16 minute read

the most influential men in digital transformation

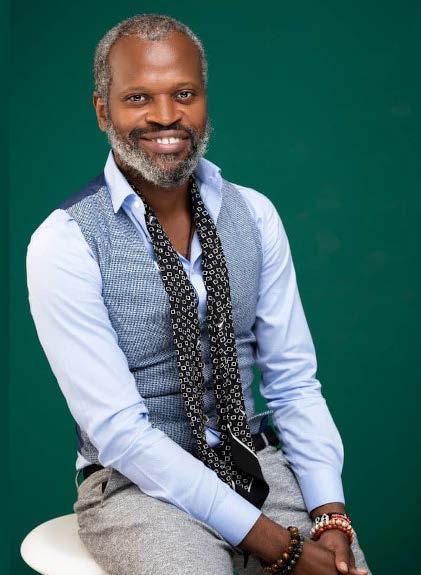

Peter Njonjo - Co-Founder & CEO, Twiga Foods (Kenya)

Njonjo is the Co-Founder and CEO of Kenyan agritech firm Twiga Foods, which is using mobile technology to align supply and demand in Africa’s agriculture sector.

Advertisement

Twiga’s technology gives it the ability to effectively track food and produce from processing to distribution, with the B2B e-commerce platform claiming that more than 100,000 Kenyan customers use its services, delivering more than 600 metric tonnes of product to more than 10,000 retailers daily.

At the helm of Twiga, Njonjo has directly contributed to the growth and strategic direction of the company has so far raised more than $100 million in both debt and equity financing rounds.

Twiga, last year, opened a multi-million-dollar distribution centre to offer fulfilment by Twiga services to expand its overall capacity and ability to deliver a selection of fresh produce, and retail products and provide partners access to over 140,000 customers across the Kenya and Uganda.

The 200,000 sq ft is fitted with the latest logistics and warehouse technology. It is equipped with racking systems, banana rooms, modern dock door systems, and product scanners which have enhanced food traceability among other functions.

The company also launched a subsidiary, Twiga Fresh, a new business focusing on contemporary and commercial farming, to assist in the delivery of low-cost, high-quality, and safe food to informal shops and urban customers.

Twiga Fresh seeks to expand the efficient production of native horticultural staples including onions, tomatoes, and watermelons, decreasing costs dramatically.

Ralph Mupita, MTN Group CEO (Zimbabwe)

Mupita, a Zimbabwe-born engineer, businessman, and corporate executive’s LinkedIn bio says he is passionate about the African continent and the role that mobile operators can play in driving sustainable digital and financial inclusion through fit-for-purpose solutions.

Since joining MTN in 2020, Ralph has been instrumental in enhancing the company’s financial stability, shaping its strategy, and ensuring its successful listing on the stock exchanges of Nigeria and Ghana.

Under his mantle, MTN has introduced several initiatives to advance digital transformation in Africa. Last year, the company rolled out 5G in South Africa, Nigeria, Zambia MTN South Africa and are planning further launches once they have completed trials in several other countries.

The Group has taken great strides in advancing digital skills through MTN Skills Academy which is crucial for advancing digital transformation in Africa.

In 2022 MTN Group announced it purchased 144 plots of digital land in Africarare, the first virtual reality metaverse in Africa. MTN said the move aligns with its ambition 2025 which entails leveraging trends to augment and increase its customers’ digital experiences. The metaverse is regarded as the next frontier in digital transformation and is envisioned as a virtual world that blends the physical and digital realms. It offers new opportunities for immersive experiences, remote collaboration, and the creation of digital assets that can have real-world value.

Agosta Liko, CEO, Pesapal (Kenya)

Agosta Liko is the visionary founder and CEO of Pesapal, a renowned leader in processing card and mobile money payments for both online and in-person transactions. Pesapal stands as one of the most rapidly advancing point-of-sale providers in the East African region, boasting a staggering valuation of over $1 billion according to media reports.

Pesapal has been making headlines with its latest feat, the launch of its innovative Forecourt Management Solution in Kenya, Tanzania, and Uganda. This ground-breaking solution is the first of its kind in Africa, offering integrated payment options with monitoring and data tools. The Pesapal Forecourt Management Solution revolutionizes fuel and retail management processes by seamlessly integrating distribution points and digital payments, backed by powerful tools that reduce costs, prevent pilfering, and elevate the customer experience.

In addition to a back-end reporting tool, Pesapal’s solution allows station owners to integrate Point of Sale (POS) and other technology platforms into forecourt operations, offering features such as centralized price changes, RFID-based attendant tagging, automatic indenting of products, and posting of outlet data to head office systems.

Pesapal’s got a Payment System Operator license from the Bank of Uganda and recognition as the 2021 Visa Innovator award winner, solidifying their position as a cutting-edge provider of digital payment solutions for consumers and merchants in Kenya and across East Africa. This prestigious annual award acknowledges fintechs working in partnership with banks to drive new payment experiences using advanced technologies like Visa Direct, tokenization, and digital wallets.

Ismael Belkhayat, Co- Founder & CEO, Chari (Morocco)

A serial entrepreneur, Belkhayat is a notable name in the North African tech ecosystem. He is the founder of Venture Builder Wib.co, Sarouty, a marketplace that facilitates real estate deals in Morocco and Chari, an e-commerce and a fintech app for retailers in French speaking countries in Africa.

Chari stands out for helping in the digital transformation of FMCG sector in Africa. The start-up, which was founded in 2020 operates as a mobile app allowing small retailers in Morocco and Tunisia to order products from partnering FMCG multinationals and local manufacturers. The retailers receive their items in less than 24 hours.

Chari made notable moves in 2022. In January 2022, they were valued at $100 million in a bridge round. In March, they acquired the credit arm of Axa Assurance. In June, Chari, acquired Ivorian B2B e-commerce site Diago and secured funding worth $1 million in September. The startup named Disrupter of the Year award at the Africa CEO Forum in Abidjan, Cote d’Ivoire that same month.

Olugbenga [GB] Agboola, Founder & CEO, Flutterwave (Nigeria)

GB has a reputation for being the Founder and CEO of Africa’s most valuable fintech start-up, Flutterwave; which provides a payment infrastructure for global merchants and payment service providers across the continent.

Agboola is considered one of the pioneers of the African fintech sector. His 15 years’ experience in the sector has seen him contribute to the development of fintech solutions at fintech companies and financial institutions such as PayPal and Standard Bank.

Under Agboola’s leadership, Flutterwave hit a $3 billion valuation on a $250 million raise in February 2022. That same year, they obtained a highly sought after payment license from the Nigerian central bank. The license, for switching and processing, enables it to carry out transactions between financial service firms. The firm had two lower-tier payments and money transfer licenses but depended on other companies to process and settle payments for its clients. It also announced plans to offer its shares through an Initial Public Offering (IPO) in the US and Nigeria. If the IPO succeeds, the fintech unicorn would become one of the very few African start-ups to achieve this in recent years.

Since it was founded in 2016, the platform claims to have processed over 200 million transactions worth over $16 billion across 34 African countries.

James Manyika, Vice President, Technology and Society, Google (Zimbabwe)

Manyika was named Google’s first-ever Vice President of Technology and Society in March 2022. Manyika, who is part of Alphabet’s management team and reports directly to CEO Sundar Pichai, is responsible for “shaping and sharing Google’s views on how technology affects society.”

With his new role, he directly contributes to the growth and strategic direction of Google. He has directly contributed to the general development of the ICT sector. He is recognised globally for his work in AI, robotics, big tech, and the future of work. He is a role model who inspires the next generation. Manyika has started a fellowship in his name at Harvard’s Hutchins Centre for African and African American Research. The J.M.D Manyika Fellowship is awarded to intellectuals and artists from Zimbabwe and other southern African countries.

Before Google, Manyika was McKinsey Global Institute Director which helps companies and governments (including tech leaders) make decisions based on economic and cultural trends.

He sits on the boards of research institutes, top academic institutions, and non-profit foundations, including the Hewlett Foundation, Stanford’s Human-Centered AI Institute, the Oxford Internet Institute, and the Aspen Institute. He’s a fellow at DeepMind and a visiting professor at Oxford’s Blavatnik School of Government. In 2011, he was named to the US National Innovation Advisory. During Obama’s administration, he served as Vice-Chair of the White House’s US Global Development Council. In 2015, he published No Ordinary Disruption: The Four Global Forces Breaking All Trends

John Kamara, Co-Founder Afya Rekod & Adanian Labs (Kenya)

The name of top brains leading digital health transformation in Africa cannot be mentioned without that of John Kamara. The brains behind Afya Rekod, a fully automated first-of-its-kind Universal Patient Portal, built on the block-chain technology, seeks to transform the face of patient care across Africa.

Through the Afya Rekod platform, patients and the medical professionals treating them have real-time access to their health data and medical history not only ensuring effective ongoing medical management but critical timely access to information in an emergency.

2022 was a good year for Kamara. Afya Rekod signed a strategic collaboration with a UK firm, Medi-Science International Limited to extend the platform’s record to all patients in Europe and across the world. Afya Rekod also raised $2 million seed round which was led by US VC firm Mac Venture Capital to scale into other African markets and accelerate the launch of its patient portal.

Kamara is also the Co-Founder of Adanian Labs which targets ideaphase tech start-ups, offering them all-round support, including capital, advisory and operational backing, building them from the ground up.

Since its establishment in 2020, Adanian Labs has incubated 14 groundbreaking tech start-ups across sectors. Last year, it selected five start-ups from Tanzania, Zambia, Nigeria, and South Africa for its 2022 Cohort Venture Building Programme.

Drew Durbin, Co-Founder & CEO, (Senegal)

Durbin co-founded Wave, a digital mobile money platform helping Africa build extremely affordable financial infrastructure. The Senegalese-born innovator started Wave in 2018 with Lincoln Quirk, his American schoolmate. The pair met at Brown University, in Rhode Island, US.

Wave is now one of Africa’s tech unicorns. The start-up had raised a $200-million Series-A funding round which brought its value to $1.7 billion.

In 2020, Wave officially spun off from Sendwave, a remittance platform that WorldRemit acquired for about $500 million in cash and stock. The company, which operated a stealth launch two years prior in Senegal, has since raised more than $290 million in equity and debt capital funding to date.

By 2022, Wave had already established itself as a leader in mobile money in both Ivory Coast and Senegal. Wave has also exanded its wings to Uganda, Mali, and Burkina Faso.

According to Durbin, when mobile money succeeded in Kenya, it lifted about a million people out of poverty. And yet, over 10 years later, most Africans still lack access to affordable ways to save, transfer or borrow the money they need to build businesses or provide for their families.

Kiaan Pillay, Co-Founder & CEO, Stitch (South Africa)

Based in Cape Town, South Africa, former developer Pillay has spent most of his career building API start-ups in Africa, including Root, a bank account for developers, and Smile Identity, a pan-African identity verification company. While working on a peer-to-peer payments app, he saw firsthand the challenges fintech innovators face due to outdated financial infrastructure across the continent.

This understanding inspired him to launch Stitch in early 2021, an API fintech startup that aims to make it easier for businesses and developers in Africa to build and scale innovative fintech products. The API fintech startup first raised $4 million seed round in February 2021, shortly after it was founded. Stitch then extended the seed round to $6 million in October 2021, after which it also expanded to Nigeria. 2022 was the year that Stitch proved it is playing a big part in digital transformation in Africa and the future also holds a lot for the API fintech start-up. So much so Stitch earned and announced a $21 million in a Series A round. He holds a Bachelor’s degree in Computer Science and Finance from the University of Cape Town.

Dr Amr Talaat, CIT Minister, Egypt

Dr Talaat is the Egyptian Minister of Communications and Information Technology, Computer Scientist and former business executive. He was appointed by the Egyptian government and has been a key figure in the development of digital transformation in the North African country. He developed Egypt’s ICT 2030 strategy to be achieved by creating a ‘Digital Egypt’ which leverages on Digital Transformation.

The Ministry has already made significant steps towards achieving Digital Egypt with a mega project he kickstarted. The Decent Life project will involve expanding the fibre optic network in Egypt to 58 million more people who are living across 4,500 villages in Egypt. With this project, in three years, each household will be connected.

Under the doctor’s watchful eye in 2022 Egypt Post, aka the National Postal Authority launched cashless payment system, was recognised as the best in digital transformation (dx) implementation, winning the African Association for Public Administration and Management (AAPAM) Award, as head of MCIT (Ministry of Communications and Information Technology) signed an agreement with SAP to establish an integrated system for cloud computing applications, along with the award-winning Egypt Post and a third entity signed protocols to issue citizen single card and as minister. Dr Taalat and his ministry have also focused on the Digital Egypt project as it develops the country’s ICT infrastructure.

With over 30 years’ experience in communications and information technology, Dr Talaat is an Adjunct Professor at Cairo University, teaching Marketing and Sales Strategies and Tactics, Organisational Behaviour and Strategic Management. He is, also, an honorary member at the ICT Board at the prestigious Cairo University and member of the ICT Board of the Academy of Scientific Research and Technology (ASRT) and the Chairman of ICT Committee of Egypt’s AmCham. He may have graduated in 1983 from the Faculty of Engineering, Cairo University where he made postgraduate studies in Electrical Engineering, earned his Doctor of Business Administration (DBA) from the University of Paris, Paris School of Business (PSB) and an MBA from Paris ESLSCA Business School. He also obtained an MSc in Computer Science from Illinois Institute of Technology. What gets the good doctor on this list is his ability to think innovatively year in and year out.

Tope Awotona, Founder & CEO, Calendly (Nigeria)

Awotona founded the modern scheduling platform for high-performing teams and individuals keen on accelerating businesses in 2013 with the vision of simplifying scheduling without the back-and-forth emails. With his strategic direction, the platform has grown and evolved to over 10 million monthly users. With a valuation of $3 billion in 2021, Forbes believes its founder, Awotona, is already potentially tapping into a $20 billion market.

While barely 40, this Nigerian American entrepreneur has gone from overseeing a small start-up to turning his company into a unicorn. With a $200,000 investment – his life savings – Calendly made $100 million in revenue by 2021. The revenue is driven in part by its spike in popularity due to the COVID-19 pandemic.

Calendly has long been considered a Black-owned startup that is “killing the game.” So much so, in September 2022 they acquire Prelude, a specialist in automating scheduling and organisation around to job recruitment. Not only is Calendly now profitable, this is its first acquisition. The latter had gone as far as raising $2.4 million. Prelude comes with clients such as Duolingo, One Media and Cloudflare. This vertical is a departure for the company, but it shows direction away from individuals and into enterprises.

Mark Straub, Co-Founder and CEO, Smile Identity (South Africa)

Straub is a true champion of using technology to promote inclusion and opportunity for underserved markets. With over a decade of experience in venture capital investing, he has worked with companies across a range of verticals, including adtech, fintech, healthcare, and energy, in locations across the world.

In 2017, Straub co-founded Smile Identity, a ground-breaking start-up that is focused on improving identity verification and Know Your Customer (KYC) compliance through artificial intelligence (AI) and machine learning. Based in Lagos, (Nigeria), London, (UK), Cape Town (South Africa) and Nairobi, (Kenya), they are a provider of a KYC onboarding and identity verification platform for Africa. They raised $20 million in Series B funding in February 2023.

By empowering dozens of start-ups in Africa, including Chipper, Paga, Paystack, oPay, and Twiga, to confirm the identity of their users in real-time using any smartphone or computer, Smile Identity has helped to make it possible for people Africans to access a range of online services. This has been especially important because without digital identity, organisations and governments will struggle to undertake the digital transformations necessary to improve the quality of services they provide without trust from their consumers.

Smile Identity’s technology is helping to overcome the significant barrier to inclusion caused by a lack of trust. Users need to feel secure when using online tools, and they need to have confidence in the authenticity of the services they are accessing. The start-up had earlier raised a $7 million Series A round in 2021.

Peter Ndegwa, CEO, Safaricom PLC (Kenya)

Ndegwa holds the position of CEO, Safaricom PLC, the largest telecommunications company in East and Central Africa, and fintech pioneer thanks to M-PESA, considered among the world’s most developed mobile payment systems. In March 2022, the telco rebranded to a technology company to play a bigger role in digitising and transforming businesses in various sectors including education, health, and manufacturing. As part of its rebranding, the company said it would leverage connectivity and experience to venture into the technology space by expanding into cloud computing, cybersecurity, and Internet of Things (IoT) underpinned by IT consulting services. Their M-PESA Super App also won the Global Mobile Award (GLOMO) at the Mobile World Congress in Barcelona, Spain, owing to its innovative contribution to the industry. It won the category of Best Mobile Innovation for Connected Living, edging out global competitors. The award recognised the Super App’s transformation of the customer experience with M-PESA and its Mini-Apps feature that enables businesses to provide services through a digital shop on the app.

Come October and the company launched 5G network across Kenya’s capital cities of Nairobi, Kisumu, and Mombasa and two other towns – Kisii and Kakamega. In the same month, Safaricom launched operations in Ethiopia, netting over two million subscribers. It has since applied for licenses for its financial services in the country. Safaricom also won a second award for their DigiTruck project under the Outstanding Mobile Contribution to the UN SDGs category. DigiTruck is a smart truck powered by Safaricom’s 4G network and it delivers IT skills training to communities across Kenya, particularly in remote areas.

Stone Atwine, Founder & CEO, Eversend (Uganda)

One of the leading fintech professionals in the continent, Atwine is the Founder and CEO of Uganda’s biggest fintech and arguably biggest tech innovation in the country. Eversend, the fintech he founded, has gotten him accolades all over the world and shone a spotlight into Uganda.

He is a five-time Laureate with his latest accolade in 2022, of the Paris-based Institut Choiseul, an annual study independently carried out by the Paris based think-tank Institut Choiseul, as one of the young African leaders aged 40 and under who have had a major impact on the continent’s economic development. He was also selected among the Choiseul100Africa 2022 list as one of the young African leaders set to play a major role in the economic development of the continent.

In 2022 still, Eversend made a great milestone as its app got to 1 million downloads, showing the growth of the Ugandan fintech. Atwine has also overseen the introduction of a new feature - a B2B crypto-fiat payment feature in the application that enables businesses to accept cryptocurrency as a payment method.

The new solution by Eversend allows companies to hold, payout, collect and convert fiat and cryptocurrencies under one platform, ensuring connectedness and accessibility, which is integral to the startup’s business offerings.

Stone got into fintech with Pretoria-based loan management vendor Payment Solutions International. He then went on to become Country Manager for Kenya before consulting for multiple banks like Stanbic Bank, Barclays Bank, and Standard Chartered Bank in Kenya and Uganda on using technology to improve loan collections.

He has co-founded Yetu Credit Finance, a USSD-based micro-lender for government employees in Uganda. He co-founded useremit.com, a remittance company delivering to mobile money in Uganda, Kenya, and Rwanda.

Shemeel Josuub, CEO, Vodafone (South Africa)

Josuub joined Vodafone in 1994, growing into his current role as CEO, Vodacom Group Ltd, a position he has held since 2012. He has extensive telco experience having operated at a senior level in various companies across the group for the last 22 years, including Managing Director at Vodacom South Africa and Chief Executive Officer at Vodafone Spain. Shameel, who holds board positions at Vodacom Group Ltd, Safaricom Plc, and several subsidiary boards across the group contributes directly to the growth and strategic direction of these organisations that have a significant impact on the digital transformation trajectory of Africa.

In January 2023, the 2Africa subsea cable, described as the largest subsea cable system in the world landed at the South African operator Vodacom’s network facility in Gqeberha. The 2Africa consortium is made up of eight international partners, including Vodafone/Vodacom. Launched in May 2022, the subsea cable project aims to significantly increase the capacity, quality, and availability of internet connectivity between Africa and the rest of the world.

Vodacom also expanded 5G network in South Africa and launched the same service in Tanzania. The 5G network will come with new opportunities for Africa including enabling new use cases such as virtual and augmented reality, remote surgery, and self-driving cars. Additionally, the increased capacity and speed of 5G networks can support the growth of the Internet of Things (IoT), which includes a wide range of connected devices such as sensors, smart home devices, and wearable technology.

Vodacom also owns Mezzanine, a company that seeks to transform agriculture sector in Africa. In 2022, the company said it trained more than 2,150 women farmers on how to employ technology in their scale their businesses and participate in the economy in meaningful ways. Vodacom Business Africa, a subsidiary of the Vodacom Group focused on enterprise ICT, has announced that its software-defined wide area networking (SD-WAN) solution is now available to clients in all 47 countries it operates in across Africa. The solution has already been deployed to several businesses in South Africa with great success.

(Egypt)

Sabry is the CEO and founder of Fawry, Egypt’s largest e-payments platform, valued at over $2 billion. The fintech company helps around 35 million Egyptians pay their bills each month. Fawry has been instrumental in promoting digital transformation and improving financial inclusion in Egypt through strategic partnerships. In January 2022, it partnered with Misr Capital investments to launch the Middle East and North Africa region’s first fintech-based money market fund. In November the same year, through its subsidiary Fawry Microfinance, it launched the Tamweelak Fawry mobile app which is a digital loan request and tracking tool designed to simplify the financing process for existing micro and small businesses by allowing them to apply for loans at the time and place of their convenience. In December, Fawry partnered with Classera, a distance learning technology provider, to enhance e-payment services and integrate digital payment solutions of both Fawry and Classera Cpay. With the above listed moves, Sabry through Fawry, is instrumental in leading digital transformation in the north African country.