10 TOP INVESTMENT IDEAS TO WATCH THIS YEAR

‘ZERO-DOLLAR’ TOURS FACE CRACKDOWN

NEW RESIDENCY RULE FUELS OFFICE BOOM

DERIVATIVES SHARPEN EDGE IN GOLD TRADING

10 TOP INVESTMENT IDEAS TO WATCH THIS YEAR

‘ZERO-DOLLAR’ TOURS FACE CRACKDOWN

NEW RESIDENCY RULE FUELS OFFICE BOOM

DERIVATIVES SHARPEN EDGE IN GOLD TRADING

Established 1982

Editorial Enquiries:

Charlton Media Group Hong Kong Ltd

Room 1006, 10th Floor, 299 QRC, 287-299 Queen’s Road Central, Hong Kong | +852 3972 7166

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton

ASSOCIATE PUBLISHER Louis Shek

EDITORIAL MANAGER Tessa Distor

PRINT PRODUCTION EDITOR Eleennae Ayson

LEAD JOURNALIST Noreen Jazul

PRODUCTION TEAM Diana Dominguez

Frances Gagua

Jaleen Ramos

Olivia Tirona

Gwyneth Bejer

EDITORIAL RESEARCHER Angelica Rodulfo

GRAPHIC ARTIST Emilia Claudio

COMMERCIAL TEAM Jenelle Samantila Dana Cruz

Karlene Kaye Camama

ADVERTISING CONTACTS Louis Shek +852 6099 9768 louis@hongkongbusiness.hk Shairah Lambat shairah@charltonmediamail.com

AWARDS Julie Anne Nuñez awards@charltonmediamail.com

ADMINISTRATION Eucel Balala accounts@charltonmediamail.com

SINGAPORE

101 Cecil St., #17-09 Tong Eng Building, Singapore 069533 +65 3158 1386

HONG KONG

Room 1006, 10th Floor, 299 QRC, 287-299 Queen's Road Central, Sheung Wan, Hong Kong +852 3972 7166

MIDDLE EAST

FDRK4467,Compass Building,Al Shohada Road, AL Hamra Industrial Zone-FZ, Ras Al Khaimah, United Arab Emirates

www.charltonmedia.com

Gear Printing Limited Flat A, 15/F Sing Teck Fty. Bldg., 44 Wong Chuk Hang Road, Aberdeen, Hong Kong

Editorial Enquiries: If you have a story idea or press release, please email our news editor at editorial@hongkongbusiness.hk. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email editorial@hongkongbusiness.hk with “Partnership” in the subject line.

Subscriptions: Please email subscriptions@charltonmedia.com. Hong Kong Business is published by Charlton Media Group. All editorial is copyright and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Hong Kong Business can accept no responsibility for loss. We will however take the gains.

Sold on newstands in Hong Kong, Macau, Singapore, London, and New York.

Between another potential round of trade wars among the world’s biggest economies, a possible rally for Asian currencies, and the continued rise of Hong Kong and China’s tech sectors, investors have plenty on their radar. Analysts warn of a “year of volatility,” but a solid strategy can still turn uncertainty into opportunity. Looking for smart ideas? Check out page 22 for the 10 best ways to invest this year.

Hong Kong is also setting its sights on the global gold market by expanding yuanbased gold derivatives—a move aimed at matching London, Shanghai, and New York. Read more on page 20. Meanwhile, a new residency rule offering foreign investors a path to settle with a $50m investment could energise the office and luxury residential markets. Read more on page 40.

On the insurance front, gross premiums rose by 2.1% to $516.5b in 2023, boosted by mainland Chinese visitors. See page 33 for our top 50 insurers in Hong Kong.

If you’re seeking legal support for your next venture, meet the region’s 20 most notable lawyers under 40 on pages 28 to 31.

Finally, as we celebrate 21 years of championing Hong Kong’s business excellence, turn to pages 58 to 78 for our High Flyers list—the innovators shaping the future of their fields.

Read on and enjoy!

HongKongBusiness is a proud media partner and host of the following events and expos:

HongKongBusiness

*If you’re

Hong Kong’s 20 most notable real estate agents under 40

Investors are bottom-fishing for properties with stable returns such as hotels that can be converted into student houses, and industrial sites that can be repurposed into cold storage or data centres after the city’s big landlords and property developers faced the steepest real estate downturn in two decades last year.

Rich families in Hong Kong are selling their villas and mansions at deep discounts so they can pay off debt, exacerbating the city’s prolonged property slump. About 40% of secondary property deals worth $50m in July were sold at a loss,” Cathie Chung, senior director of Research at JLL in Hong Kong said.

In search of the best agents under the age of 40, Hong Kong Business reached out to more than 40 property firms in the city Agents on this year’s list come from JLL, CBRE, Colliers, Savills, and Knight Frank. Leading the pack are CBRE and Savills, with six representatives each. The youngest on the list is from JLL.

Visitors to AIA Group’s headquarters in Hong Kong’s Wan Chai District could not help but feel warm and cosy as they are surrounded by off-white walls and high ceilings with a slick shine, and an atrium staircase. But AIA is not a campus. It’s a finance corporation, the third-largest insurance group in the Asia-Pacific region by market cap.

Construction firms and contractors have turned to overseas markets to stay afloat amidst a property slump in Hong Kong, where home prices have nosedived to an eight-year low. The city’s builders are trying to land deals in hot construction markets like Saudi Arabia, whilst some are turning to nearby markets such as Macau.

A second Donald Trump US presidency could heighten trade uncertainties for Hong Kong, impacting its economic stability, according to a Nomura report. Hong Kong's real GDP growth slowed to 1.8% year-on-year (YoY) in the third quarter, down from 3.2% in the previous quarter, primarily due to weaker net export growth.

With a new name under a renowned brand, CTF Life continues to be faithful to its innovative spirit, and commitment to consistently exceeding expectations. We will further leverage the collaboration with the diverse conglomerate of Chow Tai Fook Group to craft financial planning solutions that aim to enrich your life, and unleash its many amazing possibilities.

One of the chronic illnesses whose treatment costs significantly less in the Mainland than in Hong Kong is cancer.

Dr. Milind Sabnis, head of Advisory, Healthcare, Asia-Pacific at Frost & Sullivan said cancer treatment can cost less than one-fifth of Hong Kong’s prices and comes with much shorter waiting times.

As private healthcare remains costly and public hospitals overcrowded, patients are increasingly turning to the Mainland for more accessible medical care. According to Dr. Sabnis, those traveling to the Mainland typically seek primary care and are often individuals with chronic conditions.

Long wait times

Dr. Sabnis noted that some patients also seek tertiary care in the Mainland due to improvements in its hospitals, although he acknowledged that Hong Kong still offers better quality care. The problem lies in Hong Kong’s long waiting times: currently, a patient in an emergency case might wait up to eight hours before being admitted, and for elective surgeries such as hip or knee replacements, the wait can be as long as a year and a half.

To improve Hong Kong’s primary care system, Dr. Sabnis recommended diverting non-emergency patients, accounting for 60% of emergency room visits, to clinics or primary care.

“If you move these patients away to primary care, then the hospitals can get freedom, and that's how you can improve the access for the hospitals as well as for the primary care patients,” Sabnis said.

Technology and collaboration between Hong Kong and Mainland China healthcare facilities could also ease pressure on local hospitals, allowing primary care to be managed across the border whilst complex surgeries and follow-ups could take place in Hong Kong.

Hong Kong should outlaw so-called zero-dollar tours — notorious for price-gouging, forced shopping, and boring tours — if it wants to regain its iconic status as Asia’s shopping paradise, analysts said.

“The solution lies in self-regulation within the tourism industry, as well as legislation from both the source market (Mainland China) and the destination (Hong Kong), to penalise illicit or outlawed business practices," Yong Chen, an associate professor at EHL Hospitality Business School, told Hong Kong Business magazine.

The tours, which carry a ridiculously low price tag and force tourists to buy stuff at partner retail stores that provide commissions to tour operators, is a disservice to foreigners visiting Hong Kong, he pointed out. “Tourists are the victims, and there is plenty of evidence suggesting this.”

In 2015, a Chinese tourist died in Hong Kong after being attacked during a "forced shopping" tour. Just recently, the Hong Kong government revoked the license of a local tour guide for threatening mainland Chinese visitors for refusing to shop.

Mario Braz de Matos, CEO at

Singapore-based branding consulting firm Flying Fish Lab, said Chinese tourists accounted for almost 90% of Hong Kong’s retail spending in 2023.

However, the zero-dollar tour model has taken a heavy toll on mid-range and mass-market retailers because it channels tourists to partner stores, often bypassing local businesses, he said in an interview.

Braz de Matos noted that whilst luxury brands used to benefit from the influx of tourists, the availability of high-end goods in Mainland China and other regional markets has intensified competition.

Chen said zero-dollar tours have created a “shadow economy” that bypasses Hong Kong’s formal retail sector. “Tourists joining zero-dollar tours are insulated from the formal retailing sector of Hong Kong.”

"In fact, almost all tourist spending is channelled by tour guides and travel agencies to those businesses that are either under the direct control of travel agencies or have some sort of indirect relationship with them,” he said.

Tourists are the victims, and there is plenty of evidence suggesting this

As a result, small businesses, including local restaurants, mid-scale hotels, and local retailers suffer the most, Chen said. This is because the spending of tourists on zero-dollar tours are controlled by travel agencies that funnel them to specific stores that usually offer lower-quality goods.

But these cheap package tours are slowly being eclipsed as more mainland Chinese tourists opt for independent travel. “There is an increasing proportion of mainland Chinese taking independent tours in Hong Kong instead of purchasing package tours,” he added.

Hong Kong’s inbound tourism increased 64% year on year to 21.15 million visitors in the first half, averaging 116,000 daily visitors, according to data from Colliers International (Hong Kong) Ltd. Of the total, 16.5 million came from Mainland China.

However, mainland tourists are spending significantly less amidst high joblessness and stagnant wages in China, according to Simon Smith, regional head of research for the AsiaPacific region at Savills Hong Kong. “It’s a very tough time for Hong Kong at the moment,” he told the Hong Kong Business.

Hong Kong’s plan to phase out subdivided flats under 8 square metres to improve the living conditions of poor families could drive rents higher, defeating the policy purpose, according to property analysts.

“Some landlords may find it financially challenging to upgrade their units to meet the new standards, and it will potentially lead to higher rents,” Rosanna Tang, executive director and head of research for Hong Kong at Cushman & Wakefield, told Hong Kong Business. Renovating subdivided units under 8 square metres would also potentially cut the market’s flat supply, which could push rents up in

Bthe near term, she added.

Hannah Jeong, head of Valuation and Advisory Services at CBRE Hong Kong, said the lack of available units could temporarily increase rents. But prices are likely to decline in the long term.

Jeong, however, said the persquare-foot rate of these flats would decline in the long term given that the monthly rents will stay the same even if flats become bigger.

The monthly rents for these Hong Kong flats are usually less than $8,000, while in Kowloon and the New Territories, they range from $3,000 to $4,000, she said.

Jeong said it would be hard for tenants to find units they can afford,

Some landlords may find it financially challenging to upgrade their units to meet the new standards, and it will potentially lead to higher rents

so the government may need to consider providing them with shortterm rental housing.

Tang, for her part, said a comprehensive rehousing plan is important during the transition period. She added that Hong Kong should fast-track the availability of affordable housing, including light public housing or temporary units for those awaiting public housing.

She said the government could also use modular integrated construction technology, which can effectively shorten the construction period on site and enhance productivity.

On the landlord side, Jeong said the government could offer financial aid or tax deductions to help them meet the requirements.

Jeong said free consultancies would also benefit landlords, adding that most of them don’t know what the exact requirements are. “If the government can offer free consultancy services before construction, they will ensure the quality of the [units].”

There are about 150,000 subdivided units in Hong Kong, about a third of which are below eight square metres, she said. The government measure could lower their number, but it is unlikely to eliminate them from the housing market, she added.

"These subdivided units play a middle role for those who can’t get public housing but at the same time can’t afford private housing," the CBRE expert said.

rands wishing to engage Gen Z and Millennial consumers in Hong Kong must prioritise aesthetics and social media appeal in their products and services.

"Gen Z and millennial age groups prefer purchasing products or experiences that they believe will look good on photos that they post online," Adrian Lo, principal at Strategy3, Ipsos Hong Kong, told the magazine.

"For these demographics, purchasing products is not really just about owning the product or the ownership, but it is really about finding the experience that caters to the individuality and allowing them to express themselves, especially through social media," Lo added. Lo said young consumers are prioritising aesthetics to shape their online identities and social interactions, reflecting a broader trend of individualism.

In Hong Kong, individualism and autonomy have become key responses to economic pressures and global changes, with many consumers feeling that the only thing they can control is themselves. Lo said people are increasingly focused on areas they can influence, such as personal well-being, family, and their immediate environment, signaling a growing “me first” mindset.

To engage with consumers who are focusing on individualism and autonomy, brands should focus on hyperpersonalisation and creating visually appealing and shareable experiences.

"It is crucial to offer products that align with consumers’ digital and social exploration, while at the same time being adaptable enough to fit different online narratives. It is really about providing individuality without isolation," Lo said..

Hong Kong startup Braillic seeks to revolutionise surgical practice through augmented reality (AR) technology, allowing surgeons to precisely locate areas in the brain without cracking the skull open.

It enhances surgical safety, precision, and efficiency, whilst freeing doctors from medical malpractice lawsuits due to surgical errors such as incorrect incisions, which can be catastrophic.

With Braillic’s Augmented Reality Guided Surgical Navigation (ArNav), surgeons gain a clear view of the surgical area in holographic 3D, minimising the need for large openings in the skull. ArNav's accuracy range of five to seven millimetres lets them perform neurosurgery with greater precision.

ArNav is currently used in neurosurgery, but Camroo Ahmed, CEO at Braillic Ltd, told Hong Kong Business he wants to extend its application to spinal and orthopaedic procedures, such as knee and hip replacements, where precise alignment is critical. Within neurosurgery, Ahmed said their AR tool could be used in ventriculostomy procedures, which involve inserting a catheter into the brain's ventricles to drain cerebrospinal fluid or monitor intracranial pressure.

Ahmed said Braillic’s technology does not replace surgeons but is meant to boost their confidence in the operating room. A surgeon’s judgment improves when he sees what he is working on, he pointed out.

“But usually, they can't see everything — that's where we come in, to help them see the unseen,” he said. “We’re trying to enhance their capacity and boost their confidence with an X-ray-like vision, so they know they're doing it right.”

Ahmed, an electric engineer, said Braillic will apply for a certification from the Food and Drug Administration (FDA) so it could expand the technology. He also plans to develop a training platform for surgeons and introduce an artificial intelligence (AI) agent in operating rooms once the company secures US$1m in funding.

To date, the medical AR software startup has raised $1m through private angel investment.

“The Hong Kong government is pretty much putting emphasis on the advancement of medical training because there have been quite a few recent errors in the hospital sector,” Ahmed said. “We have been working with medical professionals on how we can integrate augmented reality not only as a surgical tool but also as a training platform for residents.”

Ahmed said he wants to create an AI agent to help surgeons, especially the new ones, in the decision-making process. “Of course, they are well trained, but we are human."

Hong Kong startup Stellerus Technology is helping the government and industries manage high-value assets against natural disasters and climate risks, including typhoons, using proprietary data and algorithms spanning climate risk, hazard and carbon management.

The company, which offers a suite of climate tech solutions, is seeking to raise $10m–$20m in Series A funding to fund its expansion in Southeast Asia, Jeffrey Xu, CTO at Stellerus, told Hong Kong Business. They also plan to expand to the Middle East and are now in talks for tieups with companies in Central Asia.

The startup uses data from its satellite to enhance proprietary algorithms and artificial intelligence (AI) models, developed from more than 20 years of research by Stellerus chairwoman Hui Su and chief strategist Limin Zhang Xu co-founded Stellerus in 2023 with Su and Zhang, both chair professors at Hong Kong University of Science and Technology (HKUST). Su is an expert in remote sensing, meteorological and climate modelling, and weather forecasting, whilst Zhang is an expert on hazards such as landslides and floods.

Stellerus led the launch mission of a satellite at the HKUST, which gives them

HEALTHCARE

a holistic view of “hazard situations” like inundations caused by rainstorms. The satellite, with a spatial resolution of 0.5 metre, can capture clear images on the ground.

The satellite’s surface working area spans 150 kilometres, allowing it to cover and capture the entire Hong Kong region and beyond, including areas like Shenzhen, in a single pass. This lets Stellerus evaluate hazard data during heavy rainstorms and assess their impact on buildings after the event.

The satellite data also allows Stellerus to measure a typhoon’s intensity and track where it is headed even before it hits the city.

Xu noted that when a typhoon is about to hit Hong Kong, the government institution sends cyclone hunters — aircrews that fly over tropical cyclones to gather weather data. "We use the satellite to see the typhoon when it’s still in the South China Sea."

Biotech companies often struggle to differentiate their cell therapies because most reagents target the same markers like CD20 and CD19. Allegrow addresses this challenge by providing reagents that quickly modify immune cells to target rare markers.

Allegrow offers two types of reagent products, for growing natural killer cells and T cell. These reagents are made from synthetic biomaterial purely chemical and animal-free. Its reagents also improve immune cell growth and activation, solving a key challenge for developing cell therapies. Allegrow, led by CEO Laurence Lau, has achieved 60% more cell yields for T cells and almost five times more yield for natural killer cells during cell culture or bioprocessing.

It currently sells its cells for research purposes at $1900 per vial and plans to

upgrade them to clinical-grade quality. Allegrow is raising funds to meet good manufacturing practice standards and expects to have clinical-grade products ready in two years, followed by clinical trials. The ultimate goal is to enter the therapeutics market.

Visitors find top-tier brands and museum-grade art pieces at the cultural-retail landmark.

Hong Kong’s K11 MUSEA is blurring the lines between shopping mall, art gallery, and cultural hot spot by blending luxury fashion, vibrant art, and sustainable design under its cultural retail model.

“We don’t just think of it as a pure retail shopping experience,” Horace Lam, CEO for Hong Kong, K11 Concepts Management Limited, told Hong Kong Business. “We try to fuse art, culture, and people to create a journey of imagination for our customers.”

At the glitzy K11 MUSEA at Victoria Dockside, visitors encounter not only top-tier retail brands but also museum-grade art pieces and sustainable design elements.

Lam said cultural tourism plays a key role in K11 MUSEA’s strategy by enhancing the visitor experience through a blend of cultural and retail attractions. “It's closely integrated with our customers' experience, and we aim to sort of add value to our visitor experience whenever they are in our properties.”

Integrating art and cultural experiences at Hong Kong’s pioneering cultural-retail landmark has had a profound impact on the

group’s sales and foot traffic, he said. The mall's year-round activations, including seasonal events, have contributed to these gains.

For instance, K11 MUSEA’s “100% Doraemon & Friends” exhibition set a record for single-day footfall this year, with an almost 40% increase, driven by its curated cultural programming and luxury retail experiences.

Their “Wondrous Summer — 100 Reimagined Childhood Experiences” campaign boosted consumer membership, leading to an almost 30% rise in food, beverage, and retail sales, and a 10% increase in tourist spending.

K11 MUSEA, which aspires to become the Silicon Valley of culture, has partnered with Louis Vuitton and Dior. The Louis Vuitton event attracted international attention from both the media and consumers, Lam said.

We try to fuse art, culture, and people to create a journey of imagination for our customers

Last Christmas, the mall hosted a Dior Christmas tree activation and a Dior-themed café, which quickly became a hit with visitors. “We partner with a lot of top-tier luxury brands for pop-ups, and we co-create special, unique concepts with them,” he said.

“So whenever visitors come to K

11 Musea, they could also enjoy and learn something from the exhibition on top of their retail and dining experience,” he added.

K11 MUSEA’s distinctive blend of art and culture resonates well with younger audiences, especially Gen Z. “We tend to draw a very good following from the Gen Z crowd, especially those looking for a higher quality of life and enriched cultural engagement,” Lam said.

Almost 50% of the mall’s members come from the under-35 age bracket. “In this day and age, I think consumers are not only looking for pure retail, sort of a transactional relationship when it comes to finding a place to spend their time,” he said.

“As a landlord or as a retail space operator, we need to deliver more value to our consumer base, and that's why we are very dedicated to our business model of fusing commerce with culture,” he added.

To appeal to both local and international consumers, K11 MUSEA leverages its prime location and unique offerings.

Lam noted that since borders reopened after a global COVID-19 pandemic, K11 MUSEA has become a top destination for tourists.

Wherever and whenever you take a LINDOR moment, it just seems to make life feel so much more sublime. When you unwrap LINDOR and break its delicate chocolate shell, the irresistibly smooth filling starts to melt, gently carrying you away in a moment of bliss.

LINDOR, created by the Lindt Master Chocolatiers. Passion and love for chocolate since 1845.

It joins Sotheby’s, Phillips, and Christie’s, which have all upgraded their local spaces.

London-based Bonhams has upgraded its local space with a new headquarters in Hong Kong to boost its presence in the city, where auction revenues have been declining amidst a property crisis in China.

The auction house’s 19,000 square foot Asia headquarters at Six Pacific Place, unveiled at its inaugural autumn auction in November, spans three floors and features upgraded galleries, a permanent saleroom, and office spaces.

“Our new headquarters allows us to provide clients with an elevated experience, from the moment they enter our gallery to the presentation of artworks and the events we host, all tailored to their refined tastes,” Julia Hu, managing director at Bonhams Asia, told Hong Kong Business

The 200-year-old British auction house opened the region’s first dedicated saleroom in 2014, solidifying its foothold in Hong Kong where it started in 2007.

“Since then, our sales and teams have significantly expanded, prompting our move to a larger, more versatile space to support our next phase of business development,” Hu said. “Opening our new Asia headquarters demonstrates our commitment to the region and highlights how much Asia means to Bonhams’ global business.”

The new headquarters allot an entire floor for offices, half a floor for storage, and the remaining floors for exhibition space. Its previous office only had half a floor. Installed sliding and movable walls lets Bonham host bigger auctions and events.

1 Bonhams curates fine art pieces as well as rare luxury items.

2 The new headquarters features upgraded galleries and a permanent salesroom.

3 Bonhams features a collection of Southeast Asian art.

4 Most of the modern and contemporary art pieces auctioned in Bonhams are sold by value.

5

6 A 30 carat pink diamond was sold at Bonhams for $20.4m.

The workplace features spaces for socials and quiet work to boost productivity.

Employees at global law firm Ashurst LLP’s Hong Kong office in Jardine House have unanimously chosen their favourite feature—the central shared zone. This flexible space accommodates socials, team-building activities, fitness and well-being sessions, and client events.

The central shared zone is designed with flexibility in mind, supporting social events, team-building activities, fitness and well-being sessions, and client gatherings.

Beyond the shared zone, the entire office is meticulously designed to meet varied needs. It features private and semiprivate areas, bookable and ad hoc meeting rooms, and spaces tailored for collaboration or quiet focus. For employees seeking concentration, pods and dedicated rooms offer

privacy and silence, whilst phone booths provide a discreet setting for private conversations.

Client meeting rooms and a boardroom equipped with integrated audio-video technology and flexible setups further enhance functionality. Passive acoustics throughout the office reduce ambient noise, promoting focus and productivity.

When Ashurst’s lease at Jardine House expired, the firm chose to stay, valuing continuity for clients and operations. “This was an opportunity to upgrade our space, underscoring our commitment to being the most progressive global law firm,” said Ben Hammond, office managing partner at Ashurst Hong Kong, in an interview with Hong Kong Business

Hong Kong had raised $79.0b from public flotations as of 30 November, exceeding $46b for the full year of 2023.

Dealmakers expect the value and volume of Hong Kong’s initial public offerings (IPO) to continue improving in 2025, spurred by secondary listings from the Middle East and Mainland China and in line with an IPO resurgence in Asia after a lean couple of years.

Hong Kong had raised $79.0b from public flotations as of 30 November, exceeding $46b for the full year of 2023, when it posted the lowest IPO funding since 2001, Irene Chu, a partner and head of New Economy and Life Sciences at KPMG Hong Kong, told Hong Kong Business. IPOs of companies from Mainland China dominated Hong Kong listings in 2024, capturing 96% of proceeds worth $53.7b (US$6.9b) as of 27 September, according to data from the London Stock Exchange Group.

"We expect the trend will continue [to 2025] because there’s still a lot of upcoming mainland companies that are seeking IPO are expanding their businesses to overseas markets, Hong Kong would be an ideal location for them," the KPMG expert said.

Andrew Lam, managing director of Assurance at BDO Ltd., expects IPO funds to hit $80b by year-end.

Among Chinese companies considering to sell shares in Hong Kong are Jiangsu Hengrui Pharmaceuticals Co., Chery Holding Co.’s automotive unit, condiment maker Foshan Haitian Flavouring & Food Co., Chinese express-delivery company SF Holding Co. and online retail platform Dmall, Inc., according to Bloomberg News.

Hong Kong had 60 deals, fewer than 70 for the full year

of 2023, though the average deal size climbed to $1.3b from $700m in 2023, Chu pointed out. In 2025, she expects homecoming listings from Chinese companies that are already listed overseas.

“We believe this is a good signal about the sentiment among investors,” she said, adding that she expects Hong Kong to return to the top five when it comes to global fundraising.

Hong Kong’s benchmark Hang Seng Index closed at 19,423.61 points on 29 November, gaining 13.9% from its 2023 close of 17,047.39 and is heading for its first annual gain since 2019.

Chu said the Middle East is an emerging market for Hong Kong, whose stock exchange has recognised the Saudi Exchange, Abu Dhabi Securities Exchange, and Dubai Financial Market, paving the way for their companies to apply for a secondary listing in the city.

The Stock Exchange of Hong Kong Ltd. allows firms from these bourses to seek a secondary listing in Hong Kong if they meet a $3b market capitalisation and five-year listing requirement. More than 160 companies qualify, Chu said.

“We [will] hope to see a huge number of Middle Eastern companies listed in Hong Kong, probably not right away, but I think there will be increasing interest, and hopefully we can see a few coming to our market in the coming year,”

Hong Kong would likely attract Middle Eastern companies in banking, financial services, energy, real estate, and infrastructure, she added.

HKEX ALLOWS COMPANIES FROM THE SAUDI STOCK EXCHANGE AND OTHER MIDDLE EASTERN BOURSES TO HAVE SECONDARY LISTINGS IN HONG KONG

She noted that the Middle East has long shown interest in Hong Kong, evident from past investments. Recently, Saudi Arabia’s Capital Market Authority approved two exchangetraded funds tracking Hong Kong equities.

Lam said China’s Belt and Road initiative would likely attract more successful companies from the Middle East and Southeast Asia to Hong Kong given the city’s “free market” and “abundance of capital.”

‘Continued momentum’

Chu said geopolitical tensions and policies under US President-elect Donald Trump could prompt Chinese companies to consider secondary listings closer to home.

Hong Kong would remain a top IPO destination for Greater China enterprises, especially under an eased listing process, Lam said. “We have exemptions that allow not yet profit making, but high-tech companies and medical companies come to the market. Companies with a good track record already listed in the mainland can also enter the market easier,” he added.

In November, Hong Kong’s bourse said it would streamline the listing procedures to attract more companies. Under the setup, Chu said the regulators would take no more than 40 business days to assess whether there are any material concerns after a maximum two rounds of regulatory comments. If no material regulatory concerns are raised, the IPO process could be completed within six months.

The eased application process “matches quite well with the ambitions of some of the Chinese companies to be more international,” she said.

“One of the reasons to come to Hong Kong for Chinese companies is not just about fundraising, it is also about getting their brands beyond the Mainland market and getting the brands known outside, " Chu said. “That helps them set the foundation for regional expansion.”

She added that the “positive signals” from the Hong Kong Stock Exchange continue to spur many companies from the Mainland to list. “That’s why we will see continued momentum in 2025,” Chu said. Out of 91 companies with pending IPO applications, 84 are from Mainland China, she pointed out.

Lam expects Chinese companies in manufacturing, medicine, and information technology to list in Hong Kong.

SThere’s

still a lot of upcoming mainland companies that are very successful which are not yet listed in Hong Kong

ingapore didn’t see as many initial public offerings (IPO) as Hong Kong in 2024, but both markets are expected to increase their listing volumes in 2025, driven by listing reforms in the respective markets.

Deloitte reported that Singapore raised US$34m through four Catalist IPOs in 2024’s first 10.5 months. Listings included consumer, industrial products, and healthcare firms. The Singapore Exchange also welcomed secondary listings from companies listed from Hong Kong’s bourse.

In stark contrast, KPMG reported that Hong Kong achieved HK$55.6b from 45 IPOs, reflecting a 123% yearon-year surge in funds raised.

Last year, both markets saw interest in technology, healthcare, and consumer goods, but Hong Kong drew more technology firms, while Singapore saw a rise in REIT listings, according to Danny Wan, head of Strategy for Asia-Pacific at Capco.

Chan Yew Kiang, EY Asean IPO leader, had a similar observation: “In Singapore, there is a significant proportion of mid- and large-cap issuers from the REITs and real estate as well as manufacturing sectors.”

Wan expects cross-border technology listings to increase in Hong Kong in 2025 following specialist technology companies rule changes that lower capitalisation thresholds to HK$4b for commercial Companies and HK$8b for precommercial companies.

Meanwhile, efforts to reduce listing costs through a review of requirements could position Singapore for more market activity next year, said Wan.

Such initiatives will “encourage more diverse listings and improve market efficiency, reinforcing Singapore's status as a leading financial hub,” Darren Ng, Transactions Accounting Support Partner, Deloitte Singapore.

“With these favourable conditions and regulatory support, the city-state’s IPO market, particularly in the REIT sector, is set for robust growth in 2025,” Ng added.

Apart from the review to improve and strengthen the country’s equities market, Chan said easing of interest rates and the performance of shares may have an impact on investor sentiments in Singapore in 2025.

The same goes for Hong Kong, said Wan, adding that stability in macroeconomic and geopolitical environments will increase market confidence.

Next year, Wan expects Singapore to continue serving as the hub for ASEAN markets and economies. He added that companies targeting the ASEAN economy often prefer the Singapore Exchange (SGX), whereas those seeking exposure to Greater China lean towards Hong Kong Stock Exchange (HKEX).

Hydrogen fuel is volatile, highly flammable and expensive, an energy expert says.

Hong Kong may need to rethink the use of hydrogen fuel in its transport sector given its inability to produce it on a large scale, and safety risks tied with the alternative fuel, an energy analyst said.

"Hydrogen is not like any other fuel that's currently being used in Hong Kong,” Grant Hauber, strategic energy finance advisor for Asia at the Institute for Energy Economics and Financial Analysis (IEEFA), told Hong Kong Business

“It is highly volatile, it is invisible, it is odourless and it is highly flammable. It's not something that can be readily substituted for other fuels that are out there, simply because of these safety aspects,” he said.

He noted that hydrogen must be delivered to all distribution points in Hong Kong, which is a big problem since hydrogen does not like to be transported. “It's a highly energyintensive process to get it [to the distribution points], therefore it’s costly and there's a high propensity for leakage and loss along the way.”

Implementation plans and risks

There are 14 trials approved for hydrogen use, including five hydrogen fuel cell (HFC) double-decker buses operated by Citybus and three HFC street-washing vehicles for the Food and Environmental Hygiene Department, Hong Kong’s Environment and Ecology Bureau said in an email.

There is also a hydrogen-powered light rail vehicle in Tuen Mun running as a non-revenue train for the Mass Transit Railway Corp. (MTRC), and two HFC refuse collection vehicles for Waihong Environmental Services Ltd.

Hong Kong, however, has a robust history of managing risks associated with hazardous materials like liquefied petroleum gas and dangerous goods, said Thomas Lo, market area manager for HK and Macau at Energy Systems, DNV, in a separate interview. He said recent risk studies for

It's a highly energyintensive process to get it, therefore it’s costly and there's a high propensity for leakage and loss along the way

hydrogen fuel cell buses conducted by the DNV and the Electrical and Mechanical Services Department position Hong Kong as “a leader in risk management for HFC buses.”

Still, Hauber said hydrogen’s tendency for higher energy losses and lower efficiency makes its use for transportation a lower-value application. “The ideal situation is that you use the hydrogen where you make it, so you don't have to transport it.”

For bringing large quantities of hydrogen into Hong Kong, he said hydrogen could be transported either by piping and liquefying it, or by binding it to ammonia, then transporting and breaking down the ammonia, which leads to a 75% loss of the energy used to make it.

Its application in buses and trains is a “fantasy use” because it is uncompetitive, compared to, say, electrifying those vehicles, he added.

Apart from safety issues, it would also be hard for Hong Kong to produce enough hydrogen, Hauber said.

Hong Kong has Towngas, which supplies gas with a 50% hydrogen content, which Lo said could be leveraged for hydrogen distribution and use. Towngas' infrastructure, however, must be “assessed for safety and feasibility when conveying hydrogen

blends and 100% hydrogen,” he added. Hauber added that hydrogen produced by Towngas is carbonintensive. “To replace current carbon-intensive uses with hydrogen would require a large-scale import of hydrogen.”

Lo, in his interview, also said Hong Kong must import much of its hydrogen. “It is not naturally endowed with ample resources suitable for renewable generation required to produce renewable electricity and, in turn, green hydrogen and derivative products.”

Hauber noted that even with imports from Mainland China, the world’s biggest green hydrogen producer, large-scale hydrogen use in Hong Kong is still “a very long way off.”

Sinopec’s Kuqa petrochemical refinery in Xinjiang is currently the largest green hydrogen producer, but the plant only yields 20,000 tonnes of hydrogen yearly and needs 300 megawatts of renewable energy inputs either from wind or solar. All of that output is for the refinery’s own use.

Achieving a production scale of a million tonnes would need gigawatts of renewable energy from farms that will occupy thousands of hectares of land.

A plan to increase its vault capacity means it can offer cheaper storage rates than London.

Hong Kong should strengthen yuan-denominated gold contracts in its derivative market and set up an Asia-focused gold benchmark as part of its push to become an international gold trading market that is dominated by Shanghai, New York, and London, analysts said. The city should leverage its ties with China to raise the profile of these contracts and compete with their more widely traded US dollar-denominated counterparts, Ross Maxwell, global strategy and operations lead at multi-asset broker VT Markets, told Hong Kong Business. The contract could attract more regional investors particularly from Mainland China "as it would internationalise the yuan and reduce currency risk exposure" for Asian, especially Chinese, investors, he added. Meanwhile, the benchmark would complement the pricing systems in London and New York and reduce dependency on US dollar pricing, attracting more participants, Maxwell said. It is also the next best step since Hong Kong already has a strong gold infrastructure, he pointed out.

He said the city should emulate the US’ strong derivative market to gain an edge over Shanghai, Asia’s biggest

gold market though it has a much less established futures and options market.

He added that if Hong Kong could boost its derivative market, match London’s physical liquidity and trust and Shanghai’s strength in physical gold trading, it would be wellpositioned to become a major gold trading hub.

Maxwell said Hong Kong should capitalise on its flexible regulatory regime and preserve its tax-neutral stance to attract foreign investors. Shanghai’s strict rules remain a major hurdle to its ambition to become a global trading centre.

He said Hong Kong’s established gold storage facility, the Hong Kong International Airport Precious Metals Depository, gives it an edge. Airport Authority Hong Kong has announced plans to increase the depository’s capacity to 200 from 150 tonnes, with room for at least 1,000 tonnes.

With higher capacity, the city could offer much cheaper storage costs than London, Maxwell said.

“Hong Kong's geographical location gives it a clear advantage over London and the US when looking to attract Asian investors, especially with the high costs for storing gold in London,

and the potential to align its trading hours with Asian markets,” he added.

It should also take advantage of its close ties with China, which consumed 741.732 metric tonnes of gold in the first three quarters of 2024, based on data from the council.

“Hong Kong’s deep economic ties to Mainland China make it a natural conduit for gold to access the Chinese market, which is the largest consumer market for gold in the world,” said Shaokai Fan, global head of central banks at the World Gold Council.

Whilst it is important for Hong Kong to work with Shanghai, it must also keep its market accessible to the world, Maxwell said.

He noted that the threat of geopolitical tensions and another round of trade wars under US President-elect Donald Trump, as well as perceptions of reduced Hong Kong autonomy could affect investor confidence.

“Striking a balance between leveraging its ties with China whilst also maintaining an attractive regulatory environment for foreign investors will be key,” he added.

Still, the biggest hurdle for Hong Kong’s ambition to become a major gold trading hub is intense competition from the Big Three players.” Singapore is also a potential competitor as it can offer a tax-friendly alternative,” Maxwell said.

Fan said Hong Kong should find a niche in a competitive gold market. “Hong Kong should find a specific market to serve, or offer innovative solutions that will enhance its role in the global gold market.”

“To differentiate itself, Hong Kong should seek ways to improve gold trading practices, bring in new technologies, or innovate gold-based product offerings," he added.

Hong Kong should likewise leverage technology such as blockchain and the cloud to improve security in trade integration and ownership records, giving clients transparent access to their holdings, Maxwell said.

Analysts are not too worried about the impact of US tariffs on Asian investments.

Hong Kong investors are likely to weigh another round of trade wars between the world’s biggest economies, Asian currencies’ potential rally, and Hong Kong and China’s strong tech sectors in what is shaping up to be a “year of volatility,” analysts told Hong Kong Business magazine.

Despite the expected trade uncertainty — fanned by incoming US President-elect Donald Trump’s threat to raise tariffs against China, Canada, and Mexico — most analysts are not too bothered by Asia’s chances this time around.

“We’re tempted to be pretty sanguine about the impact of tariffs,” Mel Siew, a portfolio manager at Muzinich & Co., said in an interview with Hong Kong Business

“The Asian region has got very strong fundamentals. You can make a case that there should be a pretty limited impact as well this time around, despite the initial reaction and volatility," he added.

Asian equities and currencies would probably perform well, whilst Hong Kong and China’s tech space offer attractive investment opportunities, according to the Hong Kong investors and analysts.

There should be a pretty limited impact as well this time around, despite the initial reaction and volatility

Here are some investment ideas for the next 12 months.

Sell Li & Fung and peers

Despite their more upbeat outlook for the US-China trade situation, analysts still cautioned against companies in sectors that may be caught between the trade wars.

“Li & Fung is a clear sell,” Daniel Tan, a portfolio manager at Grasshopper Asset Management, told Hong Kong Business in an interview.

The Hong Kong-based supply chain company endured a sell-off at the height of the US-China trade wars in 2018 and went private in 2020. “I will have that positioning preference for similar quality names in a similar industry,” he added.

Investors should shun sectors sensitive to international trade, Ross Maxwell, global strategy operations lead for online trading platform VT Markets, told Hong Kong Business

“This will be more sensitive as Hong Kong draws closer to mainland China and becomes more aligned with its economy,” he added.

Lucrative HK tech sector Venture capitalists targeting tech development and unicorns in Hong

Kong and the Greater Bay Area offer attractive investment opportunities in 2025, Maxwell said.

He cited Hong Kong government efforts to develop Cyberport and Science Park as it tries to become a fintech hub. “As such, fintech startups or established companies that are looking towards digital transformation can offer potential lucrative investment opportunities.”

Tech startups that focus on artificial intelligence (AI) and biotechnology also offer good opportunities. So do companies in digital payments, blockchain, and cybersecurity.

Apart from Hong Kong, China’s tech space is another solid pick.

Tan cited China’s electric vehicle (EV) industry, and prefers the stock of car brand BYD over Tesla, which he said is overvalued.

“I don't really like where Tesla is trading,” he said. “EV as a whole has been rallying too much, [and] poised to sell off early next year or throughout the whole year.”

Siew, meanwhile, cited the Chinese tech space for its strong balance sheets. “Because of its small-ticket consumption… [consumers] don’t have the hesitancy to spend,” he said, adding that tech companies have logged strong year-on-year growth.

China had 369 technology unicorns with an average value of $3.8b as of April 2024, the second-biggest in the world, according to data from the World Economic Forum (WEF).

Asian currencies are solid Asian currencies are expected to rally this year. “In the long run, we anticipate an appreciation of Asian currencies, driven by additional stimulus from China, which is likely to draw new capital inflows into the region, along with improving macro fundamentals in ASEAN (Association of Southeast Asian Nations) and India,” said Alfred Mui, managing director and head of Asia Fixed Income Investment Management at HSBC Global Asset Management.

Tan said the currency and bond

rallies could extend to emerging markets globally. “On the longer term basis, [we see a] potential for equity rally within emerging markets. Some of the countries that we like are India, China, Colombia, China, Indonesia, [and] the Philippines.”

Mui said Asia’s fixed income markets including currencies are less volatile than those in emerging global markets. “This stability, coupled with an attractive duration-insulated carry, provides essential insulation against rising global market volatility.”

Steer clear of the Hong Kong dollar

Since the Hong Kong dollar is pegged to the US dollar, its interest rates generally follow those set by the US Federal Reserve, reducing the flexibility of the Hong Kong Monetary Authority in setting policy rates. This opens it up to risks from global inflationary pressures and rate fluctuations, Maxwell said.

Ride the easing cycle with bonds

Trump’s tariff obsession will elicit some knee-jerk responses in the investment space in the early days of his second term. Overall, Asian investment-grade bonds will see little impact, just like in 2018, Siew said. The rate-easing cycle by central banks across the globe is expected to continue next year, and bonds stand to benefit. When interest rates fall, bonds are more profitable than other investments, so bondholders can sell them at a premium.

The 20-year bonds look particularly promising, and were giving 4.7% in returns in late November, Tan said.

“The front end of the curve, short-dated bonds, look best-placed, particularly in an Asian context versus the US,” Siew said. “That is where we see some pickup in Asian credit spreads over the US.”

High-coupon bonds can also be appealing. “High-coupon bonds will surprise people in terms of returns they can generate over other investments, particularly, say, longer maturity bonds and tenor bonds that have high headline yields but generate low income because they have low coupons,” he added.

Never too late to turn green Exchange-traded funds dedicated to sustainable practices, green bonds, and companies investing in renewable energy infrastructure in Asia may

also offer attractive investment opportunities.

“Global efforts to combat climate change will offer opportunities in the renewable energy sector and a focus on a company’s environmental and social criteria can give clues for long-term returns,” Maxwell said.

The shift toward cleaner energy and decarbonization through investment in solar, wind, and hydrogen would continue to be a predominant theme in the second half of the decade, he added.

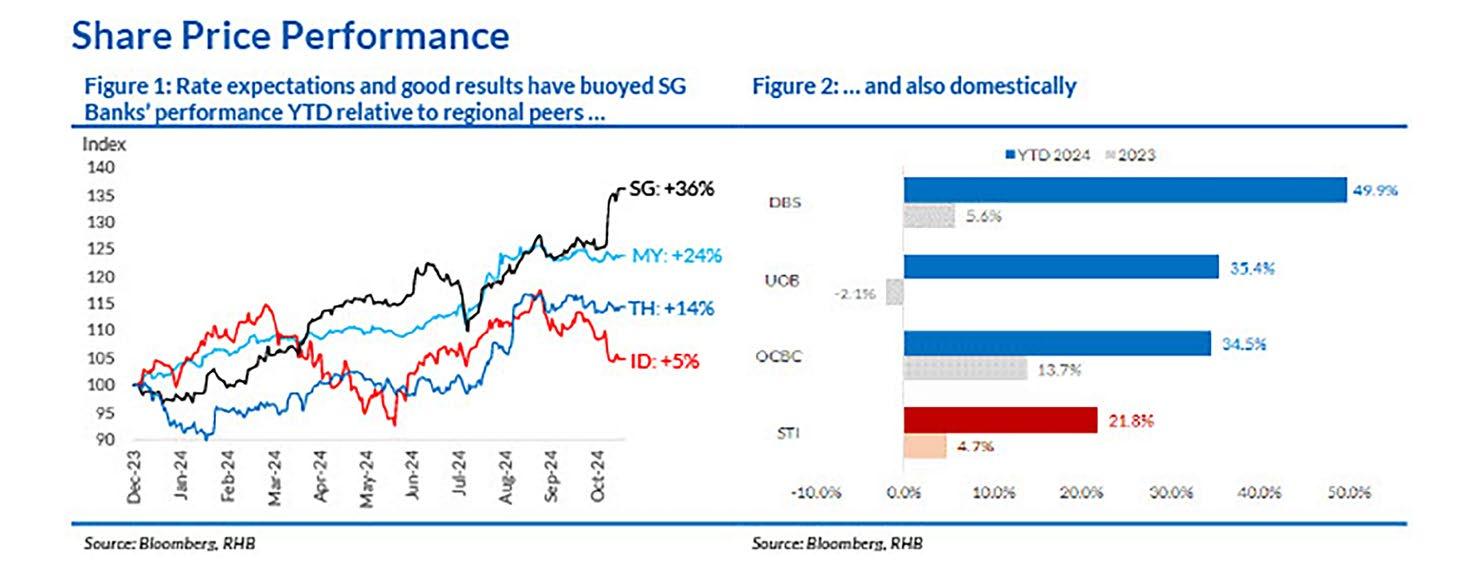

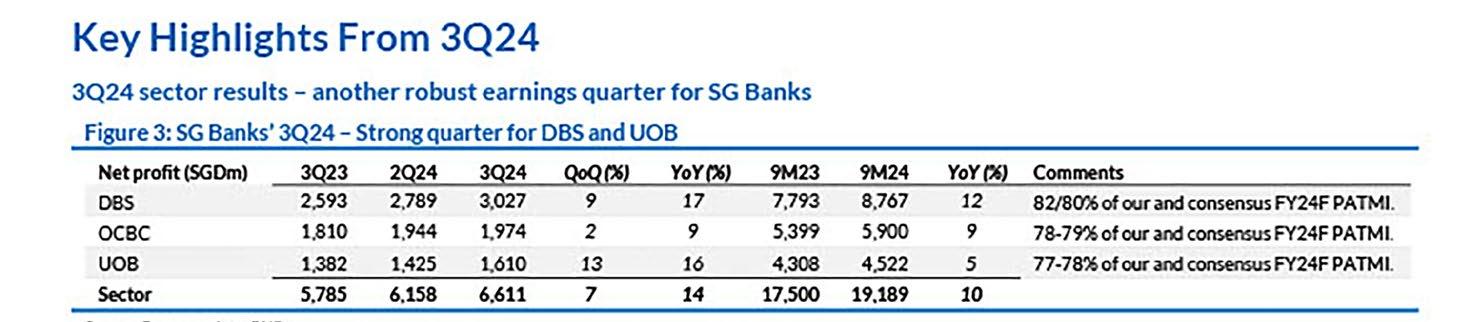

Singapore banks a good hiding place

For the truly cautious: Singapore banking stocks may be a good place to hide from the market volatility expected from Trump version 2.0 and shifting expectations about the US Federal Reserve’s next moves.

United Overseas Bank Ltd. (UOB), Oversea-Chinese Banking Corp. Ltd. (OCBC), and Development Bank of Singapore Ltd. (DBS) expect potentially low earnings next year, RHB Bank Berhad said in a November 2024 report. The three banks offer a dividend yield of 5.6% for next year.

Of the three, DBS offers dividend safety given its guidance for a fixed step-up in absolute dividend per share, whilst OCBC and UOB may offer higher dividend per share if earnings in 2025 turn out to be better.

Source: J.P. Morgan Global Research - Commodities

Whilst a safe haven, Singapore banks’ profits are expected to slow down in 2025 as their net interest margins (NIMs) are expected to have already peaked in 2024.

For Hong Kong banks, a dip in net interest margins could lead to a decline in their profitability next year, Shinoy Varghese, S&P primary credit analyst, wrote in the S&P report.

“We expect any potential negative impact on asset quality from Hong Kong and China commercial real estate to be manageable,” he added.

Private equity is poised for a dynamic year, with pent-up demand and strong financing conditions likely to catalyse deal-making, particularly in the US and Europe, said Khai Lin Sng, co-founder and chief investment officer at Alta Alternative Investments Pte. Ltd.

“Growth-oriented investors can look to buyout, growth, and venture strategies, with sectors like software, technology, and services offering attractive opportunities,” she said. “These areas are primed for innovation and expansion, creating significant value for long-term investors.”

On the other hand, investors may need to be cautious in industries facing regulatory uncertainties, such as cryptocurrencies. “Additionally, sectors heavily reliant on global supply chains like manufacturing may be more vulnerable to

geopolitical tensions and trade disruptions,” Sng said.

Be cautious of oil commodities

Analysts are bearish for oil commodities in 2025. J.P. Morgan Commodities Research forecasts Brent to decline to $60 per barrel by the end of next year.

Crude oil prices have soared amidst war in the Middle East. But even then, prices have remained pretty stable, averaging at $70 to $75 a barrel, Siew said.

“If suddenly, you were to get ceasefires in place, and especially with the US being more focused on its energy self-sufficiency, what does that mean for oil prices? We’re cautious on that commodity,” he said.

There is also likely to be an oil oversupply in 2025, Natasha Kaneva, head of Global Commodities Strategy at J.P. Morgan, said in an October 2024 report.

“Price is a function of demand for oil inventory, which in turn depends on the willingness of users to either deplete or restock their holdings,” she said. “Given the anticipation of an oversupplied market in 2025, oil consumers have so far opted to wait, causing a dislocation of the oil price from its fair value.”

“However, shifting dynamics in the Middle East might create a greater urgency to replenish inventories, thereby realigning the price of oil with its fundamental level,” she added.

Analysts cautioned on investing in Hong Kong properties– and real estate investment trust (REIT) stocks — amidst still high interest rates.

“Property prices in Hong Kong have also corrected a fair bit this year, and rental yields are coming off,” Daniel Tan, a portfolio manager at Grasshopper Asset Management, told Hong Kong Business in an interview.

Tan added that Hong Kong has also become less attractive for foreign corporations looking to establish a presence in Asia. S&P, citing Hong Kong's Census and Statistics Department data, reported a 13% drop in regional headquarters of multinational firms since 2019, with their workforce shrinking 32% to 132,000 by the end of 2023.

Ross Maxwell, global strategy operations lead at VT Markets, made a similar observation, saying that regulatory changes and mainland influence have altered the business landscape in Hong Kong.

Maxwell advised investors to stay vigilant for downturns in the real estate market, cautioning that Mainland China’s economic slowdown could further complicate Hong Kong’s recovery.

Despite these challenges, Thomas Chak, head of Capital Markets & Investment Services at Colliers Hong Kong, sees opportunities in Hong Kong's real estate market.

“In the first half of 2025, institutional and property funds are expected to explore lucratively priced markets like Hong Kong and Mainland China for value-driven investments,” he said.

Chak noted a shift toward alternative assets, particularly student accommodation, driven by government policies to position Hong Kong as an international education hub.

"These factors are encouraging for investors looking to capitalise on emerging opportunities in Hong Kong’s dynamic economic landscape," he added.

In the Q4 2024 Property Issue of Hong Kong Business, experts revealed that investors are bottom-fishing for properties with stable returns like hotels that can be converted into student houses and industrial sites that can be repurposed into cold storage or data centres amidst Hong Kong’s property slump.

Khai Lin Sng of Alta Alternative Investments said logistics and green infrastructure also offer promise. Investors, however, should steer clear of office and retail properties, especially in oversupplied markets.

Chief headhunters in Hong Kong expect increased demand for lawyers who can advise clients on business transactions in regard to the laws of a particular market amidst regulatory intensity including in the areas of risk management, governance, and data.

Legal jobs such as regulatory compliance manager, compliance officer for hedge funds, and legal counsel for funds would be in high demand next year, global recruitment firm Robert Walters Hong Kong said in a report in November.

Lawyers who specialise in cryptocurrencies would be among the most sought after, said Adrian Lam, senior director and person in charge of Hays’ legal recruitment in Hong Kong.

Law firms have been hiring legal experts in the crypto space this year, alongside finance and litigation, restructuring, new technology, and licensing, he pointed out.

The growing need for cryptospecialised lawyers could be tied to Hong Kong’s efforts to position itself as a virtual asset hub, he added.

Reed Smith Richards Butler LLP is also enhancing its regulatory compliance expertise, but more on global sanctions, according to Denise Jong, a partner at the law firm.

Stephenson Harwood LLP, the 16th-biggest law firm in Hong Kong by the number of legal professionals, based on Hong Kong Business’ annual

survey, is focusing on regulations in Mainland China amidst its growing collaboration with Hong Kong. The firm is linked to Wei Tu law firm in Guangzhou, China.

Wei Tu has been “increasingly busy with work involving the crossborder flow of data and relevant compliance issues, advising clients across transactional, operational, and contentious contexts,” said Evangeline Quek, managing partner at Stephenson Harwood's Greater China offices.

She cited the need for lawyers and law firms to work together internally and externally with peers and clients so they could better deal with the changing global regulatory landscape.

Reed Smith and Stephenson Harwood are also prioritising corporate and capital markets, which Jong expects to turn for the better by the second half of next year. Other growth areas for Stephenson Harwood include private wealth, finance and litigation.

Quek said the firm is also exploring opportunities in the global energy transition, life sciences and healthcare, transportation and trade, technology, and private capital.

Some legal firms in Hong Kong expect aggressive expansion next year, whilst others are cautious about recruitment.

Appleby, known for its offshore expertise, anticipates slower hiring in

2025 for its Hong Kong office after boosting its headcount in dispute resolution, corporate law, and banking this year. The firm, however, expects growth in their Shanghai office, which serves both Hong Kong and Mainland China clients, and is eyeing a second Mainland China office.

David Bulley, Appleby's managing partner for Hong Kong and Mainland China, said the firm would prioritise senior-level hiring in two key areas in 2025, but declined to give the details.

Over the past 12 to 18 months, Lam cited a decline in legal hiring due to market conditions. “Looking ahead to 2025, it’s neither an overly pessimistic nor an overly optimistic outlook,” he told Hong Kong Business. He added that most law firms and in house legal teams are consolidating, not restructuring to save resources.

To entice more legal professionals and retain talent, both Stephenson Harwood and Appleby are implementing performance-focused pay structures.

“We offer transparent pay structures to allow our people to understand how their performance is linked to their reward, so expectations are clear,” Quek told Hong Kong Business, adding that regular market benchmarking of their pay levels ensures they remain competitive.

Lam said law firms should structure long-term incentives, such as split-payment bonuses, similar to the practice of some major Chinese companies. Lawyers also prefer flexible work hours because their job is more of a back office function, he added.

Bulley said long-term career opportunities especially for high performers could drive high retention rates, whilst Quek said Stephenson Harwood offers legal, skill and on-thejob training, as well as mentorship for their employees.

These should help law firms attract and keep talent in the legal market, which is “very competitive,” Quek said.

Bulley said Hong Kong has become less desirable as a place to live and work for lawyers. “Many candidates for offshore firms in Hong Kong previously came from the UK, Australia and New Zealand, but we now see far fewer candidates wishing to move from these jurisdictions to Hong Kong.”

In search of the best lawyers in the region, Hong Kong Business reached out to over 80 legal institutions in Hong Kong. After rigorous review of all nominations submitted, 11 men and nine women made it to the final cut.

Agents in this year’s list come from Appleby, Bird & Bird, Clyde & Co., Cornerstone Chambers, HFW, Oldham, Li & Nie, Robertsons, Stephenson Harwood, Tanner De Witt, Timothy Loh LLP, and Withers.

Leading the pack is Withers with three representatives. The youngest in this year’s list is from Timothy Loh LLP.

This year’s lawyers excel in financial services, international law, mergers and acquisitions, real estate, and family law.

Many of this year’s awardees assisted clients in million-dollar cases, such as securing a US$34m award in an unsafe port dispute, and billion-dollar deals, including advising a New York Stock Exchange-listed asset manager on a US$720m acquisition. Many excelled locally and possess valuable international experience as well.

Here are this year’s awardees arranged from the youngest to the most senior in years.

Sally, recently promoted to Managing Associate, specialises in financial services regulation, virtual assets, crypto derivatives, FinTech, and investment funds. She advises on regulatory compliance, investigations, and disputes, including for banks, investment firms, and digital asset businesses. Notably, Sally has represented some of the top 5 global digital asset exchanges with HK$50b and HK$200b of average daily trading volume, as well as an SFC-licensed VA fund manager regarding its Web3.0 private equity fund. Sally is trusted for her strategic insight and perceptiveness in this evolving regulatory landscape.

Mary is a Managing Associate that specialises in corporate law, M&A, financial services regulation, and private equity funds. She advised a U.S. investment firm on Hong Kong regulatory issues for its HK$19.5b acquisition of a majority stake in an international insurance broker. In M&A, she guided a NYSE-listed asset manager through a HK$5.6b acquisition of a global alternative asset manager. Mary also led the formation of a HK$46.8b Asia-focused LPF private equity fund, ensuring compliance with sovereign investment requirements.

Jessica, Counsel in the Professional & Financial Disputes team at Clyde & Co’s Hong Kong office, specialises in professional liability and financial lines disputes. She handles complex professional negligence litigation across multiple sectors and jurisdictions. Jessica regularly advises auditors, directors, insurance professionals, and construction professionals. She is conversant with various dispute resolution mechanisms, including mediation, judicial settlement conferences and other forms of ADR. She also actively engages in pro bono initiatives and has a keen interest in public interest law.

Alex, a partner in the private client and tax team at Withers, specialises in trust and estate planning, US taxation, and cross-border probate matters. Qualified in Hong Kong, New York, and England & Wales, he advises high-net-worth individuals on establishing and restructuring family trusts, pre-US immigration tax planning, and relinquishment of US citizenship or green cards. Alex also assists individuals with coming into compliance with their US tax. Recognised as a Tier 1 Private Client Global Elite Lawyer in 2024, Alex is trusted by private clients navigating complex tax and estate planning globally.

Winnie, a Senior Associate at HFW’s Hong Kong shipping team, specialises in shipping arbitration and litigation, excelling in charterparty disputes. She represents shipowners, charterers, and clubs in arbitrations and court proceedings across Hong Kong, London, and Singapore. Working on shipping projects all over Asia, Winnie’s notable cases include securing an award over HK$260m in an unsafe port dispute and resolving complex shipbuilding and delivery issues. Active in the shipping community, she is a Fellow of the Chartered Institute of Arbitrators and a frequent industry speaker.

6 Whitney Chan 34, HFW

Whitney, a Senior Associate at HFW's Hong Kong Aerospace team, specialises in aircraft financing, leasing, and trading transactions. Triple-qualified in England & Wales, Hong Kong, and the British Virgin Islands, she primarily advises leading aircraft leasing companies and financial institutions. Her expertise includes aircraft portfolio financing, sale and leaseback deals, portfolio asset sales, JOLCOs, and P2F cargo leases, as well as corporate jet transactions. Fluent in English, Cantonese, and Mandarin, Whitney has led significant aviation finance and leasing projects across Asia, working with airlines and stakeholders throughout the region.

9 Samuel Leung

Samuel, a Charles Ching Scholar, was called to the Bar in 2022 and is developing a broad civil and criminal practice. He holds a Juris Doctor from CUHK, where he graduated on the Dean’s List, and a Master of Laws with Distinction from UCL. A former Judicial Assistant at the Hong Kong Court of Final Appeal, he assisted judges with substantive appeals and applications. Fluent in Chinese, Samuel advises Mainland Chinese clients and lectures at City University of Hong Kong. His research publications have been cited by apex courts like the Hong Kong Court of Final Appeal and Supreme Court of Pakistan and leading texts, including Snell’s Equity.

7 Matthew Cheung 35, Cornerstone Chambers

Matthew, called to the Bar in 2015, specialises in civil and commercial litigation with a focus on construction disputes, building management, family law, land law, intellectual property, and trust matters. He also handles criminal cases, acting for both prosecution and defence. A Society of Construction Law Hong Kong Scholar, Matthew is an associate of the Chartered Institute of Arbitrators. He holds a Bachelor of Building Engineering and is a visiting lecturer at Hong Kong Polytechnic University. Matthew frequently speaks on land and building management topics for various institutions.

8 Jonathan Lam 35, Oldham, Li & Nie

Jonathan specialises in commercial and contractual disputes involving multinational corporations, often with cross-border elements. He has extensive experience in trust and probate matters and has acted in landmark cases in the High Court and Court of Appeal. His expertise includes shareholder disputes, derivative actions, debt recovery, civil fraud, insolvency, and complex probate issues. An affiliate member of The Society of Trust and Estate Practioners (STEP), Jonathan brings a deep understanding of trust and estate matters to his practice, making him a trusted adviser to his clients in both contentious and non-contentious cases.

11 Alex Ye

Yvonne, a Partner since 2020, specialises in matrimonial and family law, with expertise in complex children applications, including Hague Convention cases, adoption, surrogacy, and custody matters. She advises high-net-worth clients on asset division, pre- and post-nuptial agreements, and estate planning. Yvonne has represented clients in high-conflict trials, including an 18-day High Court case, and handled notable cases such as securing a favourable settlement in a HK$700m asset division. She is a member of the Hong Kong Family Law Association and contributes to global family law publications.

Alex, a special counsel in the international arbitration and litigation team at Withers, specialises in cross-border disputes, including international arbitration, commercial disputes, regulatory investigations, restructuring and insolvency, and contentious probate matters in Hong Kong and Mainland China. He has acted under various arbitral institutional rules and as a tribunal secretary in complex international arbitrations. Alex’s dual civil law and common law background, along with qualifications in Hong Kong, England & Wales, and the People’s Republic of China bar exam, makes him adept at handling multi-jurisdictional contentious matters.

12

Wilfred, a partner at Bird & Bird in Hong Kong, specialises in technology, media, telecoms (TMT), and data protection law. Bilingual in Chinese and English, he advises clients on commercial, transactional, and regulatory matters, including complex crossborder technology contracts, licensing, and fintech-related compliance. With over 10 years of experience, Wilfred has expertise in data protection audits, cross-border data transfer, and cybersecurity incident management. He has led key projects across Asia, including advising on regulatory compliance for cloud services, financial institutions, and public sector technology integration.

15

Mark, a Consultant in the Employment Practice, advises employers and employees on recruitment, termination, misconduct, post-termination restrictions, and employment documentation. He specialises in antidiscrimination and anti-harassment laws, grievance management, and contentious employment matters. Mark has represented clients in the Labour Tribunal, District Court, Court of First Instance, and Court of Appeal, and conducted internal investigations into misconduct and breaches of employment contracts. He has considerable experience in conducting large scale internal trainings and seminars for clients.

Ross is a private wealth lawyer based in Hong Kong, advising clients across Asia Pacific. Specializing in international tax, trust law, estate planning, and family business governance, he assists globally mobile families, executives, entrepreneurs, and their advisers with cross-border legal and tax matters. Collaborating with teams and independent firms in Asia, Europe, and the US, Ross provides comprehensive advice. Recognized as a leading lawyer, he serves on the Executive Committee of the Hong Kong Trustees' Association and is an associate member of the Society of Trust and Estate Practitioners.

Simon, a seasoned litigator, specialises in civil and commercial disputes, including international arbitrations, shareholder conflicts, regulatory enforcement actions, and IP licensing. He has acted in highprofile cases, such as shareholder disputes involving hedge funds and investment claims exceeding HK$1b, and has represented former management in investigations by Hong Kong’s Securities and Futures Commission and Independent Commission Against Corruption. Simon’s expertise includes handling just and equitable winding-ups, unfair prejudice claims, and statutory derivative actions. He has been instrumental in leading complex litigation.

Teresa, a banking and finance lawyer, specialises in structured finance and restructuring, with expertise in syndicated and bilateral loans, real estate financing, acquisition finance, and ship finance. Her secondments with Standard Chartered Bank and ANZ Bank provided valuable insights into internal banking procedures. Promoted to Partner in May 2024, Teresa is praised for her negotiation skills, logical approach, and efficiency in delivering high-quality legal documentation. With experience in traditional finance and complex transactions like aircraft and ship financial leasing, she is known for her clientfocused solutions and dedication to teamwork.

David Bulley, Managing Partner of Appleby for Hong Kong and Mainland China, specialises in private equity, public and private M&A, and restructuring. Over the past five years, he has advised on over US$170b in M&A transactions and US$550b in restructuring mandates. David represents creditors and debtors in highvalue restructurings, including Chapter 11 proceedings, offshore schemes of arrangement, and liability management exercises. Based in Asia, he has led numerous high-profile cross-border transactions and restructurings involving major companies and financial institutions across the region.

Sharon is a senior associate at Bird & Bird and leads the real estate practice in Hong Kong. She regularly advises multinational and local private equity funds and developers on significant property transactions. Sharon is devoted to serving the community and the legal profession and serves on numerous Hong Kong government panels and nonprofit boards, including as the Chairlady of the Hong Kong Law Society’s Greater China Legal Affairs Young Solicitors' Sub-Committee and the NonOfficial Member of the HKSARG Steering Committee on Rule of Law Education.

Pan, a corporate lawyer and partner in the firm’s commercial and corporate finance teams, specialises in M&As, joint ventures, and corporate governance. He advises public and private companies, banks, and individuals across Hong Kong, Mainland China, and internationally, offering pragmatic and cost-effective legal solutions tailored to client needs. Among the first Hong Kong lawyers eligible to practice People’s Republic of China law in the Greater Bay Area, Pan frequently speaks on regulatory topics, including AI governance.

Anisha, a partner in the divorce and family team at Withers, specialises in matrimonial law with a focus on complex, international cases. She advises on divorce, separation, financial disputes, child custody, maintenance, and relocation, often involving intricate asset structures, family trusts, and third parties. Anisha’s civil litigation background adds depth to her expertise in enforcement applications and high-net-worth cases. Anisha is an accredited and trained general commercial and family mediator with HKMAAL, as well as a trained collaborative practitioner. She has experience in wills, probate, and general civil litigation.

Only four segments in the top 10, all life insurers, posted growth in 2023.

Hong Kong’s top insurers rebounded in 2023, as improved market sentiment drove a 2.1% increase in gross premiums from a year earlier, according to analysts.

The Hong Kong Business Insurance Rankings’ top 50 list showed premiums hitting HK$516.5b from HK$505.8b in 2022, with life and nonlife segments splitting the ranks.

The life segment accounted for 90.7% of the total premiums, according to data compiled from official sources.

Those in the top 10 were all life segments, only four of which experienced premium growth, led by Manulife Financial Corp. at 6.5% in fourth place, AXA China Region Insurance Co. (Bermuda) at 3.2% at No. 6, Bank of China Group Life Assurance Co. Ltd. at 5.3% in seventh place, and Chow Tai Fook Life Insurance Co. Ltd. at 60.4% at No. 8.

In terms of premiums, in first place was AIA Group Ltd. at HK$87.1b, followed by Prudential Plc. at HK$65.3b and HSBC Life (International) Ltd. at HK$55.5b.

Other insurers in the top 10 were China Life Insurance Co. Ltd at No. 5 with HK$33b, Hang Seng Insurance Co. Ltd. at ninth place with HK$22.6b, and FWD Life Insurance

needs through our payment solutions is central to our role,” Lydon said in an interview during Sibos 2024.

John Zhu, chief economist for Asia at Swiss Re Ltd. said demand from mainland visitors allowed the sector to return to its pre-2019 peak.

He also cited a reversal in the interest rate differential between Mainland China and Hong Kong, where interest rates are now higher. Insurance Authority data also showed that nonlinked new business policies grew 10% year on year, whilst their linked counterparts declined 30%.

“The latter [was] probably impacted by sluggish stock market performance,” Zhu said. “Whilst we have now entered the US Federal Reserve's rate-cutting cycle, US/ HK rates are still expected to stay above that of Mainland China for the foreseeable future.”

Other growth drivers were post-COVID income recovery and heightened risk awareness.

Co. Bermuda Ltd. at No. 10 with HK$20.3b.

Hong Kong’s life insurance sector inched up 0.3% year on year, whilst the general insurance market climbed 4.6% in 2023.

The industry’s recovery was mainly due to pent-up demand with the return of visitors from Mainland China, as well as rising sales postCOVID-19, according to WenWen Chen, S&P Global Ratings director and lead analyst.

“Mainland Chinese visitors accounted for about 30% of new business sales,” he said. “The border restriction during the pandemic led to a significant slump, but the situation reversed in 2023 with the resumption of cross-border travel.”

Tom Lydon, executive director and head of FIG Australia & New Zealand; head of Non-Bank Financial Institutions, Asia Pacific, at J.P. Morgan, compared how Hong Kong is “generally less transient than Singapore”. Which could lead to influencing premiums and retention rates.

“Overall, insurance premiums can rise or fall based on specific product types, company strategies, or even banks’ involvement in distributing policies. From our perspective, supporting the industry’s evolving

“However, both Hong Kong and mainland China's economic recoveries are challenged by various structural factors, and GDP growth is expected to be slower than prepandemic trends in future,” Zhu said.

Industry leaders remain cautiously optimistic about the future.