OF

Being near the nation’s capital, we have the ability to bring people from all over the globe into our headquarters. Having access to that diverse talent is absolutely critical for our success.

NAZZIC KEENE Chief Executive OfficerSee the advantages Virginia can offer your business at vedp.org

Salesforce founder Marc Benioff changed the world by ushering in the cloud computing revolution. His latest disruption may have an even bigger—and more enduring—impact. “We’re not coming back the way we were.”

By Dan Bigman and Ted Bililies

By Dan Bigman and Ted Bililies

What happens when the newly empowered American worker meets a slowing economy? We’re about to find out. By Dale Buss

It may not be as sexy as winning new business, but in this economy, it’s even more critical. CEOs share strategies.

By Dale BussIn the reset to a buyer’s market, acquirers are (so far) shrugging off higher interest rates to nab the right opportunities. But while the game is much the same, the rules are definitely shifting. Here’s how to play.

By Russ Banham

Even amid economic uncertainty, rising inflation, continued supply chain difficulties and myriad challenges, the theme of September’s gathering of CEOs, CHROs and business leaders was clear: Companies are still doing everything they can to add and keep great talent, and they need help doing so. Some highlights.

The past few years have made two things perfectly clear: the need to navigate uncertainty and the undeniable link between the health of one’s employees and the overall health of one’s company.

In fact, an Economist study commissioned by Cigna found that 86% of employees reported improved performance and lower rates of absenteeism after receiving treatment for depression. What does that mean for your business?

It means the right health care partner can be a strategic partner in business growth. That partner is Cigna.

Our plans and tools are already helping thousands of companies be more cost-e cient, more employee-centric, more compelling to new talent, and more future-proof by continually innovating to increase the vitality of their employees. Everything we do is designed to help you nurture a healthy work culture and improve employee productivity.

Together, we’ll help your employees achieve their best health, and help your business grow.

are business leaders prepping for a looming

new Chief Executive study has some

Melanie C. Nolen

Regional Report: The Midwest

The nation’s heartland is winning high-profile economic development projects, many in renewable energy and advanced manufacturing.

By Craig Guillot

EDITOR Dan Bigman

MANAGING EDITOR Jennifer Pellet

DIGITAL EDITOR C.J. Prince

ART DIRECTOR Gayle Erickson

PRODUCTION DIRECTOR Rose Sullivan

CHIEF COPY EDITOR Rebecca M. Cooper

CONTRIBUTING EDITORS Russ Banham, Dale Buss, Daniel Fisher, Marshall Goldsmith, Kelly Goldsmith, Garry Ridge, Jeffrey Sonnenfeld

EXECUTIVE

CEO Garry Ridge wanted to avoid the loss of top performers during WD-40 Company’s leadership transition. Here’s how he did it. By Garry Ridge

Chief Executive (ISSN 0160-4724 & USPS # 431-710), Number 316, Fall 2022. Established in 1977, Chief Ex ecutive is published quarterly by Chief Executive Group LLC at 105 West Park Drive, Brentwood, TN 37027. Wayne Cooper, Executive Chairman, Marshall Cooper, CEO. © Copyright 2021 by Chief Executive Group LLC. All rights reserved. Published and printed in the United States. Reproduction in whole or in part without permission is strictly prohibited. Basic annual subscription rate is $99. U.S. single-copy price is $33. Back issues are $33 each. Periodicals postage paid at Brentwood, TN and additional mailing offices. POSTMASTER: Send all UAA to CFS. NON-POSTAL AND MILITARY FACILITIES: send address correc tions to Chief Executive Group LLC at 105 West Park Drive, Brentwood, TN 37027.

Subscription Customer Service Chief Executive Group, LLC 105 West Park Drive Brentwood, TN 37027

615-592-1380

EXECUTIVE CHAIRMAN

Wayne Cooper

CHIEF EXECUTIVE OFFICER

Marshall Cooper

CHIEF CONTENT OFFICER

Dan Bigman

CHIEF COMMUNITY OFFICER

R.D. Whitney

DIRECTOR OF EVENTS & PUBLISHER, CORPORATE BOARD MEMBER

Jamie Tassa

VP, PUBLISHER, STRATEGICCXO360.COM

KimMarie Hagerty

DIRECTOR OF MARKETING Simon O’Neill

VICE PRESIDENT Kendra Jalbert

HR MANAGER / OFFICE ADMINISTRATOR

Patricia Amato

RESEARCH DIRECTOR Melanie Nolen

DATA SERVICES DIRECTOR Jonathan Lee

DIRECTOR, DIGITAL PRODUCTS Leigh Townes

ASSISTANT CONTROLLER Brittney Smith

STAFF ACCOUNTANT Marian Dela Cruz

MARKETING MANAGERS

Simone Bunsen, Christian Robinson

EVENTS & MEMBERSHIP MANAGER Rachael Gaffney

EVENTS COORDINATOR KP Wilinson

DATA ANALYST Denise Gilson

CLIENT SUCCESS MANAGER Victoria Campbell

STRATEGIC PARTNERSHIPS ASSOCIATES

Lara Morrison, Allison Roberto

RESEARCH ANALYST Isabella Mourgelas

CHIEF EXECUTIVE NETWORK

PRESIDENT Rob Grabill

EXECUTIVE DIRECTOR Chuck Smith

DIRECTOR OF OPERATIONS JoEllen Belcher

SENIOR MARKETING MANAGER Janine O’Dowd

DIRECTOR OF MEMBER SERVICES Brandon McGinnis

SALES SUPPORT ASSOCIATE Brittany Hochradel

Wisconsin loves to help all sorts of companies find their version of success. That includes yours. From site selection through construction, opening and expansion, we provide support to ensure your vision becomes reality. After all, your success may inspire other companies to relocate or expand here, too. That’s how we look forward.

lOve we what’s next-ers momentum builders game changers companies with vision world-first innovation industry revolutionizers competitive edge seekers

WE’RE ONCE AGAIN IN THE SILLY SEASON OF American politics. As difficult as it may be, the U.S. business community needs leaders of both parties to put aside their differences, use some common sense and remove barriers. Here are four places to start.

The defense of American business has been a bedrock principle of American government ever since our new nation’s ships were being plundered by the Barbary pirates, who seized our commerce vessels and held sailors for ransom. By 1800, the U.S. was paying an astonishing 20 percent of annual government revenue as “tribute” to the pirates. Only with the development of the Navy did the U.S. began to fight back and win.

Today, we face the same dilemma in cyberattacks, and we are repeating the policies that failed. Indi vidual companies often find it in their best interests to meet the demands of cybercriminals rather than report the crime or fight back. While that frequently resolves individual attacks, the payoffs incentivize criminals to continue targeting businesses, creating an endless, escalating spiral.

The only possible path to defeat this scourge is collective action by the Feds, which must mobilize resources and develop the will to unequivocally prosecute and destroy those who attack American commerce via the Internet.

U.S. laws that classify employees versus contractors are badly antiquated, open to wide interpretation and poorly adapted to today’s work environment. The IRS’s attempt to “clarify” this issue is providing guidance via form SS-8, which elicits answers to 44 questions, about half of which are open-ended and most of which pro vide no insights on how to properly classify people (e.g. “What types of reports are required from the worker? Attach examples”).

Rather than demanding that every contractor be an employee or making it difficult to maintain contract ing relationships, as some states do, wouldn’t a better policy be to ask both contractor and employer each year to voluntarily renew (or not) their contracting relationship? Should the contractor feel that the relationship has changed to an employee-employer relationship, both parties would have the opportunity to choose to change that status, rather than it being

forced on them. Congress can make this happen.

In 2018, the U.S. Supreme Court handed down a decision in South Dakota vs. Wayfair that allows each state to require any business that sells within its borders to collect and remit sales tax even if the business has no physical presence in that state. Every U.S. business with cross-border sales must now track the changing rules and thresholds in all 50 states and file reports and remit payments as it crosses each different threshold. Pennsylvania, for example, has a $500,000 annual revenue receipts threshold, while Maryland has a $200,000 or 200-transaction threshold. Worse still, most state rules are retroactive once you hit the tripwire.

For small and medium businesses, these rules are overly complex and unfair. Congress should enact and implement an annual revenue minimum to free small and midsized businesses from this patchwork of state laws. Or it should negotiate a standard cross-state tax rate for tracking and remittances.

The U.S. faces severe labor shortages that are crippling multiple industries, including agriculture, manufac turing, hospitality, food service and healthcare. At the same time, a lack of border security threatens the welfare and safety of border states. All this leaves CEOs in the lurch, unable to meet market demands for goods and services or plan for the future.

Congress needs to secure our borders and imple ment a working immigration policy that enables work-willing immigrants who share our values and are vetted for security and health concerns to legally enter and work in this country. Skilled professionals, including engineers and scientists, should similarly be vetted and welcomed to this country to continue our proud tradition of attracting innovators to our shores.

None of these issues are simple. But they’re not unsolvable either. Even in Washington.

—Marshall Cooper, CEO, Chief Executive Group

SEMICONDUCTORS HAVE EVOLVED from being devices found only in advanced electronics to being integral to virtually every electronic device on which companies rely. From the trucks that deliver our products and the computers that we use to send emails and track sales, down to the coffee machine in the break room, businesses cannot escape some relationship to semiconductors. The chip industry trickles down into almost all aspects of the U.S. economy, including electronics vital to national security, such as defense, cybersecurity, healthcare and domestic energy industries. To help encourage investment in the U.S. semiconductor industry, President Biden signed the $50-billion-plus CHIPS Act into law in August1 of 2022.

There are several factors that likely contributed to the passage of the CHIPS Act:

“Such a step-change expansion of the US semiconductor manufacturing industry over the next 5-10 years may likely have transformational impacts on the states and communities that receive wafer fab investments”

1. Covid lockdowns caused worldwide chip manufacturing to slow in 2020, while simultaneously skyrocketing sales in work-from-home electronics, virtual learning and healthcare industries, exacerbating a supply/demand imbalance.

2. The U.S. share of global semiconductor manufacturing has dropped from 37 percent to just 12 percent since 1990. Increasing labor costs and regulation have made it approximately 25-50 percent more expensive to construct and operate a semiconductor facility in the U.S. compared to overseas.2

3. Today, 75 percent of the world’s chip manufacturing is concentrated in East Asia. Investment-attracting policies coupled with attractive manufacturing wages have caused this area of the globe to dominate global chip production.3

The CHIPS Act is a bold play by the U.S. government to attract chip manufacturing investment to the U.S. and alleviate our dependence on East Asian chips. The cornerstone of the CHIPS Act is the “Advanced Manufacturing Tax Credit” (AMTC) of 25 percent of depreciable property of any “advanced manufacturing facility” associated with semiconductor production. Additionally, projects that qualify for CHIPS Act funding will also receive “coordinated permitting” between federal agencies to speed up the often one-year-pluspermits necessary to begin construction on manufacturing facilities.

The $52 billion CHIPS Act is predicted to stimulate over $140 billion in direct investments before the construction cutoff date.5 By comparison, South Korea recently offered up to 50 percent in investment tax credits to new semiconductor facilities, spurring over $151 billion in investment commitments between now and 2030 from a single large chip producer.6 Such government incentives and

As used

favorable operating structures have helped catapult South Korea to be the No. 2 global producer of non-memory semiconductors and No. 1 in memory semiconductors.7 Likewise, Taiwan sits securely in the No. 1 global position for overall semiconductor production, responsible for approximately 63 percent of global chip production between 2020 and 2021.8 While Taiwan has not doled out large tax incentives as readily as South Korea, the government did partake in spurring the creation of multiple semiconductor companies in the 1980s, and then housing them in a dedicated “science park.”9 Similar to Silicon Valley tech companies, this cluster of small chip makers competed, innovated and eventually grew into some of the largest semiconductor companies in the world. In 2020, Taiwan’s largest chip producer has grown to command a 54 percent share of the global semiconductor manufacturing market, the largest in the world by far.10 Considering the already $60 billion investment announcements in chip facilities in 2022 thus far and the historical success of tax incentives to the semiconductor industry, it is expected that the CHIPS Act will increase the U.S.’s global share of semiconductor production and reduce U.S. reliance on foreign chips.

Such a step-change expansion of the U.S. semiconductor manufacturing industry over the next 5 to 10 years may have transformational impacts on the states and communities that receive wafer fab investments. Growth in technical talent development, expansions in infrastructure, responses by academia to meet the demand for specialized degrees and movement by semiconductor industry suppliers are just a few potential examples of local impacts.

If you believe your business may qualify for CHIPS Act funding, keep an eye out for government rules, guidelines and updates on how to qualify and ensure that your overseas operations do not affect your eligibility. As new production facilities ramp up in the coming years, we may expect to see the global chip shortage ease. Leaders should understand how specific types of semiconductors operationally and financially affect their business, closely follow current and projected supply, and prepare for at least some degree of improvement over the pandemic-induced global chip shortage.

Darin Buelow (dbuelow@deloitte.com) is a principal and Alex Dunlap is a consultant at Deloitte Consulting LLP, where they provide clients with real estate and location strategy solutions.

1https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/09/fact-sheet-chips-andscience-act-will-lower-costs-create-jobs-strengthen-supply-chains-and-counter-china/ | 2https:// www.semiconductors.org/wp-content/uploads/2021/09/2021-SIA-State-of-the-Industry-Report.pdf | 3https://www.trendforce.com/presscenter/news/20210305-10693.html | 5https://www.semiconduc tors.org/wp-content/uploads/2021/09/2021-SIA-State-of-the-Industry-Report.pdf | 6https://wccftech. com/samsung-increases-chip-investment-to-151-billion-amidst-50-tax-break-promises-in-korea/ | 7https://asiatimes.com/2022/07/in-chip-war-korea-spends-big-to-stay-ahead-of-china/ | 8https:// www.trendforce.com/presscenter/news/20210305-10693.html | 9https://history-computer.com/tai wan-semiconductor-history/ | 10https://www.trendforce.com/presscenter/news/20210305-10693.html

reserved. SOURCES: https://www.semiconductors.org/wp-content/uploads/2021/09/2021-SIA-Stateof-the-Industry-Report.pdf | https://www.trendforce.com/presscenter/news/20210305-10693. | html https://history-computer.com/taiwan-semiconductor-history/ | https://www.reuters.com /technology/us-chip-industrysplit-over-chips-act-benefits-intel-sources-2022-07-18/ | https://asiatimes.com/2022/07/in-chip-war-korea-spends-big-to-stay-ahead-of-china/ | https://wccftech.com/samsung-increases-chip-investment-to-151-billionamidst-50-tax-break- promises-in-korea/ | https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/09/fact-sheet-chips-and-scence-act-will-lower-costs-create-jobs-strengthen-supply-chains-and-counter-china/

Copyright © 2022 Deloitte Development LLC.

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication.

Insights from Chief Executive Group’s CEO Confidence Index, a widely followed monthly poll of CEOs, including members of the Chief Exec utive Network (CEN), our nationwide membership organization that helps C-Suite executives improve their effectiveness and gain competitive advantages. For more information, visit chiefexecutivenetwork.com.

A GROWING NUMBER OF CEOS are expecting many of the current eco nomic challenges to have subsided by the fall of 2023, at least according to the most recent data from Chief Executive’s CEO Confidence Index—our monthly poll of U.S. CEOs on their short-term strategies and outlook for business.

In September our leading indicator of CEO confidence clawed back months of losses, with much of the gain happening in August. CEOs polled said they are seeing early indicators that by this time next year, the country will be in a recovery—not a recession.

“Optimism that supply chain issues resolve, Ukraine/Russia war is resolved, business across the globe improves and inflation is moderated without spiking interest rates too high from here” are the reasons a CEO of a biotech company participating in our September poll gave for forecasting improving conditions. He was echoed by others who cited the mid-term elections being behind us, the end of the Fed’s tightening policy, a loosening labor market and stablizing energy crisis.

Underpinning all of this, CEOs tell us, is insatiable demand. Earlier this year, CEOs told us they feared the Fed would wear down consumer buying power. It hasn’t happened. “We have the highest order book in our history. We are adding equipment and personnel to grow our production capacities and capa bilities,” said Scott Glaze, CEO of wire manufacturer Fort Wayne Metals.

“Demand is holding up, and we are seeing some easing of inflationary pressures on the supply chain and raw materials side,” said Will Symonds, president of global houseware company OGGI.

And while labor challenges have so far limited companies’ ability to deliver on that demand, many are reporting the beginning of a shift in the market. Mark Rubenstein, CEO of hospitality service provider A Head for Profits, says by keeping focus on tapering inflation, the Fed “will likely help ease labor pressure, which I see as the most impactful business concern currently.”

Here’s hoping.

—Melanie Nolen, Research Editor and Isabella Mourgelas, Research Analyst

How are business leaders prepping for a looming recession?

A new Chief Executive study has some answers.

ECONOMIC UNCERTAINTY is affecting every business these days, but not always in the same way—which is why peer performance data is invalu able in these challenging times. But how to get it?

To help you gain a better picture of how and what your competitors are doing, as well as how your company stacks up, Chief Executive reached out to thousands of CEOs, presidents, owners and CFOs at U.S.-based companies of nearly every size and sector. We asked them to share key KPI data, really nitty-gritty stuff like pricing changes, staffing costs and turnover data, how many days receivables/payables are tak ing, changes in R&D budgets and more, and then we analyzed it all and sliced it up in every way you can think of, by size, by industry, and so on.

The results? They were eye-opening, to say the least—and obviously a lot more than we could cram into an issue of the magazine—so we put the full results in a new study, Chief Executive Group’s 2022 Financial Benchmarks Report for U.S. Companies, available at chiefexecutive.net/benchmarksreport. For now, here are some of the top-line results we found most interesting. How do you compare?

According to our survey, 41 percent of U.S. companies are projecting their annual revenues to grow by 10 percent or more in 2022. A big contributing factor to this, of course, are the inflation-driven price increases companies are implementing.

BY MELANIE C. NOLENMore companies are raising prices in 2022 than in 2021—81 percent vs. 72 percent. The extent of those increases varies, but the great majority report numbers between 2.5 percent and 15 percent.

And while small companies (by annual revenues) tend to be more reluctant to increase prices compared to their larger peers, they are also the group with the highest proportion forecasting revenue declines this year—which showcases the importance of price in creases in navigating this environment.

As one might expect, sector also plays a prominent role. For instance, 53 percent of manufacturing compa nies focused on consumer goods forecast ending 2022 with revenue growth in excess of 10 percent—the larg est rate across all sectors. It’s no coincidence that these are also among the companies most likely to implement substantial price increases (7.5 percent or more) in 2022, compared to other industries.

Net revenue per employee is another important metric to consider in this economy, as labor costs con tinue to skyrocket. According to our research, median total net revenue per employee in 2021 was $225,000, with 35 percent reporting theirs falling between $100,000 and $199,000.

And while company size has a direct correlation to this metric, it also varies largely based on industry: 30 percent of wholesale/distribution companies and 22 percent of energy companies have total net revenue per employee of at least $1 million, far more than any other sector.

When we’re talking inflation, we’re of course talking costs. So how is it hitting companies?

We found that the median projected cost of goods sold (COGS) as a percentage of net revenues is 41 percent in 2022 (average of 45 percent), an increase from 2021 (40 percent and 43 percent, respectively). While a 1 per cent increase may seem modest, it can have a material impact on profit margins.

Construction companies have the highest COGS in 2022, with a median of 73 percent—down from 75 percent in 2021 but the highest across all sectors.

In response to rising wages, 52 percent of companies said they are increasing or have increased prices to match wage increases. Overall, the larger the company (by annual revenues), the more likely it is to invest in automation to curb the impact of wage increases, particularly when it comes to back-office operations.

In the restaurant industry, 75 percent of companies said they are increasing prices in line with wages, and 58 percent said they are investing in automation to reduce the number of employees specifi cally in response to rising wages. This is only second to the retail industry, where the study found 60 percent of companies were adopting the same strategy.

COGS as a percentage of net revenue, all sectors

What

Reducing costs

Increasing average prices

Investing in automation

Investing in automation

line

other technologies

front-line

other technologies

increases

10th Percentile

25th Percentile

50th Percentile

75th Percentile

90th Percentile

Mean

EBITDA as a percentage of net revenue, all sectors

number of back-office employees

Reducing profit expectations

Increasing average prices more than wage increases

Investing in automation and technologies

middle managers

10th Percentile

25th Percentile

50th Percentile

75th Percentile 90th Percentile

Mean

Less

Down No Change

In our current economy, all eyes are on profitability. While median EBITDA in 2022 is 14 percent of net revenue, accord ing to the benchmarking study, average EBITDA as a percentage of net revenue is projected to be 16 percent, down from 17 percent in 2021.

Here, too, size plays a role, but this time, the peer groups at both ends of the scale show an advantage. Companies with less than $10 million in annual revenues and those with more than $1 billion in an nual revenues enjoyed the highest median EBITDA as a percentage of net revenues in both 2021 and 2022, at 15 percent.

As for sector (another important component when benchmarking perfor mance), the study found real estate and pharma as the two industries with the highest median EBITDA as a percentage of net revenue in 2022. Real estate, at 23 percent, showed no change from the year prior, but pharma/biotech, at 18 percent, is down from 23 percent in 2021.

When evaluating EBITDA per employ ee, a figure of less than $50,000 is quite common, and nearly 40 percent of com panies represented in the benchmarking study reported that figure. Fewer than a quarter reported EBITDA per employee of $150,000 or more.

As you’d expect, sector is critical, and it’s been good to be in the energy business. One-third of energy companies polled reported EBITDA per employee of at least $400,000—the highest of all industries. No energy company reported EBITDA per worker under $50,000 for 2022. Will that last into a recession? We’ll see.

Utilizing data from U.S.-based companies, Chief Executive’s Financial Performance Benchmarks

an

into pricing strategies, departmental staffing costs and turnover ratios, days receivables/payables, R&D budgets and other key performance indicators

help you benchmark your operations against peers and drive growth. For more information, visit chiefexecutive.net/benchmarksreport.

is proud to partner with Salesforce to help accelerate

businesses around the world.

3M SURVIVED TWO WORLD WARS, the Great Depression and dizzying changes to the U.S. economy since it was founded in 1902 to produce sandpaper and grinding wheels. The former Min nesota Mining & Manufac turing Co. had nearly $3 billion in cash on the books as of June 30, 2022.

So why did 3M put one of its subsidiaries in bankrupt cy the following month?

J&J said only a bankruptcy court could pay claims in an orderly manner.

The march to bankruptcy court started in the early 1980s after asbestos manufacturer Johns-Manville filed Chapter 11 to resolve a wave of personal-injury lawsuits. In 1994, Congress amended the Bankruptcy Code to allow companies to settle asbestos litigation by contributing assets and insurance proceeds to a trust to pay present and future claims.

How solvent companies leverage bankruptcy to resolve lawsuits.

The answer is becoming increasingly common as mass-tort litigation spirals out of control in the U.S.: It seemed like the least-bad alternative. In 2008, 3M had the misfortune to buy Aearo, a manufacturer of military earplugs, for $1.2 billion. Then plaintiff lawyers discovered internal documents they said proved Aearo had covered up problems with the devices. Soon 3M faced more than 230,000 claims by service members claiming permanent hearing loss, representing billions of dollars in potential liability over a product that generated less than $50 million in mili tary revenue over its lifetime.

Add in a sympathetic federal judge in Florida who stripped 3M of its most im portant defense—that it was a government contractor making a government-approved device—and 3M suddenly had a very big problem on its hands. After racking up a mixed record in “bellwether” trials, including one $70 million jury verdict, 3M put Aearo in Chapter 11 bankruptcy, saying “the tort system is no longer a viable forum to resolve this litigation.” In doing so, 3M followed the lead of highly profitable Johnson & Johnson, which last year placed the unit responsible for its iconic Johnson’s Baby Powder into bankruptcy to resolve thousands of asbestos suits.

The difference with today’s bankruptcies is that solvent companies are doing it—and plaintiff lawyers and some legal academics are crying foul. University of Georgia Law School Professor Lindsey Simon, in a widely cited 2021 article in the Yale Law Journal, called sol vent companies that use Chapter 11 to sort out their tort liabilities “bankruptcy grifters.”

“Case by case, exception by exception, bankruptcy grifters have infiltrated the Chapter 11 process,” Simon wrote.

Johnson & Johnson used an aggressive technique known as the “Texas Two-Step,” forming a special subsidiary to hold the talc liabilities and pay claims, backstopped by a guarantee of the parent company’s assets. A bankruptcy judge in Delaware blessed the maneuver, but plaintiff lawyers have contest ed it at the Third Circuit Court of Appeals, saying it denies claimants their day in court.

3M didn’t use the Texas Two-Step, and its caution may wind up costing it billions. In August, U.S. Bankruptcy Judge Jeffrey J. Gra ham denied the company’s request for a stay of the earplug litigation, saying that 3M’s offer to cover Aearo’s litigation costs after it burned through several insurance policies made the bankruptcy economically meaningless.

Daniel Fisher, a former senior editor at Forbes, has covered legal affairs for two decades.

Johnson & Johnson, like 3M, denies the allegations against it. But facing the prospect of $100 million to $200 million a year in litigation expenses for “decades to come,”

In his order, Judge Graham splashed cold water on the idea that bankruptcy threat ens mass-tort claimants’ constitutionally guaranteed right to a day in court, however. With more than 290,000 claims, he wrote, it is “accurate to say that it is unlikely” most plaintiffs will get a jury trial regardless of how the litigation proceeds.

More hours in the day would make you a better leader. Here’s how to get them.

JORGE GONZALEZ HAS A GREAT track record as the CEO of City National Bank in Miami. Even when the business is going very well, he encourages his leaders to get out of their comfort zone and keep asking, “How can we do even better?” His organization is not as large as the huge national banks. He feels this size differ ential can actually be an advantage in terms of increased nimbleness, creativ ity and responsiveness to customers.

Bonus Round

Jorge taught us a wonderful three-part exercise that we are using with leaders at all levels in any organization. In part one, ask each leader, “If you were given two bonus hours per week, to do whatever you believe what would be in the best long-term interest of the company, how would you spend this time?”

team members. Many note that spending more time developing people would both be beneficial to the company and add meaning to their lives.

Here is the problem: Although leaders almost always say they would prefer to spend more time creating the organization of the future and developing the leaders of the future, they already feel over-committed. Where will this two hours come from?

In part two of this exercise, Jorge deals with the reality of overcommitment by asking each leader, “If you were forced to eliminate two hours of your existing work load, what would you stop doing?”

Creativity kicks in again. Leaders start coming up with opportunities to both eliminate unneeded work and to delegate more responsibility to their team mem bers. A common concern then begins to be expressed: “This sounds great to me, but what will my manager think?”

Kelly Goldsmith is a professor of marketing at Vanderbilt University’s Owen Graduate School of Management.

Marshall Goldsmith has been ranked as the world’s No. 1 leadership thinker and coach.

His 44 books include the New York Times bestsellers What Got You Here Won’t Get You There, Triggers and MOJO

When we observe leaders answering this question, their eyes light up! They immedi ately begin to get creative. We have seen two major themes emerge from their reflections.

• Creating the organization of the future: When leaders discuss the challenges and opportunities their organization will face in the future, they focus on long-term strategy—not only for the company but also for their part of the business. Taking a twohour break from “what is” gives them the opening to consider “what could be.”

• Developing the leaders of the future:

When leaders share what they are most proud of, they almost invariably mention the mentoring and development of high-potential

This question leads to part three of the exercise. Leaders are asked to sit down with their managers and share their ideas con cerning what to add and what to eliminate. While some modifications may take place based upon manager input, managers, more often than not, tend to agree with their direct reports—and appreciate their creativity.

As a chief executive, start with yourself. Challenge yourself to add two great hours and eliminate two less meaningful hours from your work life every week. Lead by example. Describe what you learned in this exercise to your team members. Then ask them to complete parts one and two of the exercise on their own and, finally, to complete part three with you.

We love this exercise. It empowers lead ers to take responsibility for their work week, it inspires creativity, and, on a much more personal level, it makes each week more enjoyable and meaningful.

Thank you, Jorge!

ACROSS THE LABOR MARKET, signs suggest we remain in a seller’s market as employee resignations remain higher than normal and job candidates are closely evaluating why, how and where they work, with many choosing jobs that offer more flexibility. Among nearly 300 CEOs participating in Chief Executive’s recent Confidence and Workforce survey, 85 percent reported higher or the same voluntary turnover compared to one year ago (see chart at right).

Many have taken action to boost their appeal to existing and pro spective employees (see chart below) and/or are exploring longer-term measures, from changes to compensation practices to holistic well-being initiatives. Tangible, forward-looking steps and questions CEOs may con sider to solve the labor shortage puzzle include:

• Total compensation and pay equity: In addition to implementing signing bonuses and pay increases to attract job candidates and soften inflationary impacts for current employees, leaders should consider longer-term plans to adjust their merit-increase process and incentive-based pay, with individual contributions and performance to be more equitable and results oriented. They should also consider broader opportunities to provide equity ownership in the business.

• Employee benefits: The rising cost of healthcare premiums and larger deductibles are putting more financial pressure on employees. Business leaders should work closely with their benefits administra tors to find creative ways to lower the overall cost of benefits while creating benefit plans aligned with the needs of the workforce. They should also consider opportunities to provide low-cost loans and/or crisis funds for employees.

• Skills development: Public/private initiatives to help prepare our workforces for the future are gaining traction. Vocational- and STEM-related programs leverage federal and state grants to provide apprenticeship and skill certification opportunities. Traditional internal training programs are generally not designed for the multiyear invest ment needed to develop the skills and experience required.

• Flexible work arrangements: Beyond providing the technology to enable knowledge workers to work remotely and/or utilize a flexible work schedule, business leaders should consider creative ways to connect people. Working remotely may be more productive for some than others. The isolation can create engagement and loyalty challenges, especially for new hires.

Managers may also need training and tools to help them lead a geographically dispersed team. What support are you providing managers to help them be efficient and effective? How are you com pensating those who cannot work remotely in the spirit of fairness (e.g., balancing workload, more flexible hours, longer break times, additional days off, rewards and recognition, etc.)?

Expanding

• Employee well-being: More than a third of organizations recognize the importance of well-being to workers’ overall health. Some are launching holistic well-being programs and/or training managers to help reduce the stigmas employees may experience when seek ing mental health assistance. CEOs may consider assessing their organization’s approach to employee well-being and specific benefits offered, including the metrics used to measure outcomes and the return on investment.

• Stay interviews: Stay interviews are growing in popularity as a way to increase retention rates, help employees de-stress, increase their sense of belonging by linking what they do to the vision and mis sion of the organization and learn how workforce-related investments are viewed. Some organizations are requiring leadership training on conducting stay interviews and requiring them to be performed at least two times per year.

Even as companies adapt to address changing expectations of our cur rent and future employees, solving the labor shortage puzzle sometimes feels like a catch-22. There are more than enough job seekers for the many open positions that remain unfilled. Yet, they may not possess the desired knowledge, skills and experience. Organizations seek a diverse slate of candidates but often lack visibility to diverse candidate sources. As infla tion rises, companies look for ways to reduce operating expenses even as compensation and benefit increases are being used to attract job candidates and retain employees. To solve this puzzle, business leaders will need a balanced approach, starting with empathy for their employees and an authentic, visible and transparent leadership style.

I HAVE STUDIED TOP LEADERSHIP exits for 40 years, starting with the work done for my book The Hero’s Farewell. The most traumatic leadership change is a mon arch’s departure, because it only happens following a palace revolt or the death of the leader.

(if not always smoothly) and helped guide former colonies through peaceful transi tions into independent statehood.

The end of a 70-year reign is not a tragedy of a premature passing—but still represents the loss of a bridge to our historic past.

So it is with the passing of Queen Elizabeth II. Her death is emblematic of the cultural, stra tegic and emotional complexity of such an event. Her stakeholders, in her case, subjects, had a deep emotional bond with her as the regal em blem of their nation. With her careful digni ty and thoughtful diplomacy, she made few public missteps, despite backstage palace intrigue. We fought two wars against Britain, but we join her nation, our strongest ally, as they mourn the passing of their queen.

Few of us are royalists or monarchists, but Queen Elizabeth was a global force as a prin cipled woman leader, accepting the crown at age 26 while still mourning her father, then surviving to be the longest-reigning mon arch in world history. She led as symbolic head of state through 15 different heads of government and 15 U.S. presidencies.

In corporate jobs, we rarely encourage such long-reigning leaders. Their inspiring vision and continuity of command can forti fy admired cultural values while providing stability, but they can also become overly invested in their identities as leaders. Such monarchs in industry often undermine successors and ritualize traditions that need to change. Potential successors can become discouraged and depart.

Long-Reigning Leaders Armand Hammer led Occidental Petroleum from 1957 until his death in 1990 at age 92. The company stumbled in the aftermath of his legacy of Libyan dependence for decades, finding its strategic footing only in the last two years. FedEx founder Fred Smith stepped down as CEO after over a half century of command, with people eager to see how his successor, Raj Subramaniam, a longtime FedEx insider, will fare. Ninety-three-year-old Rupert Murdoch’s patriarchal control of News Corp. was so worthy of a soap opera that HBO actually created one modeled on his reign.

Jeffrey Sonnenfeld is senior associate dean, leadership studies, Lester Crown professor in management practice at Yale School of Management, president of the Yale Chief Executive Leadership Institute and author of The Hero’s Farewell (Oxford University Press, 1988). Follow him on Twitter @JeffSonnenfeld.

Our parents, our grandparents, our selves—we knew of no other British monarch. She was a revered head of state and a reminder that Machiavelli clichés are wrong—leaders can be both loved and respected, hardly the tradeoff that Vladimir Putin and too many others seem to feel.

Paradoxically, she was a moral pillar of tra ditional values and also a bridge to the needed changes guiding our future—regal identity balanced by personal humility. Her traditional values—integrity, hard work, patriotism— forged strong bonds across the Atlantic.

She embraced ethnic and racial diversity as well as other religions, with an especially important embrace of the Islamic new comer to Britain. She embraced commoner spouses for her children and grandchildren

And so it was for Queen Elizabeth. Her frustrated, 73-year-old son Charles, now king, endured the longest royal apprentice ship in history as her heir apparent. For decades, it resembled an extended adoles cence, giving him plenty of opportunities to misstep while trying to avoid the shadow of his mother’s revered leadership.

Companies, like countries, are trauma tized by the departure of a monarch, but we cannot diminish the value they created, as much as the succession can be difficult. Queen Elizabeth’s death was inevitable and expected but is still a somber moment in the life of her nation. She was handed a unique leadership task and mastered it with dili gence and dignity. She is a reminder of the inextricably intertwined nature of the sub stance and symbolism of leadership and how very important it is to the life of a nation.

To learn more about how inspiring businesses are leading the way to a strong economy, visit ArkansasEDC.com/ whyarkansas

“

Arkansas is the perfect fit for Dassault Falcon Jet because it has an environment that encourages business and attracts the best people. And the people are the key to our success.”

Sebastien Deltheil - General Manager, Completion Center Dassault Falcon Jet, Little Rock

Winners of our 5th annual Patriots in Business Award weigh in on what they’ve learned—and how they’ve prospered—from their veteran and military hiring programs.

AT A TIME WHEN TALENT is hard to come by, veteran and active duty em ployment initiatives enable companies to support America’s military families in a meaningful way while also gaining access to a pool of highly skilled workers, many with leadership experience. It’s a double win that GuidePoint Security and John son & Johnson—winners of the Patriots in Business Award presented annually by Chief Executive and Thayer Leadership—are quick to acknowledge.

“Almost 20 percent of our organization consists of veterans, many of whom received some relevant training in cybersecurity or intelligence while serving our country,” says Michael Volk, founder of GuidePoint Security. “The military provides a great environment to recruit cybersecurity talent. Additionally, we are in a position to not only benefit from this talent but also to provide good opportunities to those who served when they transition out of the military—it’s a win-win.”

Johnson & Johnson CEO Joaquin Du ato echoed the sentiment, noting that hiring veterans fits with his company’s purpose-driven and values-based culture. “At Johnson & Johnson, we are grounded in ‘Our Credo,’ which means putting the needs and well-being of the people we serve first,” he says. “Living these values means that we have a responsibility to our employees, many of whom are veterans or service members. These individuals are valued members of our communities, and their military experience contributes to our business success.”

We asked this year’s winners to share their best advice on why and how to work with active-duty military members, veterans and their families. Here’s what they had to say.

The Why: Organizations need to be more cre ative.... We developed GuidePoint Security University to work with those transitioning out of the military to chart a career path across a range of cybersecurity disciplines based on their training and interest. Certain non-cyber skills translate well into a cyber career with the right focus and training, and so we’ve learned to take alternate routes to bringing in good talent to grow and ultimately help support our customers.

The How: Understand each branch’s transition programs, as they can be very helpful—oftentimes helping to defer some onboarding/training costs. It’s important to be real clear on what skill sets and experience you are looking for—and relay this information to the transition groups with whom you are working. Understand that veterans will require some coach ing on how things are done in the “civilian world,” but almost always have finely honed technical skills, developed over their career. Plus, the discipline, drive and leadership qualities the military embeds in almost all veterans is really helpful in the civilian world.

The Why: Supporting veterans means support ing the entire military-connected community, including their spouses, children and caregivers. We incorpo rate the unique strengths and needs of this community through company-wide programs that are part of the everyday function of our business.

The How: Engage with the military-connected community as part of your organization’s overall approach to your business. For instance, we proudly partner with many veteran-owned suppliers. We have also incorporated this community into our overall recruiting and talent management strategy. Remember: This community brings unique strengths as leaders and bridge builders, two skills that are valuable in the boardroom and the battlefield.

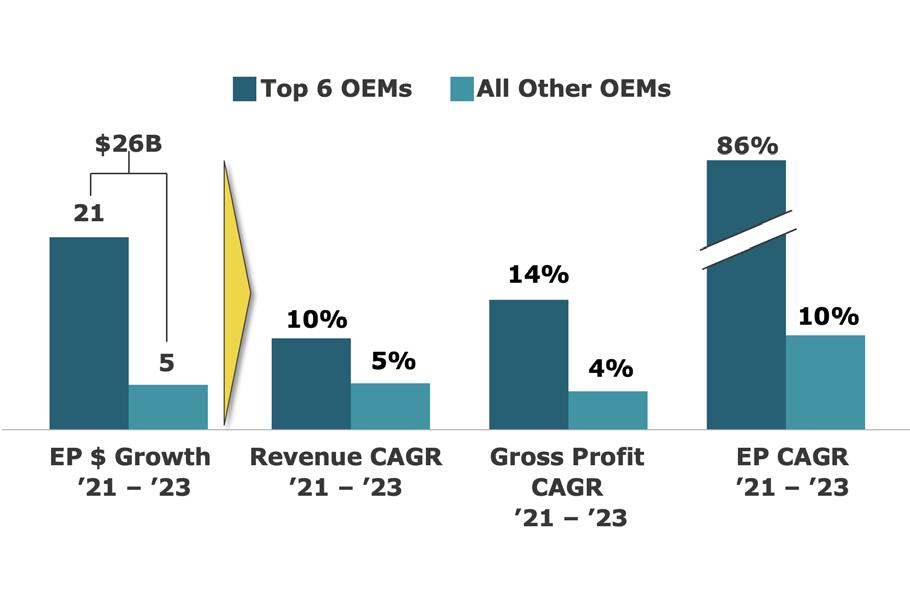

AFTER A LONG STRETCH OF undershooting investors’ expectations for Economic Profit (EP)1 growth and Total Shareholder Returns (TSRs)2, OEMs find themselves in an unfamiliar role: high performers.

Automotive OEMs have historically struggled to deliver the typical profit growth expectations set for most in dustries. The automotive industry’s high capital intensity, narrow margins and long product cycles challenged companies’ ability to consistently grow EP.

However, as new-vehicle supply tightened, expecta tions for battery-electric vehicles (BEV) rose, vehicle pric ing increased and investor expectations began to rise.

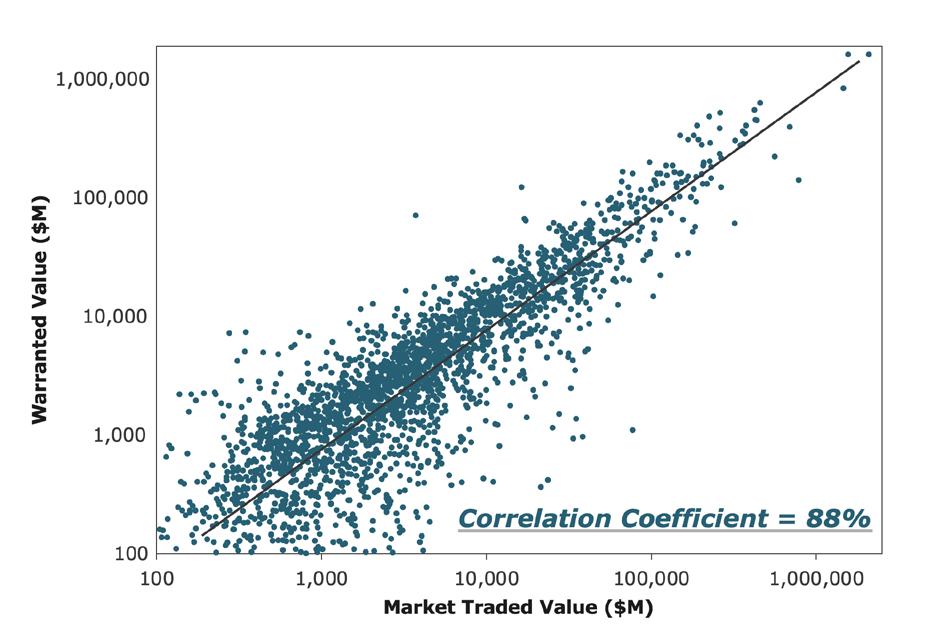

The best measure of a company’s success is delivering superior shareholder returns compared to its industry peers. Since shareholder value is driven by investor expectations of future cash flow and EP growth (See S&P 500 Warranted Value of Discounted Economic Profits vs. Actual Traded Value chart, below), EP has been used as the profitability metric for AlixPartners’ Automotive Value Creation study.

To sustain the recent increase in their TSRs, OEMs, like any other public company, will need to exceed investors’ already-high expectations for EP growth.

To understand the backdrop, consider the three-year period leading up to January 2020. During this time, the industry’s EP growth was challenged as margins were

squeezed by declining global volumes and high fixed costs. As a result, OEM TSRs underperformed the S&P 500, delivering 5 percent TSRs versus 15 percent for the broader market.

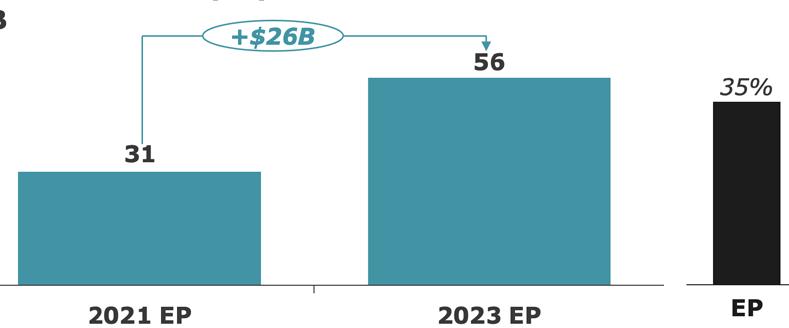

However, from December 2020 to December 2021, investors raised their outlook for OEM EP growth as supply tightened and pricing firmed, reflecting an expected rebound in U.S. auto demand, including increasing demand for BEVs, greater OEM pricing power and emerging growth in higher-margin and recurring subscription-based software and service revenues (See Growth in Investor Expectations and Shareholder Returns chart, above).

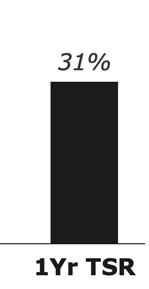

With this improving outlook, investors have priced in roughly $25 billion in EP growth from $31 billion in 2021 to $56 billion in 2023. The result: 31 percent TSR3 for OEMs (versus 29 percent for S&P 500), more than quadru ple the TSRs delivered from 2016 to 2019.

To sustain the recent capital market momentum, OEMs will need to not only meet but exceed these rising inves tor expectations for future EP growth.

A deeper look into the 2021 to 2023 growth expec tations highlights potential opportunities for OEMs. Out of nearly 40 OEMs analyzed, the top six OEMs are expected to drive ~$21 billion or ~80 percent of the total EP growth from 2021 to 2023. The forecasted EP improvement is highly reliant on sustaining increased

pricing power, which for new vehicles rose ~30 percent in Q2 2022 versus Q1 2019 levels (See Pricing Growth of Top 6 OEMs chart, below).

OEMs will also need to navigate emerging head winds. Raw materials costs are volatile; the relative appreciation of the dollar versus the yen and euro; continued supply chain issues complicate procurement and operations; and consumer sentiments may be waning amid escalation in sticker prices, inflation and recession fears.

• Leverage fully loaded economic profit (EP) to inform and prioritize current and future industry profit pools at granular segments of customers, products, services and markets

• Understand where and why traditional and emerging competitors are capturing share of these profit pools

• Outline the strategy and roadmap, including key stakeholder requirements and incentives, for increased EP growth in new segments (i.e., EV, software, services, etc.)

• Develop granular understanding of internal sources of EP by market, brand/ model, parts, services, distributors and end consumer segments

• Leverage granular business understanding to build an information advantage vs. peers to execute differentiated strategies that maximize and sustain competitive advantages

• Optimize pricing, mix (i.e., models, parts, services, etc.), and market participation based on EP growth potential and grounded EP share gain expectations

• Fix or eliminate perpetual negative EP contributors due to poor market economics or inability to achieve a distinctive competitive advantage

These headwinds will lead to even further concen tration of market profit pools and OEMs’ EP growth opportunities. Understanding where and why these concentrations exist and how they might shift in the future is the key to proactively addressing the head winds and fully focusing resources—time, talent and treasure—on an agenda of the best opportunities for sustaining and accelerating OEMs’ recent profit growth (see table at right).

These steps require disciplined leadership from CEOs and top management to ensure a cross-functional focus on maximizing EP growth and long-term sharehold er value. The OEMs that succeed will not only sus tain top-quartile TSRs but will also build a reinvest ment advantage that will be difficult for competitors to overcome.

1Economic Profit (EP) is Earnings minus a charge for the capital employed required to generate those earnings

2Share price appreciation plus dividend yield 3TSRs from Jan 1, 2021 to Dec 31, 2021

• Re-optimize supply chain given re-shoring, changes in capacity and new technologies, considering implications for customers, internal technologies and operations, partner capabilities and financial returns

• Reduce unrewarded complexity by driving out hidden costs and eliminating waste, duplication and conflicting agendas in process (i.e., tighter alignment rather than silos across functions)

• Improve ROI on SG&A and R&D by focusing resources in areas of EP growth and competitive advantage and by increasing speed to market via roadmap optimizations

• Focus investment on strategies where returns over time will exceed the cost of capital; do not tolerate consistent value destruction unless there is a clear positive EP outcome for total company

• Evaluate strategic alternatives for negative EP assets and/or assets with perpetually declining EP (i.e., restructuring, M&A/divestitures, partnerships, etc.)

• Return excess cash flow to shareholders via buybacks and dividends if reinvestment in company is unlikely to exceed produce returns above the cost of capital over the investment horizon

Elements of an OEM Agenda to Maximize EP Growth Understand Size and Growth of Granular Economic Profit Pools

The Salesforce founder changed the world by ushering in the cloud computing revolution more than two decades ago. His latest disruption may have an even bigger—and more enduring—impact. “We’re not coming back the way we were.”

BY DAN BIGMAN AND TED BILILIESIT’S CREEPING UP ON 6 P.M., AND AT THE VERY TOP OF SALESFORCE TOWER, 41 floors above Bryant Park in the heart of midtown Manhattan, company founder and co-CEO Marc Benioff is having one of the more important discussions of his year. He’s holding court with an elite group of Salesforce superusers—“Trailblazers” in the com pany’s lingo. Over spring water and finger foods prepared by Michelin-rated chefs, surrounded by a panoramic view of New York City, they’re dissecting an early draft of Benioff’s September keynote for Dreamforce, the 40,000-person-strong annual takeover of San Francisco that’s the centerpiece of his year.

From a product standpoint, the purpose of this year’s presentation is the formal rollout of “Genie”—a substantial rewrite of the Salesforce data platform that’s at the heart of the $26.5 billion (FY2022 revenue) company, one that will allow for more “customer magic.” It brings drag-and-drop ease and efficiency to the customer-data revolution for companies from the enterprise scale of Ford down to midsize market ing agencies.

But exciting as it is, Genie isn’t what’s really resonating in the room. What’s really got them revved up is the idea of a “family reunion” at Dreamforce.

“The last time we all got together was in 2019,” a young superuser in a checked blaz er tells Benioff. “This is the first time we’re going to be back together since then. You should make a bigger deal about that.”

Benioff nods in agreement, looks over at his head of marketing, who meets his eyes. Connection. Reunion. Family. Got it.

It’s a tiny moment that speaks to some thing much, much larger: While Benioff’s style of business, liberally combining enviro mentalism, higher purpose and a Da vos do-gooder tag may elicit eye rolls in jaded news rooms and redder statehouses, it resonates like cra zy with millions of his customers and employees.

That’s because, in an era of social media bub bles and deepening societal disconnection, Benioff’s way—emphasizing social responsi bility, trust, environmental stewardship and massive charitable giving—is catnip to the community he’s convened. It makes them feel like part of something larger, something with meaning beyond software or nailing quar terly goals. It’s fueled Salesforce’s perennial presence atop best places to work lists around the world for more than a decade. And it is helping to propel one of the most incred ible growth stories in modern business, a revolution that, in many ways, may come to eclipse 58-year-old Benioff’s first disruption: leading software from desktop computers to the cloud.

The company’s 78,000-plus employees— up from 4,000 in 2010—are part of a global Salesforce “ecosystem” involving millions of businesses, independent consultants and app

makers generating more than $1 trillion of estimated economic activity a year, on track to hit $1.6 trillion by 2026.

From 2017 to 2022, the company’s net income clocked a compound annual growth rate of 35 percent, and its five-year total shareholder return is 57 percent, a performance helped by co-CEO Bret Taylor, who ascended to the job in 2021, and juiced by a recent string of blockbuster acquisitions, including Mulesoft for $6.5 billion in 2018, Tableau for $15.7 billion in 2019 and Slack for $27.7 billion in 2021.

Meanwhile, the company pioneered the adaption of what’s come to be known as the 1-1-1 model of corporate philanthro py—giving away 1 percent of profits, 1 percent of equity and 1 percent of employ ee time—annually. As a result, Salesforce has donated more than $500 million, and its employees have volunteered over 7 million hours of service time during the past 23 years. Benioff is personally one of the top philanthropists in the United States, donating more than half a billion dollars in the past decade, including $100 million in 2021 as part of his effort to plant more than a trillion trees to combat climate change.

This singular combination of doing in credibly well while also doing an incred ible amount of good led his peer CEOs to name Benioff Chief Executive’s 2022 CEO of the Year. “For more than two decades, Marc has been a towering exemplar of what it means to be an innovative and forward-thinking leader,” says Ken Frazier, the former chairman and CEO of Merck and our 2021 CEO of the Year, who served on this year’s selection committee.

“As the founder and CEO of Salesforce, he consistently has achieved exception al business and financial results for customers, employees and shareholders while standing tall in the public square for policies and principles that will foster greater sustainability, prosperity and eq uity within the business community and broader society.”

“Marc created a company and helped create an industry,” says Brian Moynihan, chairman and CEO of Bank of America

“For more than two decades, Marc has been a towering exemplar of what it means to be an innovative and forwardthinking leader.” —Ken Frazier, Former CEO, Merck

and our 2020 CEO of the Year, and also a member of this year’s selection committee. “Salesforce’s track record is among one of the premier companies in recent decades. At the same time, he has proved a company can deliver on profits and purpose and do it consistently. He has championed stakeholder capitalism and demonstrated its value.”

The creation story of Salesforce is well known: A young, talented programmer growing up in the heart of San Francisco during the wild days of the 1970s and ’80s, Benioff came of age as a top salesman at Oracle under Larry Ellison during the company’s most explosive period of growth in the ’90s. Rather than sticking it out for the lucrative long haul there, he quit, and with Ellison’s support, started Salesforce in his apartment in 1999.

For those who weren’t there, it’s hard to grasp how unconventional Salesforce’s model was at the time. Software was something you installed via disk on your desktop PC or the realm of secretive armies of “IT guys” and their inscrutable, blinking, overly air-con ditioned server farms. Benioff pushed for something new. Rather than buy and manage a room full of your own machines, you could simply lease his solution, a “software as a service” CRM housed “in the cloud,” on offsite servers his team monitored, upgraded and made easily scalable depending on your needs. Salesforce listed on the NYSE in 2004, and over the next decade, with a brash “No Software” marketing campaign and a series of bet-the-company pivots, Benioff proved to be that rare Silicon Valley founder who scaled his leadership in step with the explosive growth of his company.

All the while, he was pairing his desire for growth with a passion for charity, fueled by a family with a legacy of social service, including his grandfather, Marvin Lewis, a crusading trial lawyer known in San Fran cisco as the major force behind the creation of the Bay Area Rapid Transit system. As Benioff’s company grew and his personal wealth ballooned, so did his conviction that business had a more muscular role to play in society. Through his involvement with organizations like the World Economic

Forum, Benioff famously advocated for a new “stakeholder” capitalism model, with a strong emphasis on the environment and employee well-being.

Covid marked another transformational period for Salesforce. Benioff—to the dismay, at times, of other CEOs—was outspoken about adapting a more flexible workplace. Salesforce began practicing “success from anywhere,” allowing many employees to forgo ever coming into the office, a policy that remains in place today.

But Benioff has sensed a deep desire by many in the Salesforce ecosystem to get together—in person—once again. He’s now experimenting with the Salesforce Trailblazer Ranch. Modeled on GE’s legendary Croton ville Training Center, it’s a location-TBD out post where Salesforce’s culture can be impart ed to new employees and renewed by veterans in multiday offsites and team meetings. How that will come together is still, he admits, very much a work in progress. Like so much else in his world, The Ranch feels experimental, unconventional, a bit ahead of its time—and yet tough to bet against given the Salesforce track record, much like Benioff himself.

Under Benioff, the software company he started in his San Francisco apartment has ballooned into one of the most influential technology firms in the world, with a long-term revenue trajectory that shows no signs of slowing despite the decades.

Japanese have this great word, shoshin, this idea that everything has to be looked at anew. When we look at the pandemic, that was a moment where we all had to kind of say, “What’s really happening here, and how are we going to go forward?” Things that applied before no longer applied. The way we worked didn’t apply. The technology we were using didn’t apply. For a lot of CEOs, they were able to succeed because they started with a blank piece of paper and said, “Okay, now what am I going to achieve?”

Chief Executive talked with Benioff in late August about his journey from startup founder to enterprise leader, the changing role of the CEO and how he stays a step ahead of whatever comes next. The conver sation was edited for length and clarity.

It’s a time of tremendous change, a lot of volatility. How do you lead differently in times like these? What are the keys?

Number one—always number one—is know ing what is important to you and your core values. When you have this much volatility and this much change going on in the world, when things are uncomfortable or frustrat ing or difficult, it fundamentally gets back to: What is the most important thing to you?

What are your core values, and how are you going to operationalize those into your company or into your life or into whatever you’re working on? That is more important than ever.

At Salesforce, it’s trust, it’s customer suc cess, it’s innovation, it’s quality, it’s sustainabil ity. The values are your true north. When we went through the pandemic, one reason that we were able to succeed and accelerate was we just kept coming back to our values over and over again. What is it that we really want to achieve here? What is our number one thing that really matters to us?

You’re one of the few people who have gone from founder to enterprise CEO. You’ve had to continuously learn. How do you learn? How do you go to each level of leadership?

We talk a lot about beginner’s mind. The

People who tried to do what they were doing before found that turned into a series of obstacles for them. It prevented them from moving forward.

One of the reasons I enjoy going to Kyoto, Japan, a couple of times every year and going to those gardens is because it reinforces to me, are you working on your beginner’s mind? Are you taking time? We even bring that into our business at Salesforce, where we have Zen monastics come in and guide our executives through a beginner’s mind meditation. We just had one last week. We had 500 executives come together. We had two monastics there. A lot of our executives have never meditated before, but I think in today’s world, they need that kind of grounding. They really need that ability to put the stress, the anxiety, the fear away to get a little bit clear about what is it that they’re actually trying to achieve right now.

How do you carve out the time to do that? A meditation practice has really paid off for me as CEO. Because I had that before I even started the company, it’s paid off for decades where I’m cultivating my beginner’s mind. I’m trying to encourage my executives and my company to do the same thing.

At the start of every year, we write some thing called the V2MOM, which answers five questions: Vision, what is it that we want to achieve for the year? Values, what is the most important thing to us, in priority? Methods, how are we operationalizing those values? What are we actually doing? Value by value, how are we actually creating that into the business? Obstacles, what is preventing us from achieving each one of these values? And measurements, how do we know that we have

Bain & Company congratulates and celebrates Marc Benioff for the outstanding recognition in being named 2022 CEO of the Year.

Marc, the impact of your leadership will be felt around the world for decades to come. Congratulations to a very worthy honoree.

succeeded? What are our KPIs?

Those five simple questions are remark ably difficult for an organization or, some times, for an executive. And it’s going to change. When we went through the pandemic, all of those answers changed. So, you have to be ready to shift and change also. That’s one reason why you need to be developing a beginner’s mind, so that when you ask those questions, you’re not just repeating the same answers over and over and over again, that you’re trying to come up with something new.

You have spectacular people on your team. How do you put those A players in place, and when do you know to make a change?

In terms of management teams, different man agers and different executives have different capabilities at different levels of the business.

As the business scaled, we have had four or five CFOs, four or five heads of sales, four or five heads of technology, four or five heads of marketing, four or five heads of every major function in the organization, because different people are needed at different levels.

Sometimes, somebody can go all the way from the beginning of the company to where we are now. I’m an example, and my cofound er is an example, but not every person is going to be able to move in that kind of scale. So, that’s something that you just have to have your eyes open for. A lot of founders hold onto their management teams too long, or aren’t willing to hire quickly enough or fire quickly enough. In today’s world, hiring fast and firing fast become more important than ever.

Founders sometimes get tripped up by feeling loyal to the people who were with them at the beginning even when they’ve clearly outgrown the position. Any advice to CEOs in that situation?

It’s important to have loyalty, in our friend ships, in our marriages, in our relationships.

In business, loyalty also matters. But realism also matters. Being able to look and say, “Is

this person really going to get me to where I want to go?” If they’re not, you don’t necessar ily have to fire them or remove them from the company. Maybe they can be repositioned.

It’s not uncommon for a head of sales who is managing 10 or 20 people, or 100 or 200, or even 1,000 sales executives to not be the right person to manage 10,000 or 20,000 sales executives. That doesn’t mean they can’t be a great chief customer officer. It doesn’t mean they can’t still motivate and inspire a team, but maybe their role on the team can change. That’s extremely important. You have to have that flexibility when you’re looking at people.

How do you engage with people to make those calls? How do you know when it’s time to make these kinds of changes?

You have to trust yourself. If you lose the trust in yourself, then you’re in trouble. If I don’t trust myself and I don’t have trust and exude trust, then I’m going to have a problem. This has to be the highest value in the organization, because if you do end up with an executive where people don’t trust them, or they feel like there’s a problem, that’s an issue.

We all have had that situation where all of a sudden there’s an executive in the organi zation who people don’t trust. There could be an integrity issue. There also could be a substance abuse issue. There could be lots of things where all of a sudden people are like, “I am not able to trust this person’s ability to guide us or lead us or make a decision.” This is the moment where you have to come in and make an immediate change.

The thing about the Ranch idea was that it was clear to me that people still need to get together, but they were leery about coming to the office for whatever reason. We’re in the middle of a pandemic. So, I said, “Well, maybe they’d like to go to the Ranch.” Of course, there was no Ranch. It didn’t exist. Nobody understood what I was talking about. And I said, “Yes, we’ll have a Sales force Ranch. And it will be amazing and magical, and people will be able to go there and have an experience.” Everyone was ready to go. Of course, it didn’t even exist.

The Ranch is a code word for “we’re coming

“You have to trust yourself. If you lose the trust in yourself, then you’re in trouble.”

On behalf of

being

back in a new way.” It doesn’t have to be some place in Montana. It just has to express to ev erybody that everything’s changed, and we’re going to come back together in a new way.

It’s not that we aren’t successful or pro ductive in a pure digital environment; we are. In some cases, people will never come back to the office. That’s just how it is. Some CEOs get upset when I say that. We’re not coming back the way we were. We have to come back in new ways.

We’ve gone through the Great Resignation, the Great Relocation. Ultimately, this was the renegotiation between us and our bosses and ourselves and our families. What makes you hap piest? Where do you want to live? What do you want to do? What are you doing with your life? This is a very powerful moment for everybody. Everybody had a chance to look in the mirror and say, “Where am I?”

That’s why you saw a lot of CEOs leave their jobs in the last few years. Their renego tiation with themself was, “Well, I’m not in a place where I want to be, so I want to make a change.” When you look at that, then you can say, “Okay, what are some of these other areas now that we need to do?”

In the world, we need to look outside and say, “We need, I would say, a regeneration of our planet.” That’s what inspired us around the idea of planting a trillion trees. These things are extremely important right now, that we have to keep looking at how we’re getting to the next level. It’s a re-creation.

Is some of this about competing to hire more talented people?

Absolutely. You have two kinds of CEOs. Those who are giving mandates: “You must be in the office four days a week, that’s how it is.” Or reasons: “We need to be in the office for these five reasons, because we’re doing professional development, we’re launch ing this new product, we’re mentoring our young executives.”

If you can’t articulate your reasons, your

mandates are not going to work. They’re go ing to work against you. You can see now the number of employee letters that have gotten created because of mandates. You have to be aware that it’s a different environment, and how you’re communicating with people has to be different.

It’s not just here. I’ve been in Australia, Japan, Europe. I’ve been throughout the United States. It’s a little bit different every where, but it’s remarkably similar in that this has changed everybody.

You led one of the biggest revolutions in technology, the move to the cloud. Where do you see technology going in the years to come?

It’s becoming more than just the fabric of how we operate. We don’t even know when we’re using technology in a lot of cases. That’s also the scary part of technology, that it’s more intelligent and more automated and more real-time. That’s where you can see that cer tain countries have very significant surveil lance operations now. That is not where we were with technology only a few years ago. I recently landed at the airport from another country, and the customs officer who came in on the plane just had a camera. They didn’t even know my passport number, and they knew who I was. We’re on a new level with technology. We’re not going back.

It fundamentally is changing everything, and it’s also why values matter. We’ve seen how certain companies, especially in social media—and I’ve spoken about this to exhaus tion—have basically put their values aside to increase their monetization. They don’t care about the fundamental interaction with the consumer or what they’re doing with the con sumer. In foreign countries that maybe don’t have the same kind of watchdogs that the United States has, they don’t realize the kind of shenanigans that have happened from these social media companies.

On the positive side, we have the ability to be better educated, healthier, more connect ed to our friends and families. Today, you can go in and have a scan of your heart. You will know the exact health of your heart. My father did not have that opportunity. He didn’t know what the health of his heart was

“If you can’t articulate your reasons, your mandates are not going to work. They’re going to work against you.”

Congratulations to Salesforce’s Marc Benioff on being named 2022 CEO of the Year.

We celebrate our shared commitment to building a better world through innovation and the visionary leadership that makes progress possible.

until his doctor said, “You need to have a bypass operation.” Everybody has that story in their family from our generation. But in the future, I don’t think that will be true. People will know more about their health in real time. They’ll be able to tune their meds. They’ll have the ability to live longer, because we’re using technology in new ways.

You’ve been at the vanguard of a school of thinking that says, businesses should be a force for good. In the decade to come, how do you see the role of business changing?

Business is the greatest platform for change. This is a fundamental thought that permeates our whole company.

We manage for all of our stakeholders, not just our share holders. These are core values of ours.

We don’t use Milton Friedmanism. We’re using the idea that, yeah, shareholders are important, but employees are, customers are and our com munity is. Public schools are important, and the planet is a key stakeholder, which is why we’re a net zero company today, why we build products to help companies become fully sustainable. This is extremely important.

Some of our best leaders in the world today are not in government. They’re in our busi nesses, and we all know that. They don’t want to go into government because they don’t want to be thrashed around with a bunch of non sense. But these leaders need to be empowered and enabled to improve the world.

There’s been pushback though—some people have branded it “woke capitalism.” What do you say to that?

I understand how people can misinterpret that. What they don’t realize is that compa nies have these assets called employees in them. And in today’s world, with technology, if you’re not listening to your employees, you’re going to have a very serious problem as a CEO. People call it woke capitalism right up to the point where I’m not actually

listening to my employees when they have a serious problem.

[In 2015], our employees in Indiana were upset about a law that was being passed that was discriminating against their LGBTQ community. They asked us to talk to the gov ernor, Mike Pence, and say, “Please change the law,” and he did. But when we first did it, it was like some revelatory thought that we should be able to say, “Please don’t discrim inate against our employees. They’re upset.” But if I don’t advocate for my employees’ well-being, then who will advocate for them?

Maybe this isn’t the traditional role of the CEO, but it will never go back because employees are going to hold their CEOs ac countable for their values and also for taking care of them. My job, fundamentally, is to have my employees’ back. It’s not to support any one particular group or to advocate for any one particular belief or any of that. It’s just, “Do I have my employees’ back?” It’s go ing to make them happier, more successful, and more productive in my organization.

But if [your] employees don’t think you have their back or they’re afraid, then you won’t have the company that you want. Your employees have to feel like you’ve got their back. With so many crazy presidents, may ors, governors, elected officials all over the world, employees need to know that compa nies—who have tremendous resources—that there’s some button that they can push and say, “Help me.”

If they don’t feel that, they’re not going to stick around in your company. They’ll find a company that is that. It’s not woke capital ism. It’s just paying attention that you have many stakeholders. If you don’t realize that, then you’re blindfolded as a leader.