We are reminded often that the Stone Age didn’t end because humans ran out of stones, and the Oil Age won’t end because we run out of oil. Instead, many governments are pressing industry and consumers to move away from hydrocarbonbased fuel sources and switch instead to cleaner fuels.

They tell us, in fact, that within 20 years, gasoline- and diesel-powered cars will no longer be manufactured and that in perhaps 40 years there will be few left on the roads. I’m unlikely to be here to see it, but it’s clear that within a couple of generations the young will be baffled as to why we ever felt it necessary to use dirty fuels – or even to own our own cars.

The process towards a decarbonised future is likely to be gradual. Look at marine fuels, for instance. There has been an awful lot of fuss about the new IMO restrictions on sulphur levels in bunker fuels, which come into effect in 2020. There has been an increasing rush to fit new ships with engines capable of running on LNG, as there is plenty of that about at a relatively attractive price and it avoids all the sulphur (and other emissions) concerns.

But that is only one step. LNG is still a hydrocarbon – the simplest hydrocarbon of all. Ultimately the shipping industry will have to move past that and into non-carbon fuels, which probably points to hydrogen power.

It will be the same on the roads. Certainly in Europe the move towards electric-powered vehicles (including heavy goods vehicles) is well under way. Practical concerns about cost, performance, charging time and range are being overcome, and in some countries the electricity that fuels vehicles is heavily subsidised.

But that electricity has to come from somewhere, and at the moment a lot of it is generated from hydrocarbon sources. The switch to electric vehicles merely moves the emissions problem back up the fuel supply chain. It might be easier to manage emissions control at the power plant but the endto-end calculation has to take into account efficiency losses along the way.

Maybe at some time in the future alternative power sources – solar, wind, geothermal, etc – will be able to generate all the power we need. I have heard one futurologist point out that the increasing efficiency and falling cost of solar panels will mean that electricity will one day be essentially free.

But all this is still some way off. So far off, in fact, that companies that are involved in the movement, storage and handling of oil- and gas-based fuels and other liquids are still investing heavily in new assets. Our annual review of bulk liquids storage terminal construction in this issue, for instance, takes up just as many pages as ever and a further article on recent M&A activity indicates that there is still a huge appetite for opportunities in the sector among institutional investors.

It looks likely that there will be demand for this new tank capacity, at least in the medium term. But it is also certain that there will be changes in the products being handled. Refiners are already grappling with that and terminal operators will need to be ready to engineer into their assets the flexibility that will be needed as the world gradually weans itself off hydrocarbons.

Peter Mackay

Cargo Media Ltd

Marlborough House 298 Regents Park Road, London N3 2SZ www.hcblive.com

Peter Mackay Email: peter.mackay@hcblive.com Tel: +44 (0) 7769 685 085

Sam Hearne

Email: sam.hearne@hcblive.com Tel: +44 (0) 208 371 4041

Samuel Ford

Email: samuel.ford@hcblive.com Tel: +44 (0)20 8371 4035

Ben Newall

Email: ben.newall@hcblive.com Tel: +44 (0) 208 371 4036

Craig Vine Email: Craig.Vine@hcblive.com Tel: +44 (0) 20 8371 4014

Stephen Mitchell

Email: stephen.mitchell@hcblive.com Tel: +44 (0) 20 8371 4045

Brian Dixon

Designer

Natalie Clay

HCB Monthly is published by Cargo Media Ltd. While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect.

2059-5735

VOLUME 39 • NUMBER 06

Letter from the Editor 01

30 Years Ago 04

View from the Porch Swing 06

Learning by Training 07

If you build it… Global terminal expansion survey 09

Value added

M&A deals show value of terminals 23

Little Rock and roll

Building a distribution hub in Arkansas 26

The key to success

Sofis helps with partial automation 28

Up the wall

Eddyfi improves NDT technology 29

Foam on tap SK firms automating foam making 30

You’re so vane

Sliding vane pumps a good fit for terminals 32

News bulletin – storage terminals 34

Fixture for fittings

Reporting back from FPS Expo 37

The vault is locked

BDP signs up for blockchain 41

Shipa to shipper

Agility moves into online logistics 42

Dutch barns

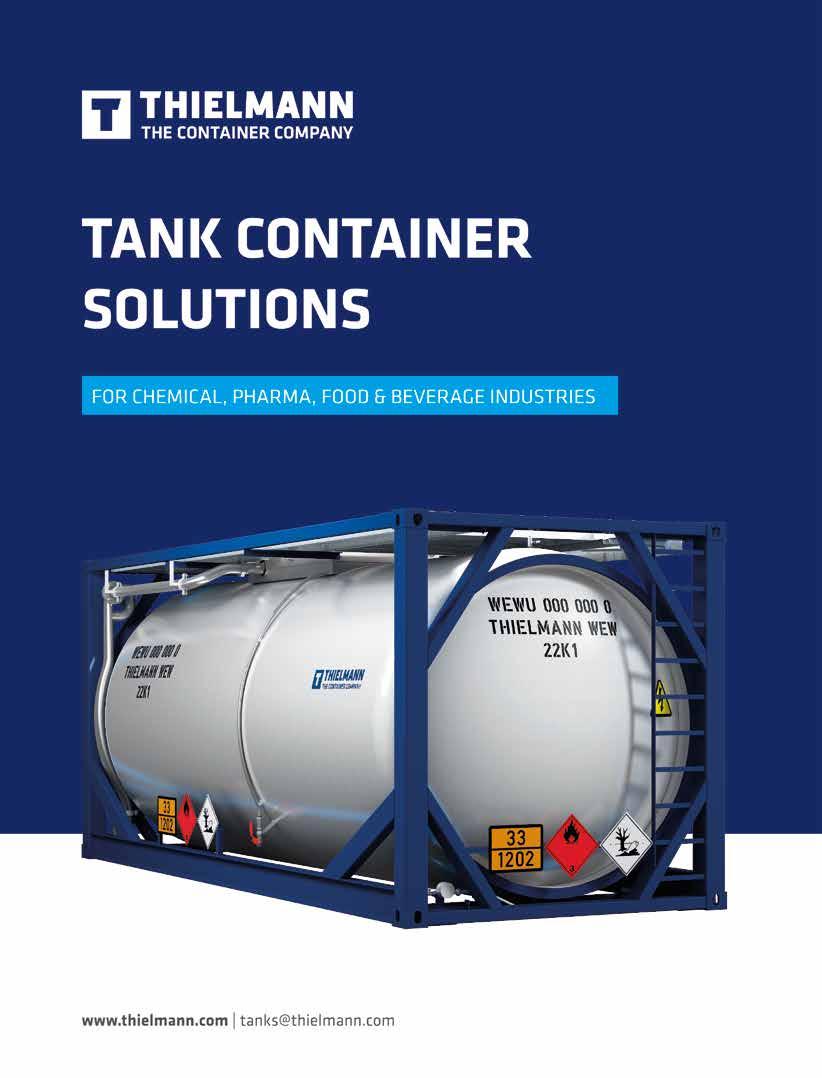

Broekman invests in warehousing 44 Alpha tanks

Thielmann designs tanks for Class 7 46

Pay it forward

Hoyer’s investments get results 47 News bulletin – tanks & logistics 48

Nice in Nice

Fecc meeting has a lot to deal with 50

The gong show CBA recognises quality 52

Brenntag invests around the world 54

Top table

New deals for Nexeo 55

To Russia with rubber

Safic-Alcan makes strategic move 56

Going for an Indian

Azelis expands in Asia 57

News bulletin – chemical distribution 58

Training courses 60 Conference diary 63

SAFETY Incident Log 64 Outside the box

New packagings for battery shipments 67

Silver safety

Changes ahead as SQAS passes 25 years 70

Pass the port

Exis moves forward with restrictions database 72

Block the blast

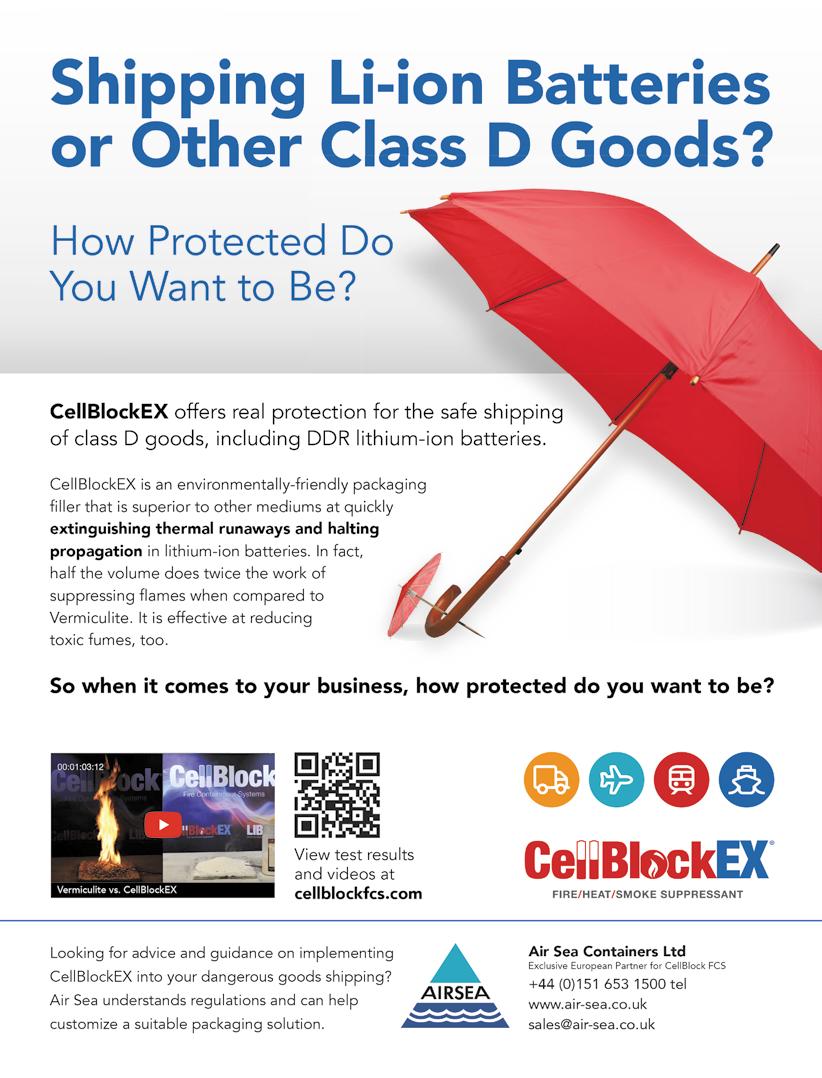

Welcome to CellBlock EX 73 News bulletin – safety 74

Crunch time

RID/ADR/ADN 2019 on their way 76

Testing, testing

Handling the 38.3 test report 82

Get the show on the road

Labeline Biennial Roadshow is on its way 84 News bulletin – regulations 86

Not otherwise specified 88

The HCB Tank Guide 2018/2019 –free to all subscribers

Thirty years ago the world was still trying to get to grips with the relatively new-fangled idea of intermediate bulk containers (IBCs). Indeed, a strap line on our cover seemed to be trying to reassure industry that such containers were “up to the task”.

But if potential users still needed convincing, the regulators were even further behind. As one feature in the June 1988 issue began: “The much-heralded UN recommendations on IBCs should have meant a speedy adoption of harmonised requirements at national and international level for all modes of transport. That was the theory…”

The UN experts had adopted in the fourth revised edition of the UN Model Regulations a new Chapter 16 that laid out for the first time a consistent set of recommendations, which was designed to get around the need for the lengthy case-by-case approvals process for international movements of IBCs containing dangerous goods.

However, as we said at the time, both IMO’s Carriage of Dangerous Goods Sub-committee and the RID/ADR experts had shown “an indifference verging on reluctance” to incorporate those recommendations into their respective regulations, “effectively denying chemical shippers the use of IBCs as a practical, costeffective distribution option”.

As it happened, the March 1988 meeting of the RID/ADR experts had done some more work on the topic and were prepared to begin adopting the provisions, but with a number of significant revisions compared to those in the UN Model Regulations. At the time – and not for the last time – we pondered on how such a state of affairs could come to be, seeing as most of the RID/ADR experts were among those who had drawn up the original provisions at UN level.

Despite that, we also reported that the previous 12 months had seen IBC manufacturers generally enjoying a healthy level of turnover and, with growing demand, investing in product innovation: “Most manufacturers, having examined the UN recommendations, are already making the necessary design and production changes to enable containers to be produced according to the UN criteria.”

Indeed, so intense was the level of innovation that our June 1988 survey only had room to cover developments in metal and flexible IBCs; we had to run a separate article later in the year to look at composite and all-plastics IBCs.

The situation was somewhat different in North America, where around 16 suppliers of rigid IBCs in the US and Canada had been providing units for more than 30 years. An article by Vince Vitollo noted that the safety record of IBCs in hazardous materials service had been “very good” and that, while the US Hazardous Materials Regulations had long provided construction and testing specifications, the use of polyethylene IBCs for the carriage of corrosives was gaining traction under an exemption provided by DOT.

The growth in the use of metal and plastics IBCs in North America was prompted not by the desire to maximise the capacity of shipping containers, as was the case elsewhere, but primarily by concerns over the disposal of non-bulk packagings. Chemical shippers were increasingly turning to IBCs in an effort to bring greater control over the distribution process and avoid problems associated with the disposal of used packagings. They were, perhaps, rather ahead of the rest of the world when it came to such issues.

The older of my two baby sisters loved two things (at least). She loved having her own room, which she kept private in her absence by adding a padlock to it. And she loved records, those old, flat, black circles of vinyl with spiral grooves that could play prerecorded music. One memorable afternoon after school, this sister became enraged at the rest of her siblings and took revenge. She turned the volume on her record-player up to 11, plopped one small record on it, moved the arm to the side, engaged the needle, and padlocked the door to her room.

The same song began to play throughout the house over and over and over again. My parents weren’t home from work, my sister had gone off to some sort of practice or meeting, and the weather was so lousy there wasn’t any place to go outside. Even in my own room with its door closed and a pillow over my head I could hear that damn song.

I know, it’s forty years later, and I should let it go. I assure you, I am still in the middle of the process of doing just that.

And now, I get to do it to you. At the risk of sounding like a broken record, almost exactly two years ago I wrote this: “A decade or so ago, I remarked to a former head of the UN Committee of Experts on the Transport of Dangerous Goods that I thought the Committee must be a very exciting place to be. He told me that the DG regulations were mature, and that only tweaking remained, which I took to mean that he thought the excitement was over and that only minor stewardship work remained.”

Yesterday, at a meeting of a notable DG organization, a regulator described this view to the room as “fine-tuning of a longstanding system”, although I’m not sure the second regulator necessarily agreed that it was an accurate assessment. Lots of our current system, especially the hazard communication basics are mature and only need fine-tuning, but lots needs major work, especially classification and packaging of articles. Please allow me several examples to explain.

Packaging of chemicals has long been mandated with the object of preventing exposure to the contents. Almost regardless of hazard (Class 1 the notable exception), as long as the chemical remains in the package, everything is fine. Corrosives don’t corrode if still in their packaging, flammables don’t burn, toxics don’t poison, and so on...

Now we’re changing our approach for at least some articles, to be more like Class 1, where mere containment of material isn’t enough. The most dramatic example of this is lithium battery packaging, where all the effects of burning are expected to be contained, or at least minimized. And there are murmurings that other articles, such as DG in equipment or devices or machinery should possibly be packaged with an eye toward containing any negative effects of their bad reactions.

Of course our current chemical classification system is starting to look like it needs a major overhaul. 5.2 materials are in fact oxidizers, just oxidizers that happen to also have a subsidiary hazard of flammability as well. Why should 5.2 even be its own classification? We have some (newer) desensitized liquids that won’t burn in Class 3 and some (older) desensitized liquids that won’t burn in a division we name ‘Flammable Solids’. In 4.1, our ‘Flammable Solids’ include self-reactive liquids and selfpolymerizing liquids. For flammability we put liquids and solids in different classifications, but for toxic materials we put liquids and solids in the same division. And we’ve even got issues with what is a liquid versus what is in a ‘liquid state’ and how to package and communicate the hazard of a DG that is solid by definition but often a liquid during normal transport.

And yes, I’ve moaned about some of this before. I apologize if I sound like a broken record. But, perhaps, it’s time to get things fixed.

This is the latest in a series of musings from the porch swing of Gene Sanders, principal of Tampa-based WE Train Consulting and chair of the Dangerous Goods Trainers Association; telephone: (+1 813) 855 3855; email gene@wetrainconsulting.com.

Last week I went fishing in Ireland on one of the lakes near Monaghan. The pike were biting and I was wondering why, after many millions of years of evolution, pike had not learned the difference between a lure with sharp hooks and a real fish without them. Why, I asked, were they programmed to bite first and think later?

I had to look for an answer and found that awareness of danger is usually being superseded by an innate need for survival. Eat first!

Of course when a pike gets hooked it tries everything to shake off the hook by diving, jumping and shaking its head. Sometimes he or she gets lucky and disappears into the deep without harm.

I usually use metaphors to visualise a story and this time I use pike to confirm the relationship with our human programming to survive. People, like pike, do not like to be caught. People do not like to be in danger. But when I look around in the hazardous cargo industries, I often notice that people too bite first and think later. Awareness of being in danger can sometimes be ignored when an operator looks at his watch and sees that he is late for lunch or coffee break.

Thoughts about other matters than the job at hand perhaps roam his or her mind and before he or she realises it, danger lures.

People and Dolphins, I learned recently, are equipped with a similar size brain and these two brains have been evolved to include ‘self-awareness and self-reflection’, whilst other animals, such as pike, do not possess these abilities, which can mean the difference between being caught or not. These are therefore natural, biological capabilities used to warn oneself a bit earlier and prevent dependance

on animalistic predatory behaviour. Our ‘reasoning’ capacity helps us to survive and stay at the top of the food chain. Ayn Rand, the Russian author, talked about the difference between people of character and predators by naming Reason, Purpose and Self-Esteem, as drivers for survival.

When we now apply this information in our daily HSEQ compliance struggle, we can easily conclude that it is our awareness and selfreflection that is guiding us safely through our daily routine in work or traffic. Human brain functioning gives us the edge. Therefore, I believe that HSEQ rules or regulations can only work as guidelines, but that people, through contemplation and thinking, are in charge of Health and Safety, because they are naturally inclined to do so.

According to the ISGOTT Marine Operator Program, the three levels of competency are: Awareness, Knowledge and Skill. I agree. Before I teach people how to operate a technical process, first I address so-called Human Factors and verify their thinking levels. Learning and developing HSEQ skills can only be achieved by understanding if a person is aware or not yet aware of this innately evolved survival mechanism. There, in short, I see the key to reducing HSEQ risk.

This is the latest in a series of articles by Arend van Campen, founder of TankTerminalTraining. More information on the company’s activities can be found at www.tankterminaltraining.com. Those interested in responding personally can contact him directly at arendvc@tankterminaltraining.com.

operators have been releasing financial results for the first quarter of 2018 that, on a like-for-like basis, mostly show a decline in profitability compared to a year ago. Margins are tighter and arbitrage opportunities harder to find.

Nevertheless, operating bulk liquids terminals is a long-term business. Operators need to feel confident that there will be a market for their capacity for decades to come, otherwise the investment is insecure. And given that so much of the new money pouring in to support terminal investment is coming from equity funds that demand a return, it is clear that there is plenty of confidence in the long-term viability of the sector.

FOR ALL THAT governments around the world are responding to the environmentalist lobby and a growing weight of public opinion to promote alternatives to hydrocarbon-based fuels and feedstocks, oil demand grows unabated. That is a function not just of the growing availability of crude oil and natural gas from the development of shale and other tight oil reserves, but also of a desire on the part of the populations of developing economies to enjoy the same standard of living as their counterparts in the developed world.

Such growth in global oil demand means necessarily that there is increasing world trade in crude oil, refined products, liquefied gases and other downstream products, including liquid chemicals, in bulk. That also means there is growing demand for terminalling services both in exporting and importing countries to handle the trade and to act as a balancing point to even out supply and demand inconsistencies.

This year’s annual review of terminal expansion projects reflects those trends.

Despite predictions that the shale oil and gas boom in North America would be short-lived, given the comparatively high cost of monetising these reserves, improvements in extraction techniques and the global thirst for liquid hydrocarbons has meant a lot of investment going in to build terminal capacity at each link of the supply chain. That shows both in the expansion of existing marine facilities, especially in the US Gulf Coast region, as well as plans for new export-oriented terminalling capacity for crude oil, refined products and – increasingly –LNG, LPG and other liquefied gases.

There is a concomitant expansion of terminal capacity in importing countries, responding both to growing demand from increasingly affluent consumers and to efforts to liberalise local markets. This has led to investment in crude oil and downstream logistics infrastructure in countries as diverse as Mexico, South Africa, Mozambique and Sri Lanka.

All this is happening at a time when terminal operators are feeling the pressure of adverse market developments. Major independents and North American midstream

The new Base Line Terminal in Edmonton opened for business in January 2018 with an initial crude oil capacity of 1.6m bbl (255,000 m3) in four tanks. The terminal, a 50/50 joint venture between Kinder Morgan and Keyera Corp, will expand to 4.8m bbl by the end of 2018 as eight more tanks come onstream. A further 1.8m bbl of crude oil storage may be added later, depending on customer demand.

Gibson Energy is to expand its Hardisty terminal in Alberta, Canada with the addition of three new tanks totalling 1.1m bbl (175,000 m3). Two 300,000-bbl tanks are underpinned by a long-term contract with an oil sands customer. The new capacity is due in service in third quarter 2019.

Gibsons has also added 800,000 bbl of new tank capacity at the Edmonton terminal; the tanks entered service in early January 2018.

“Our Hardisty Terminal continues to demonstrate its commercial competitiveness and this contract affirms the ongoing demand for our strategic storage infrastructure in support of incremental oil sands brownfield development,” says Steve Spaulding, Gibsons’ president/CEO. “We will continue to focus on the build-out of the undeveloped acreage at both our Hardisty and Edmonton terminals as our number one strategic priority.”

EXPANSIONS • DESPITE SHORT-TERM CONCERNS OVER TERMINAL PROFITABILITY, MONEY IS STILL COMING IN TO THE TANK STORAGE INDUSTRY TO SUPPORT CAPACITY ADDITIONS

Buckeye Partners has committed $80m to an expansion of the Chicago Complex, its key Midwest logistics hub. The project, backed by a long-term agreement with BP Products North America, will expand storage and throughput capacity, component blend and other services. It includes construction of 600,000 bbl (95,000 m3) of additional product blending tankage and expansion of an existing truck loading rack. The Chicago Complex currently has some 6.8m bbl (1.08m m3) of storage capacity, serving nearly 70 different customers. “This project will further enhance the liquidity of the Chicago Complex and continues to solidify our position as the premier storage and trading facility in the Chicago area,” says Robert A Malecky, executive vicepresident and president of Buckeye’s Domestic Pipeline and Terminals division.

Pin Oak Terminals put the first phase of its grassroots liquids terminal in Louisiana into service last year. The first 424,000 bbl of tankage is used for refined products and biofuels. Construction is continuing as Pin Oak heads for a planned total capacity of nearly 4m bbl (635,000 m3). The terminal is located at Mt Airy on the Mississippi River, and can handle up to 14 barges simultaneously, as well as Suezmax tankers.

Last year TransMontaigne Partners completed the final 800,000 bbl of its phase one 2m bbl (318,000 m3) expansion of the Collins terminal in Mississippi, with the new capacity all leased out. The company has permits to build a further 5m bbl and says it is in “active discussions” with several prospective customers.

Buckeye Partners, Texas Buckeye Partners has completed modifications to the berth at its Texas Hub terminal in Corpus Christi and has loaded the first Suezmax cargo of crude oil for export. The tanker Astra, under charter to Motiva Enterprises, was loaded on 31 March. “Buckeye Texas Hub has become a premier location providing marine terminal services, allowing growing US energy exports access to global markets,” says Khalid Muslih, executive vice-president of Buckeye and president of its Global Marine Terminals operations. “We are very excited to have reached this milestone and look forward to additional opportunities to partner with Trafigura to further expand the terminal’s capabilities and serve the region’s rapidly growing energy production.”

Contanda, Texas Contanda Terminals has secured a long-term lease on what it terms a “prime deepwater access property” on the Houston Ship Channel,

which will allow it to double storage capacity over the next five years and expand into the bulk petrochemical and hydrocarbon markets. “With this project, Contanda has the opportunity to make significant strides in achieving our corporate goals while firmly establishing our position as a leading storage provider in the growing petrochemical and hydrocarbon markets,” says Jerry Cardillo, president/CEO of Contanda. Contanda currently operates three storage terminals in the Houston area. The new facility will be built in phases to provide customers access to onsite processing, multiple ship and barge docks, and convenient tank truck and railcar accessibility.

Enterprise Products, Texas Enterprise Products Partners and Navigator Holdings are to develop an ethylene export facility at Enterprise’s existing Morgan’s Point ethane terminal on the Houston Ship Channel in Texas. The 50/50 joint venture will have refrigerated storage for 30,000 tonnes of ethylene and the capacity to export some 1m tonnes per year. The terminal, expected in service during the first quarter of 2020, is supported by long-term contracts with anchor »

clients including Flint Hills Resources and a Japanese trading company.

Enterprise Products Partners is also to further extend the Enterprise Hydrocarbon Terminal (EHT) on the Houston Ship Channel, having acquired a 65-acre waterfront site immediately adjacent to its existing facilities. The company plans to construct at least two deepwater docks capable of handling Suezmax tankers.

Howard Energy Partners (HEP) commenced operations at the new Maverick Terminals bulk liquids storage facility in Corpus Christi, Texas in May 2018, only six months after construction began. The facility currently has six 80,000-bbl tanks and is being used for the storage, blending and unit train loading of gasoline. HEP has permits to expand total capacity up to 1.25m bbl, while there is space to double that.

“The Corpus Christi terminal, with its strategic location, pipeline connectivity, efficient rail loading facilities and planned Suezmax dock, is poised to provide worldclass midstream services to clients seeking to export crude oil, refined products and NGLs from our major production basins and refining centres to the global markets,” says Brad Bynum, president and co-founder of HEP. “The completion of this facility is also

a significant step in our continued plans to develop key infrastructure for the movement of energy commodities into and out of Mexico.”

Expansion of Kinder Morgan’s Pasadena terminal was held up by Hurricane Harvey although new tankage began coming onstream in November 2017. The new Pit 11 project, costing some $186m, was completed in the first quarter of 2018, adding 2.0m bbl (318,000 m3) of capacity for refined products. Other ongoing projects have added a further 1.5m bbl of tankage at the company’s product storage terminals along the Houston Ship Channel.

LBC Tank Terminals is to build a new terminal in Freeport, Texas to serve MEGlobal’s worldscale monoethylene glycol (MEG) plant. The new facility, LBC Freeport, will be an integrated part of MEGlobal’s supply chain and linked to the adjacent production unit, currently under construction at Oyster Creek. It will mainly handle MEG and diethylene glycol.

“We are delighted to enter into this agreement and partner with MEGlobal Americas on this project. With over 30 years of historical experience in handling glycols, this project opportunity fits our portfolio and investment risk models and is aligned with our business strategy to

further optimise, build-out and expand our business,” says John Grimes, regional business president Americas at LBC Tank Terminals. Construction work has already started, with operational startup planned for 2019 to coincide with the commissioning of the new MEGlobal plant. The terminal will be located on land leased by LBC from MEGlobal Americas, a wholly owned subsidiary of Kuwait-based Equate Petrochemical.

Magellan Midstream Partners says the new dock at its Galena Park terminal in Texas is due in service later this year. Magellan is also reported to be planning a significant expansion of crude oil export capacity at its terminal in Corpus Christi. The company is looking to add four new docks, increase the draft alongside and also replace the harbour bridge to provide extra air draft. The work, due for completion in 2020, will allow tankers up to VLCC size to load crude at a rate of more than 30,000 bbl/hour.

Magellan Midstream and Valero Energy have agreed to expand their 50/50 joint venture petroleum product terminal currently under construction in Pasadena, Texas. Work on the first 1m bbl of capacity and a Panamax-size jetty is currently in hand for planned startup in January 2019; another 4m bbl of tankage, a second berth capable of handling Aframax tankers and a three-bay truck rack will now be added, for completion in early 2020. The partners say another 5m bbl of storage capacity could be built, depending on demand. The new Pasadena terminal will be linked by pipeline to Valero’s refineries in Houston and Texas city, Magellan’s Galena Park terminal and to the Colonial and Explorer pipelines.

Canada-based NOVA Chemicals and Sunoco Partners Marketing & Terminals, a unit of Energy Transfer Partners, have entered a non-binding memorandum of understanding to look at the development of an ethylene

export terminal on the US Gulf Coast. NOVA has new olefins capacity at Geismar, Louisiana and is looking at a joint-venture cracker in Texas. If the plan goes ahead, the partners will establish an 800,000 tpa terminal, fed from the Lone Star NGL storage hub in Mont Belvieu.

Energy Transfer Partners and Satellite Petrochemical USA have agreed to form a joint venture, Orbit Gulf Coast NGL Exports, to build an ethane export terminal on the US Gulf Coast that will provide feedstock for Satellite’s new ethane-fed crackers in Jiangsu province, China. The work will involve a new ethane pipeline from ETP’s Mont Belvieu fractionators, export facilities, an 800,000-bbl (127,000-m3) refrigerated storage tank and a 175,000-bpd ethane refrigeration unit. ETP will operate the Orbit assets, expected to be located in Texas. Commercial start-up is scheduled for fourth quarter 2020.

Phillips 66 commissioned 1.2m bbl (910,000 m3) of new product storage capacity at its Beaumont terminal in Texas in second quarter 2017 and by the end of the year had increased export capacity by 50 per cent to 600,000 bpd. The company is now in the process of adding 3.5m bbl (550,000 m3) of crude storage capacity, due for completion by the end of 2018, which will take overall capacity up to 14.6m bbl (2.3m m3).

Magellan Midstream and LBC Tank Terminals are adding 1.7m bbl of new tankage at their Seabrook Logistics joint venture in Houston this year. Pipeline links are also being added to Magellan’s Houston crude oil distribution system. Operations are expected to commence early in the third quarter.

South Texas Gateway, Texas

Buckeye Partners, Phillips 66 Partners and Andeavour (formerly Tesoro Logistics) have set up a joint venture to develop the planned South Texas Gateway Terminal on 212 acres of waterfront land at Ingleside in Corpus Christi Bay. The terminal will handle exports of crude oil and condensate from the Permian

Basin via the planned Gray Oak pipeline. It will have an initial crude oil storage capacity of 3.4m bbl (540,000 m3) and two docks capable of handling VLCCs. Eventual capacity could be as high as 10m bbl. The partners plan for commercial startup by the end of 2019. Buckeye owns 50 per cent of the venture, with Phillips 66 and Andeavour, which will both commit throughput, each holding 25 per cent.

Vopak is currently adding 138,000 m3 of new chemical tankage at its wholly owned Deer Park terminal. Work is due for completion by the end of the year. Current capacity stands at 1.1m m3 for biofuels, chemicals, refined products, base oils and lubricants.

Contanda is planning to build eight new storage tanks at its Grays Harbor terminal in Washington, US. The 1.1m bbl (175,000 m3) of new tankage responds to customer demand for biofuels. “We heard the community, met with our customers and developed a revised strategy involving the storage of clean products,” says GR ‘Jerry’ Cardillo, CEO of Contanda. In 2013 Contanda (then operating as Westway) sought permission to expand the terminal to handle products other than ethanol but this was turned down, largely due to local opposition to the storage and handling of crude oil. In January 2018 the company formally withdrew the application.

Odfjell affiliate Granel Quimíca is building a second tank farm in Santos. The new facility, due for completion in second quarter 2019, will have a capacity of 51,910 m3, just over half that of the existing Santos terminal.

Vopak is engaged in a significant expansion of its wholly owned Alemoa terminal in Santos, Brazil. During 2017 it announced two projects that will together add some 106,000 m3 of storage capacity and five truck loading bays, which will take total capacity up to almost 280,000 m3. The investment is underpinned by long-term customer contracts. All the new tankage is expected to be commissioned in the second quarter of 2019.

Avant Energy is planning a network of distribution terminals in the Bajio region of northern Mexico, linked by rail to a new marine terminal at Altamira, which will handle tankers of Panamax size and a storage capacity of up to 1.2m bbl (190,000 m3) for refined products. An inland terminal is planned at Querétaro, with direct connections to Kansas City Southern’s Mexican rail network. Construction work on the two terminals is expected to start shortly, with commercial operations scheduled for end 2019.

Sempra energy’s Mexican subsidiary Infraestructura Energética Nova (IEnova) has been awarded a 20-year build-andoperate contract for a marine terminal in the port of Veracruz on Mexico’s Gulf coast.

The terminal, expected to cost some $155m, will offer 1.4m bbl (222,600 m3) of capacity for the receipt and storage of gasoline, diesel and jet fuel for supply to central Mexico. Startup is scheduled in the second half of 2018.

IEnova has also announced plans to build a storage terminal at the La Jovita Energy Hub in Ensenada, Baja California.

The $130m Baja Refinados fuel terminal will have an initial capacity of 1.0m bbl (160,000 m3) for diesel and gasoline, around half of which has been contracted to Chevron to supply its service stations and other consumers in Baja California. Startup is due in second half 2020.

USD Group has begun work on a new multimodal transloading facility, Querétaro Energy Terminal, to serve the local market in central Mexico. The terminal will be serviced by Kansas City Southern’s Mexican

rail operation, with links to all major North American railroads. “Our investment in QET provides an attractive opportunity to establish a presence in the growing Mexican market while leveraging our logistics expertise in support of an existing and profitable business,” says Steve Magness, USDG’s vicepresident, business development.

USD Group is also expanding its network of refined products terminals in Mexico, through its local subsidiary USD Marketing Mexico. It is planning two facilities in the central Chihuahua area, the first of which is expected to be in service in the middle of 2018. It will include storage capacity and rail and truck transloading capabilities. Both terminals will be serviced by Ferromex, which provides access to all North American Class 1 railroads.

Vopak is currently building a new 360,000m3 terminal in Bahía Las Minas on the Atlantic coast in Panama. Once opened in second quarter 2019, the terminal’s nine storage tanks will handle bunker fuels, fuel oil and clean products and will be able to accommodate tankers of up to 80,000 dwt.

ITC Rubis has completed work on tank pit 5A as part of the Phase II expansion of its terminal in Antwerp. The new pit has a range of tanks with total capacity of 10,100 m3 Work started in September 2015 and was finished in December 2017. Phase II also involves addition of new deepwater berths and the company says it is looking at adding extra pressurised gas tanks.

Noord Natie is expanding its Antwerp terminal with 32,700 m3 of new stainless steel tankage in two tank pits, due for completion by the end of this year. The company is looking to continue expanding capacity at the site through to 2022.

To serve a contract with Total, SEA-Invest is adding eight new 20,000-m3 tanks at its Antwerp terminal, along with new loading and unloading bays and a pipeline link to the Total refinery. The Port of Antwerp is supporting the project by dredging to increase the depth alongside the terminal to 15.5 metres.

Vesta Terminals began FEED work last year on a potential 150,000-m3 expansion of its Antwerp terminal to improve vessel turnaround times. The terminal handles middle distillates, light ends and heavy fuels. The project, due for completion in early 2019, will also add two barge berths at the site.

Vopak ACS is expanding its block train loading capacity in Antwerp, primarily to handle acetyls. The terminal will consolidate rail shipments from producers in Germany for onward transport by sea. The new loading station will increase rail capacity by 400 per cent, Vopak says. “We are very pleased to be »

able to make this investment in a very modern, efficient loading station for block trains,” says Manon Bloemer, head of Vopak Belgium. “It offers further logistical benefits for our customers, and reinforces the already strong position of Antwerp as the chemical hub for North-West Europe.”

ATLHA Terminals has secured the rights to build a 70,000-m3 petroleum terminal in Duisburg, Germany. The operator says the facility, due to open in the first quarter of 2020, will handle gasoline, ethanol, biodiesel and chemicals. Amsterdam-based ATLHA was formed last year with the aim of offering terminalling and logistics services to major oil traders. It currently has a 40,000-m3 terminal in southern Spain, with expansion options, and is working on plans to build a 2.5m-m3 greenfield terminal in Europoort, Rotterdam for crude oil and condensate.

UTG Unabhängige Tanklogistik is expanding and upgrading its Kiel tank farm. After signing two long-term transhipment contracts, UTG has started work to install a rail tank wagon unloading station for heavy fuel oil and a road tanker loading station. It will also increase unloading and loading rates to improve throughput of petroleum products and lubricants.

HES Botlek Tank Terminal has put its latest expansion, totalling 277,000 m3 of new capacity, into service. Total capacity at the site now stands at some 490,000 m3. Work is expected to start soon on the next phase of construction, which will add another 130,000 m3 of tank capacity and a jetty capable of handling Suezmax tankers.

Parent HES International is also working on the new Hartel Tank Terminal at Maasvlakte 1, also in Rotterdam, which is expected onstream early in 2019.

LBC Tank Terminals last year upgraded jetty facilities at its Rotterdam terminal, enabling faster vessel turnaround. A new jetty is due

to be added this year, which will double throughput capacity ahead of planned expansion of the site’s storage capacity.

Switzerland-based Alpha Terminals is planning a €250m investment in a new liquid bulk terminal in Vlissingen. Permit applications will be entered this year for a 500,000-m3 facility, capable of handling chemicals, oil products and new energy liquids, including ammonia. Startup is scheduled for 2020.

Odfjell has completed the extension and strengthening of the jetty at its Rotterdam terminal in order to be able to handle LR2 product tankers up to 160,000 dwt. The work, undertaken in collaboration with the Port of Rotterdam, anticipates an increase in the size of vessels calling at the terminal in light of changes in product trades and the demand for distillation at the terminal’s PID unit.

“We are responding to the wishes of our customers to handle ever larger ships,” says Erik Kleine, managing director of Odfjell Terminals Rotterdam. “We appreciate that the Port Authority supports us by deepening the Petroleumhaven.”

Vopak is to expand its existing terminal in Botlek, Rotterdam. The work will involve construction of 15 new stainless steel storage

tanks, totalling 63,000 m3 capacity, for styrene and other chemicals. The work is due for completion in the second quarter 2020.

Last year Inter Terminals completed its largest development project for a decade at its Seal Sands terminal. Work included 27,000 m3 of new capacity for chemicals, additional pipeline links to local chemical plants and a new road tanker loading facility.

NuStar, UK NuStar Energy has completed the first phase of a £25m investment project at its terminal in Grays, UK. A new jetty, capable of handling tankers of up to 125,000 dwt, received its first vessel on 4 January 2018; a second jetty was subsequently added. In addition, four new road loading gantries have been commissioned, with another one being added in the second phase. On completion, the terminal will have seven retail and five separate commercial loading bays.

“This upgrade is a strategic investment for NuStar on the Thames and it will provide significant growth potential,” says David McLoughlin, UK vice-president of NuStar. “Independent supply in the south-east of England is critical to the competitiveness of the region and our clients have been fully supportive of this investment, which will enable the terminal to receive larger cargoes at a significantly faster rate than previously possible.”

Altintel completed a 24,000-m3 expansion of its terminal in Gebze in May 2017 and is considering a further similar project. The company is also looking at developing vacant land at its port, which could result in the terminal more than doubling in capacity to some 200,000 m3

Plans for the massive Raz Markaz crude oil storage terminal are moving forward after Oman Tank Terminal Company was granted usufruct rights by the Duqm Special Economic Zone Authority in July 2017. Under the 40-year agreement, OTTCO will build and operate a terminal with an eventual capacity of 25m bbl (4.1m m3). The terminal will be developed in five phases over ten years at an overall cost of close to $6bn. Third parties will be invited to take shares in the project.

Oman Oil Refineries & Petroleum Industries Company (Orpic) began operations at the Al Jefnain terminal, part of the Muscat Suhar Product Pipeline project, in March 2018.

The company is supplying fuels by truck to local marketers and is aiming to start supply aviation fuel to Muscat International Airport by the end of the year. Fuel is currently being supplied to the terminal by pipeline from Orpic’s Suhar refinery.

The Al Jefnain terminal, with a capacity of some 170,000 m3, expands Oman’s capacity for refined products storage by 70 per cent.

Orpic Logistic is a joint venture between stateowned Orpic and CLH of Spain.

Oiltanking commissioned its new terminal in Matola, Mozambique in November 2017. The terminal has an initial capacity of 58,600 m3

with land available for expansion; Oiltanking is planning another 70,000 m3 of liquids storage and a 33,000-m3 LPG facility at the site.

Oiltanking has a second terminal planned for Mozambique, which will be located in Beira. Both facilities, in which Oiltanking has an 80 per cent shareholding, are designed to improve fuel supply logistics into Mozambique and neighbouring countries. “Mozambique is one of the main transit hubs for petroleum products on Africa’s east coast. The recent transaction and the other projects will further strengthen Oiltanking’s presence in Africa and enhance our ability to serve new market segments on the east coast of the continent,” says Lo Vanhaelen, managing director of Oiltanking Matola.

Bidvest Tank Terminals is to build a 22,600-tonne LPG storage facility at its terminal in Richards Bay, South Africa, following an agreement with LPG trader Petredec Ltd. The completed facility will be the region’s largest pressurised LPG import terminal, with four mounded tanks, each with a capacity of 5,500 tonnes. Bidvest expects to have it in service late in 2019.

Burgan Cape Terminal officially opened for business in the third quarter of 2017. The new

122,000-m3 facility is a joint venture between Vitol, which owns 70 per cent, and two local firms, Thebe Investment Corp and Jicaro. It is initially being used to handle diesel and gasoline, with the option to offer blending of bioethanol and biodiesel. Product is imported by vessel, with the terminal’s jetty capable of handling ships up to 50,000 dwt, and loaded onto trucks via a fully automated rack for onward distribution.

Transnet, the South African national ports authority, last year awarded Oiltanking Grindrod Calulo a build-own-operatetransfer (BOOT) contract to develop a bulk liquids facility in the port of Ngqura, near Port Elizabeth in Eastern Cape province.

An initial 150,000 m3 of storage capacity is due to be commissioned in the third quarter of 2019. Further phases anticipate another 550,000 m3 of capacity. The first phase will replace tanks currently used for petroleum products in Port Elizabeth; those tanks will be decommissioned and the land redeveloped in line with plans to concentrate on commercial and tourism sectors. Once complete, the terminal will provide oil majors, traders and new entrants to the South African oil industry with a modern facility for handling refined products, while also supporting the local shipping industry. »

Vopak has two ongoing projects in South Africa, where it holds a 70 per cent interest in facilities in Durban and Lesedi. Work to add 130,000 m3 of new refined products capacity under the Growth 4 Project in Duban is underway and due for completion by the end of 2019. Fluor Corp was awarded the EPC contract late last year. In addition, work has started on the new Lesedi terminal, which will offer 100,000 m3 of capacity for refined products. Both facilities are part of a larger programme to help meet growing fuel demand in southern Africa.

In December 2017 Sahara Group commissioned a new 36,000-m3 fuel terminal in Dar es Salaam, Tanzania.

The facility is designed as a strategic hub for the distribution of fuels within Tanzania and other parts of East Africa. The storage capacity is split equally between automotive gasoil and gasoline; the terminal has 12 loading bays, giving the capacity to load up to 120 road tankers per day.

Pakistan State Oil and Attock Petroleum have opened a new tank farm to handle jet fuel at New Islamabad International Airport, the largest airport in Pakistan.

The tank farm can handle 10,000 tonnes of product and is equipped with the latest fire detection, alarm and firefighting systems.

VTTI has taken a 51 per cent ownership interest in a greenfield terminal currently under construction near Karachi. The 233,400-m3 terminal will be used to store a range of petroleum products. “VTTI’s expertise and knowledge of the industry as well as its international network, combined with the support of our local partners, Hascol and Fossil, will ensure the future terminal is one of the key independent regional terminals required to supply the growing domestic market,” VTTI says.

Ceylon Petroleum Corp (CPC) is to build

10 new storage tanks at its main import terminal at Kolonawwa, near the Sri Lankan capital, Colombo. The additional 11,200-tonne capacity will help CPC supply rising demand for fuel, which has been growing at 7 per cent per year since the country’s civil war ended in 2009.

Vopak and its joint venture partner PT AKR Corporindo are to expand the Jakarta Tank Terminal by 100,000 m3, taking total tank capacity to more than 350,000 m3. JTT mainly serves the greater Jakarta fuel distribution market and the expansion is needed to cope with rapidly increasing gasoline consumption and Indonesia’s biofuel blending mandate. The expansion, due to be commissioned over the course of 2019, will include eight new tanks for gasoline, ethanol and biodiesel, a new vapour recovery unit and additional in-line blending equipment.

Dialog Group has struck a deal with Johor Corp to lease additional land in Tanjung Langsat, which will allow construction of a third tank terminal. The two existing Langsat

terminals have a combined capacity of 647,000 m3, handling a range of refined products; capacity of the new terminal will be around 300,000 m3. Dialog has not yet indicated a likely date for the completion of the work.

The partners in the Pengerang Independent Terminals project, which include Dialog Group and Vopak, are to proceed with a further expansion of the project. A total of 24 new tanks for clean petroleum products are to be built, which will add 430,000 m3 of additional capacity and take the site’s total capacity up to 1.7m m3. The new tankage is due to come onstream progressively from first quarter 2019.

Funding has also been arranged for the PT2SB terminal at Pengerang, which will mainly serve the new refinery and petrochemical complex being built by Petronas. The 1.5m m3 terminal, which will handle crude oil, refined products, chemicals and LPG, is due for completion by third quarter 2019.

Dialog Group has also entered into agreements to advance Phase 3 of the Pengerang Deepwater Terminals, in which Dialog will have an 80 per cent holding. This phase will be built on reclaimed land adjacent to the second phase, and include tankage for refined products and chemicals »

and deepwater jetties; it will also have land available for downstream refining and petrochemical production.

Philippine Coastal Storage & Pipeline Corp completed the construction of 540,000 bbl (86,000 m3) of new tankage at its facility in Subic Bay Freeport Zone in third quarter 2017. The work included three new tanks and two truck loading racks, which were delivered on time and on budget by Aboitiz Construction.

Capacity at the site now stands at 5.2m bbl for diesel, gasoline, jet fuel and fuel oil.

Phoenix Petroleum has opened its ninth distribution terminal in the Philippines, a 15,000-m3 facility in Consolacion, Cebu.

The terminal will be used to store diesel, gasoline and fuel oils for the retail market in Cebu province as well as for transport and construction firms in the Visayas region.

Vopak is to build a 67,000-m3 expansion of its Sebarok terminal in Singapore, designed to

cater for growing demand for marine gasoil ahead of the arrival of the IMO global sulphur cab in marine fuels from 1 January 2020.

The new tankage is expected to be ready in the third quarter of 2019.

The new Weifang Liquid Terminal opened last year, with an initial capacity of 406,000 m3 for petroleum products and chemical storage. A second phase of 91,000 m3 was commissioned in fourth quarter 2017, while a third phase is under construction and will add a further 164,000 m3 in the first half of 2019.

“The launch of our liquid terminals is timely to capture the growing market for crude and refined oil, as well as chemicals in China. These commodities have benefitted from the gradual liberalisation of import and export policies in China,” says Timothy Lee Chi Tim, vice-chairman of Weifang Sime Darby Liquid Terminal Co. The project is a joint venture between Sime Darby Overseas and Dragon Crown Group Holdings.

Viva Energy last year put into service a 100,000-m3 crude oil storage tank at its

Geelong refinery in Victoria, Australia. The tank, the country’s largest, increases the company’s storage capacity by 40 per cent. Viva Energy has also added a new jet fuel gantry at the refinery and is planning to install a 25,000-m3 gasoline tank and construct a bitumen export facility.

Mobil Oil New Zealand is to build two new tanks at its fuel terminal in Lyttelton to replace tanks damaged in a landslide in 2014. “Construction of new tanks will restore fuel storage capacity at our Lyttelton operation, which, along with the Lyttelton-Woolston pipeline and Woolston Terminal, is an important part of the fuel supply chain in the South Island,” says Andrew McNaught, country manager for Mobil. The new tanks, which will be used to store gasoline and diesel, are due in service in 2019.

Timaru Oil Services Ltd has secured approval from the New Zealand government for a new 44,000-m3 fuel terminal at Timaru Primeport. The facility will have six storage tanks and is designed to improve fuel supplies and boost competition in the local market. HCB

new Hartel site currently under development in Rotterdam’s Maasvlakte area.

FOR MORE THAN a decade now, mergers and acquisitions involving bulk liquids storage terminal operators have been a feature of the equity investment business. Funds have been drawn to the sector by the attractive and comparatively dependable income streams that terminals can generate, especially at times when more traditional avenues have been providing poorer returns.

That process has continued over the past year, with a number of major transactions reported. In some cases, deals have been arranged with investment funds on both sides of the contract, as existing investors cash in on their assets or seek to rebalance their portfolios in light of changes to investment strategies.

A prime example of this is the interesting being shown in HES International. In April this year funds managed by Macquarie Infrastructure and Goldman Sachs announced their intention to acquire HES International from Riverstone Holdings and the Carlyle Group. HES focuses on the storage and handling of liquid and dry bulk products in Europe, with its liquids facilities including Botlek Tank Terminal and Wilhelmsen Tank Terminal, alongside the

“With the support of Riverstone and Carlyle we have become one of Europe’s most successful independent bulk handling companies providing products and services to our customers at 18 sites across eight countries,” says Jan Vogel, CEO of HES International. “Over the past 3.5 years we have implemented a focused strategy that makes optimal use of our prime real estate in Europe’s key ports and allows us to adjust flexibly to future changes and opportunities that energy transition will bring to our sector.”

Late last year HES International also signed an agreement to acquire the Valt Asphalt Terminal in Botlek, Rotterdam. The terminal, a joint venture between Vitol and Sargeant, provides storage, handling and blending services for the European and African bitumen market and is located close to HES’s existing Botlek Tank Terminal and European Bulk Services facilities. HES says it will invest to upgrade the terminal over the course of 2018 with new tanks and ancillary infrastructure.

Another change of investor happened last year at LBC Tank Terminals, when retirement funds State Super and Sunsuper sold their stakes to private investment firm Ardian, giving it a 35 per cent holding. This makes it the largest shareholder, alongside APG and PGGM, both with 32.5 per cent.

“LBC is at a significant transition point in its business strategy, in particular as the business shifts its focus toward expansion of its facilities in USA and Europe. This trend has been identified by Ardian and we value the experience and support they can provide to LBC during this period of strategic change,” LBC’s CEO, Walter Wattenbergh, said at the time.

A new name in the tank storage field is Alkion Terminals, launched in 2016 by InfraVia Capital Partners and Dutch energy firm Coloured Finches. In mid-2017 Alkion acquired eight smaller terminals in France, Spain and Portugal from LBC, as well as the partly owned Sogestran site. It then acquired a 230,000-m3 terminal in Vado Ligure, near Genova, from the Italian state energy firm ENI. Alkion now has ten terminals in five countries in Europe, with an aggregate capacity of some 1.3m m3

M&A • AS WITH CURRENT NEWBUILDING PROJECTS, MUCH OF THE INTEREST IN MERGERS AND ACQUISITIONS IN THE TERMINALLING SPHERE IS FOCUSED ON NORTH AMERICAN ASSETS

A more established investor making waves over the past year has been Warburg Pincus, lead investor in the acquisitive firm Zenith Energy. Last August Zenith agreed to acquire Arc Logistics Partners through a deal with Arc’s major owner, Lightfoot Capital Partners, marking Zenith’s first foray into the US market. “Arc Logistics’ diversified portfolio of logistics assets serves critical links between supply and demand locations in the US and we intend to further develop their existing terminals as well as pursue new developments throughout North America,” said Jeff Armstrong, president/CEO of Zenith Energy, at the time. The acquisition added some 7m bbl (1.1m m3) of storage capacity in the US to Zenith’s existing network in the Netherlands, Ireland and Colombia, which together represent more than 15m bbl of storage for crude oil and petroleum products.

Zenith Energy subsequently bought a bulk liquids storage terminal in Hamburg, Germany from Royal Dutch Shell. The Hamburg terminal is situated on 55 ha of land and has a potential storage capacity of 480,000 m³. Its acquisition in January 2018 was the third major deal for Zenith in Europe, following its purchase of terminalling assets in Amsterdam from BP in 2016 and the Bantry Bay terminal in Ireland from Phillips 66 in 2015.

Meanwhile, at the start of this year, Zenith Energy sold a 51 per cent interest in the Pawnee, Colorado crude oil terminal to Tallgrass Terminals for $31m. The Pawnee

Terminal acts as an injection point for the Tallgrass Pony Express Northeast Colorado Lateral and has 300,000 bbl of storage capacity. Tallgrass has also acquired a 38 per cent interest in Deeprock North LLC, which owns a crude oil terminal in North Cushing, Oklahoma. Deeprock North has now been merged into Deeprock Development, with a total storage capacity of some 4.0m bbl, in which Tallgrass has an overall 60 per cent interest.

ArcLight Capital Partners, which owns TransMontaigne Partners’ general partner, has set up a joint venture with BP West Coast Products covering refined product logistics in the US Pacific Northwest. The deal was anchored by the purchase of two largescale refined products terminals in Seattle, Washington and Portland, Oregon from BP, which are being operated by ArcLight affiliate TLP Management Services.

Last year TransMontaigne made a further acquisition on the US west coast, buying the Martinez and Richmond terminals in California from Plains All American Pipeline for $275m.

The established Australian investment funds have also been active lately, particularly Macquarie Infrastructure Corp, which owns International-Matex Tank Terminals (IMTT).

In August last year IMTT entered into an agreement to acquire Epic Midstream from affiliates of White Deer Energy and Blue Water Energy. The transaction valued Epic at

$171.5m. Epic operates seven terminals in the south-east and south-west US, with its main marine terminal operations in Savannah, Georgia. Aggregate storage capacity is some 3.1m bbl (492,000 m3) for petroleum products, asphalt, biofuels and chemicals.

Macquarie was also involved in the sale of Odfjell’s 50 per cent shareholding in the 377,000-m³ Oiltanking Odfjell Terminal Singapore (OOTS) last October; Odfjell received some $300m for its holding in a deal involving Macquarie Infrastructure and Real Assets (MIRA), booking a net gain of some $135m. “This divestment is in line with our strategy to focus on the terminals where we have managerial control of the assets and to further invest in growth opportunities in our core markets, such as Houston and Rotterdam,” CEO Frank Erkelens said at the time. This followed on from Odfjell’s sale of a 35 per cent indirect ownership in the Exir Chemical Terminal in Iran to Oiltanking in June 2017.

Subsequently, however, Lindsay Goldberg has suggested it may look to sell its 49 per cent interest in Odfjell Terminals BV, in which case Odfjell may seek buyers for its Rotterdam terminal.

Another Australia-based fund, Prostar Capital, acquired Socar Aurora Fujairah Terminal early in 2018. The terminal currently has 350,000 m3 of tank storage for refined products, with a further 315,000 m³ under construction and room for another 150,000 m³. Prostar already had a 40 per cent interest in the nearby Fujairah Oil Terminal.

London-based Whitehelm Capital acquired a 90 per cent stake in Vopak Terminal Eemshaven, a joint venture between Vopak and NIBC European Infrastructure Fund, in September last year. Vopak continues to manage and operate the terminal. The 11-tank, 684,000-m³ facility is used for the strategic storage of gasoil, gasoline and other refined products and has a deepwater jetty to handle oceangoing ships. Whitehelm focuses on investing in infrastructure assets with stable long-term cash flows and, Vopak says, has a long history of investing in the tank storage sector, including Oikos Storage in the UK.

Elsewhere in the North American midstream sector, SemGroup Corp has been busy, not least

with the acquisition last year of Houston Fuel Oil Terminal Co (HFOTCO) from investment funds managed by Alinda Capital Partners for a sum that could be as high as $2.1bn, depending on performance. The deal was, SemGroup says, “part of its long-term strategy to add secure, downstream cash flow to its portfolio mix”.

HFOTCO is located on 330 acres of land along the Houston Ship Channel. The business is fully supported by take-or-pay contracts with primarily investment-grade counterparties that have been customers for an average of 15 years. HFOTCO is currently executing on contractually supported growth projects, including a new ship dock, a new pipeline and connections, as well as an additional 1.45m bbl of crude oil storage that is expected to be in service mid-2018.

Following the acquisition of HFOTCO, and as part of its efforts to trim its borrowings, SemGroup sold its UK petroleum storage business, SemLogistics, to Valero Logistics

UK Ltd, a wholly owned subsidiary of Valero Energy Corp. SemLogistics’ main asset is the 1.4m-m³ Milford Haven terminal in Wales.

There has also been some activity on the part of the major international trading houses. Glencore, for instance, sold a 51 per cent interest in the newly formed HG Storage International Ltd (HGSI) to HNA Innovation Finance at the start of this year. HGSI was set up to consolidate Glencore’s petroleum products storage and logistics businesses in strategic ports in Europe, Africa, the Middle East and the Americas. The $775m transaction is being carried out in two phases as the transfer of the interest in Glencore’s three US sites is subject to regulatory approval. Glencore and HNA say they plan to expand the HGSI footprint through acquisition and organic growth.

Refiner/trader Gunvor agreed last October to sell its shareholding in the Maasvlakte Oil Terminal in Rotterdam to Aramco Overseas Co. Gunvor says the divestment is part of its strategy to invest in its Rotterdam refining operations. For Aramco Overseas, the deal will support its refining activities in north-west Europe, strengthening its export supply chain.

Many of the other newsworthy deals recorded over the past year have involved midstream assets in North America. For instance, in October last year Pin Oak Terminals acquired Gravity Midstream Corpus Christi, now renamed Pin Oak Corpus Christi, in a deal secured by financing from Pin Oak’s owners, Dauphine Midstream and Mercuria Energy. The terminal offers 737,500 bbl (117,250 m³) of storage capacity, pipeline links to nearby refineries, a crude processing unit and asphalt plant, rail loading and unloading facilities, truck racks and a dock capable of handling Aframax tankers. Pin Oak says there are long-term contracts in place that will allow it to significantly expand operations.

Delek Logistics Partners and Green Plains Partners have formed a 50/50 joint venture, DKGP Energy Terminals LLC, to invest in storage terminals for light refined products. DKGP’s first acquisition involved two light products terminals owned by an affiliate of American Midstream Partners and located in Texas and Arkansas. DKGP is understood to have paid $138m for the assets this past February. HCB

DELEK LOGISTICS PARTNERS and Green Plains Partners have formed a 50/50 joint venture, DKGP Energy Terminals LLC, to invest in storage terminals for light refined products. DKGP’s first acquisition is likely to be two light products terminals owned by an affiliate of American Midstream Partners located in Texas and Arkansas. DKGP has agreed to pay $138.5m in cash for the assets; subject to the usual conditions and approvals, the deal is expected to close in the first half.

The two acquired terminals have a total capacity of 1.32m bbl (210,000 m3). The North Little Rock terminal, which features ethanol blending facilities and the capability to unload ethanol unit trains, is adjacent to Delek Logistics’ existing terminal.

Green Plains and Delek Renewables formed another joint venture, NLR Energy Logistics

LLC, a year ago with the aim of developing another ethanol unit train terminal in the Little Rock area; this facility is expected to be in service before the end of this quarter. The partners stress that NLR Energy Logistics and DKGP will remain separate entities.

“We are excited to partner with Green Plains Partners for its potential ethanol volumes, logistics expertise and industry knowledge as the domestic markets expand blending, and look forward to the future of this joint venture,” says Uzi Temin, chairman/CEO of Delek Logistics’ general partner. “This is a great opportunity as it fits our strategy to grow through assets in markets that we are very familiar with, and by contributing our complementary existing logistics assets in east Texas and Little Rock, Arkansas, we expect to create additional synergies within the joint venture. In addition to serving third party customers, it should be well positioned to provide additional logistics support to Delek US’ Tyler, Texas and El Dorado, Arkansas refineries. Our financial flexibility should give us the ability to finance this investment under our revolving credit facility, while we continue to look for opportunities for future growth.”

“This transaction helps us start achieving our goal of diversifying Green Plains Partners

revenue and income streams,” adds Todd Becker, president/CEO of Green Plains Partners. “We believe this joint venture with Delek Logistics creates significant value for both our partnership unitholders and Green Plains Inc shareholders.

For American Midstream, the divestment of the terminal assets is part of its capital optimisation strategy; that process is likely to also see the sale of additional terminal facilities, including its marine and speciality chemical storage facilities.

Delek US Holdings, meanwhile, has reached agreement to sell four asphalt terminals in California and Arizona, as well as its 50 per cent share in another terminal in Nevada to an affiliate of Andeavor for $75m in cash plus working capital. The deal is expected to close before the end of the first half.

“We explored different options for these assets, including a sale to our affiliate, Delek Logistics Partners, and determined this transaction was the most attractive relative to other options,” says Yemin. Net cash proceeds could be returned to shareholders.

Delek US is, though, looking at other logistics assets that may be dropped down to Delek Logistics Partners, including assets at the Big Spring refinery in Texas that may also be transferred during the first half. HCB www.deleklogistics.com www.greenplainspartners.com www.americanmidstream.com

ONE OF THE biggest problems faced by tank storage operators is product contamination and its costly repercussions. Sofis, an industry leader in valve operations, was at StocExpo in Rotterdam this year, previewing its new key management system. The system aims to help eliminate the level of human error that is common alongside manual valve operation.

Sofis’s key management system comprises three main components: valve interlocks, which are permanently mounted to and lock the valve in the fully open or fully closed position unless specifically coded keys are inserted; a key management system that can authorise the removal of the keys; and finally a control cabinet that interfaces with the key management system to only allow specific keys to be removed after authorisation has been granted.

The system works to ensure that contamination risk is reduced to zero, without the need to implement a fully automated system, which is a costly and, in most cases, unrealistic solution.

Once it has been established that a valve needs to be operated, one of the operators in the control room can release the required open or close key from the cabinet. Once released, a field worker has to insert the key into the correct slot on the correct valve in order to operate the valve successfully. Since each key is coded specifically for a particular valve, it is

impossible to accidentally place an open key for valve X into the open slot on valve Y and, likewise, the system makes it impossible to insert the open key for valve X into the close slot on valve X, and vice versa.

Once valve operation is complete, a separate distributed control system (DCS) monitors the valve line-up using position feedback from the key management system.

Having a strictly regulated key management system ensures that all valve operations are performed correctly first time and there is very limited scope for human error.

Sofis’s move into the world of automation represents a significant step for the company. Frank Gielissen, marketing

director, explains how an intermediate solution like this opens up doors that had previously not been accessible to most operators. While full automation might be a preferable choice for most tank farm operators, logistically it simply isn’t an option. In order to implement a fully automated network of valves, all the valves have to be changed out, actuators need to be fitted and the farm has to be supplied with power. The latter can pose a significant problem for some, as digging up the ground to place wires may be prohibited by environmental agencies, making full automation next to impossible. Sofis’s system can be integrated into existing third-party software which makes it compatible with the current framework that the tank farm has in place or, in the case of a new farm, means no extra budget needs to be allocated to extra, more specific software.

Most tank farms around the world are currently operating with hundreds of manual valves and no realistic option to full automate. As a result, Sofis’s key management system allows a reasonable level of automation at a fraction of the cost of a fully automated system. HCB www.sofisglobal.com

EDDYFI TECHNOLOGIES HAS launched Swift™, a brand new ultrasonic testing instrument as part of its Silverwing product line. The new instrument in its line of non-destructive testing (NDT) solutions brings long-awaited efficiency improvements to remote-access applications such as storage tank inspections.

The importance of tank inspection should not be understated. Tank shell wall thickness, being an important measure of a tank’s structural integrity, requires in-depth and detailed analysis at regular intervals. Swift can be used alongside Eddyfi’s Scorpion2™, a steerable, remote-control ultrasonic

inspection crawler. Using ultrasonic testing (UT) crawlers like the Scorpion2 means inspections can occur efficiently, with all the scan data recorded in real time.

The Scorpion2 enables a deeper understanding of assets due to its unique UT analysis capabilities and software features. The unit combines a full-featured UT instrument as well as the capability to drive and control the UT crawler remotely. The latter brings a significant increase in the efficiency of tank inspection due to the fact that no scaffolding or rope access is necessary to perform checks.

Scorpion2 boasts several major features over its predecessor. For example, the drycoupled probe wheel removes the need for an external water source, usually needed for UT inspections. The Scorpion also comes

fitted with a gimballed probe holder, enabling the inspection of uneven surfaces. From a technological point of view, the Scorpion2 has the ability to programme with length and pattern of scans which gives users more flexibility and is capable of measuring thickness at speeds of up to 180 mm/s (6in/s). Finally, the 50-m (164-ft) umbilical removes the need for scaffolding and rope access, which is hugely beneficial for ease of use and for the safety of operators.

Scorpion2 comes equipped with four permanent magnet-drive wheels and two encoders. This combination makes it possible to compensate for the crawler’s drift from slippage and the weight of the cable. It also has a significantly simpler design, making it quicker and easier to set up than the original Scorpion.

“Swift and Scorpion2 are the perfect power UT inspection combo,” says Edwin van der Leden, product manager at Eddyfi Technologies. “Not only do they contribute to improve the overall efficiency of inspections, they also provide better accuracy. For example, we bring forth a unique way of processing gate information, rendering acquired data with floating gates and making postinspection processing of gate information possible. This translates to higher revenues for our customers.”

Eddyfi Technologies, headquartered in Quebec, Canada, employs more than 250 people and has customers in more than 80 countries. Eddyfi develops what it says are the industry’s most reliable test instruments, acquisition and analysis software, as well as more specialised surface array and tubing probes. The company focuses on offering high-performance non-destructive testing solutions for the inspection of critical components and assets.

Last month Eddyfi announced the acquisition of M2M, a French developer and manufacturer of phased array ultrasonic testing (PAUT) instruments for NDT. The deal extends Eddyfi’s presence in what CEO Martin Thériault terms “the much larger advanced ultrasound space” and also gives the company a foothold in China, where M2M has an office. HCB www.eddyfitechnologies.com

Saval was showing its new SmartMix® electronic foam mixing system, designed to bring added accuracy in the mixing ratio of foam concentrate to water. This is achieved by continuous monitoring of both flows using electromagnetic flowmeters and real-time adjustment of the concentrate control valve. The system employs a state-of-the-art logic specifically developed for SmartMix

The cabinet also includes an integrated touchscreen user interface, allowing the user to view system parameters, diagnostics and all process values, alarms and events. All data can be downloaded for analysis.

Saval’s partner company Knowsley SK had its new Turbinator foam mixing unit on display in Rotterdam. Developed from the company’s successful 2P and 3P foammaking systems, the Turbinator is designed specifically for the task using positive displacement technology.

The really clever thing about the Turbinator is that it is powered by water pressure – the water-powered motor and foam concentrate pump are close-coupled and integrated within a single body, so that while every revolution of the water motor delivers a fixed volume of water, the corresponding revolution of the foam pump delivers a fixed volume of concentrate. This means that the foam mixing ratio is maintained, regardless of the operating pressure.

AUTOMATION HAS COME to the tank storage sector with a vengeance in the last couple of years, changing established working practices and procedures and helping to improve safety and efficiency. That process has lately arrived in the firefighting department, promising better performance and environmental protection.

Two parts of SK FireSafety Group were on hand at last month’s Tank Storage Connect event in Rotterdam, where they each had new developments to show to visitors.

In addition to providing an accurately mixed firefighting medium, SmartMix can also reduce the environmental impact of firefighting operations. Its test procedures operate without the need to actually mix water and concentrate, avoiding the unnecessary use of concentrate stocks and eliminating the potential for concentrate to escape the system. During the test the injection point to the firewater system is isolated and the concentrate is diverted through the test outlet fitted with a pressure sustaining valve. Those test procedures also ensure that accurate proportioning is achieved every time.

The SmartMix system is housed in a powder-coated stainless steel cabinet that can be installed in the harshest environments.

That design also makes the device inherently self-priming and it also generates no wastewater. It is produced in three sizes, ranging from a nominal 4” to a nominal 8”. Knowsley SK also manufactures a unit specifically for offshore applications, in which the 431 stainless steel rotors are replaced by super duplex F55 grade steel, and the mechanical seals are Hastelloy and rubber rather than stainless steel and rubber. This allows it to use seawater as an alternative to fresh water. All products meet the requirements of the EU ATEX Directive.

Speaking to HCB at the Tank Storage Connect event, Peter Robinson, Knowsley SK’s UK sales manager, reported that the company has seen a lot of interest in the Turbinator, not least since its design and independence from a power source makes it ideal for use in a range of applications, such as foam monitors, deluge systems, foam makers and handline nozzles. HCB www.knowsleysk.com www.saval.nl

FIREFIGHTING • RECENT ADVANCES IN FOAM MAKING FROM THE SK GROUP MEAN LESS RISK OF ENVIRONMENTAL DAMAGE AND A MORE RELIABLE RESPONSE TO TANK FARM FIRES

ALL LIQUID COMMODITIES, be they refined petroleum products, chemicals or foodstuffs, will at some point pass through or be kept at a bulk liquids storage terminal. They may arrive at and depart from the terminal by oceangoing tanker, barge, rail tank car, pipeline or tank truck, in volumes that range from a few hundred to many thousands of gallons.

The job of the storage terminal in this supply chain is twofold: firstly to make sure that each parcel of cargo is in the right place at the right time; and secondly to do that in the most efficient, cost-effective, safe and reliable way.

Pumps play an important role in enabling the movement of bulk liquids between the terminal’s storage tanks and transport vessels.

Over the years, different types of pump technology have been used in bulk liquids storage terminals, with centrifugal and gear-type pumps proving popular. But terminal operators should perhaps look at the option of positive displacement sliding vane pumps as the go-to choice for the transfer of a range of fluids with varying viscosities at different flow rates and pressures.