MONTHLY JUNE 2024

MONTHLY JUNE 2024

CHEMICAL TANKER OPERATORS MAKE HAY WHILE THE MARKET RUNS HOT

JOINT MEETING FINALISES 2025 RULES

DISTRIBUTORS RUE RETURN TO NORMAL RAIL WOES HAMPER COMBINED TRANSPORT

Managing Editor

Peter Mackay, dgsa

Email: peter.mackay@enhesa.com

Tel: +44 (0) 7769 685 085

Advertising sales

Sarah Smith

Email: sarah.smith@enhesa.com

Tel: +44 (0) 203 603 2113

Publishing Manager

Sarah Thompson

Email: sarah.thompson@enhesa.com

Tel: +44 (0) 20 3603 2103

Chief

The word ‘politics’ does not normally interfere with the general business of transporting dangerous goods (or the ‘transportation of hazardous materials’). It’s all about safety, really, with a bit of free trade thrown in. That’s not to say that politics doesn’t come into it: the regulations themselves are, after all, agreed and adopted by sovereign states, subject to political pressures at the top of the tree – though in the transport realm, that is normally limited to setting the boundaries of the current agenda.

It is possible, then, to look at the list of agenda items for, say, the UN Sub-committee of Experts on the Transport of Dangerous Goods through a ‘political’ lens, with its new-found focus on sustainability and the circular economy, prioritising issues relating to decarbonisation and the electrification of mobility. That is not to say that there are no safety issues in that area – we have all seen stories about electric vehicles suddenly going up in flames, or burning batteries bringing down aircraft.

I think, in fact, we are quite lucky in the transport world to be relatively free of political interference. The public at large cares little about how goods get to the shops and, on the basis of recent evidence, even senior political figures are remarkably ignorant about the movement of people and freight. As such, there is little mileage in the press getting exercised about transport – unless it’s to do with the price of fuel or disruptions to trade. Even transport accidents usually have to be pretty major to trouble the newspapers, although America’s fourth estate has suddenly got itself terribly excited about railfreight accidents of late.

Politics is more evident when it comes to regulating dangerous goods in the workplace or home – the ‘supply and use’ sector of the trade – as regulated under hazard communication and workplace safety legislation, where the potential harm to people is all the more obvious. It is here where the regulatory action is at its hottest, fuelled by NGOs with an axe to grind and political hot air filling the bubble of press ‘outrage’.

And it is here that a collision of cultures that has become such a feature of the ‘advanced’ economies is happening. On the one hand, there are those who are calling loudly for increasing restrictions on the use of potentially injurious chemicals, even those that support our lifestyles (and those that may help contribute to decarbonisation), such as PFAS; on the other hand, there are those, usually on the political right, who call just as loudly for lighter regulation for fear of hampering economic activity.

Right now, the US Environmental Protection Agency seems to be aligned firmly with the former, having over the past year issued three rules of interest (and concern) to those involved in the handling and transport of hazardous materials. All three, on close inspection, appear muddled and redundant, but they also play into a political environment where such initiatives gain support. That environment may not last long, as there is an election coming up – and we know what happened last time there was a Republican in the White House. The recent European elections, which confirmed a drift to the right, have already put the brakes on some similar projects. All of which makes it difficult to plan for the future.

Peter Mackay

LOOKING BACK, the maritime industry turned a big corner thirty years ago. Regulators – and the public at large – had become tired of the constant litany of maritime incidents, especially those that resulted in large oil spills, with the attendant media coverage of oiled seabirds and sticky goo on formerly pristine coastlines.

In 1994, things were beginning to change; port state control (PSC) regimes were gaining traction and developing teeth, but perhaps the most important event was the publication in May 1994 of Lord Donaldson’s extensive report on the grounding of the tanker Braer in the Shetland Islands in January 1993, which spilled around 85,000 tonnes of crude oil. The report, Safer Ships, Cleaner Seas, co-authored by John Rendle and Alasdair McIntyre, concluded with more than 100 recommendations, urging more transparency in the often murky world of shipping – something that the UK government picked up on, starting to publish a monthly list of all those vessels that had failed inspection in port, naming names and pointing fingers.

It was rather sad, then, that Lord Donaldson was called on again only two years later, after the tanker Sea Empress ran aground at the entrance to Milford Haven in February 1996, spilling more than 70,000 tonnes of oil. His report on that incident identified the lack of overall control in the event of a maritime casualty, leading to the creation of the role of ‘SOSREP’ – the Secretary of State’s Representative – to act as the controlling hand in any response effort.

These two events – as well as the earlier wreck of Exxon Valdez in Alaska – put an end to single-hull tankers once and for all. And, it must be said, since then the idea of ‘substandard shipping’ has

become a thing of the past – although the emergence of a ‘dark’ or ‘shadow’ fleet as a way of circumventing sanctions, as is apparent now in the movement of Russian fuel, risks a return to substandard operations.

Also in 1994, the argument about Kemler versus Hazchem codes was still rumbling on. The UN ECE’s experts in WP15, which is responsible for ADR, were insistent that the European system should be implemented for domestic as well as international transport across all ADR contracting parties. UK fire brigades made representations via the UK Home Office and the European Fire Brigades Federation, promoting the Hazchem concept as the preferred pan-European emergency action system but this failed to make it into ADR, just as the European Commission was preparing the Framework Directive. Still, at least the UK managed to keep the Hazchem system for domestic transport, and it is still in place thirty years on.

Another hot topic among the ADR crowd in 1994 was the use of special agreements; these had proliferated since being introduced in 1964, initially as a way to permit the use of tanks manufactured from polyester resin with glass fibre – what we might now call FRP tanks – in those countries that were happy to allow them. In the thirty years since then, the number of special agreements had mushroomed –Special Agreement 3478 had just been created. As HCB said at the time, this amounted to a whole additional version of the technical annexes. In response, WP15 agreed in September 1993 to limit the validity of special agreements and other temporary derogations to five years. That limit is still in ADR.

THE FIRST LAW of thermodynamics is the Law of Conservation of Energy. Universal energy is constant - energy is never lost, it changes its form. Energy to do work is an accepted definition. When it is displaced or dissipated, it is still available for work somewhere else, but made unavailable for work here.

The second law of thermodynamics can be described as follows: There are two kinds of processes, heat and work, that can lead to a change in the internal energy of a system. Heat always flows from hot to cold regions. When a quantity of heat flows out of a hot body, its entropy decreases by the amount of heat divided by the original temperature. When that same quantity of heat flows into a cool body, its entropy increases by the amount of heat divided by the original temperature of the cool body. This is an irreversible process.

This is equal to any change in the energy of a living system. It results in a corresponding change in the energy of the surroundings inside and outside that system.

In other words, quantified energy cannot be created or destroyed. Information influences matter and energy because it always is a part of them. In fact matter, energy, information and mass form one physical reality because every particle, atomic or subatomic, every biological cell which form the fabric of all existence re: living systems, contain information in themselves about themselves.

Entropy and Negentropy can be understood and used as:

Physical Entropy

A measure of uncertainty about the state of a physical system. One state amongst all possible states it can be in.

Information Entropy

A measure of uncertainty about a message. One message among all possible messages that a communication source may produce.

Both forms of entropy can be attributed to a ‘cost’ of information or energy which needs to be used to restore disorder towards order (e.g. cleaning up your bedroom). Information relating to useful work to be done (energy) in physical systems such as heat or steam and communication systems is the need for correcting information by adding or deleting meaning to convey a clear message = also work to be done (energy).

Entropy in the context of our entropic universe (second law of thermodynamics) can be understood as:

1. Beneficial: it allows for life to be formed and sustained. In an non entropic universe, nothing would move.

2. Future: entropy can’t decrease, it increases over time and will lead to maximum universal equilibrium, end of times (heat death).

Entropy and negentropy can both be interpreted as information. Entropy as the information we don’t have and negentropy as the information we do have. The potential disorderly impact of using or not using information is key, as follows: less energy, more entropy; more energy, less entropy.

For our work in the petrochemical industry, awareness of entropy and negentropy is crucial. Imagine doing a job without sufficient information? And yet, this is precisely what I have been observing during my trainings worldwide. People don’t use optimal information, because they are unaware of entropy.

This is the latest in a monthly series of articles by Arend van Campen, founder of TankTerminalTraining, who can be contacted at arendvc@ tankterminaltraining.com. More information on the company’s activities can be found at www.tankterminaltraining.com.

DOES EVERY DISASTER produce meaningful prevention methods? Do even most disasters produce them? There is more to this than meets the eye – ‘learning lessons’ can be misleading.

While identifying lessons is relatively straightforward, true learning is much harder. Lessons tend to be learned on the hoof and not made permanent, as opposed to being generalised in order to become institutionalised.

Mistakes are often repeated incident after incident, even though specialists in this field can predict the problems that will arise in major incidents. Common problems include communication system failures, fractured command and control structures, and slow resource deployment.

There are factors that unfortunately contribute to repetition, namely uncertainty and Infrequency because the rarity of disasters makes it challenging to validate response strategies effectively.

Complexity Disasters occur in multifaceted contexts, such as simultaneous natural hazards and conflict.

Perishable Lessons Even when lessons are identified, they may not lead to lasting behavioural changes.

Predictable problems Certain issues (e.g. communication failures) recur across incidents.

In summary, while we strive to learn from disasters, the road to meaningful prevention remains complex. It requires sustained effort, institutionalisation of lessons, and a commitment to continuous improvement.

For example, the capsizing of the car ferry Herald of Free Enterprise in 1987 was exacerbated by the presence of dangerous goods, both declared and undeclared. That tragedy was mainly caused by the failure of the crew to close the bow doors (the assistant bosun was asleep). However, the nature of the cargo making matters worse led to lessons being identified and actually implemented.

As a result of this disaster, much stricter controls were introduced all the way through the maritime transport chain, from cargo bookings to documentation to load checking, right through to stowage on board ship.

Transporting dangerous goods is, in itself, a critical operation that requires careful planning, handling, and execution to ensure the safety of people and the environment. Let us explore some key lessons

learned from disasters involving the transport of hazardous materials:

Understanding the risks First responder personnel should receive specialised training to recognise the hazards involved in incidents. Their role is crucial in preventing further damage or injury and mitigating risks. Emergency response procedures must include measures to contain and control the spread of dangerous goods. Chemical composition matters The chemical composition and quantity of the transported substance significantly influence the consequences of accidents.

Dangerous goods can be harmful to people, the environment and infrastructure when transport accidents occur. Learning from history is essential to avoid repeating the same mistakes. To reduce risk during the transport of dangerous goods, consideration should be given to:

Optimising transport routes Choose safer paths that minimise exposure to densely populated areas and sensitive ecosystems.

Collaboration and preparedness Collaboration among manufacturers, receivers, government agencies, and emergency services is crucial. Preparedness includes training, communication, and coordinated response efforts. Containment measures play a vital role in minimising the impact of dangerous goods incidents.

In summary, learning from past disasters helps us build safer transport systems, protect lives, and safeguard the environment. By implementing preventive measures and optimizing infrastructure, we can reduce risks associated with transporting hazardous materials.

During crises, effective communication is critical for managing emergencies and minimising harm. Here are some strategies to enhance communication:

Clear Protocols and Roles Establish clear communication protocols for different scenarios. Define roles and responsibilities for responders, authorities, and affected parties. Ensure everyone knows who to contact, how, and when.

Unified Communication Channels Centralise communication channels to avoid confusion. Use tools such as emergency hotlines, broadcast systems, and official social media accounts. Provide consistent updates across all channels.

Multilingual Communication In diverse communities, multilingual communication is crucial. Translate messages into relevant languages. Use pictograms, symbols, and visual aids for

universal understanding.

Real-Time Information Sharing Use technology to provide real-time updates. Emergency apps, SMS alerts and radio broadcasts can all be used to disseminate critical information. Technology can also be extremely useful by sharing details on evacuation routes, shelter locations, and safety measures.

Empathy and Compassion Show empathy in communication. Acknowledge fear and uncertainty. Use reassuring language and emphasise community support.

Social Media Monitoring Monitor social media platforms for rumours, misinformation, and urgent requests. Respond promptly and correct false information as soon as it appears.

Two-Way Communication Encourage feedback from affected individuals. Listen actively to their concerns. Address questions and provide accurate answers.

Coordination Among Agencies Foster collaboration among emergency services, government agencies, and anyone else involved. Share information seamlessly to avoid duplication or gaps.

Visual Communication Tools Use maps, infographics, and videos to convey complex information. Visual aids are very good at helping people understand risks and actions.

Training and Drills Regularly conduct communication drills for responders and the public. Practice using communication tools effectively. Remember, effective communication saves lives and ensures a coordinated response during crises.

This discussion avoids aviation tragedies involving dangerous goods and focuses on lessons learned from avoidable disasters, although that terminology seems horribly flippant. Also, aviation accidents involving dangerous goods are the subject of another discussion (…a mythtery).

The four main modes of transport all have their own unique codes of operation and their own ways of dealing with dangerous goods, irrespective of how harmonised they have become with each other.

Each of the four modes of transport has its own inherent risks and each of the modes of transport has its own way of dealing with them. Legislation is only half the battle; compliance with the legislation seals the deal.

This is part of a regular series of articles by Grahame Moody, senior analyst (technical services) of Hazmat Logistics, who can be contacted at sales@hazmatlogistics.co.uk. More information on the company’s activities can be found at www.hazmatlogistics.co.uk.

MULTIMODAL • THE JOINT MEETING CONCLUDED ITS WORK ON THE 2025 TEXTS OF RID, ADR AND ADN AT ITS SESSION IN MARCH. ITS DECISIONS REMAIN TO BE RATIFIED BY THE MODAL BODIES

THE JOINT MEETING of the RID Committee of Experts and the Working Party on the Transport of Dangerous Goods (WP15) held its spring 2024 session in Bern from 25 to 28 March. Due to a tight schedule, the session kept itself largely concerned with revisions to amendments already adopted and some minor changes, with a few items adopted for entry into force in 2027.

The role of the Joint Meeting is to provide a forum for the modal bodies that oversee the three sets of European dangerous goods transport regulations, ADR (road), RID (rail) and ADN (inland waterways); ADR is being used more widely than just in Europe, resulting in non-European countries now attending the meetings of WP15. The aim of this forum is to encourage the harmonisation of the three sets of regulatory provisions, the better to ensure the seamless multimodal transport of dangerous goods across Europe.

The texts of RID, ADR and ADN that will enter into force on 1 January 2025 are now nearly complete; the Joint Meeting was to be followed by separate sessions of WP15 (for ADR) and the RID Committee of Experts, at the end of which the full list of amendments could be prepared.

The Joint Meeting’s spring session was chaired for the first time by Silvía Garcia Wolfrum, who has stepped up following the retirement of Claude Pfauvadel. The new vice-chair is Soedesh Mahesh (Netherlands). The session was attended by representatives of 22 full member countries (including the US) as well as Zimbabwe, along with the EU Agency for Railways (ERA) and 13 nongovernmental organisations.

The first part of this two-part report in the previous issue (HCB May 2024, page 8) covered issues related to transport in tanks, standards and a few matters of interpretation.

This second and final part of the report looks at the remainder of the agenda.

Liquid Gas Europe (LGE), following up on the decision at the previous session to update the graph at the end of packing instruction P200, arrived with text for a new note to clarify the intention of the graph. The Joint Meeting accepted the text, which will appear alongside the graph in the 2025 editions of the regulations:

Note: The graph above can be used to determine the correct filling ratios for the mixtures listed in 2.2.2.3.

LGE also continued its campaign to revise the definition of ‘liquefied petroleum gas’ to reflect the use of bio- or renewable material.

As it stands, the relevant UN entries, 1075 and 1965, refer specifically to either ‘petroleum’ or ‘hydrocarbon’, which do not, strictly speaking, cover the new brands of bio-LPG and renewable dimethyl ether (rDME) that are coming onto the market. LGE proposed adding a new special provision to those UN entries specified, so as to make it clear that material produced from renewable sources can also be covered, as well as a new definition for ‘LPG’.

As this amendment will not enter into force until the 2027 editions of the regulations appear, and also that the UN Sub-committee

of Experts on the Transport of Dangerous Goods (TDG) is due to discuss LPG/DME blends at its June 2024 meeting, the Joint Meeting felt it would be best to defer a final decision until its next session in September 2024. LGE will provide an updated document for that meeting.

The European Industrial Gases Association (EIGA) reported a problem that has emerged since the 2023 editions of RID/ADR/ADN came into force; the current text includes an additional marking requirement for existing acetylene cylinders, prompted by a decision made by the UN TDG Sub-committee in 2021. Although EIGA supported the change, in practice it has proved impossible to implement as, due to their design, certain types of non-UN pressure receptacles do not have the space needed to carry the additional marking. EIGA appealed for a new transitional measure to allow such cylinders to continue to be used.

Some delegations supported the proposal but others recommended alternative methods of cylinder marking such as additional neck

rings. There was also a suggestion that the UN TDG Sub-committee should be asked to resolve the issue. In the meantime, it was agreed that a multilateral agreement could be concluded to extend the compliance date until 2027. EIGA offered to present a revised proposal at the next session.

EIGA had a similar problem with another new requirement for the marking of new acetylene cylinders, which again places an impossible requirement on non-UN cylinders. EIGA offered a new 6.2.3.9.9.1 to provide a deviation for such cylinders. In this case, the Joint Meeting did not agree with EIGA’s proposal, though a more detailed paper may be submitted for the next session.

EIGA had a measure of success with its third paper, which included a modification of the requirements for US Department of Transportation (DOT) pressure receptacles. The relatively new 1.1.4.7 allows for the import and export of such pressure receptacles but the headings of 1.1.4.7.1 and 1.1.4.7.2 refer to ‘gases’ rather than ‘pressure receptacles’. As P200 applies to some substances that are not

gases of Class 2, the use of the word ‘gases’ in these cases is misleading. An informal document from the US supported the change but offered a slightly different text to that proposed by EIGA.

The Joint Meeting stressed that it was not the intention of 1.1.4.7 to exclude the transport of non-gaseous substances and agreed to make the suggested change, to take effect in 2027. Again, it was suggested that a multilateral agreement might be put in place to allow the transport of the affected substances. The titles of 1.1.4.7.1 and 1.1.4.7.2, respectively, will be amended in 2027 to read:

Import of dangerous substances in pressure receptacles

Export of dangerous substances in pressure receptacles and of empty uncleaned pressure receptacles

LGE sought an amendment to P200 to permit the interval between the period inspection of LPG cylinders manufactured according to EN 14140 to be extended from 10 to 15 years, as already exists for those cylinders manufactured according to EN 1442, EN 13222-1 or Annex I, parts 1 to 3 to Council Directive 84/527/EEC. Transitional provision 1.6.2.9 does allow such an extension but it is not made explicit in P200(12)(1.3).

After LGE provided some supporting information in an informal document, the Joint Meeting adopted the amendment proposed, inserting a reference to EN 14140 in P200(12) (1.3). Some delegations indicated they would look to conclude a multilateral agreement to offer a solution pending the implementation of the change in the 2027 texts.

The European Cylinder Makers Association (ECMA) raised a technical issue relating to type 4 pressure receptacles manufactured in accordance with EN 17339. These cylinders, which can be elements of both batterywagons/battery-vehicles and multiple element gas containers (MEGCs), have a non-metallic

liner, either plastic or welded metal, with a composite material overwrap. Due to this method of construction, some manufacturers require that a minimum pressure be maintained during carriage, which could be at least 5 bar and possibly up to 20 bar. While such pressure receptacles are specifically approved for the carriage of UN 1049 Hydrogen, compressed, when being transported for assembly, maintenance or disposal, however, they are typically filled with UN 1002 Air, compressed, UN 1066, Nitrogen, compressed, or UN 1956 Compressed gas, nos, in order to maintain the required pressure. This should be reflected in the regulations, ECMA felt, seeing that, as things stand, such transport is not in compliance.

The proposal attracted several comments and questions, some of which were set out in an informal document from France. Following discussion, it was agreed to resume consideration of the proposal at the next session of the Joint Meeting, on the

basis of a revised and more detailed proposal from ECMA.

ECMA also reported that similar pressure vessels are employed for the storage of high-pressure gases in fixed locations, as they have a lower weight than other types of cylinder and so lend themselves to certain installations, such as on the roof of a building. In this case, pressure vessels are constructed in accordance with design codes recognised by the relevant competent authority. In order to be able to move such pressure vessels, a new special provision would be required; ECMA offered a proposed text.

While there was general support for ECMA’s argument, it was agreed that its proposal was too broad and further work was needed to make it more specific to the topic ECMA outlined. ECMA will return with a more detailed proposal for the next session.

LGE, in an informal document, raised the topic of the marking of LPG cylinders, specifically the allowance provided by 6.2.3.9.4

that, when used for the carriage of UN 1965 Hydrocarbon gas mixtures, liquefied, nos they do not need to be marked with the mass of the cylinder and the minimum wall thickness.

LGE’s point was that many non-European countries that now apply RID/ADR/ADN use other UN numbers for LPG (such as 1011, 1075 or 1978). It sought the Joint Meeting’s opinion on whether it made sense to extend the coverage of 6.2.3.9.4.

The Joint Meeting offered support in principle but asked for more information. LGE promised to return with an official proposal at the next session.

EIGA also provided a report from the intersessional working group on test periods for battery-vehicles filled in accordance with packing instruction P200, which had met in November 2023 with the aim of working up a formal proposal for submission to the Joint

reported that the proposal will be limited to seamless steel Type 1 cylinders and tubes for helium and hydrogen, compressed. The paper elements of battery vehicles, the valves and previous session on the use of intermediate bulk containers (IBCs) for the transport of UN 2672 Ammonia solution at a concentration of 35 per cent. Its informal document recapped earlier concerns, and asked for contributions

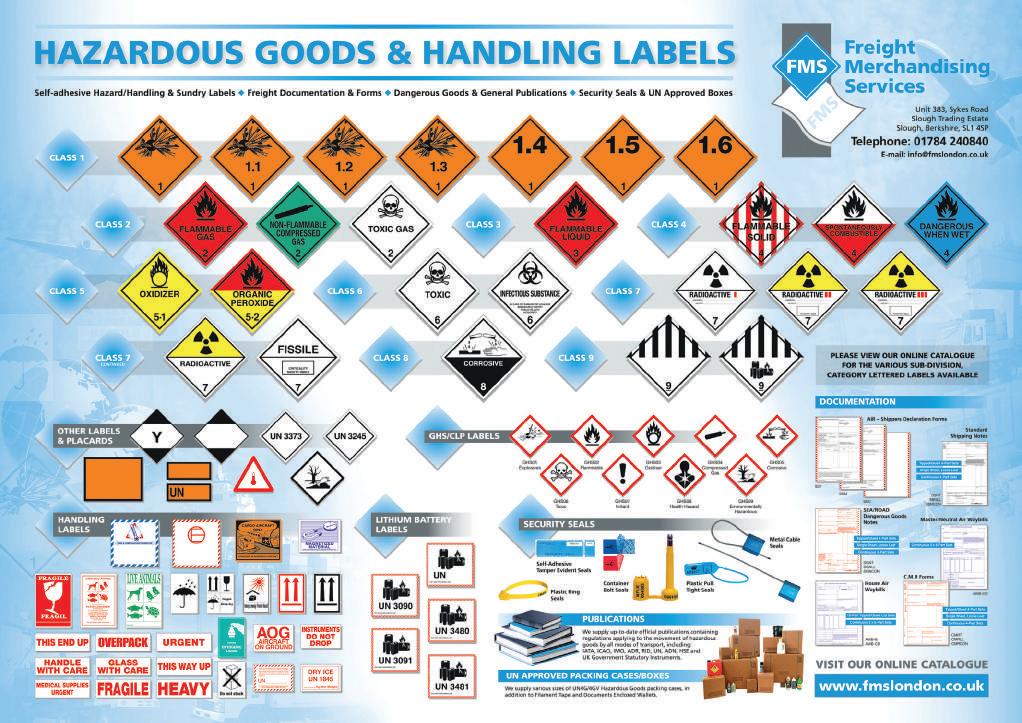

Tel: +44 (0)870 850 50 51

Email: sales@labeline.com www.labeline.com

Germany, meanwhile, offered its own informal document, reiterating its concerns with the proposal. The UK added some questions for delegates, in order to get a clearer picture of

what is the highest concentration of ammonia concentration being transported in IBCs and, where IBCs are being used, are vents routinely fitted? The UK plans to use the responses to

these questions in drawing up further proposals to present to a future session of the Joint Meeting.

There were a few proposals that had been carried over from earlier sessions that the Joint Meeting now sought to finalise, to allow the amendments to be included in the 2025 texts of RID/ADR/ADN. The first of these came from the European Council of the Paint, Printing Ink and Artists‘ Colours Industry (CEPE), on the topic of performance tests for the packaging of small quantities of paints and printing inks classified as environmentally hazardous, UN 3082. The problem goes back to the identification of certain water-based paints as environmentally hazardous as a result of the preservatives they contain. Industry continues to experience significant difficulties in sourcing suitable UN-approved packagings for the transport of these substances in small quantities. A transitional provision was included in RID/ADR 2023 but a more permanent solution would be welcome. CEPE also noted that the World Coatings Council (WCC) has made a similar approach at the UN TDG Sub-committee.

CEPE proposed certain changes to 1.6.1.51 to make the transitional provision more general in nature and to extend its applicability by a further two years to 30 June 2027. The Joint Meeting at this point agreed only to amend ’30 June 2025’ to ’30 June 2027’.

The UN ECE and OTIF secretariats followed up on the results of earlier work by the Ad Hoc Working Group on the Harmonisation of RID/ ADR/ADN with the UN Recommendations, which had made proposals to both the Joint Meeting and the UN TDG Sub-committee; this has resulted in the Sub-committee making some further changes, some of which were not considered to be purely editorial, and would thus need to be adopted by the Joint Meeting. These all relate to batteries and have been adopted for inclusion in the 2025 texts.

To reflect the insertion of parallel requirements for sodium ion batteries alongside the existing provisions for lithium cells and batteries, 2.1.5.2 is amended to read:

Such articles may in addition contain cells or batteries. Lithium metal, lithium ion and sodium ion cells and batteries that are integral to the article shall be of a type proven to meet the testing requirements of the Manual of Tests and Criteria, Part III, sub-section 38.3. For articles containing pre-production prototype lithium metal, lithium ion or sodium ion cells or batteries carried for testing, or for articles containing lithium metal, lithium ion or sodium ion cells or batteries manufactured in production runs of not more than 100 cells or batteries, the requirements of special provision 310 of Chapter 3.3 shall apply.

The words “or sodium ion cells or batteries” are inserted after “lithium cells or batteries”, twice in each case, in packing instructions P006(5) and LP03(4) and in 5.2.1.9.1. The term “lithium battery mark” had already been replaced by “lithium battery or sodium ion battery mark” but, in a flourish of good sense, this has now been replaced by “battery mark” in 5.2.1.9 and SP188.

It was noted that further editorial corrections by the secretariats would be considered at the forthcoming sessions of WP15 and the RID Committee of Experts’ standing working group.

France asked for an editorial modification to the newly adopted provision AP12, relating to the carriage in bulk of specific categories of wastes containing asbestos (UN 2590 and 2212). Having met with carriers, it emerged that the term ‘liners’ is vague. The third paragraph of AP12 provides definitions for both the inner lining and outer lining, which suggests that there is another structure to the packaging as well as the two liners. To avoid misinterpretation, France suggested this should be changes to ‘layers’ (‘enveloppes’ in French and ‘Schutzhüllen’ in German). That wording should also be reflected in the new CW38/CV38 in 7.5.11.

The Joint Meeting adopted the changes proposed by France, except that it chose ‘components’ for the English version, as from the 2025 texts.

Belgium queried the application of special provision 376 to damaged or defective cells and batteries; SP 376 requires such cells and

batteries to be packed and carried in accordance with P911 or LP906, both of which require “surrounding conditions in which the packaging may be used and carried…”. However, neither P911 nor LP906 include details about how these “surrounding conditions” are to be communicated to all parties involved in the transport chain. There is, Belgium contended, a significant risk that the specified conditions will therefore not be met. Belgium had raised this issue at the previous session in an informal document, urging that competent authority approval should be sought, at least for transport by rail or inland waterways, but this proposal was

The Joint Meeting had, though, promised to resume consideration of the topic on the basis of an official document from Belgium, which was now provided. In it, Belgium proposed the inclusion of a new special provision to require the consignor to inform the loader and carrier of the surrounding conditions, and to provide the name of a responsible person and their

While there was some support in principle for the proposals, some experts felt further

consideration was needed. Following the discussion, Belgium said it would work on an updated proposal and submit this to the UN TDG Sub-committee at its June 2024 session.

There being little time left to start discussion of new proposals for this biennium, those that were presented were largely editorial in nature, though not all found favour among the Joint Meeting experts. The first of these came from Russia, which asked for the addition of definitions for ‘net mass of dissolved gas’ and ‘gross mass of dissolved gas’ in 1.2.1. Its paper said this would clarify whether the solvent should be included in the calculation.

Most of those who spoke on the proposal felt that more detailed justification was required. A revised proposal will be prepared for the autumn session of the Joint Meeting.

Do you consign Dangerous Goods?

Finland queried the intent of 5.4.1.1.3.1, which says that the technical name of an nos substance, as required by special provision 274, need not be added in the case of wastes. Its paper said that this provision should apply

composition, classified according to 2.1.3.5.5.

Since 1st Jan 2023, all UK consignors must have an appointed DGSA.

It offered some text to clarify the provision.

The Joint Meeting agreed with Finland’s proposal, and amended the last paragraph of 5.4.1.1.3.1 to read:

If the provision for waste as set out in 2.1.3.5.5 is applied, the technical name, as prescribed in Chapter 3.3, special provision 274, need not be added.

This change will be included in the 2025 editions of the regulations.

The Netherlands came to the Joint Meeting with a proposal that it had already submitted to WP15, namely the clarification of the term ‘closed vehicle’. It said that ADR is not clear as to whether a curtain-sider can be considered ‘closed’ and that the UN Model Regulations has a better definition. Its paper to the Joint Meeting included a comparison of the definitions of various types of wagon and vehicle in RID and ADR, which highlighted the current vague definition.

The Joint Meeting agreed with the Netherlands’ proposal in principle, though some experts felt that transitional measures would be required and others were concerned about the possible impact on operators. The Netherlands offered to check if any consequential amendments might be needed and to consult with WP15 at its next meeting.

Sweden reported on a growing problem in its country, highlighted by a recent outbreak of African swine fever among wild boars. There is a need to transport infected carcasses on a large scale in a safe manner. Bulk container codes BK1 and BK2 are assigned to UN 3373 Biological substance, category B (animal material only) but it is difficult to find appropriate containers in Sweden. In addition, there is no ‘VC’ code assigned to UN 3373. As VC3 is assigned to UN 3291 Clinical waste, unspecified, nos, Category B, it would seem sensible to assign it also to UN 3373.

In addition, Sweden pointed out that animal material of Category A (UN 2814 and 2900) may also need to be carried in bulk for the same reasons. Again, the BK1 and BK2 codes

are assigned to these UN numbers but there is no ‘VC’ code. Would it be appropriate to add VC3 against these entries as well? And what about solid medical waste of UN 3549, for which there is no bulk code assigned? This might be a good time to rationalise these provisions, given the potential for a further pandemic.

The Joint Meeting agreed to Sweden’s first proposal and added ‘VC3’ in column (17) of the Dangerous Goods List against the second entry for UN 3373. This change will appear in the 2027 editions of the regulations. There was also some discussion of Sweden’s other points, which may form the basis of a revised proposal for a forthcoming session.

In an informal document, Germany argued that the requirement in 5.3.2.2.1 of RID/ADR/ ADN, which requires that the fitment of orange-coloured plates must withstand engulfment in a fire, should apply to the material of the plate itself as well, if the plate is to provide the necessary hazard communication. There have been various discussions on the fire resistance requirements in the past, as they are currently rather vague. There was an exchange of views

but no resolution; Germany invited those who spoke to clarify their positions so that a new document can be prepared for the next session.

The UK had noticed that, at the recent session of the RID Committee of Experts’ standing working group, an amendment had been adopted that used the word ‘ton’ rather than ‘tonne’. In an informal document, the UK pointed out that ‘ton’ is an imperial unit and is not the same as the metric ‘tonne’. It noticed that ‘ton’ is used occasionally in RID/ADR/ ADN and asked for these instances to be corrected to ‘tonne’. The Joint Meeting acceded and, to take effect in 2025, made the change, which affects the table in 1.2.2.1 (in the row for ‘Mass’).

Spain presented an update on the discussions of the informal working group on the reduction of the risk of a boiling liquid expanding vapour explosion (BLEVE), which has been tasked with developing technical requirements for fire suppression systems installed in the engine compartment of a vehicle, as required by 9.7.9.1 of ADR. The

VARIOUS CHANGES HAVE BEEN ADOPTED FOR 2025 TO THE PROVISIONS COVERING THE TRANSPORT OF WASTE DANGEROUS GOODS

working group has been working with the Swedish testing institute RISE, which has prepared a draft proposal. This has been discussed by the working group and with the UN ECE secretariat, the European Committee for Standardisation (CEN) and the World Forum for Harmonisation of Vehicle Regulations (WP29). The working group met again this past January to review an new draft proposal, which is intended to be developed into an independent technical code; it is expected that this will soon be ready to take back to WP29, after which it will be available for use in ADR.

The working group had also begun discussions on the thermal protection of wheels, though no definitive conclusions have so far been reached; discussions are expected to continue at the working group’s next meetings.

Germany and the International Road Transport Union (IRU) provided a report on the latest meetings of the informal working group on e-learning. In November 2023 the group agreed to limit the potential for e-learning to refresher training and developed a proposal for amendments to 8.2.2.5. At this point there was a request to clarify the meaning of ‘e-learning’, to differentiate those distance learning solutions where an instructor is present online. Proposals for new definitions for 1.2.1 were developed. It had been hoped to have all this in a final form in time for the

March session of the Joint Meeting but that was not the case; a lunchtime meeting was arranged during the session, which made more progress, but it was felt necessary to hold another online meeting in April, where amendments for ADN will be considered.

The European Waste Management Association (FEAD) reported on the eight meeting of the informal working group on the transport of hazardous waste, which took place on 8 February. The meeting reviewed the progress made so far in addressing the issues adopted by the Joint Meeting in 2019 and the further work that has been carried out. Some of that is working its way through the rulemaking process: for example, France said it would initiate a multilateral agreement to allow the new rules on the transport of wastes containing asbestos, adopted for entry into force in 2025, to be used before that date. [That agreement, M356, was initiated in early April and has so far been counter-signed by Germany and San Marino.]

The adoption of the new 5.4.1.1.3.2 in the 2023 texts of RID/ADR/ADN to allow the mass of waste to be estimated in certain circumstances has not proven very useful in practice, as its applicability is very limited. FEAD, in collaboration with Ireland, has since then submitted proposals to extend the scope of the provision and further such action was discussed. It is likely that a new proposal will be submitted to the September session of the Joint Meeting.

Other topics still being discussed by the working group include: the carriage of empty uncleaned packaging, with ideas for a new provision (provided by Ireland), tightly defined as being applicable only to waste management activities; the carriage of solid materials contaminated with clinical wastes and pharmaceuticals; household hazardous waste collections; the carriage of batteries in bulk; and the carriage of used pressure receptacles (e.g. aerosols), which is awaiting a proposal from Austria.

France provided a report from the informal working group on the improvement of transport of dangerous goods occurrence reporting, which had met in October 2023. It was agreed that the criteria described in 1.8.5.3 should be clarified. For example, for a carriage under 1.1.3.6, in the case of loss of containment there is no reporting to be done, but in the case of an imminent risk of loss of containment a report should be established even if the quantities carried are under 1.1.3.6. A modification of those criteria could be a benefit to ensure a global risk analysis. The working group was of the opinion that the notion of imminent risk of loss should be better specified by adding a list of cases.

The working group also felt that the notion of a ‘short-term report’, to include those factual elements available at the point of the occurrence, and ‘long-term report’, for those elements that require further investigation, was sound. This is the approach taken under the Common Safety Methods on the Assessment of Safety Level and Performance (CSM ASLP) of Railway Operators.

Progress has been made on drafting proposals for revision of 1.8.5.1, 1.8.5.2 and 1.8.5.4 and it is expected that a formal proposal will be made to the Joint Meeting at its next session. Discussion of the criteria in 1.8.5.3 is continuing.

The next session of the Joint Meeting will be held in Geneva from 9 to 13 September 2024. Its spring 2025 session will take place in Berne from 24 to 28 March. It was also noted that the Ad Hoc Working Group on the Harmonisation of RID/ADR/ADN with the UN Recommendations is scheduled to meet in Geneva on 15 and 16 April 2025.

about the increasing problem of counterfeit airbags and how industry and federal agencies can work together to resolve the issue.

THERE ARE MANY routes available for the harried dangerous goods professional to keep on top of regulatory changes – reading HCB among them. But perhaps the most fun way to learn about the latest amendments is to attend the Annual Forum of the Council on Safe Transportation of Hazardous Articles (COSTHA). This year’s event, the first to be entirely in-person rather than online since 2019, took place in Fort Myers, Florida from 21 to 26 April and attracted around 220 people. For many COSTHA members, this was the first time they would have managed to meet their peers in person, something that is a frequently overlooked advantage of the event. It has been COSTHA’s great success over decades to provide plenty of opportunity for conversation and the sharing of problems and solutions, not just between COSTHA members

but also with the regulators themselves. And the regulators do attend in numbers, not only from the US federal agencies but also from other territories.

The Annual Forum may be the highlight of the COSTHA year but there is constant activity, with attendance at international regulatory meetings and quarterly sessions for its members alongside advocacy efforts and information bulletins. In fact, the plenary conference forms only a small part of the Annual Forum, with sectoral meetings before the main sessions and training courses, provided by COSTHA members, book-ending the week. As an illustration of what goes on, the North American Automotive Hazmat Action Committee (NAAHAC), one of COSTHA’s sectoral groups, held a meeting prior to the conference, where there was a big discussion

Another longstanding topic at COSTHA has been improving the image of the hazmat/DG professional. Work in this area started over a decade ago, with prompting from the Pipeline and Hazardous Materials Safety Administration (PHMSA). It was clear that those working in the field do an expert job but it is not well rewarded and not highly regarded within many organisations; there is also no clear career path. COSTHA established a working group, currently being led by Tracie Cady of the Bureau of Dangerous Goods (BDG) and Carrie Ott of Honeywell, with support from COSTHA staffers L’Gena Shaffer and Chris Yakush.

The team’s mission is to develop a strategic approach to enhancing the value-adding and key role image of those in the business so as to help them achieve full recognition within their companies, the industry at large, government agencies and the general public. The main problem, COSTHA says, is that it is very difficult to define the role of the hazmat professional within an organisation – these

employees may sit in various different departments, depending on the company structure, and have different roles and responsibilities. The team is working on developing a template job description for three levels – beginner, intermediate and expert – and aiming to conduct a new salary survey (it was last carried out in 2012).

COSTHA has also arranged a series of professional development webinars, running through this year, to share experiences of career paths and help develop a ‘brand’ for DG professionals. This will culminate in a recap session, scheduled for 14 November. In addition, the team is working to create a document to act as a template for discussions with other associations and educational establishments, including the use of recognised accreditations such as the Certified Dangerous Goods Professional (CDGP) and Dangerous Goods Safety Adviser (DGSA).

This work will continue, probably for a long time. COSTHA is always open to new volunteers to help with the project.

Another focus project for COSTHA is the life sciences sector, where it has initiated a group with the mission of exploring common issues faced by the pharmaceutical and healthcare industries and identifying solutions to support companies in compliance activities for global transport. The Life Sciences Roundtable (LSR) group is led by co-chairs Janet KolodzieyNykolyn of Pfizer and Wim Verkuringen of Johnson & Johnson, with board members Jay Johnson (Labelmaster), Carolyn Weintraub (Reckitt) and Todd Haley (Eli Lilly) and support from COSTHA staffers L’Gena Shaffer and Ana Diaz.

The sector faces many issues during global transport beyond those relating to the transport of dangerous goods. There are particular packaging and classification issues, cold chain logistics, chain of custody requirements, and strict trade compliance. Other types of regulations may also apply to global shipments, including chemical control regulations such as the Toxic Substances Control Act (TSCA), Drug Enforcement Administration (DEA), Bureau of Alcohol,

Tobacco, Firearms and Explosives (ATF) and Chemical Weapons Convention (CWC), as well as customs issues.

LSR’s two active priorities include the adoption of special provision 601 from ADR into the US Hazardous Materials Regulations (HMR) and the UN Model Regulations, to provide an exemption for pharmaceutical products. SP601 states: “Pharmaceutical products (medicines) ready for use, which are substances manufactured and packaged for retail sale or distribution for personal or household consumption are not subject to the requirements of ADR”. These products do not present a hazard during transport and the inability to use the exception outside of ADR countries places COSTHA members at an economic disadvantage.

In October 2020, COSTHA petitioned PHMSA to incorporate the text of SP601 into HMR; this petition was denied in July 2021. Since then, LSR members have met with PHMSA and with

packaging companies to find a way to get around PHMSA’s concerns. At its meeting at the start of the Annual Forum, LSR agreed to submit a request for a DOT Special Permit, which would focus on last-mile deliveries.

A second priority issue is the shipment of samples of energetic materials. The problem is that there are no excepted quantity provisions for explosives, so such samples have to be shipped in full compliance with all provisions. There is a wide belief within industry that this problem needs to be addressed; the European Chemical Industry Council (Cefic) has been active in developing a potential solution using specific exemptions and COSTHA has put forward proposals for amendment of the UN Model Regulations. It has also requested a DOT Special Permit, which was denied by PHMSA.

Given the lack of progress in terms of new rulemaking, LSR has been focusing on developing a best management guidance

document for the screening of energetic compounds that are not fully tested. As such, these cannot be accurately classified for transport and, as the regulations stand, they do not accurately reflect current industry practices for assessing their risks. The group says that, by referencing scientific modelling and quantitative structure–activity relationship (QSAR) models, a more realistic classification of samples can be achieved; this avoids the ‘worst case’ default classification and also unnecessary animal testing.

The project is continuing, with the next part involving the benchmarking of current compound classification practices in the life sciences sectors.

COSTHA’s Life Sciences Roundtable has been working for more than five years now and has generated a number of proposals and petitions that have provided relief for industrial shippers. Among the most recent successes were a change to the consumer commodity and limited quantity marking provisions, which was addressed in the HM-215Q rulemaking, finalised in May 2023, and the alignment of US de minimis exceptions with those in the UN, which was incorporated in HM-219D, issued in March 2024.

The next projects are likely to involve discussion at the UN Sub-committee of

Experts on the Transport of Dangerous Goods (TDG). LSR has drafted a paper for COSTHA to present at the July session of the TDG Sub-committee on the shipment of used medical devices, such as those being returned for repair, that have been exposed to biological components. A second issue is the shipment of UN 3373 Category B infectious substances along with lithium batteries; this is being discussed by a correspondence group prior to the presentation of an informal paper at the UN.

While COSTHA’s membership is skewed towards North America corporations, many of them are multinational firms doing business around the world; in addition, it has a significant representation of overseas members. As such, the Annual Forum’s wrap-up of international regulatory developments is an important element of the event.

The structure of the international framework was explained by Duane Pfund, coordinator of PHMSA’s International Program and also chair of the UN TDG Sub-committee. Duane laid out the role of the Sub-committee and the way that its decisions are passed on to the international modal authorities and to

regional and national rulemaking bodies.

At the time of the COSTHA meeting, the TDG Sub-committee was halfway through its biennium, having held two sessions in 2023 and with two further sessions this year, prior to the adoption of the amendments that will appear in the 24th revised edition of the UN Model Regulations by the parent UN Committee in December.

Duane spoke about some of the topics that will be discussed during the first of the 2024 sessions, which is due to begin in Geneva on 24 June. Top of the agenda will, perhaps not surprisingly, be additional mitigation measures for the transport of lithium batteries, prompted by the International Civil Aviation Organisation (ICAO). A system theoretic process analysis (STPA) has been conducted during the consideration of amendments related to the state of charge, which has led to some proposals to introduce new mitigation measures in the Model Regulations.

ICAO will be progressing these potential amendments for inclusion in its Technical Instructions (which will then be picked up by the International Air Transport Association (IATA) in its Dangerous Goods Regulations). For the sea mode, the International Maritime Organisation (IMO) is currently considering the transport provisions for vehicles – including electric vehicles – in the International Maritime Dangerous Goods (IMDG) Code, which is also on the agenda at the Joint Meeting of RID/ADR/ADN Experts and the Working Party on the Transport of Dangerous Goods (WP15) that manages the road transport regulations in ADR. WP15 is also set to look at further work on reciprocity between EU and US cylinders.

Duane returned later in the meeting to bring attendees up to date with the latest developments in the transport of lithium batteries. ICAO’s safety objective is to introduce provisions to mitigate the risks posed by lithium batteries packed with or contained in equipment; it developed a bowtie diagram to identify the protective barriers and used the STPA technique to define potential mitigation measures and their effectiveness.

ICAO has been trying to get back to the fundamental considerations of battery safety, supported by data and incident reports; it also takes account of the economic impact and market feasibility of additional restrictions, and the issue of regulatory compliance liability for participants in the supply chain downstream of the original manufacturers. ICAO has been looking at the state-of-charge (SOC) issue, particularly concerns that requiring a lower SOC may lead to cell degradation. It also has to take account of the need to facilitate the transport of life-saving medical devices.

For batteries packed with equipment, there is a new ICAO recommendation due to take effect on 1 January 2025 that cells and batteries with a Watt-hour rating exceeding 2.7 much be shipped at no more than 30 per cent of their rated capacity. This recommendation will become mandatory as from 1 January 2026. Shipment of cells/ batteries with a higher SOC will be possible but only with approval from the State of Origin and State of Operator and they will have to adhere to Section I requirements. ICAO’s Dangerous Goods Panel is to provide guidance to competent authorities on the granting of such approvals.

ICAO is also to extend the 3-metre stacking capability test for lithium cells/batteries packed with equipment, which already exists for Section I cells/batteries in packing instruction P966, to cover Section II cells and batteries packed according to P969. This allows non-UN outer packagings to be used but they must be able to withstand a 3-metre stack, with that capability demonstrated by testing, assessment or experience.

ICAO is also recommending that UN 3481 lithium ion batteries contained in equipment are shipped at no more than 30 per cent of the battery rated capacity or 25 per cent of the capacity as indicated on the equipment. The 3-metre stacking test is also applied, via P970.

ICAO will also impose an SOC limit on battery electric vehicles (UN 3556, 3557 and 3558), with a battery exceeding 100 Watthours, from 1 January 2026. This provision also specifies a limit of 30 per cent of the battery rated capacity or 25 per cent of the indicated battery capacity.

These new provisions were originally planned to come into effect in tandem with new performance-based packaging standards for lithium batteries – the SAE G-27 initiative; however, work on this project is still ongoing and it is not now expected to be delivered

until next year; similarly, new simplified provisions designed to facilitate full compliance are also delayed until the latter part of 2025, as are classification provisions to provide a mechanism to identify and communicate the hazards associated with specific batteries during transport, for greater granularity with respect to classification of lithium batteries developed by the UN TDG Sub-committee and the Globally Harmonised System of Classification and Labelling of Chemicals (GHS).

As Duane had already advised, this ICAO work will be on the agenda at the July session of the UN TDG Sub-committee, along with the presentation of data from the Thermal Runaway Incident Program (TRIP). David Wroth of UL Standards & Engagement (ULSE) gave a presentation of that data at the COSTHA Annual Forum, explaining that the programme had been introduced as a formal process to take over from an existing, informal incident capture and reporting process that had been developed by airline dangerous goods managers. It is designed to maintain data in a more granular and consistent manner and to provide participants with airline-specific and anonymised industry data.

The participants are mainly North American airlines, with some Middle East carriers, as well as FedEx and UPS.

David reported that, in four years of tailored reporting, 792 incidents had been recorded up to the middle of March 2024; these include ‘near-miss’ and non-reportable incidents. Increasing participation by airlines has meant more data is available and TRIP is also now picking up lithium battery incident summaries from the Federal Aviation Administration (FAA).

There are some limitations, however. TRIP participants represent a sub-set of the airline industry, so this is not a global picture. Furthermore, the source of the information comes from the crew, who are generally more concerned about safety than data capture. In addition, airlines often lack the time or forensic processes to carry out root cause analyses. Looking specifically at thermal incidents (i.e. excluding near-misses and swollen or damaged batteries), TRIP recorded 414 events

between the start of 2019 and the end of 2023 – though this period included the Covid pandemic, which led to a sharp decline in flight numbers. However, it is clear that the figures for 2023 were well ahead of those for 2019 and that this increase is found almost entirely in passenger flights – the number of incidents in cargo aircraft has remained remarkably stable.

One salient outcome of the data analysis is that there has been a sharp fall in the number of incidents involving UN 3480 standalone cells and batteries; the largest problem is now found in UN 3481 packed with/contained in cells and batteries.

Within the limits that David outlined, TRIP is providing some valuable data to inform decision making by the regulators. More details can be found via https://mytripportal.org/.

The COSTHA Annual Forum also gave attendees a glimpse into how Europe is looking to regulate batteries, via a presentation by Marc Boolish of the legal firm Wiley, representing the Rechargeable Battery Association (PRBA). Marc began by noting that, while most Canadian provinces have legislation relating to battery recycling, only a

few states in the US have so far followed suit. The EU, by contrast, has been active in the area for some time – the first Battery Directive was passed in 2006 and established a framework for the collection and recycling of most types of batteries, with targets for recycling set to reach 45 per cent by 2016.

Marc noted that the focus of battery collection and recycling activities has changed over the years; before 2000, the main issue was preventing the leakage of heavy metals and toxic compounds from used batteries; after 2000 the additional elements of waste reduction and resource conservation were added; today, industry has to take account of broader sustainability and carbon reduction goals.

With this in mind, last year the EU enacted its new Battery Regulation; this will bring with it the need for suppliers to declare the carbon footprint of their batteries from 2024 (to be released in report form from 2026); battery ‘passport’ requirements will arrive in 2025, when the existing Battery Directive will be repealed. Next year will also see the start of feasibility studies on the phase-out of primary (non-rechargeable) portable batteries, due to

be completed by 2030. The Battery Regulation also includes a rolling process of additional enforcement.

An important aspect of this for the battery industry and its logistics partners is new harmonised specifications for labelling. Danish consultancy and engineering firm Ramboll and the German Institute for Applied Ecology (Öko-Institut) have been tasked with technical support for the development of those specifications, and are due to complete their work in July 2024. As Marc showed, there is a lot of information that will need to be included and the Regulation kindly offers a priority list of items that should be included if there is not enough space for everything.

It is difficult to avoid talk of lithium batteries at regulatory meetings but the other major topic in terms of international dangerous goods transport is China. Robert Kiefer, general manager of REACH24H USA, was invited back by COSTHA to bring attendees up to date with the latest developments.

Much of what Robert spoke about related to China’s Hazardous Chemicals Management processes, starting with the upcoming Law on Safety of Hazardous Chemicals, which is due to replace Decree No 591 by the end of 2028. This is still in draft form and due to be discussed by the State Council.

One item already in force is GACC Announcement No 29 of 2023, which introduced a new inspection mode for imported hazardous chemicals; this now requires each consignment to be accompanied by a declaration, which is reviewed for completeness, accuracy and consistency, and for each consignment to be physically inspected, either at the port of arrival or at the destination. This inspection checks whether the package is intact, whether the information on the package label DUTYHOLDERS

corresponds to that in the import declaration, whether the label and safety data sheet are prepared in line with Chinese standards, whether the package marking meet the requirements and match the import declaration, and whether the hazard properties of the contents are consistent with the import declaration.

Possibly more extensive is the ‘One Enterprise, One Chemical Product, One QR Code’ initiative, issued in January 2022 to enhance the digital and intelligent management of hazardous chemicals. The province of Guangdong initiated a pilot programme, which is not fully implemented, and a registration system was put in place in February 2022. Other provinces and cities have since introduced their own pilot programmes – importantly, Shanghai will pilot

the ‘Hazchem Traceability Code’ QR system as from this year.

There are also some important developments underway regarding the transport of dangerous goods. China opened a consultation on draft revisions to GB 6944 (Classification and Code of Dangerous Goods) and GB 12268 (List of Dangerous Goods) in 2023; these will update and replace the 2012 editions and bring China into line with the 22nd revised edition of the UN Model Regulations. Once finalised, they will enter into force 12 months later. In June 2023 China opened a consultation on a new standard for packagings containing a variety of dangerous goods, again to align with the 22nd revised edition of the UN Model Regulations.

Specifically relating to the transport of dangerous goods by road, a consultation was

opened in September 2023 to revise JT/T 617 to align with the 2023 edition of ADR; the revisions apply to the general provisions (617.1), classification (617.2), dangerous goods list and transport requirements (617.3), use of transport packaging (617.4), consignment (617.5) and the conditions of carriage, loading, unloading and handling (617.6). Once finalised, this will replace the 2018 version of JT/T 617.

China has also adopted revised provisions on the administration of the road transport of dangerous goods; these took effect on 4 December 2023. The most significant change is that ‘dangerous goods’ are now defined as those listed in JT/T 617 rather than in GB 12268.

The second part of this report on the 2024 COSTHA Annual Forum in next month’s HCB will concentrate on presentations relating to North America.

COLLABORATION • LEADING US TRADE BODIES HAVE REAFFIRMED THEIR COMMITMENT TO WORK TOGETHER TO ENHANCE SAFETY AND SUSTAINABILITY IN THE CHEMICAL SUPPLY CHAIN

(ACD), formerly the National Association of Chemical Distributors (NACD), and the American Chemistry Council (ACC) have signed a Memorandum of Understanding (MoU) to support continued collaboration and enhance safety and sustainability in the chemical supply chain, from manufacture to distribution. ACD and ACC recognise the value of their respective performance programmes, ACD Responsible DistributionTM and ACC Responsible Care®, in advancing these shared objectives.

The memorandum recognises the complementary nature of each organisation, their respective performance programs, and their members’ critical roles in the chemical supply chain. Through the MOU, ACD and ACC

pledge to work together to promote excellent performance, recruit unaffiliated organisations, and support public policy efforts to benefit the entire chemical industry.

“ACD has long worked in conjunction with ACC, and this memorandum represents a positive step forward in our continued commitment to upholding the highest standards in the chemical industry value chain,” says Eric R Byer, president and CEO of ACD. “The collaboration between chemical manufacturers and chemical distribution experts is essential to countless industries across the nation, and our performance programs are vital to improving the quality, safety, and sustainability of the entire chemical supply chain. We are excited to continue our collaboration with ACC to

support these programs and advance the best interest of our member companies.”

Since 1991, ACD Responsible Distribution™ has been a trusted, comprehensive set of environmental, health, safety, security and sustainability standards within the chemical distribution industry. This comprehensive framework demands continuous improvement in every phase of chemical storage, handling, transportation, and disposal.

Launched in the US in 1988, ACC’s Responsible Care® program drives continual improvement and supports innovation in products and processes in manufacturing and throughout the supply chain. A mandate of ACC membership, Responsible Care® companies track and transparently report performance metrics, holding themselves accountable to employees, stakeholders and community members.

“Programs like Responsible Care® and ACD Responsible DistributionTM are vital to helping companies of all sizes understand and enhance their safety and sustainability performance,” says Chris Jahn, ACC president and CEO. “At their core, they help our industry be responsible stewards of our people and our planet. We are excited to embark on this next chapter of collaboration with ACD to meet our collective goals.”

ACD and ACC have a longstanding collaborative relationship, working together on many projects, including their upcoming golf tournament, Swings for STEM, which will raise money for the Future of STEM Scholars Initiative (FOSSI). The first of what is intended to be an annual event will take place in Lansdowne, Virginia on 24 June. FOSSI is a national industry-wide programme that seeks to increase the number of underrepresented professionals in the STEM workforce by providing scholarships to students pursuing preferred STEM degrees at Historically Black Colleges and Universities (HBCUs). FOSSI is dedicated to supporting those STEM scholars who would otherwise not have access to a STEM education by eliminating financial barriers.

www.acd-chem.com

www.americanchemistry.com

The US Chemical Safety and Hazard Investigation Board (CSB) has applauded the development by the National Fire Protection Association (NFPA) of new recommended practice (RP) for hazardous waste treatment, storage, and disposal facilities. The new RP, published as NFPA 401 this past December, responds to recommendations issued by CSB following its investigation of a number of incidents, including the 2006 fire and explosions at the Environmental Quality site in Apex, North Carolina and the 2011 explosion and fire at the Donaldson Enterprises fireworks disposal site near Honolulu, Hawaii.

During its investigation into the Environmental Quality fire, CSB found that there had been 21 other fire and chemical release incidents at hazardous waste facilities across the US in the preceding five years. As a result, it recommended that the Environmental Technology Council work with NFPA to develop a standard specific to hazardous waste treatment, storage and disposal facilities. The Board reiterated this recommendation in 2010 after it investigated an explosion and fire at the Veolia ES Technical Solutions facility in West Carrollton, Ohio, in which flammable vapour released from a waste recycling process ignited and violently exploded, injuring four workers and damaging approximately 20 nearby residences and businesses in addition to eight structures at the facility.

“Although it took several years, we appreciate NFPA’s efforts to develop this significant document,” says CSB chair Steve Owens. “It provides important guidance on practices and safeguards necessary to prevent fires and explosions associated with these types of hazardous materials and can help prevent similar incidents in the future.” CSB

Recommendations Specialist Adam Henson adds: “NFPA has successfully implemented the CSB’s recommendation – we look forward to continuing to publicise NFPA 401 in an effort

to prevent fires and uncontrolled chemical reactions at work sites across the country.”

NFPA 401 is available to purchase from the Association’s website at www.nfpa.org/ codes-and-standards/nfpa-401-standarddevelopment/401.

The US National Transportation Safety Board (NTSB) has concluded its investigation into the September 2022 collision of the chemical tanker Bow Triumph with a pier at a naval base in Charleston, South Carolina, which resulted in damage to both the vessel and the pier and damages put at $29.5m. NTSB says the incident resulted from a pilot manoeuvring the vessel too close to a bank in the Cooper River, causing ‘bank effect’, where the bow is pushed away from the bank while the stern is sucked towards it.

“Hydrodynamic forces reduce rudder effectiveness (squat and shallow water effect) and yaw the bow away from the closest bank and pull the stern in (bank effect),” NTSB’s

report says. “When manoeuvring in shallow waters such as channels, shoaling can reduce the water depth below charted or expected, and therefore exacerbate the forces on a vessel. Bank effect can have an undesired effect on vessels, even for the most experienced shiphandlers. Pilots, masters, and other vessel operators should consider the risks in areas known for shoaling when planning transits.”

NTSB is currently investigating a very similar incident on the same stretch of river involving the tanker Hafnia Amessi this past January 14, which caused $3m in damages to the same pier.

Canada’s Transportation Safety Board (TSB) has released its report on an uncontrolled movement of rolling stock, including three tank cars with sulfuric acid, at Canadian Pacific’s Toronto Yard in March 2022. In the incident, 103 rail cars ran for some 975 metres before seven cars derailed, including the three acid tank cars; there were no leaks and no injuries.

TSB determined that the hand brake test carried out by the CP train crew on the evening before the incident was inadequate, as it did not allow enough time for the slack between the cars to fully adjust before the air brakes were applied. When the air brakes were released the following day, to prepare the train for switching, the train began to roll downhill, with six hand brakes still applied. TSB notes that this event was one of four similar incidents at the same yard over the past five years, at least one of which also involved dangerous goods.

A notice was issued by Transport Canada, requiring CP to take safety actions, since when it has issued a revised operating bulletin and conducted further training at the site. Transport Canada has also increased its inspections at the Toronto Yard.

The full text of TSB’s report can be found on the Board’s website at www.tsb.gc.ca/eng/ rapports-reports/rail/2022/r22t0045/r22t0045. html.

CHEMICAL TANKERS • STRONG DEMAND AND TIGHT SUPPLY HAVE COMBINED TO CREATE HEADY DAYS FOR SHIPOWNERS. WILL THEY CASH IN OR CARRY ON?

THE GLOBAL CHEMICAL tanker market is currently going through one of the strongest bull runs in living memory. Demand is strong; swing tonnage has been kept busy in a firm clean products market; war threats and canal disruptions have added further to tonne-mile demand; and, perhaps most significantly, the orderbook remains small.

This is unusual. Shipping markets are notoriously cyclical, not helped by the fact that the normal response to a period of high rates is to order new ships, which tend to arrive in the fleet only after the market has come off its peak, hastening the downturn. This time around, though, operators have held off going to the yards. The market is more concentrated than it has ever been, encouraging caution in

this regard, and there are plenty of owners and investors eager to reap the rewards of a strong secondhand market, especially for stainless steel tonnage.

As well as restraint on the part of established owners, there are two more reasons for the low orderbook. For one, it is increasingly difficult to find newbuilding slots right now, with many of the major yards booked solid with gas ships through to 2027 or 2028. Secondly, there are lingering doubts as to the propulsion requirements for future ships, given that the International Maritime Organisation (IMO) is still working on its schedule for emissions reductions and energy efficiency improvements.

For now, the major operators are

concentrating on strengthening their balance sheets, reducing debt and, in many cases, delivering massive dividends to their shareholders. Odfjell, one of the three leading specialist chemical tanker operators, says its strategy is to capture short-term gains and de-risk for the long term. Since the upturn began at the end of 2018, EBITDA from its shipping activities has grown consistently from $109m to $442m in 2023 and, with an extraordinarily strong start to 2024, it looks likely that this year’s performance will be even better. Since its last newbuilding delivery in 2020, Odfjell has reduced its debt by $448m to $807m by March 2024 and has returned $171m to shareholders in the form of dividends since mid-2022.

That is not to say that no new chemical tankers are joining the fleet. At present, the core chemical tanker orderbook is equivalent to 7.2 per cent of the active fleet, which is low by historical standards, and deliveries are scheduled to fall sharply after 2024. Around 15 per cent of the active fleet is already 20 years

old or older and, although well-maintained stainless steel tankers can continue to operate past 25 years of age, there is obvious potential for demolition activity.

At the same time, demand for chemical tankers is still on the rise; Odfjell quotes analyst forecasts of a 12 per cent increase in chemical cargoes from the 2023 level by 2027 to reach 284m tonnes, with a 13 per cent increase in chemical tanker demand to 44m dwt. A salient factor of the market in recent years is that tonne-mile demand growth has outstripped volume demand growth, in response to the centralisation of chemical production in the Middle East, US and China, leading to longer transport routes. As a result, Odfjell says, overall tonne-mile demand growth is forecast to increase by an average of 3 per cent per year between 2023 and 2026, while the fleet will grow by only 1 per cent per year.

Stolt-Nielsen, one of the other major operators, concurs with Odfjell’s analysis and points out that the MR product tanker market is also expected to remain healthy this year, which will keep the unwanted competition from swing tonnage out of the core chemicals business.

Stolt Tankers has recently announced new orders (see page 31) and Odfjell too has renewed its newbuilding activities, though in its case it is working with partners, primarily in Japan, to build 16 new vessels that will be timechartered to Odfjell with purchase options, a strategy it says offers greater flexibility. As a result, it has an interest in some 20 per cent of the global orderbook. Odfjell also notes that its last major newbuilding phase, with 26 new ships delivered in the 2016-2019 period, coincided with the bottom of the last market cycle.

Further fleet growth may come from joint ventures and mergers, as well as secondhand purchases. Odfjell has not ruled out additional newbuilding orders but says it will remain patient and order at the most advantageous time.