Judging by the reports we regularly refer to in these pages – and this issue is no exception – it almost seems as though occupational health and safety is a new concept and one that operators of hazardous facilities are still getting to grips with.

Nothing could be further from the truth. Even if some tools are comparatively new, particularly concepts such as process safety management or formal risk assessments, the idea of protecting personnel at work has a surprisingly long back story.

Anyone seriously interested in looking at how far back health and safety ideas go could pick up a copy of Craig Spence’s recent book, Accidents and Violent Death in Early Modern London (published by Boydell), a snappy title that immediately grabbed the attention of us thrill-seekers at HCB Towers.

In an article in the London Review of Books, Malcolm Gaskill begins with the case of Samuel Wood, whose right arm was torn off in an accident at a windmill on the Isle of Dogs in 1737; locals staunched the bleeding with sugar, which was known to have antiseptic properties, until he could be patched up by a surgeon. Despite these ministrations, he was widely expected to succumb to his injuries but in fact survived and became something of a celebrity.

The arrival of the industrial revolution, with its mechanical looms, steam hammers and any number of other potentially hazardous machines, brought new health and safety risks. Indeed, in the 1850s Charles Dickens was involved in a campaign to introduce legislation to require factory machines to be fenced off.

Gaskill also highlights the year 1665, when the population of London, the largest city in Europe, was some 400,000. In that

year around one quarter of them died, mostly from plague. Others were taken by smallpox, leprosy, shingles and a whole host of other maladies, including ‘rising of the lights’ and ‘teeth and worms’; 46 people were said to have died of grief.

Gaskill makes the point that fatal accidents were less mysterious than deadly diseases, whose causes might have been attributed to angels and demons or the alignment of the planets. On the other hand, Spence says that accidents are “communally constructed events contingent upon the social structures and cultural configurations within which they take place”.

An illustration of that is that, in some parts of the world (even in parts of the US), fatal accidents or an individual’s survival during an accident are ascribed to spirits, juju, angels or whatever. Authorities in some West African states have had to go on record to try and convince people that road accidents are caused by bad driving or poorly maintained vehicles and are not due to evil spirits.

Between 1654 and 1735, there were 12,394 fatal incidents recorded in London. Of those, 5,260 involved drowning and 1,469 involved falling. The UK Health & Safety Executive still places a great emphasis on preventing slips, trips and falls in the workplace, as these continue to cause a lot of fatalities and life-changing injuries.

On the other hand, as the Tank Storage Association heard at its recent conference, HSE is also this year focusing on low-frequency, high-outcome incidents at COMAH sites. We have not been told whether windmills are subject to COMAH.

Peter Mackay

Cargo Media Ltd

Marlborough House 298 Regents Park Road, London N3 2SZ www.hcblive.com

Editorial Editor–in–Chief

Peter Mackay

Email: peter.mackay@hcblive.com Tel: +44 (0) 7769 685 085

Stephen Mitchell

Email: stephen.mitchell@hcblive.com Tel: +44 (0) 20 8371 4045

Brian Dixon

Designer

Tiziana Lardieri

For advertising and sales enquiries please contact Business Development Manager Daniel Rees Email: dan.rees@hcblive.com Tel: +44 (0) 20 8371 4037

Samuel Ford

Email: samuel.ford@hcblive.com Tel: +44 (0)20 8371 4035

VOLUME 38 • NUMBER 11

HCB Monthly is published by Cargo Media Ltd. While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect.

ISSN 2059-5735

Letter from the Editor 1

30 Years Ago 4

The View from the Porch Swing 6

Shifting sands

GPCA discusses logistics needs 8

Tying the knot

Bahri and Bolloré set up JV 12

Let’s go live

Nijhof Wassink gets connected 14

Building with boxes

Neele-Vat adds to handling capacity 16

Tanks with brains

Savvy seals deal with CIMC 18

Backing a winner

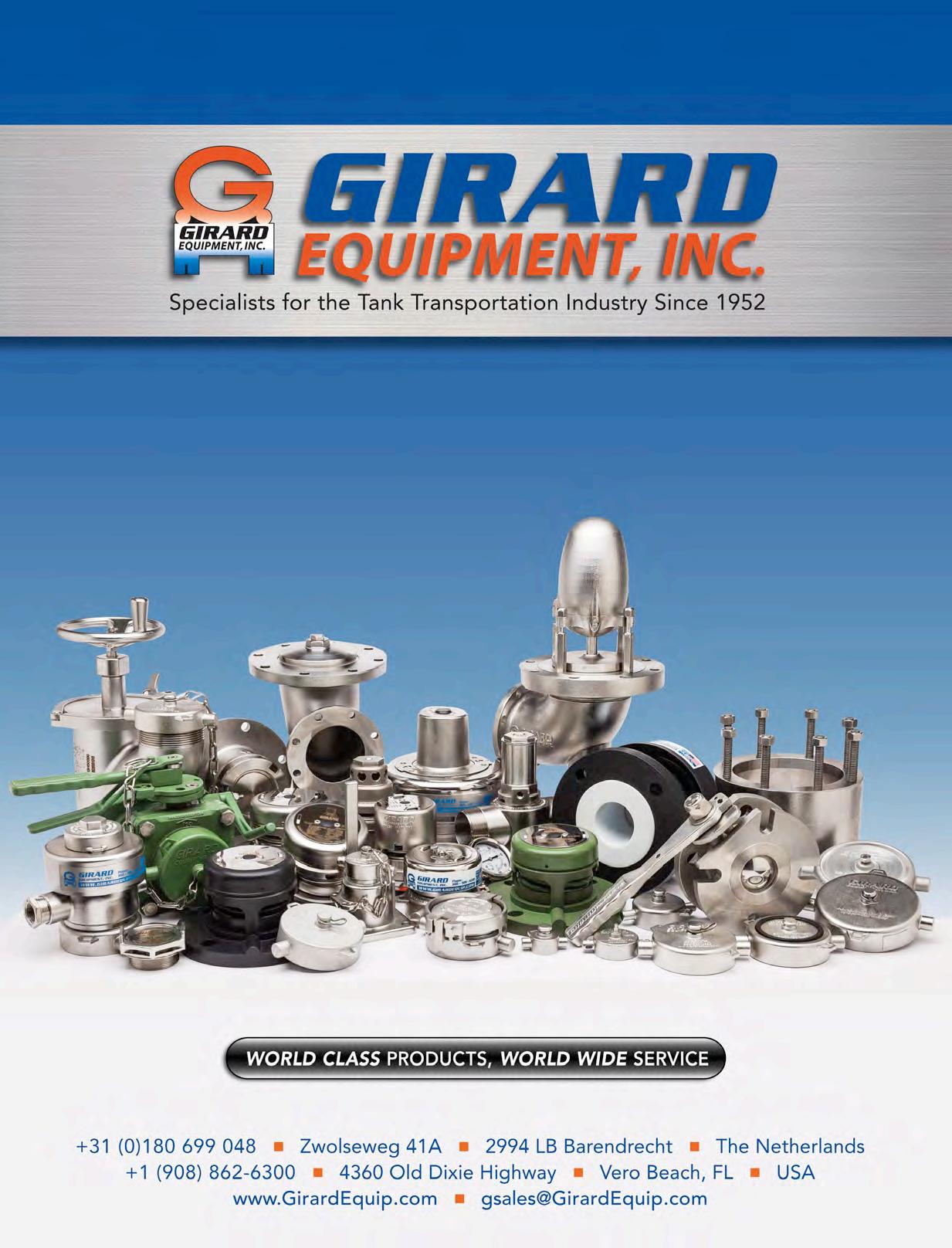

Girard reports on equipment demand 20 News bulletin – tanks & logistics 22

Platforms for growth

FECC speakers predict disruption 26

NRC buys Melrob Deal takes distributor into new markets 31

Seidler joins Maroon ranks

Further consolidation in the US 32

Consolidation in action

Azelis buys in Switzerland 34

Bodo spreads its wings

Automotive sector drives growth 35 News bulletin – chemical distribution 36

New and improved What was hot in IBCs at Interpack 38

Metalled for growth

Good prospects for metal IBCs 44

Time to talk tanks

TSA hears from the regulators 46

Let’s all make a hub

Tarragona lays Mediterranean plans 54 News bulletin – storage terminals 56

Training courses 60

Learning from training 62 Conference dairy 63

Incident Log 64 Hazards afloat

Chemtrec highlights maritime risks 67 Fire in the hold

Insurers want tighter controls 68 Hurrah for CINS

Reporting incidents at sea 70

Once more with failing CSB cites the usual problems 72

Eyes on the skies

What IATA does and how it does it 74 In the air tomorrow

DGR changes in summary 76

Border controls

Joint Meeting sees problems in the east 78 Roadside attraction

Planning for 2019’s ADR 82

THE BACK PAGE Not otherwise specified 88

Annual plastics drums survey

What’s new in gas shipping

EPCA’s Annual Meeting in review European distribution in numbers

Sometimes, when looking at copies of HCB from 30 years ago, one is struck by the distance we have travelled since then; at other times, one cannot help but think that little progress has been made. Increased computerisation has made a big difference, of course, but at the sharp end tanks still have to be welded and steel drums have to be rolled.

The front page of our November 1987 issue demonstrated just such a situation: it pictured a welder hard at work putting the finishing touches to the barrel of a tank container, much like a welder would today (though perhaps some might spot health and safety risks in the 1987 image). On the other hand, the introduction below takes us back to another world.

“In recent years European tank container builders have started to concentrate on ‘specials’ – including tanks for dedicated service and swap body tanks constructed to maximise loadings on European land and shortsea journeys,” we said at the time. “This change of direction, away from previous work on larger series of standard tanks, has been prompted by the fact that new builders are emerging outside Europe who are able to provide tanks at very competitive prices.”

How little we knew. Today there are few significant European tank container manufacturers left, and those that are still in business have mostly teamed up with counterparts in China, or are concentrating on niche business. Back in 1987 China was still largely closed off from the international market and those new volume producers were located primarily in South Africa, where investment in internationally trading assets provided a way for a country hampered by sanctions to earn foreign currency.

Those few tank container builders in the Far East in 1987 were all in Japan but were at the time suffering from a strong yen; we thought then that manufacturing might well move to South Korea – after all, the same movement was happening in shipbuilding. But the Asian currency crisis of 1988 put paid to such predictions.

We were on firmer ground with our forecast that Singapore would have an important role to play in helping develop tank container utilisation in Asia, acting as a hub for regional operations. That development had started a good decade earlier, led by Interflow, which was at that time owned by the Gallic Shipping group, although other European operators had begun to follow suit in the late 1970s, including Suttons, Leschaco, Stolt and VTG.

Development of tank container use in Asia in the 1980s was being held back by three main factors: trade imbalances and the lack of potential backhaul cargoes from Asia to Europe; a lack of tank cleaning depots outside Singapore; and a lack of awareness on the part of shippers of the potential benefits of using tank containers.

Over the years, development of the regional petrochemical industry has alleviated to some extent the problems of trade imbalance, while the opening up of tank container trades to and from North America has also offered better employment prospects. But the problems relating to cleaning and repair depot capacity and to shipper awareness are only gradually being addressed. The Asian Tank Container Organisation has done a lot in these areas in the past few years but there is still a way to go.

Busted! At the time I probably wouldn’t have used the word busted, because back then busted was common slang for arrested, as in apprehended by the police. But the sentiment was undoubtedly the same as “busted” can convey now. Caught! Discovered! My secret exposed!

It wasn’t really all that bad when my mom confronted me after a parent-teacher conference, but still…, she definitely confronted me. “Your teacher tells me you often hide a novel behind your textbook during social studies class”. During social studies class?

Heck, I tried to get away with that trick in practically every class. “What do you have to say for yourself, young man?”, my mother continued.

I couldn’t lie, in part because I wouldn’t be believed, and in part because I had made a habit of trying not to. So, I seized on a minor inaccuracy in the teacher’s observation, hoping that if I could invalidate some of what she’d said, the rest would crumble, at least in my mother’s eyes. “Mom”, I whined, “I don’t do that very often, only sometimes.” Mom wasn’t falling for it, at least not yet. “So, you admit it?” Not giving up, I tried again. “C’mon, Mom, every once in a while I’m caught up when she reviews stuff we’ve done before, and I do a little pleasure reading. If it was often, would I be getting an A?”

Bingo! My A saved me. But, honestly, I did read non-class books in class at some point almost every day. But, as long as I kept getting As, that wasn’t “often”.

I have a relative with a talent for wrecking automobiles. We were visiting, killing a little time before some family function by shooting baskets and chatting. My relative bemoaned the sad effect not having a working car was having on his social life, to which I replied that he was always wrecking his cars, and maybe that was his fault. “That’s not fair”, he said, “I don’t always do anything.”

“Okay,” I said, now upping the precision of my communication, “you often wreck your cars”, and driving the point home, “other peoples’ cars, too”. “Often,” he asked, “often, really? How can you say often?” So, we counted it up. He’d only had a license to drive for about 3½ years, but had wrecked six cars. I told him that being in a car crash

every seven months was “often”. And then he summed it up for me, albeit indirectly. “If you could only have sex every seven months, would you think that’s often?”

The light bulb went on. “Often” is relative, and “often” is subjective. And any given frequency might be often in some cases, but not often in others.

Do the DG regulations change often? In any one area (except Lithium Batteries), no, they don’t change often. But, considering all areas cumulatively together, they might be considered to change often. Added together, the changes in the last 25 years affected classification, packaging, marking, labeling, shipping documentation, acceptance, security, and most other functions, too. If you didn’t keep up with the changes, you became a DG dinosaur, and can’t do anything right now in any area.

Do CDGP questions need to be reviewed often? Compared to CHMM and a bunch of

other certifications, hell yes. Occupational safety, and industrial hygiene, and environmental protection regulations don’t change very often, at least in comparison to HazMat (DG) transport regulations. GHS based regulations change occasionally, whenever a nation (state, country) decides to make changes. But DG regulations change at least every two years, and sometimes more often. The Certified Dangerous Goods Professional (CDGP) certification exam needs to be updated at least as often as the DG regulations change.

Is a five year renewal period for DGSA or CDGP often? Five years equals five years, right? For DGSA, taking another exam every five years isn’t too often for me. But for CDGP, which can be renewed differently, five years is long enough that I sometimes forget to track the ‘renewal points’ I earn for conferences and taking training. So five years is often enough or not often enough.

The biggest DG frequency issue, though, is, IMO (wait, should that be IMHO?), the recurrent training requirements in the IMDG Code and the UN Model Regulations. Today, the way they are written, re-training could be given once a decade, or even once every other decade, and that would be compliant. Seriously, the model for our national regulations, which is also the model for our regional and international regulations, can’t come up with a better Recommendation than ‘whenever’?

“Often” is a subjective term, but really, who truly believes that every other decade DG re-training is “often enough”? Not I.

This is the latest in a series of musings from the porch swing of Gene Sanders, principal of Tampa-based WE Train Consulting; telephone: (+1 813) 855 3855; email gene@wetrainconsulting.com.

PETROCHEMICAL PRODUCERS IN the Middle East have a number of competitive advantages in the global marketplace. They have easy access to low-priced feedstock and, being newer, their facilities are generally more efficient than older plant in the mature markets. The region is also handily placed to export material both east- and westbound.

However, the distance to those markets means that producers in the region have to ensure their logistics operations are equally efficient if those cost advantages are not to

be eroded by distribution costs. That has been an increasingly important function, especially since the fall in global oil prices and the rise of shale oil and gas output in North America have changed the balance of competitivity.

More than that, changing demographics and growing pressure to reduce carbon emissions are putting something of a strain on industrial manufacturing, at the same time as customer expectations are growing. IT advances are making supply chain transparency available to more players in the chemical business,

further driving competition but also raising the potential for greater collaboration and for the capture of hidden efficiencies.

It was within that environment that the Gulf Petrochemicals & Chemicals Association (GPCA) held its ninth Supply Chain Conference this past May in Abu Dhabi.

The meeting’s stated aim was to explore the role of technology in driving agile and efficient supply chains for the petrochemical sector in the Gulf Cooperation Council (GCC) states.

Some 280 delegates from 19 countries arrived for the three-day event to hear a wide range of speakers and to network with their counterparts from other companies.

It is now generally accepted that supply chain companies have to adapt if they are going to become more agile and embrace the technology that can bring great benefits to their operations and their client industries.

But what does that mean in practice for a logistics service provider (LSP) to the petrochemical sector?

The first answer is collaboration, but this is something that many in the industry have been seeking for decades. Is it now the time to open up to partners in the supply chain? Mohammad Husain, president/CEO of Equate and chair of the GPCA Supply Chain Committee, certainly thinks so. “The industry must utilise and share common resources to ensure cost-efficiency and productivity in an increasingly competitive market environment,” he said, opening the conference.

Furthermore, supply chain efficiencies offer an excellent opportunity for the petrochemical industry to reaffirm its commitment to protecting the environment but, again, this will require industry, its LSPs and government agencies to work together to achieve sustainability goals. “The adoption and implementation of best practice initiatives, the highest industry standards, environmental programmes and rigid regulations need to be encouraged across the board,” Husain said.

Technology will play a crucial role in making sure that high-value chemicals and petrochemicals move from the manufacturing plant across roads, through ports and over the sea to their final destination in a sustainable and safe manner.

One of the largest and most modern petrochemical manufacturing plants in the GCC region is the new Sadara facility in Jubail, Saudi Arabia, whose CEO, Ziad Al-Labban, explained that the engineering of an agile supply chain was just as important to the project as the engineering of the plant itself. He described an agile supply chain as one that minimises the time from production to revenue by applying advanced work processes and systems, reduces inventory levels and relies on the building of strong partnerships.

In more quotidian terms, the need for agility in the supply chain also meant that the new

production unit should be located on the Red Sea coast, close to its suppliers, ports and logistics companies.

Al-Labban also noted the role played by various IT tools in reducing the order-torevenue period but others are still questioning whether it can generate concrete benefits. However, Nathan Scott, regional IT head for Panalpina World Transport, said that digitisation has the potential to lower production and operational costs, accelerate lead times and help in better planning and production optimisation. Scott also pointed to the potential offered by 3D printing in terms of, for example, additive manufacturing as well as the implementation of blockchain principles to simplify business processes both within and between companies. Alarmingly, though, research has indicated that, while 90 per cent of CEOs believe the digital economy will impact their industry, only 15 per cent actually have a digital strategy.

John Straw, senior adviser at IBM, had some pointers in that direction, quoting a study by Accenture that found that 58 per cent of chemical companies are already employing digital tools to get a competitive advantage. That means that established business models are being up-ended.

On a more practical level, Christian Juul Nyholm, managing director of Maersk Line’s regional operation, said that one win-win scenario could involve better forecasting by GCC petrochemical producers alongside better reliability on the part of shipping lines, through the use of digitalised collaboration.

Ralph Muessig, senior consultant at Camelot Management Consultants, said that ‘big data’ is also a game changer for the chemical logistics sector, where additional data is driving higher supply chain integration. State-of-the-art IT systems built around big data currently support typical transport management elements through order management, transport planning, transport execution, and freight cost management. With these technologies potentially disrupting the status quo, several industry experts addressed the question of how efficiency and agility could be enhanced with the new supply chain technologies.

Richard Verity, partner at McKinsey & Company, maintained that an agile supply chain is enhanced through three levels of segmentation: needs-based, asset-based and product-based. »

Needs-based segmentation reflects service requirements as well as product sophistication. Product segmentation, on the other hand, considers the variance of sales against total sales. Asset segments can employ different distribution models that cater to different product segments.

Technology disruptors such as big data can optimise the network behind the supply chain for each segment. The differentiated supply chains would drive pricing, cost, inventory, and service levels. A case study showed how Volvo has improved EBIT by 15 per cent and reduced lead times by 30 per cent through digital-enabled supply chain segmentation.

Driving efficiencies within the supply chain requires robust management of the new technology platforms. Manufacturers must use integration to extract the full efficiencies of a supply chain. At a company level, this means new organisational structures, integrative IT tools and systems that help supply chain networks work together, as well as a higher level of customer intimacy that caters to the specific needs of customers.

According to Hosnia Hashim, deputy CEO for olefins and aromatics at PIC and board chairperson at Equate, supply chain efficiency is the sum of various cross-functional collaborations. Hashim detailed how Equate’s cross-functional sales and operations teams within each business consist of people with manufacturing, sales, finance, procurement, and IT functions. They are headed by someone from supply chain.

Each team develops one integrated, tactical plan “that can direct its business to achieve competitive advantage by integrating customer-focused plans for products with supply chain.” IT serves as an enabler for people and processes and ensures continuous improvement in a measureable environment. “[IT] is your window to the world and your virtual vessel to stay ahead in an ever globalising industry,” said Hashim.

Governments can encourage this type of integration by intervening in a number of

key dimensions, Rachid Maalouli, associate partner at McKinsey & Company, explained. These include operations and maintenance upgrades alongside improved interfaces between transport modes. They could also expedite targeted expansions, enable private sector participation, provide better access to financing, assist in the adoption of disruptive technologies, and help build capabilities and attract talent.

In Saudi Arabia, Maalouli said, strong integration between different logistics assets is needed to strengthen the national supply chain infrastructure. Low levels of integration have led to diminished connectivity and lower asset utilisation. At an initial level, improved port utilisation and shorter port dwell times would help open up the supply chain.

These and other presentations made a strong case for the adoption of new technologies to improve supply chain efficiency, since a failure to take advantage of the opportunities will inevitably lead to the region falling behind.

To improve their supply chain performance, companies need to first break the circle and act in collaboration with their partners across the whole supply chain. They need to segment their supply chains; where there was one supply chain, they need to create many, but then compromise.

Customers’ demands for more and more individualised products are continuously increasing. This points to ever more microsegmentation, and finally to the

implementation of mass customisation ideas. Customers will be managed in much more granular clusters and offered a broad spectrum of suited products. This will enable customers to select one of multiple ‘logistics menus’ that exactly fits their need. At present, new transport concepts, such as drone delivery, allow companies to manage the last mile efficiently for single and high-value packages. Using big data to optimise networks for each customer segment is absolutely crucial, along with making sure that differentiated supply chain drives pricing as well as cost, inventory and service level.

While digital technologies continue to advance, the ability of people and organisations to fully use their capabilities has struggled to keep pace. Besides digital innovations in products and services, disruptive technologies may also include ways to improve human productivity. Employees should be engaged to re-think how work gets done and understand how technology can enhance rather than threaten their capabilities.

When it comes to driving efficiency, supply chain is not a solo performance. It is the sum of all cross functional collaborations. The role of IT is absolutely pivotal to achieve optimised and efficient supply chain operations as it enables processes and people, while ensuring continuous improvement in a measureable environment. IT is the new window to the world and the virtual vessel to allow companies to stay ahead of change in an ever more globalised industry. HCB www.gpca.org.ae

BOLLORÉ GROUP AND Bahri have established a joint venture, Bahri Bolloré Logistics, in Saudi Arabia, which will provide end-to-end logistics and supply chain management to local and international companies operating in the country and the wider Middle East. Bahri owns 60 per cent of the new company, with Bolloré holding the remaining 40 per cent.

Commenting on the joint venture, Abdulrahman Mohammed Al-Mofadhi, chairman of Bahri, says: “The success of this joint venture signals the importance of collaboration in creating a wider positive impact on the sector. It is only through meaningful partnerships and a shared vision that the transportation and logistics sector can break new ground and explore new horizons of growth.”

The new joint venture was celebrated and formally inaugurated at a ceremony held in the Ritz-Carlton in Riyadh in late September, attended by senior executives of the two partners as well as Éric Giraud-Telme, deputy head of mission at the French embassy in Riyadh along with other representatives of the diplomatic and military services.

“Bahri is extremely proud to be playing an active role in strengthening the Kingdom’s position as a unique global logistics gateway. Through this joint venture and other initiatives, we remain dedicated to the future growth and development of the transportation and logistics

industry in the Kingdom,” Al-Mofadhi said during the inauguration.

Ali Al-Harbi, acting CEO of Bahri, commented: “The inauguration of Bahri Bolloré Logistics will enable us to play a significant role in driving an important objective of Saudi Arabia’s Vision 2030, to further raise the Kingdom’s ranking in the global logistics market.

“The joint venture will enable us to deliver high quality logistics and supply chain management solutions as we combine Bolloré’s global footprint with our industryleading capabilities and deep understanding of the local market to meet the growing demand for these services in the regional market,” Al-Harbi added. “In doing so, we are also proud to be playing an integral role in further promoting Saudi Arabia’s credentials as a prominent logistics gateway.”

Cyrille Bolloré, chaiman of Bolloré Transport and Logistics, said: “We are particularly

honoured to conclude this strategic partnership with Bahri, one of the most recognised logistic players in Saudi Arabia. This development at the heart of a high growth potential region is an important milestone of our global network integration.”

Bolloré Logistics’ CEO, Thierry Ehrenbogen, added: “This alliance is following the development dynamic of Bolloré Logistics in the Middle East region and at the crossroads of Asia, Africa and Europe. Our joint venture with Bahri enables us to promote our expertise in our key sectors, especially in aerospace, defence, oil and gas, along with fashion and healthcare.”

Bolloré has an existing presence in Saudi Arabia, with a headquarters office and operational facility in Jeddah and another location on the Arabian Gulf coast in Dammam.

Bahri was formerly the National Shipping Corporation of Saudi Arabia (NSCSA) and remains a major player in oil and chemical tanker shipping; it has since added a dry bulk shipping operation, ship management activities, and Bahri Data, formed in 2015, which focuses on leading cross-functional initiatives to unearth the knowledge hidden inside massive amounts of data and thus create transformative impacts in the maritime industry. Last year Bahri achieved revenues of SAR 6.79bn ($1.8bn) and net income of SAR 1.76bn ($470m). HCB www.bahri.sa www.bollore-logistics.com

“OPTIMAL CONNECTIVITY 24/7 and from any location means maximum efficiency and productivity,” says Nijhof-Wassink, riding the wave of the newly digitalised supply chain. “This applies to our own processes, but primarily also for our clients. Under the name Nijhof-Wassink LIVE, we are working on the unlimited exchange of data between people and IT systems, but also between mutual systems.”

This is the basis of the latest development at the Netherlands-based bulk transport and logistics firm. Its new Transport Management System (TMS) provides its own transport planners, its clients and their customers with real-time, ‘LIVE’ information.

“Everything is about data these days,” observes Mark Burgman, Nijhof-Wassink’s business improvement manager. “The better you have set that up at the front, the better the odds of being successful on the bottom line. A large number of companies are only now starting to work with a digital plan system but at Nijhof-Wassink we have been doing this since the 1990s. We were also one of the first transport companies with onboard computers in the trucks.”

The latest iteration of the company’s digital platform provides information automatically all the way through the logistics chain. When a driver arrives to load, he presses a button and a notification is sent; the same thing happens

when he starts to load and again when he is ready to leave. This gives much more control over the process. “Approximately 150,000 status updates are exchanged between the various systems every single day,” Burgman notes.

Benno Hulzink, operations manager for Nijhof-Wassink’s dry bulk logistics division, agrees: “This system allows us to genuinely plan in real time, really LIVE. It calculates how long the expected journey time is. If there is an overnight stop, this is automatically included in the planning. In this way you know what the arrival time will be. The information is constantly kept up to date, so there is realtime shipment information. If the loading takes longer than anticipated or if the driver gets stuck in a traffic jam, this will be determined by the GPS connection and the planning will be automatically updated.”

Providing this sort of real-time information to its clients is, Nijhof-Wassink believes, a competitive advantage. “Anyone can drive from A to B,” Burgman says. “If you want to keep meeting the needs of your clients, you need more than a good truck and a driver. You also require state-of-theart automation and a far-reaching integration into the supply chain of your client.”

Hulzink illustrates what this means in practice. “We are increasingly faced with time slots that have been determined by the client. If you can plan in real time you can also plan towards such a time slot. In the old TMS there was still a lot of human thinking – subjective estimations on the basis of experience.” The new TMS provides that information quickly, objectively and in much more detail. Clients thus benefit from better delivery performance while Nijhof-Wassink optimises its own performance.

An important element of the new TMS is the way it communicates with clients’ own systems, either directly or through an intermediary platform such as Transwide or Elemica. “The client order comes to us automatically,” explains Hulzink. “Typing out information is

BETTER VISIBILITY ALLOWS NIJHOF-WASSINK TO PROVIDE BETTER CUSTOMER SERVICE AND EMPLOY ITS ASSETS EFFECTIVELY

no longer necessary and this reduces the chance of errors. This also gives our planners the time and space to set up their work differently – they can focus more on further increasing our level of service by, for example, checking whether the requirements of the transport are properly adhered to. This is crucial, in particular with chemical companies, because there even a small error in an order can lead to significant damage claims and other potentially tricky situations.

“During the implementation of the order the client constantly receives status updates, up to and including the moment the cargo has been unloaded. The client can then immediately invoice – he no longer needs to wait for a consignment note, because it has already been scanned by the driver in his truck and is already in the system.”

Such an approach also improves safety in the logistics chain. “You get more traceability,”

Burgman says. “We can get the system to also supply number plates, so the client knows which truck he can expect at the gate.”

But what Nijhof-Wassink has achieved so far is just the beginning. Hulzink explains: “We want to move towards a system that can, for instance, devise a planning proposal itself, based on orders. With such partial automatic planning, the planners can fill their time even more efficiently. It is essential, though, that they are always in control: a planner must always be able to overrule instructions from the system.

“We are already cautiously experimenting with this time of automated planning and the first results are positive,” Hulzink adds.

“With Nijhof-Wassink LIVE we can achieve the ultimate digital supply chain network, together with our clients,” Burgman says. “Thanks to 24/7 real-time information, we can offer the end client the service level that matches the modern era.” HCB www.nijhof-wassink.com

“IF YOU WANT TO KEEP MEETING THE NEEDS OF YOUR CLIENTS, YOU NEED MORE THAN A GOOD TRUCK AND A DRIVER”

IN THE FIRST half of 2017, throughput of containers at the Port of Rotterdam rose by nearly 10 per cent year on year. As many of those additional containers are carrying dangerous goods, this has meant an increase in business for specialist service providers.

Among them is Neele-Vat Logistics, which operates six facilities in and around Rotterdam, including a major warehouse on the Maasvlakte that has a total capacity of 50,000 pallet spaces and handles ADR goods, aerosols, other chemicals, electronics and goods that require temperature-controlled storage.

To handle the growing volume of inbound and – especially – outbound containers in the port, Neele-Vat has leased a further 5 ha of land opposite its existing Maasvlakte site and has already drawn up plans for another warehouse; the demand is clearly there and the company is now awaiting the award of permits from local authorities before construction can begin. It expects the warehouse to be complete late in 2018.

The second Maasvlakte facility will include drumming lines to break bulk from road tankers and tank containers. This is a new activity for Neele-Vat, reports business development manager Joost Mooijweer, as the company has traditionally focused on the transport and warehousing of packaged goods.

Another significant element of the new Maasvlakte warehouse will be an outside area devoted to the gas measurement of the atmosphere inside containers arriving into Rotterdam, which will double the company’s capacity in what Mooijweer reports is a growing activity as an increasing number of receivers are asking for a gas-free certificate before taking delivery of imported goods.

Mooijweer reports that around 15 per cent of all containers checked have gas concentrations above the acceptable limit. Only 2 per cent involve high levels of fumigants – the other 13 per cent contain gases emitted by the cargo or by the wooden pallets and dunnage inside the container. Often these gases are derived from resins and adhesives used in the manufacture of the goods.

Mooijweer says the business of gas measurement has increased rapidly from a standing start some eight years ago; it now provides a gas measurement service not only for its own clients but also for third parties, mainly other freight forwarders, which now represent some 80 per cent of activity in this business. Neele-Vat is now one of the biggest players in the market in Rotterdam and its personnel are trained and properly equipped to deal with the hazards posed by off-gassing in containers before they are delivered to the consignee.

The move into gas measurement also reflects the changing nature of Neele-Vat’s overall business since it was formed in 2014 from the merger of two long-standing family-owned companies. European land transport accounts for some 40 per cent of its business, with warehousing contributing 30 per cent, air and ocean freight services 20 per cent and customs activities 10 per cent.

This smallest sector of the business is growing fast, Mooijweer says, not least from its experience in and expertise with the ‘Delivery Duty Paid’ system required of consignments to Russia. It can only do this by maintaining its own office in the country, one of six territories covered by offices outside its Benelux base. HCB www.neelevat.com

Such a capability is already available. SAVVY Telematic Systems AG offers its customers remote temperature control and adjustment from any location at any time. Dispatchers at desktop computers or shipment staff on business trips can correct and/or adjust temperatures from a smartphone. Likewise, where temperature deviations or disturbances arise, designated persons are automatically notified. Two clicks suffice to configure the escalation workflow as needed.

was put into operation. This is not only a reliable basis for billing tank container heating costs. All of the record protocols are available retroactively as quality proofs, so taking manual – and error-prone - notes of product temperatures or pre-heating duration is no longer necessary.

A number of producers of speciality chemicals and food products are already using SAVVY’s solutions to monitor and control trace heating and cooling units remotely, including Repsol Resinas of Portugal and China-based Wanhua Chemical Group. In the event of any deviation from the target temperature or any other notable event, an automatic alarm is immediately triggered. This allows shipment personnel to intervene without delay.

The monitoring of temperature-controlled shipments is just one application for SAVVY’s telematics systems, a fact that has been recognised by the largest tank container manufacturer in the world, CIMC. David Wang, sales director for CIMC Tank, explains: “We have equipped our tank containers with the SAVVY® FleetTrac. This means we have taken the next step in further improving investment security for our customers.”

THE UNUSUAL HEA t wave in June of this year is only one of the many extreme phenomena that has characterised the weather in the last few years. The increasingly dynamic changes in the weather situation and the rise in extreme conditions pose new challenges in sectors previously unaffected by the weather. One example is the transport of temperature-sensitive goods. To ensure product quality during shipping, real-time monitoring and temperature control are increasingly important.

Ongoing temperature monitoring ensures optimum quality and safety for temperaturecontrolled shipments. SAVVY’s solution enables operators, leasing firms, and chemical companies to offer their end customers new services that reduce costs and further increase transport productivity.

For example, shipments can be automatically and precisely pre-heated or cooled depending on the conditions the goods require to arrive in good condition. Exact protocolling means there is always a record of when and how long the tank container was pre-heated, and the temperature at which it

“Thanks to SAVVY’s state-of-the-art telematics technology, uninterrupted, digital temperature protocols are not the only thing we are getting. The sophisticated alarm, diagnosis and control options offered by the SAVVY® Synergy Portal (Chinese version www.tankmiles.com) enables unprecedented real-time management for temperaturecontrolled shipments,” Wang continues.

Aida Kaeser, SAVVY CEO, adds: “For tank container operators and leasing firms, collaboration with SAVVY is not only attractive because of SAVVYs market and technology leadership. SAVVY is the exclusive telematics provider of the worldwide largest tank container manufacturer, CIMC Tank. Our customers benefit from this twofold: they get intelligent tank containers from CIMC that are already equipped with SAVVY technology ex works. This way they do not have to worry about it any more and save both installation time and money.”

SAVVY’s telematics units are built to be robust and, thanks to their very low power consumption, are also suited for long autonomous operation. The units are connected by interfaces to the container and tank wagon heating and/or cooling units. SAVVY’s intelligent interface architecture makes it possible to use the technology with a broad range of manufacturing systems.

Currently, there are SAVVY telematics units in operation with all established heating and cooling systems such as Dirac, Eltherm, Löbbe and Klinge. During operations, the unit records the current temperature and transmits the data via the SAVVY® Synergy Portal, which won the Telematic Award for the best tank container logistics solution in November 2016. This arrangement enables both real-time monitoring and, later on, seamless proof of quality. The cloud-based SAVVY Synergy Portal enables dispatchers to also have access to the individual units worldwide and maintain granular control over target values and unit parameters.

Active, non-stop shipment monitoring, with transmission every five minutes, for example, is possible with our system but does not make sense technically and economically,” Kaeser says. She puts it this way: “I don’t eat constantly to prevent feeling hunger but eat when I am actually hungry.” Similarly, SAVVY’s telematics units do not need to be in constant communication.

“Our telematics systems are hybrid and equipped with self-learning software. Instead of bombarding users non-stop with data, we notify them when there are actual deviations which are of interest for their task,” Kaeser explains. “The software takes care of the rest because it is developed to automatically recognise certain patterns, learn from them, and adjust to them accordingly.

“We are very proud of the self-learning capacity of our software, resulting from long-standing experience in the development

of highly complex algorithms. The advantage of digitisation is after all to automate flows to free employees from mindless, repetitive tasks. Valuable time is then available for tasks that truly add value.”

In addition to comprehensive transport safety and automated production of required documents, the SAVVY solution offers more cost optimisation potential. The portal provides extensive business intelligence functions to analyse the transport processes of chemical and transport companies with respect to individual indicators. These can be used to provide optimal support for capacity utilisation, asset management or to develop new business areas.

SAVVY® Telematic Systems AG, headquartered in Schaffhausen, Switzerland, is a leader in innovative telematics, sensor

and software solutions that make an important contribution to digitisation in the chemical and logistics sectors. The objective is to increase added value in these companies by means of efficient work and logistics processes, the company says.

SAVVY combines high-tech telematics system solutions for use in rail freight wagons, tank and freight containers, IBCs, vehicles or machines with sophisticated telematics technology and a process-oriented state-ofthe-art portal.

As well as its hardware and systems, SAVVY, a subsidiary of INDUS Holding Group of Germany, also offers extensive process consulting and intelligent process design services for all telematics and sensor-based applications; it is also active in digitising business processes in the chemical, industrial and logistics sectors. HCB www.savvy-telematics.com

Then in late 2014 came the slump in oil prices and, along with the opening up of new pipelines to move crude oil and NGLs, those days were suddenly over. On top of that, uncertainty during the US election year in 2016 ran into 2017 as businesses waited to see what approach the new administration would take.

jump in. That too has now calmed down although Girard says shipments are still going, particularly for stainless steel vents.

ANY MANUFACTURER SUPPLYING equipment into the hydrocarbon and petrochemical supply chain will be affected by external factors it has little or no control over. In North America, rapid development of shale oil and gas resources over the past five years generated something of a ‘gold rush’ mentality in the business, with surging demand for rail tank cars and tank trucks to move the new production and a concomitant surge in demand for safetycritical kit.

Despite all this, the market is now “picking up a head of steam,” according to Tim Girard, president of Florida-based Girard Equipment, one of the leading manufacturers of valves, vents and ancillary equipment for the oil and chemical transport sector.

In particular, Girard reports, the market for rail tank car equipment is “recovering quite nicely” with improved demand for vents for tanks handling corrosives as well as crude oil. The oil price boom in 2012 to 2014 also impacted the tank truck sector, where the big manufacturers were unable to meet demand, attracting some smaller truck builders to

Girard also says that the tank container and offshore tank sector is “pretty strong” right now. The company, now well established in this business, has carved out a significant and ever-growing share of the market, particularly in North America, where customers are realising the benefits of tank containers over other packaging formats for hazardous liquid chemicals.

Tim Girard says the company is also responding to a growing number of notable European users looking for a viable alternative to the other well known suppliers.

This is a somewhat different market with its own demands and, Girard says, aftersales service and technical support are very important. The company is being selective in

EQUIPMENT • GIRARD CONTINUES TO EXPERIENCE STRONG DEMAND FOR ITS TANK VALVES, VENTS AND OTHER EQUIPMENT AND IS INVESTING TO MAKE SURE IT CAN SUPPLY THAT DEMANDGIRARD HAS INVESTED IN A NEW FOUNDRY TO HELP KEEP PACE WITH DEMAND FOR ITS EQUIPMENT

the customers it targets, looking for niche operators for which those aspects are vital and Girard is aware that “pricing has to be good”.

In the other area of its specialities, Girard’s intermediate bulk container (IBC) business is “always pretty steady” and has not been so sharply affected by the wider market changes. Girard notes that the company offers some “great solutions” for the IBC sector, not least its sMart Vent™ pressure/vacuum relief valve, which Hoover Ferguson uses on all its metal IBCs. Girard also notes that it sells well in Europe, particularly to IBC manufacturers in Germany and Scandinavia.

Also selling well in Europe right now are Girard’s vents for road tankers. That is one outcome of the company’s reorganisation of its European operations a few years ago. Now headquartered in Barendrecht on the south side of Rotterdam, with easy access to Germany, the office is headed up by former Fort Vale sales director Anthony Malpass and has its own manufacturing facility attached.

“These are exciting times for us in Europe,” Tim Girard says. “The future looks very bright.” That outlook has been helped by recent stabilisation in exchange rates and, along with some local production, Girard is able to sell into Europe at competitive prices.

There have been changes too at Girard Equipment’s activities in the US, not least the opening a few years ago of a new foundry in Fort Pierce, Florida, some 15 miles (24 km) south along the coast from its headquarters and assembly plant in Vero Beach. Foundry capacity had always been something of a choke point in Girard’s supply chain and the addition of a dedicated plant helped the company cope with the surge in demand around 2013.

That added capacity is now coming in useful once more; Tim Girard says that new orders are coming in thick and fast now that political uncertainty has eased somewhat and that the

firm’s order backlog is “tremendous”. Nevertheless, Girard is able to keep up with demand.

And Girard Equipment is taking steps to make it easier than ever for its customers to place their orders, with a new website due to be launched before the end of this year. “A website is no longer just a billboard,” Tim Girard says. As well as an expanded and streamlined online store, the new site will offer an interactive experience with instructional videos and downloadable technical details.

In that respect, Girard is keeping up with technological developments elsewhere in the industry. It is also looking closely at the potential offered by telematics systems to add value to its customers. Tim Girard says the company is talking to RFID providers as well as to its chemical industry clients to see what they want from such systems and what is practicable. HCB www.girardequip.com

Katoen Natie has broken ground on phase II of its Specialty Chemicals Hub on Jurong Island, Singapore. The S$15m ($11m) expansion involves installation of silos, packaging lines and auxiliary equipment and is due to open in December 2018.

“ This investment represents a significant step change we offer to specialty chemical companies,” says Koen Cardon, CEO of Katoen Natie Singapore. “As Singapore is moving towards more production of high-end products, we are expanding our facilities to offer our key customers more solutions and more capacity.”

The Jurong Logistics Terminal provides a wide range of logistics and semi-industrial services to global customers, including

repackaging, sieving, grinding, blending, customising and tank container operations. “Our chemical customers are looking for total solutions that require highly skilled operators and services at the highest standards of safety, quality and environment,” Cardon notes. “We continue to innovate to develop solutions for our customers that can help them to make the difference”.

www.katoennatie.com

Gondrand expects to move into its new chemical warehouse facility in Moerdijk, the Netherlands during the first quarter of next year. “The new site will comply with the latest PGS15 guidelines for the storage of packaged hazardous and CMR substances in the area of fire safety, as well as occupational and environmental safety,” says logistics business unit manager Tom Heesakkers.

“The 17,500-m2 site, with 30,000 pallet locations, will immediately give us sufficient capacity to safely and efficiently facilitate our existing and future customers’ growth.”

Construction of the new facility, some 5 km from Gondrand’s existing warehouse, started in the second quarter of 2017. “We could have opted to upgrade our existing 16-year-old site in Moerdijk, but in the end it proved more effective and future-proof to build a completely new site,” Heesakkers says. While the current building is a steel construction with fire-resistant cladding, the new premises are being built entirely in concrete, which is “inherently fire-resistant”. The new building will have a fire compartment divided into five different temperature zones, providing a range of termperature-controlled options. “The design also includes a number of small compartments where goods that are difficult to segregate can be stored, including a room where we can safely take product samples,” Heesakkers adds.

www.gondrand-logistics.com

Hoover Ferguson has opened a new purposebuilt facility in Aberdeen, Scotland, offering tank cleaning, chemical transloading and chemical storage services. The site also has a laboratory, workshop and office space.

“Despite the challenging offshore oil and gas environment that we have been operating in, we recognised the demand in the UK market for high-quality bulk chemical storage and transloading as well as tank cleaning services,” says UK managing director Gary Wilson. “With our existing premises in Bridge of Don and Kintore, the location of this newest site perfectly positions us to further serve our customers from the north, south and centre of Aberdeen. We’re excited about what this expansion represents for Hoover Ferguson, but, more importantly, we’re looking forward to the positive impact it will have on our customers.”

www.hooverferguson.com

Finland-based LNGTainer has launched an innovative tank container concept for carrying LNG or other cryogenic liquids. The 40-foot unit has a tare weight of 9.5 tonnes and a capacity of 47.5 m3, helped by the use of Outokumpu’s Supra 16plus stainless steel.

The container looks different to other tank designs for LNG, largely because the honeycomb/perlite insulation is installed on the inside of the tank, giving a hold time of 60 days. “The most revolutionary aspect of the new tank container, and what gives a basis for the advanced design, is the fact that the insulation has been moved from the outside of the cryogenic tanks to the inside,” says Tom Sommardal, LNGTainer’s CEO. “The containers are designed as 40-foot ISO containers stackable as per international rules and regulations, and can be flexibly arranged for storage purposes at power plants when used for feeding gas turbines or engines.” www.lngtainer.com

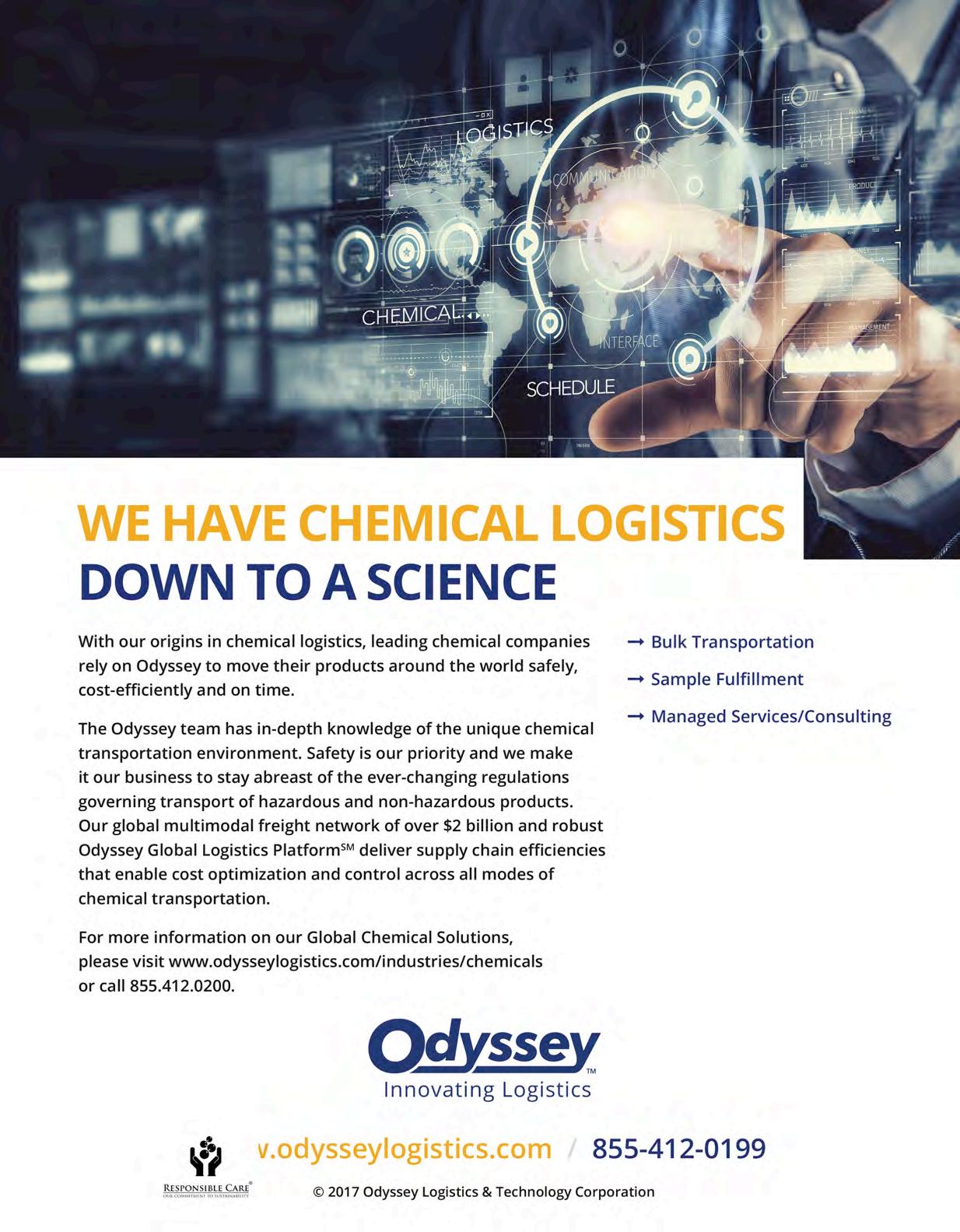

An affiliate of the Jordan Company private equity firm has signed a definitive agreement to become the new majority shareholder in US-headquartered Odyssey Logistics & Technology. The transaction is expected to close during the third quarter, with no changes expected to Odyssey’s current management, core strategy or mission.

“ With the Jordan Company, Odyssey will continue its path of strategic growth, both organically and through acquisitions,” says Odyssey president and CEO Bob Shellman. “This transaction underscores our consistent focus on providing broader service offerings, a larger transportation network and advanced technology to enhance our global supply chain capabilities.”

“ The Jordan Company targets partnerships with established and profitable companies like Odyssey,” adds Brian Higgins, senior partner at The Jordan Company. “We are excited to partner with Odyssey’s leadership team

and to support their vision for continued growth through investment in services and technologies for their customers.” www.odysseylogistics.com

Abbey Logistics Group is to close its general haulage and Pallet Track operations to concentrate on road tanker and warehousing activities. The company has grown rapidly in the past two years through its core tanker business, which handles foodstuffs, polymers and non-hazardous chemicals. In addition, it has expanded the range of value-added services it offers to include warehousing, drumming and reprocessing.

“ This closure enables us to provide a greater focus on the markets and customers where our core skills are strongest and we can make a positive impact and bring the most value to our customers,” says CEO Steve Granite. www.abbeylogisticsgroup.com

Imperial Logistics International, which handles all of Imperial Logistics’ business outside Africa, has reported a 26 per cent increase in sales for its financial year to the end of June 2017. Revenues reached €1.64bn with EBIT up 19 per cent compared to 2015/16 at €75.4m.

“ The significant increase in turnover and profits at Imperial Logistics International is

due to positive developments at the express freight service company Palletways, which was taken over in the middle of 2016, and positive organic growth through new projects in our traditional business,” says CEO Carsten Taucke. www.imperial-international.com

Den Hartogh’s Latin America division has been presented with the Solvay Excellence Supplier Award for Maritime Logistics Services, recognising Den Hartogh’s responsiveness, execution and quality and compliance performance. Solvay’s Brazilian operation, which goes under the Rhodia name, is the largest tank container exporter in the port of Santos.

“

The award is recognition of our efforts and provides motivation for our team in Rio, especially in light of a post-integration year associated with so many changes and new processes,” says Jean Felipe Albuquerque, Den Hartogh’s general manager for Latin America. “Rhodia measures their entire supply chain, not just up to the port in Santos. So this award is not only a reward for the Rio office but for all the Den Hartogh teams that work with Rhodia around the world. Without everyone performing so well throughout the year, this award would not have been possible.” www.denhartogh.com

DIGITALISATION HAS THE potential to disrupt traditional supply chains and alter the balance between different players, with those in intermediate positions in the chain probably most at risk. It was, then, entirely appropriate that the European Federation of Chemical Distributors (Fecc) put the issue high on the agenda at its 2017 Annual Congress, which took place in Warsaw, Poland in June.

As summarised in the first part of this report (HCB October 2017, page 66), the transparency offered by digitalised systems and the demands for greater sustainability through the development of a circular economy go hand in hand, although the growing risk of cybercrime is something that all players in the market need to be aware of and guard against.

But what does all this mean for chemical distributors and their existing place in the chain? Goetz Erhardt, European head of Accenture’s Industry Consulting Practice for the chemicals, metals and mining sectors, asserted that customer and user experience will take on ever greater importance as the use of digitalisation in the supply chain increases. To succeed in this new marketplace, distributors will have to focus on developing new value propositions and “distinctive customer journeys”. As such, they will have to overhaul existing solutions and experiment cautiously with new formats of customer engagement, such as inter alia chatbots and smart phone apps.

The new business-to-business (B2B) paradigm, Erhardt continued, will be

“information abundant” and marked by dynamic networks with a “relentless focus” on customer and user experience and collective value creation. Distributors will therefore have to place ever greater store on service, knowhow and infrastructure to flourish. Moreover, the coming years will see B2B trade becoming more “consumerised”. Among other things, buyers, as well as becoming much more pricevalue sensitive will exhibit higher expectations of customer service and demand solutions more tailored to their needs. They will also expect service providers to understand their end customers’ needs and be “increasingly influenced by what they hear from others”. Buyers will also become more knowledgeable and self-directed, wanting “more specific expertise” from the seller. Additionally, they will monitor and evaluate suppliers more critically and in so doing “require ongoing engagement”.

Ralph de Haan, CEO and co-founder of Kemgo, “a B2B e-commerce platform specifically designed for the chemicals, plastics and fertiliser industries”, then described the “marketing and sales funnel”: this pictures the buyer’s mindset moving from awareness to interest, consideration, intent, evaluation and finally purchasing. In the past, he noted,

marketing was largely confined to the first two stages, with sales functions covering the rest. In an ever-connected world, though, this will change, with marketing covering everything up to and partly including evaluation while sales will largely be concerned with just the actual final purchasing stage.

While digitisation refers to creating a digital version of analogue and/or physical items, such as paper documents, images and sounds, digitalisation refers to enabling, improving and/or transforming business operations, functions and models and processes by leveraging digital technologies coupled with a broader use of digitised data “turned into actionable knowledge with a specific benefit in mind”. Digital transformation is “the profound and accelerating transformation of business activities, processes, competence and models to fully leverage the changes and opportunities of digital technologies and their impact across society in a strategic and prioritised way”, he explained.

To build a successful digitalised business, companies need to “create the right mindset” and have a shared understanding of where they want to go and what they want to achieve. They must also put the right leadership in place and “launch a group focused on digital transformation”. Meanwhile, by using an e-commerce platform, they can establish an online presence; increase exposure; allow their sales team to focus on strategic customers; and benefit from lower costs to serve. They can also gain access to much more usable information, with the platform offering them generally enhanced convenience and efficiency.

Kemgo+, he revealed, is a premium service that uses Kemgo’s “global credibility and expertise” to build a distributor’s or producer’s brand while helping them to manage their sales and optimise their operations. By using the service, companies, de Haan asserted, are able

“to increase their credibility in the chemical community” while becoming visible in new markets at a low cost. Furthermore, as well as benefitting from the fact that buyers will be able to find them based on their searches for a competitor’s products, they also gain access to “thousands of buyers across the globe”.

They can also work with Kemgo to create a global brand using its patent-pending brand recognition tool. After all, if customers remain unaware of a company and its products, they will simply buy from a competitor instead. “Information is power,” he said, asserting that “Kemgo is different”. Designed “by experts in the chemical industry for the chemical industry”, the system ensures that companies using it will only be approached by qualified members of the platform, all of whom have to first be verified to use it. At the same time, companies utilising what Kemgo has to offer can control how transparent they wish to be when it comes to prices, volumes, availability and identity. Similarly, they can easily select the countries in which they want to do business as well as whether they want to deal with producers, distributors, traders, agents or all such players.

In a similar vein, Noah’s Ark Chemicals CEO Bharat Bhardwaj asserted that his company’s

GoBuyChem.com e-commerce platform can also save companies selling chemicals significant time and money while affording them easy access to new markets. To reap the potential rewards of the digitalised market, distributors will have to “embrace 21st century buying and selling habits”, noting that even the most conservative of industries use price comparison websites. Moreover, the pressure on profits in today’s slow market is a further reason to change the way they sell chemicals, he said.

At present, Bhardwaj continued, the process of selling to a large number of buyers is time consuming, depends heavily on maintaining relationships and is complicated by the issue of different payment terms. By using the GoBuyChem platform, however, the seller has just one selling point, viz GoBuyChem, and so the whole process is “immediate”, saving sellers time while meaning they only have one payment term to contend with. As well as being assured anonymity and reduced risk, the platform also gives them “instant access to a significant client base”.

As payment is always received from GoBuyChem, administrative costs are reduced, with use of the platform doing away with the need to set up and maintain multiple clients. Similarly, companies also gain the ability to post and/or amend their »

prices “on the move” using a smart phone. The platform, Bhardwaj told delegates, offers a “user-friendly personal page layout for the seller, with the seller controlling the prices shown”. Likewise, there is also a clear layout of price comparison results.

GoBuyChem, meanwhile, maintains a full back office team so contact can be readily made by email or telephone. What’s more, by the fourth quarter of next year, both suppliers and buyers will also “be able to track the supply chain prior to the collection/delivery of cargo”. The company is also seeking to further develop the price information available to companies while also providing even more data by which buyers and sellers alike can benchmark performance in real time.

To date, said Overlack co-CEO Peter Overlack, traditional channels to market have been

“working well or even very well” and cover 95 per cent of the chemical distribution sector’s business volumes. Furthermore, he stated, “not everything we do can be standardised and handled without manual processing”. There are “three focal points of digital influence”, he continued, explaining that for distributors digitalisation has the potential to optimise in-house processes, enable the receiving of online orders and facilitate the formation of webshops.

While this poses no risk to the distributor, producers offering chemicals through their own webshops can be seen as a “conflict of channel” and thus there is a “need to clarify the position of dealers”. The third focal point, meanwhile, concerns external operators setting up “functioning platforms” that take over business from traditional distributors, resulting in a potential “loss of influence and business” for the sector.

“Without panic, hype or exaggeration, there is cause for unrest,” he told delegates, noting that such a situation can, in the best case, prove to be a creative and positive force. Nevertheless, he continued, today’s

digital developments “require our attention”, particularly those concerning what he called “the so-called platforms”.

While describing Amazon and Alibaba as “the general stores of the internet age”, Overlack pondered what exactly an industrial platform is and whether such “specialised industrial platforms make sense”. If they do, how many, he asked, will there be? “In the ideal case only one,” he said, and one that is “positioned Europe-wide and most likely related to a logistically contiguous delivery area”.

Distributors, Overlack stated, do not simply provide products, but also industry knowhow and extensive knowledge regarding the regulatory landscape. They also have an important role in handling “the whole documentation business”. External platform providers, on the other hand, “receive full data control and customer master data of the suppliers”, becoming “the absolutely essential point of contact for the end customer”.

What then, he wondered, can distributors do in response to this potential threat to their business? One possible answer, he argued, is for distributors to join together and form their own e-commerce platform that benefits the sector as a whole. “We are convinced that running a platform is not rocket science,” he told delegates, reasoning that the “only one limited input factor connected with the knowhow of the platform operators” concerns IT-based matters. This IT knowhow is not impossible to attain and execute. “It will not cost a fortune and can relatively easily be adapted to the needs of the chemicals business. We are stronger than we think,” he said.

Overlack then moved on to the subject of what such a platform, which he dubbed ‘Kemix’, might look like. In one scenario, he said, 15 to 20 per cent of Kemix shares could be held by “special purpose shareholders”, viz its management, financers and other key players. The remaining 80 per cent, meanwhile, could be distributed among the suppliers of the platform, meaning that “the suppliers of this platform [would be] its shareholders” and directly profit from its success. »

Another scenario, he offered, might see the shareholders’ rights limited to “data backup measures and methods of redistribution of the profits generated”. Under this arrangement, “a buyback of shares of the fund [could] only be performed by the fund itself”, with the fund remaining in the possession of the company operating the platform. “It’s not all that difficult. The market and organisational power rest with us. But this is not the sort of business that you can develop alone,” he said, noting that a collective and cooperative approach would be needed to ensure its fruitful development.

Hans ten Cate, European commercial director for Dow Corning’s Xiameter e-commerce business, then took the podium to give delegates a run-down of the “unique e-enabled Xiameter business model”. At the turn of the

century, he explained, Dow Corning’s offering “was becoming commoditised”. Concurrent with this, “increasing capacity in a long market” was leading to utilisation concerns. Together, these factors ultimately led to the 2002 launch of Xiameter to provide “an online business model taking advantage of the integrated back office application”.

From the start, he said, “strict and transparent business rules became the foundation of setting customer expectations”. While the Dow Corning brand bases its value proposition on the relentless pursuit of innovation in the field of speciality products and services, the Xiameter brand focuses on pursuing efficiency in the field of standard silicone products. “The two brands allow us to meet the needs of all customer segments,” he said. Moreover, the Xiameter brand “enables Dow Corning to efficiently sell high quality, reliable, standard silicone products at market-based prices” by standardising options and services. At the same time, the Xiameter business model “separates products and service, [offering] customers who know how to use these standard products

a quicker, easier and more efficient way to purchase their products”.

By offering a web-enabled brand, ten Cate argued, companies can gain an efficient way to serve customers; a new growth strategy; and a streamlined way of selling and buying. It is also a means of enabling innovation; integrating strategy with operational tactics and execution; increasing efficiency in terms of operations; and providing opportunities for automation.

To achieve all this, Xiameter adheres to a number of business rules. These include the pursuit of efficient sourcing through the use of Dow Corning’s global plant and warehouse network, whereby Xiameter chooses what it considers to be the best source location for each order. It also maintains “logical and efficient order quantities” and uses tiered volume pricing to encourage efficient ordering while placing great importance on credit term options; lead-time requirements; and picking and shipping consolidation windows.

Xiameter also provides the best available shipping dates, with its website fully integrated with SAP ERP in real time coupled with stateof-the-art capacity checking capabilities to provide accurate dates. Importantly, it also strives to make online purchasing as easy and as efficient as possible. Indeed, ease of use has been a major factor in customer acceptance, ten Cate noted, revealing that customers can check prices, source product information, place an order and check order statuses and histories around the clock, seven days a week from any location. “Just seconds after [placing an] order, confirmation of price and quantity is provided along with the freight terms, credit terms and ship date, which is based on current supply capability,” he said, adding that there is “no need to call” or wait for a response. “Most paperwork has been eliminated. The job is done the moment the customer clicks to complete the order.” HCB www.fecc.org

The next part of this report in next month’s HCB will look at major trends affecting the chemical distribution sector and the possible impact that digitalisation may have upon it.

Rassmann (NRC) has purchased 100 per cent of shares in the Melrob Group, reporting that the acquisition includes all of Melrob’s various subsidiaries in Germany, India, Japan, Korea, Singapore, Spain and the US. “Acquiring Melrob not only represents the wide-reaching and strategic expansion of Nordmann, Rassmann’s current activities in Europe, but also a decisive step towards growing our business in both the Asia-Pacific region and North America,” says NRC co-managing director Dr Gerd Bergmann. Japan, NRC says, “holds a special position” in its newly expanded geographical presence “as the company has had very successful partnerships with well-known suppliers” in the country for a number of decades. “We are especially excited to be acquiring our own subsidiary in the Japanese market and thereby be able to take advantage of new business contacts and opportunities,” Bergmann states.

“On the one hand, this acquisition is the result of our continued pursuit of Nordmann, Rassmann’s growth strategy,” he continues. “On the other, and through our now complete European and global presence – which gives the whole NRC Group a markedly higher level of visibility on the international market – we’re reaching yet another one of our strategic goals.”

“Nordmann, Rassmann is Melrob’s first choice,” says Melrob’s managing director Ian Melluish. “Strategically speaking, we’ve found the ideal partner – and the extremely close cooperation throughout the negotiating period made it very clear that our companies share a great deal in terms of corporate culture, as well as identical views on ethics. We know that the enterprise we have been building since 1995, with passion and great personal commitment, is being placed in reliable, business-savvy hands.”

Through the takeover, NRC, the company says, “will be acquiring new and important points of access to the markets for industrial chemicals as well as monomers”. Furthermore, NRC will also gain “another unique selling point” borne of Melrob’s operations within the biomaterials sphere. “Melrob represents a large number of prominent suppliers and, with its own production facility in Singapore, is one of

the world’s leading manufacturers of specialty monomers,” it says.

Commenting on the news, Irina Zschaler, NRC co-managing director and board member of Georg Nordmann Holding, states: “We look to this important development in our company’s history with great pleasure and high expectations and at the same time would like to warmly welcome all of Melrob’s staff to our NRC family.”

Subsequent to the acquisition, the two companies signed a deal to distribute Evonik’s range of standard monomers across Europe with immediate effect and its line of speciality methacrylate monomers from the start of January next year. “This is clear proof of the advantages our two companies can offer now following the merger and that together [we] will be even more successful,” Melluish says.

“Evonik is convinced that realigning our distribution business in this way will allow us to address the needs of our customers better and profit from the combined experience of the two distribution companies we’ve chosen to work with,” notes Hans-Peter Hauck, head of Evonik’s methacrylates division. “By taking this approach, we’re positioning ourselves as a leading provider of methacrylate solutions and, together with our distribution partners, ensuring the best possible support for our customers.” HCB www.nrc.de www.melrob.com

THE OHIO-HEADQUARTERED Maroon Group has acquired New Jersey’s Seidler Chemical. Established in 1896, Seidler provides speciality chemicals and ingredients as well as various value-adding services to the pharmaceutical, high-purity electronics, industrial and food and beverage sectors. Seidler’s management team, led by Richard and Martha Seidler, will remain in place and continue to actively manage the business, with Maroon stating that the transaction “is another example of successful entrepreneurs choosing to join Maroon Group”. The Seidlers’ “deep experience, differentiated market insights and value-added capabilities”, it continues, “will be instrumental in executing Maroon’s strategy”.

“We are thrilled about the opportunity to work with Rich, Martha and their team and

welcome a company with a 120-year history to Maroon Group,” says Maroon president and CEO Mark E Reichard. “This acquisition allows us to expand our value-add service offering and build additional scale in attractive end markets.”

“We’re excited to be part of an organisation like Maroon Group that shares our focus on customer success,” Richard Seidler adds. “Providing stability for our employees, customers and suppliers was a priority when Martha and I set out on this course. Maroon has a proven track record of success as it relates to acquiring businesses like Seidler. They understand the importance of servicing the customer, continue to invest in acquired companies and have a thoughtful approach to integration. Maroon Group was the right partner to continue the legacy of our family’s company.”

Meanwhile Eric Post has joined Maroon as vice-president, principal management, coatings, adhesives, sealants and elastomers (CASE).

Having held various positions with Evonik, Elementis Specialties and Emerald Kalama, Post, the company says, “will be integrally involved with the management of existing Maroon Group principals that operate in the CASE market” while simultaneously working to expand the company’s already extensive product range.

“Eric will bring a well-rounded perspective to this role and assist us in identifying additional ways to create value for our customers and principal partners, as well as drive the profitable growth of the business,” says chief operating officer Mike McKenna. “We’re excited to have him as part of our team as we continue to execute on our growth strategy.”