Mark III Flex LNG Carrier

The Abu Dhabi National Oil Company (ADNOC), Jiangnan Shipyard (Group) Co., Ltd., and classification society DNV, celebrated the naming and delivery ceremony of China’s first large-scale Mark III Flex membrane LNG carrier, the 175,000 cbm, Al Shelila. The first of a six-vessel series, this landmark delivery is one of the most innovative vessels ever constructed in China, with an optimised hull form, high-efficiency propellers, twin skeg design, and air lubrication system.

As the role of liquefied natural gas (LNG) in securing the global energy supply continues to grow, demand for LNG carriers has soared. But these are some of the most sophisticated ship type in shipping, and developing the expertise and networks to successfully deliver these complex projects in a demanding market requires a truly cooperative effort.

Reduced emissions

The newly delivered Al Shelila utilises a raft of efficiency and emissions reduction features that have drawn on experts from across DNV’s global network. This includes the adoption of two sets of WinGD 5X72DF-2.1 engines with Intelligent Control by Exhaust Recycling (iCER) system for reduced methane slip, the GTT Mark III Flex membrane cargo containment system with an 0.085%/day boil-off rate, two shaft generators

There is a bright future for Chinese-built LNG carriers

for improving energy efficiency, and the Jiangnan Intelligent Ship System (JNIS) for real-time energy optimisation.

Captain Abdulkareem Al Masabi, CEO of Adnoc Logistics and Services, said: “We are proud to take delivery of ‘Al Shelila,’ from Jiangnan Shipyard. In Arabic, ‘Shelila’ represents strength and grace, qualities that reflect the legacy of our forefathers’ vessels. As we expand our fleet to meet rising global demand for natural gas, our deepening partnership with Jiangnan Shipyard underscores the strong industrial ties between

the UAE and China, reinforcing our shared commitment to powering global economic growth, and we commend DNV for their expert consultation in the design of this world-class vessel.”

Lin Ou, chairman of Jiangnan Shipyard, said: “With the great trust and support of ADNOC L&S, DNV, GTT and all relevant parties, Jiangnan has completed the construction of China’s first Mark III type large LNG carrier two months ahead of schedule. As a leading global shipbuilding company specialised in the full series of gas carriers, Jiangnan has demonstrated our comprehensive shipbuilding ability again. We are committed to delivering the upcoming series of LNG carriers, VLEC, and VLAC on time with

Charlton acquires Marine & Industrial Report Newspaper

The Charlton Media Group is marking its entry into the marine and offshore industries by acquiring Singaporebased Marine & Industrial Report

The Marine & Industrial Report is a respected publication with 47 years of history. It was launched by Mr. Steven Tan in 1977 to report on Singapore’s marine and offshore industry. It also provides trade information on the shipbuilding and repair industry, marine and offshore equipment supplies, and the latest industry tech.

The flagship publication has enjoyed a tremendously loyal reader and advertiser base amongst Singapore’s marine, shipbuilding and offshore industries. Under the leadership of Mr. Tan, the publication has borne witness to the incredible growth of the marine industry. It has been there to report on and celebrate major milestones in its almost 50 years of continuous publication.

The Marine & Industrial Report is distributed across major markets including Singapore, Hong Kong, China, and South Korea. It has also reached the Middle East, Europe, and the US.

“Our publication has evolved significantly since 1977, reflecting changes in society, culture, and technology. We’re proud to have maintained our commitment to quality content and adapting to the needs and interests of our readers,” Mr. Tan said. “From the first publication, all in black and white, to the latest one all in colour. We help the advertisers really reach out to the buyers,” he said.

Charlton Media Group managing director Tim Charlton paid tribute to Mr. Tan, who, together with his wife Jackie Tee, has devoted a lifetime to the industry, growing the publication to make it the industry standard it is today.

MARINE & INDUSTRIAL REPORT is a bi-monthly publication of Charlton Media Group covering the latest progress and development in the marine & offshore industries. Since 1977, it has provided essential trade information on shipbuilding & repairing industries and marine & offshore equipment supplies a better insight into the latest technological advancement prevailing locally and globally.

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton

EDITOR EMERITUS Steven Tan

EDITORIAL MANAGER Tessa Distor

PRINT PRODUCTION EDITOR Eleennae Ayson

JOURNALISTS Vincent Mariel Galang Noreen Jazul

EDITORIAL RESEARCHER Angelica Rodulfo

GRAPHIC ARTIST Simon Engracial

EDITORIAL ASSISTANT Vienna Verzo

COMMERCIAL TEAM Jenelle Samantila Dana Cruz

ADVERTISING CONTACTS Shairah Lambat shairah@charltonmediamail.com

AWARDS Julie Anne Nuñez awards@charltonmediamail.com

ADMINISTRATION Eucel Balala accounts@charltonmediamail.com

EDITORIAL marinereport@charltonmediamail.com

good quality, to better support ADNOC L&S to achieve its drive for fleet expansion and further deepen our strategic cooperation with ADNOC.”

“In the LNG segment achieving success requires bringing all stakeholders, from ship owners, and shipyards, to cargo owners, charterers, together on projects at the highest level of technical expertise and quality,” said Knut Ørbeck-Nilssen, CEO at DNV.

“This project is a testament to the excellent communication, planning, and coordination between ADNOC, Jiangnan Shipbuilding, and DNV and highlights the strength of our collaboration and the collective efforts of everyone involved. We are very pleased to have been part of the milestone and look forward to

“We all stand on the shoulders of giants, and the Marine & Industrial Report is the flagship publication for the industry in Singapore and beyond. Steven has created a lasting legacy, and one of the first things we will do is digitise the past issues going 1977, which will give access to the community to the complete record of marine and shipbuilding in Singapore,” Mr. Charlton said.

The Asia-Pacific region had the biggest shipbuilding market last year, followed by Western Europe, it added. Tan said he expects shipbuilding demand to continue as the world’s aging fleets upgrade to meet modern standards. Singapore would remain a key player, whilst the shipbuilding

deepening our relationship over the coming deliveries.”

“We are very proud of the support we have been able to provide to the Jiangnan shipyard in the highly challenging large LNG segment,” said Norbert Kray, regional manager for Maritime Greater China at DNV. “We have worked closely together with ADNOC and Jiangnan to find solutions that can help realise the project with maximum efficiency, whilst maintaining compliance to our rigorous class rules and the relevant industry standards. That we have been collectively able to deliver on such a highly ambitious timeline is a fantastic achievement and demonstrates that there is a bright future for Chinese-built LNG carriers.”

industries of China, South Korea, Vietnam, and Malaysia rapidly expand, he added.

“We look forward to developing new events, awards programmes, and digital platforms around the prestigious title to bring it to a broader audience and expand its reach beyond Singapore,” Charlton added.

This is the second trade media B2B publication that the Charlton Media Group acquired in 2024, following the purchase of Travel Daily Media in February 2024. The group also acquired Asia Pacific Broadcasting in 2023 and Retail Asia in 2019. Charlton Media Group currently publishes 12 trade media print publications such as the Singapore Business Review and

To help Chinese yards succeed in the emerging alternative fuels segment, DNV established a Gas Carrier and Alternative Fuels Expert Team at their technical centre in Shanghai in 2022 that provides a full range of know-how and services.

“We are the independent expert in risk management and quality assurance. Driven by our purpose, to safeguard life, property and the environment, we empower our customers and their stakeholders with facts and reliable insights so that critical decisions can be made with confidence. As a trusted voice for many of the world’s most successful organisations, we use our knowledge to advance safety and performance, set industry benchmarks, and inspire and invent solutions to tackle global transformations.”

Asian Banking & Finance, and operates 19 websites and dozens of related conferences and awards programmes. It is now one of Asia’s largest B2B trade media publishers, with offices in Singapore, Hong Kong, Jakarta, Manila, and Thailand.

Mr. Charlton said: “There is tremendous opportunity in B2B trade media to build communities of related industry professionals and bring them news and insights through media, opportunities to learn and connect at conferences, and to be recognised and celebrated at Awards nights. The Marine & Industrial Report is an excellent and well-respected publication, and we are looking forward to growing in these new arenas.”

Two state-of-the-art hybrid ferries delivered to HKKF

The new vessels boast hybrid drive trains and lithium-ion energy storage systems that can operate in zero-emissions mode.

Hong Kong & Kowloon Ferry Limited (HKKF) has taken delivery of two new state-of-the-art hybrid ferries, designed by global digital shipbuilder Incat Crowther and built by Hong Kong-based Cheoy Lee Shipyards. The new 40-metre ferries can transport up to 450 passengers and will service the busy commuter routes between Hong Kong and the islands of Lamma Island, Peng Chau, and Hei Ling Chau.

Sustainability project

The two new ferries, one of which is a carbon-hulled vessel and the other an aluminium-hulled vessel, are part of a nine-vessel order and will form part of a trial by the Hong Kong government as it seeks to reduce emissions from the local shipping sector. Each of the vessels boasts a hybrid drive train and lithium-ion energy storage systems allowing them to operate in zero-emissions mode during slow speed transit, berthing, and manoeuvring.

In a further bid to reduce the environmental footprint of the new vessels, each ferry is fitted with exhaust treatment technology and approximately 30 square metres of solar panels supported by battery technology to provide zero-emissions onboard power.

The operational and sustainability performance of both the carbon-hulled and aluminium-hulled vessel will be measured over the coming years. In addition to sustainability benefits, each of the new vessels has been designed to provide an elevated customer experience. Each vessel is capable of transporting 300 passengers on its main deck and another 150 on the upper deck, whilst they also include bike hangers, lavatory

facilities, a 10m2 cargo hold on the main deck, and additional luggage storage on the upper deck.

Sam Mackay, technical manager at Incat Crowther, said the delivery of the two new vessels was a key milestone in the project.

“The successful on-budget delivery of these two hybrid vessels is a testament to the strong collaboration between the teams at Incat Crowther, Cheoy Lee Shipyards, and Hong Kong & Kowloon Ferry. This

Alternate bunker fuels exceeded 1m t in 2024

Biofuel sales rose from 0.52m to 0.88m tonnes in 2024.

The maritime industry has recorded new highs in 2024 despite hurdles in the global supply chain, the Maritime and Port Authority of Singapore (MPA) said in a statement.

The MPA said the annual vessel arrival tonnage in the port of Singapore grew 0.6% to reach a new record of 3.11 billion gross tonnage (GT) last year. Key shipping categories - bulk carriers, container ships, and tankers - contributed to over 90% of the vessel arrival tonnage in 2024. Other categories, such as specialised vessels, ferries, and cruise liners account for the remainder.

Major cargo

This distribution reflects the city-state’s position as a major hub supporting the diversity of global shipping carrying commodities, containers, energy supplies, and various trades.

Cargo throughput handled at the port of Singapore also rose 5.2% to 622.67 million tonnes, whilst container throughput from both PSA terminals and Jurong Port breached 40 million twenty-foot equivalent unit (TEU) for the first time, and growing by 5.4% and reaching 41.12 million TEUs.

Around 90% of Singapore’s container throughput is for transshipment to other destinations. Singapore remains the largest container transshipment hub in the world.

The new Tuas Port currently has 11 operating berths, with seven to be added by 2027. Meanwhile, reclamation works in Phase 2 of the port are about 75%

completed.

Also recording a new high are total bunker sales which increased 6% to 54.92 million tonnes. This partly due to the extended Asia-Europe shipping routes via the Cape of Good Hope given the disruptions in the Red Sea.

Sales of alternative bunker fuels reached 1.34 million tonnes in 2024, exceeding one million tonnes for the first time.

Specifically, the sale of biofuel blends grew from 0.52 million tonnes in 2023 to 0.88 million tonnes in 2024, whilst LNG increased from 0.11 million tonnes to 0.46 million tonnes in the same period.

The total tonnage of ships under the Singapore flag reached a new record high of 108 million GT, up 8.5% from the previous year.

“Singapore will continue to enhance our offerings to serve all shipping segments whilst expanding capabilities in emerging domains such as space, aerial drones, and cyberspace to support businesses,” MPA said.

project continues our 20-year relationship with Hong Kong & Kowloon Ferry, and we are proud to be playing a role in helping to modernise and transition their fleet towards lower-emission solutions,” said Mr. Mackay. “Together, we’ve brought a future-focused ferry platform to life, helping to meet Hong Kong’s growing demand for more sustainable maritime transport options. As operators like HKKF look to reduce their

Projects like this showcase the potential of hybrid techs to contribute to the sustainable expansion of fleets

environmental footprint, projects like this showcase the potential of hybrid technologies to contribute to the sustainable expansion of fleets around the world,” he added.

Delivery

Incat Crowther and Cheoy Lee Shipyards will deliver HKKF nine new vessels as part of this project –seven 40-metre (two of which are hybrid vessels) and two 35-metre vessels. The successful delivery of the two hybrid vessels comes after the delivery of two conventional diesel-powered 40-metre vessels. The final five vessels in the fleet are under construction and expected to be delivered by 2025.

The new ferries will modernise HKKF’s conventionally powered fleet, also designed by Incat Crowther in the late 1990s.

The Hong Kong and Kowloon fleet of 19 vessels includes catamarans and monohulls, carrying 194-413 passengers each and with speeds ranging from 16 to 24 knots.

Towngas, Global Energy ink green fuel deal

Amemorandum of understanding has been signed between Hong Kong and China Gas Company Limited (Towngas) and Global Energy Trading Pte Ltd (Global Energy) in Singapore that aims to advance the supply and distribution of green methanol as a marine fuel for the shipping industry.

In a statement, Towngas said the partnership will integrate the parties’ production and logistics capabilities to develop green methanol supply solutions across major and regional ports in Asia.

“By combining Towngas’s strengths in green methanol production with Global Energy’s supply chain management and market operation expertise, we are creating a robust platform to accelerate the shipping

industry’s decarbonisation journey,” said Sham Man-fai, COO–Green Fuels & Chemicals of Towngas.

Loh Hong-leong, managing director of Global Energy said aside from supply, the company could also offer advisory on compliance and in managing the benefits of using green methanol.

Towngas’s methanol production plant in Ordos, Inner Mongolia converts biomass and municipal waste into green methanol. It plans to expand its production bases across China, including in Inner Mongolia, the Greater Bay Area, and Hainan, to achieve its goal of an annual production capacity of 1 million tonnes of green fuel and chemical supplies. Meanwhile, Global Energy has delivered over 4.7 million tonnes of marine fuels in 2024.

Anemoi installs largest wind-propulsion project

The five 35 m tall, 5 m diameter Rotor Sails were retrofitted onboard Sohar Max at the COSCO Zhoushan shipyard in China.

Anemoi Marine Technologies completed the installation of five Rotor Sails onboard the 400,000 dwt Very Large Ore Carrier (VLOC), Sohar Max, making it the largest vessel to receive wind propulsion technology to date. Sohar Max is a first generation Valemax, built in 2012 in China’s Rongsheng shipyard.

The project showcased global collaboration between Brazilian mining giant Vale S.A., Omani shipowner Asyad, and UK-based Rotor Sail provider Anemoi.

Specifications

The five 35 m tall, 5 m diameter Rotor Sails were retrofitted onboard Sohar Max at the COSCO Zhoushan shipyard in China, in October 2024. In addition, Anemoi has installed its bespoke folding deployment system, which will enable to sails to be folded from vertical to mitigate any impacts on the vessel’s cargo handling operations.

With the installation of the Rotor Sails, it is expected that Sohar Max will now be able to reduce its fuel consumption by up to 6% and cut carbon emissions by up to 3,000 tonnes annually. Sohar Max has just completed a voyage to Tubarao, during which the rotor sail test period began and testing will continue on future voyages.

“Since 2010, Vale has been operating with highly efficient ships and, in recent years, has fostered initiatives for the adoption of wind energy, which will play a central role in the decarbonisation of maritime transport of iron ore,” said Vale’s Director of Shipping, Rodrigo Bermelho. “This project reinforces this tradition of Vale’s shipping area of investing in innovation and stimulating the modernisation of the fleet to reduce emissions, in

partnership with shipowners.”

“This is an exciting landmark project for Anemoi, and wind propulsion in general, as it demonstrates the significant impact wind energy has on even the largest vessels. Installing our Rotor Sails on this scale is a proud moment, showcasing our award-winning technology on another ore carrier,” said Nick Contopoulos, chief production & partnerships officer of Anemoi Marine Technologies.

“We are thrilled to be a part of Vale and Asyad’s ongoing sustainability plans and to support their efforts in driving decarbonisation across the maritime industry.”

“We extend our deepest thanks to all our partners who made this retrofit possible. Together, we’re advancing meaningful change and driving the industry towards a greener future.” he added.

In October 2024, Vale announced it is also set to install

This is an exciting landmark project for wind propulsion as it demonstrates the significant impact of wind energy on the largest vessels

Anemoi’s Rotor Sails onboard the 400,000 dwt VLOC NSU Tubarao, which is owned by NS United Kaiun Kaisha. The project, which is due for completion in September 2025, is expected to achieve significant reduction of fuel consumption and carbon emissions.

These projects with Vale are the latest in a series of ongoing installation projects Anemoi has with some of the world’s biggest shipowners and operators, which are looking to harness wind energy to increase the efficiency of their vessels by reducing fuel consumption and carbon emissions. Rotor Sails are being increasingly embraced by shipowners who are aiming to achieve net-zero emissions and enhance the energy performance of vessels. Rotor Sails are a compact technology that offer a large thrust force to propel ships, helping them comply with pivotal international emission reduction benchmarks such as CII and EEDI/ EEXI.

First Flying Electric Ferry in the US is Coming to Tahoe

It will reduce travel times for locals and visitors, providing a north-south connection across the lake.

Skiers in Tahoe will soon reach the slopes faster, as Candela and FlyTahoe announce the introduction of the first US-based Candela P-12, a groundbreaking foiling electric ferry, on Lake Tahoe.

The world’s first electric, hydrofoiling ferry will reduce travel times for Tahoe locals and visitors, providing a much-needed northsouth connection across the lake, whilst also helping to cut emissions.

The Candela P-12 is the fastest electric vessel in the world with the longest range and significantly lower operational costs than dieselpowered vessels.

This marks the introduction of electric hydrofoiling passenger ships in the US, a crucial step towards decarbonising maritime transport on American waterways.

Solving road congestion

With Lake Tahoe attracting over 15 million outdoor enthusiasts year-round, road congestion has become an ever-increasing problem. Travellers often find themselves stuck in long car lines, especially in winter, due to road closures caused by heavy snowfalls.

However, local company FlyTahoe and the tech company Candela are set to solve this by introducing a revolutionary zeroemission vessel that will make its US debut: the world’s first flying electric ferry, the Candela P-12, which recently launched on Stockholm’s waterways. FlyTahoe will feature a 30-minute cross-lake service, cutting the travel time in half compared to the daily 20,000 car trips along the same route.

The Candela P-12 was recently launched into service by Stockholm’s public transport company, becoming the first operator of this innovative vessel.

The P-12 is the world’s first electric hydrofoil ferry, hailed as a “game changer” for waterborne transport by combining long range with high speed and a revolution in energy efficiency. This 30-seat vessel, designed to accommodate both skis and bikes, uses hydrofoil technology—computer-guided underwater wings—to fly above the water’s surface at high speeds, unaffected by waves and winds.

The wings lift the hull above the water, significantly reducing drag and cutting energy consumption by a staggering 80% compared to conventional vessels. This is what allows the P-12 to be fully propelled by renewable electricity instead of fossil fuels, whilst providing a smooth ride above the waves even at high speeds.

Passengers prone to seasickness need not worry. The high-tech vessel’s computer Flight Controller uses sensors and software to balance the craft above the waves and amidst the winds, adjusting the foil’s angle of attack 100 times per second to provide a silent and smooth ride.

“It basically works like a jet fighter, which is constantly balanced using ailerons. The principle of the P-12 is the same, except our wings fly in water instead of air,” said Gustav Hasselskog, CEO and founder of Swedish tech company Candela.

The P-12’s cruising speed of

It’s ironic that whilst millions, myself included, drive around Lake Tahoe to admire its beauty, the road sediment we generate contributes to the largest threat to the lake’s famous cobalt blue clarity.

25 knots (~30 mph) —the fastest for any electric vessel—is crucial for commuters looking to cut travel times. The FlyTahoe ferry will connect the northern and southern parts of the lake in under 30 minutes, whilst driving around the lake often takes over two hours in the winter. FlyTahoe will create a vital link to the 14 world-class ski resorts encircling the lake, making it an ideal option for tourists and locals alike.

“It’s ironic that whilst millions, myself included, drive around Lake Tahoe to admire its beauty, the road sediment we generate contributes to the largest threat to the lake’s famous cobalt blue clarity. Our service will provide a faster transport than cars or buses, whilst keeping Tahoe blue,” says Ryan Meinzer, founder and CEO of FlyTahoe.

Since Lake Tahoe, the second deepest lake in the US, never freezes over, the ferry can operate year-round. This added mobility convenience will enhance business and improve the lives of both locals and tourists, providing a versatile zero-emission solution to reduce traffic during both summer and winter seasons.

A detailed analysis by the Tahoe Transportation District already recognised ferries as the best solution to reduce traffic congestion along Lake Tahoe’s north-south route, citing lower costs per user and faster travel times than cars and buses. However, that analysis, conducted before the advent of the

P-12 technology, did not account for the electric ferry’s ability to reduce energy usage by 80% compared to traditional ferries—a factor that Meinzer said significantly bolsters the unit economics and overall business case.

“This fusion of flight and electric technologies not only unveils a powerful new business opportunity with nearly 10x operational efficiency but also offers an unmatched customer experience of comfort and safety. Plus, we’ll not just be moving people faster; we’ll be boosting socio-economic mobility by connecting the north and south of the lake,” Meinzer added.

“We’re proud to partner with FlyTahoe to bring this revolutionary technology to the US for the very first time. This will not only ensure more efficient commuting around Lake Tahoe and unlock business possibilities for waterfront communities, but it’s also a big step towards unlocking the potential of US waterways for zero-emission transport,” Hasselskog said.

About the P-12 Start of Operation in Stockholm

The Candela P-12 is the world’s first electric hydrofoil ferry, with

operations commencing on Stockholm’s waterways on October 29.

Revolutionising Lake Travel for Skiers and Cyclists

The Candela P-12 will accommodate 30 passengers with ample space for ski gear in the winter and bikes in the summer, offering ultimate flexibility for Tahoe’s outdoor adventurers. With Tahoe being a premier destination for biking trails in warmer months, the ferry is poised to become a yearround solution, easing road strain and reducing the environmental impact of car travel.

Keeping Tahoe Blue

FlyTahoe’s commitment to sustainability aligns with the “Keep Tahoe Blue” slogan, furthering efforts to protect the lake’s unique ecosystem.

Lake Tahoe’s iconic blue waters are not only a source of pride but also a driving force behind this new initiative. The Candela P-12’s C-POD electric propulsion system ensures zero emissions, preserving the pristine beauty of the lake for future generations. The directdrive C-POD motors are the first

maritime electric drivetrain that eliminates the risk of oil spills. Lacking the mechanical rattling of traditional transmissions, they ensure quiet operation both under and above the water, causing minimal stress to marine wildlife.

No Wakes, No Shoreline Damage

As the P-12 flies above the water, it does not displace any water, leading to dramatically smaller wakes at high speeds. Wakes from conventional vessels can otherwise cause damage to docks, moored boats, smaller vessels such as paddleboards, and shorelines but this is no longer an issue with the P-12.

The lack of wake has led to the P-12 receiving a speed exemption in Stockholm, speeding up commutes and cutting travel times in half. Located in both San Francisco and Tahoe Vista, California, FlyTahoe is elevating sustainable mobility with America’s first electric flying ferry.

Candela is a Swedish tech company with a mission to accelerate the shift to fossil fuelfree waterways. Its pioneering hydrofoiling technology drastically reduces energy consumption of vessels.

Ostseestaal/Ampereship deliver electric solar ferries

The two ships are for Lake Iseo in Italy, second in Alpine region.

Shortly before the end of the year, Stralsunder Ostseestaal GmbH & Co. KG and its Ampereship business unit delivered two electric solar ferries to Lago d’Iseo near Bergamo in northern Italy as planned. The client was the responsible local authority of the operator Navigazione Lago d’Iseo. The two newly built ships from Stralsund are the first fully electric ferries in Italy.

The 26 metre long and 6.60 metre wide Iseo ferries each have two electric drives with an output of 100 kilowatts (kW). The electricity is supplied by two battery banks with a total capacity of around 750 kWh. These are charged by shore power and by solar modules during the journey - 75% of the roof area of the solar deck is covered with PV modules. The lightweight catamarans for 140 passengers each have been optimised for a speed of 17 km/h, but can reach up to 19 km/h at top speed. They were built on the Ostseestaal site in Stralsund under the technical management of Ampereship - the business unit of Ostseestaal that specialises in zero-emission ships with

the ‘Made in Germany’ seal. Ampereship is integrating its own propulsion, automation, and energy management systems into the newbuilds. The special thing about the Iseo project is that Ampereship delivered the ships to the site in sections and assembled them on site. This meant that there were no major transport problems and no local shipyard was required. It took around four weeks to assemble each ferry on the shores of Lake Iseo before they were able to set off on test runs and are now already in operation.

The delivery to Lago d’Iseo is already the second to the Alpine region. Previously, Ostseestaal and Ampereship had already delivered three identical electric-solar passenger ships for Lake Zurich, where they are in successful operation. Dirk Zademack, general manager of Ampereship, is convinced that further orders will follow: ‘‘The fleet of passenger ships in Europe is very outdated and numerous ships will need to be replaced in the coming years. It therefore makes sense to choose emission-free alternatives whose construction process is also extremely efficient.”

Stena RoRo delivers fifth e-flexer ship

The Guillame de Normandie will be chartered to Brittany Ferries.

Stena RoRo has taken delivery of E-Flexer No. 12 – in a series of 15 vessels - from the Chinese shipyard CMI Jinling (Weihai). The ship is the Guillaume de Normandie and is longterm chartered to the French shipping company Brittany Ferries. The ship will enter service on the Portsmouth-Caen route, replacing the Normandie, which has sailed the route since 1992. This is the fifth of five ordered E-Flexer vessels for the Brittany Ferries fleet.

Just as with four of the five E-Flexer ships that Stena RoRo has delivered to Brittany Ferries, the vessel will be powered by multi-fuel engines as well as the market’s largest battery-hybrid package of 12 MWh. With these batteries, the ship will be able to operate in and out of port solely on battery power and even manoeuvre when docking and undocking without using the ship’s diesel engines.

This is a unique technical solution that provides significantly lower CO2 emissions for the ship.

E-flexer concept

The E-Flexer concept has been continuously developed in line with future environmental requirements, and through its technical design and high degree of innovation, it can fulfill and exceed both existing and future international requirements.

The Guillaume de Normandie is also equipped with a shore connection with an output of 8 MW for high-speed charging of the batteries, which also enables a completely fossil-free stay when in port. With the installed battery capacity, the vessel can operate at speeds of up to 17.5 knots on batteries alone.

The ship’s engines can be powered by marine diesel, liquefied natural gas, biodiesel, or biogas. In addition, the PTI/ PTO system with the Battery Power function can be used for propulsion at sea or maneuvering in port. The system is scalable, which means that in the future, the Guillaume de Normandie can operate entirely on batteries or with a combination of the different fuels.

The ship’s modern interior (designed by Figura Arkitekter AB) has been especially created for the current route and with clear influences from Normandy. The ship is certified for 1300 passengers along with 2410 lane metres of cargo, whereof 176 lane metres for personal cars.

The E-Flexer series is based on a basic concept with vessels larger than most existing RoPax ferries and

The battery hybrid system on the Guillaume de Normandie means that the ship can operate optimally in accordance with the operator’s own policies

features a highly flexible design. Each ship is tailored to customers’ needs, both commercially and technically. An optimised design of the hull, propellers, and rudders along with opportunities to incorporate new environmentally friendly technology contribute to the E-Flexer vessels being at the absolute forefront in terms of sustainability and performance as well as cost and energy efficiency.

“It is with great satisfaction and pride that we have now taken delivery of the twelfth E-Flexer vessel in the series,” said Stena RoRo AB Managing Director Per Westling. “Within the framework of the E-Flexer concept, there has been continuous technical development and we can offer our customers flexible and future-proof propulsion systems that by a wide margin meet both today’s and future environmental requirements. The large battery hybrid system we installed on the Guillaume de Normandie means that the ship can operate optimally, in step with regulatory developments, or in accordance with the operator’s own policies.”

Updated fleet

The Guillaume de Normandie is chartered to Brittany Ferries for 10 years.

The total of five E-Flexer ships ordered by Brittany Ferries are renewing and modernising the company’s current fleet of cargo and passenger ships. The first ferry, the Galicia, was delivered in the autumn of 2020, the second in November 2021, the third in December 2023. The Saint-Malo was delivered in October 2024, which is the fourth vessel in the series, and the Guillaume de Normandie in December 2024, the fifth and final ship.

Stena RoRo currently has 15 confirmed orders at CMI Jinling, Weihai shipyard for E-Flexer vessels, as well as two orders for New Max RoRo vessels. Twelve vessels have now been delivered.

Since 1977, Stena RoRo has led the development of new marine RoRo, cargo, and passenger concepts.

Wider integrates FPT Industrial engines in new yacht

Two FPT Industrial N67 570 EVO 349 kW variable-speed engines are combined with twin electric motors – each delivering 500 kW.

FPT Industrial, the Iveco Group brand dedicated to the design, production, and sale of low environmental impact powertrains, along with its distributor AS Labruna, have been chosen by the Wider shipyard as preferred powertrain suppliers for the new WiderCat 92 hybrid catamaran, whose third hull was recently launched at the Wider Vision Hub in Fano, Italy.

New propulsion system

Two FPT Industrial N67 570 EVO 349 kW variable-speed engines are combined with twin electric motors – each delivering 500 kW – in an innovative serial hybrid propulsion system, completed with an LFP (Lithium Iron Phosphate) battery pack for energy storage. The entire propulsion system provides a cruising speed of 12 knots thanks to the Electric Boost. The hybrid mode allows the catamaran to travel up to 1,700 nautical miles at a speed of 6 knots.

Full-electric cruising, on the other hand, provides a range of 24 nautical miles at 6 knots in complete silence with zero emissions, or else the same battery power can provide 15 hours’ run time without charging when anchored. Moreover, solar panels installed on WiderCat 92

In 2022, Wider unveiled the WiderCat 92 and began the construction of the Moonflower 72 superyacht

can deliver energy self-sufficiency for the night, thanks to the battery storage.

The compact and highperformance N67 570 EVO engines at the heart of this serial hybrid system feature advanced electronic common rail systems and provide high, constant power and torque delivery, reliability, and low fuel consumption. Layout and specific settings are focused on marine duties. Both engine and turbocharging cooling systems are specifically optimised for highpower missions.

Pioneers in innovation

Wider is an Italian yacht builder, pioneer of the serial hybrid propulsion system onboard luxury yachts. Thanks to its future-conscious approach, Wider has always been committed to a constant innovation: Wider yachts are designed and built with a strong focus on efficiency significantly reducing fuel consumption, noise and vibrations

emitted without forgetting the aesthetics of the design and the quality of the materials. The serial hybrid propulsion system is a high flexible solution that can be easily applied on a great variety of yachts like Wider’s Catamaran range and on the custom superyachts. Founded in 2010, the shipyard is now led by Marcello Maggi, head of the holding company W-Fin Sarl, of which he is a partner along with private equity. Wider facilities are based on the East coast of Italy: from the Wider Vision Hub, new cuttingedge headquarter in Fano to the

Global shipping segments to diverge in 2025

Dry bulk volumes is set to grow by about 1% from 2.7% in 2024.

Performance in tankers and dry bulk is likely to remain sound in 2025, with tankers making above-average profits, supported by high tonne-mile demand, whilst oversupply and easing of disruptions in the Red Sea will put pressure on global container shipping, Fitch Ratings said.

Fitch expects demand to grow in oil tankers and dry bulk in 2025, although more slowly than in 2024. The International Energy Agency forecasts oil demand to increase by 1 million barrels per day in 2025, which will be mostly met by supply growth from outside OPEC+. Increased tonne-miles related to oil exports from Russia will support overall demand. Easing of geopolitical tensions and the Red Sea disruptions could affect demand growth.

“We expect dry bulk volumes to grow by about 1% in 2025 compared to 2.7% in 2024. This is driven by reduced global iron ore and coal demand and trade tensions. Grain exports will continue to provide some upside. We expect broadly flat shipping rates in these segments in 2025, after some improvements in 2024.”

It expects container transport volumes to increase by about 3% in 2025; this will be outstripped by supply growth of 5%.

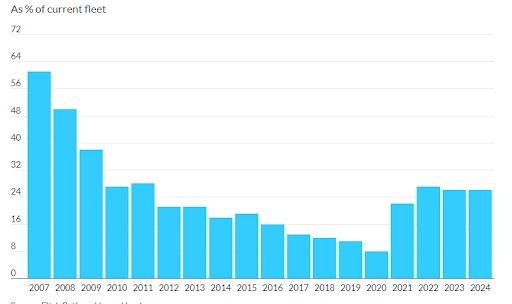

The orderbook, at 26% of the existing fleet, has remained high despite new deliveries. This reflects continuing new order intakes to replace ageing vessels and upgrade fleets to multi-fuel capability to address emission reduction targets. Average sailing speeds increased in 2024, driven by the Red Sea disruptions.

Superyacht Hub in Venice, where superyachts and full-custom projects are built. In 2022, in Dubai, Wider unveiled the new WiderCat 92, the first multihull in the history of the Marchebased shipyard and began the construction of the Moonflower 72 superyacht. Both are equipped with the state-of-the-art Wider serial hybrid propulsion system. In early 2024, the first units of both the WiderCat 92 and WiLder 60 have been launched, with a premiere for the WiderCat 92 at the Venice Boat Show. Both models are ready to debut at the

upcoming boat shows.

Born in 1971 in Monopoli, AS Labruna has been an official FPT Industrial dealer since 1986. It currently holds the positions of official distributor for the marine, on-road, off-road and power generation, Spare Parts and Service sector. Thanks to this highly qualified and sectoral preparation, AS Labruna offers rapid and highly specialised aftersales services. The AS Labruna team carries out ordinary and extraordinary maintenance interventions, complete overhauls with RINA bench testing.

Seatrium and TCOMS to expand FPSO modelling work

The P-84 and P-85 FPSOs will be deployed in the Santos Basin, approximately 200 kilometres offshore of Rio de Janeiro in Brazil in coming years.

Seatrium Limited (Seatrium) and the Technology Centre for Offshore & Marine, Singapore (TCOMS) have expanded on the master research collaboration agreement signed in April 2023 to explore cyber-physical modelling capabilities in predicting environmental loads and platform responses, including those encountered in operations in high sea states and other extreme events for floating production storage and offloading (FPSO) platforms.

Pioneering research

As a leader in the development and construction of offshore vessels, Seatrium was the first to conduct a commercial test for an FPSO vessel at TCOMS’ ocean basin facility. This development has contributed to TCOMS gaining recognition as a global leader in cutting edge research and development, with its ocean basin facility being featured in the approved basin test facility list by Seatrium’s industry partners.

Following the scaled model testing of the latest series of FPSOs that Seatrium is building for Brazil’s National Oil Company, Petróleo Brasileiro S.A. (Petrobras) in TCOMS’ ocean basin facility to validate their global and station-keeping performance, both organisations will embark on developing digital twins to be deployed in real-field scenarios through leveraging the extensive data gathered during the model tests.

The P-84 and P-85 FPSOs will be deployed in the Santos Basin, approximately 200 kilometres offshore of Rio de Janeiro in Brazil in coming years. The FPSOs will incorporate advanced technologies

and represent a new generation of offshore production assets with lower greenhouse emissions, contributing towards sustainability and a lower carbon economy.

Driving innovation

Seatrium and TCOMS have carried out various projects spanning a broad spectrum of technology capabilities to drive innovation and sustainability in the offshore, marine, and energy industries.

Ocean Lab

The Seatrium-TCOMS Ocean Lab, which was established in March 2023, comprises five research thrusts: (i) offshore renewable energy such as floating wind systems, (ii) cleaner oil and gas solutions including smart floating production platforms, (iii) smart marine systems such as autonomous vessels and green ships, (iv) new energy solutions including ammonia, hydrogen and carbon capture, utilisation, and storage, and (v) digitalisation & data analytics for enhanced predictability and reliability of ocean systems and its infrastructure.

Engineers and scientists from both companies partner to co-create, stress test, and validate solutions and concepts of future ocean systems and infrastructure. The numerical simulations and physical tests conducted in TCOMS’ ocean basin facility simulate and assess the performance of ocean systems, including those at conceptual stage, in simulated operating and extreme ocean conditions and enhance field performance through technologies such as smart sensing, artificial intelligence, and data analytics. Such modelling and simulation

Strategic Marine builds three new offshore vessels

Singapore shipbuilder Strategic Marine has commissioned three new offshore supply vessels with a maximum speed of over 53 knots to enable fast and safe passenger transfer to offshore platforms. Each 35-metre-long vessel is powered by four 16-cylinder mtu Series 2000M72 engines from Rolls-Royce and has been designed as a so-called ‘Surface Effect Ship’ which uses air-cushion technology within a catamaran hull form.

The boats have an optimised powerto-weight ratio and use powerful fans to generate an air cushion between the hulls that minimises hull drag and resistance. This also results in very low noise and vibration with reduced motions while underway. Combined with the mtu propulsion package—each delivering 5,760 kW of

capabilities facilitate the creation of digital twins of ocean infrastructure assets to improve life cycle management.

Chris Ong, CEO of Seatrium, said: “As a leading global player in the offshore, marine and energy industries, Seatrium is committed to driving innovations in improving efficiency and maritime decarbonisation. Our partnership with TCOMS nurtures aspiring engineering talents and encourages them to push the boundaries beyond what is possible in their field of work. Together, we are unlocking new efficiencies and enhancing field performance through technology that contributes towards a greener future.”

Chan Eng Soon, CEO of TCOMS, said: “As a national R&D platform dedicated to the offshore & marine, maritime and other ocean related sectors, our relentless pursuit of innovation and sustainability has made us the ideal partner to the industry looking to stay ahead and future proof their solutions and operations. By combining our expertise in cutting-edge digital modelling, simulation and physical model testing capabilities with keen business insights, we support the industry in developing future ocean systems and infrastructure that not only enhance safety, optimise efficiency and performance, but also drive long-term sustainable economic growth.”

Volvo Penta expands assisted docking system

Volvo Penta is committed to making boating as easy and accessible as possible, ensuring the ultimate experience and enabling adventures out on the water. Since its launch for the Inboard Performance System (IPS) in 2021, the Volvo Penta Assisted Docking system has been highly regarded for simplifying docking an inboard boat and making it semi-automated. Starting in 2025, the technology is being extended to boats powered by DPI sterndrives, broadening access to enhanced control, precision, and confidence.

Assisted Docking for DPI: Advanced performance and precision

power—the vessels can travel at higher speeds than conventional monohulls and catamarans, with consumption remaining at the same per hour of operations.

The vessels will be used by a national oil company in Africa for passenger transfer to offshore platforms and floating production, storage, and offloading vessels.

The ship is also tailored for offshore conditions, with its SES active motion dampening technology aiming to enhance safety and comfort for crew transfers in rough sea conditions of up to 2.5m.

Strategic Marine specialises in aluminium and steel vessel construction, producing over 600 vessels used for government patrol, offshore oilfield service, harbour and towage, passenger transport, and commercial fishing.

Volvo Penta’s Assisted Docking system is an industry-first innovation in semi-automated boating that gives boaters enhanced control and precision when docking. Now extended to a wider range of boats installed with DPI sterndrives, it brings the benefits of semi-automation to even more boaters. Introduced in 2019, the Volvo Penta DPI propulsion package is recognised for its smooth shifting and superior handling. Featuring a hydraulic clutch for silent, precise gear changes, and twin counterrotating propellers for improved acceleration and manoeuvrability , it delivers a refined boating experience. By integrating Assisted Docking into this platform, Volvo Penta further enhances the capabilities, increasing the precision, bringing peace of mind, and ensuring a smoother docking experience.

“Since its launch, the Assisted Docking system has set a new standard for precision and ease when manoeuvring and docking

Volvo Penta IPS-powered boats,” said Johan Inden, president of Volvo Penta’s Marine Business. “Now, we’re excited to expand this game-changing feature to the DPI drive, delivering the same benefits of enhanced control and confidence to an even broader group of boaters.”

Understanding how Assisted Docking elevates the experience

Originally made available for the Volvo Penta IPS drivelines, the Assisted Docking system gives the captain better control when docking a boat by automating his or her intentions, compensating for some dynamic variables, such as wind and current, and helping the vessel stay on its intended course. It seamlessly integrates the advanced sensors of Volvo Penta’s GPS-based Dynamic Positioning System (DPS) to offer an unparalleled docking experience, even in difficult conditions.

Assisted Docking enables moving in straight lines without manual compensation. With the joystick, boaters control the boat’s path and speed, whilst the system compensates for elements such as wind and current.

Rerouting may not always be the best fix for port congestion woes

Some said doing so may even worsen the situation.

Last year’s congestion at Singapore’s port led shipping lines to reroute shipments through alternative ports like Klang and Tanjung Pelepas in Malaysia to mitigate delays, but experts say this approach may not always be the ideal solution.

“One could probably diversify and call at other neighbouring ports with capacity but this may not be easy [as] the other ports may lack connectivity,” said Jayendu Krishna, director and deputy head of Maritime Advisors at Drewry Shipping Consultants.

“Reworking [the] liner network is also not an easy job,” he added. Container trading and leasing platform Container xChange also highlighted this in a report saying diversions have put “additional pressure on these alternative ports, exacerbating regional congestion and delays.”

The platform named the Mediterranean Shipping Company (MSC) as one of the shipping lines that have omitted Singapore “in favour of other regional ports.”

“MSC has diverted some transshipment operations to Indian ports, whilst carriers like OOCL are discharging Singapore-bound cargo at Port Klang in Malaysia,” it said.

Rerouting from Red Sea Vessels have been taking longer routes around Africa to avoid the Red Sea, where Yemen’s Houthi group has been attacking ships since November 2024, throwing ship schedules into disarray.

As a result, ships are unloading more cargoes at once at big transshipment hubs like Singapore, where shipments are offloaded and reloaded on different vessels for the last leg of their voyage.

As of 18 January, port congestion was holding up 8.5% of the global fleet, maritime data firm Linerlytica reported. Meanwhile, data from the supply chain visibility platform Go Comet showed that as of 20 January, the median delay at the Singapore port is now at one day.

Andrew Coldrey, vice president for the Asia-Pacific region at C.H. Robinson, said congestion in Singapore may persist through the Chinese New Year.

Yuma Ito, partner and head of Singapore at Arthur D. Little Southeast Asia, provided a similar outlook, indicating it could stretch into February if diversions persist.

Back in September 2024, global port congestion hit a two-year high, with Linerlytica noting Singapore’s queue-to-berth ratio stood at 0.2 on September 4, with 45 ships docked and nine awaiting anchorage. On a global scale, 783 ships were at port, whilst 614 remained at anchorage. Coldrey said shipping lines have had to wait for one to two days

to berth in Singapore then. Port congestion has also driven freight rates higher, said Ito.

“By the middle of 2024, the shipping costs increased to a level comparable to the peak during COVID-19,” Ito said.

As of 5 September 2024, the global average freight rate per 40ft container was $4,775, 54% below the previous pandemic peak of $7,693 in September 2021, but more than triple the average 2019 (pre-pandemic) rate of $1,052, according to Drewry Shipping Consultants data.

The 5 September average is almost three times the year-ago rate of $1,680.73.

Other alternative routes

Ito said shipping lines have been taking the Cape of Good Hope and Arctic Northern Sea Route as alternative routes amidst the Red Sea attacks. Some have used the Northern Sea Corridor, according to Krishna.

The Cape of Good Hope route could add eight to 10 more days to the shipping lead time, said Goh Puay Guan, an associate professor from the Department of Operations and Analytics at NUS Business School in Singapore.

Ito said there is also the Arctic Ocean route, but it is only available during the summer season when Arctic ice begins to melt.

Shipping and logistics companies have also been using other transportation methods where necessary, Goh said. “Companies may use air, freight, rail, or truck. It doesn’t move the same volume of [goods], but it can provide alternative routes to get cargo to the customer,” he added.

A number of companies had used multi-modal transportation to move goods during the pandemic, he pointed out.

Ito said there is also an in-land route across the Euro-Asian continent via railway. The route has experienced some volume increase after some companies started using it, Krishna said.

Goh said some shipping lines have been acquiring companies to boost their logistics capabilities.

For example, MAERSK bought Hong Kong-based LF Logistics in 2022, whilst Singapore’s PSA International has expanded its

One could probably diversify and call at other neighbouring ports with capacity but this may not be easy as the other ports may lack connectivity

logistics footprint by acquiring BDP International in the US. Meanwhile, CMA CGM bought Ingram Micro’s Commerce & Lifecycle Services to strengthen its third-party logistics services.

Apart from the modes of transportation, shippers should also diversify their carriers, Coldrey said. “In the past, shippers would consolidate their volume with a single carrier to try and negotiate the best possible price. The downside is, it’s very hard to rely on one carrier,” he said.

“What we offer our customers is a broad basket of carriers so that we can utilise different services depending on their capacity,” he added.

Coldrey said it all boils down to “better and advanced planning,” which can be done using tracking and logistics management systems. In planning, companies must also consider having flexible inventory management.

“When you know there’s going to be times of congestion, high inventory levels can really help mitigate the impact,” he said. “Sometimes, a small increase in inventory can help offset [the impact of congestion].”

For logistics players, Coldrey said local warehousing could help buffer against delays, whilst shipping lines could optimise schedules and routes to avoid peak congestion times and spread out arrivals more evenly.

Ito said shipping companies should start using artificial intelligence (AI) and big data analytics to predict and manage port congestion. “Collaboration between shippers and liners to

When you know there’s going to be times of congestion, high inventory levels can really help mitigate the impact

share services and resources during emergencies can also be crucial in minimising delays,” he added.

New wave

Whilst 2024 was a challenging year for Singapore, facing one of its worst congestion issues, it was also amongst its best, achieving record highs despite hurdles in the global supply chain.

Data from the Maritime Port Authority (MPA) showed that the port of Singapore’s annual vessel arrival tonnage grew 0.6% in 205, hitting a new record of 3.11 billion gross tonnage (GT).

Key shipping categories - bulk carriers, container ships and tankers - contributed to over 90% of the vessel arrival tonnage in 2024. Other categories, such as specialised vessels, ferries and cruise liners account for the remainder.

This distribution reflects the city-state’s position as a major hub supporting the diversity of global shipping carrying commodities, containers, energy supplies, and various trades.

Cargo throughput handled at the port of Singapore also rose 5.2% to 622.67 million tonnes, whilst container throughput from both PSA terminals and Jurong Port

breached 40 million twenty-foot equivalent unit (TEU) for the first time, and growing by 5.4% and reaching 41.12 million TEUs.

Around 90% of Singapore’s container throughput is for transshipment to other destinations. Singapore remains the largest container transshipment hub in the world.

The new Tuas Port currently has 11 operating berths, with 7 to be added by 2027. Meanwhile, reclamation works in Phase 2 of the port are about 75% completed.

Also recording a new high are total bunker sales which increased 6% to 54.92 million tonnes. This partly due to the extended AsiaEurope shipping routes via the Cape of Good Hope given the disruptions in the Red Sea.

Sales of alternative bunker fuels reached 1.34 million tonnes in 2024, exceeding one million tonnes for the first time. Specifically, the sale of biofuel blends grew from 0.52 million tonnes in 2023 to 0.88 million tonnes in 2024, whilst LNG increased from 0.11 million tonnes to 0.46 million tonnes in the same period.

The total tonnage of ships under the Singapore flag reached a new record high of 108 million GT, up 8.5% from the previous year.

“Singapore will continue to enhance our offerings to serve all shipping segments whilst expanding capabilities in emerging domains such as space, aerial drones, and cyberspace to support businesses,” MPA said.

Businessman Steven Tan started a magazine that tracked Singapore’s marine and offshore industries in 1977, a decade when many ship owners and shipbuilders all over the world went bankrupt as demand for giant tankers evaporated amidst a global oil crisis.

The collapse in demand was so sudden and so severe that many new ships under construction went straight from the shipbuilder into long-term lay-up in the fjords of Norway or the harbours of Greece and Southeast Asia, author Tim Colton said in his book “A Brief History of Shipbuilding in Recent Times.” A few went to the “breakers” without ever carrying a cargo.

It was during that time when Singapore built large ship repair yards to cater to the fleet requirements of big global tankers, which dominated new ship construction contracts given their relatively simple design.

Tan, who was 28 at that time, saw an opportunity that no one else did. Armed with his years of experience as a graphic designer, he started Marine & Industrial Report, covering developments in the shipbuilding and repair industry, marine and offshore equipment supplies, and the latest tech.

“I just followed the trend,” Tan, now 75, told Marine & Industrial Report “There was more news on marine and offshore, and I saw the prospects at that time. When I started this business, I had zero capital.”

The magazine, which has been running for almost half a decade, counts as its readers shipowners, shipbuilders, ship managers, ship classification societies, marine consultants, and oil and gas experts across major markets worldwide. Before his publishing business, Tan

Steven Tan’s journey from graphic designer to maritime publisher

Marine & Industrial Report enters a new chapter after its sale to Charlton Media Group.

sold newspapers when he was young to help his poor family. He attended Saint Joseph’s Institution, Singapore’s first Catholic school, and Baharuddin Vocational Institute where he studied advertising arts and display.

He attended classes in the morning, then worked at his sister’s studio in the afternoon. There, he helped provide various art services such as commercial art painting, brush work, lettering in English and Chinese, and drawing large posters on signboards.

The experience shaped him, helping him land his first job as a commercial artist in 1972.

“My experiences from the art studio helped me clinch the job at a company that owned three large shops — a travel centre, wine centre and shopping centre that catered to Japanese tourists,” Tan said.

“I single-handedly took charge of the advertising designs and window displays of the three stores. I also helped out at the airport, where my boss had a wine shop,” he added.

There was more news on marine and offshore, and I saw the prospects at that time. When I started this business, I had zero capital

After a year in that company, he worked as an advertising canvasser, soliciting ads for a local publisher. He and his two co-workers left after their employer failed to pay them their wages, and set up the Marine & Industrial Report

Tan said Singapore, a small nation with seemingly limited shipbuilding potential, steadily evolved into a global industry leader. The transformation began in the Kallang Basin, where ship repair activities were concentrated.

As Singapore’s economy expanded after its independence from Britain in 1965, the government focused on expanding its shipbuilding sector, Tan said. Recognising the need for larger facilities, the city-state encouraged companies to relocate to Jurong, where ample space was allocated for both shipbuilding and ship repair operations.

Jurong in west Singapore houses companies from various industries, such as shipbuilding, repair, and

breaking yards, a steel-pipe factory, and an oil refinery. Marine enterprises use the five deep water berths at Jurong port.

Some of the major companies in Jurong are Sembcorp Marine, Keppel Offshore & Marine, YTC Shipyard Pte Ltd., HSD Marine and Shiprepair Pte Ltd, and Singapore Marine Logistics Pte Ltd.

In the early stages of Marine & Industrial Report, Tan faced financial challenges especially after his partners withdrew from the venture before the first issue could be published in February 1977.

But this did not stop him.

“I had to cut alphabet by alphabet to paste the letters and words and line them up manually using sets and T-squares,” Tan said, describing the process of manual typesetting when personal computers were unheard of. “During those days, it was really called ‘cut and paste.’”

When it was time to print his second issue, Tan said he looked for advertisements to raise $135.

“I told myself, ‘I need to have advertisements to survive,” he said. “I tried to solicit for more advertisements and I managed to get a few, which covered my printing costs.”

By the early 1980’s, he had bought a second-hand Intel 286 personal computer, which made typing stories in a word processor much easier.

“I had my DOS (Disk Operating System) on a floppy disk. It helped me a lot because I could do my typesetting using limited fonts, though I still needed to buy Letrasets for headlines,” he said, referring to sheets of typefaces and other artwork that used the drytransfer lettering method.

Tan said he later upgraded his PC

to a faster Intel 386 and then an Intel 486 processor. He knew nothing about computers and had to read books from the public library on how to operate one.

“I didn’t stop upgrading myself by learning WordPerfect, CorelDRAW, Acrobat, Adobe PageMaker, and other software that could help me in my work,” he added.

The businessman noted that the Marine & Industrial Report gave him steady income, whilst letting him meet people in Singapore and around the world.

Whilst producing Marine & Industrial Report, Tan worked as a property agent, helping him send his three children to school. His daughter, who is the youngest child, is now an artist in the US.

Tan prints at least 3,000 copies of Marine & Industrial Report, which is distributed across major markets including Singapore, Hong Kong, China, and South Korea. He has also reached the Middle East, Europe, and the US.

Each Marine & Industrial Report issue is mailed directly to its readers for free. The company makes money through ads.

“From the first publication, all in black and white, to the latest one all in colour… we will help the advertisers really reach out to the buyers,” he said.

Since its inception in1977, Tan said the publication has undergone significant changes in content, style, and readership.

“Our early issues featured a more formal and traditional layout. As design trends evolved, we adapted to more modern prints and layout. We introduced color photography, illustrations, and graphics to enhance the visual appeal of our publication,” he said.

Tan said the publication has also incorporated digital elements, such as QR codes and online exclusives, to cater to its increasingly digital-savvy readership.

The Marine & Industrial Report’s readership now spans across the globe, with a strong online presence.

Tan said he has seen a significant increase in younger readers, who are drawn to our publication.

“Overall, our publication has evolved significantly since 1977, reflecting changes in society, culture, and technology. We’re proud to have maintained our commitment to quality content and adapting to the needs and interests of our readers,” Tan said.

New chapter Each issue features partner advertisers

Overall, our publication has evolved significantly since 1977, reflecting changes in society, culture, and technology

from different industries and countries, including power solution provider Cummins, digital business card platform CardMe, international maritime exhibition organizer Marintec China, and industrial group Teledyne Technologies.

One of Tan’s recent Marine & Industrial Report issues featured the collaboration between Azimut Yachts and Volvo Penta to advance hybridisation and electrification in the marine industry.

In 2012, Tan launched the digital and interactive version of Marine & Industrial Report, which helped him reach more readers. He continues to produce both versions since many still prefer hard copies.

Tan, who still works on the trade magazine with his wife Jackie Tee, said Singapore is their biggest

market, though it also performs well in Germany, Norway, the US, and Middle East.

Marine & Industrial Report is entering a new chapter after it was acquired by the Charlton Media Group.

“I’m very glad that somebody could bring my publication to a higher level. After all, I’m already 75,” Tan said about the acquisition.

Tan said the acquisition would expand Marine & Industrial Report’s readership reach. The Charlton Media Group, which publishes two-dozen print and online magazines covering industries such as finance, retail, property, energy, healthcare, and insurance for the Asian region, plans to revamp the magazine’s website and host awards for the marine and offshore sectors.

“I will carry on and help and make this publication go another level higher,” he said, adding that the marine industry holds significant potential despite economic challenges.

The global shipbuilding market is expected to grow 6.5% to $220.52b in 2024 from a year earlier, spurred by economic growth in emerging markets, increased demand for cruise ships, growth in seaborne trade, and supportive government policies, according to the Shipbuilding Global Market Report 2024.

The Asia-Pacific region had the biggest shipbuilding market last year, followed by Western Europe, it added. Tan said he expects shipbuilding demand to continue as the world’s aging fleets upgrade to meet modern standards. Singapore would remain a key player, whilst the shipbuilding industries of China, South Korea, Vietnam, and Malaysia rapidly expand, he added.

Neste’s renewable diesel aims to fuel Singapore’s maritime sector

This alternative helps reduce emissions of diesel-powered vessels.

Singapore’s cruise industry has taken delivery of renewable diesel made by Finnish oil refiner Neste, in a landmark event that would allow the citystate’s marine sector to cut its greenhouse gas emissions by as much as 90%.

Neste, the world’s biggest producer of renewable diesel and sustainable aviation fuel, worked with London-based marine fuel trader KPI OceanConnect to ship the Neste MY Renewable Diesel to the Singapore Cruise Terminal at Marina South in November 2024, KPI said in a statement.

Neste and KPI announced the transaction, which they said is a leap forward for maritime decarbonisation in the AsiaPacific region, on 8 January. Neste’s renewable diesel is made from vegetable oil and waste animal fats and replaces fossil diesel to help the industry meet its “green” goals.

“The most significant advantage for companies is that they can achieve up to 90% emission reduction without making any modifications to the existing engines or vehicles, requiring no additional cost to make the switch,” Ee Pin Lee, head of commercial for the Asia-Pacific region at Neste, told Marine & Industrial Report.

“Neste MY Renewable Diesel is a cost-efficient solution to reducing greenhouse gas emissions, especially when taking into consideration the wellto-wheels approach,” she said, referring to the environmental impact of a vehicle’s energy use throughout its entire life cycle.

Singapore was chosen for the first renewable diesel delivery in

The most significant advantage is to achieve up to 90% emission reduction without making any modifications to the existing engines or the vehicles

the region given its leadership in the marine industry, Lee said.

The city-state was No. 1 in the Xinhua-Baltic International Shipping Centre Development Index report for 2024, a spot it has held for the past 11 years.

The Port of Singapore’s vessel tonnage breached 3 billion gross tonnage (GT) for the first time in 2023, posting 9.4% growth from a year earlier, according to the report. It grew 0.6% to 3.11 billion GT last year, spurred by increased activity from bulk carriers, container ships, and tankers, data from the Maritime and Port Authority (MPA) of Singapore showed.

The island nation’s container throughput rose 5.4% to a record 41.12 million 20-foot equivalent units (TEU) in 2024, the agency said. There are 11 berths operating at Singapore’s Tuas port, with seven more to follow by 2027.

Lee also cited the state’s sustainability efforts for the maritime industry, including the publication of a decarbonisation blueprint in 2022 seeking to hit net-zero by 2050.

The blueprint calls for the development of alternative fuels and green technologies to cut reliance on fossil fuel. Major port operators Jurong Port Pte Ltd. and PSA Corporation Ltd have

Ee Pin Lee head of commercial for Asia Pacific, Neste

committed to shift to cleaner fuels in the coming years.

The MPA earlier said Singapore is working with partners and the international shipping community to digitalise, enhance energy efficiency, and deploy low and zero-carbon emission marine fuels.

Renewable fuel solutions are urgent as the world experienced the warmest year on record in 2024 at about 1.55 degrees Celsius above the pre-industrial level, Lee said, citing data from the World Meteorological Organization.

She noted that unlike Europe where there are mandates in place for road transportation, the AsiaPacific region lags on policies and diesel fuel standards.

“There is optimism that the public and private stakeholders will collaborate to accelerate the adoption of renewable diesel as a long-term viable solution,” Lee said.

She added that Neste is working on expanding its presence across

various sectors in the region.

“Besides marine, some of the key sectors include mining, mediumand heavy-duty transport, data centres and construction.”

DNV and Menon Economics’ Leading Maritime Cities of the World 2024 report also ranked Singapore as the leading maritime city in the world “unaffected by the global conflicts and the rising environmental changes of the

industry.”

Singapore ranked number one in three out of five pillars, namely Attractiveness and Competitiveness, Shipping Centres, and Ports and Logistics, the report said.

A consistent strategy for innovation and investment in green transformation and digital technologies also enabled the city-state to hold on the top spot, it added.

AET and Singapore Maritime Foundation Sign MoU

AET to sponsor four scholarships and two internships annually from 2025 to 2027 as part of the existing AET-MaritimeONE partnership.

AET, one of the leading owners and operators of maritime transportation assets and specialised services and a member of the MISC Group, and the Singapore Maritime Foundation (SMF) have signed a Memorandum of Understanding (MoU) to jointly develop Singapore’s maritime talent pool.

Scholarship details

Under the MoU, AET will sponsor four scholarships and two internships per year from 2025 to 2027, continuing its support for the AETMaritimeONE partnership. The scholarships and internships will be managed by SMF, with

both parties jointly selecting the candidates. This collaboration is part of SMF’s MaritimeONE suite of programmes, which includes a scholarship programme that connects scholars to industry mentors and an internship programme that provides tertiary students meaningful exposure to the maritime sector.

Recognised as a key global maritime hub, Singapore continues to lead the way in driving innovation and progress within the maritime sector that is increasingly being transformed by technology and sustainability. These developments highlight the need for a highly skilled and adaptable maritime workforce equipped to work with alternative fuels, adopt advanced

technologies, and navigate a rapidly changing industry. This MoU aims to nurture Singapore’s next generation of maritime talent by offering them industryrelevant training and real-world experience.

At the signing ceremony, Zahid Osman, president and CEO of AET and president and group CEO of MISC, said:

“As the headquarters of AET, Singapore is a cornerstone of our operations and today’s MoU – the first of its kind for AET –underscores our commitment to supporting the future of the maritime industry. As such, we are proud to deepen our collaboration with the SMF to support the future of our industry.”

Hong Kong needs more underwriters in marine insurance

The city may have to ease immigration rules to attract talent.

Hong Kong should develop and expand its pool of underwriters if it wants to become an international hub for marine insurance and related businesses, according to analysts.

Foreign underwriters usually take charge of major risks in the city’s marine industry given the lack of local talent and resources, said Priscilla Foo, head of Marine and Energy for the Asia-Pacific region at Swiss Re.

The government may have to relax immigration policies and offer more tax incentives to attract more talent and foreign marine insurers, she said, adding that the city needs to provide strong insurance and reinsurance services, including marine insurance, to keep its status as a sea hub.

Hong Kong has 81 insurers that provide marine insurance, though only 10 specialise in marine insurance, according to the Insurance Authority.

The marine insurance sector is vital to the shipping industry because insurance brokers help ship buyers identify risks and tailor suitable insurance coverage, according to the Hong Kong Trade Development Council.

Timothy Lee, deputy chairman of the Marine Insurance Association (MIA), said Hong Kong could mirror London, one of the world’s biggest and leading marine insurance centres. Whilst there are no official data on the number of insurance underwriters in London, the city is home to Lloyd’s of London, which serves clients in more than 200 countries and regions.

“Lloyd’s of London is [one of] the biggest and leading [markets for marine insurance] because they have one of the biggest talent pools,” he told Marine & Industrial Report. “They have good underwriters; not only good, they have a reputation and are recognised as lead underwriters.”

“We need to have more ‘Michelin Star’ rated underwriters

We need to have more ‘Michelin Star’ rated underwriters in Hong Kong too, which is not easy

in Hong Kong too, which is not easy,” he added.

In his 2024 policy address, Hong Kong Chief Executive John Lee unveiled plans to boost marine insurance talent and expand the maritime and aviation training fund to include green energy courses and marine insurance exams.

MIA Chairman Patrick Wong said their group has developed a training programme for marine insurance recognised by the International Union of Marine Insurance (IUMI) as part of efforts to fix the talent shortage.

The Hong Kong Federation of Insurers (HKFI), under which the MIA operates, is representing the “IUMI Asia Hub”, the first and only overseas branch of IUMI. Wong said the MIA also leverages its links to IUMI to promote Hong Kong’s marine insurance products to other countries.

Lee said Hong Kong offers funding and sponsorship programmes, such as the Maritime and Aviation Training Fund (MATF). Aside from marine insurance, the fund also covers shipping, maritime law, and other maritime-related industries and services.

People studying in Hong Kong could apply for an 80% refund for the cost of their online training being approved under the fund, amongst other benefits, he added.

‘State of the market’

Lee said that more reputable and capable underwriters in Hong Kong could spur foreign marine insurers to inject more capital into the city. “If we have good people

CHRIS BOLTON

here, together with the business opportunities…the companies will invest more.”

Wong noted that aside from tax incentives — the government halved marine insurers’ and brokers’ profit tax to 8.25% in 2021 — Hong Kong is leveraging its relationship with China, particularly in the Greater Bay Area, to attract more insurance players and expand its industry’s reach.

Hong Kong’s geographical closeness to Mainland China strengthens its role as a key maritime hub in the region, James Lo, a senior underwriter at HDI Global SE Hong Kong. “The industry often discusses leveraging Hong Kong’s proximity to Mainland China’s market to provide more high-value-added services for the maritime industry.”

He added that the city could broaden its insurance portfolio by offering cyber risk coverage for maritime operations, green shipping insurance, and parametric insurance for weather-related risks. There’s also a growing interest in artificial intelligence-driven solutions for autonomous shipping.

In Hong Kong, the three key marine insurance product lines are cargo, hull and machinery, and liability including Protection and Indemnity (P&I), with the ships-related portion accounting for most insurance premiums, according to Lee.