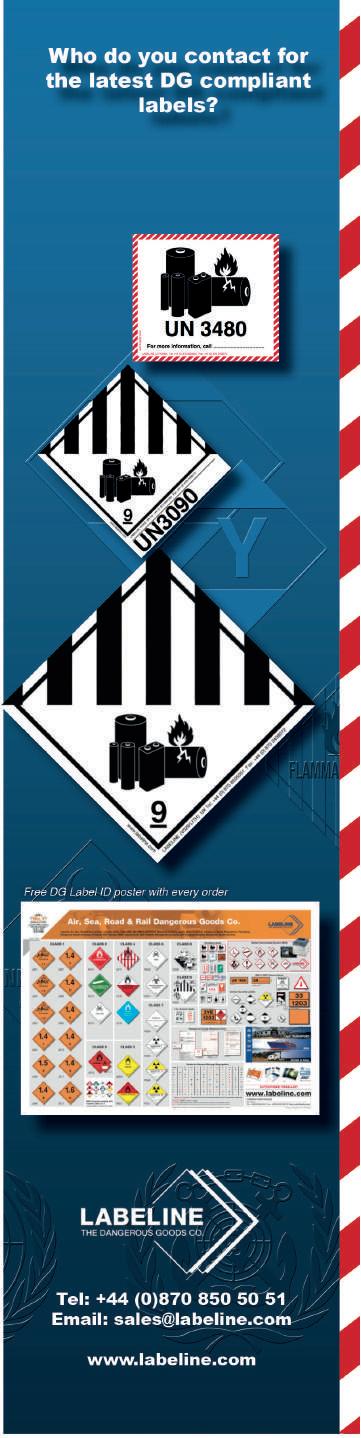

It can’t be easy being responsible for managing dangerous goods or hazmat compliance these days. Despite decades of work to refine and harmonise the regulations, there are still major differences between the modes and between countries, while new requirements pop up with depressing regularity – and not just in the area of lithium batteries.

Nowhere is that more true than in North America and in this issue, which includes our regular focus on what’s going on in that region, we look at some of the events and services that are out there that are designed to help the stressed-out hazmat professional do their job better.

We look back, for instance, to this year’s COSTHA Annual Forum, where senior regulators from around the world were on hand to explain the latest changes to the transport regulations – and why they are happening (the first part of a lengthy report on the event begins on page 58). COSTHA does a great job of getting those regulators in town to talk to industry and help dutyholders understand their responsibilities. It was also illuminating to see the number of hoops they have to jump through to move hazmat through Latin America.

We also look forward to this month’s ChemEdge event, the National Association of Chemical Distributors’ annual conference and trade show (see page 8). Chemical distributors have to worry about the transport regulations but are also impacted by other provisions, not least the CFATS anti-terrorism standards. It is, though, noticeable that industry favours CFATS and NACD has had to lobby hard to get it extended at a time when the authorities in Washington are convinced that industry deserves to have what they regard as a regulatory burden eased.

Distributors also have to worry about the US EPA, and this year are faced with new and revised responsibilities under the Resource Conservation and Recovery Act (RCRA) hazardous waste regulations. This is one area where hazmat professionals will probably need to rely on expert assistance, something highlighted in this issue by Lion Technology (see page 66).

For those working in the area of bulk liquids tank storage, the annual ILTA conference and trade show provides the opportunity to catch up with regulatory and technical developments and, as our report that starts on page 34 reveals, there was plenty to talk about this year, not least in terms of site security, safe management practices and the upcoming update to API 2350.

The North American hazmat environment does present some unique challenges, and the current surge in new business in terms of the production and export of crude oil, NGLs, LPG, LNG, ethane and ethylene is creating not just a lot of work but also a lot of new hazards. However, as all of the events we are reporting reveal, there are also many of the same issues that are facing the industry in the rest of the world.

For instance, the attraction and retention of talent is a major worry – and this is not just in terms of hiring and keeping truck drivers. Getting youngsters interested in a career in the chemical industry or chemical logistics is just as much a challenge in the US as it is in Europe. But the growing use of digital technology – another global trend – may help by updating the image of the sector.

Peter Mackay

VOLUME 40 • NUMBER 08

News bulletin – tanks and logistics 25

Letter from the editor 01

30 Years Ago 04

Learning by Training 05

The View from the Porch Swing 06

The time is right Looking ahead to ChemEdge 08

Ever ready Blackmer pumps help DEF delivery 12 News bulletin – chemical distribution 14

All about the green Greif updates sustainability tool 16 Asian expansion Schütz grows in Australia, China 18

Hazards contained Labelmaster extends Obexion range 20

Taking steppes Spectransgarant adds depot capacity 22

The digital drugstore DHL develops US network 28

A bigger box

CSafe’s larger RAP container 30

Visible monitoring

Sensire brings digital to pharma 32 Bigger in Brussels

Swissport develops Belgian hub 33

Sweet George R Brown ILTA draws a big crowd to Houston 34 Forge ahead

Tough first half for Stolthaven 40

Gassing up

Enterprises works on export capacity 41 Back to basics

NuStar takes the cash home 42 Gulf in class

Howard Energy invests in Texas 43 Precision insights

Eddyfi refines NDT tool 44

Look, no hands

Autonomous robots in tank inspection 45 News bulletin – storage terminals 46

Training courses

Conference diary

SAFETY Incident Log

Weak at the needs

CSB identifies DuPont failings

Knowledge is power How NCEC helps with accidents

Head for the beach

COSTHA gathers in Long Beach 58 Code breakers

IMO revises chemship rules

Change is constant

Lion offers support in compliance 66

Not otherwise specified

Equipment for storage terminals

Gas tanker market developments

Dangerous goods by air Report from the VCA dangerous goods seminar

Peter Mackay

Email: peter.mackay@hcblive.com Tel: +44 (0) 7769 685 085

Craig Vye

Email: craig.vye@hcblive.com Tel: +44 (0) 20 8371 4014

Stephen Mitchell

Email: stephen.mitchell@hcblive.com Tel: +44 (0) 20 8371 4045

Designer Natalie Clay

Alex Roberts

Email: alex.roberts@hcblive.com

Tel: +44 (0) 208 371 4035

Commercial Director Ben Newall

Email: ben.newall@hcblive.com

Tel: +44 (0) 208 371 4036

Binita Wilton

Email: binita.wilton@hcblive.com

Tel: +44(0)208 371 4048

HCB Monthly is published by Cargo Media Ltd. While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect.

Cargo Media Ltd

Marlborough House 298 Regents Park Road, London N3 2SZ

ISSN 2059-5735 www.hcblive.com

These days, a cost of doing business in the dangerous goods logistics sector lies in the numerous certifications, assessments and audits that need to be undergone before contracts will be signed. It is easy to assume that these hurdles have been imposed by the authorities or by the chemical industry but, looking back through the August 1989 issue of HCB, it is evident that much of the impetus came from logistics service providers (or ‘transport companies’, as they were normally known in those far-off days).

We reported in that issue on discussions that had taken place at the Tankcon 89 event – a long-gone trade show specifically for the road tanker transport sector – over the need for a harmonised concept of quality management in the fuel distribution industry.

The problem was emerging as a result of the increasing use of audits by inspection bodies and shippers, leading to hauliers promoting the use of the relatively new British Standard BS 5750.

It seems strange to think that this was once a new idea; BS 5750 rapidly became commonplace in all sorts of industrial sectors, taken up and expanded into the ISO 9000 series and supplemented now by ISO 14000 and, for those in the chemical supply chain, SQAS, Responsible Care and all the sectoral and modal standards that apply.

Elsewhere in the August 1989 issue, there was a though-provoking article by Martin Castle, who at the time was chief officer, dangerous goods at Pira International. He was promoting the idea of having a single set of regulations for the transport of dangerous goods by air, which would have the benefit not only of saving shippers a

lot of money through not having to have duplicate sets of rulebooks, but would also make enforcement simpler. Martin acknowledged the right of individual airlines – and, indeed, states – to issue their own restrictions on top of those provided in the ICAO Technical Instructions, but felt it pointless for the IATA DG Regulations to also merely reproduce the text of the Technical Instructions.

Martin’s proposal came at a time of significant change in the air transport rules, which had only just adopted the UN package testing provisions, and work was going on to adapt the UN’s new limited quantity provisions to be suitable for air transport. These changes would further reduce the variations between the UN system and that developed by IATA, which had been discussed at a joint IATA/ATA meeting in Houston in April. The two associations agreed that the UN limited quantity system was not so far away from IATA’s existing provisions for ‘non-specification packagings’, which had been in use for more than 30 years.

Pira International reappeared in the August 1989 issue in its role as the operator of the UK’s packaging certification scheme, following what we called “severe criticism” of its annual charges levied on the packaging industry. The charges had been introduced to cover the running of the scheme, after the UK Department of Transport had withdrawn funding. DTp and Pira had agreed to meet the Chemical Industries Association and the Association of Drum Manufacturers to sort out the issue but it was clear that fees in the UK were, one way or another, going to remain higher than in other European countries.

When I sit down to write this column, I usually don’t know what to write about just yet. It normally comes to me when I start typing words onto my keyboard but today, for some reason, it seems more difficult than before. I know I have written about risk management, HSEQ control and the use of Systems Sciences and Cybernetics quite a bit, so those subjects I will give a rest, because I feel that not many of you seem to have understood yet what I was trying to tell you. Few people contacted me to ask about these sciences. We are nearing summer and it is getting warmer, although now, as I am writing this, the temperature dropped 10 degrees. I have mentioned climate change before, but is man actually causing this? What man is certainly doing is using up earth’s resources at an exponential rate.

In 2018, Earth Overshoot Day fell on August 1. That marks the day when humanity has exhausted nature’s budget for the year. For the rest of the year, we are maintaining our ecological deficit by drawing down local resource stocks and accumulating carbon dioxide in the atmosphere. We are operating in overshoot.

Globally, many countries are proud that their GDP grows yearly. Politicians gloat, business owners and shareholder reap the benefits, but when I look through my cybernetical lens I conclude that this pride is undeserved, because it is based on positive feedback alone. Negative, corrective feedback, such as the above statement by Footprint Network, is not included in this politically motivated message.

Is it safe for the hazardous cargo industry to use up more resources than nature can provide? Should we cooperate and

look into some kind of rebalancing system of production, sales and transportation in accordance with natural limitations? Can we? Will we? I can’t say at this moment if there will be enough consensus to adjust the ongoing financially motivated depletion of resources, but we can sure start to cooperate towards a mutually beneficial goal, i.e. the sustainability of our planet on which we all depend.

A modus to stabilise production and usage can be achieved, but it seems that emerging markets in developing countries would speed up depletion rather that slow it down, because they too want their GDP to grow. So, I am not an optimist at all.

As a researcher and developer of sustainable systems, a road to equilibrium or homeostasis is possible, but unfortunately ignored by the many. Perhaps you will read this, think about it for some time, but as we are slaves to a path-dependent economic system, rescue will not come from outside.

No alien spaceship will land here to save us, partly because aliens will already know by analysis or synthesis that human beings used up most valuable resources themselves. For them, there will be little left of the spoils which nature created over billions of years. No, they will pass by our planet, observe the space junk flying about, because they probably made the same mistake.

This is the latest in a series of articles by Arend van Campen, founder of TankTerminalTraining. More information on the company’s activities can be found at www.tankterminaltraining.com. Those interested in responding personally can contact him directly at arendvc@tankterminaltraining.com.

I like to eat and I like hazmat. There doesn’t seem to be much overlap between the two, but if you’ll bear with me, by the end of this column you will find there’s more overlap than you’ve first thought.

Not everyone likes to eat, at least not everything. My little brother was predictably hilarious to his siblings, but not to his parents whenever they took us out to eat at an ethnic or nationalistic cuisine restaurant. “No, John,” my parents would patiently explain, “they don’t have hamburgers at a <<insert cuisine here, e.g. Chinese, French, Indian, etc.>> restaurant”, while my sisters and I giggled discretely. Then came the outright laughter as my brother, again predictably, uttered slowly and thoughtfully, “Well, if they don’t have hamburgers, how about a peanut butter and jelly sandwich?”

Years later, it wasn’t exactly ‘different’ food that bothered my daughter, but the way ‘different’ food looked. A bowl of soup or stew was an ugly brown, but apparently smelled irresistibly delicious, because Briana had one of her sisters fold a cloth napkin into a blindfold and tie it around Briana’s head. Then she proceeded to spoon fed herself every bit of the ugly deliciousness. Trying to explain to me why the blindfold was really necessary, she told me, I suppose in terms she thought I could understand, “it looked like HazMat”.

Of course, everyone knows, right, that food can’t be HazMat and Dangerous Goods aren’t edible. Eh, not! The same peppers that are sometimes ground into an edible, spicy powder for flavoring food are also sometimes ground into an edible, spicy powder that is used for an entirely different purpose: self-

defense spray. Yes, that mace substitute that’s all natural and 100% organic and, oh by the way, is edible, is also HazMat. If not in aerosol form (UN1950), check out proper shipping names beginning with Tear Gas Substances.

Other favorite restaurant memories involve flaming desserts. Similar to Pavlov’s dogs, I think I salivate just from reading the word ‘flambé’. Sure, I know that the flammable alcohol has burned off before I eat the dessert, but as I sit here on my porch swing composing this column, I’m sipping on a little liquid inspiration. Next time someone asks you what your favorite identification number is, considering answering UN3065. It is edible.

One of my favorite foods, solid foods, is crab. Crabs though, because they will decompose almost immediately upon dying, need to be cooked alive. In India there’s a place that air freights live crabs all around the country. For a few days each month, I think around the full moon but it could be the new moon, the crabs secrete pheromones that drip through the bushel baskets and corrode the aluminum aircraft floors! Sounds Class 8 to me.

Not so tasty, I hear, are MREs. Meals Ready to Eat, are used by the military (many militaries), heat themselves, and are sometimes less unpalatable than at other times. Technically, the heater portion is separately compartmented from the edible portion, but they’re often one ‘unit’ and the heating results from an exothermic reaction between an oxidizer (potassium permanganate) and water, so an MRE is HazMat. Who knew?

For alcoholic beverages, it’s pretty clear that the food is the dangerous good, and for MREs it’s pretty clear the DG is only associated with the food, but what about pressurized or nitrogenated edibles?

Cylinders of compressed CO2 that carbonate Coca-Cola from a soda fountain are clearly separate and only associated, but what about a can of Guinness with a little unopened cartridge of nitrogen at the bottom?

And what about those little helium containing wine ‘thingys’ (thingies?)? They poke through the wine bottle cork, and push out the wine on demand, all the while keeping nasty oxygen away from the wine. I know the thingies (okay,

I decided on the spelling) are DG before they’re inserted into the cork, but what about when attached? Okay, I concede that one wouldn’t transport the wine while connected to the helium, but maybe you’ll concede that Division 2.2 and food can sometimes be one and the same. Please don’t make me mention aerosol Cheez Whiz.

Some of my parents’ efforts to civilize me worked, at least partially. I’m willing to try new foods and eat ‘different’ things. While doing a little work at DGAC in Washington, DC, a DGAC employee (thank you, Blake) took me to a food truck featuring Ethiopian cuisine. Oh wow, was it delicious! My first food truck, ever, but in part due to that great first experience, far from my last food truck food.

Which brings me to the inspiration for this column. For those of you who follow HCB and/ or Peter Mackay on Twitter, and for those of you who read the Incident Log in HCB this won’t be a surprise, but worldwide there seems to be a greatly increasing number of fires and explosions from the propane

tanks that food trucks cook with. Sure, I’d occasionally wondered about food poisoning, but this put the potential dangers of food trucks in a whole new perspective. Now, not only do I have to worry about the potential Division 6.2 in food truck food, I have to worry about the whole truck going up!

Yes, food and HazMat are more connected than I realized. From Class 2 inside Guinness cans, to Class 3 alcoholic beverages, to Class 5 MREs, to 6.2, um, let’s not think about 6.2 and food, to Class 8 crab pheromones. There’s a lot of DG related to food. And we haven’t thought about Class 9. Could a particularly stinky cheese be Aviation Regulated, and are kimchee and/or kippered herring environmentally hazardous? I don’t know. But I do know I like to eat, and sometimes I like to eat HazMat.

This is the latest in a series of musings from the porch swing of Gene Sanders, principal of Tampa-based WE Train Consulting; telephone: (+1 813) 855 3855; email gene@wetrainconsulting.com.

“NEXT TIME SOMEONE ASKS YOU WHAT YOUR FAVOURITE UN NUMBER IS, TRY ANSWERING UN 3065 – IT IS EDIBLE”

THE NATIONAL ASSOCIATION of Chemical Distributors (NACD) decided many years ago that the only available space in the meeting calendar where it could find a home for ChemEdge, its annual conference and trade show, was mid-August. This would not work in Europe but North America is different and, since its inception, it has become a regular meeting point for the regional chemical distribution sector, where delegates can get the finest insight into regulatory compliance, implementing best practice and promoting safety

From 12 to 16 August this year, more than 400 executives, directors and leading minds in chemical logistics are expected to descend on Louisville, Kentucky, for training sessions, conferences and a trade show tailored to chemical distribution channels.

This year’s ChemEdge promises to be “a balance of great educational content in relevant areas for attendees,” says Matt Glaser, vice-president of education and strategic programmes at NACD. “We have sessions that cover regulatory issues and compliance. We also always have sessions that are directly related to safety. This year, there are also sessions on inventory, warehousing, transport and more.”

These topics will be widely discussed across the floor and are not just limited to the individual presentations: Glaser

mentions how previous ChemEdge events have had industry leaders continuing the conversations over coffee, in the hallways of the show or even in the hotel elevator.

NACD’s events committee got to work on the topics for this year’s sessions just 30 minutes after the doors closed on the 2018 event and it has scheduled a diverse range of matters for 2019 on the many facets of regulations and safety. For example, there will be two emergency management and response sessions to provide as much detail as possible for attendees looking to refine their processes when problems occur.

“Covering emergency management in just one hour is too much. Having two sessions allows us to dig a little deeper and get more focus,” says Glaser. The first session will be based on proactive actions, involving a lot of preventative measures, and the second will revolve around reactive actions. “It’s about prevention, ensuring safety of employees and protecting the surrounding community,” adds Glaser. Eric Byer, NACD president, mentions that the onus is still firmly set on safety while trying to allow ease of conducting business, despite the current

PREVIEW • CHEMEDGE, NACD’S FLAGSHIP EVENT, COMES TO KENTUCKY THIS YEAR, AT A TIME WHEN THERE IS PLENTY TO TALK ABOUT IN TERMS OF REGULATIONS, DIGITISATION AND TALENT

US government not introducing many new regulations.

“All of our events are about best practices, safety and operational excellence,” says Byer. “We focus a lot on security. One example of a security issue that is really important to us is the Chemical Facility Anti-Terrorism Standards (CFATS), which is something we worked hard on last year and have had extended until April 2020.”

CFATS was created to improve security and protection at sites and the US Department of Homeland Security (DHS) reviews each and every site in scope annually. The programme covers physical and electronic issues that may occur, such as a break-in or sabotage, ultimately serving as a national standard providing the highest levels of security possible to prevent any incidents.

Byer adds: “Our members have spent a lot of time and money getting security features such as fencing, doors, cameras and training protocols to protect sensitive products at their facilities, and CFATS provides a level of comfort that allows members to feel more secure and safe overall. It can also provide a business advantage against the competition.”

The CFATS project has developed and grown over the last few years, but it requires further effort in educating members of US Congress to its benefits and emphasising how beneficial it has been to the DHS and businesses around the country to ultimately gain long-term investment. “There are a lot of benefits to CFATS and very few drawbacks,” concludes Byer.

The problems of recruiting and retaining new talent in the chemical industry have been a well-discussed topic at events around the globe and it is predicted by Glaser and Byer to be a key talking point at ChemEdge this month. Glaser explains how the majority of businesses that attend ChemEdge tend to be relatively small with fewer than 30 staff members, meaning that hiring new staff is not a regular occurrence and losing a long-standing staff member with specific experience can be costly. When a new member of staff is hired, it is pivotally important that the investment in the individual

pays off, so ensuring longevity in the role is key to retaining staff.

One solution could be found in shifting the business ethos to meet the demands of the new working generations “with the aim of encouraging people to stay in a job for five or six years, rather than just two or three,” says Byer. It is vitally important that the time, effort and money put into training someone in a specialised role is recouped. Glaser concludes the conversation on worker retention by stating, “You can’t minimise the importance of this topic.”

A hurdle that needs to be overcome in the industry to improve recruitment and retention is changing the wider perception of the chemical industry. “Changing the negative image is the biggest challenge we face,” says Byer. There has historically been a negative image associated with the industry, but this image hides the truth. Glaser and Byer are both eager to highlight the many outreach programmes and educational events that businesses across the chemical industry take part in each year to showcase the true colours of the industry.

Part of the NACD Responsible Distribution programme involves community outreach where conversations with local groups are encouraged, local sponsorships are developed for sports teams or facility developments and

much more, including hosting chemistry-based challenges for students. The large amount of time, effort and resources being attributed to improving the industry image by NACD members cannot be emphasised enough.

Byer points out that there has been a large increase in the number of smaller familyrun businesses having senior partners retiring. When this happens, the business is usually either handed down a generation, or the family is bought out and the company is merged into a larger business looking to capitalise on local markets. “We’re seeing a higher number or mergers and acquisitions –which is challenging – causing the talent pool to keep shifting around,” says Byer.

The movement of talent exacerbates the ‘brain drain’ in the industry and NACD is proactively introducing training programmes that encourage staff to remain in a company for an extended period. “The hope is that the new staff go through these programmes that the companies pay for and the individuals feel that the value is there as they’re in an organisation that believes in them as they’re investing in the training for their future,” says Byer.

NACD provides support and training through its ‘Emerging Leaders’ programme where networking opportunities within the »

younger members of the industry are nurtured. Training in everything from business finance to logistical methods is provided and the peer conversations are dissected to find suitable solutions to industry-wide issues that move operational safety forwards. “We’ve had over 60 graduates out of this programme over the last six years,” says Byer. “Complacency is not a part of what we do. We are always, as an industry, looking to grow and expand our operational and safety records.”

Digitisation in the chemical supply chain is completely unavoidable and it’s here to stay. ChemEdge will have a closing discussion hosted by the Kaizen Institute’s Mike Micklewright about utilising digital innovations to downsize documentation systems. Having this as one of the final points for attendees to mull over at the end of the show emphasises just how important digitisation has become. Glaser believes that the topic of digitisation will rear its head prominently in the sessions covering inventory practices, warehousing and transport logistics: “There will be a flavour of digitisation overlapping into several of the sessions.” “We are definitely in the digitisation world,” says Byer. “I think the electronic route is quickly replacing the paper one in everything from logging driver times to e-commerce purchases. These things are happening far more now than they were a year ago and I believe that it will be even more so in a year

from now.” The conversations at ChemEdge have shifted from a mentality of ‘getting prepared’ for digitisation into ‘we’ve begun accommodating digitisation and want to utilise it’. Both Glaser and Byer feel that the proportion of businesses discussing their digitisation goals will keep increasing in the coming years as more platforms are being created and the number of digital solution users continues to grow.

The addition of digitisation has made it easier for businesses to share and analyse data, particularly when looking to improve on safety and discuss different methods to handle responsible distribution. Byer mentioned NACDU – NACD’s online university

– as a key way in which digital solutions are being embraced to not only develop a greater understanding of regulations, continue education, but also improve operational systems within the community.

“One of the key takeaways from ChemEdge is that a lot of the sessions are interactive and there is opportunity to learn some best practices and methods that are considered cutting-edge in the industry while also meeting colleagues,” says Glaser. “There is the opportunity to say, ‘I learned a lot at the show and there are two or three things that I might be able to implement in my own businesses that will prove beneficial’. We hear all the time at subsequent shows that people have implemented new ideas in their workplace that they picked up from ChemEdge.” The interactive sessions and programmes allow business members “prepare for any regulatory inspections that may come through,” adds Byer.

Registration is still available online for ChemEdge 2019. Specialist training sessions begin Monday 12 August and the opening of the main ChemEdge event is Wednesday 14 August at the Omni Louisville Hotel. HCB www.nacd.com/education-meetings/meetings/ chemedge/2019-chemedge

NACD PRESIDENT ERIC BYER (ABOVE, CENTRE):

“WE ARE DEFINITELY IN THE DIGITISATION WORLD”

these materials. This means that any transport used to haul DEF, as well as its wetted components, needs to be made of stainless steel or approved plastics. This ensures the fluid does not become contaminated during its handling and transfer. By extension, the pumps required to load DEF onto the transport and off again into a storage vessel or truck, must also be compatible with DEF’s unique characteristics.

However, not all DEF-compatible pumps are created equal. Many DEF pumps can be categorised as low-cost, short-service ‘throwaway’ pumps, which use inadequate designs and, in many cases, are constructed of cheaper plastics materials. Improper pump design can cause the equipment to lock up, shut down or leak, resulting in costly downtime or a messy cleanup.

suitable for DEF applications, they can be extremely noisy, and their design and method of operation can cause the pump to shut down and overheat when used continuously. In addition, the pumps usually cannot provide the flow rates most DEF haulers need.

DIESEL EXHAUST FLUID (DEF) is a daily necessity for hauliers and transport companies. But delivering DEF can be very challenging; it needs to be handled by equipment and transports specially designed for the purpose. DEF is incompatible with materials such as copper and brass and can lead to corrosion of

This is a lesson that Earl and ‘Little Man’ Evan Noble – the father and son team that keep trucks running for SA White Oil Company (above) - had to find out the hard way. Prior to finding their current pump solution, the two were using a brand name 12-volt transfer pump to deliver DEF. While the pumps are

“Before, we were using whatever pump fit our application because we just didn’t know that there was a better quality pump out there,” says Earl Noble. “The pumps we originally installed seemed to work fine for the smaller tanks when they didn’t have to pump that much. But when it came time to make more consistent deliveries, the pumps couldn’t handle that much pumping. If we ran the pumps too long, the 12-volt motor on the pumps would overheat and not turn back on until they were cooled down, especially in the summertime when it was hot. These are time-sensitive deliveries and our drivers can’t be waiting for the pumps to cool down or be replaced.”

In addition to material compatibility, another important consideration is pump reliability

PUMPS • THE PARTICULAR DEMANDS OF HANDLING DEF, ESPECIALLY IN LARGE VOLUMES, CALL FOR A TRANSFER SOLUTION THAT CAN ENSURE THE OPERATOR CONSISTENT UPTIME

and longevity. Pumps that use parts that are not as robust as the industry standard are more likely to wear out or break down faster. When these operational problems occur, the result is higher costs for maintenance, repair, replacement parts and, in the worstcase scenario, the purchase of a new pump. The hidden cost in these situations is the downtime incurred as a truck sits idle. And an offshoot of the downtime that can stall the delivery schedule is something that can be just as costly for the delivery company: a loss of reputation.

“We were going through three or four pumps a year on each truck,” says Earl Noble. “It’s frustrating when we have the product but we can’t deliver it because a pump broke down. It not only makes our company look bad, but it makes Little Man and me look bad because we’re the ones maintaining the trucks. So with me, it’s three strikes and you’re out. When a pump shuts off or breaks down a few times, I just want to take it off and replace it. So, when the pumps we were using hit three strikes, it was time to find something more reliable.”

To help find this solution, the pair turned to Werts Welding & Tank Service of Doraville, Georgia, a distributor of tank-trailer parts and equipment. Specifically, the father-son team contacted Elliot Noble for a pump recommendation. In addition to being the branch manager at Werts Welding, Elliot is Earl’s brother.

“My brother called me and said he was looking for a more reliable pump,” says Elliot Noble. “I could tell he was frustrated and just couldn’t take the breakdowns anymore. I knew I had to find him the best possible solution.

“I told Earl and Evan to go with a Blackmer because it provides them with the correct flow rates and pressures, and it’s able to clear the tank lines quickly, which speeds up the delivery time for the drivers,” Elliot Noble explains.

“And best of all, they are reliable. With the Blackmer, it’s all about constant pumping. You never have to worry about the pump shutting down, and they are not affected by the weather. Hot or cold, they just keep on pumping.”

Blackmer SX1B-DEF Series sliding vane pumps have been specifically designed to meet the strict handling requirements of DEF; all of the pump’s materials are either DEF-approved or have been tested to ensure there is no fluid contamination or leeching. This allows the pumps to meet the ISO

22241-3 material standards and cleanliness specifications required for DEF-handling applications. With a small, compact design, SX1BDEF Series pumps are ideal for truck mounting and for use in fleet refuelling or tote applications. What further differentiates the SX1B-DEF model from competitive models is a choice of 12-volt and 110-volt motor options. The 110-volt version is available with a 50and 60-Hz dual-rated motor.

An additional unique feature of the SX1BDEF pump is the incorporation of a 316 stainless steel motor shaft as the pump shaft. Other features include C-face pump mounting, commercial mechanical seal, and 1” NPT or 1” BSPP tapped-port options.

SX1B-DEF pumps offer a flow rates up to 10 gpm (37.9 l/min) with differential pressures to 25 psi (1.7 bar) and motor speed capabilities up to 1,750 rpm. Operating within those parameters, SA White’s DEF tanks can be offloaded in as little as 15 minutes.

The reliability of the SX1B-DEF pump can be attributed to pump’s easily maintained and replaceable Duravanes® that self-adjust for wear in order to maintain flow rate, while minimising shear and agitation. An internal relief valve protects the pump from excessive pressures. The pump also has excellent self-priming and dry-run capabilities and maintenance is reduced because internal wear is almost completely limited to the easily replaced sliding vanes, which can be accomplished without needing to take the pump out of line.

SA White Oil, a third generation family-owned company founded in 1926 and still located at its original headquarters in Marietta, Georgia, operates 25 fuel tankers within a 150-mile (240-km) radius of Atlanta. Along with its sister company Mobilized Fuels, it uses four refuelling trucks that provide fleet-fuel deliveries of both diesel and DEF; they handle more than 5,000 gal (19,000 litres) of DEF each week. HCB

This is an edited version of an article by Geoff VanLeeuwen, product management director for Blackmer, a product brand of PSG, a Dover company. For more information, visit www.blackmer.com or www.psgdover.com.

Melrob US has successfully passed its recent NACD Responsible Distribution verification for the current three-year cycle. The verification confirms the company’s commitment to the health, safety and security of employees, communities and the environment. The Responsible Distribution programme requires on-site, third-party verification of facilities against guiding principles, including strict adherence to laws and regulations and participation with in creating responsible laws, regulations and practices.

“We are delighted to have passed this NACD Responsible Distribution independent third-party verification,” says Dr Oliver Pyrlik, CEO of Melrob US. “Commitment to the 13 Codes of Responsible Distribution is at the heart of Melrob operations and will help our continued growth in the US market”. www.melrob.com

Maroon Group has acquired Amsyn, a national distributor of specialty chemicals to the US coatings, lubricants, nutraceutical,

pharmaceutical and electronics industries. “Amsyn’s ability to distinguish itself as a leading provider of technical solutions has resulted in close integration within its customers’ supply chains. The acquisition reinforces Maroon’s position in core markets and is a great fit within our comprehensive portfolio of specialty chemicals and ingredients,” says Terry Hill, Maroon Group CEO. Amsyn’s management team, led by Thomas Castrovinci, will continue to actively manage the business on a day-to-day basis. www.maroongroupllc.com

Brenntag has acquired US-based lubricants distributor B&M Oil. Headquartered in Tulsa, Oklahoma, B&M deals with the sale, marketing and distribution of lubricants to automotive, industrial, commercial, construction and agricultural consumers throughout the state. B&M Oil generated $28.5m in sales for the 2018 financial year.

Markus Klaehn, member of the management board at Brenntag Group and CEO of Brenntag North America, says: “B&M is a

bolt-on acquisition for JAM Distributing, our Brenntag Lubricants business platform in the central US region, and will expand our offering in the growing Oklahoma marketplace.”

Anthony Gerace, Brenntag’s managing director mergers and acquisitions, adds: “B&M is a good fit that strengthens our position in the Oklahoma marketplace. The company’s two metropolitan-based facilities will support the future growth of our lubricant distribution business in the area.”

Additionally, Brenntag has downgraded its forecast for its full-year EBITDA growth for 2019 after “a noticeable slowdown in demand in June”. It now expects operating EBITDA to grow by 0 per cent to 4 per cent, rather than 3 per cent to 7 per cent as previously forecast.

“During the second quarter 2019, the macroeconomic environment weakened noticeably in the two main Brenntag regions. In addition, important indicators for Brenntag as well as the company’s own market assessment point to a continued difficult environment in the course of this year,” the company says. Despite that, preliminary, unaudited figures for the second quarter point to an increase in EBITDA from €231.3m last year to around €266m.

In other news, Brenntag North America has become the primary distributor for Arkema’s waterborne resins in the US. The product line of more than 45 different resins are used in end use applications such as adhesives, caulks and sealants, construction products, architectural

paints, traffic coatings and industrial coatings. “As we evaluated potential distribution collaborators in North America, we were impressed by Brenntag’s ability to market, deliver, and support products in industries where technical expertise is required,” says Eric Kaiser, regional president for Arkema’s coating resins business in North America. www.brenntag.com

Charkit Chemical, a subsidiary of LBB Specialties, has acquired CA Specialities, a South Carolina-based distributor of personal care ingredients, and Custom Ingredients, a manufacturer of specialty ingredients. Founded in 1987, CA Specialities provides distribution and sales support to customers in the southeast US. CA expanded its business in 1995 by establishing Custom Ingredients.

Cathy Ayer Clark will continue to lead CA Specialities and Custom Ingredients in her role as president, reporting to Charkit’s president, Jay Lang. “Charkit represents the ideal partner for Custom Ingredients,” she says. “Our organisations are complementary and will support each other’s growth. With long-term vision and increased access to markets and capital, I’m delighted to partner with Jay and the Charkit/LBB Specialties team as we grow forward together.” www.charkit.com

Biesterfeld Group has merged subsidiaries to provide a heightened service in Iberia for customers seeking plastics, rubbers and chemicals. Biesterfeld Spezialchemie Ibérica SLU has merged with Biesterfeld Ibérica SLU as a part of the ‘One Biesterfeld’ concept.

Thomas Arnold, Biesterfeld CEO, explains that the ‘One Biesterfeld’ concept “aims to

achieve a uniform market presence and a strong focus on business activities. Having more effective structures in place will make us more agile. It increases our ability to respond even quicker to the challenges of the Iberian chemicals, rubber and plastics markets, and it will help Biesterfeld Ibérica to achieve sustainable growth in the future.”

The merger of the two subsidiaries has been designed to enhance procedures and management systems, generate synergies between sites and improve the processing of Iberian business activities. The two current managers will continue running operations across one Portuguese and two Spanish offices. www.biesterfeld.com

Omya has extended its reach into Malaysia and Singapore by acquiring Trilogie Polymers, a regional distributor of engineered polymers. “Trilogie and Omya share a similar culture and business approach of helping clients expand their market reach, be it locally or overseas. Our clients can benefit from the competence Trilogie will bring to our organisation,” says Sander Herden, Omya’s director of distribution, Asia-Pacific APAC.

Thomas Wee, Trilogie’s founder, adds: “For the past 14 years, Trilogie has been successfully

distributing engineered thermoplastics in Singapore, Malaysia, Indonesia, Philippines and China. Omya has an impeccable reputation and strong core values of modesty, integrity, courtesy and perseverance evident at both a group and employee level. We look forward to being part of the Group. Together, we can leverage Omya’s international presence to further drive our clients’ businesses with a broader and deeper engagement.” www.omya.com

Barentz-owned Tovani Benzaquen Ingredients has purchased Chemspecs, the largest specialised distributor of personal care ingredients serving the Brazilian cosmetics market. “This is a great step forward for all of us,” says Moses Benzaquen, Tovani Benzaquen Ingredients’ CEO. “Chemspecs’ highly trained sales team of technical experts and the wellequipped application laboratory will be of great value. It is the perfect complement to Tovani’s existing team of specialists, and it will certainly enhance the further development of our product portfolio and services.”

Barentz CEO Hidde van der Wal adds: “We had high expectations for our partnership with Tovani, and they were met above and beyond! Our collaboration quickly proved its worth by yielding more and better solutions for our current and new customer base. Our businesses complement each other in terms of markets served, principal relationships, product offerings and business culture. Our shared entrepreneurial mindset and in-depth expertise of our business bind us. I am convinced that the integration of Chemspecs will follow the same successful route.” www.barentz.com

specific sector. Using a range of crossfunctional data including geographic scope, product specifications and transport, the Greif Green Tool allows multiple stakeholders within a business to discover shared improvement opportunities. The examination results can be further used to develop an environmental baseline, helping customers make comparisons between different packaging types and tracking individual environmental progress over time.

The latest substantial updates to the Greif Green Tool include enhanced analysis that allows detailed modelling, plant-specific analysis and improved classification of Greif’s sustainable products and processes.

“As more companies develop sustainability goals, specifically carbon emissions goals, they start looking for ways to reduce their carbon impact, which includes the performance of their suppliers and the products they use,” says Aysu Katun (opposite), director of sustainability at Greif. “The Greif Green Tool provides robust information for strategic decision-making in a very easy-to-use format. With strategic sustainability decisions involving bigger groups of senior leaders, Greif’s Green Tool can help multiple parties understand and agree on the need to change.

popular Greif Green Tool as user numbers continue to grow.

THERE IS LITTLE doubt that packaging is one of the most essential parts of the dangerous goods industry, but it can come at a cost to the environment. Combatting plastic waste and reducing carbon footprints have become two of the key targets for industry across the globe. To assist in achieving and surpassing these goals, Greif has recently updated its

Originally developed in 2010, the Greif Green Tool is a flexible calculator that uses independent lifecycle data for Greif’s industrial packaging products. It is designed to help customers and companies proactively explore new ways to reduce their environmental footprint, make informed decisions about which industrial packaging is best suited to their needs, and achieve their sustainability goals.

The Greif Green Tool reviews and compares the environmental impact of different products, such as plastic drums, steel drums, fibre drums and intermediate bulk containers (IBCs), that might be relevant for a customer’s

“Both Greif and our customers are concerned about the global waste crisis,” Katun continues. “By helping our customers compare the environmental impacts of different packaging options such as new versus recycled versus reconditioned packaging, we assist them in making decisions that will proactively help them mitigate against future damage to the environment.”

Further exemplifying Greif’s environmental impact reduction is the recent Together for Sustainability (TfS) audit score of 98 per cent for its plant in Cologne, Germany. The on-site TfS examination assessed sustainability performance against a defined set of criteria across various aspects of the business, including management, health and safety, environment, quality, energy management and social responsibility.

“Cologne’s success is testament to the skill and dedication of its workforce. The audit

supports our commitment at Greif to ethical and sustainable business practices. It offers customers reassurance that we have a robust safety, health, environment and quality management structure in place,” says Michael Kolz, Greif’s SHEQ manager for EMEA-Central.

Greif’s second quarter results show strong increases in sales and profits, with net sales up $245m over the year at $1.21bn and gross profit ahead by $53.4m at $248.7m. Adjusted EBITDA rose by 31.4 per cent to $162.0m. “Greif produced solid financial results in fiscal second quarter 2019 despite the continuation of trade-related market softness in parts of our global Rigid Packaging segment and a more challenging demand environment in our Paper Packaging segment in the US,” says Pete Watson (opposite), Greif’s president and CEO.

Part of the increase can be attributed to the acquisition of Caraustar Industries in February.

“We completed the Caraustar acquisition during the quarter and are currently integrating these operations in a disciplined manner,” says Watson. “I am pleased with the energy and pace of the integration, but I am most impressed with how well our teams have come together. Through their collective efforts, the combined team has uncovered a variety of operational enhancements and new synergies not previously identified during the due diligence process.”

Greif further says it has identified $15m of new estimated run-rate synergies related to the Caraustar acquisition. The company now predicts that it will be able to achieve at least $60m of run-rate synergies over three years.

While overall figures were impressive, Greif’s Rigid Industrial Packaging & Services division fared less well. Second quarter net sales fell by $31.1m to $631.6m, although excluding foreign exchange impacts there was a $2.3m increase in sales, largely as a result of a 3.9 per cent increase in selling prices for Greif’s primary products. This was partly offset by continued softness in demand in western and central Europe, Asia-Pacific and the US Gulf.

As a result of the drop in currency-adjusted net sales, operating profit fell by $0.2m to $47.0m and adjusted EBITDA was down $2.7m at $68.9m

Looking to the remainder of 2019, Greif is feeling confident and taking the momentum of the last two quarters forward to utilise the addition of Caraustar and the continued growth of specialist services such as the Greif Green Tool.

“We have revised our fiscal 2019 guidance slightly higher, despite expected continuation of market demand challenges for the remainder of the fiscal year,” concludes Watson. “Looking beyond 2019, the long-

term fundamentals for our business remain favourable as we integrate Caraustar into our business and advance ongoing value optimisation activities in our global portfolio. Our team remains focused on delivering exceptional value for our shareholders and customers.”

Since the end of the quarter, Greif has made what it describes as a “large-scale investment” in its production facility in Casablanca, Morocco. A new blowmoulding machine has been installed, which is said to use up to 30 per cent less energy than older machines and will also offer “significantly higher productivity levels”. It will be used to manufacture plastics jerrycans and is expected to increase production capacity for one- to five-litre bottles for the lubricants market by up to 25 per cent.

“This investment guarantees supply to our customers as we experience continuing high demand for our blowmolded bottles. It demonstrates our ongoing commitment to improving customer service and driving down cost,” says Abdennour El Mosor, Greif’s regional manager, MENA. “It also reflects Greif’s commitment to minimizing its carbon footprint.”

The Casablanca plant manufactures jerrycans of up to 25 litres and also steel drums, with customers in the lubricants, chemicals and agro-food sectors. HCB www.greif.com

SCHÜTZ HAS HAD a busy start to 2019, opening new production facilities in Australia and China to capitalise on market growth and expanding its St Étienne site in France.

In Australia, Schültz has had a longstanding presence in Perth and Melbourne, but industrial packaging needs to be produced close to the centres of demand and the north and east of the country has so far been under-represented. The large investment in Yatala, south of Brisbane, is designed to provide clients in Queensland and New South Wales with sustainable packaging and related services, in addition to offering significantly increased supply reliability and flexibility.

The new facility is strategically located between Brisbane and the city of Gold Coast, both of which are economic hubs for Australia. Brisbane port is only 40 minutes away from the new site, the border into New South Wales is a mere 50 km away and the region hosts excellent road and rail transport. This new production plant will significantly optimise the supply chain for regional customers –both economically and ecologically. Shorter transport routes for the delivery of new intermediate bulk containers (IBCs) and the collection of empty containers will save time, lower costs and reduce CO2 emissions.

Aside from the prime location to cater to Shütz’s growing number of clients, the new 19,000-m2 site includes state-of-the-art facilities for the production of new IBCs, highcapacity storage and logistics facilities and equipment that provides the highest quality IBC and drum reconditioning. Production at the site also includes the IBC product lines

MX, SX and the reconditioning of the G2 110-litre drum for agricultural chemical use.

One of the main driving factors for Schütz to invest in this region is the increasing popularity of its Ecobulk and Recobulk IBCs through the Schütz Ticket Service. The existing facility in Melbourne has been running this system over the last few years. Empty Ecobulks are collected and reconditioned in compliance with globally uniform process standards at the advanced facilities. All components that come into contact with the filling product, such as inner bottles, fittings and screw caps, are replaced with brand-new components to ensure quality. All reclaimed plastic recyclate is used for the production of new pallets and corner guards. At the end of the process, the result is a Recobulk IBC that corresponds fully in terms of safety and quality to an Ecobulk with the same standard specification.

Mirroring the regional expansion in Australia, a new Schütz facility has opened in Foshan, China. Alongside Shanghai and Tianjin, the new Foshan site is the third Schütz production location in the country. Having had a presence in China since 2005, continuous investments and growth have allowed Schütz to develop a greater regional footprint along the Chinese coastline.

Logistically, the spread of these three facilities is important as it provides excellent coverage for the growing customer base and a great deal of flexibility in logistics for supplying clients with quality Schütz products. It provides Schütz with the opportunity to service a greater spread of businesses and source new clients with improved logistical solutions.

Schütz has been monitoring the recent economic growth in China and believes there is still more to come. This recent investment cements Schütz’s place in China, showing long-term commitment. Guangdong province, in which Foshan is located, is part of one of the most important economic centres for the nation and the wider Asian market, notably because it is close to Hong Kong and Shenzhen. The transport connections in the province to the rest of China, an enormous market for chemical packaging,

MANUFACTURING • SCHÜTZ HAS BEGUN 2019 BY EXPANDING IBC AND DRUM PRODUCTION AND RECONDITIONING SERVICES IN CHINA AND AUSTRALIA AS IT RESPONDS TO GROWING DEMAND

are excellent and will assist in reducing Schütz’s carbon footprint through improved logistical possibilities. Foshan is a primary location in the region as a commercial and industrial centre for pharmaceuticals and the automotive sector.

The new development in Foshan houses a 20,000-m2 high-tech plant and a state-of-the-art production building and adjoining office complex covering 9,500 m2. The structures have been designed to achieve optimum internal logistics and play an important role in reaching wider Schütz plans for sustainability targets, notably short distances to customers and short distances within the plant.

A three-layer extrusion blowmoulding machine has been installed in Foshan that complies with the latest and strictest standards. It produces both non-UN containers and IBCs with hazardous goods approval. While designing the Foshan

plant, the corresponding requirements, such as maximum safety measures for absolute cleanliness, were taken into account. The Schütz Foodcert models for sensitive products in the food industry will in future also be part of the portfolio produced in Foshan and certification to industry standard FSSC 22000 is already underway.

Finally, although a smaller development in comparison to Yatala and Foshan, a three-

layer extrusion blowmoulding machine is being added to the St Étienne facility in France. Originally opened in 2014, the site near Lyon was recently modernised by Schütz, with the installation of a new roof, flooring, and shutters. The new blowmoulding machine will serve customers in southern France and nearby regions, providing flexibility and supply security. HCB www.schuetz.net

LABELMASTER HAS EXPANDED its Obexion line of packaging, engineered specifically for the shipping and storage of lithium batteries and devices containing them. The Obexion protective packaging, Labelmaster says, “provides a simple solution that mitigates the risks of lithium battery fires and is compliant with the latest hazmat shipping regulations”.

Obexion Max, the original product, is a lightweight fibreboard box that offers a simple and compliant solution for shipping damaged, defective and recalled lithium ion batteries and devices. Its innovative, fire-retardant material and a proprietary heat shield contains pressure, fire, gases and projectiles without requiring the use of gel packs, heavy liners, pellets or fillers. US DOT Special Permit 20432 allows the shipment of these goods in an Obexion package as excepted shipments by ground or vessel without

requiring the hazard class labels, hazmat shipping documentation, specialised training or carrier surcharges typically associated with fully-regulated Class 9 shipments.

Obexion Max has now been supplemented with three additional products:

• Obexion Express, a single-use model for shipping individual lithium battery devices by ground

• Obexion Recycler, which provides fire retardance for any and all batteries being shipped for recycling or disposal; US DOT Special Permit 20527 allows users to ship mixed loads

• Obexion Vault, an armoured, multi-use receptacle designed for lithium batteries and devices that have gone into thermal runaway or are at high risk; its enhanced flame arrestment and ballistic protection can contain a thermal runaway incident that is already in progress. This model is designed for electronics retailers and manufacturers, third party logistics providers and medical device, power tool and electric vehicle original equipment manufacturers (OEMs).

“A thermal runaway event is one of the most unpredictable and damaging hazards in dangerous goods transport, and fully charged batteries pose the highest danger,” says Alan Schoen, president of Labelmaster. “Unfortunately, the self-conducted tests manufacturers use to obtain special permits are often performed using partially charged, lower-capacity batteries. As a result, packaging may receive a special permit and be considered in full compliance, yet still not provide full mitigation of a thermal runaway event. Obexion packaging, on the other hand, is tested using brand new batteries, with maximum watt-hours, at a full state of charge. So whether a lithium battery is new or old, fully or partially charged, in perfect condition or defective, shippers can be confident that Obexion packaging has been proven to provide the best protection against thermal runaway events.”

Labelmaster’s development of the Obexion packaging concept was recognised during the Industrial Pack 2019 show in Atlanta, Georgia in March, where it was given the Industrial Packaging Award in the ‘Excellence in Transit Packaging’ category. “Lithium battery fires are alarming and can cause significant damage and injury,” Schoen said at the time. “Our customers are thrilled with Obexion’s solid, uniquely engineered design that uses multiple technologies to mitigate the thermal event rather than letting it go and trying to contain it. When lives, property and brand reputation are on the line, it is important to fully understand the packaging solutions available in the marketplace.” HCB www.labelmaster.com/obexion

THE MAINTENANCE AND servicing of tank containers is fundamental to the efficient use of multimodal transport for the movement of dangerous chemicals in bulk. In Russia, however, the vast size of the nation, inconsistent infrastructure and insufficient training cause issues in achieving the proper technical conditions.

“Slowly the service component in Russia is developing,” says Maria Surina, CEO at Spectransgarant Company. “Before, we talked about an almost complete absence of servicing infrastructure, which was a significant obstacle to the development of tank container transport, now the network of depots and washing stations has expanded.” As things currently stand, there are an inadequate number of depots, washing and steaming

stations for the nation, but businesses such as Spectransgarant are working diligently to fill the gaps and raise the standards.

One of the problems faced by industry in Russia is that of maintaining and developing quality. Being able to provide the highest level of work is instrumental to protecting workers, but also developing long-lasting relationships with clients. Due to the longstanding shortage of expertise and facilities across the nation, quality has been slow to develop at the rate of other nations.

“The quality of work performed, unfortunately, does not always correspond to generally accepted standards,” says Surina. “For example, only a few [Russian] depots

have the approval of technological processes required for repairing the frame and vessel.”

To counteract low quality, Surina argues, owners of service enterprises should strongly enforce standardisation and be willing to invest in higher levels of training at all stages of tank container maintenance.

Furthermore, the use of specialised equipment across Russia can be patchy at best, limiting the possibilities for businesses. “We are working on improving the technology of repairing rubberised tank containers used to transport aggressive chemicals,” says Surina. “There are very few rubberised tank containers in Russia, therefore not all enterprises have experience in providing high-quality repairs.”

The volume of tank container business has increased in Russia so much that Spectransgarant has recently completed two new tank container washing stations at its facility in Shakhunya in the Nizhny Novgorod region and the company is aiming to increase the current daily capacity of two to four tank containers to ten.

Alongside under-supported businesses, the environment is another victim of the tank container industry in Russia. Surina explains: “We often encounter low-quality flushing and non-compliance with environmental safety requirements during storage and disposal of waste. This is unacceptable in our business. It is necessary to improve, refine, learn from the experiences of our European colleagues and send staff for training and internships.”

As Surina points out, until recently there were no more than ten repair companies specialising in tank container maintenance in the whole of Russia, but that number has doubled in 2019. Comparing this to Germany – boasting numerous tank container maintenance companies that can be three times the size of their Russian counterparts in a country a fraction of the size with stronger infrastructure – the differences are stark.

Admittedly, there is still a way to go for Russia to provide the highest quality tank container services with issues blighting infrastructure, training and more, but progress is gaining momentum and a strong desire for investment is making the difference. HCB spectransgarant.ru

VTG Tanktainer has established a joint venture with its long-standing Brazilian agent, MissionLine Logistics, to help expand business in Argentina, Brazil, Chile, Colombia and Mexico. VTG-MissionLine Tanktainer do Brasil Ltda, based in São Paulo and led by executive director Alessandra Torazan, will combine MissionLine’s comprehensive logistics network with VTG Tanktainer’s expertise, particularly in hazardous goods and chemical transports and flexitank shipments.

“We have shared a close and successful relationship with MissionLine for many years and are delighted to be extending this proven partnership now. We are confident that by combining our strengths we can create significant added value for our current and future customers,” says Jan Roebken, managing director of VTG Tanktainer.

VTG notes that Brazil is generating substantial demand for tank containers through its position as focus of the regional chemicals industry. In addition, around 20 per cent of Brazil’s chemical exports are shipped to China, where VTG Tanktainer is well established

through its joint venture with Cosco, CoscoVTG, which was established in 2007. www.vtg.com

Israel-based Gadot Group has rebranded its European warehousing and logistics subsidiary, VLS-Group, with the Gadot name as of 1 July. The move follows the sale late last year of its Benelux warehousing activities to Broekman Logistics, leaving the VLS-Group, acquired by Gadot in 2007, with independent toll manufacturing, packaging, tank storage and a warehouse facility in Belgium and chemical warehouses in Frankfurt am Main and Mannheim in Germany, as well as offices at Düsseldorf and Istanbul.

Those divestments have been followed by what Gadot calls “an intense restructuring programme”, which is now reflected in the change of name. “The re-structured VLSGroup activities represent the European platform for our ambitious growth plans in Europe in various activities along the chemical value chain,” says Opher Linchevski, Gadot Group CEO. “That they will operate under the

Gadot flag visualises our commitment and eagerness to become a truly international company with a strong presence in Europe.”

“The activities of VLS-Group in Europe with its about 240 employees do not only continue to contribute to the broad service offering of Gadot’s international supply chain and logistics activities, we also have the capabilities to integrate those services and activities and increase the accessibility for our Gadot Group European client base,” adds Thomas Brakmann, general director of VLS-Group Germany & Turkey and future CEO of Gadot Germany.

www.gadot.com

Broekman Logistics has reported a “strong” growth in revenues last year, from €188m to €200m, with CEO Raymond Riemen calling 2018 “the turning point where the company started to benefit from the investment strategy it pursued in recent years”.

Organic growth in all three business segments – breakbulk terminals, agency and international, and warehousing and distribution – also delivered strong EBITDA growth. In the warehousing and distribution division, 2018 witnessed revenue growth of 18 per cent, following on from 2017’s 16 per cent increase.

The new Venlo warehouse and the acquisition of the VLS-Group warehousing activities in the Benelux area now allow Broekman to describe itself as “the market leader in complex logistics solutions for speciality chemicals in the Benelux”.

www.broekmanlogistics.com

Junzheng Energy and Chemical Group, a privately owned firm based in Inner Mongolia, China, has acquired the Sinochem Logistics Group. Individual business units, including Albatross Tank-Leasing, TechnoPort and NewPort Tank Container, will continue to »

operate under their own names as part of the newly established Gentco Logistics. Albatross says the deal includes funding for future expansion of its tank container fleet. The move is also reported to make Gentco the largest chemical tanker owner in China. www.albatross-tanks.de

The Container Owners Association (COA) has published a Guide to Container Tracking and Telematics Technology, providing container operators, leasing companies and other stakeholders with an overview of the technology issues that they might face, and the choices that are available to them.

“The evolution from ‘wired’ to ‘wireless’ has provided great opportunities - but adds significant complexity, because of the wide range of communication technologies available, how they are used around the world in different countries and communication issues with containers on vessels,” COA says.

The Guide provides a background of the changes over the past decade and discusses the need for proper integration across the supply chain. Primarily aimed at dry box operations, with a specific section on reefer containers, the Guide is available for download from the COA website. www.containerownersassociation.org/technicalresource/it-and-telematics/

Stolt Tank Containers (STC) has launched a Track and Trace solution to enable its customers to follow the status of their cargo online in real time via its website. A direct link to Track and Trace information will be included with every booking placed with STC, which says its mission “has always been to make shipping bulk liquids as easy and convenient as possible”.

The Track and Trace page on the STC website shows details for each individual tank, clearly indicating if there is a change in ETA, if any tanks are short-shipped or if there is any change to the schedule.

“STC is committed to finding new and innovative ways to help customers manage their shipments successfully and efficiently,” the company says. “Track and Trace is a key part of this, giving customers the opportunity to access up-to-date information on their shipments and the status of their tank containers 24/7/365.” www.stolttankcontainers.com

Eurotainer says that all its newbuild tank containers will be equipped with digital thermometers, as well as an additional bracket that will allow the fitment of telematics equipment to allow its customers to track their consignments in real time.

The digital thermometers will buffer temperature measurements for two years so that customers can obtain a read-out of historical temperatures, even if no telematics unit is installed.

www.eurotainer.com

Gibson Energy has closed the sale of its Canadian trucking business to Trimac Transportation for some $70m. The two parties are also discussing the transfer of a field office and shop facilities in Edmonton, Alberta and Gibsons expects this sale to close in first quarter 2020.

The sales complete Gibsons’ divestment of all non-core businesses, as announced in January 2018, with total proceeds of some $325m being reinvested in Gibsons’ core tank storage and pipeline infrastructure projects.

www.gibsonenergy.com

H Essers has taken delivery of 50 new tank containers for the transport of liquid chemicals, taking its fleet up to 880 tanks. In addition, the company has added 44 new cooling trailers for the transport of temperature-sensitive goods.

“All these investments give our company a head start and allow us to serve our customers even more flexibly,” says Dirk Franssens, fleet manager at H Essers.

www.essers.com

FOLLOWING DISCIPLINED PROCEDURES in cold chain logistics is critical to the storage and transport of pharmaceuticals. The slightest temperature variation can cause medications to lose their effectiveness or even become lethal to those that need them most.

It is frequently the distances between manufacturing site, intermediate storage and the destination that cause problems: the longer the goods are outside a regulated environment, the greater the risk that something will go wrong. To ensure the quality of produce is maintained during variable

periods of storage and when in transport, DHL Supply Chain has now invested $150m in expanding its pharmaceutical and medical device distribution network in the US to reduce distances and improve services to customers across the nation.

That investment includes new buildings and technology, plus the fitting of equipment and start-up requirements of new or expanded operations. The plan is for nine new sites to be operational by the end of 2019, bringing critical healthcare products closer to trade partners and patients.

These nine new sites are strategically located across the US and are fully licensed with temperature-controlled spaces to support pharmaceutical storage requirements. Furthermore, the sites allow for packaging and managed transport for integrated solutions, adding another level of diversity in solutions for clients. Customers can now take advantage of a greater range of ambient and temperature-controlled facilities for singleand multi-location storage and inventory management requirements.

“This expansion allows DHL Supply Chain to continue to deepen the connections between our customers and the patients they serve,” says Scott Cubbler, president of life sciences and healthcare at DHL Supply Chain. “This most recent expansion also helps us leverage differentiated routes to market, driving even greater efficiency and productivity across the supply chain for our customers. With this expansion, DHL Supply Chain will have a total of 30 sites designed to support pharmaceutical, biotech and medical device companies.”

DHL Supply Chain has many years of experience handling pharmaceuticals and has worked diligently to create a network of compliant warehouses and vehicles. At these cold chain warehouse, packaging and shipment preparation areas are set up within the same protected environment, using innovative packaging materials to ensure the product temperature stays in the specified range, from the moment it leaves the warehouse until the time it arrives at the destination.

In a separate development, DHL Global Forwarding is expanding its capabilities at its Chicago warehouse located at O’Hare airport, with a portfolio of new services and technologies to support the company’s key growth sectors, particularly for life sciences and healthcare logistics, that was completed in June this year. As with the aforementioned

PHARMACEUTICALS • DHL IS EXPANDING AND IMPROVING ITS CAPABILITIES IN THE US TO ENSURE THE COMPLETE CONTROL OF TEMPERATURE-SENSITIVE HEALTHCARE PRODUCTSDHL HAS ADDED EXTRA CAPACITY AND NEW SERVICES AT ITS O’HARE FACILITY IN CHICAGO

projects at locations across the US, the O’Hare warehouse has been equipped as a temperature management import and export solution. This installation for life sciences and healthcare customers includes DHL SmartSensors that ensure temperaturesensitive shipments are monitored throughout the transport process, helping reduce demurrage costs.

The warehouse has also had an RFID passive and active tracking system installed. The new RFID tag technology provides the facility with the ability to detect where a container is from the moment it arrives at the 40,000-m² warehouse to the moment it leaves, without the need for manual scanning.

“By making digitalisation and automation a priority, we recognise that we can deliver meaningful service and productivity improvements to our customers,” says David Goldberg, CEO at DHL Global Forwarding. “These new services meet our customers’ needs including better and quicker visibility on rates and routes, more responsiveness from their transportation providers and the knowledge that their shipments are secure. This is particularly important to industry sectors such as life sciences and healthcare, which have highly sophisticated and specialised requirements.”

Christopher Gonsowski, station manager at DHL Global Forwarding, Chicago, adds: “Few

freight forwarders have this type of technology in place; meanwhile, DHL Global Forwarding is using it to manage all of its Chicago warehouse cargo inventory. The RFID passive and active technology will help us eliminate manual processes, reduce costs and time in our warehouse and respond more quickly to any exceptions in the transport process.”

Inaugurated in 2015, the O’Hare facility was the first DHL Global Forwarding facility in the US to become an IATA CEIV Pharma Certified Life Science Competence Centre.

The newly updated DHL SmartSensor temperature data logger, part of DHL Global Forwarding’s prioritisation of digitised and automated systems, provides distribution temperature control for the pharmaceutical and life sciences sectors. Using Near Field Communication technology, the sensors log in-transit temperature data of sensitive shipments and power DHL’s key temperaturecontrolled products, which includes DHL Air Thermonet and DHL Ocean Thermonet for air and sea freight respectively. The sensors can operate between -40˚C and +60°C, providing a reliable service for a large swathe of pharmaceutical products.

“We understand the challenges and sensitivities that come with transporting temperature-controlled products,” says

Patricia Cole, global head at DHL Temperature Management Solutions. “The new DHL SmartSensors are part of the need to provide a holistic range of patient-centric solutions and deliver them in a safe and timely manner. We ensure that our customers’ medical products will be treated with the utmost care, as we understand what is at stake – a life that will be improved or in some cases even saved.”

“We have used this alternative temperature-controlled method with various large pharmaceutical customers,” adds Gonsowski. “Through our extensive expertise handling temperature sensitive pharmaceutical products, we follow all necessary good distribution practices and monitor shipments at all times for any temperature excursions.”

These new technologies and solutions follow the recent launch of myDHLi Quote & Book, a convenient online service for comparing quotations and making instant bookings for air, ocean freight and even door-to-door shipments. DHL’s portfolio for the healthcare industry includes expert guidance and services from pharmacists, clinical trials depots, certified stations, GDPqualified warehouses, GMP-certified sites, medical express sites and a time-definite international express network covering 220 countries and territories. HCB www.logistics.dhl

AMERICAN AIRLINES CARGO, Alitalia and Swiss WorldCargo have joined the list of airlines to have approved the recently launched CSafe RAP temperature-controlled container. CSafe Global says the RAP is an industry-leading solution that offers unmatched operational performance, even in the most extreme ambient conditions –from -30˚C to +54˚C. CSafe RAP achieves this performance through a combination of vacuum-insulated panel (VIP) insulation, an innovative air recirculation technology, and a unique, autonomous temperature management system.

The CSafe RAP employs CSafe’s proprietary ThermoCor® VIP technology together with a novel compressor-driven cooling and radiant heating system to precisely maintain user-

defined payload temperatures throughout transport. It also offers a 20 per cent increase in payload capacity over competing systems, making it ideal for life-science companies shipping large volumes of temperaturesensitive pharmaceutical products.