Robert Peters is an Illinois State Senator representing the 13th District. PHOTO PROVIDED BY SG STRATEGIES.

Marcus Evans is an Illinois State Representative for the 33rd District. PHOTO PROVIDED BY MARCUS EVANS.

Robert Peters is an Illinois State Senator representing the 13th District. PHOTO PROVIDED BY SG STRATEGIES.

Marcus Evans is an Illinois State Representative for the 33rd District. PHOTO PROVIDED BY MARCUS EVANS.

WEEK OF SEPTEMBER 28, 2022 FREE | VOL 55 | ISSUE 34citizennewspapergroup.com www.facebook.com/durrell.garth.9 w advertising@citizennewspapergroup.comtwitter.com/citizennewsnow SOUTH ENDC WEEKLY citizennewspapergroup.com citizennewspapergroup.com P2 P5 P9 Taking Steps Toward Homeownership BUSINESS P4 Purpose Toys Unveils Amazon Exclusive “Crown and Coils” Styling-Head Set Bilingual collection offers free access to high-quality digital books and resources for adults, children and educators

ILLINOIS RUST BELT TO GREEN BELT ACT WOULD SPUR CLEAN ENERGY WIND PROJECT Illinois State Representative Marcus Evans introduced HB 4543 in January 2022. The Illinois Rust Belt to Green Belt Pilot Program Act would be a step in moving Illinois toward more clean energy. The DuSable Museum Presents “DRUM TALK” –THE ANNUAL BOOK AND LITERARY FAIR SATURDAY, OCTOBER 8, 2022 P7

FEMA PROVIDES $22M TO THE CITY OF CHICAGO FOR COVID-19 RESPONSE

CHICAGO – FEMA and the Illinois Emergency Management Agency announced that $22,046,100 in federal funding has been made available to the city of Chicago for costs related to the response to COVID-19 under the federal disaster declaration of March 26, 2020.

This funding will be used to reimburse the city of Chicago for costs to distribute and admin ister COVID-19 vaccines at 22 vaccination sites in the city. The funding also covers costs incurred to conduct home visits offering the vaccine to elderly individuals or people with disabilities, conduct outreach activities informing the community about the COVID-19 vaccine, and provide security services at the vaccination sites.

“FEMA’s Public Assistance program is an important resource for state and local govern ments, jurisdictions, and eligible private non-prof its to cover COVID-19 expenses,” said Tom Sivak, regional administrator, FEMA Region 5. ““We’re proud to support Chicago’s efforts to make the vaccine as accessible as possible to all residents and combat this pandemic together.”

“The continued partnerships with FEMA throughout the COVID response has been outstanding as we work together to keep every one safe,” said Illinois Emergency Management Agency Director Alicia Tate-Nadeau. “Funding this program has directly supported many vacci nation centers, served vulnerable populations, and addressed those with access and functional needs with safe and effective way to get a vaccine in the City of Chicago.”

FEMA provides a 100 percent federal share of eligible reimbursable expenses for this project. FEMA’s Public Assistance Program provides fund ing to state and local governments, jurisdictions, and eligible private non-profits for the repair, replacement, or restoration of disaster-damaged infrastructure as well as costs incurred for emer gency actions taken to protect lives or property. To learn more, visit FEMA’s website at www. fema.gov/public-assistance-local-state-tribal-andnon-profit.

REP. DANNY K. DAVIS APPLAUDS PRES IDENT AND CONGRESS FOR PASSING LEGISLATIVE TO REDUCE INFLATION AND UPLIFT COMMUNITIES

Washington, D.C. -- U. S. Representative Danny K. Davis joined his colleagues in salut ing the Biden Administration for supporting and signing legislation that will reduce inflation, lower health care costs, combat climate change, create opportunities and jobs, protect public health, lower health insurance premiums and expand coverage, lower costs for small businesses and other monu mental changes.

Davis said, “I am so proud to be a part of history in the making. The history that is made will reduce poverty and strengthen families for decades to come. The Inflation Reduction Act will help seniors and provide jobs for all, especially Afri can-Americans, while at the same time reducing reliance on natural gas. We are on a roll, and the people will benefit.”

In addition, the Inflation Reduction Act will reduce the defict by hundreds of billions and create a space that will ensure that the wealthiest and largest corporations will pay their fair share while ensuring that no one making under $400,000 per year will pay a penny more in taxes.

Illinois Rust Belt to Green Belt Act would spur clean energy wind project

BY TIA CAROL JONES

The HB4543 creates the Illinois Rust Belt to Green Belt Fund as a special fund in the Illinois Treasury. Those funds would be used by the Department of Com merce and Economic Development to facilitate work on an offshore wind project.

Clean Energy is created without coal or using fossil fuels. Part of the act would create an offshore wind proj ect, which Illinois power agencies would be directed to buy their power from.

On Sept. 15th, the Biden-Harris Administration announced the launch of actions to develop new, floating offshore wind platforms. According to the release, “The President set a bold goal of deploying 30 gigawatts (GW) of offshore wind by 2030, enough to power 10 million homes with clean energy, support 77,000 jobs, and spur private investment up and down the supply chain.”

In the Inflation Reduction Act, President Joe Biden secured clean energy tax credits. “If they’re going to put money out there for wind development, that means somebody is going to do it, so let’s do it here in Illinois,” Evans said.

Representative Evans, along with Illinois State Sena tor Robert Peters hosted a meeting to discuss the poten tial of having an offshore wind project in Lake Michi gan, near the South Chicago community. Evans believes that water near South Chicago is a prime location for the offshore wind project. Evans acknowledges that finding cleaner ways to produce energy is essential to moving into the future.

Representative Evans believes the wind project will bring economic development, with a variety of industries that will be created with the project. “We need more people in the Black community talking about energy and the energy sector, having our young people think about jobs and careers in the industry,” Evans said.

State Senator Peters is one of the sponsors in the Illinois Senate for HB 691, which amends the Petro leum Equipment Contractors Licensing Act. It restricts businesses from using petroleum contracting equipment without proper licensing.

“For a long time, there have been people in Illinois who wanted offshore wind, and there have been people who organized around that for a long time. At the same time, there have been people who have been organizing around equitable economic investment, particularly on the South sides of Chicago … This is a combination of all those different strands of organizing coming togeth er,” Peters said.

State Senator Peters said the Illinois Rust Belt to Green Belt Pilot Program Act would create clean energy, good union jobs, and would make sure it is equitably done. As the country and the State of Illinois move away from dirty energy sectors to clean energy sectors, Illinois wants to be a clean energy leader. The goal is to ensure that clean energy production, location and the jobs that come along with that happen in Black and Brown com munities.

“When you think about the Southeast side and you think about the marriage of the Industrial Revolution and the Environmental Justice Revolution, that’s why the Southeast side is somewhere I think is vitally important that we see projects like this happen,” Peters said, adding that often when there are conversations about what needs to happen in the city, the Southeast side of Chicago is forgot ten.

Peters described the Illinois Rust Belt to Green Belt Act as an important door opening opportunity to bring this project to the community. There are conversations with community residents, decision makers in labor and unions and the environmental justice movement to ensure everyone is informed about this opportunity. The next step is to vote on and make the act a law in Springfield.

Sen. Robert Peters, State Legislators, Community Leaders, Advocates Attend Public Court Watching in Support of Ending Money Bond and Creating Safer Communities

CHICAGO – Elected officials, community members and activists attended public bond court hearings and stood outside the Cook County Courthouse in a show of support for the Pre trial Fairness Act, which ends money bond in Illinois and will go into effect in January, 2023.

In the current money bond system, judges make the deci sion to jail or release a person pretrial in a matter of minutes, and the primary factor determining who is released pretrial is whether or not they can afford their freedom. In fact, today under current law, anyone can pay their bond and be released, no matter the crime they are charged with committing. The Pretrial Fairness Act corrects this injustice, which dispropor tionately impacts communities of color, and makes “innocent until proven guilty” truly the law of the land.

Illinois residents have been flooded with misinformation campaigns funded by right wing billionaires designed to scare voters. These attacks prey on people’s feelings of being unsafe under the current carceral system that is truly to blame for the violence we see in our communities.

“The status quo is what makes communities unsafe,” said State Sen. Robert Peters (D-Chicago) during the press confer ence. “The violence we see today is due to a system that ties freedom to money, that allows some people–especially those who are a threat to others–to pay bond and be released from jail. The Pretrial Fairness Act ends the preferential treatment

for the wealthy and makes sure that someone’s freedom is based on a judge’s evaluation of the facts.”

“Black and Latinx people are disproportionately impacted by the money bond system,” said Pastor Charles Straight. “This is a racial justice issue, this is a civil rights issue–when young Black men are imprisoned in jail for months before their case has been heard by a judge, they lose their jobs, custody of their children, and have a higher likelihood of being rearrested in the future. This system is not making us safer, it’s only perpetuating cycles of poverty and violence.”

Courtwatchers also used this moment to call out the misinformation circulating about the end of money bond in fake newspapers, outlandish memes, and race-baiting ads funded by Dan Proft and Richard Uihlein.

Allowing people to return home while they await trial keeps communities whole and makes them safer. Research has shown that people who are jailed are more likely to be arrested in the future than people who are able to return home to their communities.

The Pretrial Fairness Act was written by advocates and organizers in the Illinois Network for Pretrial Justice and the Coalition to End Money Bond. It was supported by elected officials, thousands of people and more than 100 organizations, including victims’ rights advocates.

NEWS South End | Week of September 28, 20222 C Continued from page 1 briefly citizennewspapergroup.com

Center for Igbo Studies at Dominican University Plans New Year of Lectures

River Forest, Ill. – Three years after its creation, the Center for Igbo Studies at Do minican University is beginning a new aca demic year with plans for a more “vibrant” series of educational programs and efforts to seek historic designation of a Georgia site linked to an 1803 slave revolt.

The center was established in 2019 at the request of the Igbo Studies Association, a global organization dedicated to pro moting and encouraging the study of Igbo history, culture, language, literature, social movements, science and technology. The Igbo are an ethnic group originating from Nigeria, with a sizable population in the United States and the Chicago metro area.

The center’s mission is to “facilitate the greater understanding of Igbo history, civilization, religion, culture, and language, while analyzing the current state of the Igbo Nation.”

For the Rev. Austin Okigbo, chairman of the advisory board to the Center for Igbo

Studies, the center will be an outlet for com municating Igbo contributions to science, medicine, athletics, education and American history itself.

Dr. Nkuzi Nnam, director of the Center for Igbo Studies and a professor of philos ophy at Dominican University, said there is an effort to raise awareness of the center this year after the pandemic prevented a more formal launch.

Goals for this year are to continue host ing educational lectures — which have large ly taken place virtually — featuring scholars and specialists from across the globe.

Perhaps most significantly, the center, with Gullah Geechee Community of the Southeast United States, is working to obtain national historic designation for Igbo Landing on St. Simons Island, Georgia, to commem orate the group of enslaved Igbo people who rebelled against their captors and committed suicide by drowning in 1803 rather than face lives as slaves in America.

The events of St. Simons Island are a testimony to the Igbo spirit of resistance, countering the narrative that enslaved people willingly accepted their fate, noted Okigbo. The Black experience in America, he ex

plains, has always been one of resistance and the quest for freedom.

“Igbo Landing is an important historic moment that tells the story from the very beginning,” Okigbo said. “Here are people brought as slaves, but they resisted. They would rather die than be slaves.”

The Center for Igbo Studies was created through a $55,000 endowment funded by donations, a $25,000 contribution from the organization 100 Igbos USA, and a $25,000 match from former Dominican University President Donna Carroll, Nnam said.

Several sites around the country were considered for the center, but Dominican was ultimately proposed based on several factors, including its proximity to Chicago and O’Hare Airport, Chicago’s sizable Igbo popu lation, and the university’s welcoming nature, Nnam and Okigbo said. Dominican’s Black World Studies major was another important reason behind the selection, Nnam noted, while Okigbo pointed to the many Igbo who are members of the Dominican order around the world.

Even before the center was established, the Igbo Studies Association’s annual confer ence was held at Dominican University.

Dating App BLK Launches In-App Election Center

Dallas, Texas -- BLK, the largest dating and lifestyle app for Black Singles, announced the launch of their in-app Election Center, a digital hub designed to shift the culture of voting and politics in the Black community, amplify voices of Black voters and drive Black voter registration. The initiative was created in partnership with Michele Obama’s When We All Vote, a leading national, nonpar tisan initiative with a goal to increase participation in each and every election by helping to close the race and age gap.

Z (18-24) registered voters.

POLITICAL AFFAIRS

SIMMONS APPLAUDS $99,000 GRANT FUNDING FOR ROGERS PARK RECOVERY EFFORTS

CHICAGO – Thanks to the advocacy of Senator Mike Simmons and the Research in Illinois to Spur Economic Recovery (RISE) program, the Rogers Park Business Alliance will see $99,000 in grant funding to finance economic recovery efforts sparked by the COVID-19 pandemic.

The RISE program reimburses the costs local governments and economic development organizations incur while expanding local eco nomic recovery efforts. These costs include salaries, research, outreach, and expenses related to administering recovery efforts.

“The efforts of Rogers Park Business Alliance to soften the economic impacts of the pandemic are a key part of the overall work being led by the community and small business owners to ensure existing businesses succeed, and new businesses are positioned for success,” said Simmons (D-Chicago). “As the son of a long-time Rogers Park salon owner, I know firsthand how beautifully diverse Rogers Park businesses are and what they do for the block and larger community. I know this economic recovery grant will help ensure those businesses can thrive and hold on during this tough economic climate and do so in a way that pre serves the character of these commercial corridors without gentrification and displacement.”

RISE empowers local governments to create meaningful plans with a focus on specific initiatives and investments that support recovery from the pandemic. The grants funding through the American Rescue Plan Act (ARPA), will help improve the quality of life for community members by taking a comprehensive approach to economic development through supporting the local workforce, improving affordable housing options and more.

CHATHAM-SOUTHEAST

Chatham, Avalon Park, Park Manor,GreaterGrand Crossing, Burnside,Chesterfield, West Chersterfield, South Shore,and Calumet Heitghts.

SOUTH END

Washington Heights,Roseland,Rosemoor, Englewood,West Englewood, Auburn-Gresham, Morgan Park, Maple Park, Mt. Vernon, Fernwood, Bellevue, Beverly, Pullman, West Pullman, West Pullman,Riverdale, Jeffrey Manor and Hegewisch.

SOUTH SUBURBAN

Serves communities in Harvey, Markham, Phoenix, Robbins, Dixmoor, Calumet Park, Blue Island,SouthHolland,and Dolton. Shopping- their favorite pastime!

HYDE PARK

Lake Meadows, Oakland, Prairie Shores,Douglas, Grand Boulevard, Kenwood, Woodland,South Shore and Hyde Park.

CHICAGO WEEKEND

Chicago Westside Communities, Austin and Garfield Park

SUBURBAN TIMES WEEKLY

BloomTownship, Chicago Heights, Flossmoor,FordHeights, Glenwood, Homewood, Lansing ,Lynwood, Olympia Fileds, Park Forest,Sauk Village,South Chicago and Steger

Citizen Newspaper Group Inc., (CNGII), Publisher of the ChathamSoutheast,South End, ChicagoWeekend,South Suburban and

For the past 154 years, Black Amer icans have faced major disparities and inequalities in accessing the right to vote. As a result, Black Americans have been less informed and engaged in both local and national elections, political initia tives, and major legislation. BLK recently conducted a survey of its members to understand the voting habits, behaviors, and preferences of Black singles.

Of the respondents, 80% of users are currently registered to vote.

Of those not registered to vote, 42% plan to register before the midterm elections.

However, this doesn’t impact dating, with 70% of users stating that they will date someone who intentionally chooses not to vote.

When asked which political beliefs would be deal breakers for a potential partner, the top three responses are 1) Trump Supporter (38%), 2) Pro-Life (34%), 3) Anti-Universal Healthcare/An ti-LGBTQ (tied at 10%)

Lastly, 52% of registered voters do NOT know the date of the 2022 Midterm Election.

Ahead of Black Voter Registration Day, the BLK Election Center will serve as a digital hub to empower Black singles to take action through voting - advocat ing for their rights and ensuring their voices are heard and amplified. Created in partnership with ‘When We All Vote,’ Mi chelle Obama’s national initiative to drive voter registrations throughout the United States, the Election Center takes users on a journey of engagement, education, and empowerment. Upon opening the app, us ers will be prompted to ‘Share Your Voice’ or ‘Shift the Culture’. When users select “Share Your Voice” they will be asked to choose policy issues of importance such as “gun violence,” “affordable housing” or “universal healthcare” which will then be displayed on their profile along with a When We All Vote sticker, allowing users to match with others that share the same concern over policy issues. Upon sharing feedback, users will then be encouraged to ‘Shift the Culture’ by registering to vote via the ‘BLK x When We All Vote’ voter registration portal. Additional BLK Election Center features include:

“When We All Vote” profile stickers

Policy issues of most concerned added to user’s profile page

Push notifications alerting BLK members of key dates (ex. National Black Voter Registration Day) and in key geo graphic locations

In-App Ad Units

Upcoming influencer and celebrity amplification

“We are grateful for the grant in the amount of $99K which will allow RPBA and the City of Evanston to work together to facilitate a highly inclusive planning process,” said Sandi Price, Executive Director of Rogers Park Business Alliance. “The outcome of the plan will show case an equitable shared vision that will chart a future course and assure the long-term resiliency of the Howard Street commercial corridor and communities on both sides of Howard Street.”

“Rogers Park is one of the most diverse neighborhoods in Chicago, and Howard Street exemplifies that from Lake Michigan to Western Avenue in its storefronts,” said Simmons. “It will take intentionality in economic planning to ensure economic recovery efforts are done for existing businesses on the Howard Street corridor, many of whom are Black, African, Latinx, and Caribbean-owned.”

For more information about the RISE program or its allocation to Rogers Park Business Alliance, please visit the DCEO website.

REP. ROBIN KELLY LEADS 25 CBC MEMBERS IN CALLING FOR EXTENDED MEDICAID COVERAGE FOR POSTPARTUM CARE IN YEAR-END FUNDING BILL

Newly released CDC data shows 4 in 5 pregnancy-related deaths are preventable, 53% of deaths occur more than a week after delivery.

Recently, Congresswoman Robin Kelly (IL-02), Chair of the Congressional Black Caucus Health Braintrust, led 25 members of the Congressional Black Caucus in issuing the statement below calling for increased investments in affordable, accessible maternal health care, following the CDC’s release of new data showing that more than 80% of maternal deaths in the U.S. are preventable:

“Maternal Mortality Review Committee Data released by the CDC this week shows that more than 80% of pregnancy-released deaths are preventable. That is shameful. Cause of death varies by race and ethnicity and Black women are disproportionately dying. More than half of these deaths occur between one week and one year after giving birth and yet there are states that still do not provide 12 full months of postpartum coverage under Medicaid.

“We have known that maternal mortality is worsening. We have known that Black women experience certain complications more. We have known that Black women have diminished access to maternal health care, especially after delivery.

“The time for lip service is over. As a result of the Dobbs decision, more women and girls will be forced to give birth, and we will see more mothers dying.

“We must act now. We must extend postpartum Medicaid coverage to 12 full months after delivery in every single state. Saving lives should not be optional. We urge our colleagues to include this vital coverage in the year-end spending bill to save the lives of women across the country.”

(872)

1251

This number jumps to 66% for Gen

To register to vote or to check your voter registration status via BLK’s Election Center, please visit: https://weall. vote/blk

Joining Rep. Kelly in this effort are: CBC Chairwoman Joyce Beatty; Reps. Troy Carter; Terri Sewell; Shontel Brown; Al Green; Eddie Bernice Johnson; Anthony Brown; Kweisi Mfume; Bonnie Watson Cole man; Lauren Underwood; Marc Veasey; Alma Adams; G.K. Butterfield; Donald Payne; Lisa Blunt Rochester; Sheila Jackson Lee; Yvette Clarke; Barbara Lee; Gregory Meeks; Ritchie Torres; Lucy McBath; Donald McEachin; Nikema Williams; Sheila Cherfilus-McCormick; and Jahana Hayes.

NEWSSouth End | Week of September 28, 2022 3C SOUTH ENDC citizennewspapergroup.com

Hyde Park Citizen and Citizen Suburban Times Weekly. Our weekly publications are published on Wednesday’s (publishing 52 issues annually). Written permission is required to reproduce contents in whole or in part from the publisher. Citizen Newspaper Group, Inc. does not assume the responsibility for nor are we able to return unsolicited materials, therefore they become property of the newspaper and can or will be discarded or used at the newspapers disgratation. Deadlines for advertising is every Friday at noon. Deadlines for press releases are Thursdays at 10 am prior to the next week’s edition. Please send press release information to: editorial@citizennewspapergroup.com. For more information on subscriptions or advertising, call us at (773) 783-

or fax

208-8793. Our offices are located at 8741 South Greenwood Suite# 107, Chicago, Illinois 60619. ELIZABETH “LIZZIE G” ELIE LICENSED REALTOR

Taking Steps Toward Homeownership

Buying a home may not be as out of reach as you think…even in this market

Buying a home is one of the most important purchases you will make in your lifetime, and the pressure is mounting for those looking to buy right now, with home prices fluctuating and mortgage rates at their highest levels in over a decade.

While existing home sales have fallen month-over-month since the beginning of the year, prices still hit a record high above $400,000 in May, according to the National Association of Realtors, as low levels of housing inventory and supply chain constraints have created an affordability squeeze for homebuyers. Mortgage rates have nearly doubled in the last six months – from 3% in 2021 to close to 6% in 2022 – making it increasingly challenging for many Americans to purchase a home, especially for those with limited income.

So, how do you know when you’re ready to buy a home? More importantly, how much home can you afford? We sat down with Miguel Alca cio, Community Home Lending Advi sor at Chase, to answer those questions and discuss what the current state of the market means for you and your family’s homebuying dreams.

Q: What are the main factors mortgage lenders look at when evaluating an application?

Miguel: When it comes to homeownership, your credit score and debt-to-income ratio are major factors in the application process.

Your credit score is set based upon how you’ve used credit, or not used credit, in the past. Using credit responsibly, such as paying bills on time and having a low utilization rate will result in a higher score. Higher credit scores can help you qualify for the lowest interest rates. A score at 700 or above is generally considered good.

Additionally, lenders look at your debt-to-income ratio. This is a simple equation of how much debt you have relative to how much money you make. Borrowers with a higher debt-to-income ratio are considered more risky while a lower debt-to-income ratio may allow you to qualify for the best rates on your home loan.

Q: What are some tips for improving your credit score?

Miguel: There are a number of things you can do to improve your credit score, starting with reviewing your credit reports to understand what might be working against you. You can also pay down your revolving credit and dispute any inaccuracies.

Additionally, there are services like Chase Credit Journey to help monitor and improve your credit score. Credit Journey monitors all of your accounts and alerts you to changes in your credit report that may impact your score. You’ll get an alert any time Chase sees new activity, including charges, account openings and credit inquiries. Chase will

also notify you if there are changes in your credit usage, credit limits or balances. You don’t have to be a Chase customer to take advantage of Credit Journey.

Q: What are some factors that can affect the cost of a mortgage?

Miguel: There are several factors to consider when reviewing mortgage options including loan term, interest rate, and loan type. Potential homebuyers should contact a home lending professional to understand and review the options available to them.

For example, there are two basic types of mortgage interest rates: fixed and adjustable. While adjustable rates are initially low, they can change over the course of a loan, so your mortgage payments may fluctuate. Loan term indicates how long you have to pay off the loan. Many homebuyers tend to opt for a 15year or 30-year mortgage, though other terms are available. A longer loan term generally means you’ll have lower monthly payments, but you’ll pay more in interest over the life of the loan. A shorter loan term may come with higher monthly payments, but you’ll likely pay much less in interest over time.

Q: What are the costs of homeownership beyond the monthly mortgage payment?

Miguel: People often think of the down payment and monthly mortgage, but buying and owning a home carries addi tional costs. Closing costs, for example, can amount to up to 3% or more of the final purchase price. Other factors that could add on to your monthly payments are property taxes, homeowner’s insurance, and homeowner’s association (HOA) fees. To get an idea of what this may look like for you, use an affordability calculator.

While there is no way for a buyer to completely avoid pay ing these fees, there are ways to save on them. Some banks offer financial assistance for homebuyers. As an example, Chase’s Homebuyer Grant offers up to $5,000 that can be used toward a down payment or closing costs in eligible neighborhoods across the country. There may also be homeowners’ or down payment assistance offered in your city or state. Contact a Home Lending Advisor to learn about resources you may be eligible for.

For a deeper dive into this topic, our Beginner to Buyer pod cast (www.beginnertobuyer.com) – episode three, “How Much Can I Afford?” is a great resource for prospective homebuyers to get answers to all their homebuying questions.

Learn more about the homebuying process, visit, www. chase.com/personal/mortgage/home.

Sponsored content from JPMorgan Chase.

VC Include Announces 2022 Cohort for Fellowship of BIPOC First-Time Fund Managers

SAN FRANCISCO, PRNewswire

--VC Include (VCI), an organization committed to evolving the traditional in vestment industry by creating an inclusive ecosystem of LPs and GPs from diverse backgrounds, today announced this year’s BIPOC First-Time Fund Manager fellows.

Twelve venture capital (VC) and private equity (PE) funds were selected for VCI’s 2022 fellowship cohort. These funds represent a total of fifteen emerging fund managers that joined the two-month education and mentoring program. The fellowship was designed for women and BIPOC fund managers based in the United States who are building their first fund. The VCI Fellowship is made possible with the generous support of Visa Foundation, Skoll Foundation, Blue Haven Initiative, the MacArthur Foundation, and the Nasdaq Foundation.

The 2022 VCI fellows are as follows:

Eunice Ajim, Ajim Capital

Carlos Torres, AMG Block Ventures

Group Black Expands Board with Industry Titans to Further the Mission to Dramatically Change the Face of Media Ownership and Investment

NEW YORK, PRNewswire -- Group Black, one of the largest collectives of Blackowned media and diverse creators, announced it will be expanding its Board of Directors with the addition of Ursula Burns, founding partner of private equity firm Integrum Holdings and former CEO of Xerox; Vivek Shah, CEO of digital media company Ziff Davis, Inc.; and Seth Kaufman, CEO of Moët Hennessy North America.

“We are honored to welcome Ursula Burns, Vivek Shah and Seth Kaufman to the Group Black board. All three leaders bring a host of business, technology and media experience, as well as expertise in building and scaling successful business endeavors,” said Travis Montaque, co-founder and CEO of Group Black. “Additionally, their passion and commitment to creating a more equitable media landscape makes them perfect additions to help further the Group Black mission.”

Ursula Burns is the first Black woman to lead a S&P 500 company. During Burns’ tenure as CEO of Xerox Corporation, Burns helped the company transform from a global leader in document technology to the world’s most diversified business services company serving enterprises and governments of all sizes. Cur rently, Burns is a member of the ExxonMobil Corporation, Uber Technologies, Inc., Endeav or Group Holdings, Inc., and IHS Holdings Board of Directors.

“As a champion for inclusion across all systems and enterprises, I believe that Group Black will be pivotal in improving the media landscape by empowering more diverse creators,” said Ursula Burns. “I am looking forward to working with Group Black to lever age its expertise in elevating content creators of color”.

Vivek Shah, CEO of Ziff Davis, is a digital media veteran who has led the transfor mation of Ziff Davis into a multi-billion-dollar public company. He began his career at Time Inc., where he held various management positions, including President of Fortune and Money. He was instrumental in Ziff Davis’ investment in Group Black and its participation in Group Black’s ‘Uplift’ initiative.

Renata Merino, Blazin’ Babes

Himalaya Rao, The BFM Fund

Tessa Flippin, Capitalize VC

Aisha T. Weeks, Dearfield Fund for Black Wealth

Azin Radsan van Alebeek, La Keisha

Landrum Pierre & Naseem Sayani, Emme line Ventures

Madeline Darcy, Kaya Ventures

Daniel Balzora, Macellum Private Capital

Kent Lucas and Sid Smith, Non Sibi Ventures

Toussaint Bailey, Uplifting Capital

Hernando Bunuan, Z2Sixtly Ventures

“I’m thrilled to welcome this year’s cohort of New Majority, next generation fund managers and wealth creators, coming on the heels of a massively successful first cohort of fund managers that have closed their first VC and PE funds” said VCI’s founder, Bahiyah Yasmeen Robinson.

“Visa Foundation is proud to support VC Include and the women and BIPOC fund managers selected for their 2022 fellow ship cohort,” said Robert Meloche, Head of

Programs, Visa Foundation. “The work that VC Include does to accelerate investment into historically underrepresented founders and fund managers aligns closely with Visa Foundation’s long-term focus of uplifting everyone, everywhere through the power of economic inclusion and advancement.”

“Investment firms led by or owned by women and people of color have faced challenges in attracting investment capital due to discrimination, implicit bias, lack of mentorship, and closed networks. We are excited to support VC Include as it works to build a more equitable future by tackling these issues through its fellow ship program,” said John Balbach, Direc tor, Impact Investments at the MacArthur Foundation.

To get the latest news on VCI and its dynamic programs, fund managers with diverse teams as well as investment professionals interested in diversity and inclusion are encouraged to visit the VCI website at https://www.vcinclude.com/.

“Group Black is a trailblazer in our industry. By partnering with leading media companies and scaling Black-owned brands, Group Black is forging a path to democratizing the media industry,” said Shah. “I’m excited to be part of this important effort to diversify the media ecosystem.”

Seth Kaufman, CEO of Moët Hennessy North America, is a time-tested global brand building heavy-weight. Kaufman will lend his decades of branding, marketing, creativity, and flawless execution to Group Black as it contin ues to build a strong presence in the industry.

“I am thrilled to roll up my sleeves to help Group Black transform the media industry, by addressing the systemic inequities that are inherent in the legacy media ownership model. We have already had several exciting meetings to exchange insights and ideas and it is easy to see that my personal passion for diversity, inclusion and equity is very much aligned with Group Black’s bold vision for the future of media,” said Kaufman.

( STOCK PHOTO GETTY IMAGES)

This page is sponsored by CSouth End | Week of September 28, 20224 BUSINESS citizennewspapergroup.com

Purpose Toys Unveils Amazon Exclusive “Crown and Coils” Styling-Head Set

LOS ANGELES, PRNewswire -- DeeDee Wright-Ward, creator of viral “Naturalistas” Fashion Doll line and CEO of one of the largest Black-owned toy start-ups, Purpose Toys, has announced the expan sion of the Naturalistas brand with the release of the Amazon Exclusive “Crown and Coils” Natural Hair Styling-Head set.

A celebration of coils and curls, the popular Naturalistas fashion doll line features seven unique core characters and offers an inclusive selection of four distinctly Black hair textures and styles. Created to help parents educate kids, “Crown and Coils” joins the “Crown and Curls” Styling-Head as the world’s first and only line of Natural Hair Styling-Heads to provide children with the opportunity to ex plore, interact with and learn to care for Natural Hair. The groundbreak ing “Crown” line of Styling-Heads features a selection of several hair types (4A and 3C), both of which commonly found across the African American and global Black Communities.

With the support of Amazon and the exclu sive release of “Crown and Coils, Naturalistas continues to make histo ry as the first all Black, culture-driven fashion doll line to not only center and celebrate children with coily and curly hair, but also to highlight the beautiful nuances of Natural Black Hair.

“Whereas straight hair, wavy and jewel-toned hair are over-represented across the Black doll category, the reality is many African American children and adults like myself, have tightly coiled natural-colored hair. But from the standpoint of authentically representing distinctively Black characteristics, many doll products marketed to Black children don’t often reflect their beautiful coils, curls or natural hair color, which can inadvertently send the message that hair that looks like theirs isn’t equally valued. We want to change this,” Wright-Ward said.

She added, “Through the Naturalistas’ “Crown and Coils” Styling-Head, children with type-4 hair are not only provided an educational tool that allows them to interact with and learn about Natural Hair manage ment, they also get to see themselves celebrated and authentically represented.”

“A Celebration of Natural Coils, Curls and Crowns,” both “Crown and Coils” and “Crown and Curls” Styling-Head sets (SRP $29.99) feature distinct ly Black (natural hair) textures, familiar (culturally) facial features, contemporary deco face paintings, and highly curated (culturally accurate) hair accessories that speak to Purpose Toys’ commitment to the celebration, education and authentic representation of Natural Hair. Naturalistas are sold and distributed by Purpose Toys.

DeeDee adds, “Our tagline across all Naturalistas brands is ‘Be Proud of Your Crown,’ and on National Afro Day and every day, we continue to support the healthy emotional development of children who wear their Natural Hair, by providing authentic, nuanced culture-driven products. It goes without saying that Purpose Toys is grateful for the support of Amazon in bringing celebratory, uplifting ‘dolls-of-culture’ to market.”

Outdoor Afro Inc. and REI Co-op Debut Co-created Collection

OAKLAND, Calif. and SEATTLE, PRNewswire -- Outdoor Afro Inc. and REI Co-op have launched a co-created hike collection to help solve unmet needs in outdoor apparel and celebrate Black joy in nature. A new chapter for national not-for-profit Outdoor Afro Found er and CEO Rue Mapp, Outdoor Afro Inc. is the corporate partner of her 13-year organization and the co-op’s inspiration for this innova tive collection.

“Nature has been, and will continue to be, a place where Black people seek connection and respite,” said Rue Mapp, founder and CEO of Outdoor Afro. “Black people have always spent time outside across a variety of activities, but the community has always felt a gap in finding gear that fits, functions well, feels good and represents their personal style. REI was the right partner to listen deeply and help us create a collection that would start to meet those needs. We are thrilled to launch this inspirational campaign, share this hike collection, and continue to elevate Black joy outdoors.”

Outdoor Afro Inc. is a new venture for Mapp that celebrates and inspires Black community connections to the outdoors through rele vant product design, manufacturing, sales, and outdoor experiences. For more than a decade, her not-for-profit organization and REI have built a relationship to address the lack of Black representation in the outdoors. That relationship led to this new collaboration.

“Our long-time relationship with Outdoor Afro provided a nat ural platform to help us better understand what the outdoors means to the Black community. This partnership allowed us to authentically identify and address barriers to create more inclusive design solutions that will connect more people to the power of the outdoors,” said Isa belle Portilla, divisional vice president of product strategy and design for REI Co-op brands.

For the first drop in the multi-launch collection, Outdoor Afro Inc. and REI worked closely with members of the Black communi ty to understand their outdoor product needs and begin developing a collection to inspire and ignite more Black joy in nature. The 22-piece hike collection includes apparel and accessories that bring more inclusive design to the forefront. Customers will find new fit options that consider a wider range of body types, shapes, and sizes. The collection uses lightweight and stretch materials that promote breathability and lead to easy wear and care. New colors and graphics embrace a desire for personal expression.

The Outdoor Afro Inc. x REI Co-op Hike Collection is now available for purchase at REI stores and REI.com. Apparel and acces sory prices range from $40 to $179 and $7 to $15, respectively.

Campaign photography was captured by Joshua Kissi and Fela Raymond from TONL, a creative company seeking to transform the idea of stock photography with diverse representation. Video content was created with Nate the Director from Invisible Collective and Maya Table from Curator. On-camera talent is a mix of Outdoor Afro leaders, REI partners and models.

TRESemmé Partners with Multi-Platinum Selling Artist Normani to Launch “Power Your Style Project”

ENGLEWOOD CLIFFS, N.J., PRNewswire -- As America’s #1 styling brand, TRESemmé knows that style is more than just a look. Style is represented by how every woman presents, speaks and acts as her authentic self. Driven by the brand’s purpose to champion personal style and the power that it brings, TRESemmé announces the “Power Your Style Project,” a commitment and partnership with The Representation Project, multi-platinum artist Normani, and American fashion designer Batsheva Hay to advocate for every woman’s truest expression of her personal style.

TRESemmé believes that when personal style is embraced, it helps women reach their full potential. How ever, not all women are able to embrace their style due to “double binds” -- the conflicting societal messages, images and queues that tell a woman how she is supposed to look, speak and act. Examples include being told to be more assertive but not bossy, dress to impress but don’t be too bold, and speak up but not too loudly. To reveal the effects of double binds on women’s personal style and profession al ambitions, TRESemmé collaborated with The Represen tation Project, a leading global gender justice non-profit organization, on a first-of-its-kind study on double binds

using both qualitative and quantitative methods. The study found:

Two-thirds of women experience double bind mes sages, especially Gen Z women ages 18-24. 90% of these women report that double binds prevent them from being their authentic self.

Nearly half of women report experiencing double binds at work, with two-in-five women reporting that double binds negatively impact their professional career/ job.

A majority of women (61%) reported they would be happier if they had more freedom to express their style.

To launch the program, TRESemmé is partnering with multi-platinum selling artist Normani who herself has experienced double bind criticism and has had to nav igate other societal expectations throughout her career. The Representation Project found that the most common double binds prominent women* experience on social media include receiving comments that they are overly confident, yet insecure (84%) and being called lazy, while also being told that they are overly ambitious (80%).

“I know what it feels like to be criticized and doubted, which I experienced in my music career,” stated

Normani. “I have since started discovering who I am and am embracing this stage in my life where I am able to express myself the way I want to and not because of any body else. By owning my personal style, it has encour aged me to continue on this path as a soloist and create a new album. I am honored to be partnering with TRESem mé, a brand that believes in championing women’s personal style and the power that it brings, to officially launch their ‘Power Your Style Project’ and empower women everywhere to express their unique styles so they can achieve more and be their best selves.”

The brand is also showcasing and celebrating wom en’s personal styles through #MyStyleIsMyPower – a social movement that the brand kicked off on TikTok that encourages women to embrace their personal style, de spite the double binds that keep them trapped in a world of seemingly wrong choices. Furthermore, TRESemmé has committed to evolve all brand content to ensure that a wide variety and diversity of styles are showcased across TRESemmé channels.

To learn more about the TRESemmé “Power Your Style Project”, visit here or follow @Tresemme on Tik Tok, Instagram, Facebook and Twitter.

DeeDee Wright-Ward, CEO of Black-owned toy start-up Purpose Toys and creator of “Naturalistas” FashION DOLL

LINE. PRNEWSFOTO.

The Amazon Exclusive Naturalistas “Crown and Coils” Styling-Head Set was created to celebrate children with coily and curly hair. PRNEWSFOTO.

HYDE PARKC

FASHIONSouth End | Week of September 28, 2022 5C citizennewspapergroup.com

6 | South End | Week of September 28, 2022 WEEKND

DuSable Museum Presents

(September 26, 2022) The DuSable Black History Museum and Education Center will pres ent its annual “Drum Talk,” Book and Literary Fair on Saturday, October 8, from 11:00 AM to 4:00 PM. The event will include “The Banned Black Book Exchange,” during which guests are invited to bring a “banned book,” which they may exchange for another “banned book” of their choosing.

More than 35 authors will be in attendance including Christian Gregory who will unveil and discuss, his new book “The Essential Dick Greg ory,” a soulful, generation-defining collection of thought provoking, agitating and liberating works from his father Dick Gregory the late activist and author of sixteen books, which will be published on October 11, 2022.

A true renaissance man, Richard Claxton “Dick” Gregory was one of the pioneering sat irists of his generation, a reformer and brilliant spokesperson for the downtrodden and forgotten who dedicated his life to speaking unadulterated

Event Will Also Celebrate The 90th Birthday of Civil Rights Activist Dick Gregory

sential Dick Gregory,” a carefully curated anthol ogy of selected writings reflects and celebrates Dick Gregory’s wisdom and his vision. Divided into three sections –Body, Mind, and Spirit—it includes previously unavailable transcriptions and excerpts taken from his sixteen books, fifteen albums and audio compilations, and more than 1,200 hours of archival video, including lectures, interviews and comedic performances. It is a breathtaking tour through the life of one of Ameri ca’s most prophetic and relevant cultural icons.

day, the launch and discussion of “The Essential Dick Gregory” will be preceded by a screening of the documentary The One and Only Dick Grego ry, on Friday October 7, 2022, at 6:00 PM in the DuSable Museum’s Ames Auditorium.

The One and Only Dick Gregory is a feature length documentary examining activist, pop-cul ture icon and thought leader Dick Gregory, whose work as a self-described “agitator” shaped a generation demanding justice. As a renowned Black comedian, Gregory has a platform to take on the most incendiary battles of hunger, gen der equity, and civil rights—stirring trouble and making headlines in the service of social justice. Featuring Gregory’s personal reflections, archival footage and interviews with the artists he influ enced—including Dave Chappelle, Chris Rock and Wanda Sykes.

Admission to the screening of The One and Only Dick Gregory and to the Drum Talk Annual Book and Literary Fair is FREE to all. For more information, please visit the museum’s website at:

What's good for the environment can also be good for your home. Save today with rebates and discounts on ENERGY STAR® certified appliances and home products, all while saving for the long run by using less energy. You may even qualify for additional FREE energy saving products.

WEEKEND South End | Week of September 28, 2022 | 7

GOOD FOR THE ENVIRONMENTG d for your budget

ComEd.com/HomeSavings LEARN MORE Savings are just estimates; actual savings will vary by customers’ usage and rates. Terms and conditions apply. The ComEd Energy Efficiency Program is funded in compliance with state law. © Commonwealth Edison Company, 2022 The

“DRUM TALK” –THE ANNUAL BOOK AND LITERARY FAIR SATURDAY, OCTOBER 8, 2022

Community Leaders Hosted A Senior Fest at Kennedy King College This Past Weekend

Photos by L M Warbington

Dancing On The 9 Youth Talent Showcase

Photos by L M Warbington

Photos by L M Warbington

Dancing On The 9 Youth Talent Showcase

Photos by L M Warbington

CSouth End | Week of September 28, 20228 ON THE MOVE SOUTH ENDC citizennewspapergroup.com ON THE MOVE C citizennewspapergroup.com C

Bilingual collection offers free access to high-quality digital books and resources for adults, children and educators

WASHINGTON, PRNewswire -- The Barbara Bush Foundation for Family Literacy and Worldreader have partnered to release ReadLife Bookshelf, a new multigener ational reading collection for adults, children, and educators.

Launched in celebration of National Adult Education and Family Literacy Week, ReadLife Bookshelf aims to promote literacy skill develop ment in adult learners, children and families, using online resources to broaden reach and access. ReadLife Bookshelf offers:

A curated collection of digital books for adults and children, including titles tai lored to the reading levels and interests of adult learners

Guided activities to encourage adult learners and their families to deepen and enhance the learning experience

Resource guides to help instructors promote literacy skill development

Bilingual (English and Span ish) books and resources

Anytime, anywhere access to online materials across all platforms (Computers, tablets and smart phones)

New books and materials each month, with upcoming seasonal themes including “Mysterious Stories,” “Gratitude” and “Let’s Celebrate.”

The ReadLife Bookshelf collection aims to promote equity and remove barriers that often prevent low-literate adults/parents from building their literacy skills by providing convenient online access to engaging, relevant reading materials.

Roughly 54% of American adults lack proficiency in literacy, reading below the equivalent of a sixth-grade level. Yet, books for emerging readers most frequently focus on topics that are of interest to children. To fill this gap, the Barbara Bush Founda tion and Worldreader worked with publishers and authors to curate a selection of books that combine high-interest topics

JAKE AND JAZZ SMOLLETT ADD COLOR AND STORAGE INTO A KITCHEN SPACE ON ‘LIVING BY DESIGN WITH JAKE AND JAZZ’

Silver Spring, Md. -- The Smollett sibling duo has returned to CLEO TV’s hit series “LIVING BY DESIGN WITH JAKE AND JAZZ” to continue to create revitalizing home makeovers and cel ebrate the renovation completion with delicious cuisine. Season three, which premiered on Sept. 14, will follow the viva cious Smollett siblings as they recreate family recipes while trans forming homes into desirable, uplifting living spaces.

Jake and Jazz are revamping Yassmin’s kitchen to reflect her love for baking. Jazz adds a popping pink to the space and fun storage options, while Jake creates a workstation and mobile table. Tonight’s meal includes chicken piccata served with red velvet cinnamon rolls.

Brother and sister duo Jake and Jazz Smollett team up to transform the living, work, and play spaces of millennial fam ilies in CLEO TV’s new lifestyle series

“LIVING BY DESIGN WITH JAKE AND JAZZ.” They know how to hold it down in fashion, food and design! In this series, Jake and Jazz create simple

solutions to everyday design dilemmas for aspiring millennial families. Whether it’s a new mom redecorating a nursery on a tight budget, a fierce young woman who’s landed her dream job and now has to spruce up her home office or a young couple moving into their first home, LIVING BY DESIGN will help transition their houses into homes.

LIVING BY DESIGN WITH JAKE AND JAZZ is produced by Powerhouse Productions, with Rochelle Brown and Sonia Armstead serving as Executive Producers. For TV One, Austin Biggers is the SVP of Pro gramming, Susan Henry is the Executive Producer in Charge of Production, and Donyell McCullough is Sr. Director of Talent & Casting.

For more information about CLEO TV’s upcoming programming, includ ing original movies, visit the network’s companion website at www.tvone.tv. CLEO TV viewers can also join the con versation by connecting via social media on Twitter, Instagram and Facebook (@ mycleotv) using the hashtag #LIVING BYDESIGN.

with accessible vocabulary – creating a unique collection for adult learners.

“Adult literacy is family literacy, but the literacy needs of parents and caregivers are far too often overlooked,” said British A. Robinson, president and CEO of the Barbara Bush Foundation. “Through the combination of high-quality content and innovative technology, ReadLife Bookshelf can empower parents to improve their own literacy skills – boost ing equity and unlocking the doors of opportunity for millions of families.”

The new collection is also designed to promote family literacy engagement by encouraging parents and children to read together, fostering a literacy-rich home environment. Learners and instructors can access the ReadLife Bookshelf collection across all their devices and platforms, thanks to Worldreader’s low-cost digital reading solution, BookSmart.

“When parents read, children read. And when chil dren read, they lay the foundation for a successful life. We are thrilled to partner with the Barbara Bush Foundation to provide the books and technology necessary to set families up for success,” said David Risher, co-founder and CEO of Worldreader.

The ReadLife Bookshelf collection will grow over the next three years to include guided activities, compelling adult learning-focused stories, and over 200 children’s books in English and Spanish. All resources are available for use by learners and educators at no cost.

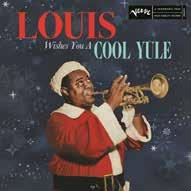

‘LOUIS WISHES YOU A COOL YULE’ SET FOR RELEASE OCTOBER 28

LOS ANGELES, PRNewswire

-- Much like Santa Claus himself, Louis “Satchmo” Armstrong devoted his life to “the cause of happiness,” as he once put it, bringing joy to audiences around the globe every time he put his trumpet to his lips or crooned with his instantly-recognizable, gravelly voice. Yet, while Satchmo’s holiday recordings have become stan dard yuletide fare, he never released a Christmas album during his lifetime. Now, for the very first time, Louis Wishes You A Cool Yule – out October 28 via Verve Re cords/UMe, presents Armstrong’s holiday recordings as a cohe sive body of work, marking his first-ev er official Christmas album.

Since his pass ing in 1971, Arm strong has become one of the most oft-played artists during the holiday season, his golden trumpet tone still able to cut through the din of even the most bustling shopping mall. Available for pre-order today, Louis Wishes You A Cool Yule features nearly the entirety of Armstrong’s hol iday output: six Decca singles from the ‘50s, including “Cool Yule,” “Christmas Night in Harlem,” and the swinging

“’Zat You Santa Claus?.” The 11-track album also features duets with two of Pops’ favorite vocal partners, Velma Middleton (“Baby, It’s Cold Outside”) and Ella Fitzgerald (“I’ve Got My Love to Keep Me Warm”). An official video for the Louis and Ella classic debuts today, hand-drawn by director and ani mator JonJon in his distinctive “line and shape” style.

For the very first time, “Louis Wishes You A Cool Yule,” presents Louis Armstrong’s holiday recordings as a cohesive body of work, marking his first-ever official Christmas album. PRNewsFoto.

Rounding out the collection is the artist’s signature hit, “What a Wonderful World,” which has become something of a year long hymn of hope and celebrates its 65th anni versary this year, plus a very special gift to fans: a previously unreleased reading of Samuel Clement Moore’s poem “A Visit from St. Nich olas,” popularly known as “The Night Before Christmas.” Paired with a groovy, newly-record ed musical underbed by New Orleans pianist Sullivan Fortner, the poignant recording marks the first new Louis Armstrong track in more than 20 years and is notable for being the last recording he ever made.

Louis Wishes You A Cool Yule will be available in a variety of formats, including on red vinyl, a limited edition vinyl picture disc (releasing November 4th), CD, and digital.

British A. Robinson, President and CEO, Barbara Bush Foundation for Family Literacy (PRNewsfoto/Barbara Bush Foundation for Family Literacy)

TVONE

citizennewspapergroup.com ENTERTAINMENTSouth End | Week of September 28, 2022 9C

SOUTH ENDC

REAL ESTATE

AC 9-14-2022

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENT - CHANCERY DIVISION BARNETT REI FINANCE 2 LLC; Plaintiff, vs. LAWSON CAPITAL TRUST, LLC, A FLORIDA LIMITED LIABILITY COMPANY; CHRISTOPHER WAYNE NATHAN LAWSON; UNKNOWN OWNERS AND NONRECORD CLAIMANT Defendants, 22 CH 4514 NOTICE OF SALE PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above entitled cause Intercounty Judicial Sales Corporation will on Tuesday, October 18, 2022 at the hour of 11 a.m. in their office at 120 West Madison Street, Suite 718A, Chicago, Illinois, sell at public auction to the high est bidder for cash, as set forth below, the follow ing described mortgaged real estate: P.I.N. 20-35203-026-0000. Commonly known as 7916 S. DORCHESTER AVENUE, CHICAGO, ILLINOIS 60619. The mortgaged real estate is improved with a single family residence. If the subject mort gaged real estate is a unit of a common interest community, the purchaser of the unit other than a mortgagee shall pay the assessments required by subsection (g-1) of Section 18.5 of the Condominium Property Act. Sale terms: 10% down by certified funds, balance, by certified funds, within 24 hours. No refunds. The property will NOT be open for inspection For information call Ms. Sheryl A. Fyock at Plaintiff's Attorney, Latimer LeVay Fyock LLC, 55 West Monroe Street, Chicago, Illinois 60603. (312) 422-8000. 35132-37 INTERCOUNTY JUDICIAL SALES CORPORATION intercountyjudicialsales.com I3202457

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENT - CHANCERY DIVISION TOWD POINT MORTGAGE TRUST 2018-3, U.S. BANK NATIONAL ASSOCIATION, AS INDENTURE TRUSTEE Plaintiff, -v.- VAL STOKES, CITIMORTGAGE INC., UNITED STATES OF AMERICA, CARY ROSENTHAL, AS SPECIAL REPRESENTATIVE OF THE ESTATE OF DONALD W. STOKES, UNKNOWN HEIRS AT LAW AND LEGATEES OF DONALD W. STOKES, UNKNOWN OWNERS AND NON-RECORD CLAIMANTS Defendants 2019 CH 12309 450 E. 89TH PLACE CHICAGO, IL 60619

NOTICE OF SALE PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on July 15, 2022, an agent for The Judicial Sales Corporation, will at 10:30 AM on October 18, 2022, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the following described real estate: Commonly known as 450 E. 89TH PLACE, CHICAGO, IL 60619 Property Index No. 25-03216-039-0000 The real estate is improved with a single family residence. The judgment amount was $204,620.78. Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The bal ance, including the Judicial Sale fee for the Abandoned Residential Property Municipality Relief Fund, which is calculated on residential real estate at the rate of $1 for each $1,000 or fraction thereof of the amount paid by the purchaser not to exceed $300, in certified funds/or wire transfer, is due within twenty-four (24) hours. No fee shall be paid by the mortgagee acquiring the residential real estate pursuant to its credit bid at the sale or by any mortgagee, judgment creditor, or other lienor acquiring the residential real estate whose rights in and to the residential real estate arose prior to the sale. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in "AS IS" condition. The sale is fur ther subject to confirmation by the court. Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confir mation of the sale. Where a sale of real estate is made to satisfy a lien prior to that of the United States, the United States shall have one year from the date of sale within which to redeem, except that with respect to a lien arising under the internal revenue laws the period shall be 120 days or the period allowable for redemption under State law, whichever is longer, and in any case in which, under the provisions of section 505 of the Housing Act of 1950, as amended (12 U.S.C. 1701k), and subsection (d) of section 3720 of title 38 of the United States Code, the right to redeem does not arise, there shall be no right of redemption. The property will NOT be open for inspection and plain tiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information. If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4). If this prop erty is a condominium unit which is part of a com mon interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g1). IF YOU ARE THE MORTGAGOR (HOME OWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCOR DANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW. You will need a photo identification issued by a government agency (driver's license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation con

ducts foreclosure sales. For information, contact JOHNSON, BLUMBERG & ASSOCIATES, LLC Plaintiff's Attorneys, 230 W. Monroe Street, Suite #1125, Chicago, IL, 60606 (312) 541-9710. Please refer to file number 19 7319. THE JUDICIAL SALES CORPORATION One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236-SALE You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales. JOHNSON, BLUMBERG & ASSOCIATES, LLC 230 W. Monroe Street, Suite #1125 Chicago IL, 60606 312-541-9710 E-Mail: ilpleadings@johnsonblumberg.com Attorney File No. 19 7319 Attorney Code. 40342 Case Number: 2019 CH 12309 TJSC#: 42-2910 NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff's attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose. Case # 2019 CH 12309 I3202498

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENT - CHANCERY DIVISION NEIGHBORHOOD LENDING SER VICES, INC Plaintiff, -v.- WALTER H SMITH, NEIGHBORHOOD LENDING SERVICES, INC. Defendants 2022 CH 01950 539 E. 68TH STREET CHICAGO, IL 60637 NOTICE OF SALE

PUBLIC NOTICE IS HEREBY GIVEN that pur suant to a Judgment of Foreclosure and Sale entered in the above cause on June 29, 2022, an agent for The Judicial Sales Corporation, will at 10:30 AM on October 19, 2022, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the fol lowing described real estate: Commonly known as 539 E. 68TH STREET, CHICAGO, IL 60637 Property Index No. 20-22-409-003-0000 The real estate is improved with a residence. Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accept ed. The balance, including the Judicial Sale fee for the Abandoned Residential Property Municipality Relief Fund, which is calculated on residential real estate at the rate of $1 for each $1,000 or fraction thereof of the amount paid by the purchaser not to exceed $300, in certified funds/or wire transfer, is due within twenty-four (24) hours. No fee shall be paid by the mortgagee acquiring the residential real estate pursuant to its credit bid at the sale or by any mortgagee, judgment creditor, or other lienor acquiring the residential real estate whose rights in and to the residential real estate arose prior to the sale. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in "AS IS" condition. The sale is fur ther subject to confirmation by the court. Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confir mation of the sale. The property will NOT be open for inspection and plaintiff makes no representa tion as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information. If this property is a condo minium unit, the purchaser of the unit at the fore closure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4). If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1). IF YOU ARE THE MORT GAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POS SESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW. You will need a photo identification issued by a government agency (dri ver's license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales. For information, examine the court file, CODILIS & ASSOCIATES, P.C. Plaintiff's Attorneys, 15W030 NORTH FRONTAGE ROAD, SUITE 100, BURR RIDGE, IL, 60527 (630) 794-9876 THE JUDICIAL SALES CORPORATION One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236-SALE You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales. CODILIS & ASSOCI ATES, P.C. 15W030 NORTH FRONTAGE ROAD, SUITE 100 BURR RIDGE IL, 60527 630-794-5300

E-Mail: pleadings@il.cslegal.com Attorney File No. 14-22-01345 Attorney ARDC No. 00468002 Attorney Code. 21762 Case Number: 2022 CH 01950 TJSC#: 42-2660 NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff's attorney is deemed to be a debt col lector attempting to collect a debt and any infor mation obtained will be used for that purpose. Case # 2022 CH 01950 I3202630

AC 9-21-2022

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENT - CHANCERY DIVISION ROCKET MORTGAGE, LLC F/K/A QUICKEN LOANS, LLC F/K/A QUICKEN LOANS INC. Plaintiff, -v.- MAURICE BUCKNER, CITY OF CHICAGO, UNKNOWN OWNERS AND NON RECORD CLAIMANTS, UNKNOWN HEIRS AND LEGATEES OF JUDITH BUCKNER, WILLIAM P. BUTCHER, AS SPECIAL REPRESENTATIVE FOR JUDITH BUCKNER (DECEASED)

Defendants 2020 CH 03232 7808 S VERNON

AVE CHICAGO, IL 60619 NOTICE OF SALE

PUBLIC NOTICE IS HEREBY GIVEN that pur

suant to a Judgment of Foreclosure and Sale entered in the above cause on June 23, 2022, an agent for The Judicial Sales Corporation, will at 10:30 AM on October 31, 2022, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the fol lowing described real estate: Commonly known as 7808 S VERNON AVE, CHICAGO, IL 60619

Property Index No. 20-27-424-017-0000 The real estate is improved with a single family residence. Sale terms: 25% down of the highest bid by certi fied funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, including the Judicial Sale fee for the Abandoned Residential Property Municipality Relief Fund, which is calcu lated on residential real estate at the rate of $1 for each $1,000 or fraction thereof of the amount paid by the purchaser not to exceed $300, in certified funds/or wire transfer, is due within twenty-four (24) hours. No fee shall be paid by the mortgagee acquiring the residential real estate pursuant to its credit bid at the sale or by any mortgagee, judg ment creditor, or other lienor acquiring the resi dential real estate whose rights in and to the resi dential real estate arose prior to the sale. The sub ject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in "AS IS" condition. The sale is further sub ject to confirmation by the court. Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale. The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information. If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assess ments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4). If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1). IF YOU ARE THE MORT GAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POS SESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW. You will need a photo identification issued by a government agency (dri ver's license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales. For information, examine the court file, CODILIS & ASSOCIATES, P.C. Plaintiff's Attorneys, 15W030 NORTH FRONTAGE ROAD, SUITE 100, BURR RIDGE, IL, 60527 (630) 794-9876 THE JUDICIAL SALES CORPORATION One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236-SALE You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales. CODILIS & ASSOCI ATES, P.C. 15W030 NORTH FRONTAGE ROAD, SUITE 100 BURR RIDGE IL, 60527 630-794-5300 E-Mail: pleadings@il.cslegal.com Attorney File No. 14-20-02450 Attorney ARDC No. 00468002 Attorney Code. 21762 Case Number: 2020 CH 03232 TJSC#: 42-2386 NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff's attorney is deemed to be a debt col lector attempting to collect a debt and any infor mation obtained will be used for that purpose. Case # 2020 CH 03232 I3203153.

AC 9-28-2022

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENT - CHANCERY DIVISION JPMORGAN CHASE BANK, NATION AL ASSOCIATION Plaintiff, -v.- KEVIN WALTERS AS INDEPENDENT ADMINISTRATOR, UNKNOWN HEIRS AND LEGATEES OF CLARENCE WALTERS, KEVIN WALTERS, SAB RINA GRACE, UNKNOWN OWNERS AND NON RECORD CLAIMANTS Defendants 2022 CH 01019 8859 S BENNETT AVE CHICAGO, IL 60617

NOTICE OF SALE PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on August 2, 2022, an agent for The Judicial Sales Corporation, will at 10:30 AM on November 4, 2022, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the following described real estate: Commonly known as 8859 S BENNETT AVE, CHICAGO, IL 60617 Property Index No. 2501-116-018-0000 The real estate is improved with a single family residence. Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accept ed. The balance, including the Judicial Sale fee for the Abandoned Residential Property Municipality Relief Fund, which is calculated on residential real estate at the rate of $1 for each $1,000 or fraction thereof of the amount paid by the purchaser not to exceed $300, in certified funds/or wire transfer, is due within twenty-four (24) hours. No fee shall be paid by the mortgagee acquiring the residential real estate pursuant to its credit bid at the sale or by any mortgagee, judgment creditor, or other lienor acquiring the residential real estate whose rights in and to the residential real estate arose prior to the sale. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to

quality or quantity of title and without recourse to Plaintiff and in "AS IS" condition. The sale is fur ther subject to confirmation by the court. Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confir mation of the sale. The property will NOT be open for inspection and plaintiff makes no representa tion as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information. If this property is a condo minium unit, the purchaser of the unit at the fore closure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4). If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1). IF YOU ARE THE MORT GAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POS SESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW. You will need a photo identification issued by a government agency (dri ver's license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales. For information, examine the court file, CODILIS & ASSOCIATES, P.C. Plaintiff's Attorneys, 15W030 NORTH FRONTAGE ROAD, SUITE 100, BURR RIDGE, IL, 60527 (630) 794-9876 THE JUDICIAL SALES CORPORATION One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236-SALE You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales. CODILIS & ASSOCI ATES, P.C. 15W030 NORTH FRONTAGE ROAD, SUITE 100 BURR RIDGE IL, 60527 630-794-5300 E-Mail: pleadings@il.cslegal.com Attorney File No. 14-22-00621 Attorney ARDC No. 00468002 Attorney Code. 21762 Case Number: 2022 CH 01019 TJSC#: 42-3041 NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff's attorney is deemed to be a debt col lector attempting to collect a debt and any infor mation obtained will be used for that purpose. Case # 2022 CH 01019 I3203762

HUD/BANK FORECLOSURES

CITY & SUBURBS

Call: FRED D. CLINK (773) 294-5870 realty services consortium

3+ Bedroom HOMES FOR SALE

SELLER FINANCING

Call: FRED D. CLINK (773) 294-5870 REALTY SERVICES CONSORTIUM

HELP WANTED

Gina's Unbelievable Learning Center 7239 S DOBSON AVENUE 773-324-2010

NOW HIRING QUALIFIED TEACHERS!

Public Notice/ Legal Notice

INVITATION TO BID

Southland Ministerial Health Network, NFP

We are now opening our bidding process to remove and replace the entire building flat roof open September 28, 2022 and will close October 12, 2022, at close of business 4pm. Bid packets will be available for pick-up September 28, 2022 through October 12, 2022 and will be publicly opened at 5pm on that day at 15406 Lexington Avenue, Harvey 60426.