PLATINUM LEVEL GOLD LEVEL SILVER LEVEL BRONZE LEVEL

YOU TO OUR SPONSORS

THANK

THANK

GET TO KNOW 2023-2024 CBA CHAIRMAN NEIL STEVENS

Neil Stevens, President & CEO, Oconee State Bank, Watkinsville, was elected 2023-2024 CBA Chair at CBA’s Annual Convention in June. Neil was gracious about answering a few questions so our members can get to know him a little better. Take a moment to learn about Neil, his bank, personal life and what community banking issues are important to him.

How did you get started in banking? What was your first job?

My brother Mark Stevens inspired me to give banking a try when I graduated from Mercer with my Finance and Communications degree back in 1989. I started to work for C&S Bank in Macon, Georgia in 1989 on their Management Associate Training Program.

How long have you been in banking? How long President & CEO?

I have been in banking for 34 years and in the President/CEO role for 11 years. Four years at KeyWorth Bank in Johns Creek and 7 years here at Oconee State Bank.

What issues are important to you with regards to community banking?

All things regulatory. We must constantly fight for a balance between appropriate regulation and extreme regulation that precludes us from serving our customers. Beyond that, I have a passion to make our industry relevant and attractive to young people graduating from college. This is such an incredible profession. But financial institutions must be flexible, creative, engaging, and make it an attractive environment that attracts top new talent.

Tell us a little about Oconee State Bank (little history), # of employees, a specific niche you serve, etc.

We began in 1960 in Watkinsville, Georgia by a group of talented and passionate business leaders who wanted to create a local bank for the local citizens of the community. Their vision is what made the bank what it is today. Over the past seven years, we have grown that vision. We are now in Athens, Gwinnett County, Central Georgia, and made an acquisition of

a mutual savings and loan based in Elberton – Elberton Federal Savings and Loan. We started an SBA division, rebranded our mortgage operation, and increased the talent level around the executive table. We have around 85 employees and are around $600 million in assets. Our specific niche is small to medium sized business where we can create extreme value in order to gain the full relationship from those businesses.

How did you become involved with CBA?

I have been involved in the CBA for a number of years. Although, it was not until the last five years that I have been involved on committees and the board. Our bank has been involved in the CBA for many, many years!

Education background/banking schools: I have a B.S. Degree in Finance and Communications for Mercer University in Macon, GA. I also attended an executive banking school at UVA’s Darden School of Business.

What do you enjoy doing outside of work?

I LOVE UGA football!!! And all UGA sports for that matter. I love working out and playing golf, working at OSB, and spending time with family.

Tell us a little about your family. I am happiest when surrounded by my family – my beautiful wife of 35 years, Tricia. And my two sons Caleb and Colin and our beautiful daughters in law, Grace and Sarah, and our “Little Bear.” Little Bear is our little 16-month-old grandson, Wesley.

Fun fact - I was featured on the TV show, Rescue 911.

Anything else you would like to add: Nothing would be possible without my faith in Jesus Christ. To God be the Glory!

14 | www.cbaofga.com | Summer 2023 SPOTLIGHT

WELCOME CBA BOARD OF DIRECTORS

Summer 2023 | Georgia Communities First | 15

Neil Stevens CEO Oconee State Bank Chairman

Frank Griffin Jr. President Flint Community Bank Chairman Elect

Mike Sale President/CEO The Commercial Bank Vice Chairman

Kelly B. Stone President Community Bank of Georgia Treasurer/Audit & Investment Chair

Scott Curry President/CEO First State Bank of Randolph County At Large

Richy Everly CEO Bank of Wrightsville Immediate Past Chairman

Shannon Henry CEO Bank of Dade Northern Division

Bill Walker President & CEO Legacy State Bank Northern Division

Monty Watson CEO The Piedmont Bank Northern Division

Derek Williams ICBA Chairman President & CEO Century Bank & Trust Northern Division

Ron Quinn President & CEO Peach State Bank & Trust Northern Division

Jane Lawson COO First Peoples Bank Northern Division

Harold R Reynolds CEO BankSouth - Lake Oconee Northern Division

Scott Curry President/CEO First State Bank of Randolph County Northern Division

Doug Williams CEO SouthState Bank, N.A. Northern Division

Charlie Crawford Chairman & CEO Hyperion Bank Northern Division

Stephen Lewis Market President/Sr Lender First National Bank of Coffee County Southern Division

Zac Frye SVP of Lending The Citizens Bank of Swainsboro Southern Division

Jolene Carroll CEO Magnolia State Bank Southern Division

Bran Thompson CEO South Georgia Bank Southern Division

Heath Fountain CEO Colony Bank Southern Division

Ray Muggridge Chairman of the Board Bank of Camilla Southern Division

Nancy Jernigan EVP EVP/Seminole Market President First Port City Bank Southern Division

Eli Tinsley President & CEO Planters First Bank Southern Division

Brian Bazemore President & CEO The Citizens Bank of Cochran Southern Division

Click Here to Read the Full Press Release SPOTLIGHT

SPOTLIGHT

SAVE THE DATE

SAVE THE DATE June 5-9, 2024 The Ritz-Carlton Amelia Island, Florida

Jessica Hudson Named CBA LEAD Board Chair

Congratulations to Jessica Hudson, AVP/Loan Operations Officer, First National Bank of Coffee County, Douglas, who was named the 2023-2024 LEAD Board Chair at CBA’s Annual Convention CONNECT, in Charleston, SC. CBA President & CEO John McNair, expressed his appreciation to Chris Cochran, Senior Vice President, Commercial Banking, Affinity Bank, Atlanta, for his leadership and success as the outgoing 2022-2023 LEAD Board Chair.

LEAD stands for Leadership, Education, Advocacy, Development. Each year designated LEAD Board Members are assigned to specific committees designed to promote and assist CBA Board initiatives. Learn more.

A BETTER STUDENT LOAN EXPERIENCE.

SIMPLE & CLEAR PROCESS. Apply in 3 minutes and find out instantly if you are approved.

YOU’RE IN CONTROL. Choose from flexible repayment options to make your payments work for you.

WE’RE HERE TO HELP. Use our tools, resources and top-notch customer service team to help you save along the way.

collegeave.com/cbaga

Summer 2023 | Georgia Communities First | 17

SPOTLIGHT

©2023 College Ave Student Loans. All Rights Reserved

Pa rt ner logo

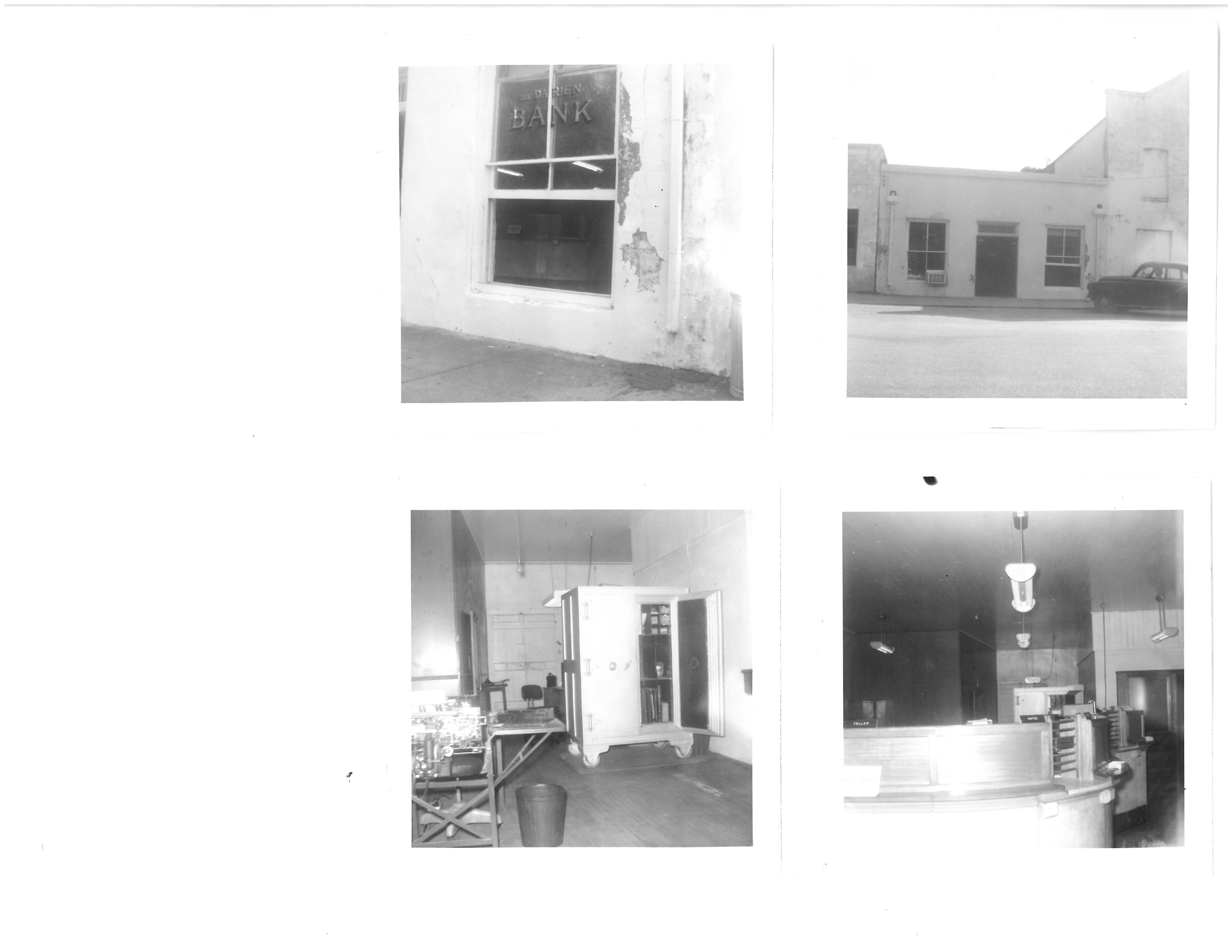

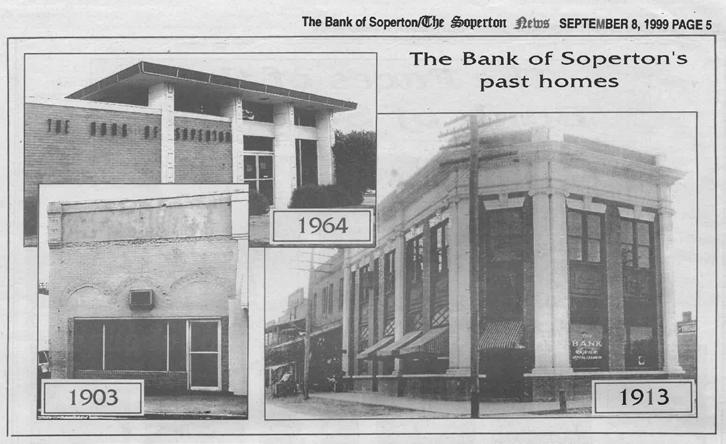

BUILDING ON THE PAST LOOKING TO THE FUTURE 100+ YEAR OLD BANKS

100+ Year Old Georgia Banks

CBA is proud to recognize the 40-plus community banks in Georgia who have been in business for over 100 years. We reached out to these banks, asking how the bank started, how they survived during challenging times, what advice they have for their peers, and of course – what’s next for their bank.

SPOTLIGHT

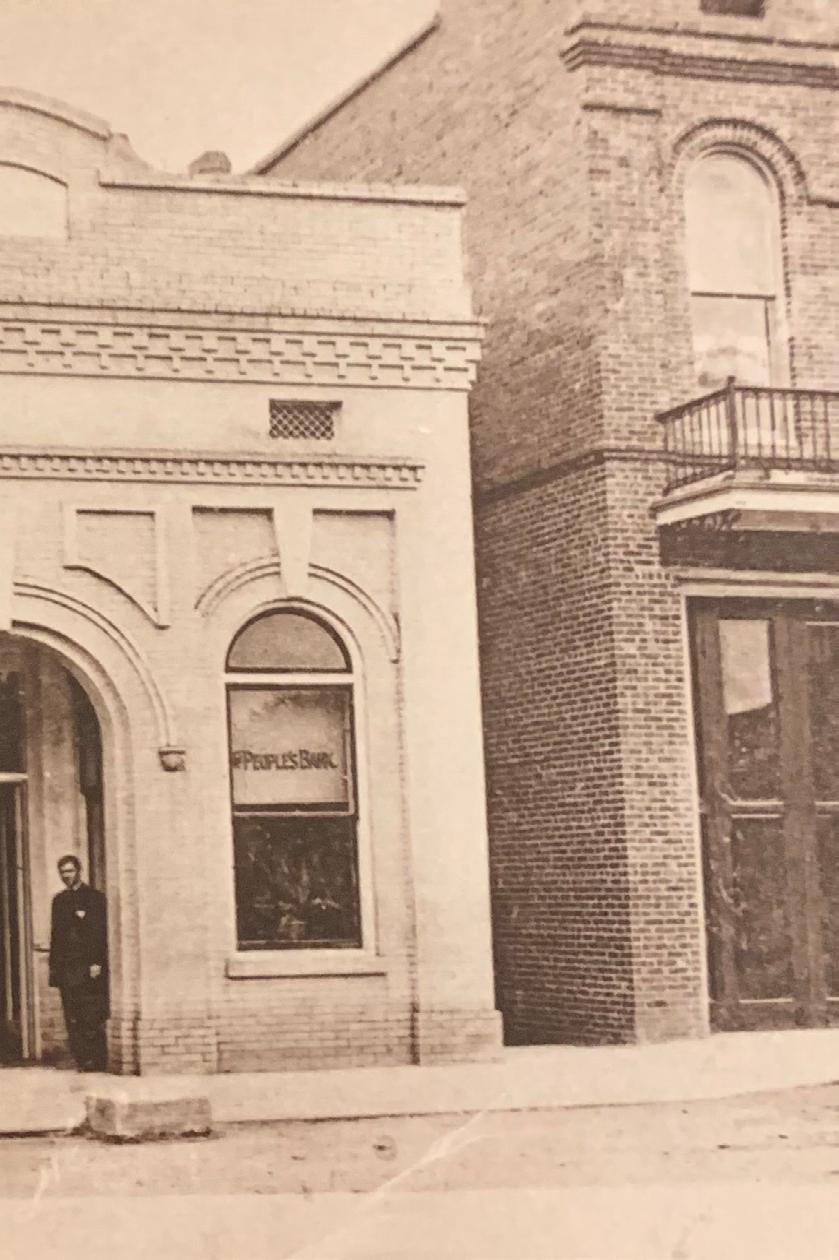

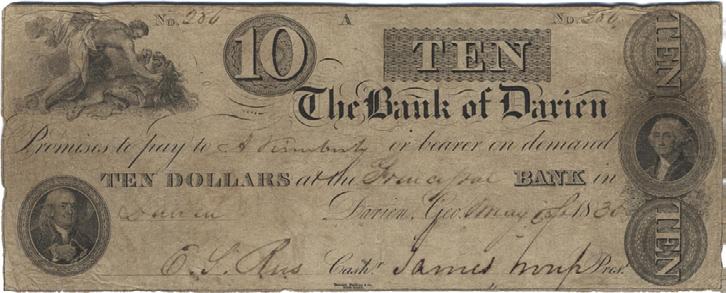

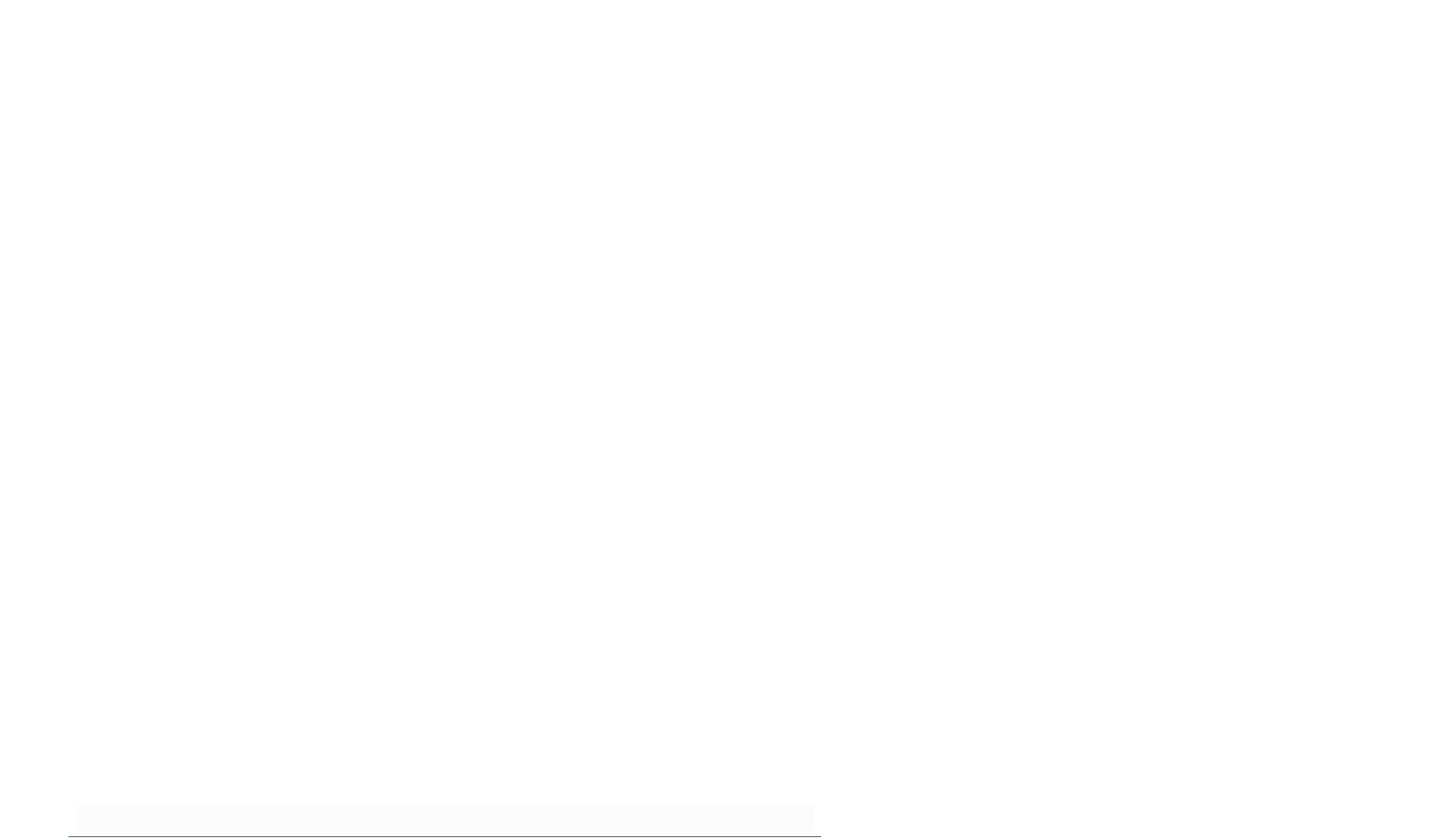

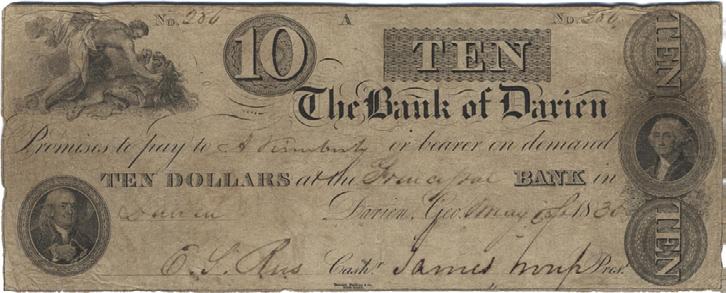

The Darien Bank (now Southeastern Bank), Darien

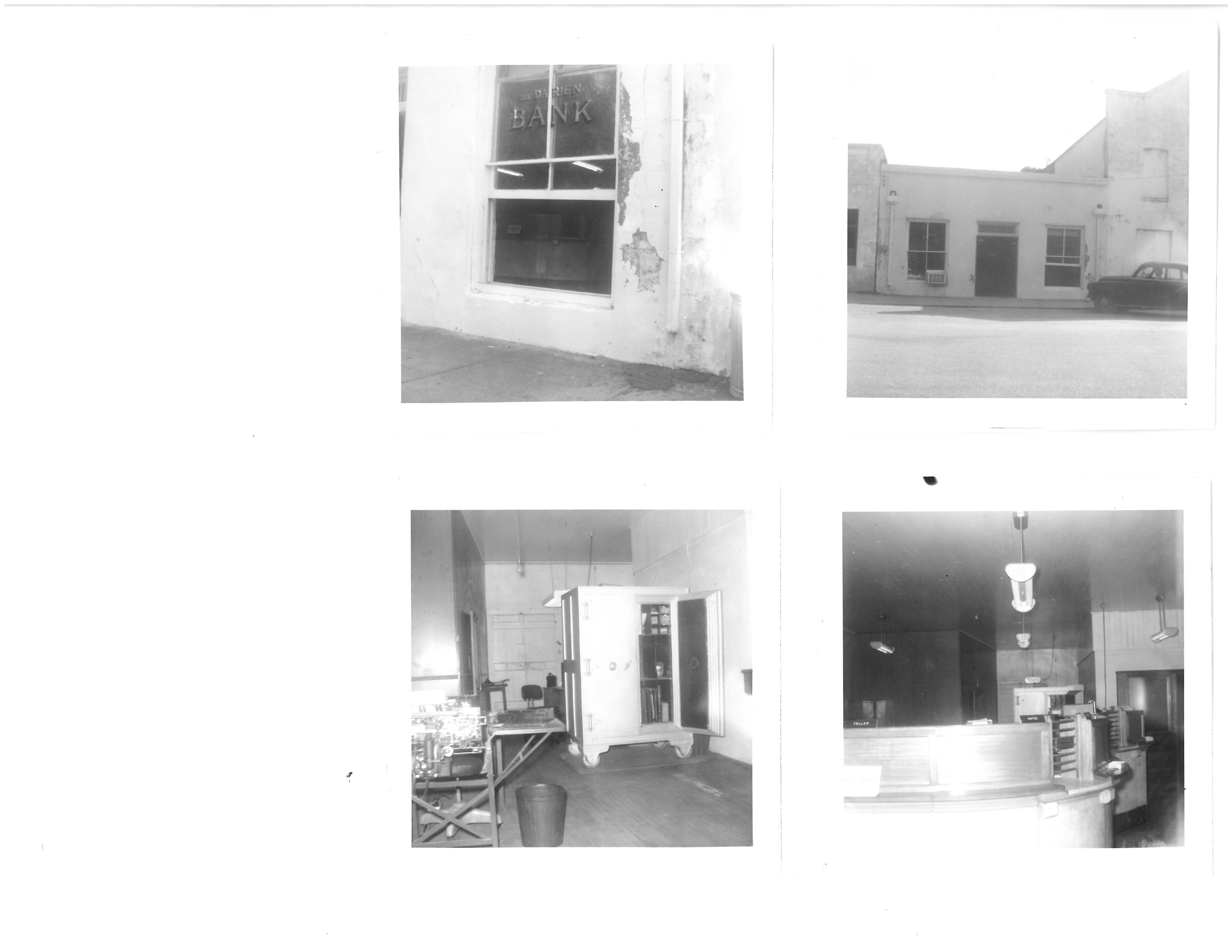

Henry Persons, President & CEO, The Peoples Bank of Georgia, Talbotton

The Peoples Bank of Georgia was founded in 1890 and I believe the 8th oldest bank in the state of Georgia - our FDIC number is 170. The Persons family was one of the initial investors and soon afterwards purchased a controlling interest which it still holds today. Following the War Between the States, the scarcity of money and excessive interest rates led to a credit system that depressed agriculture production and commerce in Georgia. There was a need for small country banks to come into existence. The Peoples Bank of Talbotton played a major role in putting its part of Georgia back together, they backed new businesses, financed crops and became involved in civic efforts.

Officers and employees are the backbone of the operations at First National Bank of Waynesboro.

Jesse Palmer, III, Chair, President & CEO, First National Bank of Waynesboro, commented “We pride ourselves as being the only familyowned and operated bank in Burke County.”

The bank was organized on September 1, 1905 and relocated to the current location in 1956. Mr. Palmer Sr. joined the bank in 1912, as a member of the Bookkeeping Department. In 1914, he became Assistant Cashier and, in the same year, was promoted to Cashier. In 1930, he was elected as President and Chairman of the Board. He remained Chairman until his death in 1981. Mr. Palmer, Jr. joined the bank in 1945 as Assistant Cashier. In 1956, he was elected as President and in 1981, he became Chairman of the Board until his death in 1986. Mr. Palmer, III joined the bank in 1968, became President in 1982 and Chairman of the Board in 1986.

The Citizens Bank of Swainsboro

Swainsboro | January 1, 1900

Milton Gray

First State Bank of Randolph County

Cuthbert | October 3, 1900

Scott Curry

Mount Vernon Bank

Mount Vernon | January 24, 1901

Alan Thigpen

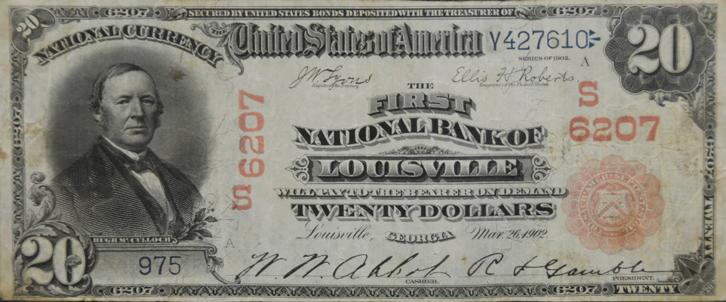

Queensborough National Bank & Trust Company

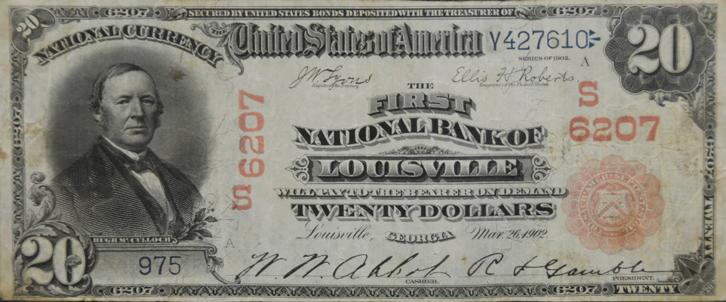

Louisville | January 1, 1902

Bill Easterlin

First State Bank of Blakely

Blakely | January 1, 1903

Billy Lanford

Exchange Bank

Milledgeville | June 1, 1903

John Childs

Georgia First Bank

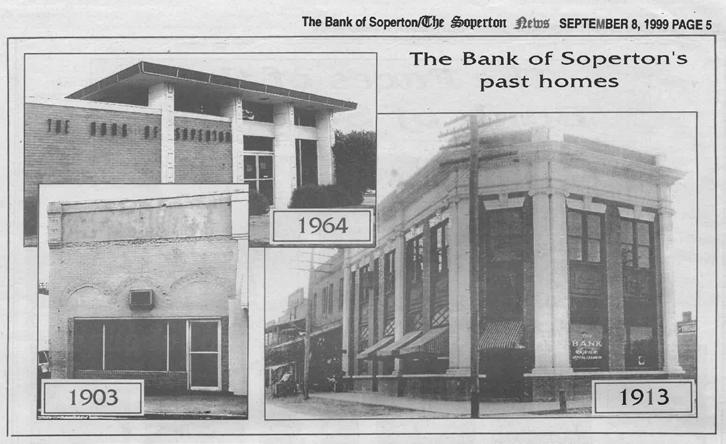

Soperton | June 1, 1903

Maury Beasley

Bank of Hancock County

Sparta | September 1, 1904

Ann Wilson

The Bank of Edison

Edison | October 1, 1904

Neil Lowe

The First National Bank of Waynesboro

Waynesboro | January 1, 1905

Jesse Palmer, III

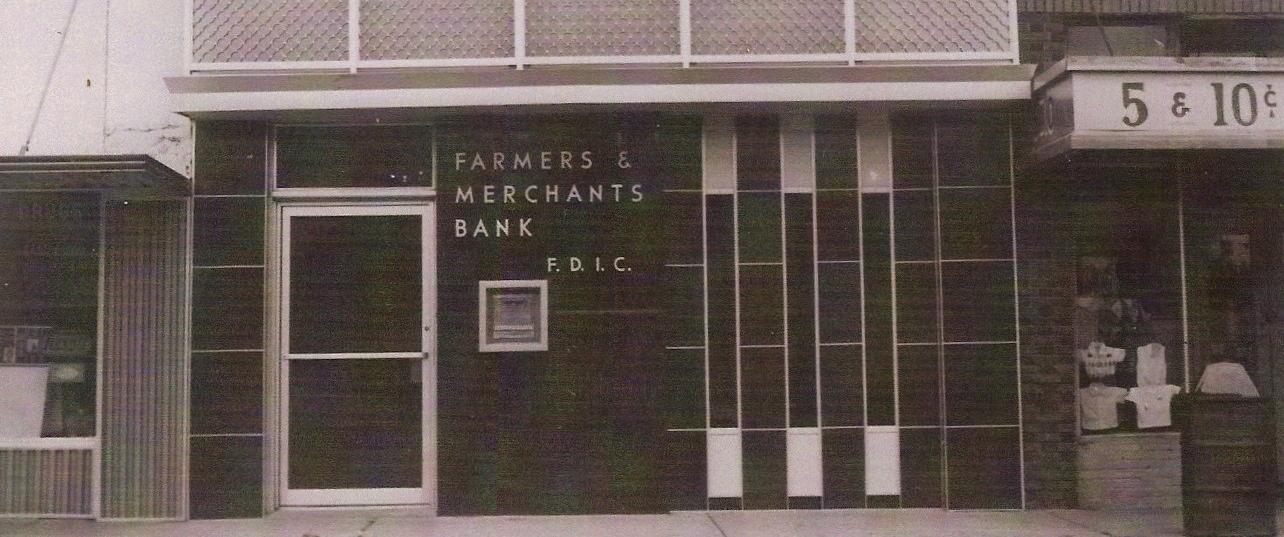

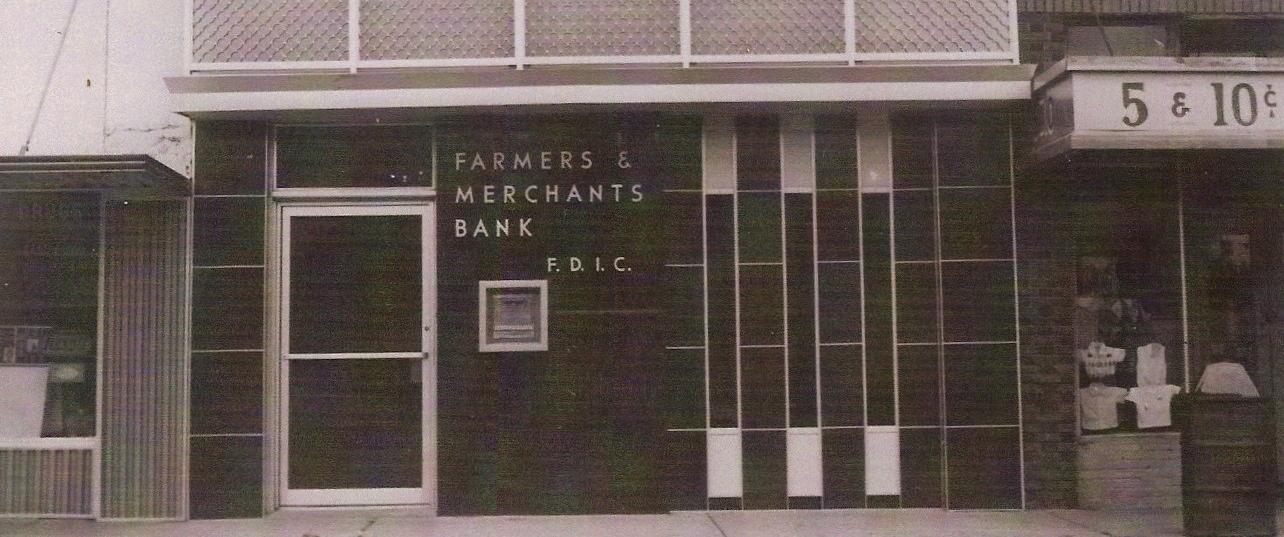

Jeff Parrish, CEO, Farmers and Merchants Bank, Lakeland: It was 1907, Theodore Roosevelt was President of the United States, Hoke Smith was Governor of Georgia and in a hustling “Milltown” in South Georgia, Farmers and Merchants Bank was established. Milltown was the first and original location for the Bank as it opened its doors on May 22, 1907, taking in a total of $30.00 for deposit on the first official day of business. The capital, deposits and staff grew as the Bank survived two world wars, the depression, recession and bad crop years. During the Great Depression, Farmers and Merchants Bank kept its doors open while banks here and across the nation were failing. It closed only on Franklin D. Roosevelt’s “Banking Holiday.”

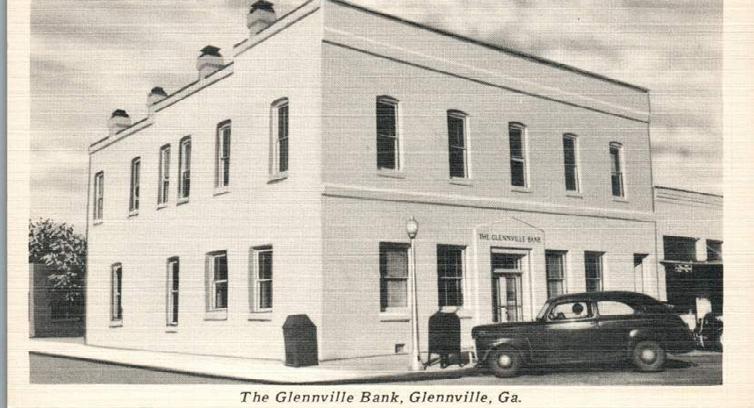

Glennville Bank

Glennville | January 18, 1905

Will Sheffield

United Bank

Zebulon | January 31, 1905

Jim Edwards

Bank of Alapaha

Alapaha | March 25, 1905

Ken Hughes

Bank of Dudley

Dudley | November 1, 1905

Sam Beall

Farmers and Merchants Bank

Lakeland | January 1, 1907

Jeff Parish

Summer 2023 | Georgia Communities First | 19 SPOTLIGHT

Farmers & Merchants Bank, Lakeland

The Peoples Bank of Georgia, Talbotton

Stable, Cost-Effective Balance Sheet Essentials: Reciprocal Deposits

Most reciprocal deposits are reportable as nonbrokered and can help strengthen your bank’s balance sheet. With insured deposit services ICS® and CDARS® from IntraFi®, your bank can build loyal, local customer relationships and receive reciprocal deposits that typically come in large-dollar increments.

The inventor and largest provider of reciprocal deposit services, IntraFi offers flexible liquidity management solutions and makes it easy for banks to quickly bring customer-pleasing services to their markets. IntraFi provides high per-depositor and per-bank capacity, thanks to The Power of Many® its unparalleled network of thousands of financial institutions. Discover how your bank, no matter its size, can benefit from reciprocal deposits in today’s competitive marketplace.

Use of CDARS or ICS is subject to the terms, conditions, and disclosures in the applicable program agreements, including the IntraFi Participating Institution Agreement. A list identifying IntraFi network banks may be found at https://www.intrafi.com/network-banks. The depositor may exclude banks from eligibility to receive its funds. IntraFi, ICS, CDARS, and The Power of Many are registered service marks, and the IntraFi hexagon is a service mark, of IntraFi Network LLC.

20 | www.cbaofga.com | Summer 2023

GROW CORE DEPOSITS & FRANCHISE VALUE TODAY Contact your Managing Director Danny Capitel at (866) 776-6426, x3476, or dcapitel@intrafi.com www.intrafi.com

Why do you think your bank has survived over the years? What is the secret to your bank’s long-term success?

Eli Tinsley, President & CEO, Planters First Bank, Cordele

At Planters First Bank, we have a rich history dating back to 1896 when we were first chartered in Hawkinsville. Over the years, we’ve faced numerous challenges, including two world wars, the Great Depression, and tough economic times. However, we’ve remained devoted to serving our customers and community with honesty and integrity. We believe that each relationship is a partnership, creating a team approach in every aspect of banking. Our success can be attributed to our customers, employees, and shareholders. We’re proud of our 125+ year banking legacy and excited about our future. As technology and the times have changed, so has the Bank, but one thing has and will always remain- our commitment to being The Best Community Bank in Middle Georgia.

is when COVID hit our communities and people were worried about their families and accessing their cash, we kept our branches open to service our customers. When PPP funds became available our employees worked around the clock to process loans for our customers because they needed us to assist them in keeping their businesses open. Through all of this I never heard one employee complain about helping our customers.

First Bank of Coastal Georgia

Pembroke | January 1, 1907

Doyce Mullis

First Southern Bank

Waycross | June 19, 1907

Bill Hughes

The Trust Bank

Lenox | June 25, 1907

Robert Griner

Apex Banking Company of Georgia

Irwinton | July 16, 1907

Ryan Tucker

Talbot State Bank

Woodland | November 25, 1907

Edgar Chapman

Bank of Monticello

Monticello | January 1, 1909

Steve Jordan

Bank of Dawson Dawson | July 1, 1911

Barry Lyle

The Farmers Bank

Greensboro | September 6, 1911

Sid Lane

Jolene Carroll, President & CEO, Magnolia State Bank, Eastman

As our history will show, our institution has weathered a depression, several recessions, and a pandemic. We have survived and prospered thanks to the support of our customers and we never lose focus of that. The key words today, just like in the 1900s, are customers, customer diversity, and liquidity, and we have survived as a result of all of three.

Since the bank’s inception on October 9, 1909, the bank’s primary focus has been to serve the banking needs of the people in the counties and surrounding communities where we are located, and this continues to be our mission today. We stay focused on what’s important, our customers. A perfect example

John Childs, Jr., President & CEO, Exchange Bank, Milledgeville Exchange Bank celebrated its 120th anniversary this year and over those many years the names and faces of the staff and leadership have changed, but the core values and beliefs have not. As a community bank, we are an advocate for the communities we serve. We have a vested interest in our customers, our local governments, our educational systems, and our community’s quality of life. Over the years, Exchange Bank has proven to be adaptable, resilient, forward-thinking, and trustworthy. We feel that these foundational building blocks have served Exchange Bank well for 120 years and will continue to serve the bank well for many years to come.

Farmers State Bank

Lincolnton | December 2, 1911

Bruce Turner

Planters and Citizens Bank

Camilla | May 24, 1913

Jud Vann

Magnolia State Bank

Eastman | January 2, 1919

Jolene Carroll

Bank of Newington

Newington | August 14, 1919

Harry Sheppard

Citizens Trust Bank

Atlanta | June 18, 1921

Cynthia Day

State Bank of Cochran

Cochran | January 5, 1922

Jackie Bowen

Farmers & Merchants Bank

Eatonton | November 15, 1922

Chip Benton

Summer 2023 | Georgia Communities First | 21

SPOTLIGHT

Bank of Eastman (now Magnolia State Bank), Eastman

Planters First Bank, Cordele

Exchange Bank, Milldgeville

How has technology changed operations or the customer experience at your bank?

Barry Lyle, President & CEO, Bank of Dawson

There are so many ways technology has changed for the better, within the bank and for customers. One way technology has changed and has been a beneficial change for our customers is when ATM and debit cards were implemented. This change has allowed our customers to bank 24/7 making an impact for people who work and cannot physically make it to the bank during banking hours.

What advice do you have for Georgia’s community banks, in particular, any newer banks?

Richy Everly, President & CEO, Bank of Wrightsville

In my humble opinion, true community banking requires a shared commitment to and sincere appreciation for the communities and the people in it through education, engagement, investment, services, and support. Well-established, independent community banks are almost always able to demonstrate a strong local presence, along with expertise in the local business landscape with an emphasis on relationships rather than transactions. Externally, longevity in this industry relies heavily on positive relationships with customers, with regulators, with vendors, and with trade associations such as CBA of GA and ICBA. Internally, those community banks that have enjoyed the benefit of longevity in their respective markets typically can attribute most of that success to several pillars of remaining independent: (1) Shared Vision, (2) Strong Performance, (3) Quality Management, (4) Board Leadership, and (5) Shareholder

Resilience. I believe that a forwardlooking approach by a community bank’s leadership, along with the bank’s continued focus on relationships over transactions will ultimately have a favorable impact on a community bank’s ability to grow, prosper, and sustain itself for many years to come.

Charles H. Haney, III, President

&

CEO, Bank of Madison

My reply is simple…. Own the community you serve. Own the reputation you have made and own the responsibility you have to your employees and stockholders.

22 | www.cbaofga.com | SPOTLIGHT

Bank of Dawson, Dawson Bank of Madison, Madison

Looking to the future, what’s next for your bank?

Bill Easterlin, Chairman, President & CEO, Queensborough National Bank & Trust Co., Louisville

After 120 years of community banking, Queensborough National Bank & Trust Company continues to stand out as a true community bank. Now the leading community bank in Augusta, the bank continues to expand in the Coastal Georgia market, an area experiencing an incredible amount of development. Queensborough’s Pooler, location opened in 2021 and, later this year, the Hinesville location will open as the bank’s 24th full-service branch.

Queensborough continues to implement new technologies like QNBTNOW Interactive Teller Machines and online customer care through the Glia platform. Throughout the growth and the tech advancements,

Queensborough continues to be committed to the communities they serve, providing uncomplicated banking and decision-making on a local level.

Ryan Tucker, President & CEO, Apex Banking Company/Wilkinson County Bank, Cleveland

Apex Banking Company of Georgia represents the next chapter of the solid 100-year legacy established by Wilkinson County Bank. In 2023, the bank expands its presence in Georgia with a new location that will serve Cleveland and the surrounding areas. As we grow, we will continue to embrace the spirit of true community banking, working hand in hand with our customers to meet their banking needs. Our new offices are currently under construction and in the meantime, we have a temporary location in place to serve our customers this summer.

Jim Walker, President & CEO, PrimeSouth Bank, Blackshear

Our company mission is to “make a positive impact on the communities we serve through offering creative solutions”. We believe to properly execute our mission daily, it is imperative to continue fostering a company culture which includes serving our team members, building trust across the organization, and improving overall engagement. We will remain focused on evolving as an organization which maintains our “customers first” mantra. This will include an intentional approach to implementing innovative technological advances and strategies centered around reducing friction in our delivery process, therefore allowing PrimeSouth Bank to continue to provide an overall exceptional client experience.

Summer 2023 | Georgia Communities First | 23 SPOTLIGHT

The Farmers Bank, Greensboro

The Bank of Soperton (now Georgia First Bank), Soperton

Bank of Darien, Darien

Merchants and Farmers Bank (now Century Bank & Trust) Milledgeville

The Geo. D Warthen Bank, Sandersville

The Blackshear Bank (now PrimeSouth Bank) , Blackshear

First National Bank of Louisville (now Queensborough National Bank), Louisville

The Glenville Bank, Glennville

Bank of Wrightsville, Wrightsville

A big STS THANK

to Community Bankers Association of Georgia!

Adam Stephens, Ryker Goodell and Chris Nelson enjoyed spending quality time "Charleston-style" with our amazing customers and the CBA team at CBA Connect Annual Convention! We can't wait to see everyone again next year!

"I can confidently say that partnering with STS Group for our security needs has been an exceptional decision. By choosing STS Group, Flint Community Bank can focus on the needs of our community while having the peace of mind that comes from knowing the physical security of our bank is in capable hands."

-Frank Griffin / Flint Community Bank

-Frank Griffin / Flint Community Bank

Adam Stephens VP / Sales & Marketing

Adam Stephens VP / Sales & Marketing

STS Comprehensive ATM / ITM Security Solutions Fortify Your Financial Institution With

Gates

Analytics

Consulting

YOU

Swing

Video

Environmental

Call us today 855-683-9259 stsgrp.com

adams@stsgrp com

New Newsletter Format Same Great Content - New Intuitive Layout!

CBA Today our weekly eNewsletter is now a blog.

What does this mean for you, our readers? Our articles are now searchable and will take less time to load on your computer and mobile devices.

Our blogs can also be separated by category or viewed all at once from the CBA website.

Navigate to Publications and then All Posts to see all of CBA’s articles all at once.

Click here to check out our helpful guide on how to navigate the new CBA Today layout.

Banking changes. Our commitment to you never does.

Throughout our long history, we’ve stayed focused on keeping community banks on the cutting edge. We do this with industry-leading specialists, expertise and offerings – all backed with local banking knowledge. Learn more at travelers.com/business-insurance/financial-institutions

Summer 2023 | Georgia Communities First | 25 1964 Travelers becomes one of the first domestic markets to write Directors & Officers Liability insurance 1999 Travelers brings its Identity Fraud Expense Reimbursement coverage to market 2011 Travelers CyberRisk coverage is introduced to the market 1890 Travelers begins to offer Financial Institutions coverage 2023 Travelers and the ICBA celebrate 40 years of partnership and $75M+ of Policyholder Safety Group Dividends

travelers.com Travelers Casualty and Surety Company of America and its property casualty affiliates. One Tower Square, Hartford, CT 06183 This material does not amend, or otherwise affect, the provisions or coverages of any insurance policy or bond issued by Travelers. It is not a representation that coverage does or does not exist for any particular claim or loss under any such policy or bond. Coverage depends on the facts and circumstances involved in the claim or loss, all applicable policy or bond provisions, and any applicable law. Availability of coverages referenced in this document may depend on underwriting qualifications and state regulations. © 2023 The Travelers Indemnity Company. All rights reserved. Travelers and the Travelers Umbrella logo are registered trademarks of The Travelers Indemnity Company in the U.S. and other countries. CP-9620 Rev. 7-23

SPOTLIGHT

Education Buzz: Pause. The faster I run, the slower I get.

I am learning to slow down and enjoy the moment. Have you stopped recently and just sat to ponder. The more I favor lifelong learning, I must pause and think about what I personally do to gain knowledge and how does it contribute to my overall wellbeing and professional success. As the honey is filling the cells of the beehive, am I storing up knowledge that will give me energy and solutions or am I wasting my resources. It’s so easy to go through the motions. If we make an intentional decision to put tools in place daily that support our goals and success, our honey will be liquid gold to bring value to those we serve.

Kristi Greer Senior Vice President Director of Professional Development Community Bankers Association of Georgia

Payment strategies are not one-size-fits all. We provide flexible, customizable and meaningful services designed to help you strengthen your merchant portfolio across every type of business.

26 | www.cbaofga.com | Summer 2023

PROFESSIONAL DEVELOPMENT

Ready

a

Let’s get started. Sarah Humphrey Director of Sales shumphrey@fitech.com | 903-241-0977 Tanner Rizenbergs Manager of Financial Institutions trizenbergs@fitech.com | 817-575-7930

for

partnership that produces?

Enhance Your Cyber Security Posture – Keep Learning & Take Action to Stop Cyber Crime

The most important topics will be covered at the annual conference on Jekyll Island. Register, book your room, and get your questions ready to discuss and assemble tools that will support your bank’s cyber security guards.

AGENDA SPEAKERS SPONSORS HOTEL EXHIBITORS

Summer 2023 | Georgia Communities First | 27 PROFESSIONAL DEVELOPMENT

We are back in person with the regulators!

CBA is excited to announce the return of the In-Person Banker Regulatory Forums! In today’s changing financial and regulatory environment you cannot afford to miss the chance to hear directly from the FDIC, OCC, FRB, and GA Dept of Banking. Hear the agencies’ hot topics, exam trends, economic outlook, and MORE! Set your bank and your community up for success by preparing today for what is coming tomorrow! September 14th we will gather in Macon for BRF focused on Safety & Soundness! C-Suite Employees, you will want to be in the room!! Submit your questions in advanced by emailing education@cbaofga.com

September 14 – Safety & Soundness Focused C-Suite employees will want to be in the room. You can submit questions in advanced by emailing education@cbaofga.com.

Panel Discussion & Agency Hot Topics

Question & Answer Session - Audience Questions

Facilitators: Doroteya Wozniak, James-Bates-Brannan-Groover, LLC & Lisa Berry

Warren Averett, LLC

FDIC

OCC

FRB of Atlanta

GA Dept of Banking

Lunch 1:00 PM 2:00 PM

12:00 PM 1:00 PM

R.A.P. Session

Recap - What did we hear from the Regulators

Group Hot Topics

Facilitators: Doroteya Wozniak & Lisa Berry

*ICBA – Michael Emancipator & Mickey Marshall 2:00 PM 2:00 PM Closing Remarks

28 | www.cbaofga.com | Summer 2023 PROFESSIONAL DEVELOPMENT

Start Time End Time 9:30 AM 10:00 AM Registration & Check ins 10:00

10:15

Welcome

Introductions 10:15

12:00

Regulatory

AM

AM

&

AM

PM

Networking

Attendee

1071 Resources

ICBA has published a summary of the rule and hosted a banker briefing. ICBA also has an advocacy resource page that highlights recent activity, as well as their “Hill visit.”.

The

Financial Protection Bureau published a small entity compliance guide in May. Upcoming

| Georgia Communities First | 29

1071 Webinars

Final Rule Highlights & Effective Dates – OnDemand

Developing a Data Collection Process Under the Final Rules – OnDemand

Reasons to Prepare for 1071 Rules: Small Business Reporting for Women & Minority Owned Businesses

OnDemand PROFESSIONAL DEVELOPMENT

Consumer

Section 1071

Section 1071:

Five

–

Cyber Risk Conference August 17-18 Jekyll Island LEAD Retreat September 28-29 Jekyll Island Mortgage Lending School November 14-16 Perimeter Consumer/ Retail Lending School October 2 – 5 Macon Advanced BSA/AML School August 21-25 St Simons Island Fintech South *CBA Members use member only code to receive a discount code at registration. September 12-13 Atlanta Contact us today. JR LLEWELLYN jr.llewellyn@newcleus.com CHARLIE HICKS charlie.hicks@newcleus.com Let us show you how to attract and maintain leadership excellence and commitment through innovative and strategic compensation planning.

Popular Schools & Conferences

30 | www.cbaofga.com | Summer 2023 PROFESSIONAL DEVELOPMENT COMMUNITY BANK FOCUSED

Choose courses a la carte. Package members receive reduce pricing. NEW!! Advanced Compliance Courses

COMPLIANCE EDUCATION

New Bankers, anyone who wants to understand the basics of compliance regulations should attend to gain a valuable summary of what and why.

Summer 2023 | Georgia Communities First | 31 PROFESSIONAL DEVELOPMENT

Compliance

NEW!! Basic Compliance for Non-Compliance Staff

NEW!! Intermediate

Course

Essential Lending Compliance 8/29/23 - Macon or Live Virtual STREAM 8/30/23 - Tifton or Live Virtual STREAM

More Compliance Courses

32 | www.cbaofga.com | Summer 2023 PROFESSIONAL DEVELOPMENT

ICBA Affiliate Education Program

Collaborating with ICBA gives our members even more choices to support the learning and development goals of the financial institution. We are here to help you find the best training to fit your needs. Call us and we will help make a connection. Check out Community Banker University Powered by ICBA.

When selecting to register for a Community Banker University Powered by ICBA program, please use our state association code. Using the code will alert ICBA to give back to Georgia through our alliance in supporting the community banking industry.

State Association Code: GA-CBA

The new Affiliate Education Program will ensure that collectively, we put community banks in contact with the training tools necessary to grow bankers’ knowledge and skills. Let’s all win by increasing knowledge, improving efficiency, and investing in our employees while working together to uplift the industry we love— COMMUNITY BANKING!

Summer 2023 | Georgia Communities First | 33 PROFESSIONAL DEVELOPMENT

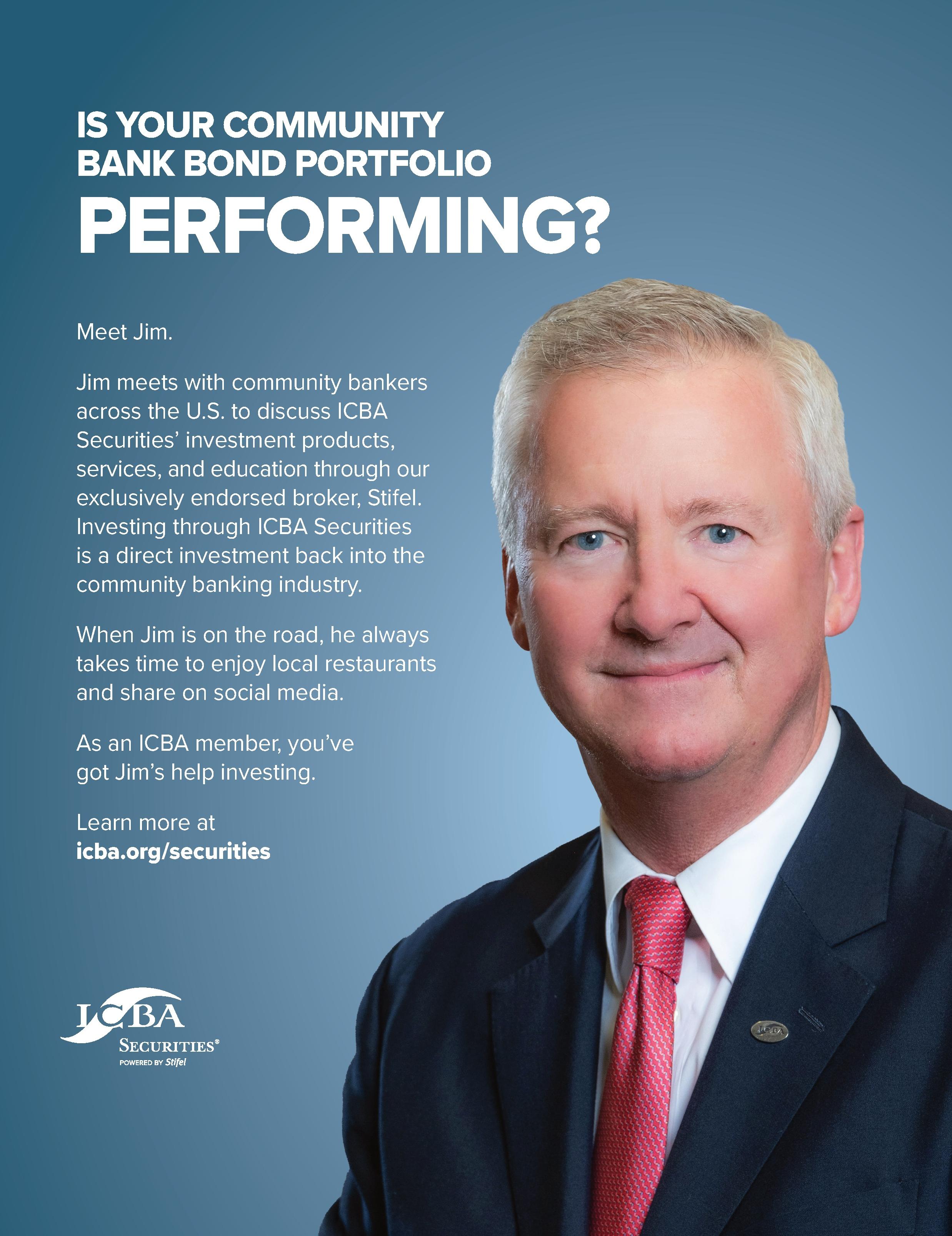

Value, added

High baseline yields accompany surprisingly wide spreads

If your responsibilities include your community bank’s bond portfolio, you’ve been confounded by several elements of its performance in the last 18 months. To the extent your portfolio has mortgage-backed securities (MBS) and government agency bonds, and the clear majority of all bonds owned by banks are in these two categories, they’ve certainly lost value since 2022. It is easy enough to put the “blame” on the Fed’s Federal Open Market Committee (FOMC), which as of this writing has taken overnight rates up fully 500 basis points (5%) since March of last year.

However, something else has occurred in period that’s contributed to the decline in bond prices: Yield spreads have actually widened during this time frame, which is highly unusual for a rising rate scenario. It has aggravated the market losses in community bank portfolios, which stood at around 8% as of June 30. About one-fifth of the market losses can be attributed to spread widening. What’s going on here?

Maybe it’s time to review why spreads widen and tighten, and why the various bond market sectors behave differently.

Jim Reber President & CEO ICBA Securities

If we can conclude with the notion that there are some opportunities for long-term benefit for your bank, all the better.

Spread basics

First, a refresher on “spreads” in this context. It is the incremental yield for a collection of bonds, over and above the benchmarks. The benchmarks are comparable maturity Treasuries, which are presumed to be risk-free. (We don’t have time here to revisit the recent elaborate game of chicken over the debt ceiling. Notice I said “elaborate” and not “elegant.”)

Incremental spreads on bonds will tend to widen as rates fall, as lower yields accompany an economy that is losing momentum. This slowdown brings with it a higher likelihood of debt service problems, so lenders, including bond investors, ask for additional yield protection.

In 2023, there’s no slowdown, yet, and so the FOMC has now hiked overnight rates to their highest levels in 15 years in its quest to get inflation under control. And still, spreads

Executive Insurance is a Preferred Service Provider of the CBA of Georgia, and has been working with community banks in Georgia since 1980.

We are totally committed to the future of community banking and consequently are setting the standard in service, knowledge and innovation in this very important area. We encourage you to call on us for a comprehensive review of your specific needs.

34 | www.cbaofga.com | Summer 2023 EXECUTIVE INSURANCE AGENCY, INC. Call Us for All Your Collateral Insurance Needs! • VSI • Flood • Creditor Placed • Collateral Protection • REO • GAP • Blanket • Tracking Services Mr. Ryan Sower • P.O. Box 480 • Stockbridge, GA 30281-0480 770-474-2355 • 800-772-1404 • www.executiveinsuranceagency.com

MEMBER SERVICES

are wider in virtually all bond sectors, so something different is in play. One factor is the Fed’s posturing related to its own balance sheet. Currently, the Fed is removing $95 billion per month from its own Treasury inventory. It has reserved the right to actually shed some of its $2.5 trillion MBS portfolio, but hasn’t yet.

Another difference this time around is the well-documented decline in excess liquidity on bank balance sheets, which I hasten to add is not the same thing as deposit runoff. Globally, the banking sector has gone from too much uninvested cash, to probably about right. Again, this has removed some demand from the fixed-income markets as the banking sector has purchased very few bonds in 2023.

Some sectors are not like others

The callable agency market gives us a good example of how spreads are historically wide. Way back in 2021 (hyperbole), a bond that matured in three years and could be called in a year (“3/1 callable” in bond-speak) would have had a stated rate of interest of around 0.50%, which was about 10 measly basis points (0.10%) over the curve. Today, the “coupon” for the same bond would be around 5.50%, which has a full 1% spread over the three-year Treasury.

Similarly, popular mortgage securities have improved yields and spreads today, over just a few months ago. A staple of community bank portfolios is a 15-year MBS issued by

Fannie Mae or Freddie Mac. A “current coupon” pool has right at a 5% yield to maturity, again around 1% over the Treasury curve. A year ago? A current coupon would have been about 3.5%, and its spread around half of today’s.

Act now, thank you

It’s time to speak into the microphone and state that things can get worse before they get better. Which is to say, Treasury yields, and spreads, can continue to gap higher and wider before coming back in line. The Fed sure doesn’t sound like it’s finished with tightening, and even though banks are making use of wholesale funding sources to maintain liquidity levels, banks aren’t likely to become deluged with excess cash in the near future.

Nonetheless, we have a baseline of yields (Treasury curve) that is at a 15-year high, coupled with spreads that are nearly unprecedented for this stage of the rate cycle. This causes me to suggest that your portfolio will thank you later for bonds you purchase in mid-2023. If more yield is considered good, then it’s summertime, and the livin’ is easy.

Summer 2023 | Georgia Communities First | 35

MEMBER SERVICES

7 ways open banking can benefit your financial institution

As technology evolves, community financial institutions are seeking innovative ways to stay competitive and provide value to their customers.

Open banking has gained traction as a potential solution in recent years, owing to its benefits of enhancing customer experience, improving customer satisfaction ratings and fostering innovation. With its potential to transform financial services, community financial institutions should now be looking at how they can embrace this technology and the wealth of opportunities that come with it.

What is open banking?

Open banking is a concept that promotes the secure sharing of customer data between different financial institutions and third-party providers through standardized application programing interfaces (APIs). In sharing that data, it facilitates collaboration, innovation and the development of new financial products and services.

Financial institutions can leverage the use of this technology to help provide their customers with a better experience and position themselves as trusted financial partners.

The benefits of open banking

Open banking empowers financial institutions to unlock new opportunities for growth while delivering the customerfocused experiences that have long been their hallmark.

For your financial institution, open banking can make it easier to:

1. Empower customers

With the use of APIs, financial institutions can integrate with various financial service providers and allow customers to view all their accounts in one centralized location. From a customer’s perspective, having a comprehensive view of account information will empower them to be more efficient with their financial management.

2. Create a personalized customer experience

Open banking provides you with greater and more secure access to customer data, giving you valuable insights into your customers’ financial behaviors, needs and preferences. Those insights can then enhance marketing efforts, allowing customers to receive personalized financial services and offerings, such as tailored product offerings and recommendations and targeted financial advice.

3. Streamline processes

Transactions such as payments and funds transfers can be simplified with open banking. Customers can then enjoy faster, more convenient payment options, such as peer-to-peer transfers, digital wallets, QR codes and real-time payments — ultimately enhancing their overall banking experience.

4. Build relationships

Open banking makes it easier for you to foster relationships and form strategic partnerships with fintech startups, technology providers and other financial institutions, creating a more collaborative financial ecosystem. With those relationships, you can leverage specialized services and innovations to enhance product offerings and deliver a wider range of financial solutions to customers.

5. Increase innovation

Building relationships with third-party providers also gives you easier access to the wealth of innovative products and services they develop. Your financial institution can connect to new technologies such as budgeting apps, robo-advisors and digital lending platforms, enriching your customer offerings without having to build these capabilities from scratch.

6. Improve security

Using APIs for open banking can help enhance security and fraud prevention.

APIs follow rigorous security standards and protocols, ensuring secure data transmission and protection. Encryption, authentication and authorization are also standard components that support APIs.

These security practices, coupled with comprehensive authentication and consent mechanisms, minimize the risk of fraud and encourage customer trust in sharing their data.

7. Streamline customer onboarding

Many banks still rely on a tedious, form-heavy onboarding process that results in a poor customer experience. Open banking simplifies the onboarding process for new customers by eliminating the need for manual data entry. With consent, customer data can be securely retrieved from other financial institutions, reducing the hassle and improving the speed of account setup. This helps you simplify the customer onboarding process and the management of customer data.

36 | www.cbaofga.com | Summer 2023

MEMBER SERVICES

Anna-Kay Sterling, CISA Manager WIPFLI Atlanta

SPONSORSHIP & ADVERTISING OPPORTUNITIES

Ready to grow your brand recognition and drive sales?

Upcoming Programs:

• Advanced BSA/AML School

• CBA Day at the Braves!

• Fall Clay Shoots

• Consumer Lending School

• BSA Fundamentals

• Advanced Compliance School

Let’s discuss your goals and design the best package for your needs. Contact Lindsay Greene.

Summer 2023 | Georgia Communities First | 37 MEMBER SERVICES

Small Business Administration – Making Strides to Encourage Small Business

The Small Business Administration (SBA) has recently taken significant steps to address the obstacles faced by community banks in extending credit through the SBA’s credit enhancement program. Through revisiting their Standard Operating Procedures (SOP) and incorporating feedback from SBA lenders, the SBA aims to streamline requirements and facilitate small business growth.

The primary objective is to reduce the notional size of new money loans and promote wider adoption of the government’s program, fostering small business expansion. Over the past decade, the average loan size of SBA products has steadily increased, nearing the $1 million mark. Consequently, a substantial funding gap for small businesses has emerged.

This trend can be attributed to the economics and profitability of larger deals, as lenders seek to establish more lucrative

banking relationships through larger deposits and increased fees. For community banks and credit unions, however, underwriting small-dollar loans has proven challenging due to onerous regulations and a lack of streamlined technology. Consequently, many small businesses have turned to nonbank lenders for their funding needs, which is far from ideal. Non-bank lenders often lack the necessary expertise and comprehensive product offerings to adequately support small businesses. Furthermore, this practice increases risk for financial institutions by fragmenting the client relationship.

The SBA is to be commended for their efforts to tackle these issues head-on. In turn, we challenge financial institutions to reevaluate their strategies regarding small business lending. By doing so, we can collectively ensure that small-dollar loans remain within federally regulated financial institutions, avoiding reliance on non-bank lenders.

WHAT CAN VERICAST DO FOR YOU?

Vericast is your data-into-dollars, rocket-ship-launching, reach-expanding, bottom-line-building marketing amplification partner. Let us show you how our data, insights and expertise can take your marketing to new heights and deliver a different kind of ROI — a return on intelligence.

38 | www.cbaofga.com | Summer 2023

VERICAST.COM/AMPLIFICATION

Vericast All rights reserved. CS1855 MEMBER SERVICES

© 2023

Here are some key takeaways, solutions, and challenges for financial institutions resulting from the recent SBA SOP changes:

Takeaway #1: Consistent increase in SBA loans: The notional loan amount for SBA products has continued to rise over the years. Recognizing the need to fund “small-dollar” loans below the $500,000 threshold, the SBA has implemented changes.

Solution: The revised SOP now allows financial institutions to employ a creditworthiness scoring system, expediting the underwriting process and accelerating the flow of funds.

Challenge: Implement a commercial score-based lending policy. While this approach may not be suitable for all commercial loans, there is likely a notional value (sub $500,000, in line with the SOP) where the utilization of scores can be deemed acceptable. Such scores can guide decision-making regarding loan sizing and pricing.

Takeaway #2: SBA Deal Structure(s): Previously, the language used in SBA lending hindered business owners from structuring buy-outs, leading to many businesses shutting down due to a lack of succession planning.

Solution: The new SOP language enables small business owners to accept payments or structure deals that facilitate their continued involvement in the business, ensuring a smoother transition of ownership. SBA structured loans now offer opportunities for financing that benefit all parties involved.

Challenge: Break down the barriers between conventional and SBA lending within your financial institution. Why do we segregate these business lines? We encourage institutions to rethink how these areas interact. Our Loan Origination Software can establish a unified “front door” for all prospects or borrowers, allowing technology to determine whether a conventional or credit-enhanced product is the best fit for the bank and borrower.

In conclusion, as an industry, we must continue to innovate to prevent non-bank lenders from seizing the low-hanging fruit. By adopting the right strategies, financial institutions can drive loan growth, generate non-interest income, and better serve their communities. After all, no one knows your customers better than you do. Let’s make conducting business easier.

If you would like to discuss these points or require any assistance, please don’t hesitate to contact us.

Will Fountain Managing Director, Advisory Services Lenders Cooperative Birmingham, AL

Consumers want a better loan.

Make sure they get it from you.

Get a 52% increase in total loan balances with a loan they actually love. All without changing your credit criteria or marketing.

The Kasasa Loan® with Take-BacksTM gives borrowers more flexibility and control over their debt with the ability to pay ahead and take back the extra payments if the unforeseen happens.

Learn more or request a demo at Kasasa.com/loans.

MEMBER SERVICES

LOOKING FOR SOLUTIONS? LOOK TO CBA FIRST! MEET

CBA’S ASSOCIATE MEMBER COMPANIES

When Georgia’s community bankers are looking to do business, they look to CBA Associate Members first. Members have been approved by CBA’s Board of Directors and these companies offer competitive products and services designed to help community banks succeed.

What’s more, CBA Associate Members support the association with their sponsorships, advertising, informative articles, and participation in CBA programs. We salute this group of professionals and offer our sincere gratitude!

360 View CRM

BDS Technology, Inc.

Bennett Thrasher

Berman Fink Van Horn P.C.

Dart Appraisal

DataSeers, Inc.

GEC, Inc.

Abrigo

Cabretta Capital

CalTech

DeNyse Companies

ebankIT

Georgia Department of Community Affairs

Adlumin

AdPharos

Affordable Equity Partners

Capital City Home Loans

Captive Solutions & Options, LLC

Carputty Inc.

Carr, Riggs & Ingram, LLC

Engage Fi

Econocheck

Elliott Davis

Georgia Student Scholarship Organization

Gerrish Smith Tuck, PC

Gulf Coast Business Credit

HC3

Alkami Technology

Alliance Funding Group

Alpharesults

Alston & Bird LLP

AmTrust Financial Services, Inc.

Angott Search Group

Arctic Wolf Networks

Asset Black

Atris Technology

Carty & Company, Inc.

Cash Transactions, LLC

CBIZ

Engaged Banker eXperience LLC

Evans, Simpson & Associates, Inc.

Human Interest

Hutchins Clenney Rumsey

Huckaby, P.C.

IBT Apps

Balch & Bingham LLP

Banc Card

Banker’s Dashboard

BankiFi Technology

Community Bankers Bank

Community Bankers Webinar Network

Community Lending Partners

Compliance & More Financial Services

Computer Services, Inc.

Consolidated Banking Services, Inc.

Consultants & Builders, Inc.

Core 10 - Accrue

Cornerstone Commercial Mortgages, LLC

ExlService Holdings, Inc.

Fairway Wholesale Lending

Federal Home Loan Bank of Atlanta

FEMAC Security Solutions

Finosec

First Community Mortgage

First Liberty

First National Bankers Bank

FIS

Fiserv

ICI Consulting, Inc.

Infusion

Integration 4.0 Inc

IR Labs, LLC (Innovation Refunds)

Jack Henry Banking

Bankers-Insight Group, LLC

Barret School of Banking

CRS Data

Darnel Quick Recovery, Inc.

Basys

Fiveash-Stanley, Inc.

Flex HR

Foresight Research

Framework Homeownership

King Computer

KlariVis

40 | www.cbaofga.com | Summer 2023 MEMBER SERVICES

GENE S Y S TECHNOLOGY GROU P

Lee & Mason Financial Services, Inc.

Lenders Cooperative

Liberty Technology

Logue Advisory Group

Novus Architects

Olsen Palmer LLC

OnBoard

OttoMoto

PaymentsFirst

PCBB

Pentegra Retirement Services

Performance Solutions Inc.

Maxwell

McNair, McLemore, Middlebrooks & Co., LLC

Miller & Martin PLLC

Moore, Clarke, DuVall & Rodgers, P.C.

National Bank Products, Inc.

National Loan Acquisitions, LLC

Nationwide Loan Inspections

Nelson Mullins

Performance Trust

Safe Systems

SBA Works

Securian Casualty Company

Securitas Financial Services, Inc.

ServisFirst Bank

Georgia

The Burke Group

The Kafafian Group

The Plateau Group, Inc.

TIB, N.A.

ProBank powered by Forvis

Profit Resources, Inc

PULSE, A Discover Company

Qualtik

Quantalytix

Small Business Assistance Corporation (SBAC)

Southern Bank Equipment & ATMs

Steve H. Powell & Company

TriData US, Inc.

Troutman Pepper

True Digital Group

United Bankers’ Bank

USDA - Department of Rural Development

Netchex

NFP Executive Benefits

Nichols Cauley & Associates

Novatech

RayCor Consulting

Reich & Tang

Rhonemus Group

S&P Global Market Intelligence

Sugar Creek Capital, LLC.

Symphona

Strategic Resource Management (SRM)

StreetShares, a MeridianLink company

Strunk, LLC

Technology Association of

VSoft Corporation

Warren Averett, LLC

William Mills Agency

Withum

York & Associates, LLC

Logos represent CBA

Preferred Service Providers

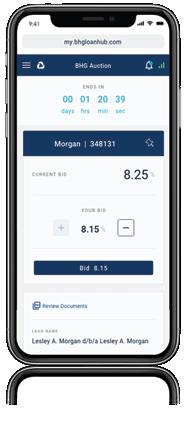

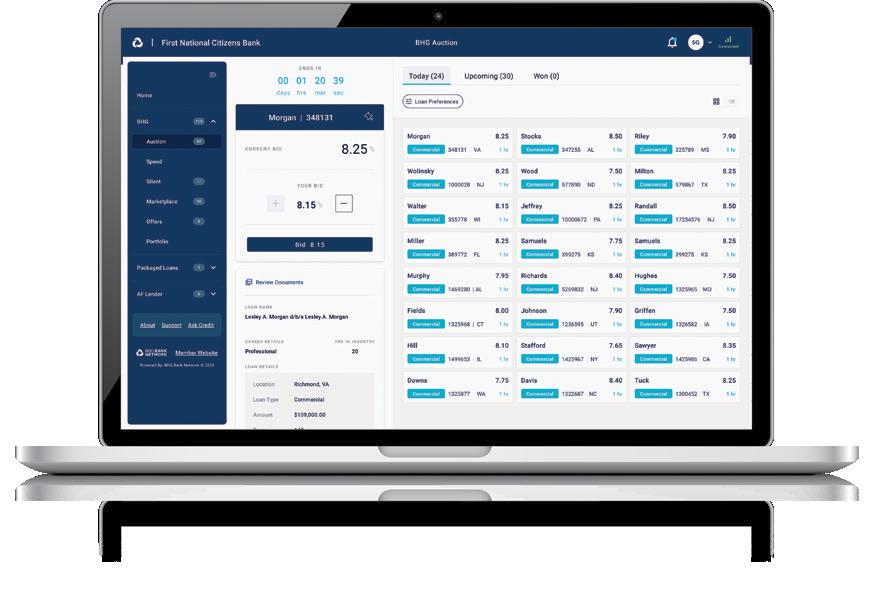

MEMBER SERVICES High-yielding. High-quality. Highly-coveted. WA FICO: 736 WA Income: $295,613 Avg Loan Size: $142,017 WA Years in Industry: 19 WA DSCR: 2.26 2023 BHG borrower: WA = Weighted Average Rachel Thorton | AVP, Institutional Relationships thornton@bhg-inc.com | 843.251.4223 To learn more about BHG, please contact: Latitude 34 PR

CBA’S 2023 PREFERRED SERVICE PROVIDERS

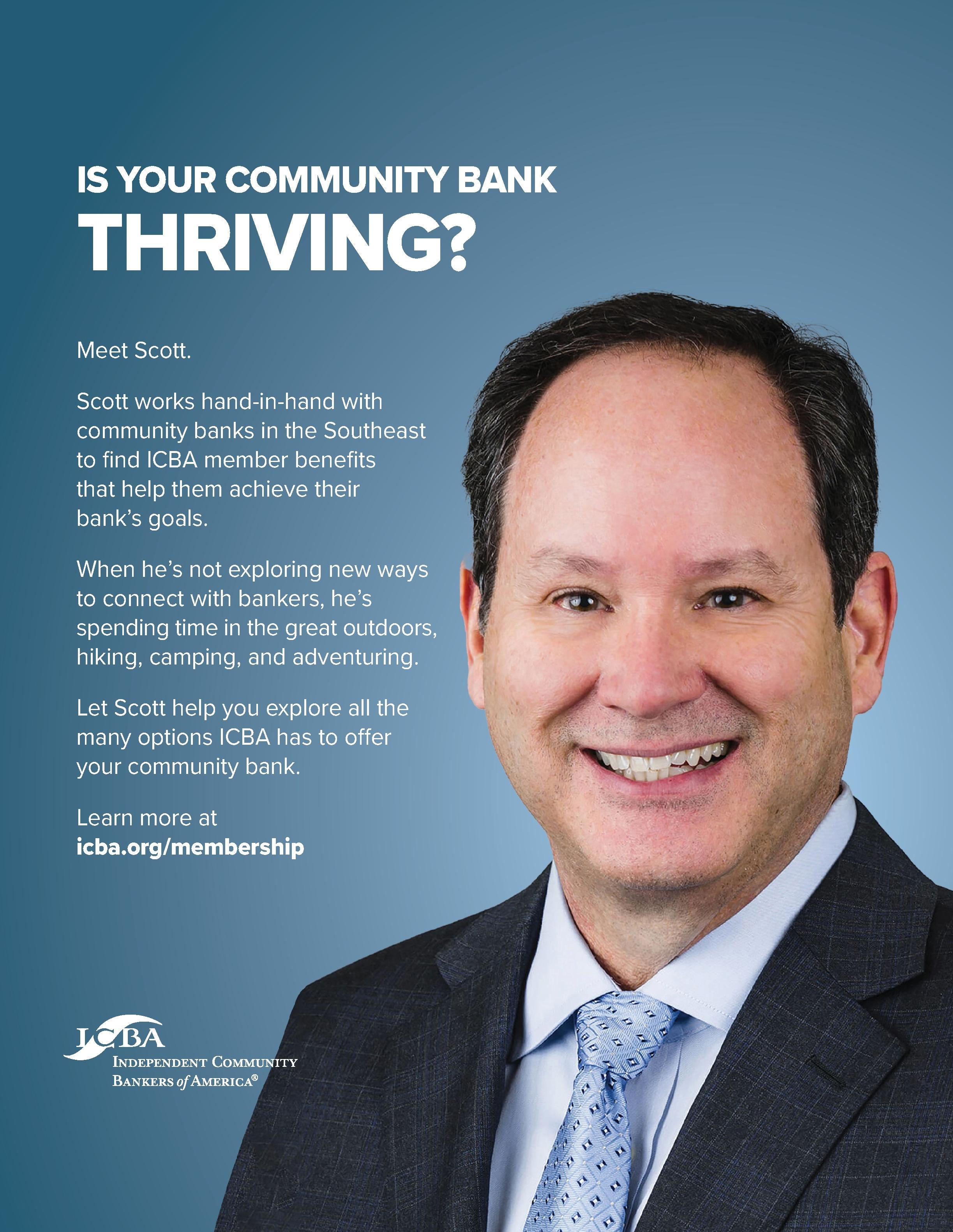

DIAMOND LEVEL

ICBA Securities

Jim Reber | jreber@icbasecurities.com | 901.762.5884

Independent Community Bankers of America

Scott Brown | scott.brown@icba.org | 334.328.5731

James Bates Brannan Groover LLP

Dan Brannan | dbrannan@jamesbatesllp.com | 404.997.6023

SHAZAM

Alex Jernigan | jjernig@Shazam.net | 229.220.0064

PLATINUM LEVEL

Genesys Technology Group, LLC

David Saylor | david@genesystg.com | 770.729.4139

GOLD LEVEL

BHG Financial

Rachel Thornton | rthornton@bhg-inc.com | 843.251.4223

Crescent Mortgage

Skip Willcox | swillcox@crescentmortgage.net | 478.357.4441

DefenseStorm

David Cross | David.Cross@defensestorm.com

Interested in becoming a Preferred Service Provider?

The Preferred Service Provider packages offers Associate Members the option of upgrading to package of your choice. A few benefits include early access to advertising, exhibiting and sponsorship opportunities, simplified budgeting and of course – increased exposure! All packages are reviewed by CBA’s Member Services Committee. To learn more, please contact Lindsay Greene at 770.541.0376.

42 | www.cbaofga.com | Summer 2023

| 716.244.1107 FITECH Sarah Humphrey | shumphrey@fitech.com | 817.698.2268 Holtmeyer & Monson Arne Monson | amonson@holtandmon.com | 800.340.7304 IntraFi Network Danny Capitel | dcapitel@promnetwork.com | 770.630.6796 Mauldin & Jenkins Ron Mitchell | rmitchell@mjcpa.com | 229.446.3600 Point to Point Environmental Mark Faas | mfaas@p2penvironmental.com | 678.565.4435 Ext 151 STS Group Adam Stephens | adams@stsgrp.com | 256.957.8018 Travelers Diana Baker | dcbaker@travelers.com | 678.317.7882 Wipfli Summer Gustin | summer.gustin@wipfli.com | 480.289.6052 SILVER LEVEL ACG Phil Winn | Phil.Winn@acgworld.com | 678.458.9899 BCC-USA John Gianacaci | JGianacaci@BCC-USA.com | 609.915.9168 College Ave Student Loans Lexy Spikes | lspikes@collegeave.com | 214.232.5272 CRA Partners David Lenoir | david.lenoir@shcpfoundation.org | 901.529.4786 Eclipse Brand Builders Joel Thompson | jthompson@eclipsebrandbuilders.com | 678.894.4360 Executive Insurance Agency, Inc. Ryan Sower | ryan@executiveinsuranceagency.com | 770.474.2355 Kasasa Ryan Busenitz | Ryan.Busenitz@kasasa.com | 678.595.0625 Newcleus Bank Advisors JR Llewellyn | jr.llewellyn@newcleus.com | 678.427.1015 QwickRate Melissa Wallace | melissa.wallace@qwickrate.com | 678.797.4062 Stokes Carmichael & Ernst LLP Michael Ernst | mje@scelaw.com | 404-603-3441 BRONZE LEVEL AgoraEversole Chis Bates | chris@agoraeversole.com | 601.366.7370 Bahr Consultants, Inc. Hank Bahr | hank@bahrconsultantsinc.com | 865.694.6098

-Frank Griffin / Flint Community Bank

-Frank Griffin / Flint Community Bank

Adam Stephens VP / Sales & Marketing

Adam Stephens VP / Sales & Marketing