Breaking Barriers: Women Leaders Making Waves in the Finance Industry

Empowering Change: Inspiring Stories of Women Leaders in Finance Making a Global Impact

The Rise of Digital Banking: Transforming Traditional Finance in the Digital Age

The Role of Cryptocurrencies in Reshaping the Future of Finance

Follow us : www.ciobusinessworld.com Editor in chief Robert Patrick Contents Managing Editor :

Collins Design

Smith

Visualizer : Jack Thomas Arts & Design Director : Adam Jones Associate Designer : Erick Williams Sales Senior Sales Manager : Scott M Marketing Manager : Andrew T Sales Executive : Mark Davis Technical Victor Anderson SME- SMO Research Analyst : Henry Martinez SEO Executive : Daniel Lee Circulation Manager Alexander Nelson

Women Leaders Making Waves in Finance Editorial Note

n recent years, the finance Iindustry has witnessed a significant shift in leadership dynamics, with women emerging as powerful forces driving innovation, diversity, and growth. From investment banking to fintech startups, women leaders are making waves, reshaping traditional norms, and challenging the status quo. This editorial note aims to shine a spotlight on the remarkable achievements and contributions of women leaders in finance, highlighting their resilience, vision, and impact on the industry.

Despite historical barriers and systemic biases, women leaders in finance have persevered, breaking through glass ceilings and carving out spaces for themselves at the highest echelons of power.

Through their expertise, determination, and trailblazing spirit, they have shattered stereotypes and paved the way for future generations of female professionals. One notable aspect of women's leadership in finance is their commitment to driving positive change and fostering inclusivity within the industry. Many women leaders are champions of diversity and equity, advocating for gender-balanced teams, inclusive workplace cultures, and equal opportunities for all. By promoting diversity of thought and perspective, they are not only driving better business outcomes but also creating more resilient and sustainable financial ecosystems.

Moreover, women leaders in finance are at the forefront of innovation, spearheading initiatives that leverage technology, data analytics, and digital platforms to revolutionize traditional practices and enhance customer experiences. From digital banking solutions to impact investing strategies, they are driving transformative change and shaping the future of finance in profound ways.

In addition to their professional achievements, women leaders in finance are also catalysts for social impact and community development. Many are actively involved in philanthropy, mentorship programs, and initiatives aimed at empowering women and underrepresented groups in finance. By leveraging their influence and resources, they are creating opportunities for socio-economic advancement and driving positive change beyond the boardroom.

As we celebrate the accomplishments of women leaders in finance, it is essential to recognize that their journey is not without challenges. Despite their remarkable achievements, women still face barriers to advancement, including gender bias, unequal pay, and limited access to leadership positions. Addressing these systemic issues requires collective action and unwavering commitment from stakeholders across the industry.

In conclusion, women leaders are making significant strides in finance, reshaping the landscape, and driving progress on multiple fronts. Their leadership is characterized by resilience, innovation, and a steadfast commitment to driving positive change. By amplifying their voices, championing their achievements, and dismantling barriers to their success, we can build a more inclusive, equitable, and prosperous future for the finance industry and society as a whole.

Contents

12Simone Grimes

COVER STORY

Article 20 Breaking Barriers: Women Leaders Making Waves in the Finance Industry Empowering Change: Inspiring Stories of Women Leaders in Finance Making a Global Impact 22 The Rise of Digital Banking: Transforming Traditional Finance in the Digital Age 26 The Role of Cryptocurrencies in eshaping the uture of Finance 28

12

From Start-Up Success to Financial Leadership

Simone

Grimes

13 www.ciobusinessworld.com

14

15 www.ciobusinessworld.com

16

17 www.ciobusinessworld.com

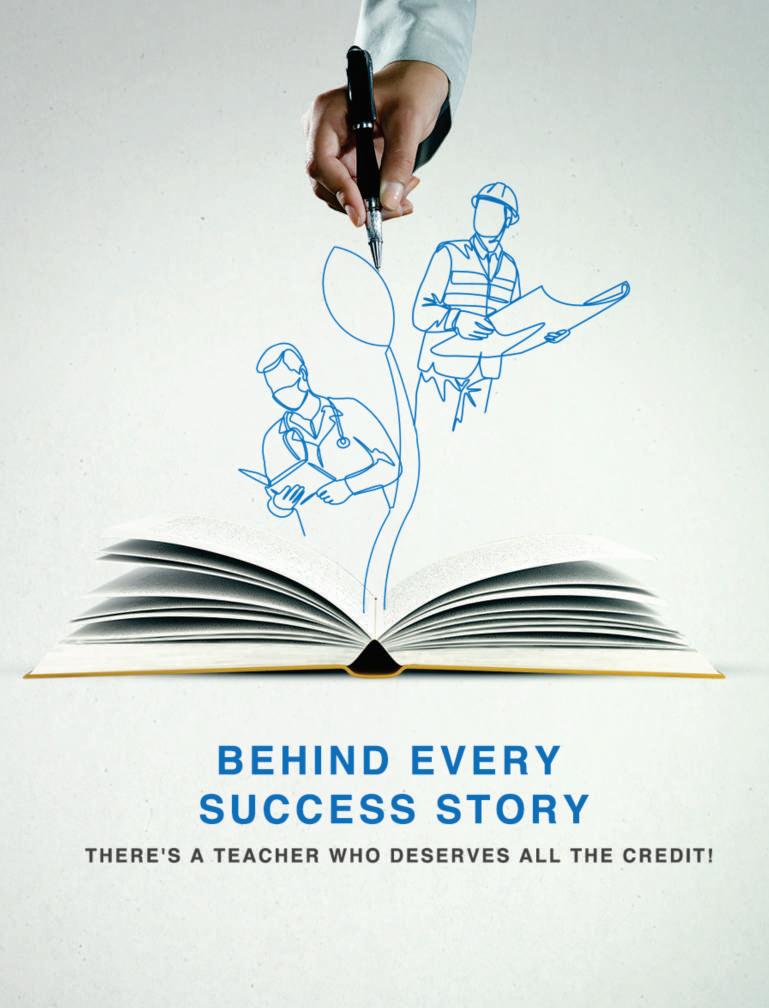

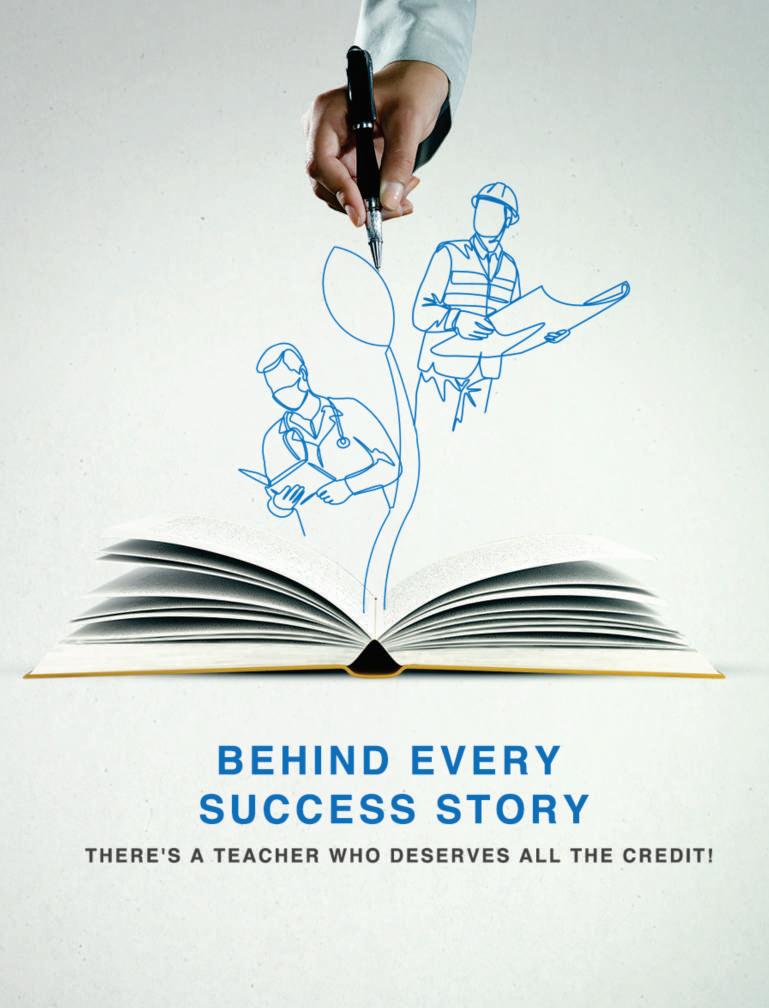

Breaking Barriers: Women Leaders Making Waves in the Finance Industry

20 ARTICLE

21 www.ciobusinessworld.com

Empowering Change: Inspiring Stories of Women

Leaders in Finance

Making a Global Impact

22

ARTICLE

Themale-dominatedworldthatwelivein today,womenleadersarebreaking barriers,challengingnorms,andpositive changeonaglobalscale.Rightfrompioneering innovativefinancialstrategiestoadvocatingfor diversity,thesetrailblazingwomenarereshaping thefinancialindustry.Herearesomeinspiring storiesofwomenleaderswhoaremakingwaves andleadingthechargeforprogress:

1.LeadershipinMajorFinancialInstitutions:

Manywomenhaverisentotopinmajorfinancial institutions,wherespearheadinginitiativesto promoteinnovation,growth,andenhance diversityandinclusionwithinorganizations. Thesewomenleadersaresettingnewstandards forexcellenceandinspiringotherstofollow footsteps.

2.EntrepreneurshipandInnovation:

Womenentrepreneursintherealmoffinanceare disruptingconventionalanddrivinginnovation throughgroundbreakingstart-ups.These innovatorsareleveragingtech,dataanalytics,and othercutting-edgetoolscreatingnew opportunitiesinfinanceandrelatedfields.

3.AdvocacyandEmpowerment:

Thewomenleadersinthefieldoffinancearenot justexcellingtheirprofessionalrolesbutusing platformstoadvocateforgenderequalityand inclusionintheworkplace.Throughleadership programs,leadershipinitiatives,andadvocacy efforts,theseleadersaretransformingwomento succeedandthriveinthefieldoffinance.

4.GlobalImpactandSocialResponsibility:

Womenleadersinfinanceareusingtheinfluence andresourcestodrivesocialandenvironmental changeonaglobalscale.Thusfromsustainable

investingandCSRinitiativesandcommunity developmentprojects,theseleadersaremakinga differenceintheworld,leavingbackalegacyof impactandempowerment.

5.InspiringFutureGenerations:

Thesewomenleadersinfinanceareinspiring futuregenerationsofwomeninordertopursue careersinfinance,entrepreneurship,and leadership.Thusbysharingtheirstories, expertise,andservingasrolemodels,these leadersarepavingthewayforamorediverseand equitablefutureinthefinanceindustry.

Womencontinuetoriseinthepromisingworldof finance,itistheirleadership,innovation,aswell asadvocacythatisdrivingchangeandshaping thefutureofindustry Throughresilience, determinationandcommitmenttoexcellence, thesewomenarebreakingdownbarriers, stereotypes,makingadifferenceintheworld.As theirstoriesothers,womenfollowtheirlead,the impactofwomenleaderscontinuetoflourishin thecomingyears.

Thewomenleadersinfinancerecognizethe importanceofdiversityindrivinginnovation, creativity,andenhancingorganizational performance.Theypromotediversityand inclusionwithinorganizations,championingthe recruitment,retention,andadvancementof femaleswithunderrepresentedgroupsinfinance. Thusbycreatingamoreinclusiveworkforce, theseleadersareunleashingthefullpotentialof otherteams,drivinggreaterinnovationand success.

23 www.ciobusinessworld.com

26 ARTICLE

The Rise of Digal Banking: Transforming Tradional Finance in e Digal Age

Digitalbankinghasemergedasapowerfulforce reshapingthelandscapeoftraditionalfinancein thedigitalage.Withtherapidadvancementof technologyandchangingconsumerpreferences,traditional brick-and-mortarbanksarefacingincreasingcompetition frominnovativedigitalbankingplatforms.Thesedigital banks,alsoknownasneobanksorchallengerbanks, leveragetechnologytoofferawiderangeoffinancial servicesentirelyonline,withouttheneedforphysical branches.Theriseofdigitalbankingrepresentsasignificant shiftinthewaypeoplemanagetheirfinances,offering convenience,accessibility,andenhancedcustomer experiences.

Thedigitalbankinghasrisenasapowerfulforcereshaping thetraditionalfinanceinthedigitalage.Whilethe smartphonesandinternetarereachingunprecedented levels,customersaregoingdigitalchannelsfortheir bankingneeds.Thedigitalbanksarecapitalizingonthis trendbyprovidinginnovativemobileapplicationsthat enablecustomerstoaccesstheiraccounts,andmanage financesanytime,anywhere.Thusbyeliminatingtheneed fordigitalbanksareabletoofferlowerfees,andfaster processingtimes,seekingaseamlessandefficientbanking experience.

Additionally,digitalbankingplatformslikedataanalytics andAItopersonalizeandoptimizethecustomer experience.Thusbyanalyzinguserbehavior,spending patterns,digitalbankscanoffertailoredinsights,and financialproductstomeettheindividualneedsofeach customer.Predictiveanalyticsforexamplecananticipate consumerfinancialneedsofferingproactivesolutionsor loanopportunities.Additionally,machinelearningcan detectfraudulentactivitiesandsecuritythreatsinreal-time, enhancingthesecurityofdigitalbankingtransactions.

Theriseofdigitalbankingisthegrowingdemandfor financialinclusionandaccessibility Thetraditionalbanks mostlystruggletoreachunbakedpopulations.Digitalbanks havethepotentialtoreachmillionsofpeoplewhoarefar fromtraditionalbankingservicesparticularlyinruralareas. Thusbyleveragingmobiletechnology,digitalbanksoffer basicbankingserviceslikesavingsaccountsandsmall loansandbusinessespreviouslyexcludedfromfinancial system.Thisdemocratizationnotjustpromoteseconomic empowermentbutalsodrivesinnovationinunderserved communities.

Lastly,digitalbankingplatformsaredrivingdisruption acrossallsectorsoffinancialindustry,andwealth management.ForexampledigitalpaymentlikeP2P transfers,mobilewallets,andcontactlesspaymentsare gainingpopularityandsecurewaystotransact.Atthesame timedigitallendingplatformsofferalternativesourcesof finance,leveragingtechnologyanddisbursementprocesses. Moreover,digitalwealthmanagementalsoknownasroboadvisorsuseautomationtoprovidepersonalizedinvestment adviceandportfoliomanagementatafractionofthecostof traditionalfinancialadvisors.

Inconclusion,theriseofdigitalbankingrepresentsa transformativeshiftinthefinancialindustry,drivenby technology,changingconsumerbehavior,andthequestfor financialinclusion.Digitalbanksofferawiderangeof benefits,includingconvenience,accessibility,personalized experiences,andlowercosts,makingthemanattractive alternativetotraditionalbanksformanyconsumers.As digitalbankingcontinuestoevolveanddisruptthe traditionalfinancesector,itisessentialforregulators, policymakers,andindustrystakeholderstocollaborateand adapttothechanginglandscape,ensuringthatconsumers areprotected,andthefinancialsystemremainsstableand resilientinthedigitalage.

27 www.ciobusinessworld.com

The Rise of Digital Banking: Transforming Traditional FINANCE IN THE DIGITAL AGE

28 ARTICLE

Digitalbankinghas emergedasapowerful forcereshapingthe landscapeoftraditionalfinance inthedigitalage.Withthe rapidadvancementof technologyandchanging consumerpreferences, traditionalbrick-and-mortar banksarefacingincreasing competitionfrominnovative digitalbankingplatforms. Thesedigitalbanks,also knownasneobanksor challengerbanks,leverage technologytoofferawide rangeoffinancialservices entirelyonline,withoutthe needforphysicalbranches. Theriseofdigitalbanking representsasignificantshiftin thewaypeoplemanagetheir finances,offeringconvenience, accessibility,andenhanced customerexperiences.

Thedigitalbankinghasrisenas apowerfulforcereshapingthe traditionalfinanceinthedigital age.Whilethesmartphones andinternetarereaching unprecedentedlevels, customersaregoingdigital channelsfortheirbanking needs.Thedigitalbanksare capitalizingonthistrendby providinginnovativemobile applicationsthatenable customerstoaccesstheir accounts,andmanagefinances anytime,anywhere.Thusby eliminatingtheneedfordigital banksareabletoofferlower fees,andfasterprocessing times,seekingaseamlessand efficientbankingexperience.

Additionally,digitalbanking platformslikedataanalytics

andAItopersonalizeandoptimizethecustomer experience.Thusbyanalyzinguserbehavior,spending patterns,digitalbankscanoffertailoredinsights,and financialproductstomeettheindividualneedsofeach customer.Predictiveanalyticsforexamplecananticipate consumerfinancialneedsofferingproactivesolutionsor loanopportunities.Additionally,machinelearningcan detectfraudulentactivitiesandsecuritythreatsinreal-time, enhancingthesecurityofdigitalbankingtransactions.

Theriseofdigitalbankingisthegrowingdemandfor financialinclusionandaccessibility Thetraditionalbanks mostlystruggletoreachunbakedpopulations.Digitalbanks havethepotentialtoreachmillionsofpeoplewhoarefar fromtraditionalbankingservicesparticularlyinruralareas.

Thusbyleveragingmobiletechnology,digitalbanksoffer basicbankingserviceslikesavingsaccountsandsmall loansandbusinessespreviouslyexcludedfromfinancial system.Thisdemocratizationnotjustpromoteseconomic empowermentbutalsodrivesinnovationinunderserved communities.

Lastly,digitalbankingplatformsaredrivingdisruption acrossallsectorsoffinancialindustry,andwealth management.ForexampledigitalpaymentlikeP2P transfers,mobilewallets,andcontactlesspaymentsare gainingpopularityandsecurewaystotransact.Atthesame timedigitallendingplatformsofferalternativesourcesof finance,leveragingtechnologyanddisbursementprocesses.

Moreover,digitalwealthmanagementalsoknownasroboadvisorsuseautomationtoprovidepersonalizedinvestment adviceandportfoliomanagementatafractionofthecostof traditionalfinancialadvisors.

Inconclusion,theriseofdigitalbankingrepresentsa transformativeshiftinthefinancialindustry,drivenby technology,changingconsumerbehavior,andthequestfor financialinclusion.Digitalbanksofferawiderangeof benefits,includingconvenience,accessibility,personalized experiences,andlowercosts,makingthemanattractive alternativetotraditionalbanksformanyconsumers.As digitalbankingcontinuestoevolveanddisruptthe traditionalfinancesector,itisessentialforregulators, policymakers,andindustrystakeholderstocollaborateand adapttothechanginglandscape,ensuringthatconsumers areprotected,andthefinancialsystemremainsstableand resilientinthedigitalage.

29 www.ciobusinessworld.com