Over my time at HCB – more than 25 years now – I have had to introduce any number of new recruits to the wonderful world of dangerous goods and what we do to help industry keep up to date. Even for people who have worked in trade journalism before, HCB offers a different perspective: not only do we deal with a comparatively complex aspect of the supply chain, we also look at the end-to-end journey of products from the manufacturer to the end user.

In our terms, we cover a vertical. That is in sharp contrast to most other trade titles, which cover horizontals: trucking magazines cover trucking, whatever the cargo; air publications cover air transport, not just dangerous goods; the big maritime press deals with all manner of topics of interest to the sector. On the other hand, we deal with all of these sectors, and more, but only from the point of view of the transport, storage and handling of dangerous goods.

That approach brings us into contact with a lot of different industrial sectors, although our coverage of them is much the same: what are they doing to improve safety and regulatory compliance, what new products and services have they developed and, at least for the larger companies, how is this translating into their financial results.

Bearing in mind that I have reported on that through several business cycles now, including the 1997 Asian financial crisis and the 2008 crash, it has often been noticeable how bulk liquids storage terminals have managed to sail through the ups and downs relatively serenely, often only reporting a blip in earnings just as things begin to pick up and cargo owners draw down their stocks.

Things have been different over the past year or so. Terminal operators are facing many of the same macro-economic and geopolitical factors

as other players in the chain, not least the changing product flows as new material is stemming from producers in cost-advantaged locations in North America and the Middle East, and more recently growing political tensions and expanding trade wars and sanctions.

Terminal operators are also being disproportionately affected by the ‘IMO 2020’ rule on the sulphur content of marine bunker fuels, which is forcing many companies to take tanks out of service for modification in anticipation of having to handle a larger number of grades.

Further ahead there will be the phasing out of hydrocarbonbased fuels, with 2050 emerging as the favoured year for a carbonneutral future. This will inevitably affect many terminals quite fundamentally but, as we are beginning to hear, there are other carbon-neutral and carbon-free options that might offer alternative cargoes for terminals. This month we report on Vopak’s investment in a project to deliver hydrogen in the form of a liquid fuel, using an organic carrier, that would fit seamlessly into the existing bulk chemical supply chain; work is also going on to develop viable e-fuels, using electrolysis powered by renewable electricity to generate liquid fuels.

These topics will doubtless be on the minds of terminal operators as they gather for the big autumn events: Tank Storage Asia in Singapore and the UK Tank Storage Association annual conference both take place this month, with the EPCA Annual Meeting just a couple of weeks later. By the end of all that we may have a better idea of where we’re going.

Peter Mackay

VOLUME 40

NUMBER

Lufthansa takes care of cargo 26 The Belgian hub

Log

Letter from the Editor

30 Years Ago

Learning by Training

The View from the Porch Swing

On the up Vopak improves results

Workin’ in Antwerpen NNOAT continues to grow

Going glocal Adnoc buys into VTTI

Sky blue thinking

TSA returns to Coventry

Steady eddy Viking adds SLOFEC

Singapore swing

Looking ahead to Tank Storage Asia 19 News bulletin – storage terminals

DG BY AIR

Head in the clouds

Qatar Airways gets it right 24 Airborne solutions

Coastair builds out Liège base 28 Boxing clever Biocair’s pharma packagings

Reaching further

Brenntag carries on buying 30 Looking good

IMCD confident for 2019

Fortune tellers

CBA askes its members’ opinions

Uncommon carrier

Delivering hydrogen in liquids 34 Sealed for quality

VSP gaskets for tank containers 36 News bulletin – tanks and logistics 37

Training courses 42 Formula for success

Channoil brings training to Malta 44 Conference Diary 46 Material gathering

Looking ahead to Contamination Expo 48

The more the merrier

APRC builds Asian response

watching

as a loss prevention

bulletin

On time,

and verify

More about

First class meeting

IGUS/CIE group

Not otherwise specified

The Europe issue

Preview of EPCA’s Annual Meeting

and inland shipping

Road tankers in Europe

next for

Editor–in–Chief

Peter Mackay

Email: peter.mackay@hcblive.com

Craig Vye

Email:

Deputy Editor

Alex Roberts

Email:

HCB

Production Manager

Binita Wilton

by

Media

Stephen Mitchell

Email: stephen.mitchell@hcblive.com

Designer Natalie Clay

Cargo Media Ltd

Marlborough House

Regents Park Road,

ISSN 2059-5735

Commercial Director

Ben Newall

Email:

By September 1989, HCB was nearing the end of its first decade of publication and the format of the magazine had settled down: bookended by regulatory updates at the front of each issue (which in this number were extensive) and at the back the latest information on safety issues in the transport of dangerous goods, each copy also contained three or four special surveys on topics of interest to readers. In September 1989, for instance, those included tank container cleaning and repair depots, the transport of cryogenic materials, and dangerous goods warehousing.

As is the case today, the editor was also given the luxury of having a page to himself to discuss hot topics. Those who have been watching our current editor’s weekly videos (available on the HCB YouTube channel – subscribe now!) will have seen him discuss a number of important incidents that have provided lessons for everyone in the industry, being worried that those lessons may be forgotten as the old hands retire and corporate memory fades.

Back in September 1989, then editor Michael Corkhill was musing on exactly one such incident, when a fully laden gasoline tanker ran out of control on a hill in Herborn, Germany in July 1987 and crashed into a café, spilling its load that caught fire and killed four people. In the wake of that incident, the West German (as it still was) government and the European Commission were of the firm opinion that road transport is inherently less safe than other modes. The government put in place restrictions on the transport of dangerous goods by road that still exist – and apply equally to international transport, which comes as a surprise to some.

Another outcome of the Herborn incident was the introduction of the concept of the ‘dangerous goods safety advisor’, something that Germany worked hard to bring into ADR.

Mike Corkhill’s opinion at the time was the imposition of routing requirements over and above anything included in international regulation was contrary to the spirit of the Treaty of Rome and, with the free European market in goods and services about to arrive, this could prove problematic – although it has been allowed to stand now for nearly three decades.

The other major story in 1989 was the introduction of the UNspecification packaging. This had proved something of a windfall for HCB, with a number of manufacturers keen to advertise their capabilities – the September issue, for instance, carried adverts from Plysu Containers, Blagden Packaging, Van Leer and Greif – but it had also encouraged a dialogue through the pages of the magazine, with consultant Arthur Hancock taking the time to argue that the transition to the new system would be fraught with problems.

Indeed, Arthur’s argument sounds very familiar: while the system was meant to introduce greater harmonisation along with greater safety, that was in doubt in international terms as Australia had already implemented a requirement for UN-specification packaging, while Europe was to introduce similar measures on May 1990 and the rest of the world was aiming for January 1991. Furthermore, while there was no possibility that there would be any delay to the deadline, he suspected that shippers might be tempted to take a risk by relying on the lack of sufficient enforcement capacity.

During the last eight years I have trained many marine tank storage operators on how to control the ship/shore interface and achieve operational excellence. The first thing I do is ask a simple question: are you really in control? After that I ask them ten relevant questions. Too often I come to the conclusion that full control has not yet been achieved.

To control any operational or management system, the first part is to become aware about the risks and vulnerabilities of the operational system. What I observe is what is called ‘compartmentalisation’. People tend to focus on a part (their task) of the organisation. Operators do the operators’ job, loading masters theirs or management ‘manages’. People usually look at ‘parts’ because they don’t understand the ‘whole’.

If I train them to understand how the whole system should work, amazing results are achieved. I show them that if feedback (information about their responsibilities) is shared and communicated, the operations can be controlled much better. It means that people in the terminal, refinery or transport company have an obligation to learn much more about the entire system. Focusing on their tasks alone and not understanding what the duties of others are, limits the ability to run and control the operations fully. It is all about an overall view.

You may ask: who is responsible for learning? I’d say there is a shared obligation to learn as much as one can. Management can order that people need training, but people must demand they are trained as well. The best scenario is that anyone working there should be motivated to reflect on his or her own awareness,

knowledge or skill: ‘I don’t seem to know enough, I will make sure I will learn more.’ To assist companies, we observe people during operations and test competencies. Only when all needed capabilities are confirmed can we certify that maximum control has been achieved.

As a training company we notice that investments are made primarily in equipment, automation, tanks or technology, but that investments in learning is overlooked. This is an error of omission: things that should have been done have not been done. No matter how much management wants to reduce costs, people must not be ignored as a decisive factor when incidents or accidents occur.

People steer the operations but can do much better if they are taught how to think in systems. When they develop an overall view of their operations and learn that every task, duty or job is interdependent and interconnected, overall excellence becomes possible. It means that everyone must understand the law of requisite variety: a terminal generates tremendous variety and tries to control them through HSEQ rules, checklists or regulations. But that is not enough.

A terminal needs to develop internal requisite variety to be able to absorb (counter-balance) ‘outside’ variety (risk). This means having the people with the combined knowledge, experience, expertise and influence to do so, sharing all relevant information, and thinking in systems.

This is the latest in a series of articles by Arend van Campen, founder of TankTerminalTraining. More information on the company’s activities can be found at www.tankterminaltraining.com. Those interested in responding personally can contact him directly at arendvc@tankterminaltraining.com.

Will I lose my job as an occasional columnist if I don’t know if the magazine is officially ‘Hazardous Cargo Bulletin’ or if the acronym ‘hcb’ is now its official name? Yeah, maybe I shouldn’t have asked that out loud. But really, aren’t they pretty much interchangeable? I guess potential new readers would find Hazardous Cargo Bulletin more descriptive than hcb, and know that it will be of interest to them, but for most of us they’re interchangeable. As an industry we use a lot of acronyms, often interchangeably with the full phrase, term, or name that the acronym has shortened.

In the world in general, though, it’s not always that way. Sometimes the acronym replaces the phrase completely. What does ‘laser’ stand for? Where did we get the word ‘sonar’? In my favorite example of the acronym becoming a freestanding word on its

own, the meaning of that word changed from when it was an acronym. ‘For Unlawful Carnal Knowledge’ (great album title, by the way, Van Halen) is an old-fashioned term referring to illegal sexual intercourse, either infidelity or underage or both. Of course, now its acronym is a word that refers to all sexual intercourse, whether unlawful or completely legal. And, of course, it’s also a swear word used as an exclamation of disgust and/or frustration.

Some acronyms aren’t unique though. Heck, browsing lists of acronyms on the interwebs makes me think almost all acronyms aren’t unique. Normally though, the set of people who use CSF to mean the California Scholarship Foundation doesn’t have much overlap with the set of people who use CSF as shorthand for CerebroSpinal Fluid. And it’s hard to imagine context that would make it difficult to distinguish one CSF

from the other CSF, or in fact from any of the other dozens of names for which CSF is an acronym.

But sometimes there can be an unfortunate acronym used for different terms in a single field or industry. Once upon a time I joined (okay, my employer joined) a US-based organization called the Hazardous Materials Advisory Council. By the way, I never got an official determination on whether HMAC was to be pronounced Aitch-mac, Hey-mac, or Aitch-Em-A-See. Anyway, as one of the first ever NGOs (non-governmental organizations) to join the United Nations Committee (Yes, it was once a committee, not just a subcommittee) on the Transport of Dangerous Goods, HMAC decided to move from being a US-focused organization to a global one. Part of that change in goals was recognition that “hazardous materials” implied US, while “dangerous goods” is the equivalent global term. So, HMAC became DGAC (with the same kind of pronunciation issues, Dee-jack, Deegack, or Dee-Gee-A-See).

Alas, there is another DGAC in our industry, France’s Direction Générale de l’Aviation Civile, which was so named in 1976, long before HMAC’s name change. So, if there were to be a DGAC meeting about fees/ taxes related to the air transport of certain dangerous goods, which organization is hosting the meeting?

There is a much more egregious example, though, potentially affecting the DG world these days. While everyone is in favor of competence (at a minimum) in DG training, both in the delivery of the training as well as in the subsequent capabilities of the trainees, calling current proposals “competency based training” is a bad idea, and using the acronym CBT is a worse one. Let’s address them in reverse order.

Professional trainers have known and used the acronym CBT as meaning Computer Based Training for at least a couple of decades. And during those decades there have been informal discussions and formal studies and all kinds of debate on the pros and cons of the various ways computers can be used to assist in training delivery. CBT, the established acronym, covers webinars, videoconferences, CDs/DVDs, digital re-

delivery of previously live presentations, and more. CBT-original does not cover live, in-person, hands-on delivery of training. CBT-original can be wonderful, and it can be horribly misused, but that’s not the point of this column. Any trainer who was interested in the varying effectiveness and costs of different methods of training delivery knew the acronym CBT.

So, how is it that those who propose competency based training would use that potentially confusing acronym? The newer CBT may involve CBT-original or live training or both. So, actually, a knowledge of CBToriginal could potentially help assess whether the CBT-new goal is likely to be achieved in a given situation.

Now, please, re-read that previous sentence ignoring the “-original” and “-new”. Hard to tell that CBT isn’t always CBT, isn’t it?

Context doesn’t help much, does it? And what if non-CBT-original (live) methods are used to try to meet CBT-new goals? Try explaining that to upper management. ‘We won’t be

using CBT even though CBT is required’. I know appearances can be deceiving, but it sure does appear that whomever chose the CBT-new acronym didn’t know much about CBT-original, or they’d’ve tried to find a different one.

Which brings me to my second point about CBT-new. Is “competency based training” really training based upon competency? Isn’t competency the desired outcome rather than the basis of the training? I’m fairly certain I know what is intended by the term, but isn’t there a more grammatically correct way to word it? How about something like Achieving Competency Through Training? Doesn’t that say it better? Oh, and it’s not got CBT as an acronym, either. Hey, there’s something about this alternate acronym that makes me think the status quo, the “but we’ve always done it the old way” method needs some action to change it. And in all-caps, doesn’t ACTT suggest we need to act sooner rather than later? Maybe I should formally submit this alternative acronym. Ah, maybe, but first a

visit to AcronymFinder.com… pause… Drat, AirCraft Total Time, and, Air & Command Tactical Trainers beat me to it. Maybe, then, instead, Achieving Functional Competence through Training, AFCTT or AFCT?

Regardless, I think if we want employers and trainers to understand and properly implement the new guidance, we have to be crystal clear in explaining what we mean. For me, step one is getting rid of the CBT (-new) acronym, and the second step is choosing a new term that is clear that competence (if not excellence) is the desired outcome and not the starting point.

HexaChloroBenzene, HTML Comment Box, and Hood Canal Bridge probably don’t mind sharing hcb with Hazardous Cargo Bulletin, with or without periods in the acronym.

This is the latest in a series of musings from the porch swing of Gene Sanders, principal of Tampa-based WE Train Consulting; telephone: (+1 813) 855 3855; email gene@wetrainconsulting.com.

RESULTS • VOPAK HAS ENJOYED A RECOVERY IN ITS FIGURES IN THE FIRST HALF, SIGNALLING THAT ITS REVISED STRATEGIC VISION IS TAKING THE COMPANY IN THE RIGHT DIRECTION

Global storage capacity at the end of the second quarter stood at 36.9m m³, up from 36.0m m³ a year earlier after a number of additions and divestments. Average occupancy slipped though, from 86 per cent in first half 2018 to 85 per cent for the same period this year and 84 per cent for the second quarter. Vopak says this drop relates primarily to temporary closures to prepare tanks for the new ‘IMO 2020’ rules on the sulphur content of marine fuels, which take effect on 1 January 2020, as well as continued weakness in some of its oil hub terminals.

European sites: Algeciras, Amsterdam and Hamburg. First State Investments is to pay some €723m for the three terminals, which is expected to deliver an exceptional pre-tax gain of around €200m in the second half of 2019. “The divestment of some of our European assets will, after completion, shift our portfolio further towards industrial, chemical and gas terminals,” Hoekstra explains. “We aim to grow our portfolio in line with market developments and expect our growth investment momentum in 2019 to continue in 2020.”

ROYAL VOPAK HAS reported improved results for the second quarter and first half of 2019. The company has this year adopted the IFRS 16 accounting principles but, on a pro-forma basis, revenue for the first half was 2 per cent ahead of last year at €641.4m and group EBITDA, excluding exceptional items, rose by 14 per cent to €398.3m. The main exceptional item booked in the second quarter was a gain of €16.4m from the sale of its 50 per cent shareholding in the Vopak EOS terminal in Estonia in April this year.

“The first half of 2019 was important as we have taken further steps in the delivery of our strategy and the alignment of our portfolio based on long-term market developments,” says CEO Eelco Hoekstra. “We have taken significant new capacity into operations to meet new customer demand. Together with our partners we fully commissioned the industrial terminal PT2SB in Malaysia and celebrated the opening of the LPG export terminal RIPET in Canada. In addition, we expanded our share in the LNG import terminal in Pakistan.”

As well as selling off its interest in Vopak EOS, Vopak has agreed the sale of three other

At the start of 2018, Vopak had 3.2m m³ of new capacity lined up for commissioning by the end of 2019. As of mid-2019, 2.1m m³ of that had been delivered, meaning there is more to come in the second half. A new joint-venture terminal in South Africa is due to be commissioned before the end of the year, along with expansions at the new Panama site and at existing terminals in Malaysia, Brazil, Singapore, Indonesia and Mexico.

In addition, the company has announced two further expansions:

• The Deer Park chemical terminal in Houston will be expanded by 33,000 m³, with the new tankage expected to be commissioned in second quarter 2021; and

• A 105,000-m³ expansion for the storage of clean petroleum products and aviation fuel is

planned for the Sydney terminal in Australia, with completion also scheduled for second quarter 2021.

Vopak’s commercial and financial performance is dependent to a large extent on global economic and market developments.

In its half-year report, the company notes that geopolitical tensions are now “impacting business optimism”, although it says that the service sector has been resilient and consumer spending is still solid.

Furthermore, cheap shale-based ethane feedstocks are prompting further investment in petrochemical facilities in the US and, although economic activity is “gradually decelerating” in Asia, it remains robust, with China, India and Vietnam still managing to generate annual growth of 6 to 7 per cent.

Trade tensions and lower chemical prices have led to changes in trade flows, which has had a positive impact of Vopak’s chemical hub in Singapore.

In the oil market, trade tensions and sanctions have affected the supply side but Vopak’s main fear is that geopolitical factors could impact economic growth and further slow growth in oil demand, which has already been affected by environmental considerations. On the other hand, the biofuels and vegoils markets continue to be strong in many areas of the world.

The opening of the Ridley Island LPG export terminal in British Columbia, Canada earlier this year signals Vopak’s interest in the LPG sector and the company notes that global LPG supply is continuing to grow; US exports were 20 per cent higher in the first half of 2019 compared to the same period last year, despite China’s imposition of a 25 per cent tariff on US LPG in August 2018. US product is moving to other markets, including India, while China is sourcing more product from the Middle East.

Those market factors have been reflected in the first-half results for Vopak’s various divisions. In Europe and Africa, for instance, revenues were down 2 per cent year-onyear, although Vopak says this was largely due to “relatively high out of service capacity” in its Rotterdam terminals as they prepare for the IMO 2020 changes. Vopak notes that the economic outlook for the Eurozone area remains weak as a result of adverse dynamics, ongoing uncertainty over Brexit, and weaker demand from the automotive sector.

Revenues from the Asia and Middle East division rose by 3 per cent against first-half 2018, with group EBITDA up 17 per cent. Vopak enjoyed higher revenues from its chemical terminals, although this was partly offset by work at its Singapore sites to ready them for IMO 2020.

The Americas division posted a 9 per cent increase in revenues and a 19 per cent rise in EBITDA, although this was partly accounted for by currency movements. Much of the

rest of the gain reflected additional capacity commissioned in Houston, although there were difficulties here during the period as a result of the fire at ITC’s nearby Deer Park terminal in March.

The small China and North Asia division recorded a 19 per cent increase in revenues and a 40 per cent rise in EBITDA compared to first half 2018. Much of the improvement was due to the acquisition of the Ningbo terminal in early 2019 and the restarting of the Heiteng industrial terminal in June 2018.

Vopak’s activities in LNG grew by 7 per cent over first-half 2018, largely as a result of its investment in the Engro Elengy Terminal in Pakistan in December 2018. This division is, though, an important part of Vopak’s strategy going forward, as Hoekstra explains: “Looking further ahead, we continue to explore opportunities in new energies.”

In addition, Vopak’s digital transformation is “progressing well”. A cloud-based digital terminal management system is being rolled out at terminals around the world. HCB www.vopak.com

NOORD NATIE ODFJELL Antwerp Terminal (NNOAT) has been expanding its facilities gradually over recent years and the project is making strong headway. HCB reported on this ongoing work in October 2018 (see page 43); one year on, Bert Druyts, commercial manager at NNOAT, here provides an update on the developments from the last 12 months.

In September 2018, two new tank pits were completed and opened, adding 32,700 m3 of storage capacity, and two further stages of the expansion project – Tank Field P and Tank Field Q/R/S/T – are in the development process. Tank Field P is planned to be a replica of the most recent tank field that was

opened (Tank Field O), while final details of Tank Field Q/R/S/T are being concluded. Total storage capacity for the site could potentially reach another 130,000 m3 divided over several tank pits by 2022. Different tank sizes will be possible, ranging from 1,200 m³ to 5,000 m³. Furthermore, another 45,000 m2 of land is available for additional tank storage or related activities including blending, warehousing and/or ADR storage.

“Tank Field P is due to be operational in June of 2020,” says Druyts. “Tank Field P will be a copy of O with seven tanks in total; three tanks of 2,500 m3 and four tanks of 1,300 m3, all stainless steel and all with dedicated stainless steel lines. These will be specialised towards handling hazardous chemicals.” The tanks in the new development are fully automated.

But there is more than just the addition of tanks and increased storage volumes for the project. The ability to manage larger quantities of product by different modes of transport has received a large

investment, with road-, rail- and sea-based transport benefitting. When discussing the developments for water transport, Druyts says: “We now have 2.5 km of berth length. I believe it’s the longest berth for a liquid terminal in the world. The big advantage is that it gives us the opportunity to handle 13 berths, of which nine can be used for seagoing vessels.” By the close of 2020, the maximum draft of much of the terminal’s berths will be increased from 11.3 m to 14.0 m.

Druyt continues: “Over the next ten years there will be a lot of road works around Antwerp to improve infrastructure, which is why we have decided to build a block train handling station. It will be finished by the end of 2019. This newly built area will be able to handle the loading and unloading of four rail cars at the same time. This means an entire block train of 20 cars will be able to be handled in just one shift. Single wagons can of course still be managed.”

The push to develop improved road and rail facilities have, in part, been fuelled by the recent troubles with low water levels in the Rhine and Druyts notes that there has been an increase in the use of rail over the last year.

NNOAT is currently in the process of attaining the necessary environmental and building permits for the next stage of expansion, which are expected to be completed early in 2020. HCB www.noordnatie.be

THE ABU DHABI National Oil Company (ADNOC) has taken a 10 per cent stake in VTTI, acquiring 5 per cent from each of its 50/50 partners, Vitol and IFM Global Infrastructure Fund. The investment in VTTI provides ADNOC access to storage capabilities across some of its key export markets in Asia, Africa and Europe, while also securing additional facilities at the port of Fujairah, UAE, its main storage hub. This transaction also significantly contributes to the development and growth of ADNOC’s global marketing, supply and trading platforms, providing greater access to knowledge and capabilities that will further enable ADNOC’s growth plans.

“We are delighted to be entering into this strategic investment opportunity in VTTI, alongside Vitol and IFM GIF, which will further complement the development of ADNOC’s integrated global trading platform while also delivering a solid financial return,” says HE Dr Sultan Ahmed Al Jaber, ADNOC Group CEO and UAE Minister of State. “VTTI’s diverse portfolio of storage assets across key target markets such as Asia, Africa and Europe, provides us with direct access to our customers around the world, a key building block to accelerating ADNOC’s transformation into a more integrated and commercially minded global energy player.”

The acquisition followed hard on the heels of the signing of a refining and trading agreement between ADNOC and ENI and OMV, and the establishment of a joint venture, ADNOC Global Trading, that will focus mainly on marketing and trading products from ADNOC Refining.

VTTI will continue to be managed by an independent management team led by CEO Rob Nijst, who says: “This exciting development is testament to the professionalism and dedication of our VTTI colleagues. Since VTTI was founded 13 years ago, we have worked tirelessly to build a market-leading hydrocarbon storage company, capable of delivering the highest standards of service in key strategic locations. We are very pleased to have ADNOC as our new shareholder and look forward to benefiting from their regional expertise, working together to further grow our global network of terminals and supporting ADNOC’s trading and supply ambitions.”

VTTI’s 50/50 ownership structure was created in November 2018 when IFM Investors acquired Buckeye Partners’ 50 per cent holding.

This past February, ADNOC announced the construction of the world’s largest underground crude oil storage cavern in Fujairah, which will have a capacity of 42m bbl. Combined with its existing 8m bbl of storage in the port, access to VTTI FTL, a 1.6m-m³ tank storage facility and 80,000 bpd oil refinery in Fujairah, will strengthen the UAE’s position as a reliable supplier of crude oil and give ADNOC greater flexibility, allowing it to manage and optimise its delivery schedule and support its broader growth in trading.

“As one of Fujairah’s largest storage operators, VTTI is a natural partner for ADNOC,” says HE Dr Al Jaber. “This investment further strengthens ADNOC’s strategic position in Fujairah and supports the continued development of Fujairah as a strategic hub for our operations.”

VTTI currently has ownership interests in 15 storage facility in 14 countries around the world, with a combined capacity of 60m bbl (9.5m m³). Buying into this network will move ADNOC closer to its customers, allowing it to be more agile and respond quickly to market needs and dynamics. It is also expected to unlock incremental revenue, margin and cost saving opportunities from the trading, transport and storage of its products, giving ADNOC better control over where, when and how its products are being supplied to key markets and customers. HCB www.vtti.com

PREVIEW • THE LEADING

MINDS IN SAFE AND EFFICIENT BULK LIQUID STORAGE WILL CONVENE IN COVENTRY

THIS SEPTEMBER FOR THE TANK STORAGE ASSOCIATION CONFERENCE AND EXHIBITION

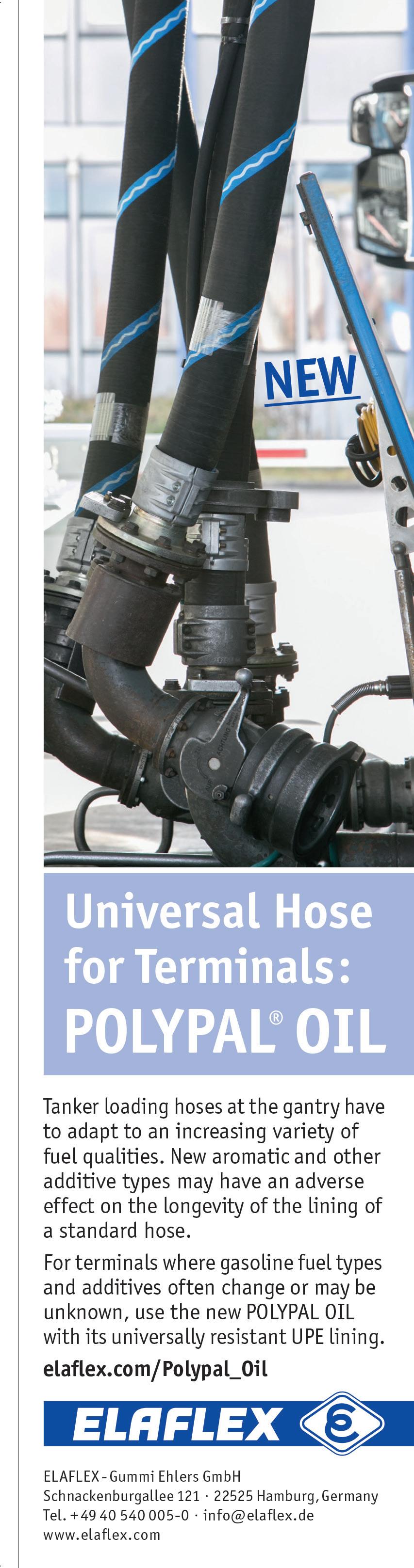

expertise for those visiting the event. Whether a business is looking for the perfect supplier of gaskets and hoses, is needing a state-ofthe-art design for a new tank terminal, or is simply looking to source the highest quality inspection team, the annual TSA event is the prime place to go.

The doors will open early to give delegates the opportunity to have coffee and buns and to wander around the exhibition hall before the conference really kicks off. They will also have the chance to catch up with colleagues and peers in the networking area, while debating whether or not Coventry City Football Club will be back at the Ricoh next year.

to provide more grades of fuel and many operators have already been making the necessary adjustments to their assets.

Keeping the theme of environmental impacts going, Dr Jo Nettleton, deputy director radioactive substances and installations regulation at the Environment Agency, will speak about the future challenges and opportunities that environmental regulation of the industry will bring. The environment has been a prominent topic in recent years and being able to keep ahead of the curve is pivotal for businesses to thrive in an ever-changing landscape, so the opportunities discussed here should not be missed.

The other main body with a remit to regulate activities in bulk liquids storage terminals in the UK is the Health and Safety Executive (HSE), which this year will once again be represented by Dr Paul Logan, director of HSE’s Chemical, Explosives and Microbiological Hazards Division. He will discuss the different approaches that can be taken to regulating high hazards industry in line with the UK government’s industrial strategy.

Also from HSE, Caron Maloney, specialist inspector – risk assessment, will look into the differences between individual and societal risk and how terminal operators need to take both into account in their risk evaluation under the Control of Major Accident Hazards (COMAH) Regulations.

THE ANNUAL TANK Storage Association (TSA) event, the Tank Storage Conference and Exhibition, will be held at the Ricoh Arena, Coventry on 26 September. As ever, the conference programme will feature presentations from regulators and industry experts on topics that are key to safe and effective bulk liquids storage operations. Representatives from all sides of the tank storage sector will be exhibiting their cutting-edge creations and industry-leading

Paul Denmead, TSA president, will open proceedings with an introduction to welcome everyone to the show and set the stage for the conference, which will be chaired by HCB’s editor-in-chief, Peter Mackay.

The first speaker will be Giacomo Boati, executive director for oil markets midstream, downstream at IHS Markit, who will discuss how the imminent arrival of the ‘IMO 2020’ regulations, and their requirement for vessels to reduce sulphur oxide emissions, will impact the European bulk liquids storage sector. It will inevitably result in terminals having

If IMO 2020 is much in the minds of terminal operators right now, they are also keeping a watching eye on what the promised decarbonisation of the energy industry will mean for them. Dr Brian Worrall, head of group sustainability at DCC, will give his views on the implications for the hydrocarbon supply chain and how terminal operators may have more options open to them than they might imagine.

Rounding off the conference proceedings will be Allan P Greensmith of APG Consulting and Training, who promises to send delegates home in a thoughtful mood after an eyeopening and informative incident case study titled “Never Again”. As explained in recent HCB TV videos by Peter Mackay (which can be found on the HCB TV YouTube channel and »

by signing up to our weekly newsletter), the lasting legacy of industrial incidents is one that should not be swept away but analysed intently and the lessons passed on to those in the industry who are too young to have been around at the time.

In between the talks at the conference, there will be plenty of time to see everything on show in the exhibition hall. Among those presenting its solutions and services will be Flotech, a familiar face at the TSA event, which will provide visitors with the chance to discover equipment covering industrial safety gates to tank venting, and superhydrophobic coatings to design services. “We have been working with TSA for many years and have a great relationship with the event and organisers,” says Tom Sadler, managing director at Flotech. “TSA provides an excellent setting to down tools and catch up with our valued customers and suppliers.”

Jesse Shaw, operations and marketing manager at Flotech, adds: “TSA is a key annual event for us that gives an excellent opportunity to network with new and existing customer and suppliers. Alongside the great speaker sessions, invaluable time is spent with fellow event professionals in an excellent setting.”

There are also some exciting new developments for visitors to experience during the show. Over at Viking Inspection, attendees will be treated to the launch of SLOFEC™ (see page 18), the latest in inspection services covering tank floor, shell, weld seam and pipeline inspection. “We have exhibited at the TSA for the last three years and I find it our most important annual event for connecting with existing and new customers,” says Davina Symonds, sales and marketing manager at Viking Inspection. “This year, we will have a new stand dedicated to the launch of SLOFEC, for which we have the sole UK licence, and I am looking forward to discussing its unique benefits for storage tanks and pipework.”

Other exhibitors include Hawkes Fire and Protego, ensuring industry has access to the latest developments in fire safety and flame arresters. Keeping the workplace brighter are Wolf Safety and Atexor, providing hazardous area lighting solutions with equipment available for zones 0, 1 and 2 covering a huge range of certifications. Anton Paar will be exhibiting its latest instruments, process measuring systems and custom-tailored automation and robotics solutions alongside Aquilar, a specialist in leak detection for commercial and petrochemical industries.

There are of course many more exhibitors (more than 60) that are eager to speak to attendees to show how their expertise and innovative products can provide great benefits to different businesses; full details of the exhibition can be found on the event website. Registration is still open for those wishing to attend and a few stands are available for those wanting to showcase their products and services. For those looking to secure a stand, please contact Joseph Quinn at Cresco Marketing on +44 1702 471 846 or email joe@crescomarketing.com. For anyone requiring accommodation, the DoubleTree by Hilton Coventry has a limited number of discounted rooms organised by the TSA –please call +44 2476 60300 and quote ATANA for more information on the special rate. HCB www.tankstorage.org.uk/conference-exhibition

INSPECTING EQUIPMENT AND pinpointing problems has become even easier for UK-based tank storage operators as Viking Inspection has acquired the sole licence to supply the full range of SLOFEC® inspection services. An agreement has been reached with KontrollTechnik Germany (KT), developers of the technology, for Viking to receive support and expert guidance while supplying and developing the UK market.

There are two types of SLOFEC floor scanner, the main differences being the weight and dimensions of each unit and their testable wall thickness. The technology is an NDT inspection method for topside and underside corrosion in a variety of walled plates and pipes.

Based on the eddy current principle with superimposed DC field magnetisation, the SLOFEC inspection system handles and tests objects with up to 25 mm wall thickness and coatings up to 10 mm thick, depending on the scanner type. This means that grit blasting is not always necessary for tank operators and, often, a high-pressure water jet is all that is needed, translating into savings in time and cost. Through superimposed DC-magnetisation, the depth of penetration is increased so that corrosion, even at the subsurface, can be detected from the surface side.

After use, the results consist of a coloured tank floor map, single plate reports and,

if required, a feature list, repair plate map and repair plate list. The tank floor map and single plate results will highlight wall thickness reductions, shown in a 2D-scan image, where the defect depth corresponds to a defined colour.

Furthermore, a remote scanner has been specifically designed to handle the scanning of storage tanks that include installations such as heating coils and tank roofs without the need for access-authorisation. One of the primary advantages for tank operators is that there is no need to disassemble installations or heating coils before the tank inspection.

“We’re currently having most interest from those using lined tanks. We’re able to go in and scan the tank floor with the SLOFEC as it will scan through the lining, which saves

costs and time for operators that would have to remove the lining to use other equipment,” says Davina Symonds, sales and marketing manager at Viking Inspection.

“We are excited to offer the whole bandwidth of SLOFEC scanners including tank floor, shell and weld seam inspection as well as pipelines,” says Viking Inspection’s managing director, Steve Delves. “We will be the only UK inspection company to have the full support from KT and the latest version six with many additional features such as automatic defect signal finder, input of defect depth calibration curves, recognition of defect size for enhanced depth evaluation, enhanced defect sizing and editing of the tank floor map.”

Currently providing EEMUA and API standard inspections of tanks, vessels and pipelines, Viking’s addition of SLOFEC to its portfolio means customers can select from an even greater range of solution services. Furthermore, the SLOFEC pipe scanner unit will be available for use in pipeline inspection in the coming months and eddyMax, the sister product of SLOFEC, will soon be providing new solutions for heat exchanges and crack detection. Viking Inspection will be displaying its capabilities at Stand 14 during the Tank Storage Association (TSA) event at the Ricoh Arena, Coventry, on 26 September. HCB www.vikinginspection.co.uk

TANK STORAGE ASIA returns to Singapore’s Marina Sands Expo and Convention Centre on 25 and 26 September. The two-day meeting is Asia’s leading event for the bulk liquids storage industry and, as ever, a host of influential and expert leaders will be attending to address the crowds. This year, Tank Storage Asia is boasting an “unparalleled line up of suppliers,” as well as some brandnew features and an inspiring conference programme.

Boasting more than 80 exhibitors and over 20 conference speakers, including experts and analysts from top terminals and oil majors, Tank Storage Asia is an “unrivalled opportunity for visitors to access in-depth

sessions, presentations and debates on the most pressing industry-related challenges and solutions of the moment,” the organisers say. Industry authorities including CEOs, terminal managers and major industry representatives will discuss the key trends shaping the industry.

This year, a hugely diverse array of exhibitors will be filling the stands and providing guidance on the latest products. Businesses specialising in everything from pipe-crawling robots to marine loading arms and roofing to biofuel will be eagerly awaiting to speak to attendees and explore new partnerships.

Alongside the exhibitors is a dedicated conference hall where industry-leading voices will be speaking on a range of topics throughout the event. There is also ample networking space for those looking to have a longer conversation with peers and arrange

meetings to develop growing friendships. Prior to the event, an online, one-to-one networking platform will be launched to allow visitors to arrange meetings and manage their schedule throughout the show.

The TSA Connect Lounge on the exhibition floor will provide a comfortable space for these meetings to take place.

Mark Rimmer, tank storage portfolio director, says: “Tank Storage Asia is alert to the biggest issues currently affecting the Asian tank storage industry. The event will examine the trends that are most prevalent in great detail. This is what brings leading professionals to the event, year-on-year.”

Digitisation and the need for industry to embrace the development of the connected world will loom large among the key topics, promising to be included in several presentations at Tank Storage Asia. Mark Stuart, speaker and trainer at Anagram Group will be kicking off proceedings after the opening remarks by the chair by discussing leadership in the digital age. The body of his presentation will explore why and how organisations need to evolve in a world of change and disruption and also examine what leading companies are doing to prepare for the future of work.

This theme is continued later in the day by Edwin Ebrahimi, innovation engagement leader at Vopak, who will look at the development of Vopak’s smart terminals and recent digital transformation. Alongside a detailed report on recent developments in digital asset management, Ebrahimi will discuss the use of drones for tank and jetty inspections and also the implementation of smart sensors for condition monitoring.

Digital innovations will also be the key point of a joint presentation by Mark Lim, commercial manager at Stolthaven Terminals, and Chye Poh Chua, CEO of ShipsFocus. The duo’s session will dissect big data and artificial intelligence, detailing how technology can be used to reduce tanker waiting times and enhance terminal utilisation. Ultimately, the aim is to promote inclusive growth, encourage marine commerce to digitise and help small and medium-sized maritime enterprises to close the digital divide.

Ian Coker of Bureau Veritas will continue the conversation surrounding the development and use of robotic tools in his presentation on emerging inspection and integrity technologies for tank asset management.

As has been seen in the last couple of years, there have been countless developments and ingenious applications when it comes to new

robotics. The industry is now at the stage where manual inspections are almost not necessary and can even be conducted without a shutdown. This is of course monumental in terms of staff safety and optimising profits for a whole host of specialist businesses.

Of course, some big changes are known to be happening in 2020 and people are preparing for the unknown in the future as the 2019 macroeconomic environment has been turbulent at best. One of the known changes to be fast approaching is ‘IMO 2020’, the new restrictions on the sulphur content of marine fuels. Sushant Gupta, director Asia-Pacific refining at Wood Mackenzie, will explain how the legislation represents a positive move to drive down emissions and improve sustainability. Questions on how the sector will adapt to changes in demand for highand low-sulphur fuel oil and what this means for storage opportunities in Asia will also be answered during the session.

Being able to navigate the commercial opportunities that will be presented once IMO 2020 has launched is part of the discussion Paul Hickin, associate director at Platts, will lead. It is inevitable that global supply and demand balances for oil will be affected by

IMO 2020 so Hickin will examine how market dynamics and structures are likely to react.

Additionally, there will be an in-depth look at OPEC’s determination to cut output beyond 2019.

Over the course of the two days there will be plenty more discussions. These expert-led talks will include topics such as the adoption of low carbon energy alternatives and the bolstering of green credentials, process safety improvements and compliance, setting up petroleum products storage terminals in India, and the role hydrogen will play in a decarbonised future.

“Tank Storage Asia is the only event in the world dedicated to the Asian storage market and, with crude oil trade routes opening in the east, there is no doubt about the profitability of the market – the industry is thriving in the region,” says Rimmer. “This reality is pushing developments in new technology, materials and automation equipment. The fact that the results of such pioneering product and service developments will be present on the show floor, and that the thought processes which led to these will be discussed, is something Tank Storage Asia is immensely proud of.”

For more information on the exhibition and attending the conference, please call +44 20 3196 4300. HCB www.tankstorageasia.com

Oiltanking has agreed the sale of its Tallinn terminal in Muuga, Estonia (above) to Aqua Marina, holding company of leading Estonian fuel distributor Olerex Group.

“Oiltanking is constantly evaluating and optimising its terminal portfolio worldwide. Product flows in the Baltic Sea area have changed considerably in the recent years, meaning that the capabilities of Oiltanking Tallinn could be better utilised by a new strong import-focused owner,” says Karl Henrik Dahl, Oiltanking’s director, west of Suez.

The 78,550-m3 terminal provides road tanker and tank container loading infrastructure for the local and regional distribution of road fuels and chemicals. On completion of the sale, which is subject to competition approval, it will be renamed Olerex Terminal.

“Olerex distributes more than a quarter of the entire Estonian retail consumption of automotive fuels,” says Antti Moppel, Olerex chairman. “These volumes and the Oiltanking terminal with its sea and rail access are a perfect match, helping us to further optimise the fuels handling and distributing costs. Lower fuel handling costs help to keep our prices at forecourts reasonable.”

www.oiltanking.com olerex.ee

Inter Pipeline has announced it is exploring the potential sale of its European bulk liquids storage business, Inter Terminals.

“Inter Terminals is a high-quality business with outstanding management and staff. It has made an important contribution to the success and growth of Inter Pipeline over the past 14 years,” says Christian Bayle, president/CEO of Inter Pipeline. “Our decision to explore alternatives is consistent with Inter Pipeline’s practice of making prudent long-term portfolio management decisions particularly in light of our organic growth initiatives.”

Should a buyer be found, proceeds from the sale could be used to pay down debt and to finance Inter Pipeline’s capital expenditure programme, including development of the Heartland petrochemical complex. Any sale is not expected to have an impact on Inter Terminals’ operations, which are continuing as normal. Inter Pipeline has not established a definitive timeline to complete this process and there is no assurance that a transaction will result from it, although the company has confirmed that it has received an unsolicited offer for Inter Terminals.

Inter Terminals delivered funds from operations of C$26.9m in the second quarter 2019, up from C$17.4m last year following the

integration of NuStar Energy’s European terminals in the UK and the Netherlands.

Inter Pipeline notes that the acquired terminals operated at a 96 per cent utilisation rate through the quarter, although overall utilisation was 83 per cent, slightly down on the year earlier level but a marked improvement on the first quarter. Indeed, with customer interest improving, particularly in Denmark, utilisation in July averaged 90 per cent across the network. interterminals.com

Stolt-Nielsen has sold its Altona terminal in Melbourne, Australia to Australasian Solvents & Chemicals Company (ASCC), which specialises in the blending, storage and warehousing of chemicals and non-chemical products.

“ASCC is very excited by this new addition to our group of companies,” says ASCC Group CEO Leanne Wilkins. “For ASCC to invest in Altona, we know that we are committing to the Australian manufacturing markets long term. Altona will continue its operations in supplying quality blending, storage and distribution facilities to existing and future customers and will retain all current employees on the site. ASCC looks forward to servicing our valued customers.” www.ascc.net.au

Jurong Port Tank Terminals (JPTT), a 60/40 joint venture between Jurong Port and Oiltanking, has been formally opened, although it has been in partial service since April. JPTT also reports that PetroChina has leased the entire phase 1 capacity of 252,000 m 3 for clean products; it will be mainly used for gasoline and blending components. A second phase of construction will take capacity up to 550,000 m3; talks are currently underway with potential clients. The terminal can handle tankers of up to Suezmax size and is linked by direct pipelines to Jurong Island’s refining and petrochemical cluster.

“This is a significant step for us as we move forward with our vision to become Singapore’s next generation multipurpose port,” says Ooi Boon Joe, CEO of Jurong Port and chairman of JPTT. “We see Jurong Port Tank Terminals as a key part in the renewal and upgrading of Singapore’s competitiveness in storage infrastructure. The joint venture with Oiltanking will meet the demand for top quality and integrated storage infrastructure emerging from petrochemical product flows into south-east Asia.”

Douglas van der Wiel, president of Oiltanking Asia Pacific, adds: “The need for supporting infrastructure to manage the increasing demand in Asia for petroleum products created the need for JPTT. The terminals will be able to handle the demand from the region and help strengthen the integrated terminal network concept and overall value offering to the market. This is the embodiment of Oiltanking’s vision for the Singapore Straits, reinforcing Singapore’s international maritime energy and chemicals hub status.” www.jp.com.sg

Odfjell has finalised the sale of its 55 per cent indirect equity interest in Odfjell Terminals (Jiangyin) Co, a 100,000-m3 bulk liquids storage terminal and jetty serving the greater Shanghai area, to Yangzijiang Shipbuilding for some $46m. Odfjell expects to book a capital gain of around $21m net in its thirdquarter results.

“We are pleased to have concluded the sale of our Jiangyin terminal and its jetty at what we believe is a fair valuation that is a testimony to the strength and quality of the investments

made since 2007,” says Kristian Mørch, CEO of Odfjell SE. “This divestment is in line with our strategy to grow and focus on chemical terminals in locations where we can harvest synergies with Odfjell Tankers. We appreciate the cooperation we have had with our partner Jiangsu Garson Gas Co Ltd in China, and wish them and their new partner Yangzijiang Shipbuilding a successful future in further developing the full potential of the terminal and its jetty.”

The sale is associated with Lindsay Goldberg’s ongoing disposal of its 49 per cent shareholding in Odfjell Terminals BV. Following the completion of the sale of its shareholdings in the US and European

terminals, Lindsay Goldberg is currently selling its stake in Odfjell Terminals Asia Holding.

The resulting restructuring in Odfjell Terminals has prompted a change at the top, with Adrian Lenning having been appointed as the new global head. Lenning, a Norwegian citizen, arrives from Invepar Group in Brazil, where he was general executive, mergers and acquisitions. He will be based in Bergen.

“We are very pleased to welcome Adrian to Odfjell and look forward to having him lead the future development of our tank terminal division,” says Mørch. “Odfjell SE remains committed to the core terminals we operate. The outlook for terminals at important crossroads of chemicals remains positive, and we continue our work to strengthen Odfjell’s core terminal activities and optimise the synergy potential between terminals and tankers.”

Odfjell Terminals recorded second-quarter revenues of $17.9m, slightly ahead of the prior period but down on the same quarter 2018 as a result of disposals. EBITDA came in at $6.2m, down from $6.7m in the first quarter due to an impairment related to a proposed ethylene project at the Houston site (below), which is not going ahead. www.odfjell.com

AS ONE OF the world’s leading air cargo operators, Qatar Airways Cargo (QAC) has to handle a lot of dangerous goods of all types. That adds noise into the cargo acceptance and booking system and sets in place hurdles that airlines have to navigate in order to maintain safety and quality.

“Risks are mitigated when transporting dangerous goods when all rules and regulations are adhered to,” says Guillaume Halleux, chief officer cargo at QAC. “Enforcing a strict set of regulation-compliant operations across all aspects of the process is key to achieving success. Risk only arises due to non-adherence to regulations.”

“QAC has a dedicated team for dangerous goods based in Doha,” Halleux continues.

“They are a highly qualified team with several years of experience, who fully support Qatar Airways staff and our ground handling agents globally to ensure all dangerous goods are moved safely throughout the network in compliance with the International Air Transport Association’s (IATA) Dangerous Goods Regulations. The team also obtain the State’s approval for the carriage of dangerous goods on all Qatar Airways flights. ‘Safety First’ remains our motto and the team carry out all relevant risk assessments for high-risk dangerous goods shipments before they are accepted for carriage on Qatar Airways flights and freighters.”

Receiving thorough training around specific forms of dangerous goods, and receiving that training regularly, is pivotal to ensuring safety. “All our dangerous goods training programmes are approved by the Qatar Civil Aviation Authority (QCAA] and all our operations staff throughout the network are

trained either in Category 6, 8 and/or 10 as applicable by the regulators and based on their job responsibilities, including recurrent training,” says Halleux.

“We also have a dangerous goods training module for our reservations staff which helps them to answer all relevant queries from customers and shippers,” he continues. “Additionally, we closely monitor the training of all our appointed ground handling agents so that our shipments are accepted and handled by well-trained personnel, ensuring full safety of our aircraft.”

This training is further strengthened by IT systems that ensure compliance and smooth operations. “Our dangerous goods operations are currently managed through Online Services, our in-house management information system, where the entire booking from pick-up to delivery is managed,” explains Halleux. “Acceptance checklists are manually completed for dangerous goods shipments using the IATA DG acceptance checklists. The system controls our embargoes and restrictions and is a state-of-the-art modern tool for our reservations teams.”

Transport providers across all modes have to tackle the problem of undeclared dangerous goods, but the continued growth of air cargo volumes, increasing air passenger numbers and rapidly changing regulations add other

dimensions to moving dangerous goods by air. QAC has put in place a structured process to manage the issue of undeclared dangerous goods.

“We undertake a thorough investigation with the origin station and the customer and obtain corrective and preventive actions (CAPA),” explains Halleux (above). “Once a shipment is stopped pending an investigation, it is only reinstated after a satisfactory CAPA is received and implemented. The dangerous goods team continuously monitors any irregularities and updates our ground handling agents so that corrective actions are taken immediately. All undeclared dangerous goods incidents are reported to the origin civil aviation authorities and also to QCAA in Doha according to the ICAO and IATA regulations. Apart from the dangerous goods, the team also assists to classify non-hazardous chemicals that can pose a potential threat of fire due to high temperatures prevailing in the summer months. Qatar Airways has a separate process implemented for such chemical shipments.”

Being able to accommodate some flexibility is beneficial when airlines handle dangerous cargo, as implementing rigid systems will mean an inability to react to changing volumes of goods and changes in global routes. QAC has “achieved a steady growth around 22 per cent year-on-year for dangerous goods for the last three years,” says Halleux, with the largest volume of dangerous goods coming from Europe. This growth in cargo was

highlighted in July as QAC finalised an order for five new Boeing 777 freighters.

Found in a vast array of different items that have become everyday essentials, such as mobile phones, power banks and laptops, lithium batteries have caused problems in recent years for airlines. Damage to or short-circuiting in such batteries and battery-powered equipment can lead to the evolution of heat and fire, which can prove very difficult to extinguish.

“We do not have any restrictions on any of the classes of dangerous goods. However, certain items like lithium batteries have restrictions on Qatar Airways passenger flights considering the safety concerns. Despite these restrictions, exemptions are provided based on reasons such as movement for medical equipment, MRI machines, Formula 1 and Moto GP cars,” explains Halleux.

“Lithium batteries still pose the biggest challenge within dangerous goods,” according to Halleux. “This is mainly due to customers being unaware of the regulations and the inherent risk they pose. Another risk arises from undeclared dangerous goods, including lithium batteries, and also inferior untested batteries being shipped globally.” Currently, QAC’s highest volumes of lithium batteries are moved from north-east Asia.

Assessing the current business environment for air cargo and looking forward to 2020, Halleux believes that education within the industry for a stronger understanding of regulations is needed to ensure safety and growth. “Undeclared dangerous goods are the biggest concern at the moment as they endanger the safety of the aircraft,” states Halleux. “It could be that shippers are deliberately sending shipments undeclared to circumvent or avoid the specific documentary requirements or because they lack essential knowledge on the regulations. Shippers who are entering the market for the first time due to the growth of the e-commerce market also pose a significant risk due to their lack of knowledge on the regulations and identifying the items as dangerous goods. Our experience on lithium batteries shows that the shippers have many misunderstandings on the regulations, on classification and packing requirements.” HCB www.qrcargo.com

THE ABILITY OF

personnel in contact with dangerous goods transported by air.” This training is further divided into more specific requirements depending on the areas of responsibility for individual employees.

Arnold continues: “The handling of dangerous goods in air traffic is strongly regulated due to the resulting danger for passengers, crews and staff. For this reason, all Lufthansa Cargo processes and systems are based upon the latest release of the IATA Dangerous Goods Regulations. These regulations cover the complete process chain of dangerous goods in air traffic down to the last detail. Furthermore, our dangerous goods experts are working with the official and latest version of the DGR book and/or software issued by IATA.”

The latest software presented by IATA is the integrated management solutions (IMX). As the air cargo industry is growing, more time is being spent on managing diverse components and vast quantities of data, so IMX has been developed to gather all quality management system and safety management system data in a user-friendly format. Furthermore, IMX provides seamless connections to the IATA Global Aviation Data Management database, STEADES, GDDB and ECCAIRS, plus many other beneficial functions such as automatic production of IOSA conformance reports.

THE POSSIBILITIES PRESENTED by air transport can vastly outweigh the benefits of alternative modes of transport, but when it comes to dangerous goods by air, precise expertise is needed. As a service provider, being able to safely and securely ensure the highest quality service for the passage of goods for clients is pivotal. But as the globe experiences a growth in air cargo, expanding numbers of international routes and constant regulatory changes, how can airlines keep ahead of the curve?

“Lufthansa Cargo has qualified personnel to accept, inspect and handle dangerous goods at most of its stations worldwide,” says Mark Arnold, dangerous goods handling specialist at Lufthansa Cargo. “In Germany, dangerous goods are only accepted in Frankfurt. Due to its outstanding position as

the Lufthansa Cargo Hub, Frankfurt is also the centre point for dangerous goods in transit from all over the world. As a result of this, a complete department of dangerous goods experts is available 24/7.”

Having access to correctly trained staff at all hours of the day is essential for the smooth running of a global operation that never closes its doors. Frankfurt airport’s CargoCity facility is able to handle all types of dangerous goods (apart from explosives) and provides storage solutions for more than 24 hours.

The training processes employed by Lufthansa are based on the latest International Air Transport Association (IATA) Dangerous Goods Regulations (DGR) requirements, explains Arnold. “This means biannual training for

A concern that often arises when handling dangerous goods is that of undeclared goods. Sometimes it can be as simple as human error and incorrect labelling, but other times it can be an act of negligence with shippers knowingly not declaring the true nature of the product in the packaging to avoid tariffs, restrictions and paperwork.

To combat this, Lufthansa enforces a policy that checks that everything is as it should be with the cargo. “During the documental and physical acceptance, an initial check of cargo and documents is carried out for possible indications of undeclared dangerous goods,” says Arnold. “In such situations, Lufthansa contacts the shipper and the goods are stored in a secured area until further action is taken by the customer.”

When looking at the industry as a whole and forecasting future developments, Lufthansa feels it is in a strong position to face any potential issues, but none appear to be brewing at the moment.

“Fortunately, there are no far-reaching problems regarding dangerous goods in aviation,” says Arnold. “The currently increasing tensions and the resulting trade barriers caused by international politics could lead to a degeneration of the market and thus to problems in the entire industry. However, I do not see the safety and the handling of dangerous goods affected.”

Even though the procedures surrounding dangerous goods are unlikely to be affected by current issues, being able to provide a higher quality service is always something to strive for. “In order to counteract these negative developments, Lufthansa Cargo is engaged in the implementation and introduction of the digital dangerous goods declaration in close cooperation with its customers. This is leading to leaner and more efficient processes and may help to overcome the growing barriers,” says Arnold.

The Electronic Dangerous Goods Shipper’s Declaration (e-DGD) has been developed from the realisation that there was a growing need by various stakeholders in the air cargo supply chain for a digital and paperless process to manage the IATA Dangerous Goods Shipper’s Declaration (DGD). The major benefit of the e-DGD is that data is available on platforms and is accessible to those who require it. The data sharing platform principle allows for a close collaboration between all stakeholders.

The use of solutions such as IMX and e-DGD is allowing Lufthansa to readily manage the growth that the industry is experiencing. This universal growth has led to a staggering diversity in types of goods needing transport across all routes, so being prepared for all forms of cargo request is pivotal. “Due to increasing globalisation, the volume of goods transported by air is increasing continuously, as is the volume of dangerous goods,” says Arnold (right).

In addition to the need to be prepared for all routes, there are still times when rapid regulatory changes come into force that lead to high-profile topics of discussion even

outside of the industry. Arnold highlights one of the most recent occurrences: “Over the last couple of years, lithium batteries became the most outstanding topic in the airline industry. In respect to the rapidly growing amount and increasing awareness of the dangers posed by lithium batteries, customers and airlines were confronted with constantly changing regulations. This led to widespread uncertainty about lithium batteries that continues to this day.”

Elsewhere, Lufthansa has joined the ranks of other airlines by approving the use of the new CSafe RAP temperature-controlled container (HCB August 2019, page 30).

Thorsten Braun, senior director of industry development and product management says of the approval: “To me it represents a typical win-win situation. With the addition of the CSafe RAP we are further expanding our portfolio of active cool containers, which is second to none, while intensifying our existing relationship with CSafe. In combination with our extensive global network, we are offering one of the leading cool containers to our customers!” HCB lufthansa-cargo.com

AS WITH OTHER MAJOR AIRLINES, LUFTHANSA CARGO IS EXPERIENCING CONSISTENT GROWTH IN THE VOLUME OF ALL TYPES OF CARGO, AND THAT INCLUDES DANGEROUS GOODS, AND IS EMPLOYING NEW TECHNOLOGIES TO HELP IT COPE

PROVIDING ANSWERS FOR the transport of dangerous goods and being able to then offer solutions and services to fulfil client needs is key to Coastair’s approach to air freight. The Belgium-based business operates out of Liège airport and specialises in worldwide airlift solutions on scheduled service and full charter flights.

“Our staff eat, drink and sleep cargo; they have the cargo virus in their blood,” states Coastair. All of the departments within

Coastair have staff that are trained to handle and advise on dangerous goods “from sales to acceptance to warehouse staff,” says Ronny Samaey, managing director of Coastair. “At this stage, we use IATA trainers to provide courses to our staff, which can be done locally at Liège airport.”

Skyhouse, Coastair’s 2,500-m2 second-line secured warehouse at Liège airport, opened recently. “Skyhouse is located at the airport logistic centre, avoiding trucking congestion at the airport handlers,” says Samaey. “We do not have offloading delays and we have very experienced warehouse staff to build and optimise pallets. We have a truck-loading system for 10+20ft build-up pallets, our own weighing system and more.”

Samaey describes Coastair’s approach to training as “old school” whereby each staff member is required to undertake frequent

training sessions using the IATA programmes. As for dangerous goods shipments, Samaey feels there is no substitute for the personal approach and being prepared: “We believe the physical checks are the best way to really confirm the shipments are ok.”

Samaey continues: “Sometimes we have the same products going to the same destination, but I would say it really differs from week to week based on the demands at the final destination. All dangerous goods can be screened in-house (EDS/EDD/ETD/ VCK) and the type of dangerous goods will dictate what screening method is to be used. We do not accept explosives of any kind and – for the time being – no radioactive shipments are going through the warehouse.”

Occasionally dangerous goods are either not declared or something has been incorrectly documented. When this occurs, Samaey explains: “We immediately contact our client or shipper and the full shipment is placed on hold until everything is corrected with the required certificates and labels. This client will then be held accountable for their dangerous transport.”

As has been seen throughout 2019, global air freight is increasing in volume. To handle the increase in demand from shippers, Coastair has been expanding and partnering with complementary services to provide the best options for clients. For example, a new partnership has been instigated with routes into China to expand the possibilities for those seeking Coastair’s expertise.

“Coastair now has four different operational services: Imperial Cargo Airlines, our African flights to Lagos, Accra and Johannesburg; Aviaflex, the cargo supervisors at different airports; Skyhouse, our new secured warehouse; and, of course, Coastair as a cargo/charter brokerage covering worldwide shipments from A-Z. All these companies are able to be compatible with each other which allows for the smooth delivery of services for one another. Being active in different cargo areas helps us to create more time and possibilities for our clients so they can focus on their core business,” says Samaey. HCB coastair.be

DESPITE EXTENSIVE PLANNING, issues can arise when managing the transport of delicate and dangerous pharmaceutical goods. Ultimately, if the quality of these goods is compromised, the results can be disastrous, particularly for cargo requiring specialised temperature-specific packaging. Even something as small as receiving incorrect measurements from clients can drastically affect the shipping process and reduce packaging effectiveness.

Biocair, a specialist in managing cold chain logistics and handling sensitive goods, is using its knowledge to improve logistics processes. Two examples of the extreme variations in pharmaceutical goods transported by Biocair include 480,000 cell samples and an API that had to remain specifically between -40°C and -70°C – outside the operating boundaries for conventional solutions.

Ensuring packaging for dangerous goods is correct in a developed region or a facility owned and operated by the logistics company is easy, but things become trickier further afield. “Receiving the wrong cargo dimensions seems minute, but it can cause big issues such as inefficient temperature-controlled packaging and having to split cargo, leading to underutilised space and increased costs,” says Don Riach, UK operations director at Biocair.

PREPARATION IS KEY Riach explains some locations simply “do not have the facilities for cold storage, the capacity to store a large range of packaging solutions or even have access to a local dry ice manufacturer”. In these circumstances, Riach says solutions can include double-walling the shipment or even sending a separate

container of replacement dry ice alongside. Biocair uses detailed packaging procedures, such as how to condition PCM’s, maintain equipment monitoring and alarm processes to ensure the units used are performing as desired, and to maintain excellent GDP.

To combat potential problems, precise documentation is needed to plan the optimum solution for the task, particularly when working internationally. Brian Padgett, US compliance manager at Biocair, explains how safeguarding a smooth process covering customs clearance for clinical trials to transport begins with “ensuring all required documentation and licensing is included”. Preparing documentation in a manner that accurately describes the material being shipped, such as HTS codes, FDA codes and clinical trial authorisation documents,

provides the foundation for planning the best course of action.

Furthermore, tracking cargo is essential in monitoring goods during transport. Biocair’s MyCair track and trace system improves customer visibility of shipments by speaking to different airlines through their own tracking websites and then providing customers with notifications at key shipment stages.

The close tracking of all shipments serves to offset delays during transport. Should a delay strike, or the temperature is compromised, problems can be swiftly rectified. Being able to act quickly to preserve the quality and efficacy of pharmaceuticals ensures that the odds of losing a shipment are drastically reduced. Monitors are installed to check temperatures and GPS tracking is a recent addition to the services provided.

“If a client asks for the delivery to arrive 24 to 48 hours later, we will find a way to make that happen, even if the cargo is highly specialised,” says Riach. “We aren’t able to guess every customer’s needs, so we have to remain flexible and work diligently to provide the exact service needed.” Highlighting the need for accuracy when it comes to packaging, Riach points out that “losing or damaging even a single shipment through poor management can cost hundreds of thousands of pounds and can set clinical trials back months”. HCB www.biocair.com

ACQUISITIONS • BRENNTAG HAS BEEN BUSY LATELY, ADDING TO ITS EXISTING NETWORK IN SOUTHERN AND EAST AFRICA AND ASIA, ALTHOUGH GLOBAL MACROECONOMIC FACTORS ARE TOUGH

Anthony Gerace, Brenntag’s managing director mergers and acquisitions, adds:

“We expect to realise cost synergies and convert cross-selling opportunities by combining Crest and Brenntag South Africa since both companies have complementary product lines. In addition, Brenntag will benefit from Crest’s mixing and blending capabilities, a service that is increasingly requested by customers.”